Value of Supply – CA Final IDT Study Material

Value of Supply – CA Final IDT Study Material is designed strictly as per the latest syllabus and exam pattern.

Value of Supply – CA Final IDT Study Material

Question 1.

Vayu Ltd. provides you the following particulars relating to goods supplied by it to Agni Ltd :

| Particulars | Amount |

| List price of the goods (exclusive of Taxes and discounts). | 76,000 |

| Special packing at the request of customer to be charged to the customer. | 5,000 |

| Duty levied by local authority on the sale of such goods. | 4,000 |

| CGST and SGST charged in invoice. | 14,400 |

| Subsidy received from a NGO (The price of ₹ 76,000 given above is after considering the subsidy) | 5,000 |

Vayu Ltd. offers 3% discount of the list price of the goods which is recorded in the invoice for the goods. Determine the value of taxable supplies made by Vayu Ltd. [May 2018, Old, 5 Marks]

Answer:

Computation of value of taxable supplies by Vayu Ltd.

| Particulars | Amount |

| List price of the goods | 76,000 |

| Add: Special packing [Note 1] | 5,000 |

| Duty levied by local authority on sale of goods [Note 2] | 4,000 |

| CGST and SGST charged [Note 2] | – |

| Subsidy received from a NGO [Note 3] | 5,000 |

| Less: Discount offered = 3% of List price = ₹ 76,000 × 3% [Note-4] | 2,280 |

Notes:

1. Being incidental expenses charged by the supplier to the recipient of supply, packing charges are includible in the value as per section 15(2)(c) of the CGST Act, 2017.

2. Taxes, duties, etc. levied under any law for the time being in force other than CGST, SGST/ UTGST, IGST are includible in the value as per section 15(2)(a) of CGST Act, 2017. Duty levied by local authority on sale of goods has been assumed to be recovered from Agni Ltd. and not included in the list price of the goods.

3. Subsidy directly linked to the price received from a non-Government body is includible in the value in terms of section 15(2)(e) of CGST Act, 2017.

4. Since discount is known at the time of supply, it is deductible from the value in terms of section 15(3)(a) of CGST Act, 2017

![]()

Question 2.

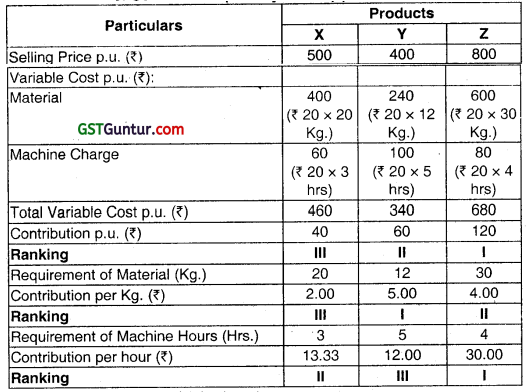

M/s. Jonty India Ltd. a manufacturer of heavy machines registered at Jaipur (Rajasthan) supplied one machine to M/s. Dhanuka Ltd. of Udaipur (Rajasthan) on 05-02-2020 under an invoice of the same date. Using the information given below, compute the value of the machine and the GST payable (CGST & SGST or IGST as the case may be) in cash for the month of February, 2020 by M/s. Jonty Ltd. with appropriate working notes.

(i) The basic price of the machine (exclusive of taxes and discount) : ₹ 28,50,000

(ii) Trade discount is allowed at 3% on the basic price and is shown in the invoice : ₹ 85,500

(iii) Secondary packing (in iron sheets) charges for safe transportation of the machine on the request of buyer. : ₹ 30,000

(iv) Design and engineering charges of the machine. : ₹ 90,000

(v) Tax levied by Municipal Authority on the sale of the machine. : ₹ 25,000

(vi) Subsidy received by the supplier form the State Government to encourage manufacture of the machine. : ₹ 80,000

(vii) Pre-delivery inspection charges paid to an independent agency in terms of the agreement for supply. The amount was paid by MIs. Dhanuka Ltd. : ₹ 22,000

(viii) Interest amount paid by MIs. Dhanuka Ltd. for delay in payment for the machine. : ₹ 12,000

Inward Supplies

(i) IGST paid on food items for consumption by employees working in the factory. : ₹ 8,000

(ii) SGST and CGST (₹ 15,000 each) paid on Electrical transformer used in the manufacturing process. : ₹ 30,000

Note:

(i) M/s. Jonty India Ltd. has no input tax credit balance at the beginning of February, 2020. All the other conditions necessary for availing the eligible input tax credit have been fulfilled.

(ii) There are no other transactions of supplies during the month of February, 2020.

(iii) M/s. Jonty India Ltd. and M/s Dhanuka Ltd. are not related persons. [Nov 2018, 10 Marks]

Answer:

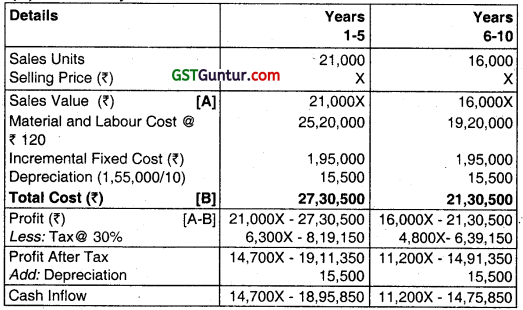

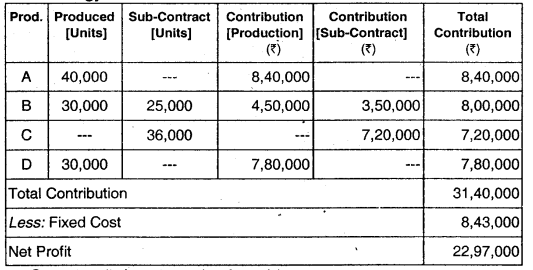

Computation of value of machine sold by M/s. Jonty India Ltd.

| Particulars | Amount |

| Basic price of machine | 28,50,000 |

| Add: Secondary packing [Note 1(iii)] | 30,000 |

| Design and engineering charges [Note 1(iii)] | 90,000 |

| Tax levied by Municipal Authority [Note 1(i)] | 25,000 |

| Pre-delivery inspection charges paid by M/s. Dhanuka Ltd. [Note 1(i)] | 22,000 |

| Interest for delay in payment [₹ 12,000 × 100/118] [Note 1 (iv)] – (rounded off) | 10,169 |

| Less: 3% Trade discount on basic price of machinery = ₹ 28,50,000 × 3% [Note 2] | (85,500) |

| Taxable value of supply | 29,41,669 |

Computation of net GST payable (in cash) by M/s. Jonty India Ltd. for the month of February, 2020

| Particulars | CGST @ 9% | SGST@ 9% |

| Tax on value of ₹ 29,41,669 (rounded off) | 2,64,750 | 2,64,750 |

| Less /Input Tax Credit [ITC] of tax paid on electrical transformer used in the manufacturing process [Note 3] | 15,000 | 15,000 |

| Net GST payable | 2,49,750 | 2,49,750 |

Note 1 : As per Section 15(2) of the CGST Act, 2017, value includes following activities or transactions:

(i) Any taxes levied under any law for the time being in force other than CGST/SGST/ UTGST/IGST, if charged separately by the supplier are includible in the value of supply.

(ii) Any amount that the supplier is liable to pay in relation to such supply, but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods and/or services is includible in the value of supply.

(iii) All incidental expenses, including packing, charged by the supplier to the recipient of a supply are includible in the value of supply and any amount charged for anything done by the supplier in respect of the supply of goods at the time of, or before delivery of goods is includible in the value of supply.

(iv) Interest for the delayed payment of any consideration for any supply is includible in the value of supply. Further, it is assumed that such interest is inclusive of tax and that the same has been received by M/s. Jonty India Ltd. in the month of February itself. Therefore, the time of supply of such interest will be in February, 2018 and the same will be considered while paying the tax liability of that month.

(v) Subsidies directly linked to the price excluding subsidies provided by the Central Government and State Governments are includible in the value of supply. Since in the given case, subsidy is received from State Government, the same has not been included in the value of supply presuming it to be directly linked to the price.

(It has been assumed that the basic price of the machine has been arrived at after adjusting the subsidy and that the basic price is the price charged from the customer. Consequently, subsidy received from State Government has not been reduced from the basic price of the machine while arriving at the taxable value of supply.

However, it is also possible to assume that the subsidy has yet not been adjusted in the basic price and that the price which will be charged from the customer is ₹ 27,70,000 (₹ 28,50,000 – ₹ 80,000) i.e., after excluding subsidy. In that case, the value of supply will be ₹ 28,61,669.)

Note 2: Trade discount has been shown in the invoice and hence, the same is excluded from the value of supply in terms of section 15(3) of the CGST Act, 2017.

Note 3: ITC on food or beverages is specifically disallowed unless the same is used for making outward taxable supply of the same category or as an element of the taxable composite or mixed supply [Section 17(5)]. (It has been assumed that the food items are provided free of cost to the employees in the course of employment) Further, since transformers are used in the course or furtherance of business, ITC thereon is available in terms of section 16(1).

Examiner’S Comment

Majority of the examinees computed the amount of GST payable correctly. However, they did not provide adequate reasoning in respect of interest and pre-delivery inspection charges.

![]()

Question 3.

Surya Agencies has agreed to supply goods to customer’s premises. Goods valued, ₹ 80,000 are taxable at 5% IGST as it is an inter-State supply. It also pays freight arid transit insurance of ₹ 12,000. GTA is a registered entity and has charged GST (6% CGST and 6% SGST) under forward charge.

(i) Compute the Invoice value of supply including IGST.

(ii) What will be the Invoice value of supply including IGST, if the supply was under ex-factory basis instead of door delivery basis? [Nov 2019, 4 Marks]

Answer:

(i) Computation of Invoice value of supply including IGST in case of door delivery.

| Particulars | Amount |

| Value of Goods | 80,000 |

| Add: Charges for freight & Insurance | 12,000 |

| Value of supply | 92,000 |

| IGST @ 5% (WN1) → 5% of 92,000 | 4,600 |

| Invoice value of supply | 96,600 |

Working Notes:

- It is a complete supply & principal element in Goods. Therefore the rate of Tax of principal element will be charged on the value.

- Surya agencies can claim ITC of GST paid on GTA services (₹ 1,440 = 12% of 12,000)

(ii) Supply at the Ex-factory price instead of door delivery basis

| Particulars | Amount |

| Supply of Goods | 80,000 |

| IGST @ 5% of value | 4,000 |

| Invoice value of supply | 84,000 |

Note: The above answer is based on the view that part (ii) of the question is an independent case and thus, the information provided in the first paragraph of the question regarding payment of freight and transit insurance by Surya Agencies does not apply to it. Moreover, when the contract is ex-factory, it implies that the freight and insurance will be the buyer’s responsibility and seller will have no role, whatsoever, in delivering the goods to the customer’s premises.

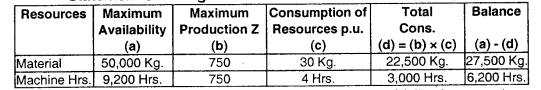

Question 4.

Dushyant rents out a commercial building owned by him to Bharat for the month of December, for which he charges a rent of ₹ 19,50,000. Dushyant pays the maintenance charges of ₹ 1,00,000 (for the December month) as charged by the local society. These charges have been reimbursed to him by Bharat. Further, Bharat had given ₹ 2,50,000 to Dushyant as interest free refundable security deposit.

Further, Dushyant has paid the municipal taxes of ₹ 2,85,000 which he has not charged from Bharat. You are required to determine the value of supply and the GST liability of Dushyant for the month of December assuming CGST and SGST rates to be 9% each.

Note: All the amounts given above are exclusive of GST. [RTP May 2020]

Answer:

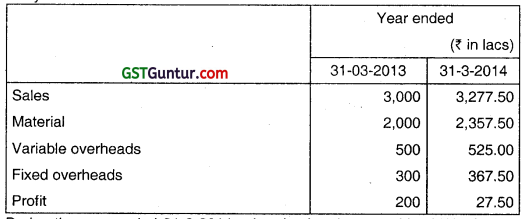

Computation of the value of supply and the GST liability of Dushyant for the month of December

| Particulars | Amount (₹) |

| Rent of the commercial building | 19,50,000 |

| Maintenance charges paid to the local society, reimbursed by Bharat [Note 1] | 1,00,000 |

| Interest free refundable security deposit [Note 2] | Nil |

| Municipal taxes paid by Dushyant [Note 3] | Nil |

| Value of supply | 20,50,000 |

| CGST@ 9% | 1,84,500 |

| SGST@ 9% | 1,84,500 |

Notes:

- Maintenance charges paid to the local society, reimbursed by Bharat, such charges ultimately form part of the rent paid by Bharat to Dushyant and thus, will form part of the value.

- Interest free refundable security deposit, Such security deposit does not constitute consideration in terms of section 2(31) of the CGST Act, 2017 and thus, is not includible in the value.

- Municipal taxes paid by Dushyant, the same is not includible in the value since such taxes are not charged to the recipient.

![]()

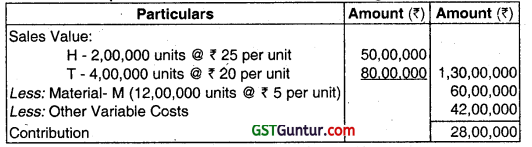

Question 5.

Honeycure Laboratories Ltd. is a registered supplier of bulk drugs in Delhi. It manufactures bulk drugs and supplies the same in the domestic and overseas market. The bulk drugs are supplied within Delhi and in the overseas market directly from the company’s warehouse located in South Delhi.

For supplies in other States of India, the company has appointed consignment agents in each such State. However, supplies in Gurgaon (Haryana) and Noida (U.P.) are effected directly from South Delhi warehouse. The drugs are supplied to the consignment agents from the South Delhi warehouse.

Honeycure Laboratories Ltd. also provides drug development services to drug manufacturers located in India, including testing of their new drugs in its laboratory located in Delhi.

The company has furnished the following information for the month of January, 20XX:

| Particulars | Rs. |

| Advance received towards drug development services to be provided to Orochem Ltd., a drug manufacturer, located in Delhi [Drug development services have been provided in February, 20XX and invoice is issued on 28.02.20XX] | 5,00,000 |

| Advance received for bulk drugs to be supplied to Novick Pharmaceuticals, a wholesale dealer of drugs in Gurgaon, Haryana [Invoice for the goods is issued at the time of delivery of the drugs in March, 20XX] | 6,00,000 |

| Supply of bulk drugs to wholesale dealers of drugs in Delhi | 60,00,000 |

| Bulk drugs supplied to Anchor Pharmaceuticals Inc., USA under bond [Consideration received in convertible foreign exchange] | 90,00,000 |

| Drug development services provided to Unipharma Ltd., a drug manufacturer, located in Delhi | 6,00,000 |

You are required to determine the GST liability [CGST & SGST or IGST, as the case may be] of Honeycure Laboratories Ltd. for the month of January, 20XX with the help of the following additional information furnished by it for the said period:

1. Consignments of bulk drugs were sent to Cardinal Pharma Pvt. Ltd. and Rochester Medicos – agents of Honeycure Laboratories Ltd. in Punjab and Haryana respectively. Cardinal Pharma Pvt. Ltd and Rochester Medicos supplied these drugs to the Medical Stores located in their respective States for ₹ 60,00,000 and ₹ 50,00,000 respectively.

2. Bulk drugs have been supplied to Ronn Medicos Pvt. Ltd. – a wholesale dealer of bulk drugs in Gurgaon, Haryana for consideration of ₹ 15,00,000. Honeycure Laboratories Ltd. owns 60% shares of Ronn Medicos Pvt. Ltd. Open market value of the bulk drugs supplied to Ronn Medicos Pvt. Ltd. is ₹ 30,00,000. Further, Ronn Medicos Pvt. Ltd. is not eligible for full input tax credit.

Note:

(i) All the given amounts are exclusive of GST, wherever applicable.

(ii) Assume the rates of GST to be as under:

| Goods/services supplied | CGST | SGST | IGST’ |

| Bulk drugs | 2.5% | 2.5% | 5% |

| Drug development services | 9% | 9% | 18% |

You are required to make suitable assumptions, wherever necessary. [MTP, May 2019, 9 Marks]

Answer:

(a) Computation of GST Liability of Honeycure Laboratories Ltd. for the month of January, 20XX

| Particulars | Rs. |

| Advance received towards drug development services to be provided to Orochem Ltd., a drug manufacturer, located in Delhi [Drug development services have been provided in February, 20XX and invoice is issued on 28.02.20XX] | 5,00,000 |

| Advance received for bulk drugs to be supplied to Novick Pharmaceuticals, a wholesale dealer of drugs in Gurgaon, Haryana [Invoice for the goods is issued at the time of delivery of the drugs in March, 20XX] | 6,00,000 |

| Supply of bulk drugs to wholesale dealers of drugs in Delhi | 60,00,000 |

| Bulk drugs supplied to Anchor Pharmaceuticals Inc., USA under bond [Consideration received in convertible foreign exchange] | 90,00,000 |

| Drug development services provided to Unipharma Ltd., a drug manufacturer, located in Delhi | 6,00,000 |

Notes:

1. Intra-State supply of services, supply of drug development services to Orochem Ltd. of Delhi is subject to CGST and SGST @ 9% each.

As per Section 13(2) of the CGST Act : The time of supply of services is the earlier of the date of invoice or date of receipt of payment, if the invoice is issued within 30 days of the supply of service. In the given case, invoice is issued within 30 days of the supply of service.

Therefore, time of supply of services will be date of receipt of advance and hence, GST is payable on the advance received in January, 2OXX.

2. Inter-State supply of goods, supply of bulk drugs to Novick Pharmaceuticals of Gurgaon, Haryana is subject to IGST @ 5%.

As per Section 12(2) of the CGST ActThe time of supply of goods is the earlier of the date of issue of invoice due date of issue of invoice as per Section 31 of CGST Act. Accordingly, the time of supply of the advance received for bulk drugs to be supplied to Novick Pharmaceuticals is the time of issue of invoice, which is in March, 20XX. Thus, said advance will be taxed in March, 20XX and not in January, 20XX.

3. Being an intra-State supply of goods, supply of bulk drugs to wholesale dealers of drugs in Delhi is subject to CGST and SGST @ 2.5 % each.

4. As per Section 16(1) of the IGST Act, 2017 Export of goods is a zero-rated supply. A zero-rated supply under bond is made without payment of integrated tax [Section 16(3) (a) of IGST Act],

5. Being an intra-State supply of services, supply of drug development services to Unipharma Ltd. of Delhi is subject to CGST and SGST @ 996 each.

6. Value of supply of goods made through an agent is determined as per rule 29 of the CGST Rules. In the given case, since open market value is not available, value of bulk drugs supplied to consignment agents – Cardinal Pharma Ltd. and Rochester Medicos – will be ₹ 99,00,000 [90% of (₹ 60,00,000 + ₹ 50,00,000)]. Further, being an inter-State supply of goods, supply of bulk drugs to the consignment agents is subject to IGST @ 5%.

7. If any person directly or indirectly controls another person, such persons are deemed as related persons. [Clause (a)(v) of Explanation to section 15 of the CGST Act]. In the given case, since Honeycure Laboratories Ltd. owns 6096 shares of Ronn Medicos, both are related persons.

Value of supply of goods between related persons (other than through an agent) is determined as per rule 28 of the CGST Rules. Accordingly, the value of supply of goods between related persons is the open market value of such goods and not the invoice value.

Furthermore, since Ronn Medicos is not eligible for full input tax credit, value declared in the invoice cannot be deemed to be the open market value of the goods. Thus, open market value of the bulk drugs supplied to Ronn Medicos i.e., ₹ 30,00,000 is the value of supply of such goods. Further, being an inter-State supply of goods, supply of bulk drugs to Ronn Medicos is subject to IGST @ 5%.

![]()

Question 6.

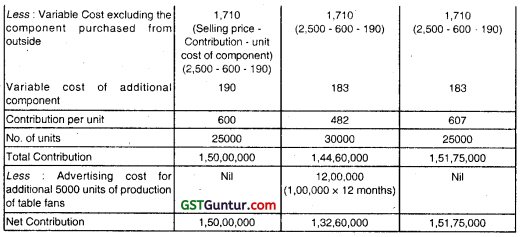

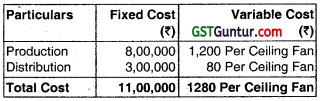

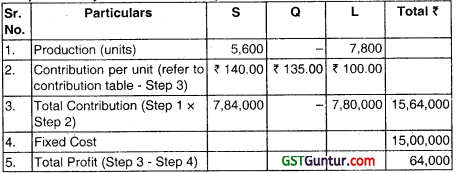

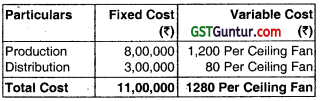

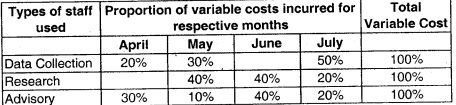

Kaya Trade Links Pvt. Ltd. is a registered manufacturer of premium ceiling fans. It sells its fans exclusively through distributors appointed across the country. The maximum retail price (MRP) printed on the package of a fan is ₹ 10,000. The company sells the ceiling fans to distributors at ₹ 7,000 per fan (exclusive of applicable taxes). The applicable rate of GST on ceiling fans is 18%.

The stock is dispatched to the distributors on quarterly basis stock for a quarter being dispatched in the second week of the month preceding the relevant quarter. However, additional stock is dispatched at any point of the year if the company receives a requisition to that effect from any of its distributors. The company charges ₹ 1,000 per fan from distributors towards packing expenses.

The company has a policy to offer a discount of 10% (per fan) on fans supplied to the distributors for a quarter, if the distributors sell 500 fans in the preceding quarter. The discount is offered on the price at which the fans are sold to the distributors (excluding all charges and taxes).

The company appoints Prakash Sales as a distributor on 1st April and dispatches 750 fans on 8th April as stock for the quarter April-June. Prakash Sales places a purchase order of 1,000 fans with the company for the quarter July-September. The order is dispatched by the company on 10th June and the same is received by the distributor on 18th June. The distributor makes the payment for the fans on 26th June and avails applicable input tax credit. The distributor reports sales of 700 fans for the quarter April-June and 850 fans for the quarter July-September.

Examine the scenario with reference to section 15 of the CGST Act, 2017 and compute the taxable value of fans supplied by Kaya Trade Links Pvt. Ltd. to Prakash Sales during the quarter July-September.

Note: Make suitable assumptions, wherever necessary. [MTP, May 2018, 8 Marks]

Answer:

Prakash Sales is entitled for 1096 discount on fans supplied by Kaya Trade Links Pvt. Ltd. for the quarter July-September as it has sold more than 500 fans in the preceding quarter April-June. However, since the entire stock for the quarter July-September has already been despatched by Kaya Trade Links pvt. Ltd. in the month of June, the discounts on the fans supplied to Prakash Sales for the quarter July-September will be a post-supply discount.

As per Section 15(3)(a) of the CGST Act, 2017 Such post-supply discount will be allowed as a deduction from the value of supply since the discount policy was known before the time of such supply and the discount can be specifically linked to relevant invoices (invoices pertaining to fans supplied to Prakash Sales for the quarter July-September) provided Prakash Sales reverses the input tax credit attributable to the discount on the basis of document issued by Kaya Trade Links Pvt. Ltd.

The value of supply will thus, be computed as under:

| Particulars | Amount (₹) |

| Price at which the fans are supplied to Prakash Sales [Note 1] | 7,000 |

| Add: Packing expenses [Note 2] | 1,000 |

| Less: Discount [Note 3] | (700) |

| Value of taxable supply of one unit of fan | 7,300 |

| Value of taxable supply of fans for the quarter July-September [₹ 7,300 × 1,000] | 73,00,000 |

Notes:

(1) The value of a supply is the transaction value, which is the price actually paid or payable for the said supply, in terms of section 15(1) of the CGST Act presuming that the supplier and the recipient of supply are not related and price is the sole consideration for the supply.

(2) The value of supply includes incidental expenses like packing charges in terms of section 15(2)(c) of the CGST Act.

(3) Since all the conditions specified in section 15(3)(b) of the CGST Act have been fulfilled, the post-supply discount will be allowed as deduction from the value of supply presuming that Prakash Sales has reversed the input tax credit attributable to such discount on the basis of document issued by Kaya Trade Links Pvt. Ltd. The input tax credit to be reversed will work out to be ₹ 1.26 lakh [1,000 × (7,000 × 10%) × 18%].

Question 7.

Determine the value of supply and the GST liability, to be collected and paid by the owner, with the following

| ₹ | |

| Rent of the commercial building | 18,00,000 |

| Maintenance charges collected by local society from the owner and reimbursed by the tenant | 2,50,000 |

| Owner intends to charge GST on refundable advance, as GST is applicable on advance | 6,00,000 |

| Municipal taxes paid by the owner | 3,00,000 |

[MTP, May/Nov 2018, Old]

Answer:

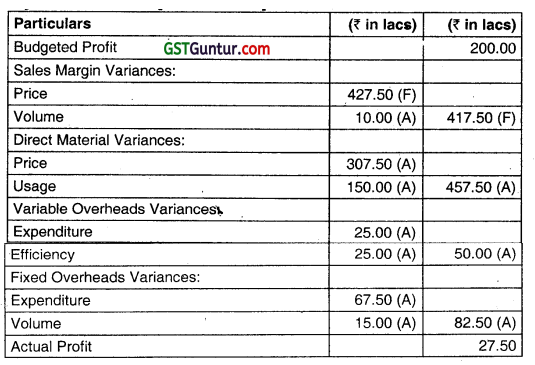

Computation of Value of Supply

| Particulars | Amount (₹) |

| Rent of the commercial building | 18,00,000 |

| Maintenance charges collected by the local society from the owner and reimbursed by the tenant [ Note-1] | 2,50,000 |

| Refundable advance [Note-2] | Nil |

| Municipal taxes paid by the owner [Note-3] | Nil |

| Value of supply | 20,50,000 |

| CGST @ 9% | 1,84,500 |

| SGST @ 9% | 1,84,500 |

Notes:-

1. Being reimbursed by the tenant, such charges ultimately form part of the rent paid by the tenant to the owner and thus, will form part of the value.

2. As per Section 2(31) of the CGST Act, 2017:- Being refundable, the advance is in the nature of security deposit which does not constitute consideration and thus, is not includible in the value.

3. Being an expenditure incurred by the supplier, the same is not includible in the value, assuming that such taxes are not charged to the recipient.

![]()

Question 8.

Maahi Ltd. of Bhopal (Madhya Pradesh) is a supplier of machinery. Maahi Ltd. has supplied machinery to ABC Enterprises in Indore (Madhya Pradesh) on 1st October, 2017. The invoice for supply has been issued on 1st October, 2017. Maahi Ltd. and ABC Enterprises are not related and price is the sole consideration for the supply.

Following information is provided:

Basic price of machinery excluding all taxes is ₹ 20,00,000. In addition to the basic price, Maahi Ltd. has collected the design and engineering charges of ₹ 10,000 and loading charges of ₹ 20,000 for the machinery. The commission of ₹ 10,000 has also been charged by Maahi Ltd. from ABC Enterprises.

Maahi Ltd. provides 1 year mandatory warranty for the machinery on payment of additional charges of ₹ 1,00,000.

Maahi Ltd. has collected consultancy charges in relation to pre-installation planning of ₹ 10,000 and freight and insurance charges from place of removal to buyer’s premises of ₹ 20,000.

Maahi Ltd. received subsidy of ₹ 50,000 from Central Government for supplying the machinery to backward region since receiver was located in a backward region. Maahi Ltd. also received ₹ 50,000 from the joint venture partner of ABC Enterprises for making timely supply of machinery to the recipient.

A cash discount of 1% on the basic price of the machinery is offered at the time of supply, if ABC Enterprises agrees to make the payment within 30 days of the receipt of the machinery at his premises. Discount @1% was given to ABC Enterprises as it agreed to make the payment within 30 days.

The machinery attracts CGST and SGST @ 18% (9% + 9%) and IGST @18%.

Compute the CGST and SGST or IGST payable, as the case may be, on the machinery. [MTP Nov 2018, 12 Marks]

Answer:

Computation of GST payable

| Particulars | Amount ₹ |

| Basic Price of the machinery | 20,00,000 |

| Add: Design and engineering charges [Note 1] | 20,000 |

| Loading charges [Note 1] | 10,000 |

| Warranty cost [Note 2] | 1,00,000 |

| Commission [Note 1] | 10,000 |

| Consultancy charges in relation to pre-installation planning [Note 1] | 10,000 |

| Freight and insurance charges [Note 2] | 20,000 |

| Subsidy received from Central Government [Note 3] | Nil |

| Receipts from Joint Venture of ABC Enterprises [Note 3] | 50,000 |

| Less: 196 discount on basic price = ₹ 20,00,000 X 196 [Note 4] | (20,000) |

| Value of supply | 22,00,000 |

| CGST @ 9% [Note 5] | 1,98,000 |

| SGST @ 9% [Note 5] | 1,98,000 |

Notes:

1. As per Section 15(2)(c) of CGST Act, 2017: – Design and engineering charges, loading charges, commission or any amount (any amount charged for anything done by the supplier in respect of the supply of goods at the time of, or before delivery of goods) are includible in the value of supply.

2. Supply of machinery (goods) with supply of ancillary services like warranty and freight and insurance is a composite supply, the principle supply of which is the supply of machinery. [Section 2(30) of the CGST Act, 2017 read with section 2(90) of that Act], Thus, value of such ancillary supply is includible in the value of composite supply.

3. Subsidies provided by the Central Government and State Governments are not includible in the value of supply in terms of section 15(2)(e) of the CGST Act, 2017. However, subsidy directly linked to the price received from a non-Government body is includible in the value in terms of section 15.

4. Cash discount has been given to ABC Enterprises upfront at the time of supply and thus would have been recorded in the invoice and hence, the same is excluded from the value of supply in terms of section 15(3)(a) of the CGST Act, 2017.

5. In the given case-

- the location of the supplier is in Bhopal (Madhya Pradesh); and

- the place of supply of machinery is the location of the machinery at the time at which the movement of the same terminates for delivery to the recipient i.e., Indore (Madhya Pradesh) vide section 10(1)(a) of IGST Act, 2017.

Therefore, as per section 8(1) of IGST Act, 2017, the given supply is an intra-State supply as the location of the supplier and the place of supply are in the same State. Thus, the supply will be leviable to CGST and SGST.

Question 9.

Cool Trade Links Pvt. Ltd. is a registered manufacturer of premium ceiling fans. It sells its fans exclusively through distributors appointed across the country. The maximum retail price (MRP) printed on the package of a fan is ₹ 10,000. The company sells the ceiling fans to distributors at ₹ 7,000 per fan (exclusive of applicable taxes). The applicable rate of GST on ceiling fans is 18%.

The stock is dispatched to the distributors on quarterly basis – stock for a quarter being dispatched in the second week of the month preceding the relevant quarter. However, additional stock is dispatched at any point of the year if the company receives a requisition to that effect from any of its distributors. The company charges ₹ 1,000 per fan from distributors towards packing expenses.

The company has a policy to offer a discount of 10% (per fan) on fans supplied to the distributors for a quarter, if the distributors sell 500 fans in the preceding quarter. The discount is offered on the price at which the fans are sold to the distributors (excluding all charges and taxes).

The company appoints Gupta Sales as a distributor on 1st April and dispatches 750 fans on 8th April as stock for the quarter April-June. Gupta Sales places a purchase order of 1,000 fans with the company for the quarter July-September. The order is dispatched by the company on 10th June and the same is received by the distributor on 18th June. The distributor makes the payment for the fans on 26th June and avails applicable input tax credit. The distributor reports sales of 700 fans for the quarter April-June and 850 fans for the quarter July-September.

Examine the scenario with reference to section 15 of the CGST Act, 2017 and compute the taxable value of fans supplied by Cool Trade Links Pvt. Ltd. to Gupta Sales for the quarter July-September.

Note: The supplier and the recipient of supply are not related and price is the sole consideration for the supply. Make suitable assumptions, wherever necessary. [MTP, Nov 2018, 8 Marks]

Answer:

As per Section 15(3)(a) of the CGST Act Pre-supply discounts recorded in invoices are allowed as deduction.

Further, post supply discounts are also allowed as deduction from the value of supply under section 15(3)(&) of the CGST Act if-

(i) such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices; and

(ii) input tax credit is attributable to the discount on the basis of document issued by the supplier has been reversed by the recipient of the supply.

In given case post-supply discount will be allowed as a deduction from the value of supply since the discount policy was known before the time of such supply and the discount can be specifically linked to relevant invoices (invoices pertaining to fans supplied to Gupta Sales for the quarter July- September) provided Gupta Sales reverses the input tax credit attributable to the discount on the basis of document issued by Cool Trade Links Pvt. Ltd.

The value of supply will thus, be computed as under:

| Particulars | Amount (₹) |

| Price at which the fans are supplied to Prakash Sales [Note 1] | 7,000 |

| Add: Packing expenses [Note 2] | 1,000 |

| Less: Discount [Note 3] | (700) |

| Value of taxable supply of one unit of fan | (7,300) |

| Value of taxable supply of fans for the quarter July-September [₹ 7,300 × 1,000] ” | 73,00,000 |

Notes:

(1) The value of a supply is the transaction value, which is the price actually paid or payable for the said supply, in terms of section 15(1) of the CGST Act.

(2) The value of supply includes incidental expenses like packing charges in terms of section 15(2)(c) of the CGST Act.

(3) Since all the conditions specified in section 15(3)(&) of the CGST Act have been fulfilled, the post-supply discount will be allowed as deduction from the value of supply presuming that Gupta Sales has reversed the input tax credit attributable to such discount on the basis of document issued by Cool Trade Links Pvt. Ltd. The input tax credit to be reversed will work out to be ₹ 1.26 lakh [1,000 × (7,000 × 10%) × 18%].

![]()

Question 10.

Mr. Nagarjun, a registered supplied of Chennai, has received during the following Amount in respected of the activities undertaken by him during the month ended on 30th September, 2020:

| Particulars | Amount |

| i. Amount charged for services provide to recognized sports body as selector of national team. | 50,000 |

| ii. Commission received as an insurance agent from insurance company. | 65,000 |

| iii. Amount charged as business correspondent for the service provide to the urban branched of nationalized bank with respect to saving bank accounts. | 15,000 |

| iv. Service to foreign diplomatic mission located in India | 28,000 |

| v. Funeral services. | 30,000 |

He received the services from the unregistered goods transport agency for his business activities relating to serial numbers (i) to (iii) above the paid freight of ₹ 45,000 (his aggregated turnover of previous year was ₹ 9,90,000).

Note: All the transaction started above are intra-State transaction and also are exclusive of GST.

You are required to calculate gross value of taxable supply on which GST is to be paid by Mr. Nagarjun for the month of September, 2020. Working note should form part of your answer. [May 2018, 7 Marks]

Answer:

Computation of Value of Supply

| Particulars | Amount (₹) |

| I. Supplies on which Mr. Nagarjun is liable to pay GST under forward charge | |

| Amount charged for service provided to recognized sports body as selector of national team [Note 1] | 50,000 |

| Commission received as an insurance agent from insurance company [Note 2] | Nil |

| Amount charged as business correspondent for the services provided to the urban branch of a nationalised bank with respect to savings bank accounts [Note 3] | 15,000 |

| Services provided to foreign diplomatic mission located in India [Note 4] | 28,000 |

| Funeral services [Note 5] | Nil |

| II. Supplies on which Mr. Nagarjun is liable to pay GST under reverse charge | |

| Services received from GTA [Note 6] | 45,000 |

| Value of taxable supply on which GST is to be paid | 1,38,000 |

Working Notes:

1. As per Entry 68 of Exemption Notification No. 12/2017-CT(R):- Exemption has been granted to services provided to may recognized sport body by an individual as player, referee, umpire, coach or team manager for participation in a sporting event organized by a recognized sports body. Hence, services provided as a selector are not exempt.

2. Note 2 : As per Notification No. 13/2017 For the tax payable on the commission of insurance agent is to be paid by the recipient of service under reverse charge ie. insurance company.

3. Note 3 : As per Entry No. 39 of Exemption Notification No. 12/2017 Services provided by Business Correspondent to a Banking Company in Rural area are exempt. Thus, such services provided in respect of urban area branch will be taxable.

4. Note 4 : As per Entry No. 59 of Exemption Notification No. 12/2017 Services provided by foreign diplomatic mission located in India are exempt. Thus Service provided to such mission are taxable.

5. Note 5: As per Entry No. 4 of Schedule III of CGST Act, 2017:- Funeral Services are not a supply and thus, are outside the ambit of GST.

6. Note 6: As per Notification No. 13/2017:- GST on services provided by GTA (not paying tax @ 12%) to inter alia a registered person is payable by the recipient of service i.e., the registered person, under reverse charge. The turnover of previous year is irrelevant.

Examiner’s Comment

The working notes for inclusion/exclusion of various activities for computation of gross value of taxable supply was missing in most of the cases. Largely, examinees answered merely on the basis of guess work instead of legal backing.

Question 11.

Determine taxable value of supply under the GST law with respect to each of the following independent services provided by the registered persons:

1. Fees charged from office staff for in-house personality development course conducted by M.V. College – ₹ 10,000.

2. Bus fees collected from students by M.V. College – ₹ 2,500 per month.

3. Housekeeping service provided by M/s. Clean well to Himavarsha Montessori school, a play school – ₹ 25,000 per month.

4. Info link supplied “Tracing Alphabets”, an online educational journal, to students of UKG class of Sydney Montessori School – ₹ 2,000. [May 2019, 4 Marks]

Answer:

1. As per Entry 66(a) of Notification No. 12/2017:

- Services provided by an educational institution to its students, faculty and staff are exempt from GST.

- Assuming that M.V. College provides education as a part of a curriculum for obtaining a qualification recognised by a law.

2. As per Entry 66(a) of Notification No. 12/2017 :

As assumed above that M.V. College provides education as a part of a curriculum for obtaining a qualification recognised by a law, the transport services provided by it to its students would be exempt from GST.

3. As per Entry 66(b) of Notification No. 12/2017:

- Services provided to an educational institution, by way of, inter alia, house-keeping services performed in such educational institution are exempt from GST.

- However such an exemption is available only when the said services are provided to a pre-school education and a higher secondary school or equivalent.

- Therefore, house-keeping services provided to Himavarsha Montessori Play School would be exempt from GST.

4. As per Entry 66(b) of Notification No. 12/2017:

Services provided to an educational institution, [except

(1) Pre-school education and education upto higher secondary school or equivalent.

(2) Education is a part of an approved vocational education course;]

- By way of supply of online educational journals or periodicals is exempt from GST.

- Therefore, supply of online journal to students to UKG class of Sydney Montessori School will not be exempt from GST. Hence, the taxable value in this case will be ₹ 2,000.

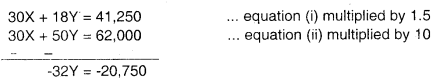

Question 12.

Laxmi Ltd. of Bhopal (Madhya Pradesh) is a supplier of machinery. Laxmi Ltd. Has supplied machinery to PQR Enterprises in Indore(Madhya Pradesh) on 1st October, 2020. The invoice for supply has been issued on 1st October, 2020.Thus the time of supply of machinery is 1st October, 2020. Laxmi Ltd. And PQR Enterprises are not related. Following information is provided.

Basic price of machineries excluding all taxes but including design and engineering charges ₹ 10,000 and loading charges ₹ 20,000 – ₹ 20,00,000.

Laxmi Ltd. provide 2 years free warranty of machineries. Laxmi Ltd. also provide an extended one year warranty on payment of additional charged of ₹ 1,00,000. PQR enterprises opted for one year warranty.

Laxmi Ltd. has collected consultancy charges in relation to pre-installation planning of ₹ 10,000 and Freight and insurance charges from place of removal to buyer’s premises of ₹ 20,000.

Laxmi Ltd. received subsidy of ₹ 50,000 from Central Government for supplying the machinery to backward region since receiver was located in a backward region. Laxmi Ltd. also received ₹ 50,000 from the joint venture partner PQR enterprises for making timely supply of machinery of the reception.

A cash discount of 1% on the basic price of the machinery is offered at the time of supply. If PQR enterprises agree to make the payment within 30 days of the receipt of the machinery at his premises. Discount @ 1% was given to PQR enterprises as it agree to make the payment within 30 days. The machineries attract COST and SGST @ 18% (9%+9%) and IGST @18%.

Compute the CGST & SGST or IGST Payable as the case may be on the machinery. [May 2018, 10 Marks]

Answer:

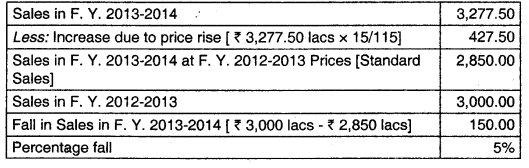

Computation of Value of Supply

| Particulars | Amount ₹₹ |

| Price of the machinery (Transaction value u/s 15 i.e. price actually paid or payable.) | 20,00,000 |

| Add: Extended warranty cost [WN 1] | 1,00,000 |

| Consultancy charges in relation to pre-installation planning [WN 2] | 10,000 |

| Freight and insurance charges [WN 3] | 20,000 |

| Subsidy received from Central Government [WN 4] | Nil |

| Receipts from Joint Venture of PQR Enterprises [WN 5] | 50,000 |

| Less: 1% discount on basic price = ₹ 20,00,000 × 1% | (20,000) |

| Value of supply | 21,60,000 |

| CGST @ 9% | 1,94,400 |

| SGST @ 9% | 1,94,400 |

Working Notes:

- Includible in value since transaction value includes all elements of the price except those specially excluded u/s 15 of CGST Act, 2017

- Includible in value of supply of machinery as per Section 15(2)(c) and Section 15(2)(d)

- Includible in value of goods, because it is something done before delivery of goods

- Not includible in value of supply as per Section 15(2)(e)

- Includible in value of supply of machinery as per Section 15(2)(e)

Examiner’s Comment

Majority of the examinees computed the GST liability correctly but did not support their answer with adequate reasoning and thus lost marks.

![]()

Question 13.

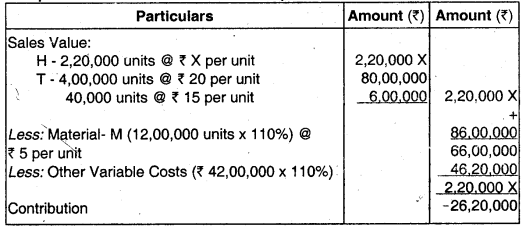

Mrs. Kajal, a registered supplier of Jaipur (Rajasthan), has made the following supplies in the

month of January, 2020:

(i) Supply of a laptop bag along with the laptop to a customer of Mumbai for ₹ 55,000 (exclusive of GST).

(ii) Supply of 10,000 kits (at ₹ 50 each) amounting to ₹ 5,00,000 (exclusive of GST) to Ram Fancy Store in Kota (Rajasthan). Each kit consists of 1 hair oil, 1 beauty soap and 1 hair comb.

(iii) 100 kits are given as free gift to Jaipur customers on the occasion of Mrs. Kajal’s birthday. Each kit consists of 1 hair oil and 1 beauty soap. Cost of each kit is ₹ 35, but the open market value of such kit of goods and of like kind and quality is not available. Input tax credit has not been taken on the goods contained in the kit.

(iv) Event management services provided free of cost for brother’s son marriage function in Indore (Madhya Pradesh). Cost of providing said services is ₹ 80,000, but the open market value of such services and of services of like kind and quality is not available.

(v) 1,400 chairs and 100 coolers hired out to Function Garden, Ajmer (Rajasthan) for ₹ 3,30,000 (exclusive of GST) including cost of transporting the chairs and coolers [₹ 20 (exclusive of GST) for each chair and each cooler] from Mrs. Kajal’s godown at Jaipur to the Function Garden, Ajmer. The cost of transportation of chairs and coolers is paid by Mrs. Kajal to an unregistered Goods Transport Agency (GTA).

Interest of ₹ 6,400 (inclusive of GST) was collected by Mrs. Kajal from Ram Fancy Store, Kota for the payment received with a delay of 30 days.

Assume rates of GST to be as under:-

| Particulars | Rate of CGST (%) | Rate of SGST (%) | Rate of IGST (%) |

| 1. Laptop | 9 | 9 | 18 |

| 2. Laptop bag | 14 | 14 | 28 |

| 3. Hair oil | 9 | 9 | 18 |

| 4. Beauty soap | 14 | 14 | 28 |

| 5. Hair comb | 6 | 6 | 12 |

| 6. Event management service | 2.5 | 2.5 | 5 |

| 7. Service of renting of chairs and coolers | 6 | 6 | 12 |

| Transportation service | 2.5 | 2.5 | 5 |

From the above information, compute the GST liability (CGST and SGST and/or IGST, as the case may be) of Mrs, Kajal for the month of January, 2020. [May 2019, Old, 9 Marks]

Answer:

Computation of GST liability of Mrs. Kajal for the month of January, 2019

| Particulars | Amount (₹) | CGST (₹) | SGST (₹) | IGST (₹) |

| (i) Supply of laptop bag along with laptop to Mumbai customer [WN 1] | 55,000 | 9,900 | ||

| (ii) Supply of kits to Ram Fancy Store [WN 2] | 5,05,000 | 70,700 | 70,700 | |

| (iii) Free gifts to customers [WN 3] | Nil | Nil | Nil | |

| (iv) Event management services provided free of cost for brother’s son marriage [WN 4] | Nil | Nil | Nil | |

| (v) Chairs and coolers hired out to Function Garden [WN 5] | 3,30,000 | 19,800 | 19,800 | |

| (vi) Transportation of chairs and coolers by GTA [WN 6] | 30,000 (₹ 20 × 1,500) | 750 | 750 | |

| Total GST liability | 91,250 | 91,250 | 9,900 |

Working Notes:

1. Being naturally bundled, supply of laptop bag along with the laptop is a composite supply which is treated as the supply of the principal supply [viz. laptop] in terms of section 8(a) of the CGST Act, 2017 and is an inter-State supply. Accordingly, IGST @ 18% will be charged.

2. It is a mixed supply and is treated as supply of that particular supply which attracts highest tax rate [viz. beauty soap] in terms of section 8(b) of the CGST Act, 2017. Also, it’s an intra-State supply. Accordingly, CGST and SGST @ 14% each will be charged.

Interest of ₹ 6,400 [It has been assumed that interest on delayed payment received has been collected in the month of January, 2020 itself and is inclusive of GST.] charged for delayed payment as collected from Ram Fancy Store will be included in the value of supply in terms of section 15(2) of the CGST Act, 2017.

Therefore, total value of supply = ₹ 5,05,000 [₹ 5,00,000 + (₹ 6,400 × 100/128)]

3. It cannot be considered as supply under section 7 read with Schedule I of the CGST Act as the gifts are given to unrelated customers without consideration

4. It Cannot be considered as supply under section 7 read with Schedule I of the CGST Act as the service is provided to unrelated person without consideration.

5. Since Mrs. Kajal is not a GTA, transportation services provided by her are exempt [Notification No. 12/2017-CT (R) dated 28.06.2017.

- However, since chairs and coolers are hired out along with their transportation, it is a case of composite supply wherein the principal supply is hiring out of chairs and coolers.

- Also, it’s an intra-State supply. Accordingly, transportation service will also be taxed at the rate applicable for renting of chairs and coolers, viz. CGST and SGST @ 6% each.

6. GST on GTA services availed is payable under reverse charge mechanism since GST is payable @ 5% [It has been most logically assumed that Mrs. Kajal has not charged, from Function Garden, any mark-up on the cost of transportation paid by her to the unregistered GTA], Being an intra-State supply, CGST and SGST will be chargeable @ 2.5% each [It has been assumed that the unregistered GTA from whom the GTA services have been availed is located in the State of Rajasthan].

7. The above answer is based on the assumption that either the event management services are provided to brother for his son’s marriage and brother is not wholly dependent on Mrs. Kajal or such services are provided directly to brother’s son for his marriage. However, it is also possible to assume that the services are provided to brother for. his son’s marriage and brother is wholly dependent on Mrs. Kajal.

![]()

Question 14.

XYZ Ltd., New Delhi, manufactures biscuits under the brand name ‘Tastypicks’. Biscuits are supplied to wholesalers and distributors located across India on FOR basis from the warehouse of the company located at New Delhi. The company uses multiple modes of transport for supplying the biscuits to its customers spread across the country. The transportation cost is shown as a line item in the invoice and is billed to the customers with a mark-up of 2% on total amount of freight paid (inclusive of taxes).

Flour used for the production process is procured from vendors located in Madhya Pradesh on ex-factory basis. The company engages goods transport Agencies (GTA) to transport the flour from the factories of the vendors to its factory located in New Delhi.

The company has provided the following data relating to transportation of biscuits and flour in the month of April 20XX:

- For sales within the NCR region (₹ 20,00,000), the company arranged a local mini-van belonging to an individual and paid him ₹ 54,000.

- For sales to locations in distant States (₹ 1,78,00,000), the company booked the goods by Indian Railways and paid rail freight of ₹ 3,17,000.

- For sales to locations in neighbouring States (₹ 55,00,000), the company booked the goods by road carriers (GTAs) and paid road freight of ₹ 3,73,000. Out of the total sales to neighbouring States, goods worth ₹ 10,00,000 were booked through a GTA which paid tax @ 12%. Freight of ₹ 73,000 was paid to such GTA.

- For purchase of flour from Madhya Pradesh (₹ 25,00,000), the company booked the goods by a GTA and paid road freight of ₹ 55,000.

- For purchase of butter from Punjab (₹ 15,00,000), the company booked the goods by a GTA and paid road freight of ₹ 35,000.

- For local purchase of baking powder, the company booked the goods by a GTA in a single carriage and paid road freight of ₹ 1,500.

- For transferring the biscuits (open market value – ₹ 4,00,000) to one of its sister concern in Rajasthan, the company booked the goods by a GTA and paid road freight of ₹ 40,000.

(i) Based on the particulars given above, compute the GST payable on the amount paid for transportation by XYZ Ltd. when it avails the services of different transporters.

(ii) Compute the GST charged on transportation cost billed by the company to its customers.

Note: – Assume the rate of GST on transportation of goods and biscuits to be 5% and 12% respectively [except where any other rate is specified in the question], [RTP, Nov. 2018]

Answer:

(i) Computation of GST payable on amount paid for transportation by XYZ Ltd. when it avails the services of different transporters

| Particulars | Freight [₹] | GST payable [₹] |

| Transportation of biscuits in a local mini van belonging to an individual [WN 1] | 54,000 | Nil |

| Transportation of biscuits by Indian Railways | 3,17,000 | 15,850 |

| Transportation of biscuits by GTA [WN 2] | 3,00,000 | 15,000 |

| Transportation of biscuits by GTA @12% [WN 3] | 73,000 | 8,760 |

| Transportation of flour by GTA [WN 4] | 55,000 | Nil |

| Transportation of butter by GTA [WN 5] | 35,000 | 1,750 |

| Transportation of baking powder by GTA [WN 6] | 1,500 | Nil |

| Transportation of biscuits by GTA to sister concern [WN 7] | 40,000 | 2,000 |

| Total tax payable by XYZ Ltd. on availing services of different transporters | 43,360 |

Working Notes:

- Transportation of goods by road otherwise than by a GTA is exempt from GST – Notification No. 12/2017

- GST is payable by XYZ Ltd. under reverse charge in terms of section 5(3) of the IGST Act, 2017.

- When the GTA pays tax @ 12%, tax is payable by the GTA under forward charge and not by the recipient under reverse charge – Notification No. 10/2017.

- Services provided by GTA by way of transport (in a goods carriage) of, inter alia, flour are exempt from GST vide Notification No. 9/2017.

- Though services provided by GTA by way of transport (in a goods carriage) of, inter alia, milk is exempt from GST vide Notification No. 9/2017, road transport of butter will not be exempted as butter is milk product and not milk. GST is payable by XYZ Ltd. under reverse charge.

- Services provided by a GTA by way of transport in a goods carriage of goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage does not exceed ₹ 1,500, are exempt from GST vide Notification No. 9/2017.

- GST is payable by XYZ Ltd. under reverse charge in terms of section 5(3) of the IGST Act, 2017.

(ii) Computation of GST charged on transportation cost billed by XYZ Ltd. to its customers

The supply of biscuits and transportation service is a composite supply, chargeable to tax at the rate applicable to the principal supply (biscuits) i.e. 12% [Section 8(a) of the CGST Act, 2017.

| Particulars | Freight paid [₹][A] | GST paid on freight [₹][B] | Freight billed (with markup @ 2% on [A]+[B]) [₹] | GST charged @ 12% [₹] |

| Transportation of biscuits in a local mini van belonging to an individual | 54,000 | 55,080 | 6,610 | |

| Transportation of biscuits by Indian Railways | 3,17,000 | 15,850 | 3,39,507 | 40,741 |

| Transportation of biscuits by GTA | 3,00,000 | 15,000 | 3,21,300 | 38,556 |

| Transportation of biscuits by GTA @ 12% | 73,000 | 8,760 | 83,395 | 10,007 |

| Total tax charged by XYZ Ltd. on transportation cost billed to the customers* | 95,914 |

*Note: It has been assumed that there is no mark-up on transportation cost billed to sister concern (non-customer).

Question 15.

ABC Ltd., registered in Noida (Uttar Pradesh) is a supplier of machinery used for making bottle caps. The supply of machinery is effected as under:

The wholesale price of the machinery (excluding all taxes and other expenses) at which it is supplied in the ordinary course of the business to various customers is ₹ 42,00,000. However, the actual price at which the machinery is supplied to an individual customer varies within a range of ± 10% depending upon the terms of contract of supply with the particular customer.

Apart from the price of the machinery, ABC Ltd. charges from the customer the following incidental expenses:

- Associated handling and loading charges of ₹ 10,000

- Installation and commissioning charges of ₹ 1,00,000. The machinery can be dismantled and erected at another site, if required. The above charges are compulsorily levied in every case of supply of machinery.

Transportation of machinery to the customer’s premises is arranged by ABC Ltd. through a third-party service provider [Goods Transport Agency (GTA)]. The customer enters into a separate service contract with the GTA and pays the freight directly to it.

The company provides one-year free warranty for the machinery. Further, the company also provides an extended two-year warranty on payment of additional charge of ₹ 3,00,000, to all its customers.

A cash discount of 2% on the price of the machinery is offered at the time of supply, if the customer agrees to make the payment within 15 days of the receipt of the machinery at his premises. In the event of failure to make the payment within the stipulated time, the company-

- Recovers the discount given; and

- Charges interest @1% per month or part of the month on the total amount due from the customer (towards the machinery supplied) from the date of making the supply till the date of payment. However, no interest is charged on the tax dues.

For every machinery supplied, ABC Ltd. receives a grant of ₹ 2,00,000 from its holding company DEF Ltd:

ABC Ltd. has supplied a machinery to D Pvt. Ltd. on August 1,20XX at a price of ₹ 40,00,000 (excluding all taxes). D Pvt. Ltd. has its corporate office in New Delhi. However, the machinery has been installed at its manufacturing unit located in Gurugram (Haryana). D Pvt. Ltd. has paid the freight directly to the GTA and the charges for two-year extended warranty. Discount @ 2% was given to D Pvt. Ltd. as it agreed to make the payment within 15 days. However, D Pvt. Ltd. paid the consideration on 31st October, 20XX.

Assume the rates of taxes to be as under:

Bottle cap making machine

| CGST – 6% | SGST- 6% | IGST – 12% |

Service of transportation of goods

| CGST – 2.5% | SGST – 2.5% | IGST – 5% |

Other services involved in the above supply

| CGST- 9% | SGST- 9% | IGST – 18% |

Calculate the GST payable [CGST & SGST or IGST, as the case may be] on the machinery and support your conclusions with legal provisions in the form of explanatory notes.

Make suitable assumptions, wherever needed.

Answer:

Computation of GST Liability of ABC Ltd.

| Particulars | (₹) |

| Price of machine [Note 1] | 40,00,000 |

| Handling and loading charges [Note 2] | 10,000 |

| Installation and commissioning charges [Note 3] | 1,00,000 |

| Transportation cost [Note 4] | Nil |

| Additional warranty cost [Note 5] | 3,00,000 |

| Grant from DEF Ltd. [Note 6] | 2,00,000 |

| Total price of the machine | 46,10,000 |

| Less: 2% cash discount on price of machinery = ₹ 40,00,000 × 2% [Note 7] | (80,000) |

| Taxable value of supply | 45,30,000 |

| Tax liability for the month of August 20XX [Note 11] | |

| IGST @ 1296 [Note 8 and Note 9] | 5,43,600 |

| Tax liability for the month of October 20XX [Note 11] | |

| Interest collected @ 3% on ₹ 44,10,000 [Note 10] | 1,32,300 |

| Cash discount recovered [Note 10] | 80,000 |

| Cum-tax value of interest and cash discount | 2,12,300 |

| IGST=(₹ 2,12,300/112) × 1296 | 22,746 |

| Total IGST payable on the machinery | 5,66,346 |

Working Notes:

1. As per section 15(1) of the CGST Act, 2017, the value of a supply is the transaction value i.e., the price actually paid or payable for the said supply when the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply. It is assumed that ABC Ltd. and D Pvt. Ltd. are not related and the price is the sole consideration for the supply.

2. All incidental expenses charged by the supplier to the recipient of a supply are includible in the value of supply in terms of section 15(2)(c) of CGST Act, 2017.

3. Any amount charged for anything done by the supplier in respect of the supply of goods at the time of, or before delivery of goods is includible in the value of supply in terms of section 15(2)(c) of CGST Act, 2017.

4. Transportation cost has not been included in the value of supply of the machinery as it is a separate service contract between the customer and the third-party service provider. The customer pays the freight directly to the service provider.

The supplier (ABC Ltd.), in this case, merely arranges for the transport and does not provide the transport service on its own account. Tax will be separately levied on the supply of service of transportation of goods under reverse charge which will be paid by the customer.

5. Warranty cost is includible in the value of the supply since transaction value includes all elements of the price excluding those that can be specifically excluded as per section 15 of the CGST Act.

6. Subsidies directly linked to the price excluding subsidies provided by the Central Government and State Governments are includible in the value of supply in terms of section 15(2)(e) of the CGST Act, 2017.

7. Cash discount was deducted by ABC Ltd. upfront at the time of supply on August 1,20XX and hence, the same is excluded from the value of supply as it did not form part of the transaction value.

8. In the given case-

- The location of the supplier is in Noida (UP); and

- The place of supply of machinery is the place of installation of the machinery i.e., Gurugram (Haryana) in terms of section 10(1)(d) of the IGST Act, 2017.

Therefore, the given supply is an inter-State supply as the location of the supplier and the place of supply are in two different States [Section 7(1 )(a) of IGST Act, 2017], Thus, the supply will be leviable to IGST in terms of section 5(1) of the IGST Act, 2017.

9. The given supply is a composite supply involving supply of goods (machinery) and services (handling and loading and installation and commissioning) where the principal supply is the supply of goods.

As per section 8(a) of the CGST Act, 2017, a composite supply is treated as a supply of the principal supply involved therein and charged to tax accordingly. Thus, tax rate applicable to the goods (machinery) has been considered.

10. Interest for the delayed payment of any consideration for any supply is includible in the value of supply in terms of section 15(2)(d) of the CGST Act, 2017. Further, cash discount recovered will also be includible in the value of supply as now the transaction value i.e., the price actually paid for the machinery is devoid of any discount.

The cash discount not allowed and interest have been considered as cum tax value on the logical assumption that tax component could not be recovered from the client. Thus, tax payable thereon has to be computed by making back calculations in terms of rule 35 of CGST Rules, 2017.

11. It has been assumed that the invoice for the supply has been issued on August 1, 20XX, the date on which the supply is made. Thus, the time of supply of goods is August 1,20XX in terms of section 12(l)(a) of the CGST Act, 2017.

As per section 12(6) of the CGST Act, 2017, the time of supply in case of addition in value by way of interest, late fee, penalty etc. for delayed payment of consideration for goods is the date on which the supplier receives such addition in value. Thus, the time of supply of interest received and cash discount recovered on account of delayed payment of consideration is 31st October, 20XX, the date when the full payment was made. The supplier may issue a debit note for such interest and cash discount recovered.

![]()

Question 16.

Dev Enterprises is the supplier of water coolers. Dev Enterprises supplied water coolers to Vimal Traders for consideration of ₹ 2,95,000 (inclusive of GST @ 18%). Vimal Traders also gave some materials to Dev Enterprises as consideration for such supply whose value was ₹ 10,000 (exclusive of GST).

Dev Enterprises has supplied the same goods to another person at price of ₹ 2,97,360 (inclusive of GST @ 18%).

You are required to:

(1) Determine the value of goods supplied by Dev Enterprises to Vimal Traders as per the provisions of the CGST Act, 2017.

(2) What would your answer be if price of ₹ 2,97,360 is not available at the time of supply of goods to Vimal Traders? Explain briefly. [May 2019, Old, 4 Marks]

Answer:

(1) As per Rule 27 of the CGST Rules, 2017 (Valuation Rules):

Where the consideration for a supply is not wholly in money, the value will be the open market value.

Open market value of a supply means the full value in money, excluding the applicable GST, where the supplier and the recipient of the supply are not related and the price is the sole consideration, to obtain such supply at the same time when the supply being valued is made.

In the given case, price is not the sole consideration for the supply. Apart from monetary consideration, the buyer has given some material to the supplier as consideration for such supply.

- Here, the value will be determined with the help of rule 27 of the CGST Rules, 2017 (Valuation Rules)

- Therefore, in the given case, the open market value of the goods supplied is ₹ 2,52,000 (₹ 2,97,360 × 100/118) and is therefore, the value of such goods.

(2) Rule 27 further provides that if open market value of the supply is not known, the value of the supply will be the consideration in money plus the money equivalent to the non-monetary consideration, if such amount is known at the time of supply.

Therefore, the value in the given case will be (₹ 2,95,000 × 100/118) + ₹ 10,000, which is ₹ 2,60,000.

Question 17.

Kamal & C». Manufacture customized products at its units situated in Rajasthan. Cost of production for Kamal & Co. For 1000 product is ₹ 20,00,000. These product required further processing before sale & for these purpose products are transferred from its Rajasthan unit to its another unit in Punjab. The Punjab unit, apart from processing its own products engages in processing of similar product of other person who supply the product of same kind and quality thereafter sells these processed products to wholesalers.

There are no other factories in the neighbouring area which are engaged in same business as that of its Punjab units product of the same kind and quality are supply in lots of 1000 each time by another manufacturer located in Punjab. The price of such goods is ₹ 19,00,000. Determine the value of 1000 product supplied by Kamal & Co. to its Punjab units as per the provision of CGST Act, 2017. [May 2018, 5 Marks]

Answer:

Statutory Provision

- As per section 25(4) of the CGST Act, 2017:

- A person who has obtained or is required to obtain more than one registration

- whether in one State or Union territory or more than one State or Union territory

- shall, in respect of each such registration, he treated as distinct persons for the purposes of this Act.

(a) As per rule 28 of CGSTRu1es, 2017:

- the value of the supply of goods between distinct persons

- other than where the supply is made through an agent

- shall –

(a) be the open market value of such supply;

(b) if open market value is not available, be the value of supply of goods of like kind and quality;

(c) if value cannot be determined under the above methods, be cost of the supply plus 10% mark-up or be determined by other reasonable means, in that sequence.

In the given case study

- As per section 25(4), units of Kamal & Co. in Rajasthan and Punjab are distinct persons.

- Rule 28 is applicable.

Step 1 To ascertain Open Market Value:

The open market value of the 1000 products being supplied to Punjab unit is not available since the supplier

manufactures customized products.

Step 2 To ascertain like kind & quality:

The value of 1000 products supplied by Rajasthan unit of Kamal & Co. to Punjab unit will be the value of the goods of like kind and quality supplied to Punjab unit by other customers which is 19,00,000.

90% criterion:

Since goods are not supplied as such by the Punjab unit, goods cannot be valued @ 90% of the price charged for the supply of like goods b the Punjab unit to its unrelated customers in terms of first proviso to rule 28 of CGST Rules, 2017.

ITC:

If Punjab unit is entitled for full ITC, the value declared in the invoice of Rajasthan unit will be deemed to be the open market value of the goods vide second proviso to rule 28 of CGST Rules, 2017.

Question 18.

Jaskaran, registered supplier of Delhi, has made the following supplies in the month of January, 2OXX:

| Particulars | Amount |

| (i) Supply of 20,000 packages at ₹ 30 each to Sukhija Gift Shop in Punjab [Each package consists of 2 chocolates, 2 fruit juice bottles and a packet of toy balloons] | 6,00,000 |

| (ii) 10 generators hired out to Morarji Banquet Halls, Chandigarh [including cost of transporting the generators (₹ 1,000 for each generator) from Jaskaran’s warehouse to the Morarji Banquet Halls] | 2,50,000 |

| (iii) 500 packages each consisting of 1 chocolate and I fruit juice bottle given as free gift to Delhi customers on the occasion of Diwali [Cost of each package is 12, but the open market value of such package of goods and of goods of like kind and quality is not available. Input tax credit has not been taken on the items contained in the package] |

|

| (iv) Catering services provided free of cost for elder son’s business inaugural function in Delhi [Cost of providing said services is ₹ 55,000, but the open market value of such services and of services of like kind and quality is not available.] |

*excluding GST

You are required to determine the GST liability [CGST & SGST and/or IGST, as the case may be] of Jaskaran for the month of January, 2OXX with the help of the following additional information furnished by him for the said period:

1. Penalty of ₹ 10,000 was collected from Sukhija Gift Shop for the payment received with a delay of 10 days.

2. The transportation of the generators from Jaskaran’s warehouse to the customer’s premises is arranged by Jaskaran through a Goods Transport Agency (GTA) who pays tax @ 12%.

3. Assume the rates of GST to be as under:

| Goods/services supplied | CGST | SGST | IGST |

| Chocolates | 9% | 9% | 18% |

| Fruit juice bottles | 6% | 6% | 12% |

| Toy balloons | 2.5% | 2.5% | 5% |

| Service of renting of generators | 9% | 9% | 18% |

| Catering service | 9% | 9% | 18% |

Answer:

Computation of GST liability of Jaskaran for the month of January, 20XX

| Particulars | CGST (₹) | SGST (₹) | IGST (₹) |

| Supply of 20,000 packages to Sukhija Gift Shop, Punjab [Note- 1][6,08,475 × 18%] | 1,09,526 | ||

| Renting of 10 generators to Morarji Banquet Halls, Chandigarh [Note-2][2,50,000 × 18%] | 45,000 | ||

| 500 packages given as free gift to the customers [Note-3] | Nil | Nil | Nil |

| Catering services provided free of cost for elder son’s business inaugural function in Delhi [Note-3][60,500 × 9%] | 5,445 | 5,445 | |

| Total GST liability (rounded off) | 5,445 | 5,445 | 1,54,526 |

Notes:

1. Supply of a package containing chocolates, fruit juice bottles and a packet of toy balloons is a mixed supply as each of these items can be supplied separately and is not dependent on any other [Section 2(74) of the CGST Act, 2017]. Consequently, being an inter-State supply of goods, supply of packages to Sukhija Gift Shop of Punjab is subject to IGST @ 18% each.

Further, Penalty of ₹ 10,000 [considered as inclusive of GST] collected from Sukhija Gift Shop for the delayed payment will be included in the value of supply [Section 15(2)(d) of the CGST Act], The total value of supply is ₹ 6,08,475 [₹ 6,00,000 + (₹ 10,000 × 100/118)]

2. Jaskaran is not a GTA, transportation services provided by him are exempt from GST [Notification No. 9/2017]. However, since the generators are invariably hired out along with their transportation till customer’s premises, it is a case of composite supply under section 2(30) of the CGST Act, 2017 wherein the principal supply is the renting of generator.

Consequently, being an inter-State supply of service, service of hiring out the generators to Morarji Banquet Halls of Chandigarh is subject to IGST @ 18% each.

3. As per section 7(1)(c) of the CGST Act, 2017 Para 2 of Schedule I of CGST Act provides that supply of goods or services or both between related persons or between distinct persons as specified in section 25, when made in the course or furtherance of business, are to be treated as supply even if made without consideration.

However, since the question does not provide that customers are related to Jaskaran, free gifts given to the customers cannot be considered as a supply under section 7. Consequently, no tax is leviable on the same.

Further, the catering services provided by Jaskaran to his elder son without consideration will be treated as supply as Jaskaran and his elder son, being members of same family, are related persons.

4. As per rule 28 of the CGST Rules, 2017.

- The value of supply is the open market value of such supply; if open market value is not available, the values of supply of goods or services of like kind and quality.

- However, if value cannot be determined under said methods, it must be worked out based on the cost of the supply plus 1096 mark-up.

- Thus, in the given case, value of catering services provided to the elder son of Jaskaran is ₹ 60,500 [₹ 55,000 × 110%],

- Further, being an intra-State supply of services, catering services are subject to CGST and SGST @ 2.596 each.

5. Jaskaran has received services from a GTA who has paid GST @ 1296, reverse charge provisions will not be applicable.

![]()

Question 19.

Power Engineering Pvt. Ltd., a registered supplier, is engaged in providing expert maintenance and repair services for large power plants that are in the nature of immovable property, situated all over India. The company has its Head Office at Bangalore, Karnataka and branch offices in other States. The work is done in the following manner.

The company has self-contained mobile workshops, which are container trucks fitted out for carrying out the repairs. The trucks are equipped with items like repair equipments, consumables, tools, parts etc. to handle a wide variety of repair work.

The truck is sent to the client location for carrying out the repair work. Depending upon the repairs to be done, the equipment, consumables, tools, parts etc. are used from the stock of such items carried in the truck.

In some cases, a stand-alone machine is also sent to the client’s premises in such truck for carrying out the repair work.

The customer is billed after the completion of the repair work depending upon the nature of the work and the actual quantity of consumables, parts etc. used in the repair work.

Sometimes the truck is sent to the company’s own location in other State(s) from where it is further sent to client locations for repairs.

Work out the GST liability [CGST & SGST or IGST, as the case may be] of Power Engineering Pvt. Ltd., Bangalore on the basis of the facts as described, read with the following data for the month of November 20XX.

| Particulars | ₹ |

| A. Truck sent to own location in Tamil Nadu (i) Value of items contained in the truck – ₹ 3,00,000 (ii) Value of truck – ₹ 25,00,000 |

|

| B. Truck sent to a client location in Tamil Nadu for carrying out repairs. Stand- alone machine is also sent in the truck to client location for repairs

(i) Value of items contained in the truck – ₹ 2,85,000 (Billing for repairs to be done afterwards depending upon the actual items used) |

|

| C. Truck sent to a client location in Karnataka for carrying out repairs (i) Value of items contained in the truck – ₹ 1,06,000 (ii) Value of truck – ₹ 20,00,000 (Billing for repairs to be done afterwards depending upon the actual items used) |

|

| D. Invoices raised for repair work carried out in Tamil Nadu [including the invoice for repair work done in ‘B’] – | 70,00,000 |

| E. Invoices raised for repair work carried out in Karnataka [including the invoice for repair work done in ‘C’] | 12,00,000 |

Also, specify the document(s), if any, which need to be issued by Power Engineering Pvt. Ltd., Bangalore for the above transactions.

All the given amounts are exclusive of GST, wherever applicable. Assume the rates of taxes to be as under:

Items used for repairs

| CGST – 6% | SGST – 6% | IGST – 12% |

Container truck. Stand-alone machines

| CGST – 2.5% | SGST – 2.5% | IGST – 5% |

Works contract for repairs and maintenance of immovable property

| CGST- 9% | SGST – 9% | IGST – 18% |

You are required to make suitable assumptions, wherever necessary. [MTP, Nov. 2019,14 Marks!

Answer:

Computation of GST Liability of Power Engineering Pvt. Ltd., Bangalore for the month of November 20XX

| Particulars | Amount |

| A. Items sent in container truck to own location in Tamil Nadu – IGST @ 12% [Note 1] | 36,000 |

| Container truck sent to own location in Tamil Nadu [Note 2] | – |

| B. Stand-alone machine sent in container truck to client location in Tamil Nadu, for carrying out repairs [Note 3] | – |

| Container truck sent to client location in Tamil Nadu [Note 3] | – |

| Items sent in container truck to client location in Tamil Nadu, for carrying out repairs [Note 4] | – |

| C. Container truck sent to client location in Karnataka [Note 3] | – |

| Items sent in container truck to client location in Karnataka, for carrying out repairs [Note 4] | – |

| D. Invoices raised for repair work carried out in Tamil Nadu: IGST @18% [Note 5 and Note 6] | 12,60,000 |

| E. Invoices raised for repair work carried out in Karnataka: CGST 9% + SGST 9% [Note 5 and Note 7] | 2,16,000 |

| Total GST liability | 15,12,000 |

Notes:

(1) Movement of goods without any consideration to a ‘distinct person’ as specified in section 25(4) of the CGST Act, 2017 is deemed to be a supply in terms of Schedule I of the said Act. The purchase value is taken as taxable value, being the open market value in terms of rule 28(a) of the CGST Rules 2017. (However, if the regional office is eligible to take full input tax credit, any value may be declared in the tax invoice and that will be taken to be the open market value in terms of the second proviso to the same rule.)

In the given case –

the location of the supplier is in Bangalore (Karnataka); and

the place of supply of items contained in the truck is the location of such goods at the time at which the movement of goods terminates for delivery to the recipient ie., Tamil Nadu in terms of section 10(1)(a) of the IGST Act, 2017.

Therefore, the given supply of items is an inter-State supply as the location of the supplier and the place of supply are in two different States [Section 7(l)(a) of IGST Act, 2017], Thus, the supply is leviable to IGST in terms of section 5(1) of the IGST Act, 2017.

Since the activity is a supply, a tax invoice is to be issued by Power Engineering Pvt. Ltd. in terms of section 31(1)(a) of the CGST Act, 2017 for sending the items to its own location in Tamil Nadu.

(2) Schedule I to the CGST Act, 2017 specifies situations where activities are to be treated as supply even if made without consideration. Supply of goods and/or services between ‘distinct persons’ as specified in section 25 of the CGST Act, 2017, when made in the course or furtherance of business is one such activity included in Schedule I under para 2.