Chapter 6(B) Employees’ State Insurance Act, 1948 – CS Professional Labour Laws and Practice Notes is designed strictly as per the latest syllabus and exam pattern.

Employees’ State Insurance Act, 1948 – CS Professional Labour Laws and Practice Study Material

Question 1.

Choose the most appropriate answer from the given options in respect of the following:

An insured person under the Employees’ State Insurance Act, 1948 is

entitled to receive certain benefits. But the insured person is –

(a) Not entitled to receive more than one benefit for the same period

(b) Entitled to receive more than one benefit for the same period on compassionate grounds

(c) Entitled to receive one benefit partly in cash and receive the other benefit in kind for the same period

(d) Entitled to receive more than one benefit on proof of authorities concerned. [CSEP-II](Dec 2008, 1 mark)

Answer:

(a) Not entitled to receive more than one benefit for the same period

Question 2.

Choose the most appropriate answer from the given options in respect of the following.

The disputes relating to benefits under the Employees’ State Insurance Act, 1948 are required to be filed in –

(a) Civil Court

(b) Employees’ Insurance Court

(c) Labour Court

(d) Industrial Tribunal. [CSEP -II] (June 2009, 1 mark)

Answer:

(b) Employee’s Insurance Court

![]()

Question 3.

Re-write the following sentences after filling-in the blank spaces with appropriate word(s)/figure(s):

(i) The ESI corporation to function efficiently has been provided with two wings namely ____ and Medical Benefit Council.

(v) The rate of contribution towards the Employees’ State Insurance Fund is ____% and _____% of employees’ wages by the employers and employees respectively. [CSEP -II] (Dec 2010, 1 mark each)

Answer:

(i) The ESI corporation to function efficiently has been provided with two wings namely Standing Committee and Medical Benefit council.

(v) The rate of contribution towards the Employee’s State Insurance Fund is 3.25% and 0.75% of employee’s wages by the employers and employees respectively.

Question 4.

Choose the most appropriate answer from the given options in respect of the following:

‘Dependent’ under the Employees’ State Insurance Act, 1948 does not mean any of the following relatives of a deceased insured person —

(a) A widowed mother

(b) A widowed grand-mother

(c) A widowed daughter-in-law

(d) A widow. [CSEP-II] (Dec 2010, 1 mark)

Answer:

(b) A widowed grand mother

Question 5.

Write the most appropriate answer from the given options in respect of the following: [CSEP -II](June 2011, 1 mark each)

(ii) Every factory or establishment to which the Employees’ State Insurance Act, 1948 applies has to be registered within —

(a) 15 Days

(b) 30 Days

(c) 45 Days

(d) 60 Days.

Answer:

(a) 15 Days

(iv) The term ‘wages’ under the Employees’ State Insurance Act, 1948 does not include —

(a) Incentives

(b) Over-time wages

(c) Travelling allowance

(d) Any other additional remuneration.

Answer:

(c) Travelling Allowance

Question 6.

Re-write the following sentences after filling-in the blank spaces with appropriate word(s)/figure(s):

All contributions paid under the Employees’ State Insurance Act, 1948 and other moneys received on behalf of the ESI Corporation shall be paid into a fund called ______. [CSEP -II] (Dec 2011, 1 mark)

Answer:

Employee’s State Insurance Fund

![]()

Question 7.

Write the most appropriate answer from the given options in respect of the following:

Under the Employees’ State Insurance Act, 1948, disputes relating to the benefits are required to be filed in the –

(a) Labour Court

(b) Civil Court

(c) Industrial Tribunal

(d) Employees’State Insurance Court. [CSEP-II](Dec 2013, 1 mark)

Answer:

(d) Employees’ State Insurance Court.

Question 8.

Write notes of the following:

‘Employment injury’ under the Employees State Insurance Act, 1948. [CSEP -II] (Dec 2008, 5 marks)

Answer:

Employment injury means an injury caused to an employee arising out of and in the course of his employment being an insurable employment, whether the accident occurs within or outside the territorial limits of India. For an employment injury there must be some nexus between the employment and the accident. Employment injury need not be confined to employer’s premises only. It extends to time & place (theory of notional extension)

In the decided case, it was held that mere road accident of an employee while going for employment will not constitute employment injury.

Question 9.

Write notes on the following:

‘Dependent’ under the Employees’ State Insurance Act, 1948. [CSEP -II] (June 2009, 5 marks)

Answer:

(i)

- Defined under Section 2 (6A) of the Employees’ State Insurance Act, 1948.

- Includes following relatives of a deceased person:-

- Widow, minor legitimate son, unmarried legitimate daughter (Son/daughter may be adopted)

- Widow mother

- Son/daughter though attained 18 years of age but were wholly dependant on insured person at the time of death.

- Other dependents also included even in case partly depend on the insured person.

Question 10.

Write notes on the following:

‘Benefits to which insured persons are entitled’ under the Employees’ State Insurance Act, 1948. [CSEP -II] (Dec 2009, 5 marks)

Answer:

Section 46 of the Employees State Insurance Act, 1948 provides for the following benefits:-

(a) periodical payments in case of sickness certified by medical practitioner.

(b) periodical payment in case of disablement on account of employment injury.

(c) periodical payment to dependants.

(d) medical treatment related payment.

(e) In case of death of insured, payment at rate of ₹ 15000 (increased from earlier ₹ 10,000) in relation to funeral expenses.

Question 11.

Write notes on the following:

Purposes for which ESI fund may be expended under the Employees’ State Insurance Act, 1948 [CSEP -II] (June 2010, 5 marks)

Question 12.

Write notes on the following:

Purposes for which ESI fund may be expended under the Employees’ State Insurance Act, 1948. [CSEP -II] (June 2012, 5 marks)

Question 13.

Write notes on the following:

Purposes for which Employees’ State Insurance Fund may be expended under the Employees’ State Insurance Act, 1948. [CSEP -II] (Dec 2012, 5 marks)

Question 14.

Write notes on the following.

Employees Insurance Court under the Employees’ State Insurance Act, 1948. [CSEP-II] (June 2013, 5 marks)

Question 15.

Write notes on the following :

‘Dependent’ under the Employees’ State Insurance Act, 1948. [CSEP -II] (Dec 2013, 5 marks)

Answer:

“Dependent” under Section 2(6A) of the Employees’ State Insurance Act, 1948 (as amended by the Employees’ State Insurance (Amendment) Act, 2010) means any of the following relatives of a deceased insured person namely:

(i) a window, a legitimate or adopted son who has not attained the age of twenty-five years, an unmarried legitimate or adopted daughter.

(ii) if wholly dependent on the earnings of the insured person at the time of his death, a legitimate or adopted son or daughter who has attained the age of 25 years and is infirm;

(iii) if wholly or in part dependent on the earnings of the insured person at the time his death:

(a) a parent other than a widowed mother

(b) a minor illegitimate son, an unmarried illegitimate daughter or a daughter legitimate or adopted or illegitimate if married and minor or if widowed and a minor

(c) a minor brother or an unmarried sister or a widowed sister if a minor

(d) a widowed daughter-in-law

(e) a minor child of a pre-deceased son

(f) a minor child of a pre-deceased daughter where no parent of the child is alive or

(g) a paternal grand parent if no parent of the insured person is alive.

![]()

Question 16.

Distinguish between the following:

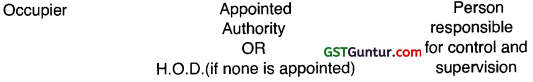

‘Principal employer’ and ‘immediate employer’ under the Employees’ State Insurance Act, 1948. [CSEP -II] (Dec 2008, 5 marks)

Answer:

According to Section 2(17) of the Employees’ State Insurance Act, 1948 principal employer means:-

Type of Organisation

Factory Under Control of Department of any Government Others

‘Immediate employer’ means a person, in relation to employees employed by or through him who has undertaken the execution on the premises of a factory or an establishment to which this Act applies or under the supervision of principal employer or his agent, of the whole or any part of any work which is ordinarily part of the work of the factory on establishment of the principal employer.

Question 17.

Distinguish between the following:

‘Principal employer’ and ‘immediate employer’ under the Employees’ State Insurance Act, 1948. [CSEP -II] (June 2010, 5 marks)

Question 18.

Distinguish between the following:

‘Sickness benefit’ and ‘medical benefit’ under the Employees’ State Insurance Act, 1948. [CSEP -II] (June 2011, 5 marks)

Answer:

Sickness benefit and medical benefit under the Employee’s state Insurance Act, 1948.

Sickness benefit: Sickness benefit is periodical payment to any insured person in case his sickness is certified by a duly appointed medical practitioner or by any person having such qualification and experience as may be specified by ESI Corporation.

Medical benefit: Medical benefit is given to an insured person or a member of his family whose condition requires medical treatment and attendance. Such medical treatment may be given either in the form of out patient treatment and attendance in a hospital or dispensary, clinic etc.

Question 19.

Distinguish between the following:

‘Principal employer’ and ‘immediate employer’ under the Employees’ State Insurance Act, 1948. [CSEP -II] (June 2012, 5 marks)

Question 20.

Distinguish between the following.

‘Permanent total disablement’ and ‘permanent partial disablement’ under the Employees’ State Insurance Act, 1948. [CSEP-II] (June 2013, 5 marks)

Answer :

Permanent Total Disablement

It means such disablement of a permanent nature as incapacitates an employee for all work which he was capable of performing at the time of the accident resulting in such disablement.

Provided that permanent total disablement shall be deemed to result from every injury specified in Part-1 of the second schedule to the Act or from any combination of injuries specified in Part- II thereof, where the aggregate percentage of loss of earning capacity, as specified in the said Part- II against those injuries, amount to one hundred percent or more.

Permanent Partial Disablement

- It means such disablement of a permanent nature, as reduced the earning capacity of an employee in every employment which he was capable of undertaking at the time of the accident resulting in the disablement.

- Provided that every injury specified in Part II of the second schedule to the Act shall be deemed to result in permanent partial disablement.

Question 21.

Discuss the following:

Benefits under the Employees’ State Insurance Act, 1948. [CSIG -II] (Dec 2005, 5 marks)

Answer:

Employees State Insurance Act 1948 provides benefits to both Insured person and dependants in the following ways:

- Provide periodical payment in case of sickness certified by medical practitioner.

- Provides medical treatment to an insured person.

- Periodical payment to dependants of insured person.

- Provides payment in case the insured person is suffering from disablement as a result of employment injury.

- Payment of funeral expenses at the prescribed rate of ₹ 15000 (increased from earlier ₹ 10,000)

Question 22.

Attempt the following stating the relevant legal provisions and case law, if any:

Raju is an employee in an establishment governed by the Employees’ State Insurance Act, 1948. His principal employer defaults in making his contribution to the ESI Fund resulting in Raju becoming disentitled to the benefits under the Act. What is the remedy available to him? [CSIG -II] (June 2004, 3 marks)

Answer:

Under Section 40 of ESI Act it is the primary duty of an employer to pay both his contribution and employee’s contribution in the first instance subject to the right of reimbursement.

In the given case Raju can approach the ESI Corporation to seek the remedy as the employer has made a default by not making required contribution. ESI corporation afterwards may recover the amount as if it were an arrear of land revenue.

![]()

Question 23.

Attempt the following stating the relevant legal provisions and case law, if any:

A worker was injured by his negligent act while knocking the belt of a moving pulley. Does it amount to an employment injury under the Employees’ State Insurance Act, 1948? [CSIG -II] (June 2005, 3 marks)

Answer:

Yes, it amounts to employment injury. In decided case of Jayanthilal Dhanji Co. V/s ESIC, a worker was injured while knocking the belt of the moving pulley, though the injury caused was due to his negligence, yet such an injury amounts to an employment injury.

Question 24.

Attempt the following stating the relevant legal provisions and case law, if any:

While fixing total remuneration, the employer included travelling allowance as part of the remuneration of an employee. The employee claimed that the employer has to include travelling allowance also for the purpose of payment of contribution towards ESI fund. Will he succeed ? [CSIG -II] (June 2006, 3 marks)

Answer:

The employee will not be able to succeed in the given case as travelling allowance paid to the employee does not form the part of wages and thus cannot be included for the purpose of payment of contribution towards ESI fund Case. S. Ganesan V the Regional Director, ESI Corporation.

Question 25.

Attempt the following stating the relevant legal provisions and case law, if any:

There was a canteen and a cycle stand run by a private contractor in a theater premises. Is the theater owner liable to pay ESI contribution as ‘principal employer’? [CSIG -II] (Dec 2006, 3 marks)

Answer:

The theater owner is liable as principal employer for the payment of ESI contribution in respect of workers employed in canteen/ cycle stand. In case of Royal Talkies Hyderabad V/s ESIC, the Supreme Court held that the two operation namely keeping a cycle stand and running a canteen are incidental or adjuncts to the primary purpose of the theater and the workers engaged therein are covered under the definition of employees.

Question 26.

Attempt of the following stating relevant legal provisions and case law, if any:

Bahadur, an employee deputed by the management to participate in a football match, met with an accident resulting in his death while on his way to the playground. Is it an ‘employment injury’ under the Employees’ State Insurance Act, 1948 ? [CSIG -II] (June 2007, 3 marks)

Answer:

Yes, it is an employment injury. Employment injury need not be confined to any injury sustained by a person within the premises. For an employment injury there must be a nexus between the circumstances of an accident and the employment. The theory of notional extension will be applied in this case.

![]()

Question 27.

Attempt the following stating the relevant legal provisions and case law, if any:

A notice of dismissal is given by an employer to Mukesh, an employee who is in receipt of sickness benefit under the Employees’ State Insurance Act, 1948. Has the employer the right to dismiss Mukesh during the period he is in receipt of sickness benefit? Give reasons. [CSIG -II] (Dec 2007, 3 marks)

Answer:

The Employer has no right to dismiss Mukesh during the period he is in receipt of sickness benefits.

Under Section 73 of ESI Act, the employer cannot discharge or reduce or punish an employee during the period the employee is in receipt of sickness benefit or maternity benefits.

Question 28.

Attempt the following stating relevant legal provisions and decided case law, if any:

(i) Muskan Theatre is maintaining a canteen and a cycle stand through private contractors. Regional Director, ESI Corporation sent notices to the management of the theatre for contribution of the employees engaged in the canteen and cycle stand. The management contends that they are not employees but are the workmen of the contractor. Hence, the management is not liable. Will the management succeed in its contention?

(iv) An employer failed to pay his contribution under the Employees’ State Insurance Act, 1948. After 6 years, the ESI Corporation issued a demand notice for payment of arrears of contribution. The employer contended that the arrears of contribution beyond 5 years are not recoverable. Will the employer succeed? [CSEP -II] (June 2009m 4 marks each)

Answer:

(i) No, the contention of the management of Muskan Theatre is not legally tenable.

The theatre owner is liable as principal employer for the payment of ESI contribution in respect of workers employed in canteen/ cycle stand. In case of Royal Talkies Hyderabad V/s ESIC, the Supreme Court held that the two operation namely keeping a cycle stand and running a canteen are incidental to the primary purpose of the theatre and the workers engaged therein are covered under the definition of employees.

(iv) In the above case, the employer contended that the arrears of contribution beyond 5 years are not recoverable. But the employer’s contention is not tenable in law as limitation period of 5 years is not applicable in this case.

Question 29.

Attempt the following stating relevant legal provisions and decided case law, if any:

An employee was on his way to the factory. He met with an accident one kilometre away from the place of his employment. He pleaded that the injury was caused by accident “arising out of and in the course of employment” and claimed employment injury benefits under the Employees’ State Insurance Act, 1948. Will the employee succeed? [CSEP -II] (June 2010, 4 marks)

Answer:

No, the employee will not succeed.

It will not amount to employment injury. The Supreme Court in Regional Director ESI V/S Frencis De Costa, held that mere road accident on a public road while the employee was on his way to place of employment cannot be said to have its origin in his employment in the factory. Therefore, Mohan is not entitled to benefits under the ESI Act 1948.

Question 30.

Attempt the following stating relevant legal provisions and decided case law.

XYZ Ltd., employing more than 50 workmen in its factory, failed to register itself and pay contributions under the Employees’ State Insurance Act, 1948. The inspector of the ESI Corporation issued a notice to the company and directed it to register and pay contributions towards its employees.

On failure to comply with the terms of notice, ESI Corporation determined the contributions payable by the company and demanded payment with interest and penalty. The company disputed its liability and asked the ESI Corporation to approach the ESI Court for adjudication of the claim. Is the company justified? [CSEP -II] (Dec 2011, 4 marks)

Answer:

- In the above case, XYZ Ltd. employed more than 50 workmen in its factory.

- XYZ Ltd. (employer) denies the liability or applicability of the provisions of the Act.

- Employee’s State Insurance Act, 1948 does not stipulate as to who has to approach the Employees Insurance Court.

- In this case, employer is not justified as by general implication of law, employer should approach the Employees Insurance Court rather than the ESI Corporation.

Question 31.

Attempt the following stating relevant legal provisions and decided case law, if any:

Visual Electronics Ltd. sells household consumer durables such as TV, washing machines, electric stoves, etc., of various manufacturers in its sales outlet. While delivering these items to the homes of the customers, it deputes its employees to install and explain the salient features of these items.

It pays its employees an additional amount of defray for the actual travelling expenses. The Employees’ State Insurance Corporation demanded contribution on this additional payment including travelling expenses under the head ‘wages’. Is the demand of Employees’ State Insurance Corporation justified ? [CSEP -II] (June 2012, 4 marks)

Answer:

In the above case, the employer is not liable to pay contribution on travelling allowance.

- Travelling allowance does not form part of wages as defined under Section 2 (22) of the ESI Act as held in ‘S. Ganeshan v/s The Regional Director, ESI Corporation.’

- Demand of Employee’s State Insurance Corporation is not justified.

Question 32.

Attempt the following stating relevant legal provisions and decided case law, if any:

Lektronics Ltd. is an establishment covered under the Employees’ State Insurance Act, 1948. The salesmen of the company were paid a commission @ 10 % of the sales done by them every month. The ESI Inspector asked the employer to deposit contributions (the sum of money payable to the ESI Corporation by the principal employer in respect of an employee) in respect of the commission paid. Is he justified? Give reasons. [CSEP -II] (Dec 2012, 4 marks)

Answer:

According to ESI Act, 1948 wages includes any remuneration paid at intervals not exceeding two months. The employee receives incentives/ commission in addition to wages. As the commission is paid every month, the ESI Inspector can ask the employer to deposit contributions.

![]()

Question 33.

Attempt of the following stating relevant legal provisions and decided case law.

An employer failed to pay his contribution under the Employees’ State Insurance Act, 1948 for six years. After the lapse of six years, the ESI Corporation issued a demand notice for payment of arrears of contribution. The employer contended that the arrears of contribution beyond 5 years are not recoverable. Will the employer succeed?

[CSEP -II] (June 2013, 4 marks)

Answer:

- The ESI Corporation can recover employer’s contribution even after lapse of five years.

- The Supreme Court in the case of ESIC V CC Santha Kumar has held that the limitation period of 5 years specified under Section 77 of the ESI Act to bring an action before the Employees Insurance Court is not applicable in case of determination of the contribution payable under section 45 A of the ESI Act, 1948.

- Therefore, the contention of the employer that the ESI Corporation cannot recover the dues pertaining to the period prior to five years, is not tenable in law.

Recent Case Laws

| Case Law | Decision |

| 1. Regional Director, E.S.I. Corpn. V L. Ranga Rao |

It was held that there should be a nexus or casual connection between the accident and employment. The place or time of accident should not be totally unrelated to the employment for covering under the definition of “employment injury” under the Act. |

| 2. Regional Director, E.S.I. V Francis de Costa |

It was held in this case by the Supreme Court that a mere road accident on a public road while employee was on his way to the place of employment cannot be said to have its origin in his employment in the factory and cannot be termed as “employment injury” under the Act |

| 3. Jayanthilal Dhanji Co. V E.S.I.C. |

It was held that in case a worker was injured while knocking the belt of the moving pulley, though the injury was caused due to the negligence of worker, yet it amounts to “employment injury”. |

| 4. E.S.I.C. V M.M. Suri & Associates Pvt. Ltd. |

It was held that for applicability of the Employees’ State Insurance Act, 1948, it is not sufficient that 20 persons are employed in the shop. Important factor is that they should be employee as per the provisions of Section 2(9) of the Act. |

| 5. Hyde abad Asbestos Cement Products,etc V E.S.I.C. |

It was held that even though the offices are located in different towns, the persons employees in zonal offices and branch offices of a factory and concerned with administrative work or the work of canvassing sale would be employee under the Employees’ State Insurance Act, 1948 |

Employees’ State Insurance Act, 1948 Notes

Objective & Scope of Employees’ State Insurance Act

- An Act to provide benefits to employees of organised sector.

- Applies to whole of India including Jammu & Kashmir.

- Objective of the Act is protect the interest of workers in contingencies such as sickness, disability, maternity or death due to employment injury.

- Amended in 2010 by virtue of ESI (Amendment), Act 2010 with a view to increase the purview of the Act.

What is Dependent as per the Act

1. Following relatives of a deceased fall within the ambit of Relative:

- Widow

- Legitimate or adopted son below 25 years

- Legitimate or adopted daughter who is unmarried

- Widowed mother

- Legitimate or adopted son or daughter, above 25 years but wholly dependent on the deceased at the time of death.

- Parents, paternal grand parents (if parents are not alive), minor illegitimate son, minor brother or sister, widowed daughter in law, minor child of pre-deceased son /daughter (if parents are not alive), but are wholly dependent on the deceased at the time of death.

What is meant by Employment injury

- Employment injury means an injury caused to an employee arising out of and in the course of his employment being an insurable employment.

- Whether the accident occurs within or outside the territorial limits of India.

- Employment injury need not be confined to employer’s premises only.

- It extends to time & place (theory of notional extension).

- It is not limited to injury or wound, but has broader coverage.

- There needs to be some nexus (means relation) between the employment and the accident.

Includes - Injury by knocking the belt of pulley though caused by ignorance of employee himself.

- Injury caused by person who was beaten at the job though there was threat pre announced due to call for strike.

Excludes

- Accident while on the way to office

![]()

What are the types of disablement so defined:

Temporary Disablement:

- Condition resulting from an employment injury which requires medical treatment & results the employee temporarily incapable

- Permanent Partial Disablement:

- It means such disablement of a permanent nature, as reduced the earning capacity of an employee in every employment which he was capable of undertaking at the time of the accident resulting in the disablement.

- Provided that every injury specified in Part II of the Second Schedule to the Act shall be deemed to result in permanent partial disablement.

Permanent Total Disablement:

It means such disablement of a permanent nature as incapacitates an employee for all work which he was capable of performing at the time of the accident resulting in such disablement.

Provided that permanent total disablement shall be deemed to result from every injury specified in Part -1 of the Second Schedule to the Act or from any combination of injuries specified in Part- II thereof, where the aggregate percentage of loss of earning capacity, as specified in the said Part – II against those injuries, amount to 100% or more.

Noteworthy Points

- The rate of contribution towards the Employee’s State Insurance Fund is 3.25% and 0.75% of employee’s wages by the employers and employees respectively.

- According to ESI Act, 1948 wages includes any remuneration paid at intervals not exceeding two months.

- The disputes relating to benefits under the Employees’ State Insurance Act, 1948 are required to be filed in Employees’ Insurance Court.

- Factory or establishment to which the Employees’ State Insurance Act, 1948 applies has to be registered within 15 days.

- The judge of Employees Insurance Court (EIC) should be either- Judicial Officer or Legal practitioner for at least 5 years.