Students should practice Cost of Capital – CS Executive Financial and Strategic Management MCQ Questions with Answers based on the latest syllabus.

Cost of Capital – Financial and Strategic Management MCQ

Question 1.

Cost of equity share or debt is called ___

(A) Related cost of capital

(B) Easy to calculate the cost of capital

(C) Specific cost of capital

(D) Burden on the shareholder

Answer:

(C) Specific cost of capital

Question 2.

In which of the cost of the following method of equity capital is computed by dividing the dividend by market price per share or net proceeds per share?

(A) Price Earning Method

(B) Adjusted Price Method

(C) Adjusted Dividend Method

(D) Dividend Yield Method

Answer:

(D) Dividend Yield Method

Question 3.

In weighted average cost of capital, a company can affect its capital cost through____

1. Policy of capital structure

2. Policy of dividends

3. Policy of investment,

Select the correct answer from the options given below:

(A) 1 only

(B) 2 & 3

(C) 1 & 3

(D) All 1, 2 & 3

Answer:

(D) All 1, 2 & 3

Question 4.

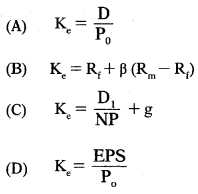

Which of the following is the correct formula to calculate the cost of equity under the dividend yield method?

Answer:

(A)

Question 5.

____ is the rate of return associated with the best investment opportunity for the firm and its shareholders that will be forgone if the projects presently under consideration by the firm were accepted.

(A) Explicit Cost

(B) Future Cost

(C) Implicit Cost

(D) Specific Cost

Answer:

(C) Implicit Cost

Question 6.

Cost of capital is equal to the required return rate on equity in case if investors are only___

(A) Valuation Manager

(B) Common Stockholders

(C) Asset Seller

(D) Equity Dealer

Answer:

(B) Common Stockholders

Question 7.

Which of the following model/ method makes use of Beta (β) in the calculation of the cost of equity?

(A) Risk-Adjusted Discount Model

(B) Capital Assets Pricing Method

(C) MM Model

(D) Price Earning Method

Answer:

(B) Capital Assets Pricing Method

Question 8.

Marginal cost____

(A) is the weighted average cost of new finance raised by the company.

(B) is the additional cost of capital when the company goes for further raising of finance.

(C) is the cost of raising an additional rupee of capital.

(D) All of the above

Answer:

(D) All of the above

Question 9.

The bond risk premium is added into bond yield to calculate____

(A) Cost of option

(B) Cost of common stock

(C) Cost of preferred stock

(D) Cost of working capital

Answer:

(B) Cost of common stock

Question 10.

The cost of equity share or debt is called the specific cost of capital. When specific costs are combined, then we arrive at____

(A) Maximum rate of return

(B) Internal rate of return

(C) Overall cost of capital

(D) Accounting rate of return

Answer:

(C) Overall cost of capital

Question 11.

Statement I:

Where earnings, dividends, and equity share price all grow at the same rate, the cost of equity capital may be computed by the dividend growth method.

Statement II:

When the risk-free rate is added to the market rate of the return risk premium for the stock is arrived.

Select the correct answer from the options given below:

(A) Statement I is false but Statement II is true

(B) Both Statement I and Statement II are false

(C) Statement II is false but Statement I is true

(D) Both Statement I and Statement II are true

Answer:

(C) Statement II is false but Statement I is true

Question 12.

Interest rates, tax rates, and market risk premium Eire factors which –

(A) Industry cannot control

(B) Industry can control

(C) Firm must control

(D) Firm cannot control

Answer:

(D) Firm cannot control

Question 13.

Assertion (A):

The cost of share capital would be based upon the expected rate of earnings of a company.

Reason (R):

Each investor expects a certain amount of earnings, whether distributed or not from the company in whose shares he invests.

Select the correct answer from the options given below:

(A) A is true but R is false

(B) A is false but R is true

(C) A and R both are true but R is not the correct explanation of A

(D) A and R both are true and R is the correct explanation of A

Answer:

(D) A and R both are true and R is the correct explanation of A

Question 14.

If we deduct ‘risk-free return’ from ‘market return’ and multiply it with ‘beta factor’ and again add ‘risk-free return’, the resultant figure will be –

(A) Nil

(B) Risk premium

(C) Cost of equity

(D) WACC of the firm

Answer:

(C) Cost of equity

Question 15.

For each component of capital, a required rate of return is considered as:

(A) Component cost

(B) Evaluating cost

(C) Asset cost

(D) Asset depreciation value

Answer:

(A) Component cost

Question 16.

____ is the rate that the firm pays to procure financing.

(A) Average Cost of Capital

(B) Combine Cost

(C) Economic Cost

(D) Explicit Cost

Answer:

(D) Explicit Cost

Question 17.

Which of the following method of cost of equity is similar to the dividend price approach?

(A) Discounted cash flow (DCF) method

(B) Capital asset pricing model

(C) Price earning method

(D) After-tax equity method

Answer:

(C) Price earning method

Question 18.

The preferred dividend is divided by preferred stock price multiply by (1 – floatation cost) is used to calculate –

(A) Transaction cost of preferred stock

(B) Financing of preferred stock

(C) Weighted cost of capital

(D) The Component cost of preferred stock

Answer:

(D) The Component cost of preferred stock

Question 19.

Statement I:

The cost of retained earnings is the opportunity cost of dividends forgone by shareholders.

Statement II:

The opportunity cost of reserve & surplus may be considered as their cost, which is equivalent to the income that would otherwise earn by placing these funds in alternative investment.

Select the correct answer from the options given below:

(A) Statement I is false but Statement II is true

(B) Both Statement I and Statement II are false

(C) Statement II is false but Statement I is true

(D) Both Statement I and Statement II are true

Answer:

(D) Both Statement I and Statement II are true

Question 20.

How you will calculate expected dividend Le. dividend at the end of year one?

(A) D1 = [D0(1 + g)]

(B) D1 = [D0(1 – t)]

(C) D1 = [D0 × (1 – g)]

(D) D1 = [D0 + (1 – g)](1 – t)

Answer:

(A) D1 = [D0(1 + g)]

Question 21.

In weighted average cost of capital, rising in interest rate leads to –

(A) Increase in cost of debt

(B) Increase the capital structure

(C) Decrease in cost of debt

(D) Decrease the capital structure

Answer:

(A) Increase in cost of debt

Question 22.

____is the cost that has already been incurred for financing a particular project.

(A) Future Cost

(B) Historical Cost

(C) Implicit Cost

(D) Opportunity Cost

Answer:

(B) Historical Cost

Question 23.

In weighted average cost of capital, capital components are funds that are usually offered by:

(A) Stock market

(B) Investors

(C) Capitalist

(D) Exchange index

Answer:

(B) Investors

Question 24.

The overall cost of capital is called as –

(A) Composite cost of capital

(B) Combined cost of capital

(C) Both (A) and (B)

(D) Neither (A) nor (B)

Answer:

(C) Both (A) and (B)

Question 25.

Premium which is considered as the difference of expected return on common stock and the current yield on Treasury bonds is called –

(A) Past risk premium

(B) Expected premium

(C) Current risk premium

(D) Beta premium

Answer:

(C) Current risk premium

Question 26.

Which of the following figure is irrelevant while calculating the cost of redeemable preference shares?

(A) Flotation cost

(B) Discount

(C) EPS

(D) Net proceeds

Answer:

(C) EPS

Question 27.

Select which of the following statement is correct?

(I) Capital budget decision largely depends on the cost of capital of each source.

(II) Capital structure is the mix or proportion of the different kinds of short-term securities.

(III) Cost of capital helps to evaluate the financial performance of the firm.

(IV) As per MM approach, the cost of equity (Ke) is equal to the capitalization rate of the pure equity stream minus a premium for business risk.

Select the correct answer from the options given below:

(A) (I) and (II)

(B) (I), (III), and (IV)

(C) (II) and (III)

(D) (I) and (III)

Answer:

(D) (I) and (III)

Question 28.

An interest rate that is paid by a firm as soon as it issues debt is classified as pre-tax –

(A) Term structure

(B) Market premium

(C) Risk premium

(D) Cost of debt

Answer:

(D) Cost of debt

Question 29.

Which of the following is a controllable factor affecting the cost of capital of the firm?

(A) Dividend policy

(B) Level of interest rates

(C) Tax rates

(D) All of the above

Answer:

(A) Dividend policy

Question 30.

Which of the following is an uncontrollable factor affecting the cost of capital of the firm?

(A) Investment Policy

(B) Capital Structure Policy

(C) Debt service charges

(D) None of the above

Answer:

(D) None of the above

Question 31.

Type of cost which is used to raise common equity by reinvesting internal earnings is classified as

(A) Cost of common equity

(B) Cost of mortgage

(C) Cost of stocks

(D) Cost of reserve assets

Answer:

(A) Cost of common equity

Question 32.

Which of the following is the correct formula to calculate the cost of irredeemable preference shares?

(A) Preference dividend ÷ Net proceeds

(B) Preference dividend × (1 – t)

(C) [Preference dividend × (1 -t)] ÷ Net proceeds

(D) [Preference dividend ÷ Net pro-ceeds] × (1 – t)

Answer:

(A) Preference dividend ÷ Net proceeds

Question 33.

Which of the following factor affects the determination of the cost of capital of the firm?

(A) General economic conditions

(B) Market conditions

(C) Operating and financing decisions

(D) All of The above

Answer:

(D) All of The above

Question 34.

The cost of equity which is raised by reinvesting earnings internally must be higher than the –

(A) Cost of the initial offering

(B) Cost of new common equity

(C) Cost of preferred equity

(D) Cost of floatation

Answer:

(B) Cost of new common equity

Question 35.

During the planning period, marginal cost to raise new debt is classified as___

(A) Debt cost

(B) Borrowing cost

(C) Relevant cost

(D) Embedded cost

Answer:

(C) Relevant cost

Question 36.

The after-tax cost of debentures not redeemable during the lifetime of the company is –

(A) [Interest ÷ Net proceeds] × (1 – t)

(B) Interest × (1 – t) ÷ Net proceeds

(C) Interest × (1 + t) ÷ Net proceeds

(D) [Interest ÷ Net proceeds] × (1 + t)

Answer:

(B) Interest × (1 – t) ÷ Net proceeds

Question 37.

The risk-free rate is subtracted from the expected market return is considered as:

(A) Country risk

(B) Diversifiable risk

(C) Equity risk premium

(D) Market risk premium

Answer:

(C) Equity risk premium

Question 38.

A firm’s overall cost of capital:

(A) varies inversely with its cost of debt.

(B) is unaffected by changes in the tax rate.

(C) is another term for the firm’s internal rate of return.

(D) is the required return on the total assets of a firm.

Answer:

(D) is the required return on the total assets of a firm.

Question 39.

Key sources of value (earning an

excess return) for a company can be attributed primarily to

(A) competitive advantage and access to capital

(B) quality management and industry attractiveness

(C) access to capital and quality management

(D) industry attractiveness and competitive advantage

Answer:

(D) industry attractiveness and competitive advantage

Question 40.

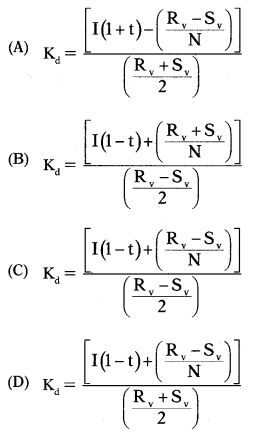

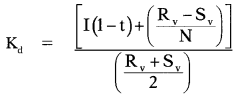

Which of the following is the correct formula to calculate the cost of redeemable debentures?

Answer:

(D)

Question 41.

The weighted average cost of capital (Ko) results from a weighted average of the firm’s debt and equity capital costs. At a debt ratio of zero, the firm is 100% equity financed. As debt is substituted for equity and as the debt ratio increases, the –

(A) Ko declines because the after-tax debt cost is less than the equity cost (Kd < Ke).

(B) Ko increases because the after-tax debt cost is less than the equity cost (Kd < Ke).

(C) Ko do not show any change and tend to remain the same.

(D) None of the above

Answer:

(A) Ko declines because the after-tax debt cost is less than the equity cost (Kd < Ke).

Question 42.

The overall (weighted average) cost of capital is composed of a weighted average of

(A) the cost of common equity and the cost of debt

(B) the cost of common equity and the cost of preferred stock

(C) the cost of preferred stock and the cost of debt

(D) the cost of common equity, the cost of preferred stock, and the cost of debt

Answer:

(D) the cost of common equity, the cost of preferred stock, and the cost of debt

Question 43.

While calculating the WACC, the cost of each component of the capital is weighted –

(A) In the ratio of 1:2:3:4

(B) by the relative proportion of that type of funds in the capital structure.

(C) by the relative proportion of that type of funds to total assets in the company

(D) Both (A) and (C)

Answer:

(B) by the relative proportion of that type of funds in the capital structure.

Question 44.

Which of the following formula you will use while calculating the value of the firm?

(A) NOPAT ÷ Ko

(B) NOPAT × K

(C) NOPAT ÷ K0 (1 – t)

(D) None of the above

Answer:

(A) NOPAT ÷ Ko

Question 45.

For which of the following costs is it generally necessary to apply a tax adjustment to a yield measure?

(A) Cost of debt

(B) Cost of preferred stock

(C) Cost of common equity

(D) Cost of retained earnings

Answer:

(A) Cost of debt

Question 46.

The cost of preference share capital is calculated –

(A) By dividing the fixed dividend per share by the price per preference share and then adding risk premium.

(B) By dividing the fixed dividend per share by the price per preference share and then adding growth rate.

(C) By dividing the fixed dividend per share by the price per preference share.

(D) By dividing the fixed dividend per share by the book value per preference share.

Answer:

(C) By dividing the fixed dividend per share by the price per preference share.

Question 47.

Statement I:

The cost of equity capital is the rate of return that equates the present value of expected dividends with the market share price.

Statement II:

The dividend Yield Method cannot be used to calculate the cost of equity of units suffering losses.

Select the correct answers from the options given below.

(A) Both Statements are false.

(B) Statement I is true but Statement II is false.

(C) Statement His true but Statement I is false.

(D) Both Statements are true.

Answer:

(D) Both Statements are true.

Question 48.

Which of the following is not a recognized approach for determining the cost of equity?

(A) Dividend discount model approach

(B) Before-tax cost of preferred stock plus risk premium approach

(C) Capital-asset pricing model approach

(D) Before-tax cost of debt plus risk premium approach

Answer:

(B) Before-tax cost of preferred stock plus risk premium approach

Question 49.

While calculating WACC on a market value basis which of the following is not considered –

(A) After-tax cost of debt

(B) Reserve and surplus

(C) Weight of each fund in capital structure

(D) Cost of term loan

Answer:

(B) Reserve and surplus

Question 50.

CAPM describes the between risk and returns for securities.

(A) Linear relationship

(B) Hypothetical relationship

(C) No relationship

(D) Diagonal relationship.

Answer:

(A) Linear relationship

Question 51.

Chetna Fashions is expected to pay an annual dividend of ₹ 0.80 a share next year. The market price of the stock is ₹ 22.40 and the growth rate is 5%. What is the firm’s cost of equity?

(A) 7.58 per cent

(B) 7.91 per cent

(C) 8.24 per cent

(D) 8.57 per cent

Hint:

D = \(\frac{\mathrm{D}_{1}}{\mathrm{P}_{\mathrm{o}}}\) + g

= \(\frac{0.8}{22.40}\) + 0.05

K = 0.0857 i.e. 8.57%

Answer:

(D) 8.57 per cent

Question 52.

Sweet Treats common stock is currently priced at ₹ 19.06 a share.

The company just paid ₹ 1.15 per share as its annual dividend. The dividends have been increasing by 2.5% annually and are expected to continue doing the same. What is this firm’s cost of equity?

(A) 8.68%

(B) 8.86%

(C) 6.18%

(D) 6.03%

Hint:

D = \(\frac{\mathrm{D}_{1}}{\mathrm{P}_{\mathrm{o}}}\) + g

= \(\frac{0.8}{22.40}\) + 0.025

K = 0.0868 i.e. 8.68%

D0 = Last dividend = 4.02

D1 = D0(1 + g)

= 1.15(1 + 0.025)

= 1.1788

Answer:

(A) 8.68%

Question 53.

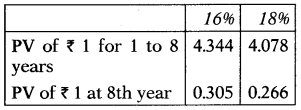

Narendra Ltd. is planning to issue 15% Preference Shares of ₹ 100 each, redeemable at par after 8 years. They are expected to be sold at a premium of 5%. Flotation cost is 9% of face value. Corporate tax is 35% and corporate dividend tax is 10%. The cost of preference shares on the basis of the present value of future cash flow shall be:

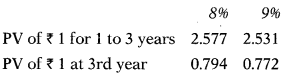

Use the following rates for your calculations:

(A) 17.49%

(B) 16.22%

(C) 18.34%

(D) 19.20%

Answer:

(A) 17.49%

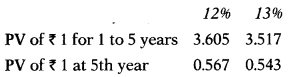

Question 54.

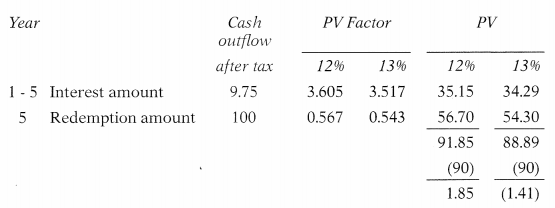

Z Ltd. is planning for the issue of 15% Debentures of ₹ 100 each, redeemable at par after 5 years. They are expected to be sold at par. Flotation cost is 10% of face value. Corporate tax is 35%. Cost of debentures on the basis of the present value of future cash flow shall be___

Use the following rates for your calculations:

(A) 11.37%

(B) 12.57%

(C) 14,87%

(D) 12.97%

Hint:

By interpolation,

Kd = 12 + \(\frac{1.85}{1.85+1.41}\) × 1

= 12 + 0.57

= 12.57%

Answer:

(B) 12.57%

Question 55.

Ramola Ltd. report its NOPAT ₹ 25,00,000. Its capital employed and economic value added is ₹ 60,00,000 & ₹ 19,00,000 respectively. What is the overall cost of capital of Ramola Ltd?

(A) 10.9%

(B) 11%

(C) 10%

(D) 9.8%

Hint:

EVA = NOPAT – (Capital Employed × WACC)

19,00,000 = 25,00,000 – (60,00,000 × x)

– 6,00,000 = – 60,00,000x

x = 0.1 i.e. 10%

Answer:

(C) 10%

Question 56.

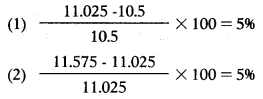

Mr. Investor purchases an equity share of the growing company, ATT Ltd. for ₹ 210. He expects that ATT Ltd. to pay dividends of ₹ 10.5, ₹ 11.025 & ₹ 11.575 in years 1, 2 & 3 respectively. He expects to sell shares at the end of year 3 at ₹ 243.10. Determine the growth rate in dividends.

(A) 4%

(B) 5%

(C) 6%

(D) 7%

Hint:

Answer:

(B) 5%

Question 57.

Mr. Lucky purchases an equity share of a growing company, XYY Ltd. for ₹ 525. He expects that XYY Ltd. to pay dividends of ₹ 26.25, ₹ 27.83 & ₹ 29.50 in years 1,2 & 3 respectively. He expects to sell shares at the end of year 3 at ₹ 607.75. What is the required rate of return of Mr. Lucky on his equity investment?

(A) 11.50%

(B) 10.50%

(C) 10.05%

(D) 11.05%

Hint:

Growth rate (as per the hints of previous question) =6%

Ke = \(\frac{\mathrm{D}_{1}}{\mathrm{P}_{\mathrm{o}}}\) + g

= \(\frac{26.5}{525}\) + 0.06

= 0.1105 i.e. 11.05%

Answer:

(D) 11.05%

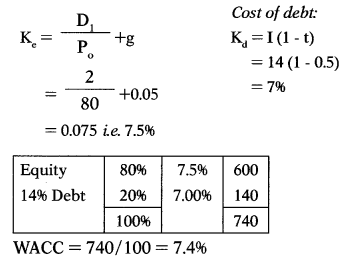

Question 58.

Mumbai Ltd. expected to pay dividends of ₹ 2 for the next year. As the company is a market leader with a good future, the dividend is likely to grow by 5% every year. The equity shares are now treaded at ₹ 80 per share in the stock exchange. The tax rate applicable to the company is 50%. The capital structure of the company also contains debt on which interest is payable @ 14%. The capital structure has a ratio of Equity & Debt 80:20. WACC =?

(A) 9.40%

(B) 7.40%

(C) 8.40%

(D) 7.98%

Hint:

Answer:

(B) 7.40%

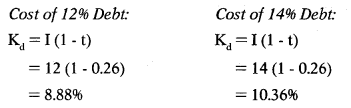

Question 59.

Beta Ltd. has furnished the following information:

Earnings Per Share (EPS) ₹ 14

Dividend Payout Ratio 25%

Market Price Per Share ₹ 140 Rate of Tax 26%

The growth rate of dividend 9%

The company wants to raise additional capital of ₹ 10 lakhs including debt of ₹ 4 lakhs. The cost of debt (before tax) is 12% up to ₹ 2 lakhs and 14% beyond that. Compute the marginal weighted average cost of additional capital.

(A) 11.75%

(B) 10.75%

(C) 11.57%

(D) 12.57%

Hint:

Ke = \(\frac{\mathrm{D}}{\mathrm{P}_{\mathrm{o}}}\) + g

= \(\frac{3.5}{140}\) + 0.09

= 0.115 i.e. 11.5%

D = 14 × 25% = 3.5

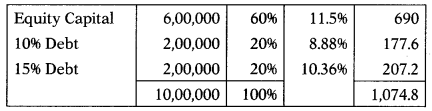

Calculation of WACC for additional capital of Rs. 10 lakhs:

WACC = 1,074.8/100 = 10.75%

Answer:

(B) 10.75%

Question 60.

National Ltd. has 12,000 equity shares of ₹ 100 each. Sale price is equity share ₹ 115 per share; flotation cost ₹ 5 per share. The expected dividend growth rate is 5% and the expected dividend at the end of the financial year is ₹ 11 per share. What is the cost of equity shares of National Ltd.?

(A) 0.1133

(B) 0.1278

(C) 0.1475

(D) 0.15

Hint:

Ke = \(\frac{\mathrm{D}_{1}}{\mathrm{NP}}\) + g

= \(\frac{11}{110}\) + 0.05

= 0.15 i.e. 15%

NP = Net Proceeds = Sale price – Flotation cost

= 115 – 5

= 110

Answer:

(D) 0.15

Question 61.

Raelian Ltd. has 1096 Preference Share Capital of ₹ 4,50,000. Face value is ₹ 10. Issue price of preference share is ₹ 100 per share; flotation cost ₹ 2 per share. What is the cost of preference shares to Raman Ltd.?

(A) 10.20%

(B) 9.10%

(C) 12.50%

(D) 11.22%

Hint:

Ke = \(\frac{\mathrm{D}_{1}}{\mathrm{NP}}\)

= \(\frac{10}{98}\)

= 0.1020 i.e. 10.20%

NP = Net Proceeds = Sale price – Flotation cost

= 100 – 2

= 98

Answer:

(A) 10.20%

Question 62.

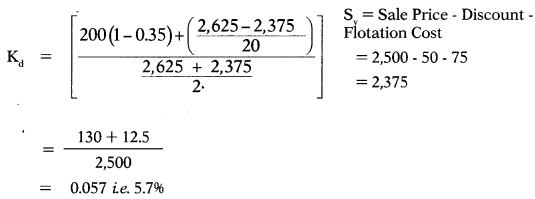

Raja Ltd. has 8% Debentures (Face value ₹ 2,500) of ₹ 9,00,000 which are redeemable at 5% premium, sold at 98%, 3% flotation costs with maturity of 20 years. The corporate tax rate is 35%. The company paid debenture interest of ₹ 60,000 out of the total interest payable of ₹ 72,000. The after-tax cost of debt is___

(A) 8.7%

(B) 7.7%

(C) 5.7%

(D) 6.7%

Hint:

Answer:

(C) 5.7%

Question 63.

Equity shares of Anuradha Ltd. are quoted in the stock exchange at ₹ 325 per share. The new issue priced at ₹ 312.5 and the flotation cost will be ₹ 12.5 per share. Dining 5 years dividend on equity shares have steadily grown from ₹ 26.5 to ₹ 35.48. Dividend at the end of the current year is expected at ₹ 37.5 per share. It has retained earning of ₹ 30,00,000. Corporate tax is 35% and shareholders are in tax slab of 20%. Ignore dividend tax. Calculate cost of equity and cost of retained earnings?

(A) Ke = 18.50%; Kr = 14.80%

(B) Ke = 18.00%; Kr = 14.40%

(C) Ke = 17.54%; Kr = 14.03%

(D) Ke = 18.94%; Kr = 15.15%

Hint:

During 5 years dividend on equity shares have steadily grown from ₹ 26.5 to ₹ 35.48. Hence, growth rate = g = 6%.

Ke = \(\frac{\mathrm{D}_{1}}{\mathrm{NP}}\) + g

= \(\frac{37.5}{300}\) + 0.06

= 0.185 i.e 18.5%

NP = Net Proceeds = Sale price – Flotation cost

= 312.5 – 12.5

= 300

Cost of retained earnings:

Kr = Ke (1 – t)

= 18.5 (1 – 0.2)

= 14.896

tp = Personal tax rate applicable to shareholder.

Answer:

(A) Ke = 18.50%; Kr = 14.80%

Question 64.

Compute the EVA with the help of the following information:

| ₹ | |

| Equity | 10,00,000 |

| Debt (10%) | 5,00,000 |

| Profit after tax | 2,00,000 |

Risk-free rate of return is 7%.

Beta (β) = 0.9,

Market rate of return = 15%.

Applicable tax rate is 40%.

(A) ₹ 57,950

(B) ₹ 57,590

(C) ₹ 57,905

(D) ₹ 59,750

Hint:

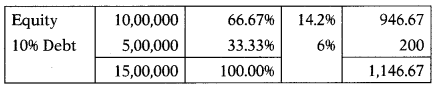

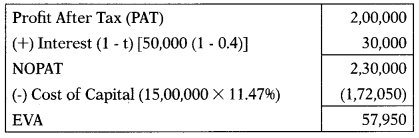

Ke = Rf + β(Rm – Rf)

= 7 + 0.9 (15 – 7)

= 14.2%

Kd = I (1 – t)

= 10 (1 – 0.4)

= 6%

WACC = 1,146.67/100 = 11.47%

Answer:

(A) ₹ 57,950

Question 65.

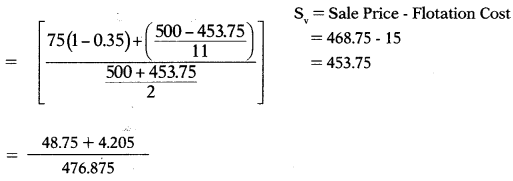

The company proposes to issue 11 year 1596 debentures of ₹ 500. Yield on debentures of similar maturity and risk class is 1696; flotation cost 3% of face value. Corporate tax is 35%. Issue price and after tax cost of debt would be –

(A) Issue price = 486.75; Kd = 12.10%

(B) Issue price = 468.75; Kd = 11.10%

(C) Issue price = 475.68; Kd = 10.10%

(D) Issue price = 457.86; Kd = 12.12%

Hint:

Market price of debentures = \(\frac{\text { Interest }}{\text { Market rate of interest }}=\frac{75}{0.16}\) =468.75

Since the yield on debentures of similar maturity and risk class is 1696, the company would be required to offer debenture at discount.

Kd = 0.1110 i.e 11.10%

Answer:

(B) Issue price = 468.75; Kd = 11.10%

Question 66.

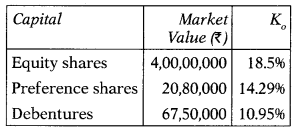

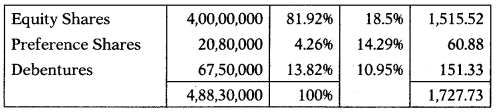

From the following details calculate the WACC:

(A) 17.28%

(B) 16.52%

(C) 16.34%

(D) 17.93%

Hint:

WACC = 1,727.73/100 = 17.28%

Answer:

(A) 17.28%

Question 67.

A Company has ₹ 180 Million of 10% Debentures having a face value of ₹ 100. The debentures are redeemable after 3 years and interest is paid annually. The current ex-interest debenture market value is ₹ 103.

The pre-tax cost of debentures on the basis of the present value of future cash flow shall be –

Use the following rates for your calculations:

(A) 9.32%

(B) 7.91%

(C) 8.02%

(D) 8.82%

Answer:

(D) 8.82%

Question 68.

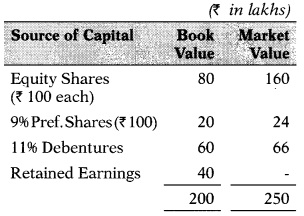

The following is the capital structure of a company:

| Source of Capital | Book Value (₹) |

| Equity Shares (₹ 100 each) | 40,00,000 |

| 9% Pref. Shares (₹ 100) | 10,00,000 |

| 11% Debentures | 30,00,000 |

| Retained Earnings | 20,00,000 |

| 1,00,00,000 |

The current market price of equity share is ₹ 200. For the last year, the company had paid an equity dividend at 25% and its dividend is likely to grow 5% every year. The corporate tax rate is 30% and shareholders’ personal income tax rate is 2096. Compute WACC on the basis of book value.

(A) 13.36%

(B) 14.50%

(C) 13.96%

(D) 12.32%

Answer:

(A) 13.36%

Question 69.

The following is the structure of a company: capital

The current market price of equity share is ₹ 200. For the last year, the company had paid an equity dividend at 25% and its

dividend is likely to grow 5% every year. The corporate tax rate is 30%. Compute WACC on the basis of market value.

(A) 14.5 per cent

(B) 13.5 per cent

(C) 12.9 per cent

(D) 14.1 per cent

Answer:

(A) 14.5 percent

Question 70.

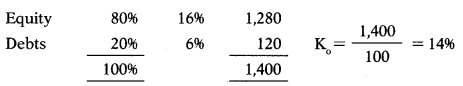

Debt as a percentage of the total capital of Kinara Ltd. is 20%. Its cost of equity is 16% and the pre-tax cost of debt is 12%. The tax rate is 50%. What is the overall cost of capital of Kinara Ltd.?

(A) 16%

(B) 14%

(C) 15%

(D) 16.6%

Hint:

Answer:

(B) 14%

Question 71.

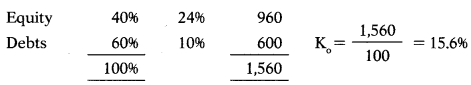

Debt as a percentage of the total capital of Tiger Ltd. is 60%. Its cost of equity is 24% and the pre-tax cost of debt is 20%. The tax rate is 50%. What is the overall cost of capital of Tiger Ltd.?

(A) 14.6%

(B) 13.6%

(C) 17.6%

(D) 15.6%

Hint:

Answer:

(D) 15.6%

Question 72.

Compute the EVA with the help of the following information:

| (₹) | |

| Equity | 15,00,000 |

| Debt (10%) | 7,00,000 |

| Profit after tax | 4,00,000 |

Risk-free rate of return is 7%. Beta (β) = 0.9, Market rate of return = 15%.

The applicable tax rate is 40%.

(A) ₹ 1,87,020

(B) ₹ 1,78,020

(C) ₹ 1,87,200

(D) ₹ 1,85,200

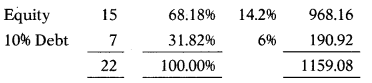

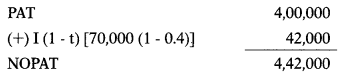

Hint:

K = Rf +β(Rm – Rf)

= 7 + 0.9 (15 – 7)

= 14.2%

Kd = I(1 – t)

= 10(1 – 0.4)

= 6%

WACC = 1159.08/100 = 11.59%

Answer:

(A) ₹ 1,87,020

Question 73.

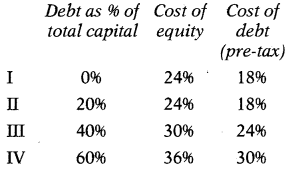

AB Ltd. estimates the cost of equity and debt components of its capital for different levels of debt; equity mix as follows:

The tax rate is 50%

Select the best capital mix for the company so that its overall cost of capital is minimum.

(A) I

(B) II

(C) III

(D) IV

Answer:

(B) II

Question 74.

The preferred stock of ISO Ltd. pays an annual dividend of ₹ 6.50 a share and sells for ₹ 48 a share. What is ISO’s cost of preferred stock?

(A) 9.19%

(B) 7.38%

(C) 13.54%

(D) 9.46%

Hint:

6.5/48 = 0.1354 i.e. 13.54%

Answer:

(C) 13.54%

Question 75.

Calculate the weighted marginal cost of capital for the company, if it raises ₹ 10 Crores next year, given the following information:

(i) Next expected dividend is ₹ 3.60 and expected to grow at the rate of 7%.

(ii) Income-tax rate is 40%.

(iii) Amount will be raised by equity and debt in equal proportions.

(iv) Additional issue of equity shares will result in the next price per share being fixed at ₹ 32.

(v) Debt capital raised by way of term loans will cost 15% for the first ₹ 2.5 Crores and 16% for the balance.

Select the correct answer from the options given below:

(A) 12.775%

(B) 15.625%

(C) 13.775%

(D) 15.475%

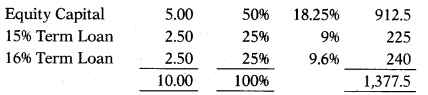

Hint:

Ke = \(\frac{\mathrm{D}_{1}}{\mathrm{P}_{\mathrm{o}}}\) + g

= \(\frac{3.6}{32}\) + 0.07

= 0.1825 i.e. 18.25%

For first 2.5 Crores

Kd = I(1 -t)

= 15(1 – 0.4)

= 9%

For next 2.5 Crores

Kd = I(1 -t)

= 16(1 -0.4)

= 9.6%

WACC = 1,377.5 = 13.775%

Answer:

(C) 13.775%

Question 76.

Nikon Enterprises just paid an annual dividend of ₹ 1.56 per share. This dividend is expected to increase by 3 percent annually. Currently, the firm has a beta of 1.13 and a stock price of ₹ 28 a share. The risk-free rate is 3 percent and the market rate of return is 10.5 percent. What is your best estimate of Nikon’s cost of equity?

(A) 8.74 per cent

(B) 11.48 per cent

(C) 9.72 per cent

(D) 10.11 percent

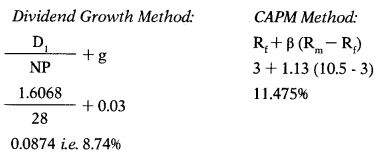

Hint:

Average cost of equity under different methods = (8.74 + 11.475)/2 = 10.11%

Answer:

(D) 10.11 percent

Question 77.

Jackson Ltd. has 12,000 bonds outstanding at a quoted price of 98% of face value. The bonds mature in 11 years and carry a 9% annual coupon. What is your best estimate of Jackson’s after-tax cost of debt if the applicable tax rate is 35%?

(A) 6.03%

(B) 5.77%

(C) 8.33%

(D) 7.04%

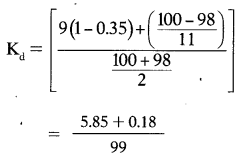

Hint:

Method 1:

= 0.0609 i.e. 6.09%

Method 2:

K = \(\frac{9(1-0.35)}{98}\) = 0.0597 i.e. 5.97%

6.09 + 5.97/2 = 6.03%

Answer:

(A) 6.03%

Question 78.

Mona Industries has a capital structure of 55% common stock, 10% preferred stock, and 45% debt. The firm has a 60% dividend payout ratio, a beta of 0.89, and a tax rate of 38%. Given this, which one of the following statements is correct?

(A) The after-tax cost of debt will be greater than the current yield-to-maturity on the firm’s bonds.

(B) The firm’s cost of preferred is most likely less than the firm’s actual cost of debt.

(C) The firm’s cost of equity is unaffected by a change in the firm’s tax rate.

(D) The cost of equity can only be estimated using the SML approach.

Answer:

(C) The firm’s cost of equity is unaffected by a change in the firm’s tax rate.

Question 79.

Baba Ltd. has a cost of equity of 12%, a pre-tax cost of debt of 7%, and a tax rate of 35%. What is the firm’s weighted average cost of capital if the debt-equity ratio is 0.60?

(A) 9.21%

(B) 10.01%

(C) 10.13%

(D) 11.11%

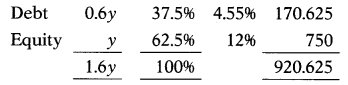

Hint:

Kd = 7 (1 – 0.35) = 4.5596. Debt equity ratio is 0.6.

0.6 = \(\frac{\text { Debt }}{\text { Equity }}\)

0.6 = \(\frac{x}{y}\)

0.6y = x

WACC = 920.65 = 9.21%

Answer:

(A) 9.21%

Question 80.

JKL Ltd. has ₹ 10 equity shares amounting to ₹ 15 Crore. The current market price per equity share is ₹ 60. The prevailing default risk-free interest rate on 10-year GOI Treasury bonds is 5.5%. The average market risk premium is 8%. The beta of the company is 1.1875. K =?

(A) 15%

(B) 11%

(C) 12%

(D) 13%

Hint:

Ke = Rf + β(Rm – Rf)

= 5.5 + 1.1875 × 8

= 15%

Answer:

(A) 15%

Question 81.

ABC Ltd. has three divisions: A, B & C. Division A has the least risk and Division C has the most risk. ABC Ltd. has an after-tax cost of debt of 4.6% and a cost of equity of 9.5%. Company is financed with 50% debt & 50% equity. Management has told the Divisional Manager of Division A that projects in that division are assigned a discount rate that is 1% less than the firm’s weighted average cost of capital. What is the discount rate applicable to Division A?

(A) 6.65%

(B) 6.31%

(C) 7.18%

(D) 6.05%

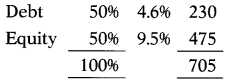

Hint:

WACC = 705/100 = 7.05%

Discount rate applicable to Division A = 7.05% – 1% = 6.05%

Answer:

(D) 6.05%

Question 82.

PWA Ltd. has ₹ 1,000, 9.5% debentures amounting to ₹ 1,500 Million. The debentures of PWA Ltd. are redeemable after 3 years and are quoting at ₹ 981.05 per debenture. The beta of the company is 1.1785. The applicable income tax rate for the company is 3596. Kd =?

(A) 1.59%

(B) 6.87%

(C) 7.86%

(D) 8.67%

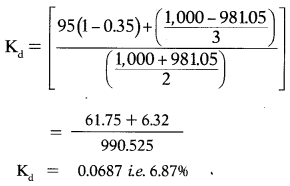

Hint:

Answer:

(B) 6.87%

Question 83.

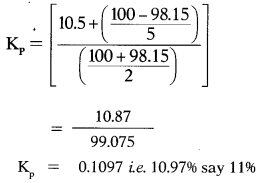

PWA Ltd. has ₹ 100, 10.5% preference shares amounting to ₹ 100 Million. The preferred stock of the company is redeemable after 5 years is currently selling at ₹ 98.15 per preference share. The beta of the company is 1.7158. The applicable income tax rate for the company is 3596. K =?

(A) 10%

(B) 11%

(C) 12%

(D) 13%

Hint:

Answer:

(B) 11%

Question 84.

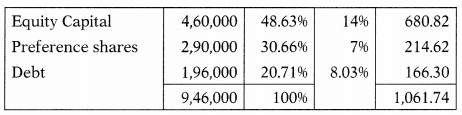

G Ltd. has 10,000 shares of common stock outstanding at a price per share of ₹ 46 and a rate of return of 14%. The Company has 5,000 shares of 7% preferred stock outstanding at a price of ₹ 58 a share. The outstanding debt has a total face value of ₹ 2,00,000 and a market price equal to 98% of face value. Yield-to-maturity (YTM) on the debt is 8.0396. What is the firm’s weighted average cost of capital?

(A) 10.62%

(B) 12.65%

(C) 8.62%

(D) 9.99%

Hint:

WACC= 1,061.74/100 = 10.62%

Answer:

(A) 10.62%

Question 85.

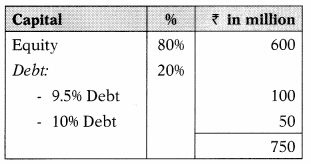

Calculate the marginal cost of capital (MCC) for the firm if it raises ₹ 750 million for a new project. The firm plans to have a target debt to value ratio of 20%. The beta of a new project is 1.4375. The debt capital will be raised through term loans. It will carry an interest rate of 9.5% for the first ₹ 100 million and 10% for the next ₹ 50 million.

The current market price per equity share is ₹ 60. The prevailing default risk-free interest rate on 10-year GOI Treasury bonds is 5.5%. The average market risk premium is 896.

(A) 14.86%

(B) 12.22%

(C) 13.04%

(D) 15.95%

Hint:

Cost of equity – QAPM Method:

Ke = R + β(Rm – Rf)

= 5.5 + 1.4375 X 8

= 17%

Cost of 9.5% debt:

Kd = 1(1 – t)

= 9.5(1 – 0.35)

= 6.175%

Cost of 10% debt

Kd = I(1 -t)

= 10(1 – 0.35)

= 6.5%

ABC Ltd. needs additional finance of ₹ 750 million with a debt to value ratio of 80%. This finance will be raised as follows:

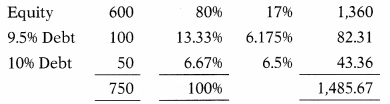

WACC (Marginal cost of additional finance) = 1,485.67/100 = 14.86%

Answer:

(A) 14.86%

Question 86.

Black & White Ltd. has a cost of equity of 11% and a pre-tax cost of debt of 8.5%. The firm’s target weighted average cost of capital is 996 and its tax rate is 35%. What is the firm’s target debt-equity ratio?

(A) 0.6203

(B) 0.5756

(C) 0.5572

(D) 0.5113

Hint:

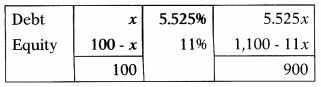

Kd = 8.5 (1 – 0.35) = 5.525%.

WACC is 9 thus a total of the product must be 900 (9 × 100).

Let the % of debt in total capital be ‘x’

Thus, % of the equity must be 100 – x

5.525x + 1,100 – 11x = 900

– 5.475x = – 200

x = 36.53

% of equity = 100 -36.53 = 63.47

Debt equity ratio = \(\frac{\text { Debt }}{\text { Equity }}=\frac{36.53}{63.47}\) = 0.5756

Answer:

(B) 0.5756

Question 87.

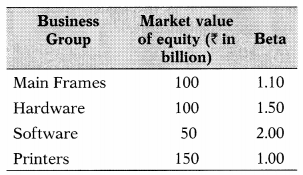

You are analyzing the beta for A Ltd. and have divided the Company into four broad business groups, with market values and betas for each 1 group.

An Ltd. had Z 50 billion in debt outstanding. The market risk premium is 8.5. The Treasury bond rate is 7.5%. Estimate cost of equity for A Ltd.

(A) 16.85%

(B) 20.25%

(C) 18.34%

(D) 24.50%

Answer:

(C) 18.34%

Question 88.

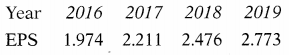

R&G Company has equity share capital (2,00,000 shares) ₹ 20,00,000. The company’s share has a current market price of ₹ 27.75 per share. The expected dividend per share in next year is 5096 of the 2019 EPS. The EPS of the last 4 years is as follows. The past trends are expected to continue.

Calculate the cost of ordinary equity.

(A) 17%

(B) 24%

(C) 16%

(D) 21%

Hint:

It can be observed from the data of EPS that it is growing by 1296 per annum. Hence, growth rate can be taken 12%.

Ke = \(\frac{\mathrm{D}_{1}}{\mathrm{P}_{\mathrm{o}}}\) + g

= \(\frac{1.3865}{27.75}\) + 0.12

= 0.1699 i.e. 17%

D1 = 2.773 × 50%

= 1.3865

It is given in the problem that the expected dividend per share in next year is 50% of the 2019 EPS.

Answer:

(A) 17%

Question 89.

The Company can issue a 14% new debenture. The company’s debenture is currently selling at ₹ 98. The face value of debenture is ₹ 100. The company’s marginal tax rate is 50%. What is the cost of debenture – (i) based on book value; (a) based on market value?

(A) 14% & 14.28%

(B) 6% & 6.12%

(C) 7% & 7.14%

(D) 8% & 8.16%

Hint:

Cost of debt based on book value:

Kd = \(\frac{\mathrm{I}(1-\mathrm{t})}{\mathrm{P}_{\mathrm{o}}}\)

= \(\frac{14(1-0.5)}{100}\)

= 0.07 i.e. 7.00%

Cost of debt based on market value:

Kd = \(\frac{\mathrm{I}(1-\mathrm{t})}{\mathrm{P}_{\mathrm{o}}}\)

= \(\frac{14(1-0.5)}{98}\)

= 0.0714 i.e. 7.14%

Answer:

(C) 7% & 7.14%

Question 90.

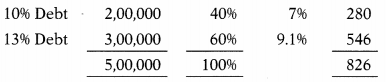

Ganesh Ltd. requires an amount of ₹ 5,00,000 to finance a project. It was decided to raise such finance by the issue of debentures. Cost of debt is 10% (before tax) up to ₹ 2,00,000 and 13% (before tax) beyond that. The tax rate is 30%. What is the average marginal cost of capital of new finance of ₹ 5,00,000?

(A) 7.37%

(B) 11.5%

(C) 8.26%

(D) 9.12%

Hint:

Cost of 10% Debt:

Kd = I(1 – t)

= 10(1 – 0.3)

= 7%

Cost of 13% Debt:

Kd = I(1 – t)

= 13(1 – 0.3)

Average cost of debt = 826/100 = 8.26%

Answer:

(C) 8.26%