Students should practice Fund Flow Statement – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Fund Flow Statement – Corporate and Management Accounting MCQ

Question 1.

Dec 2014: Net profit of A Ltd. amounted to 40,000.

| Particulars | ₹ |

| Provision of income-tax | 33,000 |

| Depreciation | 6,500 |

| Preliminary expenses written-off | 1,500 |

| Bad debts | 500 |

| Loss on sale of furniture | 2,500 |

| Discount allowed to customers | 1,900 |

| Discount received from trade creditors | 1400 |

After considering the above information, find out the funds from operation

(A) 84,000

(B) 83,500

(C) 85,400

(D) 85,900

Hint:

40,000 + 33,000 + 6,500 + 1,500 + 2,500 + 1,900 – 1,400 = 84,000

Answer:

(A) 84,000

Question 2.

Dec 2014: Which of the following results in a decrease in working capital

(A) Goods sold on credit

(B) Decrease in current liabilities

(C) Decrease in current assets

(D) Increase in current assets

Answer:

(C) Decrease in current assets

Question 3.

June 2015: Which of the following does not result in an inflow of funds in case of fund flow statement

(A) Issue of equity share capital

(B) Premium received on issue of shares/ debentures

(C) Sale of investments

(D) Cash received from debtors

Answer:

(D) Cash received from debtors

Question 4.

June 2015: Which of the following statement is not true –

(A) Fund flow statement is also known as the statement of sources and application of funds

(B) Fund is equal to current assets minus current liabilities

(C) There is an inverse relationship between current assets and working capital

(D) Fund flow statement is prepared on an accrual basis

Answer:

(D) Fund flow statement is prepared on an accrual basis

Question 5.

Dec 2015: Match the following:

| List-I | List-II |

| P. Increase in funds | 1. Application of funds |

| Q. Goods purchased on credit | 2. Drain in Working Capital |

| R. Commission | 3. Source of funds outstanding |

| S. Net loss | 4. No flow of funds |

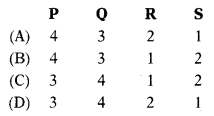

Select the correct answer from the options given below

Answer:

(D)

Question 6.

Dec 2015:

Assertion (A):

Funds are not related to working capital.

Reason (R):

The flow of funds takes place whenever there is a change in the funds.

Select the correct answer from the following

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true, but R is not the correct explanation of A

(C) A is true, but R is false

(D) A is false, but R is true

Answer:

(D) A is false, but R is true

Question 7.

June 2016: If provision for taxation is treated as a current liability, then payment of tax is

(A) An application of funds

(B) A source of funds

(C) No flow of funds

(D) None of the above

Answer:

(C) No flow of funds

Question 8.

June 2016: A company reported current year profit as ₹ 70,000 after the following adjustments:

Loss on sale of equipment: ₹ 9,000

Premium on debenture redemption: ₹ 1,500

Tax provision: ₹ 22,000

Dividend income: ₹ 4,000

Profit on revaluation of fixed asset: ₹ 2,500

The amount of fund from operations will be

(A) ₹ 96,000

(B) ₹ 93,000

(C) ₹ 78,000

(D) ₹ 61,000

Hint:

70,000 + 9,000 + 1,500 + 22,000 – 4,000 – 2,500 = 96,000

Answer:

(A) ₹ 96,000

Question 9.

June 2016: Which one of the following is a non-current item

(A) Securities premium

(B) Outstanding wages

(C) Trade payables

(D) Bank balance

Answer:

(A) Securities premium

Question 10.

June 2016: The balance of the investment account is ₹ 20,000 on 31 st March 2014 and ₹ 30,000 on 31st March 2015. As per additional information, dividend received ₹ 3,000 includes ₹ 1,000 from pre-acquisition profit which is credited to an investment account. The amount of investment purchased/sold during the year 2014-2015 is

(A) ₹ 13,000 purchased

(B) ₹ 11,000 purchased

(C) ₹ 9,000 purchased

(D) ₹ 9,000 sold

Answer:

(B) ₹ 11,000 purchased

Question 11.

Dec 2016: A company reported a current year profit of ₹ 12,00,000which includes the following:

Profit on sale of equipment:

Share issue expenses:

Dividend income:

Tax:

Profit on revaluation of fixed assets :

The amount of funds from operation will be_______

(A) 11 ,90,000

(B) 8,20,000

(C) 10,70,000

(D) 10,50,000

Note: MCQ is wrongly dropped. For further clarification see the hints.

Hint:

12,00,000 – 2,00,000 + 1,50,000 – 80,000 + 90,000 – 2,50,000 = 9,10,000

None of the options contains figure of 9,10,000 hence MCQ is wrong.

Answer:

Question 12.

June 2017: Which of the following is not applied in Management Accounting?

(A) Comparative Statement

(B) Managerial reporting

(C) Double-entry system

(D) Operation research

Answer:

(D) Operation research

Question 13.

June 2017: Management Accounting aims at:

(A) Presentation of accounting information

(B) Assist in long-term planning

(C) Assist in day to day activities

(D) All of the above

Answer:

(D) All of the above

Question 14.

June 2017:

Assertion (A):

In management accounting firm decisions on pricing policy can be taken.

Reason (R):

As the marginal cost per unit is constant from period to period within a short span of time.

Codes:

(A) A is true, but R is false

(B) A is true, but R is true

(C) Both A & R are true and R is the correct explanation of A

(D) Both A & R are true but R is not the correct explanation of A

Answer:

(C) Both A & R are true and R is the correct explanation of A

Question 15.

June 2017: Net Profit + Non-Cash expenses =

(A) Gross Profit

(B) Profit after tax

(C) Fund from the operation

(D) Distributable profit

Answer:

(C) Fund from the operation

Question 16.

June 2017: Match the following:

| List I | List II |

| (a) Cash flow statements | (1) Inflow of fund |

| (b) Inflow of cash | (2) Short-term financial planning |

| (c) Investment (maturity period 3 months) | (3) Financing activity |

| (d) Payment of dividend | (4) Cash equivalent |

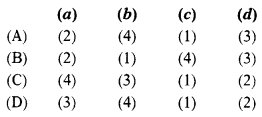

Codes:

Answer:

(B)

Question 17.

June 2017: Match the following:

| List I | List II |

| (a) Increase in fund | (1) Application of funds |

| (b) Goods purchased on credit | (2) Drain in working capital |

| (c) Commission outstanding | (3) Source of fund |

| (d) Net loss | (4) No flow of funds |

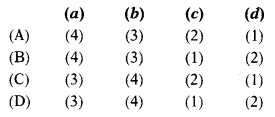

Codes

Answer:

(C)

Question 18.

Dec 2017: Management accounting and cost accounting are____to each other.

(A) Complementary

(B) Supplementary

(C) Opposite

(D) Independent

Answer:

(B) Supplementary

Question 19.

Dec2017: Management accounting works on the output of:

(A) Financial accounting

(B) Cost Accounting

(C) Statistics

(D) All of the above

Answer:

(D) All of the above

Question 20.

Dec 2017: In Management Accounting, analysis of accounting data are carried out with the help of:

(A) Tools and Techniques

(B) Statutory Forms

(C) Auditors

(D) Legal provisions

Answer:

(A) Tools and Techniques

Question 21.

Dec 2017 & Dec 2018: In the fund flow statement, the flow of fund will occur when a transaction is happened between:

(A) Current Assets & Current Liabilities

(B) Non-current Assets & Non-cur-rent Liabilities

(C) Current Assets & Non-current Assets

(D) All of the above

Answer:

(C) Current Assets & Non-current Assets

Question 22.

Dec 2017: While analyzing the opening and closing balance sheet of a company the following are observed:

The total increase in current ₹ 20,000 assets

The total increase in current ₹ 80,000 liabilities

Total decrease in current ₹ 1,30,000 assets

The total decrease in current ₹ 30,000 liabilities

The net change in working capital is:

(A) No change in working capital

(B) Net increase in working capital ₹ 1,60,000

(C) Net decrease in working capital ₹ 1,60,000

(D) None of the above

Hint:

| Sources of funds | Application/use of funds |

| Decrease in current assets | Increase in current liability |

| Increase in current assets | Decrease in current liability |

– 20,000 + 80,000 + 1,30,000 – 30,000 = 1,60,000

Answer:

(B) Net increase in working capital ₹ 1,60,000

Question 23.

June 2018:

Assertion (A):

Management accounting can be defined as processing and presenting accounting, cost accounting, and other economic data.

Reason (R):

It is an analysis of all the transactions, financial and physical, to enable effective comparison to be made between the forecasts and actual performance.

Select the correct answer from the options given below:

(A) Both A and R are true and R is the correct explanation of A

(B) Both A and R are true but R is not the correct explanation of A

(C) A is true but R is false

(D) A is false but R is true

Answer:

(B) Both A and R are true but R is not the correct explanation of A

Question 24.

June 2018: Which of the following does not come under the scope of management accounting?

(A) Formation, installation, and operation of accounting cost accounting, tax accounting, and information system.

(B) The compilation and preservation of vital data for management planning.

(C) Providing and installing an effective system of feedback.

(D) Publishing the financial statements and get them audited by a statutory auditor.

Answer:

(D) Publishing the financial statements and get them audited by a statutory auditor.

Question 25.

June 2019: Which of the following statement is correct?

(A) A decrease in current liability during the year results in an increase in working capital.

(B) Only non-cash expenses are added to net profit to find out funds from operations.

(C) Conversion of debentures into equity shares appears in the fund flow statement.

(D) Collection of debtors is a source of funds.

Answer:

(A) A decrease in current liability during the year results in an increase in working capital.

Question 26.

June 2019: Depreciation provided during the year: Furniture ₹ 15,000, Building ₹ 14,000.

The statement of P & L for the year:

Opening balance ₹ 38,500

Add Profit for the year ₹ 40,300,

Less: Goodwill wrote off ₹ 15,000,

Closing balance ₹ 63,800.

What will be the number of funds from the operation?

(A) ₹ 69,300

(B) ₹ 54,300

(C) ₹ 78,800

(D) ₹ 25,300

Hint:

63,800 + 15,000 + 15,000 + 14,000 – 38,500 = 69,300

Answer:

(A) ₹ 69,300