Students should practice Consolidation of Accounts – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Consolidation of Accounts – Corporate and Management Accounting MCQ

Question 1.

Deduction of outsiders liabilities from total assets then dividing it by number of shares, the resultant figure will be

(A) Intrinsic value per share

(B) Net asset value per share

(C) Asset backing value per share

(D) All of the above

Answer:

(D) All of the above

Question 2.

Which of the following treatment of ‘Share Capital’ of the subsidiary company is correct?

(A) Share capital held by the holding company will be added to the cost of control statement.

(B) Share capital held by minority will be deducted in minority statement.

(C) Share capital of subsidiary held by holding company will be deducted from the cost of Investment to find out goodwill/capital reserve.

(D) Share capital of the subsidiary will be set off against the negative net worth of another subsidiary.

Answer:

(C) Share capital of subsidiary held by holding company will be deducted from the cost of Investment to find out goodwill/capital reserve.

Question 3.

If the closing balance of general reserve of a subsidiary is more than the opening balance of general reserve then it can be concluded that

(A) Capital profits are debited to the General Reserve A/c

(B) Pre-acquisition dividend is declared by the subsidiary company

(C) Some profit must have been transferred to general reserve by debiting profit & loss account by the subsidiary company

(D) Bonus share capital is issued by the subsidiary company

Answer:

(C) Some profit must have been transferred to general reserve by debiting profit & loss account by the subsidiary company

Question 4.

If the closing balance of general reserve of a subsidiary is less than the opening balance of general reserve then it can be concluded that –

(A) Pre-acquisition dividend is declared by the subsidiary company

(B) Bonus share capital issued by the subsidiary company

(C) Some profit must have been transferred to general reserve by debiting profit & loss account by the subsidiary company

(D) Capital profits are credited to the General Reserve A/c

Answer:

(B) Bonus share capital issued by the subsidiary company

Question 5.

Unrealized profit on goods sold and included in stock is deducted from:

(A) Capital Profit

(B) Revenue Profit

(C) Fixed Assets

(D) Minority interest

Answer:

(B) Revenue Profit

Question 6.

Which of the following treatment is correct for mutual debts with regard to purchasing and sale of goods between holding and subsidiary company?

(A) Amount of mutual debt will be added to the Debtors and Creditors on the asset side and liability side respectively while preparing the consolidated balance sheet.

(B) Amount of mutual debt will be ignored as it is not an asset or liability at all.

(C) Amount of mutual debt will be deducted from the Debtors and Creditors on the asset side and liability side respectively while preparing the consolidated balance sheet.

(D) Amount of mutual debt will require adjustment on debtors figure on asset side only if amount receivable by the subsidiary company is more than the amount payable to holding company.

Answer:

(C) Amount of mutual debt will be deducted from the Debtors and Creditors on the asset side and liability side respectively while preparing the consolidated balance sheet.

Question 7.

Which of the following statements are incorrect with regard to the preparation of a consolidated statement of financial position?

(A) Gain on fair valuation of a subsidiary’s asset is a pre-acquisition profit.

(B) Non-controlling interest does not deserve any portion of fair valuation gain.

(C) If an asset is not reported in the subsidiary’s ledger it need not be fair valued.

(D) Gain on fair valuation of subsidiary’s asset inflates the cost of goodwill.

Select the correct answer from the options given below.

(A) (B), (C) & (D)

(B) (C) & (D)

(C) (A), (C) & (D)

(D) (A), (B) & (C)

Answer:

(A) (B), (C) & (D)

Question 8.

On a consolidated balance sheet, if the shares of a company have been bought for more than the balance sheet value then the difference would appear as:

(A) Profit on purchase

(B) Goodwill

(C) Capital reserve

(D) Loss on purchase

Answer:

(B) Goodwill

Question 9.

If less than 100% of a subsidiary’s share capital has been acquired then what is the rule for inclusion of the subsidiary’s assets on the consolidated balance sheet?

(A) Only a proportional amount should appear.

(B) All the assets should appear.

(C) None can appear until all the shares have been acquired.

(D) Half the value should appear.

Answer:

(B) All the assets should appear.

Question 10.

What is the term used to describe dividends paid by one company in the group to another in the same group?

(A) Inter-group dividends

(B) Intra-group dividends

(C) Group dividends

(D) Interim dividends

Answer:

(B) Intra-group dividends

Question 11.

Which of the following is true?

(A) Minority shareholder’s share of pre-acquisition losses should be added to the amount of Minority Interest.

(B) Holding company’s share of pre-acquisition losses must be debited to Profit & Loss A/c

(C) Dividend received out of pre-acquisition profits of the subsidiary should be credited to Investment A/c.

(D) Dividend received out of post-acquisition profits of the subsidiary should be debited to Investment A/c.

Answer:

(C) Dividend received out of pre-acquisition profits of the subsidiary should be credited to Investment A/c.

Question 12.

How is negative goodwill reported on the consolidated statement of financial position?

(A) As a negative asset i.e. shown on the asset side but as a deduction.

(B) A tenth of it is included in consolidated reserves and the remainder reported as a reserve.

(C) Included fully in the consolidated retained earnings.

(D) As a reserve, which may prefer-ably be titled a capital reserve

Answer:

(D) As a reserve, which may prefer-ably be titled a capital reserve

Question 13.

If stock is sold for a profit from one group member to another, how should this be dealt with in the final accounts?

(A) Stock should appear at the original cost.

(B) The profits should be included but the stock would appear at the value sold for.

(C) Profit on sale should be eliminated and the stock appears at the original cost.

(D) Profits on the sale should be eliminated.

Answer:

(C) Profit on sale should be eliminated and the stock appears at original cost.

Question 14.

The claim by outsiders to assets featured on a consolidated balance sheet is known as:

(A) Subsidiary

(B) Negative goodwill

(C) Minority interest

(D) Wholly owned subsidiary

Answer:

(C) Minority interest

Question 15.

On consolidation, if the total of the fair value of the assets acquired is less than the whole purchase consideration then the differences should be treated as:

(A) Negative goodwill

(B) Goodwill

(C) Profit on the acquisition

(D) Loss on the acquisition

Answer:

(B) Goodwill

Question 16.

When dealing with consolidated balance sheets, the expression cost of control could be used instead of:

(A) Acquisition expenditure

(B) Goodwill

(C) Intangible investments

(D) Negative goodwill

Answer:

(B) Goodwill

Question 17.

Which of the following is not normally considered the right of an ordinary shareholder?

(A) An interest in the profits earned by the company.

(B) An interest in the day-to-day running of the company.

(C) An interest in the net assets of the company.

(D) Voting rights at meetings.

Answer:

(B) An interest in the day-to-day running of the company.

Question 18.

Y Company has a receivable from its parent, X Company. Should this receivable be separately reported on Y’s balance sheet and in X’s consolidated balance sheet?

Y’s balance sheet X’s balance sheet

(A) Yes No

(B) Yes Yes

(C) No No

(D) No Yes

Answer:

(A) Yes No

Question 19.

Which of the following is the best theoretical justification for consolidated financial statements?

(A) Inform the companies are one entity; in substance they are separate.

(B) Inform the companies are separate; in substance, they are one entity.

(C) In form and substance the companies are on the entity.

(D) In form and substance the companies are separate.

Answer:

(B) Inform the companies are separate; in substance, they are one entity.

Question 20.

Which of the following statement is false?

(A) Minority interest shown in the consolidated balance sheet is the equity held by the outsiders in the subsidiary company.

(B) Cost of control is the excess price paid for investment over and above the proportionate share of net assets acquired by the holding company.

(C) Profit on revaluation of fixed assets is a capital profit and depreciation on such amount is a revenue loss.

(D) For calculating the cost of control there is no need to distinguish between capital and revenue profits of the subsidiary.

Answer:

(D) For calculating the cost of control there is no need to distinguish between capital and revenue profits of the subsidiary.

Question 21.

Preparation of consolidated Balance Sheet of holding company and its subsidiary company is as per –

(A) AS-11

(B) AS-20

(C) AS-21

(D) AS-23

Answer:

(C) AS-21

Question 22.

Pre-acquisition dividend received by Holding Company is credited to:

(A) Profit & Loss A/c

(B) Capital Profit

(C) Investment A/c

(D) None of the above

Answer:

(C) Investment A/c

Question 23.

Post-acquisition dividend received by Holding Company is:

(A) Debited to Profit & Loss A/c & Credited to Bank A/c

(B) Debited to Bank A/c and Credited to Investment A/c

(C) Debited to Investment A/c and Credited to Bank A/c

(D) Debited to Bank A/c and Credited to Profit & Loss A/c

Answer:

(D) Debited to Bank A/c and Credited to Profit & Loss A/c

Question 24.

Which exchange rate will be considered for the conversion of the share capital of the subsidiary company?

(A) Closing rate

(B) Opening Rate

(C) Actual rate on the date of share acquisition

(D) Average Rate

Answer:

(C) Actual rate on the date of share acquisition

Question 25.

The group’s share of the pre-acquisition reserves of a subsidiary form part of the:

(A) Goodwill calculation

(B) Group’s capital reserves

(C) Group’s revenue reserves

(D) Group’s share capital

Answer:

(A) Goodwill calculation

Question 26.

As per AS-21, a Consolidated Financial Statement will not be prepared by the parent company when-

(A) Control is intended to be temporary because the subsidiary is acquired and held exclusively with a view to its subsequent disposal in the near future.

(B) Subsidiary company operates under severe long-term restrictions, which significantly impair its ability to transfer funds to the parent.

(C) Both (A) and (B)

(D) None of the above

Answer:

(C) Both (A) and (B)

Question 27.

In which of the following case the C Ltd. will be subsidiary of A Ltd.

(A) If A Ltd. holds 75% shares in B Ltd. and B Ltd. holds 25% shares in C Ltd.

(B) If A Ltd. holds 75% shares in B Ltd. and 25% shares in C Ltd.

(C) If A Ltd. holds 75% shares in B Ltd. and A Ltd. and B Ltd. holds 25% & 30% shares in C Ltd.

(D) If A Ltd. holds 75% shares in B Ltd. and C Ltd. holds 25% shares in B Ltd.

Answer:

(C) If A Ltd. holds 75% shares in B Ltd. and A Ltd. and B Ltd. holds 25% & 30% shares in C Ltd.

Question 28.

If A Ltd. is proved to be a subsidiary company of B Ltd., C Ltd. & D Ltd. then which company is liable to prepare Consolidated Financial Statement?

(A) B Ltd.

(B) C Ltd.

(C) D Ltd.

(D) All companies excluding A Ltd.

Answer:

(D) All companies excluding A Ltd.

Question 29.

Goodwill =?

(A) Cost of Investment less Parent’s share in the equity of the subsidiary on date of investment less Minority interest

(B) Cost of Investment less Parent’s share in the equity of the subsidiary on date of investment.

(C) Parent’s share in the equity of the subsidiary on date of investment less Cost of investment

(D) Cost of Investment add Parent’s share in the equity of the subsidiary on date of investment add the Minority interest

Answer:

(B) Cost of Investment less Parent’s share in the equity of the subsidiary on date of investment.

Question 30.

H Ltd. acquires 70% of the equity shares of S Ltd. on 1.1.2019. On that date, the paid-up capital of S Ltd. was 10,000 equity shares of ₹ 10 each; the accumulated reserve balance was ₹ 1,00,000. H Ltd. paid ₹ 1,60,000 to acquire 70% interest in the S Ltd. Assets of S Ltd. were revalued on 1.1.2019 and a revaluation loss of ₹ 20,000 was ascertained. Which of the following is correct in relation to the cost of control of the group consolidated financial statement?

(A) Capital Reserve ₹ 34,000

(B) Goodwill ₹ 34,000

(C) Capital Reserve ₹ 1,26,000

(D) Goodwill ₹ 1,26,000

Hint:

| 70% of the Equity Share Capital ₹ 1,00,000 | 70,000 |

| 70% of Accumulated Reserve ₹ 1,00,000 | 70,000 |

| 70% of Revaluation Loss ₹ 20,000 | (14,000) |

| 1,26,000 |

H Ltd. paid a positive differential of 4,000 i.e. ₹ (1,60,000 – 1,26,000). This differential is also called goodwill and is shown in the balance sheet under the head intangibles.

Answer:

(B) Goodwill ₹ 34,000

Question 31.

H Ltd. holds 7,500 shares of S Ltd. Total shares of S Ltd. are 10,000 of ₹ 10 each. General Reserve and Profit & Loss balance of S Ltd. are ₹ 3 5,000 & ₹ 27,500 respectively out of which 40% relates to the post-acquisition period. Minority Interest =?

(A) ₹ 40,625

(B) ₹ 34,375

(C) ₹ 50,525

(D) ₹ 40,925

Hint:

| Share capital held by a minority (2,500 × 10) | 25,000 |

| Share in profits: | |

| (+) Pre-acquisition (35,000 + 27,500) × 60% × 25% | 9,375 |

| (+) Post-acquisition (35,000 + 27,500) × 40% × 25% | 6,250 |

| 40,625 |

Alternatively,

25.0 + (35,000 + 27,500) × 2596 = 40,625

Answer:

(A) ₹ 40,625

Question 32.

The Balance Sheet of S Ltd. is as follows:

| Shareholder’s Funds: | ₹ |

| Equity Shares (₹ 10 each) | 1,00,000 |

| General Reserve | 35,000 |

| Profit & Loss Account | 27,500 |

| Current Liabilities: | |

| Creditors | 25,000 |

| Bills Payable | 15,000 |

| 2,02,500 |

| Non-Current Assets: | ₹ |

| Land & Buildings | 40,000 |

| Machinery | 10,000 |

| Preliminary Expense | 2,000 |

| Current Assets: | |

| Stock | 85,500 |

| Debtors | 45,000 |

| Bills Receivable | 15,000 |

| Cash & Bank | 5,000 |

| 2,02,500 |

Does H Ltd. hold 8096 shares of S Ltd. Minority Interest =?

(A) ₹ 32,500

(B) ₹ 32,100

(C) MO, 125

(D) ₹ 38,450

Hint:

2,02,500 – 2,000 – 25,000 – 15,000 = 1,60,500 (Net assets) 1,60,500 × 2096 = 32,100

Alternatively,

20.0 + (35,000 + 27,500 – 2,000) × 2096 = 32,100

Answer:

(B) ₹ 32,100

Question 33.

Balances of S Ltd. on 31.3.2019 are:

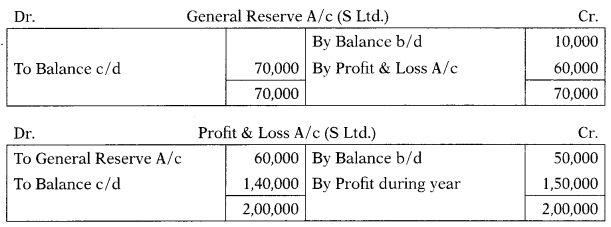

General Reserve ₹ 70,000

Profit & Loss Account ₹ 1,40,000

Balances of general reserve and profit and loss account on 1.4.2018 of S Ltd. were ₹ 10,000 and ₹ 50,000 respectively. Profit earned by S Ltd. during the year 2018-2019 =?

(A) ₹ 90,000

(B) ₹ 1,20,000

(C) ₹ 1,50,000

(D) ₹ 80,000

Hint:

Answer:

(C) ₹ 1,50,000

Question 34.

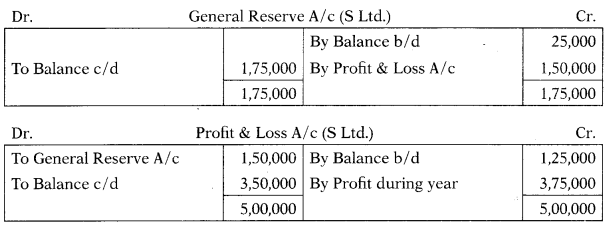

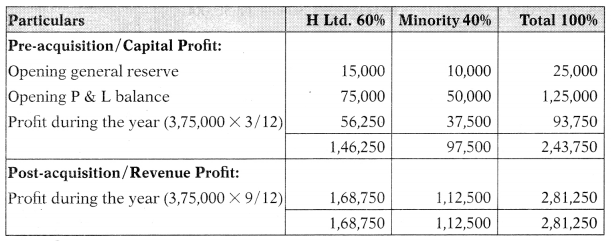

Following are the balances of S Ltd. on 31.3.2019:

General Reserve 71,75,000

Profit & Loss Account 73,50,000

H Ltd. acquired 6096 shares on 30th June 2018. Balances of general reserve and profit and loss account on 1.4.2018 of S Ltd. were ₹ 25,000 and ₹ 1,25,000 respectively. Share of H Ltd. in post-acquisition profit will be –

(A) ₹ 1,68,750

(B) ₹ 1,46,250

(C) ₹ 1,12,500

(D) ₹ 2,81,250

Hint:

Alternatively,

Prepare General Reserve A/c & Profit & Loss A/c and find out the profit made during the year.

Share of H Ltd. in post-acquisition profit will be = 3,75,000 × 9/12 × 60% = 1,68,750

Answer:

(A) ₹ 1,68,750

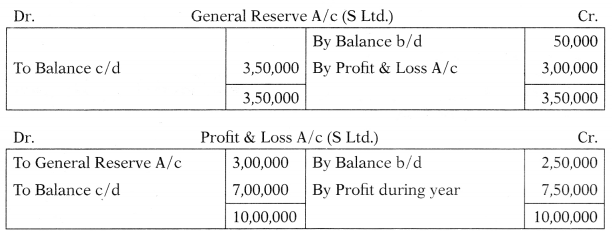

Question 35.

Following are the balances of S Ltd. on 31.3.2019:

Equity Share Capital 710,00,000

General Reserve 73,50,000

Profit & Loss Account 77,00,000

H Ltd. acquired 80% shares on 31st July 2018. Balances of general reserve and profit and loss account on 1.4.2018 of S Ltd. were 750,000 and 72,50,000 respectively. Share of Minority in post-acquisition profit will be –

(A) ₹ 1,10,000

(B) ₹ 1,00,000

(C) ₹ 5,00,000

(D) ₹ 2,70,000

Hint:

Share of Minority in post-acquisition profit will be = 7,50,000 × 8/12 × 20% = 1,00,000

Answer:

(B) ₹ 1,00,000

Question 36.

Following are the balances of S Ltd. on 31.3.2019:

Equity Share Capital 720,00,000

General Reserve 77,00,000

Profit & Loss Account 714,00,000

H Ltd. acquired 70% shares on T. 1.2019 Balances of general reserve and profit and loss account on 1.4.2018 of S Ltd. were ₹ 1,00,000 and ₹ 5,00,000 respectively. Minority Interest =?

(A) ₹ 12,90,000

(B) ₹ 5,20,000

(C) ₹ 7,00,000

(D) ₹ 12,30,000

Hint:

20,00,000 + 7,00,000 + 14,00,000 × 3096 = 12,30,000

Answer:

(D) ₹ 12,30,000

Question 37.

H Ltd. holds 75% Shares in S Ltd. In January 2019 S Ltd. sold to its parent company H Ltd. goods costing ₹ 15,000 for ₹ 20,000. On 31st March 2019 half of these goods were lying as unsold in godowns of H Ltd. Which of the following is the correct treatment for unrealized profit on stock while preparing the consolidated financial statement of H Ltd. & S Ltd.?

(A) Stock reserve of ₹ 5,000 will be reduced from ‘Stock’ on the asset side in the balance sheet and ₹ 5,000 will be added to the profit & loss account of H Ltd.

(B) ₹ 15,000 will be reduced from current asset & current liabilities

(C) Stock reserve of ₹ 5,000 will be reduced from ‘Stock’ on the asset side in the balance sheet and capital reserve of H Ltd.

(D) Stock reserve of ₹ 2,500 will be reduced from ‘Stock’ on the asset side in the balance sheet and ₹ 2,500 will be debited to the profit & loss account of H Ltd.

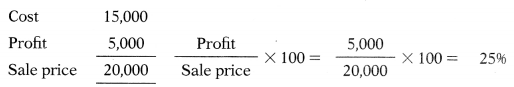

Hint:

Stock Reserve = 20,000 × 50% × 25% = 2,500.

Answer:

(D) Stock reserve of ₹ 2,500 will be reduced from ‘Stock’ on the asset side in the balance sheet and ₹ 2,500 will be debited to the profit & loss account of H Ltd.

Question 38.

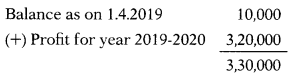

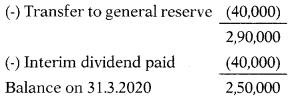

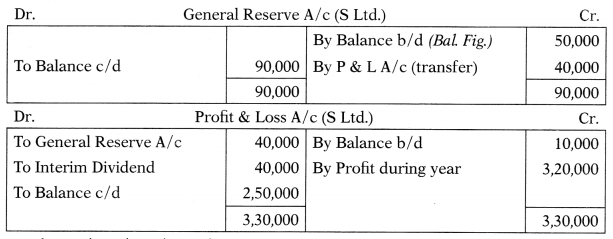

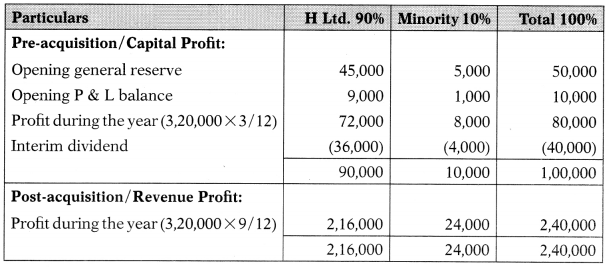

The General reserve of S Ltd. on 31.3.2020 was ₹ 90,000. Break-up of its profit and loss account is given below:

On 1.7.2019, H Ltd. acquired an interest in S Ltd. by acquiring ₹ 72,000 fully paid equity shares of ₹ 10 each for ₹ 8,00,000. The total paid-up share capital of S Ltd. is ₹ 8,00,000. H Ltd. credited the entire amount of interim dividend received to its profit and loss account.

How much goodwill or capital reserve will be shown in the consolidated balance sheet?

(A) Goodwill ₹ 46,000

(B) Capital reserve ₹ 10,000

(C) Goodwill ₹ 80,000

(D) Capital reserve ₹ 46,000

Hint:

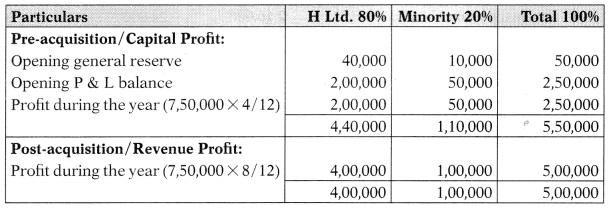

Analysis of profits of S Ltd.

| Cost of Investment | 8,00,000 |

| (-) Face value of shares | (7,20,000) |

| (-) Pre-acquisition dividend | (36,000) |

| (-) Pre-acquisition profits | (90,000) |

| Capital Reserve | (46,000) |

Answer:

(D) Capital reserve ₹ 46,000

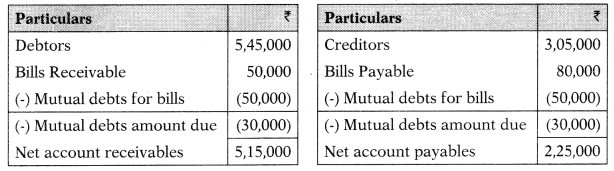

Question 39.

Following are the balances of H Ltd. &S Ltd. on 31.3.2019:

| Particulars | H Ltd. | S Ltd. |

| Debtors | 3,40,000 | 2,05,000 |

| Creditors | 1,95,000 | 1,10,000 |

| Bills Receivable | 50,000 | – |

| Bills Payable | – | 80,000 |

Bills accepted by S Ltd. were all shown by H Ltd. and H Ltd. had got bills amounting to ₹ 30,000 discounted with the bank. On 31.3.2019, S Ltd. owed ₹ 30,000 to H Ltd. for goods purchased from it. After setting-off mutual debts (a) Net, Account Receivables and (b) Net Account Payables will appear in a consolidated financial statement at:

| Account Receivables | Account Payables |

| (A) ₹ 3,85,000 | ₹ 1,95,000 |

| (B) ₹ 5,45,000 | ₹ 2,55,000 |

| (C) ₹ 5,15,000 | ₹ 2,25,000 |

| (D) ₹ 5,65,000 | ₹2,75,000 |

Hint:

Answer:

(C)

Question 40.

S Ltd. is a subsidiary of H Ltd. S Ltd. remitted a cheque for ₹ 5,000 to H Ltd. on 30th March 2018, which was received by H Ltd. on 1st April 2019. The accounting year of both companies closed on 31st March 2019. Which of the following treatment is correct in the consolidated financial statement for a cheque in transit?

(A) Bank balance of S Ltd. will be added by ₹ 5,000 and a cheque in transit of ₹ 5,000 will be separately shown in the balance sheet on the asset side.

(B) Really no treatment is required for a cheque in transit as it does not affect the aggregate bank balance of the group if proper entries are passed by the parent company and subsidiary company as and when the cheque is received or paid.

(C) Bank balance of H Ltd. will be increased by ₹ 5,000 and a cheque in transit of ₹ 5,000 will be separately shown in the balance sheet on the asset side

(D) All of the above are correct

Answer:

(B) Really no treatment is required for a cheque in transit as it does not affect the aggregate bank balance of the group if proper entries are passed by the parent company and subsidiary company as and when the cheque is received or paid.

Question 41.

A parent owns two-third of the subsidiary’s equity. As of a year-end the subsidiary’s inventory includes goods sent to it by the parent invoiced at ₹ 3,60,000. The parent has purchased these goods for ₹ 3,00,000. Which of the following are the correct entries for eliminating unrealized profit?

(A) Debit the parent’s retained earnings and credit the subsidiary’s inventory with ₹ 60,000.

(B) Debit the subsidiary’s retained earnings and credit the subsidiary’s inventory with ₹ 45,000.

(C) Debit the subsidiary’s retained earnings and credit the subsidiary’s inventory with ₹ 60,000.

(D) Debit the parents retained earnings and credit subsidiary’s inventory with ₹ 45,000.

Answer:

(A) Debit the parent’s retained earnings and credit the subsidiary’s inventory with ₹ 60,000.

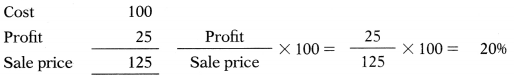

Question 42.

What is the amount of the unrealized profit to be eliminated if the parent’s year-end inventory includes ₹ 5,40,000 goods invoiced to it by its 60% owned subsidiary at cost plus 25%?

(A) ₹ 35,000

(B) ₹ 1,08,000

(C) ₹ 64,800

(D) ₹ 81,000

Hint:

5,40,000 × 20% = 1,08,000

Answer:

(B) ₹ 1,08,000

Question 43.

Subsidiary’s inventory at the year-end included ₹ 1,80,000 purchased from its parent. Further goods invoiced by the parent at ₹ 45,000 were in transit. The parent invoices the subsidiary at cost plus 20%. The amount of unrealized profit that needs to be eliminated from the parent’s retained earnings would be:

(A) ₹ 37,500

(B) ₹ 36,000

(C) ₹ 38,333

(D) ₹ 30,000

Hint:

(1,80,000 + 45,000) × 1/6 = 37,500

Answer:

(A) ₹ 37,500

Question 44.

Any amount owed by one member of a group to another needs to be canceled when preparing the consolidated statement of financial position. As of the year-end, the parent’s receivable includes ₹ 90,000 due from the subsidiary; whereas the subsidiary reports that it owes only ₹ 60,000 to the parent. The difference has arisen because of cash in transit. Which is the correct way of dealing with the situation when preparing the consolidated statement of financial position?

(A) Cancel ₹ 90,000 from both Receivable and Payable.

(B) Cancel ₹ 90,000 from parent’s Receivable, ₹ 60,000 from subsidiary’s Payable and include ₹ 30,000 with Cash.

(C) Cancel ₹ 90,000 from Receivable and ₹ 60,000 from Payable.

(D) Cancel ₹ 60,000 from both Receivable and Payable

Answer:

(B) Cancel ₹ 90,000 from parent’s Receivable, ₹ 60,000 from subsidiary’s Payable and include ₹ 30,000 with Cash.

Question 45.

As of the year-end, the parent’s statement of financial position reports rent receivable as an asset at ₹ 60,000 and this includes ₹ 15,000 due from the subsidiary. Subsidiary reports rent payable as ₹ 15,000. Which of

the following will be included in the consolidated statement of financial position?

(A) Rent is receivable as an asset at ₹45,000 and rent payable as a current liability at ₹ 15,000.

(B) Rent receivable as an asset at ₹ 60,000 and report nothing as a current liability.

(C) Rent receivable as an asset at ₹ 45,000 and report nothing within Current liabilities as rent payable.

(D) Rent receivable as an asset at ₹ 60,000 and rent payable as a current liability at ₹ 15,000.

Answer:

(C) Rent receivable as an asset at ₹ 45,000 and report nothing within Current liabilities as rent payable.