Deductions from Gross Total Income – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Deductions from Gross Total Income – CA Inter Tax Question Bank

Question 1.

Answer the following with regard to the provisions of the Income-tax Act, 1961 :

Briefly explain provisions of Section 80U of the Income-tax Act, 1961, in respect of deduction available on permanent physical disability. (Nov 2008, 4 marks)

Answer:

Section 80U – Deduction in the Case of a Person with Disability: An

individual who is a resident and who is certified by a Medical Authority to be a person with disability at any time during the previous year, shall be entitled to deduction of ₹ 75,000. If it is case of severe disability, deduction shall be ₹ 1,25,000.

A copy of the certificate issued by the Medical Authority is reqaired to be furnished in respect of the assessment year for which the deduction is claimed along with the return of income, where the condition of disability requires reassessment of its extent after a period stipulated in the medical certificate, deduction for any year failing after expiry of the said period shall be allowed only if a new certificate is obtained and furnished. For the purpose of this section :

(a) “Disability means blindness; low vision; leprosy-cured; hearing impairment; loco motor disability; mental retardation; mental illness.

(b) “Person with disability” means a person suffering from not more than 80% of any disability as certified by a medical authority.

(c) “Person with severe disability” means a person with 80% or more of one ‘or more disabilities.

![]()

Question 2.

Mr. Abhik, an individual made payment of health insurance premium to GIC in an approved scheme. Premium paid on his health ₹ 10,000 and his spouse ₹ 15,000 during the year 2020-21. He also paid health insurance premium of ₹ 25,000 on his father’s health who is a senior citizen and not dependent on him. The payments have not been made by cash. Compue the amount of deduction under chapter VI-A of the Act, available to Mr. Abhik from his total income for the assessment year 2021-22. (May 2009, 3 marks)

Answer:

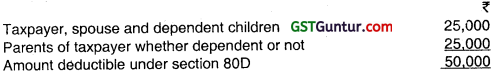

Amount deductible under Section 80D -The answer is as under:

Question 3.

Determine the eligibility and quantum of deduction under Chapter VI-A in the following case:

(2) Contribution to notified pension scheme (referred to in Section 80 CCD) by the- employer ₹ 40,000 for an employee whose basic salary plus dearness allowance is ₹ 3,00,000 for the year. (Nov 2014, 4 marks)

Answer:

Employer’s contribution to notified pension scheme qualifies for deduction under Section 80CCD(2).

The deduction under Section 80CCD(2) would be restricted to ₹ 30,000 (being 10% of ₹ 3,00,000), However, an additional deduction of ₹ 50,000 is available u/s 80CCD (1B) on payment in excess of 10%. Hence, ₹ 40,000 qualifies for deduction.

However, the deduction of employer’s contribution of ₹ 40,000 to pension scheme would be over and above the deductions which are subject to the limit of ₹ 1.5 lakhs under Section 80CCE.

![]()

Question 4.

Compute the eligible deduction under Chapter VI-A for the Assessment year 2021-22 of Ms. Roma, who has a gross total income of ₹ 15,00,000 for the assessment year 2021-22 and provide the following informations about his investments/payments during the year 2020-21: (May 2015, 4 marks)

Answer:

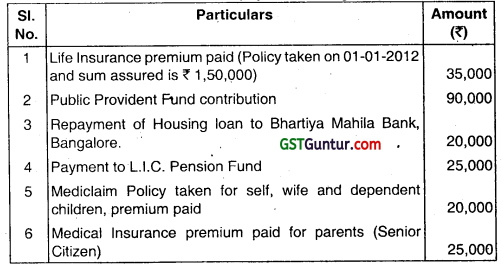

Deduction under Chapter VI-A Sec, 80C

![]()

Question 5.

Mr. Srivastava, aged 40 years, a salaried employee of Nirja Ltd. was contributing to National Pension Scheme ₹ 50,000 every year since 2018 and was claiming deduction under section 80CCD. In December 2020, he opted out of the pension scheme and withdrew a lump sum amount of ₹ 2,00,000.

Is the amount so withdrawn taxable? If yes, how much is the taxable amount? (Nov 2017, 5 marks)

Answer:

As per Section 80CCD(3), any payment from NPS to an employee [out of amount standing to the credit in his account in respect of which deduction under Section 80CCD has been allowed together with amount accrued thereon] on account of closure or his opting out of the pension scheme shall be deemed to be his income of the previous year in which the amount is received and would, accordingly, be chargeable to tax in his hands in that year.

However, as per Section 10(12A), any payment from NPS Trust to an employee on account of closure or his opting out of the pension scheme referred to in Section 80CCD, to the extent it does not exceed 60% of the total amount payable to him at the time of closure or his opting out of the scheme, shall be exempt from tax.

Accordingly, ₹ 1,20,000 (being 60% of lump sum withdrawal of ₹ 2 lakh) is exempt. The balance amount of ₹ 80,000 (₹ 2,00,000 – ₹ 1,20,000) would be deemed as Mr. Srivastava’s income of P.Y.2019-20 and would be chargeable to tax in his hands in that year, under the head “Income from other sources”.

![]()

Question 6.

Examine the following statements with regard to the provisions of the Income-tax Act, 1961:

(a) For grant of deduction under Section 80-IB, filing of audit report in prescribed form is must for a corporate assessee; filing of return within the due date laid down in Section 139(1) is not required.

(b) Filing of belated return under section 139(4) of the Income-tax Act, 1961 will debaran assessee from claiming deduction under section 80-IE.

Answer:

(a) The statement is not correct. Section 80AC stipulates compulsory filing of return of income on or before the due date specified under Section 139(1), as a pre-condition for availing the benefit of deduction, inter alia, under Seetion 80-IB.

(b) The statement is correct. As per Section 80AC, the assessee has to furnish his return of income on or before the due date specified under Section 139(1), to be eligible to claim deduction under, inter alia, section 80-IE.

![]()

Question 7.

Compute the eligible deduction under Section 80C for A.Y. 2021-22 in respect of life insurance premium paid by Mr.Ganesh during the P.Y. 2020-21, the details of which are 9iven hereunder:

| Date of issue of policy | Person insured | Actual capital sum assured (₹) | Insurance premium paid during 2020- 21 (₹) | |

| (i) | 31/3/2012 | Self | 5,00,000 | 40,000 |

| (ii) | 1/5/2015 | Spouse | 1,50,000 | 20,000 |

| (iii) | 1/6/2017 | Handicapped Son (section 80 U disability) | 4,00,000 | 80,000 |

Answer:

| Date of issue of policy | Person insured | Actual capital sum assured (₹) | Insurance premium paid during 2020-21 (₹) | Deduction u/s 80C for A.Y.2021- 22 (₹) | Remark (restricted to % of sum assured) | |

| (‘) | 31/3/2012 | Self | 5,00,000 | 40,000 | 40,000 | 20% |

| (ii) | 1/5/2015 | Spouse | 1,50,000 | 20,000 | 15,000 | 10% |

| (iii) | 1/6/2017 | Handicapped son (section 80U disability) | 4,00,000 | 80,000 | 60,000 | 15% |

| Total | 1,15,000 |

![]()

Question 8.

An individual assessee, resident in India. has made the following deposit / payment during the previous year 2020-21:

| Particulars | ₹ |

| Contribution to the public provident fund

Insurance premium paid on the life of the spouse (policy taken on 1.4.2015) (Assured value ₹ 2,00,000) |

1,50,000

25,000 |

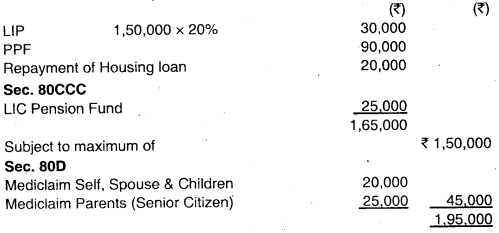

What is the deduction allowable under Section 80C for A.’Y .2021-22?

Answer:

Computation of deduction under Section 80C for A.Y.2021-22

![]()

Question 9.

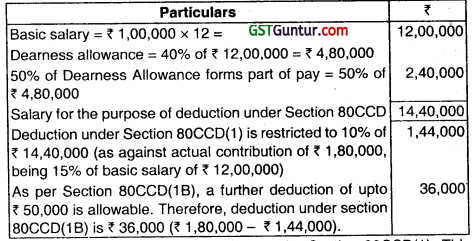

The basic salary of Mr. A is ₹ 1,00,000 p.m. He is entitled to dearness allowance, which is 40% of basic salary. 50% of dearness allowance forms part of pay for retirement benefits. Both Mr. A and his employer contribute 15% of basic salary to the pension scheme referred to in Section 80CCD. Explain the tax treatment in respect of such contribution in the hands of Mr. A.

Answer,

Tax treatment in the hands of Mr. A in respect of employer’s and own contribution to pension scheme referred to in Section 80CCD

(a) Employer’s contribution to such pension scheme would be treated as salary since it is specifically included in the definition of “salary” under Section 17(1 )(viii). Therefore, ₹ 1,80,000, being 15% of basic salary of ₹ 12,00,000, will be included in Mr. A’s salary.

(b) Mr. A’s contribution to pension scheme is allowable as deduction under Section 80CCD(1). However, the deduction is restricted to 10% of salary.

Salary, for this purpose. means basic pay plus dearness allowance, if it forms part of pay.

Therefore, “salary” for the purpose of deduction under Section 8OCCD for Mr. A would be –

₹ 1,44,000 is allowable as deduction under Section 8OCCD(1). This would be taken into consideration and be subject to the overall limit of ₹ 1,50,000 under Section 8OCCE. ₹ 36,000 allowable as deduction under Section 8OCCD(1 B) is outside the overall limit of ₹ 1,50,000 under Section 8OCCE.

In the alternative, ₹ 50,000 can be claimed as deduction under Section 8OCCD(1B). The balance ₹ 1,30,000 (₹ 1,80,000 – ₹ 50,000) can be claimed as deduction under Section 8OCCD(1).

![]()

(c)

| 80CCD(2) | Contribution by the Central Government to NPS A/c of its employees (outside the limit of ₹ 1,50,000 under section 80CCE) | 14% of salary |

| Contribution by any other employer to NPS A/c of its employees (outside the limit of ₹ 1,50,000 under section 80CCE) | 10% of salary |

Assuming in the given case employer is other than Government. Hence the deduction limit is maximum 10% of salary. Therefore, deduction under Section 8OCCD(2), would also be restricted to ₹ 1,44,000, even though the entire employer’s contribution of ₹ 1,80,000 Ls included in salary under Section 17(1 )(viii).

However, this deduction of employer’s contribution of ₹ 1,44,000 to pension scheme would be outside the overall limit of ₹ 1,50,000 under Section 8OCCE i.e., this deduction would be over and above the other deductions which are subject to the limit of ₹ 1,50,000.

![]()

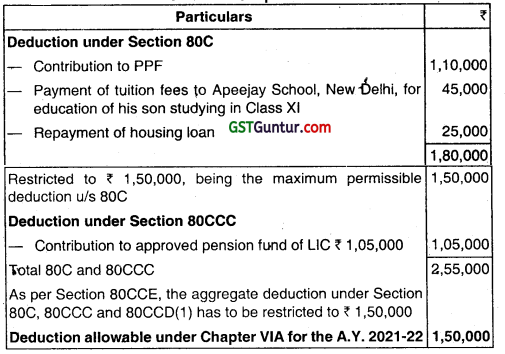

Question 10.

The gross total income of Mr. X for the A.Y.2021-22 is 5,00,000. He has made the following investments/payments during the F.Y.2020-21:

| Particulars | ₹ | |

| 1. | Contribution to PPF | 1,10,000 |

| 2. | Payment of tuition fees to Apeejay School, New Delhi, for education of his son studying in Class XI | 45,000 |

| 3. | Repayment of housing loan taken from Standard Chartered Bank | 25,000 |

| 4. | Contribution to approved pension fund of LIC | 1,05,000 |

Compute the elIgible deduction under Chapter VI-A for the A.Y.2021 -22.

Answer:

Computation of deduction under Chapter VI-A for the A.Y.2021 -22

![]()

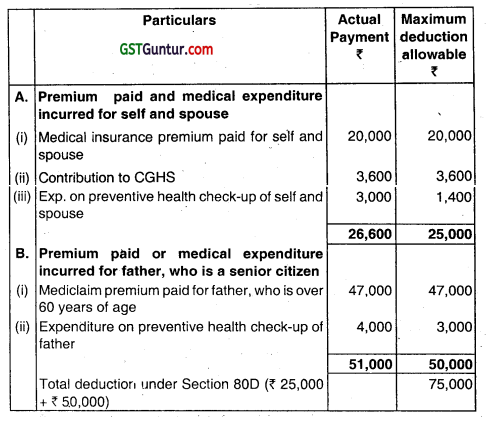

Question 11.

Mr. A, aged 40 years, paid medical insurance premium of ₹ 20,000 during the P.Y.2020-21 to insure his health as well as the health of his spouse. He also paid medical insurance premium of ₹ 47,000 during the year to insure the health of his father, aged 63 years, who is not dependent on him. He contributed ₹ 3,600 to Central Government Health Scheme during the year. He has incurred ₹ 3,000 in cash on preventive health check-up of himself and his spouse and ₹ 4,000 by cheque on preventive health check-up of his father. Compute the deduction allowable under Section 80D for the A.Y.2021-22.

Answer:

Deduction allowable under Section 80D for the A.Y.2021-22

![]()

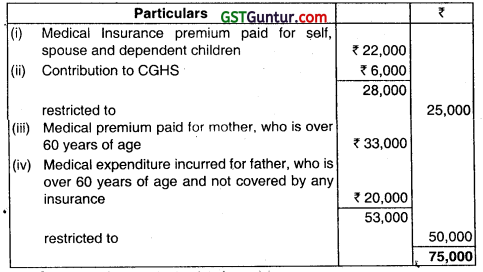

Question 12.

Mr. Y, aged 40 years, paid medical insurance premium of ₹ 22,000 during the P.Y.2020-21 to insure his health as well as the health of his spouse and dependent children. He also paid medical insurance premium of ₹ 33,000 during the year to insure the health of his mother, aged 67 years, who is not dependent on him. He incurred medical expenditure of ₹ 20,000 on his father, aged 71 years, who is not covered under mediclaim policy. His father is also not dependent upon him. He contributed ₹ 6,000 to Central Government Health Scheme during the year. Compute the deduction allowable under Section 80D for the A.Y.2021-22.

Answer:

Deduction allowable under Section 80D for the A.Y.2021-22

Question 13.

Mr. X is a resident individual. He deposits a sum of ₹ 50,000 with Life Insurance Corporation every year for the maintenance of his handicapped grandfather who is wholly dependent upon him. The disability is one which comes under the Persons with Disabilities (Equal Opportunities, Protection of Rights and Full Participation) Act, 1995. A copy of the certificate from the medical authority is submitted. Compute the amount of deduction available under Section 80DD for the A.Y. 2021-22.

Answer :

Since the amount deposited by Mr. X was for his grandfather, he will not be allowed any deduction under Section 80DD. The deduction is available if the individual assessee incurs any expense for a dependant disabled person. Grandfather does not come within the definition of dependant.

![]()

Question 14.

What will be the deduction if Mr. X had made this deposit for his dependant father?

Answer:

Since the expense was incurred for a dependant disabled person, Mr. X will be entitled to claim a deduction of ₹ 75,000 under Section 80DD, irrespective of the amount deposited. In case his father has severe disability, the deduction would be ₹ 1,25,000.

Question 15.

Mr. B has taken three education loans on April 1, 2020, the details of which are given below:

| Loan 1 | Loan 2 | Loan 3 | |

| For whose’ education loan was taken | B | Son of B | Daughter of B |

| Purpose of loan | MBA | B. Sc. | B.A. |

| Amount of loan (₹) | 5,00,000 | 2,00,000 | 4,00,000 |

| Annual repayment of loan (₹) | 1,00,000 | 40,000 | 80,000 |

| Annual repayment of interest (₹) | 20,000 | 10,000 | 18,000 |

Compute the amount deductible under Section 80E for the A.Y.2021 -22.

Answer :

Deduction under Section 80E is available to an individual assessee in respect of any interest paid by him in the previous year in respect of loan taken for pursuing his higher education or higher education of his spouse or children. Higher education means any course of study pursued after senior secondary examination.

Therefore, interest repayment in respect of all the above loans would be eligible for deduction.

Deduction under Section 80E = ₹ 20,000 + ₹ 10,000 + ₹ 18,000 = ₹ 48,000.

![]()

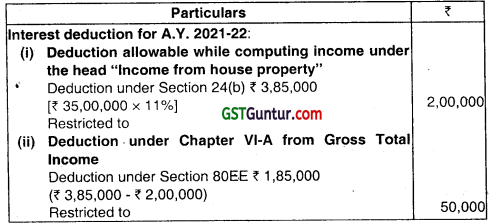

Question 16.

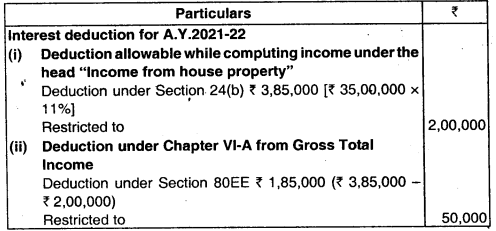

Mr. A purchased a residential house property for self-occupation at a cost of ₹ 45 lakh on 1.4.2019, in respect of which he took a housing loan of ₹ 35 lakh from Bank.of India @11% p.a. on the same date. The loan was sanctioned on 28th March, 2019. Compute the eligible deduction in respect of interest on housing loan for A.Y.2021 -22 under the provisions of the Income-tax Act, 1961, assuming that the entire loan was outstanding as on 31.3.2021 and he does not own any other house property.

Answer:

![]()

Question 17.

Mr. Shiva aged 58 years, has gross total income of ₹ 7,75,000 comprising of income from salary and house property. He has made the following payments and investments:

(i) Premium paid to insure the life of her major daughter (policy taken on 1.4.2018) (Assured value ₹ 1,80,000) – ₹ 20,000.

(ii) Medical Insurance premium for self – ₹ 12,000; Spouse – ₹ 14,000.

(iii) Donation to a public charitable institution registered under 80G ₹ 50,000 by way of cheque.

(iv) LlC Pension Fund – ₹ 60,000.

(v) Donation to National Children’s Fund – ₹ 25,000 by way of cheque

(vi) Donation to Jawaharlal Nehru Memorial Fund – ₹ 25,000 by way of cheque

(vii) Donation to approved institution for promotion of family planning – ₹ 40,000 by way of cheque

(viii) Deposit in PPF – ₹ 1,00,000

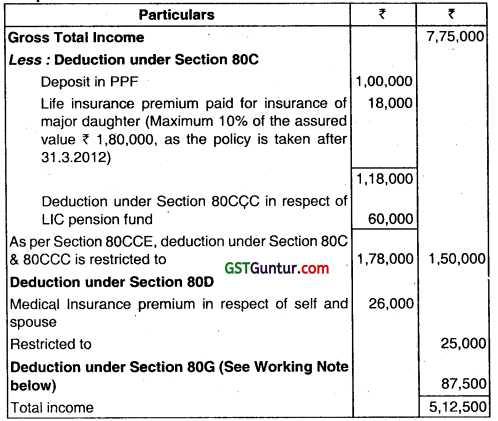

Compute the total income of Mr. Shiva for A.Y. 2021-22.

Answer:

Computation of Total Income of Mr. Shiva for A.Y. 2021-22

Working Note: Computation of deduction under Section 80G

Note : Adjusted total income = Gross Total Income – Amount of deductions under Section 80C to 80U except Section 80G i.e., ₹ 6,00,000, in this case. ₹ 60,000, being 10% of adjusted total income is the qualifying limit, in this case.

Firstly, donation of ₹ 40,000 to approved institution for family planning qualifying for 100% deduction subject to qualifying limit, has to be adjusted against this amount. Thereafter, donation to public charitable trust qualifying for 50% deduction, subject to qualifying limit is adjusted.

Hence, the contribution of ₹ 50,000 to public charitable trust is restricted to ₹ 20,000 (being, ₹ 60,000 – ₹ 40,000), 50% of which would be the deduction under Section 80G. Therefore, the deduction under Section 80G in respect of donation to public charitable trust would be ₹ 10,000, which is 50% of ₹ 20,000.

![]()

Question 18.

Mr. Ganesh, a businessman, whose total income (before allowing deduction under Section 80GG) for A.Y.2021-22 is ₹ 4,60,000, paid house rent at ₹ 12,000 p.m.. in respect of residential accommodation occupied by him at Mumbai. Compute the deduction allowable to him under Section 80GG for A.Y.2021-22.

Answer:

The deduction under Section 80GG will be computed as follows:

- Actual rent paid less 10% of total income

\(\frac{₹ 1,44,000(-)(10 \times 4,60,000)}{100}\) = ₹ 98 000 (A) - 25% of total income

\(\frac{25 \times 4,60,000}{100}\) = ₹ 1,15,000 (B) - Amount calculated at ₹ 5,000 p.m. = ₹ 60,000 (C)

Deduction allowable [least of (i), (ii) and (iii)] = ₹ 60,000

![]()

Question 19.

During the P.Y.2020-21, ABC Ltd., an Indian company,

- contributed a sum of ₹ 2 lakh to an electoral trust; and

- incurred expenditure of ₹ 25,000 on advertisement in a brochure of a political party.

Is the company eligible for deduction in respect of such contribution/expenditure, assuming that the contribution was made by cheque? If so, what is the quantum of deduction?

Answer :

An Indian company is eligible for deduction under Section 80GGB in respect of any sum contributed by it in the previous year to any political party or an electoral trust. Further, the word “contribute” in Section 80GGB has the meaning assigned to it in Section 293A of the Companies Act, 1956, and accordingly, it includes the amount of expenditure incurred on advertisement in a brochure of a political party.

Therefore, ABC Ltd. is eligible for a deduction of ₹ 2,25,000 under Section 80GGB in respect of sum of ₹ 2 lakh contributed to an electoral trust and ₹ 25,000 incurred by it on advertisement in a brochure of a political party.

It may be noted that there is a specific disallowance under Section 37(2B) in respect of expenditure incurred on advertisement in a brochure of a political party. Therefore, the expenditure of ₹ 25,000 would be disallowed while computing business income/gross total income. However, the said expenditure incurred by an Indian company is allowable as a deduction from gross total income under Section 80GGB.

![]()

Question 20.

Mr. A has commenced the business of manufacture of computers on 1.4.2020. He employed 350 new employees during the, the details of whom are as follows:

| No. of employees | Date of employment | Regular/ Casual | Total monthly emoluments per employee (₹) | |

| (i) | 75 | 1.4.2020 | Regular | 24,000 |

| (ii) | 125 | 1.5.2020 | Regular | 26,000 |

| (iii) | 50 | 1.8.2020 | Casual | 25,500 |

| (iv) | 100 | 1.9.2020 | Regular | 24,000 |

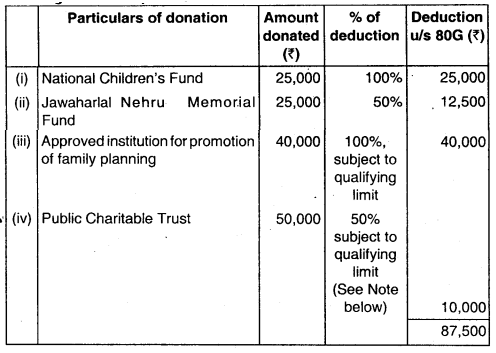

The regular employees participate in recognized provident fund while the casual employees do not. Compute the deduction, if any, available to Mr. A for A. Y.2021 – 22, if the profits and gains derived from manufacture of computers that year is ₹ 75 lakhs and his total turnover is 2.16 crores. What would be your answer if Mr. A has commenced the business of manufacture of footwear on 1.4.2020?

Answer:

Mr. A is eligible for deduction under Section 80JJAA since he is subject to tax audit under Section 44AB for A.Y.2021-22, as his total turnover from business exceeds ₹ 1 crore and he has employed “additional employees” during the P.Y.2020-21.

(I) If Mr. A is engaged in the business of manufacture of computers

Additional employee cost = ₹ 24,000 × 12 × 75 [See Working Note below]

= ₹ 2,16,00,000

Deduction under Section 80JJAA = 30% of ₹ 2,16,00,000 = ₹ 64,80,000.

![]()

Working Note:

Number of additional employees

Notes: Since casual employees do not participate in recognized provident fund, they do not qualify as additional employees. Further, 125 regular employees employed on 1.5.2020 also do not qualify as additional employees since their monthly emoluments exceed ₹ 25,000. Also, 100 regular employees employed on 1.9.2020 do not qualify as additional employees for the P.Y. 2020-21, since they are employed for less than 240 days in that year.

Therefore, only 75 employees employed on 1.4.2020 qualify as additional employees, and the total emoluments paid or payable to them during the P.Y. 2020-21 is deemed to be the additional employee cost.

![]()

(i) As regards 100 regular employees employed on 1.9.2020, they would be treated as additional employees for previous year 2021-22, if they continue to be employees in that year for a minimum period of 240 days. Accordingly, 30% of additional employee cost in respect of such employees would be allowable as deduction under Section 80JJAA in the hands of Mr. A for the A.Y. 2022-23.

(II) If Mr. A is engaged in the business of manufacture of footwear:

If Mr. A is engaged in the business of manufacture of footwear, then, he would be entitled to deduction under Section 80JJAA in respect of employee cost of regular employees employed on 1.9.2020, since they have been employed for more than 150 days in the previous year 2020-21.

Additional employee cost = ₹ 2,16,00,000 + ₹ 24,000 × 7 × 100 = ₹ 3,84,00,000 Deduction under Section 80JJAA = 30% of ₹ 3,84,00,000 = ₹ 1,15,20,000

![]()

Question 21.

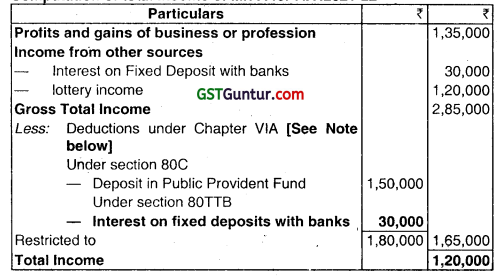

Mr. A, a resident individual aged about 61 years, has earned business income (computed) of ₹ 1,35,000, lottery income of ₹ 1,20,000 (gross) during the P.Y. 2020-21. He also has interest on Fixed Deposit of ₹ 30,000 with banks. He invested an amount of ₹ 1,50,000 in Public Provident Fund account. What is the total income of Mr. A for the A.Y.2021 -22?

Answer:

Computation to total income of Mr. A for A.Y. 2021-22

Note: Though the value of eligible deductions is ₹ 1,80,000, however, deduction under Chapter Vl-A cannot exceed the gross total income exclusive of long term capital gains taxable under Section 112 and Section 112A, short-term capital gains covered under Section 111A and winnings of lotteries of the assessee.

Therefore, the maximum permissible deduction under Chapter VI-A = ₹ 2,85,000 – ₹ 1,20,000 = ₹ 1,65,000.

In case of resident individuals of the age of 60 years or more, interest on bank fixed deposits qualifies for deduction upto ₹ 50,000 under Section 80TTB.

![]()

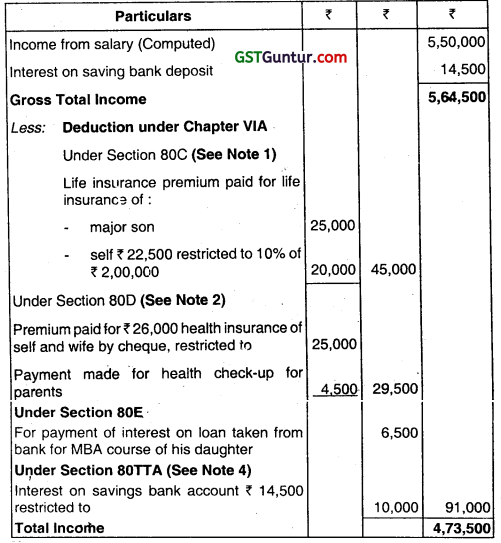

Question 22.

Mr. Gurnam, aged 42 years, has salary income (computed) of ₹ 5,50,000 for the previous year ended 31.03.2021. He has earned interest of ₹ 14,500 on the saving bank account with State Bank of India during the year. Compute the total income of Mr. Gurnam for the assessment year 2021-22 from the following particulars:

(i) Life insurance premium paid to Birla Sunlife Insurance in cash amounting to ₹ 25,000 for insurance of life of his dependent parents. The insurance policy was taken on 15.07.2017 and the sum assured on life of his dependent parents is ₹ 2,00,000.

(1) Life insurance premium of ₹ 25,000 paid for the insurance of life of his major son who is not dependent on him. The sum assured on life of his son is ₹ 2,75,000 and the life insurance policy was taken on 30.3.2013.

(2) Life insurance premium paid by cheque of ₹ 22,500 for insurance of his life. The insurance policy was taken on 08.09.2017 and the sum assured is ₹ 2,00,000.

(3) Premium of ₹ 26,000 paid by cheque for health insurance of self and his wife.

(4) ₹ 1,500 paid in cash for his health check-up and ₹ 4,500 paid in cheque for preventive health check-up for his parents, who are senior citizens.

(5) Paid interest of ₹ 6,500 on loan taken from bank for MBA course pursued by his daughter.

(6) A sum of ₹ 15,000 donated in cash to an institution approved for purpose of Section 80G for promoting family planning.

Answer:

Computation of total income of Mr. Gurnam for the Assessment Year 2021-22

![]()

Notes:

(1) As per Section 80C, no deduction is allowed in respect of premium paid for life insurance of parents whether they are dependent or not. Therefore, no deduction is allowable in respect of ₹ 25,000 paid as premium for life insurance of dependent parents of Mr. Gurnam.

In respect of insurance policy issued after 01.04.2012, deduction shall be allowed for life insurance premium paid only to the extent of 10% of sum assured. In case the insurance policy is issued before 01.04.2012, deduction of premium paid on-life insurance policy shall be allowed up to 20% of sum assured.

Therefore, in the present case, deduction of ₹ 25,000 is allowable in respect of life insurance of Mr. Gurnam’s son since the insurance policy was issued before 01.04.2012 and the premium amount is less than 20% of ₹ 2,75,000. However, in respect of premium paid for life insurance policy of Mr. Gurnam himself, deduction is allowable only up to 10% of ₹ 2,00,000 since, the policy was issued after 01.04.2012 and the premium amount exceeds 10% of sum assured.

![]()

(2) As per Section 80D, in case the premium is paid in respect of health of a person specified therein and for health check-up of such person, deduction shall be allowed up to ₹ 25,000. Further, deduction up to ₹ 5,000 in aggregate shall be allowed in respect of health check-up of self, spouse, children and parents. In order to claim deduction under Section 80D, the payment for health-checkup can be made in any mode including cash. However, the payment for health insurance premium has to be paid in any mode other than cash.

Therefore, in the present case, in respect of premium of ₹ 26,000 paid for health insurance of self and wife, deduction would be restricted to ₹ 25,000. Since the limit of ₹ 25,000 has been exhausted against medical insurance premium, no deduction is allowable for preventive health check-up for self and wife. However, deduction of ₹ 4,500 is allowable in respect of health check-up of his parents, since it falls within the limit of ₹ 5,000.

(3) No deduction shall be allowed under Section 80G in case the donation is made in cash of a sum exceeding ₹ 2,000. Therefore, no deduction is allowed under Section 80G in respect of donation made to institution approved therein.

(4) As per Section 80TTA, deduction shall be allowed from the gross total income of an individual or Hindu Undivided Family in respect of income by way of interest on deposit in the savings account included in the assessee’s gross total income, subject to a maximum of ₹ 10,000. Therefore, a deduction of ₹ 10,000 is allowable from the gross total income of Mr. Gurnam, though the interest from savings bank account is ₹ 14,500.

![]()

Question 23.

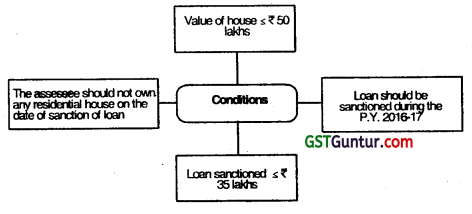

Explain the deduction for interest on loan borrowed for acquisition of house property by an individual [Section 80EE]?

Answer:

(i) Eligible assessee: An individual who has taken a loan for acquisition of residential house property from any financial institution. Interest payable on such loan would qualify for deduction under this section.

(ii) Conditions: The conditions to be satisfied for availing this deduction are as follows-

(ii) Period of benefit: The benefit of deduction under this section would be available till the repayment of loan continues.

(iv) Quantum of deduction: The maximum deduction allowable is ₹ 50,000. The deduction of upto ₹ 50,000 under Section 8OEE is over and above the deduction of upto ₹ 2,00,000 available under Section 24 for interest paid in respect of loan borrowed for acquisition of a self- occupied property.

![]()

(v) Meaning of certain terms:

| Term | Meaning | |

| (a) | Financial Institution |

|

| (b) | Housing Finance Company | A public company formed or registered in India with the main object of carrying on the business of providing long-term finance for construction or purchase of houses in India for residential purposes. , |

![]()

Question 24.

Mr. A purchased a residential house property for self-occupation at a cost of ₹ 45 lakh on 1.4.2018, in respect of which he took a housing loan of ₹ 35 lakh from Bank of India @ 11 % p.a. on the same date. The loan was sanctioned on 28th March, 2018. Compute the eligible deduction in respect of interest on housing loan for A. Y. 2021 -22 under the provisions of the Income-tax Act, 1961, assuming that the entire loan was out standing as on 31.3.2021 and he does not own any other house property.

Answer:

Question 25.

Explain the deduction in respect of interest payable on loan taken for acquisition of residential house property [Section 80EEA]?

Answer:

(i) Eligible assessee: An individual who has taken a loan for acquisition of residential house property from any financial institution. Interest payable on such loan would qualify for deduction under this section.

(ii) Conditions: The conditions to be satisfied for availing this deduction are as follows-

(iii) Period of benefit: The benefit of deduction under this section would be available from A.Y. 2021 -22 and subsequent assessment years till the repayment of loan continues.

(iv) Quantum of deduction: The maximum deduction allowable is ₹ 1,50,000- The deduction of upto ₹ 1,50,000 under Section 80EEA is over and above the deduction available under Section 24(b) in respect of interest payable on loan borrowed for acquisition of a residential house property. In respect of self-occupied house property, interest deduction under Section 24(b) is restricted to ₹ 2,00,000.

In case of let out or deemed to be let out property, even though there is no limit under Section 24(b), Section 71 (3A) restricts the amount of loss from house property to be set-off against any other head of income to ₹ 2,00,000. Accordingly, if interest payable in respect of acquisition of eligible house property is more than ₹ 2,00,000, the excess can be claimed as deduction under Section 8OEEA. subject to fulfilment of conditions.

![]()

(v) No deduction under any other provision: The interest allowed as deduction under Section 8OEEA will not be allowed as deduction under any other provision of the Act for the same or any other assessment year.

(vi) Meaning of certain terms:

| Term | Meaning | |

| (a) | Financial institution |

|

| (b) | Housing finance company | A public company formed or registered in India with the main object of carrying on the business of providing long-term finance for construction or purchase of houses in India for residential purposes. |

![]()

Question 26.

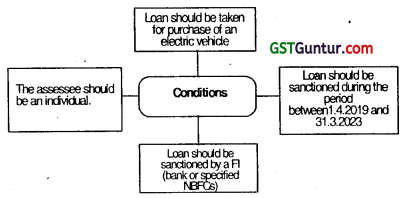

Explain the deduction in respect of interest payable on loan taken for purchase of electric vehicle [Section 80EEB]?

Answer:

(i) Eligible Assessee: An individual who has taken a loan for purchase of an electric vehicle from any financial institution. Interest payable on such loan would qualify for deduction under this section.

(ii) Conditions: The conditions to be satisfied for availing this deduction are as follows-

(iii) Period of benefit: The benefit of deduction under this section would be available from A.Y. 2021-22 and subsequent assessment years till the repayment of loan continues.

(iv) Quantum of deduction: Interest payable, subject to a maximum of ₹ 1,50,000.

(v) No deduction any other provision: The interest allowed as deduction under section 8OEEB will not be allowed as deduction under any other provision of the Act for the same or any other assessment year.

(vi) Meaning of certain terms:

| Term | Meaning | |

| (a) | Financial institution |

|

| (b) | Electric Vehicle | A vehicle which is powered exclusively by an electric motor whose traction energy is supplied exclusively be traction battery installed in the vehicle. The vehicle should have electric regenerative braking system, which during braking provides -for the conversion of vehicle kinetic energy into electrical energy. |

![]()

Question 27.

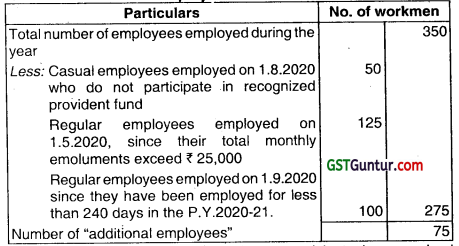

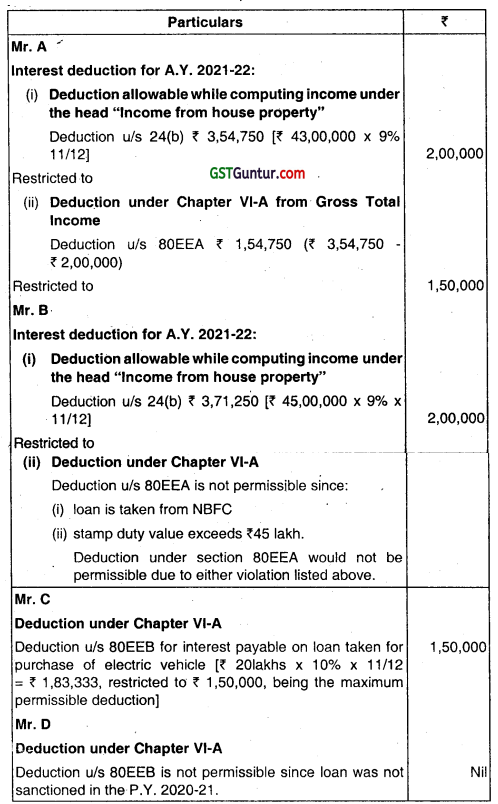

The following are the particulars relating to Mr. A, Mr. B, Mr. C and Mr. D, salaried individuals, for AY. 2021-22- .

| Particulars | Mr. A | Mr. B | Mr. C | Mr. D |

| Amount of loan taken | ₹ 43 lakhs | ₹ 45 lakhs | ₹ 20 lakhs | ₹ 15 lakhs |

| Loan taken from | HFC | Deposit taking NBFC | Deposit taking NBFC | Public sector bank |

| Date of sanction of loan | 1.4.2020 | 1.4.2020 | 1.4.2020 | 30.3.2020 |

| Date of

disbursement of loan |

1.5.2020 | 1.5.2020 | 1.5.2020 | 1.5.2020 |

| Purpose of loan | Acquisition of residential house property for self occupation | Acquisition of residential house property for self occupation | Purchase of electric vehicle for personal use | Purchase of electric vehicle for personal use |

| Stamp duty value of house property | ₹ 45 lakhs | ₹ 48 lakhs | “ | – |

| Cost of electric vehicle | – | – | ₹ 22 lakhs | ₹18 lakhs |

| Rate of interest | 9% p.a. | 9% p.a. | 10% p.a. | 10% p.a. |

![]()

Compute the amount of deduction, if any, allowable under the provisions of the income-tax Act, 1961 for AY. 2021-22 in the hands of Mr. A, Mr. B, Mr. C and Mr. D. Assume that there has been no principal repayment during the P.Y. 2020-21.

Answer:

![]()

Multiple Choice Question

Question 1.

Gross total income means the total income computed in accordance with the provisions of the Income Tax Act, 1961 before making-

(a) Any rebate and relief

(b) Any deductions under Chapter VI-A

(c) Surcharge

(d) Education Cess and Secondary Higher Education Cess

Answer:

(b) Any deductions under Chapter VI-A

Question 2.

Deduction u/s. 80C in respect of LIP, contribution to PF, etc. is allowed to:

(a) Any Assessee

(b) Individual Assessee only

(c) Individual or HUF

(d) Individual or HUF who is resident in India

Answer:

(c) Individual or HUF

![]()

Question 3.

For claiming deduction under Section 80C in respect of P.P.F., the contribution must be paid by the individual in the P.P.F. account of:

(a) himself only

(b) himself and spouse

(c) himself, spouse or any child

(d) None of the above

Answer:

(c) himself, spouse or any child

Question 4.

The aggregate amount of deduction under Section 80C, 80CCC and 80CCD(1) shall not exceed —

(a) ₹ 1,00,000

(b) ₹ 1,50,000

(c) ₹ 2,00,000

(d) ₹ 40,000

Answer:

(b) ₹ 1,50,000

![]()

Question 5.

Quantum of deduction under Section 80G, clean ganga fund, Swachh Bharat Kosh allowed

(a) 25%

(b) 50%

(c) 100%

(d) Nil

Answer:

(c) 100%

Question 6.

Deduction under Section 80DDB in respect of medical treatment for specified ailment or disease is allowed to:

(a) Any assessee

(b) Individual or HUF

(c) Individual or HUF who is Resident in India

(d) Individual or HUF who is non-resident in India

Answer:

(c) Individual or HUF who is Resident in India

![]()

Question 7.

The overall limit in case of deduction under Section 80G is:

(a) 10% of gross total income

(b) 10% of total income

(c) 10% of gross total income as reduced any portion thereof on which income-tax is not payable under any provisions of the Act and by any amount in respect of which the assessee is entitled to a deduction under Chapter VIA except deduction under Section 80G

(d) 20% of total income

Answer:

(c) 10% of gross total income as reduced any portion thereof on which income-tax is not payable under any provisions of the Act and by any amount in respect of which the assessee is entitled to a deduction under Chapter VIA except deduction under Section 80G

Question 8.

Deduction is allowed _________ of additional employee cost incurred in course of business by assessee in the previous year.

(a) @10%

(b) @20%

(c) @30%

(d) @50%

Answer:

(c) @30%

![]()

Question 9.

The quantum of deduction allowed under Section 80U is:

(a) ₹ 40,000

(b) ₹ 75,000 in case of individual who is Resident in India and who is a person with disability and ₹ 1,25,000 in case such individual is a person with severe disability

(c) ₹ 50,000 in case of individual Resident in India who is a person with disability

(d) ₹ 1,00,000

Answer:

(b) ₹ 75,000 in case of individual who is Resident in India and who is a person with disability and ₹ 1,25,000 in case such individual is a person with severe disability

Question 10.

Deduction under Section 80RRB is allowed to the extent of:

(a) 50% of royalty or ₹ 3,00,000 whichever is less

(b) 100% of royalty or ₹ 3,00,000 whichever is less

(c) 100% of royalty or ₹ 2,00,000 whichever is less

(d) 100% royalty or ₹ 5,00,000 whichever is less

Answer:

(b) 100% of royalty or ₹ 3,00,000 whichever is less

![]()

Deductions from Gross Total Income Notes

Insertion of new sections 80EEA and 80EEB [w.e.f. 01.04.2020]

After section 80EE of the Income-tax Act, the following sections shall be Inserted with effect from the 1st day of April, 2020, namely:-

‘80EEA. Deduction in respect of interest on loan taken for certain house property.- (1) In computing the total income of an assessee, being an individual pot eligible to claim deduction under section 80EE, there shall be deducted, in accordance with and subject to the provisions of this section, interest payable on loan taken by him from any financial institution for the purpose of acquisition of a residential house property.

(2) The deduction under sub-section (1) shall not exceed one lakh and fifty thousand rupees and shall be allowed in computing the total income of the individual for the assessment year beginning on the 1st day of April, 2020 and subsequent assessment years.

(3) The deduction under sub-section (1) shall be subject to the following conditions, namely:-

- the loan has been sanctioned by the financial institution during the period beginning on the 1st day of April, 2019 and ending on the 31st day of March, 2020;

- the stamp duty value of residential house property house not exceed forty-five lakh rupees;

- the assessee does not own any residential house property on the date of sanction of loan.

![]()

(4) Where a deduction under this section is allowed for any interred to in subsection (1), deduction shall not be allowed in respect of such interest under any other provision of this Act for the same or any other assessment year.

(5) For the purposes of this section,-

(a) the expression “financial institution” shall have the meaning assigned to it in clause (a) of sub-section (5) of section 80EE;

(b) the expression “stamp duty value” means value adopted or assessed or assessable by any authority of the Central Government or a State Government for the purpose of payment of stamp duty in respect of an immovable property.

80EEB. Deduction in respect of purchase of electric vehicle-

(1) In computing the total income of an assessee, being an individual, there shall be deducted, in accordance with and subject to the provisions of this section, interest payable on loan taken by him from any financial institution for the purpose of purchase of an electric vehicle.

(2) The deduction under sub-section (1) shall not exceed one lakh and fifty thousand rupees and shall be allowed in computing the total income of the individual for the assessment year beginning on the 1st day of April, 2020 and subsequent assessment years.

(3) The deduction under sub-section (1) shall be subject to the condition that loan has been sanctioned by the financial institution during the period beginning on the 1st day of April, 2019 and ending on the 31s1 day of March, 2023.

![]()

(4) Where a deduction under this section is allowed for any interred to in sub-section (1), deduction shall not be allowed in respect of such interest under any other provision of this Act for the same or any other assessment year.

(5) For the purposes of this section,-

(a) “electric vehicle” means a vehicle which is powered exclusively by an electric motor whose traction energy is supplied exclusively by traction battery installed in the vehicle and has such electric regenerative braking system, which during braking provides for the conversion of vehicle kinetic energy into electrical energy;

(b) “financial institution” means a banking company to which the Banking Regulation Act, 1949 (10 of 1949) applies, or any bank or banking institution referred to in section 51 of that Act and includes any deposit taking non-banking financial company or a systemically important non-deposit taking non-banking financial company as defined in clauses (e) and (g) of Explanation 4 to section 43B .

Amendment of section 80G.

In section 80G of the Income-tax Act,.with effect from the 1st day of June, 2020,-

(i) in sub-section (5),-

(a) in’ clause (vi), for the words “approved by the Commissioner in ‘ accordance with the rules made in this behalf; and”, the words “approved by the Principal Commissioner or Commissioner”, shall be substituted;

(b) after sub-clause (vii), the following shall be inserted, namely:- “(vii)the institution or fund prepares such statement for such period as may be prescribed and deliver or cause to be delivered to the prescribed income-tax authority or the person authorised by such authority such statement in such form and verified in such manner and setting forth such particulars and within such time as may be prescribed :

![]()

Provided that the institution or fund may also deliver to the said prescribed authority a correction statement for rectification of any mistake or to add, delete or update the information furnished in the statement delivered under this sub-section in such form and verified in such manner as may be prescribed; and

(ix) the institution or fund furnishes to the donor, a certificate specifying the amount of donation in such manner, containing such particulars and within such time from the date of receipt of donation, as may be prescribed :

Provided that the institution or fund referred to in clause (vi) shall make an application in the prescribed form and manner to the Principal Commissioner or Commissioner, for grant of approval,-

- where the institution or fund is approved under clause (vi) [as it stood immediately before its amendment by the Finance Act, 2020], within three months from the date on which this proviso has come into force;

- where the institution or fund is approved and the period of such approval is due to expire, at least six months prior to expiry of the sard period;

- where the institution or fund has been provisionally approved, at least six months prior to expiry of the period of the provisional approval or within six months of commencement of its activites, whichever is earlier;

- in any other case, at least one month prior to commencement of the previous year relevant to the assessment year from which the said approval is sought:

Provided further that the Principal Commissioner or Commissioner, on receipt of an application made under the first proviso, shall,-

(i) where the application is made under clause (i) of the said proviso, pass an order in writing granting it approval for a period of five years;

(ii) where the application is made under clause (ii) or clause (iii) of the said proviso,-

(a) call for such documents or information from it or make such inquiries as he thinks necessary in order to satisfy himself about-

(A) the genuineness of activities of such institution or fund; and

(B) the fulfilment of all the conditions laid down in clauses (i) to (v) ; and

![]()

(b) after satisfying himself about the genuineness of activities under item (A), and the fulfillment of all the conditions under item (B), of sub-clause (a),-

(A) pass an order in writing granting it approval for a period of five years;

(B) if he is not so satisfied pass an order in writing rejecting such application and also cancelling its approval after affording it a reasonable opportunity of being heard;

(iii) where the application is made under clauses (iv) of the said proviso, pass an order in writing granting it approval provisionally for a period of three years from the assessment year from which the registration is sought, and send a copy of such order to the institution or fund: Provided also that the order under clause (i), sub-clause (b) of clause (ii) and clause (iii) of the first proviso shall be passed in such form and manner as may be prescribed, before expiry of the period of three months, six months and one month, respectively, calculated from the end of the month in which the application was received: Provided also that the approval granted under the second proviso shall apply to an institution or fund, where the application is made under-

(a) clause (i) of the first proviso, from the assessment year from which approval was earlier granted to such institution or fund;

(b) clause (iii) of the first proviso, from the first of the assessment years for which such institution or fund was provisionally approved;

(c) in any other case, from the assessment year immediately following the financial year in which such application is made”.,

(ii) in sub-section (5D), after Explanation 2, the following Explanation shall be inserted, namely:-

“Explanation 2A,- For the removal of doubts, it is hereby declared that claim of the assessee for a deduction in respect of any donation made to an institution or fund to which the provisions of sub-section (5) applies, in the return of income for any assessment year filed by him, shall be allowed on the basis of information relating to said donation furnished by the institution or fund to the prescribed income-tax authority or the person authorised by such authority, subject to verification in accordance with the risk management strategy formulated by the Board from time to time.”,

![]()

(iii) after sub-section (5D), the following sub-section shall be inserted, namely:-

“(5E) All applications, pending before the Commissioner on which no order has been passed under clause (vi) of sub-section (5) before the date on which this sub-section has come into force, shall be deemed to be applications made under clause (iv) of the first proviso to sub-section (5) on that date.”.

Deduction in respect of donations for scientific research and rural development [Section 80 GGA]

(i) Eligible assessee: Any assessee not having income chargeable . under the head “profits and gains of business or profession”, who makes donations for scientific research or rural development.

(ii) Donations qualifying for deduction:

(1) Any sum paid by the assessee in the previous year to a research association which has, as its object, the undertaking of scientific research or to a University, college or other institution to be used for scientific research;

Such association, University, college or institution must be approved under section 35(1 )(ii).

(2) Any sum paid to a Research Association which has as its object the undertaking of research in social science or statistical research, University, College or other institution to be used for research in social science or statistical research.

Such association, University, college or institution must be approved under section 35(1 )(iii).

Further, it has been clarified that the deduction to which an assessee (i.e. donor) is entitled on account of payment of any sum to a research association or university or college or other institution for scientific research or research in a social science or statistical research, shall not be denied merely on the ground that subsequent to payment of such sum by the assessee, the approval granted to any of the aforesaid entities is withdrawn.

(3) Any sum paid by the assessee in the previous year to an association or institution which has as its object the undertaking of any programme of rural development, to be used for carrying out any programme of rural development approved by the prescribed authority for purposes of section 35CCA or to an institution or association which has as its object the training of persons for implementing Programmes of rural development.

![]()

It is, however, essential that in respect of both the aforesaid donations, the association or institution to which the donation is given must be approved by the prescribed authority; in the case of donation for scientific research, the donation must be to the institution approved under section 35(1 )(ii) whereas in the case of donation for rural development the institution or association must be approved by the prescribed authority under section 35CCA(2)/(2A).

(4) Any sum paid to a public sector company or a local authority or to an association or institution approved by the National Committee for carrying out any eligible project or scheme.

(5) Any sum paid to a rural development fund set up and notified under section 35CCA.

(6) Any sum paid by the assessee in the previous year to National Urban Poverty Eradication Fund (NUPEF).

(iii) Restrictions on deductions :

- No deduction under this section would be allowed in the case of an assessee whose gross total income includes income which is chargeable under the head “Profits and gains of business or profession.”

- Where a deduction under this section is claimed and allowed for any assessment year, deduction shall not be allowed in respect of such payment under any provision of this Act for the same or any other assessment year.

- No deduction shall be allowed in respect of donation of any sum exceeding ₹ 2,000 [w.e.f 01.06.2020] unless such sum is paid by any mode other than cash.

Insertion of new section 80M.

After section 80LA of the Income-tax Act, the following section shall be inserted with effect from the 1s* day of April, 2021. namely :-

![]()

‘80M. Deduction in respect of certain inter-corporate dividends -(1) Where the gross total income of a domestic company in any previous year includes any income by way of dividends from any other domestic company or a foreign company or a business trust, there shall, in accordance with and subject to the provisions of this section, be allowed in computing the total income of such domestic company, a deduction of an amount equal to so’much of the amount of income by way of dividends received from such other domestic company or foreign company or business trust as does not exceed the amount of dividend distributed by it on or before the due date.

(2) Where any deduction, in respect of the amount of dividend distributed by the domestic company, has been allowed under sub-section (1) in any previous year, no deduction shall be allowed in respect of such amount in any other previous year.

Explanation- For the purposes of this section, the expression “due date” means the date one month prior to the date for furnishing the return of income under sub-section (1) of section 139′.