Divisional Transfer Pricing – CA Final SCMPE Question Bank is designed strictly as per the latest syllabus and exam pattern.

Divisional Transfer Pricing – CA Final SCMPE Question Bank

Question 1.

Answer the following questions:

Enumerate the expected disadvantages in taking divisions as profit centres. (May 2013, 4 marks)

Answer:

The expected disadvantages of taking divisions as profit centres are as follows:

- It may lead to reduction in the company’s overall total profits.

- Top management loses control by delegating decision making to divisional managers. There are risks of mistakes committed by the divisional managers, which the top management, may avoid. .

- It may under utilize corporate competence.

- It leads to complications associated with transfer pricing problems.

- It becomes difficult to identity and defines precisely suitable profit centres.

- It confuses division’s results with manager’s performance.

- Series of control reports prepared for several departments may not be effective from the point of view of top management.

- The cost of activities, which are common to all divisions, may be greater for decentralized structure than centralized structure. It may thus result in duplication of staff activities.

- It may adversely affect co-operation between the divisions and lead to lack of harmony in achieving organizational goals of the company. Thus it is hard to achieve the objective of goal congruence.

- Divisions may compete with each other and may take decisions to increase profits at the expense of other divisions thereby overemphasizing short term results.

![]()

Question 2.

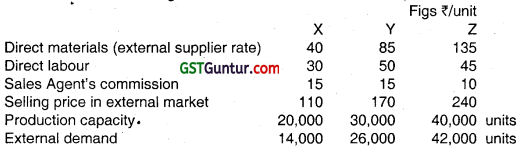

Tripod Ltd. has three divisions-X, Y and Z, which make products X, Y and Z respectively. For division Y, the only direct material is product X and for Z, the only direct material is-product Y. Division X purchases all its raw material from outside. Direct selling overhead, representing commission to external sales agents are’ avoided on all internal transfers. Division Y additionally incurs ₹ 10 per unit and ₹ 8 per unit on units delivered to external customers and Z respectively. Y also incurs ₹ 6 per unit picked up from X, whereas external suppliers supply at Y’s factory at the stated price of ₹ 85 per unit. (Nov 2008, 11 marks)

Additional information is given below :

You are required to discuss the range of negotiation for Managers X, Y and Z, for the number of units and the transfer price for internal transfers.

Answer:

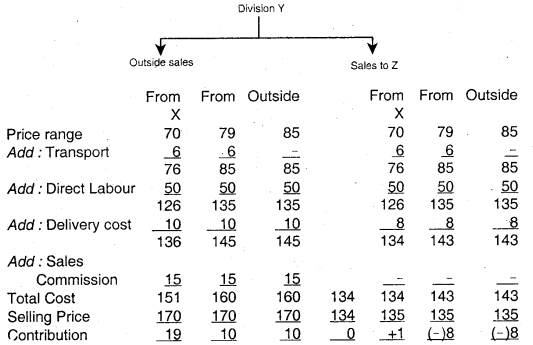

Analysis of range of negotiation for Manager of Division X (Figures in ₹)

Analysis of range of negotiation for Manager of Division Y (Figures in ₹)

![]()

Range of Negotiations :

Manager of division X will sell 14,000 units outside at 110 ₹ per unit and earn contribution of ₹ 3.50 lakhs.

Excess capacity of 6,000 units can be offered to Y at a price between 70 (the variable manufacturing cost at X) and ₹ 95 (the maximum amount to equal outside contribution). But Y can get the material outside @ 85. So, y will not pay to X anything.above (₹ 85 – 6) = ₹ 79 to match external available price. X will be attracted to sell to Y only in the range of 71 – 79 ₹ per unit at a volume of 6,000 units.

At ₹ 70, X will be indifferent, but may offer to sell to Y to use idle capacity. Z will not buy from Y at anything above 135. If X sells to Y at 70 per unit, Y can sell to Z at 134 and earn no contribution, only for surplus capacity and if units transferred by X to Y at ₹ 70 per unit.

| Y | Z | |

| Provided X sells to Y at ₹ 70 per unit | Sell 4,000 units to Z at 134 (Indifferent) | Buy 4,000 units from y at 134 (attracted) |

| Sell 4,000 units to Z at 135 (willingly for a contribution of ₹ 1) | Indifferent, since market price is also 135 |

For buying from X at 71 – 79 price range, Y will be interested in selling to Z only at prices 136 – 143, which will not interest Z.

Thus Y will sells to Y at ₹ 70 per unit any Y will supply to Z maximum 4,000 units.

![]()

Question 3.

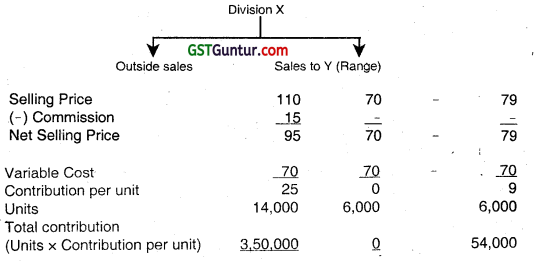

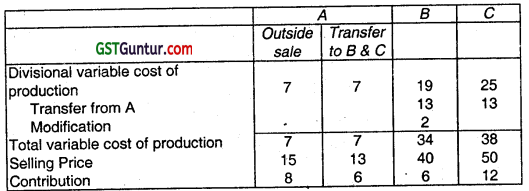

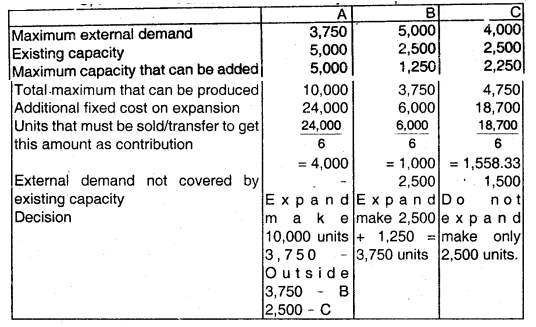

Bearings Ltd. makes three products, A, B and C in Divisions A, B and C respectively. The following information is given : (May 2009, 12 marks)

B and C need material A as their input. Material A is available outside at ₹ 15 per unit. Division A supplies the material free from defects. Each unit of B and C requires one unit of A as the input material.

If B purchases from outside, it has to pay ₹ 15 per unit. If B purchases from A, it has to incur in addition to the transfer price, ₹ 2 per unit as variable cost to modify it.

B has sufficient idle capacity to inspect its inputs without additional costs.

If C gets material from A, it can use it directly, but if it gets material from outside, which is at ₹ 15, it has to do one of the following :

(i) Inspect it at its own shop floor at ₹ 3 per unit.

(Or)

(ii) Get the supplier to supply inspected products and pay the supplier ₹ 2 p.u. as inspection charges.

(Or)

(iii) A has enough idle labour, which it can lend to C to inspect at ₹ 1 p.u. even though C purchases from outside.

A has to fix a uniform transfer price for both B and C. The transfer price will not be known to outsiders and is at the discretion of the Divisional Managers. What is the best strategy for each division and the company as a whole?

Answer:

B will not pay A anything more than 13, because at 13, it will incur additional cost of ₹ 2/- to modify it, 13 + 2 = 15, the outside cost.

Option for C, Purchase all units from A @ 13 : Any other option is costlier.

| A | B | C | ||

| Outside sale | Transfer to B & C | |||

| Units Contribution/units Contribution (₹) |

3,750 8 30,000 |

3,750 + 2,500 = 6,250 6 37,500 |

3,750 6 22,500 |

2,500 12 30,000 |

| Additional Fixed Cost | 67,500

24,000 |

22,500

6,000 |

30,000

– |

|

| Net revenue addition | 43,500 | 16,500 | 30,000 | |

![]()

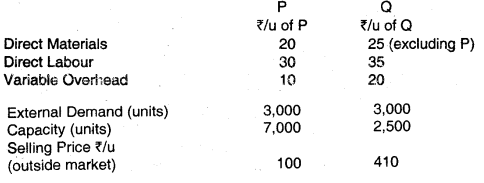

Question 4.

Opticals Ltd. makes two kinds of products, P (lenses) and Q (swimming goggles) in divisions P and Q respectively. P is an input for Q and twp units of P are needed to make one unit of Q. (Nov 2009, 12 marks)

The following data is given to you for a period:

If Q buys P from outside, it has the following costs :

for order quantity 2,499 or less – ₹ 90 per unit for the entire quantity ordered.

for order quantity 2,500 – 5,000 – ₹ 80 per unit for the entire quantity ordered.

for order quantity more than 5,000 – ₹ 70 per unit for the entire quantity ordered.

You are required to :

(i) Evaluate the best strategies for Divisions P and Q.

(ii) Briefly explain the concept of goal congruence.

Answer:

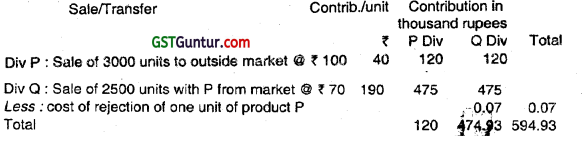

Opticals Ltd. manufactures P (lenses) and Q (swimming goggles).

Division P has option to supply to Division Q or sell to outside market.

Division Q has option to buy from Division P or purchase from outside market. However, both divisions have to work within their individual capacity.

Variable Cost for product P in Division P = ₹ 60.

Variable cost for product Q in Division Q (excluding 2 Nos P’s) = ₹ 80.

Division P has better market price of its product P than the market price offered to Q division.

For maximizing profit of the organization : – ₹

P division should optimise its profit by selling maximum units to outside market.

Contribution per unit for sale to outside for division P – ₹ 40

Contribution per unit for Div Q as follows :

Sale price – Variable cost (excluding lenses) – ₹330

Max Contribution per unit (if procured from P div at its variable cost i.e. ₹ 60) – ₹ 210

Min Contribution per unit (if procured at ₹ 90 per unit from outside) – ₹150

Contribution per unit at transfer price of ₹ 70 i.e. minimum market price – ₹ 190

![]()

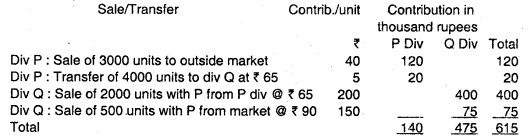

Option 1 : Division Q buys 5001 units from market @ ₹ 70 and meets its capacity.

Division P sells 3000 units to outside market @ ₹ 100

Option 2 : Division P sells 3000 units to outside market, transfer 4000 units to div Q and Division Q buys 1000 units from outside market to work within the capacity

P Division agrees to a transfer price so that profitability of Q is not affected. To maintain the same profitability of Q, contribution required from 2000 units for Div Q is ₹ 4,00,000 i.e. contribution per unit ₹ 200 i.e. transfer price per unit of P is ₹ 65 per unit to make cost of lenses ₹ 130.

Under Option 1, both divisions worked dis-jointly without caring for capacity utilization resulting lower profitability of the organization.

Under Option 2, both divisions worked with mutual advantages for optimizing their individual profits and overall profit for the organization has gone up by effective utilization of capacity.

Product P from Division P fetches higher price from open market indicating good quality of product. Moreover, supply from P division is well assured in the long run which is the justification of establishment of two parallel divisions. Hence, Option 2 is suggested.

(i) Division functioning as profit centers strive to achieve maximum divisional profits, either by internal transfers or from outside purchase. This may not match with the organisation’s objective of maximum overall profits.

(ii) Divisions may be commercial to advice overall objects objectives, where divisional decision are in line with the overall best for the company, and this is goal congruence. Divisions at a disadvantage may be given due weightage while appraising their performance. Goal incongruence defeats the purpose of divisional profit centre system.

![]()

Question 5.

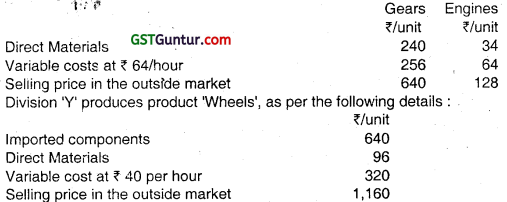

A company has two manufacturing divisions X and Y. X has a capacity of 96000 hours per annum. It manufactures two products, ‘Gears’ and ‘Engines’ as per the following details : (May 2011, 11 marks)

The fixed overheads for X and Y are ₹ 24 lakhs and ₹ 4 lakhs respectively. With a view to minimizing dependence on the imported component, the company has explored a possibility of Division Y using product ‘Gears’ instead of the imported component. This is possible provided Division Y spends 2 machine hours entailing an additional expenditure of ₹ 64 per component on modification of product ‘Gears’ to fit into ‘Wheels’. Production and sales of ‘Wheels’ in Division Y is limited to 5000 units per annum.

(i) What will be the maximum transfer price per unit that Y will offer ?

(ii) In each of the following independent situations, state with supporting calculations, the minimum transfer price per unit that X will demand from Y, if 5000 units are required by Y.

(iii) in which of the above situations in (ii) will the Management step in and compel X to sell to Y in the interest of overall company’s profits?

Answer:

(i) Y will pay Only a maximum of ₹ (640 – 64) = ₹ 576 so that its outside purchase cost is matched. i.e. Maximum Transfer price by Y = ₹ 576 per unit

| Particulars ‘ | Gears (no. of units) | Engines |

| Market demand is limited to | 20,000 | 20,000 |

| Market demand is limited to | 15,000 | 10,000 |

| Market demand is limited to | 18,000 | 24,000 |

| Particulars | Gears | Engines |

| Hours per unit | 4 | |

| Hours available (96,000 hrs p.a) | 24,000 | |

| Units possible | or | 96,000 |

(ii)

Contribution per units = 624,000/5,000 = 124.80

Minimum Transfer price per unit = Contribution + variable cost

= 124.8 + 240 + 256

= ₹ 620.80

![]()

Question 6.

In a company, Division A makes product A and Division B makes product B. One unit of A needs one unit of B as input. State the unit transfer price to be adapted by the transferring Division A to B in each of the following independent situations : (Nov 2011, 8 marks)

(i) There is a ready market for A. There are no constraints for production or demand for A and A does not incur any external selling cost.

(ii) Supply is more than demand for A. External market resorts to distress price for A and this is expected to last for a temporary period. The product cannot be stocked until better times.

(iii) Product A is highly specialized. Internal specifications are too many that B has to only buy from A.

(iv) A has excess capacity. It can transfer any quantity to B. Goal congruence is to be achieved.

(v) A has no spare capacity, has adequate demand in a competitive market.

(vi) A has no spare capacity and has adequate demand in a competitive market. But on units transferred to B, it incurs ₹ 10 per unit as additional transport cost and ₹ 10,000 as fixed expenses irrespective of the number of units transferred.

(Candidates need not copy the above situations into their answer books).

Answer:

Transfer Price :

(i) Market Price = Transfer price

(ii) For any quantity that the market can absorb, Price offered by B or Market price whichever is higher.

For quantity that the market can no longer absorb, any price that B may offer.

(iii) Maximum Transfer price = Total Cost + Profit subject to maximum price B can pay to keep its ultimate product profitable.

Minimum transfer price = Variable cost

(iv) Transfer Price = Variable Cost to A

(v) Transfer price = Either Market Price or Variable Cost + Opportunity Cost of diverting market sale

(vi) Transfer Price = Variable Cost + Opportunity Cost + specific cost + (fixed cost/units transferred)

Transfer price/unit = (Market Price + 10) + (10,000/units transferred)

![]()

Question 7.

AB Ltd. makes component ‘C’ and billing machines. Division A makes component ‘C’ that is used in the final assembly of the machine in Division B. (May 2012, 10 marks)

(One unit of Component ‘C’ is used per machine.) Component C has an outside market also. A and B operate as profit centres and each can take its own decisions. The following data is given in the existing scenario for Divisions A and B, under which Division A has enough special and external demand to use its capacity and hence is offering B rates of 800 ₹ /unit for quantity up to 750 units and 900 ₹ /unit for more than 750 units, so that its outside contribution is not affected by transfers to B. A and B can sell any quantity up to the maximum indicated under ‘units sold’, without affecting their future demands.

| Division A | Division B | |||

| External Market (normal sales) | (Special Sales) | External Market (normal sales) | ||

| Selling Price (₹/u) | 1,000 | 800 | 4,000 | |

| Variable manufacturing cost (₹/u) | 600 | 600 | 1,500* | (‘excluding Component C) |

| Variable selling cost (₹/u) | 100** | 200** | (“Not incurred on inter division transfers) | |

| Total variable cost (₹/unit) | 700 | 600 | 1,700* | (‘excluding component C) |

| Contribution (₹/unit) | 300 | 200 | ||

| Units Sold | 1,250 | 750 | 900 | |

| Production capacity | 2,000 units | 900 units | ||

For the next period, A requires for its own use in its selling outlets, 50 units of billing machines produced by B. B’s manager proposes as follows:

Option I- B will supply 50 machines to A on its variable manufacturing cost basis provided A supplies to B, 500 units of Component C at A’s variable manufacturing cost basis.

Option II- Both A and B resort to total variable cost per unit basis applicable to normal external sale, though neither A nor B incurs any selling cost on inter division transfers. A will be given 50 machines for its use. A will have to supply B all the 900 units that B requires.

Option III- Both A and B use the external market selling price (i.e. 1,000 and

4,000 ₹ / unit for 900 units of Component ‘C’ and 50 machines respectively). From a financial perspective, advise Division A’s manager what he should choose. Support your advice with relevant figures.

![]()

What is the change in the rate of discount per unit given by B to A (based on unit transfer price to market price ratio) from option I to option II?

(Note: Students need not work out the total cost statements. Steps showing relevant figures for evaluation are sufficient).

Answer:

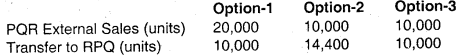

Assumption: The basic assumption for division A is to first divert the Special Sales and then the Normal Sales in the external market to minimize the opportunity loss. Therefore analysis is done on this basis.

| Particulars | Option 1 | Option 2 | Option 3 |

| Opportunity Lost (Units) | |||

| Special Sales | 500 | 750 | 750 |

| External Market | – | 150 | 150 |

| Agreed Selling Price by Division A – | 600 | 700 | 1,000 |

| Agreed Selling Price by Division B (Including the Transfer price of Division A) | 2,100 | 2,400 | 4,000 |

| Contribution (Lost) / Gain ₹ per unit | |||

| Special Sales | (200) | (100) | 200 |

| External Market | – | (200) | 100 |

| Total Contribution (Lost) /Gain (₹) | |||

| Special Sales | (1,00,000) | (75,000) | 1,50,000 |

| External Market | – | (30,000) | 15,000 |

| Total | (1,00,000) | (1,05,000) | 1,65,000 |

| Contribution Gain per unit by buying from B (₹/u) | 1,900 | 1,600 | – |

| Total Contribution Gained (50 Machines) ₹ | 95,000 | 80,000 | – |

| Net Contribution Gained (50 Machines) ₹ | (5,000) | (25,000) | 1,65,000 |

DecisIon : Option 3 is preferred.

Rate of change in discount (1900 – 1600)14000 = 7.5%

![]()

Question 8.

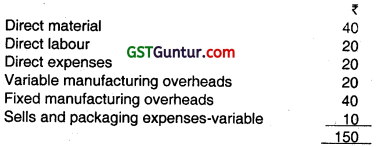

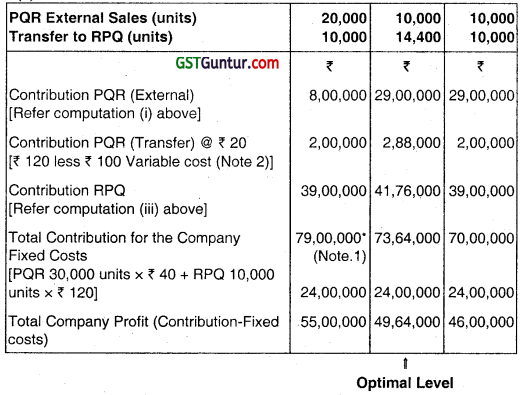

PEX is a manufacturing company of which division PQR manufactures a single standardized product. Some of the output is sold externally whilst the remainder is transferred to division RPQ where it is a subassembly in the manufacture of that division’s product. PQR has the capacity (annual) to produce 30,000 units of the product. The unit costs of division PQR’s product are as under: (Nov 2012, 11 marks))

Annually 20,000 units of the product are sold externally at the standard price of ₹ 300 per unit.

In addition to the external sales, 10,000 units are transferred annually to division RPQ at an internal transfer price of ₹ 290 per unit. This transfer price is obtained by deducting variable selling and packing expenses from the external price since those expenses are not incurred for internal transfers. Division RPQ incorporates the transferred-in goods into a more advanced product. The unit costs of this product are as follows:

Division RPQ’s manager disagrees with the basis used to set the transfer price. He argues that-the transfers should be made at variable cost plus an agreed (minimal) mark up because his division is taking output that division PQR would be unable to sell at the price of ₹ 300.

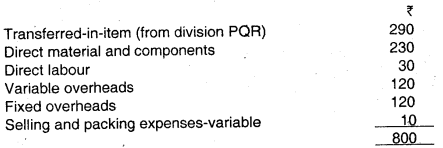

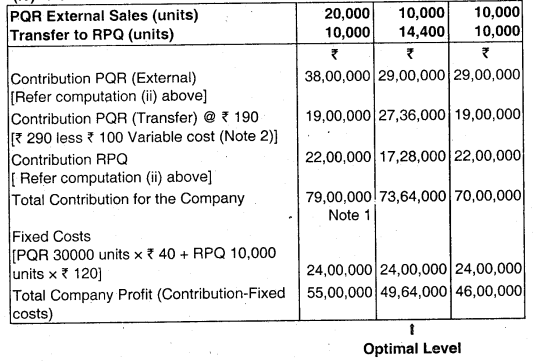

Partly because of this disagreement, a study of the relationship between selling price and demand has recently been carried out for each division by the company’s sales director. The study has brought out the following demand schedule:

The manager of the division RPQ claims that this study supports his case. He suggests that a transfer price of ? 120 would give division PQR a reasonable contribution to its fixed overheads while allowing division RPQ to earn a reasonable profit. He also believes that it would lead to an increase of output and an improvement in the overall level of company profits.

![]()

Required:

(i) Calculate the effect of the transfer price of ₹ 290 per unit on company’s operating profit. Calculate the optimal product mix.

(ii) Advise the company on whether the transfer price should be revised to ₹ 120 per unit.

Answer:

Contribution Analysis of Divisions :

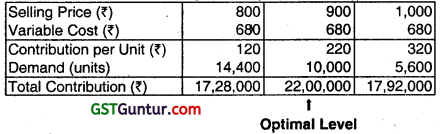

(i) Contribution-Division PQR

The above table shows ₹ 300 price to be the most profitable and that cutting prices would not result in increased profits.

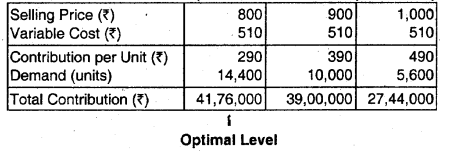

(ii) Contribution-Division RPQ (transfer price at ₹ 290)

(iii) Contribution-Division RPQ (at alternative transfer price ₹ 120)

Comment:

The maximum capacity of the PQR division is given as 30,000 units. Hence there is no question of internal transfer if the entire 30,000 units are sold by PQR in the external market.

However, from the above computations it is clear that division POR would sell 20,000 units in external market to optimize its profit and therefore the maximum transfer to division RPQ is 10,000 units only.

The question of transferring 14,400 units would arise as an alternative to analyze the overall profitability only when POR sells 10,000 units in the external market. Based on the demand projection of RPQ, the demand level of 5,600 units is not relevant.

It can be further noted from the question that Division RPQ will purchase the entire quantity only from Division POR and not externally.

Hence the various options would be as follows.

Overall Profitability of the Company:

(iv) Transfer Price at ₹ 290

(v) Transfer Price at ₹ 120

Comment: The revision of transfer price has no impact on the overall profitability of the company. However, it will alter the profitability of the divisions.

Note – 1 : The optimal level is 30,000 of POR of which 20,000 units are for external sale and 10,000 units are transferred to RPQ under both the transfer prices.

Note – 2 : On internal transfers, PQR’s variable cost per unit is ₹ 100, since the ₹ 10 on selling is not incured.

![]()

Question 9.

B Ltd. makes three products X, Y and Z ¡n Divisions X , Y and Z resDectively. The following information is given: (Nov 2013, 12 marks)

Y and Z need material X as their input. Material X is available in the market at ₹ 23 per unit. Defectives can be returned to suppliers at their cost. Division X supplies the material free from defects and hence is able to sell at ₹ 25 per unit. Each unit of Y and Z require one unit of X as input with slight modification. If Y purchases from outside at ₹ 23 per unit, it has to incur ₹ 3 per unit as modification and inspection cost. If Y purchases from Division X, it has to incur, in addition to the transfer price, ₹ 2 per unit to modify it.

If Z gets the material from Division X, it can use it after incurring a modification cost of ₹ 1 per unit. If Z buys material X from outside, it has to either inspect and modify it at its own shop floor at ₹ 5 per unit or use idle labour from Division X at ₹ 3 per unit. Division X will lend its idle labour as per Z’s requirement even if Z purchases the material from outside.

The transfer prices are at the discretion of the Divisional Managers and will remain confidential. Assume no restriction on quantities of inter-division transfers or purchases.

Discuss with relevant figures the best strategy for each division and for the company as a whole.

Answer:

Statement Showing Contribution per unit (₹)

| Particulars | Division X | Division Y | Division Z | |||

| Sale to | Internal Transfer to | Purchase from | Transfer from | Transfer from | ||

| Outside | Y | Z | Outside | X | X | |

| Selling Price | 25.00 | – | – | 65.00 | 65.00 | 90.00 |

| Transfer Price | – | 24.00* | 25.00* | – | – | – ‘ |

| Direct Material (Excluding Material ‘X’) | 8.00 | 8.00 | 8.00 | 22.00 | 22.00 | 40.00 |

| Direct Labour | 4.00 | 4.00 | 4.00 | 6.00 | 6.00 | 8.00 |

| Variable Overhead | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 |

| Purchase Price ‘X’ | – | – | – | 23.00 | – | – |

| Transfer Price ‘X’ | – | – | – | – | 24.00 | 25.00 |

| Modification Cost | – | – | – | 3.00 | 2.00 | 1.00 |

| Contribution | 11.00 | 10.00 | 11.00 | 9.00 | 9.00 | 14.00 |

(*) Division ‘Y’ will not pay Division ‘X’ anything more than ₹ 24, because at 24, it will incur additional cost of 2 per unit to modify it, ₹ 23 + ₹ 3 = 26, the outside cost.

(*) To purchase material X from outside is costly for Division (Z’ as after modification at own shop floor, cost of the same comes to Division Z’ is ₹ 28(23 + ₹ 5),

If Division ‘X’ goes to utilize its full capacity in that case labour would not be available for modification to Department ‘Z’.

![]()

Accordingly Division ‘Z may purchase material X at 25 from Division ‘X’ i.e. market price to outsiders.

Statement Showing Internal Transfer Decision (Units)

| Particulars | X | Y | Z |

| Existing Capacity (A) | 6,000 units | 3,000 units | 3,000 units |

| Maximum Capacity that can be added (B) | 6,000 units | 2,000 units | 2,250 units |

| Total Maximum that can be produced (C) = (A) + (B) | 12,000 units | 5,000 units | 5,250 units |

| Maximum External Demand (D) | 5,000 units | 5,000 units | 5,000 units |

| Balance (C) – (D) | 7,000 units | – | 250 units |

| Internal Transfer to Other Divisions | 5,000units to Z* 2,000 units to Y |

N.A. | N.A. |

| Internal Transfer from Other Divisions | N.A. | 2,000 units transfer from X (material X) | 5,000 units transfer from X (material X) |

(*) Division ‘X will supply its production to Division ‘Z’ first (after meeting its external requirement) as contribution from product Z is high.

Statement Showing Decision Whether to Expand or Not:

| Particulars | X | Y | Z |

| Additional Fixed Cost on Expansion | ₹ 45,000 | ₹ 9,000 | ₹ 23,100 |

| Contribution that can be earned by expansion | ₹ 64,000 (4,000 units × ₹ 11 + 2,000 units × ₹ 10) | ₹ 18,000 (2,000 units × ₹ 9) | ₹ 28,000 (2,000* units × ₹ 14) |

| Net Benefit from Expansion | ₹ 19,000 | ₹ 9,000 | ₹ 4,900 |

| Decision | Expansion | Expansion | Expansion |

(*) As maximum demand of product Z is 5,000 units which Division ‘Z’ first complete with existing capacity of 3,000 units. Balance 2,000 units from expansion.

![]()

Statement Showing Net Revenue Addition (₹)

| Particulars | X | Y | Z | Total |

| Contribution – External Sales | 55,000 (5,000 units × ₹11) | 45,000 (5,000 units × ₹ 9) | 70,000 (5,000 units × ₹ 14) | 1,70,000 |

| Contribution – Internal Transfer | 75,000 (2,000 units × ₹ 10 + 5,000 units × ₹ 11) | 75,000 | ||

| Additional Fixed Cost | 45,000 | 9,000. | 23,100 | 77,100 |

| Net Revenue Addition | 1,67,900 | |||

Strategy for Company & Divisions:

(i) Division ‘X’ will transfer maximum possible material to Division ‘Z’ as Division ‘Z’ is offering maximum transfer price to Division ‘X’. At the same time Division ‘Z, is fetching maximum contribution for the organisation so it is beneficial for both the Divisions as well as organisation as a whole.

(ii) As show above all the three Divisions are getting net benefit when they are taking decision to expand and hence, all the three Divisions should expand there activity by incurring additional fixed cost on expansion.

![]()

Question 10.

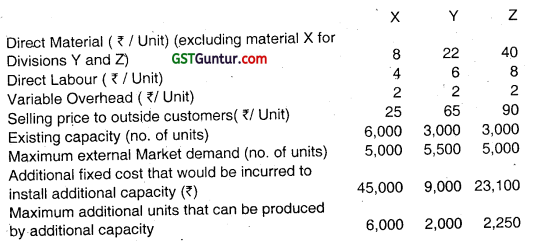

Divisions X and Y are two divisions in XV Ltd. Division X manufactures a component (X) which is sold to external customers and also to Division Y. (May 2014, 8 marks)

Details of Division X are as follows:

| Market price per component | ₹ 300 |

| Variable cost per component | ₹ 157 |

| Fixed costs per production period | ₹ 20,62,000 |

| Demand from Y Division per production period | 20,000 components |

| Capacity per production period | 35,000 components |

Division Y assembles a product (Y) which is sold to external customers. Each unit of Y requires two units of X.

Details of Division Y are as follows:

| Selling price per unit | ₹ 1,200 |

| Variable cost per unit: | |

| (i) Two components from X | 2 @ transfer price |

| (ii) Other variable costs per unit | ₹ 375 |

| Fixed costs per production period | ₹ 13,50,000 |

| Demand per production period | 10,000 units |

| Capacity per production period | 10,000 units |

The Group Transfer Pricing Policy stipulates that Transfers must be at opportunity cost.

Y must buy the components from X.

X must satisfy the demand from Y before making external sales.

(i) Present figures showing the weighted average transfer price per component transferred to Y and the total profits earned by X for each of the following levels of external demand of X :

External demand = 15,000 components

External demand = 19,000 components

External demand = 35,000 components

(ii) Compute Division Y’s profits when Division X has each of the above levels of demand.

(Only relevant figures need to be discussed. A detailed profitability statement for each situation is not required).

Answer:

(i) Calculation of Weighted Average Transfer Price

Opportunity Cost for a Component is the Contribution forgone by not selling it to the market.

Contribution

= Market Selling Price – Variable Cost

= ₹ 300 – ₹ 157 = ₹ 143

![]()

Contribution of Profitability of Division X

| Particulars | External Demand 15,000 Components (₹) | External Demand 19,000 Components (₹) | External Demand 35,000 Components (₹) |

| Sales: | |||

| Division – Y | 31,40,000 (₹ 157 × 20,000) | 37,12,000 (₹ 185.60 × 20,000) | 60,00,000 (₹ 300 × 20,000) |

| Market | 45,00,000 (₹ 300 × 15,000) | 45,00,000 (₹ 300 × 15,000) | 45,00,000 (₹ 300 × 15,000) |

| Total Revenue | 76,40,000 | 82,12,000 | 1,05,00,000 |

| Less: Variable Cost (₹ 157 × 35,000) | 54,95,000 | 54,95,000 | 54,95,000 |

| Less: Fixed Cost | 20,62,000 | 20,62,000 | 20,62,000 |

| Profit | 83,000 | 6,55,000 | 29,43,000 |

(ii) Contribution of Profitability of Division – Y

| Particulars | External Demand 15,000 Components (₹) | External Demand 19,000 Components (₹) | External Demand 35,000 Components (₹) |

| Selling Price per unit | 1,200.00 | 1,200.00 | 1,200.00 |

| Less: Variable Cost per unit: | 314.00 (₹ 157 × 2) | 371.20 (₹ 185.60 × 2) | 600.00 (₹ 300 × 2) |

| Component-X | |||

| Others | 375.00 | 375.00 | 375.00 |

| Contribution per unit | 511.00 | 453.80 | 225.00 |

| No. of units | 10,000 | 10,000 | 10,000 |

| Total Contribution | 51,10,000 | 45,38,000 | 22,50,000 |

| Less: Fixed Cost | 13,50,000 | 13,50,000 | 13,50,000 |

| Profit | 37,60,000 | 31,88,000 | 9,00,000 |

![]()

Question 11.

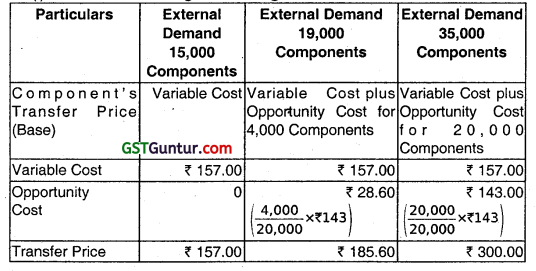

X Division and Y Division are two divisions in the XY group of companies. X Division manufactures one type of component which it sells to external customers and also to Y Division. (Nov 2014, 10 marks)

Details of X Division are as follows: –

Market price per component – ₹ 300

Variable cost per component – ₹ 157

Fixed costs – ₹ 20,62,000 per period

Demand from Y Division – 20,000 components per period

Capacity – 35,000 components per period

Y Division assembles one type of product which it sells to external customer. Each unit of that product requires two of the components that are manufactured by X Division.

Details of Y Division are as follows:

Selling price per unit – ₹ 1,200

Variable cost per unit –

(i) Two components from X – 2 @ transfer price

(ii) Other variable costs per unit – ₹ 375

Fixed costs – ₹ 13,50,000 per period

Demand – 10,000 units per period

Capacity – 10,000 units per period

Group Transfer Pricing Policy

Transfers must be at opportunity cost.

Y must buy the components from X.

X must satisfy demand from Y before making external sales.

![]()

Required:

(1) Calculate the profit for each division if the external demand per period for the components that are made by X Division is:

(i) 15,000 components

(ii) 19,000 components

(iii) 35,000 components

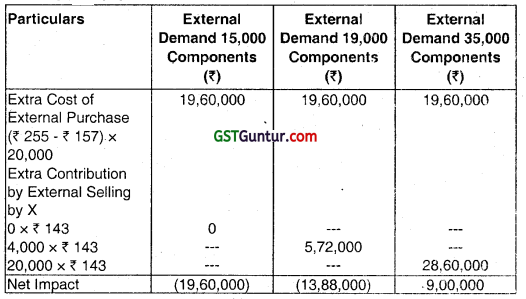

(2) Calculate the financial impact on the Group if Y Division ignored the transfer pricing policy and purchased all of the 20,000 components that it needs from an external supplier for ₹ 255 each. Your answer must consider the impact at each of the three levels of demand (15,000, 19,000 and 35,000 components) from external customers for the component manufactured by X Division.

Answer:

(i) Calculation of Weighted Average Transfer Price

Opportunity Cost for a Component is the Contribution forgone by not selling it to the market.

Contribution = Market Selling Price – Variable Cost

= ₹ 300 – ₹ 157 = ₹ 143

Statement of Computation of Profitability of Division: X

| Particulars | External Demand 15,000 Components (₹) | External Demand 19,000 Components (₹) | External Demand 35,000 Components (₹) |

| Sales: | |||

| – Division – Y | 31,40,000 (₹157 × 20,000) | 37,12,000 (₹ 185.60 × 20,000) | 60,00,000 (₹ 300 × 20,000) |

| – Market | 45,00,000 (₹ 300 × 15,000) | 45,00,000 (₹ 300 × 15,000) | 45,00,000 (₹ 300 × 15,000) |

| Total Revenue | 76,40,000 | 82,12,000 | 1,05,00,000 |

| Less: Variable Cost (₹ 157 × 35,000) | 54,95,000 | 54,95,000 | 54,95,000 |

| Less: Fixed Cost | 20,62,000 | 20,62,000 | 20,62,000 |

| Profit | 83,000 | 6,55,000 | 29,43,000 |

![]()

Statement of Computation of Profitability of Division: Y

| Particulars | External Demand 15,000 Components (₹) | External Demand 19,000 Components (₹) | External Demand 35,000 Components (₹) |

| Selling Price Per unit | 1,200.00 | 1,200.00 | 1,200.00 |

| Less: Variable Cost per unit: Component – X | 314.00 (₹ 157 × 2) | 371.20 (₹ 185.60 × 2) | 600.00 (₹ 300 × 2) |

| Others | 375.00 | 375.00 | 375.00 |

| Contribution per unit | 511.00 | 453.80 | 225.00 |

| No. of units | 10,000 | 10,000 | 10,000 |

| Total Contribution? | 51,10,000 | 45,38,000 | 22,50,000 |

| Less: Fixed Cost | 13,50,000 | 13,50,000 | 13,50,000 |

| Profit | 37,60,000 | 31,88,000 | 9,00,000 |

(ii) Financial Impact on the Group ¡t Y Division Ignored the Transfer Pricing Policy

Alternative Solution:

Calculation of Profit of each division:

Note: (i) It is assumed that X must satisfy the demand from Y, so,. Y must buy the component from X so, X can not sell more than 15000 component to external market so, X can fulfill the demand of external market up to 15000 component only so, profit at this level is.

| Particular | Division – X | Division – Y | |

| External Demand | Transfer | External Sale | |

| Unit/Components | 15000 | 10000 | 10000 |

| Nature | Sale | Transfer | Sale |

| Selling price | 300 | 600 | 1200 |

| Variable Cost | |||

| – Own | 157 | 314 | 375 |

| – Transfer | _ – | – | 600 |

| Contribution | 143 | 286 | 225 |

| Total Contribution – F.C. |

(21,45,000 + 28,60,000) 20,62,000 |

22,50,000 13,50,000 |

|

| Profit | 29,43,000 | 9,00,000 | |

Total Profit = 29.43,000 + 9,00,000 = ₹ 38,43,000

![]()

(ii) Calculating Financial Impact on Y Division

∴ Profit of Division X at maximum level.

| Particulars | Div. X | Div. Y | Total |

| Components/unit | 35,000 | 10,000 | |

| Selling price | 300 | 1200 | |

| Less: Variable Cost | |||

| Own | 157 | ‘ 375 | |

| Purchase cost | – | 510 | |

| Contribution | 143 | 315 | |

| Total Contribution | 50,05,000 | 31,50,000 | 81,55,000 |

| F.C. | (20,62,000) | (13,50,000) | (34,12,000) |

| Profit | 29,43,000 | 18,00,000 | 47,43,000 |

Financial impact if Div. Y Purchase the component from the market than it increase the profit of that Division by ₹ 9,00,000.

So. it is advisable to purchase the unit/component by Division Y from the market and Division X work at their maximum capacity to increase the profit of the Division.

![]()

Question 12.

G is the transferring division and R, the receiving division in a company. R has a demand for 20% of G’s production capacity which has to be first met as per the company’s policy. State with reason, which division. G or R enjoys more advantage in each of the following independent situations, assuming no inventory build up. (May 2015, 5 marks)

| G Transfers to R at Transfer Price equal to | G’s Production level | External Demand | Division having more advantage | Reason |

| (i) Full cost; No markup | 60% | 40% | ||

| (ii) Market Price | 80% | 60% | ||

| (iii) Marginal Cost | 100% | 80% | ||

| (iv) Market Price | 100% | 90% |

(Only the Sl No. column and last two columns need to be written in the answer books).

Answer:

| SI. No. | Division Having More Advantage | Reason |

| (i) | G | G is utilizing only 40% of production capacity by selling to ‘External Market’ which implies that G might have not been able to recover its full fixed costs. By transferring 20% of its production capacity to division R at full cost, G will be able to recover fixed costs components. |

| (») | G | G will not be losing any external market demand as it is within its production capacity. By transferring 20% of G production capacity to division R at market price, G will earn extra contribution towards the fixed costs and profit. |

| (iii) | R | Here G is operating at 100% capacity level and external market demand is 80% only i.e. G is not losing any external market demand. But by transferring 20% of production capacity to R at marginal cost i.e. at variable cost, G may not be able to recover fixed cost part of total cost. On the other hand R will be able to get these units at marginal cost only. |

| (iv) | G | Though G is losing its 10% of external market demand but it would be able to earn the same revenue by transferring the goods to division R at market price. Moreover G will be able to utilize 100% of its production capacity. |

![]()

Question 13.

Four product P, Q, R and S are produced by profit centre Division A. Each product is sold in the external market also. Data for the period are as follows: (Nov 2015, 12 marks)

| P | Q | R | S | |

| Market price per unit (₹) | 70 | 69 | 56 | 46 |

| Variable cost of production per unit (₹) | 66 | 59 | 36 | 37 |

| Labour hours per unit | 3 | 2 | 2 | 3 |

| Specific fixed costs (₹) per 10,000 units of product | 2500 | 12600 | 15000 | 18000 |

Product S can be transferred to Division B but the maximum quantity that might be required for transfer is 20,000 units of S. The specific fixed costs given above are avoidable if a product is not – made. They are incurred for every 10,000 units.

The maximum sales (units) in the external market are:

P – 30,000

Q – 31,000

R – 28,000

S – 18,000

Division B can purchase the same product at a slightly cheaper price of ₹ 45 per unit instead of receiving transfers of product S from Division A without any extra transport/inspection costs. B can also take partial supplies from A. The total labour hours available in Division A is 192000 hours.

(i) What is A’s optimal product mix and the corresponding contribution net of specific fixed costs?

(ii) How many units should A transfer to B and at what price?

(iii) Is it in the company’s interest to transfer 20,000 units of S to B?

Answer:

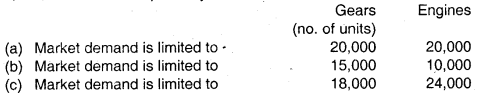

(i) Contribution net of specific fixed cost

Calculation of contribution per unit of key factor i.e. Labour Hours

| Particulars | P | Q | R | S |

| Market Price p.u. | 70 | 69 | 56 | 46 |

| Variable Cost p.u. | 66 | 59 | 36 | 37 |

| Contribution p.u. | 4 | 10 | 20 | 9 |

| Labour Hours p.u. | 3 | 2 | 2 | 3 |

| Contribution p.u. per Labour Hour | 1.33 | 5 | 10 | 3 |

| Ranking | IV | II | I | III |

| Specific Fixed Costs (₹/10,000 Units) | 2,500 | 12,600 | 15,000 | 18,000 |

Optimal Product Mix – Labour Hours = 192,000

![]()

| Product | Units | Labour Hour P.U. | Total Labour Hour | Labour Hour Remain |

| R | 28000 | 2 | 56000 | 136000 |

| Q | 30000 | 2 | 60000 | 76000 |

| S | 18000 | 3 | 54000 | 22000 |

| P | 7333.33 | 3 | 22000 | – |

(i) Statement Showing “Optimal Product Mix and Contribution Net of Specific Net of Specific Fixed Costs on the basis of ranking”

| Particulars | P | Q | R | S | Total |

| Rank | IV | 11 | I | III | |

| Units | 7,333.33 | 30,000 | 28,000 | 18,000 | |

| Contribution (₹/u) | 4 | 10 | 20 | 9 | |

| Total Contribution (₹) | 29,333.32 | 3,00,000 | 5,60,000 | 1,62,000 | 10,51,333.32 |

| Specific Fixed Cost (₹) | 2,500 | 37,800 | 45,000 | 36,000 | 1,21,300 |

| 26,833.32 | 2,62,200 | 5,15,000 | 1,26,000 | 9,30,033.32 |

(ii) Statement Showing “Contribution per unit as well as Contribution per labour hour – Product P & S”

| Maximum Sales/Transfer (Units | |||

| 30,000 | 18,000 | 20,000 | |

| P | SEXT. | SDIV.B | |

| Market Price(₹/u)

Less: Variable Cost of Production (₹/u) |

70 | 46 | 45 |

| 66 | 37 | 37 | |

| Contribution (₹/u) | 4 | 9 | • 8 |

| Labour Hours per unit | 3 | 3 | 3 |

| Contribution (₹/hr.) | 1.33 | 3 | 2.66 |

| Rank [Contribution (₹/hr.)] | III | I | II |

| Specific Fixed Costs (₹/10,000 units) | 2,500 | 18,000 | 18,000 |

![]()

Statement Showing “Computation of Qty. Transfer to Division B”

| Hrs. | |

| Hours Available (After allocation to Q & R) | .76,000 |

| Less: Allocated for SEXT (Rank I) {18,000 units x 3 hrs.} | 54,000 |

| Balance | 22,000 |

| Less: Allocated for SDIV.B (Rank II) {\(\frac{22,000 \mathrm{hrs} .}{3 \mathrm{hrs}}\) = 7,333.33 units} | 22,000 |

Statement Showing “Computation of Transfer Price”

| Units | |

| Variable Cost {7,333.33 units × 37} | 2,71,333.21 |

| Add: Loss of Contribution Net of Specific Fixed Cost “P” | 26,833.32 |

| Add: Additional Specific Fixed Cost “S” | 18,000 |

| Total | 3,16,166.53 |

| Transfer Qty • | 7,333.33 |

| Transfer Price \(\left\{\frac{₹ 3,16,166.53}{7,333.33 \text { units }}\right\}\) | 43.11 |

(iii) Statement Showing “Qty. of ‘Loss of External Sales”

| Units | |

| Requirement SDIV.B | 20,000 |

| Less: On the basis of allocation (ii) SDIV.B | 7,333.33 |

| Loss of External Sales SEXT | 12,666.67 |

![]()

Statement Showing “Net Gain on Transfer of 20,000 units to Division B”

| Savings {20,000 units × (₹ 45 – × 37)} | 1,60,000 |

| Less: Loss of Contribution SEXT (12,666.67 units × ₹ 9) | 1,14,000 |

| Less: Loss of Contribution Net of Specific Fixed Cost “P” | 26,833.32 |

| Less: Additional Specific Fixed Cost “S” | 18,000 |

| Net Gain | 1,1666.68 |

Conclusion

From the financial perspective net gain from transfer of 20,000 units to Division B is negligible. To take final call to transfer 20,000 units to Division B Company should consider other factors also such as its market share, future market demand, market price, and transportation cost etc.

![]()

Question 14.

Division X and Y are two divisions of XY Ltd., which operates as profit centres, Division X makes and sells product X. The budgeted Income statement of Division X, based on a sales volume of 30,000 units, is given below: (May 2016, 8 marks)

Budgeted Income Statement of Division X

| Particulars | ₹ in ‘000 |

| Sales Revenue | 6,000 |

| Component purchase costs | 1,050 |

| Other variable costs | 1,680 |

| Fixed costs | 480 |

| Variable marketing costs | 270 |

| Fixed marketing overheads | 855 |

| Operating profit | 1,665 |

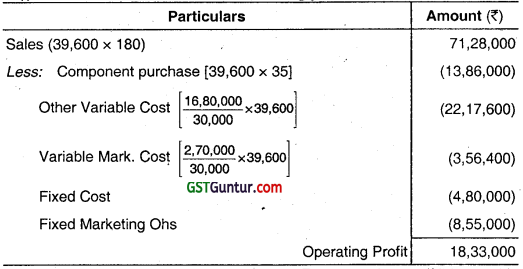

The manager of Division X suggests that sales can be increased by 9600 units, if the selling price is reduced by ₹ 20 per unit from the present price of ₹ 200 per unit and that for this additional volume, no additional fixed costs will be incurred.

Division Y makes a component Y which ¡s sold outside at a price of ₹ 50 per unit.

![]()

Division X presently uses a component which is purchased from outside at ₹ 35 per unit. This component is similar to component made by Division Y. Division Y can make this component for Division X with a minor modification in specification which would cause reduction in direct material cost for the Division Y by ₹ 1.5 per unit and would require extra labour hour of 1 per unit at the rate of ₹ 1.5 per hour.

Further the Division Y will not incur variable selling marketing cost on units transferred to the Division X. Division X’s manager has offered to buy the component from Division Y at ₹ 25.00 per unit. Division Y has the capacity to produce 85,000 units.

The current budgeted information of Division Y are as follows:

Number of units sold outside 60,000 units @ ₹ 50 per unit, variable cost including material and labour ₹ 15 Rer unit, variable marketing cost ₹ 3 per unit, operating profit ₹ 12,00,000 and fixed overheads ₹ 7,20,000.

Advise

(i) Should the Division X reduce the selling price by ₹ 20 per unit even if it is not able to procure the component from Division Y at ₹ 25 per unit?

(ii) Should the Division Y be willing to supply 39,600 units to Division X at ₹ 25 per unit?

Support each of your conclusions with appropriate calculations.

Answer:

(i) Decision whether reduction in selling price of X

Yes, Division X should reduce price by ₹ 20 per unit even if it is not able to procure component from Division ‘Y’ as overall profitability can be increased.

(ii) Comparison for Division Y

Assumption: As direct material cost per units transferred to Dept. X is reduced by 1.5/ unit and direct labour would increased by 1.5 × 1 = 1.5/ unit. So, total direct material and labour cost remain same as ₹ 15/ unit.

Conclusion: Dept. ‘Y’ should not be willing to supply 39,600 units to Dept. ‘X’ as overall profitability is decreased.

![]()

Question 15.

Supreme Limited has two Divisional Profit Centres A and B. A produces two components ‘AC’ and ‘PC’ and has a maximum capacity of 1,20,000 hours per annum, which can be used for AC or PC. (May 2017, 8 marks)

The following information is given:

| Details | Division | Division | |

| A | B | ||

| AC | PC | RAC | |

| Direct Material ₹ / unit | 25 | 10 | 100 |

| Imported Component (equivalent of AC) ₹ / unit | – | – | 450 |

| Direct Labour and Variable | – | – | – |

| Overhead ₹ / unit | |||

| @ ₹ 50 / hour | 200 | 50 | |

| @ ₹ 35/ hour | – | – | 350 |

| Fixed cost ₹ / annum | 30,00,000 | 6,00,000 | |

| External demand (no. of units) | 18,000 | Unlimited | 6,000 |

| External selling price (₹ / unit) | 450 | 90 | 1,050 |

Division B presently imports a component which is similar to AC at ₹ 450. If it uses AC from Division A, it has to make some modification which will involve two direct labour hours, thereby increasing the cost by ₹ 70/- per modified unit. What is the minimum transfer price per unit that A will agree to, if the requirement of B is

![]()

(i) 12,000 units

(ii) 15,000 units?

(iii) What is the maximum price that B will offer A per unit of AC transferred if its labour hours are restricted to 6,00,000 hours? Is it in the company’s interest that A transfers units to B after meeting its external demand for AC.

(iv) If B’s labour hours are restricted to 6,00,000 hours?

(v) If B’s labour hours have no limitation?

(Present your answers from a financial perspective and with only relevant figures. A detailed profitability statement is not required)

Answer:

Basic Workings

Statement Showing “Contribution per unit” (₹)

| Particulars | Division A | Division B | |

| AC | PC | RAC | |

| External Demand (units) | 18000 | unlimited | 6000 |

| Selling Price …. (A) | 450 | 90 | 1050 |

| Direct Material | 25 | 10 | 100 |

| Imported Component | …… | … | 450 |

| Direct Labour & Overheads | 200 | 50 | 350 |

| Variable Cost …(B) | 225 | 60 | 900 |

| Contribution …(A)-(B | 225 | 30 | 150 |

| Hours | 4 | 1 | 10 |

| Contribution/ Hour | 56.25 | 30 | 15 |

![]()

Division A

Allocation of Hours on the basis of.contribution/hour

Production of AC = 18,000 units

Hours Required = 72,000 hrs (18,000 units × 4.0 hrs.)

Balance Hours Available = 48,000 hrs (1,20,000 hrs. – 72,000 hrs.)

Production of PC = 48,000 units (\(\frac{48,000 \mathrm{hrs}}{1 \mathrm{hr} / \mathrm{u}}\))

Note:

Analysis of Hours Available and Required in Division B

| Particulars | If Requirement | ||

| 6,000 units | 12,000 units | 15,000 units | |

| Hrs. Required for Manufacturing @ 10p.u. | 60,000 hrs. | 1,20,000 hrs. | 1,50,000 hrs. |

| Hrs. Required for Modification @ 2 p.u. | 12,000 hrs. | 24,000 hrs. | 30,000 hrs. |

| Total Hrs. Available | 6,00,000 hrs. | 6,00,000 hrs. | 6,00,000 hrs. |

Division B’s required hours are less than the available hours (considered various scenarios). Hence, the same has no impact on the figures arrived specifically for point (iii). (iv) & (v).

(i) Minimum Transfer Price per unit

li Requirement of B is 12000 units

Transfer Price = Variable Cost + Opportunity Cost

= ₹ 225 + \(\frac{(48,000 \text { hrs. } \times ₹ 30)}{12,000 \text { units }}\)

= ₹ 345

(ii) Minimum Transfer Price per unit

If Requirement of B is 15,000 units

Transfer Price = Variable Cost + Opportunity Cost

= ₹ 225 + \(\frac{(48,000 \text { hrs. } \times ₹ 30)+(12,000 \text { hrs. } \times ₹ 56.25)}{15,000 \text { units }}\)

= ₹ 366

![]()

(iii) Maximum Price (B will Offer A)

The price being paid to Outside Supplier less Cost of Modification

= ₹ 450 – ₹ 70

= ₹ 380

(iv) & (v)

Division B is not in a position to sell more than 6,000 units as given in the question and therefore any transfer of component from Division A of over 6,000 units will NOT be in the overall interest of the company. Although Division B has spare hours of 5,40,000 hours (6,00,000 – 60,000) which will not help it to increase its sales.

If division B able to sell entire units transferred, then

Company would be able to save ₹ 35 per unit.

Cost of Modified ‘AC’ vs Cost of Imported Component

| Particulars | Modified ‘AC’ (₹) | Imported Component (₹) |

| Transfer Price ‘AC’ | 345 | … |

| Cost of Modification (2 hrs. ×₹ 35) | 70 | … |

| Cost of Import | … | 450 |

| Effective Cost per unit | 415 | 450 |

![]()

Question 16.

ABC miners operates two divisions, one in Japan and other in United Kingdom (U.K). Mining Division is operated in Japan which is rich in raw emerald. (Nov 2017, 8 marks)

The other division is United Kingdom Processing Division. It processes the raw emerald into polished stone fit for human wearing.

The cost details of these divisions are as follows:

| Division | Japan Mining Division | United Kingdom Processing Division |

| Per carat of raw emerald | Per carat of polished emerald | |

| Variable Cost | 2,500 Yen | 150 Pound |

| Fixed Cost | 5,000 Yen | 350 Pound |

Several polishing companies in Japan buy raw emerald from other local Mining Companies at 9000 Yen per carat. Current Foreign Exchange Rate is 50 Yen = 1 Pound. Income Tax rates are 20% and 30% in Japan and the United Kingdom respectively.

It takes 2 carats of Raw Yellow emerald to yield 1 carat of Polished Stone. Polished emerald sell for 3,000 Pounds per carat.

Required:

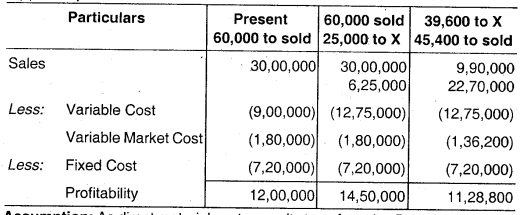

(i) Compute the transfer price for 1 carat of raw emerald transferred from Mining Division to the Processing Division under two methods – (a) 200% of Full Costs and (b) Market Price.

(ii) 1,000 carats of raw emerald are mined by the Japan Mining Division and then processed and sold by the U.K. Processing Division. Compute the after tax operating income for each division under both the Transfer Pricing Methods stated above in (i).

Answer:

(i) Calculation for transfer price for 1 carat of raw emerald transferred from Mining Division to the Processing Division under two methods (following are methods)

(a) 200% of full costs:

At 200% Of full costs = \(\frac{200 \% \times(2,500+5,000)}{50 \text { yenperpound }}\)

= £ 300

(b) At market price

Market Price = \(\frac{9,000}{50 \text { yenperpound }}\) = £ 180

![]()

(ii) Division and Company Profitability at different Transfer Prices (in $)

![]()

Question 17.

GL Ltd. is a multi product manufacturing concern functioning with four divisions. The Eleptrical Division of the company is producing many electrical products including electrical switches. This division functioning at its maximum capacity sells its switches in the open market at ₹ 25 each. The variable cost per switch to the division is ₹ 16. (May 2018)

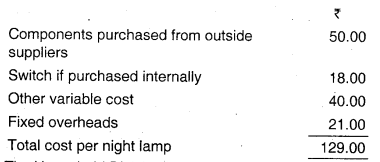

The Household Division, another division of GL Ltd., functioning at 70% capacity asked the Electrical Division to supply 5000 switches per month at the rate of ₹ 18 each to fit in night lamps produced by it. The total cost per night lamp is being estimated as detailed below:

The Household Division is marketing night lamps at a price of ₹ 130 each, with a very small margin, as it is doing business is a very competitive environment. Any increase in price made by the division will push out the division from the market. Therefore, the division cannot pay anything more to switches if they the Electrical Division. Further, the manager of the division informed that it is very much essential to keep on the market share for night lamps by the Household Division to retain the experienced workers of the division. The company is using return on investments (ROI) as a scale to measure the divisional performances and also marginal costing approach for decision making.

Required:

(i) Would you recommend the supply of switches to Household Division by Electrical Division at a price of ₹ 18 each? Substantiate your recommendation with suitable reasons. (5 marks)

(ii) Analyze whether it would be beneficial to the company as a whole the supply of switches to Household Division at a unit price of ₹ 18 by Electrical Division. (6 marks)

(iii) Do you feel that the Divisional Managers should accept the inter-divisional transfers in principle? If yes, what should be the range of transfer price? (5 marks)

(iv) Suggest the steps to be taken by the chief executive of the company to change the attitude of divisional heads if they are against the inter-divisional transfers. (4 marks)

Answer:

(i) Electrical Division is operating at full capacity and selling its switches in the open market at ₹ 25 each. Therefore, it can transfer its production internally by giving up equal number of units saleable in the open market.

In this situation, transfer price should be based on variable cost plus opportunity cost {₹ 16 + (₹ 25 – ₹ 16)} = ₹ 25/-.

As the price quoted by Household Division ₹ 18 is less than the transfer price based on opportunity cost, the Electrical Division should not accept internal transfer. Further, the company is measuring divisional performances based on ROI. Therefore, transferring for a price which is less than the minimum price would affect the return on investments and divisional performance severely.

![]()

(ii) In the total cost per night lamp, the Fixed Overheads being a fixed cost is not relevant for decision making. Similarly, the variable cost of switch (₹ 16 p.u.) included in the cost of night lamp is also irrelevant as it is common for both internal and external transfers. The only relevant cost is the loss of revenue when units are transferred internally.

Accordingly, the benefit from internal transfer would be {₹ 130 – (₹ 50 + ₹ 40) – ₹ 25) = ₹ 15/- on each unit sale on night lamp. Therefore, it is beneficial to the company as a whole to the extent of ₹ 15 per unit of night lamp sold.

Hence, internal transfer is profitable to the company as a whole. Further, Household Division is operating at 70% capacity and has experienced workers which may be utilized for other divisions requirements if any and based on contribution earned fixed cost could be minimized due to large scale of production.

(iii) Internal transfer pricing develops a competitive setting for managers of each division, it is possible that they may operate in the best interest of their individual performance. This can lead to sub-optimal utilization of resources. In such cases, transfer pricing policy may be established to promote goal congruence. The market price of ₹ 25 per switch leaves Electrical Division in an identical position to sale outside.

Thus, ₹ 25 is top of the price range. Division Household will not pay to Electrical Division anything above (₹ 130 – ₹ 50 – ₹ 40) = ₹ 40/-. The net benefit from each unit of night lamp sold internally is ₹ 15. Thus, any transfer price within the range of ₹ 25 to ₹ 40 per unit will benefit both divisions. Divisional Managers should accept the inter divisional transfers in principle when the transfer price is within the above range.

(iv) Transfer at marginal cost are unsuitable for performance evaluation since they do not provide an incentive for the supplying division to transfer goods and services internally. This is because they do not contain a profit margin for the supplying division.

Chief Executive’s intervention may be necessary to instruct the supplying division to meet the receiving division’s demand at the marginal cost of the transfers. Thus, divisional autonomy will be undermined. Transferring at cost plus a mark-up creates the opposite conflict. Here the transfer price meets the performance evaluation requirement but will not induce managers to make optimal decisions.

To resolve the above conflicts the following transfer pricing methods have been suggested:

![]()

Dual Rate Transfer Pricing System

The supplying division records transfer price by including a normal profit margin thereby showing reasonable revenue. The purchasing division records transfer price at marginal cost thereby recording purchases at minimum cost. This allows for better evaluation of each division’s performance. It also improves co-operation between divisions, promoting goal congruence and reduction of sub-optimization of resources.

Two Part Transfer Pricing System

This pricing system is again aimed at resolving problems related to distortions caused by the full cost based transfer price. Here, transfer price = marginal cost of production + a lump-sum charge (two part to pricing).

While marginal cost ensures recovery of additional cost of production related to the goods transferred, lump-sum charge enables the recovery of some portion of the fixed cost of the supplying division. Therefore, while the supplying division can show better profitability, the purchasing division can purchase the goods at lower rate compared to the market price.

![]()

Question 18.

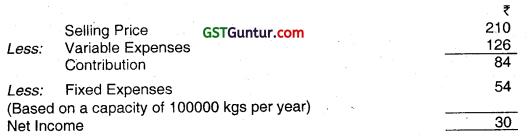

Usha Products Co. operates a Pulp Division that manufactures Wood Pulp for use in the production of various paper goods. The following informations are available : (Nov 2018,

Usha Products has just acquired a small company that manufacturers paper cartons. This company will be treated as a division of Usha with full profit responsibility. The newly formed Carton Division is currently purchasing 10,000 kgs of pulp per year from supplier at a cost of ₹ 210 per kg. less a 10% quantity discount. Usha’s President is anxious that the Carton Division begins purchasing its pulp from the Pulp Division if an acceptable transfer price can be worked out.

Required: (Answer any 2 items from situations I, II and III below)

Situation I

If the Pulp Division is in a position to sell all of its pulp to outside customers at the normal price of ₹ 210 per kg. will the Managers of the Carton and Pulp Division agree to transfer 10,000 kgs of pulp next year at a determined price? Explain with reasons. (5 marks)

Situation II

Assuming that the Pulp Division is currently selling only 60,000 kgs of pulp each year to outside customers at the stated price of ₹ 210 per kg. will the Managers agree to a mutually acceptable transfer price for 10,000 kgs of pulp in next year? Explain with reasons. (5 marks)

Situation III

If the outside supplier of the Carton Division reduces its price to ₹ 177 per kg. will the Pulp Division meet this price? Explain. If the Pulp Division does not meet the price of ₹ 177 per kg. what will be the effects on profits of the company as a whole? (5 marks)

Answer:

Situation I:

The lowest acceptable transfer price from the perspective of the selling division is given by the following formula:

Transfer price ≥ Variable cost + Per unit \( \frac{\text { Totalcontribution marginonlostsales }}{\text { Number of units transferred }}\)

The Pulp Division has no idle capacity, so transfers from the Pulp Division to the Carton Division would cut directly into normal sales of pulp to outsiders. Since the costs are the same whether the pulp is transferred internally or sold to outsiders, the only relevant cost is the lost revenue of ₹ 210 per kg from the pulp that could be sold to outsiders. This is confirmed below:

Transfer price ≥ ₹ 126 + \(\frac{(₹ 210-₹ 126) \times 10,000}{10,000}\) = ₹ 210

Therefore, the Pulp Division will refuse to transfer at a price less than ₹ 210 per kg.

![]()

The Carton Division can buy pulp from an outside supplier for ₹ 210 per kg, less a 10% quantity discount of ₹ 21, or ₹ 189 per kg. Therefore, the Division would be unwilling to pay more than ₹ 189 per kg.

Transfer Price ≤ Cost of Buying from Outside Supplier = ₹ 189

The requirements of the two divisions are incompatible. The Carton Division won’t pay more than ₹ 189 and the Pulp Division will not accept less than ₹ 210. Thus, there can be no mutually agreeable transfer price and no transfer will take place.

Situation II

The Pulp Division has idle capacity, so transfers from the Pulp Division to the Carton Division do not cut into normal sales of pulp to outsiders. In this case, the minimum price as far as the Carton Division is concerned is the variable cost per kg of ₹ 126. This is confirmed in the following calculation:

Transfer price ≥ ₹ 126 +\(\frac{₹ 0}{10,000}\) = ₹ 126

The Carton Division can buy pulp from an outside supplier for ₹ 189 per kg and would be unwilling to pay more than that for pulp in an internal transfer. If the managers understand their own businesses and are cooperative, they should agree to a transfer and should settle on a transfer price within the range:

₹ 126 ≤ Transfer price ≤ ₹ 189

Situation III

Yes, ₹ 177 is a bona fide outside price. Even though ₹ 177 is less than the Pulp Division’s ₹ 180 “full cost” per unit, it is within the range and therefore will provide some contribution to the Pulp Division.

If the Pulp Division does not meet the ₹ 177 price, it will lose ₹ 5,10,000 in potential profits.

10000 kgs × ₹ 51 per kg ₹ 5,10,000 potential increased profits.

This ₹ 5,10,000 in potential profits applies to the Pulp Division and to the company as a whole.

Note: For situation Ill also considered that “the Pulp Division is currently selling only 60,000 kgs of pulp each year to outside customers”.

![]()

Question 19.

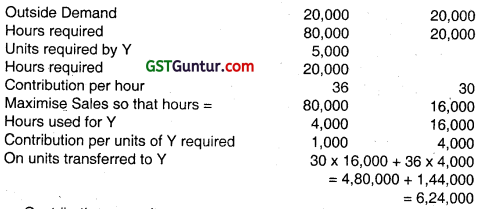

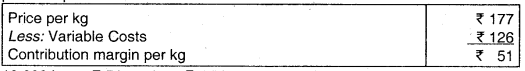

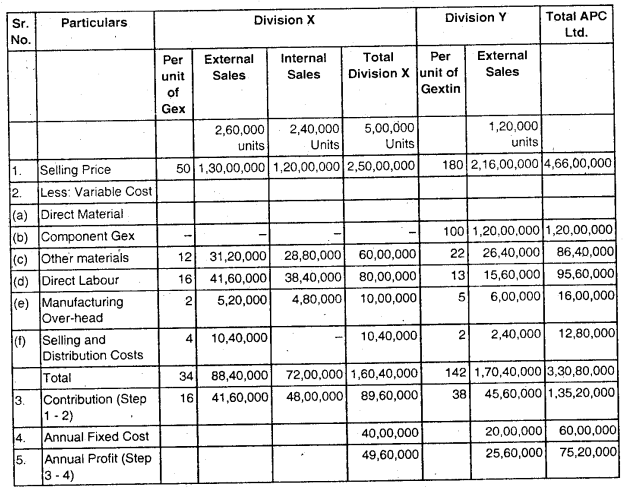

APC Ltd. has two divisions- Division X and Division Y with full profit responsibility. Division X produces components ‘Gex’ which is supplied to both division Y and external customers. (Nov 2019)

Division Y produces a product called ‘Gextin’ which incorporates component ‘Gex1. For one unit of ‘Gextin’ two units of component ‘Gex’ and other materials are used.

Till date, Division Y has always bought component ‘Gex‘ from division X at ₹ 50 per unit since the lowest price at which the component ‘Gex’ could have been bought by Division Y was ₹ 52 per unit.

Division X charges the same price for component ‘Gex’ to both division Y and external customers. However, it does not incur selling and distribution costs when transferring internally.

Division Y has received a proposal from a new supplier who has offered to supply component ‘Gex’ for ₹ 47 per unit at least for the next three years. Manager of Division Y requests the manager of Division X to supply component ‘Gex’ at or below ₹ 47 per unit. Manager of Division X is not ready to reduce the transfer price since the divisional performance evaluation is done based on profit margin ratio of the division.

The following additional information is made available to you:

![]()

Required:

(i) Calculate the present profit of each division and the company as a whole. (2 marks)

(ii) Analyse the impact on the total annual profits of each division and the company as a whole if Division Y accepts the offer of the new supplier. (4 marks)

(iii) In the changed scenario, discuss why the top management should intervene and advise a suitable transfer price for component ‘Gex’ for resolving transfer pricing conflict which promotes goal congruence through efficient performance of the concerned division. (4 marks)

Answer:

APC Ltd. Transfer Pricing

(i) Profitability of each division and the company as a whole when Division X supplies 240,000 units of Gex annually to Division Y.

Division Y produces 1,20,000 units of Gextin. Each component of Gextin requires 2 components of Gex that it currently procures from Division X. Therefore, it procures 2,40,000 units of Gex from Division X annually. Division X has an overall capacity of 5,00,000 units annually to produce Gex. Of this it produces 2,40,000 units for Division Y, which it must first cater to. The remaining 2,60,000 units of Gex is sold to external customers.

Note:

Division X does not incur marketing costs on internal sales. Therefore, cost not incurred on transfer of 240000 units to Division Y.

![]()

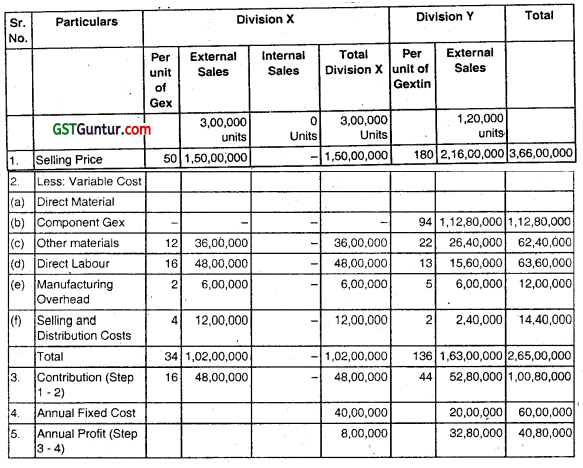

(ii) Impact if Division Y accepts to buy 240,000 units of Gex annually from the external supplier ₹ 47 ner unit of Gex.

Analysis

APCLtd

Overall profitability of APC Ltd. reduces from ₹ 75,20,000 per annum to ₹ 40,80,000 per annum. The reduction in profit is therefore ₹ 34,40,000 per annum. Reasons are:

(a) The cost of manufacturing Gex is only ₹ 30 per unit while Division Y is procuring this at ₹ 47 per unit from an external supplier. Annually this results in a loss of ₹ 40,80,000 (240,000 units of Gex × ₹ 17 per unit).

(b) Since Division X no longer makes Gex for internal sales, it can ramp up its external sales to meet the full annual demand of 300,000 units. This results in extra external sales of 40,000 units annually. Each unit gives a contribution of ₹ 16 per unit. Therefore, additional contribution from sale of 40,000 units of Gex to external customers is ₹ 640,000 per annum.

(c) Therefore, netting both (a) and (b) above, the net loss to the company is ₹ 34,40,000 per annum.

![]()

Division Y

Impact on profit of Division Y, increase from₹ 25,60,000 per annum to 32,80,000 per annum that is ₹ 7,20,000 per annum increase. This is due to the savings in procurement cost of Gex for Division Y. Instead of procuring Gex at 50 per unit Division Y proposes to buy it at ₹ 47 per unit externally. For its annual demand of 2,40,000 units of Gex, it translates to savings of ₹ 7,20,000 annually in procurement cost for Division Y.

Division X

Impact on profit of Division X, reduction from ₹ 49,60,000 per annum to ₹ 8,00,000 per annum. A substantial reduction of ₹ 41,60,000 in its divisional profit per year. Division X earns a contribution of ₹ 20 per unit of Gex from its internal transfer to Division Y. (Selling price ₹ 50 per unit less variable cost of manufacturing ₹ 30 per unit). If Division Y procures Gex externally, this would result in an annual loss of ₹ 48,00,000 in contribution for Division ₹ (240,000 units × ₹ 20 per unit).

However, due to additional external sales of 40,000 units of Gex, Division X can earn an additional contribution of ₹ 6,40,000 per year (40,000 units of Gex × ₹ 16 contribution per unit of external sale). Offsetting, this results in a lower contribution of ₹ 41,60,000 per annum for Division X. This also results in excess capacity of 2,00,000 units per annum in Division X.

(iii) APC Ltd. can suffer a loss of ₹ 34,40,000 per annum if Division Y decides to procure Gex from the external supplier. It costs on ₹ 30 per unit to manufacture Gex internally as compared to ₹ 47 per unit that ‘ Division Y is willing to pay to the external supplier.

However, Division X is unwilling to reduce the price from ₹ 50 per unit since divisional performance is done based on the profit margin ratio of the division. Therefore, the management of the company has to step in to promote goal congruence. If Division Y buys GEX from the external supplier, not only is it costly for the company, it also results in a lot of unused capacity lying idle in Division X.

In the current scenario, one possible way of arriving at an acceptable transfer price range could be:

Division X is currently working at full capacity of 5,00,000 units per annum. Of this production, 2,40,000 units is supplied internally to Division Y while the balance is supplied to external market. The marginal cost of production of Gex is ₹ 30 per unit. If this were sold externally, it would earn a contribution of ₹ 16 per unit. Therefore, the minimum transfer price the Division X would demand = marginal cost of production per unit + opportunity cost per unit = ₹ 30 + ₹ 16 = ₹ 46 per unit of Gex.

![]()

(The other way of looking at this could also be that Division X does not incur any selling and distribution costs on internal transfers. To outside clients it needs to spend ₹ 4 per unit towards the same. Therefore, to make its price more competitive with the external market, Division X can reduce the price by ₹ 4 per unit, which it his been recovering from Division Y for a cost it does not incur in internal transfers. Thus, based on its cost structure and the competitive profit margin it earns from external sales, it can price its internal transfers at ₹ 46 per unit.)

Division Y will be willing to pay the lower of net marginal revenue or the external buy- in price.

The Net Marginal Revenue per unit of Gextin = Selling price per Gextin – (marginal cost for Division Y other than the cost of Gex) = ₹ 180 – ₹ 42 = ₹ 138 per unit of Gextin. This translates that Division Y will be willing to pay upto ₹ 69 per unit of Gex, that it can incur without incurring a divisional loss. Meanwhile, the external buy-in price is ₹ 47 per unit. Therefore, the maximum price Division Y will be willing to pay = lower of Net Marginal Revenue or external buy-in price = lower of ₹ 69 or ₹ 47 per unit of Gex. Therefore, Division Y will be willing to pay maximum ₹ 47 per unit of Gex to Division X.

Therefore, the transfer price range can be set between ₹ 46 – ₹ 47 per unit of Gex. Division X would then have to compete with the external supplier to retain its internal sales. This would promote more efficient working between Division X and Y. By selling it at ₹ 46 per unit, the contribution of Division X would be maintained at ₹ 16 per unit. For Division Y. the procurement of Gex at ₹ 46 per unit would be beneficial since it is lower than the external market price. If transfer price set at external market rate ₹ 47 per unit, Division Y would still be able to improve its profit margin as compared to the original transfer price of ₹ 50 per unit.

Given that the marginal cost of manufacturing Gex is only ₹ 30 per unit, the management has to ensure that production of Gex is made in-house. Performance measure at a divisional level should then not be restricted to financial performance alone (full profit responsibility) and should be accordingly modified to include non- financial / operational measures as well.

![]()

Question 20.

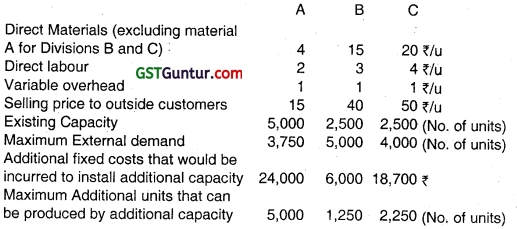

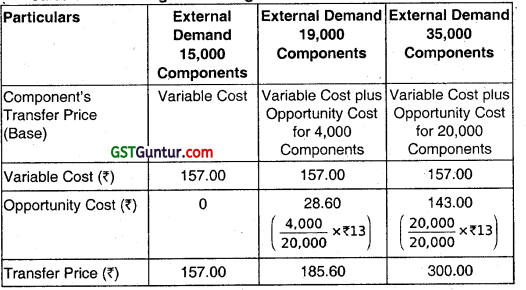

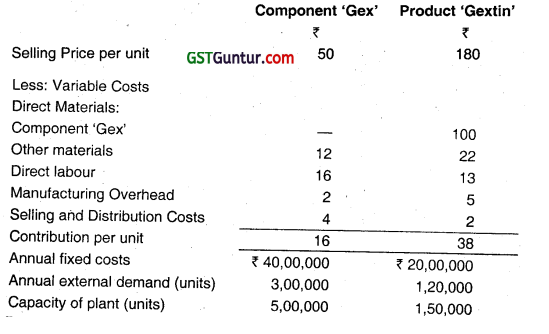

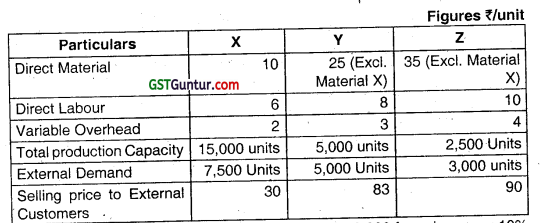

TRISEL Ltd. makes three products X, Y and Z in Divisions A, B and C respectively. The division X is currently working at 60%, Y is working at 80% and Z is working at 100% of the total production capacity. (Nov 2020, 10 marks)

The following information is given:

The company has to incur additional fixed cost of ₹ 9,000 for using every 10% of idle production capacity. Production capacity cannot be enhanced beyond total production capacity.

Product X can be used as input material for Y and Z. Product X is available in the market at ₹ 30 per unit. Each unit of Y and Z need one unit of X as their input material.

X supplies the product without any defects, error free for direct use at shop floor without any further quality inspection to Y and Z. If Y gets transfer of material from X, it can be directly used, but if it buys from outside vendor, it has to pay ₹ 30 plus quality inspection charges of ₹ 2. Z gets material from outside vendor at ₹ 30. If it buys from X, it has to slightly alter the product X which will cost ₹ 3 as alteration cost.

X wants to fix uniform transfer price for both Y and Z. This price will be for divisional transfer only and it has nothing to do with outside sales.

Required:

Recommend the best strategy for each division and company as a whole.

![]()

Question 21.

Alpha and Beta are two divisions of the Active Multinational Ltd. (AML). The Division Alpha manufactures auto components which it sells to other divisions and external customers. (Jan 2021)

The Division Beta has designed a new product, Product BZ, and has asked Division Alpha to supply the auto component, Component AX, that is needed in the new product. Each unit of Product BZ will require one Component AX. This Component will not be sold by Division Alpha to external customers. Division Alpha has quoted a transfer price to Division Beta of ₹ 40 for each unit of Component AX.

It is the policy of the company to reward managers based on their individual division’s return on capital employed.

Division Alpha produces the Component AX in batches of 1000 units. The maximum capacity is 8000 Components per month. Variable costs amount to ₹ 12 per component. Fixed costs per month are ₹ 60,000.00 which is specifically incurred to produce Component AX.

Product BZ will be produced in batches of 1000 units in Division Beta. The maximum customer demand is 8000 units of Product BZ. Variable Costs will be ₹ 8 per unit plus the cost of component AX. Fixed costs of ₹ 90,000.00 are to be incurred specifically to produce Product BZ.

The head of Division Beta has given the following forecast:

| Demand | Selling price per unit (₹) |

| 2000 units | 120 |

| 4000 units | 100 |

| 5000 units | 90 |

| 6000 units | 82 |

| 7000 units | 70 |

| 8000 units | 65 |

Required :

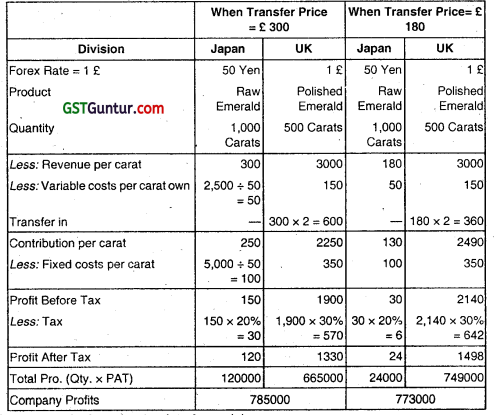

(a) Calculate, based on a transfer price of ₹ 40 per Component AX, the monthly profit that would be earned as a result of selling Product BZ by (Here the situation is governed by the actions of the manager of Division Beta):

(i) Division Beta

(ii) Division Alpha

(iii) Company as a whole (5 marks)

![]()

(b) Find out the profit maximizing output from the sale of Product BZ for the Active Multinational Ltd. (6 marks)

(c) Calculate, using the marginal cost of Component AX as the transfer price, the monthly profit that would be earned as a result of selling Product BZ by

(i) Division Alpha

(ii) Division Beta

(iii) Company as a whole (3 marks)

(d) The Operation Head of the company requires internal transfer between the divisions at marginal cost from the overall company’s perspectives. If marginal cost is used as the transfer price the manager of the Division Alpha will not be motivated as there will be no incentive to the division to transfer components internally.

What transfer pricing policy would you suggest to help the company to overcome the conflict between optimum decision making and performance evaluation? (6 marks)