Defective Return Notice Under Section 139 (9): An income tax is a form of direct tax levied by the Government on its citizens’ income. The income tax return is a statement that assesses the financial position of a person in a financial year. It is a statement showing the position of a person with all his sources of revenue and deductions, and at the end, it shows the amount of tax payable or tax refund.

The income tax return has to be filed at the end of every financial year. When a person files his/her tax return, it is checked, assessed, and processed bit by bit by the Income-tax department. The income-tax department matches all the information provided by you, such as your income sources, tax deducted with the information available with them. If all the information is correct, the department sends a final intimation under section 143(1), which says that you have filed your income tax return.

At times, people filling income tax return receive a notice from the Income-tax department that says, Defective return u/s 139(9). Why does this happen? What is a defective return notice?

A defective return notice under section 139(9) is issued to a person when the tax information provided by him is either incorrect or is missing.

Here in this article, you will get all the information regarding defective return notice and steps to respond to them.

Reasons That Render An Income Tax Return Defective

There are multiple reasons that can render an income tax return defective. Here we have mentioned those reasons:

- The first and the most common error is when a person does not submit his/her Permanent Account Number (PAN), employer details, income details or tax paid.

- Another error that can prove an income tax return as defective is when the tax deducted has been claimed as a refund. But there is no income information related to such deduction is available.

- It is essential for the taxpayers that they furnish updated record of self-assessment tax paid. The details of tax challans numbers and other relevant information shall be filled in correctly. If the tax and interest have not been paid or information regarding it is not available, then it can render your ITR defective.

- Not paying tax on bank deposits such as FDs and other such deposits can prove your income tax return as defective. Every bank deducts a 10% tax at the source on FDs and submits the documents to the income tax department. But persons coming under 20-30% tax slabs have to pay the remaining tax amount, which they don’t. This error can result in a defective income tax return.

- An income tax return statement can be treated as defective when a person has not attached a balance sheet and profit and loss statement to the income tax return statement.

- When a person’s total presumptive income is less than 8% of gross turnover or gross receipt, He/she has to file ITR-4. But most of the time, taxpayers file ITR-4S, which makes the income tax return defective. It is treated as error code 8 under the 139(9) section of the income tax act 1961.

- According to the provisions of section 139(9), the error code 14 states that an income tax return is treated as a defective return if there is any negative amount under the gross profit or net profit section.

- Lastly, an income tax return can be treated as a defective return if the tax determined is payable for ITR but is not paid. It is treated as an income tax error code 38 under section 139(9) of the Income Tax Act.

What To Do After You Receive Defective Return Notice

If a person receives a defective return notice under section 139(9) from the income tax department, he/she need to respond to it as soon as possible. In response to the notice, the person can file a revised statement within 15 days of receiving the notice. While filing the revised statement, it is essential to mention the date of receipt of the notice.

If a person cannot file the revised statement within the stipulated time, he/she can seek an extension from the Assessing Officer. But after the extension period, if a person fails to file the revised return, the Assessing Officer will treat the income-tax return as invalid.

Steps To Follow To Respond To The Defective Return Notice

Once you have filed the return and the income tax department has processed it, and you receive a defective return notice. You have to respond to the defective notice by filing a revised statement with the Assessing Officer. Here we have provided the detailed step-by-step process which will help you to respond to the defective notice under section 139(9).

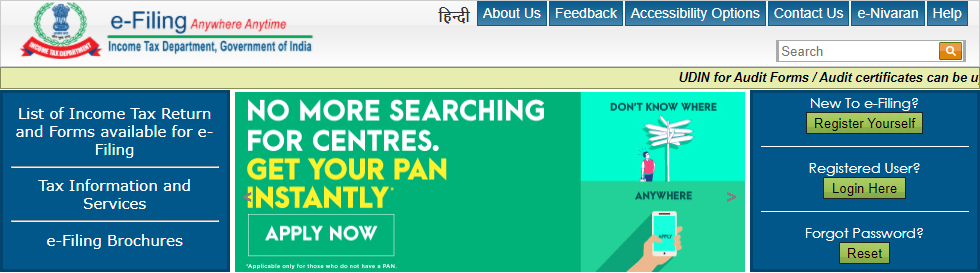

Step 1: Go to www.incometaxindiaefiling.gov.in. After opening the website, login into your account with your ID, password, and Date of Birth.

Step 2: If according to you, the notice sent by the Income-tax Department is correct, then you have to revise the ITR statement provided by you. For the revision of the ITR statement, click on the “e-file” tab and select “e-file in response to notice u/s 139(9)” from the drop-down menu.

Step 3: Once the page loads, you will find the notice under section 139(9) that has been issued to you. A defective return notice can either be issued by Assessing Officer or by the Central Processing Center. The process to respond in both cases are different.

Step 4: If you have received the defective return notice from the Assessing Officer, Click on the submit button.

Step 5: After the successful validation, upload the corrected XML file you have prepared and click on submit. Once the submission is made, a page with successful notice will be displayed on the screen.

Step 6: If the defective notice has been raised by the Central Processing Center and you agree with the defect, select ‘yes’ from under the “Do you agree with the defect?” column. Now, you can fill your Income-tax return by correcting the defect. Once you have corrected the defect, generate the XML file and upload it and then click submit. After successful submission, a success message will be displayed on the screen.

Step 7: In case if you do not agree with the defect, then click on ‘no’ from the “Do you agree with the defect?” column. After clicking on ‘no’, give the remarks under the “Assessee Remarks” column and click submit.

Withdrawal of Defective Response

In case if you want to withdraw any response submitted by you for defective return, it can also be done but within 3 days of filing such response. For withdrawal of the response, all you need to do is, click on the “withdrawal link” under the “Response Column”.

Once you click on it, the details of the response submitted by you will be displayed on the screen. Now, you need to agree with the withdrawal by checking the checkbox and clicking on the “Confirm Withdrawal” button. Once the response has been withdrawn successfully, a message will be displayed on the screen.

Conclusion

Income tax is a form of revenue for the Government of India, and every person has to file an Income-tax return. The tax so collected from the taxpayers is put into public use. Providing wrong information or manipulating income-related information can render your return statement defective, which can also lead to the cancellation of the return filed by you. It is essential to provide the correct information for tax calculation. In case you receive notice of a defective return, you should always respond to it.