Capital Market Instruments – Securities Laws and Capital Markets Important Questions

Question 1.

Distinguish between: Pure Instruments & Hybrid Instruments [Dec. 2013 (3 Marks)]

Answer:

Following are the main difference between pure & hybrid instruments:

| Points | Pure Instruments | Hybrid Instruments |

| Meaning | Equity shares, preference shares, debenture, and bonds which are issued with the basic characteris¬tics without mixing the features of other instruments are called pure instruments. | Instruments that are created by combining the features of equity, preference, bond are called hybrid instruments. |

| Examples | Following are pure instruments:

|

Following are hybrid instruments:

|

| Beneficial | These are beneficial but not like hybrid instruments. | These are more beneficial than a pure instrument. |

Question 2.

Distinguish between: ‘Hybrid Funds’ and ‘Hybrid Instruments’. [Dec. 2015 (2 Marks)]

Answer:

Hybrid funds: Such funds cover both needs of an investor i.e. provide regular income as well as provides capital appreciation. Therefore, investment targets of these mutual funds are a judicious mix of both the fixed income securities like bonds and debentures and also sound equity scrips. In fact, these funds utilize the concept of balanced investment management. These funds; are, thus, also known as “balanced funds”.

Hybrid Instruments: Instruments that are created by combining the features of equity, preference, bond are called hybrid instruments.

Example: Hybrid instruments are:

- Convertible preference shares

- Non-convertible debentures with equity warrant

- Partly convertible debentures

- Secured premium notes

Question 3.

Distinguish between: Naked Debentures & Secured Debentures [Dec. 2009 (3 Marks)]

Answer:

Naked or Unsecured Debentures: Debentures of this kind do not carry any charge on the assets of the company. The holders of such debentures do not, therefore, have the right to attach particular property by way of security as to repayment of principal or interest and thus called as naked or unsecured debentures.

Secured Debentures: Debentures that are secured by a charge of the whole or part of the assets of the company are called mortgage debentures or secured debentures. After creating a charge on debentures, a charge is required to be registered with ROC within 30 days of creation.

Question 4.

Distinguish between: Perpetual Debentures & Bearer Debentures [June 2011 (2 Marks)]

Answer:

Perpetual Debentures: If the debentures are issued subject to redemption on the happening of specified events that may not happen for an indefinite period, e.g. winding-up, they are called perpetual debentures.

Bearer Debentures: Such debentures are payable to the bearer and are transferable by mere delivery. The name of the debenture holder is not registered in the books of the company, but the holder is entitled to claim interest and principal as and when due. A bona fide transferee for value is not affected by the defect in the title of the transferor.

Question 5.

Write a short note on Debt Securities [June 2011 (4 Marks)]

Answer:

Debt security represents borrowed funds that must be repaid. In other words, debt securities are interest-paying Bonds, Notes, Bills, or Money Market Instruments that are issued by governments or corporations.

Some debt securities pay a fixed rate of interest over a fixed time period in exchange for the use of the principal. In that case, that principal, or par value, is repaid at maturity.

Some are pass-through securities, with principal and interest repaid over the term of the loan. Still, other issues are sold at discount, with interest included in the amount paid at maturity.

Example of debt securities includes:

- Debentures

- Bonds

- Notes

- Certificates of deposit (CD)

- Commercial paper (CP)

- Treasury bills

- Mortgage-backed bonds

Question 6.

Write a short note on Fixed Income Products [June 2011 (4 Marks)]

Answer:

Following are the fixed income products:

Deposit: Deposit includes any receipt of money by way of deposit. Deposits serve as a medium of saving and as a means of payment and are a very important variable in the national economy.

A bank basically has three types of deposits:

- Time Deposit

- Savings Deposit

- Current Account

Fixed Deposit: A fixed deposit (FD) is a financial instrument provided by NBFCs and banks that provides investors with a higher rate of interest than a regular savings account, until the given maturity date.

The amount of deposits that may be raised by NBFCs is linked to their net worth and rating. However, the interest rate that may be offered by an NBFC is regulated. The deposits offered by NBFCs are not insured whereas the deposits accepted by most banks are insured up to a maximum of ₹ 1,00,000.

Question 7.

Write a short note on Fixed Income Products [Dec. 2011 (4 Marks)]

Answer:

Following are the fixed income products:

Deposit: Deposit includes any receipt of money by way of deposit. Deposits serve as a medium of saving and as a means of payment and are a very important variable in the national economy.

A bank basically has three types of deposits:

- Time Deposit

- Savings Deposit

- Current Account

Fixed Deposit: A fixed deposit (FD) is a financial instrument provided by NBFCs and banks that provides investors with a higher rate of interest than a regular savings account, until the given maturity date.

The amount of deposits that may be raised by NBFCs is linked to their net worth and rating. However, the interest rate that may be offered by an NBFC is regulated. The deposits offered by NBFCs are not insured whereas the deposits accepted by most banks are insured up to a maximum of ₹ 1,00,000.

Question 8.

Distinguish between: Fixed Coupon Rate & Floating Coupon Rate [June 2012 (3 Marks)]

Answer:

Following are the main points of distinction between fixed coupon & floating coupon rate:

| Points | Fixed Coupon Rate | Floating Coupon Rate |

| Meaning | When a rate is fixed for interest payment of debenture or bond it is known as a fixed coupon rate. | When the rate of interest on debenture or bond is linked with index or benchmark rate it is known as the floating coupon rate. |

| Security is known as | A bond that has a fixed coupon rate is known as a fixed-rate bond. | A bond that has a floating coupon rate is known as a floating rate bond or variable rate bond or floater. |

| Benefit | The benefit of owning a fixed-rate bond is that investors know with certainty how much interest they will earn and for how long. | Though such bonds offer protection against future increases in interest rates the investor is not sure about the return they will get on their investments. |

| Investor | An investor who is willing to take less risk and desire to have constant fixed income on his investment generally invest in fixed-rate bonds. | An investor who is willing to take more risk and desire to have his income similar to the market generally invest in floating-rate bonds. |

Question 9.

Explain the financial instrument: Naked debenture[June 2012 (2 Marks)]

Answer:

Naked or Unsecured Debentures: Debentures of this kind do not carry any charge on the assets of the company. The holders of such debentures do not, therefore, have the right to attach particular property by way of security as to repayment of principal or interest and thus called as naked or unsecured debentures.

Question 10.

Write a short note on Fixed Income Products [Dec. 2012 (4 Marks)]

Answer:

Following are the fixed income products:

Deposit: Deposit includes any receipt of money by way of deposit. Deposits serve as the medium of saving and as a means of payment and are a very important variable in the national economy.

A bank basically has three types of deposits:

- Time Deposit

- Savings Deposit

- Current Account

Fixed Deposit: A fixed deposit (FD) is a financial instrument provided by NBFCs and banks that provides investors with a higher rate of interest than a regular savings account, until the given maturity date.

The amount of deposits that may be raised by NBFCs is linked to their net worth and rating. However, the interest rate that may be offered by an NBFC is regulated. The deposits offered by NBFCs are not insured whereas the deposits accepted by most banks are insured up to a maximum of ₹ 1,00,000.

Question 11.

Distinguish between: Debt Market & Equity Market [June 2015 (3 Marks)]

Answer:

Following are the main difference between the debt & equity market:

| Points | Debt Market | Equity Market |

| Meaning | The debt market is the market where debt instruments are traded. | The equity market is the market where equity shares are traded. |

| Instruments | Debt instruments include debentures, bonds, Notes & Mortgages. | Inequity market equity and preference shares are traded. |

| Status of holder | Debt instrument holders are creditors of the issuing companies. | Equity holders are the owners of the issuing companies. |

| Risk | Investments in debt securities typically involve less risk than equity investments. | Investments in equity typically involve more risk than debt investments. |

| Volatility | The debt market is less volatile. | The equity market is more volatile. |

| Returns | In the debt market, there is less risk and hence returns are also low. | The equity market is riskier and may offer attractive and higher returns as compared to the debt market. |

| Income | Income of debt is the market is fixed. | Income in the equity market is variable. |

Question 12.

Distinguish between: Fully Convertible Debentures & Partly Convertible Debentures [June 2015 (3 Marks)]

Answer:

Following are the main points of distinctions between fully and partly convertible debentures:

| Points | Partly Convertible Debentures | Fully Convertible Debentures |

| Meaning | When only part of debenture is converted into equity shares they are known as partly convertible debentures. | When the full value of debenture is converted into equity shares they are known as fully convertible debentures. |

| Suitability | Better suited for companies with an established track record. | Better suited for companies without an established track record |

| Capital base | Relatively lower equity capital on the conversion of debentures. | Higher equity capital on the conversion of debentures. |

| Flexibility in financing | Favorable debt-equity ratio. | Highly favorable debt-equity ratio. |

| Classification for debt-equity ratio | Convertible portion classified as ‘equity’ and non-convertible portion as ‘debt’. | Classified as equity for debt-equity computation. |

| Popularity | Not so popular with investors. | Highly popular with investors. |

| Servicing of equity | The relatively lesser burden of equity servicing. | Higher burden of servicing of equity. |

Question 13.

What is meant by differential voting rights (DVR)? Discuss the conditions subject to which a company may issue shares with DVR? [Dec. 2012 (4 Marks)]

Answer:

‘Shares with differential voting rights’ means a share issued with the differential right as to dividend, voting, or otherwise in accordance with Section 43(a)(ii).

Conditions for issuing shares with differential rights [Rule 4(1) of the Companies (Share Capital & Debentures) Rules, 2014]: Company limited by shares shall not issue equity shares with differential rights as to dividend, voting, or otherwise, unless it complies with the following conditions, namely:

- The AOA authorizes the issue of shares with differential rights.

- The issue of shares is authorized by an ordinary resolution passed at a general meeting.

In the case of a listed company, the issue shall be approved by the shareholders through a postal ballot.

- The shares with differential rights shall not exceed 26% of the total post-issue paid-up equity share capital including equity shares with differential rights issued at any point in time.

- The company should have a consistent track record of distributable profits for the last 3 years.

- The company has not defaulted in filing financial statements and annual returns for the last 3 financial years.

- The company has no subsisting default in the payment of a declared dividend to its shareholders or repayment of its matured deposits or redemption of its preference shares or debentures that have become due for redemption or payment of interest on such deposits or debentures or payment of dividend.

Company has not defaulted in:

- payment of the dividend on preference shares;

- repayment of principal or interest on any term loan from a PFI or State Level Financial Institution or Scheduled Bank;

- dues with respect to statutory payments relating to its employees to any authority;

- crediting the amount in Investor Education & Protection Fund to the Central Government.

However, a company may issue equity shares with differential rights upon expiry of 5 years from the end of the financial year in which such default was made good.

The company has not been penalized by Court or Tribunal during the last 3 years of any offense under the RBI Act, 1934, the SEBI Act, 1992, the Securities Contracts (Regulation) Act, 1956, the FEMA Act, 1999, or any other special Act.

Question 14.

Discuss the conditions subject to which a company may issue shares with differential voting rights. [June 2013 (6 Marks)]

Answer:

‘Shares with differential voting rights’ means a share issued with the differential right as to dividend, voting, or otherwise in accordance with Section 43(a)(ii).

Conditions for issuing shares with differential rights [Rule 4(1) of the Companies (Share Capital & Debentures) Rules, 2014]: Company limited by shares shall not issue equity shares with differential rights as to dividend, voting, or otherwise unless it complies with the following conditions, namely:

- The AOA authorizes the issue of shares with differential rights.

- The issue of shares is authorized by an ordinary resolution passed at a general meeting.

In the case of a listed company, the issue shall be approved by the shareholders through a postal ballot.

- The shares with differential rights shall not exceed 26% of the total post-issue paid-up equity share capital including equity shares with differential rights issued at any point in time.

- The company should have a consistent track record of distributable profits for the last 3 years.

- The company has not defaulted in filing financial statements and annual returns for the last 3 financial years.

- The company has no subsisting default in the payment of a declared dividend to its shareholders or repayment of its matured deposits or redemption of its preference shares or debentures that have become due for redemption or payment of interest on such deposits or debentures or payment of dividend.

The company has not defaulted in

- payment of the dividend on preference shares;

- repayment of principal or interest on any term loan from a PFI or State Level Financial Institution or Scheduled Bank;

- dues with respect to statutory payments relating to its employees to any authority;

- crediting the amount in Investor Education & Protection Fund to the Central Government.

However, a company may issue equity shares with differential rights upon expiry of 5 years from the end of the financial year in which such default was made good.

The company has not been penalized by Court or Tribunal during the last 3 years of any offense under the RBI Act, 1934, the SEBI Act, 1992, the Securities Contracts (Regulation) Act, 1956, the FEMA Act, 1999, or any other special Act.

Question 15.

Explain the conditions for the issue of shares with differential voting rights? [June 2015 (4 Marks)]

Answer:

‘Shares with differential voting rights’ means a share issued with the differential right as to dividend, voting, or otherwise in accordance with Section 43(a)(ii).

Conditions for issuing shares with differential rights [Rule 4(1) of the Companies (Share Capital & Debentures) Rules, 2014]: Company limited by shares shall not issue equity shares with differential rights as to dividend, voting, or otherwise, unless it complies with the following conditions, namely:

- The AOA authorizes the issue of shares with differential rights.

- The issue of shares is authorized by an ordinary resolution passed at a general meeting.

In the case of a listed company, the issue shall be approved by the shareholders through a postal ballot.

- The shares with differential rights shall not exceed 26% of the total post-issue paid-up equity share capital including equity shares with differential rights issued at any point in time.

- The company should have a consistent track record of distributable profits for the last 3 years.

- The company has not defaulted in filing financial statements and annual returns for the last 3 financial years.

- The company has no subsisting default in the payment of a declared dividend to its shareholders or repayment of its matured deposits or redemption of its preference shares or debentures that have become due for redemption or payment of interest on such deposits or debentures or payment of dividend.

Company has not defaulted in

- payment of the dividend on preference shares;

- repayment of principal or interest on any term loan from a PFI or State Level Financial Institution or Scheduled Bank;

- dues with respect to statutory payments relating to its employees to any authority;

- crediting the amount in Investor Education & Protection Fund to the Central Government.

However, a company may issue equity shares with differential rights upon expiry of 5 years from the end of the financial year in which such default was made good.

Company has not been penalized by Court or Tribunal during the last 3 years of any offense under the RBI Act, 1934, the SEBI Act, 1992, the Securities Contracts (Regulation) Act, 1956, the FEMA Act, 1999, or any other special Act.

Question 16.

Write a short note on Dual Option Warrants [June 2009 (5 Marks)]

Answer:

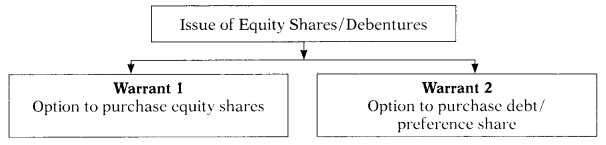

Equity shares or debentures may be issued with two warrants –

1.one warrant giving the right to the purchaser to be allotted one equity share at the end of a certain period and

2. another warrant gives the right to purchase debt or preference share option. Dual option warrants provide the buyer with good capital appreciation.

- Dual option warrants have limited downside risk.

- Dual option warrants may be used to sell equity shares in different markets.

- Dual option warrants may be used to sell equitY shares in different markets.

Question 17.

Write a short note on Hybrid Instruments [June 2009 (2 Marks)]

Answer:

Hybrid Instruments: Instruments that are created by combining the features of equity, preference, bond are called hybrid instruments.

Example: Hybrid instruments are:

- Convertible preference shares

- Non-convertible debentures with equity warrant

- Partly convertible debentures

- Secured premium notes

Question 18.

Write a short note on Hybrid Instruments [Dec. 2011 (3 Marks)]

Answer:

Hybrid Instruments: Instruments that are created by combining the features of equity, preference, bond are called hybrid instruments.

Example: Hybrid instruments are:

- Convertible preference shares

- Non-convertible debentures with equity warrant

- Partly convertible debentures

- Secured premium notes

Question 19.

Explain briefly with reference to capital market: Dual option warrant. [Dec. 2012 (3 Marks)] f

Answer:

Equity shares or debentures may be issued with two warrants

1. one warrant giving the right to the purchaser to be allotted one equity share at the end of a certain period and

2. another warrant gives the right to purchase debt or preference share option. Dual option warrants provide the buyer with good capital appreciation.

- Dual option warrants have limited downside risk.

- Dual option warrants may be used to sell equity shares in different markets.

- Dual option warrants may be used to sell equitY shares in different markets.

Question 20.

Explain briefly: Share warrants [Dec. 2015 (3 Marks)]

Answer:

A share warrant is a bearer document of title to shares and can be issued only by public limited companies and that against fully paid up shares only.

A share warrant is transferable by mere delivery of the warrants without execution of any written instrument of transfer being registered by the company. The bearer of a share warrant is not a member of the company unless otherwise so provided in the articles of the company.

Question 21.

Write a short note on Foreign Currency Convertible Bond [Dec. 2008 (3Marks)]

Answer:

Foreign Currency Convertible Bond (FCCB) means a bond issued by an Indian company expressed in foreign currency, and the principal and interest in respect of which is payable in foreign currency.

Peculiarities of FCCB:

- FCCB is a hybrid instrument. It is issued as a bond but later it is converted into shares.

- FCCB carries a fixed rate of interest until the bond is converted into shares.

- FCCB can be secured as well as unsecured. Mostly the FCCB issued by the Indian Companies are unsecured.

- FCCBs are denominated foreign currency.

- Interest is payable in foreign currency.

- The redemption price is payable in foreign currency (if the option of conversion is not exercised).

Question 22.

Explain the meaning of the following in the context of the international capital market: Global Depository Receipts [Dec. 2009 (3 Marks)]

Answer:

It is a form of a depository receipt created by the Overseas Depository Bank outside India denominated in the dollar and issued to non-resident investors against the issue of ordinary shares or foreign currency convertible bonds of issuing company.

In simple words, GDR is a negotiable instrument denominated in US dollars.

It is traded in Europe or the US or both.

After getting approval from the Ministry of Finance and completing other X formalities, a company issues rupee-denominated shares in the name of de- if position which delivers these shares to its local custodian bank, the holder on records, thus depository.

GDR as defined in Section 2(44) of the Companies Act, 2013: Global Depository Receipt means any instrument in the form of a depository receipt, by whatever name called, created by a foreign depository outside India and authorized by a company making an issue of such depository receipts

As per Section 41 of the Companies Act, 2013, a company may, after passing j a special resolution in its general meeting, issue depository receipts in any foreign country in the prescribed manner, and subject to prescribed conditions.

Listing of GDR: Listing of GDR may take place in international stock exchanges such as London Stock Exchange, New York Stock Exchange, American Stock Exchange, NASDAQ, Luxembourg Stock Exchange, etc.

Question 23.

FCCB and ECB are different modes for raising foreign capital. [Dec. 2011 (3 Marks)]

Answer:

Following are the main points of difference between ECB and FCCB:

| Points | External Commercial Borrowings (ECBs) | Foreign Currency Convertible Bonds (FCCBs) |

| Meaning | ECBs refer to commercial loans in the form of bank loans, securitized instruments, buyer’s credit, supplier’s credit availed of from non-resident lenders with a minimum average maturity of 3 years. | FCCBs means a bond issued by an Indian company expressed in foreign currency and the principal and interest in respect of which is payable in foreign currency. |

| Nature | ECB is borrowing and is thus purely debt finance. | FCCB is a hybrid instrument. It is issued as a bond but later it is converted into equity. |

| How to obtain | ECBs are to be availed as per the relevant guideline, notifications, and circulars issued by the RBI from time to time. | FCCBs are required to be issued in accordance with the scheme viz., Issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depositary Receipt Mechanism) Scheme, 1993. |

| Listing | Since ECB is borrowing/loan it can be listed at all in the stock exchange. | FCCBs can be listed in the stock exchange after their conversion into shares. |

Question 24.

IDR and GDR have distinct features. Comment. [Dec. 2011 (3 Marks)]

Answer:

Following are the main points of difference between GDR & IDR:

| Points | GDR | IDR |

| Meaning | Global Depository Receipt (GDR) means any instrument in the form of a depository receipt, created by a foreign depository outside India and authorized by a company making an issue of such depository receipts. | Indian Depository Receipt (IDR) means any instrument in the form of a depository receipt created by a Domestic Depository in India against the underlying equity shares of a company incorporated outside India. |

| Denomination | GDR is denominated in foreign currency. | IDR is denominated Indian currency. |

| Underlying shares | In the case of GDR underlying shares are held by Domestic Custodian Bank (DCB). | In the case of IDR, underlying shares are held by Overseas Custodian Bank (OCB). |

| Issue of DRS | GDR is issued by Overseas Custodian Bank to foreign investors. | IDR is issued by Domestic Depository to Indian investors. |

| Rules | GDR is regulated by the Companies (Issue of Global Depository Receipts) Rules, 2014. | IDR is regulated by the Companies (Issue of Indian Depository Receipts) Rules, 2004. |

| Listing | GDR are listed in foreign countries. | IDR is listed in Indian Stock Exchanges. |

Question 25.

Write a short note on Indian Depository Receipts (IDRs) [June 2012 (4 Marks)]

Answer:

Indian Depository Receipt (IDR) means any instrument in the form of a depository receipt created by a Domestic Depository in India against the underlying equity shares of a company incorporated outside India.

Peculiarities of IDR:

- IDR is an instrument denominated in Indian Rupees.

- IDR is a depository receipt created by a Domestic Depository.

- IDR is issued against the underlying equity of foreign companies.

- IDR helps foreign companies to raise funds from the Indian securities markets.

Global banking giant Standard Chartered PLC was coming out with the first issue of IDR and listed on the Indian stock exchanges in the year 2010.

Question 26.

Write a short note on Listing of Indian Depository Receipts (IDRs) [Dec. 2012 (4 Marks)]

Answer:

Listing of IDRs [Rule 9 of the Companies (Issue of IDRs) Rules, 2004]: The IDRs shall be listed on the recognized Stock Exchange in India, and g such IDRs may be purchased, possessed, and freely transferred by a person resident in India as defined in Section 2(v) of FEMA, subject to the provisions of the said Act.

Question 27.

“Both foreign currency exchangeable bonds (FCEBs) and foreign currency convertible bonds (FCCBs) are convertible into equity shares.” Since both are convertible into equity shares, you are required to highlight the advantages of FCEBs over FCCBs. [Dec. 2014 (6 Marks)]

Answer:

Foreign Currency Exchangeable Bonds (FCEB) as defined includes the following:

- A bond expressed in foreign currency.

- The principal and the interest of which is payable in foreign currency,

- The issuer of the bond is an Indian company.

- The bonds are subscribed by a person resident outside India.

- The bonds are exchangeable into equity shares of another company which is also called the offered company.

Foreign Currency Convertible Bond (FCCB) means a bond issued by an Indi a company expressed in foreign currency, and the principal and interest in j respect of which is payable in foreign currency.

The launch of the FCEB scheme affords a unique opportunity for Indian promoters to unlock value in group companies. FCEBs are another arrow in the I quiver of Indian promoters to raise money overseas to fund their new projects and acquisitions, both Indian and global, by leveraging a part of their shareholding I in listed group entities.

FCEB involves three parties: The issuer company offered company (OC) and an investor.

Under this option, an issuer company may issue FCEBs in foreign currency, and these FCEBs are convertible into shares of another company (offered company) that forms part of the same promoter group as the issuer company.

Thus, FCEBs are exchangeable into shares of the offered company. They have an inherent advantage in that it does not result in dilution of shareholding at the offered company level.

Foreign Currency Exchangeable Bonds (FCEB) vs. Foreign Currency Convertible Bonds (FCCB):

FCCBs are issued by a company to non-residents giving them the option to convert them into shares of the same company at a predetermined price. On the other hand, FCCBs are issued by the investment or holding company of an I group to non-residents which are exchangeable for the shares of the specified group company at a predetermined price.

The key difference, therefore, is while FCCB involves just one company, FCEB involves at least two companies – the bonds are usually of the parent company while the shares are of the operating company which must be a listed company.

Question 28.

Distinguish between: FCCB & FCEB [Dec. 2015 (2 Marks)]

Answer:

FCCBs are issued by a company to non-residents giving them the option to convert them into shares of the same company at a predetermined price. On the other hand, FCCBs are issued by the investment or holding company of a group to non-residents who are exchangeable for the shares of the specified group company at a predetermined price.

The key difference, therefore, is while FCCB involves just one company, FCEB involves at least two companies – the bonds are usually of the parent company while the shares are of the operating company which must be a listed company. I

Question 29.

Briefly explain Indian Depository Receipt (IDR) [Dec. 2015 (3 Marks)]

Answer:

Indian Depository Receipt (IDR) means any instrument in the form of an I depository receipt created by Domestic Depository in India against the underlying equity shares of a company incorporated outside India.

Peculiarities of IDR:

- IDR is an instrument denominated in Indian Rupees.

- IDR is a depository receipt created by a Domestic Depository.

- IDR is issued against the underlying equity of foreign companies.

- IDR helps foreign companies to raise funds from the Indian securities markets.

Global banking giant Standard Chartered PLC was coming out with the first issue of IDR and listed on the Indian stock exchanges in the year 2010.

Question 30.

Investment in Indian depository receipts (IDRs) is an opportunity for Indian investors to invest funds in foreign equity. [June 2016 (4 Marks)]

Answer:

Indian Depository Receipt (IDR) means any instrument in the form of a depository receipt created by a Domestic Depository in India against the underlying equity shares of a company incorporated outside India.

Peculiarities of IDR:

- IDR is an instrument denominated in Indian Rupees.

- IDR is a depository receipt created by a Domestic Depository.

- IDR is issued against the underlying equity of foreign companies.

- IDR helps foreign companies to raise funds from the Indian securities markets.

Global banking giant Standard Chartered PLC was coming out with the first issue of IDR and listed on the Indian stock exchanges in the year 2010.

Benefits of IDRs to the Issuing Company:

- It provides access to a large pool of capital to the issuing capita.

- It gives brand recognition in India to the issuing company.

- It facilitates acquisitions in India.

- Provides an exit route for existing shareholders.

Benefits of IDRs to Investors:

- It provides portfolio diversification to the investor.

- It gives the facility of ease of investment.

- There is no need to know your customer norms.

- No resident Indian individual can hold more than $ 2,00,000 worth of foreign securities purchased per year as per Indian foreign exchange regulations. However, this will not be applicable for IDRs which gives Indian residents the chance to invest in an Indian listed foreign entity.

Question 31.

“Not only Indian companies are going abroad to raise funds, but foreign companies are also coming to India to raise funds.” Name the instrument(s) through which a foreign company can raise funds in India by issuing its own equity shares. Also, state the eligibility and conditions for the issue of such instrument(s) in India. [Dec. 2016 (8 Marks)]

Answer:

A foreign company can access the Indian securities market for raising funds through the issue of Indian Depository Receipts (IDRs).

[ Indian Depository Receipt (IDR) means any instrument in the form of a depository receipt created by Domestic Depository in India against the underlying | equity shares of a company incorporated outside India.

Eligibility conditions to make an issue of IDRs [Regulation 183 of the SEBI | (ICDR) Regulations, 2018]:

1. An issuer shall be eligible to make an issue of IDRs only if:

(a) The issuing company is listed in its home country for at least 3 immediately preceding years.

(b) The issuer is not prohibited to issue securities by any regulatory body.

(c) The issuer has a track record of compliance with the securities market regulations in its home country.

(d) Any of its promoters or directors is not a fugitive economic offender.

2. The issue shall be subject to the following conditions:

(a) Issue size shall not be less than ₹ 50 Crore.

(b) At any given time, there shall be only one denomination of IDRs of the issuer.

(c) Issuer shall ensure that the underlying equity shares against which IDRs are issued have been or will be listed in its home country before listing of IDRs in the stock exchange(s).

(d) Issuer shall ensure that the underlying shares of IDRs shall rank pari passu with the existing shares of the same class.

3. The issuer shall ensure that:

(a) It has made an application to one or more stock exchanges to seek an in-principle approval for listing of the IDRs on such stock exchanges and has chosen one of them as the designated stock exchange, in terms of Schedule XIX.

(b) It has entered into an agreement with a depository for dematerialization of the IDRs proposed to be issued.

(c) It has made firm arrangements of finance through verifiable means towards 75% of the stated means of finance for the project proposed to be funded from issue proceeds, excluding the amount to be raised through the proposed issue of IDRs or through existing identifiable internal accruals, have been made.

4. The amount for general corporate purposes, as mentioned in objects of the issue in the draft offer document and the offer document, shall not exceed 25% of the amount being raised by the issuer.

Issuance conditions [Regulation 191]: The procedure to be followed by each class of applicant shall be mentioned in the offer document. The minimum application amount shall be ₹ 20,000.

Question 32.

What do you mean by foreign currency convertible bonds (FCCBs)? State the benefits of FCCBs to investors and the issuer. [Dec. 2016 (5 Marks)]

Answer:

Foreign Currency Convertible Bond (FCCB) means a bond issued by an Indian company expressed in foreign currency, and the principal and interest in respect of which is payable in foreign currency.

Peculiarities of FCCB:

- FCCB is a hybrid instrument. It is issued as a bond but later it is converted into shares.

- FCCB carries a fixed rate of interest until the bond is converted into shares.

- FCCB can be secured as well as unsecured. Mostly the FCCB issued by the Indian Companies are unsecured.

- FCCBs are denominated foreign currency.

- Interest is payable in foreign currency.

The redemption price is payable in foreign currency (if the option of conversion is not exercised).

Benefits of FCCB to the issuer company:

- FCCB generally has a low rate of interest as compared to pure debt instruments. Thus, it reduces the debt financing cost.

- FCCB does not require a credit rating.

- FCCB saves risks of immediate equity dilution as in the case of public shares.

- FCCB can be raised within a month while pure debt takes a longer period to raise.

Benefits of FCCB to investors:

- FCCB has the advantage of both equity and debt.

- FCCB gives the investor much of the upside of investment in equity, and the debt portion protects the downside.

- Assured return on bond in the form of fixed interest payments.

- Ability to take advantage of price appreciation in the stock by means of warrants attached to the bonds, which are activated when the price of a stock reaches a certain point.

- Significant Yield to maturity (YTM) is guaranteed at maturity.

- Lower tax liability as compared to pure debt instruments due to the lower interest rates.

Question 33.

Explain: Foreign Currency Convertible Bond (FCCB) [Dec. 2017 (3 Marks)]

Answer:

Foreign Currency Convertible Bond (FCCB) means a bond issued by an Indian company expressed in foreign currency, and the principal and interest in respect of which is payable in foreign currency.

Peculiarities of FCCB:

- FCCB is a hybrid instrument. It is issued as a bond but later it is converted into shares.

- FCCB carries a fixed rate of interest until the bond is converted into shares.

- FCCB can be secured as well as unsecured. Mostly the FCCB issued by the Indian Companies are unsecured.

- FCCBs are denominated foreign currency.

- Interest is payable in foreign currency.

The redemption price is payable in foreign currency (if the option of conversion is not exercised).

Benefits of FCCB to the issuer company:

- FCCB generally has a low rate of interest as compared to pure debt instruments. Thus, it reduces the debt financing cost.

- FCCB does not require a credit rating.

- FCCB saves risks of immediate equity dilution as in the case of public shares.

- FCCB can be raised within a month while pure debt takes a longer period to raise.

Benefits of FCCB to investors:

- FCCB has the advantage of both equity and debt.

- FCCB gives the investor much of the upside of investment in equity, and the debt portion protects the downside.

- Assured return on bond in the form of fixed interest payments.

- Ability to take advantage of price appreciation in the stock by means of warrants attached to the bonds, which are activated when the price of a stock reaches a certain point.

- Significant Yield to maturity (YTM) is guaranteed at maturity.

- Lower tax liability as compared to pure debt instruments due to the lower interest rates.

Question 34.

Explain: Global Depository Receipts [June 2018 (3 Marks)]

Answer:

It is a form of a depository receipt created by the Overseas Depository Bank outside India denominated in the dollar and issued to non-resident investors against the issue of ordinary shares or foreign currency convertible bonds of issuing company.

In simple words, GDR is a negotiable instrument denominated in US dollars.

It is traded in Europe or the US or both.

After getting approval from the Ministry of Finance and completing other X formalities, a company issues rupee-denominated shares in the name of de- if position which delivers these shares to its local custodian bank, the holder on records, thus depository.

GDR as defined in Section 2(44) of the Companies Act, 2013: Global Depository Receipt means any instrument in the form of a depository receipt, by whatever name called, created by a foreign depository outside India and authorized by a company making an issue of such depository receipts

As per Section 41 of the Companies Act, 2013, a company may, after passing j a special resolution in its general meeting, issue depository receipts in any foreign country in the prescribed manner, and subject to prescribed conditions.

Listing of GDR: Listing of GDR may take place in international stock exchanges such as London Stock Exchange, New York Stock Exchange, American Stock Exchange, NASDAQ, Luxembourg Stock Exchange, etc.

Question 35.

Indian Companies are allowed to raise equity capital in the international market through the issue of ADR/GDR/FCCB/FCEB. Briefly discuss the regulatory framework of ADR & GDR in India. [June 2018 (5 Marks)]

Answer:

Issue of ADR/GDR/FCCBs/FCEBs is regulated by the following regulations in India:

- The Foreign Currency Convertible Bonds & Ordinary Shares (Through Depository Receipt Mechanism) Scheme, 1993

- Foreign Currency Exchangeable Bonds Scheme, 2008

- Notifications issued by the Ministry of Finance

- Circulars issued by the Ministry of Finance

- Consolidated FDI Policy

- RBI Regulations

- RBI Circulars

- The Companies Act, 2013

- Rules made under the Companies Act, 2013

- Listing Agreement

Question 36.

‘Derivative contracts are of various types”. Comment. [Dec. 2011 (3 Marks)]

Answer:

A derivative is a financial contract that derives its value from the l performance of another entity such as an asset, index, or interest rate, called the “underlying”.

Derivatives include a variety of financial contracts, including futures, forwards, swaps, options.

As per Section 2(ac) of the Securities Contracts (Regulation) Act, 1956, ‘derivative’ includes:

(a) A security derived from a debt instrument, share, loan, whether secured | or unsecured, risk instrument or contract for differences or any other: a form of security;

(b) A contract that derives its value from the prices, or index of underlying securities.

In derivatives contracts, the gain of one person results in the loss of another person, so it is also called a zero-sum game.

Question 37.

Write a short note on: ‘Future’ and ‘Options’ [June 2012 (3 Marks)]

Answer:

A futures contract is a contract between two parties to buy or sell an asset at a specified future time at a price agreed upon today. Thus, an instrument that is similar to a forwarding contract but traded and under which no risk of default is called a futures contract.

A futures contract is a standardized contract between two parties where one of the parties commits to sell, a specified quantity of a specified asset at an agreed price on a given date in the future.

An option is a contract that gives the holder the right to purchase or sell the underlying security at a specified price within a specified period of time. Option may be Put Option or Call Option.

Question 38.

Explain: Option Contract [June 2018 (3 Marks)]

Answer:

An option is a contract between two parties under which the buyer of the I option buys the right, and no obligation, to buy or sell a standardized quantity of a financial instrument (underlying asset) at or before a pre-determined date (expiry date) at a price decided in advance (exercise price or strike price). ; Option may be Put Option or Call Option.

1. Call Option: When the option gives the buyer the right to buy is called the call option.

Standardization: The contract is standardized as to quantity, date and month of delivery, and minimum amount by which price would move. Each deal has a market lot.

Thus, if you want to enter into Future Contract in Tata Ltd. stock, you have to buy 100 Tata stock or in multiples thereof.

The date and month of delivery are determined by the exchange. As of now, the exchange has fixed the last Thursday of the month for settlement and delivery.

Deal with clearing house: The clearinghouse plays important role in the trading of futures contracts. It does all back-office operations. More importantly, it guarantees performance. Thus, there is no risk of default.

Mark to market margin: The clearinghouse requires the parties to maintain a deposit (margin) with it. The margin amount changes with the change in daily prices. If the price goes up, the buyer’s margin is reduced and the seller’s margin is increased by an equal amount. If the price goes down, the buyer’s margin is increased and the seller’s margin is reduced by an equal amount.

This is because an increase in price is good for the buyer and bad for the seller while a decrease in price is bad for the buyer and good for the seller. This process is called marking to market. In effect marking to market ensures that the profits and losses are settled on day to day basis.

Question 40.

Jai Ltd. announced the issue of bonus shares in the ratio of 1:3 (i.e. one share for every three shares held). At present the face value share is ₹ 10, the current market price is ₹ 621. In addition, it announced a split of shares by reducing the face value from ₹ 10 to 2. Calculate the share price if all other things remain constant. What would have been the situation if the split would have been done before the issue of bonus shares? [Dec. 2015 (5 Marks)]

Answer:

Calculation of share price after issue of bonus shares (without split):

\(\frac{\text { Existing shares } \times \text { Market value }}{\text { Existing shares }+\text { Bonus Shares }}=\frac{3 \times 621}{3+1}\) = 465.75

The company desires to split the shares from 110 to 12 per share i.e. one share will be converted into 5 shares.

Calculation of share price after issue of bonus & split:

No. of shares after split = (Existing shares + bonus shares) × Split ratio

= (3 + 1) × 5

= 20

If split would have been done before tite issue of bonus sitares:

No. of shares after split = Existing shares × Split ratio

= 3 × 5

= 15

Market price after split = \(\frac{621 \times 3}{15}\) = 124.2

calculation of share price after- split & issue of bonus shares:

\(\frac{\text { Existing shares } \times \text { Market value }}{\text { Existing shares }+\text { Bonus Shares }}=\frac{15 \times 124.2}{15+5}\) = 93.15

Question 41.

Prime Ltd. issued some warrants which allowed the holders to purchase, with one warrant, one equity share at ₹ 18.275 per share. The equity share was quoted at ₹ 25 per share and the warrant was selling at ₹ 9.50. In this case, you are required to compute:

(i) The minimum price of warrant and

(ii) The warrant premium [June 2016 (4 Marks)]

Answer:

The value of the warrant is calculated as follows:

| Condition | The minimum value of the warrant |

| Ps > Pc | (Ps – Pc) × N |

| Ps ≤ Pc | 0 |

Ps = Current market price for the equity shares

Pc = exercise price of the warrant

N = No. of equity shares per warrant (Generally N = 1)

Thus,

Value of warrant = 25 – 18.275 = 6.725

Warrant premium = 9.50 – 6.725 – 2.775

Question 42.

Does Manish own 250 preference shares of Amaze Ltd. which currently sells for ₹ 77 per share and pays an annual dividend of ₹ 13 per share:

(i) What is Manish’s expected return?

(ii) If Manish requires a 13% return, should he sell or buy more preference shares at the current price? [June 2016 (4 Marks)]

Answer:

Dividend 13

Expected return on preference shares = \(\frac{\text { Dividend }}{\text { Market price }}\) × 100 = \(\frac{13}{77}\) × 100 = 16.88

The required return of Manish is 13%.

Analysis: Since the expected return is more than the required return, Manish should buy more shares.

Question 43.

Earnings per share of Alexa Piston Ltd. expected at the end of the year 2017-2018 is ₹ 18. The earnings per share in the year 2016-2017 is ₹ 16. The required rate of return is 25% p.a. and the dividend payout ratio is 30% which is expected to remain constant. If the earnings are expected to grow at the historical rate, compute the value of the share of the company at the beginning of 2017-2018. [June 2018 (4 Marks)]

Answer:

Growth Rate = \(\frac{18-16}{16}\) × 100 = 12.5%

Dividend at the end of year 1 = D1 = 18 × 30% = 5.4 per share

Market price = \(\frac{\mathrm{D}_{1}}{\mathrm{~K}_{\mathrm{e}}-\mathrm{g}}\)

= \(\frac{5.4}{0.25-0.125}\)

= 43.2

Question 44.

Narender purchased a bond with a face value of ₹ 1,000 for ₹ 950. The coupon rate on the bond is 12%. If he sells the bond one year later for ₹ 960. Compute the holding period return for the Narender. [June 2018 (4 Marks)]

Answer:

Return = \(\frac{\left(P_{1}-P_{0}\right)+I}{P_{0}}\) × 100

Where,

R = Return

P1 = Market price at the end of the period

P0 = Market price at the beginning of the period

I = Interest

Return = \(\frac{(960-950)+120}{950}\) × 100 = 13.68%

Question 45.

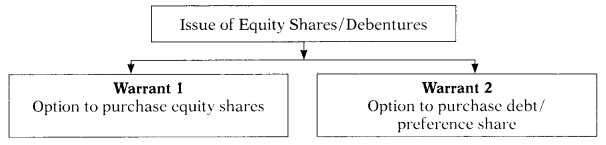

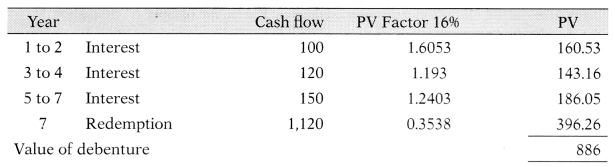

Blue Line Shoe Company is contemplating a debenture issue on the following terms:

Face value : ₹ 1,000

Terms to maturity: 7 years Coupon rate of interest Year 1 – 2: 10%p.a.

Year 3-4 : 12% p.a.

Year 5-7 : 15% p.a.

The current market rate of interest on similar debentures is 15% p.a. The company proposes to price the issue so as to yield a (compounded) return of 16% p.a. to the investors. The debentures would be redeemed at a premium of 12% at the end of 7 years. Compute the maturity price of the debentures. [June 2018 (4 Marks)] |

Answer:

Question 46.

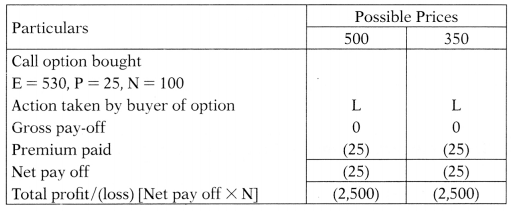

Naman had executed the following trades on Gama Ltd. stock:

(I) Purchased one 3-month call option with a premium of 25 at an exercise price of 530.

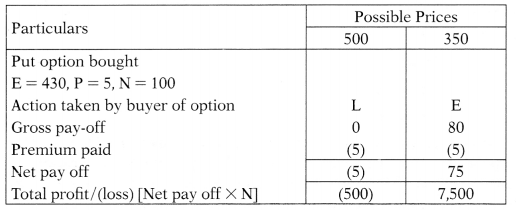

(ii) Purchased one 3-month put option with a premium of 5 at an exercise price of 430.

The lot size is loo shares per lot and the current price of Gama Ltd. stock is 500. Determine Naman’s profit or loss, if the price of Gama Ltd. stock after 3 months is:

(a) 500

(b) 350. [Dec. 2018 (5 Marks)]

Answer:

The explanation for solving the above problem:

Call option buys: Buying a call option is right to buy the underlying asset at the exercise price on a future date. The call option will be exercised by the buyer of the option when the spot price is more than the exercise price.

Example: If you buy a call option at an exercise price of 1200 by paying a premium of ₹ 10, it means you have the right to buy at ₹ 200 irrespective prices of the underlying share. Suppose the price of a share in the spot market goes up to ₹ 250, you will exercise your option to buy the underlying share at ₹ 200 and thus get the benefit of ₹ 50 and after deducting premium of ₹ 10 your net benefit will be ₹ 40.

On the other hand, if the price of a share in the spot market falls to ₹ 150, then it is beneficial to buy a share in the spot market and you will lap your option. The only loss to you is the premium you have paid ie. ₹ 10.

Thus, a person will normally buy a call option when he anticipates that prices of shares will increase in the future.

Put option buys: Buying a put option is ‘right to sell the underlying asset at the exercise price on a future date.

In ‘put option bought’ we buy the right to sale at exercise price underlying asset on a future date. Thus, the person who sale the put option is a buyer of the option. He buys the ‘right to sale’ by paying a premium.

A put option will be exercised by the buyer of the option when the spot price (market price) is less than the exercise price. Thus, a person will normally buy a put option w7hen he anticipates that prices of shares will fall in the future.

Question 47.

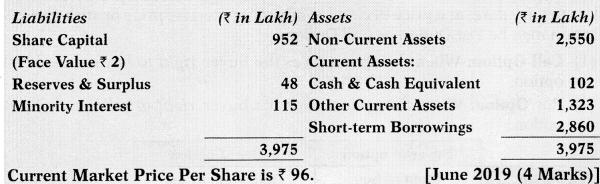

From the following information, calculate the Enterprise Value of E Ltd.: Balance Sheet of E Ltd. as of 31st March 2018

Answer:

The enterprise value of a company can be ideally defined as an amount that represents the entire cost of the company in case some investor intends to acquire 100% of it. The formula for enterprise value is computed by adding the company’s market capitalization, preferred stock, outstanding debt, and minority interest together, and then deducting the cash and cash equivalents j obtained from the balance sheet. The cash and cash equivalents are deducted from the enterprise value since post-acquisition of the complete ownership of j the company, the cash balance basically belongs to the new owner.

Mathematically, it is represented as,

Enterprise Value Formula = Market Capitalization + Preferred stock + Outstanding Debt + Minority Interest – Cash & Cash Equivalents

Market Capitalization = 952/2 × 96 = 45,696

Outstanding Debt = 2,860

Minority Interest =115

Cash & Cash Equivalents = 102

Enterprise Value = 45,696 + 2,860 + 115 – 102 = 48,569 lakh.

Question 48.

What are the Option contracts? You are required to compute the profit/ loss for each investor in the below option contracts:

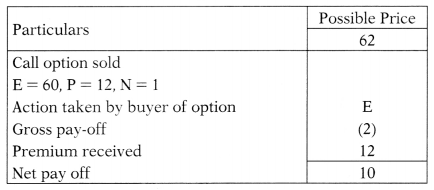

(i) Mr. X writes a call option to purchase a share at an exercise price of ₹ 60 for a premium of 112 per share. The share price rises to ₹ 62 by the time the option expires.

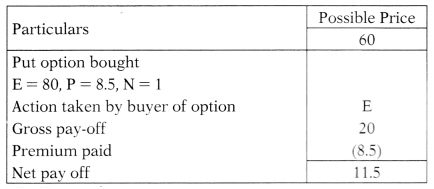

(ii) Mr. Y buys a put option at an exercise price of ₹ 80 for a premium of ₹ 8.50 per share. The share price falls to ₹ 60 by the time the option expires.

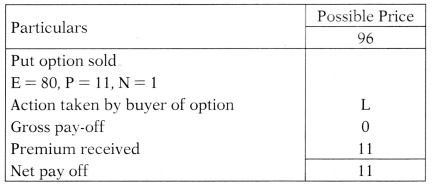

(iii) Mr. Z writes a put option at an exercise price of ₹ 80 for a premium of ₹ 11 per share. The price of the share rises to ₹ 96 by the time the option expires.

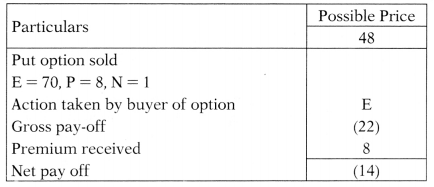

(iv) Mr. XY writes a put option with an exercise price of ₹ 70 for a premium of ₹ 8 per share. The price falls to ₹ 48 by the time the option expires.

Answer:

An option is a contract between two parties under which the buyer of the option buys the right, and no obligation, to buy or sell a standardized quantity of a financial instrument (underlying asset) at or before a pre-determined date (expiry date) at a price decided in advance (exercise price or strike price). Option may be Put Option or Call Option.

- Call Option: When the option gives the buyer the right to buy is called the call option.

- Put Option: When the option gives the buyer the right to sell is called the put option.

| Buyer of option | Seller of option | |

| Call option | Right to buy | Obligation to sell |

| Put option | Right to sell | Obligation to buy |

(i) Mr. X sales/writes call option:

(ii) Mr. Y buys put option:

(iii) Mr. Z sales/writes put option:

(iv) Mr. XY sales/writes put option:

The explanation for solving the above problem:

Buying call option: Buying a call option is the right to buy the underlying asset at the exercise price on a future date. The call option will be exercised by the buyer of the option when the spot price is more than the exercise price.

Example: If you buy a call option at an exercise price of ₹ 200 by paying a premium of ₹ 10, it means you have the right to buy at ₹ 200 irrespective prices of the underlying share. Suppose the price of a share in the spot market goes up to ₹ 250, you will exercise your option to buy the underlying share at ₹ 200 and thus get the benefit of ₹ 50 and after deducting premium of ₹ 10 your net benefit will be ₹ 40.

On the other hand, if the price of a share in the spot market falls to ₹ 150, then it is beneficial to buy a share in the spot market and you will lap your option. The only loss to you is the premium you have paid ie. ₹ 10.

Thus, a person will normally buy a call option when he anticipates that prices of shares will increase in the future.

Selling call option: Selling/writing a call option is an ‘obligation to sell’ at the exercise price on a future date. As we have obligation to sell at the exercise price, the buyer of the option will exercise the option when the price is more than the exercise price. (Remember it is a buyer who will always exercise the option, as a seller of the option you can not exercise the option as you have obligation to sell and not right to sell)

Example: If you sell a call option at an exercise price of ₹ 200 by receiving a premium of ₹ 10, it means you take the obligation to sell at ₹ 200 irrespective prices of the underlying share. So whether the price moves upward or downward you made fix income of ₹ 10.

Suppose the price of a share in the spot market goes up to ₹ 250, the buyer of the option will exercise the option to buy the underlying share at ₹ 200 and as you have obligation to sell at ₹ 200 you will have to sell it at ₹ 200. Thus, you lose ₹ 50 and after setting off the premium that you have received of ₹ 10 your net loss will be ₹ 40.

On the other hand, if the price of a share in the spot market falls to ₹ 150, then the buyer of the option will not exercise his option as it will be beneficial for him to purchase the share from the spot instead of purchasing from you at ₹ 200. Thus, he will lapse his option and you will not incur any loss on this transaction. But you make a profit of ₹ 10, the premium you already received.

Thus, as the seller of a call option, we will incur a loss if the price rises above the exercise price. But for selling an option we will receive a premium and that is our gain. If the price falls the buyer will not exercise the option and the premium received by you will be gain in the contract.

Buying a put option: Buying a put option is the ‘right to sell’ underlying asset at the exercise price on a future date.

In ‘put option bought’ we buy the right to sale at exercise price underlying asset on a future date. Thus, a person who sale the put option is the buyer of the option. He buys the ‘right I to sale’ by paying a premium.

A put option will be exercised by the buyer of the option when the spot price is less than the exercise price. Thus, a person will normally buy a put option when he anticipates that prices of shares will fall in the future. But as the future is uncertain price may increase also.

Selling a put option: Selling/writing a put option is an obligation to buy the underlying asset at the exercise price on a future date.

In ‘put option sold’ we sell the obligation to ‘buy at exercise price’ underlying asset on a future date. Thus, the person who sale the put option is the seller of the option. He sells the ‘obligation to buy’ by receiving a premium.

As we have obligation to buy at the exercise price, the buyer of the option will exercise the option when the price is less than the exercise price. (Remember it is a buyer who will always exercise the option, as a seller of option we cannot exercise the option as we have obligation to buy and not the right to buy)

Thus, as a seller of the option, we will incur a loss as the price falls below the exercise price. But for selling an option we will receive a premium and that is our gain. If the price increase the buyer will not exercise the option and the premium received by you will be gain in the contract.

The above discussion is given for the understanding of the students as to how ‘option contracts’ are traded. It is not part of the answer.

Securities Laws and Capital Markets Questions and Answers