Mergers, Acquisitions and Corporate Restructuring – CA Final SFM Study Material is designed strictly as per the latest syllabus and exam pattern.

Mergers, Acquisitions and Corporate Restructuring – CA Final SFM Study Material

Part-1(Theory)

Question 1.

Write short note on Horizontal Merger and Vertical Merger. [May 2016] [4 Marks]

Answer:

A merger is generally understood to be a fusion of two companies. It may be classified as horizontal merger or vertical merger.

Horizontal Merger: Under this type of merger, the two companies which have merged are in the same industry. Normally the market share of the new consolidated company would be larger and it is possible that it may move closer to being a monopoly or a near monopoly to avoid competition.

Vertical Merger: This merger happens when two companies that have ‘buyer- seller’ relationship (or potential buyer-seller relationship) come together.

Question 2.

What are the problems for “Merger and Acquisitions” in India? [Nov. 2016] [4 Marks]

Answer:

The following are the problems of mergers and acquisitions in India:

- Controlling Interest: The Indian companies are largely promoter-controlled and managed.

- Legal Compliances: There are strict SEBI rules and regulations. In addition, the need for ‘prior negotiations and concurrence of financial institutions and banks’ also creates problem.

- Funding Problem: The reluctance of financial institutions and banks to fund acquisitions directly.

- Exit Policy: There is a lack of exit policy for restructuring or downsizing of schemes of mergers and acquisitions.

- Valuation Problem: The absence of efficient capital market system makes the market capitalisation not fair in some cases. The fair valuation of entity is still creating hurdles.

Question 3.

Explain “Synergy” in the context of Merger and Acquisitions? [Nov. 2012] [4 Marks]

Answer:

The one of the most common reasons for Mergers and Acquisition (M&A) is Synergistic operating economics. In simple terms, synergy implies that one plus one is more than two. In terms of mergers and acquisition, if V (A) and V (B) denote the Values of two Firms ‘A’ and ‘B’ then following shall prevail:

V (AB) > V (A) + V (B)

In other words the combined value of two firms or companies shall be more than their individual value. The ‘Synergy’ is the increase in performance of the combined firm over what the two firms are already expected or required to accomplish as independent firms. The synergy benefits arise due to following:

1. Economics of combined efforts: A company may have a good networking of branches and other company may have efficient production system. Thus, the merged companies will be more efficient than individual companies.

2. Economies of scale: The economies of large scale are also one of the reasons for synergy benefits. The main reason is that, the large scale production results in lower average cost of production e.g. reduction in overhead costs on account of sharing of central services such as accounting and finances, office executives, top level management, legal, sales promotion and advertisement etc.

3. Real and Pecuniary Economies: The economics can be “real’’ arising out of reduction in factor input per unit of output, whereas pecuniary economics are realized from paying lower prices for factor inputs for bulk transactions.

Question 4.

How synergy is used as a tool when deciding merger and acquisitions? – [May 2017] [4 Marks]

Answer:

The mergers and acquisitions are made with the goal of improving the company’s financial performance for the shareholders. The shareholders will benefit if company’s post-merger share price increases due to the synergistic effect of the deal. The expected synergy achieved through the merger can be attributed to various factors, such as increased revenues, combined talent and technology or cost reduction.

The two businesses can merger to form one company that is capable of producing more revenue than either could have been able to independently or to create one company that is able to eliminate or streamline redundant processes, resulting in significant cost reduction.

When two companies merge to create greater efficiency or scale, it is called as synergy merge. It is clear the synergy may be used as a tool for deciding the merger or acquisition.

Question 5.

What is equity carve out? How does it differ from a spin off? [Nov. 2013] [4 Marks]

Answer:

Equity Carve out:

It is partial spin-off in which a company creates its own new subsidiary and subsequently brings out its IPO. The parent keeps a controlling stake in the newly traded subsidiary. A carve-out is a strategic avenue a parent firm may take when one of its subsidiaries is growing faster and carrying higher valuations than other businesses owned by the parent. A carve-out generates cash because shares in the subsidiary are sold to the public, but the issue also unlocks the value of the subsidiary unit and enhances the parent’s shareholder value.

Spin-off

In this case, a part of the business is separated and created as a separate firm. The existing shareholders of the firm get proportionate ownership. So there is no change in ownership and the same shareholders continue to own the newly created entity in the same proportion as previously in the original firm.

Difference between Equity Carve Out and Spin-Off

- Under spin-off, the shareholders in new company remain the same but not in case of equity curve out.

- Under Spin-off parent company does not receive any cash but equity carve-out generates cash because shares in the subsidiary are sold to the public.

Question 6.

Write short note on “Takeover by Reverse Bid”. [Nov, 2011, 2014, 2019] [4 Marks]

Answer:

Usually, a large company takes over smaller company. In a ‘reverse takeover’, a smaller company gains control of a larger one. The concept of takeover by reverse bid, or of reverse merger, is thus not the usual case of amalgamation of a sick unit which is non-viable with a healthy or prosperous unit but is a case whereby the entire undertaking of the healthy and prosperous company is to be merged and vested in the sick company which is non-viable. A company becomes a sick industrial company when there is erosion in its net worth. This alternative is also known as taking over by reverse bid.

Conditions for Reverse Takeover:

The following are the conditions of reverse merger:

(a) Value of Assets: The assets of the transferor company are greater than the transferee company,

(b) Value of Shares issued: The equity capital to be issued by the transferee company pursuant to the acquisition exceeds its original issued capital, and

(c) Controlling Interest: The change of control in the transferee company through the introduction of a minority holder or group of holders.

Question 7.

Write short note on “Financial Restructuring.” [Nov. 2008, May 2013] [4 Marks]

Answer:

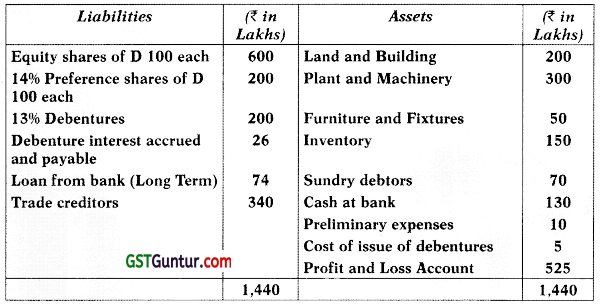

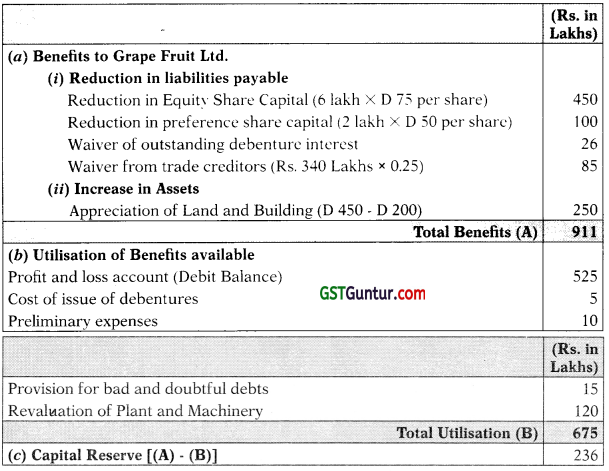

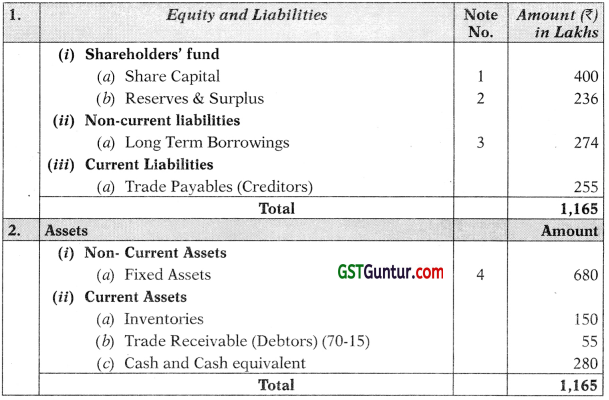

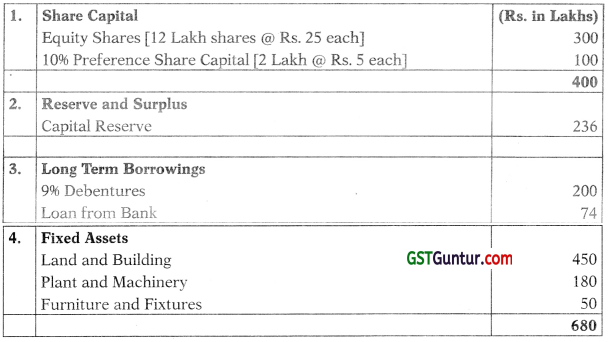

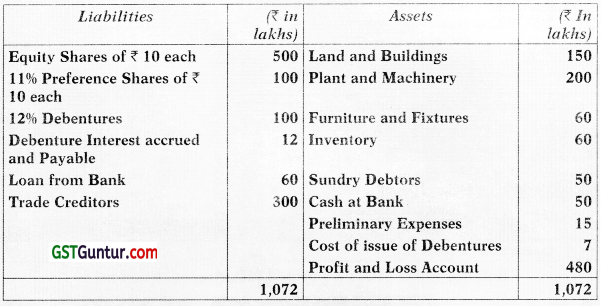

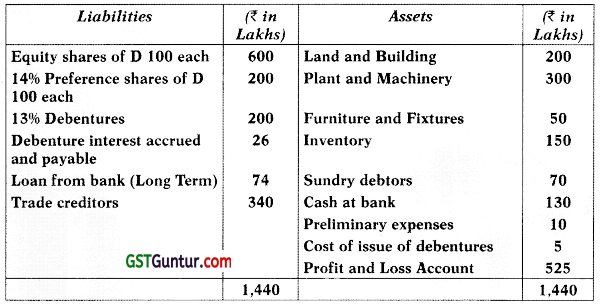

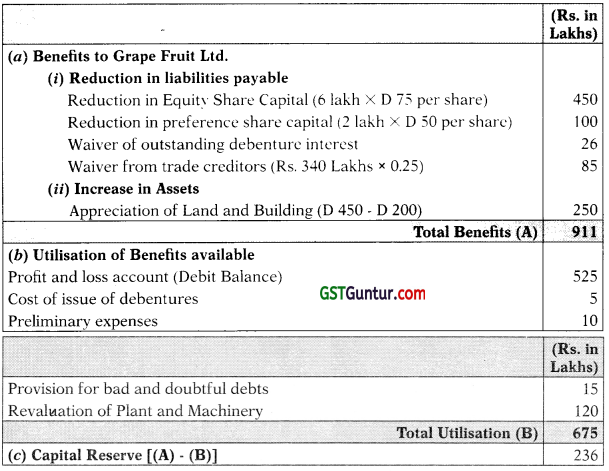

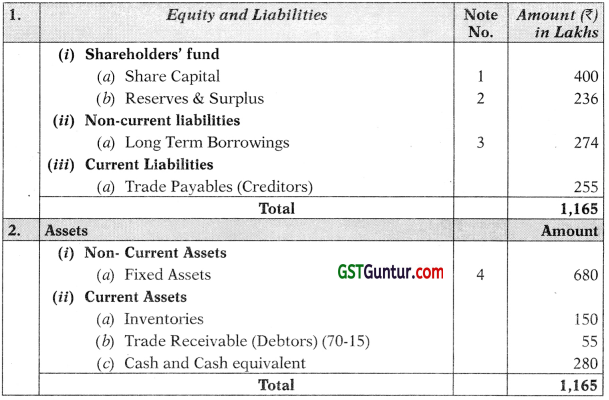

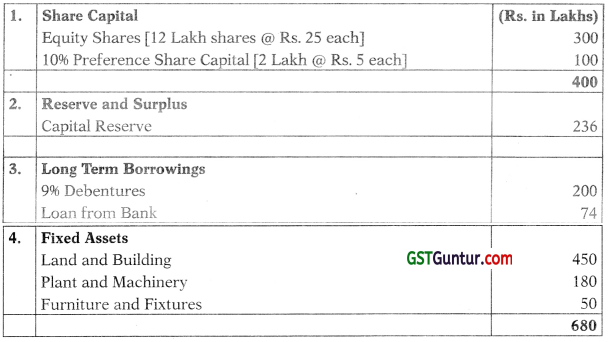

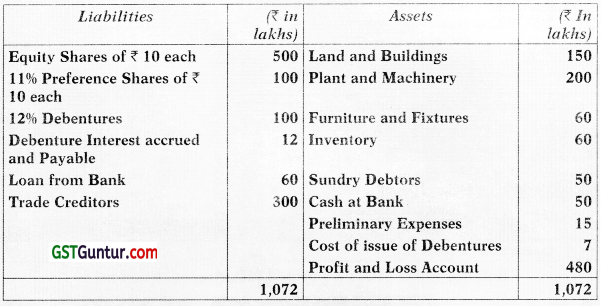

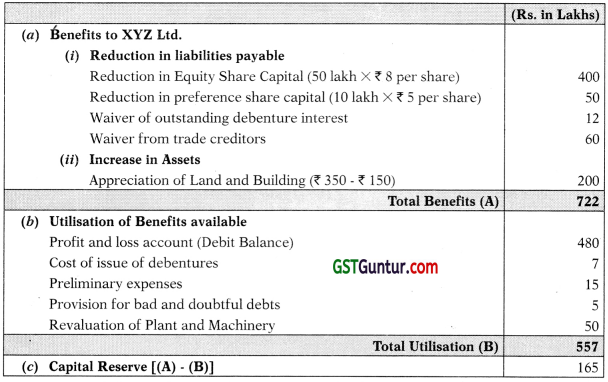

When a company incurs continuous losses, the share capital or net worth of such companies gets substantially eroded. In fact, in some cases, the accumulated losses are even more than the share capital and thus leading to negative net worth, putting the firm on the verge of liquidation. In order to revive such firms, financial restructuring is one of the techniques to bring into health such firms which are having potential and promise for better financial performance in the years to come. Financial restructuring refers to a kind of internal changes made by the management in Assets and Liabilities of a company with the consent of its various stakeholders. With the help of restructuring, the firm re-starts with a fresh balance sheet free from losses and fictitious assets and show share capital at its true worth.

Normally equity shareholders make maximum sacrihce by foregoing certain accrued benefits, followed by preference shareholders and debenture holders, lenders and creditors etc. The sacrifice may be in the form of waving a part of the sum payable to various liability holders. The foregone benefits may be in the form of new securities with lower coupon rates so as to reduce future liabilities. The sacrifice may also lead to the conversion of debt into equity. Sometime, creditors, apart from reducing their claim, may also agree to convert their dues into securities to avert pressure of payment. These measures will lead to better financial liquidity. The financial restructuring leads to significant changes in the financial obligations and capital structure of corporate firm, leading to a change in the financing pattern, ownership and control and payment of various financial charges.

The financial restructuring results into the following:

(i) The reduction or waiver in the claims from various stakeholders.

(ii) The revaluation of various properties and assets of the entity.

(iii) The profit accruing on account of appreciation of assets is utilised to write off accumulated losses and fictitious assets (such as preliminary expenses and cost of issue of shares and debentures) and creating provision for bad and doubtful debts.

Part-2(Numerical Problems: Topic Wise In Chronological Order)

Question 1.

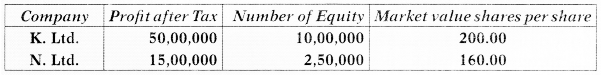

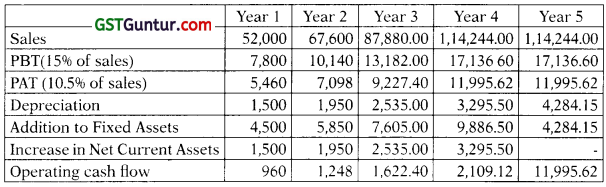

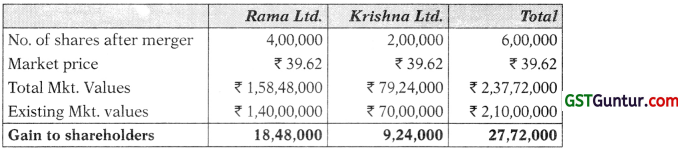

1K Ltd. is considering acquiring N. Ltd., the following information is available:

Exchange of equity shares for acquisition is based on current market value as above. There is no synergy advantage available:

(i) Find the earning per share for company K. Ltd. after merger.

(ii) Find the exchange ratio so that shareholders of N. Ltd. would not be at a loss. [Nov. 2008] [12 Marks]

Answer:

(i) Determination of new EPS of K. Ltd. after Merger:

| Exchange Ratio |

= \(\frac{\text { Market Value of } N \text { Ltd } .}{\text { Market Value of } K \mathrm{Ltd} .}\) = \( \frac{160}{200} \) = 0.8

[0.8 shares of K Ltd. for every 1 share of N Ltd.] |

| No. of shares to be issued |

= 2,50,000 × 0.8 = 2,00,000 Shares |

| Total Shares of K Limited (after merger) |

= 10,00,000 + 2,00,000 = 12,00,000 Shares |

| Total Profits of K Ltd. (After Merger) |

Rs. 50,00,000 + Rs. 15,00,000 = Rs. 65,00,000 |

| EPS of K Ltd. (After Merger) |

= \( \frac{R s .65,00,000}{12,00,000 \text { Shares }} \) = Rs. 5.42

|

(ii) Exchange Ratio so that shareholder of N. Ltd. would not be at a Loss:

The shareholders of N Limited would not be at loss if the exchange ratio is based on EPS.

|

K Ltd. |

N Ltd. |

| EPS before Merger |

= \(\frac{\text { Rs. } 50,00,000}{10,00,000 \text { Shares }} \) = Rs. 5.00 |

= \(\frac{R s \cdot 15,00,000}{2,50,000 \text { Shares }} \) = Rs. 6.00 |

Exchange Ratio (with EPS as base) = \(\frac{E P S \text { of } N \text { Ltd. }(\text { Target Co. })}{\text { EPS of } K \text { Ltd. }(\text { Acquirer Co. })}\)

= \(\frac{R s .6}{R s .5}\) = 1.2

It means 1.2 shares of K Ltd. for every 1 share of N Ltd.

Shares to be issued to N Ltd. = 2,50,000 Shares × 1.2 = 3,00,000 Shares

Total number of Shares = 10,00,000 + 3,00,000 = 13,00,000 Shares

EPS of K Ltd. (after merger) = \(\frac{R s .65,00,000}{R s .13,00,000}\) = ₹ 5.00

Verification that the shareholders of target company are not at loss:

Method 1 (Total Earnings approach)

Total Earnings available to Shareholders of N. Ltd,:

Before Merger = 2,50,000 Shares × ₹ 6.00 (EPS) = ₹ 15,00,000

After Merger = 3,00,000 Shares × ₹ 5.00 (EPS) = ₹ 15,00,000

Method 2 (EPS approach)

The EPS available to Shareholders of N. Ltd.:

Before Merger = ₹ 6

After Merger = EPS of K Ltd, after merger × Exchange Ratio = 5 × 1.2 = ₹ 6

Therefore, the exchange ratio on the basis of EPS is recommended.

Question 2.

You have been provided the following Financial data of two companies:

|

Krishna Ltd. (₹) |

Rama Ltd. (₹) |

| Earnings after taxes |

7,00,000 |

10,00,000 |

| Equity shares (outstanding) |

2,00,000 |

4,00,000 |

| EPS |

3.5 |

2.5 |

| P/E ratio |

10 times |

14 times |

| Market price per share |

35 |

35 |

Company Rama Ltd. is acquiring the company Krishna Ltd., exchanging its shares on a one-to-one basis for company Krishna Ltd. The exchange ratio is based on the market prices of the shares of the two companies.

Required:

(i) What will be the EPS subsequent to merger?

(ii) What is the change in EPS for the shareholders of companies Rama Ltd. and Krishna Ltd.?

(iii) Determine the market value of the post-merger firm: PE ratio is likely to remain the same.

(iv) Ascertain profits accounting to shareholders of both the companies. [Nov. 2009] [10 Marks]

Answer:

(i) Determination of new EPS subsequent to Merger:

| Exchange Ratio |

= \(\frac{\text { Market Value of Krishna Ltd. } . \text { Target Co.) }}{\text { Market Value of Rama Ltd. }}\) = \(\frac{35}{35}\) = 1

[1 share of K Ltd. for every 1 share of Krishna Ltd.] |

| No. of shares to be issued |

= 2,00,000 × 1 = 2,00,000 |

| Total Shares of Rama Limited (after merger) |

= 4,00,000 + 2,00,000 = 6,00,000 Shares |

| Total Profits of Rama Ltd. (After Merger) |

= (2,00,000 × 3.5) + (4,00,000 × 2.5) = Rs. 7,00,000 + Rs. 10,00,000 = Rs. 17,00,000 |

| EPS of Rama Ltd. (After Merger) |

= \(\frac{R s, 17,00,000}{6,00,000 \text { Shares }}\) = Rs. 2.83 |

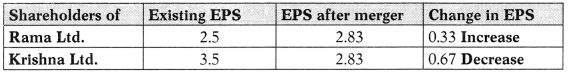

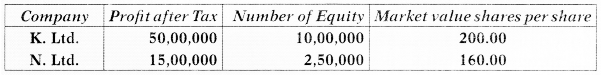

(ii) Change in EPS for shareholders of both companies:

The exchange ratio is 1:1, therefore the new EPS of Rama Ltd. i.e. Rs. 2.83 need not to be adjusted while determining the impact on EPS.

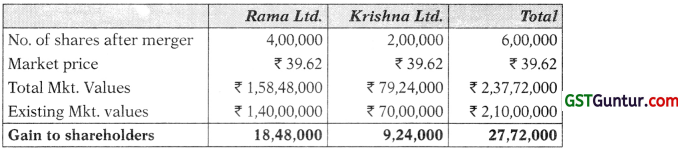

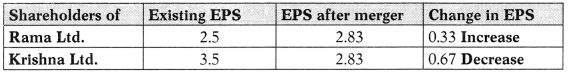

(iii) Market Value of merged firm:

| P/E ratio of new firm (expected to remain same) |

14 times |

| New market price (14 × ₹ 2.83) |

₹ 39.62 |

| Total No. of Shares (4,00,000 + 2,00,000) |

6,00,000 |

| Total market Capitalization (6,00,000 × ₹ 39.62) |

₹ 2,37,72,000 |

| Existing market capitalization (₹ 70,00,000 + ₹ 1,40,00,000) |

₹ 2,10,00,000 |

| Total gain |

₹ 27,72,000 |

(iv) Determination of profits to shareholders of companies:

Question 3

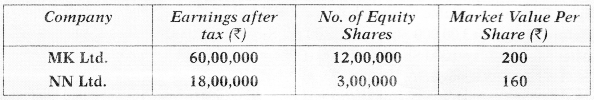

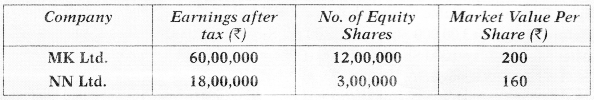

MK Ltd. is considering acquiring NN Ltd. The following information is available:

Exchange of equity shares for acquisition is based on current market value as above. There is no synergy advantage available.

(i) Find the earning per share for company MK Ltd. after merger, and

(ii) Find the exchange ratio so that shareho1rers of NN Ltd. would not be at a loss. [Nov. 2010] [8 Marks]

Answer:

(i) Determination of new EPS of MK Ltd. after merger:

| Exchange Ratio |

= \(\frac{\text { Market Value of NN Ltd }}{\text { Market Value of MK Ltd. }} \) = \( \frac{160}{200} \) = 0.8

[0.8 shares of MK Ltd. for every 1 share of NN Ltd.] |

| No. of shares to be issued |

= 3,00,000 × 0.8 = 2,40,000 Shares |

| Total Shares of MK Limited (after merger) |

= 12,00,000 + 2,40,000 = 14,40,000 Shares |

| Total Profits of MK Ltd. (After Merger) |

Rs. 60,00,000 + Rs. 18,00,000 = Rs. 78,00,000 |

| EPS of MK Ltd. (After Merger) |

= \(\frac{\text { Rs. } 78,00,000}{14,40,000 \text { Shares }} \) = Rs. 5.42 per share |

(ii) Exchange Ratio so that shareholder of NN Ltd. would not be at a Loss: The shareholders of NN Limited would not be at loss if the exchange ratio is based on EPS.

|

MK Ltd. |

NN Ltd. |

| EPS before Merger |

= \(\frac{\text { Rs. } 60,00,000}{12,00,000 \text { Shares }}\) = Rs. 5.00 |

= \(\frac{\text { Rs. } 18,00,000}{3,00,000 \text { Shares }}\) = Rs. 6.00 |

Exchange Ratio (with EPS as base) = \(\frac{E P S \text { of } N N \text { Ltd } .(\text { Target Co. })}{\text { EPS of MK Ltd. }(\text { Acquirer Co. })}\) = \(\frac{\text { Rs. } 6}{\text { Rs. } 5}\) = 1.2

It means 1.2 shares of MK Ltd. for every 1 share of NN Ltd.

Shares to be issued to NN Ltd. = 3,00,000 Shares × 1.2 = 3,60,000 Shares

Total number of Shares = 12,00,000 + 3,60,000 = 15,60,000 Shares

EPS of MK Ltd. (after, merger) = \(\frac{R s .78,00,000}{15,60,000 \text { Shares }}\) = ₹ 5.00

Verification that the shareholders of target company are not at loss:

Method 1 (Total Earnings approach)

Total Earnings available to Shareholders of NN Ltd.:

Before Merger = 3,00,000 Shares × ₹ 6.00 (EPS) = ₹ 18,00,000

After Merger = 3,60,000 Shares × ₹ 5.00 (EPS) = ₹ 18,00,000

Method 2 (EPS approach)

The EPS available to Shareholders of NN Ltd.:

Before Merger = ₹ 6

After Merger = EPS of MK Ltd, after merger × Exchange Ratio = 5 × 12 = ₹ 6

Therefore, the exchange ratio on the basis of EPS is recommended.

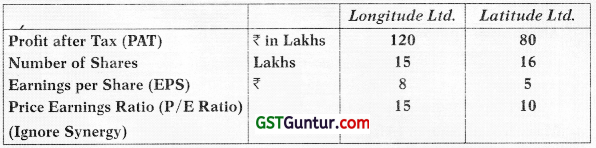

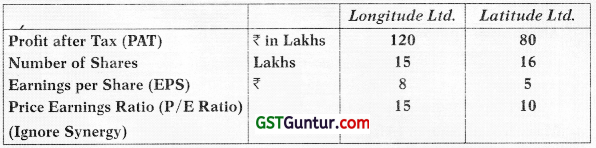

Question 4.

Longitude Limited is in the process of acquiring Latitude Limited on a share exchange basis. Following relevant data are available:

You are required to determine:

(i) Pre-merger Market Value per Share, and

(ii) The maximum exchange ratio Longitude Limited can offer without the dilution of

(1) EPS and

(2) Market Value per Share

Calculate Ratio/s up to four decimal points and amounts and number of shares up to two decimal points. [May 2013] [8 Marks]

Answer:

(i) Pre-Merger Market Value of Share (in unit):

| Formula |

Longitude Ltd. |

Latitude Ltd. |

| P/E Ratio × EPS |

15 × Rs. 8 = Rs. 120 |

10 × Rs. 5 = Rs. 50 |

(ii) (i) Maximum Exchange Ratio without dilution of EPS:

The shareholders of Latitude Ltd. would not be at loss if the exchange ratio is based on EPS.

Exchange Ratio (with EPS as base)

= \(\frac{\text { EPS of Latitude Ltd. }(\text { Target Co.) }}{\text { EPS of Longitude Ltd. }(\text { Acquirer Co.) }}\) = \(\frac{R s .5}{R s .8}\) = 0.625

It means 0.625 shares of Longitude Ltd. for every 1 share of Latitude Ltd.

Shares to be issued to Latitude Ltd. = 16 Lakh Shares × 0.625 = 10 Lakh Shares

(ii) Maximum Exchange Ratio without dilution of Market Value per share: The shareholders of Latitude Ltd. would not be at loss if the exchange ratio is based on Market Price.

Exchange Ratio (with Market Price as base)

= \(\frac{\text { Market Price of Latitude Ltd. }(\text { Target Co.) }}{\text { Market Price of Longitude Ltd. }(\text { Acquirer Co.) }}\) = \(\frac{R s .50}{R s .120}\) = 0.4167

It means 0.4167 shares of Longitude Ltd. for every 1 share of Latitude Ltd.

Shares to be issued to Latitude Ltd.= 16 Lakh Shares × 0.4167 = 6,66,666.67 Shares

Alternative approach:

|

Longitude Ltd. |

Latitude Ltd. |

Total |

| Pre-merger |

= Rs. 120 × 15 Lakhs |

= Rs. 50 × 16 Lakhs |

Rs. 2,600 Lakhs |

| Market Capitalisation |

= Rs. 1800 Lakhs |

= Rs. 800 Lakhs |

|

Max. No. of Shares (After Merger)

= \(\frac{\text { Combined Market Capitalisation }}{\text { Current Market Price of Longitude Lid. }}\)

= \(\frac{R s .2600}{R s .120}\) = 21.67 Lakh Shares

Max. Shares no. be issued to Latitude Limited = 21.67 – 15 = 6.67 Lakh Shares

Therefore, the maximum share exchange ratio is 6.67:16 or 0.4169:1

Question 5.

Cauliflower Limited is contemplating acquisition of Cabbage Limited. Cauliflower Limited has 5 lakh shares having market value of ₹ 40 per share while Cabbage Limited has 3 lakh shares having market value of ₹ 25 per share. The EPS for Cabbage Limited and Cauliflower Limited are ₹ 3 per share and ₹ 5 per share respectively. The managements of both the companies are discussing two alternatives for exchange of shares as follows:

(i) In proportion to relative earnings per share of the two companies.

(ii) 1 share of Cauliflower Limited for two shares of Cabbage Limited.

Required:

(i) Calculate the EPS after merger under both the alternatives.

(ii) Show the impact of EPS for the shareholders of the two companies under both the alternatives. [Nov. 2014] [10 Marks]

Answer:

(i) Calculation of EPS after merger:

|

Alternative I (EPS Basis) |

Alternative II (Exchange Ratio 1:2) |

| Total Earnings (W.N.1) |

Rs. 34,00,000 |

Rs. 34,00,000 |

| Total Shares (W.N.3) |

6,80,000 |

6,50,000 |

| EPS of Cauliflower after Merger |

\( \frac{34,00,000}{6,80,000} \) = ₹ 5.00 |

\( \frac{34,00,000}{6,50,000} \) = ₹ 5.23 |

(ii) Merger impact of EPS for the shareholders of the two companies:

With EPS based Share Exchange Ratio:

|

EPS (Existing) |

EPS (After Merger) |

Change in EPS |

| Cauliflower Ltd. |

Rs. 5 |

Rs. 5 |

No Change |

| Cabbage Ltd |

Rs. 3 |

Rs. 5 × 0.6 = Rs. 3 |

No Change |

With Exchange Ratio of 1:2

| EPS |

Existing |

After Merger |

Change in EPS |

| Cauliflower Ltd. |

Rs. 5 |

Rs. 5.23 |

Increase [0.23] |

| Cabbage Ltd. |

Rs. 3 |

Rs. 5.23 × 0.5 = Rs. 2.615 |

Decrease [0.385] |

Note: While comparing the EPS (before and after merger) for the shareholders of target company (Cabbage Ltd.), the post-merger EPS has to be adjusted on the basis of Exchange Ratio.

Working Note-1 Calculation of total earnings

| Company |

Existing No. of Shares |

EPS |

Total earnings |

| Cauliflower Ltd. |

5,00,000 |

5.00 |

25,00,000 |

| Cabbage Ltd. |

3,00,000 |

3.00 |

9,00,000 |

| Total earnings |

|

Rs. 34,00,000 |

|

Working Note-2 Calculation of total shares to be issued to Cabbage Company:

No. of shares (EPS Basis) = Shares in Cabbage Ltd. × \(=\frac{\text { EPS of Cabbage }}{\text { EPS of Cauliflower }}\)

= 3,00,000 × \(\frac{\text { Rs. } 3}{\text { Rs. } 5}\) = 1,80,000 shares

No. of shares (ER 1:2) = Shares in Cabbage Ltd. × Exchange Ratio

= 3,00,000 × \(\frac{\text { Rs. } 1}{\text { Rs. } 2}\) = 1,50,000 shares

Working Note-3 Calculation of total number of shares

No. of shares after merger = 5,00,000 + 1,80,000 = 6,80,000

|

Alternative I (EPS Basis) |

Alternative II (Exchange Ratio 1:2) |

| Existing Shares |

5,00,000 |

5,00,000 |

| Fresh Shares issued |

1,80,000 |

1,50,000 |

| Total Shares |

6,80,000 |

6,50,000 |

Question 6.

East Co. Ltd. is studying the possible acquisition of Fost Co. Ltd. by way of merger. The following data are available in respect of the companies.

|

East Co. Ltd. |

Fost Co. Ltd. |

| Earning after tax (₹) |

2,00,000 |

60,000 |

| No. of equity shares |

40,000 |

10,000 |

| Market value per share (₹) |

15 |

12 |

(i) If the merger goes through by exchange of equity share and the exchange ratio is based on the current market price, what is the new earning per share for East Co. Ltd.?

(ii) Fost Co. Ltd. wants to be sure that the merger will not diminish the earnings available to its shareholders. What should be the exchange ratio in that case? [Nov. 2017] [8 Marks]

Answer:

(i) Determination of new EPS of East Ltd. (After Merger):

| Exchange Ratio |

= \(\frac{\text { Market Value of Fost Ltd }}{\text { Market Value of East Ltd. }}\) = \(\frac{12}{15}\) = 0.8

[0.8 shares of East Ltd. for every 1 share of Fost Ltd.] |

| No. of shares to be issued |

= 10,000 x 0.8 = 8,000 Shares |

| Total Shares of East Limited (after merger) |

= 40,000 + 8,000 = 48,000 Shares |

| Total Profits of East Ltd. (After Merger) |

Rs. 2,00,000 + Rs. 60,000 = Rs. 2,60,000 |

| EPS of East Ltd. (After Merger) |

= \( \frac{R s, 2,60,000}{48,000 \text { Shares }\) = Rs. 5.416 |

(ii) Exchange Ratio so that shareholder of Fost Ltd. would not be at a Loss: The shareholders of Fost Limited would not be at loss if the exchange ratio is based on EPS.

|

East Ltd. |

Fost Ltd. |

| EPS before Merger |

= \(\frac{R s .2,00,000}{40,000 \text { Shares }}\) = Rs. 5.00 |

= \(\frac{R s .60,000}{10,000 \text { Shares }}\) = Rs. 6.00 |

Exchange Ratio (with EPS as base) = \(\frac{\text { EPS of Fost Ltd. }(\text { Target Co.) }}{\text { EPS of East Ltd. }(\text { Acquirer Co. })}\) = \(\frac{R s .6}{R s .5}\) = 1.2

It means 1.2 shares of East Ltd. for every 1 share of Fost Ltd.

Shares to be issued to Fost Ltd. = 10,000 Shares × 1.2 = 12,000

Shares Total number of Shares = 40,000 + 12,000 = 52,000 Shares

EPS of East Ltd. (after merger) = \(\frac{R s .2,60,000}{R s .52,000}\) = Rs. 5.00

Verification that the shareholders of target company are not at loss:

The EPS available to Shareholders of Fost Ltd.:

Before Merger = 10,000 shares × Rs. 6 = Rs. 60,000

After Merger = Shares issued to Foster × Post merger EPS = 12,000 × 5 = Rs. 60,000

Therefore, the exchange ratio on the basis of EPS is recommended.

Question 7.

Tatu Ltd. wants to takeover Mantu Ltd. and has offered a swap ratio of 1:2 (0.5 shares for everyone share of Mantu Ltd.). Following information is provided:

|

Tatu Ltd. |

Mantu Ltd. |

| Profit after tax |

Rs. 24,00,000 |

Rs.4,80,000 |

| Equity shares outstanding (Nos.) |

8,00,000 |

2,40,000 |

| EPS |

Rs. 3 |

Rs. 2 |

| PE Ratio |

10 times |

7 times |

| Market price per share |

Rs. 30 |

Rs. 14 |

You are required to calculate:

(i) The number of equity shares to be issued by Tatu Ltd. for acquisition of Mantu Ltd.

(ii) What is the EPS of Tatu Ltd. after the acquisition?

(in) Determine the equivalent earnings per share of Mantu Ltd.

(iv) What is the expected market price per share of Tatu Ltd. after the acquisition, assuming its PE multiple remains unchanged?

(v) Determine the market value of the merged firm. [May 2018][8 Marks]

Answer:

(i) The number of equity shares to be issued by Tatu Ltd.:

= Shares in Mantu Ltd. × Exchange Ratio

= 2,40,000 × 0.5 = 1,20,000 Shares

(ii) Determination of new EPS subsequent to Merger:

| Total Shares of Tatu Limited (after merger) |

= 8,00,000 + 1,20,000 = 9,20,000 Shares |

| Total Profits of Tatu Ltd. (After Merger) |

= Rs. 24 Lakhs + Rs. 4,80,000 = Rs. 28,80,000 |

| EPS of Tatu Ltd. (After Merger) |

= \(\frac{\text { Rs. } 28,80,000}{9,20,000 \text { Shares }}\) = Rs. 3.13 |

(iii) Equivalent EPS of Mantu Limited:

= New EPS × Exchange Ratio = 3.13 × 0.5 = 1.57

(iv) New Market price of Tatu Limited (P/E remaining unchanged)

= Expected EPS × P/E Ratio = 3.13 × 10 = ₹ 31.30

(v) Market value of Merged Firm

= Total No. of Shares × Expected market price

= 9,20,000 Shares × Rs. 31.30 = Rs. 287,96,000

Question 8.

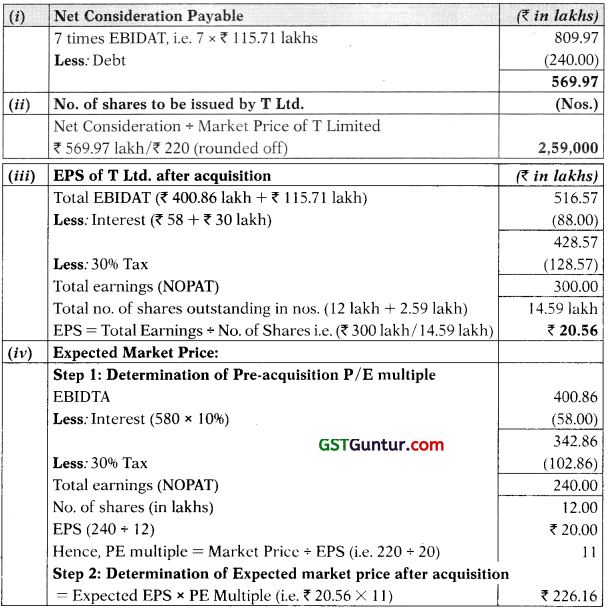

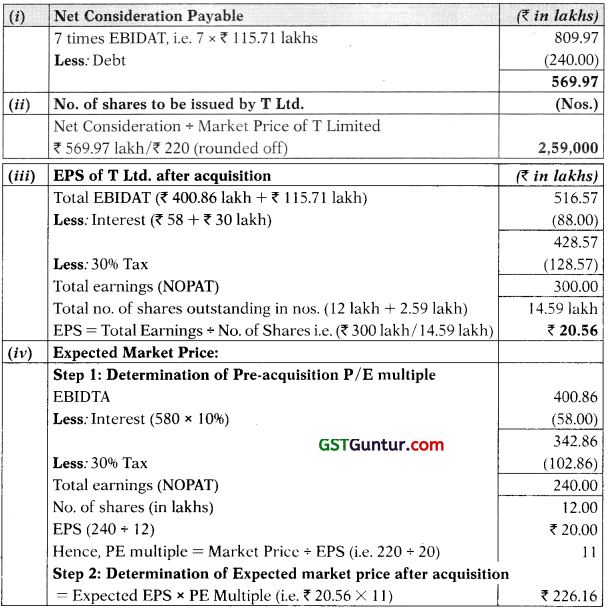

T Ltd. and E Ltd. are in the same industry. The former is in negotiation for acquisition of the latter. Important information about the two companies as per their latest financial statements is given below:

|

T Ltd. |

E Ltd. |

| Number of outstanding Equity shares @ ₹ 10 each |

12 lakhs |

6 lakhs |

| Debt: |

|

|

| 10% Debentures (₹ lakhs) |

580 |

– |

| 12.5% Institutional Loan (₹ lakhs) |

– |

240 |

| Earnings before interest, depreciation and Tax (EBI- DAT) (₹ lakhs) |

400.86 |

115.71 |

| Market Price/Share (₹) |

220.00 |

110.00 |

T Ltd. plans to offer a price for E Ltd., business as a whole which will be 7 times EBITDAT reduced by outstanding debt, to be discharged by own shares at market price.

E Ltd. is planning to seek one share in T Ltd. for every 2 shares in E Ltd. based on the market price. Tax rate for the two companies may be assumed as 30%.

Calculate and show the following under both alternatives – T Ltd.’s offer and E Ltd.’s plan:

(i) Net consideration payable.

(ii) No. of shares to be issued by T Ltd.

(iii) EPS of T Ltd. after acquisition.

(iv) Expected market price per share of T Ltd. after acquisition.

(v) State briefly the advantages to T Ltd. from the acquisition.

Calculate (except EPS) may be rounded off to 2 decimals in lakhs.

[May 2010] [16 Marks]

Answer:

As per T Ltd’s Offer

As per E Ltd’s Plan

|

(₹ in lakhs) |

| (i) Net Consideration Payable |

|

| 6 lakh shares × ₹ 110 |

660 |

| (ii) No. of shares to be issued by T Ltd. |

|

| ₹ 660 lakhs ÷ ₹ 220 |

3 lakh |

| (iii) EPS of T Ltd. after Acquisition |

|

| NPAT (as per earlier calculations) |

300.00 |

| Total no. of shares outstanding (12 lakhs – 3 lakhs) |

1 5 lakh |

| Earnings per share (EPS) ₹ 300 lakh 15 lakh |

₹ 20.00 |

| (iv) Expected Market Price (₹ 20 × 11) |

220 |

Advantage of Acquisition T Ltd.

Since the two companies are in the same industry, the following advantage could accrue:

(i) Synergy, cost reduction and operating efficiency.

(ii) Better market share

(ii) Avoidance of competition

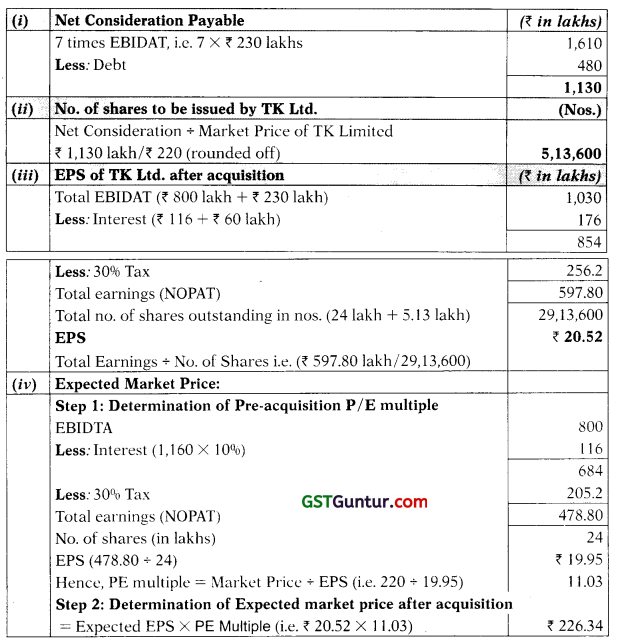

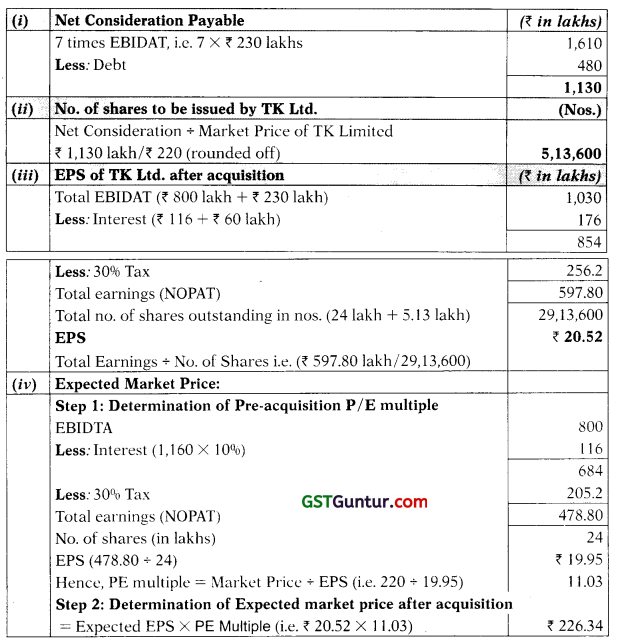

Question 9.

TK Ltd. and SK Ltd. are both in the same industry. The former is in negotiation for acquisition of the latter. Information about the two companies as per their latest financial statements are given below:

|

TK Ltd. |

SK Ltd. |

| ₹ 10 Equity shares outstanding |

24 Lakhs |

12 Lakhs |

| 10% Debentures (₹ Lakhs) |

1160 |

– |

| 12.5% Institutional loan (₹ Lakhs) |

– |

480 |

| Earnings before interest, depreciation and tax (EBIDAT) (₹ Lakhs) |

800.00 |

230.00 |

| Market Price/Share (₹) |

220.00 |

110.00 |

TK Ltd. plans to offer a price for SK Ltd. business, as a whole, which will be 7 times of EBIDAT as reduced by outstanding debt and to be discharged by own shares at market price.

SK Ltd. is planning to seek one share in TK Ltd. for every 2 shares in SK Ltd. based on the market price. Tax rate for the two companies may be assumed as 30%.

Calculate and show the following under both alternatives- TK Ltd.’s offer and SK Ltd.’s plan:

(i) Net consideration payable.

(ii) No. of shares to be issued by TK Ltd.

(iii) EPS of TK Ltd. after acquisition.

(iv) Expected market price per share of TK Ltd. after acquisition.

(v) State briefly the advantages to TK Ltd. from the acquisition.

Calculate may be rounded off to two decimals points. [Nov. 2018 New Syllabus] [12 Marks]

Answer:

As per TK Ltd’s Offer

As per SK Ltd.’s Plan

|

(₹ in lakhs) |

| (i) Net Consideration Payable |

|

| 12 lakhs shares × ₹ 110 |

1,320 |

| (ii) No. of shares to be issued by TK Ltd. |

|

| ₹ 1,320 lakhs + ₹ 220 |

6 lakh |

| (iii) EPS of TK Ltd. after Acquisition |

|

| NOPAT (as per earlier calculations) |

597.80 |

| Total no. of shares outstanding (24 lakhs – 6 lakhs) |

30 lakh |

| Earnings Per share (EPS) ₹ 597.8 lakh 30 lakh |

₹ 19.93 |

| (iv) Expected Market Price (₹ 19.93 × 11) |

₹ 219.23 |

Advantage of Acquisition TK Ltd

Since the two companies are in the same industry, the following advantage could accrue.

(i) Synergy, cost reduction and operating efficiency.

(ii) Better market share.

(iii) Avoidance of competition.

Question 10

LMN Ltd. is considering merger with XYZ Ltd. LMN Ltd’s shares are currently traded at ₹ 30.00 per share. It has 3,00,000 shares outstanding. Its earnings after taxes (EAT) amount to ₹ 6,00,000. XYZ Ltd. has 1,60,000 shares outstanding and its current market price is ? 15.00 per share and its earnings after taxes (EAT) amount to ₹ 1,60,000. The merger is decided to be effected by means of a stock swap (exchange). XYZ Ltd. has agreed to a proposal by which LMN Ltd. will offer the current market value of XYZ Ltd’s shares.

Find out:

(i) The pre-merger earning per share (EPS) and price/earnings (P/E) ratios of both the companies.

(ii) If XYZ Ltd’s P/E Ratio is 9.6, what is its current Market Price? What is the Exchange Ratio? What will LMN Ltd.’s post-merger EPS be?

(iii) What should be the exchange ratio; if LMN Ltd.’s pre-merger and post-merger EPS are to be the same? [May 2012] [8 Marks]

Answer:

(i) Determination of Pre-merger EPS and P/E ratios:

| Particulars |

LMN Ltd.

(Acquirer) |

XYZ Ltd.

(Target) |

| Earnings after taxes |

6,00,000 |

1,60,000 |

| Number of shares outstanding |

3,00,000 |

1,60,000 |

| (Earnings per share) EPS (Rs. per share) |

2 |

1 |

| Market Price per share |

30 |

15 |

| P/E Ratio (times) |

15 |

15 |

(ii) Current Market Price of XYZ Ltd. if P/E ratio is 9.6

Current Market Price of XYZ = P/E Ratio × EPS = ₹ 1 × 9.6 = ₹ 9.60

Exchange ratio = \(\frac{\text { Market Price of Target Co. }(X Y Z \text { Lld. })}{\text { Market Price of Acquirer Co. }(L M N \text { Lid. })}\) = \(\frac{9.6}{30}\) = 32

Shares to be issued = 1,60,000 × 0.32 = 51,200 Shares

Post-merger EPS of LMN Ltd. = \(\frac{6,00,000+1,60,000}{3,00,000+51,200}\) = \(\frac{7,60,000}{3,51,200}\) = ₹ 2.16

(iii) Desired Exchange Ratio:

Exchange ratio = \(=\frac{\text { EPS of Target } C o .(X Y Z \text { Ltd.) }}{\text { EPS of Acquirer Co.(LMN Ltd.) }}\) = \(\frac{1}{2}\) = 0.5

Shares to be issued = 1,60,000 × 0.5 = 80,000 Shares

Post-merger EPS of LMN Ltd. = \(\frac{6,00,000+1,60,000}{3,00,000+80,000}\) = \(\frac{7,60,000}{3,80,200}\) = ₹ 2

Verification:

Before Merger = ₹ 1

Equivalent post-merger = ₹ 2 × 0.5 (exchange Ratio) = ₹ 1

Alternative Method of computation:

| Total number of shares in post merged company |

= \(\frac{\text { Post-merger earnings }}{\text { pre-merger EPS of LMN Ltd. }}\) = \( \frac{7,60,000}{2} \) = 3,80,000 shares |

| Number of shares required to be issued to XYZ Ltd. |

= 3,80,000 – 3,00,000 = 80,000 shares |

| Therefore, the exchange ratio (ER) should be |

= 80,000 : 1,60,000 = \(\frac{80,000}{1,60,000}\) = 0.50 |

Question 11.

XYZ Ltd. wants to purchase ABC Ltd. by exchanging 0.7 of its share for each share of ABC Ltd., Relevant financial data are as follows:

|

XYZ Ltd. |

ABC Ltd. |

| Equity shares outstanding (in numbers) |

10,00,000 |

4,00,000 |

| EPS (₹) |

40 |

28 |

| Market price per share (₹) |

253 |

160 |

(i) Illustrate the impact of merger on EPS of both the companies.

(ii) The management of ABC Ltd. has quoted a share exchange ratio of 1:1 for the merger. Assuming that P/E ratio of XYZ Ltd. will remain unchanged after the merger, what will be the gain from merger for ABC Ltd.?

(iii) What will be the gain/loss to shareholders of XYZ Ltd.?

(iv) Determine the maximum exchange ratio acceptable to shareholders of XYZ Ltd. [Nov. 2015] [10 Marks]

Answer:

Calculation of Earnings and P/E Ratio:

|

Earnings (EPS × No. of Shares) |

P/E Ratio(MPS + EPS) |

| XYZ Ltd. |

10,00,000 × 40 = ₹ 400 Lakhs |

Rs. 250 ÷ 40 = 6.25 |

| ABC Ltd. |

4,00,000 × 28 = ₹ 112 Lakhs |

Rs. 160 ÷ 28 = 5.71 |

Calculation of EPS after merger:

Share to be issued by XYZ to ABC = 4,00,000 × 1.7 = 2,80,000 shares

EPS = \(\frac{\text { Rs. } 400 \text { Lakhs }+ \text { Rs. } 112 \text { Lakhs }}{10 \text { Lakhs + 2.8 Lakhs Shares }}\) = \(\frac{\text { Rs. } 512 \text { Lakhs }}{12.8 \text { Lakh Shares }}\) = ₹ 40

(i) Merger impact of EPS with Exchange Ratio 0.7

|

EPS (Existing) |

EPS (After Merger) |

Change in EPS |

| XYZ Ltd. |

₹40 |

₹40 |

No Change |

| ABC Ltd. |

₹28 |

₹4 × 0.7 = ₹ 28 |

No Change |

(ii) Gain from Merger if Exchange Ratio is 1:1

Share to be issued by XYZ to ABC = 4,00,000 × 1 = 4,00,000 shares

EPS = \(=\frac{\text { Rs. } 400 \text { Lakhs }+ \text { Rs. } 112 \text { Lakhs }}{10 \text { Lakhs }+4 \text { Lakhs Shares }}\) = \(\frac{\text { Rs. } 512 \text { Lakhs }}{14 \text { Lakh Shares }}\) = ₹ 36.57

Market Price of Share = ₹ 36.57 × 6.25 = ₹ 228.56

Market Price (Before Merger of ABC) = ₹ 160

Gain from Merger = ₹ 68.56

(iii) Gain/Loss from the Merger to the shareholders of XYZ Ltd.

Market Price of Share = ₹ 228.56

Market Price (Before Merger of ABC) = ₹ 250

Loss from Merger (per share) = ₹ 21.44

(iv) Maximum Exchange Ratio acceptable to XYZ Ltd. Shareholders

|

₹ in Lakhs |

| Market Value of Merged Entity (₹ 228.57 × 14,00,000) |

3,199.98 |

| Less: Value acceptable to shareholders of XYZ Ltd. |

2,500.00 |

| Value of Merged Entity available to shareholders of ABC Ltd. |

699.98 |

| Market Price per share |

250.00 |

| No. of shares to be issued to shareholders of ABC Ltd. (Lakhs) |

2.80 |

Thus, maximum ratio of issue shall be 2.80:4.00 or 0.70 share of XYZ Ltd. for one share of ABC Ltd.

Question 12.

A Lid., a listed company, is considering merger of B Ltd. which is also a listed company, with itself by means of a stock swap (exchange). B Ltd. has agreed to a plan under which A Ltd. will offer the current market value of B Ltd’s shares.

Additional Information :

| Particulars |

A Ltd. |

B Ltd. |

| Earnings after tax (Rs.) |

10,00,000 |

2,50,000 |

| Number of shares outstanding |

4,00,000 |

2,00,000 |

| Current market price (Rs.) per share |

50 |

20 |

On the basis of above information, you required to calculate the following:

(i) What is the pre-merger Earnings Per Share (EPS) and P/E ratios of both the companies?

(ii) If B Ltd.’s P/E is 10, what will be its current market price per share ? What will be the exchange ratio on the basis of such market price? What will be the A Ltd.’s post-merger EPS?

(iii) What must be the exchange ratio if A Ltd.’s Pre-merger and Post-merger EPS to be the same? [Nov. 2019, Modified] [8 Marks]

Answer:

(i) Calculation of Pre-merger EPS & P/E Ratio

|

EPS = Earnings ÷ No. of Shares |

P/E Ratio = MPS ÷ EPS |

| A Ltd. |

\(\frac{\mathrm{Rs} .10,00,000}{4,00,000}\) = Rs. 2.50 |

Rs. 50 ÷ 2,5 = 20 Times |

| B Ltd. |

\(\frac{\text { Rs. } 2,50,000}{2,00,000}\) = Rs. 1.25 |

Rs. 20 ÷ 1.25 = 16 Times |

(ii) Current Market Price of B Ltd. if P/E is 10

EPS (B Ltd.) = Rs. 1.25

P/E Ratio = 10 times

Market Price = 1.25 × 10 = Rs. 12.50

Exchange Ratio (ER) on the basis of Revised Market Price

Exchange Ratio = \(\frac{\text { Market Price of B Ltd. }}{\text { Market Price of A Ltd. }}\) = \(\frac{12.50}{50}\) = 0.25

Share to be issued by A Ltd. to B Ltd. = 2,00,000 × 0.25 = 50,000 shares.

Post Merger EPS of A Ltd.

EPS (A Ltd.) = \(\frac{10,00,000+2,50,000}{4,00,000+50,000}\) = Rs. 2.78

(iii) Required Exchange Ratio to maintain EPS of A Ltd.

The pre-merger and post-merger EPS would be the same if Exchange Ratio is based on EPS. It may be determined as under:

Exchange Ratio = \(\frac{\text { EPS of B Ltd. (Target Company) }}{\text { EPS of A Ltd. (Acquiring Company) }}\) = \(\frac{1.25}{2.50}\) = 0.5

Verification:

EPS (After Acquisition) = \(\frac{10,00,000+2,50,000}{4,00,000+(2,00,000 \times 0.5)}\) = Rs. 2.50

Question 13.

A Ltd. wants to acquire T Ltd. and has offered a swap ratio of 1:2 (0.5 shares for every one share of T Ltd.). Following information is provided:

|

A Ltd. |

T Ltd. |

| Profit after tax (₹) |

18,00,000 |

3,60,000 |

| Equity shares outstanding (Nos.) . |

6,00,000 |

1,80,000 |

| EPS (₹) |

3 |

2 |

| PE Ratio |

10 times |

7 times |

| Market price per share (₹) |

30 |

14 |

(i) The number of equity shares to be issued by A Ltd. for acquisition of T Ltd.

(ii) What is the EPS of A Ltd. after the acquisition?

(iii) Determine the equivalent earnings per share of T Ltd.

(iv) What is the expected market price per share of A Ltd. after the acquisition, assuming its PE multiple remains unchanged?

(v) Determine the market value of the merged firm. [Nov. 2007] [10 Marks]

Answer:

(i) The number of shares to be issued by A Ltd.:

The Exchange ratio is 0.5

So, new Shares = 1,80,000 × 0.5 = 90,000 shares.

(ii) EPS of A Ltd. after acquisition:

Total Earnings (₹ 18,00,000 + ₹ 3,60,000) = ₹ 21,60,000

No. of Shares (6,00,000 + 90,000) = 6,90,000

EPS (₹ 21,60,000/6,90,000) = ₹ 3.13

(iii) Equivalent EPS of T Ltd.:

No. of new Shares = 0.5

EPS = ₹ 3.13

Equivalent EPS (₹ 3.13 × 0.5) = ₹ 1.57

(iv) New Market Price of A Ltd. (P/E remaining unchanged):

Present P/E Ratio of A Ltd. = 10 times

Expected EPS after merger = ₹ 3.13

Expected Market Price (₹ 3.13 × 10) = ₹ 31.30

Market Value of merged firm:

Total number of Shares = 6,90,000

Expected Market Price = ₹ 31.30

Total’ alue (6,90,000 × 31.30) = ₹ 2,15,97,000

Question 14.

ABC Ltd. is intending to acquire XYZ Ltd. by merger and the following information is available in respect of the companies:

|

ABC Ltd. |

XYZ Ltd. |

| Number of equity shares |

10,00,000 |

6,00,000 |

| Earnings after tax (₹) |

50,00,000 |

18,00,000 |

| Market value per share (₹) |

42 |

28 |

Required:

(i) What is the present EPS of both the companies?

(ii) If the proposed merger takes place, what would be the new earning per share for ABC Ltd.? Assume that the merger takes place by exchange of equity shares and the exchange ratio is based on the current market ‘ price.

(iii) What should be exchange ratio, if XYZ Ltd. wants to ensure the earnings to members are as before the merger takes place? [May 2004] [8 Marks]

Answer:

(i) Earnings per share = Earnings after tax/No. of equity shares

ABC Ltd. = ₹ 50,00,000/10,00,000 = ₹ 5

XYZ Ltd. = ₹ 18,00,000/6,00,000 = ₹ 3

(it) Number of Shares XYZ limited’s shareholders will get in ABC Ltd. based on market value per share = ₹ 28/42 × 6,00,000 = 4,00,000 shares

Total number of equity shares of ABC Ltd. after merger = 10,00,000 + 4,00,000 = 14,00,000 shares.

Earnings per share after merger = (₹ 50,00,000 + 18,00,000)/14,00,000 = ₹ 4.86

(iii) Calculation of exchange ratio to ensure shareholders of XYZ Ltd. to earn the same as was before merger:

Shares to be exchanged based on EPS = (₹ 3/₹ 5) × 6,00,000 = 3,60,000 shares

EPS after merger = (₹ 50,00,000 + 18,00,000)/13,60,000 = ₹ 5

Total earnings in ABC Ltd. available to shareholders of XYZ Ltd. = 3,60,000 × ₹5 = ₹ 18,00,000.

Thus, to ensure that Earning to members are same as before, the ratio of exchange should be 0.6 share for 1 share.

Question 15.

XYZ Ltd. is considering merger with ABC Ltd. XYZ Ltd.’s shares are currently traded at ₹ 25. It has 2,00,000 shares outstanding and its earnings after taxes (EAT) amount to ₹ 4,00,000. ABC Ltd. has 1,00,000 shares outstanding: its current market price is ₹ 12.50 and its EAT is ₹ 1,00,000. The merger will be effected by means of a stock swap (exchange). ABC Ltd. has agreed to a plan under which XYZ Ltd. will offer the current market value of ABC Ltd.’s shares.

(i) What is the pre-merger earnings per share (EPS) and P/E ratios of both the companies?

(ii) If ABC Ltd.’s P/E ratio is 8, what is its current market price? What is the exchange ratio? What will XYZ Ltd.’s post merger EPS be?

(iii) What must the exchange ratio be for XYZ Ltd.’s pre-merger and postmerger EPS to be the same? [May 2005] [8 Marks]

Answer:

(i) Determination of Pre-merger EPS and P/E ratios:

| Particulars |

XYZ Ltd. (Acquirer) |

ABC Ltd.

(Target) |

Earnings After taxes (₹)

Number of shares outstanding |

4,00,000

2,00,000 |

1,00,000

1,00,000 |

| (Earnings per share) EPS (₹ per share) share) |

2 |

1 |

| Market Price per share (₹) |

25 |

12.5 |

| P/E Ratio (times) |

12.5 |

12.5 |

(ii) Current Market Price of ABC Ltd. if P/E ratio is 8

Current Market Price of ABC = P/E Ratio × EPS = 8 × ₹ 1 = ₹ 8

Exchange ratio = \(\frac{\text { Market Price of Target Co. }(A B C \text { Ltd. })}{\text { Market Price of Acquirer }{Co}(X Y Z ~ L t d .)}\) = \(\frac{8}{25}\) = 32

Shares to be issued = 1,00,000 × 0.32 = 32,000 Shares

Post-merger EPS of XYZ Ltd. = \(\frac{4,00,000+1,00,000}{2,00,000+32,000}=\frac{5,00,000}{2,32,000}\) = ₹ 2.16

(iii) Desired Exchange Ratio:

Exchange ratio = \(\frac{\text { EPS of Target Co. (ABC Ltd.) }}{\text { EPS of Acquirer Co. (XYZ Ltd.) }}\) = \(\frac{1}{2}\) = 0.5

Shares to be issued = 1,00,000 × 0.5 = 50,000 Shares

Post-merger EPS of XYZ Ltd. = \(\frac{4,00,000+1,00,000}{2,00,000+50,000}=\frac{5,00,000}{2,50,000}\) = ₹ 2

Verification:

Before Merger = ₹ 1

Equivalent post-merger = ₹ 2 × 0.5 (exchange Ratio) = ₹ 1

Alternative Method of computation:

| Total number of shares in post-merged company |

= \(\frac{\text { Post }- \text { merger earnings }}{\text { pre }- \text { merger EPS of XYZ Ltd. }}\)

= \(\frac{5,00,000}{2}\) = 2,50,000 Shares |

| Number of shares required to be issued to ABC Ltd. |

= 2,50,000 – 2,00,000 = 50,000 Shares |

| Therefore, the exchange ratio (ER) should be |

= 50,000 : 1,00,000 = \( \frac{50,000}{1,00,000} \) = 0.50 |

Question 16.

M Co. Ltd., is studying the possible acquisition of N Co. Ltd., by way of merger. The following data are available in respect of the companies:

| Particulars |

M Co. Ltd. |

N Co. Ltd. |

| Earnings after tax (₹) |

80,00,000 |

24,00,000 |

| No. of equity shares |

16,00,000 |

4,00,000 |

| Market value per share (₹) |

200 |

160 |

(i) If the merger goes through by exchange of equity and the exchange ratio is based on the current market price, what is the new earning per share for M Co. Ltd.?

(ii) N Co. Ltd. wants to be sure that the earnings available to its shareholders will not be diminished by the merger. What should be the exchange ratio in that case? [Nov. 2003] [8 Marks]

Answer:

(i) Determination of new EPS of M Ltd. (After Merger):

| Exchange Ratio |

= \(\frac{\text { Market Value of } N L t d}{\text { Market Value of } M L t d .}\) = \(\frac{160}{200\) = 0.

[0.8 shares of M Ltd. for every 1 share of N Ltd.] |

| No. of shares to be issued |

= 4,00,000 × 0.8 = 3,20,000 Shares |

| Total Shares of M Limited (after merger) |

= 16,00,000 + 3,20,000 = 19,20,000 Shares |

| Total Profits of M Ltd. (After Merger) |

₹ 80,00,000 + ₹ 24,00,000 = ₹ 104,00,000 |

| EPS of M Ltd. (After Merger) |

= \(\frac{R s \cdot 104,00,000}{19,20,000 \text { Shares }}\) = ₹ 5.416 |

(ii) Exchange Ratio so that shareholder of N Ltd. would not be at a Loss:

The shareholders of N Limited would not be at loss if the exchange ratio is based on EPS.

|

M Ltd. |

N Ltd. |

| EPS before Merger |

= \(\frac{R s \cdot 80,00,000}{16,00,000 \text { Shares }}\) = ₹ 5.00 |

= \(\frac{R s .24,00,000}{4,00,000 \text { Shares }}\) = ₹ 60 |

Exchange Ratio (with EPS as base) = \(\frac{E P S \text { of } N L t d .(\text { Target Co.) }}{E P S \text { of } M L t d .(\text { Acquirer Co.) }}\)

= \(\frac{R s .6}{R s .5}\) = 1.2

It means 1.2 shares of M Ltd. for every 1 share of N Ltd.

Shares to be issued to N Ltd. = 4,00,000 Shares × 1.2 = 4,80,000 Shares

Total number of Shares = 16,00,000 + 4,80,000 = 20,80,000 Shares

EPS of M Ltd. (after merger) = \(\frac{\text { Rs. } 80,00,000+R s .24,00,000}{\text { Rs.20,80,000 }}\) = ₹ 500

Verification that the shareholders of target company are not at loss:

The EPS available to Shareholders of N Ltd.:

Before Merger = 4,00,000 shares × ₹ 6 = ₹ 24,00,000

After Merger = Shares issued to N × Post merger EPS

= 4,80,000 × 5 = ₹ 24,00,000

Therefore, the exchange ratio on the basis of EPS is recommended.

Question 17.

The following information is provided related to the acquiring Mark Limited and the target Mask Limited:

|

Mark Limited |

Mask Limited |

| Earnings after tax (₹) |

2,000 lakhs |

400 lakhs |

| Number of shares outstanding |

200 lakhs |

100 lakhs |

| P/E ratio (times) |

10 |

5 |

Required:

(i) What is the Swap Ratio based on current market prices?

(ii) What is the EPS of Mark Limited after acquisition?

(iii) What is the expected market price per share of Mark Limited after acquisition, assuming P/E ratio of Mark Limited remains unchanged?

(iv) Determine the market value of the merged firm.

(v) Calculate gain/loss for shareholders of the two independent companies after acquisition. [Nov. 2004] [8 Marks]

Answer:

(i) Determination of SWAP Ratio based on Current Market Price:

Determination of Current Market Price Per Share:

| Particulars |

Mark Ltd. (Acquirer) |

Mask Ltd. (Target) |

Earnings After taxes (₹)

Number of shares outstanding |

2,000 Lakhs

200 Lakhs |

400 Lakhs

100 Lakhs |

| EPS (Earnings per share) |

₹ 10 |

₹ 4 |

| P/E Ratio (times) |

10 |

5 |

| Market Price per share |

₹ 100 |

₹ 20 |

Determination of SWAP Ratio:

Exchange Ratio = \(\frac{\text { Market Value of Mask Ltd. }(\text { Target Co. })}{\text { Market Value of Mark Ltd. }(\text { Acquiring Co. })}\) = \(\frac{20}{100}\) = 0.2

[0.2 share of Mark Ltd. for every 1 share of Mask Ltd.]

(ii) Determination of EPS of Mark Limited after acquisition:

| Exchange Ratio |

0.2 |

| No. of shares to be issued |

= 100 Lakhs × 0.2 = 20 Lakhs Shares |

| Total Shares of Mark Limited (after merger) |

= 200 Lakhs + 20 Lakhs = 220 Shares |

| Total Profits of Mark Ltd. (After Merger) |

= ₹ 2,000 + ₹ 400 = ₹ 2,400 Lakhs |

| EPS of Mark Ltd. (After Merger) |

= \(\frac{\text { Rs. 2,400 Lakhs }}{220 \text { Lakhs Shares }}\) = ₹ 10.91 |

(iii) Determination of Expected Market Price of Mark Limited after acquisi-tion:

P/E ratio of new firm (expected to remain same) = 10 times

New market price (10 × ₹ 10.91) = ₹ 109.10

(iv) Market value of merged firm

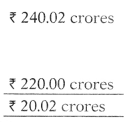

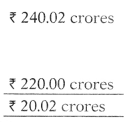

= ₹ 109.10 market price × 220 lakhs shares = ₹ 240.02 crores

(v) Gain from the merger

Post merger market value of the merged firm = ₹ 240.02 crores

Less: Pre-merger market value

Mark Ltd. 200 Lakhs × ₹ 100 = 200 crores

Mask Ltd. 100 Lakhs × ₹ 20 = 20 crores = ₹ 220.00 crores

Gain from merger = ₹ 20.02 crores

Appropriation of gains from the merger among shareholders:

|

Mark Ltd. |

Mask Ltd. |

| Post-merger value

Less: Pre-merger market value |

218.20 crores

200.00 crores |

21.82 crores

20.00 crores |

| Gain to Shareholders |

18.20 crores |

1.82 crores |

Question 18.

Following information is provided relating to the acquiring company Mani Ltd. and the target company Ratnam Ltd:

|

Mani Ltd. |

Ratnam Ltd. |

| Earnings after tax (₹ in lakhs) |

2,000 |

4,000 |

| Number of shares outstanding (lakhs) |

200 |

1,000 |

| P/E ratio (No. of times) |

10 |

5 |

Required:

(i) What is the swap ratio based on current market prices?

(ii) What is the EPS of Mani Ltd. after the acquisition?

(iii) What is the expected market price per share of Mani Ltd. after the acquisition, assuming its P/E ratio is adversely affected by 10%? [June 2009] [10 Marks]

Answer:

(i) Determination of SWAP Ratio based on Current Market Price:

Determination of EPS and Current Market Price before acquisition:

| Particulars |

Mani Ltd. (Acquirer) |

Ratnam Ltd. (Target) |

Earnings After taxes (₹)

Number of shares outstanding |

2,000 Lakhs

200 Lakhs |

4,0000 Lakhs

1,0000 Lakhs |

| P/E Ratio (times) |

10 |

5 |

| EPS (Earnings per share) ₹ |

10 |

4 |

| Market Price per share ₹ |

100 |

20 |

Determination of SWAP Ratio:

Exchange Ratio = \(\frac{\text { Market Value of Ratnam Ltd. (Target } C o .)}{\text { Market Value of Mani Ltd. }(\text { Acquiring Co.) }}\) = \(\frac{20}{100}\) = 0.2

[0.2 share of Mani Ltd. for every 1 share of Ratnam Ltd.]

(ii) Determination of EPS of Mani Limited after acquisition:

| Exchange Ratio |

0.2 |

| No. of shares to be issued |

= 1,000 Lakhs × 0.2 = 200 Lakhs Shares |

| Total Shares of Mani Limited (after merger) |

= 200 Lakhs + 200 Lakhs = 400 Shares |

| Total Profits of Mani Ltd. (After Merger) |

= ₹ 2,000 + ₹ 4,000 = ₹ 6,000 Lakhs |

| EPS of Mani Ltd. (After Merger) |

= \(\frac{\text { Rs.6,000 Lakhs }}{400 \text { Lakhs Shares }}\) = ₹ 15 |

(iii) Determination of Expected Market Price of Mani Limited after acquisition:

EPS after acquisition ₹ 15

P/E ratio (after acquisition) = 10 × 0.9 = 9 times

New market price (9 × ₹ 15) = ₹ 135

(iv) Market value of merged company:

= ₹ 135 × 400 Lakh Shares = ₹ 54,000 Lakhs or ₹ 540 Crores

(v) Gain from the merger

|

Mani Ltd. |

Ratnam Ltd. |

| Total value before acquisition Less: Value after acquisition |

200 crores

270 crores |

200 crores

270 crores |

| Total Gain |

70 crores |

70 crores |

| No. of shares (pre-merger) (Lakhs) |

200 |

1,000 |

| Gain per share (₹) |

35 |

7 |

Question 19.

ABC Ltd. is a company operating in the software industry. It is considering the acquisition of XYZ Ltd. which is also into software industry. The following information are available for the companies:

|

ABC Ltd, |

XYZ Ltd, |

| Earnings after tax (Rs.) |

9,00,000 |

2,40,000 |

| Number of equity shares |

1,50,000 |

60,000 |

| P/E ratio (no. of times) |

14 |

10 |

ABC Ltd. is planning to offer a premium of 25% over the market price of XYZ Ltd. Required:

(i) What is the swap ratio based on current market price ?

(ii) Find the number of shares to be issued by ABC Ltd. to the shareholders of XYZ Ltd.

(iii) Compute the new EPS of ABC Ltd. after merger and comment on the impact of merger.

(iv) Determine the market price of the share when P/E ratio remains unchanged.

(v) Compute the market price when P/E declines to 12 and comment on the results. Figures are to be rounded off to 2 decimals. [Nov. 2019 Old Syllabus] [10 Marks]

Answer:

(i) Determination of SWAP Ratio based on Current Market Price:

Determination of EPS and Current Market Price before acquisition:

| c |

ABC Ltd. (Acquirer) |

XYZ Ltd. (Target) |

| Earnings after tax (Rs.) |

9,00,000 |

2,40,000 |

| Number of shares outstanding |

1,50,000 |

60,000 |

| P/E Ratio (times) |

14 |

10 |

| EPS (Earnings per share) Rs. |

6 |

4 |

| Market Price per share Rs. |

84 |

40 |

Determination of SWAP Ratio Based on Current Market Price:

The Premium offered by ABC Limited has not been considered as SWAP ratio is to be calculated on the basis of Current Market Price.

Exchange Ratio = \(\frac{\text { Market Value of XYZ Ltd. (T arg et Co.) }}{\text { Market Value of ABC Ltd. (Acquring Co.) }}\) = \(\frac{0 \times 1.25}{84}\) = 0.6

[0.6 share of ABC Ltd. for every 1 share of XYZ Ltd.]

(ii) Determination of No. of Shares:

Exchange Ratio = 0.6 (as calculated above)

Agreed Exchange Ratio = 0.60

No. of Shares of XYZ Ltd. = 60,000

Share to be issued by ABC Ltd. = 60,000 × 0.6 = 36,000 shares.

(iii) Determination of EPS of ABC Limited after acquisition:

| No. of shares issued |

= 36,000 Shares |

| Total Shares of ABC Limited (after merger) |

= 1,50,000 + 36,000 = 1,86,000 Shares |

| Total Profits of ABC Ltd. (After Merger) |

= Rs.9,00,000 + 2,40,000 = 11,40,000 |

| EPS of ABC Ltd. (After Merger) |

= \(\frac{\text { Rs. } 11,40,000}{1,86,000 \text { Shares }}\) = Rs. 6.13 |

(iv) Determination of Expected Market Price of ABC Limited after acquisition if P/E ratio remains unchanged:

EPS after Acquisition = Rs. 6.13

New Market Price (14 × Rs. 6.13) = Rs. 85.82

(v) Determination of Expected Market Price of ABC Limited after acquisition if P/E ratio declines to 12:

EPS after acquisition = Rs. 6.13

Declined P/E ratio (after acquisition) = 12 times

Resultant New market price (12 × Rs. 6.13) = Rs. 73.56

Question 20.

P Ltd. is considering takeover of R Ltd. by the exchange of four new shares in P Ltd. for every five shares in R Ltd. The relevant financial details of the two companies prior to merger announcement are as follows:

|

P Ltd. |

R Ltd. |

| Profit before Tax (₹ Crore) |

15 |

13.50 |

| No. of Shares (Crore) |

25 |

15 |

| P/E Ratio |

12 |

9 |

| Corporate Tax Rate 30% |

|

|

You are required to determine:

(i) Market value of both the company.

(ii) Value of original shareholders.

(iii) Price per share after merger.

(iv) Effect on share price of both the company if the Directors of P Ltd. expect their own pre-merger P/E ratio to be applied to the combined earnings. [Nov. 2010 (Modified)] [10 Marks]

Answer:

|

P Ltd. |

R Ltd. |

| Profit before Tax (₹ in crore) |

15 |

13.50 |

| Tax 30% (₹ in crore) |

4.50 |

4.05 |

| Profit after Tax (₹ in crore) |

10.50 |

9.45 |

| Earning per Share (₹) |

\(\frac{10.50}{25}\) = ₹ 0.42 |

\(\frac{9.45}{15}\)= ₹ 0.63 |

| Price of Share before Merger |

₹ 0.42 × 12 |

0.63 × ₹ 9 |

| (EPS X P/E Ratio) |

= ₹ 5.04 |

= ₹ 5.67 |

(i) Market Value of company

P Ltd. = ₹ 5.04 × 25 Crore = ₹ 126 crore

R Ltd. = ₹ 5.67 × 15 Crore = ₹ 85.05 crore

Combined = ₹ 126 + ₹ 85.05 = ₹ 211.05 Crores

After Merger

|

P Ltd. |

R Ltd. |

| No. of Shares |

25 crores |

15 × \(\frac{4}{5}\) = 12 crores |

| Combined |

37 crores |

| % of Combined Equity Owned |

\(\frac{25}{37}\) × 100 = 67.57% |

\(\frac{12}{37}\) × 100 = 32.43% |

(ii) Value of Original Shareholders

| P Ltd. |

R Ltd. |

| ₹ 211.05 crore × 67.57% = ₹ 142.61 |

₹ 211.05 crore × 32.43% = ₹ 68.44 |

(iii) Price per Share after Merger

EPS = ₹ \(\frac{₹ 19.95 \text { crore }}{37 \text { crore }}\) = ₹ 0.539 per share

P/E Ratio = 12

Market Value per Share = ₹ 0.539 × 12 = ₹ 6.47

Total Market Value = ₹ 6.47 × 37 crore = ₹ 239.39 crore

Price of Share = \(\frac{\text { Market Value }}{\text { Number of Shares }}\) = \(\frac{239.39 \text { crore }}{37 \text { crore }}\) = ₹ 6.47

(iv) Effect on Share Price

| MPS before merger |

₹ 5.04 |

₹ 5.67 |

MPS after merger

(Equivalent for R Ltd.) |

₹ 6.47 |

6.47 × \(\frac{4}{5}\) = ₹ 5.18 |

| Gain (Loss) per share |

₹ 1.43 (Gain) |

₹ 0.49 (Loss) |

| Change in share price |

= \(\frac{1.43}{5.04}\) × 100

= 0.284

= 28.4%Rise in share price |

= \(\frac{-0.49}{5.67}\) × 100

= – 0.0864

(- ve) 8.64%

Decrease in share price |

Question 21.

Reliable Industries Ltd. (RIL) is considering a takeover of Sunflower Industries Ltd. (SIL). The particulars of 2 companies are given below:

| Particulars |

Reliable Industries Ltd. |

Sunflower Industries Ltd. |

| Earnings After Tax (EAT) |

₹ 20,00,000 |

₹ 10,00,000 |

| Equity shares Outstanding |

10,00,000 |

10,00,000 |

| Earnings per share (EPS) |

2 |

1 |

| P/E Ratio (Times) |

10 |

5 |

Required:

(i) What is the market value of each Company before merger?

(ii) Assume that the management of RIL estimates that the shareholders of SIL will accept an offer of one share of RIL for four shares of SIL.

If there are no synergic effects, what is the market value of the Postmerger RIL? What is the new price per share? Are the shareholders of RIL better or worse off than they were before the merger?

(iii) Due to synergic effects, the management of RIL estimates that the earnings will increase by 20%. What are the new post-merger EPS and Price per share? Will the shareholders be better off or worse off than before the merger? [May 2006] [8 Marks]

Answer:

(i) Market value of Companies before Merger

| Particulars |

RIL |

SIL |

| EPS |

₹ 2 |

₹ 1 |

| P/E Ratio |

10 |

5 |

| Market Price Per Share |

₹ 20 |

₹ 5 |

| Equity Shares |

10,00,000 |

10,00,000 |

| Total Market Value |

2,00,00,000 |

50,00,000 |

(ii) Post-Merger Effects on RIL

|

₹ |

| Post-merger earnings |

30,00,000 |

| Exchange Ratio (1:4) |

|

| No. of equity shares outstanding (10,00,000 + 2,50,000) |

12,50,000 |

| EPS : 30,00,000/12,50,000 |

2.4 |

| P/E Ratio |

10 |

| Market Value (10 × 2.4) |

24 |

| Total Value (12,50,000 × 24) |

3,00,00,000 |

Gains from Merger:

Apportionment of Gains between the Shareholders:

| Particulars |

RIL (₹) |

SIL (₹) |

| Post Merger Market Value: |

10,00,000 × 24 = 2,40,00,000 |

2,50,000 × 24 = 60,00,000 |

| Less: Pre-Merger Market Value |

2,00,00,000 |

50,00,000 |

| Gains from Merger |

40,00,000 |

10,00,000 |

Thus, the shareholders of both the companies (RIL + SIL) are better off than before

(iii) Post-Merger Earnings:

| Increase in Earnings by 20% |

|

| New Earnings = ₹ 30,00,000 × (1 + 0.20) |

₹ 36,00,000 |

| No. of equity shares outstanding |

12,50,000 |

| EPS (₹ 36,00,000/12,50,000) |

₹ 2.88 |

| P/E Ratio |

10 |

| Market Price Per Share = ₹ 2.88 × 10 |

= ₹ 28.80 |

| Shareholders will be better-off than before the merger situation. |

|

Question 22.

The CEO of a company thinks that shareholders always look for EPS. Therefore he considers maximization of EPS as his company’s objective. His company’s current Net Profits are ₹ 80 lakhs and P/E multiple is 10.5. He wants to buy another firm which has current income of ₹ 15.75 lakhs & P/E multiple of 10.

What is the maximum exchange ratio which the CEO should offer so that he could keep EPS at the current level, given that the current market price of both the acquirer and the target company are ₹ 42 and ₹ 105 respectively₹

If the CEO borrows funds at 15% and buys out Target Company by paying cash, how much should he offer to maintain his EPS₹ Assume tax rate of 30%. [May 2016] [8 Marks]

Answer:

(i) Determination of Maximum Exchange Ratio

|

Acquirer Company |

Target Company |

| Net Profit |

₹ 80 Lakhs |

₹ 15.75 Lakhs |

| P/E multiple |

10.50 |

10.00 |

| Market Capitalisation |

₹ 840 Lakhs |

₹ 157.50 Lakhs |

| Market Price |

₹ 42 |

₹ 105 |

| No. of Shares |

20 Lakhs |

1.50 Lakhs |

| EPS |

₹ 4 |

₹ 10.50 |

Maximum Exchange ratio = \(\frac{\text { EPS of Target Co. }}{\text { EPS of of Acquirer Co. }}\) = \(\frac{10.5}{4}\) = 2.625

Thus, for every one share of Target Company 2.625 shares of Acquirer Company will be issued.

(ii) Determination of Maximum Exchange Ratio

Let x lakhs be the amount paid by ‘Acquirer Company’ to ‘target company’. Then, to maintain the same EPS (i.e. Rs. 4) the number of shares to be issued will be:

\(\frac{(80 \text { Lakhs }+15.75 \text { Lakhs })-0.70 \times 150 \times x}{20 \text { Lakhs }}\) = ₹ 4

\(\frac{95.75-0.105 x}{20}\) = ₹ 4

x = ₹ 150 Lakhs

Thus, ₹ 150 Lakhs shall be offered in cash to target company to maintain same EPS.

Question 23.

C Ltd. & D Ltd. are contemplating a merger deal in which C Ltd. will acquire D Ltd. the relevant information about the firms are given as follow:

|

C Ltd. |

D Ltd. |

| Total Earning (E) (in millions) |

₹ 96 |

₹ 30 |

| Number of outstanding shares (S) (in millions) |

20 |

14 |

| Earnings per share (EPS) (₹ ) |

4.8 |

2.143 |

| Price earnings ratio (P/E) |

8 |

7 |

| Market price per share (P) (₹) |

38.4 |

15 |

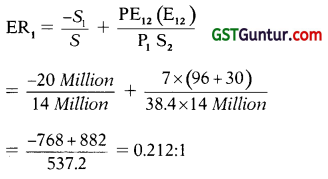

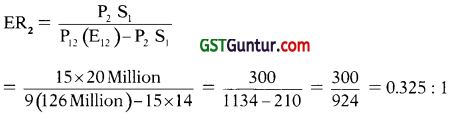

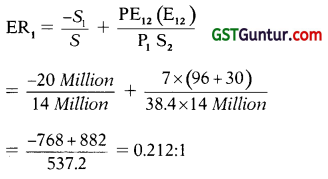

(i) What is the maximum exchange ratio acceptable to the shareholders of C Ltd., if the ratio of the combined firm is 7?

(ii) What is the minimum exchange ratio acceptable to the shareholder of D Ltd., if the P/E ratio of the combined firm is 9? [Nov. 2018 Old Syllabus] [12 Marks]

Answer:

(i) Maximum Exchange Ratio acceptable to the shareholders of C Limited

| Market Price of share of C Ltd. (₹ 4.8 × 8) |

₹ 38.40 |

| No. of Equity Shares |

20 Million |

| Market Capitalisation of C Ltd. (₹ 38.40 × 20 Million) |

₹ 768 Million |

| Combined Earnings (₹ 96 + ₹ 30 Million) |

₹ 126 Million |

| Combined Market Capitalisation (₹ 126 Million × 7) |

₹ 882 Million |

| Market Capitalisation of C Ltd. (₹ 38.40 × 20 Million) |

₹ 768 Million |

| Balance for D Ltd. |

₹ 114 Million |

Let D be the no. of equity shares to be issued to D Ltd. then,

D = \(\frac{₹ 114 \text { Million }}{\left[\frac{126 \text { Million }}{D+20}\right] \times 7}\)

Solving for D, we get

D = 2.96875 Million Shares

Exchange Ratio = \(\frac{2.96875}{14}\) = 0.212:1

(ii) Minimum Exchange Ratio: acceptable to the shareholders of D Ltd.

| Market Price of share of D Ltd. |

₹ 15.00 |

| No. of Equity Shares |

14 Million |

| Market Capitalisation of D Ltd. (₹ 15.00 × 14 Million) |

₹ 210 Million |

| Combined Earnings (₹ 96 + ₹ 30) Million |

₹ 126 Million |

| Combined Market Capitalisation (₹ 126 Million × 9) |

₹ 1,134 Million |

| Balance for C Ltd. |

₹ 924 Million |

Let D be the no. of equity shares to be issued to D Ltd. then,

D = \(\frac{\text { Rs. } 210 \text { Million }}{\left[\begin{array}{c}

126 \text { Million } \\

\text { D }+20

\end{array}\right] \times 9}\)

D = 4.54545 Million Shares

Exchange Ratio = \(\frac{4.54545}{14}\) = 0.325:1

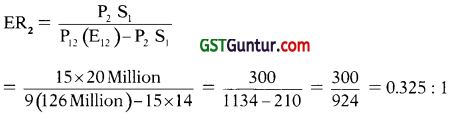

Alternative Method of finding Minimum and Maximum Ratio

(i) Maximum Exchange Ratio from the point of the shareholders of C Ltd.

(ii) Minimum Exchange Ratio from the point of the shareholders of D Ltd.

Question 24.

The following information relating to the acquiring Company Abhiman Ltd. and the target Company Abhishek Ltd. are available. Both the Companies are promoted by Multinational Company, Trident Ltd. The promoter’s holding is 50% and 60% respectively in Abhiman Ltd. and Abhishek Ltd. :

|

Abhiman Ltd. |

Abhishek Ltd. |

| Share Capital (₹) |

200 lakh |

100 lakh |

| Free Reserves and Surplus (₹) |

800 lakh |

500 lakh |

| Paid up Value per share (₹) |

100 |

10 |

| Free float Market Capitalisation (₹) |

400 lakh |

128 lakh |

| P/E Ratio (times) |

10 |

4 |

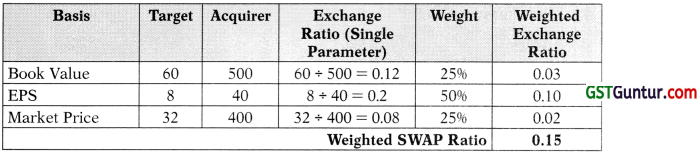

Trident Ltd. is interested to do justice to the shareholders of both the Companies. For the swap ratio weights are assigned to different parameters by the Board of Directors as follows:

| Book Value |

25% |

| EPS (Earning per share |

50% |

| Market Price |

25% |

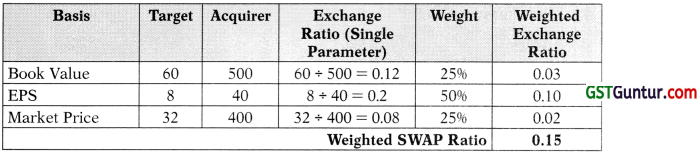

(a) What is the swap ratio based on above weights?

(b) What is the Book Value, EPS and expected Market price of Abhiman Ltd. after acquisition of Abhishek Ltd. (assuming P.E. ratio of Abhiman Ltd. remains unchanged and all assets and liabilities of Abhishek Ltd. are taken over at book value).

(c) Calculate:

(i) Promoter’s revised holding in the Abhiman Ltd.

(ii) Free float market capitalization

(iii) Also calculate No. of Shares, Earning per Share (EPS) and Book Value (B.V.), if after acquisition of Abhishek Ltd., Abhiman Ltd. decided to:

(1) Issue Bonus shares in the ratio of 1 : 2; and

(2) Split the stock (shares) as ₹ 5 each fully paid. [May 2009] [20 Marks]

Answer:

(a) Calculation of Book Value, Market Price and EPS

|

Abhiman Ltd. (Acquirer Co.) |

Abhishek Ltd. (Target Co.) |

| Share Capital |

200 Lakh |

100 Lakh |

| Free Reserves |

800 Lakh |

500 Lakh |

| Total |

1000 Lakh |

600 Lakh |

| No. of Shares |

2 Lakh |

10 Lakh |

| Book Value per share |

₹ 500 |

₹ 60 |

| Promoter’s holding |

50% |

60% |

| Non-promoter’s holding |

50% |

40% |

| Free Float Market Cap. i.e. Relating to Public’s holding |

400 Lakh |

128 Lakh |

| Hence Total market Cap. |

800 Lakh |

320 Lakh |

| No.of Shares |

2 Lakh |

10 Lakh |

| Market Price |

₹ 400 |

₹ 32 |

| P/E Ratio |

10 |

4 |

| EPS |

₹ 40 |

₹ 8 |

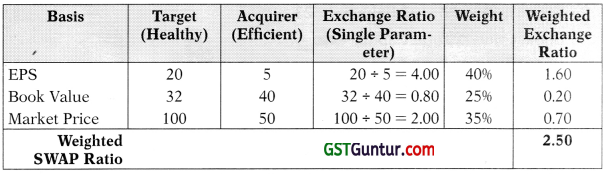

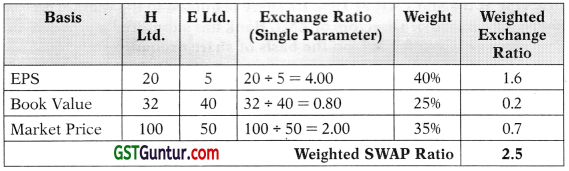

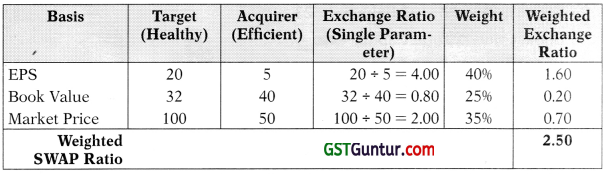

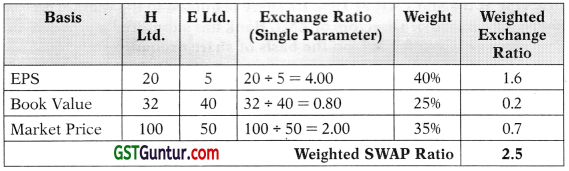

Calculation of weighted Swap Ratio

Swap ratio is for every one share of Abhishek Ltd. to issue 0.15 shares of Abhiman Ltd.

Hence total No. of shares to be issued 10 Lakh × 0.15 = 1,50,000 shares

(b) Values of Abhiman Ltd. after acquisition of Abhishek Limited

Total No. of Shares = 2 Lakhs + 1.5 Lakhs = 3,50,000 shares

Total Capital (in ₹) = 3,50,000 @ ₹ 10 = ₹ 350 Lakh

Total Reserves (in ₹) = 800 Lakhs + 450 Lakhs = Rs. 1,250 Lakh

| Book Value |

(350 Lakhs + 1250 Lakhs) ÷ 3.5 Lakhs |

₹ 45.71 |

| EPS(Total Profits ÷ No. of Shares) |

[(2 × 40) + (10 × 8)] ÷ 3.5 Lakhs |

₹ 45.71 |

| Expected Market price(P/E Ratio × EPS) |

10 × 45.71 |

₹ 457.10 |

(c) (1) Promoter’s holding after merger

= Holding in Abhiman + Holdings in Abhishek

= (50 + of 2,00,000)+ (60 + of 1,50,000) = 1,90,000 Shares

% Holding = (1,90,000 + 3,50,000) × 100 = 54.29%

(2) Free Float Market Capitalisation after merger

= Non-promoters holding × Expected Market Price

= (3,50,000 – 1,90,000) × 457.10 = ₹ 731.36 Lakhs

(3) (i) & (ii)

Revised Share Capital after Bonus = ₹ 350 Lakh + ₹ 175 = ₹ 525 Lakhs

No. of Shares before Split (EV. ₹ 100) = 525 – 100 = 5.25 Lakh

No. of Shares after Split (F.V. ₹ 5) = (5.25 Lakh × 100) ÷ 5 = 105 Lakh

EPS = 160 Lakh/105 Lakh = 1.523

Book Value = Total Capital ÷ No. of Shares

= (525 Lakh + 1075 Lakh) ÷ 105 Lakh = × 15.23809 per share

Question 25.

The following information is provided relating to the acquiring company Efficient Ltd. and the target Company Healthy Ltd.

|

Efficient Ltd. |

Healthy Ltd. |

| No. of shares (F.V. ₹ 10 each) |

10.00 lakhs |

7.5 lakhs |

| Market capitalization |

500.00 lakhs |

750.00 lakhs |

| P/E ratio (times) |

10.00 |

5.00 |

| Reserves and Surplus |

300.00 lakhs |

165.00 lakhs |

| Promoter’s Holding (No. of shares) |

4.75 lakhs |

5.00 lakhs |

Board of Directors of both the Companies have decided to give a fair deal to the shareholders and accordingly for swap ratio the weights are decided as 40%, 25% and 35% respectively for Earning, Book Value and Market Price of share of each company:

(i) Calculate the swap ratio and also calculate Promoter’s holding % after acquisition.

(ii) What is the EPS of Efficient Ltd. after acquisition of Healthy Ltd.?

(iii) What is the expected market price per share and market capitalization of Efficient Ltd. after acquisition, assuming P/E ratio of Firm Efficient Ltd. remains unchanged.

(iv) Calculate free flat market capitalization of the merged firm. [12 Marks] [May 2005]

Answer:

Calculation of Basic required values

|

|

Efficient Ltd. |

Healthy Ltd. |

| Market capitalization (Given) |

A |

500 lakhs |

750 lakhs |

| No. of shares (Given) |

B |

10 lakhs |

7.5 lakhs |

| Market Price per share (A/B) |

C |

₹ 50 |

₹ 100 |

| P/E ratio (Given) |

D |

10 |

5 |

| EPS(C/D) |

E |

₹ 5 |

₹ 20 |

| Profit (B X E) |

F |

₹ 50 lakh |

₹ 150 lakh |

| Share capital (B X Face Value @ X 10) |

G |

₹ 100 lakh |

₹ 75 lakh |

| Reserves and surplus (Given) . |

H |

₹ 300 lakh |

₹ 165 lakh |

| Total (G + H) |

I |

₹ 400 lakh |

₹ 240 lakh |

| Book Value per share (I -r B) |

J |

₹ 40 |

₹ 32 |

(i) Calculation of weighted Swap Ratio

Swap ratio is for every one share of Healthy Ltd., to issue 2.5 shares of Efficient Ltd. Hence, total no. of shares to be issued 7.5 lakh × 2.5 = 18.75 lakh shares

Promoter’s holding = 4.75 lakh shares + (5 × 2.5 = 12.5 lakh shares) = 17.25 lakh i.e. Promoter’s holding % is (17.25 lakh/28.75 lakh) × 100 = 60%.

Calculation of EPS, Market price, Market capitalization and free float market capitalization.

(ii) Total No. of shares = 10 lakh + 18.75 lakh = 28.75 lakh

Total capital = 100 lakh + 187.5 lakh = ₹ 287.5 lakh

EPS = \(\frac{\text { Total profit }}{\text { No.of shares }}\) = \(\frac{50 \text { lakh }+150 \text { lakh }}{28.75 \text { lakh }}\) = \(\frac{200}{28.75}\) = ₹ 6.956

(iii) Expected market price = EPS 6.956 × P/E 10 = ₹ 69.56 Market capitalization= ₹ 69.56 per share × 28.75 lakh shares

= ₹ 1,999.85 lakh

(iv) Free float of market capitalization = ₹ 69.56 per share × (28.75 lakh × 40%) = ₹ 799.94 lakh

Question 26.

Abhiman Ltd. is a subsidiary of Janam Ltd. and is acquiring Swabhi- man Ltd. which is also a subsidiary of Janam Ltd. The following information is given:

|

Abhiman Ltd. |

Swabhiman Ltd. |

| % Share holding of promoter |

50% |

60% |

| Share capital |

₹ 200 |

100 lacs |

| Free Reserves and surplus |

₹OO |

600 lacs |

| Paid up value per share |

₹ 100 |

10 |

| Free float market capitalization |

₹ 500 lacs |

156 lacs |

| P/E Ratio (times) |

10 |

4 |

Janam Ltd., is interested in doing justice to both companies. The following parameters have been assigned by the Board of Janam Ltd., for determining the swap ratio :

| Book value |

25% |

| Earning per share |

50% |

| Market price |

25% |

You are required to compute :

(i) The swap ratio.

(ii) The book value, Earning per share and expected market price of Swabhiman Ltd., (assuming P/E Ratio of Abhiman ratio remains the same and all assets and liabilities of Swabhiman Ltd. are taken over at book value) [May 2011] [8 Marks]

Answer:

Calculation of Book Value, Market Price and EPS

|

Abhiman Ltd. (Acquirer Co.) |

Swabhiman Ltd. (Target Co.) |

| Share Capital |

200 Lakh |

100 Lakh |

| Free Reserves |

900 Lakh |

600 Lakh |

| Total |

Rs. 1,100 Lakh |

Rs. 700 Lakh |

| No. of Shares |

2 Lakh |

10 Lakh |

| Book Value per share |

₹ 550 |

₹ 70 |

| Promoter’s holding |

50% |

60% |

| Non-promoter’s holding |

50% |

40% |

| Free Float Market Cap. i.e. Relating to Public’s holding |

500 Lakh |

156 Lakh |

| Hence Total market Cap. |

1,000 Lakh |

390 Lakh |

| No. of Shares |

2 Lakh |

10 Lakh |

| Market Price |

₹ 500 |

₹ 39 |

| P/E Ratio |

10 |

4 |

| EPS |

₹ 50 |

₹ 9.75 |

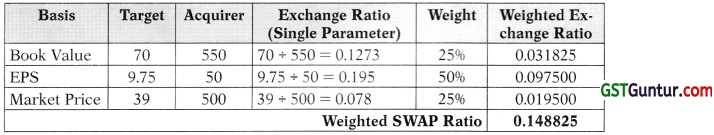

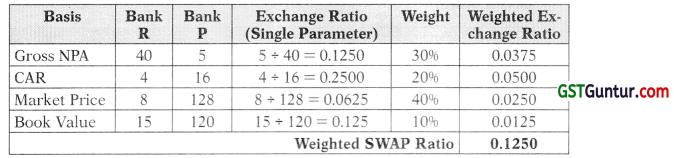

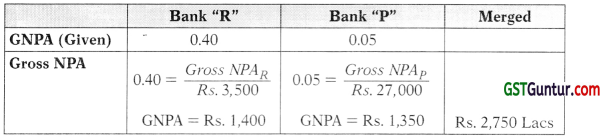

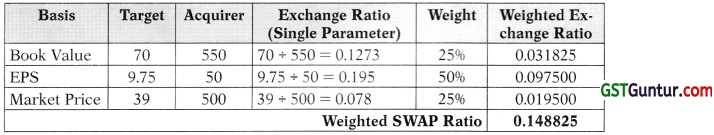

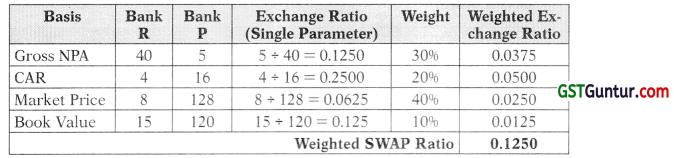

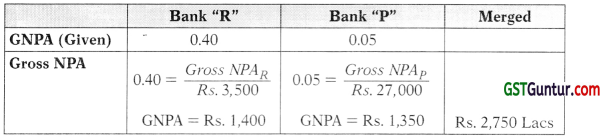

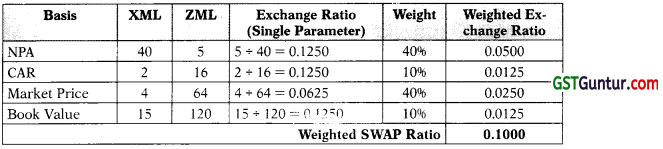

Calculation of weighted Swap Ratio

(a) The swap ratio is for every one share of Swabhiman Ltd. to issue 0.148825 shares of Abhiman Ltd.

Hence, total No. of shares to be issued by Abhiman to Swabhiman Ltd.

= 10 Lakh × 0.148825 = 1,48,825 shares.

(b) Calculation of various Values of Abhiman Ltd. after merger

Total No. of shares = 2,00,000 + 1,48,825 = 3,48,825 Shares

Total capital = ₹ 200 lakhs + ₹ 148.825 lakhs = ₹ 348.825

Lakhs Reserves = ₹ 900 lac + ₹ 551.175 lakhs = ₹ 1,451.175 Lakhs

Book Value per share:

= \(\frac{\text { Total Capital }+ \text { Reserve and Surplus }}{\text { No. of shares }}\) = \(\frac{R s .348 .825+\text { Rs. } 1451.175}{3.48825 \text { Lakhs }}\) = Rs. 516.02

Earnings per share: