Browsing through CA Foundation BCK Notes Chapter 5 Organizations Facilitating Business helps students to revise the complete subject quickly.

Organizations Facilitating Business – BCK CA Foundation Notes Chapter 5

Government of India has constituted several bodies to regulate and control business activities for protecting the interests of various stakeholders. Similarly, several development banks have been established to assist in the establishment and growth of business enterprises. These regulatory bodies and development banks are described in this chapter.

5.1 Indian Regulatory Bodies:

Regulation and Control of business and related activities are necessary to ensure health growth and to safeguard the interests of various sections of the society. Some of the regulatory bodies in India are given below:

5.1.1 Securities and Exchange Board of India (SEBI):

In order to protect the interests of investors the Government of India constituted the Securities and Exchange Board of India (SEBI) in April, 1988. It is meant to be a supervisory body to regulate and promote the securities market in the country.

Objectives: The main objectives of SEBI are as under:

- to promote fair dealings by the issuers of securities and to ensure a market place where they can raise funds at a relatively low cost;

- to provide a degree of protection to the investors and safeguard their rights and interests so that there is a steady flow of savings into the market;

- to regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers, etc. with a view to making them competitive and professional.

Thus, the basic objectives of SEBI are to protect the interests of investors in securities and to pro-mote the development of, and to regulate, the securities markets.

Functions: SEBI performs the following functions:

1. Protective Functions – In order to protect the common investor, SEBI undertakes the following activities:

- It prohibits fraudulent and unfair trade practices on stock exchanges.

- It prohibits insider trading.

- It undertakes steps to educate investors.

- It promotes fair practices and code of conduct in securities market.

- It is empowered to investigate cases of insider trading, impose fines and imprisonment.

- It has issued guidelines for preferential allotment of shares.

2. Developmental Functions – These functions are as follows:

- Training intermediaries in stock market.

- Developing capital markets through internet trading, permitting stock exchanges to market/ IPO and making underwriting optional.

3. Regulatory Functions:

- Prescribing rules and regulations for merchant bankers, underwriters and registrars.

- Registering and regulating stock brokers, sub-brokers, etc.

- Registering and regulating the working of mutual funds.

- Regulating takeover of companies.

- Conducting inquiries and audits of stock exchanges.

5.1.2 Reserve Bank of India (RBI):

Every country has a Central Bank as an apex body to supervise and control the banking sector. Reserve Bank of India is India’s Central Bank. It was set up under the Reserve Bank of India Act, 1934. It began its operations on April 1, 1935. It is managed by a Board of Governors headed by the RBI Governor.

The functions performed by the Reserve Bank of India may be classified broadly into three categories –

- Traditional central banking functions

- Supervisory functions

- Development functions.

The central banking functions are given below:

(i) Issue of Bank Notes: Under the RBI Act, the RBI has the monopoly (sole right) to issue bank notes of all denominations. The RBI has a separate Issue Department to make issues of cur-rency notes. It has adopted the minimum reserve system of note issue.

(ii) Banker to Government: The Reserve Bank acts as the banker, agent and adviser to Government of India:

- It maintains and operates government deposits.

- It collects and makes payments on behalf of the government.

- It helps the government to float new loans and manages the public debt.

- It sells for the Central Government treasury bills of 91 days duration.

- It makes ‘Ways and Means’ advances to the Central and State Governments for periods not exceeding three months.

- It provides development finance to the government for carrying out five year plans.

- It undertakes foreign exchange transactions on behalf of the Central Government.

- It acts as the agent of the Government of India in the latter’s dealings with the International institutions.

- It advises the government on all financial matters such as loan operations, investments, agricultural and industrial finance, banking, planning, economic development, etc.

(iii) Bankers’ Bank: The RBI keeps the cash reserves of all the scheduled banks and is, therefore, known as the ‘Reserve Bank’. The scheduled banks can borrow in times of need from RBI. The RBI acts not only as the bankers’ bank but also the lender of the last resort by providing rediscount facilities to scheduled banks. The RBI extends loans and advances to banks against approved securities.

(iv) Controller of Credit: A major function of the RBI is to formulate and administer the country’s monetary policy. The RBI controls the volume of credit created by banks in India. It can ask any particular bank or the entire banking system not to lend against particular type of securities or for a particular purpose. The RBI controls credit in order to ensure price stability and economic growth.

(v) Custodian of Foreign Exchange Reserves: The RBI acts as the custodian of India’s reserve of international currencies. In addition, RBI has the responsibility of maintaining exchange rate of the rupee and of administering the exchange controls of the country.

(vi) Clearing House Facility: As a clearing house, the central bank settles the claims of commercial banks and enables them to clear their dues through book entries. It makes debit and credit entries in their accounts for convenient adjustment of their daily balances with one another.

(vii) Collection and Publication of Data: The central bank conducts surveys and publishes reports and bulletins. It may provide staff training facilities to the personnel of commercial banks. It maintains relations with international financial institutions such as World Bank, IME etc.

Regulatory and Supervisory Functions: The RBI is the supreme banking authority in the country. Every bank has to get a licence from the RBI to do banking business in India. The licence can be cancelled if the stipulated conditions are violated.

Each scheduled bank is required to send a return of its assets and liabilities to the RBI. In addition, the RBI can call for information from any bank. It also has the power to inspect the accounts of any commercial bank. Thus, the RBI controls the banking system through licensing, inspection and calling for information.

The RBI has been given wide powers of supervision and control over commercial and cooperative banks. It can carry out periodical inspections of the banks and to call for returns from them. The supervisory and regulatory functions of the RBI are meant for improving the standard of banking in India and for developing the banking system on sound lines.

With liberalisation and growing integration of the Indian financial sector with the international market, the supervisory and regulatory role of RBI has become critical for the maintenance of financial stability. RBI has been continuously fine-tuning its regulatory and supervisory mechanism in recent years to match international standards.

Migration to new capital adequacy framework (Basel II) based on a three-pillar approach, namely, minimum capital requirements, supervisory review, and market discipline, involves implementation challenges for both RBI and banks. RBI has taken a number of initiatives to make migration to Base II smoother.

Promotional or Developmental Functions: The RBI is expected to promote banking habit, extend banking facilities to rural and semi-urban areas, establish and promote new specialised financial agencies. The RBI has helped in the setting of the IFCI, the SFCs, the UTI, the IDBI, the Agricultural Refinance Corporation of India, etc. These institutions were established to mobilise savings and to provide finance to industry and agriculture.

The RBI has developed the cooperative credit movement to encourage savings, to eliminate moneylenders from the villages and provide short-term credit to agriculture. The RBI has also taken initiative for widening financial facilities for foreign trade. It facilitates the process of industrialisation by setting up specialised institutions for industrial finance. It also undertakes steps to develop bill market in the country.

Functions of the RBI:

- Monetary Functions: Issue of currency, banker to Government, banker’s bank, credit control, custodian of foreign exchange.

- Supervisory Functions: Licensing, branch expansion, liquidity of assets, working methods, inspection, amalgamation and reconstruction.

- Developmental Functions: Promotion and mobilisation of savings, extension of banking, elimination of money lenders.

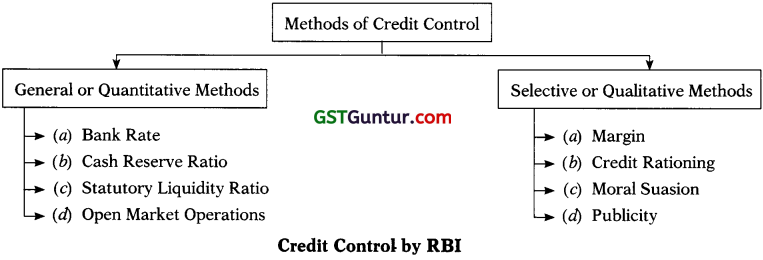

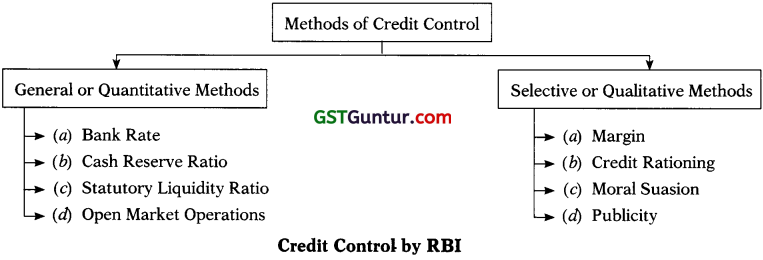

Credit Control by RBI:

As stated earlier, RBI is the controller of credit in India. Credit control means the regulation of credit by the central bank for achieving the desired objectives. It involves expansion and contraction of credit. The control over credit is necessary for preventing too much money supply in the economy and to prevent price rise.

The objectives of credit control are as follows:

- to stabilise the general price level in the country;

- to keep the exchange rate stable;

- to promote and maintain a high level of income and employment;

- to maintain a normal and steady growth rate in business activity;

- to eliminate undue fluctuations in production and employment.

In order to control the volume of credit in the country, the RBI employs both general and selective methods:

(i) Bank Rate – The standard rate at which the RBI is prepared to discount bills of exchange or extends advances to the commercial banks is known as the bank rate. When the RBI increases the bank rate, borrowing from banks becomes costlier and the amount of borrowings from banks is reduced.

The effectiveness of bank rate is, however, limited due to certain constraints in the economy. Existence of non-banking finance institutions, large profit margins on speculative dealings, priority sector advances and increase in prices of final products to offset high interest rates are examples of these constraints.

(ii) Cash Reserve Ratio (CRR) – CRR refers to that portion of total deposits of a commercial bank which it has to keep with the RBI in the form of cash reserves. By raising the CRR, the RBI reduces the amount of loanable funds with commercial banks. As they can lend lesser amount, the volume of credit in the country gets reduced.

(iii) Statutory Liquidity Ratio (SLR) – SLR means that portion of total deposits of a commercial bank which it has to keep with itself in the form of cash reserves. An increase in the SLR has the same effect on the volume of credit as increase in the CRR.

(iv) Open Market Operations – These refer to the purchase and sale by the RBI of a variety of assets such as gold, government securities, foreign exchange and industrial securities from the market to increase money supply and lower interest rates. This is done to stimulate banks to give out more loans, boost private spending and increase inflation.

It is called quantitative easing. If the RBI wants to reduce the volume of credit, it sells these assets. Such sale reduces money supply with banks and leads to increase in rates of interest. The open market operations of the RBI are however restricted to government securities due to underdeveloped securities market, and narrow gilt edged market.

Selective Credit Controls – Under these measures, the RBI diverts the flow of credit from speculative and unproductive activities to productive and priority areas. Under the Banking Regulation Act, 1949 the RBI is empowered to issue directives to banks, regarding their advances.

These directives may relate to:

- the purpose for which advances may or may not be made

- the margins to be maintained in respect of secured advances

- the maximum amount of advances to any borrower

- the maximum amount upto which guarantees may be given by the bank on behalf of any firm, company, etc.

- the rate of interest and other terms and conditions for granting advances.

The selective methods of credit control are as follows:

1. Margin Requirements – Commercial banks have to keep a margin between the amount of loan granted and the market value of the security against which the loan is granted. For example, they may be asked to grant loans upto 80 per cent of the security or asset. When the central bank raises margin requirements, the volume of credit is reduced. In the same manner, lowering of margin requirements leads to expansion of credit. Margin requirements is a selective method of credit control.

2. Credit Rationing – Sometimes, the Reserve Bank of India fixes a limit to the credit facilities avail¬able to commercial banks. The available credit is rationed among them according to the purpose of credit. This method of credit control is used in exceptional situations of monetary stringency. Moreover, credit rationing cannot be used for the expansion of credit in the economy.

3. Moral Suasion – Under this method, the central bank requests and persuades the commercial banks not to grant credit for speculative and non-essential activities. It is an informal and non-statutory method. But commercial banks honour the authority of the central bank. The central bank may also issue directives to commercial banks to refrain from certain types of lending. For example, the RBI asked banks to refrain from lending against food grains to check* hoarding.

4. Publicity – The central bank issues reports and review statements of assets and liabilities. These publications keep commercial banks aware of conditions in the money market, public finance, trade and industry in the country. They adjust their credit activities accordingly.

Role of RBI in Economic Development:

In a developing country like India, the central bank has to play a vital role. The developing countries generally do not have well organised money market and capital market. Therefore, the central bank is expected to develop the banking system and financial system of the country. In addition to the traditional functions, the RBI contributes towards the Indian economy in the following ways:

1. Development of Banking System – The RBI takes steps to develop a sound banking system in the country. Over the years, an integrated commercial banking structure has been developed under the supervision and control of the RBI. Regulation and control by the RBI creates public confidence in the banking system.

2. Development of Financial Institutions – The RBI has played an active role in the establishment of specialised institutions for agriculture, industry, small scale sector and foreign trade.

3. Development of Backward Areas – The RBI has encouraged banks to set up branches in backward regions so that financial facilities could be made available to people in these areas and to priority sectors. Social banking made rapid progress in India after the nationalisation of major banks in 1969.

4. Economic Stability – The RBI has used its monetary and credit policy to regulate inflationary pressures in the economy. The bank has controlled the volume of credit for this purpose. According to the Planning Commission, “the central bank has to take a direct and active role in creating or helping to create the machinery needed for financing development activities all over the country, and in ensuring that the finance available flows in the intended directions”.

5. Economic Growth – The RBI ensures adequate money supply for meeting the growing needs of different sectors of the economy.

6. Proper Interest Rate Structure – The RBI has helped in establishing a suitable interest rate struc¬ture so as to direct investment in the economy. A policy of low interest rate has been adopted for encouraging investment.

7. Miscellaneous – The RBI provides training and research facilities. It provides special facilities to priority sectors. It also guides the efforts of planners by its economic policies.

5.1.3 Insurance Regulatory and Development Authority (IRDA):

IRDA is a statutory and apex body that supervises and regulates insurance industry in India. It was established under the IRDA Act on December 16, 2014. It is managed by a chairman, five whole time members and four part time members all appointed by the Government of India.

Objectives:

- to promote the interests and rights of policy holders

- to promote and ensure the growth of insurance industry

- to ensure speedy settlement of genuine claims and to prevent frauds and malpractices

- to bring transparency and orderly conduct of financial markets dealing with insurance.

Functions:

- to issue, register and regulate insurance companies

- to protect the interests of policyholders

- to provide licence to insurance intermediaries such as agents and brokers who met the qualifications and code of conduct specified by it

- to promote and regulate the professional organizations related with insurance business so as to promote efficiency in the insurance sector

- to regulate and supervise the rates of insurance premium and terms of insurance covers

- to specify the conditions and manners according to which the insurance companies and other intermediaries have to make their financial reports

- to regulate the investment of policyholders funds by insurance companies, and

- to ensure the maintenance of solvency margin (Company’s ability to payment claims) by insurance companies.

5.1.4 Competition Commission of India (CCI):

Government of India constituted the CCI under the Competition Act, 2002 – Duties, Powers and Functions of the Commission:

Duties of Commission –

Under Section 18, Competition Commission has been charged with the following duties :

- to eliminate practices having adverse effect on competition,

- to promote and sustain competition,

- to protect the interests of consumers, and

- to ensure freedom of trade carried by other participants in markets in India.

Powers and Functions of Commission:

With a view to perform the duties enumerated under section 18, the Commission has been charged with certain obligations and conferred with certain powers. These obligations and powers are as follows:

1. Inquiry into Certain Agreements (Section 19) – The Commission may inquire into any alleged contravention of the provisions contained in section 3(1) or 4(1) either on its own motion or on:

- receipt of a complaint from any person, consumer or their association or trade association; or

- a reference made to it by the Central Government or a State Government or a statutory authority [Section 19(1)].

2. Inquiry whether an Enterprise Enjoys Dominant Position – The Commission shall, while inquiring whether an enterprise enjoys a dominant position or not under Section 4, have due regard to all or any of the following factors, namely :

- market share of the enterprise

- size and resources of the enterprise

- size and importance of the competitors

- economic power of the enterprise including commercial advantages over competitors

- vertical integration of the enterprises or sale or service network of such enterprises

- dependence of consumers on the enterprise

- monopoly or dominant position whether acquired as a result of any statute or by virtue of being a Government company or a public sector undertaking or otherwise

- entry barriers including barriers such as regulatory barriers, financial risk, high capital cost of entry, marketing entry barriers, technical entry barriers, economies of scale, high cost of substitutable goods or service for consumers

- countervailing buying power

- market structure and size of market

- social obligations and social costs

- relative advantage by way of contribution to the economic development by the enterprise enjoying a dominant position having or likely to have appreciable adverse effect on competition

- any other factor which the Commission may consider relevant for the inquiry [Section 19(4)].

3. Inquiry into Combination by Commission (Section 20) – Inquiry into acquisition, control and combination. The Commission may, upon its own knowledge or information relating to acquisition referred to in Section 5(a) or acquiring of control or merger or amalgamation referred to in Section 5(6) or merger or amalgamation referred to in Section 5(c), inquire into whether such a combination has caused or is likely to cause an appreciable adverse effect on competition in India.

The Commission shall not initiate any inquiry under this sub-section after the expiry of one year from the date on which such combination has taken effect [Section 20(1)]. The Commission shall, on receipt of a notice or upon receipt of a reference under Section 6(2), inquire whether a combination referred to in that notice or reference has caused or is likely to cause an appreciable adverse effect on competition in India [Section 20(2)].

Factors having effect on combination. For the purposes of determining whether a combination would have the effect of or is likely to have an appreciable adverse effect on competition in the relevant market, the Commission shall have due regard to all or any of the following factors, namely :

- actual and potential level of competition through imports in the market

- extent of barriers to entry to the market

- level of combination in the market

- degree of countervailing power in the market

- likelihood that the combination would result in the parties to the combination being able to significantly and sustainably increase prices or profit margins

- extent of effective competition likely to sustain in a market

- extent to which substitutes are available or are likely to be available in the market

- market share, in the relevant market, of the persons or enterprise in a combination, individually and as a combination

- likelihood that the combination would result in the removal of a vigorous and effective com-petitor or competitors in market.

- nature and extent of vertical integration in the market.

- possibility of a failing business.

- nature and extent of innovation.

- relative advantage by way of contribution to the economic development, by way of combination having or likely to have appreciable adverse effect on competition.

- whether the benefits of the combination outweigh the adverse impact of the combination, if any [Section 20(4)].

4. Power to Grant Interim Relief (Section 33) – Section 33 empowers the Commission to grant interim relief by way of temporary injunctions.

Where during an inquiry before the Commission, it is proved to the satisfaction of the Commission, by affidavit or otherwise, that an act in contravention of Section 3(1), or Section 4(1) or Section 5 has been committed and continues to be committed or that such act is about to be committed, the Commission may grant a temporary injunction restraining any party from carrying on such act until the conclusion of such inquiry or until further orders, without giving notice to the opposite party, where it deems it necessary [Section 33(1)].

5. Power to Award Compensation (Section 34) – Without prejudice to any other provisions contained in this Act, any person may make an application to the Commission for an order for the recovery of compensation from any enterprise for any loss or damage shown to have been suffered, by such person as a result of any contravention of the provisions of Chapter II (Sections 3 to 6), having been ’ committed by such enterprise [Section 34(1)].

The Commission may, after an inquiry made into the allegations mentioned in the application made under sub-section (1), pass an order directing the enterprise to make payment to the applicant, of the amount determined by it as realisable from the enterprise as compensation for the loss or damage caused to the applicant as a result of any contravention of the provisions of Chapter II having been committed by such enterprise [Section 34(2)].

Orders by Commission after Inquiry into Agreements or Abuse of Dominant Position (Section 27):

Orders by Commission. Where after inquiry the Commission finds that any agreement or action of an enterprise in a dominant position, is in contravention of Section 3 or Section 4, it may pass all or any of the following orders, namely :

(a) direct any enterprise or association of enterprises or person or association of persons, involved in such agreement, or abuse of dominant position, to discontinue and not to re-enter such agreement or discontinue such abuse of dominant position.

(b) impose such penalty, as it may deem fit which shall be not more than 10 per cent of the average of the turnover for the three preceding financial years upon each of such person or enterprises which are parties to such agreements or abuse.

However, where any agreement referred to in Section 3 (i.e., any anti-competitive agreement) has been entered into by any cartel, the Commission shall impose upon each producer, seller, distributor, trader or service provider included in that cartel, a penalty equivalent to three times of the amount of profits made out of such agreement by the cartel or ten per cent of the average of the turnover of the cartel for the last preceding three financial years, whichever is higher.

(c) award compensation to parties in accordance with the provisions contained in Section 34;

(d) direct that the agreements shall stand modified to the extent and in the manner as may be specified in the order by the Commission;

(e) direct the enterprises concerned to abide by such other orders as the Commission may pass and comply with the directions, including payment of costs, if any;

(f) recommend to the Central Government for the division of an enterprise enjoying dominant position;

(g) pass such other order as it may deem fit.

Division of Enterprise Enjoying Dominant Position (Section 28):

The Central Government, on recommendation by the Commission under Section 27(f), may, in writing, direct division of an enterprise enjoying dominant position to ensure that such enterprise does not abuse its dominant position [Section 28(1)]. This order may provide for all or any of the following matters, namely:

- the transfer or vesting of property, rights, liabilities or obligations.

- the adjustment of contracts either by discharge or reduction of any liability or obligation or otherwise.

- the creation, allotment, surrender or cancellation of any shares, stocks or securities

- the payment of compensation to any person who suffered any loss due to dominant position of the enterprise

- the formation or winding up of an enterprise or the amendment of the memorandum of association or articles of association or any other instruments regulating the business of any enterprise

- the extent to which, and the circumstances in which, provisions of the order affecting an enterprise may be altered by the enterprise and the registration thereof;

- any other matter which may be necessary to give effect to the division of the enterprise [Section 28(2)].

5.2 Indian development banks:

A development bank may be defined as “a multipurpose institution which shares entrepreneurial risk, changes its approach in tune with the industrial climate and encourages new industrial projects to bring about speedier economic growth.

The concept of development banking is based on the assumption that mere provision of finance will not bring about entrepreneurial development. Development banks provide a package of financial and non-financial assistance. Their activities include discovery of new projects, preparation of project report, provision of funds, technical assistance and managerial advice.

These institutions do not compete with the conventional institutions but supplement them. Therefore, development banks are called ‘gap fillers’. They serve as motive engines of industrial development. As catalysts of economic growth they provide injections of capital, enterprise and management.

The distinctive features of a development bank are as follows:

- It provides medium and long-term finance.

- It is ‘project oriented’ rather than ‘security oriented’.

- It acts as a ‘partner in progress’ by guiding, supervising and advising the entrepreneurs.

- It provides both equity capital and debt capital.

5.2.1 Industrial Finance Corporation of India (IFCI):

The IFCI was set up under the IFCI Act on July 1, 1948. On July 1, 1993 it was converted into a public limited company. This was done to enable the IFCI to reshape its business strategies with greater authority, to tap the Capital market for funds to expand its equity base and to provide better customer services. It is now named IFCI Ltd.

Objects – IFCI has been set up for “making medium and long-term credits more readily available to industrial concerns in India, particularly in circumstances where . normal banking facilities are inappropriate or recourse to capital issue methods is impracticable”.

The corporation aims at assisting industrial concerns which have carefully considered schemes for manufacture or for modernisation and expansion of a plant for the purpose of increasing their productive efficiency and capacity. Now, public sector undertakings can also avail of assistance from the corporation.

IFCI provides project finance, merchant banking, suppliers credit, equipment leasing, finance to leasing and hire-purchase concerns, etc. and promotional services. The corporation gives priority to development of backward areas, new entrepreneurs and technocrats, indigenous technology, ancillary industries, cooperative sector, import substitution and export promotion.

The focus of IFCI is on providing financial assistance to public companies and cooperative societies engaged in manufacturing, mining, shipping, hotel business, etc.

Functions, Scope and Forms of Assistance:

- Granting loans and advances to or subscribing to debentures of industrial concerns.

- Guaranteeing loans raised by industrial concerns from the capital market, scheduled banks or State cooperative banks.

- Providing guarantees in respect of deferred payments for imports of capital goods manufactured in India.

- Guaranteeing with the approval of the Central Government, loans raised from or credit arrangements made by industrial concerns with any bank or financial institution outside India.

- Underwriting the issue of shares and debentures by industrial concerns.

- Subscribing directly to the shares and debentures of industrial concerns.

- Acting as an agent of the Central Government and World Bank in respect of loans sanctioned by them to industrial concerns in India.

- Participating along with other all India term lending institutions, in the administration of the Soft Loan Scheme for modernisation and rehabilitation of sick industries.

- Providing financial assistance on concessional terms for setting up industrial projects in backward areas notified by the Central Government.

- Providing guidance in project planning and implementation through specialised agencies like Technical Consultancy Organisations.

The financial assistance is available for setting up of new projects as well as for the expansion, diversification, and modernisation of existing units. IFCI Ltd. also provides financial assistance to industrial concerns not tied to any project. The following schemes of assistance have been introduced for this purpose:

- Equipment leasing

- Suppliers’ credit

- Buyers’ credit.

Indirect finance is provided as assistance to leasing companies. Now IFCI also provides short-term loans for working capital purposes.

5.2.2 Industrial Development Bank of India (Now IDBI Ltd.):

The Industrial Development Bank of India (IDBI) was set up as an apex institution and it started its operations with effect from July 1, 1964. It was set up as a statutory corporation under Industrial Development Bank of India Act, 1964.

The needs of rapid industrialisation, long-term financial needs of heavy industry beyond the resources of the then existing institutions, absence of a central agency to coordinate the activities of other financial institutions and gaps in the financial and pro-motional services were the main causes behind the establishment of the IDBI.

The Bank represents an attempt to combine in a single institution the requirements of an expanding economy and need for a coordinated approach to industrial financing. The setting up of the IDBI is thus an important landmark in the history of institutional financing in the country IDBI was established as a wholly owned subsidiary of the Reserve Bank of India. But in 1976 the ownership of IDBI was transferred to the Central Government.

In March, 1994 the IDBI Act was amended to permit the Bank to issue equity- shares in the capital market. The majority of its shares are still owned by the Government.

Objects – The objectives of the IDBI are to:

- co-ordinate, regulate and supervise the activities of all financial institutions providing term finance to industry;

- enlarge the usefulness of these institutions by supplementing their resources and by widening the scope of their assistance;

- provide direct finance to industry to bridge the gap between demand and supply of long-term and medium-term finance to industrial concerns in both public and private sectors;

- locate and fill up gaps in the industrial structure of the country;

- adopt and enforce a system of priorities so as to diversify and speed up the process of indus-rial growth. The Bank has been conceived of as a development agency that will ultimately be concerned with all questions or problems relating to industrial finance in the country.

Functions – The main functions of the IDBI are as follows:

- subscribing to the shares and bonds of financial institutions and guaranteeing their under¬writing obligations;

- refinancing term loans and export credits extended by other financial institutions;

- granting loans and advances directly to industrial concerns;

- guaranteeing deferred payments due from and loans raised by industrial concerns;

- subscribing to and underwriting shares and debentures of industrial concerns;

- accepting, discounting and rediscounting bona fide commercial bills or promissory notes of industrial concerns including bills arising out of sale of indigenous machinery on deferred payment basis;

- financing turnkey projects by Indians outside India and providing credit to foreigners for buying capital goods from India;

- planning, promoting and developing industries to fill gaps in the industrial structure of the country. The Bank may undertake promotional activities like marketing and investment research, techno-economic surveys, etc.

- providing technical and managerial assistance for promotion and expansion of industrial undertakings;

- coordinating and regulating the activities of other financial institutions.

Besides providing assistance to industry directly, IDBI also provides assistance to industries through other financial institutions and banks. IDBI provides project finance for new projects and for expansion, diversification and modernisation of existing projects. IDBI also provides equipment finance, asset credit, corporate loans, working capital loans, refinance, rediscounting, and fee based services (e.g., merchant banking, mortgage, trusteeship, forex services).

Thus, the Bank performs financial, promotional and coordinating functions. As an apex institution in the field of development banking, the IDBI supplements and coordinates the activities of various National and State level financial institutions in the country.

The IDBI has been given wide powers and it enjoys full operational autonomy. The Bank can provide ‘ financial assistance directly as well as through other institutions to all types of industrial concerns irrespective of their size or form of ownership. There are no maximum or minimum limits on the amount of assistance or security. The Bank has the freedom to deal with any problem relating to industrial development in general and industrial finance in particular.

The IDBI has created a special fund known as Development Assistance Fund to assist industrial concerns which are not able to get assistance from normal sources. It makes available foreign funds to industrial concerns.

5.2.3 Small Industries Development Bank of India (SIDBI):

SIDBI was set up on April 2, 1990 under a special Act of Parliament, as a wholly owned subsidiary, of the IDBI. SIDBI took over the outstanding portfolio of IDBI relating to the small scale sector worth over ₹ 4,000 crores. It has taken over the responsibility of administering Small Industries Development Fund and National Equity Fund which were earlier administered by IDBI. SIDBI was r delinked from the IDBI through the SIDBI (Amendment) Act, 2000 with effect from March 27,2000. Its management vests with an elected Board of Directors.

Objectives – SIDBI was envisaged as “the principal financial institution for the promotion, financing and development of industry in the small scale sector and to coordinate the functions of other institutions engaged in the promotion, financing and developing industry in the small scale sector and for matters connected therewith or incidental thereto”.

Thus, financing, promotion, development, and coordination are the basid objectives of SIDBI.

Functions – SIDBI’s main functions are:

- Refinancing loans and advances extended by primary lending institutions to small scale industrial units.

- Discounting and rediscounting bills arising from sale of machinery to or manufactured by industrial units in the small scale sector.

- Extending need capital soft loan assistance under National Equity Fund, Mahila Udyam Nidhi, Mahila Vikas Nidhi and through specified agencies.

- Granting direct assistance and refinance for financing exports of products manufactured in the small scale sector.

- Extending support to State Small Industries Development Corporations (SSIDCs) for providing scarce raw materials to and marketing the end products of industrial units in the small scale sector.

- Providing financial support to National Small Industries Corporation (NSIC) for providing leasing, hire-purchase and marketing support to industrial units in the small scale sector.

5.2.4 Export-Import (EXIM) Bank of India:

Two major institutions which provide finance to exporters are the Export-Import Bank of India, and the Export Credit Guarantee Corporation. The Export-Import Bank of India was established on January 1,1982 under an Act of Parliament for the purpose of financing, facilitating and promoting India’s foreign trade. It is the principal financial institution for coordinating the working of institutions engaged in financing exports and imports.

Mission – The mission of Exim Bank is “to develop commercially viable relationships with externally oriented companies by offering them a comprehensive range of products and services to enhance their internationalisation efforts”.

Objectives – The main objectives of the Exim Bank are as follows:

- To translate India’s foreign trade policies into concrete action plans.

- To assist exporters to become internationally competitive by providing them alternate financing solutions.

- To develop mutually beneficial relationships with international financial community.

- To forge close working relationships with other export financing agencies, multilateral funding agencies and investment promotion agencies.

- To initiate and participate in debates on issues central to India’s international trade.

- To anticipate and absorb new developments in banking, export financing and information technology.

- To be responsive to export problems of Indian exporters and pursue policy resolutions.

Exim Bank concentrates on medium and long-term financing, leaving the short-term financing to commercial banks. The Bank has developed a global network through strategic linkages with World Bank, Asian Development Bank and other agencies

Functions:

The Exim Bank provides a wide range of financial facilities and services. Some of these are sum-marised below:

(i) Pre-Shipment Credit: This credit is provided to buy raw materials and other inputs required to produce capital goods meant for exports. It meets temporary funding requirement of export contracts. Exim Bank offers pre-shipment credit for periods, exceeding 180 days. Exporters can also avail of pre-shipment credit in foreign currency for imports of inputs needed for manufacture of export products.

(ii) Supplier’s Credit: Exim Bank offers supplier’s credit in rupees or foreign currency at post-shipment stage to finance exports of eligible goods and services on deferred payment terms. Supplier’s credit’s available both for supply contracts and project exports which includes construction, turnkey or consultancy contracts undertaken overseas.

(iii) Finance for Exports of Consultancy and Technology Services: A special credit facility is available to exporters of consultancy and technology services on deferred payment terms. The services include transfer of technology/know-how, preparation of project feasibility reports, providing personnel for rendering technical services, maintenance and management contracts, etc.

(iv) Finance for Project Export Contracts: This scheme is meant to finance rupee expenditure for execution of overseas project export contracts such as for acquisition of materials and equipment, mobilisation of personnel, payments to be made to staff, sub-contractors, and to meet project related overheads. The amount involved is usually in excess of ₹ 50 lakhs and the maximum period of loan is four years.

(v) Credit to Overseas Entities: Overseas buyers can avail of Buyer’s Credit for importing eligible goods from India on deferred payment basis. Exim Bank also extends Lines of credit to overseas financial institutions, foreign governments and their agencies for enabling them to provide term loans for importing eligible goods from India.

(vi) Finance for Export-Oriented Units: Exim Bank offers several facilities to export-oriented units (EOUs). Some of these are:

(a) Project Finance – Exim Bank offers term loans for setting up new units and for mod-ernization expansion of existing units. The Bank also extends 100 per cent refinance to commercial banks for term loans sanctioned to an EOU.

(b) Equipment Finance – Exim Bank offers a line of credit for Indian/foreign production equipment, including equipment for packaging, pollution control, etc. It also provides term loans to vendors of EOUs to enable them to acquire plant and machinery and other assets required for increasing export capability. Such finance is given for non-project related capital expenditure of EOUs.

(c) Working Capital Finance – Exim Bank provides term loans both in rupees and foreign currency to help EOUs meet their working capital requirements. Short-term working capital finance is provided for imports of eligible inputs.

(d) R&D Finance – Exim Bank offers term loans to EOUs for development of new techno-logy as well as to develop and/or commercialise new product process applications.

(e) Import Finance – Term loans in Indian rupees/foreign currency are available to Indian manufacturing companies for import of consumable inputs, canalised items, capital goods, plant and machinery, technology and know-how.

(f) Export Facilitation – Exim Bank offers term finance and non-funded facilities to Indian companies to create infrastructure facilities for developing Indian’s foreign trade and thereby enhance their export capability. Software exporters can get term loans to set up/expand software training institutes and software technology parks. This facility is also available to Indian companies involved in development of ports and port related services.

(g) Export Marketing Finance – Term loans are offered to assist the firms in export marketing and development efforts. Desk/field research, overseas travel, quality certification, product launch are the typical activities eligible for finance under this schemes. Finance is also given to support export product development plans with focus on industrialised market.

(h) Underwriting – Exim Bank extends underwriting facility to help the firms raise finance from capital markets. It also issues guarantees to facilitate export contracts and import transactions.

(vii) Finance for Joint Ventures Abroad:

(a) Overseas Investment Finance – Any Indian promoter making equity investment abroad t in an existing company or in a new project is eligible for finance under the scheme. Assistance is provided both in terms of loans and guarantees.

(b) Asian Countries Investment Partners Programme – This programme seeks to promote joint ventures in India between Indian companies and companies from other Asian countries. Finance is provided at various stages of project cycle, viz., sector study, 1 project identification, feasibility study, proto-type development, setting up project, and technical and managerial assistance.

Exim Bank also offers a wide range of information, advisory and support services which help exporters to evaluate international risks, exploit export opportunities and improve competitiveness.

5.2.5 National Bank for Agriculture and Rural Development (NABARD):

NABARD was established on December 15, 1981 under the NABARD Act. It started functioning on July 1, 1982. It was set up to provide credit for the promotion of agriculture, cottage and village industries, handicrafts and other rural crafts and other economic activities in rural areas with a view to promote Integrated Rural Development Program (IRDP) and to secure prosperity in rural areas.

Objectives:

- to serve as a financing institution for institutional credit (both long term and short term) for promoting economic activities in rural areas.

- to provide direct lending to any institution as approved by the Central Government.

Functions:

1. Credit Functions :

(a) providing short term credit to State Cooperative Banks, Regional Rural Banks and other RBI approved financial institutions for the following activities:

- Seasonal agricultural operations

- marketing of crops

- pisciculture activities

- production/procurement and marketing of co-operative weavers and rural artisans, i.e. individuals and societies.

- production and marketing activities of industrial co-operations.

(b) providing medium term credit to State Cooperative Banks, State Land Development Banks, Regional Rural Banks and other RBI approved financial institutions for converting short-term agricultural purposes.

(c) Providing long term credit to State Land Development Banks, Regional Rural Banks, Commercial Banks, State cooperative Banks and other approved financial institutions.

(d) refinancing cottage/village and small scale industries located in rural areas.

2. Development Functions:

- Co-coordinating the operations of rural credit institutions

- Developing expertise to deal with agricultural and rural development efforts

- Acting as an agent to the Government and RBI for business transactions in relevant areas and provide facilities for training, research and dissemination of information in rural banking and development

- Contributing to the share capital of eligible institutions

- Providing direct loans to centrally approved cases.

3. Regulatory Functions:

- inspecting Regional Rural Banks and Cooperative Banks other than the Primary cooperative Banks

- recommending for RBI approval opening of a new branch by Regional Rural Banks or Cooperative Banks

- asking Regional Rural Banks and Cooperative Banks to file returns and documents.

![]()

![]()

![]()