Financial Statements of Companies – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Financial Statements of Companies – CA Inter Accounts Question Bank

Question 1.

What are the basic characteristics of a Private Ltd. Company? (Nov 2009, 2 marks)

Answer:

Characteristics of a Private Company (As per Companies Act, 2013)

1. Restricts the rights of members to transfer its shares.

2. Limits the number of its member to 200 excluding:

(i) persons who are in employment of the company; and

(ii) persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased. For this purpose joint holders of shares will be counted as a single member.

3. Prohibits any invitation to the public to subscribe to any shares in or debentures of the company.

4. Prohibits any invitation or acceptance of deposits from any person other than its members, directors and relatives.

Question 2.

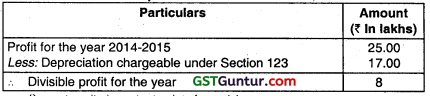

In a concern, the opening provision for doubtful debts is ₹ 51,000. During the year a sum of ₹ 10,000 was written off as bad debt. The closing balance of sundry debtors amounts to ₹ 6,30,000. It was decided that 10% of the debtor is to be maintained as provision. Calculate the closing balance toward provision for doubtful debts and pass journal entry for giving effect to the provision maintained. (May 2008, 2 marks)

Answer:

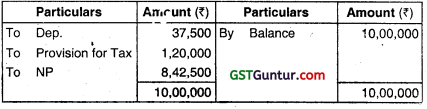

For calculating balance towards provision for doubtful debts we should prepare an account for provision for doubtful debts:-

Journal Entries

Note:-

In this question closing debtor is given. It means that amount of Bad Debts (₹ 10,000) arises during the year is already adjusted during the year, no further adjustment is therefore required.

![]()

Question 3.

The Articles of Association of S Ltd. provide the following:

(i) That 20% of the Profits of each year shall be transferred to Reserve fund.

(ii) That an amount equal to 10% of equity dividend shall be set aside for Staff bonus.

(iii) That the balance available for distribution shall be applied :

(a) in paying 14% on cumulative Preference shares.

(b) in paying 20% dividend on Equity shares.

(c) one-third of the balance available as additional dividend on Preference shares and 2/3 as additional equity dividend.

A further condition was imposed by the articles viz. that the balance carried forward shall be equal to 12% on Preference shares after making provisions (i), (ii) and (iii) mentioned above. The company has issued 13,000, 14% Cumulative participating preference shares of ₹ 100 each fully paid and 70,000 Equity shares of ₹ 10 each fully paid up.

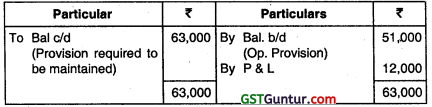

The profit for the year 2008 was ₹ 10,00,000 and balance brought from previous year ₹ 80,000. Provide ₹ 31,200 for depreciation and ₹ 80,000 for taxation before making other appropriations. Prepare Profit and Loss Appropriations A/c. (Nov 2008, 8 marks)

Answer:

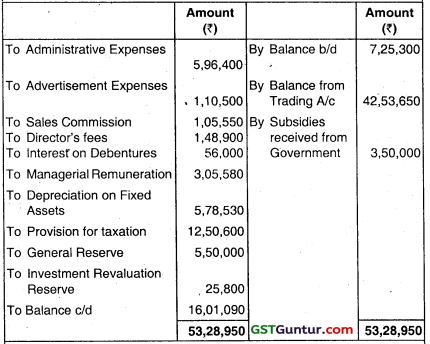

Profit and Loss Appropriation A/c

(For the year ended 31st March 2008)

Working Note:

Let remaining balance after staff bonus is x

Preference shareholders will get share from remaining balance x × \(\frac{1}{3}\) = \(\frac{1}{3}\) x

Equity shareholders will get share from remaining balance = x × \(\frac{2}{3}\) = \(\frac{2}{3}\) x

Bonus to Employees = \(\frac{2}{3}\)x × \(\frac{10}{100}\) = \(\frac{2}{30}\)x

\(\frac{2}{3}\)x × \(\frac{1}{3}\)x × \(\frac{2}{30}\)x = 2,99,040

32 x = 89,71,200

x = 89,71,200/32 = ₹ 2,80,350

Share of preference shareholders = ₹ 2,80,350 × \(\frac{1}{3}\) = ₹ 93,450

Share of equity shareholders = ₹ 2,80,350 × \(\frac{2}{3}\) = ₹ 1,86,900

Bonus to employees = ₹ 2,80,350 × \(\frac{2}{30}\) = ₹ 18,690

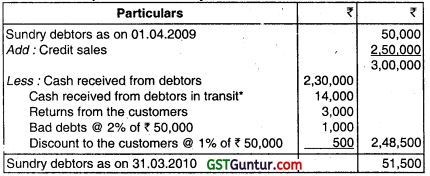

Question 4.

From the following information, calculate the amount of Sundry Debtors as on 31.3.2010:

Balance as on 1.4.2009 is ₹ 50,000.

Bad debts are 2% and discount to the customers is given @ 1% of the opening balance of Sundry Debtors.

Returns from the customers are ₹ 3,000.

Cash received from Debtors is ₹ 2,30,000.

Gash received from Debtors in transit is ₹ 14,000.

Cash Sales are ₹ 5,00,000.

Credit Sales are ₹ 2,50,000. (May 2010, 2 marks) [IPCC Gr. II]

Answer:

Computation of Sundry Debtors as on 31.03.2010

* It is assumed that information for cash in transit has already been received.

Question 5.

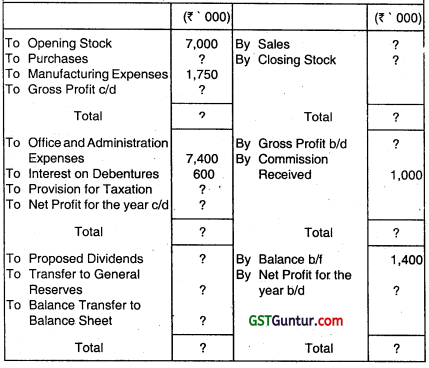

Following information of the Final Accounts of Kumaran Ltd. are missing as shown below :

Trading and Profit & Loss A/c for the year ended 31.03.2012

Balance Sheet as on 31.03.2012

You are required to provide the missing figures with the help of following information:

(i) Current Ratio 2:1.

(ii) Closing stock is 25% of sales.

(iii) Proposed dividends are 40% of the paid up capital.

(iv) Gross profit ratio is 60%.

(v) Ratio of Current Liabilities to Debentures is 2:1.

(vi) Transfer to General Reserves is equal to proposed dividends.

(vii) Profit carried forward are 10% of the proposed dividends.

(viii) Provision for taxation is 50% of profits.

(ix) Balance to the credit of General Reserves at the beginning of the year is twice the amount transferred to that account from the current profits. (Nov 2012, 16 marks)

Answer:

1. Amount of proposed dividend

= Paid up share capital × 40% = 10,000 × 40% = 4,000

2. Transfer to general reserves

= Amount of proposed dividend i.e. 4,000

3. Profit carried forward

= 10% of proposed dividend = 10% of 4,000 = 400

4. Net profit for the year

= Proposed dividend + Transfer to general reserve + Profit carried forward – Net profit carried forward = (4,000 + 4,000 + 400) – 1,400 = 7,000

5. Provision for taxation

Provision for taxation = 50% of profit (i.e. before net profit)

It means that net profit is 50% and provision for tax is 50%.

Therefore, if net profit is 7,000 then, Provision for taxation is also 7,000

6. Gross profit

= Net profit + All expenses – Commission received

= (7,000 + 7,000 + 600 + 7,400) – 1,000

= 21,000

7. Sales

= \(\left(\frac{\text { Gross profit }}{\text { Rate of profit }} \times 100\right)\)

= \(\left(\frac{21,000}{60} \times 100\right)\) = 35,000

8. Closing stock

= 25% of sales = 25% × 35,000 = 8,750

9. Purchases

= (Sales + Closing stock) – (Opening stock + Manufacturing expenses + Gross profit)

= (35,000 + 8,750) – (7,000 + 1,750 + 21,000)

= 43,750 – 29,750 = 14,000

10. Balance of general reserve as on 1.4.2011

= Twice the amount transferred to general reserve during the year

= 2 × 4,000 = 8,000

11. Amount of debentures

\(=\left(\frac{\text { Interest on debentures }}{\text { Rate of interest }} \times 100\right)\)

= \(\left(\frac{600}{10} \times 100\right)\) = 6,000

12. Current liabilities

= Current liabilities are twice of amount of debentures.

= 2 × 6,000 = 12,000

13. Current assets

Current Assets = Current ratio × Current liabilities

= 2 × 12,000 = 24,000

14. Sundry debtors

Sundry Debtors = Current assets – Stock in trade – Bank balance

= 24,000 – 8,750 – 1,250 = 14,000

15. Total of liabilities part of the balance sheet

= Shareholders’ capital + Non-current liabilities + Current liabilities

= (10,000+ 12,000+ 400)+ 6,000+ 12,000 = 40,400

16. Other PPE

= Total of Liabilities part of the balance sheet – (Current assets + Plant and Machinery)

= 40,400 – (24,000 + 14,000) = 2,400

![]()

Question 6.

Vasudha Ltd. provides following information:

Raw Material stock holding period : 3.5 months

Work-in progress holding period 1 month

Finished goods holding period : 4.5 months

Debtors collection period : 6 months

You are required to compute the operating cycle of Vasudha Ltd. What would happen if the trade payables of the company are paid in 14 months- whether these should be classified as current or non-current liability? (Nov 2013, 21/2 marks)[IPCCGr.II]

Answer:

As per Schedule III of the Companies Act, 2013, “An operating cycle is the time between the acquisition of assets for processing and their realization in cash or cash ‘equivalents”.

Therefore, operating cycle of Vasudha Ltd. will be computed as under:

Raw material stock holding period + WIP holding period + finished goods holding period + Debtor collection period = 3.5 + 1 + 4.5 + 6 = 15 months. A liability shall be classified as current when it is expected to be settled in the company’s normal operating cycle. Since the operating cycle of Vasudha Ltd. is 15 month.s, trade payables expected to be paid in 14 months should be treated as a current liability.

Question 7.

The management of Kshitij Ltd. contends that the work in progress is not valued since it is difficult to ascertain the same in view of the multiple processes involved. They opine that the value of opening and closing work in progress would be more or less the same. Accordingly, the management had not separately disclosed the work in progress in its financial statements. Comment in line with Schedule III. (21/2 marks) [IPCC Gr. II]

Answer:

Schedule III to the Companies Act, 2013 does not require to disclose in the statement of profit and loss, the amounts for which WIP have been completed at the beginning and at the end of the accounting period. Therefore, the non-disclosure in the financial statements by the company may not amount to violation of Schedule III if the differences between opening and closing WIP are not material.

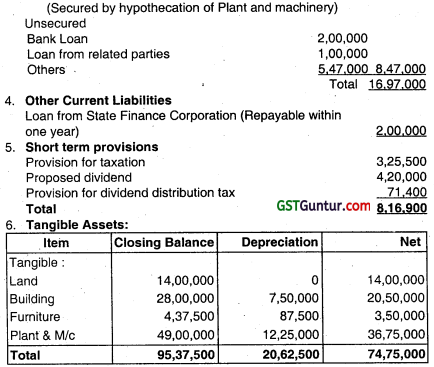

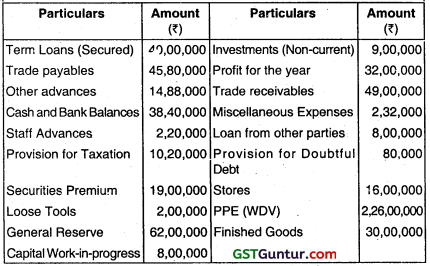

Question 8.

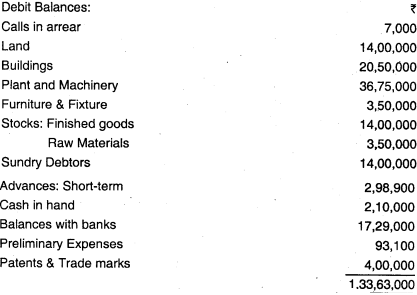

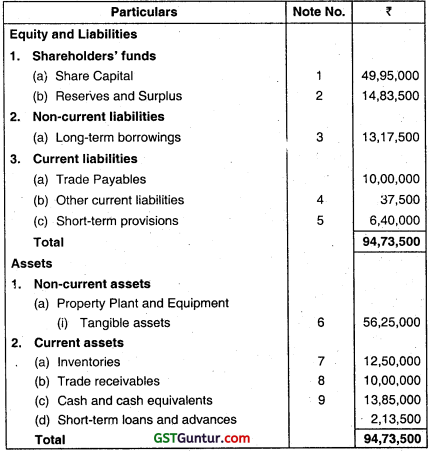

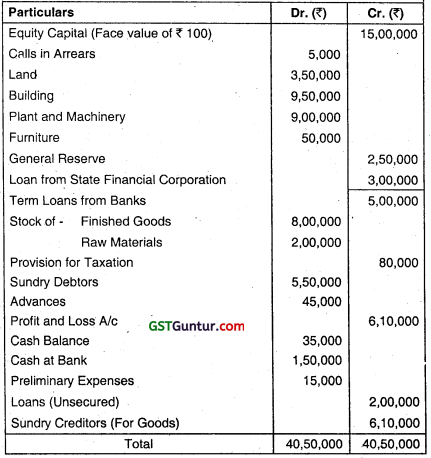

On 31st March, 2013 Bose and Sen Ltd. provides to you the following ledger balances after preparing its Profit and Loss Account for the year ended 31st March, 2013:

The following additional information is also provided:

(i) 4,20,000 fully paid equity shares were allotted as consideration for land & buildings.

(ii) Cost of Building ₹ 28,00,000

Cost of Plant & Machinery ₹ 49,00,000

Cost of Furniture & Fixture ₹ 4,37,500

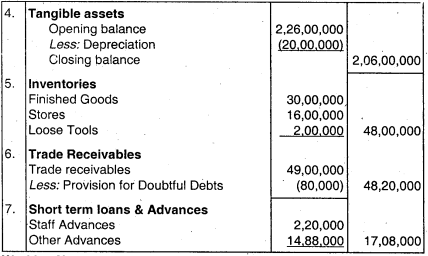

(iii) Sundry Debtors for ₹ 3,80,000 are due for more than 6 months.

(iv) The amount of Balances with Bank includes ₹ 18,000 with a bank

which is not a scheduled Bank and the deposits of ₹ 5 lakhs are for a period of 9 months.

(v) Unsecured loan includes ₹ 2,00,000 from a Bank and ₹ 1,00,000 from related parties.

You are not required to give previous year figures. You are required to prepare the Balance Sheet of the Company as on 31st March, 2013 as required under Schedule III of the Companies Act, 2013. (Nov 2013, 16 marks)

Answer:

Balance Sheet of Bose & Sen Ltd. as on 31.3.2013

Notes:

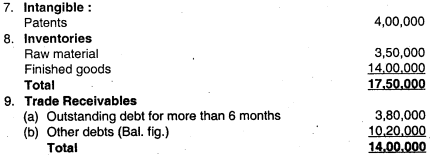

Question 9.

The Articles of Association of Samson Ltd. provide the following :

(i) That 25%. of the net profit of each year shall be transferred to reserve fund.

(ii) That an amount equal to 10% of equity dividend shall be set aside for staff bonus.

(iii) That the balance available for distribution shall be applied :

(1) in paying 15% on cumulative preference shares.

(2) in paying 20% dividend on equity shares.

(3) one-third of the balance available as additional dividend on preference shares and two-third as additional equity dividend.

A further condition was imposed by the articles viz. that the balance carried forward shall be equal to 14% on preference shares after making provision (i), (ii) and (iii) mentioned above. The company has issued 12,000, 15% cumulative participating preference shares of ₹ 100 each fully paid and 75,000 equity shares of ₹ 100 each fully paid up.

The profit for the year 2013-14 was ₹ 10,00,000 and balance brought from previous year ₹ 1,50,000. Provide ₹ 37,500 for depreciation and ₹ 1,20,000 for taxation before making other appropriations.

Show net balance of Profit and Loss Account after making above adjustments. (May 2014, 8 marks)

Answer:

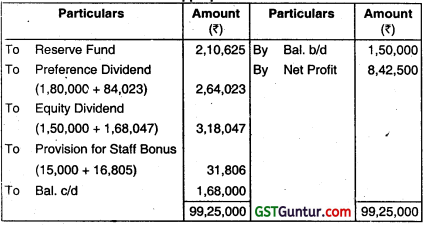

(i) 1/3 to Preference Share Holder

(ii) 2/3 to Equity Share Holder

(iii) 10% of 2/3 = \(\frac{0.2}{3}\) to Staff Bonus

∴ Total = \(\frac{1}{3}\) + \(\frac{2}{3}\) + \(\frac{0.2}{3}\) = \(\frac{3.2}{3}\)

∴ (i) Additional Dividend on Preference Share = 2,68,875 ÷ 3.2 = 84,023

(ii) Additional Dividend on Equity Share = 2,68,875 × \(\frac{2}{3.2}\) = 1,68,047

(iii) Additional Provision for staff Bonus = 2,68,875 × \(\frac{0.2}{3.2}\) = 16,805

P/L Appropriation A/c

Note: Nominal Value of Equity shares should be 75,000 Equity shares @ 10 instead of ₹ 100 in the question. It seems to be a misprint in the question.

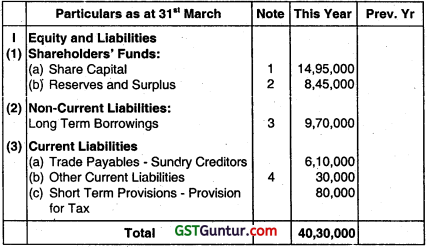

Question 10.

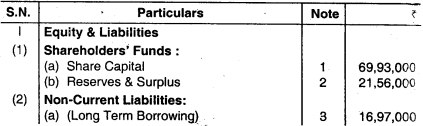

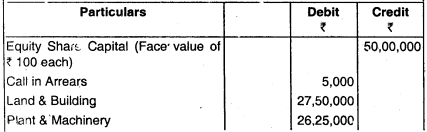

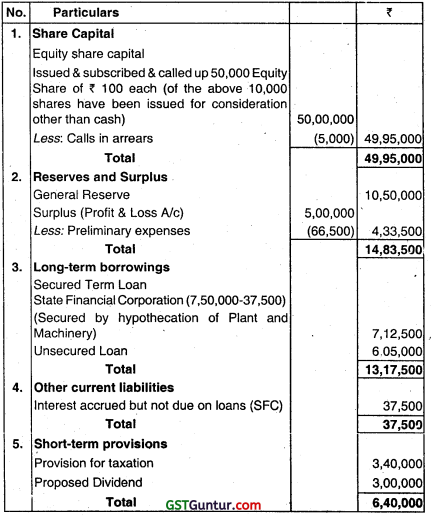

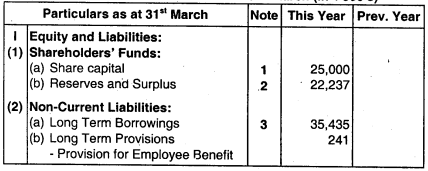

From the following particulars furnished by Elegant Ltd., prepare the Balance Sheet as on 31st March 2014 as required by Part I, Schedule III of the Companies Act.

The following additional information is also provided:

(I) Preliminary expenses Included ₹ 25,000 Audit Fees and ₹ 3,500 for out of pocket expenses paid to the Auditors.

(ii) 10000 Equity shares were Issued for consideration other than cash.

(iii) Debtors of ₹ 2,60,000 are due for more than 6 months.

(iv) The cost of the PPE were:

Building ₹ 30,00,000, Plant & Machinery ₹ 35,00,000 and Furniture ₹ 3,12,500

(v) The balance of ₹ 7,50,000 in the Loan Account with State Finance

Corporation is inclusive of ₹ 37,500 for Interest Accrued but not Due. The loan is secured by hypothecation of Plant & Machinery.

(vi) Balance at Bank includes ₹ 10,000 with Global Bank Ltd., Which is not a Scheduled Bank. (Nov 2014, 10 marks)

Answer:

Elegant Ltd.

Balance Sheet as on 31st March, 2014

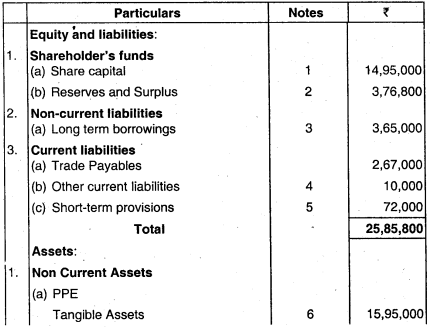

Notes to Accounts

Note : As per para 56 of AS 26, preliminary expenses are not shown in the balance sheet, thus they are written off. The amount of ₹ 25,000 as audit fee and out of pocket expenses paid to auditors amounting ₹ 3,500 have been included in the amount of ₹ 66,500. The combined figure of ₹ 66,500 has been reduced from Profit and Loss Account balance in the given solution.

![]()

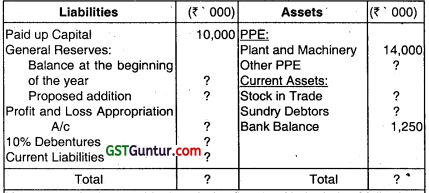

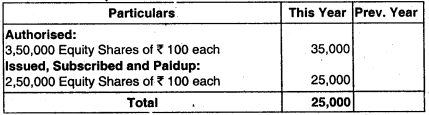

Question 11.

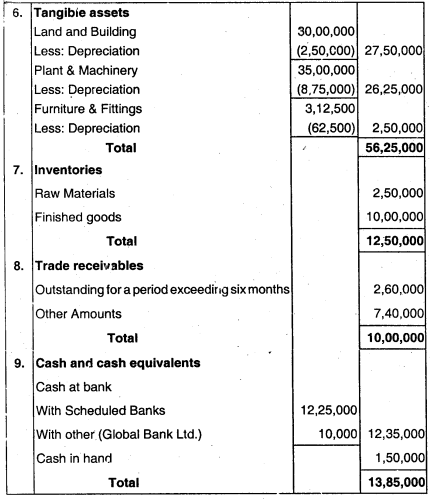

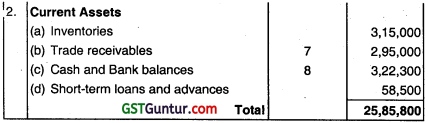

From the following particulars furnished by the Prashant Ltd., prepare the Balance Sheet as at 31st March, 2019 as required by Schedule III of the

Companies Act, 2013:

The following additional information is also provided:

1. 10,000 equity shares were issued for consideration other than cash.

2. Trade receivables of ₹ 55,000 are due for more than six months.

3. The cost of building and plants machinery is ₹ 5,50,000 and ₹ 6,25,000 respectively.

4. The loan from State Financial Corporation is secured by hypothecation of plant & machinery. The balance of ₹ 2,10,000 in this account is inclusive of ₹ 10,000 for interest accrued but not due.

5. Balance at Bank included ₹ 15,000 with Aakash Bank Ltd., which is not a scheduled bank. (Nov 2019, 10 marks)

Answer:

Prashant Ltd.

Balance Sheet as on 31st March, 2019:

Notes to Accounts

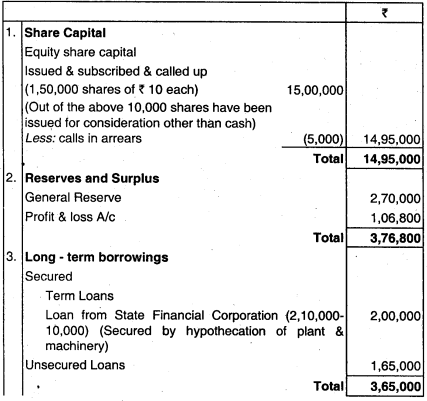

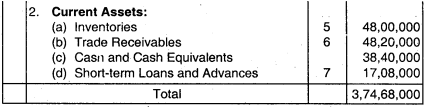

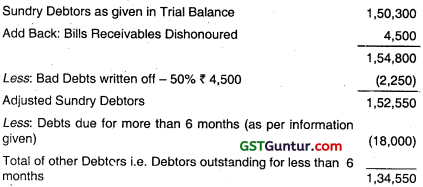

Question 12.

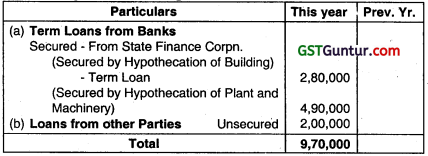

From the following, prepare the Balance Sheet of ABC Ltd. as at 31st March as required by Companies Act. Give Notes at the foot of the Balance Sheet as may be necessary: (amount in ₹)

The following additional information is provided-

1. 5,000 Equity Shares were issued for consideration other than cash.

2. Debtors of ₹ 1,02,000 are due for more than six months.

3. Cost of Assets are as follows:

(a) Building – ₹ 13,00,000

(b) Plant and Machinery – ₹ 20,00,000, and

(c) Furniture – ₹ 65,000.

4. The Balance of ₹ 3,00,000 in the Loan Account with State Financial Corporation is inclusive of ₹ 20,000 for interest accrued but not due. The Loan is secured by hypothecation of building.

5. The Balance of ₹ 5,00,000 in the Term Loan Account with Bank is Inclusive of ₹ 10,000 towards interest accrued and due. The Loan is secured by hypothecation of Plant and Machinery.

6. Bills receivable for ₹ 2,00,000 maturing on 15th May, have been discounted.

7. The Company had a contract for the Erection of Machinery at ₹ 2,50,000 which is incomplete on 31st March.

8. Proposed Dividend ₹ 2,10,000.

Answer:

Balance Sheet of ABC Ltd. as on 31st March

Note: Contingent Liabilities and Commitments, refer Note 9.

Note: Proposed Dividend = 14% of Paid Up Capital ₹ 15,00,000 = ₹ 2,10,000.

Dividend Per Share = \(\frac{2,10,000}{15,000 \text { Shares }}\) = ₹ 6.00

Note 1: Share Capital

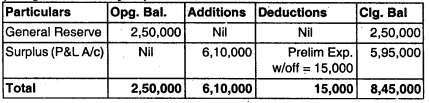

Note 2: Reserves and Surplus (showing appropriations and transfers) all figures for this year)

Note: Preliminary Expenses is not recognised as Asset as per AS-26, arid is hence fully written off out of Surplus.

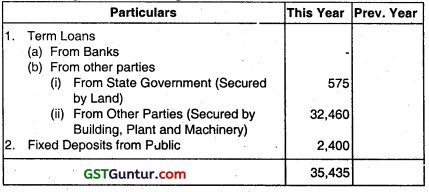

Note 3: Long Term Borrowings

Note 4: Other Current Liabilities

Note 5: Tangible Assets (Note: In the absence of data. Other Columns are not filled up in this Table).

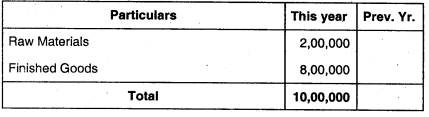

Note 6: Inventories

Note 7: Trade Receivables (assumed as Secured and considered good)

Note 8: Cash and Cash Equivalents

Note 9: Contingent Liabilities and Commitments (to the extent not provided for):

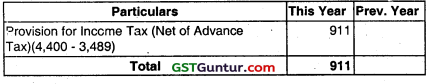

![]()

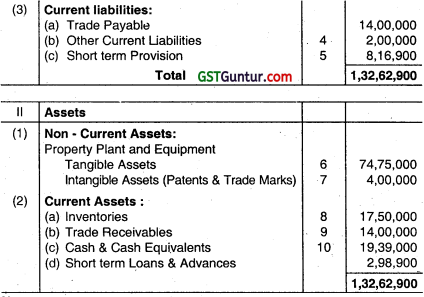

Question 13.

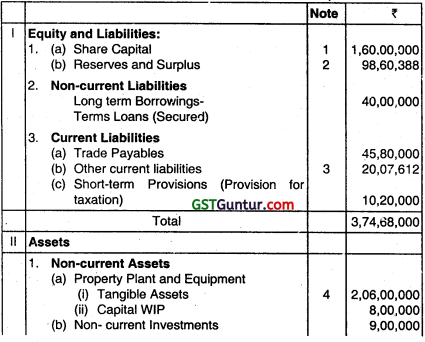

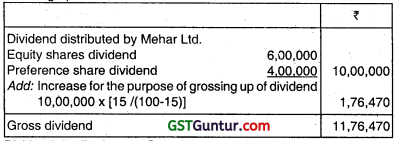

You are required to prepare a Balance Sheet as at 31st March 2018, as per Schedule III of the Companies Act, 2013, from the following information of Mehar Ltd.:

Additional Information:

1. Share Capital consist of-

(a) 1,20,000 Equity Shares of ₹ 100 each fully paid up.

(b) 40,000, 10% Redeemable Preference Shares of ₹ 100 each fully paid up.

2. The company declared dividend @ 5% of equity share capital. The dividend distribution tax rate is 17.647%.

3. Depreciate Assets by ₹ 20,00,000.

Answer:

Balance Sheet of Mehar Ltd, as at 31st March, 2018

Notes to accounts

Working Note:

Calculation of Dividend distribution tax

(i) Grossing-up of dividend:

(ii) Dividend distribution tax @ 17.647% 2,07,612

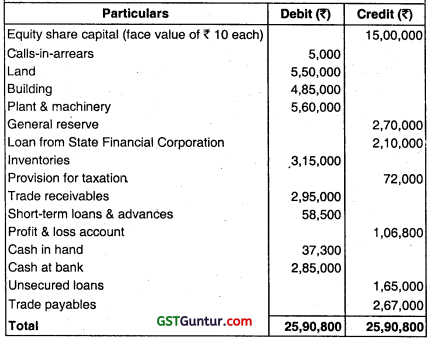

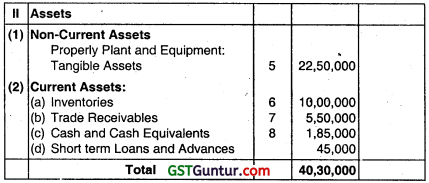

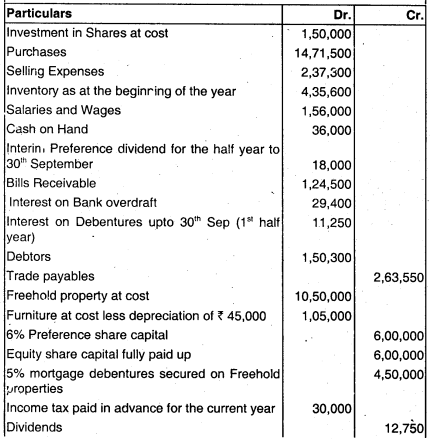

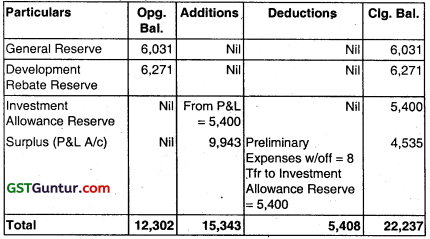

Question 13.

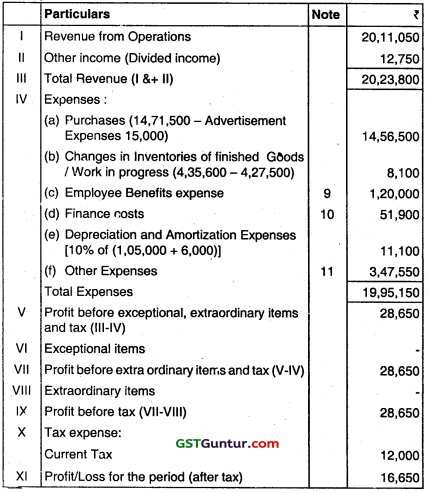

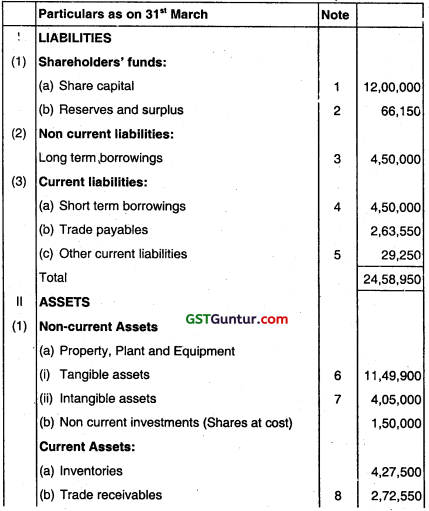

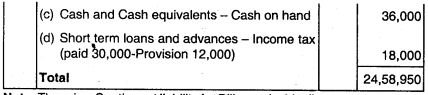

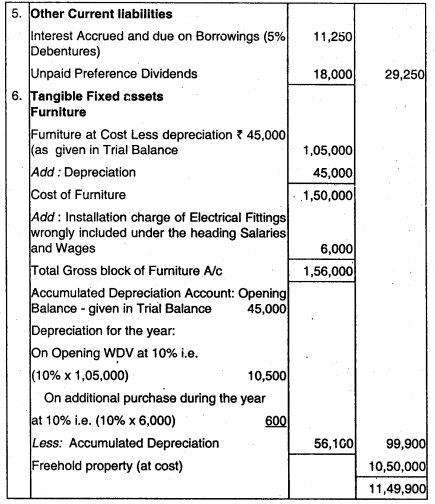

Shweta Ltd. has the Authorised Capital of ₹ 15,00,000 consisting of 6,000 6% Preference shares of ₹ 100 each and 90,000 equity shares of ₹ 10 each. The following was the Trial Balance of the Company as on 31st March, 2018:

You are required to prepare the Profit and Loss Statement for the year ended 31st March, 2018 and the Balance Sheet as on 31st March, 2018 as per Schedule III of the Companies Act, 2013 after taking into account the following –

- Closing Stock was valued at ₹ 4,27,500.

- Purchases include ₹ 15,000 worth of goods and articles distributed among valued customers.

- Salaries and Wages include ₹ 6,000 being Wages incurred for installation of Electrical Fittings which were recorded under “Furniture”.

- Bills Receivable include ₹ 4,500 being dishonoured bills. 50% of which had been considered irrecoverable.

- Bills Receivable of ₹ 6,000 maturing after 31st March were discounted.

- Depreciation on Furniture to be charged at 10% on Written Down Value.

- Investment in shares is to be treated as non-current investments.

- Interest on Debentures for the half year ending on 31st March was due on that date.

- Provide Provision for taxation ₹ 12,000.

- Technical Knowhow Fees is to be written off over a period of 10 years.

- Salaries and Wages include ₹ 30,000 being Director’s Remuneration.

- Trade receivables include ₹ 18,000 due for more than six months.

Answer:

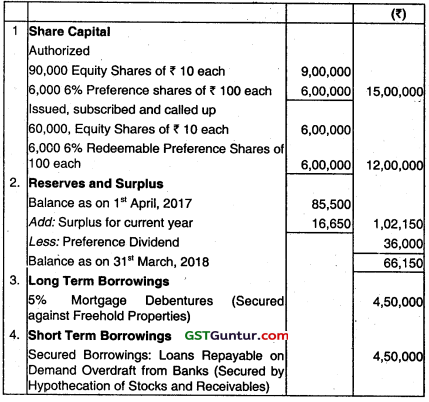

Statement of Profit and Loss of Shweta Ltd. for the year ended 31st March, 2018

Balance sheet of Shweta Ltd, as on 31st March, 2018

Note: There is a Contingent liability for Bills receivable discounted with Bank ₹ 6,000

Notes to accounts

Working Note

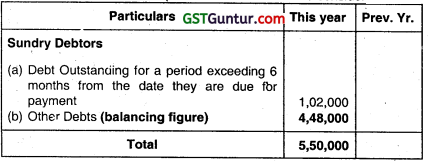

Calculation of Sundry Debtors-Other Debts

![]()

Question 14.

The Companies Act, 2013 limits the payment of managerial remuneration. What is the maximum managerial remuneration, which can be paid in case of a company consistently earning profits and has more than one managerial persons. (Nov 2009, 2 marks)

Answer:

Sec. 197 of the Indian Companies Act, 2013 prescribes the overall maximum managerial remuneration payable and also managerial remuneration in case of absence or inadequacy of profits. In the given case, the company is earning profits consistently and has more than one managerial person. Hence, the maximum limit is 10% of net profit.

Question 15.

What are the maximum limits of managerial remuneration for companies having adequate profits? (May 2012, 4 marks)

Answer:

Managerial Remuneration: Maximum limits as per Sec. 197 of Companies Act, 2013.

For companies having profits:

- Overall (excluding fee for attending meetings) : 11% of net profit

- If there is one managerial person : 5% of net profit

- If there are more than one managerial person : 10% of net profit

- Remuneration of part-time directors:

- If there is no managing or whole-time director : 3% of net profit

- If there is a managing or whole-time director : 1% of net profit

Question 16.

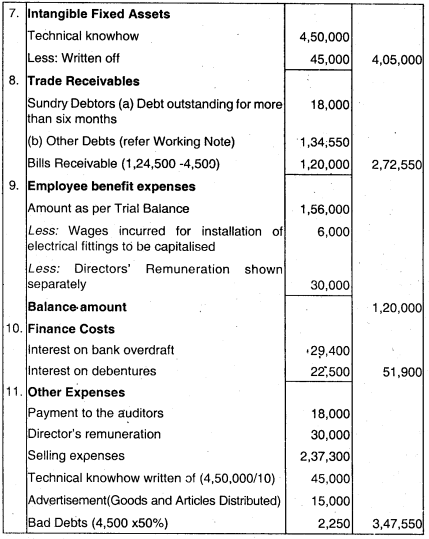

Following particulars are available from the books of Rajat Ltd

Net profit before provision for income-tax and managerial remuneration, but after depreciation and provision tor repairs : ₹ 98,04,100

Depreciation provided in the books : ₹ 35,00,000

Provision for repairs of machinery during the year : ₹ 2,50,000

Depreciation allowable under Schedule II of the Companies Act, 2013 : ₹ 28,00,000

Actual expenditure incurred on repairs during the year : ₹ 1,50,000

You are required to calculate the managerial remuneration in the following cases:

(i) If there is one whole-time director; and

(ii) If there are two whole-time directors, a part-time director and a manager. (Dec 2007, 5 marks) [CS Exe -1]

Answer:

Section 197 of the Companies Act, 2013 prescribe the maximum percentage of profit that can be paid as managerial remuneration. For this purpose, profit is to be calculated in the manner as prescribed in Section 197 of the Companies Act, 2013.

Calculation of net profit u/s 197 of the Companies Act, 2013:

Calculation of managerial remuneration:

(i) If there is only one whole-time director:

Managerial remuneration = 5% of net profit = 5% of ₹ 1,06,04,100

= ₹ 5,30,205

(ii) If there are two whole-time directors, a part time director and a manager:

Managerial remuneration = 1 % of net prof it = 11% of ₹ 1,06,04,100

= ₹ 11,66,451

Question 17.

Answer the following :

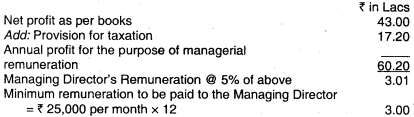

The Managing Director of A Ltd. is entitled to 5% of the annual net profits, as his remuneration, subject to a minimum of ₹ 25,000 per month. The net profits, for this purpose, are to be taken without charging income-tax and his remuneration itself. During the year, A Ltd. made net profit of ₹ 43,00,000 before charging MD’s remuneration, but after charging provision for taxation of ₹ 17,20,000. Compute remuneration payable to the Managing Director. (May 2009, 2 marks)

Answer:

Calculation of remuneration of the Managing Director

Hence, in this case, remuneration to be paid to the Managing Director of A Ltd. = ₹ 3,01,000.

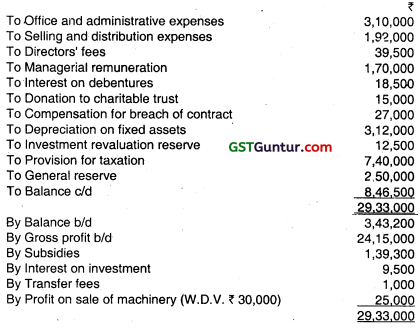

Question 18.

Following is the profit and loss account of Azad Ltd. for the year ended 31st March, 2009 :

Additional information:

- Original cost of the machinery sold was ₹ 40,000.

- Depreciation on fixed assets as per Schedule II of the Companies Act, 2013 was ₹ 3,42,000.

You are required to calculate managerial remuneration in the following situations:

(i) when there is only whole-time director;

(ii) when there are two whole-time directors; and

(iii) when there are two whole-time directors, a managing director and a part-time director. (June 2009, 6 marks) [CS Exe -1]

Answer:

Computation of managerial remuneration:

Question 19.

Answer the following question :

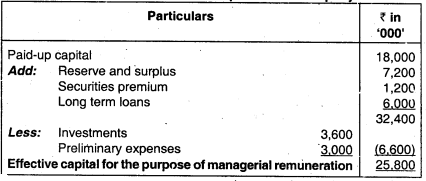

Calculate the maximum remuneration payable to the Managing Director based on effective capital of a non-investment company for the year, from the information given below :

: (₹ in ‘000)

(i) Profit for the year : 3,000

(ii) Paid up Capital : 18,000

(iii) Reserves & Surplus : 7,200

(iv) Securities Premium : 1,200

(v) Long term Loans : 6,000

(vi) Investments : 3,600

(vii) Preliminary expenses not written off : ₹ 3000

(viii) Remuneration paid to the Managing Director during the year : ₹ 600 (Nov 2011, 5 marks)

Answer:

Assumption: It is assumed that the company is having inadequate net profit and is not exceeding the ceiling limit of ₹ 24,00,000 p.a.

Calculation of Effective Capital of the Company

As effective capital is less than 15 crores but more than ₹ 1 crore, therefore maximum remuneration payable to the Managing Director should be @ ₹ 1,00,000 per month.

So, maximum remuneration payable to the Managing Director for the year (₹ 1,00,000 × 12) = ₹ 12,00,000.

![]()

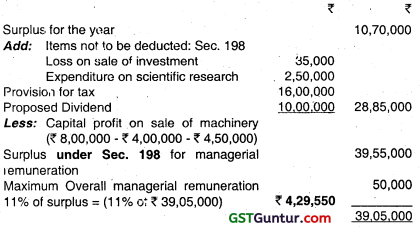

Question 20.

The following particulars are extracted from the statement of profit and loss of S.S. Ltd. for the year ended 31st March, 2014:

(i) Gross profit : ₹ 40,00,000

(ii) Profit on sale of machinery (cost ₹ 8,00,000 and written down value ₹ 4,00,000) : ₹ 4,50,000

(iii) Subsidy from the Government : ₹ 1,00,000

(iv) Salaries and wages : ₹ 1,50,000

(v) Repairs to fixed assets : ₹ 50,000

(vi) General expenses : ₹ 40,000

(vii) Compensation for breach of contract : ₹ 25,000

(viii) Depreciation : ₹ 2,40,000

(ix) Loss on sale of investment : ₹ 35,000

(x) Expenditure on scientific research (cost of setting-up a new laboratory) : ₹ 2,50,000

(xi) Debenture interest : ₹ 75,000

(xii) Interest on unsecured loans : ₹ 15,000

(xiii) Provisions for income tax : ₹ 16,00,000

(xiv) Proposed dividends : ₹ 10,00,000

(xv) Net profit : ₹ 10,70,000

Calculate the overall managerial remuneration under section 197 of the Companies Act, 2013. (June 2014, 5 marks) [CS Exe -1]

Answer:

Calculation of the Managerial Remuneration under Sec. 197

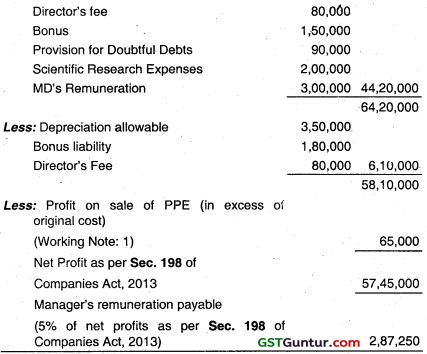

Question 21.

Calculate the managerial remuneration from the following particulars of Zen Ltd. The company has only one Managing Director:

: ₹

Net profit : ₹ 20,00,000

Net profit is calculated after considering the following:

Depreciation : ₹ 4,00,000

Preliminary expenses : ₹ 1,00,000

Provision for tax : ₹ 31,00,000

Director’s fee : ₹ 80,000

Bonus : ₹ 1,50,000

Profit on sale of PPE

(original cost ₹ 2,00,000; WDV ₹ 1,10,000 : ₹ 1,55,000

Provision for doubtful debts : ₹ 90,000

Scientific research expenditure

(for setting-up new laboratory) : ₹ 2,00,000

Managing Director’s remuneration paid : ₹ 3,00,000

Other information:

- Depreciation allowable is ₹ 3,50,000.

- Bonus liability as per the Payment of Bonus Act, 1965 is ₹ 1,80,000.

- Looking at the past records of debtors, provision for doubtful debts is not required.

- Rate of managerial remuneration is 5%. (Dec 2014, 5 marks) [CS Exe – I]

Answer:

Calculation of Managerial Remuneration

Working Note; 1

Sale Price of Fixed Asset = Book Value + Profit

= ₹ 1,10,000 + 1,55,000

= ₹ 2,65,000

Original Cost = ₹ 2,00,000

Profit on sale of fixed assets (in excess of original cost)

= ₹ 2,65,000 – 2,00,000

= ₹ 65,000

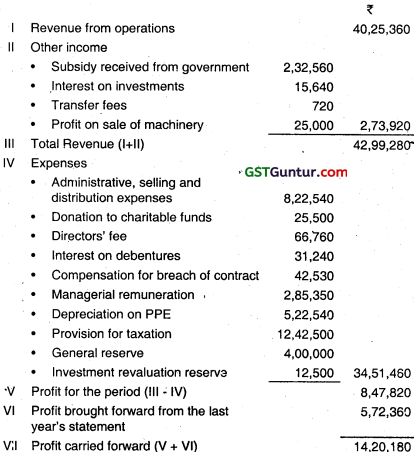

Question 22.

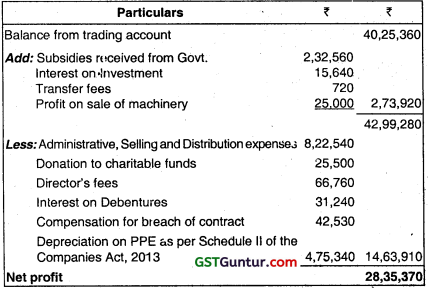

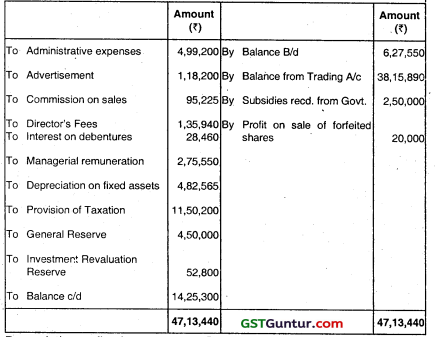

Following is the statement of profit and loss of Target Ltd. for the year ended 31st March, 2015:

Additional information:

Original cost of machinery sold was ₹ 55,000. The written down value as on the date of sale was ₹ 30,000.

Depreciation on PPE as per Schedule II of the Companies Act, 2013 was ₹ 4,75,340.

You are required to calculate and comment on managerial remuneration in the following cases in accordance with the provisions of the Companies Act, 2013 if:

(i) there is only one whole-time director;

(ii) there are two whole-time directors; and

(iii) there are two whole-time directors, a part-time director and a manager. (Dec 2015, 7 marks) [CS Exe – II]

Answer:

Calculation of Net Profit u/s 198 of the Companies Act, 2013:

Calculation of Managerial Remuneration

(i) When there is only one whole time director

When there is only one Whole time director, Managerial remuneration = 5% of ₹ 28,35,370 = ₹ 1,41,768.50

(ii) When there are two whole-time directors, Managerial remuneration = 10% of ₹ 28,35,370

= ₹ 2,83,537

(iii) When there are two whole time directors, a part time director and a manager. Managerial remuneration = 11 % of ₹ 28,35,370 = ₹ 311890.70 Since, the managerial remuneration as per profit and loss account is ₹ 2,85,350 which exceeds the maximum amount payable in situation (a) and (b) above, therefore the company should obtain the necessary approval.

Alternate Answer for calculation of Net Profit U/s 198 of the Companies Act, 2013

Question 23.

Answer the following:

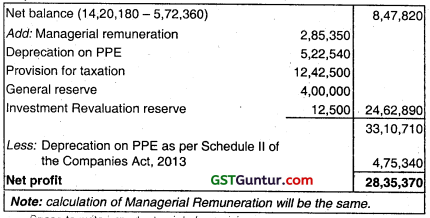

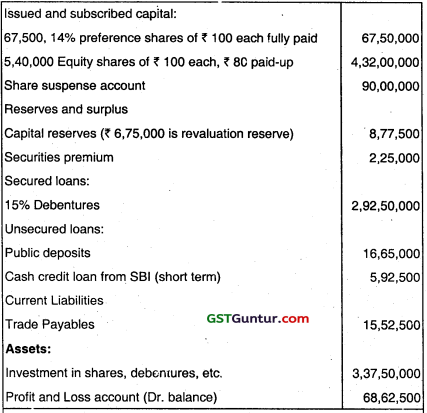

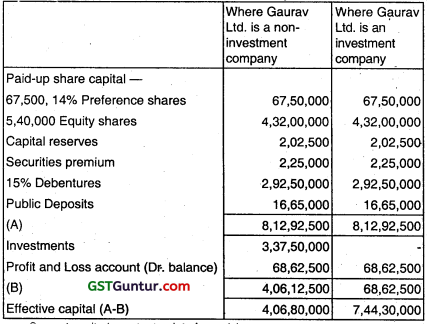

The following extract of Balance Sheet of Prabhat Ltd. (Non-investment Company) was obtained:

Balance Sheet (Extract) as on 31st March, 2019

Share suspense account represents application money received on shares, the allotment of which is not yet made.

You are required to compute effective capital as per the provisions of Schedule V. Would your answer differ if Prabhat Ltd. is an investment company? (Nov 2019, 5 marks)

Answer:

Computation of Effective Capital

Question 24.

Answer the following :

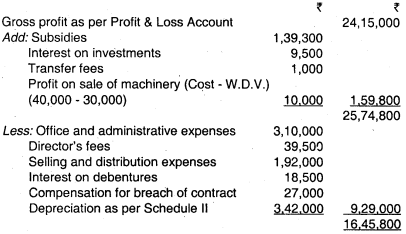

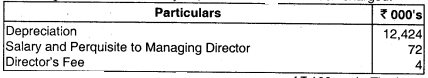

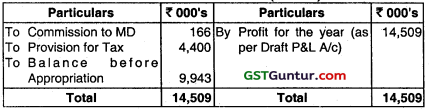

Following is the draft Profit & Loss Account of X Ltd. for the year ended 31st March, 2020:

Depreciation on Fixed Assets as per Schedule II of the Companies Act, 2013 was ₹ 6,51,750. You are required to calculate the maximum limits of the managerial remuneration as per Companies Act, 2013. (Nov 2020, 5 marks)

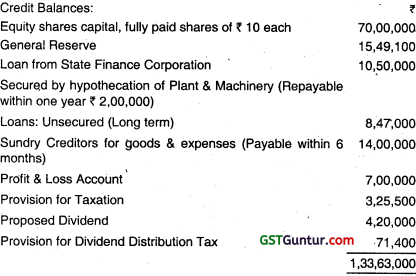

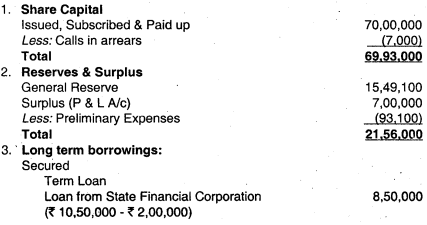

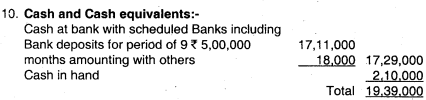

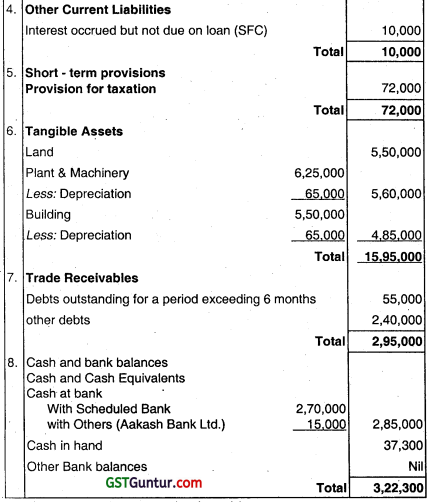

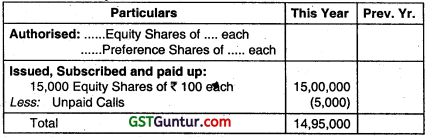

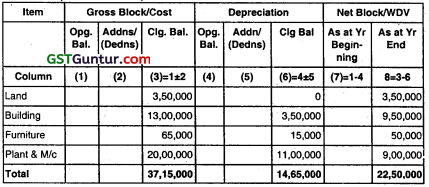

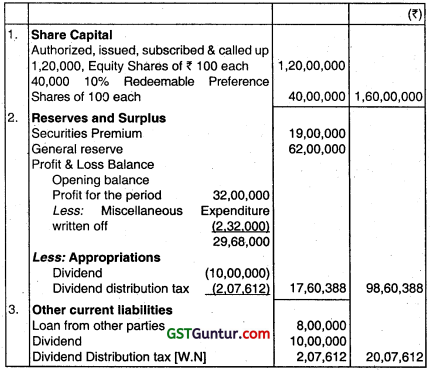

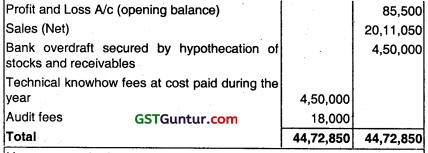

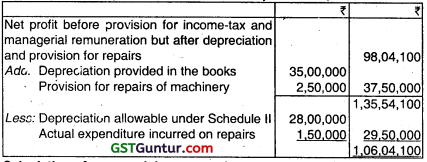

Question 25.

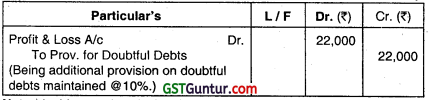

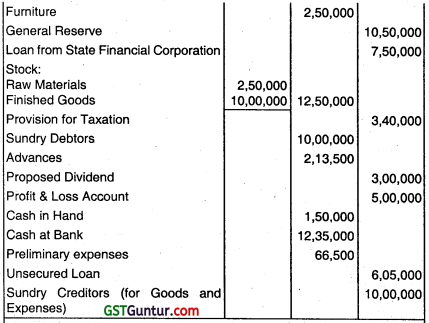

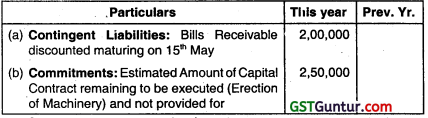

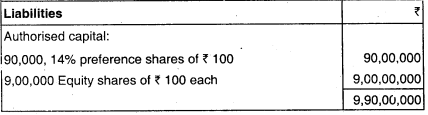

The following is the Draft Profit & Loss A/c of Brown Ltd. the year ended 31st March, 2020:

Depreciation on fixed assets as per Schedule II of the Companies Act, 2013 was ₹ 5,15,675. You are required to calculate the maximum limit of the managerial remuneration as per Companies Act, 2013. (Jan 2021, 5 marks)

![]()

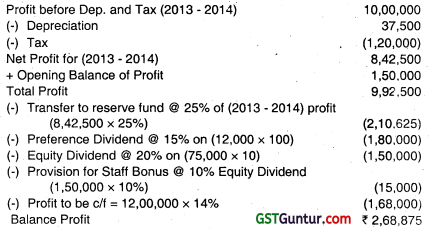

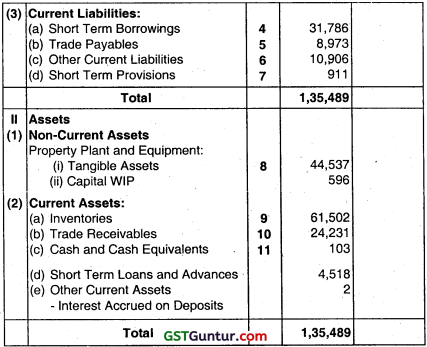

Question 26.

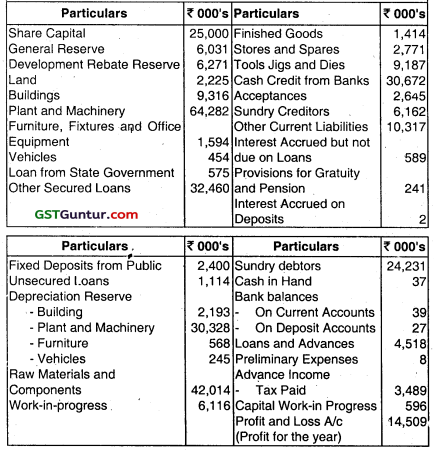

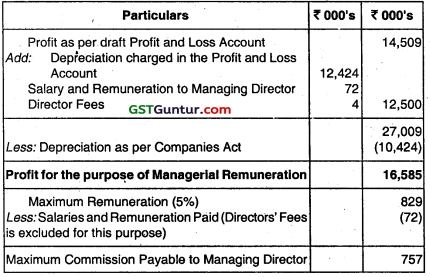

ABC Ltd. is in the midst of finalising its accounts for the year-ended 31st March. A Profit and Loss Account has been prepared in draft, the account balances as rounded of to the nearest thousands, are listed below:

In arriving at the Profit for the year, the following have been charged:

The Authorized Capital is 3,50,000 Equity Shares of ₹ 100 each. The Loan from the State Government is secured by a charge on the Land. Cash Credits by hypothecation of Stocks and” Book Debts and the Other Secured Loans on the Buildings and Plant and Machinery.

The following adjustments are yet to be made:

- Investment Allowance Reserve to be created ₹ 5,400 (000’s)

- Provision to be made for Income-Tax in ₹ 4,400 (000’s)

- Provision to be made for Managing Director’s Commission at 1 % of the Net Profits.

- Proposed Dividend at 10%.

Depreciation as per Companies Act, is ₹ 10,424 (000’s)

Prepare:

(a) Show the computation of Commission Payable to the Managing Director, and

(b) Prepare the Balance sheet of the Company, based on all the above.

Answer:

Balance Sheet of ABC Ltd. as at 31st March (in ₹ 000’s)

Note: Proposed Dividend = 10% of paid up Capital ₹ 25,000 (000s)

= ₹ 2,500 (000s)

Dividend per share = \(\frac{2,500(000 \mathrm{~s})}{250(000 \mathrm{~s}) \text { Shares }}\) = ₹ 10.00

Note 1: Share Capital

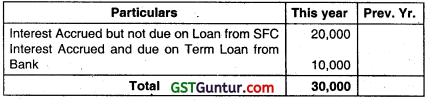

Note 2: Reserves and Surplus (showing appropriations and transfers) (all figures for this year)

Note: Preliminary Expenses is not recognised as Asset as per AS-26, and is hence fully written off out of Surplus.

Note 3: Long Term Borrowings

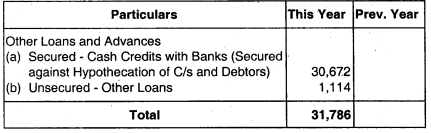

Note 4: Short Term Borrowings

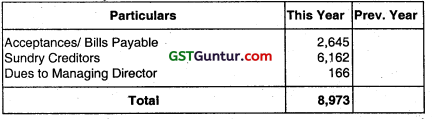

Note 5: Trade Payables

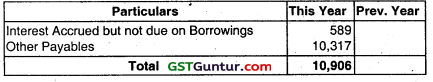

Note 6: Other Current Liabilities

Note 7: Short Term Provisions

Note 8: Tangible Assets

Note: In the absence of information, the Other Columns are not filled up in the above Table.

Note 9: Inventories

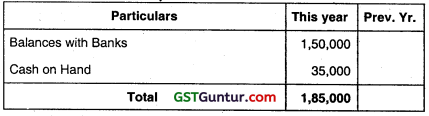

Note 10: Trade Receivables (assumed as Secured and considered goods and not outstanding for a period > 6 months)

Note 11: Cash and Cash Equivalents

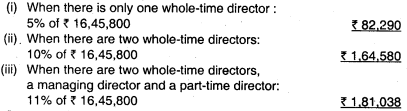

Working Note:

1. Profit and Loss Account (Extract)

2. Computation of Commission to the Managing Director

![]()

Note: Since the Commission Payable is within the statutory limits, it is provided for in the books.

Question 27.

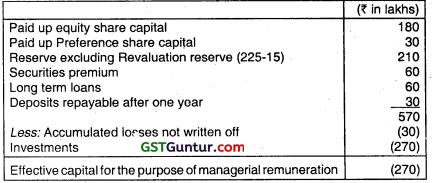

PQ Ltd., a non-investment company has been incurring losses for the past few years. The company provides the following information for the current year:

Paid up equity share capital 180

Paid up preference share capital 30

Reserves (including Revaluation reserve ₹ 15 lakhs) 225

Securities premium 60

Long term loans 60

Deposits repayable after one year so

Application money pending allotment 1080

Accumulated losses not written off 30

Investments 270

PQ Ltd. has only one whole-time director, Mr. Hello. You are required to calculate the amount of maximum remuneration that can be paid to him as per provisions of Companies Act, 2013, if no special resolution is passed

at the general meeting of the company in respect remuneration for a period not exceeding three years of payment of remuneration for a period not exceeding three years.

Answer:

Calculation of effective capital and maximum amount of monthly remuneration

Since PQ Ltd. is incurring losses and no special resolution has been passed by the company for payment of remuneration, managerial remuneration will be calculated on the basis of effective capital of the company, therefore maximum remuneration payable to the Managing Director should be @ ₹ 60,00,000 per annum*.

*lf the effective capital is less then 5 Crore, limit of yearly remuneration payable should not exceed ₹ 60 lakhs as per Companies Act, 2013.

Question 28.

The following extract of Balance Sheet of Gaurav Ltd. was obtained:

Balance Sheet (Extract) as on 31st March, 2018

Share suspense account represents application money received on shares, the allotment of which is not yet made. You are required to compute effective capital as per the provisions of Schedule V. Would your answer differ if Gaurav Ltd. is an investment-company?

Answer:

Computation of effective capital

Question 29.

Write a short note on the following:

Taxation on distributed profits. (June 2009, 3 marks)

Answer:

Corporate Dividend tax : Finance Act, 1997 introduced additional income tax, called tax on distributed profits, on Joint stock companies on the account of their profits distributed by them among the shareholder as dividends. This tax is known as Corporate Dividend Tax.

According to Sec. 115-O(1) of the Income tax Act, any amount declared, distributed or paid by domestic company by way of dividends, whether interim or otherwise shall be charged tax on distributed profits at the rate of 20.555%. (including surcharges and Health and Education cess).

As per Sec. 115 – O(3) provides that the tax has to be paid within 14 days from the date of:

- Declaration of dividend

- Distribution of dividend, or

- Payment of dividend, whichever is earliest.

Note: Like rates of income tax the rate of corporate dividend tax may vary from one financial year to another financial year.

Question 30.

Write a short note on the following Tax on distributed profits. (June 2009, 3 marks) (CS Exe – I)

Answer:

Corporate Dividend tax : Finance Act, 1997 introduced additional income tax, called tax on distributed profits, on Joint stock companies on the account of their profits distributed by them among the shareholder as dividends. This tax is known as Corporate Dividend Tax.

According to Sec. 115-0(1) of the Income tax Act, any amount declared, distributed or paid by domestic company by way of dividends, whether interim or otherwise shall be charged tax on distributed profits at the rate of 20.555%. (including surcharges and Health and Education cess).

As per Sec. 115 – O(3) provides that the tax has to be paid within 14 days from the date of:

- Declaration of dividend

- Distribution of dividend, or

- Payment of dividend, whichever is earliest.

Note: Like rates of income tax the rate of corporate dividend tax may vary from one financial year to another financial year.

![]()

Question 31.

Write a short note on the following:

Tax on distributed profit (June 2011, 3 marks) (Cs Exe -I)

Answer:

Tax on distributed Profits: It is a tax chargeable on any amount declared, distributed or paid by a domestic company by way of dividend whether interim or otherwise.

It is paid in addition to the income tax chargeable on total income.

Tax on distributed profit is payable to the credit of Central Government within 14 days from the date of declaration, distribution or payment whichever is earlier.

The present rate of tax is 17.647% plus surcharge @ 12% and Health and Education cess @ 4%.

Question 32.

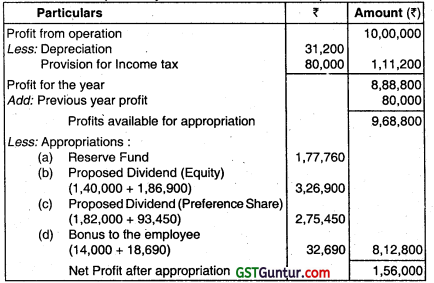

Sumo Ltd. has a profit of ₹ 25 lakhs before charging depreciation for Financial year 2014-15. Depreciation in the books was ₹ 11 lakhs and depreciation chargeable under Section 123 comes to ₹ 17 lakhs. Compute divisible profit for the year.

Answer:

Computation of Divisible Profit