Capital Gains – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Capital Gains – CA Inter Tax Question Bank

Question 1.

State with reason, any whether the following statements is true or false with regard to the provisions of the Income-tax Act, 1961 for the Assessment year 2021 -22:

Capital gain of T 75 lakh arising from transfer of long term capital assets will be exempt from tax if such capital gain is invested in the bonds redeemable after three years, issued by NHAI u/s 54 EC of the Act. (Nov 2008, 2 marks)

Answer:

False : Because the maximum limit of investment in bond of NHAI u/s 54 EC, is just ₹ 50 lakhs.

![]()

Question 2.

Answer the following : (Nov 2009)

(a) What are the circumstances under which the Assessing officer can make reference to the valuation officer u/s 55A of the Income Tax Act, 1961 ? (3 marks)

(b) Explain the concept of reverse mortgage and discuss its tax implications. (3 marks)

Answer:

(a) Reference to Valuation Officer

With a view to ascertaining the fair market value of a capital asset, the Assessing Officer may refer valuation of the capital asset to the Valuation Officer, in the following cases:

- Where the value of the asset, as claimed by the assessee, is in accordance with the estimate made by the registered valuer but the Assessing Officer is of the opinion that the value so claimed is less than its fair market value;

- Where the Assessing Officer is of the opinion that the fair market value of the asset exceeds the value of the asset as claimed by the assessee by more than 15% of the value of the asset as so claimed or by more than ₹ 25,000.

- Where the Assessing Officer is of opinion that, having regard to the nature of the asset and relevant circumstances, it is necessary to make a reference to the Valuation Officer.

(b) Reverse Mortgage Scheme and its Tax Implications

(i) The Reverse Mortgage scheme is for the benefit of senior citizens, who own a residential house property. In order to supplement their existing income, they can mortgage their house property with a scheduled bank or housing finance company, in return for a lump-sum amount or for a regular monthly/ quarterly/annual income. The senior citizens can continue to live in the house and receive regular Income, without the botheration of having to pay back the loan.

(ii) The borrower can use the loan amount for renovation and extension of residential property, family’s medical and emergency expenditure etc.;’ amongst others. However, he cannot use the amount for speculative or trading purposes.

(iii) Clause (xvi) of Section 47 clarifies that any transfer of a capital asset in a transaction of reverse mortgage under a scheme made and notified by the Central Government would not amount to transfer for the purpose of capital gains.

(iv) Clause (43) of Section 10 provides that any amount received by an individual as a1 loan, either in lump sum or in installments, in a transaction of reverse mortgage would be exempt from income-tax.

![]()

Question 3.

How will you calculate the period of holding in case of the following assets ?

(1) Shares held in a company in liquidation

(2) Bonus shares

(3) Flat in a co-operative society

(4) Transfer of a security by a depository (i.e., demat account) (Nov 2010, 4 marks)

Answer:

Period of Holding Sec. 2(42A) of the following asset:

1. Shares held in a company in liquidation : Period of holding will be taken from the date of acquisition of shares to the date on which the company goes into liquidation :

2. Bonus Shares : The period of holding shall be taken from the date of allotment of shares till the date preceding the date of transfer of shares.

3. Flat in a co-operative society : The period of holding shall be taken from the date of allotment of the flat from the society to the date preceding the date of transfer of the flat.

4. Transfer of a security by a depository : Period of holding shall be calculated on FIFO basis. For deciding FIFO technique the date of entry in ‘Demat Account’ is significant and the date of purchase of security is irrelevant.

![]()

Question 4.

Discuss the tax implication arising consequent to conversion of a Capital Asset into stock-in-trade of business and its subsequent sale. (Nov 2012, 4 marks)

Answer:

Conversion of a capital asset into stock-in-trade

The conversion of a capital asset into stock-in-trade is treated as a transfer under Section 2(47). It would be treated as a transfer in the year in which the capital asset is converted into stock-in-trade.

However, as per Section 45(2), the profits or gains arising from the transfer by way of conversion of capital assets into stock-in-trade will be chargeable to tax only in the year in which the stock-in-trade is sold or otherwise transferred by the assessee. The indexation benefit for computing indexed cost of acquisition would, however, be available only up to the year of conversion of capital asset to stock-in-trade and not up to the year of sale of stock-in-trade.

For the purpose of computing-capital gains in such cases, the fair market value of the capital asset on the date on which it was converted into stock-in-trade shall be deemed to be the full value of consideration received or accruing as a result of the transfer of the capital asset.

On subsequent sale of such stock-in-trade, business profits would arise. The business income chargeable to tax would be the difference between the price at which the stock-in- trade is sold or transferred and the fair market value on the date of conversion of the capital asset into stock-in-trade.

![]()

Question 5.

Answer the following with regard to the provisions of the Income-tax Act, 1961:

Mrs. X an individual resident woman wanted to know whether Income- tax is attracted on sale of gold and jewellery gifted to her by her parent at the occasion of her marriage in the year 1980 which was purchased at a total cost of ₹ 2,00,000? (Nov 2008, 4 marks)

Answer:

Capital gains in the hands of Mrs. X – Long-term capital gains arising on transfer of gold and jewellery is chargeable to tax in the hands of Mrs. X . Cost of acquisition will be taken as cost of the gold and jewellery to her parents or the Fair Market Value of the asset on April 1,2001, whichever is higher-Long-term capital gain will be calculated after deducting indexed cost of acquisition.

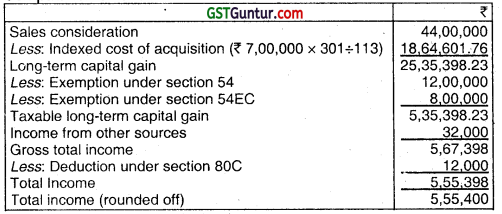

Question 6.

Mr. Kumar is the owner of a residential house which was purchased in September, 2004 for ₹ 7,00,000. He sold the said house on 5th August, 2020 for ₹ 30,00,000. Valuation as per stamp valuation authority of the said plot of land was ₹ 44,00,000. He invested ₹ 8,00,000 in NHAI Bonds on 12th January, 2021. He purchased a residential house on 8th September, 2020 for ₹ 12,00,000. He gives other particulars as follows :

Interest on Bank Deposit – ₹ 32,000

Investment in public provident fund – ₹ 12,000

You are requested to calculate the taxable income for the assessment year 2021-22.

Cost inflation index for F.Y. 2004-05 and 2020-21 are 113 and 301 respectively (May 2009, 8 marks)

Answer:

![]()

Question 7.

Mr. Abhik’s father, who is a senior citizen had pledged his residential house to a bank under a notified reverse mortgage scheme. He was getting loan from bank in monthly instalments. Mr. Abhik’s father did not repay the loan on maturity and given possession of the house to the bank to discharge his loan. How will the treatment of long-term capital gain be made on such reverse mortgage transaction? (May 2009, 3 marks)

Answer:

Reverse Mortgage- At the time of pledging the property to the bank, capital gain is not chargeable to tax. There is no capital gain tax liability in the hands of . Abhik’s Father when bank gives loan or monthly instalment. When possession of the pfoperty is given to the bank, there is no transfer and, consequently, capital gain is not chargeable to tax.

However, when bank transfers the property to realise the amount of loar; and interest, capital gain will be taxable as the transaction is treated as “transfer”. If this transfer takes place during the lifetime of Abhik’s Father (generally in the case of reversed mortgage, bank transfers the property after the death of the person who has pledged the property), capital gain would be taxable in the hands of Abhik’s Father.

If transfer by the bank takes place after the death of Abhik’s father then capital gain will be taxable in the hands of legal heirs of Abhik’s Father.

![]()

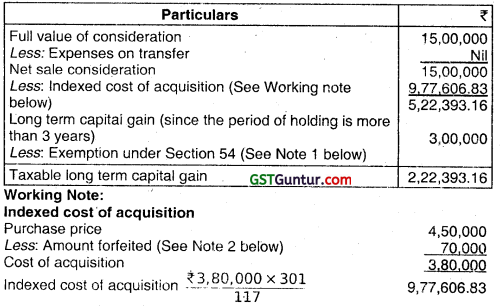

Question 8.

Answer the following :

Compute the net taxable capital gains of Smt. Megha on the basis of the following information :

A house was purchased on 1.05.2005 for ₹ 4,50,000 and was used as a residence by the owner. The owner had contracted to sell this property in June, 2012 for t 10 lacs and had received an advance of ₹ 70,000 towards sale. The intending purchaser did not proceed with the transaction and the advance was forfeited by the owner. The property was sold in April, 2020 for ₹ 15,00,000. The owner, from out of sale proceeds, invested ₹ 3 lacs in a new residential house in January, 2021. (Nov 2009, 6 marks)

Answer:

Computation of net taxable capital gains of Smt. Megha for the A.Y. 2021-22

Notes:

(1)

- There should be a transfer of residential house (buildings or lands appurtenant thereto)

- It must be a long term capital asset

- Income from such house should be chargeable under the head “Income from house property”

- Where the amount of capital gains exceeds ₹ 2 crore

Where the amount of capital gain exceeds ₹ 2 crore, one residential house in India should be:- purchased with 1 year before or 2 years after the date of transfer(or) constructed within a period of 3 years after the date transfer

Where the amount of capital gains does not exceed ₹ 2 crore

Where the amount of capital gains does not exceed ₹ 2 crore, the assessee i.e., individual or HUF, may at his option,

- purchase two residential houses in India within 1 year before or 2 years after the date of transfer(or) construct two residential houses in – India within a period of 3 years after the date of transfer.

Where during any assessment year, the assessee has exercised the option to purchase or construct two residential houses in India, he shall not be subsequently entitled to exercise the option for the same or any other assessment year.

(2) As per Section 51, any advance received and retained by the assessee, as a result of earlier negotiations for sale of the asset, shall be deducted from the purchase price for computing the cost of acquisition of the asset.

![]()

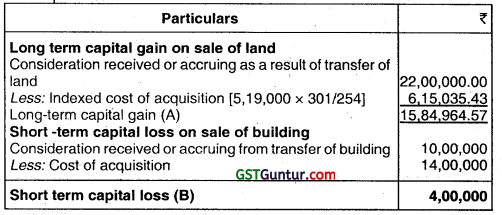

Question 9.

Mr. Raj Kumar sold a house to his friend Mr. Dhuruv on 1st November, 2020 for a consideration of ₹ 25,00,000. The Sub-Registrar refused to register the document for the said value, as according to him, stamp duty had to be paid on ₹ 45,00,000, which was the Government guideline value, Mr. Raj Kumar preferred an appeal to the Revenue Divisional Officer, who fixed the value of the house as ₹ 32,00,000 (₹ 22,00,000 for land balance for building portion). The differential stamp duty was paid, accepting the said value determined. Assuming that the fair market value is ₹ 32,00,000, what are the tax implications in the hands of Mr. Raj Kumar and Mr. Dhuruv for the assessment year 2021-22? Mr. Raj Kumar had purchased the land on 1st June, 2015 for ₹ 5,19,000 and completed the construction of house on 1st October, 2018 for ₹ 14,00,000. (May 2010, 6 marks)

Answer:

In the hands of the seller, Mr. Raj kumar

As per Section 50C(1), where the consideration received or accruing as a result of transfer of land or building or both, is less than the value adopted or assessed or assessable by the stamp valuation authority, the value adopted or assessed or assessable by the stamp valuation authority shall be deemed to be the full value of consideration received or accruing as a result of transfer.

However, where the stamp duty value does not exceed 110% of the sale consideration received or accruing as a result of transfer, the consideration so received or accruing as a result of transfer shall, for the purpose of section 48, be deemed to be the full value of the consideration.

![]()

Where the assessee appeals against the stamp valuation and the value is reduced in appeal by the appellate authority( Revenue Divisional Officer, in this case), such value will be regarded as the consideration received or accruing as a result of transfer.

In the given problem, land has been held for a period exceeding 24 months and building for a period less than 24 months immediately preceding the date of transfer. So land is a long – term capital asset, while building is a short – term capital asset.

As per Section 70, short – term capital loss can be set-off against long term capital gains. Therefore, the net taxable long- term capital gains would be ₹ 11,84,964.57 (i.e.) ₹ 15,84,964.57 – ₹ 4,00,000.

In the hands of the buyer Mr. Dhuruv

Purchase of immovable property for an adequate consideration is income in the hands of purchaser i.e. Mr. Dhuruv.

Income u/h other sources = 32,00,000 – 25,00,000 = 7,00,000

![]()

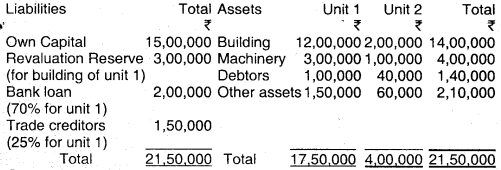

Question 10.

Mr. A is a proprietor of Akash Enterprises having 2 units. He transferred on 1.4.2020 his unit 1 by way of slump sale for a total consideration of ₹ 25 Lacs. The expenses incurred for this transfer were ₹ 28,000/-. VHis Balance Sheet as on 31.3.2020 is as under:

Other information :

(i) Revaluation reserve is created by revising upward .the value of the building of unit 1.

(ii) No individual value of any asset is considered in the transfer deed,

(iii) Other assets of unit 1 include patents acquired on 1.7.2018 for ₹ 50,000/- on which no depreciation has been charged.

Compute the capital gain for the assessment year 2021-22. (Nov 2010, 5 marks)

Answer:

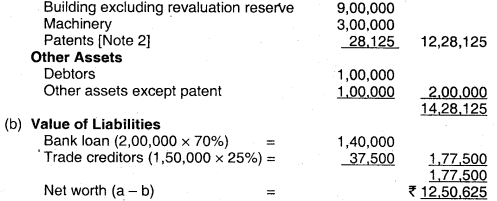

Capital gain on transferee of unit 1 by way of slump sale u/s 50 B

Note 1:

Cost of acquisition or improvement = Net worth of the undertaking

Net worth of the undertaking

(a) Aggregate value of total assets

Depreciable Assets

Note 2 : Since patent have been acquired 1.7.2018 therefore depreciation @25% p.a. will be charged for two years on WDV basis . Therefore book values as on 31.3.2020 = 50,000 × .75 × .75 = ₹ 28,125

Note 3: For the purpose of computation of net worth, the WDV determined as per Section 43(6) has to be considered in the case of depreciable assets. The said problem has been solved assuming that B/S value of ₹ 3 lakhs and ₹ 9 lakhs (₹ 12 lakhs – 3 lakhs) represents the written down value of machinery & building respectively, of unit 1.

![]()

Question 11.

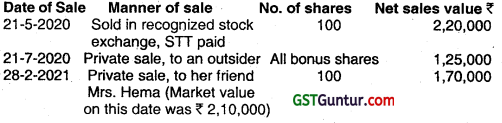

On 21-3-2020, Mr. Janak gifted to his wife Mrs. Thilagam 200 listed shares, which had been bought by him on 19.4.2019 at ₹ 2,000 per share. On 1.6.2019, bonus shares were allotted in the ratio of 1:1. All these shares were sold by Mrs. Thilagam as under:

Briefly state the income-tax consequences in respect of the sale of the shares by Mrs. Thilagam, showing clearly the person in whose hands the same is chargeable, the quantum and the head of income in respect of the above transactions. Detailed computation of total income is not required. Net sales value represents the amount credited after all taxes, levies, brokerage, etc., and the same may be adopted for computing the capital gains.

Cost inflation index for the FY 2019-20 is 289 and for the FY 2020-21 is 301. (May 2011, 5 marks)

Answer:

- When an asset has been transferred by an individual to his spouse otherwise than for adequate consideration, the income arising from the sale of the said asset by the spouse will be clubbed in the hands of the individual.

- When there is any accretion to the asset transferred, income arising to the transferee from such accretion will not be clubbed. Therefore, the profit from sale of bonus shares allotted to Mrs. Thilagam will be chargeable to tax in the hands of Mrs. Thilagam.

- Hence, the capital gain arising from the sale of the original shares has to be included in the hands of Mr. Janak, and the capital gains arising from the sale of bonus shares would be taxable in the hands of Mrs. Thilagam.

- When an asset received by way of gift has been sold, the period of holding of the previous owner should be considered for determining whether the capital gain is long term or short term. The cost to the previous owner has to be taken as the cost of acquisition.

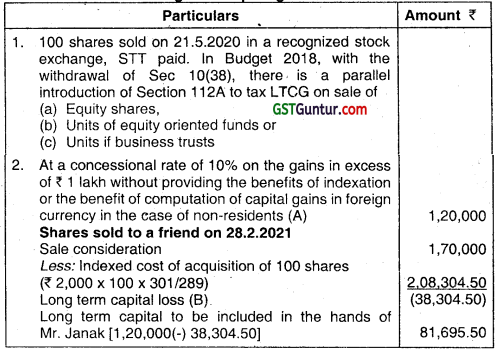

1. Income/loss to be clubbed in the hands of Mr. Janak

Long-term capital gains/loss

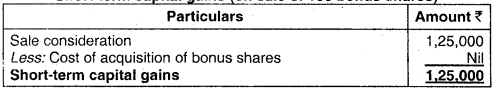

2. Taxability in the hands of Mrs. Thilagam

Short-term capital gains (on sale of 100 bonus shares)

3. TaxabIlity in the hands of Mrs. Hema under the head “Income from other sources”

Mrs. Hema has received shares from her friend, Mrs. Thilagam, for inadequate consideration. Even though shares fall within the definition of “property” under Section 56(2)(vii), the provisions of Section 56(2)(vii) would not be attracted in the hands of Mrs. Hema, since the difference between the fair market value of shares and actual sale consideration does not exceed ₹ 50,000.

![]()

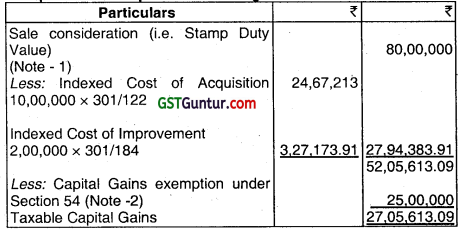

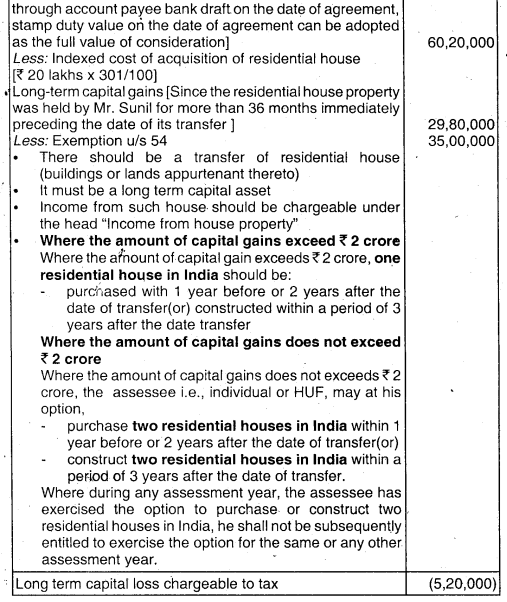

Question 12.

Mr. Selvan, acquired a residential house in January, 2007 for ₹ 10,00,000 and made some improvements by way of additional construction to the house, incurring expenditure of ₹ 2,00,000 in October, 2011. He sold the house property in October, 2020 for ₹ 75,00,000. The value of property was adopted as ₹ 80,00,000 by the State stamp valuation authority for registration purpose. He acquired a residential house in January, 2021 for ₹ 25,00,000. He deposited ₹ 20,00,000 in capital gains

bonds issued by National Highways Authority of India (NHAI) in June, 2021. Compute the capital gain chargeable to tax for the assessment year 2021-22.

What would be the tax consequence and ¡n which assessment year it would be taxable, if the house property acquired in January, 2021 is sold for ₹ 40,00,000 in March, 2022?

Cost inflation index :

F.Y. 2006-2007 = 122

F.Y. 2011-2012 = 184

F.Y. 2020-202 1 = 301 (Nov 2011, 8 marks)

Answer:

(i) Computation of Capital Gains Chargeable to tax for A.Y. 2021 -22

Notes:

1. As per the provisions of Section 50C, in case the stamp duty value adopted by the stamp valuation authority is higher than the actual sale consideration, the stamp duty value shall be deemed as the full value of consideration. However, where the stamp duty value does not exceed 110% of the sale consideration received or accruing as a result of transfer, the consideration so received or accruing as a result of transfer shall, for the purpose of section 48, be deemed to be the full value of the consideration.

![]()

2.

- There should be a transfer of residential house (buildings or lands appurtenant thereto)

- It must be a long term capital asset

- Income from such house should be chargeable under the head “Income from house property”

- Where the amount of capital gains exceeds ₹ 2 crore

Where the amount of capital gain exceeds ₹ 2 crore, one residential house in India should be:

purchased with 1 year before or 2 years after the date of transfer(or) constructed within a period of 3 years after the date transfer

Where the amount of capital gains does not exceed ₹ 2 crore

Where the amount of capital gains does not exceeds ₹ 2 crore, the assessee i.e., individual or HUF, may at his option,

- purchase two residential houses in India within 1 year before or 2 years after the date of transfer(or)

- construct two residential houses in India within a period of 3 years after the date of transfer.

Where during any assessment year, the assessee has exercised the option to purchase or construct two residential houses in India, he shall not be subsequently entitled to exercise the option for the same or any other assessment year.

3. Exemption under Section 54EC is available in respect of investment in bonds of National Highways Authority of India only if the investment is made within a period six months after the date of such transfer. In this case, since the investment is made after six months, exemption under Section 54EC would not be available.

(ii) If the new asset purchased by the assessee on the basis of which exemption under Section 54 is claimed, is transferred within 3 years from the date of its acquisition, then for computing’ the taxable short-term capital gain on such-transfer, the capital gain exempted earlier shall be reduced from the cost of acquisition of such asset.

Hence, in the present case, if the house property acquired in January, 2021 is sold for ₹ 40,00,000 in March, 2023 (i.e. before the expiry of 3 years from the date of acquisition), the capital gains exempted earlier (i.e. ₹ 25,00,000) would be reduced from the cost of acquisition (i.e. ₹ 25,00,000) to arrive at the short-term capital gains far A.Y. 2023- 24.

![]()

Question 13.

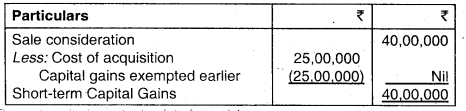

On 10-10-2020, Mr. Govind (a bank employee) received ₹ 5,00,000 towards interest on enhanced compensation from State Government in respect of compulsory acquisition of his land effected during the financial year 2013-14.

Out of this interest, ₹ 1,50,000 relates to the financial year 2015-16; % 1,65,000 to the financial year 2016-17; and ₹ 1,85,000 to the financial year 2017-18. He incurred ₹ 50,000 by way of legal expenses to receive the interest on such enhanced compensation.

How much of interest on enhanced compensation would be chargeable to tax for the assessment year 2021 -22? (Nov 2011, 4 marks)

Answer:

Section 145B provides that interest received by the assessee on enhanced compensation shall be deemed to be the income of the assessee of the year in which it is received, irrespective of the method of accounting followed by the assessee and irrespective of the financial year to which it relates.

Section 56(2)(viii) states that such income shall be taxable as income from other sources’.

50% of such income shall be allowed as deduction by virtue of Section 57(iv) and no other deduction shall be permissible from such Income.

Therefore, legal expenses incurred to receive the interest on enhanced compensation would not be allowed as deduction from such income.

Computation of interest on enhanced compensation taxable as “Income from other sources” for the A.Y. 2021-22.

![]()

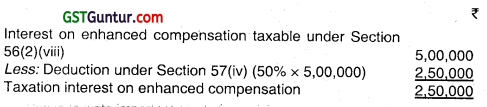

Question 14.

Anshu transfers land and building on 02-01-2021 and furnishes the following informations.

| Particulars | ₹ |

| (i) Net consideration received | 14,00,000 |

| (ii) Value adopted by Stamp Valuation Authority | 23,00,000 |

| (iii) Value ascertained by Valuation Officer on reference by the Assessing Officer. | 24,00,000 |

| (iv) This land was acquired by Anshu on 1 -04-2001. Fair Market value of the land as on 01-04-2001 was | 1,10,000 |

| (v) A Residential building was constructed on land by Anshu at cost of ₹ 3,20,000 (construction completed on 01-12-2005 during financial year 2006-07). | |

| Short term capital loss incurred on sale of shares during financial Year 2012-13 b/f of ₹ 1,00,000. |

Anshu seeks your advice to the amount to be invested in NHAI bonds so as to be exempt from capital gain tax under Income Tax Act.

Cost inflation index for FY 2001-2002 = 100

Cost inflation index for FY 2006-2007 = 122

Cost inflation index for FY 2020-2021 = 301 (May 2012, 8 marks)

Answer:

Computation of Capital Gains of Ms. Anshu for the A. Y. 2021-22

Notes:

(i) As per Section 50C(1), where the consideration received or accruing as a result of transfer of a capital asset, being land or building or both, is less than the value adopted by the Stamp Valuation Authority for the purpose of payment of stamp duty, such value adopted by the Stamp Valuation Authority shall be deemed to be the full value of the consideration received or accruing as a result of such transfer.

Accordingly, full value of consideration would be ₹ 23 lakhs in this case. However, where the stamp duty value does not exceed 110% of the sale consideration received or accruing as a result of transfer, the consideration so received or accruing as a result of transfer shall, for the purpose of section 48, be deemed to be the full value of the consideration.

![]()

(ii) As per Section 50C(3), where the valuation is referred by the Assessing Officer to Valuation Officer and the value ascertained by such Valuation Officer exceeds the value adopted by the Stamp Valuation Authority for the purpose of payment of stamp duty, the value adopted by the Stamp Valuation Authority shall be taken as the full value of the consideration received or accruing as a result of the transfer. Since the value ascertained by the Valuation Officer (i.e. ₹ 24 lakhs) is higher than the value adopted by the Stamp Valuation Authority (i.e. ₹ 23 lakhs), the full value of consideration in this case would be ₹ 23 lakhs.

(iii) Since the cost of land acquired by Anshu on 1.4.2001 is not given in the question, the fair market value as on 1.4.2001 is taken as the cost of acquisition. Indexation benefit is available since land and building are both long-term capital assets, as they are held by Anshu for more than 24 months.

(iv) As per Section 74, brought forward unabsorbed short term capital loss can be set-off against any capital gains, short term or long term, for 3 assessment years immediately succeeding the assessment year for which the loss was first computed.

Therefore, short-term capital loss on sale of shares during the F.Y.2010-11 can be set-off against the current year long-term capital gains on sale of land and building.

(v) As per Section 54EC, an assessee can avail exemption in respect of long-term capital gains, if such capital gains are invested in the bonds issued by the NHAI redeemable after 5 years. Such investment is required to be made within a period of 6 months from the date of transfer of the asset.

The exemption shall be the amount of capital gains or the amount of such investment made, whichever is less. Therefore, in this case if Anshu invests the entire capital gains of ₹ 10,69,982 in bonds of NHAI, she can get full exemption from tax on capital gains.

![]()

Question 15.

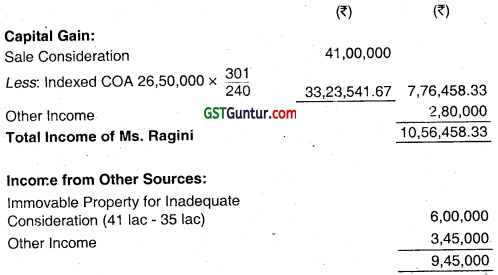

Ms. Mohini transferred a house to her friend Ms. Ragini for ₹ 35,00,000 on 01-10-2020. The Sub Registrar valued the land at ₹48,00,000. Ms. Mohini contested the valuation and the matter was referred to Divisional Revenue Officer, who valued the house at ₹ 41,00,000. Accepting the said value, differential stamp duty was also paid and the transfer was completed.

The total income of Mohini and Ragini for the assessment year 2021-22, before considering the transfer of said house are ₹ 2,80,000 and ₹ 3,45,000, respectively. Ms. Mohini had purchased the house on 15th May 2014 for ₹ 25,00,000 and registration expenses were ₹ 1,50,000.

You are required to explain provisions of Income-tax Act, 1961 applicable to present case and also determine the total income of both Ms. Mohini and Ms. Ragini taking into account the above said transactions. Cost inflation indices for:

(i) Financial Year 2014-15 : 240 and

(ii) Financial Year 2020-21 : 301 (May 2015, 8 marks)

Answer:

Total income of Ms. Mohini

![]()

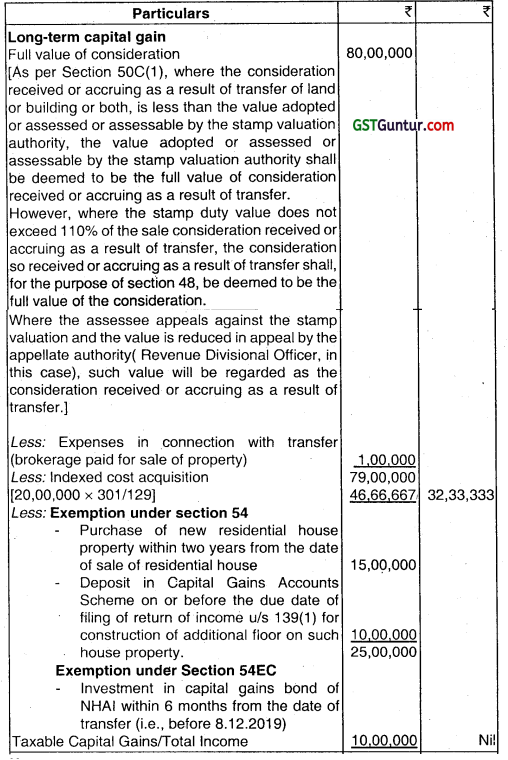

Question 16.

Mr. Martin sold his residential house property on 08-06- 2020 for 70 lakhs which was purchased by him for 20 lakhs on 05-05-2007. He paid ₹ 1 lakh as brokerage for the sale of said property. The stamp duty valuation assessed by sub registrar was ₹ 80 lakhs.

He bought another house property on 25-12-2020 for 15 lakhs.

He deposited 10 lakhs on 10-11-2020 in the capital gain bond of National Highway Authority of India (NHAI).

He deposited another 10 lakhs on 10-07-2021 in the capital gain deposit scheme with SBI for construction of additional floor of house property.

Compute income under the head “Capital Gains” for A.Y. 2021-22 as per Income Tax Act, 1961 and also Income tax payable on the assumption that he has no other income chargeable to tax.

Cost inflation index for Financial Year 2007-08 = 129 and 2020-21 = 301. (Nov 2015, 8 marks)

Answer:

Computation of income under the head “Capital Gains” of Mr. Martin for A.Y. 2021-22

![]()

Note:

- There should be a transfer of residential house (buildings or lands appurtenant thereto)

- It must be a long term capital asset

- Income from such house should be chargeable under the head “Income from house property”

- Where the amount of capital gains exceeds ₹ 2 crore

Where the amount of capital gain exceeds ₹ 2 crore, one residential house in India should be:- purchased with 1 year before or 2 years after the date of transfer(or) constructed within a period of 3 years after the date transfer

Where the amount of capital gains does not exceed ₹ 2 crore

Where the amount of capital gains does not exceed ₹ 2 crore, the assessee i.e., individual or HUF, may at his option,

- purchase two residential houses in India within 1 year before or 2 years after the date of transfer(or)

- construct two residential houses in India within a period of 3 years after the date of transfer.

Where during any assessment year, the assessee has exercised the option to purchase or construct two residential houses in India, he shall not be subsequently entitled to exercise the option for the same or any other assessment year.

![]()

Question 17.

Discuss the taxability or otherwise in the hands of the recipients, as per the provisions of the Income-tax Act, 1961: (May 2016)

(i) ABC Private Limited, a closely held company, issued 10,000 share at ₹ 130 per share. (The face value of the share is ₹ 100 per share and the fair market value of the share is ₹ 120 per share). (2 marks)

(ii) Mr. A received an advance of ₹ 50,000 on 1-09-2020 against the sale of his house. However, due to non-payment of instalment in time, the contract has cancelled and the amount of ₹ 50,000 was forfeited. (2 marks)

Answer:

(i) [130 – 120] × 10,000 = ₹ 1,00,000 is taxable in the hands of ABC Pvt. Ltd.

(ii) Taxable under “Income from Other Sources” u/s 56 in the hands of Mr. A.

![]()

Question 18.

State with reason whether the following receipt is taxable or not under the provision of Income-tax Act, 1961 ?

Mr. Suman received an advance of ₹ 3 lakhs on 06-06-2020 to transfer his residential house property. Since the transfer was not effected during the previous year due to failure in negotiations, he deducted the advance money forfeited from the cost of acquisition of the property. (Nov 2016, 2 marks)

Answer:

Taxability of receipt under the provision of the Income-tax Act, 1961

| Taxable/ Not Taxable | Reason |

| Taxable | As per Section 56(2)(ix), any sum of money received as an advance or otherwise on or after 1.4.2014 in the course of negotiations for transfer of a capital asset would be chargeable to tax under the head “Income from Other Sources”, if such amount is forfeited and the negotiations do not result in transfer of such capital asset.

Therefore, the amount of ₹ 3 lakhs received as advance on 6.6.2020 for transfer of residential house would be chargeable to tax in the hands of Mr. Suman under the head “Income from Other Sources”, since it is forfeited due to failure in negotiations. |

![]()

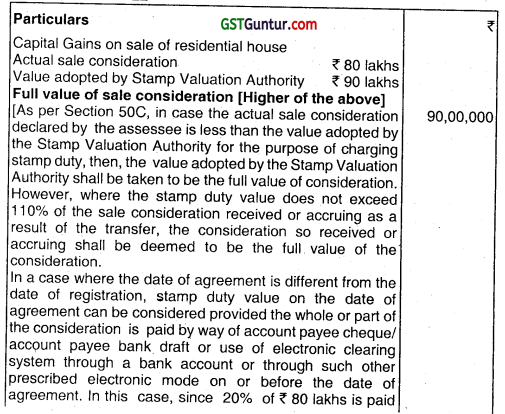

Question 19.

Mr. Sunil entered into an agreement with Mr. Dhaval to sell his residential house located at Navi Mumbai on 16.08.2020 for ₹ 80,00,000. The sale proceeds was to be paid in the following manner;

(i) 20% through account payee bank draft on the ante of agreement.

(ii) 60% on the date of the possession of the property.

(iii) Balance after the completion of the registration of the title of the property.

Mr. Dhaval was handed over the possession of the property on 15.12.2020 and the registration process was completed on 14.01.2021. He paid the sale proceeds as per the sale agreement.

The value determined by the Stamp Duty Authority on 16.08.2020 was ₹ 90,00,000 whereas, on 14.01.2021 it was ₹ 91,50,000.

Mr. Sunil had acquired the property on 01.04.2001 for ₹ 20,00,000. After recovering the sale proceeds from Dhaval, he purchased another residential house property for ₹ 35,00,000.

Compute the income under the head “Capital Gains” for the Assessment Year 2021-22.

Cost Inflation Index for Financial Year(s)

2001-02 – 100

2003-04 – 109

2020-21 – 301 (Nov 2017, 5 marks)

Answer

(a) Computation of income chargeable under the head “Capital Gains” for A-Y. 2021-22

![]()

Question 20.

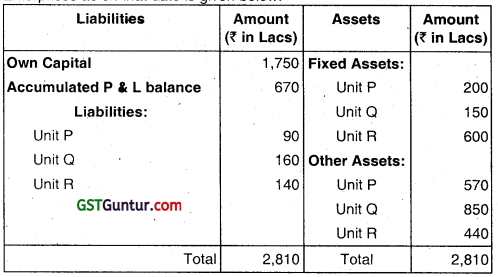

Star Enterprises has transferred its unit R to A Ltd. by way of Slump Sale on January 23, 2021. The summarized Balance Sheet of Star Enterprises as on that date is given below:

Using the further information below, compute the Capital Gains arising from slump sale of Unit R for Assessment year 2021 -22.

(i) Slump sale consideration on transfer of Unit R was ₹ 930 lacs.

(ii) Fixed Assets of Unit R includes land which was purchased at ₹ 110 lacs in the year 2010 and was revalued at ₹ 140 lacs

(iii) Other fixed assets are reflected at ₹ 460 lacs. (i.e. ₹ 600 lacs less value of land) which represents written down value of those assets as per books. The written down value of these asset is ₹ 430 lacs.

(iv) Unit R was set up by Star Enterprises in Oct, 2009.

Note: Cost of inflation Indices for the financial year 2010-11 and financial year 2020-2 1 are 167 and 301 respectively. (May 2018, 10 marks)

Answer:

2. In case of Slump sale indexation benefit is not available.

3. Revaluation is ignored in slump sale.

4. Period of holding in case of slump sale commenced from the date of commencement of the unit which is transferred upto the date of transfer of such unit which is more than 36 months in given case. Hence gain is long term capital gain.

![]()

Question 21.

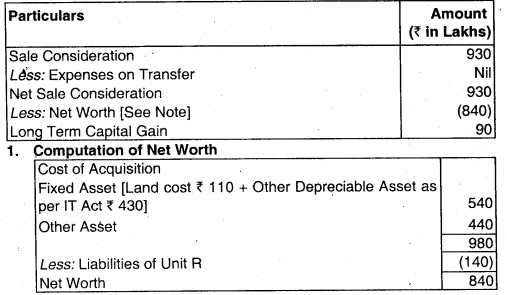

Mr. Subramarti sold a house plot to Mrs. Vimala for ₹ 45 lakhs on 12-5-2020. The valuation determined by the stamp valuation authority was ₹ 53 lakhs. Discuss the tax consequences of above, in the hands of each one of them, viz, Mr. Subramani & Mrs. Vimala.

Mrs. Vimala has sold this plot to Ms. Padmaja on 21-3-2021 for ₹ 55 lakhs.

The valuation as per stamp valuation authority remains the same at ₹ 53 lakhs.

Compute the capital gains arising on sale of the house plot by Mrs. Vimala.

Note: None of the parties viz Mr. Subramani, Mrs. Vimala & Ms. Padmaja are related to each other the transactions are between outsiders. (Nov 2018, 6 marks)

Answer:

(i) Tax consequences in the hands of Mr. Subramani

As per section 50C, the stamp duty value of immovable property, being land or building or both, would be deemed to be the full value of consideration arising on transfer of such property, if the same is higher than actual consideration.

Accordingly, in this case, capital gains would be computed in the hands of Mr. Subramani, for A.Y.2021-22, taking the stamp duty value of ₹ 53 lakh of house plot as the full value of consideration arising on transfer of such house plot, since the same is higher than the actual consideration of ₹ 45 lakh. In the given case since stamp duty value exceeds 110% hence stamp duty value will be taken as full value of considieration.

Note: – If it is assumed that Mr. Subramani is a property dealer, the income would be taxable as his bLisiness income under section 43CA

![]()

(ii) Tax consequences In the hands of Mrs. Vimala In case immovable property is received for inadequate consideration, the difference between the stamp duty value and actual consideration would be taxable under section 56(2)(x) in the hands of the recipient, if such difference exceeds ₹ 50,000.

Therefore, in this case, ‘ 8 lakh (₹ 53 Iakh – ₹ 45 lakh) would be taxable in the hands of Mrs. Vimala under the head “Income from Other Sources” in A.Y.2021 -22.

At the time of subsequent sale of property by Mrs. Vimala to Mrs. Padmaja (on 21.3.2021), short-term capital gains would arise in the hands of Mrs. Vimala in A.Y.2021-22, since the property is held by her for less than 24 months.

![]()

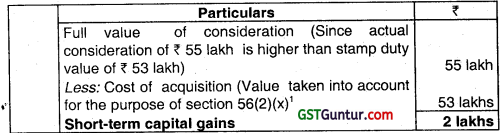

Question 22.

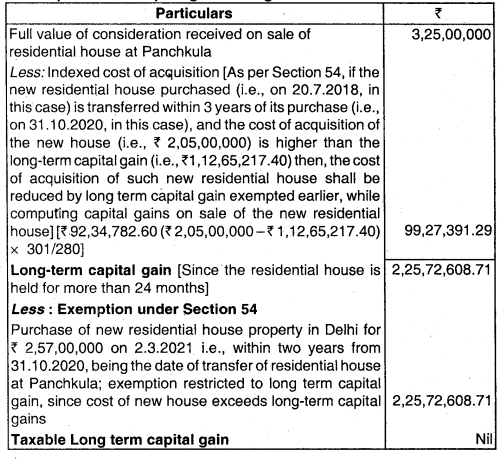

Mr. Roy owned a residential house in Noida. It was acquired on 09.09.2011 for ₹ 30,00,000. He sold it for ₹ 1,57,00,000 on 07.01.2018.

Mr. Roy utilized the sale proceeds of the above property to acquire a residential house in Panchkula for ₹ 2,05,00,000 on 20.07.2018. The said house property was sold on 31.10.2020 and he purchased another residential house in Delhi for ₹ 2,57,00,000 on 02.03.2021. The property at Panchkula was sold for ₹ 3,25,00,000.

Calculate capital gains chargeable to tax for the assessment year 2018-19 and 2021 -22. All workings should form part of your answer.

Cost inflation index for various financial years are as under:

2011-12 – 184

2017- 18 – 272

2018- 19 – 280

2020 – 21 – 301 (May 2019, 6 marks)

Answer:

Computation of capital gains chargeable to tax for for AY. 20.18-19:

Computation of capital gains chargeable to tax for for AY. 2021-22:

![]()

Question 23.

(a) Mr. Rajan provides you the following details with regard to sale of certain securities by him during F.Y. 2020-21: (Nov 2019)

(i) Sold 10000 shares of A Ltd. on 05-04-2020 @ ₹ 650 per share

A Ltd. is a listed company. These shares were acquired by Mr. Rajan on 05-04-2018 @ ₹ 100 per share. STT was paid both at the time of acquisition as well as at the time of transfer of such shares which was affected through a recognized stock exchange. On 31-01-2020, the shares of A Ltd. were traded on a recognized stock exchange as under:

Highest price – ₹ 300 per share

Average price – ₹ 290 per share

Lowest price – ₹ 280 per share

(ii) Sold 1000 units of B Mutual Fund on 20-04-2020 @ ₹ 50 per unit

B Mutual Fund is an equity oriented fund. These units were acquired by Mr. Rajan on 15-04-2019 @ ₹ 10 per unit. STT was paid only at the time of transfer of such units. On 31 -01 -2020, the Net Asset Value of the units of B Mutual Fund was ₹ 55 per unit.

(iii) Sold 100 shares of C Ltd. on 25-04-2020 @ ₹ 200 per share

C Ltd. is an un-listed company. These shares were issued by the company as bonus shares on 30-09-1998. The Fair Market Value of these shares as on 01 -04-2001 was ₹ 50 per share.

Cost Inflation Index for various financial year are as under:

2001-02 – 100

2018-19 – 280

2019-20 – 289

2020-21 – 301

Calculate the amount chargeable to tax under the head ‘Capital Gains’ and also calculate tax on such gains for A.Y. 2021 -22 assuming that the other incomes of Mr. Rajan exceeds the maximum amount not chargeable to tax. (Ignore surcharge and cess). ( 6 marks)

![]()

(b) MLX Investments (P) Ltd. was incorporated during P.Y. 2018-19 having a paid up capital of ₹ 10 LAKHS. In order to increase its capital, the company further issues, 1,00,000 shares (having face value of ₹ 100 each) during the year at par as on 01 -08-2020. The FMV of such share as on 01 -08-2020 was ₹ 85.

(i) Determine the tax implications of the above transaction in the hands of company, assuming it is the only transaction made during the year.

(ii) Will your answer change, if shares were issued at ₹ 105 each?

(iii) What will be your answer, if shares were issued at ₹ 105 and FMV of the share was ₹ 120 as on 01 -08-2020? (4 marks)

Answer:

(a) Computation of Income chargeable to tax of Mr. Rajan for AY 2021-22

The cost of acquisition in relation to the long-term capital assets being,

- equity shares in a company on which STT is paid both at the time of purchase and transfer or

- unit of equity oriented fund or unit of business trust on which STT is paid at the time of transfer.

acquired before 1st February, 2018 shall be the higher of

(i) cost of acquisition of such asset; and

(ii) lower of

(a) the fair market value of such asset; and

(b) the full value of consideration received or accruing as a result of the transfer of the capital asset.

(i) In the given case since listed shares are acquired by Rajan on 05.04.2018 and sold on 05.04.2020 and STT is paid both at the time of acquisition and transfer, the period of holding if it exceeds 12 months then it is a long term capital asset. Since the period of holding is more than 12 months hence it is a long term capital asset. Moreover Long-term capital gains exceeding ₹ 1 lakh on sale of original shares through a recognized stock exchange (STT paid at the time of acquisition and sale) is taxable under Section 112A at a concessional fate of 10%, without indexation benefit.

Sale consideration = 10000 shares * 650 = ₹ 65,00,000

Less: Expenses on transfer = —

Net Sale Consideration = ₹ 65,00,000

Less:

Cost of acquisition [Since covered

u/s 112A hence no indexation] = ₹ 30,00,000

Long term capital Gain = ₹ 35,00,000

[Cost of acquisition in the given case is higher of 10,00,000 or 30,00,000 i.e. 30,00,000 [Calculation below]

![]()

(a) cost of acquisition of such asset i.e.10000 shares *100 per share = 10,00,000; and

(b) lower of

I. the fair market value of such asset(lf there is trading in such asset on such exchange on 31.01.2018. The highest price of the capital asset quoted on such exchange on the said date i.e. 300 per share total = 300*10000 = 30,00,000

II. the full value of consideration received or accruing as a result of the transfer the capital asset i.e. 650*10000 = 65,00,000 Lower of I or II = 30,00,000

(ii) In the given case since units of equity oriented fund are acquired by Rajan on 15.04.2019 and sold on 20.04.2020 and STT is paid at the time of transfer, the period of holding if it exceeds 12 months then it is a long term capital asset. Since the period of holding is more than 12 months hence it is a long term capital asset.

Sale consideration = 1000 units * 50 = ₹ 50,000

Less: Expenses on transfer = —

Net Sale Consideration = ₹ 50,000

Less:

Cost of acquisition [Since covered u/s 112A hence no indexation] = ₹ 50,000

Long term capital Gain ‘ = 0

[Cost of acquisition in the given case is higher of 10000 or 50000 i.e. [ Calculation below]

(a) cost of acquisition of such asset i.e. 1000 units *10 per unit = 10,000; and

(b) lower of

I. the fair market value of such asset 55* 1000 = 55,000 [i.e. The net asset value of such unit as on the said date in case where, the capital asset is a unit which is not listed on any recognized stock exchange as on 31.01.2018

II. the full value of consideration received or accruing as a result of the transfer of the capital asset i.e. 50*1000 = 50,000 Lower of I or II = 50,000

![]()

(iii) In the given case since bonus shares are allotted before 01.04.2001 cost of acquisition of bonus shares wilt be FMV as 01.04.2001.

Sale Consideration 100*200 = 20,000

Less: Expenses =

Net Sale Consideration = 20000

Less: Indexed Cost of acquisition = 14,450

(100*50 = 5000*289/100)

Long terni Capital Gain = 5,550/-

Amount chargeable to tax under the head capital gain =

Total of (i) + (ii) + (iii) = 35,00,000 + 0 + 5,550 = 35,05,550/-

Tax on LTCG covered u/s 112A @ 10 % (i + ii) i.e. [35,00,000 – 1,00,000]

34,00,000 @ 10% = 3,40,000/-

Tax on LTCG other than 112A @ 20%

(iii) i.e. 5,550 @ 20% = 1,110

Total Tax before surcharge and cess = 3,41,110

Note: In case of a resident individual or a Hindu Undivided Family (HUF), the.long- term capital gain taxable u/s 112 or 112A or short-term capital gain taxable u/s 111A shall be reduced by the unexhausted basic exemption limit and the balance shall be subject to tax. Since the other income already exceeds the exemption limit hence unexhausted basic exemption limit benefit is not available.

![]()

(b) (i) The provisions of Section 56(2)(viib) are attracted in a case where the shares are issued at a premium (i.e., issue price exceeds the face value of shares). The excess of the issue price of the shares over the FMV would be taxable under Section 56(2)(viib).

In the given case since shares are issued at par hence it is not taxable.

(ii) The provisions of Section 56(2)(viib) are attracted in a case where the shares are issued at a premium (i.e., issue price exceeds the face value of shares). The excess of the issue price of the shares over the FMV would be taxable under Section 56(2)(viib).

In the given case since shares are issued at ?105 i.e. at premium greater than face value of ₹ 100, the excess of the issue price of the shares over the FMV would be taxable under Section 56(2)(viib) i.e 105(-) 85= 20 per share taxable Total taxable value = 20 * 100000 = 20,00,000/-

(iii) The provisions of Section 56(2)(viib) are attracted in a case where the shares are issued at a premium (i.e., issue price exceeds the face value of shares). The excess of the issue price of the shares over the FMV would be taxable under Section 56(2)(viib).

The shares are issued at premium but the issue price does not exceeds the FMV of the shares, hence not taxable.

![]()

Question 24.

Mr. Govind purchased 600 shares of “Y” limited at ₹ 130 per share on 26.02.1979. “Y” limited issued him, 1,200 bonus shares on 20.02.1984. The fair market value of these shares at Mumbai Stock Exchange as on 1.04.2001 was ₹ 900 per share and ₹ 2,000 per share as on 31.01.2018. On 31.01.2020 he converted 1000 shares as his stock in trade. The shares was traded at Mumbai Stock Exchange on that date at a high of ₹ 2,200 per share and closed for the day at ₹ 2,100 per share.

On 07.07.2020 Mr. Govind sold all 1800 shares @ ₹ 2,400 per share at Mumbai Stock Exchange and securities-transaction tax was paid.

Compute total income of Mr. Govind for the assessment year 2021-22. (Nov 2020, 5 marks)

Question 25.

A is the owner of a car. On 1-4-2020, he starts a business of purchase and sale of motor cars. He treats the above car as part of the stock-in-trade of his new business. He sells the same on 31 -3-2021 and gets a profit of ? 1 lakh. Discuss the tax implication.

Answer:

Since car is a personal asset, conversion or treatment of the same as the stock-in-trade of his business will not be trapped by the provisions of section 45(2). Hence, A is not liable to capital gains tax.

![]()

Question 26.

X converts his capital asset (acquired on June 10, 2003 for ₹ 60,000) into stock-in-trade on March 10,2020. The fair market value on the date of the above conversion was ₹ 5,50,000. He subsequently sells the stock-in-trade so converted for ₹ 6,00,000 on June 10, 2020. Discuss the year of chargeability of capital gain.

Answer:

Since the capital asset is converted into stock-in-trade during the previous year relevant to the A.Y. 2020-21, it will be a transfer under Section 2(47) during the P.Y. 2019-20. However, the profits or gains arising from the above conversion will be chargeable to tax during the A.Y. 2021 -22, since the stock-in-trade has been sold only on June 10,2020. For this purpose, the fair market value on the date of such conversion (i.e. 10th March, 2020) will be the full value of consideration.

Year of Chargeability: Capital gains are chargeable as the income of the previous year in which the sale or transfer takes place. In other words, for determining the year of chargeability, the relevant date of transfer is not the date of the agreement to sell, but the actual date of sale i.e., the date on which the effect of transfer of title to the property as contemplated by the parties has taken place.

However, as already noted, Income-tax Act has recognised certain transactions as transfer in spite of the fact that conveyance deed might not have been executed and registered. Power of Attorney sales as explained above or co-operative society transactions for acquisition of house are examples in this regard.

![]()

Question 27.

M held 2000 shares in a company ABC Ltd. This company amalgamated with another company during the previous year ending 31-3-2021. Under the scheme of amalgamation, M was allotted 1000 shares in the new company. The market value of shares allotted is higher by ₹ 50,000 than the value of holding in ABC Ltd. The Assessing Officer proposes to treat the transaction as an exchange and to tax ₹ 50,000 as capital gain. Is he justified?

Answer:

In the above example, assuming that the amalgamated company is an Indian company, the transaction is squarely covered by the exemption explained above and the proposal of the Assessing Officer to treat the transaction as a transfer is not justified.

![]()

Question 28.

In which of the following situations capital gains tax liability does not arise?

(i) Mr. A purchased gold in 1970 for ₹ 25,000. In the P.Y. 2020-21, he gifted it to his son at the time of marriage. Fair market value (FMV) of the gold on the day the gift was made was ₹ 1,00,000.

(ii) A house property is purchased by a Hindu undivided family in 1945 for ₹ 20,000. It is given to one of the family members in the P.Y. 2020-21 at the time of partition of the family. FMV on the day of partition was ₹ 12,00,000.

(iii) Mr. B purchased 50 convertible debentures for ₹ 40,000 in 1995 which are converted in to 500 shares worth ₹ 85,000 in November 2020 by the company.

Answer:

We know that capital gains arise only when we transfer a capital asset. The liability of capital gains tax in the situations given above is discussed as follows:

(i) As per the provisions of Section 47(iii), transfer of a capital asset under a gift is not regarded as transfer for the purpose of capital gains. Therefore, capital gains tax liability does not arise in the given situation.

(ii) As per the provisions of Section 47(i), transfer of a capital asset (being in kind) on the total or partial partition of Hindu undivided family is not regarded as transfer for the purpose of capital gains. Therefore, capital gains tax liability does not arise in the given situation.

(iii) As per the provisions of Section 47(x), transfer by way of conversion of bonds or debentures, debenture stock or deposit certificates in any form of a company into shares or debentures of that company is not regarded as transfer for the purpose of capital gains. Therefore, capital gains tax liability does not arise in the given situation.

![]()

Question 29.

Examine, with reasons, whether the following statements are True or False.

(i) Alienation of a residential house in a transaction of reverse mortgage under a scheme made and notified by the Central Government is treated as “transfer” for the purpose of capital gains.

(ii) Zero coupon bonds of eligible corporation, held for more than 12 months, will be long-term capital assets.

(iii) Where an urban agricultural land owned by an individual, continuously used by him for agricultural purposes for a period of two years prior to the date of transfer, is compulsorily acquired under law and the compensation is fixed by the State Government, resultant capital gain is exempt.

(iv) Zero Coupon Bond means a bond on which no payment and benefits are received or receivable before maturity or redemption.

(v) Income from growing and manufacturing tea in India is treated as agricultural income wholly.

Answer:

(i) False: As per Section 47(xvi), such alienation in a transaction of reverse mortgage under a scheme made and notified by the Central Government is not regarded as “transfer” for the purpose of capital gains.

(ii) True: Section 2(42A) defines the term ‘short-term capital asset’. Under the proviso to Section 2(42A), zero coupon bond held for not more than 12 months will be treated as a short-term capital asset. Consequently, such bond held for more than 12 months will be a long-term capital asset.

(iii) False: As per Section 10(37), where an individual owns urban agricultural land which has been used for agricultural purposes for a period of two years immediately preceding the date of transfer, and the same is compulsorily acquired under any law and the compensation is determined or approved by the Central Government or the Reserve Bank of India, resultant capital gain will be exempt.

(iv) True: As per Section 2(48), ‘Zero Coupon Bond’ means a bond issued by any infra structure capital company or infrastructure capital fund or a public sector company, or Scheduled Bank on or after 1st June 2005, in respect of which no payment and benefit is received or receivable before maturity or redemption from such issuing entity and which the Central Government may notify in this behalf.

(v) False: Only 60% of the income derived from the sale of tea grown and manufactured by the seller in India is treated as agricultural income and the balance 40% of the income shall be non-agricultural income chargeable to tax [Rule 8 of Income-tax Rules, 1962],

![]()

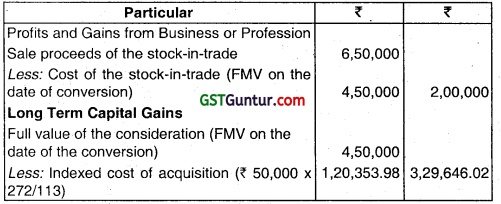

Question 30.

Mr. A converts his capital asset acquired for an amount of ₹ 50,000 in June, 2005 into stock-in-trade in the month of November, 2017. The fair market value of the asset on the date of conversion is ₹ 4,50,000. The stock-in-trade was sold for an amount of ₹ 6,50,000 in the month of September, 2020. What will be the tax treatment?

| Financial year | Cost Inflation Index |

| 2004-05 | 113 |

| 2017-18 | 272 |

| 2020-21 | 301 |

Answer:

The capital gains on the sale of the capital asset converted to stock-in-trade is taxable in the given case. It arises in the year of conversion (i.e. P.Y. 2017-18) but will be taxable only in the year in which the stock-in-trade is sold (i.e. P.Y. 2020-21). Profits from business will also be taxable in the year of sale of the stock-in-trade (P.Y. 2020-21).

The long-term capital gains and business income for the A.Y. 2021-22 are calculated as under:

Note: For the purpose of indexation, the cost inflation index of the year in which the asset is converted into stock-in-trade should be considered.

![]()

Question 31.

On January 31,2021, Mr. A has transferred self-generated goodwill of his profession for a sale consideration of ₹ 70,000 and incurred expenses of ₹ 5,000 for such transfer. You are required to compute the capital gains chargeable to tax in the hands of Mr. A for the A.Y.

2021- 22.

Answer:

The transfer of sell-generated goodwill of profession is not chargeable to tax. It is based upon the Supreme Court’s ruling in CIT vs. B.C. Srinivasa Shetty.

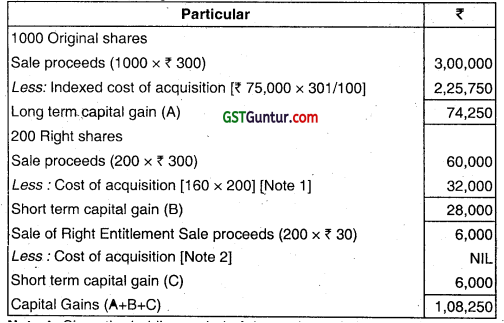

Question 32.

Mr. R holds 1000 shares in Star Minus Ltd., an unlisted company, acquired in the year 2001 -02 at a cost of ₹ 75,000. He has been offered right shares by the company in the month of August, 2020 at ₹ 160 per share, in the ratio of 2 far every 5 held. He retains 50% of the rights and renounces the balance right shares in favour of Mr. Q for ₹ 30 per share in September 2020. All the shares are sold by Mr. R for ₹ 300 per share in January 2021 and Mr. Q sells his shares in December 2020 at ₹ 289 per share.

What are the capital gains taxable in the hands of Mr. R and Mr. Q?

| Financial Year | Cost Inflation Index |

| 2001 – 02 | 100 |

| 2020 – 21 | 301 |

Answer:

Computation of capital gains in the hands of Mr. R for the A.Y. 2021-22

Note 1: Snce the holding period of these shares is less than 24 months, they are short term capital assets and hence cost of acquisition will not be indexed.

![]()

Note 2: The cost of the rights renounced in favour of another person for a consideration is taken to be nil. The consideration so received is taxed as short-term capital gains in full. The period of holding is taken from the date of the rights offer to the date of the renouncement.

Computation of capital gains In the hands of Mr. Q for the A.Y. 2021-22.

| Particulars | ₹ |

| 200 shares | |

| Sale proceeds (200 × ₹ 289) | 57,800 |

| Less: Cost of acquisition [200 shares × (₹ 30 + ₹ 160)] [See Note below] | 38,000 |

| Short term capital gain | 19,800 |

Note: The cost of the rights is the amount paid to Mr. R as well as the amount paid to the company. Since the holding period of these shares is less than 24 months, they are short term capital assets.

![]()

Question 33.

Mr. C purchases a house property for ₹ 1,06,000 on May 15, 1976. The following expenses are incurred by him for making addition/alternation to the house property.

| Particulars | ₹ | |

| a.

b. c. |

Cost of construction of first floor in 1983-84

Cost of construction of the second floor in 2003-04 Reconstruction of the property in 2013-14 |

3,10,000

7,35,000 5,50,000 |

Fair market value of the property on April 1,2001 is ₹ 8,50,000. The house property is sold by Mr. C on August 10,2020 for ₹ 68,00,000 (expenses incurred on transfer ₹ 50,000) Compute the capital gain for the assessment year 2021-22.

| Financial year | Cost Inflation Index |

| 2001-02 | 100 |

| 2003-04 | 109 |

| 2013-14 | 220 |

| 2020-21 | 301 |

Answer:

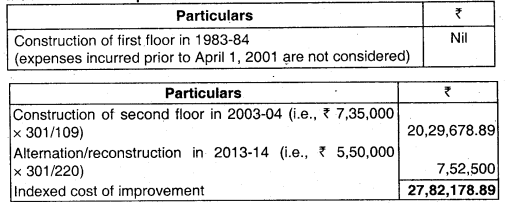

Computation of capital gain of Mr. C for the A.Y. 2021-22

Notes:

Indexed cost of acquisition: ₹ 850000 × 301 /1 00 = ₹ 25,58500

Fair market value on April 1, 2001 (actual cost of acquisition is ignored as it is lower than market value on April 1,2001).

Indexed cost of improvement is determined as under: .

![]()

Question 34.

Mr. Cee purchased a residential house on July 20, 2018 for ₹ 10,00,000 and made some additions to the house incurring ₹ 2,00,000 in August 2018. He sold the house property in April 2020 for ₹ 20,00,000. Out of the sale proceeds, he spent ₹ 5,00,000 to purchase another house property in September 2020.

What is the amount of capital gains taxable in the hands of Mr. Cee for the A.Y. 2021 -22?

Answer:

The house is sold before 24 months from the date of purchase. Hence, the house is a short-term capital asset and no benefit of indexation would be available.

| Particulars | ₹ |

| Sale consideration

Less: Cost of acquisition Cost of improvement Short-term capital gains |

20,00,000

10,00,000 2,00,000 |

| 8,00,000 |

Note: The exemption of capital gains under Section 54 is available only in case of long-term capital asset. As the house is short-term capital asset, Mr. Cee cannot claim exemption under Section 54. Thus, the amount of taxable short-term capital gains is ₹ 8,00,000.

![]()

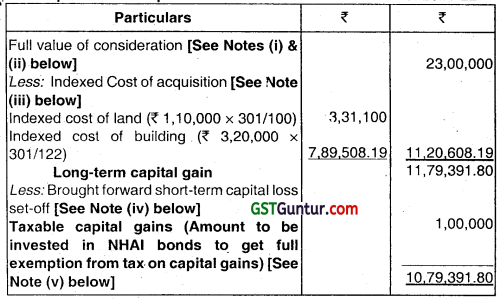

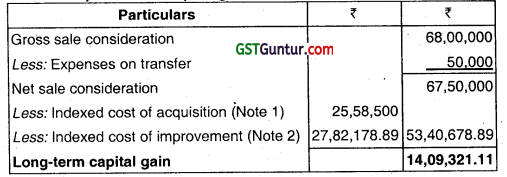

Question 35.

Mr. Dinesh received a vacant site as gift from his friend in November 2006. The site was acquired by his friend for ₹ 7,00,000 in April 2003. Dinesh constructed a residential building during the year 2011-12 in the said site for ₹ 15,00,000. He carried out some further extension of the construction in the year 2013-14 for ₹ 5,00,000.

Dinesh sold the residential building for ₹ 55,00,000 in January 2021 but the State stamp valuation authority adopted ₹ 65,00,000 as value for the purpose of stamp duty.

Compute his long-term capital gain, for theassessment year 2021 -22 based on the above information, The cost inflation indices are as follows:

| Financial Year | Cost inflation index |

| 2003-04 | 109 |

| 2006-07 | 122 |

| 2011-12 | 184 |

| 2013-14 | 220 |

| 2020-21 | 301 |

Answer:

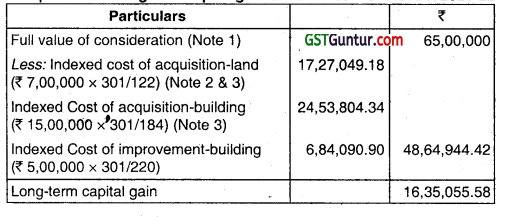

Computation of long term capital gain of Mr. Dinesh for the A.Y. 2021-22

Notes:

1. As per Section 50C, where the consideration received or accruing as a result of transfer of a capital asset, being land or building or both, is less than the value adopted by the Stamp Valuation Authority, such value adopted by the Stamp Valuation Authority shall be deemed to be the full value of the consideration received or accruing as a result of such transfer. Accordingly, full value of consideration will be ₹ 65 lakhs in this case since the stamp duty value exceeds 110% of the sales consideration.

2. Since Dinesh has acquired the asset by way of gift, therefore, as per Section 49(1), cost of the asset to Dinesh shall be deemed to be cost for which the previous owner acquired the asset i.e., ? 3,00,000, in this case.

3. Indexation benefit is available since both land and building are long-term capital assets. However, as per the definition of indexed cost of acquisition under clause (iii) of Explanation below Section 48, indexation benefit for land will be available only from the previous year in which Mr. Dinesh first held the land i.e., P.Y. 2006-07.

Alternative view: In the case ofCIT v. Manjula J. Shah 16Taxmann42 (Bom.), the Bombay High court held that indexation cost of acquisition in case of gifted asset can be computed with reference to the year in which the previous owner first held the asset.

As per this view, the indexation cost of acquisition of land would be ₹ 19,33,027.52 and long term capital gain would be ₹ 14,29,077.24.

![]()

Question 36.

Explain the provisions related to Section 54EC?

Answer:

Eligible assessee – Any assessee

Conditions to be fulfilled

- There should be transfer of a long-term capital asset being land or building or both.

- Such asset can also be a depreciable asset held for more than 36 months.

- The capital gains arising from such transfer should be invested in a long-term specified asset within 6 months from the date of transfer.

- Long-term specified asset means specified bonds, redeemable after 5 ‘ years, issued on or after 1.4.2018 by the National Highways Authority of India (NHAI) or the Rural Electrification Corporation Limited (RECL) or any other bond notified by the Central Government in this behalf.

- The assessed should not transfer or convert or avail loan or advance on the security of such bonds for a period of 5 years from the date of acquisition of such bonds.

Quantum of Exemption:

- Capital gains or amount invested in specified bonds, whichever is lower.

- The maximum investment which can be made in notified bonds or bonds of NHAI and RECL, out of capital gains arising from transfer of one or more assets, during the previous year in which the original asset is transferred and in the subsequent financial year cannot exceed ₹ 50 lakhs.

Violation of condition

In case of transfer or conversion of such bonds or availing loan or advance on security of such bonds before the expiry of 5 years, the capital gain exempted earlier shall be taxed as long-term capital gain in the year of violation of condition.

![]()

Question 37.

Long term capital gain of ₹ 75 lakh arising from transfer of building on 1.5.2020 will be exempt from tax if such capital gain is invested in the bonds redeemable after five years, issued by NHAI under section 54EC. Examine with reasons whether the given statement is true or false having regard to the provisions of the Income-tax Act, 1961.

Answer:

False: The exemption under Section 54EC has been restricted, by limiting the maximum investment in long term specified assets (i.e. bonds of NHAI or RECL or any other bond notified by Central Government in this behalf, redeemable after 5 years) to ₹ 50 lakh, whether such investment is made during the relevant previous year or the subsequent previous year, or both.

Therefore, in this case, the exemption under Section 54EC can be availed only to the extent of ₹ 50 lakh, provided the investment is made before 1.11.2020 (i.e., within six months from the date of transfer).

![]()

Question 38.

Explain the provision of Sec 112A?

Answer:

(i) Concessional rate of tax in respect of LTCG on transfer of certain assets: In order to minimize economic distortions and curb erosion of tax base, new Section 112A has been inserted. This section provides that notwithstanding anything contained in Section 112, a concessional rate of tax @ 10% will be leviable on the long-term capital gains exceeding ₹ 1,00,000 on transfer of –

(a) an equity share in a company or

(b) a unit of an equity oriented fund or

(c) a unit of a business trust.

(ii) Conditions: The conditions for availing the benefit of this concessional rate are-

(a) In case of equity share in a company, STT has been paid on acquisition and transfer of such capital asset

(b) In case of unit of an equity oriented fund or unit of business trust, STT has been paid on transfer of such capital asset.

However, the Central Government may, by notification in the Official Gazette, specify the nature of acquisition of equity share in a company on which the condition of payment of STT on acquisition would not be applicable.

Further, long-term capital gains arising from transaction undertaken on a recognized stock exchange located in an International Financial Service Centre (IFSC) would be taxable at a concessional rate of 10%, where the consideration for transfer is received or receivable in foreign currency, even though STT is not leviable in respect of such transaction.

(iii) Adjustment of Unexhausted Basic Exemption Limit: In the case of resident individuals or HUF, if the basic exemption is not fully exhausted by any other income, then such long-term capital gain exceeding ₹ 1 lakh will be reduced by the unexhausted basic exemption limit and only the balance would be taxed at 10%. However, the benefit of adjustment of unexhausted basic exemption limit is not available in the case of non-residents.

(iv) No deduction under Chapter VI-A against LTCG taxable under Section 112A: Deductions under Chapter Vl-A cannot be availed in respect of such long- term capital gains on equity shares of a company or units of an equity oriented mutual fund or unit of a business trust included in the total income of the assessee.

(v) No benefit of rebate under Section 87A against LTCG taxable under section 112A: Rebate under section 87A is not available in respect of tax payable @ 10% on LTCG under section 112A.

Subsequent to insertion of Section 112A, the CBDT has issued clarification F. No. 370149/20/2018-TPL dated 04.02.2018 in the form of a Question and Answer format to clarify certain issues raised in different fora on various issues relating to the new tax regime for taxation of long-term capital gains. The relevant questions raised and answers to such questions as per the said Circular are given hereunder.

![]()

Question 39.

What is the meaning of long term capital gains under the new tax regime for long term capital gains?

Answer:

Long term capital gains mean gains arising from the transfer of long-term capital asset.

It provides for a new long-term capital gains tax regime for the following assets:

- Equity Shares in a company listed on a recognised stock exchange;

- Unit of an equity oriented fund; and

- Unit of a business trust.

The new tax regime applies to the above assets, if:

(a) the assets are held for a minimum period of twelve months from the date of acquisition; and

(b) the Securities Transaction Tax (STT) is paid at the time of transfer. However, in the case of equity shares acquired after 1.10.2004, STT is required to be paid even at the time of acquisition (subject to notified exemptions).

Question 40.

What is the point of chargeability of the tax?

Answer:

The tax will be levied only upon transfer of the long-term capital asset on or after 1st April, 2018, as defined in clause (47) of Section 2 of the Act.

![]()

Question 41.

What is the method for calculation of long-term capital gains?

Answer:

The long-term capital gains will be computed by deducting the cost of acquisition from the full value of consideration on transfer of the long-term capital asset.

Question 42.

How do we determine the cost of acquisition for assets acquired on or before 31st January, 2018?

Answer:

The cost of acquisition for the long-term capital asset acquired on or before 31st of January, 2018 will be the actual cost.

However, if the actual cost is less than the fair market value of such asset as on 31st of January, 2018, the fair market value will be deemed to be the cost of acquisition.

Further, if the full value of consideration on transfer is less than the fair market value, then such full value of consideration or the actual cost, whichever is higher, will be deemed to be the cost of acquisition.

![]()

Question 43.

Whether the cost of acquisition will be inflation indexed?

Answer:

Third proviso to Section 48, provides that the long-term capital gain will be computed without giving effect to the provisions of the second provisos of Section 48. Accordingly, it is clarified that the benefit of inflation indexation of the cost of acquisition would not be available for computing long-term capital gains under the new tax regime.

Question 44.

What will be the tax treatment of transfer made on or after 1st April 2018?

Answer:

The long-term capital gains exceeding ₹ 1 lakh arising from transfer of these assets made on after 1st April, 2018 will be taxed at 10 per cent. However, there will be no tax on gains accrued upto 31st January, 2018.

Question 45.

What is the date from which the holding period will be counted?

Answer:

The holding period will be counted from the date of acquisition.

Question 46.

Whether tax will be deducted at source in case of gains by resident tax payer?

Answer:

No. There will be no deduction of tax at source from the payment of long-term capital gains to a resident tax payer.

![]()

Question 47.

What will be the cost of acquisition in the case of right share acquired before 1st February 2018?

Answer:

The cost of acquisition of right share acquired before 31st January, 2018 will be determined as per Section 55(2)(ac). Therefore, the fair market value of right share as on 31st January, 2018 will be taken as cost of acquisition (except in some typical situations explained in Ans 5), and hence, the gains accrued upto 31st January, 2018 will continue to be exempt.

Question 48.

What will be the treatment of long-term capital loss arising from transfer made on or after 1st April, 2018?

Answer:

Long-term capital loss arising from transfer made on or after 1st April, 2018 will be allowed to be set-off and carried forward in accordance with existing provisions of the Act. Therefore, it can be set-off against any other long-term capital gains and unabsorbed loss can be carried forward to subsequent eight years for set-off against long-term capital gains.

![]()

Multiple Choice Question

Question 1.

Capital asset-

(a) means property of any kind

(b) does not include personal effects

(c) includes jewellery whether used for personal purpose or not

(d) all of the above

Answer:

(d) all of the above

Question 2.

In terms of Section 2(42A), listed securities are treated as long term capital asset, if they are held for a period of more than:

(a) 12 Months

(b) 36 months

(c) 24 months

(d) 48 months

Answer:

(a) 12 Months

![]()

Question 3.

Any profits or gains arising from the slump sale effected in the previous year shall be chargeable to Income-tax as:

(a) Short term capital gain only

(b) Short term capital gains or Long term capital gains depending upon the period of holding of the undertaking.

(c) Long term capital gain only

(d) No capital gain but the same will be taxable as business profits.

Answer:

(b) Short term capital gains or Long term capital gains depending upon the period of holding of the undertaking.

Question 4.

The benefit of exemption under Section 54 is available when following capital asset is transferred:

(a) Long term residential house property

(b) Short term residential house property

(c) Long term residential plot of land

(d) Short term residential plot of land

Answer:

(a) Long term residential house property

Question 5.

For claiming exemption u/s 54B, the asset transferred should be:

(a) Urban agricultural land

(b) Any agricultural land

(c) Rural agricultural land.

(d) None of the above

Answer:

(a) Urban agricultural land

![]()

Question 6.

Exemption u/s 54D is available if there is:

(a) a transfer

(b) compulsory acquisition by law

(c) sale

(d) None of the above

Answer:

(b) compulsory acquisition by law

Question 7.

The maximum amount of investment in bonds during the financial year or years for claiming exemption u/s 54EC is—

(a) ₹ 10 lakhs

(b) No limit

(c) ₹ 25 lakhs

(d) ₹ 50 lakhs

Answer:

(d) ₹ 50 lakhs

Question 8.

The benefit of exemption under Section 54F is available when following capital asset is transferred:

(a) Long term residential house property

(b) Any long term capital asset other than residential house property

(c) Short term residential house property

(d) Short term capital asset other than residential house property

Answer:

(b) Any long term capital asset other than residential house property

![]()

Question 9.

The exemption under Section 54GB of capital gains arising from transfer of residential property is available to:

(a) Individual

(b) HUF

(c) Any person

(d) Both (a) & (b)

Answer:

(d) Both (a) & (b)

Question 10.

With a view to ascertaining the fair market value of a capital asset, the Assessing Officer may refer the valuation of a capital asset to a Valuation Officer in a case where the value of the asset as claimed by the assessee is in accordance with the estimate made by a registered if the Assessing Officer is of opinion that —

(a) that the fair market value of the asset exceeds the value of the asset as claimed by the assessee by ₹ 25,000

(b) that the fair market value of the asset exceeds the value of the asset as claimed by the assessee by 15% of the value claimed by the assessee;

(c) (a)or(b)

(d) None of these

Answer:

(c) (a)or(b)

![]()

Capital Gains Notes

Amendment of section 49.

In section 49 of the Income-tax Act, after sub-section (2AF), the following shall be inserted, namely:-

‘(2AG) The cost of acquisition of a unit or units in the segregated portfolio shall be the amount which bears, to the cost of acquisition of a unit or units held by the assessee in the total portfolio, the same proportion as the net asset value of the asset transferred to the segregated portfolio bears to the net asset value of the total portfolio immediately before the segregation of portfolios.

(2AH) The cost of the acquisition of the original units held by the unit holder in the main portfolio shall be deemed to have been reduced by the amount as so arrived at under sub-section (2AG).

Explanation.- For the purposes of sub-section (2AG) and sub-section (2AH), the expressions “main portfolio”, “segregated portfolio” and “total portfolio” shall have the meanings respectively assigned to them in the circular No. SEBI/HO/IMD/DF2/CIR/P/2018/160, dated the 28!h December, 2018, issued by the Securities and Exchange Board of India under section 11 of the Securities and Exchange Board of India Act, 1992 (15 of 1992).

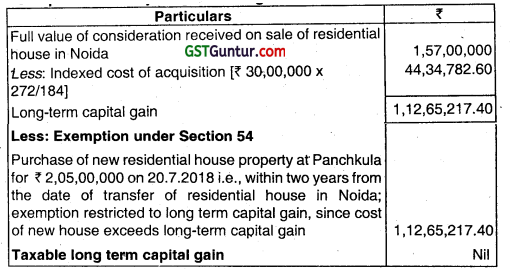

CAPITAL GAINS IN RESPECT OF SLUMP SALE [SECTION50B]

(i) Long term capital gains – Any profits or gains arising from the slump sale of one or more undertakings held for more than 36 months, shall be chargeable to income-tax as capital gains arising from the transfer of long-term capital assets and shall be deemed to be the income of the previous year in which the transfer took place.

Short term capital gains – Any profits and gains arising from such transfer of one or more undertakings held by the assessee for not more than 36 months shall be deemed to be short-term capital gains [Sub-section(1)].

![]()

(ii) Deemed cost of acquisition and cost of improvement – The net worth of the undertaking or the division, as the case may be, shall be deemed to be the cost of acquisition and the cost of improvement for the purposes of sections 48 and 49 in relation to capital assets of such undertaking or division transferred by way of such sale and the provisions contained in the second proviso to section 48 shall be ignored [Sub-section (2)]. It means no indexation benefit would be available.

(iii) Report of a Chartered Accountant – Every assessee in the case of slump sale shall furnish in the prescribed form along with the return of income, a report of a chartered accountant as defined in the “Explanation below sub-section (2) of section 288 before the specified date referred to in section 44AB[w.e.f. 01.04.2020]” indicating the computation of net worth of the undertaking or division, as the case may be, and certifying that the net worth of the undertaking or division has been correctly arrived at in accordance with the provisions of this section fSub-section(3)].

Meaning of Certain Terms:

| Explanation | Term | Particulars |

| 1 | Net Worth | Aggregate value of total assets of the undertaking or division as reduced by the value of liabilities of such undertaking or division as appearing in the books of account. However, any change in the value of assets on account of revaluation of assets shall not be considered for this purpose |

| 2 | Aggregate value of total assets of undertaking or division | In the case of depreciable assets: The written down value of block of assets determined in accordance with the provisions contained in sub-item (c) of item (i) of section 43(6)(c);

Capital asset in respect of which 100% deduction is claimed: In case of capital assets in respect of which the whole of the expenditure has been allowed or is allowable as a deduction under section 35AD: Nil; For all other assets: Book value |

![]()

SPECIAL PROVISION FOR FULL VALUE OF CONSIDERATION IN CERTAIN CASES [SECTION 50]