Charge of GST – CA Final IDT Study Material is designed strictly as per the latest syllabus and exam pattern.

Charge of GST – CA Final IDT Study Material

Question 1.

Define ‘intra-state supply’ and ‘inter-state supply’ under GST law. Is it correct to say that inter-state supply attracts both CGST and SGST? [Nov. 2017, 3 Marks]

Answer:

Inter State Supply [Section 7 Of IGST Act, 2017]:

The supply shall be treated as a supply of goods/services in the course of inter-state in the following cases:

1. When location of the supplier and the place of supply are in

- Two different States

- Two different Union Territory’s

- A state and a Union Territory

2. Supply of goods/services imported into the territory of India

3. Supply to/by an SEZ developer or SEZ unit; or

Intra State Supply [Section 8 of IGST Act, 2017]

The supply of goods/services shall be treated as intra-state supply, where the location of the supplier and the place of supply are in –

- Same State

- Same Union Territory

GST on Inter-state supply

It is not correct to say that inter-State Supply attracts both CGST and SGST as inter-State Supply attracts IGST. However, IGST is the sum total of CGST and SGST/UTGST.

Question 2.

Rama Industries manufactures 1,500 Nos, of a product having assessable value @ ₹ 900 per piece. Rama Industries sold 1100 pieces In Domestic Tariff Area (DTA) and balance pieces were exported. If the rate of SGST & CGST payable is 9% each, calculate CGST, SGST and IGST on outward supplies. The DTA is In the same state.

Answer:

| Type of Supply | Units | Levy of GST | Reason |

| 1. Export | 400 | Being zero rated supply, the GST payable is Nil. | When goods are exported, they come under the category of zero rated supply. Hence, Integrated Tax (IGST) is not payable. Obviously, there is no question about levy of SGST and CGST. |

| 2. DTA | 1100 | Chargeable to GST | Since the DTA is in the same state, both CGST as well as SGST are levied simultaneously. |

Calculation of GST on given transaction:

| Type of Supply | GST Rate | Assessable Value | GST on Outward Supplies | |

| CGST | SGST | |||

| 1. Export | Nil | Not Applicable | Nil | Nil |

| 2.DTA | 1896 | 1100 units @ ₹ 900 = ₹ 9,90,000 | ₹ 9,90,000 @9% = ₹ 89,100 | ₹ 9,90,000 @9% = ₹ 89,100 |

Note: The amount of GST payable may be less than above amounts as Input Tax Credit will be available.

![]()

Question 3.

Write a short note on Charging Provisions in CGST Act, 2017.

Answer:

In CGST Act, Section 9 is the charging provision of Central tax (ie. CGST).

Statutory Provisions under CGST Act, 2017

Section 9(1) “Subject to the provisions of sub-section (2), there shall be levied, a tax called the central goods and services tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 and at such rates, not exceeding 20%, as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person.”

Section 9(2) The central tax on the supply of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel shall be levied with effect from such date as maybe notified by the Government on the recommendations of the Council.

Analysis of provisions of Sec. 9(1) & 9(2)

(1) No CGST shall be levied on alcoholic liquor for human consumption as the charging section prohibits imposition of GST on it.

(2) It provides that all intra-State Supplies would be liable to CGST.

(3) The levy is on supply of all goods and services or both except the following:

(a) On supply of alcoholic liquor for human consumption.

(b) On five petroleum products, which are although covered under Act but tax will be levied only w.e.f. such date as may be notified by the Government after recommendation of council.

(4) The section also provides for the

(a) Value on which tax shall be paid (as per section 15)

(b) The maximum rate of Central tax that can be levied on such supplies (specified at 20%).

(c) The manner of collection of tax by the Government and

(d) The person who will be liable to pay tax. (Taxable Person)

Question 4.

Prem is running a consulting firm and also a fancy store, registered under the same PAN number. Turnover of the fancy store is ₹ 65,00,000 and receipt of consultancy firm is 1000,000 in the preceding financial year 2018-2019.

You are required to provide answers with supporting explanatory note for each answer to the following questions:

(i) Is Prem eligible for composition scheme under CGST Act for 2019-2020?

(ii) Whether it is possible for Prem to opt for composition scheme only for fancy store?

(iii) If Prem is running a restaurant with turnover of ₹ 65,00,000 instead of consultancy firm as well as a fancy store, would he be eligible for composition scheme in 2019-2020? [May 2018, 3 Marks]

Answer:

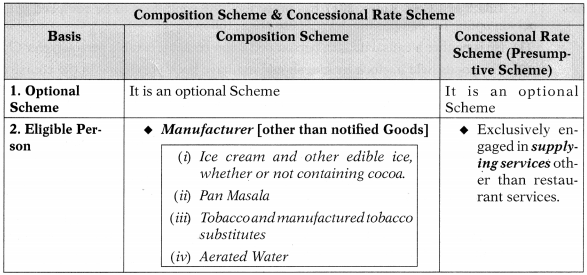

(i) Eligibility of Prem for composition scheme under CGST Act

Facts of the given Case Study

- Prem is running consulting firm and fancy store under same PAN.

- The turnover in preceding year is ₹ 65 lakhs (fancy store) and ₹ 10 lakhs (consulting firm)

Related Provisions

As per Notification No. 14/2019 Central Tax dated 7-3-2019:

If aggregate turnover is up to ₹ 1.5 Crore in the preceding financial year, such person will be eligible to opt for payment of tax under the composition scheme. In case of Special Category States the aggregate turnover in the preceding financial year shall be ₹ 75 lakh.

Decision

Since the aggregate turnover in preceding year is ₹ 75 lakhs only, Prem is eligible to opt for composition levy for 2019-2020.

But, as per second proviso to section 10(1), Prem can supply consultancy services of value not exceeding ₹ 7.5 lakhs only (being 1096 of turnover in preceding year or ₹ 5,00,000 whichever is higher). If the value of services exceeds ₹ 7.5 lakhs, then Prem will become ineligible for the composition scheme.

(ii) To opt for composition scheme only for fancy store?

In accordance to Proviso to section 10(2), the registered person is required to opt for composition for all the entities under same PAN. Thus, Prem cannot opt composition scheme only for fancy store.

(iii) If Prem is running a restaurant instead of consultancy firm?

If Prem is running a restaurant with turnover of 65,00,000 instead of consultancy firm as well as a fancy store, he is eligible for composition scheme. In this case, composition tax is payable @5%

![]()

Question 5.

MN Ltd. has two registered business verticals in the State of Haryana. Its aggregate turnover during the previous financial year for both the business verticals was ₹ 62 lakh. It wishes to opt for composition levy for one of the verticals in the current year and wants to continue with registration and pay taxes at the merit rate for the second vertical. Can MN Ltd. do so? Explain with reason. [Nov. 2018 (Old), 3 Marks]

Answer:

Facts of the given Case Study

- MN Ltd. has two registered business verticals (Same PAN) in the State of Haryana.

- It wishes to opt for composition levy for one of the verticals and wants to pay taxes at the merit rate for the second vertical.

- Question is whether MN Ltd. Can do so?

Related Provisions

As per proviso to section 10(2) of the CGST Act, 2017:

- Where more than one registered persons are having the same PAN issued under the Income-tax Act, 1961

- The registered person shall not be eligible to opt for the composition scheme

- unless all such registered persons opt to pay tax under composition scheme.

Decision

- MN Ltd. CANNOT opt for composition levy for only one of the business verticals and pay tax under regular scheme for other business vertical.

Question 6.

M/s. Ranveer Industries, registered in Himachal Pradesh, is engaged in making inter-State supplies of readymade garments. The aggregate turnover of M/s. Ranveer Industries in the financial year 2019-20 is ₹ 70 lakh. It opted for composition levy in the year 2020-21 and paid tax for the quarter ending September, 2020 under composition levy.

The proper officer has levied penalty for wrongly availing the scheme on M/s. Ranveer Industries in addition to the tax payable by it.

Examine the validity of the action taken by proper officer. [Nov. 2018 (Old), 4 Marks]

Facts of the given Case Study

- M/s. Ranveer Industries is engaged in making inter-State supplies of readymade garments.

- Aggregate turnover in preceding year is 70 Lakhs.

- Company opted for composition levy in current financial year.

- Proper officer has imposed penalty.

Related Provisions

As per section 10 of the CGST Act, 2017.

A registered person, whose aggregate turnover in the preceding financial year did not exceed ₹ 1.5 crore in a State/UT [₹ 75 lakh in case of Special Category States except Jammu and Kashmir and Assam, Himachal

Pradesh], may opt for composition scheme.

However, he shall not be eligible to opt for composition scheme if, inter alia, he is engaged in making any inter-State outward supplies of goods.

Decision

M/s. Ranveer Industries is engaged in making inter-State supplies of readymade garments. Thus, it is NOT eligible to opt for composition scheme in FY 2017-18 irrespective of its turnover in the preceding FY.

Further, if the proper officer has reasons to believe that a taxable person has paid tax under composition scheme despite not being eligible, such person shall, in addition to any tax payable, be liable to a penalty.

Thus, the action taken by the proper officer is VALID in law.

Question 7.

Radheshyam Foods is engaged in supplying restaurant service in Gujarat. In the preceding financial year, it has a turnover of ₹ 145 lakh from the restaurant service.

(a) You are required to advise Radheshyam Foods whether it is eligible for composition scheme in the current year assuming that in the current financial year, his turnover is expected to be ₹ 125 lakh from supply of restaurant services and ₹ 15 lakh from the supply of farm labour in said State. Further, it also expects to earn bank interest of ₹ 20 lakh from the fixed deposits.

(b) Also compute the estimated tax payable by Radheshyam Foods in the current FY.

Answer:

(a) Eligible for composition scheme:

Facts of the given case study

- Radheshyam Foods is in restaurant service.

- In the preceding financial year, it has a turnover of ₹ 145 lakh.

- In the current financial year:

- Expected Turnover (restaurant services) = ₹ 125 lakh

- Supply of farm labour = ₹ 15 lakh

- Bank interest on fixed deposits = ₹ 20 lakh

Related Provisions

(a) Notification No. 14/2019 Central Tax dated 7-3-2019, w.e.f. 1-04-2019

A registered person, whose aggregate turnover in the preceding financial year did not exceed ₹ 1.5 Crore, will be eligible to opt for payment of tax under the composition scheme. The limit is ₹ 75 Lakh in case of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura and Uttarakhand.

(b) Inclusion of exempt services:

Section 2(6)of the CGST Act, 2017 provides that the exempt services are included in the definition of aggregate turnover.

(c) Exclusion of some exempt services:

Order No. 01/2019 CT dated 01.02.2019 clarifies that the value of supply of exempt services by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount, shall not be taken into account.

(d) Supply of services allowed to some extent:

As per second proviso to section 10(1), a composition dealer is allowed to provide services of value not exceeding 10% of the turnover in the preceding financial year in a State or ₹ 5 lakh, whichever is higher.

Analysis and Decision

In the given case, the aggregate turnover of Radheshyarn Foods from restaurant services in the preceding FY is ₹ 145 lakh. Therefore, it is eligible to opt for composition scheme in the current FY.

Further, apart from restaurant services, it can provide services upto ₹ 14.5 lakh [i.e. 10% of 145 lakh or ₹ 5 lakh, whichever is higher, in the current FY. As already seen, bank interest of ₹ 20 lakh from fixed deposits will not be considered while determining this limit.

Further, Radheshyam Foods is expected to provide the exempt services of supply of farm labour worth ₹ 15 lakh in current financial year. Thus, turnover of supply of farm labour [₹ 15 lakh] along with the turnover of restaurant services [₹ 125 lakh] will be eligible for composition scheme, in the current financial year.

(b) Calculation of estimated tax payable in the current FY

Tax rate applicable for restaurant services under composition scheme is 5% [CGST & SGST 2.5% each]. Assessable Value = ₹ 125 lakh + ₹ 15 lakh = ₹ 140 lakh

CGST = 2.5% of ₹ 140 Lakh = ₹ 3.5 Lakh

SGST = 2.5% of 1140 Lakh = ₹ 3.5 Lakh

![]()

Question 8.

Examine whether the suppliers are eligible for composition scheme in the following independent cases. Is there any other option available for concessional tax payment with any of these suppliers, wherever composition scheme cannot be availed?

(a) M/s. Devlok, a registered dealer, is dealing in intra-State trading of electronic appliances in Jaipur (Rajasthan). It has turnover of ₹ 130 lakh in the preceding financial year. In the current financial year, it has also started providing repairing services of electronic appliances.

(b) M/s Narayan & Sons, a registered dealer, is running a “Khana Khazana” Restaurant near City Palace in Jaipur. It has turnover of ₹ 140 lakh in the preceding financial year. In the current financial year, it has also started dealing in intra-State trading of beverages in Jaipur (Rajasthan).

(c) M/s Indra & Bro, a registered dealer, is providing restaurant services in Uttarakhand. It has turnover of ₹ 70 lakh in the preceding financial year. It has started providing intraState interior designing services in the current financial year and discontinued rendering restaurant services.

(d) M/s Him Naresh, a registered dealer, is exclusively providing intra-state architect services in Uttarakhand. It has turnover of ₹ 40 lakh in the preceding financial year. [RTP, Nov. 19]

Answer:

Statutory Provisions:

(a) As per section 10 of the CGST Act, 2017, the following registered persons, whose aggregate turnover in the preceding financial year did not exceed ₹ 1.5 crore, may opt to pay tax under composition levy.

Who is eligible for composition scheme?

- Manufacturer other than manufacturers of such goods as may be notified by the government

- Other Suppliers (Dealers)

- Suppliers making supplies referred to in Clause (b) of Para 6 of Schedule II E.g. Restaurant Services

(b) As per second Proviso to section 10(1) : A composition scheme taxpayers is permitted to render services other than restaurant services upto a value not exceeding:

(a) 10% of the turnover in a State/Union territory in the preceding financial year; or

(b) ₹ 5 lakh,

Whichever is higher.

(c) Option to Pay Concessional Tax @ 3% (CGST @ 3%, SGST/UTGST @ 3%): With effect from 01.04.2019, Notification No. 2/2019 CT (R) dated 07.03.2019 has provided an option to a registered person whose aggregate turnover in the preceding financial year is upto ₹ 50 lakh and who is not eligible to pay tax under composition scheme, to pay tax @ 3% on first supplies of goods and/or services upto an aggregate turnover of ₹ 50 lakh.

Analysis of given cases

In view of the abovementioned provisions, the answer to the given independent cases is as under:

| Summary of Facts of given case | Eligibility for Composition Levy | |||

| (a) | M/s. Deviok

a registered dealer Rajasthan intrastate trading Turnover In preceding Year is ₹ 130 lakh In the current year, it has also started providing repairing services of electronic appliances. |

Applicable Limit: The turnover limit for composition scheme in case of Jaipur (Rajasthan) is ₹ 1.5 crore.

M/s. Deviok can opt for composition scheme as its aggregate turnover is less than ₹ 1.5 crore. M/s. Deviok can supply repair services as per following limit.

10% of ₹ 130 lakh or ₹ 5 lakh Whichever is higher Thus, the firm can supply services up to a value of ₹ 13 Iakh in the current financial year. |

||

| (b) | M/s Narayan & Sons

a registered dealer running a Restaurant It has turnover of ₹ 140 lakh in the preceding financial year In the current financial year, it has also started dealing in intra-State trading of beverages in Jaipur (Rajasthan). |

In the given case:

(i) the turnover in the preceding year is less than the eligible turnover limit, i.e. ₹ 1.5 crore. (ii) the supplier is engaged in providing restaurant service which is an eligible supply under composition scheme. (iii) the supplier wants to engage in trading of goods which is also an eligible supply under composition scheme. Thus, M/s Narayan & Sons is eligible for composition scheme. |

||

| (c) | M/s Indra & Bro

a registered dealer providing restaurant services in Uttarakhand It has turnover of 70 lakh in the preceding financial year. It has started providing intra-State interior designing services and discontinued rendering restaurant services. |

Applicable Limit: The turnover limit for composition scheme in case of Uttarakhand is ₹ 75 lakh.

Further, a registered person who is exclusively engaged in supplying services other than restaurant services is not eligible for composition scheme. Thus, M/s. Indra & Bro cannot opt for composition scheme. Alternative Scheme: The benefit of concessional tax payment under Notification No.2/2019 CT (R) dated 07.03.2019 is available in case of a registered person whose aggregate turnover in the preceding financial year does not exceed ₹ 50 lakh. Thus, in view of the above-mentioned provisions, M/s Indra & Bro Applicable Limit: as its aggregate turnover in the preceding financial year is more than 50 lakh. |

||

| (d) | M/s Him Naresh

a registered dealer exclusively providing intra-state architect services in Uttarakhand It has turnover of 40 lakh in the preceding financial year. |

An exclusive service provider can opt for the composition scheme only if he is engaged in supply of restaurant services.

Since M/s Him Naresh is exclusively engaged in supply of services other than restaurant services, it is not eligible for composition scheme. However, M/s Him Naresh is entitled to avail benefit of concessional payment of tax under Notification No. 2/2019 CT(R) dated 07.03.2019. |

||

Question 9.

Mr. Pujari is running a restaurant in Mumbai. In the preceding financial year, it has turnover of ₹ 130 lakh from the restaurant services. In the current financial year, apart from restaurant service, he also wants to provide food delivery services to other restaurants. He estimated the turnover of such services upto ₹ 10 lakh.

Mr. Pujari wishes to opt for composition scheme in the current financial year. You are required to advise him for same. Further, also advise the documents to be issued by him for billing the restaurant services as well as food delivery services in case he opts for composition scheme.

Answer:

Statutory Provisions:

(a) As per Notification No. 14/2019 Central Tax dated 7-3-2019, with effect from 01-042019, a registered person, whose aggregate turnover in the preceding financial year did not exceed ₹ 1.5 Crore, will be eligible to opt for payment of tax under the composition scheme. However, the aggregate turnover in the preceding financial year shall be ₹ 75 Lakh in case of an eligible person, registered under section 25 of CGST Act, in any of the following states, namely: – Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura and Uttarakhand.

(b) As per second Proviso to section 10(1) : A composition scheme taxpayers is permitted to render services other than restaurant services up to a value not exceeding:

(a) 10% of the turnover in a State/Union territory in the preceding financial year; or

(b) ₹ 5 lakh,

Whichever is higher.

Analysis of given case

Eligibility for Composition Levy

- Since the turnover of Mr. Pujari is ₹ 130 lakh in preceding financial year, he is eligible for composition scheme in the current financial year.

- Further, in the current financial year, he can also supply services other than restaurant services for a value upto ₹ 13 lakh (10% of ₹ 130 lakh) or ₹ 5 lakh, whichever is higher.

- Thus, till the time his turnover from food delivery services does not exceed ₹ 13 lakh, he is eligible for the scheme.

Documents to be issued

- In terms of section 31(3)(c) of the CGST Act, 2017. Mr. Pujari is required to issue Bill of Supply in both the cases i.e. while providing restaurant services and food delivery services.

- He shall also mention the words “composition taxable person, not eligible to collect tax on supplies” at the top of the bill of supply issued by him.

Question 10.

M/s. Verma Industries, registered in Himachal Pradesh, is engaged in making inter-State supplies of readymade garments. The aggregate turnover of M/s. Verma Industries in the preceding financial year is ₹ 100 lakh. It has opted for composition levy in the current financial year and paid tax for the July-Sep quarter of current year under composition levy.

The proper officer has levied penalty for wrongly availing the scheme on M/s. Verma Industries in addition to the tax payable by it.

Examine the validity of the action taken by proper officer.

Answer:

| Question | Statutory Provision | In the given case |

| Eligibility for Composition Levy | Section 10(2)(c)

The registered person shall not be eligible to opt for composition scheme if, inter alia, he is engaged in making any inter-State outward supplies of goods. |

♦ The M/s Verma Industries is engaged in making inter-State supplies of readymade garments.

♦ Therefore, it is not eligible to opt for composition scheme in current year irrespective of its turnover in the preceding FY. |

| Penalty by proper officer | Section 10(5) If the proper officer has reasons to believe that a taxable person has paid tax under composition scheme despite not being eligible, such person shall, in addition to any tax payable, be liable to a penalty. |

♦ The action taken by the proper officer of levying the penalty for wrongly availing the composition scheme is valid in law. |

![]()

Question 11.

Mr. Rajbeer, a registered person at Delhi, is in the business of selling goods relating to interior decoration under the Firm name M/s. Rajbeer & Sons. He has opted for Composition scheme for the Financial Year (FY) 2018-19

His turnover for FY 2018-19 is ₹ 80 lakhs and is expected to achieve ₹ 130 lakhs in FY 2019-20. Discuss whether M/s. Rajbeer & Sons can still enjoy the benefits of Composition Scheme in FY 2019-20.

His son Karan wants to start business of providing services relating to interior decoration, after completing post-graduation course in interior decoration under same firm name M/s. Rajbeer & Sons with effect from 1.4.2019 and wants to enjoy the benefits of composition scheme under GST.

Advise Mr. Rajbeer and his son Karan. [Nov 2019, 5 Marks]

Answer:

Statutory Provisions:

As per second Proviso to section 10(1): A composition scheme taxpayers is permitted to render services other than restaurant services up to a value not exceeding:

(a) 10% of the turnover in a State/Union territory in the preceding financial year; or

(b) ₹ 5 lakh,

Whichever is higher.

Analysis of given case

- In this case Karan wants to start business of providing services relating to interior decoration under same firm name M/s. Rajbeer & Sons with effect from 1.4.2019.

- M/s. Rajbeer & Sons firm can enjoy the benefit of composition scheme under GST but they cannot provide services exceeding the specified limit.

- M/s. Rajbeer & Sons can supply services of interior decoration in financial year 2019-20 as per following limit.

| 10% of ₹ 80 lakh or ₹ 5 lakh | Whichever is higher |

Advise: Mr. Rajbeer and his son that they can provide services of interior decoration only upto ₹ 8 Lakhs. If this limit is crossed by them, then composition scheme will be withdrawn.

Question 12.

M/s. Heeralal and Sons registered in Karnataka has opted to avail the benefit of composition scheme. It has furnished the following details for the tax period ended on 30-06-2018.

| S. No. | Items | ₹ |

| (i) | Taxable turnover of goods within the sale | 15,00,000 |

| (ii) | Exempted turnover of goods within the state | 17,00,000 |

| Total Turnover | 32,00,000 |

Using the above information, calculate total GST (No need for bifurcation between CGST and SGST) to be paid by the firm for the tax period ended on 30-06-2018 in following independent situations:

(i) M/s. Heeralal and sons is a Manufacturer.

(ii) M/s. Heeralal and sons is a Trader. [Nov. 2018, 3 Marks]

Solution:

Rates under composition scheme.

| Taxpayer | SGST/UTGST Rate | CGST Rate | Total Rate |

| (1) Manufacturer other than manufacturers of such goods as may be notified by the government | 0.50% of Aggregate T/O | 0.50% of Aggregate T/O | 1 % of Aggregate T/O |

| (2) Other Suppliers (Trader) | 0.50% of Taxable Supplies | 0.50% of Taxable Supplies | 1% of Taxable Supplies of Goods & Services |

Computation of amount payable under composition scheme

| If M/s. Heeralal is | Tax is to be paid |

| (i) Manufacturer | Rate of Tax: @1% (CGST + SGST) of the turnover in the State Total GST = 1% of [₹ 15,00,000 + 17,00,000] = 1% of ₹ 32,00,000= ₹ 32,000 |

| (ii) Trader | Rate of Tax: @ 1% (CGST + SGST) of the Taxable turnover Total GST = 1% of ₹ 15,00,000 = ₹ 15,000 |

Examiner’s Comment

Some examinees failed to appreciate that amount payable under composition scheme in case of trader is specified percentage of the turnover of taxable supplies of goods in the State instead of turnover in the State.

Question 13.

(Additional Important Question) M Ltd. a manufacturing concern in Mumbai has opted for composition scheme furnishes you with the following information for Financial Year 2019-20. It requires you to determine its composition tax liability and total tax liability. In Financial Year 2019-20 total value of supplies including inward supplies taxed under reverse charge basis are ₹ 1,30,00,000. The break up of supplies are as follows –

| Particulars | ₹ |

| (1) Intra State Supplies of Goods X chargeable @ 5% GST | 66,00,000 |

| (2) Intra State Supplies made which are chargeable to GST at Nil rate | 18,00,000 |

| (3) Intra state supplies which are wholly exempt under section 11 of CGST Act, 2017 | 12,00,000 |

| (4) Value of inward supplies on which tax payable under RCM (GST Rate 5%) | 25,00,000 |

| (5) Intra State Supplies of Goods Y chargeable @ 18% GST | 9,00,000 |

Answer:

The composite tax liability of M Ltd. shall be as under:

(1) Computation of Aggregate Turnover and composite tax:

| Particulars | Amount (₹) |

| (1) Supplies made under forward charge | 66,00,000 |

| (2) Supplies made which are chargeable to GST at Nil rate | 18,00,000 |

| (3) Supplies which are wholly exempt under section 11 of CGST Act, 2017 | 12,00,000 |

| (4) Value of inward supplies on which tax payable under RCM (GST Rate 5%) (not to be included) | NIL |

| (5) Intra State Supplies of Goods Y chargeable @18% GST | 9,00,000 |

| Aggregate turnover | 1,05,00,000 |

| Rate of Composite tax | 1% |

| Total Composite tax | 1,05,000 |

(2) Tax payable under reverse charge basis:

| Particulars | Amount (₹) |

| Value of inward supplies on which tax payable under RCM | 25,00,000 |

| Rate of GST | 5% |

| Tax payable under RCM | 1,25,000 |

Total Tax Payable = ₹ 1,05,000 + ₹ 1,25,000 = ₹ 2,30,000

Question 14.

Write short flotes on the list of persons not eligible for composition scheme.

Answer:

As per section 10(2) of CGST Act, 2017, the following persons are not eligible for composition Scheme:

(a) A service provider (except Restaurant Services & a Registered person whose Value of Service ≤ 10% of the Turnover in a state/UT in Preceding F.Y. OR ₹ 5 Lakh, whichever is Higher)

(b) Person making non-taxable supplies (Alcohol, Petrol & Supplies under Schedule III)

(c) Person making inter-State supply of goods.

(d An electronic commerce operator responsible for collecting tax at source and

(e) Manufacturer of notified goods.

(f) Non-resident Taxable Person or Casual Taxable Person

Question 15.

Distinguish between Composition Scheme and Presumptive Scheme.

Answer:

![]()

Question 16.

Explain Conditions and Restrictions as per Rule 5 of CGST Rules.

Answer:

The Rule 5 of CGST Rules, 2017 has prescribed the conditions to be complied with by the person opting for composition levy. These are as follows:

(1) He is neither a causal taxable person nor a non-resident taxable person [refer Chapter 3]

(2) The goods held in stock by him should not have been purchased in the course of interstate trade/commerce or imported from a place outside India. Likewise, he should not have received goods from his branch situated outside the state or from his agent/principal outside the state.

(3) The goods held in stock by him have not been purchased from an unregistered supplier and where purchased, he pays the tax under reverse charge under section 9(4).

(4) He shall pay tax under section 9(3)/9(4) (reverse charge) on inward supply of goods or services or both.

(5) He was not engaged in the manufacture of goods as notified under section 10(2)(e), during the preceding Financial Year. The following goods have been hereby notified vide Notification No. 8/2017 CT dated 27.06.2017

(a) Ice cream and other edible ice, whether or not containing cocoa.

(b) Pan Masala

(c) Tobacco and manufactured tobacco substitutes

(d) Aerated water (With effect from 1-10-2019)

(6) He shall mention the words composition taxable person, not eligible to collect tax on supplies at the top of the bill of supply issued by him; and

(7) He shall mention the words “Composition Taxable Person” on every notice or signboard displayed at a prominent place at his principal place of business and at every additional place or places of business.

Question 17.

Discuss with reasons whether the following persons are eligible to opt for Composition levy if all the cases are independent.

- Mr. Anjaan wants to sell taxable goods in an exhibition organized for a week in Delhi. He does not have fixed place of business in Delhi and is participating in the exhibition for the first time only.

- Mr. Banarsi Dass is in the business of tobacco products.

- Mr. Bean wants to opt for Composition scheme with effect from 8th July, 2018. The stock held on this date consists of goods purchased in the course of intra-state trade

- Mr. Vishal runs a restaurant which supplies food articles at second floor under the brand “Raffles” in Karol Bagh, Delhi. He also deals in garment in a shop in the same building on ground floor.

Answer:

- Mr. Anjaan is a casual taxable person. Hence, he cannot exercise the option to pay tax under the Composition scheme.

- As per the Government notification, manufacturer of “Ice-cream, Pan Masala & Tobacco products” are not eligible to opt composition scheme. Therefore, Mr. Banarsi Dass cannot opt for composition scheme.

- Mr. Bean can opt for composition scheme as the stock does not include inter-state purchases.

- Mr. Vishal is eligible for composition levy as supplier of food articles is allowed to opt for composition scheme.

Question 18.

KRVV Enterprises has opted for composition scheme in the Financial Year 2019-20. Its aggregate turnover in Financial Year 2018-19 is t 70 Lakhs. In Financial Year 2019-20, the entity desires to supply services (Other than restaurant services) also but in such a manner so that it may continue to remain eligible for composition scheme. What is the maximum value of services that can be supplied by the firm?

Answer:

Statutory Provisions:

As per second Proviso to section 10(1): A composition scheme taxpayers is permitted to render services other than restaurant services up to a value not exceeding:

(a) 10% of the turnover in a State/Union territory in the preceding financial year; or

(b) ₹ 5 lakh,

Whichever is higher.

Analysis of given case

In case of KRVV enterprises, this maximum specified value of services- will be:

| 10% of ₹ 70 lakh or ₹ 5 lakh | Whichever is higher |

i.e. ₹ 7,00,000

Thus, in the given case, KRVV Enterprises can supply services up to a value of ₹ 7,00,000 in financial year 2019-20, and still it will remain under composition levy.

Question 19.

Examine the following cases, keeping in view the latest provisions of GST law regulating Composition Scheme-

(a) Mr. X is a manufacturer of ice-cream and Pan Masala in state of Maharashtra. His turnover for the year does not exceed ₹ 1 crore. He wants to register for Composition Scheme. Is he eligible for it?

(b) Mr. Y of Gujarat opts for Composition Scheme during a financial year 2019-20. But on October 10, 2019 his turnover crosses ₹ 1.5 Crore. Can he continue under Composition Scheme?

(c) Z Limited has 2 branches-branch K and branch L in Delhi (having same PAN). Branch K opts for normal scheme. Z Limited wants to opt for Composition Scheme in case of branch L. Is it possible?

Solution:

(a) The Rule 5 of CGST Rules provides conditions and restrictions to be complied with by the person opting for composition scheme. One of the condition is that the taxpayer is not engaged in the manufacture of goods as notified under section 10(2)(e) ie. Ice-cream and other edible ice (whether or not containing cocoa), Pan Masala and Tobacco and manufactured tobacco substitutes. Since, Mr. X is manufacturer of ice-cream and pan masala, he is NOT ELIGIBLE for Composition Scheme.

(b) As per section 10(3) of CGST Act, 2017 the composition scheme availed by a registered person shall lapse with effect from the day on which aggregate turnover during a financial year exceeds the specified limit. In the given case, the turnover has crossed ₹ 1.5 crore on October 10, 2019. He is required to file intimation for withdrawal from the composition scheme in Form GST CMP-04 within 7 days from October 10, 2019.

(c) The first proviso to section 10(2) of CGST Act, 2017 provides that where more than one registered persons are having the same PAN, the registered person shall not be eligible to opt for the composition scheme unless all such registered persons opt to pay tax under composition scheme. Accordingly, in the given case, it is not possible to opt for composition scheme for Branch L only. If the company wants to pay tax under composition scheme, it will have to opt the same for all branches ie. for Branch K also.

![]()

Question 20.

‘Bansal traders’ is engaged in trading of goods within the State of Uttar Pradesh. In the preceding financial year, it has a turnover of ₹ 140 lakh from the trading of goods. In the current year, the firm wishes to opt for alternative composition scheme under Notification No. 2/2019 – CT(R). The firm has the planning to supply taxable services up to ₹ 3,00,000 in the current year. Briefly explain whether the firm is eligible to opt for “Alternative composition scheme” under Notification No. 2/2019 in the current year?

Answer:

One of the conditions for alternative composition scheme is that the supplier is not eligible to pay tax under section 10(1) of CGST Act (ie. Normal composition levy). Therefore, firstly it is necessary to check whether the normal composition scheme under section 10 is available?

To check applicability of composition levy under section 10(1):

Since, the aggregate turnover in preceding financial year does not exceed ₹ 1.5 crores, the firm is eligible for composition scheme in current financial year. Further, in current year, it can supply services [other than restaurant services] up to a value not exceeding:

| (a) 10% of ₹ 140 lakh, i.e., ₹ 14 Lakh or (b) ₹ 5 Lakh |

Whichever is higher i.e., ₹ 14 Lakh |

The expected supply of service in current year is ₹ 3,00,000 only. Thus, the firm is eligible for the composition scheme.

Alternative composition scheme under Notification No. 2/2019:

Since, in the given case, the firm is eligible to opt for composition levy under section 10(1), it is ineligible for alternative composition scheme & cannot opt the same.

Question 21.

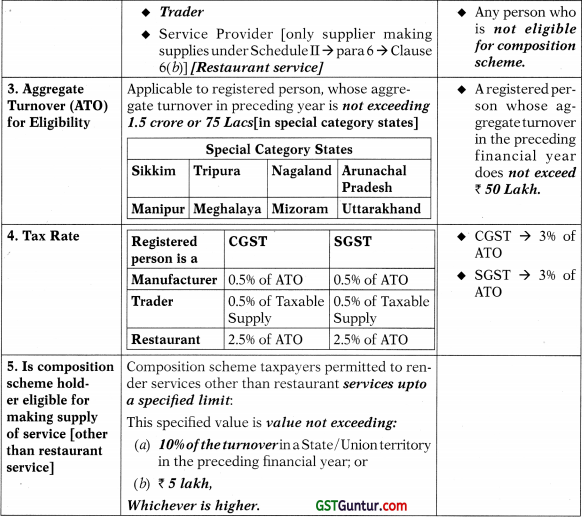

Mr. Sanjay of New Delhi made a request for a Motor cab to “Super ride” for travelling from New’ Delhi to Gurgaon (Haryana). After Mr. Sanjay pays the cab charges using his debit card, he gets details of the driver Mr. Jorawar Singh and the cab’s Registration number.

“Super Ride” is a mobile application owned and managed by D.T. Ltd. located in India. The application “Super Ride” facilities a potential customer to connect with the persons providing cab service under the brand name of “Super Ride”.

D.T. Ltd. claims that cab service is provided by Mr. Jorawar Singh and hence, he is liable to pay GST under the provisions of GST laws.

With reference to the provisions of IGST Act, 2017, determine who is liable to pay GST in this case?

Would your answer be different, if D.T. Ltd. is located in New York (USA)?

Also briefly state the statutory provisions involved. [Nov. 2018, 5 Marks]

Answer:

I. Tax payable by e-commerce operator on notified services [sec 9(5)]

Electronic Commerce Operators (ECO) display products as well as services which are actually supplied by some other person to the consumer, on their electronic portal.

Tax liability on some specified services notified by Govt, shall be paid by ECO like services by way of transportation of passengers by a radio-taxi, motor cab (not more than 6 passengers), maxicab (Capacity > 6 passengers but less than 12 excluding driver) and motor cycle;

Conclusion

“Super Ride” will be liable for Payment of Tax

II. If ECO is located in New York.

Conclusion

If D.T. Ltd. is located in New York (USA), any person representing D.T. Ltd. for any purpose in India is liable to pay tax.

Further, if D.T. Ltd. also does not have a representative in India, it shall appoint a person in India for the purpose of paying tax and such person shall be liable to pay tax.

Question 22.

State person liable to pay GST in the following independent cases provided recipient is located in the taxable territory:

(a) Services provided by an arbitral tribunal to any business entity.

(b) Sponsorship services provided by a company to an individual.

(c) Renting of immovable property service provided by the Central Government to an unregistered business entity. (Additional Important Question)

Answer:

Solution.

(a) Since GST on services provided or agreed to be provided by an arbitral tribunal to any business entity located in the taxable territory is payable under reverse charge, in the given case, GST is payable by the recipient- business entity.

(b) GST on sponsorship services provided by any person to any body corporate or partnership firm located in the taxable territory is payable under reverse charge. Since in the given case, services have been provided to an individual, reverse charge provisions will not be attracted. GST is payable under forward charge by the supplier in company.

(c) GST on services provided or agreed to be provided by the Central Government, State Government, Union Territory, or local authority to any business entity located in the taxable territory is payable under reverse charge. However, renting of immovable property service provided to unregistered person is an exception to it. Therefore, in the given case, reverse charge provisions will not be attracted. GST is payable under forward charge by the supplier – Central Government.

Question 23.

Kapil and Jaithmalani are partners in a firm of advocates. The firm has provided legal professional services to the following:

(1) An advocate of Delhi High Court.

(2) A firm of five advocates.

(3) ABC Limited, a business entity whose turnover of the preceding year is more than ₹ 20 Lakhs.

(4) PQR Limited, a business entity whose turnover of the preceding year is ₹ 20 Lakhs or less.

(5) Rakesh Kumar, an individual.

Answer:

| Case | Whether covered under Exemption Notifications | Applicability of RCM | |

| (1) | An advocate of Delhi High Court. | Exempt | Since exempted, no GST Liability. |

| (2) | A firm of five advocates. | Exempt | |

| (3) | ABC Limited, a business entity whose turnover of the preceding year is more than ₹ 20 Lakhs. | Not covered by exemption notifications. | RCM is applicable |

| (4) | PQR Limited, a business entity whose turnover of the preceding year is ₹ 20 Lakhs or less. | Exempt | Since exempted, no GST Liability arises |

| (5) | Rakesh Kumar, an individual. | Exempt | |

Question 24.

Taxmann Publications Private Limited has come out with a book on “GST and Customs Law” as per the latest CBCS curriculum of B. Com. Hons. The terms of agreement with the author “Dr. K. M. BansaJ” provides that royalty shall be paid @ 8% of value of books sold. The publisher has paid ₹ 4,75,000 as royalty to the author. Mr. Bansal has not opted for forward change as per Notification No. 22/2019 – Central Tax (Rate).

You are required to answer the following:

(а) Do you think the supply by the author should be treated as supply of goods under GST laws?

(b) Who is liable to pay GST on royalty?

(c) Is there any tax concession available to the author under Income-tax Act, 1961?

Answer:

Solution:

(a) It is supply of services where the publisher “Taxmann Publications” is recipient and the author “CA. K. M. Bansal” is the supplier of service.

(b) Since supply of services by an author comes under RCM, the recipient (i.e. Taxmann Publications) is liable to pay GST.

(c) Yes, subject to fulfilment of conditions given under section 80QQB of Income-tax Act, the amount of deduction from Gross Taxable Income in respect of royalty is the lower of the following:

- ₹ 3,00,000 or

- Income from Royalty

In the given case, a deduction of ₹ 3,00,000 is admissible.

![]()

Question 25.

State the person liable to pay GST in the following independent cases. The recipient is located in taxable territory in all the cases:

(a) Services provided by an arbitral tribunal to any business entity.

(b) Renting of immovable property service provided by Central Government to a Business entity.

(c) Sponsorship services provided by a Company to an individual.

(d) Sponsorship services provided to a body corporate by a body corporate.

Answer:

(a) Reverse charge is applicable. Thus, GST in service transaction shall be payable by the recipient i.e. Business entity.

(b) Reverse charge is not applicable. Generally, GST on services provided by Govt, to business entity is payable under reverse charge. However, renting of immovable property is an exception to it. Therefore, GST is payable by supplier i.e. Government.

(c) Reverse charge is not applicable. Because the sponsorship services have been provided to an individual. Thus, GST is payable under forward charge by the supplier (i.e. company).

(d) Reverse charge is applicable, as the sponsorship services are provided to a body corporate. Hence, the recipient shall be liable to pay GST.

Question 26.

On 4th September, 2018, A. R. Rehman, a famous music composer, received ₹ 3 crore of consideration from T Series Co. Ltd. for sale of copyright of his original music album. He finished his work & made available the CD to the music company on 20th July, 2018 & raised the invoice on 24th July, 2018.

Do you think the GST is payable on this service as per forward charge mechanism?

Answer:

As per section 9(3) of CGST Act, 2017, in case of notified goods and services, the GST is payable on Reverse Charge Mechanism.

The services like literary, musical or artistic works, etc. have been specified under CGST notification on which the recipient like publisher, Music Company, producer, etc. are required to pay GST and not the supplier of service.

- Therefore, in the given case, the recipient of service (i.e. T Series Co. Ltd.) is required to pay GST.

- Hence the service in question attracts GST under Reverse Charge Mechanism.