Framework for Preparation and Presentation of Financial Statements – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Framework for Preparation and Presentation of Financial Statements – CA Inter Accounts Question Bank

Question 1.

Briefly define the Fundamental Accounting Assumptions? (Nov 2017, 4 marks) [IPCC Gr. II]

Answer:

Fundamental Accounting Assumptions

As per the Framework on Preparation and Presentation of Financial Statements, there are three fundamental accounting assumptions: Going Concern, Accrual Basis and Consistency.

| 1. Going Concern | Financial statements are normally prepared on the assumption that an enterprise will continue in operation in the foreseeable future and neither there is intention, nor there is need to materially curtail the scale of operations. |

| 2. Accrual Basis | Under this basis of accounting, transactions are recognized as soon as they occur, whether cash or cash equivalent is actually received or paid. Accrual basis ensures better matching between revenue and cost and profit/loss obtained on this basis reflects activities of the enterprise during an accounting period, rather than cash flows generated by it. |

| 3. Consistency | It refers to the practice of using same accounting policies for similar transactions in all accounting periods. The consistency improves comparability of financial statements through time. |

![]()

Question 2.

Answer the following :

Summarised Balance Sheet of Cloth Trader as on 31.03.2017 is given below:

| Liabilities | Amount (₹) | Assets | Amount (₹) |

| Proprietor’s Capital | 3,00,000 | Fixed Assets | 3,60,000 |

| Profit & Loss Account | 1,25,000 | Closing Stock | 1,50,000 |

| 10% Loan Account | 2,10,000 | Sundry Debtors | 1,00,000 |

| Sundry Creditors | 50,000 | Deferred Expenses | 50,000 |

| Cash & Bank | 25,000 | ||

| 6,85,000 | 6,85,000 |

Additional Information is as follows :

1. The remaining life of fixed assets is 8 years. The pattern of use of the asset is even. The net realisable value of fixed assets on 31.03.2018 was ₹ 3,25,000.

2. Purchases and Sales in 2017-18 amounted to ₹ 22,50,000 and ₹ 27,50,000 respectively.

3. The cost and net realizable value of stock on 31.03.2018 were ₹ 2,00,000 and ₹ 2,50,000 respectively.

4. Expenses for the year amounted to ₹ 78,000.

5. Deferred Expenses are amortized equally over 5 years.

6. Sundry Debtors on 31.03.2018 are ₹ 1,50,000 of which ₹ 5,000 is doubtful. Collection of another ₹ 25,000 depends on successful re-installation of certain product supplied to the customer.

7. Closing Sundry Creditors are ₹ 75,000, likely to be settled at 10% discount.

8. Cash balance as on 31.03.2018 is ₹ 4,22,000.

9. There is an early repayment penalty for the loan of ₹ 25,000.

You are required to prepare:

(Not assuming going concern)

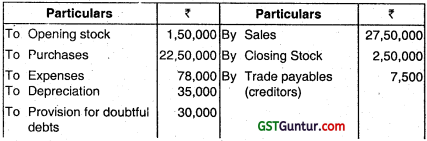

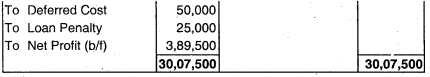

1. Profit & Loss Account for the year 2017-18.

2. Balance Sheet as on 31st March, 2018. (May 2019, 5 marks)

Answer:

1. Profit and Loss Account for the year 2017-18:

2. Balance Sheet as on 31st March, 2018

Question 3.

Answer the following :

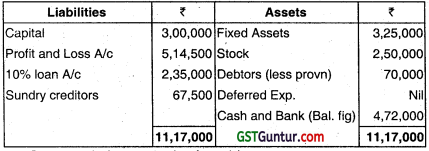

Following is the Balance Sheet of M/s. S. Traders as on 31st March, 2019:

Additional information:

(i) Remaining life of Fixed Assets is 6 years with even use. The net realizable value of Fixed Assets as on 31st March, 2020 is ₹ 90,000.

(ii) Firm’s Sales & Purchases for the year ending 31st March, 2020 amounted to ₹ 7,80,000 and ₹ 6,25,000 respectively.

(iii) The cost & net realizable value of the stock as on 31st March, 2020 was ₹ 60,000 and ₹ 66,000 respectively.

(iv) General expenses (including interest on Loan) for the year 2019-20 were ₹ 53,800.

(v) Deferred expenditure is norm’ally amortised equally over 5 years starting from the Financial year 2018-19 i.e ₹ 6,000 per year.

(vi) Debtors on 31st March, 2020 is ₹ 65,000 of which ₹ 5,000 is doubtful. Collection of another ₹ 10,000 debtors depends on successful re-installation of certain products supplied to the customer.

(vii) Closing Trade payable ₹ 48,000, which is likely to be settled at 5% discount.

(viii) There is a prepayment penalty of ₹ 4,000 for Bank loan outstanding.

(ix) Cash & Bank balances as on 31st March, 2020 is ₹ 1,65,200. Prepare Profit & Loss Account and Balance Sheet for the year ended 31st March, 2020 assuming the firm is not a going concern. (Nov 2020, 5 marks)

![]()

Question 4.

What are the qualitative characteristics that improve the usefulness of information provided in the financial statements? (May 2007, May 2013, 4 marks each) [IPCC Gr. II]

Answer:

Qualitative characteristics are those attributes which make the information provided in the financial statement useful to the users.

The principal qualitative characteristics are as follows:

1. Understandable

The basic quality of financial statement is that it is understandable by the user. However to understand, the user is expected to have basic knowledge of business and accounting.

2. Relevance

The information provided in the financial statement will loose its importance if it is not relevant. An information is relevant when it influences the decision of users while evaluating the past, present and future.

3. Materiality

The information provided in a financial statement is relevant only if it is material. Materiality provides a threshold rather than being a primary qualitative characteristic.

4. Reliability

The financial statement loses its purpose it it is not reliable. Thus it should be error free and unbiased showing the true and fair picture.

5. Neutrality

The financial statement should be neutral, It should not be a manipulated statement.

6. Completeness

The financial statement should be complete in all respect within the boundary of materiality and cost. An omission can cause information misleading.

7. Substance over form

The purpose of financial statement is to provide information. it should be thus presented in accordance with their substance and economic reality arid not merely their legal form.

8. Comparability

The measurement and display of information should be consistent in order to make it comparable over times to come.

Question 5.

“One of the characteristics of financial statements in neutrality” – Do you agree with this statement? Explain in brief. (May 2008, 2, 5 marks) [IPCC Gr. II]

Answer:

Yes, one of the characteristics of financial statements is neutrality. To be reliable, the information contained in financial statements must be neutral, that is free from bias. Financial Statements are not neutral if by the selection or presentation of information, the focus of analysis could shift from one area of business to another thereby arriving at a totally different conclusion based on the business results.

Question 6.

Give the four qualitative characteristics which the financial statements should observe. (Nov 2008, 2 marks) [IPCC Gr. II]

Answer:

The financial statements should have the following qualitative characteristics:

- Understandability

- Relevance

- Reliability

- Comparability.

Question 7.

Answer the following :

What are the qualitative characteristics of the Financial Statements which improve the usefulness of the information furnished therein? (Nov 2020, 5 marks)

Question 8.

Write short note on main elements of Financial Statements. (May 2017, 4 marks) [IPCC Gr. II]

OR

Answer the following:

Briefly explain the elements of financial statements. (May 2018, 5 marks)

Answer:

Elements of Financial Statements:

The Framework for preparation and presentation of financial statements classifies items of financial statements. Financial statements can be classified in five broad groups depending on their economic characteristics:

1. Asset

Resource controlled by the enterprise as a result of past events from which future economic benefits are expected to flow to the enterprise.

2. Liability

Present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow of a resource embodying economic benefits.

3. Equity

Residual interest in the assets of an enterprise after deducting all its liabilities.

4. Income/Gain

lncease in economic benefits during the accounting period in the form of mf lows or enhancement of assets or decreases in liabilities that result in increase in equity other than those relating to contributions from equity participants.

5. Expense/Loss

Decrease in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrence of liabilities that result in decrease in equity other than those relating to distributions to equity participants.

Question 9.

Explain in brief, the alternative measurement bases, for determining the value at which an element can be recognized in the Balance Sheet or Statement of Profit and Loss. (Nov 2016, 4 marks) [IPCC Gr. II]

Answer:

Measurement is the process of determining money value at which an element can be recognised in the balance sheet or statement of profit and loss. The framework recognises four alternative measurement bases for the purpose. These basis relate explicitly to the valuation of assets and liabilities. The valuation of income or expenses, i.e. profit is implied, by the value of change in assets and liabilities.

Measurement basis are as follows:

- Historical cost

- Current cost

- Realisable value

- Present value

In preparation of financial statements, all or any of the measurement basis can be used in varying combinations to assign the cost.

![]()

Question 10.

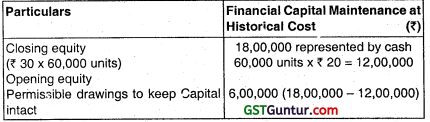

Mohan started a business on 1st April 2017 with ₹ 12,00,000 represented by 60,000 units of ₹ 20 each. During the financial year ending on 31st March, 2018, he sold the entire stock for ₹ 30 each. In order to maintain the capital intact, calculate the maximum amount, which can be withdrawn by Mohan in the year 2017-18 if Financial Capital is maintained at historical cost.

Answer:

Thus, in order to maintain the capital intact Mohan can withdraw ₹ 6,00,000 as the maximum amount.

Question 11.

Answer the following:

Explain how financial capital is maintained at historical cost?

Kishore started a business on 1st April, 2019 with ₹ 15,00,000 represented by 75,000 units of ₹ 20 each. During the financial year ending on 31st March, 2020, he sold the entire stock for ₹ 30 each. In order to maintain the capital intact, calculate the maximum amount, which can be withdrawn by Kishore in the year 2019-20 if Financial Capital is maintained at historical cost. (Jan 2021, 5 marks)