Students should practice Goods & Service Tax (GST) – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Goods & Service Tax (GST) – CS Executive Tax Laws MCQ Questions

Question 1.

Which of the following countries was the first to introduce GST?

(A) the United States

(B) Britain

(C) Canada

(D) France [Dec. 2017]

Answer:

(D) France

Question 2.

All decisions of the GST Council must have a majority in order to implement the same.

(A) One-half

(B) Three-fourth

(C) 60%

(D) 90% [Dec. 2017]

Answer:

(B) Three-fourth

Question 3.

Which law will govern the inter-State supply of goods or services?

(A) CGST

(B) SGST

(C) UTGST

(D) IGST [Dec. 2017]

Answer:

(D) IGST

Question 4.

Which of the following has been kept out of the GST Levy?

(A) Generator

(B) Computer

(C) Jewellery

(D) Electricity [Dec. 2017]

Answer:

(D) Electricity

Question 5.

Abhijit Sen is engaged in running a textile showroom at Gangtok (Sikkim). In order to avail composition scheme under GST law, his “aggregate turn-over” in the preceding financial year should not have exceeded:

(A) ₹ 50 lakh

(B) ₹ 40 lakh

(C) ₹ 75 lakh

(D) ₹ 150 lakh [Dec. 2017]

Answer:

(C) ₹ 75 lakh

Question 6.

When employer gifts goods to his employees, it will not be considered as a taxable supply for the purpose of GST if the value of supply to an employee does not exceed:

(A) ₹ 5,000

(B) ₹ 20,000

(C) ₹ 50,000

(D) ₹ 1,00,000 [Dec. 2017]

Answer:

(C) ₹ 50,000

Question 7.

Which of the following incomes/ activities is liable for GST?

(A) Salary

(B) Salary and allowances of MPs

(C) Services by Court

(D) Sale of jewellery [Dec. 2017]

Answer:

(D) Sale of jewellery

Question 8.

Which of the following represents composite supply?

(A) Doctor’s service with medicines

(B) Package with fruits and chocolates

(C) Coaching centre with monthly excursions on trekking

(D) Supply of computer printer and laptop [Dec. 2017]

Answer:

(A) Doctor’s service with medicines

Question 9.

In the case of a manufacturer who opts for composition scheme the rate of GST (including CGST and SGST) is:

(A) 1% CGST + 1% SGST = 2%

(B) 0.5% CGST + 0.5% SGST = 1%

(C) 2% CGST + 2% SGST = 4%

(D) 0.25% CGST + 0.25% SGST = 0.5% [Dec. 2017]

Answer:

(B) 0.5% CGST + 0.5% SGST = 1%

Question 10.

Who among the following is eligible for availing composition scheme under GST?

(A) Supply through e-commerce operators

(B) Service supply like Company Secretary

(C) Goods not taxable under CGST/ SGST/UTGST/IGST

(D) Restaurants [Dec. 2017]

Answer:

(D) Restaurants

Question 11.

Which of the following GST model is adopted in India?

(A) Australian model

(B) Bagchi-Poddar model

(C) Dual model

(D) American model [Dec. 2017]

Answer:

(C) Dual model

Question 12.

For the purpose of deciding “aggregate turnover” in order to determine the GST payable under the composition scheme, which of the following is to be excluded?

(A) Exemption supply

(B) Export of goods

(C) Inter-state branch transfer

(D) CGST [Dec. 2017]

Answer:

(D) CGST

Question 13.

Goods and Services Tax (GST) noted to be the greatest tax reform in India and therefore was rolled out with effect from 1st July 2017. It transforms a system of taxation and administration into the digital world by adopting the latest information technology. The GST model rolled out in India has been adapted from:

(A) France

(B) Canada

(C) Argentina

(D) None of the above [June 2018]

Answer:

(B) Canada

Question 14.

Special purpose vehicle to cater for the IT needs of GST is called:

(A) HSN

(B) GSTN

(C) IGSTN

(D) SGSTN [June 2018]

Answer:

(B) GSTN

Question 15.

GST in India is levied on the basis of:

(A) Consumption principle

(B) Set-off against that payable principle

(C) Destination base principle

(D) Both consumption and destination base principle [June 2018]

Answer:

(D) Both consumption and destination base principle

Question 16.

The tax under GST legislation in India is being levied:

(A) Exclusively by Union and State Laws

(B) Simultaneously by Union and State Laws

(C) Only by Union Laws

(D) Only by State Laws [June 2018]

Hint:

Inter-State supply of service is covered in Section 7(3) of the IGST Act, 2017.

None of the options covers Section 7 and hence Question itself is wrong.

Answer:

(B) Simultaneously by Union and State Laws

Question 17.

GST Council comprises of various persons from Union and States and is being headed by a Chair Person who is:

(A) Finance Secretary to Government of India

(B) Union Finance Minister

(C) Any State Finance Minister

(D) Union Revenue Minister [June 2018]

Answer:

(B) Union Finance Minister

Question 18.

Construction of a complex, building, civil structure or the part thereof including a complex or building intended for sale to a buyer, wholly or partly except where the entire consideration has been received after issuance of the completion certificate, where required, by a competent authority or after its first occupation, whichever is earlier for the purpose of taxability under the CGST Act, 2017 shall be treated as supply of:

(A) Goods

(B) Both goods and services

(C) Services

(D) Contract work [June 2018]

Answer:

(C) Services

Question 19.

Which of the following categories of registered persons are not eligible for the Composition Scheme under the CGST Act, 2017?

(i) Supplier of the Restaurant Ser-vices

(ii) Manufacturer of notified goods

(iii) Non-resident taxable persons

(iv) Casual taxable person

Select correct answer from the options given below:

(A) (iii) and (iv)

(B) (ii), (iii) and (iv)

(C) (ii) and (iv)

(D) (i), (iii) and (iv) [June 2018]

Answer:

(B) (ii), (iii) and (iv)

Question 20.

Mr Bala has made supply (within State) of taxable goods to the tune of ₹ 17 lakh, export supplies of ₹ 3 lakh and intra-state supply of exempt services of ₹ 4 lakh. His aggregate turnover as per Section 2(6) of the CGST/SGST Act, 2017 is:

(A) 17 lakh

(B) 20 lakh

(C) 24 lakh

(D) None of the above [June 2018]

Answer:

(C) 24 lakh

Question 21.

A supply made by a taxable person to a recipient consisting of two or more taxable supply of goods or services or both or any combination thereof which are only bundled and supplied in conjunction with each other in the ordinary course of business out of which one is a principal supply has been defined u/s 2(30) of CGST Act, 2017 to mean:

(A) Mixed supply

(B) Composite supply

(C) Bundled supply

(D) Both (A) and (B) [June 2018 and December 2018]

Answer:

(B) Composite supply

Question 22.

Provision for levy and collection of tax on intra-State supply of goods or services or both by the Union Territory and for matters connected therewith or incidental thereto are being enumerated in:

(A) CGST Act, 2017

(B) IGST Act, 2017

(C) UTGST Act, 2017

(D) None of the above [June 2018]

Answer:

(C) UTGST Act, 2017

Question 23.

The highest enabling limit of a tax rate of IGST has been prescribed at:

(A) 20%

(B) 14%

(C) 28%

(D) None of the above [June 2018]

Answer:

(D) None of the above

Question 24.

Taxes that were replaced by GST legislation are:

(A) Purchase tax

(B) Luxury tax

(C) Central Sales tax

(D) Options (A) and (B) above [June 2018]

Note: MCQ is wrong, as none of the given options is correct.

Answer:

Question 25.

A registered supplier under com-position levy can withdraw at any time and be required to file the Form for withdrawal from composition levy in:

(A) GSTCMP-3

(B) GSTCMP-4

(C) GST MIS-1

(D) GST PCT-2 [June 2018]

Answer:

(B) GSTCMP-4

Question 26.

Mr S, a manufacturer of medicines, whose turnover for the financial year 2018-2019 was ₹ 90 lakh opted to pay tax under GST as per the composition scheme from 1st April 2019. His turnover crosses ₹ 1.5 Crore on 30 November 2019. Will he be allowed to pay tax under the composition scheme for the remainder of the year ie. from 1st December 2019 to 31st March 2020?

(A) Yes, he can avail of the benefit till 31st March 2020

(B) No, the option availed shall lapse from the day on which his aggregate turnover during the financial year 2019-2020 exceeds ₹ 1.5 Crore

(C) Yes, the option can be availed up to the completion of half financial year Le. till 30th September 2019

(D) None of the above [Dec. 2018]

Answer:

(B) No, the option availed shall lapse from the day on which his aggregate turnover during the financial year 2019-2020 exceeds ₹ 1.5 Crore

Question 27.

The payment of tax by an electronic operator who does not have a physical presence in taxable territory in India be made by……..

(A) E-commerce operator himself

(B) His appointed representative in India

(C) The person who receives supply

(D) Either (A) or (B) [Dec. 2018]

Answer:

(B) His appointed representative in India

Question 28.

The GST Council for ensuring a single interface has distributed the administrative control of taxpayers of certain percentage with Central Tax Administration:

(A) 5% of taxpayers having turnover below ₹ 1 Crore

(B) 10% of taxpayers having turnover below ₹ 1.5 Crore

(C) 10% of taxpayers having turnover below ₹ 1 Crore

(D) 20% of taxpayers having turnover below ₹ 1.5 Crore [Dec. 2018]

Answer:

(B) 10% of taxpayers having turnover below ₹ 1.5 Crore

Question 29.

Find out from the following, who will be the member of the GST Council on behalf of each of the State:

(A) Chief Minister of the State

(B) Home Minister of the State

(C) The Minister in charge of Finance or Taxation or any other Minister nominated by the State Government

(D) Chief Secretary of the State [Dec. 2018]

Answer:

(C) The Minister in charge of Finance or Taxation or any other Minister nominated by the State Government

Question 30.

GST Council is being constituted for making a recommendation on various issues relating to policy making, formulation of principle and implementation of policies relating to CGST Act, 2017. It is thus……..

(A) An administrative body

(B) A Central level body

(C) A Committee of Finance Ministers

(D) An Apex Body [Dec. 2018]

Answer:

(D) An Apex Body

Question 31.

Exempt supply means the supply of any goods or services or both which may be wholly exempt from tax under section 11 or under section 6 of the IGST Act and includes……..

(i) Non-taxable supply

(ii) Zero-rated supply

(iii) Supply having Nil rate of tax

(iv) Composite supply

Select correct answer from the options given below:

(A) (i), (it) and (iii)

(B) (i) and (iv)

(C) (i) and (iii)

(D) All the four above [Dec. 2018]

Answer:

(C) (i) and (iii)

Question 32.

The exception to the general rule that “normally, the supplier of goods and services is liable to pay tax on supply, even if he does not collect from his customer ie. recipient of supply of goods or services” shall be applicable where there are:

(A) Supply from an unregistered dealer to a registered dealer

(B) Specified services through an e-commerce operator

(C) Both (A) and (B)

(D) None of the above [Dec. 2018]

Hint:

A→only in notified cases.

Answer:

(A) Supply from an unregistered dealer to a registered dealer

Question 33.

A registered person of Delhi is buying and selling goods only in Delhi and Puducherry. The applicable law for GST in his case will be:

(A) State GST

(B) UTGST Act, 2017

(C) GST (Compensation to States) Act, 2017

(D) CGST Act, 2017 [June 2019]

Note: MCQ is wrong. For further clarification please see not provided.

Hint:

For Buying/selling goods in Delhi → CGST+SGST.

For: Puducherry – i.e. Inter-state supply: IGST

∴ Correct Answer → CGST SGST & IGST law.

Answer:

Question 34.

Which of the following goods is not exempt from GST:

(A) Fish seed

(B) Icecream

(C) Pappad

(D) Plastic Bangles [June 2019]

Answer:

(B) Icecream

Question 35.

Power to declare certain activities/ transactions as neither supply of goods nor of services is given in:

(A) Schedule IV

(B) Schedule IE

(C) Schedule II

(D) Schedule I [June 2019]

Answer:

(B) Schedule IE

Question 36.

Section 2(6) of the CGST/SGST Act, 2017 defines aggregate turnover which is being computed on an India basis excluding the taxes charged under CGST Act, SGST Act, UTGST Act and IGST Act. Aggregate turnover shall include all supplies made by a taxable person comprising of:

(i) Taxable supply

(ii) Exempt supply

(iii) Export of goods or services

(iv) All Interstate supply of person having the same PAN

(v) Supply on which tax is levied on reverse charge basis

(vi) Value of all inward supply

Select the correct answer from the options given below

(A) (i), (iii), (iv) and (v)

(B) (i), (iii), (iv) and (vi)

(C) All the above in (i) to (vi)

(D) (i), (ii), (iii) and (iv) [June 2019]

Answer:

(D) (i), (ii), (iii) and (iv)

Question 37.

President of India gave assent to

(i) Central Goods and Services Tax Act, 2017

(ii) Integrated Goods and Services Tax Act, 2017

(iii) Union Territory Goods and Services Tax Act, 2017 and

(iv) Goods and Services Tax (Compensation to State) Act, 2017 on:

(A) 13th May 2017

(B) 13th April 2017

(C) 16th April 2017

(D) 6th June 2017 [June 2019]

Answer:

(B) 13th April 2017

Question 38.

The decision of the GST Council will be adopted when it has the support of:

(A) One-third majority

(B) Two-third majority

(C) Three-fourth majority

(D) Simple majority [June 2019]

Answer:

(C) Three-fourth majority

Question 39.

The Compensation to States for loss of revenue on account of implementation of GST is for……..years.

(A) 2

(B) 5

(C) 8

(D) 10 [June 2019]

Answer:

(B) 5

Question 40.

When agriculturist registered under GST supplies tobacco leaves to a factory, the liability to pay GST is on.

(A) Tobacco leaves the seller

(B) The buyer under reverse charge

(C) The agriculturist

(D) Consumer of tobacco leaves [June 2019]

Answer:

(B) The buyer under reverse charge

Question 41.

Composition scheme is not applicable to service providers except the following:

(A) Consultancy Service

(B) Restaurant Service

(C) Beauty Parlours

(D) Cleaning work [June 2019]

Answer:

(B) Restaurant Service

Question 42.

When goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance as per provisions of the CGST Act, 2017, is called as:

(A) Mixed Supply

(B) Uniform Supply

(C) Complex Supply

(D) Composite Supply [June 2019]

Answer:

(D) Composite Supply

Question 43.

Service shall be a continuous supply of service agreed to be provided continuously or on a recurrent basis under a contract when the period of service exceeds:

(A) 1 month

(B) 3 months

(C) 6 months

(D) 1 year [June 2019]

Answer:

(B) 3 months

Question 44.

Every decision of the Goods and Services Tax Council shall be taken at a meeting, by the majority of not less than……..of the weighted votes of the members present and voting. The vote of the Central Government shall have the weightage of……..of the total votes cast and the votes of all the State Government taken together shall have a weightage of……..of the total votes cast in that meeting.

(A) 2/3, 1/3, 3/4

(B) 3/4, 1/3, 2/3

(C) 2/3, 2/3, 1/3

(D) 3/4, 1/2, 2/3 [Dec. 2019]

Answer:

(B) 3/4, 1/3, 2/3

Question 45.

The Goods and Services Tax Council shall establish a mechanism to adjudicate any dispute……..

(A) Relating to any defect in the appointment of a person as a Member

(B) Relating to any procedural irregularity of the Council

(C) Between the Government of India and one or more States

(D) Relating to the weightage of the vote for taking decision [Dec. 2019]

Answer:

(C) Between the Government of India and one or more States

Question 46.

Administration and procedural aspects of Goods and Services Tax are to be administered by the……..which is under the control of the Department of Revenue, Ministry of Finance, Government of India.

(A) Central Board of Indirect Taxes and Customs

(B) Central Board of Indirect Taxes

(C) Central Board of Direct Taxes

(D) GST Council [Dec. 2019]

Answer:

(A) Central Board of Indirect Taxes and Customs

Question 47.

GST is a comprehensive tax regime covering both Goods and Services and is collected on value-added at each stage of the supply chain. GST is thus levied on the basis of ……..

(A) Consumption principle

(B) Destination principle

(C) Set-off against that payable principle

(D) Both consumption and destination base principle [Dec. 2019]

Answer:

(B) Destination principle

Question 48.

Most of the countries in the world follow a uniform GST System whereas considering the federal nature of the Indian Constitution, the Model of GST proposed and implemented in India from 1st July 2017 is……..

(A) Unilateral Model

(B) Bilateral Model

(C) Dual Model

(D) None of the above [Dec. 2019]

Answer:

(C) Dual Model

Question 49.

Section 7 of the CGST Act, 2017 defines the term ‘supply’ which are further being enumerated in the various schedules as specified in that section. The section includes certain transactions which are even without consideration but being construed as supply and also known as deemed supply. Such transactions are being specified in……..

(A) Schedule II

(B) Schedule I

(C) Schedule HI

(D) Schedule IV [Dec. 2019]

Answer:

(B) Schedule I

Question 50.

Permanent transfer or disposal of goods forming part of a business asset by or under the directions of the person carrying on the business whether or not for consideration as well as the transfer of title in goods under an agreement where the property in goods passes at a future date on payment of full consideration as per Schedule – II of the CGST Act, 2017 to be treated as ……..

(A) Supply of Goods

(B) Supply of Services

(C) Deemed supply

(D) Both, supply and deemed supply [Dec. 2019]

Answer:

(A) Supply of Goods

Question 51.

Construction of a complex, building, civil structure or the part thereof including a complex or building intended for sale to a buyer, wholly or partly except where the entire consideration has been received after issuance of the completion certificate, where required, by a competent authority or after its first occupation, whichever is earlier as per section 7 of the CGST Act, 2017 read with item specified in schedule is known as……..

(A) Goods

(B) Both Goods and Services

(C) Services

(D) Contract work [Dec. 2019]

Answer:

(C) Services

Question 52.

Which of the categories of registered persons who are being eligible for the composition scheme under the CGST Act, 2017:

(A) Supplier of the Restaurant Ser-vices

(B) Manufacturer of notified goods

(C) Non-resident taxable persons

(D) Casual taxable person [Dec. 2019]

Answer:

(A) Supplier of the Restaurant Ser-vices

Question 53.

The composition levy payable by a registered person whose aggregate turnover in the preceding Financial Year did not exceed one crore and fifty lakh rupees making supply by way of or as part of any services or in any other manner whatsoever of goods being food or any other article for human consumption or any drink (other than Alcoholic Liquor for human consumption) where such supply or service is for cash or defer payment or other valuable consideration shall be at ….. of the turnover.

(A) 0.5%

(B) 1%

(C) 2.5%

(D) 5% [Dec. 2019]

Answer:

(D) 5%

Question 54.

The liability to pay GST would depend on the mechanism the transaction aligns to the supplier who is registered with GST, issues a tax invoice, collects the GST and pays it to the Government. This mechanism under GST is known as……..

(A) Forward charge mechanism

(B) Reverse charge mechanism

(C) Composition levy mechanism

(D) Taxable supply mechanism [Dec. 2019]

Answer:

(A) Forward charge mechanism

Question 55.

The exempt supply has been defined as the supply of any goods/services/ both, which attract a Nil rate of tax, or which may be wholly exempt from tax, and therefore, includes non-taxable supplies. Which of the following is covered as an exempt supply under GST?

(A) Branded Atta/Besan/Maida

(B) Services by IRDA, SEBI, RBI, EPFO

(C) Services by Post Office

(D) Services by the Government for transportation of passenger [Dec. 2019]

Answer:

(B) Services by IRDA, SEBI, RBI, EPFO

Question 56.

The supply of Goods/Services/ both, where the location of the supplier and the place of supply is in the same State or same Union Territory under CGST Act, 2017 and UTGST Act, 2017 is known as a……..

(A) Inter-State supply

(B) Export supply

(C) Intra-State supply

(D) Not Intra-State supply [Dec. 2019]

Answer:

(C) Intra-State supply

Question 57.

Service would be called as “continuous supply of service” if the service under a contract is provided continuously or on a recurrent basis exceeding:

(A) One year

(B) 6 months

(C) 3 months

(D) 1 month [Dec. 2017]

Answer:

(C) 3 months

Question 58.

Mr Ram supplied goods to Mr Laxman. The invoice is dated 30.7.2018. The payment was received for the supply on 30.10.2018. The goods were dispatched on 5.8.2018. What is a time of supply under the GGST Act?

(A) 5.8.2018

(B) 30.7.2018

(C) 30.10.2018

(D) None of the above [Dec. 2017]

Answer:

(B) 30.7.2018

Question 59.

Which of the following though shown in Bill will not be included in determining the value of supply for the purpose of GST?

(A) Packing

(B) Discount

(C) Interest for late payment

(D) Installation charges [Dec. 2017]

Answer:

(B) Discount

Question 60.

Refreshments were supplied on board in an aircraft proceeding from Chennai to Delhi. It had a stop at Hyderabad. The refreshments were taken on board at Hyderabad. The place of supply is:

(A) Delhi

(B) Chennai

(C) Hyderabad

(D) None of the above [Dec. 2017]

Answer:

(C) Hyderabad

Question 61.

The time of supply “where goods or services or both have been supplied in a situation where the invoice issued before the change in the rate of tax but payment received after the change in the rate of tax” as per section 14 of the CGST Act, 2017 shall be:

(A) Date of issue of invoice

(B) Date of receipt of payment or the date of issue of the invoice whichever is earlier

(C) Date of receipt of payment

(D) None of the above [Dec. 2018]

Answer:

(A) Date of issue of invoice

Question 62.

The subsidy is given by the Central Government or a State Government while determining the value of taxable supply under Goods and Services Tax (GST) as per section 15 of the CGST Act, 2017: [Dec. 2018]

(A) Included in the transaction value Le. value of taxable supply

(B) Just ignored no treatment

(C) Shall not be included in trans-action value Le. value of taxable supply

(D) Deducted from the transaction value Le. value of taxable supply

Answer:

(C) Shall not be included in trans-action value Le. value of taxable supply

Question 63.

ABC Ltd. of Mumbai supplied goods to XYZ Ltd. of Delhi under a contract for the goods to be delivered at the factory of the buyers. Goods removed from the factory of ABC Ltd. on 9.8.2019 and were delivered to the factory of XYZ Ltd. of Delhi on 16.8.2019. The invoice for the supplies was raised by ABC Ltd. on 18.8.2019. Payment of the bill was received on 20.9.2019. The time of supply in this case under GST be taken as:

(A) 9.8.2019

(B) 16.8.2019

(C) 18.8.2019

(D) 20.9.2019 [June 2019]

Answer:

(A) 9.8.2019

Question 64.

When an unregistered dealer sup-plied goods to a registered dealer, the time of supply under reverse charge shall be earliest of the:

(A) date of receipt of goods

(B) date of supply of goods

(C) date of loading of goods in transport

(D) date of intimation of supply of goods [June 2019]

Hint:

Time of supply of Goods under RCM shall be earlier than 3:

- Date of Receipt of Goods

- The day immediately following 30 days from invoice.

- Date of making payment.

Answer:

(A) date of receipt of goods

Question 65.

Ram & Company of Delhi has taken a contract to supply of food in New Delhi- Mumbai Rajdhani Express and the supplies of food in the train are being taken on board at Kota in Rajasthan from Agarwal Food & Caterers. The place of supply in such case shall be……..

(A) Delhi

(B) Kota

(C) Mumbai

(D) None of the above [Dec. 2019]

Answer:

(B) Kota

Question 66.

Mr Ravi Raj a registered person based in Ahmedabad solicits the services of an Event Management Company based in Mumbai for his daughter’s marriage planned as a destination wedding at a Palace located in Udaipur. The place of supply, in this case, shall be…….. and tax to be charged under ……..

(A) Ahmedabad, IGST

(B) Mumbai, IGST

(C) Udaipur, IGST

(D) Ahmedabad, SGST [Dec. 2019]

Answer:

(A) Ahmedabad, IGST

Question 67.

ABC Ltd. supplied goods to XYZ Ltd. under a contract for the goods to be delivered to the factory of XYZ Ltd. The goods were removed from the factory of ABC Ltd. on 9th September 2020 and the goods were delivered to the factory of XYZ Ltd. on 15th September 2020.

The invoice was issued on 18th September 2020 and the payment was credited to ABC’s account on 20th Oct. 2020 although the entry in the books was made on 19th Sept. 2020 when the cheque was received. The time of supply, in this case, will be :

(A) 18th September 2020

(B) 9th September 2020

(C) 15th September 2020

(D) 20th October 2020 [Dec. 2019]

Answer:

(B) 9th September 2020

Question 68.

What will the value of the supply of the mobile phone sold by Micromax to Anil Kumar for ₹ 35,000 in exchange for his old mobile phone? The sale price of the new mobile phone without exchange is ₹ 40,000. The value of the old mobile phone so exchanged was ₹ 7,000.

(A) ₹35,000

(B) ₹ 40,000

(C) ₹ 42,000

(D) ₹ 33,000 [Dec. 2019]

Answer:

(B) ₹ 40,000

Question 69.

Mishra Enterprises had made supplies of ₹ 5,50,000 to Bee Kay Enterprises. Municipal Authorities of Jaipur on such supplies levied the tax @ 10% of ₹ 55,000. CGST and SGST chargeable on the supply was of ₹ 66,000. Packing charges not included in the price of ₹ 5,50,000 amounted to ₹ 15,000. A subsidy of ₹ 25,000 was received from an NGO on the sale of such goods and the price of ₹ 5,50,000 is after taking into account the amount of subsidy so received. The discount offered is @ 1% which was mentioned on the invoice. The value of supply, in this case, shall be……..

(A) ₹ 6,45,000

(B) ₹ 6,39,500

(C) ₹ 6,20,000

(D) ₹ 6,38,550 [Dec. 2019]

Answer:

(B) ₹ 6,39,500

Question 70.

Babur Automobiles of Jaipur has supplied the goods of ₹ 2,66,090 to Goel Automobiles of Ajmer in the month of March 2020. The supply so made was inclusive of tax charged as CGST and SGST which on the products so sold as per rates prescribed under CGST Act, 2017 is @ 1896. The value of supply as per Rule 35 of the CGST Rules, 2017 of such supply shall be ……..

(A) ₹ 2,66,090

(B) ₹ 2,25,000

(C) ₹ 3,13,986

(D) ₹ 2,25,500 [Dec. 2019]

Answer:

(D) ₹ 2,25,500

Question 71.

Mani gave goods for processing by Murali. While Mani is registered in GST, Murali is not registered in GST. Both are in Chennai. The processing is liable for GST @ 596. The goods were received after processing on 11.7.2018. Entries in the books were made by Mr Mani on 12.7.2018. The delivery challan was also received on 11.7.2018. Job work charges amount to ₹ 1,00,000 (without GST). When and how much is the GST liability? And who must pay?

(A) 11.7.2018; ₹ 5,000 and Murali must pay

(B) 12.7.2018; ₹ 1,050; and Murali must pay

(C) 11.7.2018; ₹ 5,000 and Mani must pay

(D) 12.7.2018; ₹ 2,500 and Mani must pay [Dec. 2017]

Answer:

(C) 11.7.2018; ₹ 5,000 and Mani must pay

Question 72.

Which of the following expenditure is eligible for an input tax credit?

(A) Membership fee of a club

(B) Home travel concession extended to employees

(C) Goods given as free gifts

(D) Caterer using the service another caterer [Dec. 2017]

Answer:

(D) Caterer using the service another caterer

Question 73.

Who must perform the function of Tax Collection at Source (TCS) under GST?

(A) E-commerce operator

(B) Transport operator

(C) Job workers

(D) Input service distributor [Dec. 2017]

Answer:

(A) E-commerce operator

Question 74.

Section 2(62) of the CGST Act, 2017 specifies input tax in relation to a registered person to mean Central Tax, State Tax, Integrated Tax or Union Territory Tax charged on any supply of goods or services or both and also include:

(i) Integrated goods and services tax charged on import of goods.

(ii) Tax under the provisions of section 9(3) and 9(4)

(iii) Tax paid under composition levy

(iv) Tax under Union Territory Goods and Services Tax Act.

The correct answer is –

(A) All the above four

(B) (i), (ii) and (iv)

(C) (i) and (ii)

(D) (ii), (iii) and (iv) [June 2018]

Answer:

(B) (i), (ii) and (iv)

Question 75.

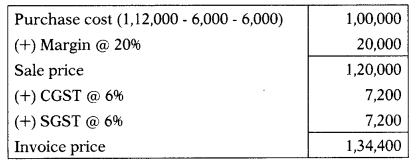

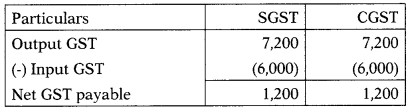

Mr Pankaj of Delhi supplied goods to Mr Krishna of Delhi for ₹ 1 lakh, on which total GST was charged @ 12%. Mr Krishna, after purchasing of goods, added a 20% margin of profit (on cost) and sold the entire goods to Mr Ravi of Delhi. The total amount of tax payable after claiming input tax on such transaction by Mr Krishna is:

(A) ₹ 12,000

(B) ₹ 14,400

(C) ₹ 2,400

(D) None of the above [June 2018]

Hint:

Calculation of Net GST payable by Mr. Krishna:

Total GST = 1,200 + 1,200 = 2,400

Short cut method to calculate GST:

GST is payable on value addition. Value addition made by the trader is ‘profit’ ie. 120,000.

SGST = 20,000 × 6% = 1,200

CGST = 20,000 × 696 = 1,200

Answer:

(C) ₹ 2,400

Question 76.

Patel of Surat, Gujarat supplied goods to Patil of Mumbai, Maharashtra for ₹ 1,20,000 (excluding GST) but after adding 30% profit margin (on cost). Patil is also a taxable person. IGST rate is 18%. The amount of input tax credit that can be availed and the maximum time limit for availing such input tax credit by Patil of Mumbai, Maharashtra as per CGST Act, 2017 is……..

(A) ₹ 28,080 and within 6 months from the date of issue of tax invoice

(B) ₹ 7,020 and within next quarter from the date of issue of tax invoice

(C) ₹ 21,600 and within 1 year from the date of issue of tax invoice

(D) None of the above [Dec. 2018]

Answer:

(C) ₹ 21,600 and within 1 year from the date of issue of tax invoice

Question 77.

The stipulated time limit within which inputs and capital goods sent to a job working in job work, shall be brought back and beyond that period it will be treated as supply and tax is payable by the principal as per CGST Act, 2017 is……..

(A) 6 months and 1 year in case of inputs and capital goods respectively

(B) 1 year and 2 years in case of inputs and capital goods respectively

(C) 1 year and 3 years in case of inputs and capital goods respectively

(D) None of the above [Dec. 2018]

Answer:

(C) 1 year and 3 years in case of inputs and capital goods respectively

Question 78.

The credit of tax paid on input services used by more than one supplier be distributed as per provisions of the CGST Act, 2017 ……..

(A) Only to one supplier

(B) Equally among all the suppliers

(C) Among the suppliers who used such input service on a pro-rata basis of turnover in such state

(D) Cannot be distributed [Dec. 2018]

Answer:

(C) Among the suppliers who used such input service on a pro-rata basis of turnover in such state

Question 79.

Section 51 of the CGST Act, 2017 mandates deduction of tax at source (TDS) at a specified percentage by the Government or Local Authorities from the payments made or credited to the supplier where the value of supply under a contract exceeds the specified limit. State the specified percentage of TDS and the threshold limit of taxable goods or services or both under the contract ……..

(A) 0.50% & ₹ 1,00,000

(B) 0.75% & ₹ 1,50,000

(C) 2% ₹ 5,00,000

(D) 1% & ₹ 2,50,000 [Dec. 2018]

Answer:

(D) 1% & ₹ 2,50,000

Question 80.

The available balance of input tax credit in the electronic ledger of the registered person on account of Union territory tax shall be utilized as per section 9 of UTGST Act, 2017……..

(A) First towards payment of central tax

(B) First towards payment of integrated tax

(C) First towards payment of Union territory tax and the amount remaining, if any towards payment of integrated tax

(D) None of the above [Dec. 2018]

Answer:

(C) First towards payment of Union territory tax and the amount remaining, if any towards payment of integrated tax

Question 81.

When the goods are sent to the job worker input tax credit will be reversed if the goods are not received back by the principal after completion of job work within……..of being sent out.

(A) 3 months

(B) 6 months

(C) 1 year

(D) 3 years [June 2019]

Answer:

(C) 1 year

Question 82.

Input Service Distributor (ISD) may distribute the CGST credit within the State as:

(A) UTGST

(B) CGST

(C) SGST

(D) Any of the above [June 2019]

Answer:

(B) CGST

Question 83.

The registered person, in case of the supply of capital goods or of plant and machinery on which input tax credit (ITC) has been availed/taken shall pay an amount equal to the Input Tax Credit on such capital goods or plant and machinery which is being arrived at by reducing the Input-tax at percentage points for every quarter or part thereof from the date of issue of invoice of such goods or the tax on the transaction value of such capital goods, whichever is higher.

(A) 3

(B) 5

(C) 6

(D) 2 [June 2019]

Answer:

(B) 5

Question 84.

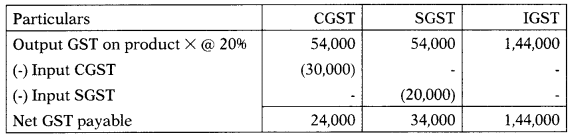

Radhey & Company registered supplier paying GST under the regular scheme had made Interstate Taxable Supply of ₹ 8,00,000 and Intra-State Taxable Supply of ₹ 6,00,000 chargeable under CGST, SGST, and IGST at the rates of 9%, 9% and 18% respectively. He is having the available amount of ITC under CGST of ₹ 30,000 and under SGST of ₹ 20,000. Supplies made are exclusive of taxes. Amount of the total tax payable as CGST, SGST and IGST after availing the amount of ITC by Radhey & Company on such supplies shall be of……..

(A) ₹ 2,30,000

(B) ₹ 2,00,000

(C) ₹ 2,22,000

(D) ₹ 2,26,000 [June 2019]

Note: This MCQ is wrongly designed. For further clarification please see hints.

Hint:

24,000 + 34,000 + 1,44,000 = 2,02,000. None of the given option contains figure of 2,02,000 and hence MCQ itself is wrong.

Answer:

Question 85.

To avail input tax credit, which of the following factors is not relevant:

(A) Tax invoice

(B) Furnishing of return by the supplier

(C) Receipt of goods and services

(D) Payment by the buyer for supply received [June 2019]

Answer:

(D) Payment by the buyer for supply received

Question 86.

The input tax credit cannot be availed after the expiry of……..from the date of issue of tax invoice of supply.

(A) 6 months

(B) 3 months

(C) 1 year

(D) 2 years [June 2019]

Answer:

(C) 1 year

Question 87.

Section 2(62) of CGST Act, 2017 specify input tax in relation to a registered person, which means the Central Tax, State Tax, Integrated Tax or Union Territory Tax charged on any supply of goods or services or both made to him but does not include :

(A) Integrated goods and services tax charged on import of goods

(B) Tax under the provisions of section 9(3) and 9(4)

(C) Tax paid under composition levy

(D) Tax under Union Territory Goods & Services Tax Act [Dec. 2019]

Answer:

(C) Tax paid under composition levy

Question 88.

A registered taxable person is eli-gible to obtain Input Tax Credit (ITC) as per section 16 of the CGST Act, on fulfilling of certain conditions which consist of that such person should :

(i) Be in possession of tax invoice

(ii) Have received the goods

(iii) Supplier have not paid the tax charged

(iv) Supplier have furnished the re-turn u/s 39

(A) (i), (ii) & (iv)

(B) (i), (iii) & (iv)

(C) (i), (ii) & (iii)

(D) (i), (ii), (iii) & (iv) [Dec. 2019]

Answer:

(A) (i), (ii) & (iv)

Question 89.

Availability of Input Tax Credit in special cases as per section 18( 1) of the CGST Act, 2017 is available where a registered person is having a tax invoice relating to such supply issued not after the expiry of……..from the date of issue of tax invoice.

(A) 3 months

(B) 6 months

(C) 1 year

(D) 9 months [Dec. 2019]

Answer:

(C) 1 year

Question 90.

ABC Ltd. is engaged in the manufacture of electrical appliances supply following details relating to GST paid on various items by them:

| Item | GST Paid (₹) |

| Electrical Transformers utilized in the manufacturing process | 1,20,000 |

| Trucks used for transporting Materials | 80,000 |

| Cakes and Pastries for consumption within the factory | 12,500 |

The amount of Input Tax Credit (ITC) available to ABC Ltd. shall be ……..

(A) ₹ 2,00,000

(B) ₹ 2,12,500

(C) ₹ 52,500

(D) ₹ 1,00,000 [Dec. 2019]

Answer:

(A) ₹ 2,00,000

Question 91.

The Input Tax Credit (ITC) is being credited to……..of a person which may be used by the person to pay his output tax liability.

(A) Electronic Cash Ledger

(B) Electronic Credit Ledger

(C) Electronic Tax Ledger

(D) Electronic Tax Credit Ledger [Dec. 2019]

Answer:

(B) Electronic Credit Ledger

Question 92.

Zebra, a supplier of goods located at Jaipur paid GST under regular scheme both inter-State and intra-State. The supplies are chargeable to GST @ 18%. The outward taxable supply in the month of February 2020 made by him of intra-State ₹ 12,00,000 and inter-State ₹ 5,00,000. The total tax liability under GST Act on both these supplies shall be…….. if he is having the Opening Balance of ITC available of ₹ 45,000 each under CGST and SGST and of ₹ 55,000 under IGST.

(A) ₹ 3,06,000

(B) ₹ 2,16,000

(C) ₹ 1,61,000

(D) ₹ 1,71,000 [Dec. 2019]

Answer:

(A) ₹ 3,06,000 / (C) ₹ 1,61,000

Question 93.

Integrated tax credit as per section 9 A of UTGST Act, 2017 on account of Union Territory Tax shall be utilized towards payment of ……..only after the input tax credit available on account of …….. has first been utilized towards such payment.

(A) Integrated Tax and Union Terri-tory Tax, Integrated Tax

(B) Union Territory Tax, Input Tax

(C) Integrated Tax or Union Territory Tax, Union Territory Tax

(D) Integrated Tax or Union Territory Tax, Integrated Tax [Dec. 2019]

Answer:

(D) Integrated Tax or Union Territory Tax, Integrated Tax

Question 94.

The threshold limit of turnover for registration under GST in the case of a person earning on the business of supplying goods in Gujarat is:

(A) ₹ 10 lakh

(B) ₹ 40 lakh

(C) ₹ 30 lakh

(D) ₹ 50 lakh [Dec. 2017]

Answer:

(B) ₹ 40 lakh

Question 95.

XYZ Co. Ltd. registered under GST has to maintain accounts and records until the expiry of……..months from the due date furnishing the annual return for the year.

(A) 36 months

(B) 84 months

(C) 72 months

(D) 60 months [Dec. 2017]

Answer:

(C) 72 months

Question 96.

Debit note is issued by the supplier of goods when:

(A) Tax charged in the invoice is excessive

(B) When the goods are returned by the recipient

(C) Tax charged is less than the tax payable

(D) When the goods supplied are deficient [Dec. 2017]

Answer:

(C) Tax charged is less than the tax payable

Question 97.

Madhan is located in Chennai. He has a branch office in Cochin. He wants to transfer goods. His turnover was always below ₹ 10 lakh. His registration under GST is:

(A) Voluntary

(B) Compulsory

(C) Compulsory only when turnover exceeds ₹ 40 lakh

(D) As and when deemed by the Revenue [Dec. 2017]

Answer:

(B) Compulsory

Question 98.

A taxable person whose registration has been cancelled or surrendered must file the final return of GST within:

(A) 6 months of the cancellation

(B) 6 months after the end of the financial year

(C) 3 months after the end of the financial year

(D) 3 months after the date of cancellation [Dec. 2017]

Answer:

(D) 3 months after the date of cancellation

Question 99.

When a person liable to pay tax under GST claims excess input tax credit or excess reduction in output tax liability, he shall pay interest not exceeding:

(A) 12%

(B) 15%

(C) 24%

(D) 21% [Dec. 2017]

Answer:

(C) 24%

Question 100.

When a special audit is directed under GST with the prior approval of the Commissioner the audit report signed and certified must be submitted within ……..days.

(A) 15

(B) 45

(C) 90

(D) 150 [Dec. 2017]

Answer:

(C) 90

Question 101.

When a person evades GST or avails of input tax credit exceeding ₹ 500 lakhs he is liable for the following punishment:

(A) Imprisonment for 5 years and with fine

(B) Imprisonment for 3 years and with fine

(C) Imprisonment for 3 years

(D) Imprisonment for 5 years [Dec. 2017]

Answer:

(A) Imprisonment for 5 years and with fine

Question 102.

Online information and database access or retrieval service do include the following:

(A) Online gaming

(B) Cloud services

(C) Advertising on the internet

(D) Physical delivery of goods [Dec. 2017]

Note: This MCQ is wrong. For further clarification please see hints.

Hint:

Online information and database access or retrieval service includes all the four option given in the MCQ and hence MCQ itself is wrong.

Answer:

Question 103.

XYZ Limited engaged in various activities is having a garment showroom in Allahabad and a leather processing unit in Kanpur. Both these units of XYZ Limited under Section 2 of the CGST Act, 2017 shall be treated as:

(A) Business Partners

(B) Business units

(C) Show-room and Factory

(D) Business Verticals [June 2018]

Note: Definition of ‘Business Verticals’ is deleted and hence this MCQ is not relevant for Dec. 2018 and onward exam.

Answer:

(D) Business Verticals

Question 104.

Raj & Co., applied for voluntary registration under CGST Act, 2017 on 5th July 2018 and the registration was granted on 15th July 2018. Raj & Co. was having the stock available against the invoices for a period of 3 months old. Raj & Co. shall be eligible for an input tax credit on such stock as held as on:

(A) 30th June 2017

(B) 5th July 2017

(C) 15th July 2017

(D) 14th July 2017 [June 2018]

Answer:

(D) 14th July 2017

Question 105.

A registered person as per Section 35 of the GST Act, 2017 is required to maintain proper accounts and records, and keep at his registered, principal place of business. Following are the records specified under this section are to be maintained by the registered person:

(i) Production or manufacturing of goods

(ii) Inward and Outward supply of goods or services or both

(iii) Stock of goods

(iv) Input credit availed

(v) Output tax payable and paid

(vi) Such other particulars as may be prescribed

Select correct answer from the options given below:

(A) (i), (ii) and (iv)

(B) All the six as given in above

(C) (i), (ii), (iii) and (v)

(D) (i), (ii), (iv), (v) and (vi) [June 2018]

Answer:

(B) All the six as given in above

Question 106.

Time duration as per section 36 of the CGST Act, 2017 for retention of accounts and records under GST is until the expiry of……..months from the due date of furnishing of annual return for the year pertaining to such accounts and record.

(A) 72

(B) 84

(C) 60

(D) None of the above [June 2018]

Answer:

(A) 72

Question 107.

A casual taxable person or a non-resident taxable person shall be required to apply for registration at least ……..days prior to the commencement of business.

(A) 30

(B) 5

(C) 15

(D) 7 [June 2018]

Answer:

(B) 5

Question 108.

A non-resident taxable person is required to provide details in the return for a non-resident foreign taxable person in the Return Form No.:

(A) GSTR-3

(B) GSTR-5

(C) GSTR-8

(D) None of the above [June 2018]

Answer:

(B) GSTR-5

Question 109.

Input Service Distributor shall file the return in GSTR-6 for the input service distributed by:

(A) 10th of the next month

(B) 18th of the next month

(C) 13th of the next month

(D) 20th of the next month [June 2010]

Answer:

(C) 13th of the next month

Question 110.

Section 56 of the CGST Act, 2017 specifies that if any tax ordered to be refunded after the order of an Appellate Authority is not refunded within 60 days from the date of the application filed consequent to such order, interest as such rate not exceeding……..shall be payable in respect of such refund.

(A) 90%

(B) 6%

(C) 12%

(D) 18% [June 2018]

Note: MCQ is wrong. For further clarification please see hints.

Hint:

The interest rate is 996 for delayed refunds in case of an order of adjudicating authority or Appellate Authority or Appellate Tribunal or Court. Option (A) needs to be corrected. Hence, the question is wrong.

Answer:

Question 111.

A taxable person who makes an excess claim of input tax credit or excess reduction in output tax liability shall pay interest at such rate not exceeding:

(A) 18%

(B) 24%

(C) 20%

(D) 21% [June 2018]

Answer:

(B) 24%

Question 112.

A proper officer not below the rank of Joint Commissioner or an officer authorized by such proper Officer can make an order of seizure in Form:

(A) GST INS-01

(B) GST INS-02

(C) GST INS-03

(D) None of the above [June 2018]

Answer:

(B) GST INS-02

Question 113.

Goods seized by a proper Officer or an Authorized Officer can be released on a provisional basis upon execution of a bond for the value of goods and furnishing of security. The bond so executed will be in Form:

(A) GST INS-06

(B) GST INS Bond-03

(C) GST INS-01

(D) GST INS-4 [June 2018]

Answer:

(D) GST INS-4

Question 114.

A taxable person whose registration has been surrendered or cancelled is required to file the return within 3 months of the date of cancellation or date of cancellation order whichever is later in Form Number……..

(A) GSTR-13

(B) GSTR-10

(C) GSTR-7

(D) GSTR-9 [Dec. 2018]

Answer:

(B) GSTR-10

Question 115.

The time duration for retention of accounts and records under Goods and Services Tax (GST) as per section 36 of the CGST Act, 2017 is:

(A) Untilexpiryof36monthsfromthe due date of furnishing of annual return for the year pertaining to such accounts and records

(B) Until the expiry of 48 months from the due date of furnishing of annual return for the year pertaining to such accounts and records

(C) Until the expiry of 60 months from the due date of furnishing of annual return for the year pertaining to such accounts and records

(D) Untilexpiryof72monthsfromthe due date of furnishing of annual return for the year pertaining to such accounts and records [Dec. 2018]

Answer:

(D) Untilexpiryof72monthsfromthe due date of furnishing of annual return for the year pertaining to such accounts and records

Question 116.

Find out from the following, who are the persons not liable for registration under section 23 of the CGST Act, 2017:

(A) Non-resident making taxable supply

(B) Person supplying exempted goods and services or goods or services which are not liable for tax under GST

(C) An agriculturist, to the extent of supply of produce out of cultivation of land

(D) Both (B) and (C) [Dec. 2018]

Answer:

(D) Both (B) and (C)

Question 117.

The maximum validity period of the certificate of registration issued to a casual and non-resident taxable person as per Section 27 of the CGST Act, 2017 is:

(A) 90 days from the effective date of registration

(B) 180 days from the effective date of registration

(C) 365 days from the effective date of registration

(D) None of the above [Dec. 2018]

Answer:

(A) 90 days from the effective date of registration

Question 118.

The quantum of punishment “where any person convicted of an offence under section 132(2) of the CGST Act, 2017 and again convicted of an offence under this section” is:

(A) Imprisonment for a term which may extend to five years and with a fine.

(B) Imprisonment for a term which may extend to four years and with a fine.

(C) Imprisonment for a term which may extend to three years and with a fine.

(D) Imprisonment for a term which may extend to two years and with a fine. [Dec. 2018]

Answer:

(A) Imprisonment for a term which may extend to five years and with a fine.

Question 119.

The validity period specified for an e-way bill or a consolidated e-way bill under E-way rules as specified in rule 138 for ……..

(A) Distance up to 1 km – half day

(B) Distance up to 10 km – 1 day

(C) For every 100 km or part thereof thereafter—one additional day

(D) Both (B) and (C) above [Dec. 2018]

Answer:

(C) For every 100 km or part thereof thereafter—one additional day

Question 120.

Grounds which leads a commissioner to order for a special audit in case of a registered person by a communication in writing for getting his records including books of account examined and audited and by a person who……..

(A) Supplies any goods or service or both without the issue of any invoice by Cost Accountant or Company Secretary.

(B) Avail input tax credit with a bogus invoice by Company Secretary or Cost Accountant.

(C) Has not correctly declared the value or the credit availed is not within the normal limits, by a Chartered Accountant or a Cost Accountant.

(D) None of the above [Dec. 2018]

Answer:

(C) Has not correctly declared the value or the credit availed is not within the normal limits, by a Chartered Accountant or a Cost Accountant.

Question 121.

State the default committed on the part of a registered person which attracts an action by the proper officer to make best judgment assessment and also state the time limit within which such assessment is to be made:

(A) Furnish inaccurate data in return and within 2 years from the due date of annual return of the period to which the tax not paid relates

(B) Fails to file a general return under section 39 and within 5 years from the due date of annual return of the period to which tax not paid relates

(C) Fails to file a final return under section 45 even after the notice under section 46 and within 5 years from the due date of annual return of the period to which tax not paid relates

(D) Both (B) and (C) above [Dec. 2018]

Answer:

(D) Both (B) and (C) above

Question 122.

State which shall be taken as the effective date of registration as per CGST Act, 2017 where the aggregate turnover of Madhur Company engaged in the supply of taxable services in the state of Rajasthan exceeded ₹ 40 lakh during the year on 25th September 2018, the application for registration under GST was filed on 19th October 2018 and the

registration certificate was granted on 29th October 2018 by the authority:

(A) 25-9-2017

(B) 19-10-2017

(C) 24-10-2017

(D) 29-10-2017 [Dec. 2018]

Answer:

(A) 25-9-2017

Question 123.

Consumer Welfare Fund has been constituted by the Government of India and as per section 57 of the CGST Act, 2017, the following amounts will be credited to this fund:

(i) Amount referred to in section 54(5)

(it) Refund of tax in pursuance of section 77

(iii) Income from investment of the fund amount

(iv) Refund of unutilized input tax credit

Select correct answer from the options given below:

(A) (ii) and (iii)

(B) (i) and (iii)

(C) (i), (it) and (iv)

(D) All the four above [Dec. 2018]

Answer:

(B) (i) and (iii)

Question 124.

The assessee is required mandatorily to mention the Harmonized System Nomenclature (HSN) or Service Accounting Code (SAC) on the tax invoice of the product or service supplied under GST:

(A) Having a turnover of ₹ 2 Crore and above

(B) Having a turnover of ₹ 3 Crore and above

(C) Having a turnover of ₹ 4 Crore and above

(D) Having a turnover of ₹ 5 Crore and above [Dec. 2018]

Answer:

(D) Having a turnover of ₹ 5 Crore and above

Question 125.

A supplier registered under the composition scheme must file the return within……..

(A) 7 days after the end of every month

(B) 20 days after the end of every month

(C) 30 days from the end of F.Y.

(D) 20 days after the end of every quarter [June 2019]

Hint:

Now Amended → Ans.: 30th April following the end of F.Y.

Answer:

(D) 20 days after the end of every quarter

Question 126.

Mr. Pandit is engaged in the trading of gifts articles and his annual turn-over will exceed ₹ 200 lakh. The due date for filing the annual return would be……..of the following financial year.

(A) 31st October

(B) 31st December

(C) 30th September

(D) 30th November [June 2019]

Answer:

(B) 31st December

Question 127.

When a movement of goods is of more than in value, the e-way bill must accompany the goods.

(A) ₹ 20,000

(B) ₹ 50,000

(C) ₹ 1,00,000

(D) ₹ 2,00,000 [June 2019]

Answer:

(B) ₹ 50,000

Question 128.

When the goods are dispatched to a destination which is 280 km from the place of dispatch, the e-way bill generated is valid for:

(A) 1 day

(B) 3 days

(C) 2 days

(D) 5 days [June 2019]

Answer:

(B) 3 days

Question 129.

The proper officer may cancel the GST registration, if any registered person other than a person paying tax under section 10 of CGST Act, 2017 has not furnished the returns for a continuous period of:

(A) 12 months

(B) 9 months

(C) 6 months

(D) 3 months [June 2019]

Answer:

(C) 6 months

Question 130.

Goods and Services to be supplied chargeable under the CGST Act, 2017 have been classified under different specified Code Number/s which are known as Harmonized System Nomenclature (HSN) Codes. These HSN codes have been evolved and developed by:

(A) GST Council

(B) HSN/SAC Codes Committee

(C) Customs Cooperation Council of Belgium

(D) None of the above [June 2019]

Hint:

Though the correct answer is ‘Custom Co-operation Council of Belgium’ [option (c)] now it is known as ‘World Custom Organizations’.

Answer:

(C) Customs Cooperation Council of Belgium

Question 131.

Section 24 of the CGST Act, 2017 lists categories of persons who are required to take registration even if they are not covered under section 22 of the Act. Find out from the following categories of persons who are being required to take registration as per section 24 of the CGST Act, 2017:

(i) Casual taxable person

(ii) Non-resident taxable person

(iii) Recipient of service under reverse charge

(iv) Inter-state supplier of goods

(v) Input service distributor

Select the correct answer from the options given below:

(A) (i), (iii) and (v)

(B) (i), (ii), (iv) and (v)

(C) (i), (ii) and (v)

(D) All the 5 in (i) to (v) [June 2019]

Answer:

(D) All the 5 in (i) to (v)

Question 132.

The certificate of registration issued to a casual taxable person or to a non-resident taxable person shall be valid for the period specified in the application for registration or for……..days from the effective date of registration whichever is earlier. The validity of the registration period on a request made by such taxable person may be further extended by the Proper Officer for a period not exceeding……..days.

(A) 60,45

(B) 90,60

(C) 90,90

(D) 90,30 [June 2019]

Answer:

(B) 90,60

Question 133.

The Proper Officer may make the best judgment assessment of the registered person where he fails to file a general return under section 39 or final return under section 45 even after notice is given under section 46 of the CGST Act, 2017 within……..years from the due date of annual return of the period to which the tax not paid relates.

(A) 5

(B) 3

(C) 2

(D) 1 [June 2019]

Answer:

(A) 5

Question 134.

Refund order should be made by the Proper Officer within……..days from the date of receipt of application which is complete in all respects and where the Proper Officer is satisfied with the amount so refundable is payable to the applicant, he shall make an order in Form……..which shall be credited to the account of the applicant.

(A) 45, GST-RFD-5

(B) 90, GST-RFD-4

(C) 60, GST-RFD-6

(D) 90, GST-RFD-6 [June 2019]

Answer:

(C) 60, GST-RFD-6

Question 135.

Which of the following is not liable to be registered as per provisions of the CGST Act, 2017:

(A) Person supplying exempted goods

(B) Non-resident making taxable supplies

(C) Deductor of tax at source

(D) Supplier on behalf of another person [June 2019]

Answer:

(A) Person supplying exempted goods

Question 136.

The registration under GST is……..based on a State-specific number and is known as GST Identification Number (GSTIN) which is a ……..digit number under the CGST Act, 2017.

(A) TAN, 12

(B) PAN, 15

(C) TAN, 15

(D) PAN, 12 [Dec. 2019]

Answer:

(B) PAN, 15

Question 137.

Every supplier as per section 22 of the CGST Act, 2017 shall be liable to be registered under this Act in the State where he makes taxable supplies of goods or services or both if his aggregate turnover in the Financial Year exceeds……..

(A) ₹ 20,00,000

(B) ₹ 40,00,000

(C) ₹ 30,00,000

(D) ₹ 60,00,000 [Dec. 2019]

Answer:

(A) ₹ 20,00,000

Question 138.

Section 22 of the CGST Act, 2017 refers to the expression “Special Category States” and there are total……..special category States as per sub-clause (2) of Clause (4) of Article 279A of the Constitution. However, special category States for the purpose of registration under the CGST Act, 2017 out of which are……..

(A) 7, 2

(B) 7,4

(C) 11,4

(D) 11,7 [Dec.2019]

Answer:

(C) 11,4

Question 139.

Section 2(77) of CGST Act, 2017 defines a “non-resident taxable person” who has a business outside India, comes to India for a temporary business purpose. Such person would need to register as a non-resident taxable person in the State and he will be granted registration for a maximum period of……..under the Act.

(A) 90 days

(B) 45 days

(C) 60 days

(D) 30 days [Dec. 2019]

Answer:

(A) 90 days

Question 140.

The application for registration filed as per Rule 8, prior to the grant of registration be examined and if found to be deficient, a notice to the applicant in Form ……..be issued within a period of ……..days from the date of submission of application.

(A) GST REG-03, 7

(B) GST REG-03, 3

(C) GST REG-05, 7

(D) GST REG-01, 3 [Dec. 2019]

Answer:

(B) GST REG-03, 3

Question 141.

Any person required to deduct tax or required to collect tax at source under GST as per Rule 12 shall electronically submit an application for the grant of registration in Form……..and after verification of the application, the proper officer may grant the registration and issue the certificate of registration in Form……..

(A) GST REG-5, GST REG-4

(B) GST REG-8, GST REG-7

(C) GST REG-7, GST REG-6

(D) GST REG-10, GST REG-9 [Dec. 2019]

Answer:

(C) GST REG-7, GST REG-6

Question 142.

The proper officer, it has reasons to believe that the registration of a person is liable to be cancelled under section 29 of CGST Act, then he shall issue a notice to such person in Form ……..and after considering the reply furnished by such person shall pass on the order to drop proceedings in Form ……..

(A) GST REG-16, GST REG-17

(B) GST REG-17, GST REG-18

(C) GST REG-17, GST REG-19

(D) GST REG-17, GST REG-20 [Dec. 2019]

Answer:

(D) GST REG-17, GST REG-20

Question 143.

Mundra Manufacturing Company of Jaipur on the order placed by Dheer- aj Enterprises of Noida for the supply of goods despatched the goods from the factory located at Jaipur on 1 st March 2021. The tax invoice for such supply by Mundra Manufacturing Company must be issued on Dheeraj Enterprises on or before……..

(A) 30th March 2021

(B) 1st March 2021

(C) 15th March 2021

(D) 7th March 2021 [Dec. 2019]

Answer:

(B) 1st March 2021

Question 144.

A draft template of invoice to be raised by a registered person liable to pay tax under Reverse Charge Mechanism (RCM) under GST is known as……..

(A) GSTINV-1

(B) GSTINV-2

(C) GSTINV-3

(D) GSTINV-4

Answer:

Question 145.

Tax invoice referred to in Rule 46 of CGST Rules, 2017, in case of taxable supply of services shall be issued under Rule 47 of CGST Rules, 2017, within a period of……..from the date of supply of service.

(A) 7 days

(B) 15 days

(C) 30 days

(D) on the same day [Dec. 2019]

Answer:

(C) 30 days

Question 146.

Section 35(5) of the Central Goods & Services Tax (CGST) Act, 2017 mandates that every registered person must

get his accounts audited by a……..if his aggregated turnover during a financial year exceeds ₹……..

(A) Chartered Accountant or Company Secretary, 2 Crore

(B) Chartered Accountant or Cost Accountant, 2 Crore

(C) Chartered Accountant or Company Secretary or Cost Accountant, 3 Crore

(D) Chartered Accountant, 3 Crore [Dec. 2019]

Answer:

(B) Chartered Accountant or Cost Accountant, 2 Crore

Question 147.

Every registered person as per section 68 of CGST Act, 2017 who causes movement of goods of consignment value greater than……..whether for supply or otherwise or due to the inward supply from an unregistered person, shall before the commencement of such movement, furnish the necessary information electronically on the portal in the prescribed form.

(A) ₹ 50,000

(B) ₹ 25,000

(C) ₹ 1,00,000

(D) ₹ 5,000

Answer:

(A) ₹ 50,000

Question 148.

The Electronic Liability Register specified under section 49(7) of the CGST Act, 2017 as per Rule 85 of the CGST Rules, 2017 shall be maintained in Form……..for each person liable to pay tax, penalty, late fees or any other amounts payable by him on the common portal which shall be debited to the said register.

(A) GST PMT-10

(B) GST PMT-01

(C) GST PMT-05

(D) GST PMT-02 [Dec. 2019]

Answer:

(B) GST PMT-01

Question 149.

Section 56 of the CGST Act, 2017 states that claim of refund arising from an order passed by an adjudicating authority or Appellate Authority or an Appellate Tribunal or Court which is not being refunded within ……..days from the date of receipt of an application filed consequent to such order, interest at such rate not exceeding……..per annum, shall be payable in respect of such refund.

(A) 30 days, 6%

(B) 30 days, 9%

(C) 60 days, 9%

(D) 60 days, 6% [Dec. 2019]

Answer:

(B) 30 days, 9%

Question 150.

The advance ruling means a decision provided to an applicant on the matter or a question specify u/ss 97(2) and 100(1) of the CGST Act, in relation to the supply of goods or services or both being undertaken by the applicant.

(A) Commissioner (Appeals)

(B) Authority or Appellate Authority

(C) Appellate Tribunal

(D) Adjudicating Authority

Answer:

(A) Commissioner (Appeals)

Question 150A. Section 22 of the UTGST Act, 2017 lays down the power of the Central Government to make rules on the recommendation of the Council. Any rule made under sub-section (1) of section 22 may provide that a contravention thereof shall be liable to a maximum penalty of……..

(A) ₹ 10,000

(B) ₹ 1,000

(C) ₹ 5,000

(D) ₹ 2,500 [Dec. 2019]

Answer:

(B) ₹ 1,000

Question 151.

For the purpose of calculating the compensation payable to the States under the Goods and Services Tax (Compensation to States) Act, 2017 the base year for reckoning the Revenue is:

(A) 31.3.2014

(B) 31.3.2015

(C) 31.3.2016

(D) 31.3.2017 [Dec. 2017]

Answer:

(C) 31.3.2016

Question 152.

Export of service does not include:

(A) The supplier of service located outside India

(B) The recipient of service located outside India

(C) The place of supply of service is outside India

(D) The supplier of service is located in India [Dec. 2017]

Answer:

(A) The supplier of service located outside India

Question 153.

Inter-State supply of service is primarily covered in……..of the CGST Act, 2017.

(A) Section 12

(B) Section 14

(C) Section 8

(D) Section 18 [June 2018]

Note: MCQ is wrong. For further clarification please see hints.

Answer:

Question 154.

Tax on inter-State supplies, import into India, supplies made outside India and supplies made in SEZ shall be charged to:

(A) CGST and SGST

(B) CGST and UTGST

(C) CGST and IGST

(D) IGST [June 2018]

Answer:

(D) IGST

Question 155.

The base Financial Year for the purpose of calculating compensation amount payable to the State as per Goods & Services Tax (Compensation to States) Act, 2017 shall be taken:

(A) 2014-2015

(B) 2016-2017

(C) 2012-2013

(D) 2015-2016 [June 2018]

Answer:

(D) 2015-2016

Question 156.

The proceeds of the cess and such other amounts as being recommended by the GST Council shall be credited to a non-lapsable fund known as:

(A) Goods and Services Tax Compensation Fund

(B) Goods and Services Tax Cess Fund

(C) Goods and Services Tax Welfare Fund

(D) None of the above [June 2018]

Answer:

(A) Goods and Services Tax Compensation Fund

Question 157.

State the “Base Year” and “Projected Growth Rate” for the purpose of calculating the compensation amount payable by the Centre on account of revenue loss to the States as specified under the Goods & Services Tax (Compensation to States) Act, 2017:

(A) Financial Year 2014-2015, @ 14%

(B) Financial Year 2015-2016, @ 14%

(C) Financial Year 2016-2017, @ 14%

(D) Financial Year 2017-2018, @ 14% [Dec. 2018]

Answer:

(B) Financial Year 2015-2016, @ 14%

Question 158.

The limit of nautical miles from the baseline of sea coast into the sea in order to determine the supply in territorial water as per Section 9 of the IGST Act, 2017 is:

(A) Up to 7 nautical miles

(B) Up to 10 nautical miles

(C) Up to 12 nautical miles

(D) Up to 20 nautical miles [Dec. 2018]

Answer:

(C) Up to 12 nautical miles

Question 159.

Which of the following called the Union territory as being covered under the Union Territory Goods and Services Tax Act, (UTGST), 2017?

(A) Andaman and Nicobar Island

(B) Puducherry

(C) Delhi

(D) None of the above [Dec. 2018]

Answer:

(A) Andaman and Nicobar Island

Question 160.

Who is authorized under the Integrated Goods and Services Tax (IGST) Act, to levy tax:

(A) State

(B) Centre

(C) Union Territory

(D) Both (A) and (B) [Dec. 2018]

Answer:

(B) Centre

Question 161.

Tax on inter-State supplies, import into India, supplies made outside India and supplies made in SEZ shall be charged under………

(A) CGST&SGST

(B) CGST& UTGST

(C) CGST&IGST

(D) IGST [Dec. 2019]

Answer:

(D) IGST

Question 162.

Provision for levy and collection of tax on intra-State supply of goods or services or both by the Union Territory and for matters connected therewith or incidental thereto are being enumerated in:

(A) CGST Act, 2017

(B) IGST Act, 2017

(C) UTGST Act, 2017

(D) None of the above [Dec. 2019]

Answer:

(C) UTGST Act, 2017

Question 163.

Total proceeds of the cess levied under section 8 of GST (Compensation to States) Act, 2017 as per section 10 shall be credited to a fund which is known as……… and shall form part of the public account of India to be utilized for the purposes specified and shall be a non-lapsable fund.

(A) GST Cess Fund

(B) GST Cess Compensation Fund

(C) GST Compensation Fund

(D) GST Fund [Dec. 2019]

Answer:

(C) GST Compensation Fund