Divisional Transfer Pricing – CA Final SCMPE Study Material is designed strictly as per the latest syllabus and exam pattern.

Divisional Transfer Pricing – CA Final SCMPE Study Material

Question 1.

AUXER is a manufacturing organization. Product manufactured by AUXER passes by two division Division A1 and Division Bl. Division A1 produces goods at a cost of ₹ 10 p.u. and transfers the goods to Division Bl which has additional costs of ₹ 5 p.u. Division Bl sells externally at ₹ 16 p.u. The company has a policy of setting transfer prices at cost 4- 20%.

Calculate:

(i) Profit of each division and the overall profit the company made.

(ii) Write a brief analysis of the results

Answer:

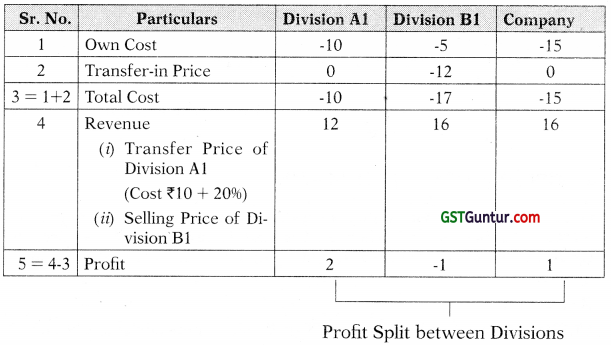

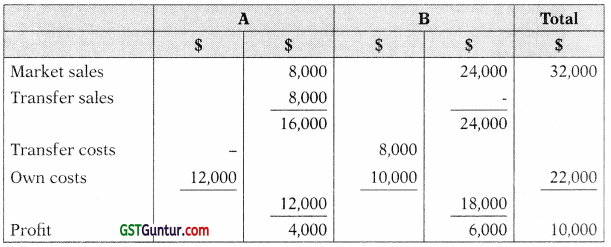

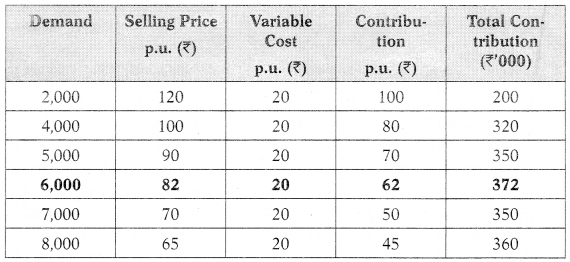

(i) Division Wise Profitability Statement: Summarizing the information from the question, the division wise profitability statement will be as below:

Note

Transfer price of 2 does not affect the overall company profits since they get eliminated at the time of consolidation. These records are useful for internal evaluation purposes and may not involve actual cash settlement.

Therefore, transfer pricing methodology would greatly influence each : division’s financials, thereby underlining the need to have an accurate measurement system.

(ii) Analysis of the Results: As shown above, Division A1 shows a profit of ₹ 2 while Division B1 shows a loss of ₹ 1. Division A1 that incurs 2/3rd of the cost while Division B1 incurs only 1 /3rd of it. The net profit

margin for the product is 6.7% (₹ 1 /₹ 15) while the internal mark-up that Division A1 charges is 20%. Therefore, Division A1 will always make a profit. Division B1 is bearing internal mark-up at a much higher rate j than the mark-up it can charge its customers. Therefore, it will always be a loss-making unit, Behavioural Consequences Manager of Division B1 could get demotivated since performance of the unit is affected by a higher internal mark-up. Moreover, since the manager of Division A1 will always make a profit under this method, efforts may not be taken to make costs efficient.

The management can take steps to review the following:

(i) Is the transfer pricing policy of cost plus 20% justified? If so, should the pricing policy for external customers be revised?

(ii) What share of Division Al’s costs are controllable? Is it possible for Division A1 to take measures for cost efficiencies and charge Division B1 a lower amount?

(iii) Alternatively, should Division B1 be allowed to source the component from outside?

![]()

Question 2.

YASK is a manufacturing organization, engage in production of product ‘LO’. X is Its transferring division and Y, the receiving division. Y has a demand for 20% of X’s production capacity which has to be first met as per the company’s policy.

Requirement:

STATE with reason, which division, X or Y enjoys more advantage in each of the following independent situations, assuming no inventory buildup.

Answer:

The feedback of information relates to the reporting of things that have happened in the past. For example,

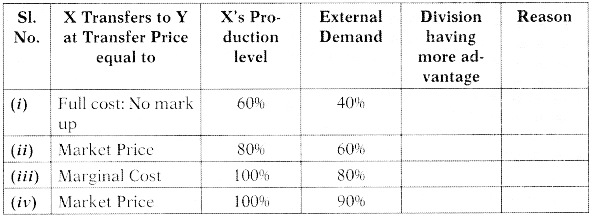

| Division Having More Advantage | Reason |

| (i) X | X is utilizing only 40% of production capacity by selling to ‘External Market’ which implies that X might have not been able to recover its full fixed costs. By transferring 20% of its production capacity to division Y at full cost, X will be able to recover fixed costs components. |

| (ii) X | X will not be losing any external market demand as it is within its production capacity. By transferring 20% of production capacity to division Y at market price, X will earn extra contribution towards the fixed costs and profit. |

| (iii) Y | Here X is operating at 100% capacity level and external market demand is 80% only L e. X is not losing any external market demand. But by transferring 20% of production capacity to Y at marginal cost Le. at variable cost, X may not be able to recover fixed cost part of total cost. On the other hand Y will be able to get these units at marginal cost only. |

| (iv) Y | Though X is losing its 10% of external market demand but it would be able to earn the same revenue by transferring the goods to division Y at market price. Moreover, X will be able to utilize 100% of its production capacity. |

Question 3.

(Market Price & Shared Contribution Method)

RS Ltd. is a Popcorn manufacturing company. It has two division, one division producing the popcorn and another division that manufactures the pouch. The production division purchases all the Pouches from the j packaging division. Cost of pouch’s from outside vendors would be:

| Number of Pouch | (₹) |

| 5,000 | 77,000 |

| 8,000 | 95,000 |

Production cost incurred by the packaging division for similar volume of Pouchs:

| Number of Pouchs | (₹) |

| 5,000 | 75,000 |

| 8,000 | 80,000 |

The production and sale of the final product, Popcorn are as below:

| Volume (Number of Pouch of Popcorn sold) | Total Cost (Excluding Cost of Pouch)(₹) | Sales Value (Packed in Pouchs) (₹) |

| 5,000 | 1,20,000 | 2,00,000 |

| 8,000 | 1,80,000 | 3,00,000 |

An appropriate transfer pricing policy is being framed. As the corporate management accountant,

Calculate-

(i) The transfer pricing based on (1) shared profit relative to cost method and (2) market method. Show the profitability of each division under both methods.

(ii) Discuss the effect of both methods on the profitability of the divisions.

Answer:

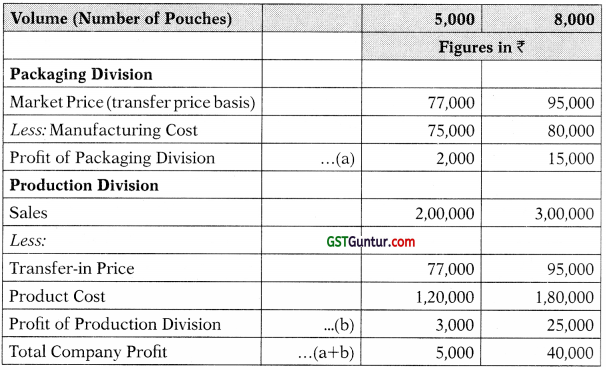

(i) Calculation of Profitability under both methods

Method 1: Shared Profit Relative to Cost Method

Methodology: Calculate the profit for both volume of Pouches 5,000 units and 8,000 units. Information about sales and costs are given in the problem and tabulated as below.

Statement of Profitability – Shared Profit Relative to Cost Method

| Volume (Number of Pouches) | 5,000 | 8,000 |

| Figures in ₹ | ||

| Sales …(a) | 2,00,000 | 3,00,000 |

| Less: Costs | ||

| Production Division | 1,20,000 | 1,80,000 |

| Packaging Division | 75,000 | 80,000 |

| Total Costs …(b) | 1,95,000 | 2,60,000 |

| Profit …(a) – (b) | 5,000 | 40,000 |

The next step is to distribute this profit between the divisions based on the cost incurred. This is done for both levels of production.

Distribution of Profit Based on Relative Cost

| Volume (Number of Pouches) | 5,000 8,000 | |

| Figures in ₹ | ||

| Share of Production Division | ||

| (5,000 × 1,20,000/1,95,000) | 3,077 | XXX |

| (40,000 × 1,80,000/2,60,000) | XXX | 27,692 |

| Share of Packaging Division | ||

| (5,000 × 75,000/1,95,000) | 1,923 | XXX |

| (40,000 × 80,000/2,60,000) | XXX | 12,308 |

| Total Profit | 5,000 | 40,000 |

The last step is to calculate transfer price of Pouches that packing division will charge the production division = manufacturing cost of Pouchs + profit that is allocable to it under the shared profit method (refer workings above).

Transfer Prices of Pouches under the Shared Profit Relative to Cost Method

| Volume (Number of Pouch) | 5,000 | 8,000 |

| Figures in ₹ | ||

| Manufacturing Cost of Pouch | 75,000 | 80,000 |

| Profit Allocated as per working above | 1,923 | 12,308 |

| Transfer Price | 76,923 | 92,308 |

| Transfer Price p.u. | 15.3,8 | 11.54 |

Method 2: Market Price Method

Methodology: Transfer price for the pouchs is already given. It is the external market price of the pouches. This is viewed as an unbiased price, that the packaging division will charge the production division. The profitability statement will be as below:

Statement of Profitability – Market Price Method

Transfer price per unit will be based on the external market price given in the problem.

| Volume (number of pouch) | 5,000 | 8,000 |

| Market Price of Pouch | 77,000 | 95,000 |

| Transfer Price per pouch p.u. based on Market Price = Market Price/Number of Pouch | 15.40 | 11.88 |

(ii) Analysis of Results

Overall company profits are the same under both methods. It is the distribution between the divisions that is different, depending on the method followed. Consequently, the transfer price per unit that the packaging division charges the production division will also be differ-ent.

When production volume is 5,000 pouches, transfer price per unit is approximately the same under both methods ₹ 15.38 and ₹ 15.40 shared profit and market price method respectively. This is because the cost of production for this volume is approximately the same as the outside procurement price. Similarly, when production volume is 8,000 pouches, transfer price per unit under the shared profit method has a slightly lower transfer price because lower profit has been allocated to packaging department.

When the volume increases to 8,000 pouch, in-house production has benefitted from economies of scale. The cost of manufacturing one j pouch is ₹ 15 p.u. for 5,000 pouch (₹ 75,000/ 5,000 pouch) while it reduces to ₹ 10 p.u. when volume increases to 8,000 pouches (₹ 80,000/8,000 j pouchs). Cost reduction is almost 33% due to economies of scale.

On the other hand, at 8,000 pouchs volume, the production department has not benefitted much from economies of scale. Cost of manufacturing a pouch of Popcorn excluding packing cost is ₹ 24 for 5,000 Pouchs (₹ 1,20,000/5,000 pouch) and is marginally lower at ₹ 22.50 p.u. for 8,000 Pouch (₹ 1,80,000/8,000 units). Cost reduction is only 6% due to economies of scale.

Therefore, when production volume is 8,000 units, out of the total production cost of ₹ 2,60,000, major portion of the cost pertains to production department. Consequently, when profit gets allocated based on cost, more profit has been allocated to the production division and lesser percentage to packaging department. Hence the transfer price base is lower at ₹ 92,308 under the shared profit method as compared to the market price method which is at ₹ 95,000.

![]()

Question 4.

(Transfer Pricing at Market Value)

GIOR Armina is an Italian luxury fashion house, which designs, manufac-tures, distributes and retails haute couture, ready to wear leather Jackets.

In 2016, estimated sales of the company were around $ 2.65 billion.

GIOR Armina announced that his company will revamp two of its fashion lables, Armina Collezioni and Armina Jeans, as part of the restructuring process for his company.

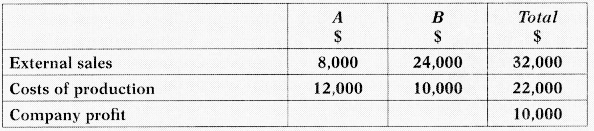

GIOR company has two profit centers, A and B. Profit center A sells half of its output on the open market and transfers the other half to profit center B. For an accounting period cost and external revenues are given below.

Required

What are the consequences if the company decided to set transfer price at market value?

Answer:

If the transfer price is at market price, A would be happy to sell the output to B for $8,000, which is what A would get by selling it externally instead of transferring it.

The transfer sales of profit center A are self cancelling with the transfer cost of profit center B, so that the total profits of the organization remain unaffected by the transfer items. The decided transfer price simply spreads the total profit between profit center A and B.

Consequences

(i) Profit center A earns the same profit on transfers as on external sales, % a commercial price must be paid by profit center B for transferred goods, and both divisions will have their profit in a fair way.

(ii) Profit center A will be indifferent about selling externally or transferring goods to B because for both types of transaction profit will be same. Profit center B can therefore ask for and obtain as many units as it wants from profit center A.

Therefore Market based Transfer Price seems to be the ideal transfer price.

Question 5.

IXIAM chemical company is a market leader in the development and manufacturing of high performance specialty chemical. Company’s chemists and engineers are working with corporations, universities and forward-thinking organisations to pioneer new technologies and innovative approaches through advance materials. Company build business by creating the best performance chemicals through innovation and collaboration with our partners.

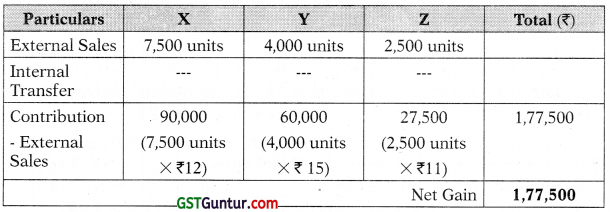

IXIAM Company’s process has two divisions, A and B. Three types of chemicals products: Product X, Y and Z are produces in division A using a common process. After the common process is complete Division A either sell each of the products to the external market at split-off point or can be transferred to Division B for further processing into individual products XAL, YAL and ZAL.

Fora typical month Nov. 2011, Following are the output of division A;

| Product | Kg |

| X | 1,200 |

| Y | 1,400 |

| Z | 1,800 |

Followings are the marketing selling ptices per kg. for the products, both at split-off point and further processing;

| $ | $ | ||

| X | 5.60 | XAL | 6.70 |

| Y | 6.50 | YAL | 7.90 |

| Z | 6.10 | ZAL | 6.80 |

For each of the individual further processing the specific costs are: Variable cost of $0.50 per kg of XAL

Variable cost of $0.70 per kg of YAL Variable cost of $ 0.80 per kg of ZAL

Each of the products lead to a normal loss of 5% at the beginning of further processing for each of the products being processed.

Required

(a) CALCULATE and Conclude that in order to optimize the profit for the company as a whole whether any of the products should be further processed in Division B.

In order to optimize the profit of the company as a whole it has been suggested that division A should transfer products X and Y to Division B for further processing. Company’s both Division A and Division B are investment centers and all transfer from Division A to Division B would be made using the actual marginal cost.

As a result if the Division A of the company were to make transfers as suggested, company’s divisional profits would be much kwer than if it were to sell both products externally at split-off point. Profit of Division B’s, however, would be much higher.

(b) Discuss the issues arises for the company from this suggested approach of transfer pricing.

Answer:

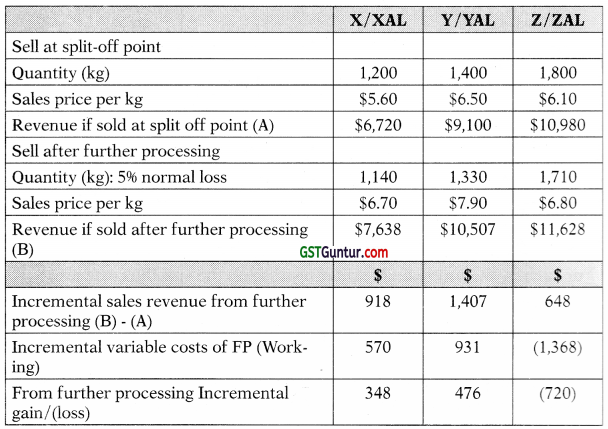

(a) To decide the further processed in Division B

Working

It is assumed that variable costs relate to output units, since loss occurs at the beginning of the further process.

| XAL | 1,140 × $ 0.50 = $ 570 |

| YAL | 1,330 × $ 0.70 = $ 931 |

| ZAL | 1,710 × $ 0.80 = $ 1,368 |

Conclusion

Products X and Y should be further processed, but product Z should not.

(b) issues arises for the company

The IXIAM Company should try to establish such transfer prices so that it provides incentive for each profit center’s manager, to make and sells such quantities of products that will maximize the company’s total profit and in doing so also maximizing their own divisional profit.

It is pointless to set a transfer price at marginal costs for the proposal. At this price, Division A will not make any profit at all on the units of X and S that it produces, and it will not even be able to cover its divisional fixed costs. It will therefore be transferring units at a net loss.

Also it is pointless and undesirable to transfer units at full cost because j Division A would make zero net profit on the transfers.

The manager of Division A will want to sell the units of X and Y externally, in order to earn a profit for the division. However as the solution to part (a) shows, the company would not benefit if this were to happen. Division B would have to buy the same quantity of units in the external market. Internal transfers should in general be preferred to external sales and purchases, because there is better management control and (often) lower administration and distribution costs.

An appropriate transfer price for units of X and Y would be a price that represents opportunity costs. For Division A, this is the opportunity cost of not being able to sell the units externally at the external selling price. For Division B this is the opportunity cost of being able to purchase in the market at the market price for X and Y instead of j buying them internally at the transfer price.

Therefore the most appropriate transfer prices for X and Y are their market price at the split- off point $ 5.60 and $ 6.50 per kg respectively.

Question 6.

(Transfer Pricing)

MAYA Pvt. Ltd. is a manufacturing organization. It has two divisions g Division A and Division B. Division A produces product Za, which it sells to external market and also to Division B. Divisions in the Maryanne Ltd. are treated as profit centres and divisions are given autonomy to set transfer prices and to choose their supplier. Performance of each division measured on the basis of target profit given for each period.

Division A can produce 1,00,000 units of product Za at full capacity. Demand for product Za in the external market is for 70,000 units only at selling price of ₹ 2,500 per unit. To produce product Za Division A incurs ₹ 1,600 as variable cost per unit and total fixed overhead of ₹ 4,00,00,000. Division A has employed ₹ 12,00,00,000 as working capital, working capital is financed by cash credit facility provided by its lender bank @ 11.50% p.a. Division A has been given a profit target of ₹ 2,50,00,000 for the year.

Division B has found two other suppliers Rap Ltd. and Sap Ltd. who are agreed to supply product Za.

Division B has requested a quotation for 40,000 units of product Za from Division A.

Required

(i) CALCULATE the transfer price per unit of product Za that Division A should quote in order to meet target profit for the year.

(ii) CALCULATE the two prices Division A would have to quote to Division B, if it became Maryanne Ltd. policy to quote transfer prices based on opportunity costs. [RTP May 2018]

Answer:

(i) Transfer Price per unit of Product Za that Division A Should Quote in order to meet Target Profit

Quotation for the 40,000 units of product Za should be such that meet Division A’s target profit and interest cost on working capital. Therefore the minimum quote for product Za will be calculated as follows:

| Particulars | Amount (₹) |

| Target Profit (given for the year) | 2,50,00,000 |

| Add: Interest Cost on Working Capital (₹ 12,00,00,000 @11.5%) | 1,38,00,000 |

| Required Profit | 3,88,00,000 |

| Add: Fixed Overhead | 4,00,00,000 |

| Target Contribution | 7,88,00,000 |

| Less: Contribution Earned — External Sales {60,000 units × (₹ 2,500 – ₹ 1,600)) | 5,40,00,000 |

| Contribution Required – Internal Sales | 2,48,00,000 |

| Contribution per unit of Product Za (₹ 2,48,00,000 × 40,000 units) | 620 |

| Transfer Price of Product Za to Division B (Variable Cost per unit A Contribution per unit) | 2,220 |

(ii) The Two Transfer Prices Based on Opportunity Costs

For the 30,000 units (i.e. maximum capacity – maximum external market demand) at variable cost of production i.e. ₹ 1,600 per unit. For the next 10,000 units (ie. external market demand – maximum possible sale) at market selling price i.e. ₹ 2,500 per unit.

Question 7.

C Pvt. Ltd. operates a Pulp Division that manufactures Wood Pulp for use in production of various paper goods. The following information are available:

| ₹ | |

| Selling Price | 210 |

| Less: Variable Expenses | 126 |

| Contribution | 84 |

| Less: Fixed Expenses (based on a capacity of 1,00,000 kgs per year) | 54 |

| Net Income | 30 |

C Pvt. Ltd. has just acquired a small company that manufacturers paper cartons. This company will be treated as a division of C Pvt. Ltd. with full profit responsibility. The newly formed Carton Division Is currently purchasing 10,000 kgs of pulp per year from supplier at a cost of ₹ 210 per kg less a 10% quantity discount. C Pvt. Ltd.’s President is anxious that the Carton Division begins purchasing its pulp from the Pulp Division if an acceptable transfer price can be worked out.

(Answer any 2 items from situations I, II and III below)

Situation I

If the Pulp Division is in a position to sell all of its pulp to outside customers at the normal price of ₹ 210 per kg, will the Managers of the Carton and Pulp Division agree to transfer 10,000 kgs of pulp next year at a determined price? EXPLAIN with reasons.

Situation II

Assuming that the Pulp Division is currently, selling only 60,000 kgs of pulp each year to outside customers at the stated price of ₹ 210 per kg will the Managers agree to a mutually acceptable transfer price for 10,000 kgs of pulp in next year? EXPLAIN with reasons.

Situation III

If the outside supplier of the Carton Division reduces its price to ₹ 77 per kg, will the Pulp Division meet this price? EXPLAIN. If the Pulp Division does not meet the price of ₹ 177 per kg, what will be the effects on profits of the company as a whole? [Nov. 2018] (ISMarks)

Answer:

Situation I

The lowest acceptable transfer price from the perspective of the selling division is given by the following formula –

Transfer price = Variable Cost per unit + \(\frac{(Total contribution margin on lost sales)}{Number of units transferred}\)

The Pulp Division has no idle capacity, so transfers from the Pulp Division to the Carton Division would cut directly into normal sales of pulp to outsiders. Since the costs are the same whether the pulp is transferred internally or sold to outsiders, the only relevant cost is the lost revenue of ₹ 210 per kg from the pulp that could be sold to outsiders. This is confirmed below:

Transfer Price3 = ₹ 126 + \(\frac{(₹ 210-₹ 126) \times 10,000}{10,000}\) = ₹ 2,10

Therefore, the Pulp Division will refuse to transfer at a price less than 10 per kg.

The Carton Division can buy pulp from an outside supplier for ₹ 210 per kg, less a 10% quantity discount of ₹ 21, or ₹ 189 per kg. Therefore, the Division would be unwilling to pay more than ₹ 189 per kg.

Transfer Price ≤ Cost of Buying from Outside Supplier = ₹ 189

The requirements of the two divisions are incompatible. The Carton Division won’t pay more than ₹ 189 and the Pulp Division will not accept less than ₹ 210. Thus, there can be no mutually agreeable transfer price and no transfer will take place

Situation II

The Pulp Division has idle capacity, so transfers from the Pulp Division to the Carton Division do not cut into normal sales of pulp to outsiders. In this case, the minimum price as far as the Carton Division is concerned is the variable cost per kg of ₹ 126. This is confirmed in the following calculation:

Transfer price

₹ 126 + \(\frac{₹ 0}{10,000}\) = ₹ 126

The Carton Division can buy pulp from an outside supplier for ₹ 189 per kg and would be unwilling to pay more than that for pulp in an internal transfer. If the managers understand their own businesses and are cooperative, they should agree to a transfer and should settle on a transfer price within the range:

Rs.126 £ Transfer price £ Rs.189

Situation III

Yes, ₹ 177 is a bona fide outside price. Even though ₹ 177 is less than the Pulp Division’s ₹ 180 “full cost” per unit, it is within the range and therefore will provide some contribution to the Pulp Division.

If the Pulp Division does not meet the ₹ 177 price, it will lose ₹ 5,10,000 in potential profits.

| Price per kg | ₹ 177 |

| Less: Variable Costs | ₹ 126 |

| Contribution margin per kg | ₹ 51 |

10,000 kgs × ₹ 51 per kg = ₹ 5,10,000 potential increased profits.

This ₹ 5,10,000 in potential profits applies to the Pulp Division and to the company as a whole.

Note – For situation III also considered that “the Pulp Division is currently selling only 60,000 kgs of pulp each year to outside customers”.

![]()

Question 8.

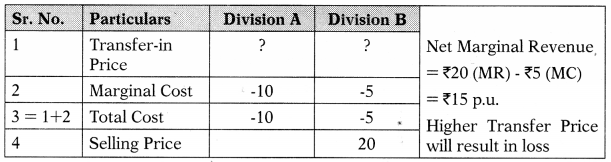

WER Pvt. Ltd. is a manufacturing organization. It has two division, division A and division R. Division A transfers goods to Division B. Division A incurs marginal cost of MO p.u. and Division B incurs marginal cost of ₹ 5 p.u to process it further. Division B sells finished product externally at ₹ 20 p.u.

To promote goal congruence:

(i) What should be the minimum transfer price that Division A should j charge? Assume there is no external market for this intermediate product.:

(ii) If Division B can buy the intermediate part externally for (i) ₹ 14 p.u, (ii) M 8 p.u what should be the maximum price that Division A can charge to remain competitive with the external vendor?

(iii) Assume that intermediate goods of Division A can be sold externally 4 at ₹ 12 p.u. How does opportunity cost affect the transfer price range x

when Division B can procure the part externally at ₹ 14 p.u.?

Answer:

Tabulating the information

Min. Recovery needed for Div.

A Range of transfer price that promotes goal congruence:

(i) Minimum Transfer Price

= Marginal Cost p.u. to Division A :

= ₹ 10 p.u.

Note there is no opportunity cost here. Hence, the minimum that Division A will wish to recover will be the marginal cost (or variable cost) p.u. that it incurs, which here is MO p.u.

(ii) Calculation of maximum transfer price when Division B can procure externally.

Maximum Transfer Price

= Lower of Net Marginal Revenue and the External Buy-in Price Net Marginal Revenue

= Marginal Revenue – Marginal Cost to Division B

= ₹ 20 – ₹ 5

= ₹ 15 p.u.

This is the maximum price that Division B will pay for the intermediate good, whether it purchases from Division A or procures from outside. Any higher is a loss to Division B.

Case 1: When procurement price is ₹ 14 p.u.

Maximum Transfer Price = Lower of Net Marginal Revenue ₹ 15, the External Buy-in Price ₹ 14

Maximum transfer price in this case will be external buy-in price ₹ 14 p.u. While, Division B can afford to pay upto ₹ 15 p.u. to break even, it will prefer to buy at a lower rate from the external vendor as that would yield a profit of ₹ 1 p.u. (Selling price ₹ 20 – MC X5 – purchase price ₹ 14). Hence, for Division A to remain competitive, it can charge no more than ₹ 14 p.u. Since MC of Division A is only ₹ 10 p.u. with no opportunity cost, a maximum price of ₹ 14 p.u. should be acceptable to Division A as well.

To conclude transfer price range between X 10 and X14 p.u. will promote goal congruence.

Case 2: When procurement price is ₹ 18 p.u.

Maximum Transfer Price = Lower of Net Marginal Revenue ₹ 15, the External Buy-in Price ₹ 18

Maximum transfer price in this case will be the net marginal revenue ₹ 15 p.u. External buy-in price of ₹ 18 p.u. will result in losses for Division B. Hence, Division A here can charge upto ₹ 15 per unit. With no other opportunity cost, Division A can have a reasonable margin, while Division B can procure the intermediate product at a price lower than market.

To conclude transfer price range between X10 and X15 p.u. will promote goal congruence.

(iii) Range when opportunity costs exists for Division A and Division B has buy-in price ₹ 14 p.u. When Division A can sell externally at ₹ 12 p.u.

I Minimum Transfer Price

= Marginal Cost per unit + Opportunity Cost per unit. Opportunity Cost per unit

= External Sale Price – Marginal Cost

= ₹ 12 – ₹ 10

= ₹ 2, this represents the contribution per unit when external sales are made by Division A.

For the internal transfer to Division B to be equally profitable, Division A will demand a minimum price of ₹ 12 = marginal cost ₹ 10 + opportunity cost ₹ 2.

As explained in sub-question (ii), Case 1, Division B will be ready to pay maximum ₹ 14 p.u. which is the buy-in price. Hence, subject to o negotiating skills of manager of Division B, the transfer price can be set between ₹ 12 p.u. – ₹ 14 p.u. The ideal transfer price would be ₹ 12p.u.

Division A is able to achieve profitability at par with its external sales, while Division B can procure its material at a much lower cost.

Question 9.

(Transfer Pricing and Goal Congruence) Business Model

Easy Company is a rapidly growing start-up in the technology sector. It develops customized ERP packages for clients across various business sectors. The business comprises primarily of two departments (1) consultant and (2) customer support. Consultant department has highly ® qualified professionals from management, accounting, and technology background, who approach clients as a team and work out solutions that meet their needs. Customer support personnel are in charge of IT implementation and provide support through telephone, e-mail or on-site. Currently, the strength of the consultant’s department is 200 while that of customer support is 150.

Yash, the founder and CEO of the company, is Very passionate about this business model. To deliver high-quality product solutions, he believes that his staff should be well-trained and up-to-date with developments in their professional fields. Therefore, Easy company provides periodic training to its staff in-house. All employees are expected to undergo 2 weeks of training annually. A training department has been set up with qualified trainers in various fields, who provide periodic training sessions to both Consultant and Customer Service departments. The training department has 5 trainers. Training sessions are aimed at providing skills that the executives need to provide better service to their clients. This in-house focus of high-quality delivery, is the key factor that Yash believes would set apart Easy company from its competitors.

In addition to delivering training sessions, trainers are responsible for developing training material for routine, on-going as well as specialized training sessions. They attend conferences, train the trainer sessions and subscribe to journals to keep themselves up-to-date with various developments that consultants and customer support executives need to be aware of.

At the beginning of each year, heads of consultant and customer service departments advise the training department on the expected number of training sessions that their staff would undertake. In special situations, where developments need to be communicated rapidly, extra sessions can also be conducted. Training department budgets are prepared based on these needs.

Transfer Pricing – Training Cost Allocation

Cost incurred by the training department is allocated to the consultant and customer service department based on the training sessions availed by both departments. A standard quote (transfer price) based on budgets is provided at the beginning of the year. At the end of the year, actual %>, cost is allocated based on actual training sessions of each department.

Each of the user departments use the transfer price to prepare their individual budgets, that further gets built into their pricing models used for billing clients. One of the metric for manager appraisal is also the financial performance of their individual departments. Hence, managers of both consultant and customer service departments are very cost conscious.

Figures for budget and actual costs for 2018 of the training department are as follows:

Figures in ₹

| Cost Particulars | —yr

Budget |

Actual |

| Salaries | 25,00,000 | 30,00,000 |

| Depreciation on Office Equipment | 2,00,000 | 5,00,000 |

| Software Licenses for Training Packages | 80,000 | 1,05,000 |

| Conference Travel for Train the Trainer Sessions | 10,000 | 15,000 |

| Telephone | 20,000 | 25,000 |

| Training Supplies | 50,000 | 60,000 |

| Trainee Lunch | 100,000 | 120,000 |

| Total Expenses | 29,60,000 | 38,25,000 |

Consultant and Customer service departments are charged based on the number of training sessions actually availed. Details of training sessions for each department are:

| Department | Budget | Actual |

| Consultant | 100 | 100 |

| Customer Service | 100 | 80 |

| Total | 200 | 180 |

Problem of Goal Congruence

In accordance with the above explanation, the training department quoted a rate of ₹ 4,800 per session based on the budgeted cost and budgeted training sessions. (Budgeted cost ₹ 29,60,000 for 200 training sessions). Actual cost per session is ₹ 21,250 (Actual cost ₹ 38,25,000 for 180 training sessions). Cost overrun of ₹ 6,450 per session, a jump of 44% from the original quote.

Consequently, a meeting was called that was attended by the managers of consultant, customer service and training departments, along with the CEO Yash.

The user departments were unhappy with the higher charge. Manager of 5 the consultant department raised the following concerns:

(a) The market rate for similar trainings provided by external vendors was only ₹ 12,000 per session. He has accepted a higher transfer price of ₹ 14,800 per session only because the in-house training program was more customized towards Easy company’s end-user-clients. However, if the department is actually going to be charged ₹ 21,250 per session, he would rather source the training to the outside vendor.

(b) Further, he pointed out that while his department had adhered to its commitment of 100 training sessions, the customer service department has availed of 20 lesser sessions than its commitment. Reviewing the cost structure of the training department, most of the expenses are fixed in nature. Therefore, when the transfer price is based on the actual cost and actual training sessions, the per session cost has increased because the customer service department did not undergo the entire 100 sessions. He questions, why he should bear a higher allocation of cost due to variance in actual and budgeted usage of training resources of the customer service department?

Manager of the customer service department explained that the variance of 20 training session is on account of the executives handling high-priority work pressure that did not allow them enough time to complete some of the training sessions. At the same time, she contended that she should not be charged for those 20 sessions for which no training was availed.

Manager of the training department explained that the ₹ 500,000 cost overrun on salary due to new hire of a trainer. The trainer’s experience is very valuable to the company and hence to get her on board, the company had to offer a higher pay scale. Depreciation on office equipment was higher by ₹ 300,000 due to higher replacement cost of ageing equipment. A specialized software license resulted in an excess spend of ₹ 25,000. The manager argued that the rest of the expenses were normal increases which were not controllable.

Yash, the CEO, was understandably not happy with the cost over-run. Higher internal transfer price to the end user departments would affect employee morale. However, even though a cheaper option was available from an outside vendor, he could still foresee the value of investing in in-house training programs. Intangible benefits from these customized sessions, would definitely help the company’s growth.

To conclude, he was not willing to shut down the training department. At the same time, he had to resolve the dispute resulting from internal transfer pricing in an amicable way. Like profits, teamwmrk is critical to success.

Required

(i) IDENTIFY the threats to goal congruence due to internal transfer pricing.

(ii) During the meeting, an alternate transfer pricing methodology based on two-part pricing system was formulated. Costs would be segregated into fixed and variable categories. A transfer price for each category would be arrived based on budgeted costs and budgeted usage. The standard rate for fixed cost will be applied to the budgeted training sessions and charged to the user departments. The standard rate for variable cost will be applied to the actual training sessions and charged to the user departments. Fixed cost would be defined as those that are not directly impacted by the number of training sessions. CALCULATE the transfer price to be charged to each department under this method.

(iii) EVALUATE how the two-part pricing price method of transfer pricing address the threats to goal congruence as identified in question?

Answer:

(i) Threats to goals congruence due to internal transfer pricing are:

(a) User groups, consulting and customer service department are concerned that training department is not controlling its costs.

Since the entire actual costs gets allocated to the users, training department may not be managing its costs efficiently. Since the financials of user departments are affected, it may lead to conflict between the departments.

(b) Yash, the CEO is a firm believer of in-house training and its benefits. However, there are outside vendors that provide similar service at substantially reduced costs. Performance assessment of managers of consulting and customer service are based on their department’s financial metrics. Higher internal transfer price for training would affect employee morale since they have no control over these allocated costs. However, their performance is being evaluated based on uncontrollable factors. This could lead to discontent among the managers. Alternatively, Yash may want to re-consider his strategy of in-house training. When suitable, training can be sourced to cheaper options available in the market, without compromising on quality.

(c) Most costs of the training department are fixed in nature, as they need to be incurred irrespective of the number of training sessions. These costs are being allocated to the users based on actual training sessions. The budgeted target price is used by the user departments, to determine their billing model to Easy company’s end user clients. Hence it is important that the budget transfer price is not very different from the actual transfer price charged at the end of the year.

In the given problem, internal transfer price has been based on a budget of200 sessions. Here the customer service department does not adhere to its commitment of 100 training sessions, training sessions actually availed are only 80. Since costs are mostly,fixed in nature, the actual cost per training session increases. This is then charged out to the consultant and customer service departments. Consequently, despite meeting its commitment, the consultant department bears a higher cost allocation due to variance in the usage of training resources. This can lead to friction between the user departments.

(ii) By segregating the costs into fixed and variable components, Easy Company is working out two-part pricing system for transfer price. Two-Part Pricing System = Lump-Sum Charge + Marginal Cost

To segregate the costs into fixed and variable categories, the criteria is whether the costs change per additional training session. Accordingly, the classification of costs will be as below:

| Cost Particulars | Budget (₹) | Classification |

| Salaries | 25,00,000 | Fixed |

| Depreciation on Office Equipment | 2,00,000 | Fixed |

| Software Licenses for Training Packages | 80,000 | Fixed |

| Conference Travel for Train the Trainer Sessions | 10,000 | Fixed |

| Telephone | 20,000 | Fixed |

| Training Supplies | 50,000 | Variable |

| Trainee Lunch | 100,000 | Variable |

| Total Expenses | 29,60,000 |

The lump-sum charge would be based on the fixed cost budget. Marginal cost would be based on the variable cost budget.

Total budget fixed expenses = ₹ 2 8,10,000 and total budget variable expenses = ₹ 1,50,000. Number of training sessions is 200, that is 100 each for consultant and customer service departments. Hence the fixed cost allocation rate would be ₹ 14,050 per session and variable cost allocation rate is ₹ 750 per session.

Transfer price to the consulting department = lump-sum charge + marginal cost

= (Standard Fixed Cost per session × Budgeted Training Sessions) + (Standard Variable Cost per Session × Actual Training Sessions)

= (₹ 14,050 × 100) + (₹ 750 × 100)

= ₹ 14,05,000 + 75,000

= ₹ 14,80,000.

Transfer price to the customer service department = lump-sum charge + marginal cost ‘

= (Standard Fixed Cost per session × Budgeted Training Sessions) + (Standard Variable Cost per session × Actual Training Sessions)

= (₹ 14,050 × 100) + (₹ 750 × 80)

= ₹ 14,05,000 + ₹ 60,000

= ₹ 14,65,000.

Total transfer price allocation is ₹ 29,45,000 versus actual expenses of ₹ 38,25,000. Unallocated expenses are ₹ 880,000.

(iii) Evaluate how the two-part transfer pricing model would address the goal congruence issues listed in question 1?

(a) Since transfer prices are based on budgets, the training department would become more cost-conscious. As explained above, as per this transfer pricing method, unallocated expenses of ₹ 8 80,000 would have to be borne by the training department. As given in the problem, this variance is mainly on account of extra cost for the newly hired trainer and the higher depreciation expense. The department will be more cautious while taking future decisions. However, Yash the CEO must ensure that the quality of training is not compromised and remains in line with the company’s strategic policy.

(b) Internal transfer price of 4,800 per session is still higher than the outside rate of ₹ 12,000 per session. Further decisions would be based on the company’s strategic objective. At the same time, if ; the number of training sessions are expected to increase beyond the budget, this transfer pricing method charges the user department only a marginal cost of ₹ 750 per session. This is definitely lower that the external rate.

(c) Under this method, fixed expenses that form majority of the cost are allocated based on budgeted cost and budgeted usage. Variable expense are allocated based on actual training sessions, Hence, any variance in the utilization of training resources, does not impact the other user department.

Therefore, most of the goal congruence issues can be addressed 5 through this methodology.

![]()

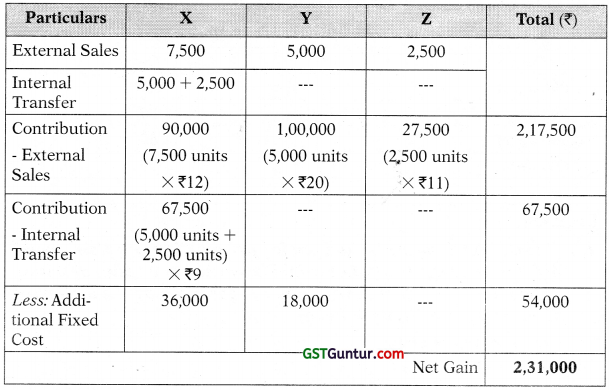

Question 10.

PAW Pvt. Ltd. is a manufacturing organization. PAW Pvt. Ltd. has two divisions, Division A and Division B. Division B produces components that are used by both Division A as well as external customers. Division A gets its entire requirement for the component from Division B.

The annual production capacity of Division B is 100,000 units. The division Operates at full capacity, with no inventory at the beginning and end of the year. It sells its components to external customers at 14,000 per unit. Variable cost of production for the component is ₹ 2,750. Internally, it transfers ft components to Division A factoring any opportunity cost in the form of lost sales. Total sales of Division B were ₹ 36 crores, of which sales to external customers was ₹ 20 crores.

As per company policy, demand from Division A has priority over exter-nal customers. This year, there was an additional demand from external customers for 18,000 components. However, since Division B operated at full capacity, this demand was not catered to.

Required

(i) ANALYZE the Sales in terms of ₹ and units made by Division B to both external and internal customers.

(ii) RECOMMEND the transfer pricing range that would promote goal congruence between Divisions A and B.

(iii) DISCUSS the effect of changes in external demand on the transfer price for the company, assuming the current policy continues. [RTPNov. 2019]

Answer:

(i) Sales Analysis of Division B

Total annual capacity and actual production of Division B is 100,000 units of components. Zero inventory implies that sales for the year was also 100,000 units of components. Sales to external customers was ₹ 20 crores, at ₹ 4,000 per unit. Therefore, units sold to external customers would be 50,000 units this year (₹ 20 crores sales/₹ 4,000 per unit sale price).

Therefore, internal sales can be derived to be 50,000 units for the year (annual sales 100,000 units less external sales 50,000 units). For the year, value of sales made to Division A is ₹ 16 crore (Division B’s total sales of ₹ 36 crore less external sales of ₹ 20 crores).

Had there been no extra demand, opportunity cost for Division B would have been nil. Therefore, transfer price would only be the variable cost of ₹ 2,750 per unit of component, However, given in the problem, that there was excess demand for 18,000 units of components from external customers, that could not be met since Division B had to give priority to internal demand. Had these sales been made Division B would have earned ₹ 1,250 per unit contribution (Sale price ₹ 4,000 per unit less variable cost ₹ 2,750 per unit). This lost contribution of ₹ 1,250 per unit is the opportunity cost per unit for Division B. Due to company’s policy of giving priority to internal-demand, Division B lost a profit of ₹ 2.25 crore during the year. (18,000 units X contribution of ₹ 1,250 per unit).

Therefore, internal sales comprises of two parts:

32,000 units of components transferred at variable cost of ₹ 2,750. This amounts to ₹ 8.8 crores.

18,000 units of components transferred factoring any opportunity cost = variable cost + contribution per unit = external sale price = ?

4,000 per unit. This amounts to ₹ 7.2 crores.

Therefore, internal sales = ₹ 8.8 crores + ₹ 7.2 crores = ₹ 16 crores.

Summarizing

External sales are 50,000 units amounting to ₹ 20 crores annual sales value. Internal sales are 50,000 units amounting to ₹ 16 crores annual sales value. Transfer price for 32,000 units is at variable cost of ₹ 2,750 per unit while for 18,000 units is at external sales price of ₹ 4,000 per unit.

(ii) Transfer Price Range for Divisions A and B

Division A procures its entire demand of 50,000 units from Division B. Out of this, 18,000 units at market price of ₹ 4,000 per unit while

32,000 units are procured at a lower rate of ₹ 2,750 per unit. Had Division A procured 32,000 units from the market, the additional cost of procurement would be ₹ 4 crores {(External price of ₹ 4,000 per unit less internal transfer price at variable cost of ₹ 2,750 per unit) × 32,000 units}. Only Division A currently enjoys this benefit of lower procurement cost. Financials of Division B show no profit from such internal transfers. This may skew the performance assessment of the divisions, if it is based primarily on financial metrics of each division. In order, promote goal congruence, some portion of this benefit can be shared with Division B.

Division B will at the minimum want to recover its variable cost of ₹ 2,750 per unit, while Division A will be ready to pay only up to external market price of ₹ 4,000 per unit. Therefore, transfer price range can be set between ₹ 2,750 – ₹ 4,000 per unit. Division A enjoys lower procurement rate while Division B financial reflect some benefit of transferring components internally to Division A.

(iii) Impact of External Demand on Transfer Price

As per the company’s transfer pricing policy, Division B gives priority to demand from Division A. The division has a production capacity of 100,000 units annually. If there is no external market for Division B’s components, then transfer price for the entire internal transfer would be the variable cost of ₹ 2,750 per unit plus portion of the fixed cost (if any). This is the minimum cost that Division B would like to recover from Division A.

When there is an external market, transfer price would depend on whether Division B had to incur any opportunity in the form of lost sales. When total demand (internal and external) is within production capacity of 100,000 units, the entire demand can be met. There would be no lost sales for Division B, no opportunity cost. Therefore, transfer price for the entire internal transfer would be the variable cost of ₹ 2,750 per unit. This is the minimum cost that Division B would like to recover from Division A.

When there is an external market, such that total demand (internal and external) is more than production capacity of 100,000 units, due to priority given to internal transfer, some portion of the external demand might not be met. This would be lost sales for Division B, opportunity cost would be the contribution lost from such sales at ₹ 1,250 per unit. This opportunity cost would be passed onto Division A. As explained in part (ii) above, transfer price range will be from ₹ 2,750 – ₹ 4,000 per unit. More lost sales for Division B would keep the average transfer price higher towards ₹ 4,000 per unit. Lesser lost sales for Division B would keep the average transfer price towards the lower bound of ₹ 2,750 per unit. Therefore, the proportion of external demand that could not be catered to, would determine the average transfer price. Higher the demand from external customers would drive up the average transfer price within the company.

![]()

Question 11.

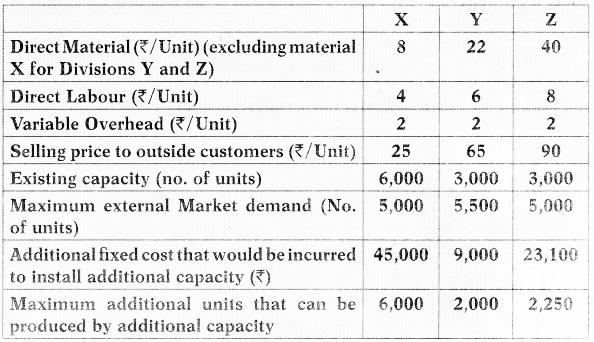

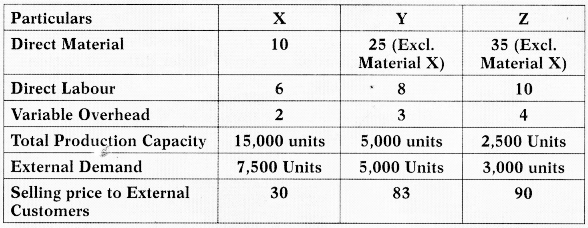

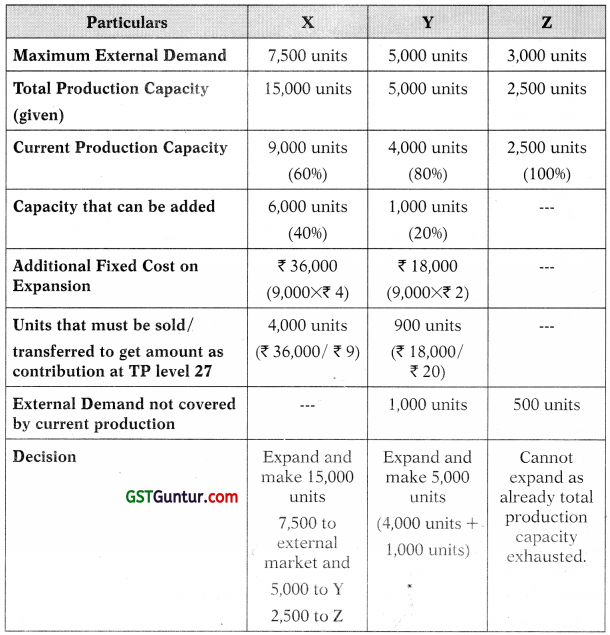

TCX Pvt. Ltd. is a manufacturing organization, company has x division A and division B. Division A of the company has a division A producing three products called X, Y, Z. Each product can be sold in the open market in the following manner.

Maximum external sales are X 800 units, Y 500 units, Z 300 units, All figures in ₹

| Particulars | X | Y | Z |

| Selling Price per unit | 96 | 92 | 80 |

| Variable Cost of Production in Division A | 33 | 24 | 28 |

| Labour Hours Required per unit in Division A | 6 | 8 | 4 |

Product Y can be transferred to Division B, but the maximum quantity that might be required for transfer is 300 units of Y.

Division B could buy similar product in the open market at a price of ₹ 45 p.u.

(i) What should be the transfer price per unit for 300 units of Y, if the total labour hours available with Division A are:

(a) 13,000 hours (b) 8,000 hours and (c) 12,000 hours.

(ii) Indicate the transfer pricing range that can promote goal congruence

Answer:

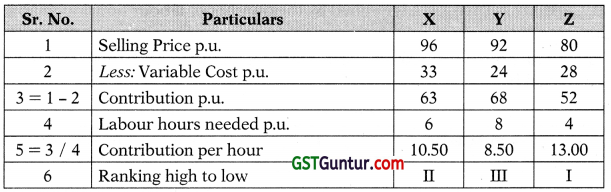

Division A has two type of clientele, external customers and Division B. Capacity in Division A is defined by the number of labour hours available for production.

The total hours needed to meet external demand is 10,000 hours as explained below:

Statement of Hours Needed for External Sales

| External Sales | Qty | Hours p.u. | Total Hours Needed |

| X | 800 | 6 | 4,800 |

| Y | 500 | 8 | 4,000 |

| Z | 300 | 4 | 1,200 |

| Hours Needed for External Sales | 10,000 |

Case 1: When 13,000 hours are available, after meeting the external demand requiring 10,000 hours, Division A will have surplus capacity of 3,000 hours.

Hours needed to produce 300 units of Y = 300 × 8 hours = 2,400 hours. Since Division A has surplus capacity, it can meet the demand of Division B also without curtailing its external sales. Hence, there is no opportunity cost on account of lost contribution.

Transfer price range:

Minimum Transfer Price p.u.

= Marginal Cost of Production p.u. of Y = ₹ 24. Maximum Transfer Price

= Lower of Net Marginal Revenue and the External Buy-in Price

The Maximum Transfer Price would be the External Procurement Price for Division B

= ₹ 45 p.u.

Note: Additional cost information related to Division B would be needed to calculate net marginal revenue.

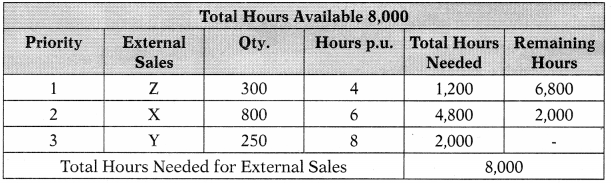

Case 2: When 8,000 hours are available, Division A has limited capacity as explained below.

The total hours needed for external sales is 10,000 and those need for internal transfer is 2,400 hours. In all, 12,400 hours are needed, when only 8,000 hours are available. There is a shortfall of 4,400 hours. Capacity is hence limited.

Therefore, labour hours have to be utilized optimally. This is determined by calculating the contribution per hour from sale each product that is sold externally. It determines how valuable each hour is product wise.

The entire demand of Product Z will be produced first. This requires 1,200 hours. Out of the balance 6,800 hours, Product X will require 4,800 hours. This leaves a balance of 2,000 hours for Product Y. Product Y requires 8 hours p.u. Hence maximum production of product Y = 2,000 hours/8 = 250 units.

Statement of Product Wise Contribution per hour

Product Z gives the maximum contribution per hour, hence ranked I. Product X and Y follow at rank 2 and 3 respectively. This is the basis to allocate limited hours for optimal production in Division A. The entire demand of Product Z will be produced first. This requires 1,200 hours. Out of the balance 6,800 hours, Product X will require 4,800 hours. This leaves a balance of 2,000 hours for Product Y. Product Y requires 8 hours p.u. Hence maximum production of product Y = 2,000 hours/8 = 250 units.

Statement of Optimum Mix

If Division A accepts to produce 300 units of Y for Division B, the total hours required for internal sales would be 2,400 hours. This can be catered to by curtailing its external sales. 2,000 hours from production of external sales of Product Y is first diverted and the balance 400 hours are diverted from production of Product X. Hence this results in lost contribution, an opportunity cost that has to be included in transfer pricing.

Contribution Lost from Reduced External Sales

= Product Y (2000 hours × contribution per hour of ?8.5) + Product × (400 hours × contribution per hour of ?10.5)

= ₹ 17,000 + ₹ 4,200

= ₹ 21,200

On a per unit basis, lost contribution works out to 21,200/300 units = ₹ 70.66. Therefore, Transfer Price

= Marginal Cost p.u. + Contribution Lost from Reduced External Sales = ₹ 24 + ₹ 70.66 = ₹ 94.66

Since Division B can source at ₹ 45, it would be cheaper to purchase the component from outside.

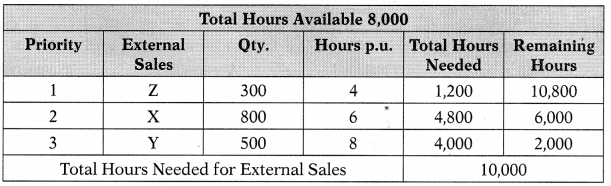

Case 3: When 12,000 hours are available, Division A has limited capacity as explained below.

The total hours needed for external sales is 10,000 and those need for internal transfer is 2,400 hours. In all, 12,400 hours are needed, when only 12,000 hours are available. There is a shortfall of 400 hours. Capacity is hence limited.

Therefore, labour hours have to be utilized optimally. Again, as explained in Case 2, this is determined by calculating the contribution per hour from sale each product that is sold externally. Referring to the table above, Contribution per hour is X: ₹ 10.5; Y: ₹ 8.5 and Z: ₹ 13. Accordingly, production wise Z will be given first priority, followed by X and then Y.

The entire demand of Product Z will be produced first. This requires 1,200 hours. Out of the balance 10,800 hours, Product X will require 4,800 hours. This leaves a balance of 6,000 hours for Product Y. Product Y requires 8 hours p.u. External sales of product require 4,000 hours (500 units X 8 hours p.u.).

Statement of Optimum Mix

This leaves 2,000 hours available for production of 300 units of Y to be sold to Division B. These 300 units will require 2,400 hours (300 units × 8 hours p.u.). Hence, there is a shortfall of 400 hours to meet this internal demand. This shortfall of 400 hours will be made up with diverting hours earmarked for external sale of Product Y (Rank 3 as explained in the table above). Loss of contribution on account of curtailed sales would then be built into the transfer price.

Contribution Lost by Diverting 400 hours from Product Y for External Sales

= 400 hours × contribution per hour

= 400 hours × ₹ 8.5

= ₹ 3,400.

On a per unit basis,

= 3,400/300 units

= ₹ 11.33

Therefore, Transfer Price

= Marginal Cost p.u. + Contribution Lost from Reduced External Sales

= ₹ 24 + ₹11.33

= ₹ 35.33

Division B can source this at ₹ 45 p.u. from outside. Hence transfer price can be in the range ₹ 35.33 to ₹ 45.

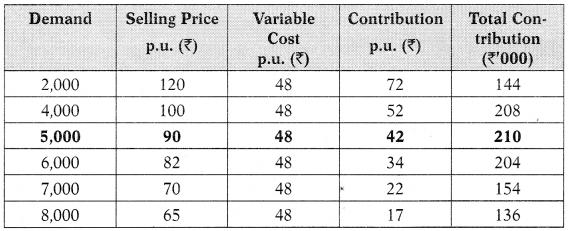

Question 12.

(Transfer Pricing that Promote Goal Congruence)

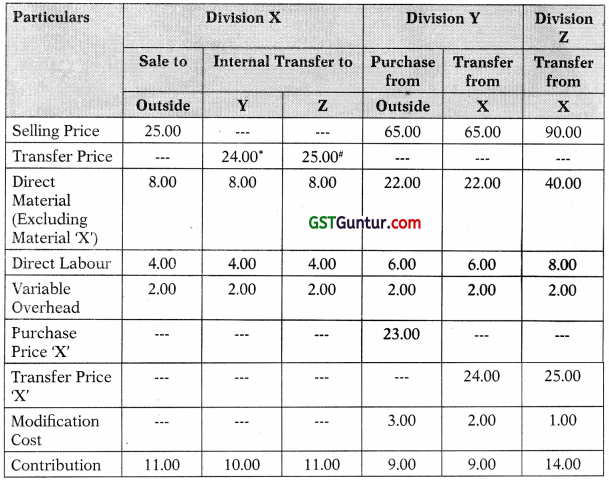

PC Ltd. has two divisions- Division X and Division Y with full profit responsibility. Division X produces components ‘ex’ which is supplied to both division Y and external customers.

7 Division Y produces a product called ‘Xtin’ which incorporates component ‘ex’. For one unit of ‘Xtin’ two units of component ‘ex’ and other

S materials are used.

Till date, Division Y has always bought component ‘ex’ from division X at ₹ 50 per unit since the lowest price at which the component ‘ex’ could have been bought by Division Y was ₹ 52 per unit.

Division X charges the same price for component ‘ex’ to both division Y and external customers. However, it does not incur selling and distribu-tion costs when transferring internally.

Division Y has received a proposal from a new supplier who has offered to supply component ‘ex’ for ₹ 47 per unit at least for the next three years.

Manager of Division Y requests the manager of Division X to supply component ‘ex’ at or below, ₹ 47 per unit. Manager of Division X is not ready to reduce the transfer price since the divisional performance evaluation is done based on profit margin ratio of the division.

The following additional information is made available to you :

| Component ‘ex’ ₹ | Product ‘Xtin ’ ₹ | |

| Selling Price per unit | 50 | 180 |

| Less: Variable Costs | ||

| Direct Materials | ||

| Component ‘ex’ | – | 100 |

| Other materials | 12 | 22 |

| Direct labour | 16 | 13 |

| Manufacturing Overhead | 2 | 5 |

| Selling and Distribution Costs | 4 | 2 |

| Contribution per unit | 16 | 38 |

| Annual fixed costs | ₹ 40,00,000 | ₹ 20,00,000 |

| Annual external demand (units) | 3,00,000 | 1,20,000 |

| Capacity of plant (units) | 5,00,000 | 1,50,000 |

(i) CALCULATE the present profit of each division and the company as a whole.

(ii) ANALYSE the impact on the total annual profits of each division and the company as a whole if Division Y accepts the offer of the new supplier.

(iii) In the changed scenario, DISCUSS why the top management should intervene and advise a suitable transfer price for component ‘ex’ for resolving transfer pricing conflict which promotes goal congruence through efficient performance of the concerned division. [Nov. 2020] (10 Marks)

Answer:

PC Ltd. Transfer Pricing

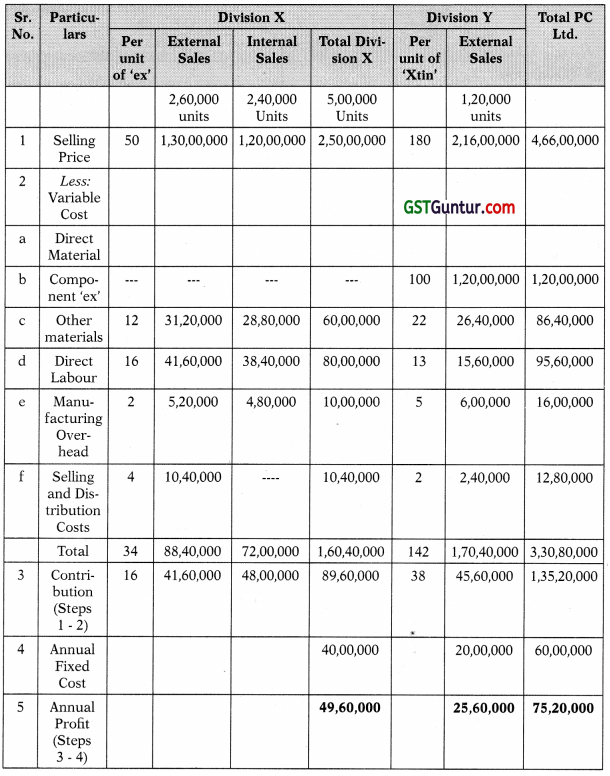

(i) Profitability of each division and the company as a whole when Division X supplies 240,000 units of ‘ex’ annually to Division Y.

Division Y produces 1,20,000 units of Xtin. Each component of Xtin requires 2 components of ‘ex’ that it currently procures from Division X. Therefore, it procures 2,40,000 units of ‘ex’ from Division X annually.

Division X has an overall capacity of 5,00,000 units annually to produce ‘ex’. Of this it produces 2,40,000 units for Division Y, which it must first cater to. The remaining 2,60,000 units of ‘ex’ is sold to external customers.

Divisional and Overall Profitability of PC Ltd.

Note

Division X does not incur marketing costs on internal sales. Therefore, cost not incurred on transfer of 240,000 units to Division Y.

(ii) Impact if Division Y accepts to buy 240,000 units of ‘ex’ annually from the external supplier at ₹ 47 per unit of ‘ex’.

Analysis PC Ltd.

Overall profitability of PC Ltd. reduces from ₹ 75,20,000 per annum to ₹ 40,80,000 per annum. The reduction in profit is therefore ₹ 34,40,000 per annum. Reasons are:

(a) The cost of manufacturing ‘ex’ is only ₹ 30 per unit while Division Y is procuring this at ₹ 47 per unit from an external supplier.

Annually this results in a loss of ₹ 40,80,000 (240,000 units of ‘ex’ × ₹ 17 per unit).

(b) Since Division X no longer makes ‘ex’ for internal sales, it can ramp up its external sales to meet the full annual demand of

300,0 units. This results in extra external sales of 40,000 units annually. Each unit gives a contribution of ₹ 16 per unit. Therefore, additional contribution from sale of 40,000 units of ‘ex’ to external customers is ₹ 640,000 per annum.

(c) Therefore, netting both (a) and (b) above, the net loss to the company is ₹ 34,40,000 per annum.

Division Y

Impact on profit of Division Y, increase from ₹ 25,60,000 per annum to ₹ 32,80,000 per annum that is ₹ 7,20,000 per annum increase. This is due to the savings in procurement cost of ‘ex’ for Division Y. Instead of procuring ‘ex’ at ₹ 50 per unit Division Y proposes to buy it at ₹ 47 per unit externally. For its annual demand of 2,40,000 units of ‘ex’, it translates to savings of ₹ 7,20,000 annually in procurement cost for Division Y.

Division X

Impact on profit of Division X, reduction from ₹ 49,60,000 per annum to ₹ 8,00,000 per annum. A substantial reduction of ₹ 41,60,000 in its divisional profit per year. Division X earns a contribution of ?20 per unit of ‘ex’ from its internal transfer to Division Y. (Selling price ₹ 50 per unit less variable cost of manufacturing ?30 per unit). If Division Y procures ‘ex’ externally, this would result in an annual loss of ₹ 48,00,000 in contribution for Division X (240,000 units X ₹ 20 per unit). However, due to additional external sales of 40,000 units of ‘ex’, Division X can earn an additional contribution of ₹ 6,40,000-pcr year (40,000 units of ‘ex’ X ₹ 16 contribution per unit of external sale). Offsetting, this results in a lower contribution of ₹ 41,60,000 per annum for Division X.

This also results in excess capacity of 2,00,000 units per annum in Division X.

(iii) PC Ltd. can suffer a loss of ₹ 34,40,000 per annum if Division Y decides to procure ‘ex’ from the external supplier. It costs on ₹ 30 per unit to manufacture ‘ex’ internally as compared to ₹ 47 per unit that Division Y is willing to pay to the external supplier. However, Division X is unwilling to reduce the price from ₹ 50 per unit since divisional performance is done based on the profit margin ratio of the division. Therefore, the management of the company has to step in to promote goal congruence. If Division Y buys ‘ex’ from the external supplier, not only is it costly for the company, it also results in a lot of unused capacity lying idle in Division X.

In the current scenario, one possible way of arriving at an acceptable transfer price range could be:

Division X is currently working at full capacity of 5,00,000 units per annum. Of this production, 2,40,000 units is supplied internally to Division Y while the balance is supplied to external market. The marginal cost of production of ‘ex’ is ₹ 30 per unit. If this were sold externally, it would earn a contribution of ₹ 16 per unit. Therefore, the minimum transfer price the Division X would demand = marginal cost of production per unit + opportunity cost per unit = ₹ 30 + ₹ 16 = ₹ 46 per unit of ‘ex’.

(The other way of looking at this could also be that Division X does not incur any selling and distribution costs on internal transfers. To outside clients it needs to spend per unit towards the same. Therefore, to make its price more competitive with the external market, Division X can reduce the price by ₹ 4 per unit, which it has been recovering from Division Y for a cost it does not incur in internal transfers. Thus, based on its cost structure and the competitive profit margin it earns from external sales, it can price its internal transfers at ₹ 46 per unit.)

Division Y will be willing to pay the lower of net marginal revenue or the external buy- in price.

The Net Marginal Revenue per unit of Xtin = Selling price per ‘Xtin’ – (marginal cost for Division Y other than the cost of ‘ex’)

= ₹ 180 – ₹ 42

= ₹ 138 per unit of ‘Xtin’.

This translates that Division Y will be willing to pay upto ₹ 69 per unit of ‘ex’, that it can incur without incurring a divisional loss. Meanwhile, the external buy-in price is ₹ 47 per unit.

Therefore, the maximum price Division Y will be willing to pay = lower of Net Marginal Revenue or external buy-in price = lower of ₹ 69 or ₹ 47 per unit of ‘ex’. Therefore, Division Y will be willing to pay maximum ₹ 47 per unit of ‘ex’ to Division X.

Therefore, the transfer price range can be set between ₹ 46 – ₹ 47 per unit of ‘ex’. Division X would then have to compete with the external supplier to retain its internal sales. This would promote more efficient working between Division X and Y. By selling it at ₹ 46 per unit, the contribution of Division X would be maintained at ₹ 16 per unit. For Division Y. the procurement of ‘ex’ at ₹ 46 per unit would be beneficial since it is lower than the external market price. If transfer price set at external market rate ₹ 47 per unit, Division Y would still be able to improve its profit margin as compared to the original transfer price of ₹ 50 per unit.

Given that the marginal cost of manufacturing ‘ex’ is only ₹ 30 per unit, the management has to ensure that production of ‘ex’ is made in-house. Performance measure at a divisional level should then not be restricted to financial performance alone (full profit responsibility) and should be accordingly modified to include non-financial/operational measures as well.

![]()

Question 13.

(Dual Rate & Two Part Transfer Pricing)

AMG Ltd. is a manufacturing organization having two Divisions ‘E’ and ‘G’ with full profit responsibility. The Division ‘E’ produces Component ‘e’ which it sells to ‘outside’ customers only. The Division ‘G’ produces a product called the ‘g’ which incorporates Component ‘e’ in its design. ‘G’ Division is currently purchasing required units of Component ‘e’ per year from an outside supplier at market price.

New’ CEO for Indian Operations has explored that ‘E’ Division has enough capacity to meet entire requirement of Division ‘G’ and accordingly he required internal transfer between the divisions at marginal cost from the overall company’s perspective.

Manager of Division ‘E’ claims that transfer at marginal cost are unsuit-able for performance evaluation since they don’t provide an incentive to the division to transfer goods internally. He stressed that transfer price should be ‘Cost plus a Mark-up’.

New CEO worries that transfer price suggested by the manager of Division ‘E’ will not induce manager of both Divisions to make optimum decisions.

Required

DISCUSS transfer pricing methods to overcome performance evaluation conflicts [Nov. 2017 Exam]

Answer:

To overcome the optimum decision making and performance evaluation conflicts that can occur with marginal cost-based transfer pricing following methods has been proposed:

Dual Rate Transfer Pricing System

“With a ‘Dual Rate Transfer Pricing System’ the ‘Receiving Division’ is charge with marginal cost of the intermediate product and ‘Supplying Division ‘G’ may be charged only marginal cost. Any inter divisional profit margin”.

Accordingly Division ‘E’ should be allowed to record the transactions at full cost per unit plus a profit margin. On the other hand Division ‘G’ may be charged only marginal cost. Any inter divisional profits can be eliminated by accounting adjustment.

Impact:

- Division ‘E’ will earn a profit on inter-division transfers.

- Division ‘G’ can chose the output level at which the marginal cost of the component ‘e’ is equal to the cost marginal revenue of the product ‘g’

Two Part Transfer Pricing System

“The ‘Two Part Transfer System’ involves transfers being made of the mar-ginal cost per unit of output to the ‘Supplying Division’ plus a lump-sum fixed free charged by the ‘Supplying Division’ to the ‘Receiving Division’ for the use the capacity allocated to the intermediate product.”

Accordingly Division ‘E’ can transfer its products to Division ‘G’ at marginal cost per unit and a lump-sum fixed fee.

Impact:

‘Two Part Transfer System’ will inspire the Division ‘G’ to choose the optimal output level.

This pricing system also enable the Division ‘E’ to obtain a profit on inter-division transfer.

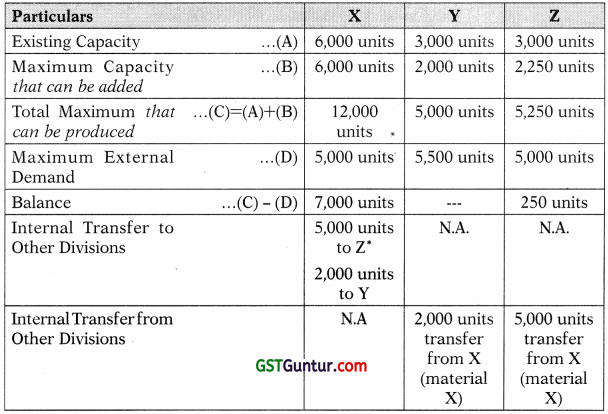

Question 14.

Speedex is a car manufacturing company. It has two manufacturing divisions in different countries. Division A in India manufactures engines for the cars. It has a capacity to manufacture 10,000 units each year. The variable cost of production is ₹ 8,000 p.u. and the division can sell 8,000 engines externally to customers within India at ₹ 11,000 p.u. The other division, Division B is in Italy that requires 5,000 engines every year to assemble them further into cars. It purchases these engines from a vendor in Italy at a price that is equivalent to ₹ 9,000 p.u. If Division B were to purchase these units from Division A, the transfer price would be ₹ 10,000 p.u. Since no selling expenses need to be incurred on internal sales, variable cost of such transfers would be ₹ 7,000 p.u. If Division A accepts the internal order from Division B, it will have to curtail some of its external sales.

Given that the tax rate is 30% in India and 40% in Italy. Determine if the company will benefit overall if Division B purchases from Division A.

Answer:

Problem Definition: If Division B buys from Division A, will it benefit the company as a whole? Key Considerations: Contribution p.u. under external and internal sale options and the tax impact.

Methodology:

Part 1: Benefit to Division A

Currently external sales are 8,000 units. If Division A accepts to cater to Division B’s requirements, external sales have to be curtailed by 3,000 units. The sales mix would be external sales 5,000 units and internal transfer 5,000 units, (refer working note 1).

Division A was previous producing 8,000 units. On accepting Division B’s order, it is operating at full capacity of 10,000 units, an additional 2,000 units are being produced. As per working note 2, contribution from each option is the same at ₹ 3,000 p.u.

Additional Contribution = 2,000 units × ₹ 3,000 p.u.

= ₹ 60,00,000.

Division A pays tax in India at 30%. Hence the Net Tax Contribution = ₹ 60,00,000 × (100% – 30%)

= ₹ 42,00,000.

Part 2: Net Additional Cost to Division B

Division B is currently purchasing the engine within Italy at ₹ 9,000 p.u. (T equivalent value). If it purchases from Division A, it will pay 0,000 p.u. Additional Purchase Cost = 5,000 units × (₹ 10,000 – ₹ 9,000)

= ₹ 50,00,000.

However, this extra cost is tax deductible at a rate of 40%, the tax rate in Italy. Hence Additional Cost (net of tax)

= ₹ 50,00,000 × (100% – 40%)

= ₹ 30,00,000.

Part 3: Overall benefit (after tax) to the company

As explained above, Division A benefits by ₹ 42,00,000 while Division B incurs an extra cost of ₹ 30,00,000. Hence, the net after tax benefit to the company is ₹ 12,00,000. Therefore, Division B should purchase engines internally from Division A.

Working.

Notes

| Sr. No. | Particulars | Number of units |

| 1 | Maximum Capacity | 10,000 |

| 2 | External Sales | 8,000 |

| 3 = 1-2 | Spare Capacity | 2,000 |

| 4 | Division B’s Requirement – | 5,000 |

| 5 = 4-3 | External Sales Curtailed to meet B’s Demand = B’s Requirement – Spare Capacity Available = 5,000 units – 2,000 units | 3,000 |

From the above table it can be seen that Division A has a spare capacity of 2,000 units currently. However, if it has to cater to Division B’s requirements, external sales have to be curtailed by 3,000 units.

2. Statement of Contribution p.u.

Figures in ₹

| Sr. No. | Options | External Sale | Internal Sale |

| 1 | Selling Price p.u. | 11,000 | 10,000 |

| 2 | Less: Variable Cost p.u. | 8,000 | 7,000 |

| 3 = 1-2 | Contribution p.u. | 3,000 | 3,000 |

Question 15.

(International Transfer Pricing)

Highlife Corporation Inc. (HCI) is a US based multinational company engaged in manufacturing and marketing of Printers and Scanners. It has subsidiaries spreading across the world which either manufactures or sales Printers and Scanners using the brand name of HCI.

The Indian subsidiary of the HCI buys an important component for the Printers and Scanners from the Chinese subsidiary of the same MNC group. The Indian subsidiary buys 1,50,000 units of components per annum from the Chinese subsidiary at CNY (¥) 30 per unit and pays a total custom duty of 29.5% of value of the components purchased.

A Japanese MNC which manufactures the same component which is used in the Printer and Scanners of HCI, has a manufacturing unit in India and is ready to supply the same component to the Indian subsidiary of HCI at ₹ 320 per unit.

The HCI is examining the proposal of the Japanese manufacturer and asked its Chines subsidiary to presents its views on this issue. The Chinese subsidiary of the HCI has informed that it will be able to sell 1,20,000 units of the components to the local Chinese manufactures at the same price i.e. ¥ 30 per unit but it will incur inland taxes @ 10% on sales value. Variable cost per unit of manufacturing the component is ¥ 20 per unit. The Fixed Costs of the subsidiaries will remain unchanged.

The Corporation tax rates and currency exchange rates are as follows:

| Corporation Tax Rates | Currency Exchange Rates | ||

| China | 25% | 1 US Dollar ($) | = ₹ 61.50 |

| India | 34% | 1 US Dollar ($) | = ¥ 6.25 |

| USA | 40% | 1 CNY (¥) | = ₹ 9.80 |

Required

(i) PREPARE a financial appraisal for the impact of the proposal by the Japanese manufacturer to supply components for Printers and Scanners to Indian subsidiary of HCI. [Present your solution in Indian Currency and its equivalent.]

(ii) IDENTIFY other issues that would be considered by the HCI in relation to this proposal.

(Note: While doing this problem use the only information provided in the problem itself and ignore the actual taxation rules or treaties

prevails in the abovementioned countries)

Answer:

(i) Impact of the Proposal by the Japanese Manufacturer to Supply S Components for Printers and Scanners to the Indian Subsidiary of the HCI.

On Indian Subsidiary of HCI

| Particulars | Amount (₹) |

| Cost of Purchase from the Chinese Manufacturer: | |

| Invoiced Amount {(1,50,000 units × ¥ 30) × 79.80) | 4,41,00,000 |

| Add: Total Custom Duty (₹ 4,41,00,000 × 29.5%) | 1,30,09,500 |

| Total Cost of Purchase from the Chinese Manufacturer -(A) | 5,71,09,500 |

| Cost of Purchase from Japanese Manufacturer in India: | |

| Invoice Amount (1,50,000 units × 7320) | 4,80,00,000 |

| Total Cost of Purchase from Japanese Manufacturer in India -(B) | 4,80,00,000 |

| Savings on Purchase Cost Before Corporate Taxes ………(A)-(B) | 91,09,500 |

| Less: Corporate Tax @34% | 30,97,230 |

| Savings after Corporate Taxes | 60,12,270 |

On Chinese Subsidiary of HCI

| Particulars | Amount (?) |

| Loss of Contribution

[{(1,50,000 – 1,20,000 units) × ¥ (30 – 20)} × ₹ 9.80] |

29,40,000 |

| Add: Inland taxes on Local Sale – Chinese Manufacturer [{(1,20,000 units × ¥ 30) × 10%} × ₹ 9.80] | 35,28,000 |

| Total Loss Before Corporate Taxes | 64,68,000 |

| Less: Tax Savings on the Losses (₹ 64,68,000 × 25%) | 16,17,000 |

| Net Loss after Corporate taxes | 48,51,000 |

On HCI Group

| Particulars | Amount (₹) |

| Saving from Indian Subsidiary | 60,12,270 |

| Loss from Chinese Subsidiary | 48,51,000 |

| Net Benefit to HCI Group | 11,61,270 |

From the above analysis, it can be seen that the proposal from the Japanese manufacturer in India is beneficial for the HCI as it give a net benefit of ₹ 11,61,270.

(ii) The HCI need to consider various other issues before reaching at a final decision of accepting the proposal of the Japanese manufacturer f in India. The few suggestive issues that should be considered are as follows:

- The longevity of the proposal of the Japanese manufacturer: Whether Japanese manufacturer will supply the components in the future also. For this purpose, a long term agreement between the Indian Subsidiary of HCI and Japanese manufacturer in India needs to be entered.

- Certainty of the fiscal policy in India: The Japanese manufacturer will not be able to supply the component at the present price if the fiscal policy of India will change in the future.

- Repatriation of Profit earned in India: Though the Indian subsidiary is making profit but it depends on the Government policy on [ the repatriation of profit from India to USA.

- Operating Conditions in China: The HCI has to make sure that the Chinese subsidiary is operating profitably and able to use the spare capacity in the future as well.

- The fiscal policy in China: If the Government of China liberalize its fiscal policies in China in future then the manufacturing cost will be cheaper than the today’s cost.

- Apart from above suggestive points the foreign relations and other tax treaties and accords should also be kept in consideration.

![]()

Question 16.

(International Transfer Pricing)

Deep miners operates two divisions, one in Japan and other in United Kingdom (U.K.). Mining Division is operated in Japan which is rich in raw emerald.

The other division is United Kingdom Processing Division. It processes the raw emerald into polished stone fit for human wearing.

The cost details of these divisions are as follows:

| Division | Japan Mining Division | United Kingdom Processing Division |

| Per carat of raw emerald | Per carat of polished emerald | |

| Variable Cost | 2,500 Yen | 150 Pound |

| Fixed Cost | 5,000 Yen | 350 Pound |

Several polishing companies in Japan buy raw emerald from other local Mining Companies at 9,000 Yen per carat. Current Foreign Exchange Rate is 50 yen = 1 Pound. Income Tax rates are 20% and 30% in Japan and the United Kingdom respectively.

It takes 2 carats of Raw Yellow emerald to yield 1 carat of Polished Stone. Polished emerald sell for 3,000 Pounds per carat.

Required

(i) COMPUTE the transfer price for 1 carat of raw emerald transferred from Mining Division to the Processing Division under two methods – (a) 200% of Full Costs and (b) Market Price.

(ii) 1,000 carats of raw emerald are mined by the Japan Mining Division and then processed and sold by the U.K. Processing Division. COMPUTE the after tax operating income for each division under both the Transfer Pricing Methods stated above in (i). [MTP April 2019/Oct. 2020]

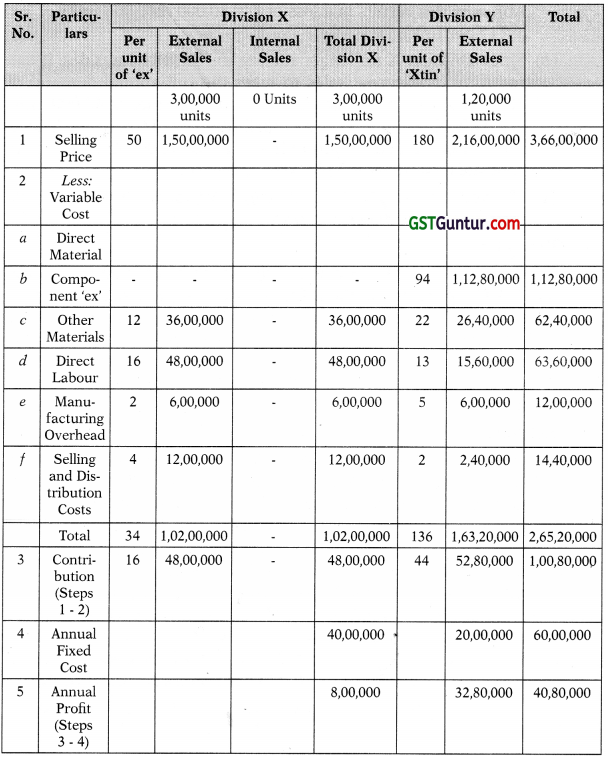

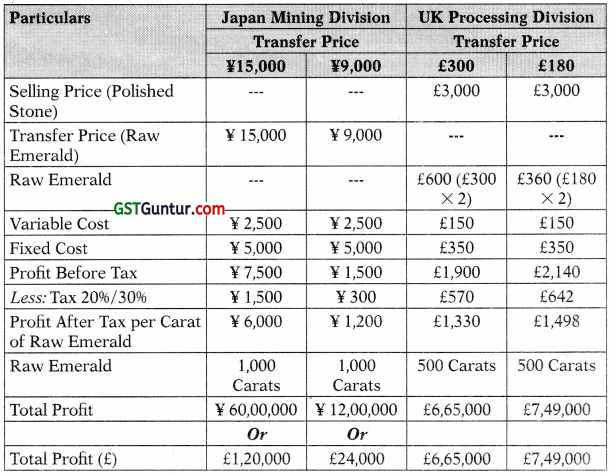

Answer:

(i) Transfer Price: 200% of Full Cost Basis

= 200% of (¥ 2,500 + ¥ 5,000)

= ¥ 15,000 or £300 (¥ 15,000/50)

Transfer Price: Market Price Basis

= ¥ 9,000 or £180 (¥ 9,000/50)