Introduction to Company Accounts – CS Foundation Fundamentals of Accounting Notes

Go through this Theoretical Framework – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Introduction to Company Accounts – CS Foundation Fundamentals of Accounting Notes

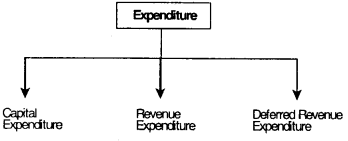

Basic Concepts of Company Accounts:

- The company form of business organization is an association of persons who contribute money for some common purpose.

- The money so contributed is the capital of the company.

- The persons who contribute capital are its members.

- Therefore members of a joint stock company are known as shareholders and the capital of the company is known as share capital.

- The total share capital is divided into a number of units known as ‘shares’.

- The word company is derived from a Latin word “Com” meaning with or together and “Panis” meaning bread.

- It originally referred to association of people taking food together and discussing matters.

- It is a form of business organisation of people to carry on a business.

- Company law recognizes a company as one which is formed and registered under the Companies Act, 2013 or under any previous company law.

Features of a Company:

- Incorporated association

- Separate legal entity

- Perpetual existence

- Limited liability

- Transferability of shares

Artificial legal person:

- The persons who contribute money in the company are called the members of the company.

- The total amount of capital of the company is termed as stock and part of stock to which every member is entitled, is called the share and the persons are called shareholders.

- As per the Companies Act, a company is an artificial person created by law, having separate legal entity with a perpetual succession.

As per the Companies Amendment Act, 2015:

In Section 22 of the Principal Act –

(i) in sub section (2)

(a) for the words “under its common seal”, the words “under its common seal, if any, “shall be substituted;

(b) the following proviso shall be inserted, namely:

“Provided that in case a company does not have a common seal, the authorisation under this sub-section shall be made by two directors or by a director and the company secretary, wherever company has appointed a company secretary.”

(ii) in sub-section (3), the words “and have the effect if it were made under its common seal” shall be omitted.

In Section 46 of the Principal Act, in sub-section (1), for the words” issued under the common seal of the company” the words “issued under the common seal, if any, of the company or signed by two directors or by a director and the company secretary, wherever the company has appointed a company secretary” shall be substituted.

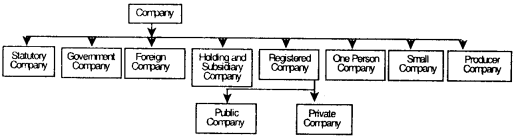

Types of Companies:

1. Statutory Company:

Companies that have been incorporated under a special act of Parliament E.g. Unit Trust of India, Life Insurance Corporation of India.

2. Government Company:

It means a company in which not less than 51% of the paid up share capital is held by –

(a) Central Government ;or

(b) any State government or governments; or

(c) partly by central government and partly by one or more state governments and includes a company which is a subsidiary company of such a government company.

3. Foreign Company:

Foreign company means any company or body corporate incorporated outside India which –

(a) has a place of business in India, whether by itself or through agent, physically or through electronic mode; and

(b) conducts any business activity in India in any other manner.

Thus, the companies doing business through electronic mode are also termed as foreign company and need to comply with the specified provision.

4. Holding Company and Subsidiary Company:

When a Company –

(a) controls the composition of the board of directors; or

(b) exercises or controls more than one half of the total share capital either at its own or together with one or more of its subsidiary companies, then it is known as the holding company and the other company is the subsidiary company.

Total share capital for this purpose means the aggregate of –

1. paid up equity share capital; and

2. convertible preference share capital.

5. Registered Companies:

All companies registered under the Companies Act, 2013 or under any previous company law are called the registered companies.

6. Public Company

Public company means a company which –

(a) Is not a private company;

(b) Has a minimum paid-up share capital of five lakh rupees or such higher paid-up capital, as may be prescribed. [Omitting requirement for minimum paid up share capital and consequential changes [Section 2 (71)] of the Companies Act, 2013.]

(c) Is a subsidiary of a company, not being a private company, shall be deemed to be public company for the purposes of this Act;

(d) Should have minimum seven members and have no limit for maximum members.

7. Private Company:

A company which has the following features is a private company:

- Restricts the right to transfer its shares.

- Except in case of one person company, limits the number of its members to 200.

- Prohibits any invitation to the public to subscribe for any securities of the company.

- Has a minimum paid up capital of one lakh rupees or such higher paid – up capital as prescribed [Omitting requirement for minimum paid up capital and consequential changes (Section 2 (68)) of Companies Act. 2013.]

8. One Person Company (OPC):

it means a company which has only one person as a member. It is considered as a private company. Only a natural person who is an Indian citizen and resident in India is eligible to incorporate OPC.

9. Small Company:

it means a company other than a public company, whose –

(a) Paid-up capital does not exceeds ₹ 50 lakh or such higher amount as maybe prescribed which shall not be more than crore; or

(b) Turnover as per last profit and loss account does not exceeds ₹ 2 crore or such higher amount as may be prescribed, which shall not be more than ₹ 20 crore.

Amendment made by Companies (Amendment) Act, 2017:

“Small Company means a company, other than a public company, –

(i) paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than ten crore rupees; and

(ii) turnover of which as per profit and loss account for the immediately preceding financial year does not exceed two crore rupees or such higher amount as may be prescribed which shall not be more than one hundred crore rupees.”

10. Producer Company:

Sec. 465(1) of the Companies Act, 2013 provides that the Companies Act, 1956 and the registration of the Companies (Sikkim) Act, 1961 (hereafter) in this section referred to as the repeated enactments shall stand repeated.

According to the provisions as prescribed under Section 581 A(1) of the Companies Act, 1956, a producer company is a body corporate having objects or activities specified in this Section 581B and which is registered as such under the provision of the Act. The membership of producer company is open to such people who themselves are the primary producers. Which is an activity by which some agricultural produce is produced by such primary producers.

Share:

- Shares are defined under Section 2(84) of the Companies Act, 2013

- A share is defined as the share in the share capital of a company and includes stock.

- A share is one unit into which total share capital is divided.

- Every person who contributes capital into the company gets a share in the company which represents his capital in the company.

Types of Shares:

- Preference Shares

- Equity Shares

(i) Preference Shares:

1. Preference Shares are those shares which have the following preference rights over other shares:

2. Rights conferred by Article of Association.

- Payment of dividend at a fixed rate or as a fixed amount

- Return of capital on winding up of a company

3. The holders of preference shares are called preference shareholders.

4. Preference shareholders do not have a voting right.

Note: When dividend is outstanding for more than 2 years for cumulative preference shares and 3 years for non cumulative preference share, the preference shareholders will get voting right.

5. Depending upon the articles of association of the company, in addition to the preferential rights, they may also get the following:

- to participate in surplus profits after payment of dividend at a fixed rate to equity.

- to receive arrears of dividend at the time of winding up.

- to receive premium on redemption of preference shares.

- to participate in surplus remaining after the equity shares are redeemed in winding up.

Types of preference shares:

1. Cumulative preference shares – The holders of cumulative preference shares have a fixed right to receive present as well as future dividend. This means that even if the company does not have sufficient profit to pay dividend, the dividend of such shareholders keeps on accumulating and will be paid in future in the years of profits.

2. Non cumulative preference shares – When the preference shares do not have a right to cumulate their dividend then, these are called non cumulative preference shares.

3. Participating preference shares – Holders of these shares have a right to participate in the surplus profits if any, after equity shareholders have been paid at a fixed rate.

4. Non participating preference shares – When shareholders have a fixed right of dividend and not over and above that, even in case of surplus profits then, these are called non participating preference shares.

5. Redeemable preference shares – When shares are issued with a condition that they will be repaid (redeemed) after a fixed period of time, these are called redeemable preference shares.

A company may issue preference shares for a period exceeding 20 years but not exceeding 30 years for infrastructure projects [Specified in Schedule VI). However, it is subject to redemption of minimum 10% of such preference shares per year from the twenty-first year onwards or early on proportionate basis, at the option of the preference shareholders.

6. irredeemable Preference Shares – No company Ltd. by share, can issue any preference shares which are irredeemable.

7. Convertible Preference Shares – The shares which carry an option to get converted into equity shares are called convertible preference shares.

8. Non Convertible Preference Shares – Preference shares which do not have an option of conversion are called non convertible preference shares.

(ii) Equity Shares:

- Shares other than preference shares are termed as equity shares.

- They do not carry a preferential right but have a right to vote.

- There is no compulsion to pay equity dividend they are paid dividends only when there are sufficient profits after payment of preference dividends.

- These are also called as risk bearing shares as they do not have a fixed rate of dividend. But after payment to preference shareholders ail surplus remaining will he distributed among equity shareholders.

Share Capital:

- The total capital of the company is divided into small shares, hence it is known as the share capital.

- Every share has a face or nominal value. Share capital is the sum of the total face value of all the shares.

Categories / Types of Share Capital:

1. Authorized (Nominal) Capital:

This is the maximum amount of capital mentioned in the Memorandum of Association of a company, which it can raise during its life time it is also known as the registered capital. In order to increase the limit of authorized capital, the memorandum of the company should be altered.

2. issued Capital:

It refers to that portion of authorised capital which has been offered to the public for subscription.

3. Subscribed Share Capital:

It refers to that part of the issued share capital which has been subscribed by the public. It also includes the issue of shares for consideration other than cash.

4. Called up Share Capital:

It is that portion of subscribed capital which the shareholders are called upon to pay. The amount remaining to be called up is called as the uncalled capital.

5. Paid up Capital:

It is that portion of called up capital that is paid by the shareholders. The amount that is not paid is known as the calls in arrear. This is the actual capital of the company that is included in the Balance Sheet.

Capital Reserve:

Reserves which are created out of capital profits and cannot be used for declaration of dividend are called capital reserve.

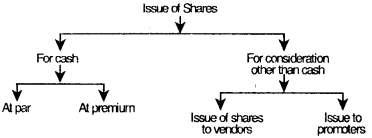

Issue of Shares:

(a) Issue of Shares for Cash

When a company issues share for cash either full amount is received at once or in installments. The share price is generally received in installments and these are known as :

- First installment – Application money

- Second installment – Allotment money

- Third installment – First call money

- Fourth installment – Second call money

- Last/fifth – Final call money

Note : Nowadays, practically the whole amount is received at once and hence, above installments are not required. We will use this method only for academic purpose.

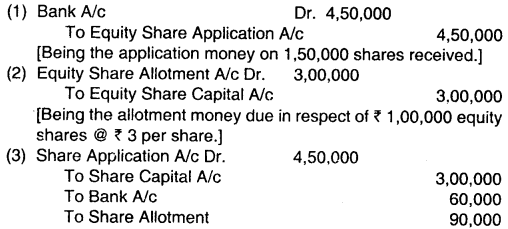

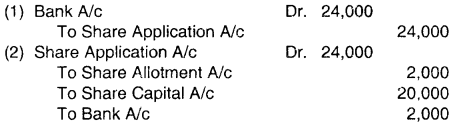

Journal entries for issue of shares :

(a) When shares are issued at par:

(i) On receipt of application money :

Bank A/c Dr.

To Share Application A/c

(ii) On allotment of share :

Share Allotment A/c Dr. (Amount due on allotment)

Share Application A/c Dr.

(Application amount received on allotment) To Share Capital A/c

(iii) On receipt of allotment money :

Bank A/c Dr.

To Share Allotment A/c

(iv) On call being made :

Share Call A/c Dr. (With amount due on calls)

To Share Capital A/c

Bank A/c Dr. (With amount received on calls)

To Share Call A/c

Notes:

- Unless the shares are allotted, it cannot become the share capital of the company hence, cannot be credited to Share Capital A/c.

- When a company fails to raise minimum subscription then, no shares can be allotted and the amount received on application will be refunded back.

→ entry for refund of application money.

Share Application A/c

Dr. (with application money received)

To Bank A/c

Concept of minimum subscription :

Minimum subscription refers to that amount that the company should raise as subscription before allotment of shares. A public Ltd. company cannot make allotment of shares unless the amount of minimum subscription is received. As per the SEBI guidelines a company must receive 90% subscription against the entire issue before making allotment of any shares or debentures.

(b) Issue of shares at premium:

- When a company issues a share at a price which is more than its face value, it is called issue at premium.

- Premium = Issue price – face value.

- Premium amount is generally called at the time of allotment.

- Amount of premium is credited to a separate account called “Securities Premium A/c.”

- Securities premium is not a part of share capital of the company, it is a type of capital receipt.

- Securities premium is shown in the liability side of Balance Sheet under the head “Reserves and Surplus.

- Generally, highly reputed companies or companies with a huge market value issue shares at a premium. A new company cannot issue shares at premium.

Accounting Treatment:

When allotment money becomes due :

Share Allotment A/c Dr.

(Amount due on allotment + premium)

To Securities Premium A/c (Amt. of premium)

To Share Capital A/c

(Amount of share allotment)

Always remember Share Capital A/c will always be shown at face value.

Note :

Section 52 : Use of Securities Premium:

Securities premium amount can be used only for the following purposes –

- For issuing fully paid bonus shares.

- To write off preliminary expenses of the company.

- To write off the expenses of, or commission paid or discount allowed on any securities or debentures of the company.

- For purchase of its own shares or other securities u/s 68.

- To pay premium on redemption of preference shares or debentures of the company.

Securities premium can never be used for any other purpose.

Note:

If Securities Premium amount is utilised for any purpose, other than stated above, then it will attract provisions relating to reduction of share capital of company [Section 66].

(c) Issue of Shares at a discount:

Section 53 of the Companies Act, 2013 provides that the company shall not issue shares at a discount except in case of issue of sweat equity shares. Any share issued by a company at a discount shall be void.

Note:

Since, new shares can not be issued at a discount, any problem relating to’t is not relevant as per the provisions of Companies Act, 2013. If company contravenes this provision shall be punishable with:

- fine which shall not be less than ₹ 1 lakh but may exceed to ₹ 5 lakh and

- every officer in default shall be punishable within imprisonment for a term which may extend to 6 months or

- with fine which shall not be less than 1 lakh but may extend to 5 lakh rupees, or

- with both.

Amendment made by Companies (Amendment) Act, 2017 in sub-section (2), for the words “discounted price”, the word “discount” shall be substitued.

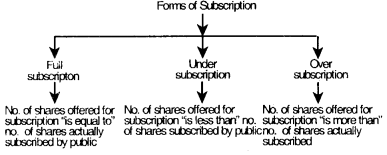

Subscription of Shares:

Subscription means the application received from the applicants for issue of shares to them.

1. Full Subscription:

In case of full subscription, accounting entries will be the same as done earlier.

2. Under Subscription:

- Under subscription means that the number of shares subscribed by public is less than the number of shares offered for subscription.

- Allotment can be made in this case only if minimum subscription is received.

- All accounting entries will be same by taking the number of shares actually applied and allotted.

3. Over Subscription:

- This means when the number of shares subscribed by the public is more than the shares offered for subscription by the company.

- As per the guidelines issued by SEBI the company cannot reject out rightly any application for shares unless it has incomplete information or absence of signature(s) or insufficient application money.

In such case the company adopts the following procedure:

- Total rejection of some applications.

- Acceptance of some applications in full.

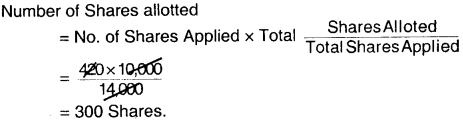

- Allotment to the remaining applicants on pro-rata basis.

Note : Pro rata basis allotment :

1. Under pro rata basis, no applicant is refused, no applicant is allotted in full.

2. They are allotted shares proportionately.

3. Here the excess amount received is not refunded but will be adjusted in further calls.

4. In case of pro rata allotment, the excess amount is not refunded but it is first adjusted towards the amount due on allotment and if the amount is still remaining to be adjusted then it is adjusted from amount due on calls.

5. Thus, the excess amount which is adjusted from the calls is called as calls in advance in the case of pro rata adjustment.

6. However, the company can adjust this amount from calls only if the following conditions are satisfied

- Acceptance of calls in advance is agreed by the articles of the company.

- The consent of the applicant has been taken either by a separate letter or by inserting a clause in the company’s prospectus.

7. For adjusting the excess money, the following entry is passed – Share Application A/c Dr.

To Share Allotment A/c

(Being excess amount received on application adjusted in allotment)

Calls in Advance and Calls in Arrears:

1. Calls in Advance –

(i) When the call is not yet due but the amount is paid by the applicant it is known as Calls in Advance.

(ii) For recording calls in advance the following entry is passed :

1. For receiving calls in advance :

Bank A/c Dr.

To Calls in Advance A/c

2. When that call finally becomes due :

Calls in Advance A/c Dr.

To Particular call A/c

(iii) Since the amount is received in advance by the company, hence it is a liability for the company and shown under the heading namely “Calls in Advance” on the liability side of Balance Sheet. Till the call becomes due, the company is liable to pay interest to the applicant. If the articles do not specify the rate, then, such internet will be charge against profits of the company.

(iv) According to Table F, interest at such rate not exceeding 12% p.a. is to be paid on such advance call money.

(v) No dividend is paid on calls in advance.

2. Callls in arrear:

(i) When the shareholders fail to pay amount due on allotment or calls it is said to be calls in arrear/unpaid calls.

(ii) Calls in arrear are recorded as follows :

Calls in Arrear A/c Dr.

To Share Allotment A/c

To Share A/c

(iii) This amount represents the uncollected amount of capital from the shareholders hence, it is shown by way of deduction from “called up capital” to arrive at paid value of share capital which is shown in the Balance Sheet.

(iv) Since the amount of the call is due hence, the applicants are required to pay interest on the amount due but not paid to the company.

If the articles are silent:

- According to table F, interest @ 10% or such lower rate as the board may determine is charged from the date the call becomes due till the date of actual payment.

- However the directors have a right to waive the interest i.e. the company will not charge interest on calls in arrears.

- Interest on call in Arrears are transferred to P&L A/c at the end of the year.

Issue of Shares for consideration other than cash:

Share issued for consideration other than cash can be in two forms –

- Issue of shares to vendors

- Issue of shares to promoters

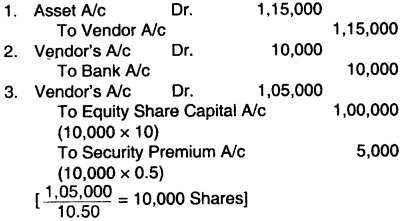

1. Issue of Shares to vendors:

- When assets are purchased from vendors then, payment is made to them.

- Sometimes instead of paying them cash the company issues its shares to the vendors in the settlement of the payment.

- These shares can be issued at par or premium

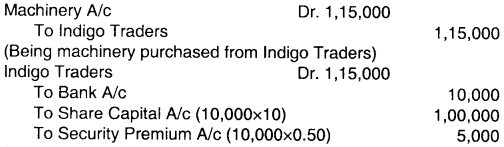

Journal entries recording issue of shares to vendors –

1. On acquisition of asset –

Sundry Asset A/c Dr.

To Vendor A/c

2. When fully paid shares are issued to vendors –

(a) At par : Vendor A/c Dr.

To Share Capital A/c

(b) At premium : Vendor A/c Dr.

To Share Capital A/c To Securities premium A/c

Note: Students should note that the Companies Act, 2013 totally prohibits the issue of shares at a discount.

2. Issue of Shares to promoters:

- Promoters are the persons who actively participate in the incorporation of the company.

- Sometimes for the services rendered by them, the company may issue shares to them.

- The amount paid to the promoters is treated as a capital expenditure of the company and debited to Goodwill A/c.

- Accounting entry

Goodwill A/c Dr

To share Capital A/c

(Being shares issued to promoters as a consideration other than cash)

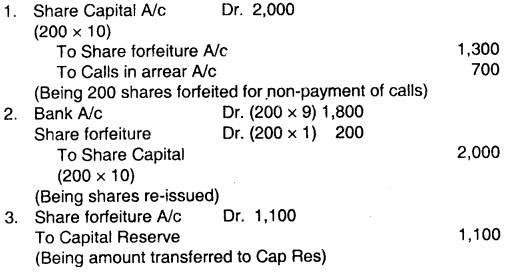

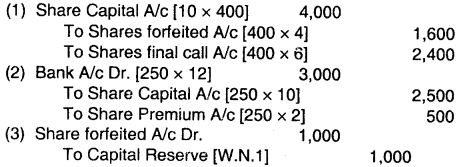

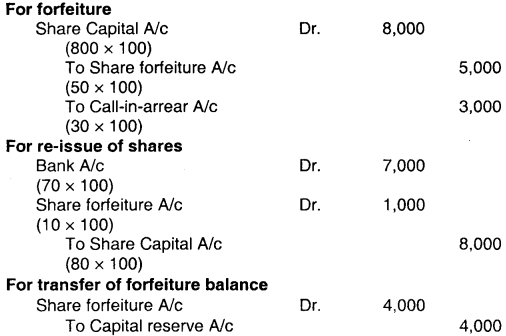

Forfeiture and Reissue of Shares:

Forfeiture of Shares –

1. The term forfeiture means taking away a property if a condition has not been fulfilled.

2. When shares are allotted to the applicants, a condition is imposed on them that they will have to pay calls on their due date.

3. When the shareholders fails to pay call money, their shares are forfeited by the company.

4. Once the shares are forfeited, the shareholders name is removed from the register of members and he is not entitled to any future claim on such shares.

5. The amount already paid on shares will not be refunded to the defaulting shareholder.

6. A person whose shares have been forfeited shall cease to be a member in respect of the forfeited shares, but shall remain liable to pay the company all the monies which, at the date of forfeiture, were presently payable by him to the company in respect of the shares. He is not entitled to future dividends and rights of membership.

The liability ceases when the company shall have received payment in full of all such monies in respect of such shares.

7. For carrying out forfeiture “Share Forfeiture A/c” is opened in the books. It is shown on the liability side of Balance Sheet as an addition to paid up share capital. Forfeiture of share is not a cancellation of shares, it is just the cancellation of present membership as the forfeited shares can be further reissued.

8. Forfeiture can be done of shares issued at par, at premium.

9. Shares can be forfeited only if it is permitted by the articles.

10. The directors must pass a resolution for forfeiting the shares at Board Meeting and send a notice to the members requiring them to pay the amount due along with interest within the time specified in the notice. However, the time specified cannot be less than 14 days.

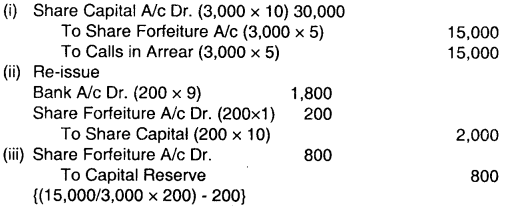

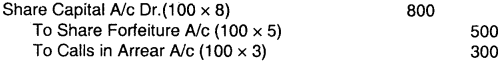

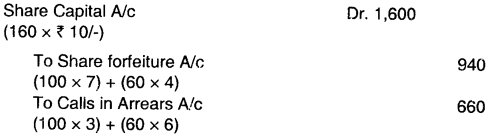

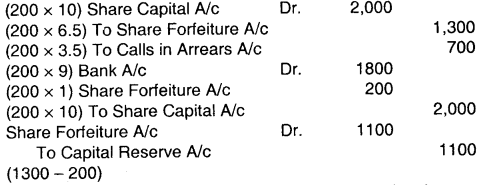

(i) Forfeiture of Share issued at par:

(a) When all unpaid calls have been transferred to Calls in Arrear A/c :

Share Capital A/c Dr.

(No. of shares x called up value)

To Shares Forfeiture A/c

(Amount paid-up by shareholders)

To Calls in Arrear A/c

(Amount of unpaid calls)

(b) When unpaid calls have not been transferred to Calls in Arrear A/c:

Share Capital A/c Dr. (Amount called up)

To Share Forfeiture A/c (Amount paid)

To Share Allotment A/c (Unpaid on allotment)

To Share First Call A/c (Unpaid on calls)

To Share Final Call A/c (Unpaid on calls)

Example :

Y Ltd. forfeited 200 equity shares of ₹ 10 each, ₹ 8 called up for non payment of first call @ ₹ 2 each. Application money @ ₹ 2 per share and allotment money @ ₹ 4 per share have already been received by the company. Give journal entry for forfeiture of shares.

Solutions:

Equity Share Capital A/c (200 x 8) Dr. 1,600

To Calls in arrear A/c (200 x 2) 400

To Share forfeiture A/c (200 x 6) 1,200

(Being forfeiture of shares, ₹ 8 called up for non payment of first call of ₹ 2)

2. Forfeiture of Shares issued at premium:

When shares were issued at premium there can be two situations:

(i) If the premium is not paid by the shareholder – securities premium will be debited to cancel it.

(ii) If premium has already been received by the company – it cannot be cancelled even if the shares are forfeited in future.

Share Capital A/c Dr.

Securities Premium A/c Dr.

To Share Forfeiture A/c

To Calls in Arrear A/c

(Being forfeiture of shares for non-payment of calls and premium money)

Re-issue of forfeited Shares:

- The shares forfeited shall be re-issued on some specific terms.

- Forfeited shares can be reissued at par, premium or discount.

Note:

During the reissue of the forfeited shares, the following things should be kept in mind:

- The amount receivable on reissue together with the amount already received from defaulting member shall not be less than the face value of shares.

- Loss on reissue should not exceed the forfeited amount.

- If the loss on reissue is less than the amount forfeited, the surplus should be transferred to capital reserve in proportion to the number of shares reissued.

- When shares are forfeited at a loss, such loss is to be debited to Share Forfeiture A/c.

- Even though original shares can not be issued at a discount, but forfeited shares can be issued at a discount.

- If forfeited shares are re-issued at a discount, the amount of discount can in no case, exceed the amount credited to the share forfeiture account.

1. Reissue of shares at par:

(a) On reissue of shares :

Bank A/c Dr. (Amt. received on reissue)

To Share Capital A/c

(No. of share x amt. received)

(b) On transfer of Share Forfeited A/c to Capital Reserve :

Share Forfeiture A/c Dr.

To Capital Reserve A/c

Note:

On reissue of shares, if there is any loss then it is made good from the balance in Share Forfeiture A/c. After reissue, the balance in Share Forfeiture A/c becomes a capital profit for the company and is transferred to the Capital Reserve A/c.

2. Reissue of forfeited shares at a premium:

(a) On reissue of shares :

Bank A/c Dr. (amt. received on reissue)

To Share Capital A/c (paid up value of shares)

To Securities Premium A/c (premium received)

(b) Transfer of Share Forfeited A/c to Capital Reserve A/c :

Share Forfeiture A/c Dr.

(with forfeited amt. on shares reissued)

To Capital Reserve A/c

3. Reissue of forfeited shares at a discount:

- Amount of discount cannot be more than balance in Share Forfeiture A/c

- Discount allowed will be debited to Share Forfeiture A/c.

- If discount allowed is less than balance in Share Forfeiture A/o, the surplus of Share Forfeiture A/c, will be transferred to Capital Reserve A/c in proportion to the number of shares reissued.

(a) On reissue of shares :

Bank A/c Dr. (amt. received on reissue)

Share Forfeiture A/c Dr. (discount allowed)

To Share Capital A/c

(b) On transfer of balance to Share Forfeiture A/c :

Share Forfeiture A/c Dr.

To Capital Reserve A/c

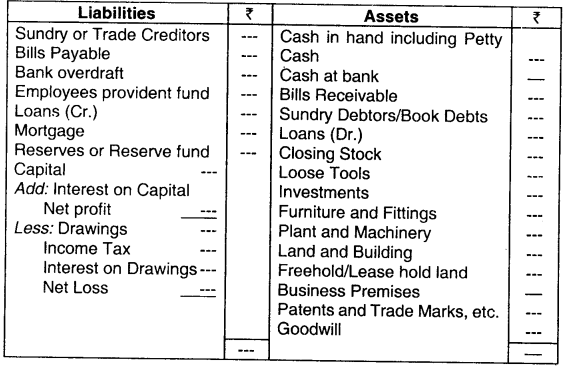

General Instructions for preparing the Balance Sheet of a company:

1. An asset shall be classified as current when it satisfies any of the following criteria:

- It is expected to be realized in, or is intended for sale or consumption in, the company’s normal operating cycle;

- it is held primarily for the purpose of being traded;

- it is expected to be realized within twelve months after the reporting date; or

- It is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting date.

All other assets shall be classified as non-current.

2. An operating cycle is the time between the acquisition of assets for processing and their realization in Cash or cash equivalents. Where the normal operating cycle cannot be identified. it is assumed to have a duration of 12 months.

3. A liability shall be classified as current when it satisfies any of the following criteria:

- it is expected to be settled in the company’s normal operating cycle;

- it is held primarily for the purpose of being traded:

- it is due to be settled within twelve months after the reporting date: or

- the company does not have an unconditional right to defer settlement of the liability for at least twelve months after the reporting date. Terms of a liability that could, at the option of the counter party, result in its settlement by the issue of equity instruments do not affect its classification.

All other liabilities shall be classified as non-current,”

4. A receivable shall be classified as a ‘trade receivable’ if it is in respect of the amount due on account of goods sold or services rendered in the normal course of business.

5. A payable shall be classified as a ‘trade payable’ if it is in respect of the amount due on account of goods purchased or services received in the normal course of business.

6. Depending upon the turnover of the company, the figures appearing in the financial statement may be rounded o ff as given below:

| Turnover | Rounding off | |

| (a) | Less than one hundred crore rupees | To the nearest hundreds thousands, lakhs or millions or decimals thereof |

| (b) | One hundred crore rupees or more | To the nearest lakhs, millions or crores or decimals thereof. |

A. Share Capital:

For each class of share capital(different classes of preference shares to be treated separately):

- The number and amount of shares authorized;

- The number of shares issued, subscribed and fully paid, and subscribed but not fully paid;

- Par value per share;

- A reconciliation of the number of shares outstanding at the beginning and at the end of the period;

- The rights, preferences and restrictions attaching to that class including restrictions on the distribution of dividends and the repayment of capital;

- Shares in the company held by its holding company or its ultimate holding company or by its subsidiaries or associates;

- Shares in the company held by any shareholder holding more than 5 percent shares;

- Shares reserved for issue under options and contracts/commitments for the sale of shares/disinvestment, including the terms and amounts;

- Separate particulars for a period of five years following the year in which the shares have been allotted/bought back, in respect of;

- Aggregate number and class of shares allotted as fully paid up pursuant to contract(s) without payment being received in cash.

- Aggregate number and class of shares allotted as fully paid up by way of bonus shares (Specify the source from which bonus shares are issued).

- Aggregate number and class of shares bought back.

- Terms of any security issued along with the earliest date of conversion in descending order starting from the farthest such date.

B. Reserves and Surplus:

(i) Reserves and Surplus shall be classified as:

- Capital Reserves;

- Capital Redemption Reserves;

- Securities Premium Reserve;

- Debenture Redemption Reserve;

- Revaluation Reserve;

- Share Options Outstanding Account;

- Other Reserves – (specify the nature of each reserve and the amount in respect thereof);

- Surplus i.e. balance in statement of Profit & Loss disclosing allocations and appropriations such as dividend paid, bonus shares and transfer to/from reserves.

(Additions and deductions since last balance sheet to be shown under each of the specified heads)

(ii) A reserve specifically represented by earmarked investments shall be termed as a fund.

(iii) Debit balance of Statement of Profit and Loss shall be shown as a negative figure under the head -Surplus’ Similarly, the balance of ‘Reserves and Surplus’, after adjusting negative balance of surplus, if any shall be shown under the head ‘Reserves and Surplus’ even if the resulting figure is in the negative.

C. Long – term Borrowings:

(i) Long-term borrowings shall be classified as:

- Bonds/debentures

- Term loans – From banks, From other parties

- Deferred payment liabilities.

- Deposits.

- Loans and advances from related parties.

- Long-term maturities of finance lease obligations

- Other loans and advances (specify nature).

(ii) Borrowings shall further be sub-classified as secured and unsecured. Nature of security shall be specified separately in each case.

(iii) Where loans have been guaranteed by directors or others, the aggregate amount of such loans under each head shall be disclosed.

(iv) Bonds/debentures (along with the rate of interest and particulars of redemption or conversion, as the case may be) shall be stated in descending order of maturity or conversion, starting from farthest redemption or conversion date, as the case may be. Where bonds/debentures are redeemable by installments, the date of maturity for this purpose must be reckoned as the date on which the first installment becomes due.

(v) Particulars of any redeemed bonds/ debentures which the company has power to reissue.

(vi) Terms of repayment of term loans and other loans shall be stated.

(vii) Period and amount of default in repayment of dues, providing break¬up of principal and interest shall be specified separately in each case.

D. Other Long-term Liabilities:

Other Long-term Liabilities shall be classified as:

- Trade payables

- Others

E. Long-term Provisions:

The amounts shall be classified as:

- Provision for employee benefits.

- Others (specify nature).

F. Short-term borrowings

(i) Short-term borrowings shall be classified as:

- Loans repayable on demand – (a) from banks, (b) from other parties.

- Loans and advances from subsidiaries/ holding company/ associates/ business ventures.

- Deposits.

- Other loans and advances (specify nature).

(ii) Borrowings shall further be sub-classified as secured and unsecured. Nature of security shall be specified separately in each case.

(iii) Where loans have been guaranteed by directors or others, a mention thereof shall be made and also the aggregate amount of loans under each head.

(iv) Period and amount of default in repayment of dues, providing break up of principal and interest shall be specified separately in each case.

G. Other current liabilities:

The amounts shall be classified as:

- Current maturities of long-term debt;

- Current maturities of finance lease obligations;

- Income received in Advance;

- Interest accrued but not due on borrowing;

- Interest accrued and due on borrowings;

- Unpaid Dividends;

- Unpaid matured deposits and interest accrued thereon;

- Unpaid matured debentures and interest accrued thereon;

- Other payables (specify nature);

Application money received for allotment of securities and due for refund and interest accrued thereon. Share application money includes advances towards allotment of share capital. The terms & conditions including the number of shares proposed to be issued, the amount of premium, if any, and the period before which shares shall be allotted shall be disclosed.

It shall also be disclosed whether the company has sufficient authorized capital to cover the share capital amount resulting from allotment of shares out of such share application money. Further, the period for which the share application money has been pending beyond the period for allotment as mentioned in the document inviting application for shares along with the reason for Such share application money being pending shall be disclosed.

Share application money not exceeding the issued capital and to the extent not refundable shall be shown under the head Equity and share application money to the extent refundable i.e., the amount in excess of subscription or in case the requirements of minimum subscription are not met, shall be separately shown under ‘Other current liabilities’;

H. Short-term provisions:

The amounts shall be classified as:

- Provision for employee benefits;

- Others (specify nature).

I. Tangible assets

(i) Classification shall be given as:

- Land

- Buildings

- Plant and Equipment

- Furniture and Fixtures

- Vehicles

- Office Equipment

- Others (specify nature)

(ii) Assets under lease shall be separately specified under each class of asset.

(iii) A reconciliation of the gross and net carrying amounts of each class of assets at the beginning and end of the reporting period showing additions, disposals, acquisitions and other movements and the related depreciation and impairment losses/reversals shall be disclosed separately.

(iv) Where sums have been written off on a reduction of capital or revaluation of assets or where sums have been added on revaluation of assets, every balance sheet subsequent to date of such write-off, or addition shall show the reduced or increased figures as applicable and shall by way of a note also show the amount of the reduction or increase as applicable together with the date therefore for the first five years subsequent to the date of such reduction or increase.

J. Intangible assets:

(i) Classification shall be given as:

- Goodwill

- Brands/trademarks.

- Computer software.

- Mastheads and publishing titles.

- Mining rights.

- Copyrights, and patents and other intellectual property rights, services and operating rights.

- Recipes, formulae, models, designs and prototypes.

- Licences and franchise.

- Others (specify nature).

(ii) A reconciliation of the gross and net carrying amounts of each class of assets at the beginning and end of the reporting period showing additions, disposals, acquisitions and other movements and the related amortization and impairment losses/reversals shall be disclosed separately.

(iii) Where sums have been written off on a reduction of capital or revaluation of assets or where sums have been added on revaluation of assets, every balance sheet subsequent to date of such write-off, or addition shall show the reduced or increase as applicable and shall by way of a note also show the amount of the reduction or increase as applicable together with the date therefore for the first five years subsequent to the date of such reduction or increase.

K. Non-Current Investments

(i) Non- current investments shall be classified as trade investments and other investments and further classified as:

- Investment property;

- Investments in Equity Instruments;

- Investments in Preference shares;

- Investments in Government or trust securities;

- Investments in units, debentures or bonds;

- Investments in Mutual Funds;

- Investments in partnership firm;

- Other non-current investments (specify nature)

Under each classification, details shall be given of names of the bodies corporate (indicating separately whether such bodies are –

- subsidiaries

- associates

- joint ventures

- controlled special purpose entities

in whom investments have been made and the nature and extent of the investment so made in each such body corporate (showing separately investments which are partly paid). In regard to investments in the capital of partnership firms, the names of the firms (with the names of all their partners, total capital and the shares of each partner) shall be given.

(ii) Investments carried at other than at cost should be separately stated specifying the basis for valuation thereof.

(iii) The following shall also be disclosed:

- Aggregate amount of quoted investments and market value thereof;

- Aggregate amount of unquoted investments;

- Aggregate provision for diminution in value of investments;

- Aggregate amount of partly paid-up investments;

- The names of bodies corporate (indicating separately the names of subsidiaries, associates and other business ventures) in whose securities, investments have been made and the nature and extent of the investments so made in each such body corporate.

L. Long-term loans and advances:

(i) Long-term loans and advances shall be classified as:

- Capital Advances;

- Security Deposits;

- Loans and Advances to related parties (giving details thereof);

- Other Loans and Advances (specify nature).

(ii) The above shall also be separately sub-classified as;

- To the extent secured, considered good;

- Others, considered good;

- Doubtful.

(iii) Allowance for bad and doubtful loans and advances shall be disclosed under the relevant heads separately.

(iv) Loans and Advances due by directors or other officers of the company or any of them either severally or jointly with any other persons or amounts due by firms or private companies respectively in which any director is a partner or a director or a member should be separately stated.

M. Other non-current assets:

Other non-current assets shall be classified as:

(i) Long-term Trade Receivables (including trade receivables on deferred credit terms);

(ii) Others (specify nature)

(iii) (a) Long-term Trade Receivables, shall be sub-classified as:

- secured, considered good;

- unsecured, considered good;

- Doubtful

(b) Allowance for bad and doubtful debts shall be disclosed under the relevant heads separately.

(c) Debts due by directors or other officers of the company or any of them either severally or jointly with any other person debts due by firms or private companies respectively in which any director is a partner or a director or a member should be separately stated.

N. Current Investments:

(i) Current investments shall be classified as:

- Investments in Equity Instruments;

- Investments in Preference shares;

- Investments in Government or trust securities;

- Investments in units, debentures or bonds;

- Investments Mutual Funds;

- Investments partnership firm;

- Other investments (specify nature)

Under each classification, details shall be given of names of the bodies corporate (indicating separately whether such bodies are (i) subsidiaries, (ii) associates, (iii) joint ventures, or (iv) controlled special purpose entitles) in whom investments have been made and the nature and extent of the investment so made in each such body corporate (showing separately investments which are partly paid).

In regard to investments in the capital of partnership firms, the names of the firms (with the names of all their partners, total capital and the shares of each partner) shall be given.

(ii) The following shall also be disclosed:

- The basis of valuation of individual investments:

- Aggregate amount of quoted investments and market value thereof;

- Aggregate amount of unquoted investments;

- Aggregate amount of partly paid-up investments.

- Aggregate provision for diminution in value of investments.

O. Inventories:

(i) Inventories shall be classified as :

- Raw material;

- Work-in-progress;

- Finished goods;

- Stock-in-trade;

- Stores and spares;

- Loose tools;

- Others (specify nature).

(ii) Goods-in-transit shall be disclosed under the relevant sub-head of inventories.

(iii) Mode of valuation should be stated.

P. Trade Receivables:

(i) Aggregate amount of Trade Receivables outstanding for a period exceeding six months from the date they are due for payment should be separately stated.

(ii) Trade receivables shall also be classified as:

- To the extent secured, considered good;

- Others, considered good;

- Doubtful

(iii) Allowance for bad and doubtful debts shall be disclosed under the relevant heads separately.

(iv) Debts due by directors or other officers of the company or any of them either severally or jointly with any other person debts due by firms or private companies respectively in which any director is a partner or a director or a member should be separately stated.

Q. Cash and cash equivalents:

(i) Classification shall be made as:

- Bank balances;

- Cheques, drafts on hand;

- Cash on hand;

- Cash equivalents – short-term, highly liquid investments that are readily convertible into known amount of cash and which are subject to an insignificant risk of changes in value;

- Others (specify nature)

(ii) Earmarked bank balances (example – unpaid dividend) shall be separately stated.

(iii) Balance with banks to the extent held as security against the borrowings, guarantees, other commitments shall be disclosed separately.

(iv) Repatriation restrictions, if any, in respect of cash and bank balances shall be separately stated.

(v) Bank deposits with more than 12 months maturity shall be disclosed separately.

R. Short-term loans and advances:

(i) Short-term loans and advances shall be classified as:

- Loans and Advances to related parties (giving details thereof);

- Others (specify nature).

(ii) The above shall also be sub-classified as:

- To the extent secured, considered good;

- Others, considered good;

- Doubtful;

(iii) Allowance for bad and doubtful loans and advances shall be disclosed under the relevant heads separately.

(iv) Loans and Advances due by directors or other officers of the company or any of them either severally or jointly with any other person debts due by firms or private companies respectively in which any director is a partner or a director or a member should be separately stated.

S. Other current assets (specify nature):

This is an all-inclusive heading, which incorporates current assets that do not fit into any other assets categories.

T. Contingencies and commitments:

(to the extent not provided for)

(i) Contingent liabilities shall be classified as:

- Claims against the company not acknowledged as debt;

- Guarantees;

- Other money for which the company is contingently liable

(ii) Commitments shall be classified as:

- Estimated amount of contracts remaining to be executed on capital account and not provided for;

- Uncalled liability on shares and other investments partly paid;

- Other commitments (specify nature).

U. The amount of dividends proposed to be distributed to equity holders for the period and the related amount per share shall be disclosed separately. Arrears of fixed cumulative dividends shall also be disclosed separately.

V. Where in respect of an issue of securities made for a specific purpose, the whole or part of the amount has not been used for the specific purpose at the Balance Sheet date, they shall be indicated by way of note how such unutilized amounts have been used or invested.

W. If, in the opinion of the board, any of the assets other than fixed assets and non-current investments do not have a value on realization in the ordinary course of business at least equal to the amount at which they are stated, the fact that the board is of the opinion, shall be stated.

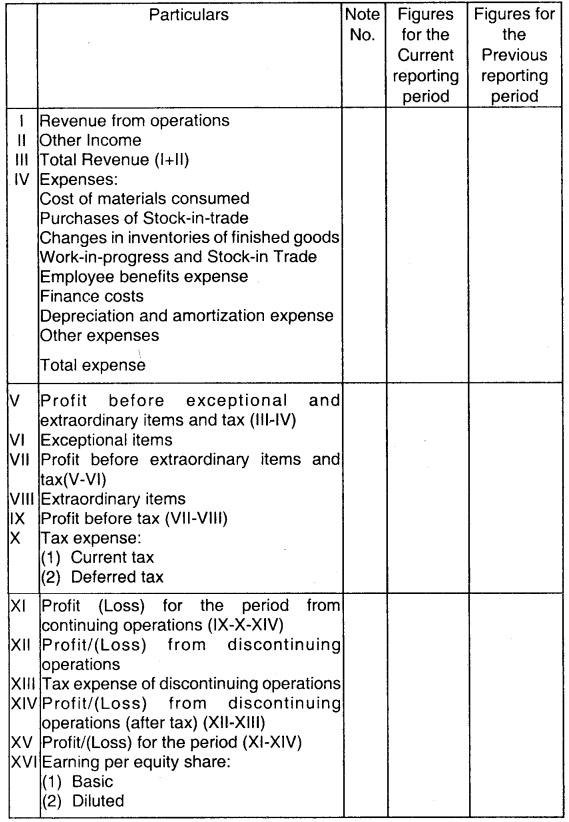

PART – II

Form of statement of profit and loss

Name of Company __________

Profit and Loss Statement for the year ended __________

(₹ in ……….)

General Instructions for Preparation of Statement of Profit and Loss:

1. The Provision of this Part shall apply to the Income and Expenditure account referred to in sub-section (2) of Section 210 of the Act, in like manner as they apply to a statement of profit and loss.

2. (A) In respect of a company other than a finance company, revenue from operations shall be disclosed separately in the notes revenue from –

- Sale of products;

- Sale of services;

- Other operating revenues;

- Excise duty.

(B) In respect of a finance company, revenue from operations shall include revenue from –

- Interest; and

- Other financial services

Revenue under each of the above heads shall be disclosed separately by way of notes to accounts to the extent applicable.

3. Finance Costs:

Finance costs shall be disclosed as:

- Interest expense;

- Other borrowing costs;

- Applicable net gain/loss on foreign currency transaction and translation.

4. Other Income:

Otner income shall be classified as:

- Interest Income (in case of a company other than a finance company);

- Dividend Income;

- Net gain/loss on sale of investments

- Other non-operating income (net of expenses directly attributable to such income).

5. Additional Information:

A Company shall disclose by way of notes additional information regarding aggregate expenditure and income on the following items:

- Employee Benefits Expense [showing separately –

(a) salaries and wages

(b) contribution to provident and other funds

(c) expense on Employee Stock Option Scheme (ESOP) and Employee Stock Purchase Plan (ESPP)

(d) staff welfare expense - Depreciation and amortization expense;

- Any item of income or expenditure which exceeds one percent of the revenue from operations or ? 1,00,000, whichever is higher;

- Interest Income;

- Interest Expense;

- Dividend Income;

- Net gain/loss on sale of investments;

- Adjustments to the carrying amount of investments;

6. Net gain or loss on foreign currency transaction and translation (other than considered as finance cost);

7. Payments to the auditors as –

- audit

- for taxation matters

- for company matters

- for management services

- for other services

- for reimbursement of expense;

8. Details of items of exceptional and extraordinary nature;

(i) Prior Period Items;

(ii) (a) In the case of manufacturing companies;

- Raw materials under broad heads.

- Goods purchased under broad heads.

(b) In the case of trading companies, purchases in respect of goods traded in by company under broad heads.

(c) In the case of companies rendering or supplying services, gross income derived from services rendered or supplied under broad heads.

(d) In the case of a company, which falls under more than one of the categories mentioned in (a), (b) and (c) above, it shall be sufficient compliance with the requirements herein if purchase, sales and consumption of raw material and the gross income from services rendered is shown under broad heads.

(e) In the case of other companies, gross income derived under broad heads.

(iii) In the case of all concerns having work-in-progress, work-in-progress under broad heads.

(iv) (a) The aggregate, if material, of any amounts set aside or propose to be set aside, to reserve, but not including provisions made to meet any specific liability, contingency or commitment known to exit at the date as to which the Balance Sheet is make up.

(b) The aggregate, if material, of any amounts withdrawn from such reserves.

(v) (a) The aggregate, if material, of the amounts set aside to provisions made for meeting specific liabilities, contingencies or commitment.

(b) The aggregate, if material, of the amounts withdrawn from such provisions, as no longer required.

(vi) Expenditure incurred on each of the following items, separately for each item:

- Consumption of stores and spare parts

- Power & fuel

- Rent

- Repairs to building

- Repairs to Machinery

- Insurance

- Rates and Taxes, excluding, taxes on income.

- Miscellaneous expense,

(vii)

- Dividends from subsidiary companies

- Provisions for losses of subsidiary companies

(viii) The profit and loss account shall also contain by way of a note the following information, namely:

(a) Value of imports calculated on C.I.F. basis by the company during the financial year in respect of –

- Raw materials;

- Companies and spare parts;

- Capital goods;

(b) Expenditure in foreign currency during the financial year on account of royalty, know-how, professional and consultation fees, interest, and other matters;

(c) Total value of all imported raw materials, spare parts and the components consumed during the financial year and the total value of all indigenous raw materials, spare parts and components similarly consumed and the percentage of each to the total consumption;

(d) The amount remitted during the year in foreign currencies on account of dividends with specific mention of the total number of nonresidents shareholders, the total number of shares held by them on which the dividends were due and the year to which the dividends relate;

(e) Earnings in foreign exchange classified under the following heads, namely:

- Exports of goods calculated on F.O.B basis;

- Royalty, know-how professional and consultation fees;

- Interest and dividends;

- Other Income, indicating the nature thereof.

Note:

Broad heads shall be decided taking into account the concept of materiality and presentation of true and fair view of Financial Statements.

Introduction to Company Accounts MCQ Questions

1. Member’s in private company are (Maximum):

(a) 100

(b) 200

(c) 500

(d) Unlimited.

Answer:

(b) 200

2. Amount of share application should not be less than _________ % of face value:

(a) 5%

(b) 10%

(c) 75%

(d) None.

Answer:

(a) 5%

3. Amount of share forfeited after re-issue of shares should be transferred to:

(a) Add to Share Capital

(b) Capital Reserve A/c

(c) The Head Revenue & Surplus

(d) Share Forfeited A/c.

Answer:

(b) Capital Reserve A/c

4. If shares are issued at premium then, the amount of premium can be utilized.

(a) for issue of bonus shares

(b) for payment of dividend

(c) for redemption of debenture

(d) None.

Answer:

(a) for issue of bonus shares

5. Value of share is ₹ 100 and only ₹ 80 called up only and a shareholder did not paid the final call of ₹ 30 and his share is forfeited. On forfeiture Share Capital A/c will be debited by:

(a) ₹ 100

(b) ₹ 80

(c) ₹ 50

(d) ₹ 70

Answer:

(b) ₹ 80

6. All those companies, which operate under the special act passed by the state Legislature or Parliament, are called:

(a) Unregistered Company

(b) Registered Company

(c) Statutory Company

(d) Government Company.

Answer:

(c) Statutory Company

7. Time period between 2 calls should be _________.

(a) Minimum 15 Days

(b) Minimum 21 Days

(c) Minimum 1 Month

(d) Minimum 3 Months.

Answer:

(c) Minimum 1 Month

8. “Securities Premium A/c” is shown in B/S on:

(a) Asset side (Loan & Advances)

(b) Liabilities side (Reserve & Surplus)

(c) Liabilities side (Loan & Advances)

(d) Asset side (Misc Assets).

Answer:

(b) Liabilities side (Reserve & Surplus)

9. Which capital is shown in B/S:

(a) Authorised Share Capital

(b) Issued Share Capital

(c) Subscribed Share Capital

(d) All of the above.

Answer:

(d) All of the above.

10. The maximum amount beyond which a company is not allowed to raise funds by issue of shares is known as:

(a) Nominal Capital

(b) Issued Capital

(c) Subscribed Capital

(d) None.

Answer:

(a) Nominal Capital

11. Maximum amount that can be collected as premium as a percentage of face value:

(a) 10%

(b) 20%

(c) 30%

(d) Unlimited.

Answer:

(d) Unlimited.

12. The minimum amount that should be called by a company with application for its shares is the following percent of face value of shares:

(a) 2%

(b) 5%

(c) 10%

(d) 15%.

Answer:

(b) 5%

13. A company cannot issue:

(a) Redeemable Equity Shares

(b) Redeemable Preference Shares

(c) Redeemable Debentures

(d) Fully Convertible Debentures.

Answer:

(a) Redeemable Equity Shares

14. Which of the following is not a capital profit?

(a) Profit prior to incorporation of the company

(b) Profit from the sale of fixed assets

(c) Premium on issue of shares

(d) Compensation received on the termination of a contract.

Answer:

(d) Compensation received on the termination of a contract.

15. Unless otherwise stated, a preference share is always deemed to be:

(a) cumulative, participating and non – convertible

(b) non – cumulative, non – participating and non – convertible

(c) cumulative, non – participating and non – convertible

(d) non – cumulative, participating and non – convertible.

Answer:

(c) cumulative, non – participating and non – convertible

16. Premium on issue of shares can be used for:

(a) issue of bonus shares

(b) payment of dividends

(c) payment of operating expenses

(d) redemption of debentures.

Answer:

(a) issue of bonus shares

17. The rate of interest paid on calls in advance as per Table F is:

(a) 5% p.a.

(b) 6% p.a.

(c) 10% p.a

(d) 12% p.a.

Answer:

(d) 12% p.a.

18. The document inviting offers from public to subscribe for the debentures or shares or deposits of a company is a:

(a) Share Certificate

(b) Articles of Association

(c) Fixed Deposit Receipt

(d) Prospectus.

Answer:

(d) Prospectus.

19. When shares are issued to promoters for their services, the account that will be debited is:

(a) Preliminary Expenses A/c

(b) Goodwill A/c

(c) Promoters A/c

(d) Share Capital A/c.

Answer:

(b) Goodwill A/c

20. The maximum amount beyond which a company is not allowed to raise funds, by issue of shares, is its:

(a) Issued Capital

(b) Reserve Capital

(c) Authorised Capital

(d) Subscribed Capital

Answer:

(c) Authorised Capital

21. Dividends are usually paid on:

(a) Authorised Capital

(b) Issued Capital

(c) Cailed – up Capital

(d) Paid – up Capital

Answer:

(d) Paid – up Capital

22. Which of the following should be deducted from the share capital to find out paid – up capital?

(a) Calls – in – advance

(b) Calls – in arrears

(c) Share forfeiture

(d) Discount on issue of shares.

Answer:

(b) Calls – in arrears

23. Which of the following does not appear under the head ‘share capital’ of a balance sheet?

(a) Preference Share Capital

(b) Share Forfeiture A/c

(c) Equity Share Capital

(d) Capital Reserve A/c.

Answer:

(d) Capital Reserve A/c.

24. Which of the following statements is true regarding calls – in – arrears?

(a) Calls – in – arrears is that part of called up capital which remains unpaid.

(b) It is not shown in the balance sheet until the defaulted shares are forfeited.

(c) The rate of interest on calls – in – arrear is chargeable at 5% p.a. if a company adopts Table F.

(d) Charging of interest on calls – in arrear need not be permitted by the articles of association.

Answer:

(a) Calls – in – arrears is that part of called up capital which remains unpaid.

25. Which one of the following is known as Registered Capital of the Company?

(a) Paid – up Capital

(b) Authorised Capital

(c) Uncalled Capital

(d) Reserve Capital.

Answer:

(b) Authorised Capital

26. The directors of B Ltd. made the final call of ₹ 30 per share on January 15,2004 indicating the last date of payment of call money to be January 31,2004. Mr. C holding 7,500 shares paid the call money on March 15, 2004.

If the company adopts Table F of the Companies Act the amount of interest on calls – in – arrear to be paid by Mr. C is?

(a) ₹ 1937.50

(b) ₹ 1,406.00

(c) ₹ 2812.50

(d) ₹ 1,687.50.

Answer:

(c) ₹ 2812.50

27. O Ltd. issued 10,000 equity shares of ₹ 10 each at a premium of 20% payable ₹ 4 on application (including premium), 15 on allotment and the balance on first and final call. The company received applications for 15,0 shares and allotment was made pro-rata. P, to whom 3,000 shares were allotted failed to pay the amount due on allotment. All his shares were forfeited before the call was made. The forfeited shares were reissued to Q at par. Assuming that no other bank transactions took place, the bank balance of the company after effecting the above transactions is?

(a) ₹ 1,14, 000

(b) ₹ 1,32,000

(c) ₹ 1,20,000

(d) ₹ 1,00,000.

Answer:

(b) ₹ 1,32,000

28. A company forfeited 2,000 shares of ₹ 10 each (which were issued at par) held by Mr. John for non – payment of allotment money of ₹ 4 per share. The called – up value per share was ₹ 9. On forfeiture, the amount debited to share capital A/c is?

(a) ₹ 10,000

(b) ₹ 8,000

(c) ₹ 2,000

(d) ₹ 18,000.

Answer:

(d) ₹ 18,000.

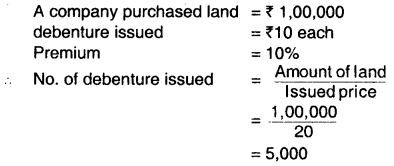

29. G. Ltd. acquired assets worth ₹ 7,50,000 from H. Ltd. by issue of shares of ₹100 at a premium of 25%. The number of shares to be issued by, G. Ltd. to settle the purchase consideration is?

(a) 6,000 Shares

(b) 7,500 Shares

(c) 9,375 Shares

(d) 5,625 Shares

Answer:

(a) 6,000 Shares

30. B. Ltd., a listed company, proposed to issue 1,00,000 equity shares of ₹ 10 each at par by way of private placement. The maximum amount of brokerage that can be paid by the company is?

(a) ₹ 5,000

(b) ₹ 10,000

(c) ₹ 50,000

(d) ₹ 25,000

Answer:

(a) ₹ 5,000

31. UK Ltd. issued 20,000 shares of ₹10 each at a premium of 20% on May 01,2004, payable as follows:

On application ₹ 4.50 (inclusive of premium)

On allotment ₹ 2.50

On first and final call ₹ 5.00

Mrs. M, to whom 1,000 shares were allotted, has paid ₹ 5,000 on June 01, 2004. At the time of remitting the allotment money, she indicated that the excess money should be adjusted towards the call money. The directors of the company made the first and final call on October 31,2004. The company has a policy of paying interest on calls- in-advance.

The amount of interest paid to Mrs. M on calls-in-advance is?

(a) ₹ 62.00

(b) ₹ 52.08

(c) ₹ 250

(d) ₹ 150.00

Answer:

(c) ₹ 250

32. Z Ltd. issued 10,000 shares of ₹ 10 each. The called up value per share was ₹ 8. The company forfeited 200 shares of Mr. A for non- payment of 1st call money of per share. He paid ₹ 6 for application and allotment money. On forfeiture, the share capital account will be _________.

(a) Debited by ₹ 2,000

(b) Debited by ₹ 1,600

(c) Credited by ₹ 1,600

(d) Debited by ₹ 1,200

Answer:

(b) Debited by ₹ 1,600

33. B Ltd. invited applications for 5,000 shares of ₹10 each at a premium of ₹ 2 per share payable as follows:

On application – ₹ 5 (including premium)

On allotment – ₹ 4

On final call – ₹ 3

Allotment was made on pro rate basis to the applicants of 6,000 shares. Mr. C to whom 60 shares were allotted, failed to pay allotment money and call money. Mr. D the holder of 100 shares, failed to pay call money. All these shares were forfeited after proper notice.

(i) On forfeiture, the amount credited to share allotment account is?

(a) ₹ 480

(b) ₹ 640

(c) ₹ 180

(d) ₹ 400

Answer:

(c) ₹ 180

(ii) On forfeiture, the amount credited to share forfeiture account is?

(a) ₹ 300

(b) ₹ 880

(c) ₹ 320

(d) ₹ 940

Answer:

(b) ₹ 880

34. When shares are forfeited, the Share Capital Account Is debited with _________ and the Share Forfeiture Account is credited with _________.

(a) Paid – up capital of shares forfeited; Called up capital of shares forfeited

(b) Called up capital of shares forfeited; Calls in arrear of shares forfeited.

(c) Called up capital of shares forfeited; Amount received on shares forfeited

(d) Calls in arrears of shares forfeited; Amount received on shares forfeited.

Answer:

(c) Called up capital of shares forfeited; Amount received on shares forfeited

35. The following statements apply to equity/preference shareholders. Which one of them applies only to preference shareholders?

(a) Shareholders risk the loss of investment

(b) Shareholders bear the risk of no dividends in the event of losses

(c) Shareholders usually have the right to vote

(d) Dividends are usually given at a set amount in every financial year.

Answer:

(d) Dividends are usually given at a set amount in every financial year.

36. What do you mean by foreign company?

(a) Company that is incorporated outside India but operates in India

(b) Company that is incorporated in India but operates in India

(c) Subsidiary company in India of a foreign holding

(d) None of these

Answer:

(a) Company that is incorporated outside India but operates in India

37. The amount of capital that is mentioned in ‘Capital clause’ Is known as:

(a) Authorised Capital

(b) Registered Capital

(c) Nominal Capital

(d) All of these

Answer:

(d) All of these

38. That portion of called up capital which is not received is known as:

(a) Uncalled capital

(b) Unpaid calls

(c) Reserved capital

(d) None of these

Answer:

(b) Unpaid calls

39. The minimum subscription as prescribed by SEBI against the entire issue is:

(a) 95%

(b) 90%

(c) 5%

(d) None of these

Answer:

(b) 90%

40. The amount called over and above the nominal value of share should be credited to:

(a) Share premium a/c

(b) Share capital a/c

(c) Share allotment a/c

(d) None of these

Answer:

(a) Share premium a/c

41. The excess of the nominal value over the issue price represents:

(a) Premium on share

(b) Discount on share

(c) Forfeiture of share

(d) None of these

Answer:

(b) Discount on share

42. Pro-Rata allotment is done in case of:

(a) Full subscription

(b) Over subscription

(c) Under subscription

(d) Shares issued at premium

Answer:

(b) Over subscription

43. Share application account is of the nature of a _________.

(a) Reala/c

(b) Personal a/c

(c) Nominal a/c

(d) None of the above

Answer:

(b) Personal a/c

44. Profit prior to incorporation is an example of _________.

(a) Revenue reserve

(b) Secret reserve

(c) Capital reserve

(d) General reserve

Answer:

(c) Capital reserve

45. The company charges interest on calls in arrear at rate of:

(a) 6%

(b) 10%

(c) 5%

(d) 14%

Answer:

(b) 10%

46. If the Premium of the forfeited share has already been received, then share Premium a/c should be:

(a) Credited

(b) Debited

(c) Cannot be cancelled

(d) None of these

Answer:

(c) Cannot be cancelled

47. What percentage of shares issued to the public must be subscribed so that the shares can be allotted?

(a) 75%

(b) 50%

(c) 90%

(d) None of these

Answer:

(c) 90%

48. Dividend proposed to be paid is calculated as a percentage of _________.

(a) Net Profits

(b) Authorised Capital

(c) Issued Capital

(d) Paid up Capital

Answer:

(d) Paid up Capital

49. Which account will be credited if the gain on forfeiture is more than the loss on reissue _________.

(a) Capital Reserve

(b) Profit & Loss

(c) General Reserve

(d) Share Forfeiture

Answer:

(a) Capital Reserve

50. The subscribed capital of a company is ₹ 80,00,000 and the nominal value of the share is ₹ 100 each. There were no calls in arrear till the final call was made. The final call made was paid on 77,500 shares only. The balance in the calls in arrear amounted to ₹ 62,500. Calculate the final call on share.

(a) ₹ 7

(b) ₹ 20

(c) ₹ 22

(d) ₹ 25

Answer:

(d) ₹ 25

51. On the forfeiture of shares, the share capital will be debited by _________.

(a) Paid up value

(b) Called up value

(c) Uncalled capital

(d) Nominal value

Answer:

(b) Called up value

52. If the shares are issued at a premium and the amount of premium has been received, then what will be the treatment of the premium amount at the time of forfeiture.

(a) Debit Security Premium A/c

(b) Debit Capital Reserve A/c

(c) Credit Security Premium A/c

(d) No treatment

Answer:

(d) No treatment

53. As per Section 52, the balance standing in the securities premium account cannot be utilized for _________.

(a) Payment of dividend

(b) Writing off discount on issue of shares

(c) Issue of fully paid Bonus Shares

(d) None of these

Answer:

(a) Payment of dividend

54. Voluntary return of shares for cancellation by the shareholders is called _________.

(a) Cancellation of shares

(b) Forfeiture

(c) Surrender of shares

(d) None of these

Answer:

(c) Surrender of shares

55. Balance in the share forfeiture account appears in the balance sheet under the head of _________.

(a) Share Capital

(b) Reserve & Surplus

(c) Current Liabilities

(d) None of these

Answer:

(a) Share Capital

56. The statement issued to the public for issue of shares is called as _________.

(a) Statement in lieu of prospectus

(b) Prospectus

(c) Articles of association

(d) None of the above

Answer:

(b) Prospectus

57. Right shares are issued to _________.

(a) The existing shareholders

(b) Promoters

(c) Employees

(d) Vendor

Answer:

(a) The existing shareholders

58. Share allotment account is _________.

(a) Personal A/c

(b) Nominal A/c

(c) Real A/c

(d) All of the above

Answer:

(a) Personal A/c

59. If the shares are issued to the promoters, then which account will be debited _________.

(a) Promoters A/c

(b) Share Capital A/c

(c) Goodwill A/c

(d) P & L A/c

Answer:

(c) Goodwill A/c

60. A company forfeited 5,000 shares of ₹ 10 each held by A for non payment of allotment money of ₹ 4 per share. The called up value per share is ₹ 8. Calculate the amount to be debited to the share capital A/c at the time of forfeiture of such shares _________.

(a) ₹ 28,000

(b) ₹ 40,000

(c) ₹ 18,000

(d) None of these

Answer:

(b) ₹ 40,000

61. A vender has been allotted shares of ₹ 5,50,000 in consideration of net assets purchased worth ₹ 5,00,000. Then the balance of ₹ 50,000 will be considered as _________.

(a) Goodwill

(b) Capital Reserve

(c) Loss

(d) Profit

Answer:

(a) Goodwill

62. ABC Ltd. acquired the assets worth ₹ 10,00,000 from XYZ Ltd. by issuing shares of ₹ 10 each at a premium of ₹ 10 each. Calculate the number of shares to be issued to settle the liability

(a) ₹ 50,000

(b) ₹ 1,00,000

(c) ₹ 5,000

(d) ₹ 10,000

Answer:

(a) ₹ 50,000

63. ABC Ltd. allotted 20,000 shares to the applicants of 28,000 shares on pro-rata basis. If the application money is ₹ 5 per share, calculate the number of shares allotted to Ram and also the amount to be adjusted from further calls if he has applied for 840 shares.

(a) 800 shares, ₹ 1,200

(b) 600 shares, ₹ 800

(c) 600 shares, ₹ 1,800

(d) 600 shares, ₹ 1,200

Answer:

(d) 600 shares, ₹ 1,200

64. If a share of ₹ 100 on. which ₹ 80 has been paid is forfeited, then calculate the minimum price at which it can be re-issued.

(a) ₹ 80

(b) ₹ 100

(c) ₹ 20

(d) ₹ 50

Answer:

(c) ₹ 20

65. A company has issued 50,000 shares of ₹ 10 each at 20% premium payable as follows Application ₹ 3, Allotment ₹ 5 (including premium) and first & final call of ₹ 4 each. A holder of 2,500 shares failed to pay the first & final call and his shares were forfeited thereafter. Calculate the amount to be credited to the share forfeiture A/c.

(a) ₹ 11,000

(b) ₹ 15,000

(c) ₹ 22,000

(d) None of these

Answer:

(b) ₹ 15,000

66. Which of the following statement is true?

(a) Authorised Capital = Issued Capital

(b) Authorised Capital > Issued Capital

(c) Paid up Capital ≥ Issued Capital

(d) None of the above.

Answer:

(b) Authorised Capital > Issued Capital

Authorised Share Capital means that amount of capital which is mentioned in ‘Capital Clause’ of the ‘Memorandum of Association’ registered with the Register of Company. Issued share capital means that portion of the Authorised Capital which is issued by the company. Paid – up share capital means that capital which is paid up by the shareholders. Thus, authorised capital is always greater than issued capital.

67. Which of the following will define, when appropriation of a certain number of shares is made to an applicant in response to his application?

(a) Share allotment

(b) Share forfeiture

(c) Share trading

(d) Share purchase

Answer:

(a) Share allotment

Allotment means the appropriation of a certain number of shares to an applicant in response to his application. If the number of shares applied for is less than the number of shares offered, the allotment can be only for the shares applied for, provided, minimum subscription is raised.

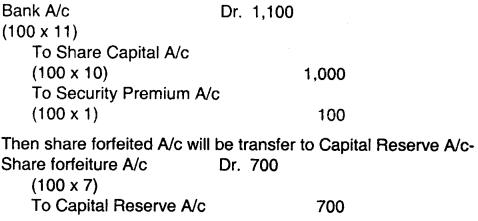

68. P Ltd. forfeited 150 shares of ₹ 10 each, issued at a premium of ₹ 2, for non – payment of the final call of ₹ 3. Out of these, 100 shares were re-issued @ ₹ 11 per share. How much amount would be transferred to capital reserve?

(a) ₹ 700

(b) ₹ 500

(c) ₹ 1,200

(d) ₹ 300

Answer:

(a) ₹ 700

₹ 700 would be transferred to Capital Reserve A/c.

69. If the number of shares offered to public for subscription is less than the number of applications received, it is termed as:

(a) Minimum subscription

(b) Over subscription

(c) Under subscription

(d) Maximum subscription

Answer:

(c) Under subscription

When the number of shares applied for less than the number of shares issued, the shares are said to be under – subscribed. In such situation, the directors allot shares on some reasonable basis because the company can allot only that number of shares which are actually offered for subscription.

70. XY Limited issued 2,50,000 equity shares of ₹ 10 each at a premium of ₹ 1 each payable as ₹ 2.5 on application, ₹ 4 on allotment and balance on the first and final call. Applications were received for 5,00,000 equity shares but the company allotted to them only 2,50,000 shares. Excess money was refunded after adjustment for further calls. Last call on 500 shares were not received and shares were forfeited after due notice. This is a case of:

(a) Over subscription

(b) Pro-rata allotment

(c) Forfeiture of shares

(d) All of the above

Answer:

(d) All of the above