Foreign Exchange Exposure and Risk Management – CA Final SFM Study Material is designed strictly as per the latest syllabus and exam pattern.

Foreign Exchange Exposure and Risk Management – CA Final SFM Study Material

Part-1(Theory)

Question 1.

Write a short note on the following:

Arbitrage operations [Nov. 2008] [5 Marks]

Answer:

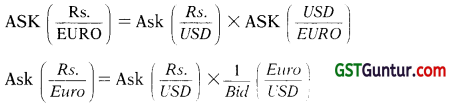

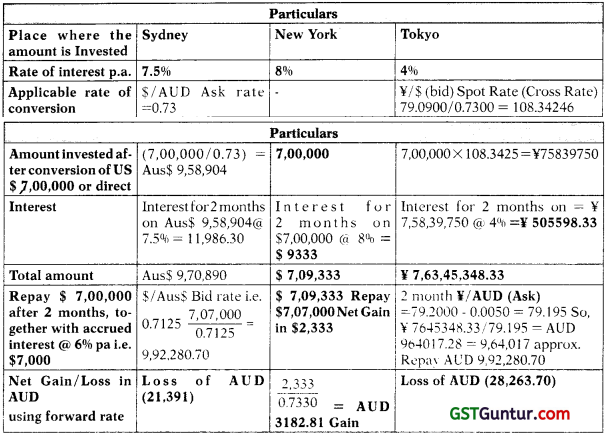

Arbitrage means making riskless profits without any investment. It is buying and selling the same commodity in the different markets at the same time at such a price that the buying is always less than the selling price, so that the profits are certain. A number of pricing relationships exist in the foreign exchange market, and at times an opportunity may arise for making arbitrage profits even if for a small moment of time. An arbitrageur takes the benefit of price differentials. For example, in case of foreign currency exchange rates, there could be a direct exchange rate and another through cross currency rates and if the bid of one is more than the ask rate of another, there will be an arbitrage opportunity.

![]()

Question 2.

Write a short note on the following:

Leading and Lagging [Nov. 2011] [4 Marks]

Answer:

Leading and lagging are the methods of hedging risk due to foreign currency exposure or a means to take advantage of the foreign exchange rate fluctuations. Leading means making the payment before the due date, i.e. advancing a payment. It is resorted to by the payer if he apprehends appreciation in currency in which the payment is to be made. The payer will have to arrange the money which he will convert into the foreign currency to make the pre-payment. Therefore, the costs of this fund should not exceed the expected appreciation in foreign currency, on the other hand, lagging means delaying the payment. If the payer anticipates that there will be fall in the currency in which the payment is to be made, he will like to lag the payment. The benefit of lagging should be more than the interest cost in delaying the payment. The purpose of both lagging and leading is to reduce the debt burden.

Another purpose of leading and lagging is also shifting the liquidity by modifying the credit terms between inter-group entities. The decision regarding leading and lagging should be taken on the basis of cost of funds to both paying entity and receiving entity. If paying and receiving entities have different home currencies, likely movements in exchange rate fluctuations should also be considered.

Question 3.

Write short note on the following:

Nostro, Vostro and Loro Accounts [May 2012] [4 Marks]

Answer:

Nostro, is an account, which is maintained by a bank in one country, with a bank in a foreign country. It is in the home currency of that foreign country. For Example, if a bank in India maintains an account with a bank in America and money is held in $ or in Britain in £. The Indian Bank will refer the Account as Nostro Account in correspondence with the foreign bank. It means “Our A/c with you.” All foreign exchange transactions are routed through Nostro account. The foreign bank will refer this account as Vostro Le. “your Account with us”. So, a “Vostro Account” on the other hand is an account by a foreign bank in India held in Rs. The Indian bank will call this A/c as Vostro account. For exchange control purposes such accounts are known as “ non-resident bank accounts”.

Loro Account is an account wherein a Bank remits funds in foreign currency to another Bank for credit to an account of a third Bank. It means “their account with you”. For example if SBI has an A/c with Citi bank US in $, then for SBI it is Nostro A/c, for Citi bank it is Vostro A/c and when the same A/c is referred by HDFC India in its correspondence with Citi Bank, for HDFC it is LORO A/c.

Question 4.

Write short note on the following:

Forward Rate Agreements (FRA) [May 2014] [4 Marks]

Answer:

FRA’s are an effective tool for managing risk in interest rates if the requirement is to borrow or lend money after a specific period for a fixed tenure.

Features of FRA:

(a) They are a kind of over the counter derivative, and are not exchange traded.

(b) It is normally used by banks to fix interest costs on anticipated future deposits or interest revenues on variable rate, loan indexed to LIBOR.

(c) It is an off Balance sheet instrument.

(d) There is no transfer of principal.

(e) The buyer of the FRA fears rise in interest rate as he is a borrower. If rate of interest actually rises he is compensated. He may bear loss if rate of interest falls.

(f) The seller of FRA fears fall in interest rates and he is looking forward to lend or deposit money in the future and he is compensated if rate actually falls. But he will have to bear loss if the rate of interest rises.

(g) It is settled at maturity in cash representing the profit or loss.

![]()

Question 5.

Write short note on the following:

What are the risks to which foreign exchange transactions are exposed? [Nov. 2014] [4 Marks]

Answer:

A firm dealing with foreign exchange may be exposed to foreign currency fluctuations. The exposure is the result of possession of assets and liabilities and transactions denominated in foreign currency. When exchange rate fluctuates, assets, liabilities, revenues and expenses that are expressed in foreign currency will result in either gain or loss. The following types of risks are present for a firm dealing with foreign exchange.

Transaction exposure; a firm may have some contractually fixed payments and receipts in foreign currency, such as import payables, export receivables, interest payable on foreign currency loans etc. All such items are to be settled in a foreign currency. Unexpected fluctuation in exchange rate will have favourable or adverse impact on its cash flows.

Translation exposure; it is basically the exposure on the assets and liabilities shown in the balance sheet and which are not going to be liquidated in the near future.

Economic exposure; it measures the probability that fluctuations in foreign exchange rate will affect the value of the firm is calculated by discounting the expected future cash flows with appropriate discounting rate.

Question 6.

Write short note on the following:

Operations in foreign exchange market are exposed to number of risks. [May 2016] [4 Marks]

Answer:

Transaction exposure: A firm may have some contractually fixed payments and receipts in foreign currency, such as, import payables, export receivables, interest payable on foreign currency loans etc. all such items are to be done in foreign currency. Unexpected fluctuations in exchange rate may have favourable or adverse impact on its cash flows. Such exposures are termed as transactions exposures.

Translation exposure: Also known as the accounting exposure or the Balance sheet exposure it is basically the exposure on the assets and liabilities shown in the balance sheet and which are not going be liquidated in near future. It refers to the probability of loss that the firm may have to face because of decrease in value of assets due to devaluation of a foreign currency despite the fact that there was no foreign exchange transactions during the year.

Economic exposure: Economic exposures measures the probability that fluctuations in foreign exchange rate will effect the value of the firm.

The intrinsic value of the firm is calculated by discounting the expected future cash flows with appropriate discounting rate. The risk involved in economic exposure requires measurement of the effect of fluctuations in exchange rate on different future cash flows.

Question 7.

Write short note on the following:

Briefly explain the main strategies for exposure management. [May 2017] [4 Marks]

Answer:

Strategies for exposure management are

1. Low risk, low reward

This option involves automatic hedging of exposures in the forward market as soon as they arise, irrespective of the attractiveness or otherwise of the forward rate.

2. Low risk, reasonable reward

This strategy requires selective hedging of exposures whenever forward

rates are attractive but keeping exposures open whenever they are not.

3. High risk low reward

Perhaps the worst strategy is to leave all exposures un-hedged.

4. High risk, high reward;

This strategy involves active trading in the currency market through continuous cancellations and re-bookings of forward contracts. With exchange controls relaxed in India in recent times, a few of the larger companies are adopting this strategy.

![]()

Question 8.

Answer the following

Explain the significance of LIBOR in international financial transactions. [May 2011] [4 Marks]

Answer:

Libor stands for London inter-bank offer rate. Other features of Libor are as follows;

It is the base rate of exchange with respect to which most international financial transaction are priced.

It is used as the base rate for a large number of financial products such as options and swaps.

Banks also use the libor as the base rate when setting the interest rate on loans, savings and mortgages.

It is mentioned by large number of professionals and private individuals worldwide.

Question 9.

What is the meaning of:

(i) Interest rate parity

(ii) Purchasing power parity. [May 2011] [4 Marks]

Answer:

(i) Interest Rate Parity: The Purchasing power parity gives the equilibrium in the commodity market. The equivalent in the financial market is the theory called the Interest rate parity (IRP) or the covered interest parity condition. According to this theory, the cost of covering foreign exchange risk is equal across different currencies. This is so because in the absence of any transaction costs, taxes and capital controls, investors will tend to transact in those currencies which provide them the most attractive prices. Besides, the arbitrageurs will always be on the look – out for an opportunity to make riskless profits. The resultant effects on the demand and supply would drive the value of currencies towards equalization. Thus, the size of the forward premium or discount should be equal to the interest rate differential between the two countries of concern. The equation is given by:

Forward rate = Spot rate \(\left[\frac{1+\text { Interest rate in domestic currency }}{1+\text { Interest rate in foreign currency }}\right]^t\)

(ii) Purchasing Power Parity: The Purchasing power parity was enunciated by a Swedish economist Gustav Cassel in 1918. According to the theory, the price levels in different countries determine the exchange rates of the currencies of these countries. This law is based on the law of one price. It is based on the following assumptions:

(a) There is no restriction on movement of goods between the countries.

(b) Commodities can be transported.

(c) There are no transportation costs.

(d) The commodities are homogenous.

Since the spot rate is determined by price level in two countries, the spot rate expected on a future date depends on the change in price levels in two countries during period between the current date and future date.

According to Purchasing Power Parity

Forward rate = Spot rate \(\left[\frac{1+\text { Annual Inflation rate in domestic currency }}{1+\text { Annual Inflation rate in foreign currency }}\right]^t\)

There are three forms of PPP theory one is “The Absolute Form” as discussed above and the other is the “The Relative form” which accounts for the possibility of market imperfections such as transportation costs tariffs and quotas.

The third form is the expectation form. According to this form, the expected percentage change in the spot rate is equal to the difference in the expected inflation rates in the two countries.

Question 10.

Write short note on’‘Exposure Netting.”

Answer:

Exposure Netting refers to offsetting exposures in one currency with exposures in the same or another currency, where exchange rates are expected to move in such a way that losses or gains on the first exposed position should be offset by gains or losses on the second currency exposure.

The objective of the exercise is to offset the likely loss in one exposure by likely gain in another. This is a manner of hedging foreign exchange exposures though different from forward and option contracts. This method is similar to portfolio approach in handling systematic risk.

For example, let us assume that a company has an export receivables of US$ 10,000 due 3 months hence, if not covered by forward contract, here is a currency exposure to US$.

Further, the same company imports US$ 10,000 worth of goods/commodities and therefore also building up a reverse exposure. The company may strategically decide to leave both exposures open and not covered by forward, it would be doing an exercise in exposure netting.

Despite the difficulties in managing currency risk, corporates can now take some concrete steps towards implementing risk mitigating measures, which will reduce both actual and future exposures. For years now, banking transactions have been based on the principle of netting, where only the difference of the summed transactions between the parties is actually transferred. This is called settlement netting. Strictly speaking in banking terms this is known as settlement risk. Exposure netting occurs where outstanding positions are netted against one another in the event of counter party default.

![]()

Part-2(Numerical Problems: Topic)

Question 1.

If the exchange rate (₹ /$) is 65.25/65.90 and 3 months swap points are 50/30

(i) Identify, whether this is a direct quote for an Indian or an indirect quote. What is the spot bid rate and spot ask rate.

(ii) Find the inverse (Indirect quote) spot rate.

(iii) How much $ should one pay to get ? 20,00,000.

(iv) What amount will a person receive if he sells $1,00,000.

(v) What will be the exchange rate after 3 months?

(vi) Is Dollar at Premium or Discount after 3 months?

(vii) Find the annualized premium/discount per cent.

(viii) How much amount is to be paid in order to receive $5,00,000 after 3 months? [Practice Question]

Answer:

(i) This is a direct quotation for an Indian. The spot bid rate is ₹ 65.25 and the spot ask rate is ₹ 65.90

(ii) When inverse quotation is determined

(iii) Amount of dollars to be paid to get ₹ 20,00,000 = \(\frac{20,00,000}{65.25}\)

= $ 30651.34

Alternatively by using indirect quotation of \(\left(\frac{\$ .}{R s .}\right)\) Ask

20,00,000 × 0.015325 = $ 30650 (approx.)

(iv) Selling $ 1,00,000 means bid rate of direct quotation will be applicable. This means the person will receive 1,00,000 × 65.25 = ₹ 65,25,000

(v) Exchange rate after 3 months will be determined on the basis of Swap points. Since, these points are in decreasing order, they will be subtracted from spot rate to arrive at the forward rate.

Therefore, 3 months forward rate = 64.75/65.60 (65.25-0.50/65.90-0.30)

(vi) The dollar is at discount after 3 months.

(vii) Calculation of forward Discount on $. = \(\frac{\text { Forward rate }- \text { Spot Rate }}{\text { Spot Rate }}\) × 100

| Bid rate: | Ask rate: |

| = \(\frac{64.75-65.2}{65.25}\) × 100 (-) 0.766% for 3 months |

\(\frac{65.60-65.90}{65.90}\) × 100 (-)0.4552% for 3 months |

| 0.766 × \(\frac{12 \text { Months }}{3 \text { Months }}\) = 3.064% | 0.4552 × \( = 1.80209% |

(viii) To receive dollar 5,00,000 after 3 months the person will have to pay 5,00,000 × 65.60 = ₹ 3,28,00,000.

![]()

Question 2.

An extract from exchange rate list of a Kolkata based bank is given below: ₹ /¥ 0.3992 : 0.4002

(i) How many Yen will it cost for a Japanese tourist visiting India to purchase ₹ 25,000 worth of television?

(ii) How much will Mr. Basu in Kolkata have to spend in rupees, to purchase a Sony Camera worth Yen 1,25,000 ? [Practice Question]

Answer:

The Exchange rate of ₹ /¥ is 0.3992/0.4002

The rate 0.3992 is the bid rate at which bank will purchase ¥ from the Japanese tourist and 0.4002 is the ask rate at which the bank will sell ¥ to him.

(i) If Japanese tourist is purchasing something in ₹, he will need to buy ₹ against Yen, and he will sell ¥ to get the ₹, therefore bank will buy ¥.

The bid rate will be applicable = [latex]\frac{R s .25,000}{R s .0 .3992}\) = ¥62625.25

(ii) Mr. Basu will need 1,25,000 ¥ to buy Sony Camera. He will buy Yen from the bank and the bank will sell¥. The ask rate will be applicable. Mr. Basu will have to pay (¥ 1,25,000 × 0.4002) = ₹ 50,025

Question 3.

Consider the following rates:

| Spot Rate | 3 month Forward Rate | ||

| ₹/$ | 42.17/42.59 | ₹/$ | 43.15/43.60 |

| ₹/DM | 24.61/25.10 | ₹/DM | 25.36/25.90 |

(i) From these rates, calculate the spot and forward DM/$ rates.

(ii) What are the upper and lower boundaries for the DM/$ quotations? [Practice Question]

Answer:

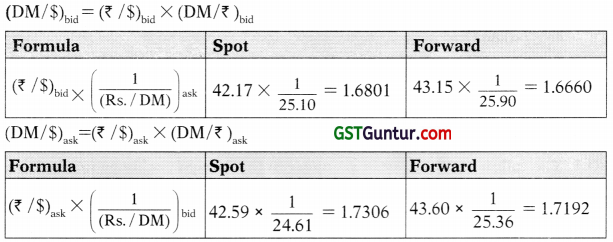

(i) The rate of (DM/$) will be the cross currency rate as direct quote is not available. The upper and lower boundaries will be the bid and the ask rate.

The rates available are:

| Quote | Spot | Forward |

| (₹ /$) bid | 42.17 | 43.15 |

| (₹ /$) ask | 42.59 | 43.60 |

| (₹ /DM) bid | ₹ 24.61 | 25.36 |

| (₹ /DM) ask | ₹ 25.10 | 25.90 |

From above available rates we can compute required rate as follows:

(ii)

| Rate DM/$ | Lower Boundary (Bid) | Upper Boundary (Ask) |

| Spot DM/$ | 1.6801 | 1.7306 |

| Forward DM/$ | 1.6660 | 1.7192 |

![]()

Question 4.

An Indian customer who has imported equipment from Germany has approached a bank for booking a forward Euro contract. The delivery is expected six months from now. The following rates are quoted:

| $/Euro Spot | 0.8453/0.8457 | ₹ /$ Spot | 46.47/46.57 |

| 6m-Swap points | 15/20 | 6m-Swap points | 20/30 |

What rate the bank will quote, if it needs a margin of 0.5%?

Answer:

The Spot Exchange rate of ₹ /$ is 46.47/46.57

The Spot Exchange rate of $/€ is 0.8453/0.8457

The 6 months forward exchange = (Original rate + swap points)

Rate of ₹ /$:

(46.47 + 0.20/46.57 + 0.30)

= 46.67/46.87

Rate of $/€:

(0.8453 + 0.0015/0.8457 + 0.0020)

= 0.8468/0.8477

The 6 month forward rate of ₹ /€ will be the cross currency rate, as direct quote is not available.

(₹ /€)bid = (₹/$)bid × ($/€.)bid

= 46,67 × 0,8468 = 39.52

(₹/€)ask = (₹/$)ask × ($/€)ask

46.87 × 0.8477 = 39.73

₹/€ = 39.52/39.73

The Indian importer will buy €, so ask rate of ₹ 39.73 will be applicable. Add to this, the bank’s margin of 0.5%, the rate quoted by the bank will be ₹/€ = 39.93 (39.73 + 0.5%).

Question 5.

The following 2-way quotes appear in the foreign exchange market:

| RS/US$ | Spot | 2-months forward |

| ₹ 46.00/₹ 46.25 | ₹ 47.00/₹ 47.50 |

Required:

(i) How many US dollars should a firm sell to get ₹ 25 lakhs after 2 months?

(ii) How many Rupees is the firm required to pay to obtain US $ 2,00,000 in the spot market?

(iii) Assume the firm has US $ 69,000 in current account, earning no interest. (ROI) on Rupee investment is 10% p.a. Should the firm encash the US $ now or 2 months later? [June 2009] [6 Marks]

Answer:

(i) US $ required to get ₹ 25 Lakhs after 2 months at the Rate of ₹ 47/$

\(\frac{25,00,000}{47}\) = US$ 53,191.49

(ii) ₹ required to get US$ 2,00,000 now at the rate of 7₹ 46.25/$

US $ 2,00,000 × ₹ 46.25 = ₹ 92,50,000

(iii) Encashing US $ 69000 now or 2 month later:

| Particulars | Calculation | Amount |

| Proceeds, if encashed in the open market | $ 69000 × ₹ 46 | ₹ 31,74 ,000 |

| Interest earned | 31,74,000 × \(\frac{10}{100}\) × \(\frac{2}{12}\) | ₹ 52,900 |

| Likely sum at the end of 2 months | (31,74,000 + 52,900) | 32,26,900 |

| If encashed after 2 months, using forward rate | $ 69000 × ₹ 47.00 | 32,43,000 |

Conclusion: It is better to encash the US $ after 2 months using forward rates as Rs. 32,43,000 is higher.

![]()

Question 6.

The US dollar is selling in India at ₹ 55.50. If the interest rate for a 6 months borrowing in India is 10% per annum and the corresponding rate in USA is 4%.

(i) Do you expect that US dollar will be at a premium or at discount in the Indian FOREX Market?

(ii) What will be the expected 6- month’s forward rate for US dollar in India? And

(iii) What will be the rate of forward premium or discount? [Nov. 2012] [5 Marks]

Answer:

(i) The currency of that country will be at premium where the interest rate is lower as compared to the other country. Therefore, the US dollar is expected to quote at a premium in India.

(it) According to Interest Rate Parity

Forward rate after 6 months = Spot rate \(\left[\frac{1+\text { Interest rate in India }}{1+\text { Interest rate in } U S A}\right]^1\)

= 55.50 \(\left[\frac{1+0.10 / 2}{1+0.04 / 2}\right]^1\) = 55.50 (1.029412) = Rs. 57.13

(iii) Premium Rate (Annualised) = \(\frac{57.13-55.50}{55.50} \times \frac{12}{6}\) × 100 = 5.87%

Question 7.

Shoe Company sells to a wholesaler in Germany. The purchase price of a shipment is 50,000 Deutsche Marks with term of 90 days. Upon payment, Shoe company will convert the DM to Dollars. The present spot rate for DM per Dollar is 1.71, whereas the 90-day forward rate is 1.70. (Use Interest-Rate parity Assumption).

You are required to calculate and explain:

(i) If Shoe company were to hedge its foreign exchange risk, what would it do? What transactions are necessary?

(ii) Is the Deutsche Mark at a forward premium or at a forward discount?

(iii) What is the implied differential in interest rates between the two countries?

Answer:

(i) To hedge the foreign exchange risk, shoe company can take forward contract, by selling DM @ 1.70DM/$.

Realization after 90 days: 50,000/1.70 = $ 29,411.76

If the company would not have taken the forward contract it would have faced the risk of depreciation in the value of DM. At spot rate it would have realized 50,000/1.71 = 29239.766.

(ii) The Deutsche Mark is at forward premium. The 90 day forward rate of DM against $ is 1.70 as compared to the present rate of $1.71.

(iii) Under interest rate parity, the difference in interest rate is reflected in the difference in spot and forward rate. This difference is approximately equal to the forward premium or discount. The currency of the country having higher interest rate is traded at discount.

Calculation of forward discount on $.

= \(\frac{\text { Forward Rate }- \text { Spot Rate }}{\text { Spot Rate }}\) × 100

= \(\frac{1.70-1.71}{1.71}\) × 100

= 0.58479% for 90 days

Annualized Discount = 0.58479 × \(\frac{365 \text { days }}{90 \text { days }}\) = 2.3716%

Therefore, the approximate interest difference in the two countries is 2.37% with interest rate in US being higher.

Question 8.

Digital exporters are holding an export bill in United States dollar (USD) 5,00,000 due after 60 days. They are worried about the falling USD value, which is currently at ₹ 75.60 per USD. The concerned Export consignment has been priced on an Exchange rate of ₹ 75.50 per USD. The firm’s Bankers have quoted a 60 day forward rate of ₹ 75.20.

Calculate:

(i) Rate of discount quoted by the bank, assuming 365 days in a year.

(ii) The probable loss of operating profit if the forward sale is agreed to. [Nov. 2018] [5 Marks]

Answer:

The following are the relevant information:

USD Receivables = 5,00,000

Due after 60 days.

₹/$ .

Spot = 75.60

Forward rate = 75.20

(i) Rate of discount quoted by the Bank

= \(\frac{F w d .-S p o t}{S p o t}\) × 100

= \(\frac{75.20-75.60}{75.60}\) = – 0.529% for 60 days

The negative sign indicates that the US$ is at discount against Rupees.

Annualized = \(\frac{0.529}{60}\) × 365 = 3.22% (Approx.)

Loss of operating Profit

(Exchange rate finally received – Exchange Rate for the consignment)

= USD 5,00,000 (75.20 – 75.50)

= ₹ 150,000 (Received-Contracted)

![]()

Question 9.

On April 3, 2016, a Bank quotes the following:

| Spot Exchange Rate (US $ 1) | NR 66.2525 | INR 67.5945 |

| 2 months’ swap points | 70 | 90 |

| 3 months’ swap points | 160 | 186 |

In a spot transaction, delivery is made after two days.

Assume spot date as April 5, 2016.

Assume 1 swap point = 0.0001,

You are required to:

(i) Ascertain swap points for 2 months and 15 days. (For June 20, 2016),

(ii) Determine foreign exchange rate for June 20, 2016, and

(iii) Compute the annual rate for premium/discount of US$ on INR, on an average rate. [Nov. 2016] [5 Marks]

Answer:

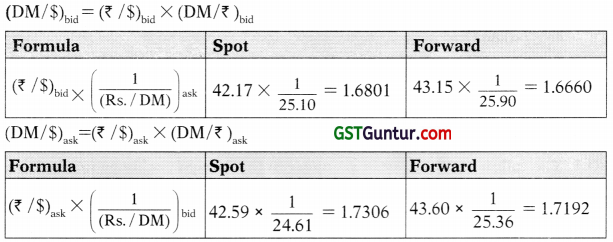

(i) Ascertainment of Swap points for 2 months and 15 days. (For June 20, 2016),

| Bid | Ask | |

| Swap points for 2 months | 70 | 90 |

| Swap points for 3 months | 160 | 186 |

| Swap points for 30 days | 160 – 70 = 90 | 186 – 90 = 96 |

| By interpolating, Swap points for 15 days after 2 months | 90 ÷ 2 = 45 | 96 ÷ 2 = 48 |

| Swap points for 2 months and 15 days | 115 [ 70+ 45] | 138 [90+ 48] |

(ii) Determination of foreign exchange rate for June 20, 2016, and

| Foreign Exchange Rate on 20th June, 2016 | 66.2640 | 67.6083 |

| (Original Price + Swap Points) | [66.2525 + 0.0115] | [67.5945 + 0.0138] |

(iii) Computation of the annual rate for premium/discount of US$ on INR, on an average rate.

![]()

Question 10.

On Sep. 3, 2018, a Bank quotes the following:

| Spot Exchange Rate (US $ 1) | INR 66.2525 | INR 67.5945 |

| 2 months’ swap points | 90 | 80 |

| 3 months’ swap points | 150 | 174 |

In a spot transaction, delivery is made after two days.

Assume spot date as Sep. 5, 2018.

Assume 1 swap point = 0.0001,

You are required to:

(i) Ascertain swap points for 2 months and 15 days. (For Nov. 20, 2018),

(ii) Determine foreign exchange rate for Nov. 20, 2018, and

(iii) Compute the annual rate for premium/discount of US$ on INR, on an average rate.

Answer:

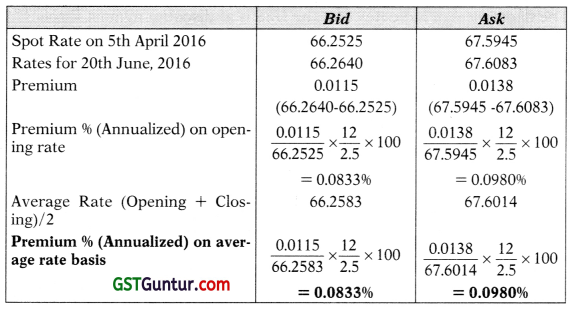

(i) Ascertainment of Swap points for 2 months and 15 days. (For Nov. 20,2018),

| Bid | Ask | |

| Swap points for 2 months | -90 | -80 |

| Swap points for 3 months | 150 | 174 |

| Swap points for 30 days | 150 – (-90) = 240 | 174 – (-80) = 254 |

| By interpolating, Swap points for 15 days after 2 months | 240÷2 = 120 | 254÷2 = 127 |

| Swap points for 2 months and 15 days | 30 [-90 + 120] | 47[-80 + 127] |

(ii) Determination of foreign exchange rate for Nov. 20, 2018

| Foreign Exchange Rate on 20th Nov., 2018 | 66.2555 | 67.5992 |

| (Original Price + Swap Points) | [66.2525 + 0.0030] | [67.5945 + 0.0047] |

(iii) Computation of the annual rate for premium/discount of US$ on INR, on an average rate.

Question 11.

You have following quotes from Bank A and Bank B:

| Bank A | Bank B | |

| SPOT | USD/CHF 1.4650/55 | USD/CHF 1.4653/60 |

| 3 months | 5/10 | |

| 6 months | 10/15 | |

| SPOT | GBP/USD 1.7645/60 | GBP/USD 1.7640/50 |

| 3 months | 25/20 | |

| 6 months | 35/25 |

(i) How much minimum CHF amount you have to pay for 1 Million GBP spot?

(ii) Considering the quotes from Bank A only, for GBP/CHF what are the Implied Swap points for Spot over 3 months. [May 2009] [6 Marks]

Answer:

1. Required: Buy 1 million GBP Spot against CHF using cross currency rates.

2. Action: As the direct quotation for CHF against GBP is not available, First sell CHF against USD and then buy GBP by selling USD. The rates are quoted by two banks i.e. Bank A and Bank B. The transaction will be done with the Bank where it is more profitable.

3. Best alternative: Based on the two cross rates available in the two Banks, trans-action will be done where it is more beneficial. In this case CHF will be converted into USD in Bank A and USD will be converted into GBP in Bank B. (W.N.l)

(W.N.l)

COMPARISON BETWEEN Bank A and Bank B for acquiring USD

| (a) USD1 = CHF 1.4650/55 | (b) USD1 = CHF 1.4653/60 |

| Ask rate 1.4655 | Ask rate 1.4660 |

| Since the USD is less expensive in the Bank A (1.4655 < 1.4660) therefore, USD will be acquired from Bank A | |

| COMPARISON BETWEEN Bank A and Bank B for acquiring GBP | |

| (c) 1GBP = USD 1.7645/60 | (d) 1 GBP = USD 1.7640/50 |

| Since the Ask rate for GBP is less in Bank B,(1.7650 < 1.7660) the USD will be sold in Bank B to acquire GBP | |

(CHF/£)ask = (CHF/$)ask × ($/£)ask

I GBP = 1.4655 × 1.7650

1 GBP = CHF 2.5866

Amount payable for acquiring 1 million GBP will be CHF 2.5866 Million or CHF 25,86,600

(ii) Spot Bid rate GBP 1 = CHF

(CHF/£)Bid = (CHF/$)Bid × ($/£)Bid = 1.4650* 1.7645 = 2.5850

(CHF/£)ask = (CHF/$)ask × ($/£)ask = 1 – 4655* 1.7660 = CHF 2.5881

GBP/USD 3 months swap points are at discount

3 Months forward rate GBP 1 = USD 1.7645-0.0025/1.7660-0.0020

GBP 1 = USD 1.7620/1.7640

USD/CHF 3 months swap points are at premium

3 Months forward rate USD 1 = CHF (1.4650 + 0.0005/1.4655 + 0.0010.) = CHF 1.4655/1.4665

Hence

3 Months forward rate

(CHF/£)Bid = (CHF/$)Bid × ($/£)Bid = 1.4655 × 1.7620 = 2.5822

(CHF/£)ask = (CHF/$)ask × ($/£)ask = 1.4665 × 1.7640 = 2.5869

| SPOT (CHF/£) | 2.5850/2.5881 |

| 3 months | 2.5822/2.5869 |

| Swap points | 28/12 |

![]()

Question 12.

You have following quotes from Bank A and Bank B:

| Bank A | Bank B | |

| SPOT | USD/FFr.7.50/7.55 | USD/FFr.7.49/7.57 |

| 3 months | 5/10 | 10/15 |

| 6 months | 10/15 | 12/18 |

| SPOT | GBP/USD 1.7645/60 | GBP/USD 1.7640/50 |

| 3 months | 25/20 | 20/15 |

| 6 months | 35/25 | 30/24 |

Calculate :

(i) How much minimum FFr. amount you have to pay for 1 Million GBP spot?

(ii) Considering the quotes from Bank A only, for GBP/FFr. What are the Implied Swap points for Spot over 6 months.

Answer:

1. Required: Buy 1 million GBP Spot against FFr. using cross currency rates.

2. Action: As the direct quotation for FFr. against GBP is not available, First Buy USD against FFr. and then buy GBP by selling USD. The rates are quoted by two banks i.e. Bank A and Bank B. The transaction will be done with the Bank where it is more profitable.

3. Compare FFr./ USD ask:

Bank A FFr. 7.55

Bank B FFr. 7.57.

Buy USD from Bank A as (7.55 < 7.57)

4. Compare GBP/ USD ask:

Bank A GBP/USD 1.7645/60

Bank B GBP/USD 1.7640/50

Buy GBP from Bank B as (1.7650 < 1.7660)

5. Best alternative: Based on the two cross rates available in the two Banks, transaction will be done where it is more beneficial. In this case FFr. will be converted into USD in Bank A and USD will be converted into GBP in Bank B.

(FFr/£)ask = (FFr/$)ask × ($/£)ask

1 GBP = 7.55 × 1.7650 1 GBP = FFr. 13.32575

Amount payable for acquiring 1 million GBP will be FFr.13.32575 Million

(ii) Spot rate GBP 1 = FFr.:

(FFr./£)Bid = (FFr./$)Bid × ($/£)Bid = 7.50 × 1.7645 = Fr. 13.234

(FFr./£)ask = (FFr/$)ask × ($/£)ask =7.55 × 1.7660 = FFr. 13.333

USD/FFr. 6 months swap points are at premium

6 Months forward rate USD 1 = FFr 7.50 + 0.10/7.55+0.15.

Hence, USD 1= FFr 7.60/7.70

6 Months forward rate GBP/USD

6 months swap points are at discount

6 Months forward rate GBP 1 = USD 1.7645 – 0.0035/1.7660-0.0025

GBP 1 = USD 1.7610/1.7635

Forward rate GBP 1 = FFr.:

(FFr./£)Bid = (FFr./$)Bid × ($/£)Bid = 7.6 × 1.7610 = 13.384

(FFr./£)ask = (FFr./$)ask × ($/£)ask = 7.70 × 1.7635 = 13.579

| SPOT (FFr./£) | 13.234/13.333 |

| 6 months | 13.384/13.579 |

| Swap points | 150/246 |

![]()

Question 13.

The rate of inflation in USA is likely to be 3% per annum and in India it is likely to be 6.5%. The current spot rate of US $ in India is ? 43.40. Find the expected rate of US $ in India after one year and 3 years from now using purchasing power parity theory. [Nov. 2008, 2017] [4 Marks]

Answer:

Basic information given in the question

The rate of inflation in USA – 396 per annum

The rate of inflation in India – 6.596 per annum

Spot rate 1 USD = Rs. 43.40

According to Purchasing Power Parity

Forward rate after 1 year = Spot rate \(\left[\frac{1+\text { Annual Inflation rate in India }}{1+\text { Annual Inflation rate in USA }}\right]^t\)

= 43.40\(\left[\frac{1+0.065}{1+0.03}\right]^1\) = 43.4 (1.03398) = ₹ 44.875

Forward rate after 3 years = 43.40 \(\left[\frac{1+0.065}{1+0.03}\right]^3\) = 43.40 (1.03398)3 = ₹ 47.9762

Question 14.

The rate of inflation in India is 8% per annum and in the U.S.A. it is 4%. The current spot rate for USD in India is ₹ 46. What will be the expected rate after 1 year and after 4 years applying the Purchasing Power Parity theory. [May 2010] [4 Marks]

Answer:

Basic information given in the question

The rate of inflation in USA – 4% per annum

The rate of inflation in India – 8% per annum

Spot rate 1 USD = Rs. 46

According to Purchasing Power Parity

Forward rate after 1 year = Spot rate\(\left[\frac{1+\text { Annual Inflation rate in India }}{1+\text { Annual Inflation rate in USA }}\right]^t\)

= 46\(\left[\frac{1+0.08}{1+0.04}\right]^1\) = 46 (1.03846) = ₹ 47.769

Forward rate after 4 year = 46\(\left[\frac{1+0.08}{1+0.04}\right]^4\) = 46 (1.038460)4 = ₹ 53.495

Alternative Solution:

The differential inflation is 4%. Hence the rate will keep changing adversely by 4% every year. Assuming that the change is reflected at the

| End of Year | ₹ × (1 + lnflation Rate) | ₹/USD |

| 1 | ₹ 46.00 × 1.04 | 47.84 |

| 2 | ₹ 47.84 × 1.04 | 49.75 |

| 3 | ₹ 49.75 × 1.04 | 51.74 |

| 4 | ₹ 51.74 × 1.04 | 53.81 |

Tutorial Note:

The first alternative is more preferable.

Question 15.

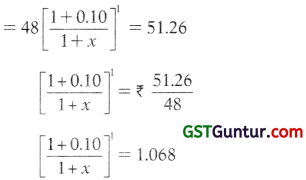

The rate of inflation in India is 10% per annum. What will be the rate of inflation in the U.S.A. if the current spot rate for USD in India is ₹ 48 and the expected rate after 1 year is t 51.26, by applying the Purchasing Power Parity theory.

Answer:

Basic information given in the question

The rate of inflation in USA -?

The rate of inflation in India – 10% per annum

Spot rate 1 USD = ₹ 48

Forward rate after 1 year 1 USD = ₹ 51.26

According to Purchasing Power Parity

Forward rate after 1 year = Spot rate \(\left[\frac{1+\text { Annual Inflation rate in India }}{1+\text { Annual Inflation rate in USA }}\right]^t\)

The rate of inflation in US is 3% p.a.

![]()

Question 16.

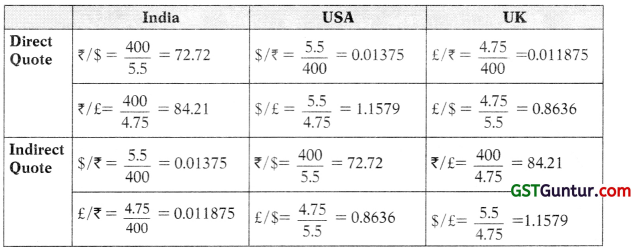

The Price of a particular book is ₹ 400 in India, $ 5.50 in USA and £ 4.75 in England.

(a) Determine the exchange rate of $, £ and ₹ if the law of one price holds good, i.e. Purchasing power parity theorem holds good.

(b) If the actual exchange rate is ₹ 70 per USD and ₹ 88 per £, where should

the book be purchased from. [Practice Question]

Answer:

(a)

(b) In order to find the place from where the book must be purchased, so that it is most beneficial, can be calculated by finding the price in one common currency, using the exchange rates calculated in part (a) of the solution. Keeping the common currency as ₹ i.e. home currency, the price of the book in ₹:

The Book should be bought in USA, as it is cheapest to buy from there.

Tutorial Note:

The same opinion may be arrived by comparing the exchange rate as per purchasing power parity as calculated in part (a) and those given in the question in part (b) as the US exchange rate is less while in U.K it is higher than calculated in part (a), it will be most beneficial to buy from US.

Question 17.

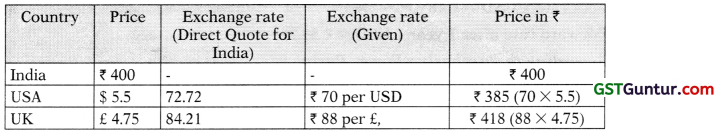

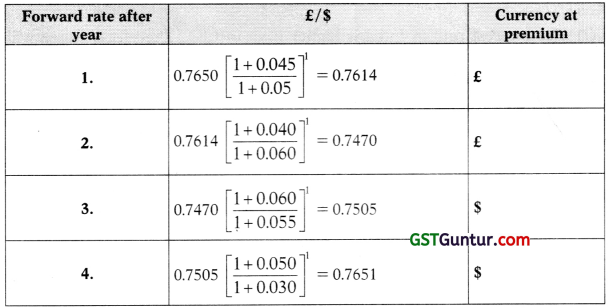

The Dollar is available in the London Market for £0.7650 i.e. £/$ = 0.7650. If the rates of inflation in the two countries is given as under for the next 4 years, what will be the forward rates for $ if purchasing power parity holds good. Which currency will be at premium in different years taking previous year as base.

Answer:

According to Purchasing Power Parity

Forward rate = Spot rate \(\left[\frac{1+\text { Annual Inflation rate in } U K}{1+\text { Annual Inflation rate in } U S A}\right]^t\)

![]()

Question 18.

On April 1, 3 months interest rate in the UK £ and US $ are 7.5% and 3.5% per annum respectively. The UK £/US $ spot rate is 0.7570. What would be the forward rate for US $ for delivery on 30th June? [Nov. 2008] [Nov. 2018] [4 Marks]

Answer:

Basic information given in the question

The rate of interest in USA – 3.5% per annum or 0.875% per 3 months

The rate of interest in UK – 7.5% per annum or 1.875% per 3 months

Spot rate 1 US $ = UK £ 0.7570

According to Interest Rate Parity

Forward rate after 3 months = Spot rate\(\left[\frac{1+\text { Interest rate in } U K}{1+\text { Interest rate in } U S A}\right]^t\)

= 0.7570\(\left[\frac{1+0.01875}{1+0.00875}\right]^1\) = 0.7570 (1.009999) = £ 0.7645

Forward rate 1US$ = UK£ 0.7645

Question 19.

If the present interest rate for 6 months borrowings in India is 9% per annum and the corresponding rate in USA is 2% per annum, and the US$ is selling in India at ? 64.50/$.

Then:

(i) Will US$ be at a premium or at a discount in the Indian forward market?

(ii) Find out the expected 6-month forward rate for US$ in India.

(iii) Find out the rate of forward premium/discount. [Nov. 2012 Modified] [Nov. 2017] [5 Marks]

Answer:

(i) The interest rate in India is higher than in USA. Therefore, rupee will depreciate and hence dollar will be at premium.

(ii) According to Interest Rate Parity

The rate of interest in INDIA – 9% per annum or 4.5% per 6 months

The rate of interest in USA – 2% per annum or 1% per 6 months

Spot rate 1 US $ = Rs. 64.50

Forward rate after 6 months = Spot rate \(\left[\frac{1+\text { half yearly interest rate in INDIA }}{1+\text { half yearly interest rate in USA }}\right]^t\)

= 64.50\(\left[\frac{1+0045}{1+0.01}\right]^1\) = 64.50 (1.03465) = Rs. 66.735

(iii) Calculation of forward premium of Dollar.

= \(\frac{\text { Forward Rate }- \text { Spot Rate }}{\text { Spot Rate }}\) × 100 \(\frac{66.735-64.50}{64.50}\) × 100

= 3.4651% for 6 months

Annualized Premium = 3.4651 × \(\frac{12 \text { Months }}{6 \text { Months }}\) = 6.93%

Question 20.

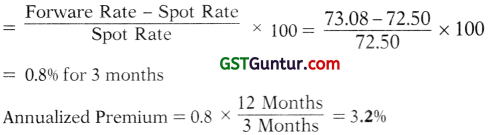

The US Dollar is selling in India at Rs. 72.50. If the interest rate for a 3 months borrowing in India is 6% per annum and the corresponding rate is USA is 2.75%.

(i) Do you expect that US dollar will be at a premium or at discount in the Indian Forex Market ?

(ii) What will be the expected 3-months forward rate for US dollar in India ?

(Hi) What will be the rate of forward premium or discount ? [Nov. 2019 Old Syllabus] [6 Marks]

Answer:

(i) The interest rate in India is higher than in USA. Therefore, rupee will de-preciate and hence dollar will be at premium in the Indian forex market.

(ii) According to Interest Rate Parity

The rate of interest in INDIA – 6% per annum or 1.5% per 3 months

The rate of interest in USA – 2.75% per annum or 0.6875% per 3 months

Spot rate 1 US $ = Rs. 72.50

Forward rate after 3 months = Spot rate

\(\left[\frac{1+3 \text { months interest rate in INDIA }}{1+3 \text { months interest rate in USA }}\right]\)

= 72.50\(\left[\frac{1+0.015}{1+0.006875}\right]^1\) = 72.50 (1.008) = Rs.73.08

(iii) Calculation of forward premium of Dollar.

![]()

Question 21.

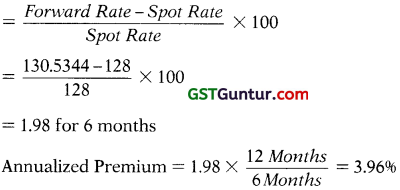

If the present interest rate for 6 months borrowings in Japan is 6% per annum and the corresponding rate in USA is 2% per annum and the US$ is selling in Japan at JPY128/$.

Then:

(i) Will US$ be at a premium or at a discount in the Japanese forward market?

(ii) Find out the expected 6-month forward rate for US$ In Japan.

(iii) Find out the rate of forward premium/discount on Japanese Yen as well as on US$.

Answer:

(i) The interest rate in Japan is higher than in USA. Therefore, Yen (¥) will depreciate and hence dollar will be at premium.

(ii) According to Interest Rate Parity

The rate of interest in Japan – 6% per annum or 3% per 6 months

The rate of interest in USA – 2% per annum or 1% per 6 months

Spot rate 1 US $ = ¥128

Forward rate after 6 months = Spot rate

\(\left[\frac{1+\text { half yearly interest rate in Japan }}{1+\text { half yearly interest rate in USA }}\right]^t\)

= 128 \(\left[\frac{1+003}{1+0.01}\right]^1\) = 128 (1.0198) = ¥ 130.5344

(iii) Calculation of forward premium on $.

(iv) Calculation of forward Discount on ¥.

= \(\frac{\text { Spot Rate-Forward Rate }}{\text { Forward Rate }}\) × 100

= \(\frac{128-130.5344}{130.5344}\) × 100

= (-)1.9416 for 6 months

(The negative sign indicates that ¥ is at discount in the forward market.)

Annualized Discount = 1.9416 × \(\frac{12 \text { Months }}{6 \text { Months }}\) = 3.8832%

Question 22.

Presently, one US $ is worth 140 Japanese Yen in the spot market. The interest rate in Japan on 90 days Government securities is 4% per annum. If the interest rate parity theorem holds true and 3-month forward rate is 138 Yen per US $, what is the implied interest rate in USA?

If the actual interest rate is 7% per annum in USA, what action would follow?

Answer:

Basic information given in the question

The rate of interest in Japan – 4% per annum or 1.00% for 90 days

Spot rate 1 US $ = JPY 140

Forward rate 1 US $ = JPY 138

According to Interest Rate Parity

Forward rate after 3 months = Spot rate \(\left[\frac{1+\text { Interest rate in Japan }}{1+\text { Interest rate in USA }}\right]^t\)

130 = 140 \(\left[\frac{1+0.01}{1+\text { Interest rate in } U S A}\right]^1\)

1 + Interest rate in USA = 140\(\left[\frac{1+0.01}{138}\right]^1\)

1 + Interest rate in USA = 1.024637

Interest rate in U.K = 1.024637 – 1

= 0.024637

Annualized interest rate = 0.024637 × 4 = 0.09855 = 9.855%

If the actual interest rate in US is 7%, it is below the implied interest as per forward rate, therefore there will be arbitrage opportunity. A person will gain by borrowing in US @ 1%, converting $ into JPY, investing in Japan and reconverting into $ using forward rate.

![]()

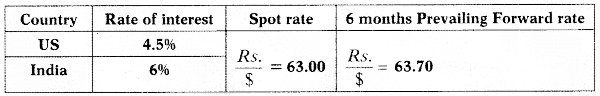

Question 23.

Mr. Shekhawat has ₹ 1,00,000 to Invest which he can do in India or in US. You are given the following information:

Advise him where should he invest and the net gain by doing so.

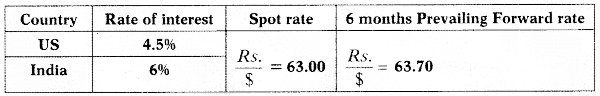

Answer:

Basic information given in the question

The rate of interest in USA – 4.5% per annum or 2.25% per 6 months

The rate of interest in India – 6% per annum or 3.00% per 6 months

Spot rate 1 US $ = ₹ 63.00

According to Interest Rate Parity

Forward rate after 6 months = Spot rate \(\left[\frac{1+\text { Interest rate in India }}{1+\text { Interest rate in USA }}\right]^t\)

= 63.00\(\left[\frac{1+0.030}{1+0.0225}\right]^1\) = ₹ 63.46

Since the theoretical forward rate is not equal to the prevailing forward rate, there is an arbitrage opportunity. As the theoretical forward rate is less, Mr. Shekhawat will gain by investing in USA, as $ is expected to appreciate more than influenced bv interest rate.

| 1. Action | Convert ₹ 1,00,000 into $ at the prevailing rate of ₹ 63. Total $ = \(\frac{1,00,000}{63}\) = 1,587.30 |

| 2. Invest | Invest in US @ 4.5% p.a. i.e. 2.25% for 6 months |

| 3. Enter into forward contract | Take a forward contract to sell $ @ prevailing forward rate i.e ₹ 63.70. |

| 4. After 6 months | Realize the investment = $1,623.01 (1,587.30 × 1.0225) |

| 5. Convert $ into ₹ | 1,623.01 × 63.70 = ₹ 1,03,385.74 = ₹ 1,03,386 (as per forward contract) |

Had he made the investment in India, he would have got interest @ 3% for 6 months and total value of investment would be ₹ 1,03,000 (₹ 1,00,000 × 1.03). Hence, his net gain is ₹ 386

Question 24.

ABC Ltd. has to make a US$ 5 million payment in three months’ time. The required amount in dollars is available with ABC Ltd. Management of the company decides to invest them for three months and following information is available in this context:

| The US$ deposit rate is 9% p.a. | The spot exchange rate is $ 1.82/pound. |

| The sterling pound deposit rate is 11% p.a. | The 3 month forward rate is $ 1.80/pound. |

Answer the following questions:

(i) Where should the company invest for better returns?

(ii) Assuming that the interest rates and the spot exchange rate remain as above, what forward rate would yield an equilibrium situation?

(iii) Assuming that the US interest rate and the spot and forward rates remain as above, where should the company invest if the sterling pound deposit rate were 15% per annum?

(iv) With the originally stated spot and forward rates and the same dollar deposit rate, what is the equilibrium sterling pound deposit rate?

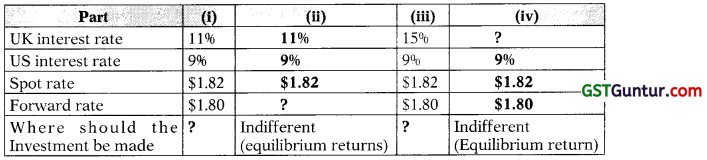

Answer:

Basic information given in the question:

Total $ to be paid $5 million

The rate of interest in UK- 11% per annum or 2.75% per 3 months

The rate of interest in US – 9% per annum or 2.25% per 3 months

Spot rate 1 £ = $1.82

Forward rate 1 £ = $1.80

Asked:

(i) If the investment is made in US:

Receipts after 3 months = 5 million (1.0225) = 51,12,500

Balance left after making the payment = $1,12,500

Convert into £ @ forward rate of 1.80$/ £

= 1,12,500/1.80 = £ 62,500

Alternatively if investment is made in UK

Convert $5 million into £ at the prevailing spot rate = $ 1.82/£

= 50,00,000/1.82 = £ 2747,252.75

Invest in UK for 3 months @11% p.a.

Receipts after 3 months = 27,47,252.75 (1.0275) = £ 28,22,802.20

Use the required £ to convert into $ 5 million at the forward rate of $1.80/£.

=50,00,000/1.80 = £ 27,77,777.78

Balance in hand; = £ 45,024.42 (£ 28,22,802.20 – £ 27,77,777.78)

Therefore, It is better to invest in US

(ii) Equilibrium forward rate:

Forward rate after 3 months = Spot rate \(\left[\frac{1+\text { Interest rate in } U S A}{1+\text { Interest rate in } U . K}\right]^t\)

= 1.82 \(\left[\frac{1+0.0225}{1+0.0275}\right]^1\) = 1.82 (0.99513) = $1.81114

Since the theoretical forward rate is not equal to the prevailing forward rate, there is an arbitrage opportunity. As the theoretical forward rate is more, the investor will gain by investing in USA as £ is expected to depreciate more than influenced by the interest rate. Therefore, the answer in part (i) suggests investment in USA.

(iii) Place of investment, it Pound deposit rate is 15% p.a.

Forward rate after 3 months = Spot rate\(\left[\frac{1+\text { Interest rate in } U S A}{1+\text { Interest rate in U.K }}\right]^t\)

= 1.82\(\left[\frac{1+0.0225}{1+0.0375}\right]^1\) = 1.82 (0.98554) = $ 1.7937

Since the theoretical forward rate is not equal to the prevailing forward rate, there is an arbitrage opportunity. As the theoretical forward rate is less, the investor will gain by investing in UK as £ is expected to depreciate less than influenced by the interest rate.

Verification:

Convert $5 million into £ at the prevailing spot rate = $1.82/£

= 50,00,000/1.82 = £2747,252.75

Invest in UK for 3 months @15% p.a.

Receipts after 3 months = 27,47,252.75(1.0375) =£28,50,274.73

Use the required £ to convert into $ 5 million at the forward rate of $1.80/£.

=50,00,000/1.80 = £27,77,777.78

Balance in hand = £72,496.95 (£28,50,274.73 – £27,77,777.78)

So, it is better to invest in U.K

(iv) Equilibrium Sterling Pound deposit rate:

Forward rate after 3 months = Spot rate \(\left[\frac{1+\text { Interest rate in } U S A}{1+\text { Interest rate in } U \cdot K}\right]^t\)

1.80 = 1.82 \(\left[\frac{1+0.0225}{1+\text { Interest rate in U.K }}\right]^1\)

1 + Interest rate in U.K = 1.82 \(\left[\frac{1+0.0225}{1.80}\right]^1\)

1 + Interest rate in U.K = 1.03386

Interest rate in U.K= 1.03386 – 1 = 0.03386

Annualized interest rate = 0.03386 × 4 =0.13544 = 13.54%

To sum up the answer

| Part | Answer |

| (i) | USA |

| (ii) | 1.81114 |

| (iii) | UK |

| (iv) | 13.54% |

![]()

Question 25.

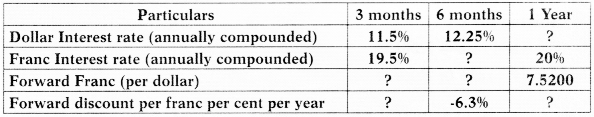

The following table shows interest rates for the United states dollar and French francs (FFr.). The spot exchange rate is 7.05 francs per dollar. Complete the missing figures:

Answer:

Basic information given in the question

The rate of interest in US- 11.5% per annum or 2.875% per 3 months

The rate of interest in France – 19.5% per annum or 4.875% per 3 months

Spot rate 1 USD = FFr7.05

According to Interest Rate Parity

1. Missing value for 3 months period:

(i) Forward rate after 3 months = Spot rate \(\left[\frac{1+\text { Interest rate in France }}{1+\text { Interest rate in } U S A}\right]^t\)

= 7.05 \(\left[\frac{1+004875}{1+0.02875}\right]^1\) = 7.05 (1.01944) = FFr7.18705

(ii) Calculation of forward Discount on FFr.

= \(\frac{\text { Spot Rate }- \text { Forward Rate }}{\text { Forward Rate }}\) × 100 = \(\frac{7.05-7.18705}{7.18705}\) × 100

= (-) 1.9069 for 3 months

(The negative sign indicates that FFr is at discount in the forward market.)

Annualized Discount = 1.9069 × \(\frac{12 \text { Months }}{3 \text { Months }}\) = 7.627%

2. Missing value for 6 months period

(i) Calculation of Franc interest and Forward rate after 6 months

(The negative sign indicates that FFr is at discount in the forward market.)

Solving for x

Forward rate = 7.28FFr

(ii) Interest rate in France

7.28 = 7.05\(\left[\frac{1+\text { Interest rate in France }}{1.06125}\right]^t\)

= 0.09587 = 9.587% for 6 months

Annualized = 19.17% (9.587 × \(\frac{12}{6}\))

3. Missing value for 1 year period

(i) Calculation of interest in US:

Forward rate after 1 year = Spot rate \(\left[\frac{1+\text { Interest rate in France }}{1+\text { Interest rate in } U S A}\right]^t\)

FFr 7.52 = 7.05\(\left[\frac{1+0.20}{1+x}\right]^1\)

Solving for x

1 + x = 1.125

x = 0.125 = 12.5%

Therefore annual interest in US = 12.5%

(ii) Calculation of forward Discount on FFr.

= \(\frac{\text { Spot Rate }- \text { Forward Rate }}{\text { Forward Rate }}\) × 100 = \(\frac{7.05-7.52}{7.52}\) × 100

= 6.25%

![]()

Question 26.

ABC Ltd. of UK has exported goods worth Singapore $ (S$) 1,00,000 receivable in 6 months. The exporter wants to hedge the receipt in the forward market. The following information is available:

| Spot Exchange Rate (S$/£) | 3.60 |

| Interest Rate in UK | 6% |

| Interest Rate in Singapore | 15% |

The forward rates truly reflect the interest rates differential. Find out the gain/loss to UK exporter if S $ spot rates (i) declines 2%, (ii) gains 4% or (iii) remains unchanged over next 6 months. [Practice Question]

Answer:

According to Interest Rate Parity

Forward rate after 6 months = Spot rate \(\left[\frac{1+\text { Interest rate in Singapore }}{1+\text { Interest rate in } U K}\right]^t\)

Forward Rate = \(\frac{3.60(1+0.075)}{(1+0.030)}\) = S$ 3.7573/£

(i) If Singapore $ (S$) spot rate decline by 2% then, the rate will be

\(\frac{1}{3.6}\) × 0.98 = \(\frac{0.2722 £}{\text { S. } \$}\) = S $ \(\frac{0.2722 £}{\text { S. } \$}\) /£ = S$ 3.6735/£

| £ | |

| £ receipt as per Forward Rate (SS 1,00,000/3.7573) (Rounded off) | 26,615 |

| £ receipt as per Spot Rate after the decline (S$ 1,00,000/3.6735) | 27,222 |

| Loss due to forward contract | 607 |

Since the forward price implies a higher rate of decline in rates, there will be loss in taking forward cover.

(ii) If S$ spot rate gains by 4% then the rate will be

\(\frac{1}{3.6}\) × 1.04 = \(\frac{0.2889 £}{\mathrm{~S} \$}\) = S$ \(\frac{1}{0.2889}\)/£ = S$ 3.4614/£

| £ | |

| £ receipt as per Forward Rate (S$ 1,00,000/3.7573) | 26,615 |

| £ receipt as per Spot Rate (S$ 1,00,000/3.4614) | 28,890 |

| Loss due to forward contract | 2,275 |

(iii) If spot rate remains unchanged

| £ | |

| £ receipt as per Forward Rate (S$ 1,00,000/3.7573) | 26,615 |

| £ receipt as per Spot Rate (S$ 1,00,000/3.6) | 27,778 |

| Loss due to forward contract | 1,163 |

Question 27.

An Indian company obtains the following quotes (₹/$)

| Spot: | 35.90/36.10 |

| 3-months forward rate: | 36.00/36.25 |

| 6-months forward rate: | 36.10/36.40 |

The company needs $ funds for six months. Determine whether the company should borrow in $ or ₹.

Interest rates are:

3-months interest rate: ₹ : 12%; $: 6%

6-months interest rate: ₹ : 11.50%; $:5.5%

Also determine what should be the rate of interest after 3-months to make the company indifferent between 3-month borrowing and 6-months borrowing in the case of:

(i) Rupee borrowing

(ii) Dollar borrowing

Note: For the purpose of calculation, you can take the units of dollar and rupee as 100 each. [Nov. 2018] [8 Marks]

Answer:

The following information is given

Spot Rate \(\left(\frac{₹}{\$}\right)\) = 35.90/36.10

3 months forward rate: 36.00/36.25

6 months forward rate: 36.10/36.40

3 months interest rate: ₹ 12%/$6%

6 months interest rate: ₹ 11.50%/$5.5%

The Company needs to Borrow $ for 6 months.

If the Company Borrows in $ [Let us assume it needs $ 100]

Borrow = 100 $ @ 5.5%

Repay = 100 $ after 6 months together with interest

6 Months interest = 100 × \(\frac{5.5}{100}\) × \(\frac{6}{12}\) =$2.75

Total outflow = Principal ($ 100) + Int. ($ 2.75) = $ 102.75

Amount in ₹ required to repay the loan taken in dollars

= 102.75 × 6 months forward ask rate

= 102.75 × 36.40 = ₹ 3,740.10

If the Indian Company borrows in Rupees, equivalent to $ 100

Rupees required to buy 100 $ in Spot market = 100 × 36.10 = ₹ 3,610

Rate of interest for 6 months borrowing in ₹ = 11.5096 p.a. i.e. 5.75% for 6 months.

Interest on loan (₹ 3,610 × 5.7596) = ₹ 207.5.75

Total Outflow in ₹ (Principal + Interest) = ₹ 3,610 + ₹ 207.575

= 3,817.575 or ₹ 3817.60 app.

Conclusion: Since the outflow is less if money is borrowed in $, therefore the Company should make the borrowings in $ only.

Determination of Forward Rate of Interest [3 months after 3 months]

The rate of interest after 3 months to as to make the Company indifferent between 3 months borrowing and 6 months borrowing shall be the 3 months forward rate of interest after 3 months.

(i) In case of Rupee borrowing

3 months interest rate = 12% p.a.

Rate of Interest for 3 months = 12/4 = 3% or 0.03

6 months interest rate = 11.50% p.a.

Rate of interest for 6 months = 5.75% p.a.

∴ 3 months forward rate (f):

= (1.03) (1 + f) = 1.0575

(1 + f) = \(\frac{1.0575}{1.03}\) = 1.0267

Rate = (1.0267 – 1) × 100 = 2.67%

∴ 3 month interest after 3 months in Rupee = 2.67%

Annualized = 2.67 × 4 = 10.68%

(ii) In case of Dollar borrowing

3 month interest rate = 6% p.a.

6 months interest rate = 5.5% p.a

(1.015) (1 + f) = 1.0275

(1 + f) = 1.01231

Forward rate = (1.01231 – 1) × 100 = 1.23%

Annualized = 1.23 × 4 = 4.9296

![]()

Question 28.

Your FOREX dealer had entered into a cross currency deal and had sold US $ 10,00,000 against EURO at US $ 1 = EURO 1.4400 for spot delivery.

However, later during the day, the market became volatile and the dealer in compliance with his management’s guidelines had to square-up the position when the quotations were:

| Spot US $ 1 | INR 31.4300/4500 |

| 1 month margin | 25/20 |

| 2 months margin | 45/35 |

| Spot US $ 1 | Euro 1.4400/4450 |

| 1 month forward | 1.4425/4490 |

| 2 months forward | 1.4460/4530 |

What will be the gain or loss in the transaction? [May 2009] [6 Marks]

Answer:

| 1. Exposure | US $ 10,00,000 sold against Euros. EURO Receivables 10,00,000 × 1.4400 = EURO 14,40,000 |

| 2. Action | Square off Position i.e. Buy US $ 10,00,000 Spot US $ 1 = Euro 1.4400/4450 EURO Payables 10,00,000 × 1.4450 = EURO 14,45,000 |

| 3. Net position | Net Loss in the Transaction = EURO 5,000 |

| 4. Convert loss into Rs. | As the direct quotation for Rupee against Euro is not available, Cross currency Ask rate for Euro is required to be calculated. |

Given:

(a) USD 1 = EURO 1.4400/4450

(b) USD 1 = INR 31.4300/4500

Cross Currency ask rate of 1EURO =

Rs. 31.4500/1.440 i.e. Rs. 21.8403

Loss in the Transaction to acquire EURO 5,000 from the market Rs. 21.8403 × 5,000 = Rs. 1,09,201.50

Question 29.

A Bank sold Hong Kong Dollars 40,00,000 value spot to its customer at ₹ 7.15 and covered itself in London Market on the same day, when the exchange rates were :

U$$ 1 = HK$ 7.9250/7.9290

Local inter-bank market rates for US$ were

Spot US$ 1 = ₹ 55.00/55.20

You are required to calculate rate and ascertain the gain or loss in the transaction. Ignore brokerage.

You have to show the calculations for exchange rate up to four decimal points. [May 2013] [5 Marks]

Answer:

| 1. Exposure | HK $ 40,00,000 sold against Rupees Rupees Receivables 40,00,000 × 7.15 = RS. 2,86,00,000 |

| 2. Action | Cover Position i.e. Buy HK $ 40,00,000 Payables 40,00,000 × 6.9653 (WN) = RS. 2,78,61,200 |

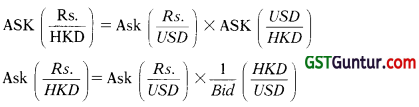

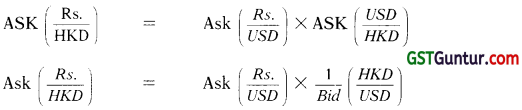

| 3. Determine Ask rate of HK$ against rupee | As the direct quotation for HK$ against Rupee is not available, Cross currency Ask rate for HK$ is required to be calculated. |

| 4. Net position | Net gain in the Transaction = Rs. 7,38,800 |

Working Note:

To acquire HK$40,00,000 from the market

(a) US$ 1 = HK$ 7.9250/7.9290 (London Market)

(b) USD 1 = INR Rs. 55.00/55.20 (Local Market)

Cross Currency buying rate of 1HKS =

Rs.55.20/7.9250 i.e. Rs.6.9653

Payables 40,00,000 × 6.9653 = ₹ 27,861,200

Gain in the Transaction Rs. (2,86,00,000 – 2,78,61,200) = Rs. 7,38,800

Alternatively :

Gain in the Transaction = 40,00,000 (₹ 7.15 – ₹ 6.9653) = ₹ 7,38,800

Question 30.

Edelweiss Bank Ltd. sold Hong Kong dollar 2 crores value spot to its customer at ₹ 8.025 and covered itself in the London market on the same day, when the exchange rates were

US $ 1 = HK $ 7.5880 – 7.5920

Local inter-bank market rates for US $ were

Spot US $ 1 = ₹ 60.70 – 61.00

Calculate the cover rate and ascertain the profit or loss on the transaction. Ignore brokerage. [May 2014] [Nov. 2014] [5 Marks]

Answer:

| Exposure | HK $ 2,00,00,000 sold against Rupees Rupees Receivables 2,00,00,000 × 8.025 = Rs. 16,05,00,000 |

| Action | Cover Position i.e. Buy HK $ 2,00,00,000 Payables 2,00,00,000 × 8.039(WN)= Rs. 16,07,80,000 |

| Determine Ask rate of HK$ against rupee | As the direct quotation for HK$ against Rupee is not available, Cross currency Ask rate for HK$ is required to be calculated. |

| Net position | Net Loss in the Transaction = Rs. 2,80,000 |

Working Note:

To acquire HK$2,00,00,000 from the market

(a) US$ 1 = HK$ 7.5880 – 7.5920

(b) USD 1 = ₹ 60.70 – 61.00 (Local Market)

Cross Currency buying rate of 1 HK$ = INR

Rs. 61.00/7.5880 i.e. Rs. 8.0390

Payables 2,0000000 × 8.039 = 16,07,80,000

Loss in the Transaction Rs. (16,05,00,000 – 16,07,80,000) = Rs. 2,80,000

Alternatively:

Loss in the Transaction = 2,00,00,000 (₹ 8.025 – ₹ 8.039) = ₹ 2,80,000

Question 31.

The Bank sold Hong Kong Dollar 1,00,000 spot to its customer at ₹ 7.5681 and covered itself in London market on the same day, when the ex-change rates were

US $ 1 = HK $ 8.4409 HK $ 8.4500

Local inter-bank market rates for US $ were:

Spot US 1 = ₹ 62.7128 ₹ 62.9624

Calculate the cover rate and ascertain the profit or loss in the transaction. [May 2014] [5 Marks]

Answer:

| 1. Exposure | HK $ 1,00,000 sold against Rupees Rupees Receivables 1,00,000 × 7.5681 = Rs. 7,56,810 |

| 2. Action | Cover Position i.e. Buy HK $ 1,00,000 Payables 1,00,000 × 7.4592(WN) = RS. 7,45,920 |

| 3. Determine Ask rate of HK$ against rupee | As the direct quotation for HK$ against Rupee is not available, Cross currency Ask rate for HK$ is required to be calculated. |

| 4. Net position | Net gain in the Transaction = Rs. 10,890 |

Working Note:

To acquire HK$1,00,000 from the market

(a) USD 1 = HK $ 8.4409/8.4500 (London Market)

(b) USD 1 = ₹ 62.7128/62.9624 (Local Market)

Cross Currency buying rate of 1HK$ =

Rs. 62.9624/8.4409 i.e. Rs. 7.4592

Payables = 7.4592 × 1,00.000 = ₹ 7,45,920

Gain in the Transaction Rs. (7,56,810 – 7,45,920) = Rs. 10,890

Alternatively:

Gain in the Transaction = 1,00,000 (₹ 7.5681 – ₹ 7.4592) = ₹ 10,890

![]()

Question 32.

You as a forex dealer had entered into a cross currency deal and had sold US $ 10,000 against GBP at US $ 1 = GBP 0.7650 for spot delivery.

However, the management has ordered immediate cancellation of the same considering the increased volatility in the market.

| Spot US $ 1 | INR 68.2500/4500 |

| 1 month margin | 15/20 |

| 2 months margin | 45/70 |

| Spot US $ 1 | GBP 0.7650/0.7720 |

| 1 month forward points | 20/35 |

| 2 months forward points | 35/25 |

What will be the gain or loss in the transaction?

Answer:

| 1. Exposure | US $ 10,000 sold against GBP. GBP Receivables 10,000 × 0.7650 = £ 7,650 |

| 2. Action | Square off Position i.e Buy US $ 10,000 Spot US $ 1 = GBP 0.7650/0.7720 £ Payables 10,000 × 0.7720 = £ 7720 |

| 3. Net position | Net Loss in the Transaction = £70 |

| 4. Convert loss into ₹ | As the direct quotation for Rupee against £ is not available, Cross currency Ask rate for £ is required to be calculated. |

The spot rates available are:

(£/$) bid = £0.7650

(£/$) ask = £0.7720

(₹/$) bid = ₹ 68.25

(₹/$) ask = ₹ 68.45

From above available rates we can compute required rate as follows:

(₹/£)ask = ($/£)ask × (₹/$)ask

\(\left(\frac{1}{£ / \$}\right)_{\text {bid }}\) × (₹/$)ask

= (1/0.7650) × (68.45) = ₹ 89.4771

Total Loss = ₹ 6,263 (89.4771 × 70)

Question 33.

You, a foreign exchange dealer of your bank, are informed that your bank has sold a T.T. on Copenhagen for Danish Kroner 10,00,000 at the rate of Danish Kroner 1 = ₹ 6.5150. You are required to cover the transaction either in London or New York market. The rates on that date are as under:

| Mumbai – London | ₹ 74.3000 | ₹ 74.3200 |

| Mumbai- New York | ₹ 49.2500 | ₹ 49.2625 |

| London – Copenhagen | DKK 11.4200 | DKK 11.4350 |

| New York – Copenhagen | DKK 07.5670 | DKK 07.5840 |

In which market will you cover the transaction, London or New York, and what will be the exchange profit or loss on the transaction? Ignore brokerages. [Nov. 2013] [5 Marks]

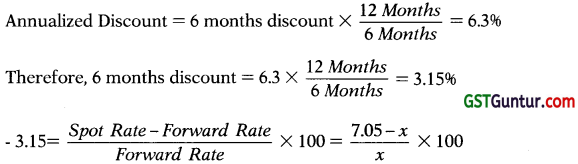

Answer:

| 1. Exposure | Danish Kroner DKK 10,00,000 sold against Rupees Rupees Receivables 10,00,000 × 6.5150 = Rs. 65,15,000 |

| 2. Action | Cover Position Le. Buy DKK 10,00,000 Option 1 (London Market) Payables 10,00,000 × 6.5079(WN 1) = Rs. 65,07,880 Option 2 (New York Market) Payables 10,00,000 × 6.51017(WN 2) = Rs. 65,10,170 |

| 3. Determine Ask rate of DKK against rupee | As the direct quotation for DKK against Rupee is not available, Cross currency Ask rate for DKK is required to be calculated. It is available both in the London Market and in the New York Market. |

| 4. Option | Based on the two cross rates available in the two markets, transaction will be done where it is more beneficial. In this case it will be done through London Market. |

| 5. Net position | Net gain in the Transaction = Rs. 7,120 (65,15,000 – 65,07,880 |

Comparison Between London Market And New York Market

| To acquire DKK 10,00,000 from the London market | To acquire DKK 10,00,000 from the New York market |

| (a) GBP1 = DKK 11.4200/11.4350 (London Market) | (a) USD1 = DKK 7.5670/7.5840 (London Market |

| (b) GBP 1 = ₹ 74.3000/74.3200(Mumbai Market)

Cross Currency buying rate of DKK = 74.3200/11.4200 i.e. Rs 6.50788 Gain in the Transaction Rs. (65,15,000 – 65,07,880) = Rs. 7,120 |

(b) USD 1 = ₹ 49.2500/49.2625 (Mumbai Market)

Cross Currency buying rate of DKK = Rs. 49.2625/7.567 i.e. Rs 6.51017 Gain in the Transaction Rs. (65,15,000 – 65,10,170) = Rs. 4830 |

| Alternatively: | |

| Gain in the Transaction = 10,00,000 (6.5150 – 6.50788) = ₹ 7,120 | Gain in the Transaction = 10,00,000 (6.5150 – 6.51017) = ₹ 4,830 |

| Therefore, it is better to buy from London Market. | |

![]()

Question 34.

You, a foreign exchange dealer of your bank, are informed that your bank has sold a T.T. on Swiss Francs 1,00,000 (CHF) at the rate of CHF 1 = ₹ 15.65. You are required to cover the transaction either in London or New York market. The rates on that date are as under:

| Mumbai – London | ₹ 85.40 | ₹ 85.65 |

| Mumbai- New York | ₹ 65.25 | ₹ 65.45 |

| London – Switzerland | CHF5.80 | CHF5.90 |

| New York – Switzerland | CHF4.50 | CHF 4.75 |

In which market will you cover the transaction, London or New York, and what will be the exchange profit or loss on the transaction? [Practice Question]

Answer:

| 1. Exposure | CHF 1,00,000 sold against Rupees

Rupees Receivables 1,00,000 × 15.65 = Rs. 15,65,000 |

| 2. Action | Cover Position i.e Buy CHF 1,00,000 Option 1 (London Market) Payables 1,00,000 × 14.7672(WN 1) = Rs. 14,76,720 Option 2 (New York Market) Payables 1,00,000 × 14.544 (WN 1) = Rs. 14,54,444 |

| 3. Determine Ask rate of CHF against rupee | As the direct quotation for CHF against Rupee is not available, Cross currency Ask rate for CHF is required to be calculated. It is available both in the London Market and in the New York Market. |

| 4. Option | Based on the two cross rates available in the two markets, transaction will be done where it is more beneficial. In this case it will be done through New York Market. |

| 5. Net position | Net gain in the Transaction = ₹ 1,10,560 (15,65,000 -14,54,440) |

Working Note -1 (W.N. 1)

Comparison Between London Market and New York Market

| To acquire CHF 1,00,000 from the London market | To acquire CHF 1,00,000 from the New York market |

| (a) GBP1 = CHF 5.80/5.90 (London Market)

(b) GBP 1 = ₹ 85.40/85.65 (Mumbai Market) = \(\frac{\text { Cross Currency Ask rate of CHF }}{85.65 / 5.80 \text { i.e. Rs. } 14.7672}\) |

(a) USD1 = CHF 4.50/4.75 (London Market)

(b) USD 1 = ₹ 65.25’65.45 (Mumbai Market) = \(\frac{\text { Cross Currency Ask rate of CHF }}{\text { Rs. } 65.45+.50 \mathrm{icc} \text { Rs. } 14.5444} \) |

| Alternatively: | |

| Gain in the Transaction = 1,00,000 (15.6514.7672) = ₹ 88280 | Gain in the Transaction = 1,00,000 (15.65 . 14.5444) = ₹ 1,10,560 |

| Therefore, it is better to cover the transaction in New York Market. | |

![]()

Question 35.

An Indian importer has to settle an import bill for $ 1,30,000. The exporter has given the Indian exporter two options.

(i) Pay immediately without any interest charges.

(ii) Pay after three months with interest at 5 per cent per annum.

The importer’s bank charges 15 per cent per annum on overdrafts. The ex-change rates in the market are as follows :

Spot rate (₹/$): 48.35/48.36

3-Months forward rate (₹/$): 48.81/48.83

The importer seeks your advice. Give your advice. [Nov. 2011] [6 Marks]

Answer:

Alternative I: To pay immediately without interest to the supplier

He will borrow the required amount from his bank @ 15%. The applicable Spot Rate is (₹/$) 48.35/48.36. Accordingly, the outflow under this option after 3 months will be the overdraft amount together with interest

| ₹ | |

| Amount required to purchases $ 1,30,000 [$ 1,30,000 × ₹ 48.36] | 62,86,800 |

| Add: Overdraft Interest for 3 months @ 15% p.a. | 2,35,755 |

| 65,22,555 |

Alternative II: To pay after 3 months together with 5% interest to the supplier

Amount Payable = Invoice Amount + Interest for 3 months @ 5% p.a.

= $ 1,30,000 + ($ 1,30,000 × 5% × 3/12) = $ 1,31,625

Accordingly, he will have to buy $ in forward market. The applicable Forward Rate is (₹/$) 48.81/48.83. Accordingly, the outflow under this option after 3 months will be

Outflow = US$ 131625 × 48.83 = ₹ 64,27,249

Since outflow of cash is less in second alternative, the importer should pay the supplier after 3 months together with 5% p.a.

Question 36.

Z Ltd. importing goods worth USD 2 million, requires 90 days to make the payment. The overseas supplier has offered a 60 days interest free credit period and for additional credit for 30 days and interest of 8% per annum. The bankers of Z Ltd. offer a 30 days loan at 10% per annum and their quote for foreign exchange is as follows:

| ₹ | |

| Spot 1 USD | 56.50 |

| 60 days forward for 1 USD | 57.10 |

| 90 days forward for 1 USD | 57.50 |

You are required to evaluate the following options :

(i) Pay the supplier in 60 days, or

(ii) Avail the supplier’s offer of 90 days credit. [Nov. 2012] [8 Marks]

Answer:

I: To pay in 60 days without interest to the supplier

He will borrow the required amount from his bank @ 10%. The applicable Forward Rate is (₹/$) 57.10. Accordingly, the outflow under this option after 90 4ays will be overdraft amount + interest

| ₹ | |

| Amount required to purchases $ 20,00,000 [$ 20,00,000 × ₹ 57.10] | 11,42,00,000 |

| Add: Overdraft Interest for 30 days @ 10% p.a. | 9,51,667 |

| 11,51,51,667 |

II: To pay after 30 days after the interest free credit period together with 8% interest to the supplier

Amount Payable = Invoice Amount + Interest for 30 days @ 8% p.a.

= $ 20,00,000 + ($ 20,00,000 × 8% × 1/12) = $ 20,13,333

Accordingly, he will have to buy $ in forward market. The applicable Forward Rate is (₹/$) 57.50. Accordingly, the outflow under this option after 30 davs will be Outflow = US$ 20,13,333 × 57.50 = ₹ 11,57,66,648

Since outflow of cash is less in first alternative, the importer should pay the supplier after 60 days by borrowing from the bank.

![]()

Question 37.

Gibralter Limited has imported 5,000 bottles of shampoo at landed cost in Mumbai, of US $ 20 each. The company has the choice for paying for the goods immediately or in 3 months time. It has a clean overdraft limit where 14% p.a. rate of interest is charged.

Calculate which of the following method would be cheaper to Gibralter Limited.

(i) Pay in 3 months time with interest @ 10% and cover risk forward for 3 months.

(ii) Settle now at a current spot rate and pay interest of the overdraft for 3 months.

The rates are as follow:

Mumbai ₹/$ spot: 60.25 – 60.55

3 months swap: 35/25 [Nov. 2014] [8 Marks]

Answer:

Alternative I: To pay after 3 months together with 10% interest to the supplier

Amount Payable = Invoice Amount + Interest for 3 months @10% p.a.

= $ 1,00,000 + ($ 1,00,000 × 10% × 3/12) = $ 1,02,500

Accordingly, he will have to buy $ in forward market. The applicable Forward Rate is Mumbai ₹/$ spot: 60.25 – 60.55

3 months swap: 35/25

Therefore Forward rate is = 59.90/60.30 since the swap points are decreasing therefore $ is at discount and swap points should be deducted from spot rates. Accordingly, the outflow under this option after 3 months will be Outflow = US$ 1,02,500 × 60.30 = ₹ 61,80,750

Alternative II: To pay immediately without interest to the supplier

He will borrow the required amount from his bank @ 14%. The applicable Spot Rate is (₹/$): 60.25 – 60.55

Accordingly, the outflow under this option after 3 months will be

| ₹ | |

| Amount required to purchases $ 1,00,000 [ $ 1,00,000 × ₹ 60.55] | 60,55,000 |

| Add: Overdraft Interest for 3 months @ 14% p.a. | 211,925 |

| 62,66,925 |

Since outflow of cash is less in first alternative, the importer should pay the supplier after 3 months together with 10% p.a.

Question 38.

DEF Ltd. has imported goods to the extent of US$ 1 crore. The payment terms are 60 days interest-free credit. For additional credit of 30 days, interest at the rate of 7.75% p.a. will be charged.

The banker of DEF Ltd. has offered a 30 days loan at the rate of 9.5% p.a. Their quote for the foreign exchange is as follows :

| Spot rate INR/US$ | 62.50 |

| 60 days forward rate INR/US$ | 63.15 |

| 90 days forward rate INR/US$ | 63.45 |

Which one of the following options would be better?

(i) Pay the supplier on 60th day and avail bank loan for 30 days

(ii) Avail the supplier’s offer of 90 days credit [May 2015] [5 Marks]

Answer:

I: To pay in 60 days without interest to the supplier

He will borrow the required amount from his bank @ 9.5%. The applicable Forward Rate is (₹/$) 63.15. Accordingly, the outflow under this option after 30 days will be

| ₹ | |

| Amount required to purchases $ 1,00,00,000 [$ 1,00,00,000 × ₹ 63.15] | 63,15,00,000 |

| Add: Overdraft Interest for 30 days @ 9.5% p.a. | 49,99,375 |

| 63,64,99,375 |

II: To pay after 30 days together with 7.75% interest to the supplier

Amount Payable = Invoice Amount + Interest for 30 days @ 7.75% p.a.

= $ 1,00,00,000 + ($ 1,00,00,000 × 7.75% × 1/12) = $ 1,00,64583.33

Accordingly, he will have to buy $ in forward market. The applicable Forward Rate is (₹/$). 63.45, the outflow under this option after 30 days will be

Outflow = US$ 1,00,64,583.33 × 63.45 = ₹ 63,85,97,812. Since outflow of cash is less in first alternative, the importer should pay the supplier after 60 days by borrowing from the bank.

![]()

Question 39.

An Indian importer has to settle an import bill for $ 2,50,000.

The exporter has given the Indian exporter two options.

(i) Pay immediately without any interest charges.

(ii) Pay after three months with interest at 6 per cent per annum.

The importer’s bank charges 15 per cent per annum on overdrafts. The exchange rates in the market are as follows:

Spot rate (Rs./$) :65.28/65.82 3-Months forward rate (Rs./$) :66.10/66.85

The importer seeks your advice. Give your advice. [Practice Question]

Answer:

Alternative I: To pay immediately without interest to the supplier

He will borrow the required amount from his bank @ 15%. The applicable Spot Rate is (₹/$) 65.28/65.82. Accordingly, the outflow under this option after 3 months will be:

| ₹ | |

| Amount required to purchases $ 2,50,000 [$ 2,50,000 × ₹ 65.82] | 1,64,55,000 |

| Add: Overdraft Interest for 3 months @ 15% p.a. | 6,17,063 |

| 1,70,72063 |

Alternative II: To pay after 3 months together with 5% interest to the supplier

Amount Payable = Invoice Amount + Interest for 3 months @ 6% p.a.

= $ 2,50,000 + ($ 2,50,000 × 6% × 3/12) = $ 2,53,750

Accordingly, he will have to buy $ in forward market. The applicable Forward Rate is (/$) ask is 66.85. Accordingly, the outflow under this option after 3 months will be

Outflow = US$ 2,53,750 × 66.85 = ₹ 1,69,63,188

Since outflow of cash is less in second alternative, the importer should pay the supplier after 3 months together with interest @ 6% p.a.

Note: The amount in Rupee has been rounded of in multiples of 1 rupee wherever fraction arose.

Question 40.

An exporter is a UK based company. Invoice amount is $ 3,50,000. Credit period is three months. Exchange rates in London are:

| Spot Rate | ($/£) 1.5865 – 1.5905 |

| 3-month Forward Rate | ($/£) 1.6100-1.6140 |

Rates of Interest in Money Market:

| Deposit | Loan | |

| $ | 7% | 9% |

| £ | 5% | 8% |

Compute and show how a money market hedge can be put in place. Compare and contrast the outcome with a forward contract. [Nov. 2008] [6 Marks]

Answer:

Money Market Hedge:

Since the UK exporter has $ 3,50,000 receivable after 3 months, he must create an opposite situation where he has exactly $ 3,50,000 payables after 3 months. This can be done by borrowing the present value of $ 3,50,000 as per the borrowing rates applicable in US, which is 9% p.a.

Exposure and action to be taken Today

| Asset | $ 3,50,000 receivables after 3 months |

| Create | $ 3,50,000 liability after 3 months |

| Borrow | Present Value of $ 3,50,000 at 9% for 3 months = \(\frac{\$ 3,50,000}{1.0225}\) = $ 3,42,299 |

| Convert into £ | Indirect Quote is ($/£) 1.5865 – 1.5905

Conversion Value = \(\frac{\$ 3,42,299}{1.5905}\) = £ 2,15,214.71 |

| Invest | £2,15,214.71 (a deposit rate in L K i.e. 54 p.a. |

Situation after 3 months

| Receive | $ 3,50,000 |

| Repay Loan with Int. | $ 3,42,299 + $ 77,701 = $ 3,50,000 |

| Realise the Investment | £2,15,214.71 × 1.0125 = £ 2,17,904.89 |

| Final Inflow in £ | £ 2,17,904.89 |

Forward Contract:

Using forward rate, amount receivable is = 3,50,000/1.6140 = £ 2,16,852.54

Calculation of money market hedge gain/loss:

Since inflow in money market hedge is higher, therefore money market hedge should be used as a technique for hedging.

Amount received through money market hedge = £2,17, 904.45

Using forward rate, amount receivable is = 3,50,000/1.6140 = £ 2,16,852.54

Gain = 2,17,904.45 – 2,16,852.54 = £ 1,051.91

So, money market hedge is beneficial for the exporter.

![]()

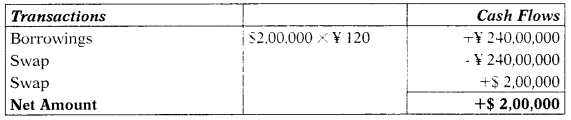

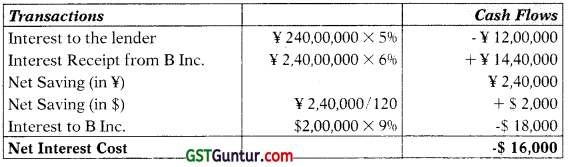

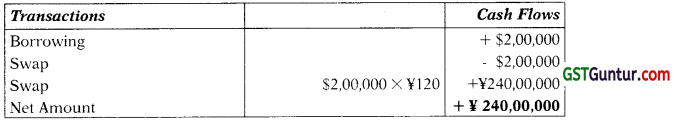

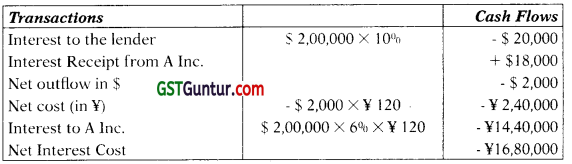

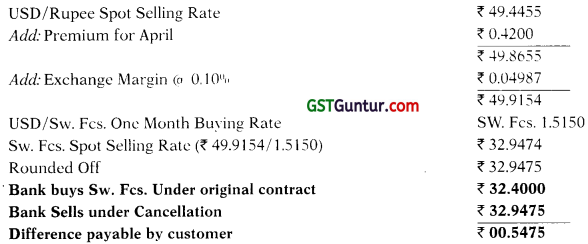

Question 41.