E-way Bill GST: The GST Eway Bill was introduced on 1st April 2018. The e-Way Bill GST is an electronic document that needs to be generated before the goods are transported or shipped in excess of INR 50.000 within the state or intrastate. The transporter or the person in charge of the transport must have a physical copy of the GST electronic bill and should contain all the information such as goods, the recipient, consignor or transporter. On this page, let’s learn everything about e way bill registration and its purpose in detail.

- Who Can Generate Eway Bill Under GST?

- E Way Bill Registration Documents Required

- How To Generate Eway Bill Through Online?

- Eway Bill Registration Methods

- When Eway Bill Is Not Necessary?

- GST Eway Bill Format

- Validity of E-Way Bill GST

- FAQs on EWay Bill

Who Can Generate Eway Bill Under GST?

Before starting the transport of goods from place to place, the Eway bill must be generated. The E-Way bill GST is generated for:

- Supply of goods with regard

- Supply of goods regardless

- Supply received from a non-registered person

The supply covers the movement of goods not only due to sales but also due to any other reason such as cross-branch transfers, unregistered purchase and trade in goods. However, in some cases, an Eway bill is also generated even though the goods’ value does not exceed INR 50,000.

- Transfer of goods between states by the principal to the worker by the principal or by the registered worker.

- The transfers of handicraft products between states by a dealer are exempt from GST registration

The following people can generate the Eway Bill:

- Registered Person

- Unregistered Person

- A Transporter

However, if goods are supplied to a registered individual by an unregistered person, the beneficiary shall ensure the creation of an Eway bill. If the supplier has not produced the same, a carrier shall generate an E-way bill. For unregistered transporters, a Transporter ID will be provided on the registration portal for the Eway bill.

E Way Bill Registration Documents Required

An e-Way bill can be registered either through an SMS facility or through the official website. However, before applying for GST e-Way Bill, one will have to keep the following documents handy to generate the E-Way bill:

- Invoice/Supply Bill / Challan concerning goods shipment

- Road Transport: ID or number of transporters

- Rail, Air or Ship transport: Transport ID, Document date and document transport number

How To Generate Eway Bill Through Online?

Follow the steps as listed below to generate the E-Way Bill online:

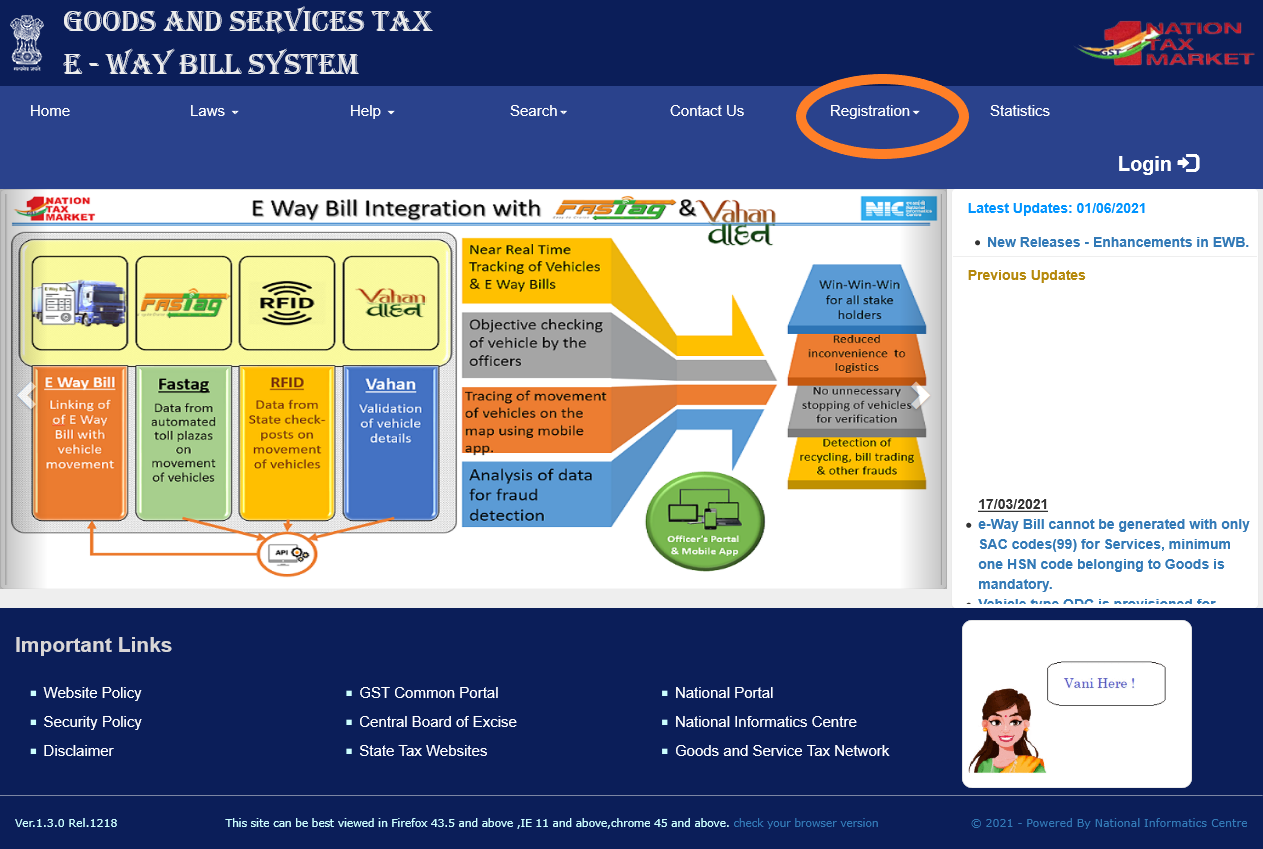

- Step 1: Visit the official website of E-WayBill System – Click Here

- Step 2: Click on the tab “Registration” and select “e-way Bill Registration” from the drop-down menu.

- Step 3: Enter your “GSTIN” number.

- Step 4: Enter the Captcha Code as displayed on the screen.

- Step 5: Click on the “Go” button.

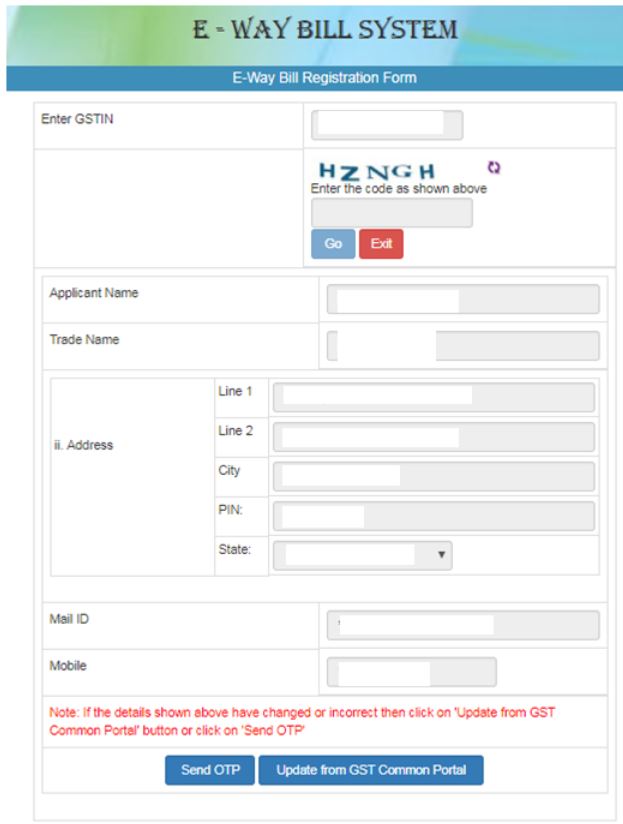

- Step 6: The user will then be forwarded to the registration form of the e-Way Bill. The registration form will look like the following image.

- Step 7: This information will be automatically repleted with the name, trade name, address, mail identification and mobile number of the applicant.

- Step 8: If you have changed the details or if they are incorrect, click on the GST Common Portal Update button to pull the latest GST Common Portal data.

- Step 9: Click on “Send OTP” to receive the OTP.

- Step 10: Enter the OTP and click “Verify OTP” to validate it.

- Step 11: Next, enter the user ID or Username to operate this system’s account. The username should be unique. It should contain approximately 8 to 15 alphanumeric characters and special characters.

- Step 12: The system validates the entered values when a request has been submitted for registration.

- Step 13: Now the password and username with the e-Way Bill System are also created and registered.

Now one can use this registered username and password for operating the E-Way Bill.

Eway Bill Registration Methods

Other ways to register for E-Way Bill are:

- By SMS

- Android application

- Web-based mode

- API based and

- GST Suvidha Providers.

The user must first log on to the web-based system for all these modes.

When Eway Bill Is Not Necessary?

In accordance with Rule 138 of the CGST rules, in the following situations an e-way should not be generated:

- Transport by Custom: Transport of goods to an inland container depot or freight container station from a customary port, airport, air freight facility and customs station to clearance.

- Non-motorized Transport: Goods carried through non-motorized transport do not require an automatic payment.

- Transportation of Goods in Customs Bonds: Transportation of the goods under customs bonds to a customs port, airport, air cargo complex and land customs station by intra-Container Depot or container freight station from one customs station to another or customs port to another.

- Rail transport: Transportation of goods by rail where the central, state or local government acts as the consignor.

- Defense Ministry: movement of goods incurred as a consignor by the Ministry of Defense.

- Unoccupied Cargo Container: Empty containers without an Eway bill can be transported.

- Using the Challan Delivery: The transport of products between the consignor’s place of business and the weighbridge for cargo weight and distance is less than 20 km. During transportation, a delivery challan is made and transported.

GST Eway Bill Format

The GST Eway Bill format is explained below:

- Recipient’s GSTIN: Mention the recipient’s GSTIN number.

- Place of Delivery: The place where the goods are delivered must be indicated here by the Pin code.

- Check the invoice or the Challan number for which the goods are delivered.

- Goods value: the shipment value of goods should be noted.

- HSN Code: Enter the transported HSN goods code. You need to specify the first two digits of the HSN code if your turnover reaches INR 5 crores. If there are more than INR 5 crores, 4 HSN code digits are necessary.

- Transportation Reason: The reason for the transport is defined and the most appropriate option from the list needs to be selected.

- Transport Document Number: This includes either the number receiving the goods, the number receiving the railway, the number of the billing airway or the bill of loading.

Validity of E-Way Bill GST

The validity of an Eway bill or a consolidated e-Way bill is dependent on the distance of transport of the goods. The validity of the bill is determined from the date of generation of the Eway bill.

| Conveyance Type |

Distance |

Validity Period

|

|

Non Over dimensional cargo

|

Less Than 100 Km | 1 Day |

| For every additional 100 Kms or part thereof |

additional 1 Day

|

|

|

Only For Over dimensional cargo

|

Less Than 20 Km | 1 Day |

| For every additional 20 Kms or part thereof |

additional 1 Day

|

FAQs on EWay Bill

Question 1.

What is the purpose of E way Bill?

Answer:

E-way bills are an effective tool in monitoring goods and in checking tax evasion, ensuring that products are being transported comply with the law on GST.

Question 2.

Is E way Bill print out mandatory?

Answer:

Yes, the E-Way bill is necessary to carry the charges with the goods when the value of the goods exceeds Rs. 50,000.

Question 3.

Can we generate an Eway bill without a GST number?

Answer:

No, an E-Way bill cannot be generated without a GST number.