CA Final SCMPE Question Paper Dec 2021 – CA Final SCMPE Study Material is designed strictly as per the latest syllabus and exam pattern.

SCMPE CA Final Dec 2021 Question Paper

Question 1.

ABC Metals Limited, a pioneer in pure Lead metal and alloys commenced its operations in the year 2005 in 150 acres of land. The Lead smelting involves a series of steps that lead to, the extraction of pure Lead from its ore. Smelting is carried out in a blast, reverberatory, and rotary kiln furnaces. Blast furnaces produce hard or antimonial Lead containing about 10 per cent antimony. The industry generates wastes in the form of toxic wastewater, solid waste, as well as volatile compounds like sulfur dioxide that are released into the air.

The plant since its inception is doing well commercially, but has long been opposed by environmentalist on the contention that it is polluting the environment and causing health problems. The plant has been subjected to several demands of closure on the grounds of violating environmental norms. The environmental activists recently came down heavily in print and electronic media, alleging that the promoters of ABC Metals Ltd. are violators of numerous regulations. They allege that the commercial considerations of the management are completely replacing the cause of social responsibility.

The promoters of ABC Metals Ltd. hail from a business family having a good reputation. With the happenings at the Lead smelter, the family decided to give a fair thought and to develop a constructive approach to draw a reasonable conclusion. They want to put all the allegations, counter allegations and consequential litigations to rest by revamping the practices and by adopting all necessary precautions. The Chairman of ABC Metals Ltd. believes in the principle that “for discharging any social or ethical responsibility, the commercial viability also is one of the prerequisite”. They approached “XYZ Consulting Group”, having an international reputation, to strike a meaningful solution to this complex situation.

![]()

The Chairman of ABC Metals Ltd., got very much impressed by the following initial remarks of the Chief Consultant of ‘XYZ Consulting Group’, in the first meeting itself and decided to engage their services.

“Economic growth of a Nation as well as organization’s financial growth is driven by many factors such as technological advancement, savings and investment rates, government policies and in turn it is resulting in reduction in Natural Resources, Pollution, Climate Change, Global Warming, Industrial and Household Waste, Ozone Layer Depletion etc. This requires special attention and therefore preservation of natural resources and environmental awareness has initiated a novel branch of accounting known as Environmental Accounting or Green Accounting which seems to be lacking in major areas of your organization. In an increasingly global economy, effective management of environmental cost and performance may become a source of competitive advantage.”

ABC Metals Ltd. documented terms with ‘XYZ Consulting Group’ to initiate Green Accounting aspects. ‘XYZ Consulting Group’ deployed a team of consultants with a right blend of juniors and seniors to carry out the analysis on environmental costs of ABC Metals Ltd. by dividing them in first place into four sections viz.:

(1) Conventional Costs;

(2) Hidden Costs;

(3) Contingent Costs;

(4) Relationship Costs.

Which are further sub-divided into Internal Costs and External Costs. After discussions and thorough analysis, the working team in its final report identified and suggested many areas for control and out of which four areas of Environmental Cost control are more crucial viz.:

(1) Waste,

(2) Water consumption,

(3) Energy and

(4) Consumables and Raw materials.

Based on the above stated scenario you are required to :

(a) Analyze the views expressed by the Chief Consultant in the initial remarks. (2 Marks)

(b) List the major areas which are likely to be suggested by ‘XYZ Consulting Group’ where Environmental Management Accounting (EMA) can be applied for ABC Metals Limited. (2 Marks)

(c) Discuss briefly all the six forms of environmental costs classified by the working team for ABC Metals Limited. (6 Marks)

(d) Describe what is meant by identification of Environmental costs. (2 Marks)

(e) Analyse two Environmental Management Accounting Techniques; Input-Output Analysis and Flow Cost Accounting with their relevance in the context of manufacturing process of ABC Metals Limited. (3 Marks)

(f) Evaluate the steps that could be suggested in the final report by ‘XYZ Consulting Group’ in the four areas of Environmental cost control referred by the working team. (5 Marks)

Answer:

(a) The chief consultant has made initial remark of ‘ABC Metal Ltd’ that, Economic and financial growth of the nation is driven by various factors such as technological advancement, savings and investment rates, government policies and in turn it is resulting in reduction in Natural Resources, Pollution, Climate Change, Global Warming, Industrial and Household Waste, Ozone Layer Depletion etc. In this era of Global economy, the chief consultant has correctly stated here that effective management of environmental cost and performance may become a source of competitive advantage for ‘ABC Metal Ltd.’

It is important to understand here that poor environmental behaviour may have a real adverse impact on the business, which may include g fines, lawsuits, destruction of brand values and damage of corporate g image, loss of sales and inability to secure finance, etc. hence there is need to address the environmental issues.

Hence the chief consultant has correctly preservation of natural resources and environmental awareness though Environmental Accounting is important for every organization which seems to ,be lacking in major areas of ABC Metal Ltd.

(b) List the major areas which are likely to be suggested by ‘XYZ Consulting Group’ where Environmental Management Accounting (EMA) can be applied for ABC Metals Limited.

- Waste

- Water Consumption

- Energy

- Consumable and Raw Materials

(c)

- Conventional costs: Conventional costs are those raw material and energy costs having environmental relevance.

- Hidden costs: Hidden costs are those which are captured by accounting systems, but then lose their identity in ‘overheads’.

- Contingent costs: Contingent costs may be incurred at a future date – for example, costs for cleaning up. They are also referred to as contingent liabilities.

- Relationship costs: Relationship costs are intangible in nature and include, for example, the costs of producing environmental reports.

- Internal Costs: Internal Costs incurred from activities that have been produced but not discharged into the environment. Examples include : Recycling scrap, Disposing toxic material, Back end costs such as decommissioning costs on project completion.

- External Costs: External Costs incurred on activities performed after discharging waste into the environment. These costs have adverse impact on the organisation’s reputation and natural resources. Examples include; Cleaning up contaminated soil, Restoring land to its natural state.

(d) Identification of Environmental costs involves an intense review of the general ledger containing costs of materials, utilities, energy, water, and waste disposal, etc. Since the portion of environmental costs is generally ‘hidden’ in general overheads of the company, hence it becomes difficult for management to identify opportunities to cut environmental costs; but it is crucial for them to do so.

One should recognise that environmental costs are not a separate type of cost, rather they are part of money flowing throughout a corporation hence identification is important and critical.

(e) Input-Output Analysis

This technique involves the preparation of records for material inflows and then balances these inflows with the quantum of outflows relying on principle ‘what enters in the production system, must move out, either at a productive output or unproductive output (waste) ’.

So, Lead smelting involves a series of steps that lead to the extraction of pure Lead from its ore. Smelting is carried out in a blast, reverberatory, and rotary Kiln furnaces. Blast furnaces produce hard or antimonial Lead containing about 10 per cent antimony. The industry generates wastes in the form of toxic wastewater, solid waste, as well as volatile compounds like sulfur dioxide that are released into the air. By accounting for outputs in this way, both in terms of physical quantities and, at the end of the process, in monetary terms too, businesses are forced to focus on environmental costs.

Flow Cost Accounting:

In the flow cost accounting, the organisational structure is also considered apart from material flows. Material losses incurred at various stages of production are also recorded. Further to bring transparency apart from the quantity of material, the cost per unit and value in total also recorded. The material flows are divided into three categories, material, system (cost of in-house handling), delivery, disposal (costs of flows leaving the company). In this case Ore of Lead is a raw material.

As per UNDSD, EMA can be benefited from flow cost accounting because it aims to reduce the quantities of materials, which leads to J increased ecological efficiency and reduction of cost in long run.

(f) Steps that could be suggested in the final report by ‘XYZ Consulting Group’ in the four areas of Environmental cost control referred by the working team. Following are the Environmental costs that can be controlled by focusing on individual elements throughout the organisation.

Waste: ‘Mass balance’ approach can be used to determine how much material is wasted in production, whereby the weight of materials bought is compared to the product yield. From this process, potential cost savings may be identified.

Water: Businesses pay for water twice, firstly to buy it and secondly to dispose of it. If savings are to be made in terms of reduced water bills, it is important for organizations to identify where water is used S and how the consumption can be reduced.

Consumables and Raw Materials: These are directly attributable costs and discussions with management can reduce such costs. For example, toner cartridges for printers could be refilled rather than replaced. This should produce a saving both in terms of the financial cost for the organization and a waste saving for the environment.

Energy: Energy Often, energy costs can be reduced significantly that too at very little cost. EMA may help to identify inefficiencies and wasteful practices therefore create opportunities for cost savings.

![]()

Question 2.

SUNEET Automotives Limited (SAL) is engaged in the production i and sale of premium segment bikes under the brand “Sunstar”. It also manufactures related auto components including spare parts. The company operates a state of the art service network covering all parts of the country to take care of the after sale service and maintenance of bikes.

Based on the buying preferences and culture, the company categorizes its loyal customers into two categories : Good and Excellent.

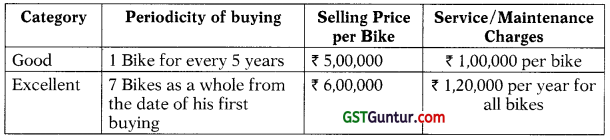

Relevant details pertaining to sales are:

Profit Margin :

| Good | Excellent | |

| On Sale of each Bike | 25% | 25% |

| On Service/Maintenance Charges | 60% | 65% |

Age analysis of customers undertaken by SAL reveals a general statistical estimate that, a person may become the first customer by buying a bike when he attains 20 years of age and remains riding the bikes until he reaches the age of 40 years and 3 months.

It is further observed that the “Good” category customers would not prefer waiting to purchase the bike beyond 5 years.

Required:

(a) (i) Calculate the life time value of a ‘Good customer’ who is 20 years of age. (2 Marks)

(ii) Calculate the life time value of an ‘Excellent customer’ who is 25 years of age. (2 Marks)

(iii) Sunayna, holding an International management degree and the daughter of the Managing Director who has taken up the position of an Executive Director recently, came up with an idea of engaging a National Cricketing Icon to promote the bike. This brand endorsement should cost the company ₹ 10 Crores over a period of time. Sunayna, a conservative analyst by her nature, perceives that this brand endorsement is likely to turn 500 customers who attain 30 years of age, and who are bound to be otherwise “Good” customers into “Excellent” customers. (4 Marks)

Advise the management whether the brand endorsement programme is worth ? 10 Crores ?

Notes:

- Ignore the Net Present Value of money and Tax implications.

- Assume that the service/maintenance charges would be incurred on the last day of the year.

- Show calculations in support of your answer.

(b) The purpose of a business is to create and keep a customer, and Cus-tomer Lifetime Value (CLV) is a prediction of “the net profit attributed to the future relationship with a customer”.

In the light of this statement, recommend the steps to ascertain CLV of a particular customer.

(c) The whole concept of ‘Customer Lifetime Value’ revolves around four terms.

(1) Customer Selection;

(2) Customer Acquisition;

(3) Customer Retention and

(4) Customer Extension.

Briefly explain these terms.

(d) Consider the different scenarios listed below and categorize them to the most appropriate term of CLV as mentioned in sub-question (c) above. (You are required to mention the appropriate term only and don’t need to explain):

(i) A company producing environmentally friendly products, sending e-mails to its customers to tell them how much less carbon dioxide they have produced by using the company product.

(ii) The Marketing Manager of a large MNC says that “the service, product and experience personalization are paramount now-a- days if you want customers to be happy and spend more on your business in the long run”.

(iii) A Telecom company developed and added a Movie App that could attract its customer towards premium plan service from the basic plan.

(iv) A business looking to buy a website domain, would as a natural choice, likely be interested in web hosting and privacy protection services too.

(v) A company is keeping small list of popular products on the side bar of the web page. This allows its customers to see the most popular products when they are browsing the website.

(vi) The Marketing Manager cautions his team “don’t overwhelm potential customers with too many choices. Otherwise, you run the risk of customers abandoning the cart”.

(vii) SG Analytics team aggregated the customer and transaction data for the last 7-10 years of its rival company. SG Analytics then ranked all the customers based upon a weighted score calculated using 10 different matrices.

(viii) Mr. Charan, a Ph.D., aspirant and doing dissertation on the role of advertising says that, “To be successful in the twenty-first century, advertisers must find creative ways to transform customers into life-long purchasers and die hard advocates. The lifetime value of a loyal customer far exceeds any short-term buzz generated by a one-time promotion gimmick.

Answer:

(a) (i) Calculate the life time value of a ‘Good customer’ who is 20 years of age. Customer Life Time Value = [(25% ₹ 5,00,000) + (60% ₹ 1,00,000)] = ₹ 1,85,000

Calculate the lifetime value of an ‘Excellent customer’ who is 25 years of age. Customer Life Time Value = [(25% ₹ 6,00,000 × 7) + (65% ₹ 1,20,000)] = ₹ 11,28,000

(ii) Since the margin earned by excellent customers are more than good customers by Margin from the customers who turned into excellent customers

= (₹ 2,28,000 – ₹ 1,85,000) × 500 customers Brand endorsement cost = ₹ 10 crores

There is net benefit therefore it is advisable to management to follow the brand endorsement programme worth ₹ 10 crores.

(b) Customer lifetime value is the present value of net profit that we derive from a customer over the entire lifetime of relationship with that particular customer. It is net present value of the projected future cash flows from a lifetime of customer relationship. Steps to ascertain CLV of a particular customer

- First of all, we need to ascertain the profits generated from each customer.

- ABC model helps in associating direct costs and revenues to a particular customer over a period of time to ascertain the profit margins from that particular customer.

- To ascertain the lifetime value, judgments with regards to the duration of relationships have to be made.

- These require detailed analysis of the strength of relationships, the likelihood, frequency and amount of repeated or additional purchases, competitive products, customer loyalty etc.

- Thus, profit margins are then discounted at the firm’s cost of capital or any other rate that may be determined by the organi-zation to arrive at the CLV.

(c) (1) Customer Selection:Customer selection means identifying the customer which company needs to target has to be selected. For this customers by value and their detailed lifecycle with company are reviewed and the company must also try to find how such customer can be reach.

(2) Customer Acquisition – Customer Acquisition means a relationship needs to be developed with in new customers. Methods of acquiring customer include traditional off-line techniques (e.g. advertising, direct mail, etc.) and online techniques (e.g. search engine marketing, online PR, online partnerships, interactive adverts, opt-in e-mail, viral marketing etc.)

(3) Customer Retention – Customer Retention means keeping the existing customers. Emphasis on understanding customer needs to ensure better customer satisfaction. Ensure ongoing service quality by focusing on tangibles, reliability, responsiveness, assurance and empathy. E-techniques for retaining customers are personalization, J mass customization, extranets, opt – in e- mail and online communities.

(4) Customer Extension – Customer Extension means the products j bought by the customers need to be increased. It can be increased by following methods; “Re-sell” similar products to previous sales, “Cross- sell” closely related products and “Up-sell” more expensive products.

(d) (i) Customer Acquisition

(ii) Customer Retention

(iii) Customer Extension

(iv) Customer Selection

(v) Customer Acquisition

(vi) Customer Retention

(vii) Customer Selection

(viii) Customer Retention

![]()

Question 3.

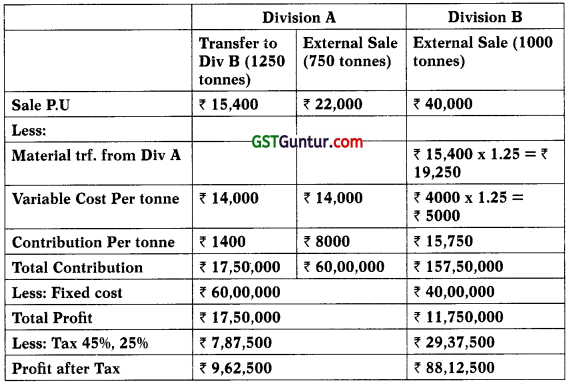

ABC Ltd. harvests, processes and roasts cocoa beans. The company has two divisions:

Division A is located in Country X. It harvests and processes cocoa beans. The processed cocoa beans are sold to Division B and external customers.

Division B is located in Country Y. It roasts processed cocoa beans and then sells them to external customers.

Both the countries X and Y use the same currency but have different Tax rates.

The budgeted information for the next year is as follows :

Division A

| Capacity | 2,000 tonnes |

| External demand for processed cocoa beans | 1600 tonnes |

| Demand from Division B for processed cocoa beans | 1250 tonnes |

| External market selling price for processed cocoa beans | ₹ 22,000 per tonne |

| Variable costs | ₹ 14,000 per tonne |

| Annual fixed costs | ₹ 60,00,000 |

Division B

| Sales of roasted cocoa beans | 1000 tonnes |

| Market selling price for roasted cocoa beans | ₹ 40,000 per tonne |

The production of one tonne of roasted cocoa beans requires an input of ₹ 1.25 tonnes of processed cocoa beans. The cost of roasting is ₹ 4,000 per tonne of input plus annual fixed costs of ₹ 40,00,000.

Transfer Pricing Policy of ABC Ltd.:

5 Division A must satisfy the demand from Division B for processed cocoa beans before selling any to external customers. The transfer price for the processed cocoa beans is variable cost plus 10% per tonne.

Taxation:

The rate of taxation on company profits is 45% in country X and 25% in country Y.

Required:

(a) (i) Prepare statements that show the budgeted profit after tax for the next year for each of the two divisions. Your profit statements should show sales and costs split into external sales and internal transfers wherever appropriate. (5 Marks)

(ii) Discuss the expected tax consequences of ABC’s current transfer pricing policy. (4 Marks)

(b) Prepare statements that show the budgeted contributions that would be earned by each of the two divisions if ABC’s head office changed its policy to state that transfers must be made at opportunity cost. Your statements should show sales and costs split into external sales and internal transfers wherever appropriate. (4 Marks)

(c) Discuss TWO behavioural issues that could arise as a result of the head office of ABC Ltd. imposing transfer prices instead of allowing the divisional managers to set the prices. (4 Marks)

(d) Evaluate how taxation, import duty and dividend play role while determining International Transfer Pricing ? (3 Marks)

Answer:

(a) (i) Calculation of budgeted profit after tax for the next year for each of the two division:

(ii) Organization that works in different countries try to maximize profits by using transfer pricing as a tool to reduce the tax impact on earnings. Where, the supplying division is in a country with higher tax rate in this case Division A is in country X where tax rate is high which is 45%, the transfer price will be set lower which in this case is Marginal cost plus 10% to reflect higher earnings (resulting from lower purchase cost) in the purchasing division which is Division B in country Y in this case, which has a lower tax rate of 25%. So under current tax policy company is manage to save tax liabilities and increase the overall profitability of the organisation.

(b) Calculation of budgeted profit after tax for the next year for each of j the two division:

(c) Since internal transfer pricing develops a competitive setting for managers of each division, it is possible that they may operate in the best interest of their individual performance. This can lead to sub-optimal utilization of resources. In such cases, transfer pricing policy may be established to promote goal congruence.

So if Head office of ABC Ltd. is imposing transfer pricing the following behavioural issues may arise:

- This allows for better evaluation of each division’s performance.

- It also improves cooperation between divisions,

- promoting goal congruence and reduction of sub-optimization of resources.

(d) Taxation, import duty and dividend play* important role while determining international taxation. Taxation, profit repatriation and transfer prices are critical considerations to the senior management of the multi-national companies. Multi-national organizations try to maximize profits by using transfer pricing as a tool to reduce the tax impact on earnings. Where, the supplying division is in a country with higher tax rate, the transfer price will be set lower in order to reflect higher earnings (resulting from lower purchase cost) in the purchasing division, which has a lower tax rate. Likewise, supply from lower tax rate countries may be priced higher, in order to reflect higher earnings for that unit, thereby reducing the tax impact.

![]()

Question 4.

(a) Bell Engineering, located in Yanam contemplating the introduction of cost reduction measures, is tilting towards introduction of

Kaizen costing in the organization. As someone who is having an expert awareness on management accounting, you have been asked to suggest the management on this move. Some of your colleagues are questioning the management about the differences between the standard costing and Kaizen costing and there is not much of the difference between Kaizen and Value Engineering, Business Process Re-engineering (BPR) as well. (5 Marks)

You are required to:

Discuss any five differences between Standard costing and Kaizen costing as a reply to the colleagues.

(b) B Ltd. is considering expansion. Fixed costs amount to ₹ 4,20,000 and are expected to increase by ₹ 1,25,000 when plant expansion is completed. The present production capacity is 80,000 units per year. Capacity will in-crease by 50% with the expansion. Variable costs are currently ₹ 6.80 per unit and are expected to go down by ₹ 0.40 per unit with the expansion. The current selling price is ₹ 16 per unit and is expected to remain same under either alternative. What are the break even points under either alternative? Recommend the better alternative with reason. (5 Marks)

OR

Analyse any five factors contributing for a low customer’s price sensitivity. (5 Marks)

(c) (i) Lifeline Limited provides you the following financial information as on 31st March, 2021. (4 Marks)

| (₹ in Lakhs) | |

| Share Capital | 440 |

| Reserves and Surplus | 630 |

| Long term Debt | 60 |

| Trade Payables | 15 |

Additional information is as follows :

- Profit before interest and tax is ₹ 1,100 Lakhs

- Interest paid ₹ 6.8 Lakhs

- Tax rate is 30%

- Cost of equity 12% and Cost of debt 6%

You are required to calculate Economic Value Added of Lifeline Limited.

(ii) Lifeline Limited now wants to use the technique of ‘Shareholder Value Added’ (SVA) for value measurement. Discuss briefly the concept of Shareholder Value Added (SVA) (2 Marks)

(iii) Recommend the value drivers that affect shareholder value. (4 Marks)

Answer:

(a) Difference between Kaizen costing and Standard costing

(1) Kaizen, also known as continuous improvement, is a long-term approach to work that systematically seeks to achieve small, incremental changes in processes in order to improve efficiency and quality.

Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records, and then periodically recording variances showing the difference between the expected and actual costs.

(2) Kaizen costing – the emphasis is on continuous reduction of production costs rather than standards or targets, the goal is current costs that are less than previous costs. Standard costing – the use of carefully predetermined product costs for budgeting and performance evaluation. Standard costs are typically used in established production processes.

(3) Kaizen costing – Goal is to achieve cost reduction standard by comparing actual cost reduction with standard. Standard Costing – Goal to meet cost performance standard by comparing actual with standard cost.

(4) Kaizen costing – Workers set kaizen standards Standard costing – Managers & engineers set standards

(5) Kaizen costing – Investigate when target cost reduction not achieved

Standard costing – Investigate when standard not met.

(b) Fixed cost = ₹ 4,20,000 expected to increase by ₹ 1,25,000

Production capacity = 80,000 units per year, capacity will increase by 50% with expansion

Variable cost ₹ 6.80 per unit expected to grow ₹ 0.40 per unit

Current selling price ₹ 16 per unit

| (i)

Fixed Cost = ₹ 4,20,000 |

(ii)

Fixed Cost = ₹ 5,45,000 |

First alternative is better than second as in first alternative breakeven point is 45,652 units which is less than the capacity 80,000 unit while in second option breakeven point is 1,94,643 units which is more than the capacity 1,20,000.unit so it is not possible to achieve.

Five factors contributing for a low customer’s price sensitivity:

It measures the customer’s behaviour to the change in price of a product. Following factors that contribute to price sensitivity. These factors are:

- Unique Value Effect – More unique the product, lower is the price sensitivity.

- Substitute Awareness Effect – If the buyers are aware of substitutes and these perform the same function, then the buyer’s price sensitivity will be high.

- Difficult Comparison Effect – Price sensitivity will be low if the buyer has difficulty comparing two alternatives.

- Total Expenditure Effect – If then expenditure on the product represents a low proportion of the consumer income, the price sensitivity will be less visible for such a product.

- End-Benefit Effect – Buyers are less price sensitive where the expenditure on the product is low compared to the total cost of the end product.

- Shared Cost Effect – If the cost of the product is shared by another party, the buyer will have less prone to price sensitivity.

- Sunk Investment Effect – Price sensitivity is low in products which are used along with assets previously bought.

- Price Quality Effect – Higher the perceived quality of the product, lower the price sensitivity.

- Inventory Effect – If the product cannot be stored, the buyer will be less price sensitive.

![]()

(c) (i) Calculation of Economic Value Added of Lifetime Limited

EVA = NOPAT – WACC × Capital Employed

Capital Employed = ₹ 440 L + ₹ 630 L + ₹ 60 L

= ₹ 1130 L

WACC = \(\frac{(440+630)}{1130}\) × \(\frac{12 \%+(60)}{1130}\) × 6%

= 11.36% + 0.32%

= 11.68%

NOPAT = [PBIT- Interest – Tax] + Interest (net of tax)

| ₹ in lakhs | |

| PBIT | 1,100 |

| Less: Interest | (6.8) |

| PBT | 1,093.2 |

| Less: Tax @30% | (327.96) |

| PAT | 765.24 |

| Add: Interest (net of tax) [6.8 × (1 – 0.30)] | 4.76 |

| NOPAT | 760.48 |

EVA = NOPAT – WACC × Capital Employed

= ₹ 760.48 L – 11.68% × ₹1130

= ₹ 892.46 L

(ii) Concept of Shareholder Value Added

Shareholder value added (SVA) is a measure of the operating profits that a company has produced in excess of its funding costs, or cost of capital. The basic calculation is net operating profit after tax (NOPAT) minus the cost of capital, which is based on the company’s weighted average cost of capital.

- Shareholder value added (SVA) is a measure of the operating profits that a company has produced in excess of its funding costs, or cost of capital.

- The SVA formula uses NOPAT, which is based on operating profits and excludes the tax savings that result from the use of debt.

- A prime disadvantage of shareholder value added is that it is difficult to calculate for privately held companies.

How Shareholder Value Added (SVA) Works

Some value investors use SVA as a tool to judge the corporation’s profitability and management efficacy. This line of thinking runs congruent with value-based management, which assumes that the foremost consideration of a corporation should be to maximize economic value for its shareholders.

Shareholder value is created when a company’s profits exceed its costs. But there is more than one way to calculate this. Net profit is a rough measure of shareholder value added, but it does not take into account funding costs or the cost of capital. Shareholder value added (SVA) shows the income that a company has earned in excess of its funding costs.

Formula for Shareholder Value Added (SVA)

SVA = NOPAT – CC

Where NOPAT = Net operating profit after tax

CC = Cost of capital

NOPAT also excludes extraordinary items and is thus a more precise mea-sure than the net profit of a company’s ability to generate profits from its normal operations. Extraordinary items include restructuring costs and other one-time expenses that may temporarily affect a company’s profits

(iii) Following are the value drivers that affect shareholder value

- Value Growth Duration

- Sales Growth

- Operating Profit Margin

- Income Tax Rate

- Working Capital Investments

- Fixed Capital Investments

- Cost of Capital

![]()

Question 5(a).

Sakara Ltd., manufactures spare parts. For production it uses many machines. It supplies the following information pertaining to one of the vital machines used by it for the month September, 2021.

Total production in that month 3000 units

No. of units accepted out of the above production 2860 units

Std. time for actual production 200 hrs.

Actual time worked during the month 240 hrs.

Time lost during the month 35 hrs.

Required:

(i) Identify a suitable approach to measure the total productive maintenance performance of the machine. (1 Mark)

(ii) List the losses to be identified to measure the maintenance performance. (2 Marks)

(iii) Calculate the total productive maintenance performance of the machine under the identified approach in (i) above. (4 Marks)

(iv) Evaluate the effectiveness of the maintenance of the machine if the World Class Index is more than 85%. (3 Marks)

Answer:

| Total production during the month | 3,000 units. |

| No. of units accepted out of total production | 2,860 units. |

| Standard time for actual production of the month | 200 hrs. |

| Actual time worked during the month | 240 hrs. |

| Time lost during the month | 35 hrs. |

(i) The most important approach to the measurement of TPM performance is known as Overall Equipment Effectiveness (OEE) measure. The calculation of OEE measure requires the identification of “six big losses”

- Equipment Failure/Breakdown

- Set-up/Adjustments

- Idling and Minor Stoppages

- Reduced Speed

- Reduced Yield and

- Quality Defects and Rework

The first two losses refer to time losses and are used to calculate the availability of equipment. The third and fourth losses are speed losses that determine performance efficiency of equipment. The last two losses are regarded as quality losses.

Performance × Availability × Quality = OEE %

OEE may be applied to any individual assets or to a process. It is unlikely that any manufacturing process can run at 100% OEE.

(ii) Following are the list of Six Big losses to be identified to measure performance

- Set-up/Adjustments

- Idling and Minor Stoppages

- Reduced Speed

- Reduced Yield

- Quality Defects and Rework

- Equipment failure/breakdown

(iii) Calculation of Total Productive maintenance performance of the j machine

Availability Ratio = Operating time (Run Time)/planned production time % = 240 hr./240 hr. + 35 hr. = 87.27%

(total time worked = actual time worked + time lost = 240 hr. + 35 hr.)

Performance Ratio = Standard time required (Net operating Time)/ J Run time = 200 hr./240 hr. = 83.33%

Quality Ratio = Good Quality Product/Actual Product = 2,860 units/3,000 units = 95.33%

Total OEE = Availability Ratio × Performance Ratio × Quality Ratio = 87.27 % × 83.33 % × 95.33 % = 69.33 %

(iv) World Class OEE is 85% or greater, Sakara Ltd’s OEE is somewhere around 69.33%. It just means that company got some opportunities for improvement. Sakara Ltd., may improve OEE by collecting information related to all downtime and losses on equipment, analyzing such information through graphs and charts, making improvement decisions thereon like autonomous maintenance, preventive maintenance, reduction in set-up time etc. and implementing the same.

![]()

Question 5(b).

TAX ADVISER ASSOCIATION (TAA) is a not-for-profit organisation with the objective of skill development of professionals in the area of Accounts, Taxation and Management. TAA believes that there is a great demand of persons with perfect skill for handling the affairs of not-for-profit organisations, like itself, which may be engaged in similar other charitable objects like healthcare, education, community development etc.

TAA recognises the need of Strategic Management of entities in the not- for-profit sector, so that the true purpose of committing funds to such charitable objects, is effectively achieved. Funds may be obtained from donors, subscribers, surplus from internal activities of the not-for-profit entities, etc.

TAA also recognises that the underlying objective of these not-for-profit entities is not to earn profits and distribute dividends to the members. Hence, the performance evaluation using Financial Measures like Profitability, Return on Net Assets, Economic Value Added, Residual Income, etc. are not relevant, since the objective of Shareholder’s Wealth Maximisation is not relevant. In spite of that the management of TAA wants to know the need for performance measurement of not-for-profit entities and the scope for the same. Hence, the management raises the following issues to get your j expertise input.

You are required to :

(i) Explain the objects of not-for-profit entities. (1 Mark)

(ii) Describe in brief the reasons why Performance Measurement is required for not-for-profit entities. (1 Mark)

(iii) List the challenges in Performance Measurements of not-for-profit entities. (3 Marks)

(iv) Analyse the Value for Money (VFM) framework for Performance Measurement of not-for-profit entities. (2 Marks)

(v) Explain how the Adapted Balance scorecard Approach can be applied for not-for-profit entities. (3 Marks)

Answer:

(i) The Objectives of not-for-profit entities:

A single not-for profit organisation may have diverse stakeholders to deal with, and each section of society or group of stakeholders has its own need. This will cause multiple objectives to be achieved by such not-for-profit organisation.

Strategic Objective:

A non-profit organization’s strategic objectives focus on the services provided to its target market. This requires identifying the needs of the relevant community and developing programs 2 and projects geared at fulfilling those needs.

Financial objectives include raising enough money to fund the activities included in their strategic plan, as well as fixed costs such as premises rental, staff compensation and utility bills.

Operational objectives of a non-profit organization relate to the management of funds and resources to achieve specific tasks,

Governance Objective – Non-profit organizations are subject to stringent governance requirements, mainly because they usually use donor or grant funding to do their work. This makes them accountable to their donors and the grant programs, as well as to the public whose taxes go toward grant funding. Governance objectives include the establishment of sound policies for issues such as compensation, purchasing and procurement, human resource and volunteer management and asset and risk management.

(ii) Following are the requirement of Performance Measurement of not-for-profit entities:

The performance measurement process typically starts with identification of the overriding objectives and mission of the not-for-profit organisation. This includes evaluating the mission, vision and strategy on a continuous basis. This stage typically defines the problem being solved and the stakeholder which would be addressed by the organisation. The various objectives/mission of the organisation are broken down and mapped with key strategies: Stakeholder (Customer), Financial, Internal Process and Learning & Growth. In other words, the objectives are mapped with various perspectives of the balanced scorecard. The performance measures/key performance indicators of each of the perspectives is defined. The actual outcome is measured and evaluated against the performance measures defined. Any changes which are required to the performance measures are carried out after analysis of the outcome on a periodic basis.

(iii) List of the challenges in Performance Measurement of not-for-profit entities:

The performance measurement in not-for-profit organisations is subject to certain challenges. The key challenges are-

Difficult to quantify the cost and benefits:

It is difficult to quantify the benefit derived from the activities of these organisations in the scale of money, especially due to the nature and timing of benefits. Nature of benefit can be behavioral, which can only measure in term of utility or satisfaction initially; then can be quantified after a lot of efforts. For example, if a not-for-profit organisation is formed for providing free education to poor students, then the benefits derived by the students cannot be easily quantified and benefits are futuristic too (that too for a longer period till the life of j such pupil). There is also a time gap between the cost incurred and I benefit accrued, which makes trade-off difficult and complex.

Similarly, all the costs can’t be measured in monetary terms. Additional and auxiliary costs in form of externalities can be there, which is difficult to quantify due to involved complexities. For example, if some affordable housing scheme is approved, the cost will not only be limited to construction; it also involves provisioning of road, causing pollution in that area (due to vehicle running on such roads by potential residents), and social aspects due to parking issues. This is merely one aspect; hence auxiliary costs are not easy to quantify.

Way Out → Despite it is difficult still, an attempt shall be made to trade-off costs and benefits based upon opportunity value and cost. Relative value can be used to assign value to cost incurred and benefits earned.

(iv) Value for Money (VFM) framework for performance measurement of not-for-profit entities.

VFM framework can be used for measurement of performance in the not-for-profit sector, because Not-for-profit organisations are expect – ed to provide the best possible value from available money (usually limited).

VFM framework ensures-

Effectiveness (spend wisely) (an output measure, the goal approach)

→ whether the organisation has achieved its desired mission and objectives?

Efficiency (spend well) (a link between input and output factor, as process approach)

→ Whether the resources and funds available to the organisation has been utilised efficiently i.e. maximum output has been obtained with minimum input?

Economy (spend less) (as an input measure, the resource approach)

→ Whether the appropriate quantity and quality of inputs is available at the lowest cost?

(v) Adapted Balance Scorecard (by Kaplan) Approach can be applied for not- for- profit entities.

Robert S Kaplan (one of the co-founder of Balanced Scorecards) wrote an article in the year 2001 ‘Strategic Performance Measurement and Management in Non-profit Organizations’ with a theme of adaption of balanced scorecard by non-profit organisation with several examples of actual implementation. In this article, considering the increasing need of measuring and managing organizational performance in case of not-for-profit organisation Kaplan suggest ‘Adapted Balanced Scorecard’ for measuring performance at NGOs.

| Prospective | Focus |

| Customer Perspective | Satisfaction of beneficiary, Market Growth, & Other stakeholder’s interest |

| Financial Perspective | Fund raising, Funds growth, and Funds distribution |

| Internal Processes Perspective | Internal efficiency, Volunteer development, Information communication, and Quality |

| Innovation and Learning Perspective | The capability of organisation to adjust to the changing environment and Innovative changes |

![]()

Question 6(a).

XYZ Ltd., is engaging in the production of three joint products X, Y and Z. Product Z has a realizable value of ₹ 42 p.u., if it is processed further after the point of separation. Otherwise Z has no saleable value. The costs attributable to Z upto the point of separation is ₹ 70 p.u. (variable ₹ 40 and fixed ₹ 30). To process Z further, after the point of separation, the cost to be incurred p.u. is ₹ 30 (variable ₹ 20 and fixed ₹ 10). Before taking a decision on further processing of Z and on some other issues the company seeks your advice. The issues are : (10 Marks)

Required:

(i) Advise whether the joint product Z should be processed further or not.

(ii) If product Z is not a joint product what is your advise regarding the further processing of Z.

(iii) List the situations in which minimum pricing approach is followed by an organization.

(iv) Analyse how “Keep or drop” operating decisions are taken in a normal situation.

Answer:

(i) XYZ Ltd. If producing three products X, Y and Z. Cost incurred on Product ‘Z’ upto point of separation is irrelevant for decision making as Product ‘Z’ is a Joint Product. Joint Products are the result of same P raw material & same process Operations. Cost incurred after point j of separation will be considered for decision making as specifically incurred for Product ‘Z’. ,

After further processing Product ‘Z’ will contribute ? 12 per unit toward ‘Joint Production Cost’. Calculation is as follows:

| Particulars | Amount (₹) |

| Selling Price per unit | 42.00 |

| Less: Cost after separation: | |

| Marginal Cost per unit | 20.00 |

| Fixed Cost per unit | 10.00 |

| Contribution toward ‘Joint Production Cost’ | 12.00 |

Since XYZ Ltd. is incurring profit after further processing of product Z, hence further processing of product Z is recommended.

(ii) If product Z is not a joint product with the same cost structure. In this case there will be negative contribution on production of Product “Z”.

The calculation is as follows:

Cost incurred on Product ‘Z’ is relevant for decision making.

Product ‘Z’ will incur contribution loss ₹ 12 per unit toward Production. Calculation is as follows:

| Particulars | Amount (₹) |

| Selling Price per unit | 42.00 |

| Less: Cost | |

| Marginal Cost per unit (₹ 20 + ₹40) | 60.00 |

| Contribution toward product Z | (18.00) |

Hence, production of Product ‘Z’ will not be recommended.

(iii) Following are the situation in which minimum pricing approach is followed

- The minimum pricing approach is a useful method in situations where there is a lot of intense competition, surplus production capacity, clearance of old inventories, getting special orders and/ or improving market share of the product.

- The minimum price should be set at the incremental costs of manufacturing, plus opportunity costs (if any).

- For this type of pricing, the selling price is the lowest price that a company may sell its product at usually the price will be the total relevant costs of manufacturing.

(iv) Keep or drop unprofitable segments, such as product lines, services, divisions, departments, stores, or outlets.

The decision is based on whether or not the segment’s revenue exceeds the costs directly traceable to the segment, including any direct fixed costs.

Decision – Keep or Drop?

- If incremental cost savings > incremental revenue lost, the segment should be dropped, unless qualitative characteristics fiercely impact the decision.

- If incremental revenue lost = incremental cost savings, qualitative effects must be used to make the decision.

- If incremental cost savings < incremental revenue lost, the segment should not be dropped, unless qualitative characteristics fiercely impact the decision.

Qualitative Factors

Qualitative factors related to keep or drop decisions often include considerations of employees that will be terminated if the product is dropped, the effect a lay off might have on employees that are not terminated, effects of suppliers from which the materials needed for the product will no longer be purchased, and the effect of customers who previously purchased the product being dropped.

![]()

Question 6(b).

K Ltd. had a profit plan approved for selling 5000 units per month at an average price of ₹ 10 per unit. The budgeted variable cost of

production was ₹ 4 per unit and the fixed costs were budgeted at ₹ 20,000 and the planned income being ₹ 10,000 per month. Due to shortage of raw materials, only 4000 units could be produced and the cost of production increased by 50 paise per unit. The selling price was raised by ₹ 1 per unit.

In order to improve the production process, an expenditure of ₹ 1000 was incurred for research and development activities. (10 Marks)

You are required to prepare a performance budget and a summary report for the month by incorporating the planned income, actual income and variances.

Answer:

K Ltd. Performance Budget & a Summary Report %

| Planned Income (per month) | Actual Income (per month) | Variances (per month) | |

| Sale unit | 5000 unit | 4,000 unit | |

| Avg SP | ₹ 10 p.u | ₹ 11 p.u | |

| Variable cost | ₹ 4 p.u (Budgeted) | ₹ 4.50 | |

| Fixed Cost | ₹ 20,000 | ₹ 20,000 + ₹ 1000 (research &development) | |

| Income | ₹ 10,000 | ₹ 5,000 | (₹ 1,000) Adverse |