Employee Cost – CA Inter Costing Study Material is designed strictly as per the latest syllabus and exam pattern.

Employee Cost – CA Inter Costing Study Material

1. Straight Time Rate System: Wages is paid on the basis of time irrespective of production volume.

Wages = Time Worked (Hours/Days/Months) × Time Rate

- Straight Piece Rate System: Wages is paid on the basis of number of units produced irrespective of lime spent for production.

Wages = Number of units produced × Rate per unit - Halsey Premium Plan = Time taken × Time rate + 50% of time saved × Time rate

- Rowan Premium Plan:

= Time Taken × Rate per hour + \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × Time Taken × Rate per hour

2. Employee Efficiency: It the time taken by a worker on a job equals or less i than the standard time, then he is rated efficient.

Efficiency (%) = \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × 100

3. Employee Productivity: It is used for measuring the efficiency of individual workers. It is an index of efficiency in the utilisation of human resources, materials, capital, power and all kinds of services and facilities.

= \(\frac{\text { Standard time for doing actual work }}{\text { Actial time }}\)

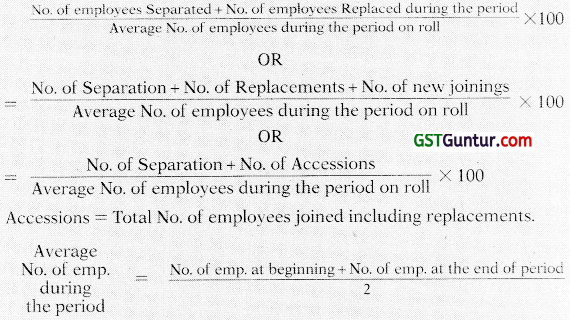

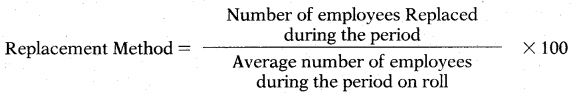

4. Employee (Labour) Turnover: It is the rate of change in the composition of employee force during a specif ied period measured against a suitable index.

Methods of calculating employee turnover;

Replacement Method = \(\frac{\text { No. of employees Replaced during the period }}{\text { Average No. of employees during the period on roll }}\) × 100

Separation Method:

= \(\frac{\text { No. of employees Separated during the period }}{\text { Average No. of employees during the period on roll }}\) × 100

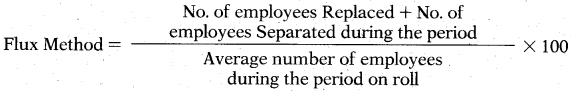

Flux Method:

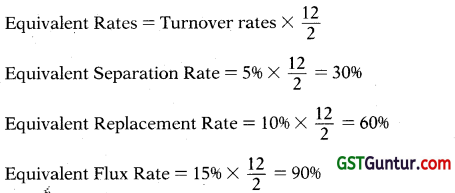

Equivalent Employee (Labour) Turnover Rate: Ii is used when data given is for a period other than a year to convert it into equivalent annual employee turnover rate.

= \(\frac{\text { Employee Turnover rate for the period }}{\text { Number of days in the period }}\) × 365

Question 1.

Distinguish between ‘Direct and Indirect labour costs’. [CA In ter Nov. 2001, 2 Marksj

Answer:

Direct Labour Cost is the cost of benefits paid or payable to the employees which can be directly attributed to a cost object in an economically feasible manner. This can be easily identified and allocated to an activity, contract, cost centre, customer, process, product etc.

Indirect Labour Cost is the cost of benefits paid or payable to the employees, which cannot be directly attributable to a particular cost object in an economically feasible manner.

The direct labour cost can be identified with and can be charged to the job. However, indirect labour costs cannot be so charged and is therefore, to be treated as part of the factory OH and it is to be included in the cost of production.

![]()

Question 2.

Discuss any four objectives of ‘Time keeping’ in relation to attendance and payroll procedures. [CA Inter Nov. 2020, 4 Marks]

Answer:

The objectives of time-keeping in relation to attendance and paxroll procedures are as follows:

- For the preparation of payrolls.

- For calculating overtime.

- For ascertaining and controlling employee cost.

- For ascertaining idle time.

- For disciplinary purposes.

- For overhead distribution.

Question 3.

Enumerate the various methods of Time booking. [CA Inter May 2007, 2 Marks]

Answer:

Following are the methods of Time Booking:

- Job ticket

- Combined Time and Job ticket.

- Daily time sheet

- Piece work card

- Clock card

Question 4.

Discuss accounting treatment of idle capacity costs in cost accounting. [CA Inter May 2009, May2006, May 2005, May 2003, 3 Marks]

Answer:

Idle time is the time during which no production is carried out because the workers remain idle hut are paid. In other words, it is the difference between the lime paid and the time booked. Idle time can be normal or abnormal.

Treatment of Idle Capacity Cost:

(i) Normal idle time: It is the time which cannot be avoided or reduced in the normal course of business. E.g., Time lost between factory gate and place of work, interval between one job and another, machine setup time, normal rest time, lunch break etc.

Normal idle time cost will be treated as a part of cost of production. In case of direct workers, an allowance for normal idle time is considered setting of standard hours or standard rate and in case of indirect workers, normal idle time is considered for the computation of overhead rate.

(ii) Abnormal idle time: There may be some factors which may give rise to abnormal idle time such as lack of coordination, power failure, machine breakdown, non-availability of raw materials, strikes, lockouts, poor supervision, fire, flood etc.

Abnormal idle time cost is not included as a part of production cost, but it is shown as a separate item in the Costing Profit and Loss Account.

Question 5.

Discuss the effect of overtime payment on productivity. [CA Inter Nov 2001, 3 Marks]

Answer:

Effect of overtime payment on productivity:

Overtime work should be resorted to, only when it is extremely essential because it involves extra cost. The overtime payment increases the cost of production in the following ways:

- The overtime premium paid is an extra payment in addition to the normal rate.

- The efficiency of operators during overtime work may fall and thus output may be less than normal output.

- In order to earn more, workers may not concentrate on work during normal time and thus the output during normal hours may also fall.

- Reduced output and increased premium of overtime will bring about an increase in costs of production.

![]()

Question 6.

Discuss the treatment of overtime premium in Cost Accounting. [CA Inter May 2008, May 2006, Nov. 2004, May 2003, 3 Marks]

Answer:

- If overtime is resorted to at the desire of the customer, then overtime premium may be charged to the job directly.

- If overtime is required to cope with general production programmes or for meeting urgent orders, the overtime premium should be treated as overhead cost of the particular department or cost centre which works overtime.

- If overtime is worked in a department due to the fault of another department, the overtime premium should be charged to the latter department.

- Overtime worked on account of abnormal conditions such as flood, earthquake etc., should not be charged to cost, but to Costing Profit and Loss Account.

Question 7.

State the circumstances in which time rate system of wage payment can be preferred in a factory. [CA Inter Nov 2001, 3 Marks]

Answer:

Time rate system of wage payment is suitable for the employees:

- whose services cannot be directly or tangibly measured, e.g. general helpers, supervisory and clerical staff etc.

- engaged on highly skilled jobs.

- where the pace of output is independent of the operator e.g., automatic chemical plants.

Question 8.

Describe briefly, how wages may be calculated under the following systems:

(i) Rowan system

(ii) Halsey system. [CA Inter Nov 2008, 9 Marks}

Answer:

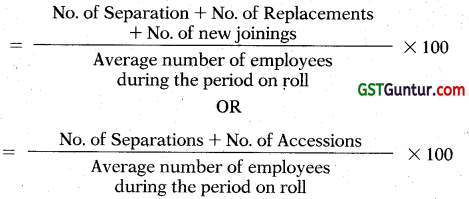

(i) Rowan System: Under the Rowan system, a standard time allowance is fixed for the performance of a job and bonus is paid if time is saved. Under Rowan System the bonus is that proportion of the time wages as time saved bears to the standard time.

Time taken × Rate per hour + \(\frac{\text { Time saved }}{\text { Time allowed }}\) × Time taken × Rate per hour

(ii) Halsey System: Under the Halsey system, a standard time is fixed for

each job or process and the workers are encouraged to do the job in less than the standard time. If there is no saving on this standard time allowance, the worker is paid only his day rate. He gets his time rate even if he exceeds the standard time limit, since his day rate is guaranteed. If, however, he does.the job in less than the standard time, he gets a bonus of 50% of the wages of time saved; the employer benefits by the other 50%.

Time taken × Time rate + 50% of time saved × Time rate.

Question 9.

Which is better plan out of Halsey 50% bonus scheme and Rowan bonus scheme for an efficient worker? In which situation the worker get came bonus in both schemes? [CA Inter May 2010, 3 Marks]

Answer:

Rowan Bonus Scheme pays more bonus if the time saved is below 50% of time allowed and if the time saved is more than 50% of time allowed then Halsey bonus scheme pays more bonus. Generally, time saved by a worker is not more than 50% of time allowed. So, the Rowan bonus scheme is better for an efficient worker. When the time saved is equal to 50% of time allowed then both plans pays same bonus to a worker.

Bonus under Halsey Plan = Time saved × 50% × Time rate

Bonus under Rowan Plan

\(\frac{\text { Time taken }}{\text { Time allowed }}\) × Time saved × Rate per hour

Bonus under Halsey Plan will be equal to the Bonus under Rowan Plan when the following condition holds good:

Time saved × 50% × Time rate = \(\frac{\text { Time taken }}{\text { Time allowed }}\) × Time saved × Time rate

50% = \(\frac{\text { Time taken }}{\text { Time allowed }}\)

Hence, when the actual time taken is 50% of the time allowed, the bonus under Halsey and Rowan Plans is equal.

Question 10.

List important factors which must be taken into consideration for increasing labour productivity. [CA Inter May 2018, 4 Marks]

Answer:

The important factors which must be taken into consideration for increasing labour productivity are as follows:

- Employing only those workers who possess the right type of skill.

- Placing a right type of man on the right job.

- Training young and old workers by providing them the right types of opportunities.

- Taking appropriate measures to avoid the situation of excess or shortage of labour at the shop floor.

- Carrying out work study for the fixation of wage rate, and for the simplifi-cation and standardisation of work.

![]()

Question 11.

What do you understand by labour turnover? How is it measured? [CA Inter Nov.2014, Nov. 2010, Nov. 2004, May 2003, 5 Marks]

Answer:

Employee turnover or labour turnover in an organisation is the rate of change in the composition of employee force during a specified period measured against a suitable index.

The standard of usual employee turnover in the industry or locality or the employee turnover rate for a past period may be taken as the index or norm against which actual turnover rate is compared.

The methods for measuring labour turnover are:

(i) Replacement Method: This method takes into consideration actual replacement of employees irrespective of number of persons leaving

the organisation.

Note: New employees appointed on account of expansion plan of the organisation are not included in number of replacements.

(ii) Separation Method: In this method employee turnover is measured by dividing the total number of employees separated during the period by the average total number of employees on payroll during the same period.

(iii) Flux Method: This method takes both the number of replacements as well as the number of separations during the period into account for calculation of employee turnover.

When number of accessions are considered for measuring employee turnover, the employee turnover rate by Flux method may be computed by using any one of the following expressions:

Question 12.

Enumerate the causes of labour turnover. [CA Inter May 2011, 4 Marks]

Answer:

The main causes of labour turnover in an organisation/industry can be broadly classified under the following three heads:

(a) Personal Causes: These are the causes which induce or compel workers to leave their jobs such as change of jobs for betterment; premature retirement due to ill health or old age; domestic problems and family responsibilities; discontent over the jobs and working environment.

(b) Unavoidable Causes: These are the causes under which it becomes obligatory on the part of management to ask one or more of their employees to leave the organisation such as seasonal nature of the business; shortage of raw material, power, slack market for the product; change in the plant location; marriage (generally in the case of women) etc.

(c) Avoidable Causes: These are the causes which require the attention of management on a continuous basis so as to keep the labour turnover ratio as low as possible. The main causes are dissatisfaction with job, remuneration, hours of work, working conditions; strained relationship with management, supervisors or fellow workers; lack of training facilities and promotional avenues; low wages and allowances.

Question 13.

Discuss the two types of cost associated with labour turnover. [CA Inter Nov. 20033 Marks]

Answer:

The two types of costs associated with labour turnover are:

(a) Preventive Costs: These costs are incurred to prevent employee turnover or keep it as lowest as possible. It includes cost of medical benefit provided to the employees, cost incurred on employees’ welfare like pension etc., cost on other benefits with an objective to retain employees.

(b) Replacement Costs: These are the costs which arise due to employee turnover. If employees leave soon after they acquire the necessary’ training and experience of good work, additional costs will have to be incurred on new workers, i e., cost of recruitment, training and induction, abnormal breakage and scrap and extra wages and overheads due to the inefficiency of new workers.

A company will incur very high replacement costs if the rate of employee turnover is high. Similarly, only adequate preventive costs can keep Employee turnover at a low level. Therefore, each company must work out the optimum level of Employee turnover keeping in view its personnel policies and the behaviour of replacement cost and preventive costs at various levels of Employee turnover rates.

![]()

Question 14.

Describe the remedial steps to be taken to minimize the labour turnover. [CA Inter May 2019, Nov. 2007, 4 Marks]

Answer:

The following steps are useful for minimizing labour turnover:

- Exit interview: An interview to be arranged with each outgoing employee to ascertain the reasons of his leaving the organisation.

- Job analysis and evaluation: to ascertain the requirement of each job.

- Organisation should make use of a scientific system of recruitment, placement and promotion for employees.

- Organisation should create healthy atmosphere, providing education, medical and housing facilities for workers.

- Committee for settling workers grievances.

Practical Questions

Calculation of Employee Cost With Idle Time

Question 1.

Following data have been extracted from the books of M/’s. ABC Private Limited:

| (i) Salary (each employee, per month) | ₹ 30.000 |

| (ii) Bonus | 25% of salary |

| (iii) Employer’s contribution to PF, ESI etc. | 15% of salary |

| (ir) Total cost at employees’ welfare activities | 6,61,500 per annum |

| (v) Total leave permitted during the year | 30 days |

| (vi) No. of employees | 175 |

| (vii) Normal idle time | 70 hours per annum |

| (viii) Abnormal idle time (due to failure of power supply) | 50 hours |

| (ix) Working days per annum | 310 days of 8 hours |

You are required to calculate:

(i) Annual cost of each employee

(ii) Employee cost per hour

(iii) Cost of abnormal idle time, per employee. [CA Inter Nov 2018, 5 Marks]

Answer:

(i) Calculation of Annual Cost of each employee

| ₹ | |

| Salary (₹ 30,000 × 12) | 3,60,000 |

| Bonus (25% of salary) | 90,000 |

| Contribution to PF, ESI (15% of salary) | 54,000 |

| Cost of employees welfare activities (₹ 6,61,500/175 employees) | 3,780 |

| Total Annual cost of each employee | 5,07,780 |

(ii) Calculation of Employee cost per hour

| Hours | |

| Working Hours (310 days × 8 hours) | 2,480 |

| Less: Employee leave hours (30 days × 8 hours) | 240 |

| Available working Hours | 2,240 |

| Less: Normal Idle Time | 70 |

| Effective Working Hours | 2,170 |

Employee Cost per Hour = ₹ 5,07,780/2,170 hours = ₹ 234

Note: It is assumed that 310 working days does not include leave days permitted to the employees.

(iii) Cost of abnormal idle time, per employee will be ₹ 11,700 (₹ 234 × 50 hours).

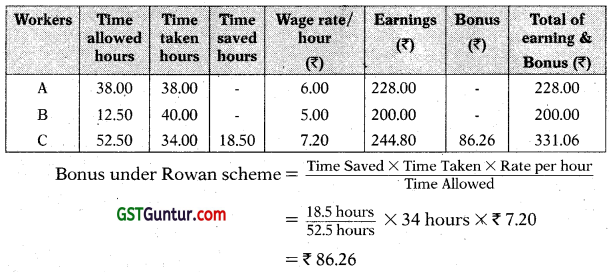

Incentive Plans: Rowan And Halsey

Question 2.

X executes a piece of work in 120 hours as against 150 hours allowed to him. His hourly rate is ₹ 10 and he gets a dearness allowance ₹ 30 per day of 8 hours worked in addition to his wages. You are required to calculate total wages received by X under the Rowan Premium Plan. [CA Inter Nov 2011, 5 Marks]

Answer:

Rowan Premium Plan:

| ₹ | |

| Normal wages (₹ 10 × 120 hrs) | 1,200 |

| Dearness allowance (120 hrs/8 hrs × ₹ 30) | 450 |

| Bonus \(\frac{30 \mathrm{hrs}}{150 \mathrm{hrs}}\) × 120 hrs × ₹ 10 150 hrs | 240 |

| Total Wages | 1,890 |

![]()

Question 3.

Rowan Premium Bonus system does not motivate a highly efficient worker as a less efficient worker and a highly efficient worker can obtain same bonus under this system. Discuss with an example.

Answer:

In Rowan premium bonus system a worker cannot increase his earnings or bonus by merely increasing its work speed. The reason for this is that the bonus under Rowan Scheme is maximum when the time taken by worker on a job is half of the time allowed.

Example:

Time allowed – 10 hours

Time rate – ₹ 20.00

Time taken by Mr. X (highly efficient worker) – 4 hours

Time taken by Mr. Y (less efficient worker) – 5 hours

Now,

Bonus to Mr. X = AH / SH (SH – AH) × R = 4/10(10 – 4) × 20 = ₹ 48

Bonus to Mr. Y = AH / SH (SH – AH) × R = 5/10(10 – 5) × 20 = ₹ 50

Hence it can be said that under Rowan Premium Bonus System even a highly efficient worker can get same bonus as a less efficient worker.

Question 4.

A worker takes 15 hours to complete a piece of work for which time allowed is 20 hours. His wage rate is ? 5 per hour. Following additional in-formation are also available:

| Material cost of work | ₹ 50 |

| Factory overheads | 100% of wages |

Calculate the factory cost of work under the following methods of wage payments:

(i) Rowan Plan

(ii) Halsey Plan [CA Inter May 2018, 5 Marks]

Answer:

Calculation of Factory Cost of Work:

| Rowan Plan (₹) | Halsey Plan (₹) | |

| Materials Direct Wages (Refer W.N.) |

50 93.75 |

50 87.50 |

| Prime Cost Factory Overheads (100% of Direct Wages) |

143.75

93.75 |

137.50 87.50 |

| Factory Cost | 237.50 | 225.00 |

Working Note:

Calculation of Direct Wages:

Rowan Plan = Time Taken × Rate per hour + \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × Time Taken × Rate per hour

= 15 hours × 5 + \(\frac{5 \text { hours }}{20 \text { hours }}\) × 15 hours × 5

= 93.75

Halsey Plan = Time Taken × Time Rate + 50% of Time Saved × Time Rate

= 15 hours × 5 + (50% of 5 hours) × 5

= 87.50

Question 5.

A skilled worker is paid a,guaranteed wage rate of ₹ 150 per hour. The standard time allowed for a job is 50 hours. He gets an effective hourly rate of wages of ₹ 180 under Rowan Incentive Plan due to saving in time. For the same saving in time, calculate the hourly rate of wages he will get, if he is placed under Halsey Premium Scheme (50%). [CA Inter Nov 2017, May 2013, Nov 2009, 5 Marks]

Answer:

Increase in hourly rate of wages under Rowan Plan is ₹ 30 ie. (₹ 180 – ₹ 150)

\(\frac{\text { Time saved }}{\text { Time Allowed }}\) × ₹ 150 = ₹ 30 (Refer Working Note)

Or, \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × ₹ 150 = ₹ 30

Or, Time Saved = \(\frac{₹ 30 \times 50 \text { hours }}{₹ 150}\) = 10 hours

Therefore, Time Taken is 40 hours i.e. (50 hours – 10 hours)

Effective Hourly Rate under Halsey System:

Time Saved = 10 Hours

Bonus 50% = 10 hours × 50% × ₹ 150 = ₹ 750

Total wages = ₹ 150 × 40 hours + ₹ 750 = ₹ 6,750

Effective hourly rate = ₹ 6,750/40 = ₹ 168.75

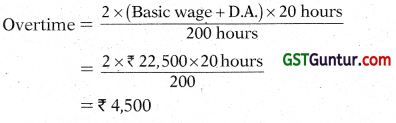

Working Note:

Effective Hourly Rate

![]()

Question 6.

You are given the following information of a worker:

| (i) Name of worker | ‘X’ |

| (ii) Ticket No. | 002 |

| (iii) Work started | 1-4-20 at 8 a.m. |

| (iv) Work finished | 5-4-20 at 12 noon |

| (v) Work allotted | Production of 2,160 units |

| (vi) Work done and approved | 2,000 units |

| (vii) Time and units allowed | 40 units per hour |

| (viii) Wages rate | ₹ 25 per hour |

| (ix) Bonus | 40% of time saved |

| (x) Worker X worked | 9 hours a day |

You are required to calculate the remuneration of the following basis:

(i) Halsey plan and

(ii) Rowan plan [CA Inter May 2011, 5 Marks]

Answer:

No. of units, produced and approved = 2,000

Standard time = 40 units per hour

Hourly Wages Rate = 25

Time allowed = 40 units per hour

Time allowed for 2,000 units = \(\frac{2,000}{40}\) = 50 hours

(i) Calculation of Remuneration under Halsey Plan:

| Standard time allowed for 2,000 units Actual time taken for 2,000 units |

50 hours 40 hours |

| Time saved (W.N.2) | 10 hours |

| Basic wages for time taken (40 hours @ ₹ 25) Bonus (40% of time saved of 10 hrs × ₹ 25) |

₹ 1,000 ₹ 100 |

| Total | ₹ 1,100 |

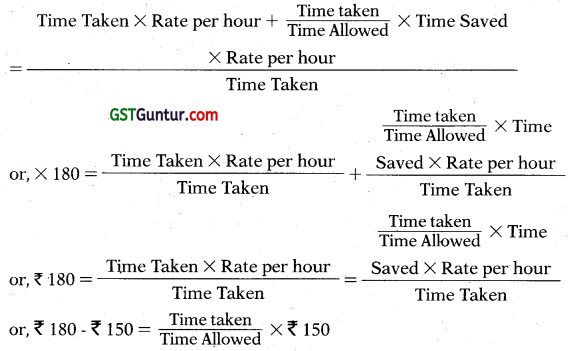

(ii) Calculation of Remuneration Under Rowan Plan:

Basic wages for time taken (40 hours @ ₹ 25) = ₹ 1,000

Bonus = \(\frac{40}{50}\) × 10 × ₹ 25 = ₹ 200

Total = ₹ 1,200

9 hrs per day from 1.4.2020 to 4.4.2020 ie. 36 hrs + 4 hrs on 5.4.2020 = 40 hrs.

Question 7.

M/s. Zeba Private Limited allotted a standard time of 40 hours for a job and the rate per hour is 75, The actual time taken by a worker is 30 hours.

You are required to calculate the total earnings under the following plans:

(i) Halsey Premium Plan (Rate 50%)

(ii) Rowan Plan

(Hi) Time Wage System

(iy) Piece Rate System [CA Inter May 2019, 5 Marks]

Answer:

(i) Halsey Premium Plan:

= Time taken × Time Rate + 50% of time saved × time rate

= (30 hrs × ₹ 75) + (40 hrs – 30 hrs) × 50% ₹ 75

= ₹ 2,625

(ii) Rowan Plan:

= Time taken × Rate per hour + \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × Time taken × Rate per hour

= 30 hours × ₹ 75 + \(\frac{10 \mathrm{hrs}}{40 \mathrm{hrs}}\) × 30 hrs × ₹ 75

= ₹ 2,812.50

(iii) Time Wage System:

= Hours Work × Rate Per hour

= 30 hours × ₹ 75

= ₹ 2,250

(iv) Piece Rate System:

Std. Time × Rate per hour

= 40 × ₹ 75 = ₹ 3,000

![]()

Question 8.

Zico Ltd. has its factory at two locations viz Nasik and Satara. Rowan plan is used at Nasik factory and Halsey plan at Satara factory. Standard time and basic rate of wages are same for a job which is similar and is carried out on similar machinery. Normal working hours is 8 hours per day in a 5 day week.

Job in Nasik factory is completed in 32 hours while at Satara factory it has taken 30 hours. Conversion costs at Nasik and Satara are ₹ 5,408 and ₹ 4,950. Overheads account for ₹ 25 per hour.

Required:

(i) To. find out the normal wages; and

(ii) To compare the respective conversion costs. [CA Inter Nov. 2019, 10 Marks]

Answer:

Calculation of Total labour costs at both the factories

| Nasik | Satara | |

| Hours worked Conversion Costs Less: Overheads |

32 hrs. ₹ 5,408 ₹ 800 (₹ 25 × 32 hrs.) |

30 hrs. ₹ 4,950 ₹ 750 (₹ 25 × 30 hrs.) |

| Labour Costs | ₹ 4,608 | ₹ 4,200 |

(i) Calculation of Normal wages rate:

Let Wage rate be ₹ R per hour which is same for both the Nasik and Satara factory.

Normal time allowed for completing the job is 40 hours i.e. 8 hours per day × 5 days.

Normal wage rate can be found out taking total cost of either factory.

Nasik: Rowan Plan

Total Labour Cost = Wages for hours worked + Bonus as per Rowan plan

₹ 4,608 = Time taken × Rate per hour + \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × Time taken × Rate per hour

₹ 4,608 = 32 hrs × R + \(\frac{40-32}{40}\) × 32 × R

₹ 4,608 = 32R + 6.4R

R = ₹ 120 per hour

OR

Satara: Halsey Plan

Total Labour Cost = Wages for hours worked + Bonus as per Halsey plan

₹ 4,200 = Time taken × Time Rate + 50% of time saved × time rate

₹ 4,200 = 30 hrs × R + 50% of (40 hrs – 30 hrs) × R

₹ 4,200 – 35 R

R = ₹ 120

(ii) Comparative Statement of respective conversion costs

| Nasik (₹) | Satara (₹) | |

| Normal Wages | 3,840 (₹ 120 × 32) | 3,600 (₹ 120 × 30) |

| Bonus | 768 (6.4 × ₹ 120) | 600 (5 × ₹ 120) |

| Factory overhead | 800 | 750 |

| Conversion costs | 5,408 | 4,950 |

Question 9.

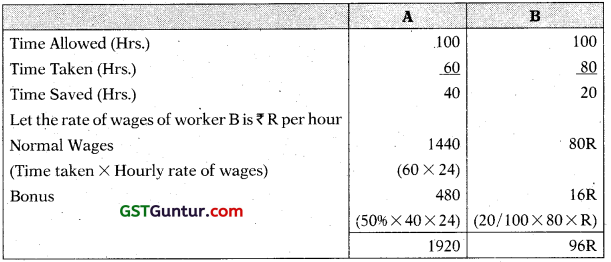

Two workmen, A and B, produce the same product using the same material. A is paid bonus according to Halsey plan, while B is paid bonus according to Rowan plan. The time allowed to manufacture the product is 100 hours. A has taken 60 hours and B has taken 80 hours to complete the product. The normal hourly rate of wages of workman A is ₹ 24 per hour. The total earnings of both the workers are same. Calculate normal hourly rate of wages of workman B. [CA Inter May 2009, 2 Marks]

Answer:

Now, it is said that the total earnings of both the workers are same and therefore,

Total earnings of A = Total earnings of B

1,920 = 96R

R = 1,920/96

R = 20

So, the hourly rate of wages of the worker B is ₹ 20 per hour.

![]()

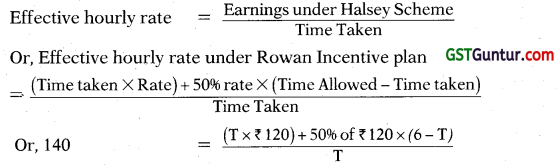

Question 10.

A skilled worker is paid a guaranteed wage rate of ? 120 per hour. The standard time allowed for a job is 6 hour. He took 5 hours to complete the job. He is paid wages under Rowan Incentive Plan.

(i) Calculate his effective hourly rate of earnings under Rowan Incentive Plan.

(ii) If the worker is placed under Halsey Incentive Scheme (50%) and he wants to maintain the same effective hourly rate of earnings, calculate the time in which he should complete the job. [CA Inter Dec. 2021, May 2013, 5 Marks]

Answer:

(i) Effective hourly rate of earnings under Rowan Incentive Plan Earnings under Rowan Incentive plan

= Actual Time Taken × Wage rate + \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × Time Taken × Wage Rate

= (5 hours × ₹ 120) + \(\frac{1 \text { hour }}{6 \text { hours }}\) × 5 hours × ₹ 120

= ₹ 600 + ₹ 100 = ₹ 700

Effective Hourly Rate = ₹ 700/5 hours = ₹ 140/hour

(ii) Let time taken = T

Or, 140T = 120T + 360 – 60T

Or, 80T = 360

Or, T = \(\frac{360}{80}\) = 4.5 hours

Therefore, to earn effective hourly rate of ₹ 140 under Halsey Incentive Scheme-worker has to complete the work in 4.5 hours.

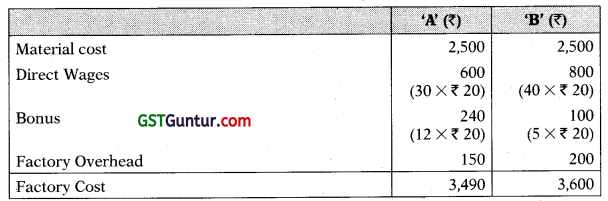

Question 11.

Two workmen ‘A’ and ‘B’, produce the same product using the same material. Their normal wage rate is also the same. ‘A’ is paid bonus according to the Rowan system, while ‘B’ is paid bonus according to the Halsey system. The time allowed to make the product is 50 hours. ‘A’ takes 30 hours while ‘B’ takes 40 hours to complete the product. The factory overhead rate is 5 per man-hour actually worked. The factory cost for the product for ‘A is ₹ 3,490 and for ‘B’ it is ₹ 3,600.

Required:

(a) Compute the normal rate of wages;

(b) Compute the cost of materials cost;

(c) Prepare a statement comparing the factory cost of the products as made by the two workmen. [ICAJModule] .

Answer:

Let X be the cost of material and Y be the normal rate of wages per hour. Bonus:

Workman A under Rowan plan = \(\frac{20}{50}\) × 30 × Y = 12Y

Workman B under Halsey plan = 50% of (50 – 40) × Y = 5Y

Factory cost = Material cost + Wages + Bonus + Overhead For Workman A:

X + 30Y + 12Y + (30 hrs. × ₹ 5) = ₹ 3,490

X + 42Y + ₹ 150 = ₹ 3,490

X + 42Y = ₹ 3,340 ……………………….. equation (i)

For Workman B:

X + 40Y + 5Y + (40 hrs. × ₹ 5) = ₹ 3,600

X + 45Y + ₹ 200 = ₹ 3,600

Subtracting equation (i) from equation (ii)

Therefore, normal rate of wages is ₹ 20 per hour.

X + 45Y = ₹ 3,400

X + (45 × 20) = ₹ 3,400

X = ₹ 2,500

Therefore, the cost of material is ₹ 2,500.

Comparative Statement of the Factory Cost of two workmen

![]()

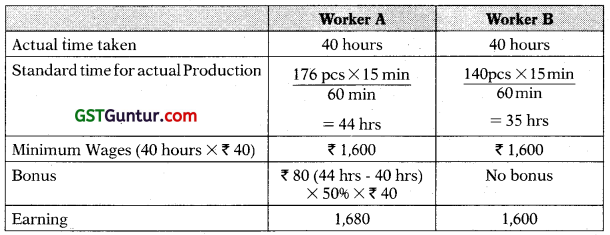

Question 12.

The management of a company wants to formulate an incentive plan for the workers with a view’ to increase productivity. The following particulars have been extracted from the books of company.

Piece Wage rate ₹ 10

Weekly working hours 40

Hourly wages rate ₹ 40 (guaranteed)

Standard/normal time taken per unit is 15 minutes.

Actual output for a week:

Worker A 176 pieces

Worker B 140 pieces

Differential piece rale: 80% of piece rate when output below normal and 120% of piece rate when output above normal.

Under Halsey scheme, worker gets a bonus equal to 50% of Wages of time saved.

Calculate the earnings of workers under Halsey’s and Rowan’s premium scheme. [CA Inter May 2012, 8 Marks]

Answer:

Calculation of earnings for workers under different incentive plans:

Halsey’s Premium Plan:

Rowan’s Premium Plan:

| Worker A | Worker B | |

| Minimum Wages | ₹ 1,600 | ₹ 1,600 |

| Bonus \(\frac{4 \mathrm{hrs}}{44 \mathrm{hrs}}\) × 40 hrs × ₹ 40 = 145.45 | No Bonus | |

| Earning | 1745.45 | 1,600 |

Question 13.

The finishing shop of a company employs 60 direct workers. Each worker is paid ₹ 400 as wages per week of 40 hours. When necessary, over-time is worked up to a maximum of 15 hours per week per worker at time rate plus one-half as premium. The current output on an average is 6 units per man hour which may be regarded as standard output. If bonus scheme is introduced, it is expected that the output will increase to 8 units per man hour. The workers will, if necessary, continue to work Overtime up to the specified limit although no premium on incentives will be paid.

The company is considering introduction of either Halsey Scheme or Rowan Scheme of Wage Incentive system. The budgeted weekly output is 19,200 units. The selling price is ₹ 11 per unit and the direct Material Cost is ₹ 8 per unit. The variable overheads amount to ₹ 0.50 per direct labour hour and the fixed overhead is ₹ 9,000 per week.

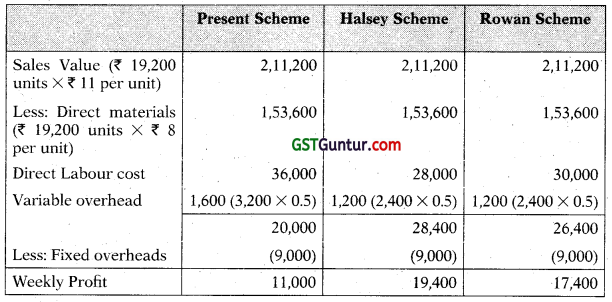

Prepare a Statement to show the effect on the Company’s weekly Profit of the proposal to introduce (a) Halsey Scheme, and (b) Rowan Scheme. [CA Inter May 2002, 8 Marks]

Answer:

Present System:

| Normal wage rate (₹ 400/40 hours) | ₹ 10 per hour |

| Overtime Rate (Normal rate + 50%) | ₹ 15 per hour |

| Average current output per hour | 6 units |

| Hours to be worked for budgeted weekly output (19,200 units/6) | 3200 man hours |

| Total normal hours available in a week (60 workers × 40 hours) | 2,400 man hours |

| Overtime required to be worked (3,200 hours – 2,400 hours) | 800 man hours |

Calculation of total wages under the present scheme

| ₹ | |

| Normal wages for total hours worked (3,200 hours × ₹ 110 per hour) | 32,000 |

| Add: Overtime Premium (800 hours × ₹ 5 per hour (₹ 15 – ₹ 10) | 4,000 |

Proposed scheme:

Time taken for 19,200 units = 19,200/8 = 2,400 man hours

Time saved = 3,200 – 2,400 = 800 man hours

Total wages under the proposed scheme:

(i) Under Halsey Scheme:

| ₹ | |

| Normal wages for total hours worked (2,400 hours × ₹ 10 per hour) | 24,000 |

| Add: Bonus (800 hours × 50% × ₹ 10 per hour) | 4,000 |

| Total | 28,000 |

![]()

(ii) Under Rowan Scheme:

| ₹ | |

| Normal wages for total hours worked (2,400 hours × ₹ 10 per hour) | 24,000 |

| Add: Bonus (800 hours × 2,400/3,200 × ₹ 10 per hour) | 6,000 |

| Total | 30,000 |

Statement of Profit

Question 14.

ZED Limited Is working by employing 50 skilled workers. It is considered the introduction of incentive scheme-either Halsey scheme (with 50% bonus) or Rowan scheme of wage payment for increasing the labour productivity to cope up the Increasing demand for the product by 40%. It is believed that proposed incentive scheme could bring about an average 20% Increase over the present earnings of the workers; If could act as sufficient incentive for them to produce more.

Because of assurance, the increase In productivity has been observed as revealed by the figures for the month of April, 2020.

Hourly rate of wages (guaranteed) ₹ 30

Average time for producing one unit by one worker at the previous performance (This may be taken as time allowed) 1.975 hours

| Number of working hours per day of each worker | 8 |

| Number of working days in the month | 24 |

| Actual production during the month | 6,120 |

Required:

(i) Calculate the effective rate of earnings under the Halsey scheme and the Rowan scheme,

(ii) Calculate the savings to the ZED Limited in terms of direct labour cost per piece.

(iii) Advise ZED Limited about the selection of the scheme to fulfil his assurance. [CA Inter May 2004, 8 Marks]

Answer:

Working Notes:

1. Computation of time saved (in hours) per month:

= Standard production time of 6,120 units – Actual time taken by the workers

= (6,120 units × 1.975 hrs. – 24 days × 8 hours/day × 50 skilled workers)

= 12,087 hrs. – 9,600 hrs.

= 2,487 hours

2. Computation of bonus for time saved (in hours) under Halsey & Rowan Plan:

Time saved = 2,487 hrs.

Wage rate = ₹ 30 per hour

Bonus under Halsey Scheme = 2,487 hrs. × 50% × ₹ 30 = ₹ 37,305

Bonus under Rowan scheme = \(\frac{2,487 \mathrm{hrs} .}{12,087 \mathrm{hrs} .}\) × 9,600 hrs × ₹ 30

= ₹ 59,258

(i) Computation of effective rate of earning under the Halsey & Rowan Scheme

Total earnings under Halsey Scheme = Time wages + Bonus

(W.N.2) = 24 days × 8 hrs × 50 skilled × ₹ 30 + ₹ 37,305

= ₹ 3,25,305

Effective earnings rate per hour = ₹ 3,25,305/9,600 hrs = ₹ 33.89

Total earning under Rowan Scheme = Time wages + Bonus

(W.N.2) = 2,88,000 + 59.258

= ₹ 3,47,258

Effective earnings rate per hour = ₹ 3,47,258/9,600 hrs = ₹ 36.17

(ii) Saving to ZED Ltd. in direct labour cost per piece:

Direct labour cost per unit under times wages system ₹ 59.25

(1.975 times per unit × ₹ 30)

Direct labour cost per unit under Halsey Plan ₹ 53.15

(₹ 3,25,305/6,120 units)

Direct labour cost per unit under Rowan plan ₹ 56.74

(₹ 3,47,258/6,120 units)

Savings of direct labour cost per piece under:

Halsey Plan (₹ 59 25 – ₹ 53.15) ₹ 6.10

Rowan Plan (₹ 59.25 – ₹ 56.74) ₹ 2.51

(iii) Advised to ZED Ltd:

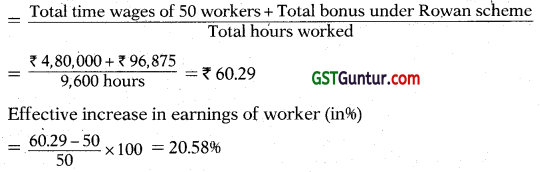

Halsey scheme brings more saving to the management of ZED Ltd. over the present earning of ? 2,88,000, but the other scheme Le. Rowan fulfil the promise of 2096 increase over the present earnings of ₹ 2,88,000 by paying 20.58% in the form of Bonus. Hence, Rowan Plan should be adopted.

![]()

Question 15.

The existing Incentive system of Alpha Limited is as under:

| Normal working week | 5 days or 8 hours each plus 3 late shifts of 3 hrs. each |

| Rate of Payment | Day work: 160 per hour Late shift: 225 per hour |

| Average output per operator for 49 hours week i.e. including 3 late shifts. | 120 articles |

In order to increase output and eliminate Overtime, it was decided on to a system of payment by results. The following information is obtained.

| Time rate (as usual) | 60 per hour |

| Basic time allowed for 15 articles | 5 hours |

| Piece-work rate | Add 20% to basic piece- rate |

| Premium Bonus | Add 50% to time. |

Required:

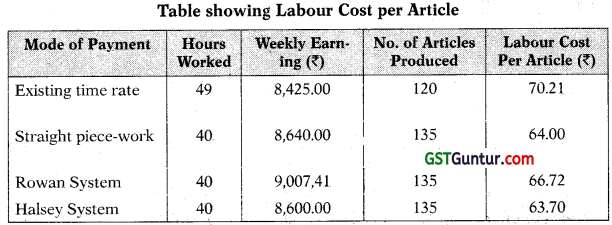

Prepare a Statement showing hours worked, weekly earning, number of articles produced and labour cost per article for one operator under the following systems:

(a) Existing time-rate

(b) Straight piece-work

(c) Rowan system

(d) Haisey premium system .

Assume that 135 articles are produced in a 40-hour week under straight piece work, Rowan Premium system, and Halsey premium system above and workers earn half the time saved under Halsey premium system. [CA Inter Nov 2005, 8 Marks]

Answer:

Table showing Labour Cost per Article

Working Notes:

Existing time rate:

Weekly wages 40 hrs @ ₹ 160/hr

9 hrs @ ₹ 225/hr

Price rate system:

Basic Time is 5 hours for 15 articles

Cost of 15 articles at hourly rate of 160/hr.

Add: 20%

Therefore, Rate per article = ₹ 960/15 = ₹ 64

Earnings for the week = 135 articles × ₹ 64 = ₹ 8,640

Rowan premium System:

Basic Time 5 hrs for 15 articles

Add: 50% to time (m)

Total time 7.5 hrs for 15 articles or 30 minutes per article

Time allowed for 135 articles = 67.5 hrs.

Actual time taken for 135 article = 40 hrs.

Earnings = Time Taken × Rate per hour + \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × Time Taken

= 40 hrs × ₹ 160 + \(\frac{67.5 \mathrm{hrs}-40 \mathrm{hrs}}{67.5 \mathrm{hrs}}\) × 40 hrs × ₹ 160

= 9,007.41

Halsey premium system:

Earnings = Time Taken × Time Rate + 50% of Time Saved × Time Rate

= 40 hrs × ₹ 160 + 50% of 27.5 hrs (67.5 hrs – 40 hrs) × ₹ 160

= ₹ 8,600

![]()

Labour Turnover

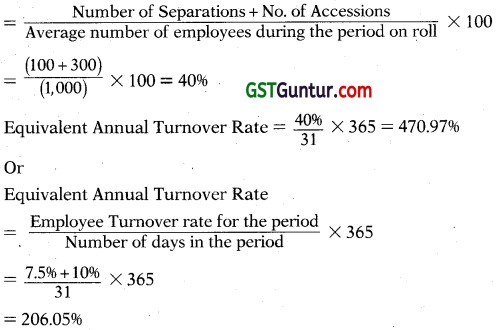

Question 16.

The information regarding number of employees on roll in a shopping mall for the month of December, 2020 are given below:

| Number of employees as on 01-12-2020 | 900 |

| Number of employees as on 31-12-2020 | 1,100 |

During December, 2020, 40 employees resigned and 60 employees were discharged. 300 employees were recruited during the month. Out of these 300 employees, 225 employees were recruited for an expansion project of the mall and rest were recruited due to exit of employees.

Assuming 365 days in a year, calculate Employee Turnover Rate and Equivalent Annual Employee Turnover Rate by applying the following:

(i) Replacement Method

(ii) Separation Method

(iii) Flux Method [CA Inter May 2018, May 2001, 10 Marks]

Answer:

(i) Replacement Method:

Employee Turnover Rate

= \(\frac{\text { Number of employees Replaced during the period }}{\text { Average number of employees during the period on roll }}\) × 100

= \(\frac{75}{1,000}\) × 100 = 7.5%

Equivalent Annual Turnover Rate = \(\frac{7.59}{31}\) × 365 = 88.31%

(ii) Separation Method:

Employee Turnover Rate

= \(\frac{\text { Number of employees Separated during the period }}{\text { Average Number of employees during the period on roll }}\) × 100

= \(\frac{40+60}{1,000}\) × 100 = 10%

Equivalent Annual Turnover Rate = \(\frac{10 \%}{31}\) × 365 = 117.7496

(iii) Flux Method:

Employee Turnover Rate

Question 17.

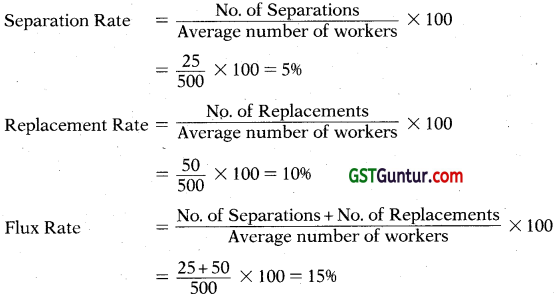

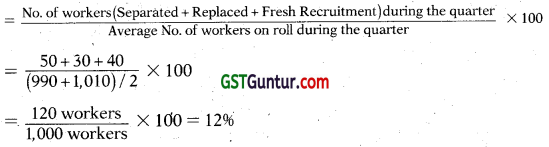

Following information is given of a newly setup organisation for the year ended on 31st march, 2021.

| Number of workers replaced during period | 50 |

| Number of workers left and discharged during the period | 25 |

| Average Number of workers on the roll during the period | 500 |

You are required to:

(i) Compute the employee turnover rates using Separation Method and Flux Method.

(ii) Equivalent Employee Turnover Rates for (i) above, given that the organisation was setup on 31st January, 2021. [CA Inter July 2021, 5 Marks]

Answer:

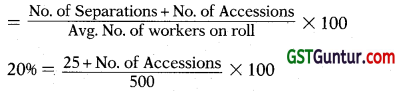

(i) Employee Turnover Rates using Separation Method and Flux Method

![]()

(ii) Equivalent Employee Turnover Rates

Question 18.

RST Company Ltd. has computed labour turnover rates for the quarter ended on 31st March, 2020 as 20%, 10% and 5% under flux method, replacement method and separation method respectively, if the number of workers replaced during that quarter 1s50, find out (i) Workers recruited and joined (ii) Workers left and discharged and (iii) Average number of workers on roll, (iv) Number of workers at the beginning of the Quarter. [CA Inter May 2018, May 2017, Nov. 2013, Nov. 2O12 8 Marks]

Answer:

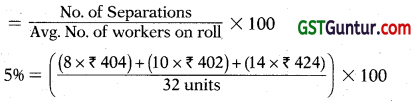

1. Average Number of workers on roll during the quarter:

Employee turnover rate using Replacement method

= \(\frac{\text { No of Replacements }}{\text { Avg. No. of workers on roll }}\)

10% = \(\frac{50}{\text { Avg. No. of workers on roll }}\)

Average Number of workers on roll = 500

2. Number of workers left and discharged:

Employee turnover rate using Separation method

No. of Separations = 25

3. Number of workers recruited and joined

Employee turnover rate under Flux Method

No. of workers recruited and joined = 75

4. No. of workers at the beginning of the Quarter:

Let workers at the beginning of the quarter were ‘X’

Average No. of workers on roll

Question 19.

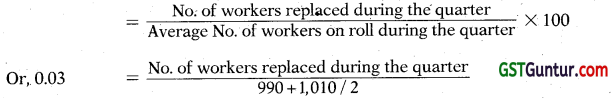

Human Resources Department of A Ltd. computed labour turnover by replacement method at 3% for the quarter ended on June 2021. During the quarter, fresh recruitment of 40 workers wras made. The number of workers at the beginning and end of the quarter was 990 and 1,010 respectively.

You are required to calculate the labour turnover rate by Separation Method and Flux Method. [CA Inter Nov. 2015, 5 Marks]

Answer:

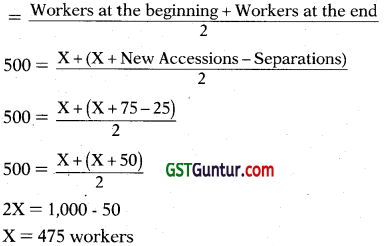

Labour Turnover by Replacement Method

Or, No. of workers replaced during the quarter = 0.03 × 1,000 = 30 workers

(i) Labour Turnover by Separation Method

(ii) Labour Turnover by Flux Method

![]()

Miscellaneous

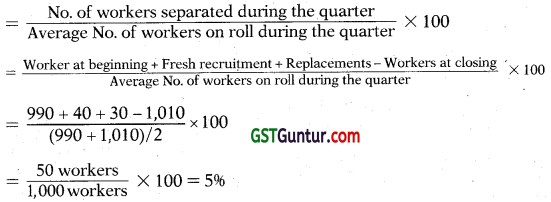

Question 20.

The management of a company is worried about their increasing labour turnover in the factory and before analysing the causes and taking remedial steps, they want to have an idea of the profit foregone as a result of labour turnover in the last year.

Last year sales amounted to ₹ 83,03,300 and the profit-volume ratio was 20%. The total number of actual hours worked by the Direct Labour Force was 4.45 lakhs. As a result of the delays by the Personnel Department in filling vacancies due to labour turnover, 1,00,000 potentially productive hours (excluding unproductive training hours) were lost. The actual direct labour hours included 30,000 hours attributable to training new recruits, out of which half of the hours were unproductive.

The costs Incurred consequent on labour turnover revealed on analysis the following:

| Settlement costs due to leaving ₹ 43 | 820 |

| Recruitment costs ₹ 26 | 740 |

| Selection costs ₹ 12 | 750 |

| Training costs ₹ 30 | 490 |

Assuming that the potential production lost as a consequence of labour turnover could have been sold at prevailing prices, find the profit foregone last year on account of labour turnover. [CA Inter Nov 2019, Nov 2001, 5 Marks]

Answer:

Actual Production Hours:

Actual Hours worked (including hrs. attributable to training new recruits) 4,45,000

Less: Unproductive hours (30,000 ÷ 2) 15,000

Productive hours lost:

Loss of potential productive hours 1,00,000

Add: Unproductive training hours 15,000

Loss of contribution due to unproductive hours:

Contribution from 4,30,000 Productive Hrs.

(Sales value × PV ratio) = 83,03,300 × 20% = 16,60,660

Contribution from 1,15,000 productive hours lost

= \(\frac{16,60,660}{4,30,000}\) × 1,15,000 = 4,44,130

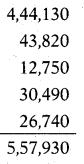

Profit foregone as a result of labour turnover:

Contribution foregone = 4,44,130

Settlement costs due to leaving = 43,820

Selection costs = 12,750

Training costs = 30,490

Recruitment costs = 26,740

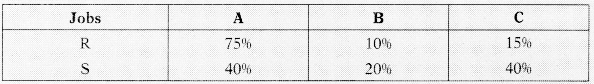

Question 21.

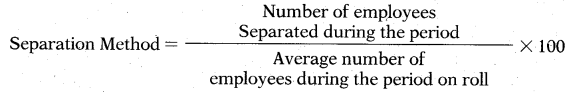

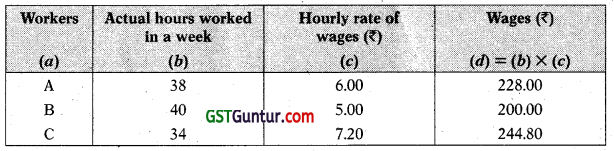

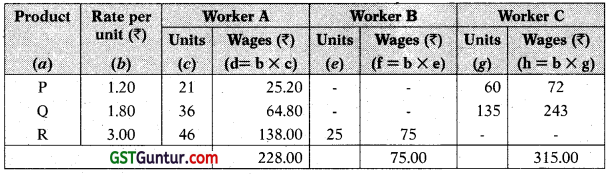

A Company is undecided as to what kind of wage scheme should be introduced. The following particulars have been compiled in respect of three systems, which are under consideration of the management:

For the purpose of piece rate, each minute is valued at ₹ 0.10. You are required to calculate the wages of each worker under:

(i) Guaranteed hourly rates basis

(ii) Piece work earnings basis, but guaranteed at 75% of basic pay (guaranteed hourly rate) If his earnings are less than 50% of basic pay.

(iii) Premium bonus basis where the worker receives bonus based on Rowan scheme. [CA Inter Nov. 2002, 9 Marks]

Answer:

(i) Computation of wages of each worker under guaranteed hourly rate basis

(ii) Computation of wages of each worker under piece work earnings basis

Since each worker has been guaranteed at 75% of basic pay, if his earnings are less than 50% of basic pay (guaranteed hourly rate), therefore, earning of the workers will be as follows Workers A and C will be paid the wages as computed viz., ₹ 228 and ₹ 315 respectively. The computed earnings under piece rate basis for worker B is ₹ 75 which is less than 50% of basic pay i.e., ₹ 100 (₹ 200 × 50) therefore he would be paid ₹ 150 Le. 75% × ₹ 200.

Working Notes:

1. Piece rate/per unit

2. Time allowed to each worker

Worker A = (21 units × 12 min) + (36 units × 18 min) + (46 units × 30 min)

= 2,280 min or 38 hours

Worker B = 25 units × 30 min

= 750 min or 12.5 hours

Worker C = (60 units × 12 min) + (135 units × 18 min)

= 3,150 min or 52.5 hours

![]()

(iii) Computation of wages of each worker under Premium bonus basis

(where each worker receives bonus based on Rowan Scheme)

Question 22.

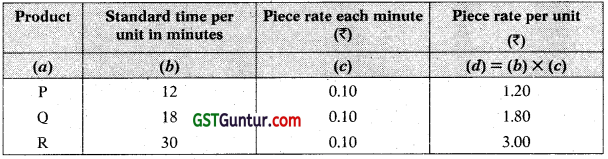

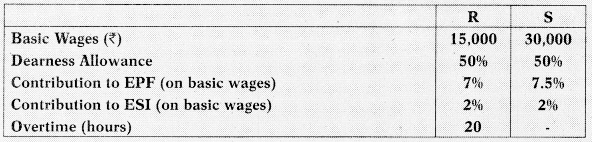

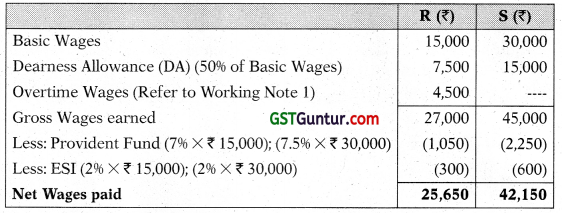

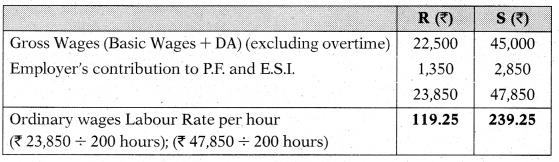

Following are the particulars of two workers ‘R’ and ‘S’ for a month:

The normal working hours for the month are 200 hrs. Overtime is paid at double the total of normal wages and dearness allowance. Employer’s contribution to State Insurance and Provident Fund are at equal rates with employees’ contributions.

Both workers were employed on jobs A, B and C in the following proportions:

Overtime was done on job ‘A’

You are required to:

(i) Calculate ordinary wages rate per hour of ‘R’ and ‘S’.

(ii) Allocate the worker’s cost to each job ‘A’, ‘B’ and ‘C’. [CA Inter Nov. 2020, 6 Marks]

Answer:

(i) Calculation of Net Wages paid to Workers ‘R’ and ‘S’

Calculation of ordinary wage rate per hour of Workers ‘R’ and ‘S’

(ii) Statement Showing Allocation of workers cost to each Job

Working Note:

Normal Wages are considered as basic Wages

![]()

Question 23.

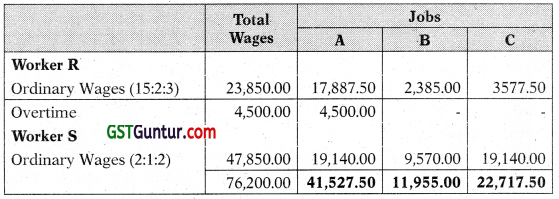

AD V Pvt. Ltd. manufactures a product which requires skill and precision in work to get quality products. The company has been experiencing high labour cost due to slow speed of work. The management of the company wants to reduce the labour cost but without compromising with the quality of work. It wants to introduce a bonus scheme but is indifferent between the Halsey and Rowan scheme of bonus.

For the month of November 2020, the company budgeted for 24,960 hours of work. The workers are paid ? 80 per hour.

Required: CALCULATE and suggest the bonus scheme where the time taken (in%) to time allowed to complete the works is

(a) 100%

(b) 75%

(c) 50% &

(d) 25% of budgeted hours. [CA Inter Nov 2019, RTPJ

Answer:

The Cost of labour under the bonus schemes are tabulated as below:

Bonus under Halsey Plan = 50% of (Time Allowed – Time Taken) × Rate per hour

Bonus under Rowan Plan= \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × Time Saved Rate per hour

Rowan scheme of bonus keeps checks on speed of work as the rate of incentive increases only up to 50% of time taken to time allowed but the rate decreases as the time taken to time allowed comes below 50%. It provides incentives for efficient workers for saving in time but also puts check on careless speed. On implementation of Rowan scheme, the management of ADV Pvt. Ltd. would resolve issue of the slow speed work while maintaining the skill and precision required maintaining the quality of product.

Question 24.

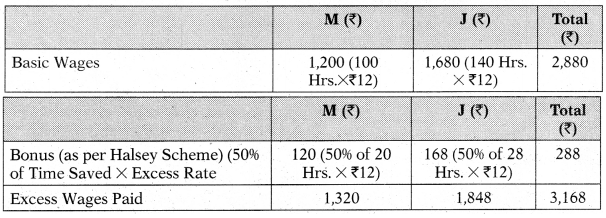

IBL Sisters operates a boutique which works for various fashion houses and retail stores. It has employed 26 workers and pays them on time rate basis. On an average an employee is allowed 8 hours for boutique work on a piece of garment. In the month of December 2020, two workers M and J were given 15 pieces and 21 pieces of garments respectively for boutique work. The following are the details of their work:

| M | J | |

| Work assigned | 15 pcs. | 21 pcs. |

| Time taken | 100 hours | 140 hours |

Workers are paid bonus as per Halsey System. The existing rate of wages is ₹ 60 per hour. As per the new wages agreement the workers will be paid 172 per hour w.e.f. 1st January 2021. At the end of the month December 2020, the accountant of the company has wrongly calculated wages to these two workers taking ₹ 72 per hour.

Required:

(i) Calculate the loss incurred due to incorrect rate selection.

(ii) Calculate the loss incurred due to incorrect rate selection, had Rowan scheme of bonus payment followed.

(iii) Calculate the loss/savings if Rowan scheme of bonus payment had followed.

(iv) Discuss the suitability of Rowan scheme of bonus payment for JBL Sisters? [CA Inter May 2021, RTP]

Answer:

(i) Calculation of loss incurred due to incorrect rate selection

(While calculating loss only excess rate per hour has been taken)

(ii) Calculation of loss incurred due to incorrect rate selection had Rowan scheme of bonus payment followed:

(iii) Calculation of amount that could have been saved if Rowan Scheme were followed

| M (₹) | J(₹ ) | Total (₹) | |

| Wages paid under Halsey Scheme | 1,320 | 1,848 | 3,168 |

| Wages paid under Rowan Scheme | 1,400 | 1,960 | 3,360 |

| Difference (loss) | (80) | (112) | (192) |

![]()

(iv) Rowan Scheme of incentive payment has the following benefits, which is suitable with the nature of business in which JBL Sisters operates:(a) Under Rowan Scheme of bonus payment, workers cannot increase their earnings or bonus by merely increasing its work speed. Bonus under Rowan Scheme is maximum when the time taken by a worker on a job is half of the time allowed. As this fact is known to the workers, therefore, they work at such a speed which helps them to maintain the quality of output too.

(b) If the rate setting department commits any mistake in setting standards for time to be taken to complete the works, the loss incurred will be relatively low.

Question 25.

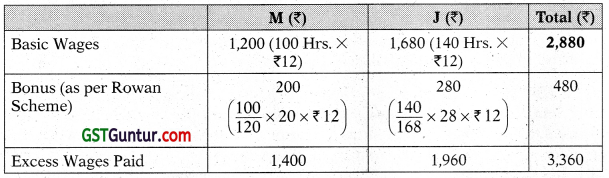

GZ Ltd. pays the following to a skilled worker engaged in production works. The following are the employee benefits paid to the employee:

| (a) Basic salary per day | ₹ 1,000 |

| (b) Dearness allowance (DA) | 20% of basic salary |

| (c) House rent allowance | 16% of basic salary |

| (d) Transport allowance | ₹ 50 per day of actual work |

| (e) Overtime | Twice the hourly rate (considers basic and DA), only if works more than 9 hours a day otherwise no overtime allowance. If works for more than 9 hours a day then overtime is considered after 8th hour. |

| (f) Work of Holiday and Sunday | Double of per day basic rate provided works atleast 4 hours. The holiday and Sunday basic is eligible for all allowances and statutory deductions. |

| (g) Earned leave & Casual leave | These are paid leave |

| (h) Employer’s contribution to Provident fund | 12% of basic and DA |

| (i) Employer’s contribution to Pension fund | 7% of basic and DA |

The company normally works 8-hour a day and 26 day in a month. The company provides 30 minutes lunch break in between.

During the month of August 2020, Mr. Z works for 23 days including 15th August and a Sunday and applied for 3 days of casual leave. On 15th August and Sunday he worked for 5 and 6 hours respectively without lunch break.

On 5th and 13th August he Worked for 10 and 9 hours respectively. During the month Mr. Z worked for 100 hours on Job no. HT 200.

You are required to calculate:

(i) Earnings per day

(ii) Effective wages rate per hour of Mr, Z

(iii) Wages to be charged to Job no. HT 200. [CA Inter Nov. 2020, RTP]

Answer:

(i) Calculation of earnings per day

| ₹ | |

| Basic salary (₹ 1,000 × 26 days) | 26,000 |

| Dearness allowance (20% of basic salary) | 5,200 |

| 31,200 | |

| House rent allowance (16% of basic salary) | 4,160 |

| Employer’s contribution to Provident fund (12% × ₹ 31,200) | 3,744 |

| Employer’s contribution to Pension fund (7% × ₹ 31,200) | 2,184 |

| 41,288 |

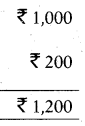

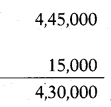

(ii) ) Calculation of effective wage rate per hour of Mr. Z:

![]()

(iii) Calculation of wages to be charged to Job no. HT 200

= ₹ 240 × 100 hours = ₹ 24,800

Question 26.

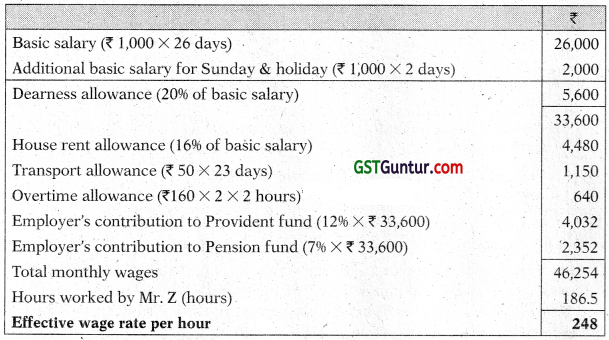

Z Ltd. is working by employing 50 skIlled workers. It Is considering the introduction of an Incentive scheme . either Halsey Scheme (with 50% Bonus) or Rowan Scheme – of wages payment for Increasing the labour productivity to adjust with the increasing demand for Its products by 40% The company feels that If the proposed Incentive scheme could bring about an average 20% increase over the present earnings of the workers, it could act as sufficient incentive for them to produce more and the company has accordingly given assurance to the workers.

Because of this assurance, an increase in productivity has been observed as revealed by the figures for the month of April, 2020:

| Hourly rate of wages (guaranteed) | ₹ 50 |

| Average time for producing one unit by one worker at the previous performance (ibis may be taken as time allowed) | 1.975 hours |

| Number of working days in a month | 24 |

| Number of working hours per day of each worker | 8 |

| Actual production during the month | 6,120 units |

Required:

(i) Calculate the effective increase in earnings of workers in percentage terms under Halsey and Row an scheme.

(ii) Calculate the savings to Z Ltd. in terms of direct labour cost per unit under both the schemes.

(iii) Advise Z Ltd. about the selection of the scheme that would fulflil its assurance of incentivizing workers and also to adjust with the increase in demand. [CA Inter January 2021, 10 Marks]

Answer:

Working Notes:

1. Total time wages of 50 workers per month

= No. of working days in the month × No. of working hours per day of each worker × Hourly rate of wages × No. of workers

= 24 days × 8 hrs. × ₹ 50 × 50 workers = ₹ 4,80,000

2. Time saved per month:

Time allowed per unit to a worker = 1.975 hours

No. of units produced during the month by 50 workers = 6,120 Units

Total time allowed to produce 6,120 units (6,120 × 1.975 hrs) = 12,087 hours

Actual time taken to produce 6,120 units (24 days × 8 hrs. × 50 workers) = 9,600 hours

Time saved (12,087 hours – 9,600 hours) = 2,487 hours

3. Bonus under Halsey scheme to be paid to 50 workers .

Bonus = (50% of time saved) × hourly rate of wages

= 50/100 × 2,487 hours × ₹ 50 = ₹ 62,175

Total wages to be paid to 50 workers is ₹ 5,42,175 (₹ 4,80,000 + ₹ 62,175), if Z Ltd, considers the introduction of Halsey.Incentive Scheme to increase the worker productivity.

4. Bonus under Rowan Scheme to be paid to 50 workers:

Bonus taken = \(\frac{\text { Time saved }}{\text { Time Allowed }}\) × Time Saved × Hourly rate

= \(\frac{9,600 \text { hours }}{12,087 \text { hours }}\) × 2,487 hrs × ₹ 50 = ₹ 9,764

Total wages to be paid to 50 workers are (₹ 4,80,000 + ₹ 98,764) ₹ 5,78,764, if Z Ltd. considers the introduction of Rowan Incentive Scheme to increase the worker productivity.

(i) (a) Effective hourly rate of earnings under Halsey scheme

(Refer to working Notes 1, 2 and 3)

(b) Effective hourly rate of earnings under Rowan scheme

(Refer to Working Notes 1, 2 and 4)

![]()

(ii) (a) Saving in terms of direct labour cost per unit under Halsey scheme:

(Refer to Working Note 3)

Labour cost per unit (under time wage scheme)

= 1.975 hours × ₹ 50 = ₹ 98.75

Labour cost per unit (under Halsey scheme)

= \(\frac{\text { Total wages paid under the scheme }}{\text { Total number of units produced }}\) = ₹ \(\) = ₹ 88.60

Saving per unit = ₹ 98.75 – ₹ 88.60 = ₹ 10.15

(b) Saving in terms of direct worker cost per unit under Rowan Scheme:

(Refer to Working Note 4)

Labour cost per unit under Rowan scheme = ₹ 5,78,764/6,120 units = ₹ 94.57

Saving per unit = ₹ 98.75 – ₹ 94.57 = ₹ 4.18

(iii) Calculation of Productivity

| Normal Production Hours worked/Unit per Hour (9,600/1.975) | 4,861 |

| Actuals Production Units | 6,120 |

| Increase in labour productivity | 1,259 |

| % Productivity i.e. increase in production/Norma! production | 25.9% |

Advice: Rowan plan fulfils the company’s assurance of 20% increase over the present earnings of workers. This would increase productivity by 25.9% only. It will not adjust with the increase in demand by 40%.

Question 27.

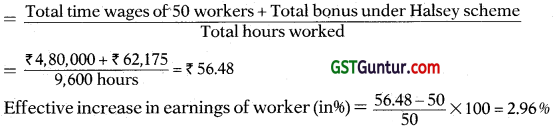

In a factory, the basic wages rate is ₹ 100 per hour and overtime rates are as follows:

| Before and after normal working hours | 175% of basic wage rate |

| Sundays and holidays | 225% of basic w age rate |

| During the previous year, the following hours were worked | |

| Normal lime | 1,00.000 hours |

| Overtime before and after working hours | 20,000 hours |

| Overtime on Sundays and holidays | 5,000 hours |

| Total | 1,25,000 hours |

The following hours have been worked on job ‘Z

| Normal | 1000 hours |

| Overtime before and alter working hrs. | 100 hours |

| Sundays and holidays | 25 hours |

| Total | 1,125 hours |

You are required to CALCULATE the labour cost chargeable to job ‘Z’ and overhead in each of the following instances:

(a) Where overtime is worked regularly throughout the year as a policy due to the workers’ shortage.

(b) Where overtime is worked irregularly to meet the requirements of production.

(c) Where overtime is worked at the request of the customer to expedite the job. [lCAI Module]

Answer:

Computation of effective average wage rate (including overtime premium):

| ₹ | |

| Normal wages (1,00,000 hrs. × ₹ 100) | 1,00,00,000 |

| Wages for overtime before and after working hours (20,000 hrs. × ₹ 100 × 175%) |

35,00,000 |

| Wages for overline on Sundays and holidays (5,000 hrs. × ₹ 100 × 225%) |

11,25,000 |

| Total Wages for 1,25,000 hrs. | 1,46,25,000 |

Effective average wage rate = \(\left(\frac{₹ 1,46,25,000}{1,25,000 \text { hours }}\right)\) = ₹ 117

(a) Where overtime is worked regularly as a policy due to workers’ shortage:

The overtime premium is treated as a part of employee cost and job is charged at an effective average wage rate.

Employee cost chargeable to Job Z = 1,125 hrs. × ₹ 117 = ₹ 1,31,625

![]()

(b) Where overtime is worked irregularly to meet the requirements of production:

Basic wages will be charged to the job and overtime premium will be charged to factory overheads.

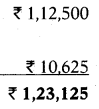

Employee cost chargeable to Job Z = 1,125 hours × ₹ 100 = ₹ 1,12,500

Factory overhead:

= [100 hrs. × (₹ 175 – ₹ 100)] + [25 hrs. × (₹ 225 – ₹ 100)]

= ₹ 7,500 + ₹ 3,125 = ₹ 10,625

(c) Where overtime is worked at the request of the customer, to expedite the job:

Overtime premium will also be charged to Job Z.

Employee cost of Job Z:

Normal wages (1,125 hrs. × ₹ 100) = ₹ 1,12,500

Overtime premium .

[(100 hrs. × ₹ 75) + (25 hrs. × ₹ 125)] = ₹ 10.625

Total ₹ 1,23,125

Question 28.

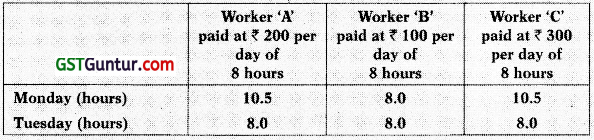

It is seen from the job card for repair of the customer’s equipment that a total of 154 labour hours have beep put in as detailed below:

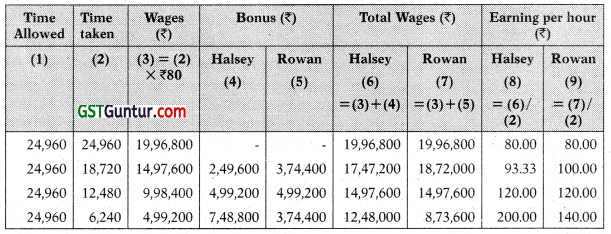

In terms of an award in employee conciliation, the workers are to be paid dearness allowance on the basis of cost of living index figures relating to each month which works out @ ₹ 968 for the relevant month. The dearness allowance is payable to all workers irrespective of wages rate if they are present or are on leave with wages on all working days.

Sunday is a weekly holiday and each worker has to work for 8 hours on all week days and 4 hours on Saturdays; the workers are however paid full wages for Saturday (8 hours for 4 hours worked).

Overtime is paid twice of ordinary wage rate if a worker works for more than nine hours in a day or forty-eight hours in a week. Excluding holidays, the total number of hours works out to 176 in the relevant month. The company’s contribution to Provident Fund and Employees State Insurance Premium are absorbed into overheads.

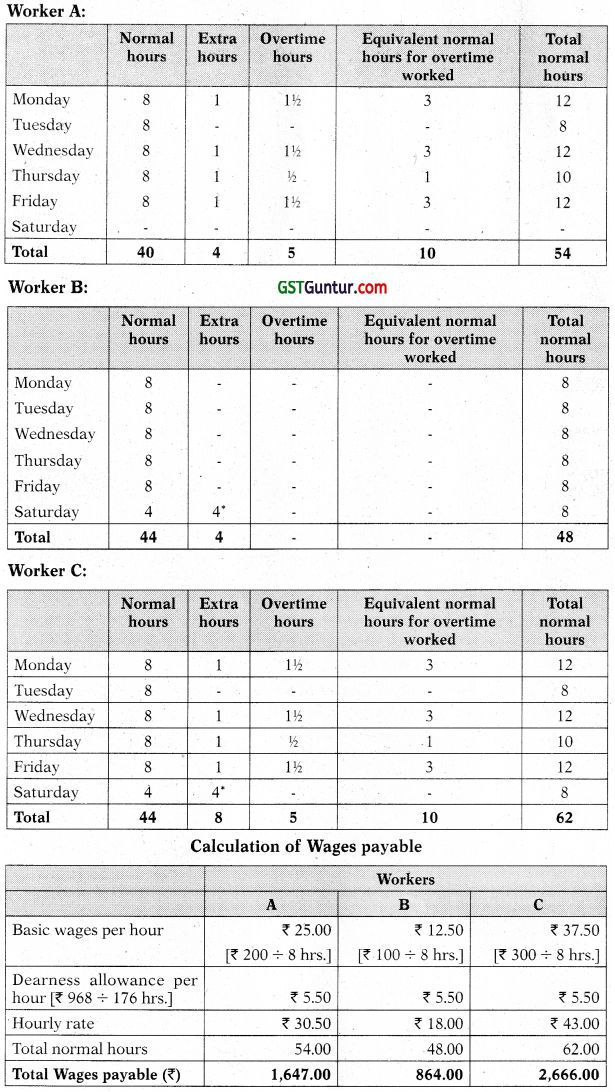

Calculate the wages payable to each worker. [ICAI Module]

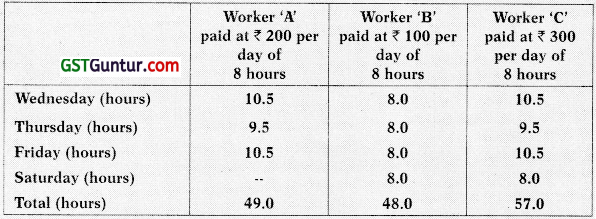

Answer:

Calculation of equivalent hours to be paid to the workers