Form 12BB for Claiming Income Tax Deductions by Employees

Form 12BB for Claiming Income Tax Deductions by Employees: Section 192 of the relevant Income Tax Act states that anyone who is liable for paying every salary shall be charged “Under the Head Salary” must exempt TDS.

As a consequence, section 192 applies only if the three specifications mentioned below are met.

There are two types of people present in the scenario: employers and employees.

- The employer’s contribution to the employee comes in the form of a paycheck.

- The benefit chargeable under the head wage is in excess of the estimated sum not considered for taxation. (In accordance with the relevant Income Tax Slab)

TDS is expected to be accumulated by all companies. The employer’s legal standing (e.g., HUF, business corporation, etc.) is inconsequential under the act. Besides this, the number of workers used by the employer when measuring and deducting TDS is similarly of no use and does not play any role.

What is TDS?

Citizens, but even more so compensated individuals, who are expected to pay tax ahead of time, also widely recognized as tax deducted at source (TDS), are compelled by their business owners to apply investment declarations at the beginning of each new budgetary year.

- Such tax-deductible expenditure statements will reduce the tax burden because TDS is withdrawn from your estimated income statement.

- Tax Deducted at Source or the popularly referred to as TDS is a nominal sum that is withdrawn anytime a specific payment is made, such as a paycheck, commission, rent, interest, professional fees, and so on.

- The person who contributes deducts tax at the source and collects the payment/income is obligated to pay tax.

- It reduces tax-dodging since tax is paid at the exact hour of the payment made.

- You have to make an initial estimate of the funds you aim to introduce at the beginning of the monetary year.

- Legitimate documents are not deemed necessary until the end of the following economic year. You have the alternative of investing less or more than the amount mentioned earlier. The ultimate investment decisions often will not have to be essentially precisely as said.

- You are not necessary to request evidence of investment as part of this declaration. However, documentation of investment is asked for at a later point in time; that’s exactly where Form 12BB comes into the equation.

What Exactly is Form-12 BB?

Form 12BB is a clear statement of an individual employee’s eligibility for tax deductions.

Form 12BB is the form that you fill out with the appropriate credentials and send to the employer – and most importantly, not the Income Tax Department – because then your employer can determine the total how much income tax to exempt from your monthly income.

Fundamentally, it includes information on tax-deductible investments and savings that you will generate during the current budget season.

You can exclude qualifying tangible assets or expenditures for which a tax refund is issued.

Each and every tax-paying individual should never forget that Form 12BB must be filed alongside factual evidence of assets or expenditures on which state subsidies are being tried to claim, and it applies to all employed tax-paying citizens.

There really was no uniform format for declaring the tax-deductible spending and contributions formerly. With impact from June 1st, 2016, the Income Tax Department has incorporated a standardized framework for Form 12BB.

12BB Format

Form 12BB is now in a regular format owing to the Income Tax Department. The taxpayer must prepare it in accordance with Income Tax Rule 26C.

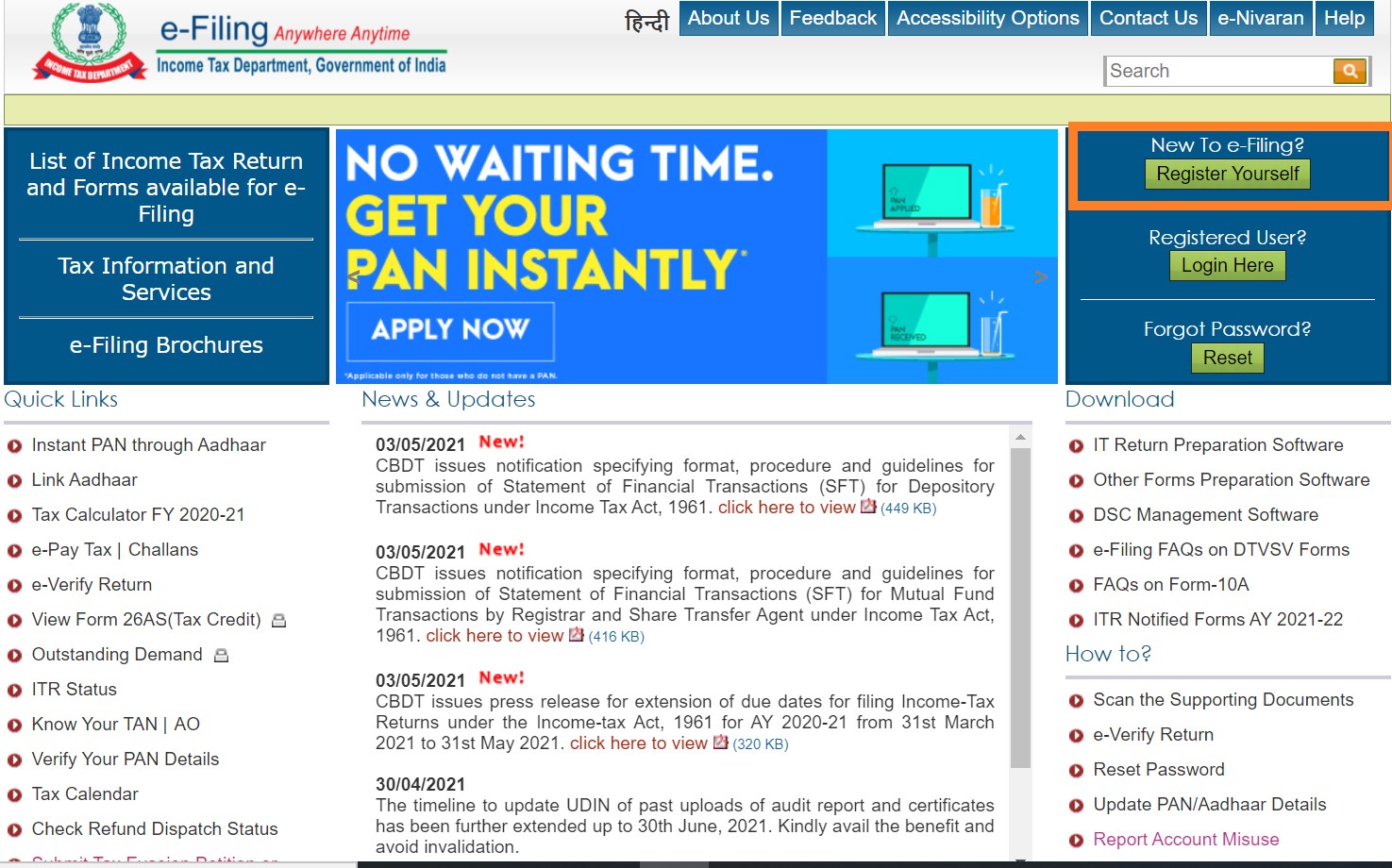

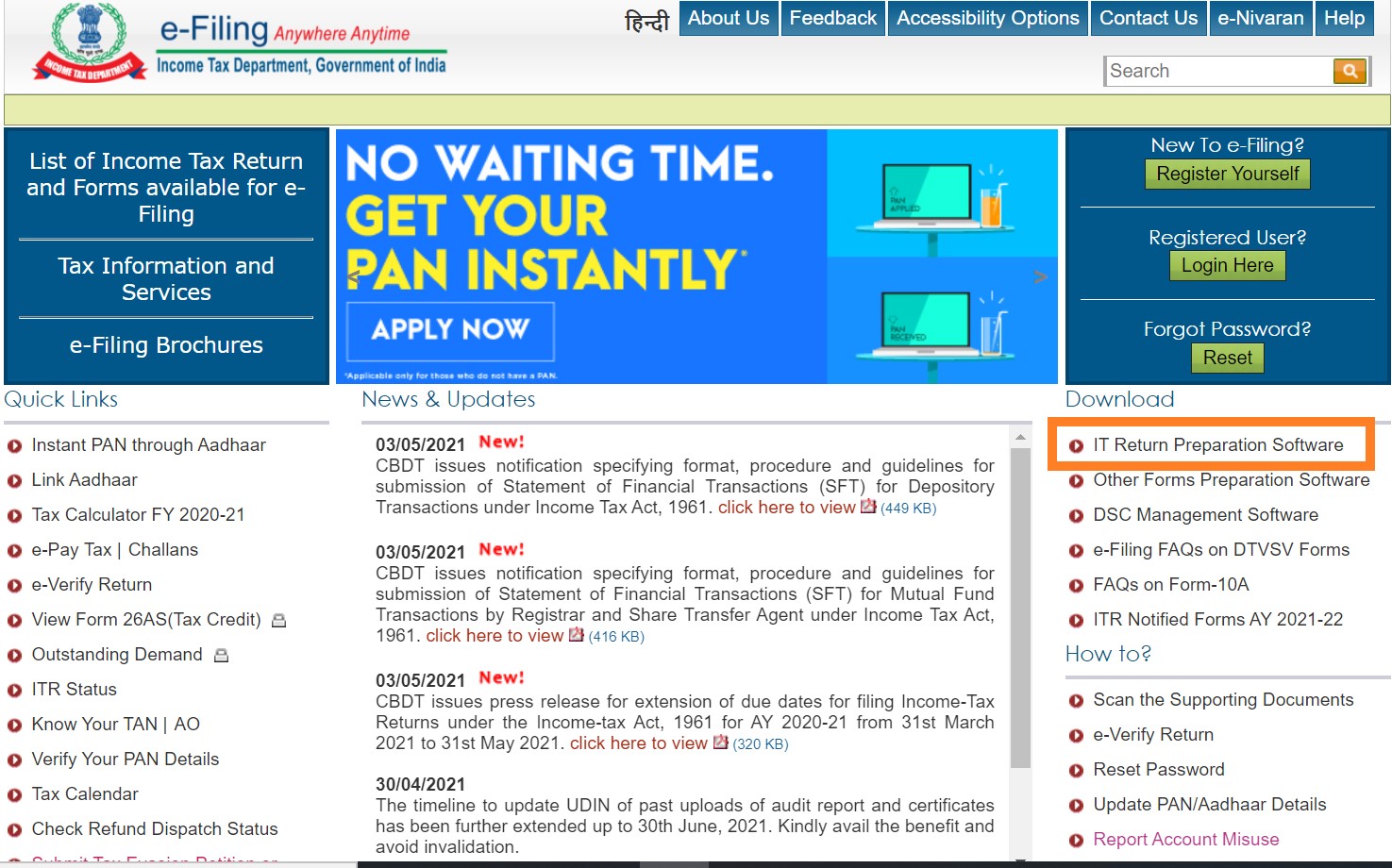

You can get the form 12BB online in pdf or word template, download it, fill it out, and consequently email it to your boss along with the required proof documents.

Additionally, you can fill out Form 12BB electronically and mail it to your HR team, or you can print, sign, and email it to your boss along with the appropriate certificates.

Is It Necessary To Submit Form 12BB?

With force from June 1st, 2016, each and every employed individual is supposed to declare Form 12BB with his employer in exchange for receiving tax benefits on such savings and expenditures.

And therefore, it is likewise necessary to submit proper supporting documentation along with Form 12BB.

What Do You Do Well Before Figuring Out Form 12BB?

Examine the CTC structure closely to determine if HRA or LTA are included with your kit.

- You can only assert these allowances if the company clearly and explicitly has them in the CTC arrangement.

- Go to the bank or download your interest certificate, loan repayment plan, and bank account balance online.

- Organize and keep in hand’s reach all of your receipts for all of your tax-exempt income costs and deposits, such as rent receipts, LIC rate receipts, tuition fees receipts, gift receipts, so on and so forth.

Which Statements Am I Required To Produce on Form 12BB?

When filing Form 12BB, you can report the following tax-deductible income elements, along with relevant verification certificates (where applicable):

Allowance for Housing Rent or the HRA

You will seek the tax exclusion for Housing Rent Allowance in the very first section of Form 12BB (HRA). To assert HRA, you would have to have the necessary statement and information:

- Payment slips with the homeowner’s name and address, as well as the,

- landlord’s PAN (in case the annual rent charged exceeds Rs.1 lakh)

Points to consider when requesting the HRA tax exemption:

- One can only guarantee HRA tax exemption if and only if HRA is part of one CTC.

- If your HRA is not included in your CTC and you reside in a rental home, you can obtain a tax break under Section 80GG.

- Rent invoices are only requested if the monthly rent surpasses Rs. 3,000.

- In case you live in your very own residence, you cannot demand HRA.

- If you pay your parents’ rent, remind them to include it as profits as they file their income tax return.

- Never email altered rent receipts; doing so might land you in hot water with the IRS.

Regardless of when the boss would not request a tenancy lease, it is smart to have one written on Rs. 500 stamp paper or at the rate of your state for documentation for future reference.

Allowance for Leave Travel or the LTA

The employee may also identify LTA for accounting purposes.

Section 10 (5), according to the Income Tax Act of 1961, provides tax-advantaged treatment for an employee’s LTA.

However, one should always acknowledge that the taxpayers can only seek tax incentives on LTA for domestic travel and only up to two times in a four-year period.

Points to bear in mind while asking for LTA tax exemption:

- One can only confirm LTA tax exemption if and only if LTA is part of one CTC.

- Clients must attach travel documents such as boarding passes, airline fares, travel agency invoices, boarding passes, and so on to their employers in order to receive LTA.

You may invoke LTA on behalf of yourself, your partner, your children, your dependent parents, and your responsible sibling.

- It can be asserted twice in a four-year span.

- Under a situation where you only claimed one LTA in the previous four-year phase, you will continue and use the second LTA, but you should really do so in the first year of the current four-year frame.

- It is only permitted for domestic travel, not overseas travel.

Home Loan Interest

When completing form 12BB, the employee will claim tax deductions on the home loan under sections 80C (principal repaid) and 24 (home loan interest payment).

You may also subtract filing fees, excise duty, and brokerage fees for tax purposes in different provisions.

The applicant should always fill out the following details on Form 12BB:

During the fiscal year, interest payable/paid to the debtor

- The name and the corresponding residential address of the lender from which the loan is obtained

- PAN of the lender: Financial Institutions/Employers/Others, from which the loan is obtained

The following documents are eligible to demand a deduction under Section 24B for home loan interest payments:

A statement or certificate specifying the overall EMI owed, but also the interest and primary elements.

- Authorization certificate of possession/completion of a building

- Employee self-declaration about whether the house is owned or rented.

Details one should keep in mind when seeking the Interest on Home Loan Tax Exemption:

- In case you happen to take a home loan on a partnership basis, you will claim the interest deduction percentage-wise.

- If you obtained a home mortgage from a lender except for a bank, such as associates, family, or a moneylender, the cost of borrowing would be deducted under section 24 only while you issue a certificate of interest from the source to whom your interest accrues.

The reimbursement of principal on loan purchased by associates, family, or another moneylender, except maybe a trust, is not taxable under section 80C.

Parts 80C, 80CCC, 80CCD, 80D, and 80E Deduction

One may assert a variety of deductions under section 80C and its provisions when filing form 12BB.

Chapter VI-A mentions income tax deductions under different sections such as 80C, 80D (Medical insurance), and 80G (Donation). Scientific proof of spending or expense sustained is necessary to obtain a deduction.

After deducting the claimed income tax exemptions, the remaining gross income will be charged at the individual’s income tax slab rates. The following are the benefits permissible under different provisions of Chapter VIA of the Income Tax Act.

- Section 80C: Life insurance premiums or investments in PPF, ELSS, NPS, PPF, kid’s tuition fees, etc., with a gross cap of Rs. 1.5 lakh.

- Section 80CCC: Reimbursement for annuity contract premiums charged

- Section 80CCD: Additional NPS interventions

- Section 80D: Health care premiums charged

- Section 80E: School or any other education filed related loan interest

- Section 80G: Donations to designated charities

- Section 80TTA: Interest as gained on a savings account

What Happens In The Event If You Fail To Attach Your Form 12bb To Your Employer?

In case you fail to apply form 12BB to the employer within the specified timeframe specified, the employer will be unable to provide you with the benefits of deductions and other tax exemptions. As a direct consequence, any overpayment of TDS will be withdrawn from your monthly wage.

You may, furthermore, seek a refund of such excess TDS when filing your income tax return.

What Is The Objective Of A Declaration Of Investment?

Workers must file a report detailing the deductions and privileges they choose to assert. Based on these declarations, the contractor will withhold TDS from the employee’s wages.

In many of these circumstances, the concerned taxpayer must make these contributions through the employer’s HR portal.