Students should practice Clubbing of Incomes – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Clubbing of Incomes – CS Executive Tax Laws MCQ Questions

Question 1.

Shyam transferred 2,000 shares of X Ltd. to Ms. Babita without any consideration. Later, Shyam and Ms. Babita got married to each other. The dividend income from the shares transferred would be

(A) Taxable in the hands of Shyam both before and after marriage

(B) Taxable in the hands of Shyam before marriage but not after marriage

(C) Taxable in the hands of Shyam after marriage but not before marriage

(D) Never taxable in the hands of Shyam [June 2015]

Answer:

(D) Never taxable in the hands of Shyam [June 2015]

Question 2.

Rohit (a Chartered Accountant) is working as Accounts Officer in Raj (P) Ltd. on a salary of ₹ 20,000 p.m. He got married to Ms. Pooja who holds 25% shares of this company. What will be the impact of salary paid to Rohit by the company in the hands of Ms. Pooja

(A) 100% salary to be clubbed

(B) 50% salary to be clubbed

(C) No amount be clubbed

(D) 25% salary be clubbed [Dec. 2015]

Answer:

(C) No amount be clubbed

Question 3.

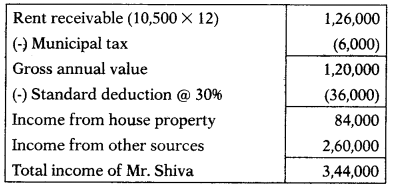

Mr. Shiva gifted a let-out building that fetches rental income of ₹ 10,500 per month to his son’s wife on 1-11-2020. The municipal tax of ₹ 6,000 on the property was paid on 10-1-2021. The total income from all other sources (computed) amounts to ₹ 2,60,000 except income from the above-said property. His total income chargeable to tax is:

(A) ₹ 3,11,450

(B) ₹ 3,44,000

(C) ₹ 3,80,000

(D) ₹ 3,33,500 [June 2017]

Hint:

Income of house property up to 1st Nov. will be taxable in the hands of Mr. Shiva. He had transferred assets on 1st Nov. to his son’s wife without consideration. Hence, income after 1st Nov. will also be clubbed in the hands of Mr. Shiva. Thus, practically a whole year’s income from house property is taxable in the hands of Mr. Shiva.

Answer:

(B) ₹ 3,44,000

Question 4.

Baby Meena (age 12) a child artist acted in feature films and earned ₹ 3,50,000. The total income of her father is ₹ 5,20,000 and her mother is ₹ 4,80,000.

The minor’s income would be:

(A) Chargeable to tax in the hands of father

(B) Chargeable to tax in the hands of mother

(C) Chargeable to tax in her own hands

(D) Fully exempt from tax [Dec. 2017]

Answer:

(C) Chargeable to tax in her own hands

Question 5.

Ram has gifted an amount of ₹ 10,00,000 to his wife Sita without consideration (but not to live apart), which was invested by his wife in interest-bearing security. She earned an interest of ₹ 1,00,000. The interest of ₹ 1,00,000 was further invested by her in the business from which she earned a profit of ₹ 15,000.

The income which is to be included out of this gifted amount in the hands of Ram is:

(A) ₹ 1,15,000

(B) ₹ 15,000

(C) ₹ 1,00,000

(D) Nil, because the gift is too relative [June 2018]

Answer:

(C) ₹ 1,00,000

Question 6.

Kapoor gifted ₹ 10,00,000 to his wife Sunita Kapoor on 15th May 2020. The amount of gift of ₹ 10,00,000 was invested by his wife in debentures of a company on 1st June 2020 earning interest @12% p.a.

The income of interest from the debentures earned by Sunita Kapoor shall be with the income of Kapoor in AY 2020-21.

(A) 1,20,000, not clubbed

(B) 1,00,000, clubbed

(C) 1,00,000, not clubbed

(D) 1,20,000, clubbed [Dec. 2018]

Answer:

(B) 1,00,000, clubbed

Question 7.

All income which arises or accrues to the minor child (not suffering from any disability as specified in section 80U) shall be clubbed with the income of parent whose total income excluding the income to be included of the minor not derived from any activity involving application of his skill, talent or specialized knowledge:

(A) in the hands of the father only

(B) in the hands of a mother only

(C) equally in the hands of both mother and father

(D) with the income of that parent whose total income is greater before clubbing of such income [Dec. 2018]

Answer:

(D) with the income of that parent whose total income is greater before clubbing of such income [Dec. 2018]

Question 8.

Which out of the following income is not to be clubbed while computing income of the Hindu Undivided Family (HUF) for the assessment year 2021-22?

(A) Fees or remuneration received by the member as a director or a partner in the company or firm if the funds of the HUF are invested in a company or firm.

(B) Income from ‘strident and personal income of the members.

(C) Income of minor sons out of the investments of the family funds.

(D) None of the above [Dec. 2018]

Answer:

(B) Income from ‘strident and personal income of the members.

Question 9.

Aiyer gifted 100 shares to his wife on 1st August 2015. She received 200 bonus shares from the company in April 2019. All the shares were sold to a friend for ₹ 1,50,000 in May 2020. The 100 shares were originally acquired by Aiyer for ₹ 5,000.

The capital gain on sale of shares in the month of May 2020 shall be chargeable to tax:

(A) Fully in the hands of Aiyer

(B) Fully in the hands of Mrs. Aiyer

(C) For 100 shares in the hands of Aiyer and balance 200 shares in the hands of Mrs. Aiyer

(D) For 200 shares in the hands of Aiyer and balance 100 shares in the hands of Mrs. Aiyer [June 2019]

Hint:

Income from accretion to a gifted asset cannot be clubbed in the hands of the person who transfers the asset by way of gift. Thus, if the husband transfers 100 shares to wife and wife received 200 bonus shares then capital gain arising on the transfer of 300 shares by the wife will be taxed as follows:

- Capital gain on 100 shares will be taxable in the hands of husband and

- Capital gain on 200 shares will be taxable in the hands of the wife.

Answer:

(C) For 100 shares in the hands of Aiyer and balance 200 shares in the hands of Mrs. Aiyer

Question 10.

Rohit is working as Company Secretary in Raj Chem Pvt. Ltd. on a salary of ₹ 20,000 p.m. He got married to Pooja who holds 25% shares of this Company. What will be the impact of salary paid to Rohit by the company in the hands of Pooja?

(A) No amount to be clubbed

(B) Club 50% salary

(C) Club 100% salary

(D) 25% salary be clubbed [Dec. 2019]

Answer:

(A) No amount to be clubbed

Question 11.

Transfer of income is revocable in the following cases :

(A) Sale with a condition of re-purchase

(B) Power to change beneficiary or trustees

(C) Both (A) and (B)

(D) Neither (A) nor (B) [Dec. 2019]

Answer:

(C) Both (A) and (B)

Question 12.

Ram has gifted on 11th May 2020 an amount of ₹ 10,00,000to his wife Sita without consideration and also for not to live apart. The gifted amount was invested by his wife in interest-bearing security on which she earned interest of ₹ 1,00,000 on 1st January 2020. The amount of interest of ₹ 1,00,000 was further invested by her in the business from which she earned a profit of ₹ 15,000 for the period ended on 31st March 2020. Specify the income which is to be included in the hands of Ram in A. Y. 2021-22.

(A) ₹ 1,15,000

(B) ₹ 1,00,000

(C) ₹ 15,000

(D) Nil

Answer:

(B) ₹ 1,00,000