Business Combinations and Corporate Restructuring – CA Final FR Study Material is designed strictly as per the latest syllabus and exam pattern.

Business Combinations and Corporate Restructuring – CA Final FR Study Material

Questions On Scope (Asset Acquisition) [Based On Para No. 2]

Question 1.

What are the key differences in accounting of an asset acquisition and a business combination?

Answer:

The following are the key differences in accounting of an asset acquisition and a business combination:

| Topic | Business combination | Acquisition of group of assets under Ind AS |

| Intangible assets, including goodwill | Intangible assets are recognized at fair value, if they are separately identifiable. Goodwill is recognized as a separate asset. | Intangible assets acquired as part of a group of assets would be recognized and measured based on an allocation of the overall cost of the transaction with reference to their relative fair values. No goodwill would be recognized. |

| Transaction costs | In a business combination, acquisition-related costs (including stamp duty) are expensed in the period in which such costs are incurred and are not included as part of the consideration transferred. | Transaction costs are capitalized as a component of the cost of the assets acquired. |

| Deferred tax accounting | Deferred taxes are recorded on temporary differences of assets acquired (other than goodwill) and liabilities assumed in a business combination. | Ind AS prohibits recognition of deferred taxes for temporary differences that arise upon initial recognition of an asset or liability in a transaction that (r) is not a business combination and (it) at the time of the transaction, affects neither accounting nor taxable income. Accordingly, no deferred taxes are recognized for temporary differences on asset acquisitions (on initial recognition). |

| Situations where the fair value of the assets acquired and liabilities assumed exceeds the fair value of consideration transferred (referred to as bargain purchases) | If the fair value of the assets acquired and liabilities assumed exceeds the fair value of the consideration transferred (plus the amount of non-controlling interest and the fair value of the acquirer’s previously held equity interests in the acquiree), a gain is recognized by the acquirer in other comprehensive income and accumulated in capital reserve. | The assets acquired and liabilities assumed are measured using an allocation of the fair value of consideration transferred based upon relative fair values. As a result, no gain is recognized for a bargain purchase. |

Identification of A Business Combination (Based On Para No. 3 And Para Nos. B5 To B12 Of Appendix B)

![]()

Question 2.

Which of the following scenario represents a Business Combination?

(a) Case A: On 1st January, 2012, A Ltd. owns a majority share of its investee’s voting equity interests. The other investors in the investee hold contractual rights (for example, board membership rights accompanied by veto rights on operating matters, or other substantive participation rights) which preclude A Ltd. from exercising control over the investor. The contractual rights of other investors were for 5 years which lapsed on 31st December, 2016 as per the terms of the contract.

(b) Case B: P Ltd. owns an equity investment in an investee that gives it significant influence but not control. During the year, the investee repurchased its own shares from other parties and the same were extinguished which resulted in an increase in the P Ltd.’s proportional interest in the investee (to 60% of the voting rights), which results in P Ltd, acquiring control of the investee.

Answer:

(a) In Case A, on 1st January 2017, it represents a change in the rights of other shareholders (elimination or expiration of the contractual rights precluding control) which result in A Ltd. obtaining control of the in-vestee and qualifying as a business combination.

(b) In Case B, the repurchase by investee of its own shares from other parties results in P Ltd. obtaining control of the investee (presuming no other indicator impacting control). This transaction qualifies as a business combination and the acquisition method would be applied by P Ltd.

![]()

Determine The Acquisition Date (Based On Para Nos. 8 And 9)

Question 3.

Company A Ltd. acquired all the shares of Company X Ltd. The negotiations had commenced on 1st January, 2016 and the agreement was finalized on 1 March, 2016. While A Ltd. obtains the power to control X’s operations on 1 March, 2016, the agreement stales that the acquisition is effective from 1 January, 2016 and that A Ltd. is entitled to all profits after that date. In addition, the purchase price is based on X’s net asset position as at 1 January 2016. What is the date of acquisition?

Answer:

The answer is based on Paragraphs 6, 7, 8 and 9 of Ind AS 103.

Therefore, in this case, notwithstanding that the price is based on the net assets at 1 January, 2016 and that X’s shareholders do not receive any dividends after that date, the date of acquisition for accounting purposes will be 1 March 2016. It is only on 1 March, 2016 and not 1 January, 2016, that A has the power to direct the relevant activities of X Ltd. so as to affect its returns from its involvement with X Ltd. Accordingly, the date of acquisition is 1 March, 2016.

Question 4.

Company A Ltd. and Company X Ltd. are manufacturers of rubber components for a particular type of equipment. A Ltd. makes a bid for X Ltd.’s business and the Competition Commission of India (CCI) announces that the proposed transaction is to be scrutinized to ensure that competition laws are not breached. Even though the contracts are made subject to the approval of the CCI, A Ltd. and X Ltd. mutually agree the terms of the acquisition and the purchase price before competition authority clearance is obtained. Can the acquisition date in this situation be the date on w’hich A Ltd. and X Ltd. agree the terms even though the approval of CCI is awaited (Assume that the approval of CCI is substantive)?

Answer:

The answer is based on Paragraphs 8 and 9 of Ind AS 103.

Since CCI approval is a substantive approval for A Ltd. to acquire control of X Ltd.’s operations, the date of acquisition cannot be earlier than the date on which approval is obtained from CCI. This is pertinent given that the approval from CCI is considered to be a substantive process and accordingly, the acquisition is considered to be completed only on receipt of such approval.

![]()

Question 5.

X Ltd. makes an offer (subject to the satisfactory completion of due diligence) to buy all of the shares in Y Ltd. which is wholly owned by Z Ltd. Pending transfer of shares to X, the parties agree that X Ltd. should be consulted on any major business decisions. Whether offer date can be considered to be the date of acquisition?

Answer:

The answer is based on paragraphs 8 and 9 of Ind AS 103.

In the given case, X Ltd. cannot be considered to have the power to direct the relevant activities of Y Ltd. only due to the fact that it will be consulted on major decisions. X Ltd. does not have the power to impose its decisions on Y Ltd. Accordingly, based on the above, the offer date cannot be considered to be the date of acquisition.

Computation of Consideration Transferred (Based On Para Nos. 37 To 40 And 53)

Question 6.

A Ltd. acquired the entire equity share capital of P Ltd. for INR 8 , crores. A Ltd. paid INR 2 crores in cash and the balance INR 6 crores has been agreed to be paid to the seller in 5 years as a deferred consideration. How should the deferred consideration be valued for determining the consideration transferred in relation to computation of goodwill?

Answer:

The answer is based on Paragraph 37 of Ind AS 103.

The deferred consideration issued is required to be measured at its fair value. The deferred consideration will be valued at its net present value determined with reference to an appropriate discount rate (e.g. the rate at which entity A Ltd. could issue the same amount of debt in a separate market transaction with the appropriate adjustment for credit rating) for the purpose of computation of the consideration transferred.

Subsequent unwinding of the discounting discussed above is required to be recognized as finance cost in the respective years’ statement of profit and loss.

![]()

Question 7.

Should stamp duty paid on acquisition of land pursuant to a business combination be capitalized to the cost of the asset or should it be treated as an acquisition related cost and accordingly be expensed off?

Answer:

The transfer of land and the related stamp duty is required to be accounted as part of the business combination transaction as per requirements of Ind AS 103 and not as a separate transaction under Ind AS. Accordingly, stamp duty incurred in relation to land acquired as part of a business combination transaction are required to be recognized as an expense in the period in which the acquisition is completed and given effect to in the financial statements of the acquirer.

Question 8.

On 1 st April, 2016, Company P Ltd. acquired 30% of the voting ordinary shares of Company X Ltd. for INR 8,000 crores. P Ltd. accounts its investment in X Ltd. using equity method as prescribed under Ind AS 28, Investments in Associates and Joint Ventures. At 31 March, 2017, P Ltd. recognized its share of the net asset changes of X Ltd. using equity accounting as follows:

(Amounts in INR-crores)

Share of profit or loss : 700

Share of exchange difference in OCI : 100

Share of revaluation reserve of PPE in OCI : 50

The carrying amount of the investment in the associate on 31 March, 2017

was therefore 8,850 (8,000 + 700 + 100 + 50).

On 1 April, 2017, P Ltd. acquired the remaining 70% of X Ltd. for cash of INR 25,000 crores. The following additional information is relevant at that date

(Amount in INR-crores)

Fair value of the 30% interest already owned : 9,000

Fair value of X’s identifiable net assets : 30,000

How should such business combination be accounted for?

Answer:

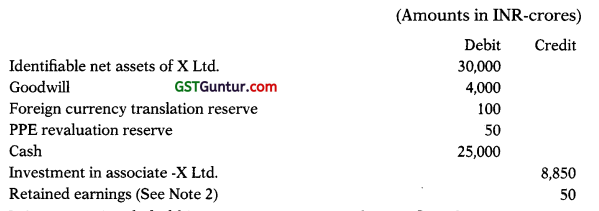

P Ltd. records the following entry in its consolidated financial statements:

Gain on previously held interest in X recognized in Profit or loss P 1 250

[To recognize acquisition of X Ltd.]

Notes:

1.

2. The credit to retained earnings represents the reversal of the unrealized gain of INR 50 crores in Other Comprehensive Income related to the revaluation of property, plant and equipment. In accordance with Ind AS 16, this amount is not reclassified to profit or loss.

3. The gain on the previously held equity interest in X Ltd. is calculated as follows:

![]()

Question 9.

Deepak Lid., an automobile group acquires 25% of the voting ordinary shares of Shaun Ltd., another automobile business, by paying ₹ 4,320 crore on 01.04.2017. Deepak Ltd. accounts its investment in Shaun Ltd. using equity method as prescribed under Ind AS 28. At 31.03.2018, Deepak Ltd. recognised its share of the net asset changes of Shaun Ltd. using equity accounting as follows:

(₹ in crore)

Share of Profit or Loss : 378

Share of Exchange difference in OCI : 54

Share of Revaluation Reserve of PPE in OCI : 27

The carrying amount of the investment in the associate on 31.03.2018 was therefore ₹ 4,779 crore (4,320 + 378 + 54 + 27).

On 01.04.2018, Deepak Ltd. acquired remaining 75% of Shaun Ltd. for cash ₹ 13,500 crore. Fair value of the 25% interest already owned was ₹ 4,860 crore and fair value of Shaun Ltd.’s identifiable net assets was ₹ 16,200 crore as on 01.04.2018.

How should such business combination be accounted for in accordance with the applicable Ind AS ? [May 2019 – 8 Marks]

Answer:

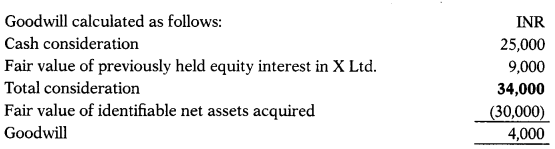

Deepak Ltd. records the following entry in its consolidated financial statements:

Working Notes:

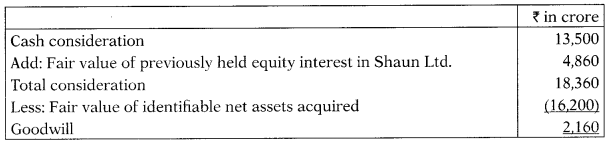

1. Calculation of Goodwill

2. The credit to retained earnings represents the reversal of the unrealized gain of ₹ 27 crore in Other Comprehensive Income related to the revaluation of property, plant and equipment. In accordance with Ind AS 16, this amount is not reclassified to profit or loss.

3. The gain on the previously held equity interest in Shaun Ltd. is calculated as follows:

Contingent Consideration (Based On Para Nos. 39, 40 And 58)

Question 10.

How should contingent consideration payable in relation to a business combination be accounted for on initial recognition and at the subsequent measurement in the following cases:

(a) On 1 April, 2016, A Ltd. acquires 100% interest in B Ltd. As per the terms of agreement the purchase consideration is payable in the following 2 tranches:

- an immediate issuance of 10 lakhs shares of A Ltd. having face value of INR 10 per share;

- a further issuance of 2 lakhs shares after one year if the profit before interest and tax of B Ltd. for the first year following acquisition exceeds INR 1 crore.

The fair value of the shares of A Ltd. on the date of acquisition is INR 20 per share. Further, the management has estimated that on the date of acquisition, the fair value of contingent consideration is INR 25 lakhs.

During the year ended 31 March, 2017, the profit before interest and tax of B Ltd. exceeded INR 1 crore. As on 31 March, 2017, the fair value of shares of A Ltd. is INR 25 per share.

(b) Continuing with the fact pattern in (a) above except for:

4 The number of shares to be issued after one year is not fixed.

4 Rather, A Ltd. agreed to issue variable number of shares having a fair value equal to INR 40 lakhs after one year, if the profit before interest and tax for the first year following acquisition exceeds INR 1 crore.

Answer:

The answer is based on Paragraphs 37 and 39 of Ind AS 103.

(a) The amount of purchase consideration to be recognized on initial recognition shall as follows:

Fair value shares issued (10,00,000 × INR 20) = INR 2,00,00,000

Fair value of contingent consideration = INR 25,00,000

Total purchase consideration = INR 2,25,00,000

Subsequent measurement of contingent consideration payable for business combination In general, an equity instrument is any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities. Ind AS 32 describes an equity instrument as one that meets both of the following conditions:

- There is no contractual obligation to deliver cash or another financial asset to another party, or to exchange financial assets or financial liabilities with another party under potentially unfa-vourable conditions (for the issuer of the instrument).

- If the instrument will or may be settled in the issuer’s own equity instruments, then it is:

- a non-derivative that comprises an obligation for the issuer to deliver a fixed number of its own equity instruments; or

- a derivative that will be settled only by the issuer exchanging a fixed amount of cash or other financial assets for a fixed number of its own equity instruments.

In the given case, given that the acquirer has an obligation to issue fixed number of shares on fulfilment of the contingency, the contingent con-sideration will be classified as equity as per tfie requirements of Ind AS As per paragraph 58 of Ind AS 103, contingent consideration classified as equity should not be re-measured and its subsequent settlement should be accounted for within equity.

In the given case, the obligation to pay contingent consideration amounting to INR 25,00,000 is recognized as a part of equity and therefore not re-measured subsequently or on issuance of shares.

![]()

(b) The amount of purchase consideration to be recognized on initial recognition is as follows-:

Fair value shares issued (10,00,000 × INR 20) = INR 2,00,00,000

Fair value of contingent consideration = INR 25,00,000

Total purchase consideration = INR 2,25,00,000

Subsequent measurement of contingent consideration payable for business combination

In the given case, the contingent consideration will be classified as liability as per Ind AS 32.

As per paragraph 58 of Ind AS 103, contingent consideration not classified as equity should be measured at fair value at each reporting date and changes in fair value should be recognized in profit or loss.

As at 31 March, 2017 (being the date of settlement of contingent consideration), the liability would be measured at its fair value and the resulting loss of INR 15,00,000 (INR 40,00,000 – INR 25,00,000) should be recognized in the profit or loss for the period. A Ltd. would recognize issuance of 1,60,000 (INR 40,00,000/25) shares at a premium of INR 15 per share.

Question 11.

A Ltd. acquires P Ltd. in September 2016 for cash. Additionally, A Ltd. agrees to pay the selling shareholder an amount equivalent to 10% of profits in excess of INR 10 crores generated over the next two years in cash in lump sum at the end of the three years. A Ltd. determines the fair value of the contingent consideration liability to be INR 1 crores at the date of acquisition.

A year after the acquisition, P Ltd. has performed better than initially projected by A Ltd. and a higher payment is now expected to be made at the end of year two. The fair value of this financial liability is INR 2.5 crores at the end of the first year.

Whether there should be any adjustment in the acquisition accounting? If yes, by what amount?

Answer:

The answer is based on Paragraph 58 of Ind AS 103.

Where contingent consideration is not classified as equity, the changes in its fair value that are not measurement period adjustment should be remeasured to fair value at each reporting date until the contingency is settled. Such changes in fair value are required to recognized in profit or loss (in accordance with Ind AS 109 where such contingent consideration is within the scope of the standard).

Thus, A Ltd. should re-measure contingent consideration at the end of the year i.e. 31 March 2017 as follows:

Profit and loss A/c : Dr. : 1,50,00,000

Liability for contingent consideration : Cr. : 1,50,00,000

Similarly, the adjustment to the financial liability to reflect the final settlement amount (final fair value) is required to be recognized in profit or loss if the amount differs from the fair value estimate at the end of the first year.

![]()

Question 12.

Entity A Ltd. acquired entity P Ltd. for INR 5 crores. To protect A for false representations and warranties (if any) asserted by the sellers of entity P Ltd. the acquisition agreement provides that A Ltd. will pay INR 4.5 crores at the acquisition date and place the balance INR 50 Lakhs in an es-crow account (being a protective clause). If no violation of the representations and warranties is reported or noticed within one year of the acquisition date, the amount of INR 50 Lakhs in the escrow account will be released to the sellers. Should INR 50 Lakhs lying in escrow be accounted for as contingent consideration by entity A Ltd.?

Answer:

In the given case, the funds lying in escrow are released to the sellers based on the validity of conditions that existed at the acquisition date and are not dependent on the future performance of entity P Ltd. Further, as the escrow arrangement is only protective in nature. Therefore, INR 50 Lakhs will not be considered as a contingent consideration. It is instead required to be treated as part of the consideration for the business combination on the date of acquisition and consequently should be considered for computation of goodwill in relation to the acquisition.

Subsequently, based on paragraph 45 of Ind AS 103, adjustments, if any, to the amount in escrow would be accounted, for as a measurement period ad-justment that impacts goodwill given that they result from new information that is obtained after the acquisition date about facts and circumstances that existed as of the acquisition date.

Question 13.

A Ltd. agrees to acquire P Ltd. for INR 60 crores as per an agreement dated 15 March, 2017. The acquisition is however subject to the successful completion of the closing conditions. As per the agreement between A Ltd. and P Ltd , to the extent the working capital (that is, inventory, receivables and payables) at the acquisition date (on successful completion of closing conditions) exceeds a specified minimum level of 10 crores, A Ltd. will pay additional consideration to the seller. For instance, if P’s working capital is INR 11 crores, A will pay an additional INR 1 crores. Should A Ltd. account for the working capital adjustment as contingent consideration?

Answer:

The answer is based on Paragraph 45 of Ind AS 103.

The working capital adjustment in relation to A Ltd.’s acquisition of P Ltd. is a mechanism to determine the working capital as of the acquisition date. While the working capital computation may be completed post the acquisition date, the computation does not consider the impact of any future event, conditions, contingencies etc.

Accordingly, given that the working capital adjustment reflects the consideration to be paid as of the acquisition date, the same may not be treated as contingent consideration.

![]()

Question 14.

P Ltd., a manufacturing company, prepares consolidated financial statements to 31st March each year. During the year ended 31st March, 2018, the following events affected the tax position of the group:

Q Ltd., a wholly owned subsidiary of P Ltd., incurred a loss adjusted for tax purposes of ₹ 30,00,000. Q Ltd. is unable to utilise this loss against previous tax liabilities. Income-tax Act does not allow Q Ltd. to transfer the tax loss to other group companies. However, it allows Q Ltd. to carry the loss forward and utilise it against company’s future taxable profits. The directors of P Ltd. do not consider that Q Ltd. will make taxable profits in the foreseeable future.

During the year ended 31 st March, 2018, P Ltd. capitalised development costs which satisfied the criteria as per Ind AS 38 ‘Intangible Assets’. The total amount capitalised was ₹ 16,00,000. The development project began to generate economic benefits for PQR Ltd. from 1st January, 2018. The directors of P Ltd. estimated that the project would generate economic benefits for five years from that date. The development expenditure was fully deductible against taxable profits for the year ended 31st March, 2018.

On 1st April, 2017, P Ltd. borrowed ₹ 1,00,00,000. The cost to P Ltd. of arranging the borrowing was ₹ 2,00,000 and this cost qualified for a tax deduction on 1st April 2017. The loan was for a three-year period. No interest was payable on the loan but the amount repayable on 31st March 2020 will be ₹ 1,30,43,800. This equates to an effective annual interest rate of 10%. As per the Income-tax Act, a further tax deduction of ? 30,43,800 will be claimable when the loan is repaid on 31st March, 2020.

Explain and show how each of these events would affect the deferred tax assets/liabilities in the consolidated balance sheet of P Ltd. group at 31st March, 2018 as per Ind AS. The rate of corporate income tax is 30%.

Answer:

Impact on consolidated balance sheet of PQR Ltd. group at 31st March, 2018

- The tax loss creates a potential deferred tax asset for the P Ltd. group since its carrying value is nil and its tax base is ₹ 30,00,000. However, no deferred tax asset can be recognised because there is no prospect of being able to reduce tax liabilities in the foreseeable future as no taxable profits are anticipated.

- The development costs have a carrying value of ₹ 15,20,000 [₹ 16,00,000 – (₹ 16,00,000 × 1/5 × 3/12)]. The tax base of the development costs is nil since the relevant tax deduction has already been claimed. The deferred tax liability will be ₹ 4,56,000 (₹ 15,20,000 × 30%). All deferred tax liabilities are shown as non-current.

- The carrying value of the loan at 31st March, 2018 is ₹ 1,07,80,000 [₹ 1,00,00,000 – ₹ 200,000 + (₹ 98,00,000 × 10%)]. The tax base of the loan is 1,00,00,000. This creates a deductible temporary difference of ₹ 7,80,000 and a potential deferred tax asset of ₹ 2,34,000 (₹ 7,80,000 × 30%).

![]()

Contingent Liability-T- Indemnification Assets (Based On Para Nos. 22, 23, 27 And 28)

Question 15.

(a) A Ltd. acquired a beverage company P Ltd. from X Ltd. At the time of the acquisition, P Ltd. is the defendant in a court case whereby certain customers of P Ltd. have alleged that its products contain pesticides in excess of the permissible levels that have caused them health damage.

P Ltd. is being sued for damages of INR 2 crores. X Lid has indemni-fied A Ltd. for the losses, if any, due to the case for amount up to INR 1 crore. The fair value of the contingent liability for the court case is INR 70 lakhs.

How should A Ltd. account for the contingent liability and the indemnification asset?

(b) A Ltd. acquires P Ltd. in July 2017. P Ltd. is in dispute with local tax authorities over its tax return for 2015. A Ltd. receives an indemnity from the selling shareholder(s) of P Ltd. to cover the outcome of the tax dispute. A Ltd. ascertains that an outflow in relation to the tax case is probable and estimates the amount expected to be paid as INR 25 lakhs i.e., the full amount being claimed by the tax authorities. The fair value of the liability is INR 17.4 lakhs.

Paragraph 24 of Ind AS 103 requires the acquirer to recognize and measure a deferred tax asset or liability arising from the assets acquired and liabilities assumed in a business combination in accordance with Ind AS 12, Income Taxes. Thus, A Ltd. recognized a liability of INR 25 lakhs. If the tax authorities require this amount to be paid, the seller of P Ltd. will pay A Ltd. the full INR 25 lakhs. A Ltd. considers the creditworthiness of selling shareholders of P Ltd. to be such that the indemnification asset is fully collectible. How should indemnification asset be accounted for?

(c) A Ltd. pays INR 50 crores to acquire P Ltd. from X Ltd. P Ltd. man-ufactured products containing fiber glass and has been named in 10 class actions concerning the effects of these fiber glass. X Ltd. agrees to indemnify A Ltd. for the adverse results of any court cases up to an amount of INR 10 crores. The class actions have not specified amounts of damages and past experience suggests that claims may be up to INR 1 crore each, but that they are often settled for small amounts.

A Ltd. makes an assessment of the court cases and decides that due to the potential variance in outcomes, the contingent liability cannot be measured reliably and accordingly no amount is recognized in respect of the court cases. How should indemnification asset be accounted for?

Answer:

(a) In the current scenario, A Ltd. measures the identifiable liability of entity P Ltd. at INR 70 lakhs and also recognizes a corresponding asset of INR 70 lakhs on its consolidated balance sheet. The net impact on goodwill from the recognition of the contingent liability and associated indemnification asset is nil. However, in the case where the liability’s fair value is more than INR 1 crore (for example INR 1.2 crores), the asset will be limited to INR 1 crore.

(b) A Ltd. recognizes an indemnification asset of INR 25 lakhs which is measured on the same basis as the indemnified liability as no adjust-

ment has been required for collectability or contractual limitations on the indemnified amount.

(c) Since no liability is recognized in the given case, A Ltd. will also not recognize an indemnification asset as part of the business combination accounting.

Further, A Ltd. is required to make the necessary disclosures for contingent consideration arrangements and indemnification assets as required by para-graph B64 (g) of Ind AS 103.

![]()

Measurement After Acquisition Accounting – Adjustments To Provisional Amounts

Question 16.

As part of Its business expansion strategy, K Ltd. is in process of setting up a pharma intermediates business which is at very initial stage. For this purpose, K Ltd. has acquired on 1st April, 2018, 100% shares of A Ltd. that manufactures pharma intermediates. The purchase consideration for the same was by way of a share exchange valued at ₹ 35 crores. The fair value of A Ltd.’s net assets was ₹ 15 crores, but does not include:

(i) A patent owned by A Ltd. for an established successful intermediate drug that has a remaining life of 8 years. A consultant has estimated the value of this patent to be ₹ 10 crores. However, the outcome of clinical trials for the same are awaited. If the trials are successful, the value of the drug would fetch the estimated ₹ 15 crores.

(ii) A Ltd. has developed and patented a new drug which has been approved for clinical use. The cost of developing the drug was ₹ 12 crores. Based on early assessment of its sales success, the valuer has estimated its market value at ₹ 20 crores.

(iii) A Ltd.’s manufacturing facilities have received a favourable inspection by a Government department. As a result of this, the Company has been granted an exclusive five-year license to manufacture and distribute a new vaccine. Although the license has no direct cost to the Company, its directors believe that obtaining the license is a valuable asset which assures guaranteed sales and the value for the same is estimated at ₹ 10 crores.

K Ltd. has requested you to suggest the accounting treatment of the above transaction under applicable Ind AS.

Answer:

The company can recognise following Intangible assets while determining Goodwill/Bargain Purchase for the transaction:

(i) Patent owned by A Ltd.: The patent owned will be recognised at fair value by K Ltd. even though it was not recognised by A Ltd. in its financial statements. The patent will be amortised over the remaining useful life of the asset ie. 8 years. Since the company is awaiting the outcome of the trials, the value of the patent cannot be estimated at ₹ 15 crore and the extra ₹ 5 crore should only be disclosed as a Contingent Asset and not recognised.

(ii) Patent internally developed by A Ltd.: Further as per para 75 of Ind AS 38 ‘Intangible Assets’, after initial recognition, an intangible asset shall be carried at revalued amount, being its fair value at the date of the revaluation less any subsequent accumulated amortisation and any subsequent accumulated impairment losses. For the purpose of revalu-ations under this Standard, fair value shall be determined by reference to an active market.

From the information given in the question, it appears that there is no active market for patents since the fair value is based on early assessment of its sale success. Hence it is suggested to use the cost model and recognise the patent at the actual development cost of ? 12 crore.

(iii) Grant of Licence to A Ltd. by the Government: As regards to the five- year license, para 44 of Ind AS 38 requires to recognize grant asset at fair value. K Ltd. can recognize both the asset (license) and the grant at ₹ 10 crore to be amortised over 5 years.

Hence the revised working would be as follows:

Reacquired Rights (Based On Para No. 29 + Para Nos. B35 And B36 of Appendix B + Para Nos. B51 To B53 of Appendix B)

Question 17.

Entity A acquires entity P for a consideration of INR 1 crore. Four years ago, Entity A had granted a ten-year license allowing entity P to operate in Europe. The cost of the license was INR 2,50,000. The contract allows either party to terminate the franchise at a cost of the unexpired initial fee plus 20%. At the date of acquisition, the settlement amount is INR 1,80,000 ((INR 2,50,000 × 6/10) + 20%).

Entity A has acquired entity P, because it sees high potential in the European market and wishes to exploit it. Entity A calculates that under current economic conditions and at current prices it could grant a six-year franchise for a price of INR 4,50,000.

How is the license accounted for as part of the business combination?

Answer:

The answer is based on Paragraphs B51 and B52 of Ind AS 103.

The license is recognized at INR 4,50,000, the fair value at market rates of a license based on the remaining contractual life.

The gain or loss on settlement of the contract is the lower of:

INR 3,00,000, which is the amount by which the right is unfavorable to entity A compared to market terms. This is the difference between the amount that entity A could receive for granting a similar right, INR

4,50,0, compared to the carrying value (or the unamortized value) that it was granted for, INR 1,50,000 (2,50,000 × 6/10).

INR 1,80,000, which is the amount that entity A would have to pay to terminate the right at the date of acquisition.

The loss on settlement of the contract is INR 1,80,000. Therefore, out of the INR 1 crore paid, INR 98.2 lakhs is accounted for as consideration for the business combination and INR 1,80,000 is accounted for separately as a settlement loss on the re-acquired right.

![]()

Computation of NCI (Based On Para Nos. B44 And B45 of Appendix B)

Question 18.

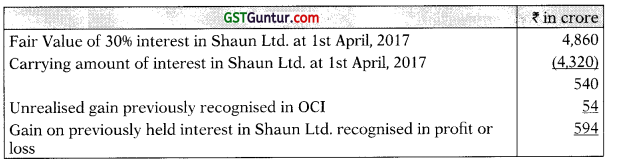

C Ltd. acquires 60% of the ordinary shares of N Ltd. a private entity, for INR 97.5 crores. The fair value of its identifiable net assets is INR 150 crores. The fair value of the 40% of the ordinary shares owned by non-controlling shareholders is INR 65 crores. Carrying amount of N Ltd’s net assets is INR 120 crores.

How will the non-controlling interest be measured?

Answer:

Non-controlling interests will be measured in either of the following manner:

(a) Non-controlling interests are measured at fair value

Under this method, goodwill represents the difference between the fair value of N Ltd. and the fair value of its identifiable net assets.

Thus, C Ltd. will recognize the business combination as follows:

Note: Goodwill is calculated as 97.5 + 65 – 150 = 12.5 or 162.5 – 150 = 12.5

Option 2 -Non-controlling interests are measured at proportionate share of identifiable net assets

Under this method, goodwill represents the difference between the total of the consideration transferred less the fair value of the acquirers share of net assets acquired and liabilities assumed. The non-controlling interests that are present ownership interests and entitle their holders to a proportionate share of the N Ltd’s net assets in the event of liquidation (i.e. the ordinary shares) are measured at the non-controlling interest’s proportionate share of the identifiable net assets of N Ltd.

Thus, C Ltd. will recognize the business combination as follows:

*Note: Goodwill is calculated as 97.5 + 60 – 150 = 7.5 or 97.5 – (150 * 60%) = 7.5

![]()

Goodwill Or Bargain Purchase Gain (Including Step Acquisition) [Based On Para Nos. 32 To 36a + Para Nos. 41 And 42]

Question 19.

On 1st January, 2017, A Ltd. acquIres 80 per cent of the equity interests of B Ltd. in exchange for cash of INR 15 crores. The former owners of B

Ltd. were required to dispose of their Investments in B Ltd. by a specified date, and accordingly they did not have sufficient time to find potential buyers. A qualified valuation professional hired by the management of A Ltd. measures the Identifiable net assets acquired, In accordance with the requirements of md AS 103, at INR 20 crores and the fair value of the 20 per cent non-controlling interest in B Ltd. at INR 4.2 crores.

How should A Ltd. recognize the above bargain purchase?

Answer:

The answer is based on Paragraphs 34, 35, 36 and 36A of md AS 103.

In the instant case, the amount of B Ltd.’s identifiable net assets i.e., INR 20 crores exceeds the fair value of the consideration transferred plus the lair value of the non-controlling interest in B Ltd. i.e. INR 19.2 crores. Therefore, A Ltd. should review the procedures it used to identify and measure the net assets acquired and the fair value of non-controlling interest in B Ltd. and the consideration transferred. After the review, A Ltd. decides that the procedures and resulting measures were appropriate.

A Ltd. measures the gain on its purchase of the 80 per çent interest at INR 80 lakhs, as the difference between the amount of the identifiable net assets which is INR 20 crores and the sum of purchase consideration and fair value of non-controlling interest, which is INR 19.2 crores (cash consideration of INR 15 crores and fair value of non-controffing interest of INR 4.2 crores).

Assuming there exists clear evidence of the underlying reasons for classifying the business combination as a bargain purchase, the gain on bargain purchase of 80 per cent interest calculated at INR 80 Iakhs, which will be recognized in other comprehensive income on the acquisition date and accumulated the same in equity as capital reserve.

If the acquirer chose to measure the non-controlling interest in B Ltd. on the basis of its proportionate share of identifiable net assets of the acquiree, the recognized amount of the non-controlling interest would be INR 4 crores (INR 20 crores × 0.20). The gain on the bargain purchase then would be INR 1 crore [INR 20 crores – (INR 15 crores + INR 4 crores)].

![]()

Question 20.

M Ltd. acquires 75% of S Limited on 1st April, 2017 for consideration transferred ₹ 60 lakh M Limited intends to recognize the Non-Controlling Interest (NCI) at proportionate share of fair value of identifiable assets. With the assistance of a suitably qualified valuation professional, M Limited measures the identifiable net assets of S Limited at ₹ 90 lakh. M Limited performs a review and determines that the business combination did not include any transactions that should be accounted for separately from the business combination.

State whether the procedures followed by M Limited and the resulting measurements are appropriate or not. Also calculate the bargain purchase gain in the process.

Answer:

The amount of S Ltd.’s identifiable net assets exceeds the fair value of the consideration transferred plus the fair value of the NCI in S Ltd.’s, resulting in an initial indication of a gain on a bargain purchase. Accordingly, M Ltd. reviews the procedures it used to identify and measure the identifiable net assets acquired, to measure the fair value of both the NCI and the consideration transferred, and to identify transactions that were not part of the business combination.

Following that review, M Ltd. can conclude that the procedures followed and the resulting measurements were appropriate.

Measurement Period (Based On Para Nos. 45 To 50)

Question 21.

A Ltd. acquires X Ltd. in a business combination on 15 January, 20 17. Few days before the date of acquisition, one of X Ltd.’s customers had claimed that certain amounts were due by X Ltd. under penalty clauses for completion delays Included in the contract.

A Ltd. evaluates the dispute based on the information available at the date of acquisition and concludes that XYZ Ltd. was responsible for at least some of the delays in completing the contract. Based on the evaluation, A Ltd. recognizes ¡NR 1 crore towards this liability which 18 Its best estimate of the fair value of the liability to the customer based on the Information available at the date of acquisition. .

In October 2017 (within the measurement period), the customer presents additional information as per which A Ltd. concludes the fair value of liability on the date of acquisition to be INR 2 crores.

A Ltd. continues to receive and evaluate information related to the claim after October 2017. Its evaluation doesn’t change till February 2018 (i.e. after the measurement period), when it concludes that the fair value of the liability for the claim at the date of acquisition is INR 1.9 crores. A determines that the amount that would be recognized with respect to the claim under Ind AS 37, Provisions, Contingent Liabilities and Contingent Assets as at February 2018 is INR 2.2 crores.

How should the adjustment to the provisional amounts be made in the financial statements during and after the measurement period?

Answer:

The answer is based on Paragraphs 45 and 46 of Ind AS 103.

The consolidated financial statements of A Ltd. for the year ended 31 March, 2017 should include INR 1 crore towards the contingent liability in relation to the customer claim.

When the customer presents additional information in support of its claim, the incremental liability of INR 1 crore (INR 2,00,00,000 – INR 1,0, 00,000) will be adjusted as a part of acquisition accounting as it is within the measurement period. In its financial statements for the year ending on 31 March, 2018, A will disclose the amounts and explanations of the adjustments to the provisional values recognized during the current reporting period. Therefore, it will disclose that the comparative information for the year ending on 31 March, 2017 is adjusted retrospectively to increase the fair value of the item of liability at the acquisition date by INR 1 crore, resulting in a corresponding increase in goodwill.

The information resulting in the decrease in the estimated fair value of the liability for the claim in February 2018 was obtained after the measurement period. Accordingly, the decrease is not recognized as an adjustment to the acquisition accounting. If the amount determined in accordance with Ind AS 37 subsequently exceeds the previous estimate of the fair value of the liability, then ABC Ltd. recognizes an increase in the liability. As the change has occurred after the end of the measurement period, the increase in the liability amounting to INR 20 lakhs (INR 2.2 crores- INR 2 crores) is recognized in profit or loss.

![]()

Contingent Payments To Employee Shareholders (Based On Para Nos. B54 To B55 Of Appendix B)

Question 22.

A Ltd. acquires all of the outstanding shares of X Ltd. in a business combination. X Ltd. had three shareholders with equal share holdlngs, two of whom were also senior-level employees of X Ltd. and would continue as employee post acquisition of shares by A Lid.

- The employee shareholders each will receive INR 60,00,000 plus an additional payment of INR 1,50,00,000 to 2,00,00,000 based on a multiple of earnings over the next two years.

- The non-employee shareholders each receive INR 1,00,00,000.

The additional payment of each of these employee shareholders will be forfeited if they leave the employment of X Ltd. at any time during the two years following its acquisition by A Ltd. The salary received by them is considered reasonable remuneration for their services.

How much amount is attributable to post combination services?

Answer:

The answer is based on Paragraph B55(a) of Ind AS 103.

The additional consideration of INR 1,50,00,000 to INR 2,00,00,000 represents compensation for post-combination services, as the same represents that part of the payment which is forfeited if the former shareholder does not remain in the employment of X for two years following the acquisition -i.e., only INR 60,00,000 is attributed to consideration in exchange for the acquired business.

![]()

Share Based Payment Awards For Acquiree’s Employees (Based On Para Nos. B56 To B62b of Appendix B)

Question 23.

On 1st April, 2014, Company A Ltd. granted equity-settled share- based payment awards with a grant-date fair value of INR 1,00,000 to its employees which is subject to a three-year service condition.

Company X Ltd. acquires entire shares of A Ltd. on 1 April, 2016 and as part of the acquisition agreement, it is required to issue equity-settled replacement awards to A’s employees. At the date of acquisition, the market-based measure of the original awards is 1,80,000; the market-based measure of the replacement awards is 2,00,000. The replacement awards have a one-year vesting condition.

Determine the amount attributable to the pre-combination service and post-combination service in a situation where all employees are expected to meet the service condition?

Answer:

In its consolidated financial statements, X Ltd. will record the following entries.

Consideration payable : 1,20,000

To Employee Stock Option Plan Outstanding Account : 1,20,000

(To recognize replacement awards attributable to pre-combination service as part of consideration transferred)

Employee Remuneration Cost : 80,000

To Employee Stock Option Plan Outstanding Account : 80,000

(To recognize replacement awards attributable to post-combination service in accordance with md AS 102, Share-based Payment)

(80,000 × (1 year/I year))

Note 1:

Amount attributable to pre-combination service

1,80,0 × 67% (2 years/3 years) = 1,20,000

Note 2:

Amount attributable to post-combination service

2,0, 000 – 1,20,000 = 80,000

![]()

Comprehensive Questions On Ind As 103

Question 24.

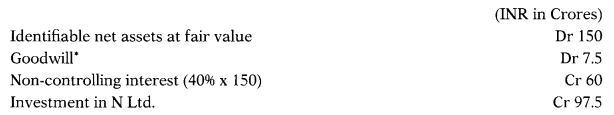

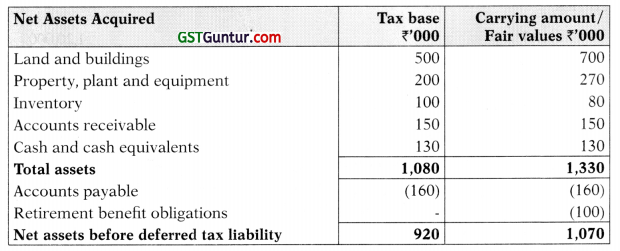

On 1 January 2020, entity H acquired 100% share capital of entity S for ₹ 1 5,00,000. The book values and the fair values of the identifiable assets and liabilities of entity S at the date of acquisition are set out below, together with their tax bases in entity S’s tax jurisdictions. Any goodwill arising on the acquisition is not deductible for tax purposes. The tax rates in entity H’s and entity S’s jurisdictions are 30% and 40% respectively.

You are required to calculate the deferred tax arising on acquisition of Entity S.

Also calculate the Goodwill arising on acquisition. [RTP-November2020]

Answer:

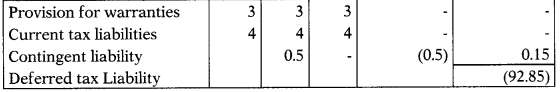

Computation of Net Assets Acquired:

[excluding the effect of DTL]

Computation of Deferred tax:

[arising on acquisition of Entity S and Goodwill]

Note:

- The tax base of Goodwill is nil, which gives rise to taxable temporary difference of ₹ 4,90,000. However, no deferred tax is recognized on the goodwill as Ind AS 12 prohibits the same.

- The deferred tax on other temporary differences arising on acquisition is provided at 40% and not 30%, because taxes will be payable or recoverable in entity S’s tax jurisdictions when the temporary differences will be reversed.

![]()

Question 25.

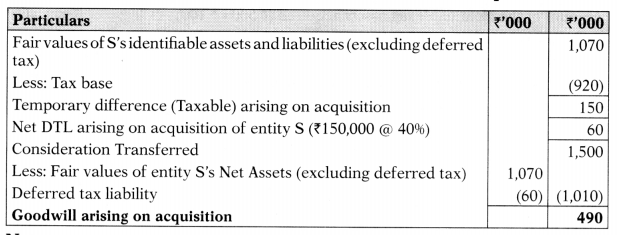

On 1 April, 20X1, A Ltd. acquires 80 per cent of the equity interest of B Ltd. in exchange for cash of ₹ 300. Due to legal compulsion, B Ltd. had to dispose of their investments by a specified date. Therefore, they did not have sufficient time to market B Ltd. to multiple potential buyers. The management of A Ltd. initially measures the separately recognizable identifiable assets acquired and the liabilities assumed as of the acquisition date in accordance with the requirement of Ind AS 103. The identifiable assets are measured at ₹ 500 and the liabilities assumed are measured at ₹ 100.A Ltd. engages on independent consultant, who determined that the fair value of 20 per cent non-controlling interest in B Ltd. is ₹ 84.

A Ltd. reviewed the procedures it used to identify and measure the assets acquired and liabilities assumed and to measure the fair value of both the non-controlling interest in B Ltd. and the consideration transferred. After the review, it decided that the procedures and resulting measures were appropriate.

Calculate the gain or loss on acquisition of B Ltd. and also show the journal entries for accounting of its acquisition. Also calculate the value of the non-controlling interest in B Ltd. on the basis of proportionate interest method, if alternatively applied?

Answer:

The amount of B Ltd. identifiable net assets (₹ 400, calculated as ₹ 500 – ₹ 100) exceeds the fair value of the consideration transferred plus the fair value of the non-controlling interest in B Ltd. [₹ 384 calculated as 300 + 84]. Alpha Ltd. measures the gain on its purchase of the 80 per cent interest as follows:

If the acquirer chose to measure the non-controlling interest in B Ltd. on the basis of its proportionate interest in the identifiable net assets of the acquire, the recognized amount of the non-controlling interest would be ₹ 80 (₹ 400 × 0.20). The gain on the bargain purchase then would be ₹ 20 [₹ 400 – (₹ 300 + ₹ 80)]

![]()

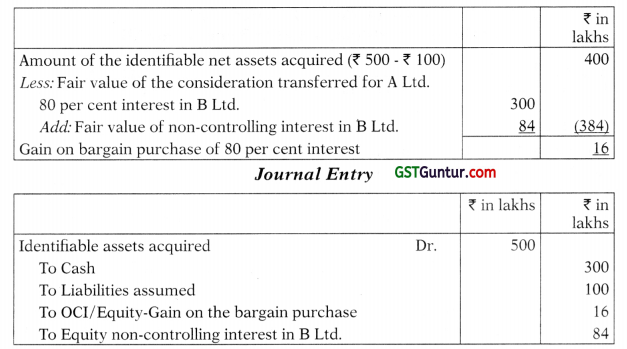

Question 26.

In March 2018, P Ltd. acquires D Ltd. in a business combination for a total cost of ₹ 12,000 lakhs. At that time D Ltd.’s assets and liabilities are as follows:

| Item | ₹ in lakhs |

| Assets | |

| Cash | 780 |

| Receivables (net) | 5,200 |

| Plant and equipment | 7,000 |

| Deferred tax asset | 360 |

| Liabilities | |

| Payables | 1,050 |

| Borrowings | 4,900 |

| Employee entitlement liabilities | 900 |

| Deferred tax liability | 300 |

The plant and equipment has a fair value of ₹ 8,000 lakhs and a tax written down value of ₹ 6,000 lakhs. The receivables are short-term trade receivables net of a doubtful debts allowance of ₹ 300 lakhs.

Bad debts are deductible for tax purposes when written off against the allowance account by D Ltd. Employee benefit liabilities are deductible for tax when paid.

D Ltd. owns a popular brand name that meets the recognition criteria for intangible assets under Ind AS 103 ‘Business Combinations’. Independent valuers have attributed a fair value of ₹ 4,300 lakhs for the brand. However, the brand does not have any cost for tax purposes and no tax deductions are available for the same.

The tax rate of 30% can be considered for all items. Assume that unless otherwise stated, all items have a fair value and tax base equal to their carrying amounts at the acquisition date.

You are required to:

(i) Calculate deferred tax assets and liabilities arising from the business combination (do not offset deferred tax assets and liabilities)

(ii) Calculate the goodwill that should be accounted on consolidation.

Answer:

Breakdown of assets and liabilities acquired as part of the business combination, including deferred taxes and goodwill.

Working Notes:

- This amount has been derived from D Ltd.’s Balance Sheet as it is stated that ‘unless otherwise stated, all items have a fair value and tax base equal to their carrying amounts in D Ltd.’s Balance Sheet at the acquisition date’.

- Stated fair value in the fact pattern (different to the carrying amount in D Ltd.’s Balance Sheet at the acquisition date).

- Because bad debts are only deductible when written off against the allowance account by D Ltd. the tax base of the receivables is their gross value, ie., (₹ 5,200 + ₹ 300) lakhs allowance account.

- Tax written down value of the plant and equipment as stated in the fact pattern.

- As the brand name does not have a cost for tax purposes and no tax deduction is available in relation to it, its tax base is nil.

- As the employee entitlement liabilities are only deductible for tax purposes when paid, their tax base is nil.

- The aggregate deferred tax asset is ₹ 360 lakhs, comprised of ₹ 90 lakhs in relation to the receivables and ₹ 270 lakhs in relation to the employee entitlement liabilities.

- The aggregate deferred tax liability is ₹ 1,890 lakhs calculated as follows:

| ₹ In lakhs | DTL amount in Dorman Ltd’s Balance Sheet | Deferred tax impact of fair value adjustments | Total DTL in Pharma Ltd’s consolidated financial statements |

| Plant and equipment | 300 ([7,000 – 6,000] × 30%) | 300(1,000 × 30%) | 600 |

| Brand names | 0 | 1,290 (4,300 × 30%) | 1,290 |

| TOTAL | 300 | 1,590 | 1,890 |

9. Goodwill is effectively the ‘balancing item’ in the equation, applying the requirements of Ind AS 103, para 32. The consideration transferred is ₹ 12,000 lakhs and the net of the acquisition date amounts of the identifiable assets acquired and the liabilities assumed measured in accordance with Ind AS 103, including the deferred tax assets and liabilities arising, is ₹ 9,900 lakhs.

![]()

Question 27.

H Ltd. acquired equity shares of S Ltd., a listed company, in two tranches as mentioned in the below table:

| Date | Equity stake purchased | Remarks |

| 1st November, 2016 | 15% | The shares were purchased based on the quoted price on the stock exchange on the relevant dates. |

| 1st January, 2017 | 45% |

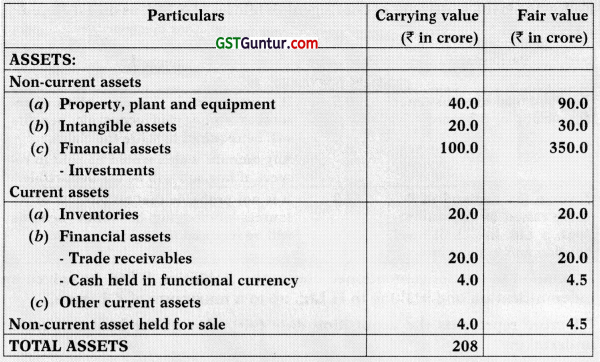

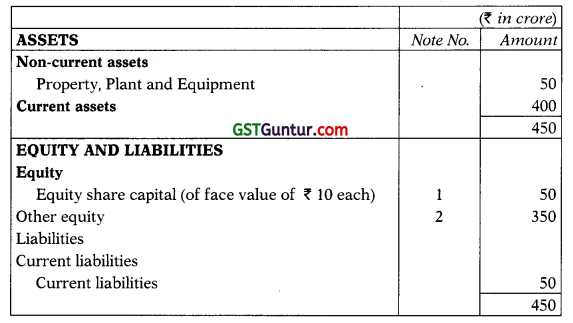

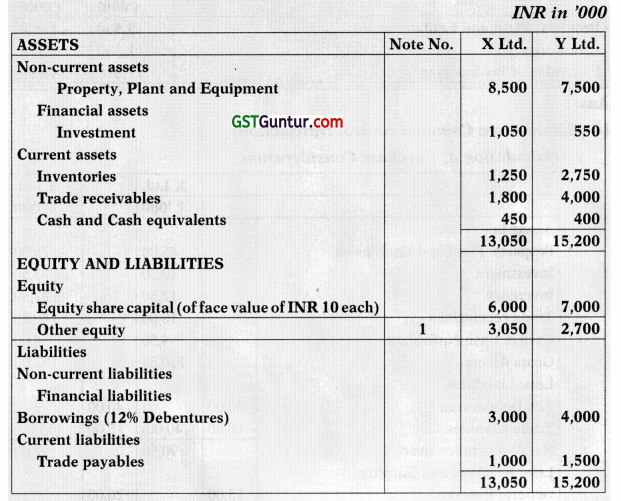

Both the abovementioned companies have INR as their functional currency. Consequently, H Ltd. acquired control over S Ltd. on 1st January, 2017. Following is the Balance Sheet of S Ltd. as on that date:

Other information:

Property, plant and equipment in the above Balance Sheet include leasehold motor vehicles having carrying value of ₹ 1 crore and fair value of ₹ 1.2 crore. The date of inception of the lease was 1st April, 2010. On the inception of the lease, S Ltd. had correctly classified the lease as a finance lease. However, if facts and circumstances as on 1st April, 2017 are considered, the lease would be classified as an operating lease.

Following is the statement of contingent liabilities of S Ltd. as on 1st January, 2017:

| Particulars | Fair value (₹ in crore) | Remarks |

| Law suit filed by a customer for a claim of ₹ 2 crore | 0.5 | It is not probable that an outflow of resources embodying economic benefits will be required to settle the claim.

Any amount which would be paid in respect of lawsuit will be tax deductible. |

| Income tax demand of ₹ 7 crore raised by tax authorities; S Ltd. has challenged the demand in the court. | 2.0 | It is not probable that an outflow of resources embodying economic benefits will be required to settle the claim. |

In relation to the abovementioned contingent liabilities, S Ltd. has given an indemnification undertaking to H Ltd. up to a maximum of ₹ 1 crore.

₹ 1 crore represents the acquisition date fair value of the indemnification undertaking.

Any amount which would be received in respect of the above undertaking shall not be taxable.

The tax bases of the assets and liabilities of S Ltd. is equal to their respective carrying values being recognised in its Balance Sheet.

Carrying value of non-current asset held for sale of ₹ 4 crore represents its fair value less cost to sell in accordance with the relevant Ind AS.

In consideration of the additional stake purchased by H Ltd. on 1st January, 2017, it has issued to the selling shareholders of S Ltd. 1 equity share of H Ltd. for every 2 shares held in S Ltd. Fair value of equity shares of H Ltd. as on 1st January, 2017 is ₹ 10,000 per share.

On 1st January, 2017, H Ltd. has paid ₹ 50 crore in cash to the selling share-holders of S Ltd. Additionally, on 31 st March, 2019, H Ltd. will pay ₹ 30 crore to the selling shareholders of S Ltd. if return on equity of S Ltd. for the year ended 31st March, 2019 is more than 25% per annum. H Ltd. has estimated the fair value of this obligation as on 1st January, 2017 and 31st March, 2017 as ₹ 22 crore and ₹ 23 crore respectively. The change in fair value of the obligation is attributable to the change in facts and circumstances after the acquisition date.

Quoted price of equity shares of S Ltd. as on various dates is as follows:

As on November, 2016 : ₹ 350 per share

As on 1st January, 2017 : ₹ 395 per share

As on 31st March, 2017 : ₹ 420 per share

On 31st May, 2017, H Ltd. learned that certain customer relationships existing as on 1st January, 2017, which met the recognition criteria of an intangible asset as on that date, were not considered during the accounting of business combination for the year ended 31st March, 2017. The fair value of such customer relationships as on 1st January, 2017 was ₹ 3.5 crore (assume that there are no temporary differences associated with customer relations; consequently, there is no impact of income taxes on customer relations).

On 31st May, 2017 itself, H Ltd. further learned that due to additional customer relationships being developed during the period 1st January, 2017 to 31st March, 2017, the fair value of such customer relationships has increased to ₹ 4 crore as on 31st March, 2017.

On 31st December, 2017, H Ltd. has established that it has obtained all the information necessary for the accounting of the business combination and that more information is not obtainable.

H Ltd. and S Ltd. are not related parties and follow Ind AS for financial reporting. Income tax rate applicable is 30%.

You are required to provide your detailed responses to the following, along with reasoning and computation notes:

(a) What should be the goodwill or bargain purchase gain to be recognised by H Ltd. in its financial statements for the year ended 31st March, 2017. For this purpose, measure non-controlling interest using proportionate share of the fair value of the identifiable net assets of S Ltd.

(b) Will the amount of non-controlling interest, goodwill, or bargain purchase gain so recognised in (a) above change subsequent to 31st March, 2017? If yes, provide relevant journal entries.

(c) What should be the accounting treatment of the contingent consideration as on 31st March, 2017? [RTP – Nov. 19]

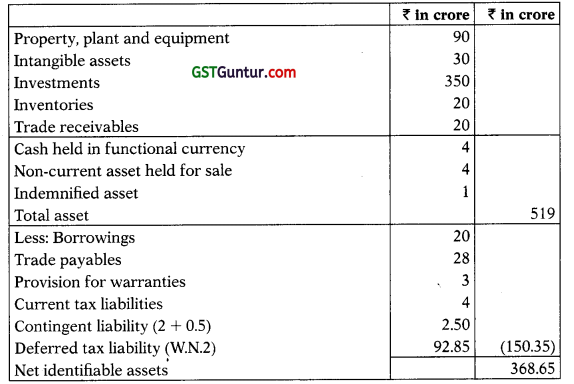

Answer:

(i) As an only exception to the principle of classification or designation of assets as they exist at the acquisition date is that for lease contract and insurance contracts classification which will be based on the basis of the conditions existing at inception and not on acquisition date. Therefore, H Ltd. would be required to retain the original lease classification of the lease arrangements and thereby recognise the lease arrangements as finance lease.

![]()

(ii) The requirements in Ind AS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’, do not apply in determining which contingent liabilities to recognise as of the acquisition date as per Ind AS 103 ‘Business Combination’. Instead, the acquirer shall recognise as of the acquisition date a contingent liability assumed in a business combination if it is a present obligation that arises from past events and its fair value can be measured reliably. Therefore, contrary to Ind AS 37, the acquirer recognises a contingent liability assumed in a business combination at the acquisition date even if it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation. Hence H Ltd. will recognize contingent liability of ₹ 2.5 cr.

Since S Ltd. has indemnified for ? 1 cr., H Ltd. shall recognise an indemnification asset at the same time for ₹ 1 cr.

As per the information given in the question, this indemnified asset is not taxable. Hence, its tax base will be equal to its carrying amount. No deferred tax will arise on it.

(iii) As per Ind AS 103, non-current assets held for sale should be measured at fair value less cost to sell in accordance with Ind AS 105 ‘Non-current Assets Held for Sale and Discontinued Operations’. Therefore, its carrying value as per balance sheet has been considered in the calculation of net assets.

(iv) Any equity interest in S Ltd. held by H Ltd. immediately before obtaining control over S Ltd. is adjusted to acquisition date fair value. Any resulting gain or loss is recognised in the profit or loss of H Ltd.

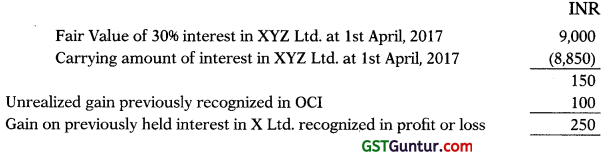

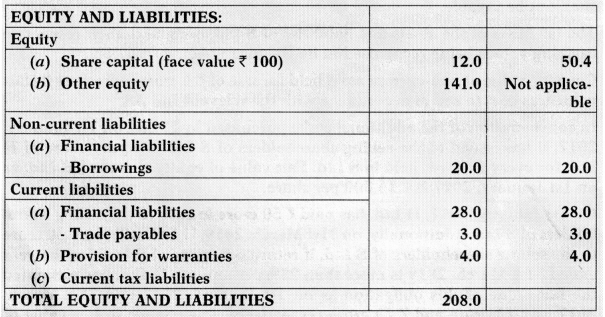

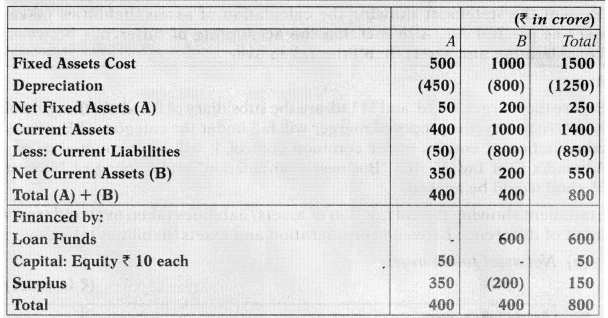

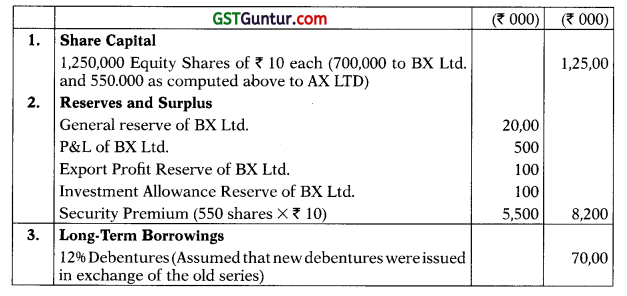

Calculation of purchase consideration as per Ind AS 103

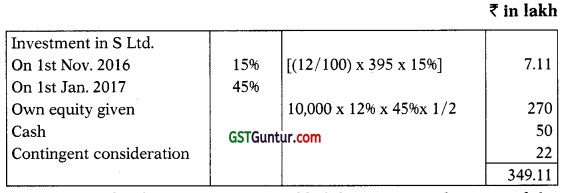

(v) Calculation of defer tax on assets and liabilities acquired as part of the business combination, including current tax and goodwill.

(vi) Calculation of identifiable net assets acquired

(a) Calculation of NCI by proportionate share of net assets

Net identifiable assets of S Ltd. on 1.1.2017 (Refer W.N.3) = 372.85 crore

NCI on 1.1.2017 = 368.65 crore × 40% = 147.46 crore

Calculation of Goodwill as per Ind AS 103

Goodwill on 1.1.2017 ‘ = Purchase consideration + NCI – Net assets

= 349.11 + 147.46 -368.65

= 127.92 crore

![]()

(b) On 31st December, 2017, H Ltd. has established that it has obtained all the information necessary for the accounting of the business combination and the more information is not obtainable. Therefore, the measurement period for acquisition of S Ltd. ends on 31st December, 2017.

On 31st May, 2017 (i.e. within the measurement period), H Ltd. learned that certain customer relationships existing as on 1st January, 2017 which met the recognition criteria of an intangible asset as on that date were not considered during the accounting of business combination for the year ended 31 st March, 2017. Therefore, H Ltd. shall account for the acquisition date fair value of customer relations existing on 1 st January, 2017 as an identifiable intangible asset. The corresponding adjustment shall be made in the amount of goodwill.

Accordingly, the amount of goodwill will be changed due to identification of new asset from retrospective date for changes in fair value of assets and liabilities earlier recognised on provisional amount (subject to meeting the condition above for measurement period). NCI changes would impact the consolidated retained earnings (parent’s share). Also NCI will be increased or decreased based on the profit during the post-acquisition period.

Journal entry

Customer relationship : Dr. : 3.5 crore

To NCI : 1.4 crore

To Goodwill : 2.1 crore

However, the increase in the value of customer relations after the acquisition date shall not be accounted by H Ltd., as the customer relations developed after 1st January, 2017 represents internally generated intangible assets which are not eligible for recognition on the balance sheet.

(c) Since the contingent considerations payable by H Ltd. is not classified as equity and is within the scope of Ind AS 109 ‘Financial Instruments’, the changes in the fair value shall be recognised in profit or loss. Change in Fair value of contingent consideration (23-22) ₹ 1 crore will be recognized in the Statement of Profit and Loss.

![]()

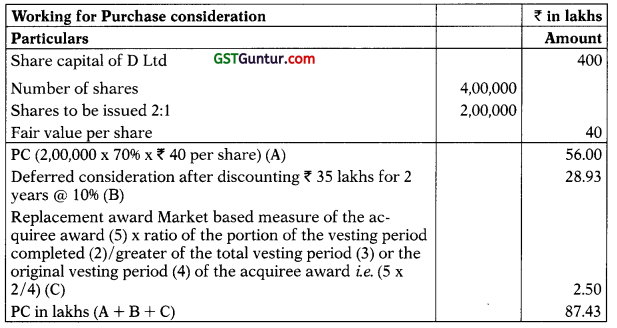

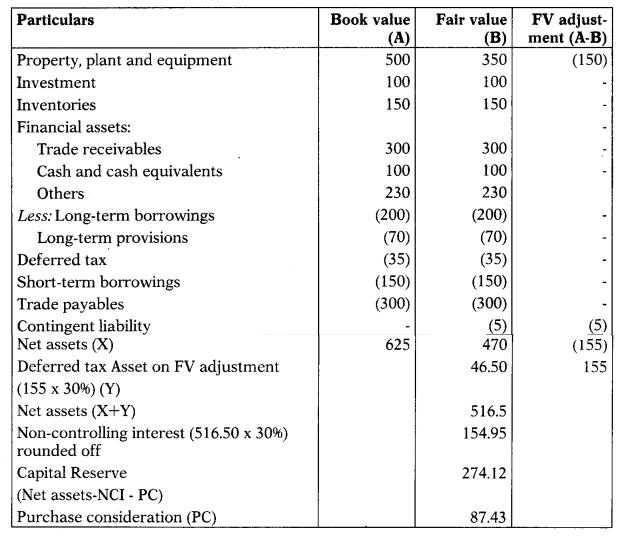

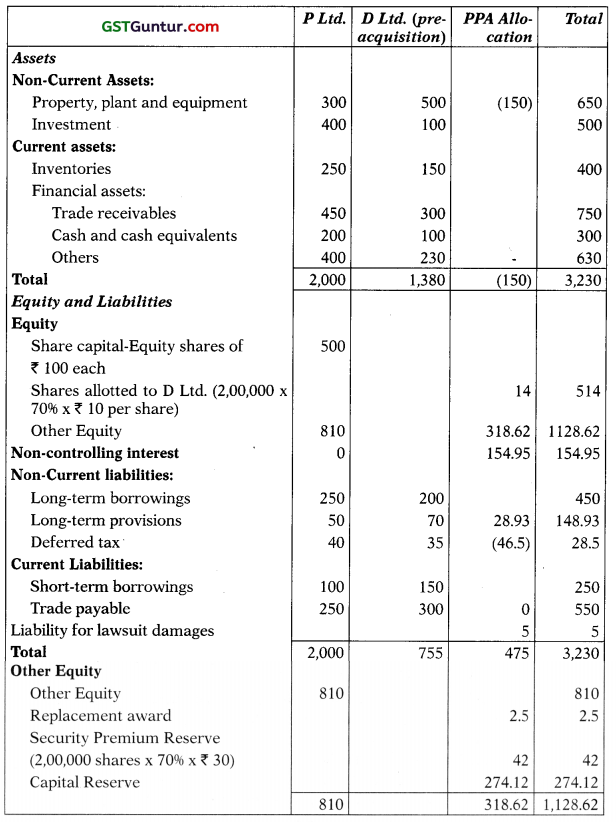

Question 28.

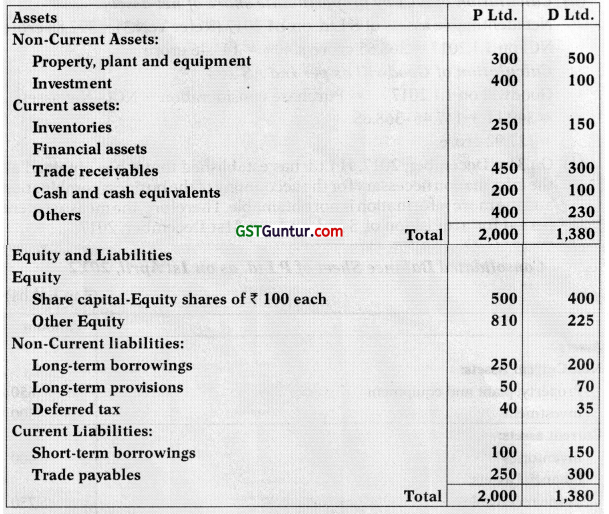

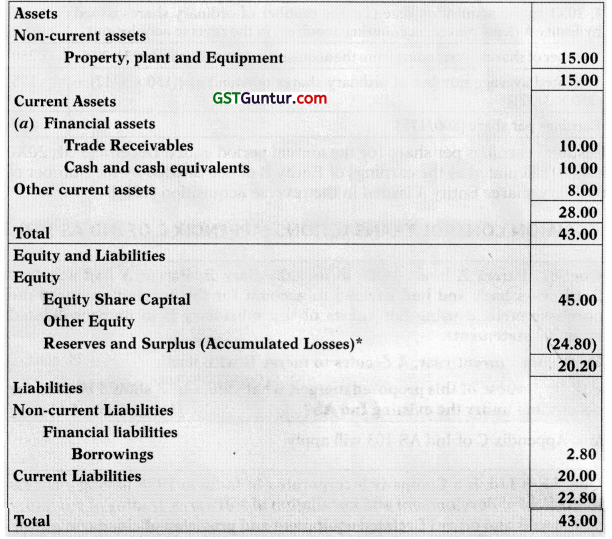

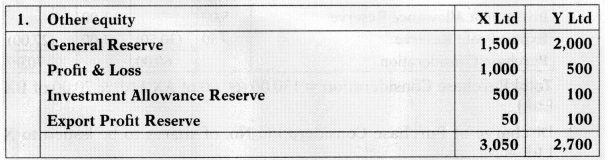

The balance sheet of P Ltd. and D Ltd. as of 31st March, 20X2 is given below:

Other information

(a) P Ltd. acquired 70% shares of D Ltd. on 1st April, 20X2 by issuing its own shares in the ratio of 1 share of P Ltd. for every 2 shares of D Ltd. The fair value of the shares of P Ltd. was ₹ 40 per share.

(b) The fair value exercise resulted in the following: (all nos. in Lakh)

(c) Fair value of PPE on 1st April, 20X2 was ₹ 350 lakhs.

(d) P Ltd. also agreed to pay an additional payment as consideration that is higher of 35 lakh and 25% of any excess profits in the first year, after acquisition, over its profits in the preceding 12 months made by D Ltd. This additional amount will be due after 2 years. D Ltd. has earned ₹ 10 lakh profit in the preceding year and expects to earn another ₹ 20 Lakh.

(e) In addition to above, P Ltd. also had agreed to pay one of the founder shareholder a payment of ₹ 20 lakh provided he stays with the Company for two year after the acquisition.

(f) D Ltd. had certain equity settled share based payment award (original award) which got replaced by the new awards issued by P Ltd. As per the original term the vesting period was 4 years and as of the acquisition date the employees of D Ltd. have already served 2 years of service. As per the replaced awards the vesting period has been reduced to one year (one year from the acquisition date). The fair value of the award on the acquisition date was as follows:

- Original award – ₹ 5 lakh

- Replacement award – ₹ 8 lakh.

(g) D Ltd. had a lawsuit pending with a customer who had made a claim of ₹ 50 lakhs. Management reliably estimated the fair value of the liability to be ₹ 5 lakh.

(h) The applicable tax rate for both entities is 30%.

You are required to prepare opening consolidated balance sheet of P Ltd. as on 1st April, 20X2. Assume 10% discount rate.

Answer:

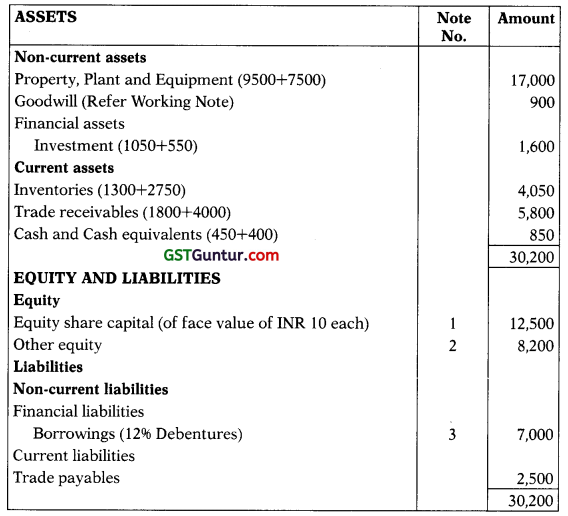

Consolidated Balance Sheet of P Ltd. as on 1st April, 20X2

Notes:

(a) Fair value adjustment- As per Ind AS 103, the acquirer is required to record the assets and liabilities at their respective fair value. Accordingly, the PPE will be recorded at ₹ 350 lakhs.

![]()

(b) The value of replacement award is allocated between consideration transferred and post combination expense. The portion attributable to purchase consideration is determined based on the fair value of the replacement award for the service rendered till the date of the acquisition. Accordingly, 2.5 (5 × 2/4) is considered as a part of purchase consideration and is credited to P Ltd. equity as this will be settled in its own equity. The balance of 2.5 will be recorded as employee expense in the books of D Ltd. over the remaining life, which is 1 year in this scenario.

(c) There is a difference between contingent consideration and deferred consideration. In the given case 35 is the minimum payment to be paid after 2 years and accordingly will be considered as deferred consideration. The other element is if company meet certain target then they will get 25% of that or 35 whichever is higher. In the given case since the minimum what is expected to be paid the fair value of the contingent consideration has been considered as zero. The impact – of time value on deferred consideration has been given @ 10%.

(d) The additional consideration of ₹ 20 lakhs to be paid to the founder shareholder is contingent to him/her continuing in employment and hence this will be considered as employee compensation and will be recorded as post combination expenses in the income statement of D Ltd.

Purchase price allocation workings

![]()

Consolidation workings

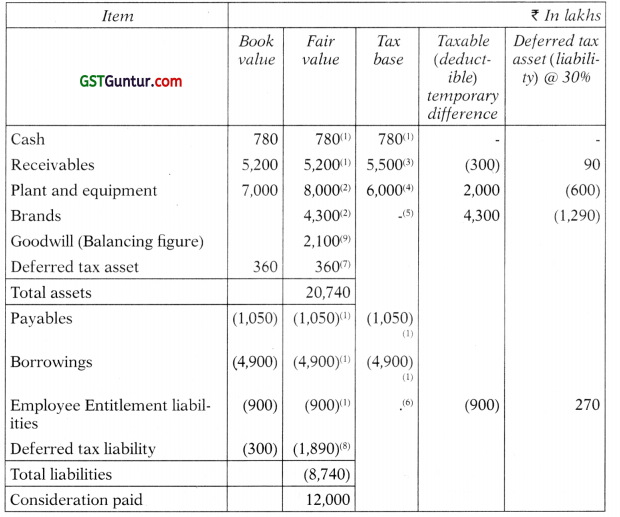

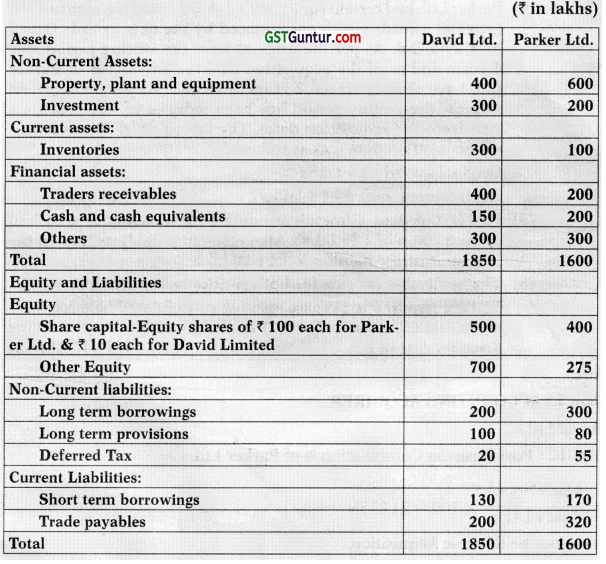

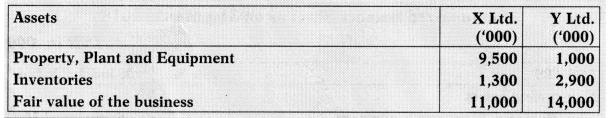

Question 29.

The Balance Sheet of David Ltd. and Parker Ltd. as on 31st March, 2019 is given below:

Other information:

(i) David Ltd. acquired 70% shares of Parker Ltd. on 1st April, 2019 by issuing its own shares in the ratio of 1 share of David Ltd. for every 2 shares of Parker Ltd. The fair value of the shares of David Ltd. was ₹ 50 per share.

(ii) The fair value exercise resulted in the following:

(1) Fair value of property, plant and equipment (PPE) on 1st April, 2019 was ₹ 450 lakhs.

(2) David Ltd. agreed to pay an additional payment as consideration that is higher of t 30 lakh and 25% of any excess profits in the first year after acquisition, over its profits in the preceding 12 months made by Parker Ltd. This additional amount will be due after 3 years. Parker Ltd. has earned ₹ 20 lakh profit in the preceding year and expects to earn another ₹ 10 Lakh.

(3) In addition to above, David Ltd. also has agreed to pay one of the founder shareholder-Director a payment of ₹ 25 lakhs provided he stays with the Company for two years after the acquisition.

(4) Parker Ltd. had certain equity settled share-based payment award (original award) which got replaced by the new awards issued by David Ltd. As per the original term the vesting period was 4 years and as of the acquisition date the employees of Parker Ltd. have already served 2 years of service. As per the replaced awards, the vesting period has been reduced to one year (one year from the acquisition date). The fair value of the award on the acquisition date was as follows:

Original award – ₹ 6 lakhs

Replacement award – ₹ 9 lakhs

(5) Parker Ltd. had a lawsuit pending with a customer who had made a claim of ₹ 35 lakhs. Management reliably estimated the fair value of the liability to be ₹ 10 lakhs.

(6) The applicable tax rate for both entities is 40%.

You are required to prepare opening consolidated balance sheet of David Ltd. as on 1st April, 2019 along with workings. Assume discount rate of 8%. [Nov. 2019 – 16 Marks]

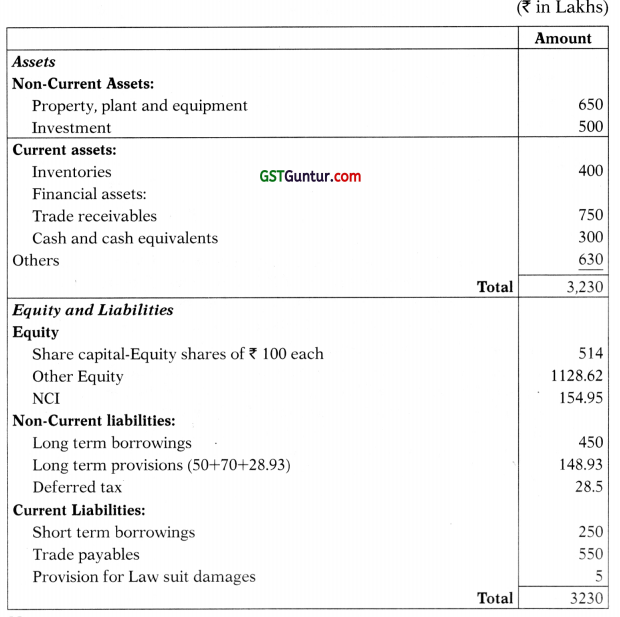

Answer:

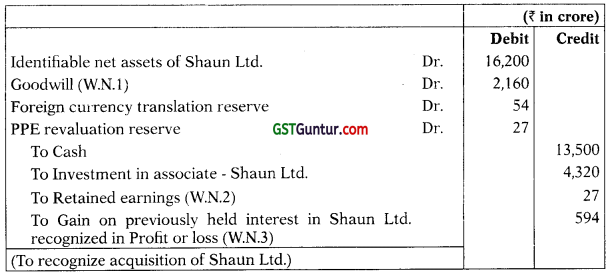

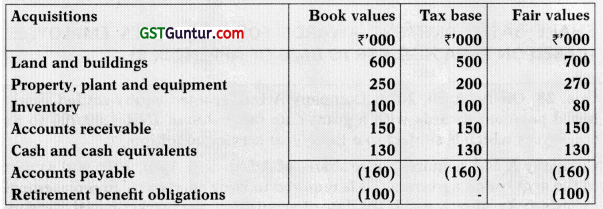

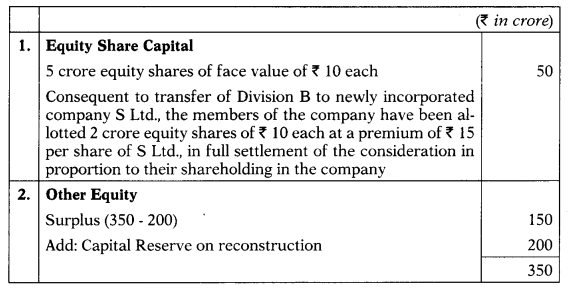

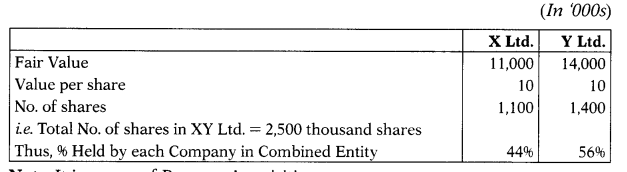

Step 1 : ACCOUNTING ACQUIRER

David Ltd.

LOGIC : Post Business Combination % of Parker Ltd.:

= \(\frac{4 \mathrm{lac} \times 70 \% \times \frac{1}{2}}{5 \mathrm{lac}+1.4 \mathrm{lac}}\) × 100 = 21.875%

It cannot be Reverse Acquisition

Step 2 : Date of Acquisition

1/4/2019

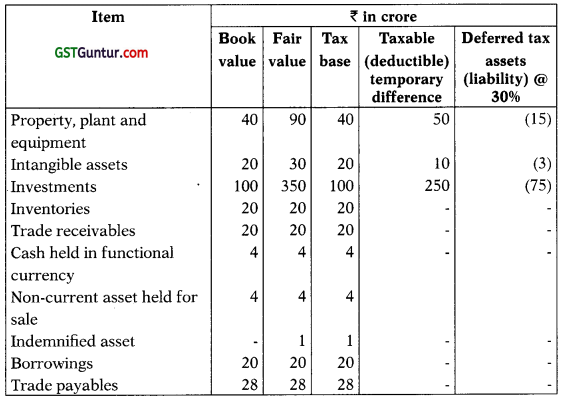

Step 3 : Ind AS-12 + STATEMENT of Net Assets at FV.

Ind AS-12 :

| Particulars | G4 | TB | Taxable Deductible TD | DTL/DTA |

| PPE | 600 | 450 | 150 Taxable | 60 DTL |

| Contingent Liability | NIL | 10 | 10 Taxable | 4 DTL |

| DTL | 64 |

![]()

| NET ASSETS | FV |

| PPE | 450 |

| Investment | 200 |

| Inventory | 100 |

| Trd. Receivables | 200 |

| C& CE | 200 |

| Others | 300 |

| (-) Contingent | |

| Liability | 10 |

| LTB | 300 |

| LTP | 80 |

| DTL(55 + 64) | 119 |

| STB | 170 |

| Trade Payables | 320 |

| 451 |

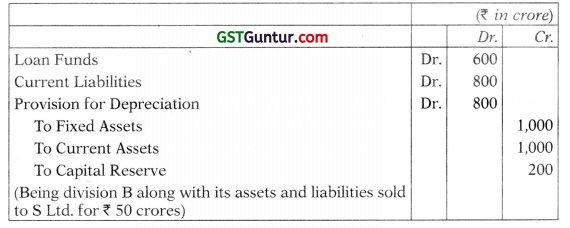

Step 4 : Consideration Transferred

| Equity shares | Lacs |

| (4 lac × 70%) × \(\frac{1}{2}\) × 50 | 70 |

| Deferred consideration | 27.78 |

| [30 lac × \(\frac{1}{0.8}\)] | |

| Contingent Consideration | FV Not given |

| Payment to Employee shareholder | Nil |

| Share Based Payment | 3 |

| [6 lac × \(\frac{2}{4}\)] | |

| 100.78 |

Step 5 : Non-Controlling Interest (NCI) (at P.S. N.A.)

= 451 × 30 %= 135.3

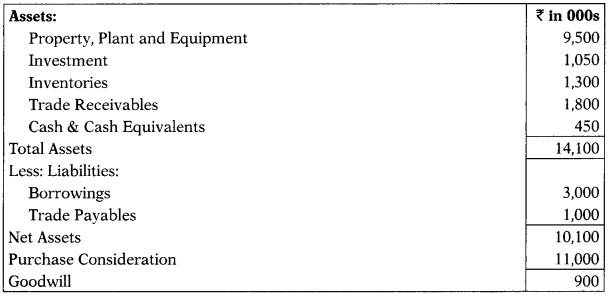

![]()

Step 6 : Goodwill or Bargain Purchase Gain

| Consideration Transferred | 100.78 |

| Add : NCI | 135.3 |

| 236.08 | |

| V/s Net Assets (Step 3) | 451 |

| Capital Reserve | 214.92 |

Step 7 : Journal Entry :

| Net Asset | Dr. | 451 |

| To Consideration Transferred | 100.78 | |

| To NCI | 135.3 | |

| To C/Reserve. | 214.92 |

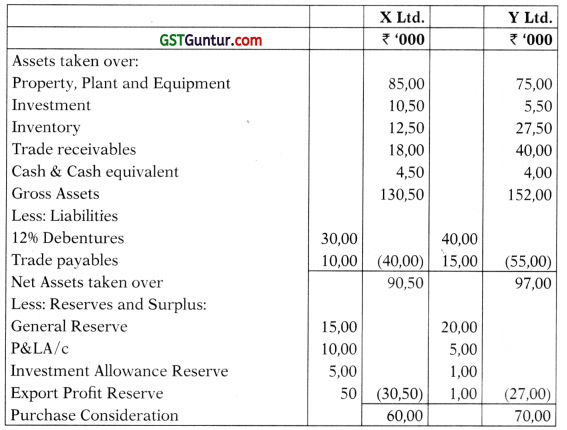

Consideration

| Transferred | Dr. | 100.78 |

| To ESC | 14 | |

| To Security premium | 56 | |

| To Deferred Consideration | 27.78 | |

| To Share Based Payment Reserve | 3 |

= \(\frac{\text { CBS of David Ltd. }}{\text { B } / \text { S of David Ltd }+ \text { Journal Entries of Step } 7}\)

![]()

Reverse Acquisition (Based On Para Nos. B19 To B27 of Appendix B)

Question 30.

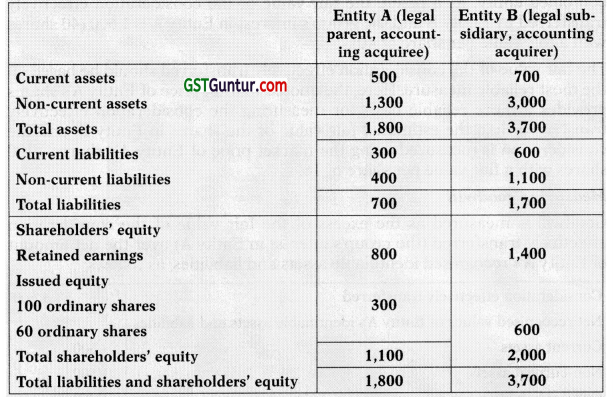

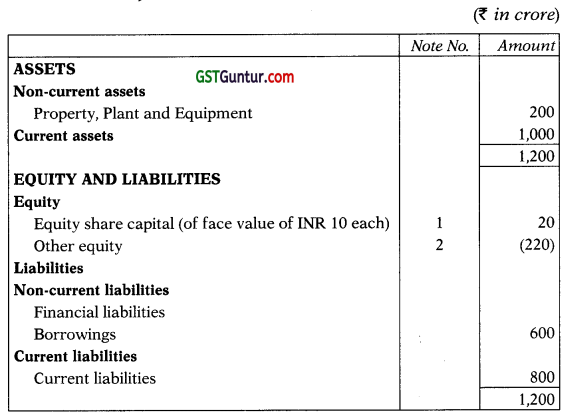

The Balance sheet of Entity A and Entity B immediately before the business combination on 30 September, 2017 are as below:

| Entity A (Legal acquirer/Accounting acquiree) (in crores) | Entity B (Legal acquiree/Accounting acquire) (in crores) | |

| Current assets | 500 | 700 |

| Non-current assets | 1,300 | 3.000 |

| Total assets | 1,800 | 3,700 |

| Current liabilities | 300 | 600 |

| Non-current liabilities | 400 | 1,100 |

| Total liabilities | 700 | 1,700 |

| Shareholders’ equity | ||

| Retained earnings | 800 | 1,400 |

| Issued equity | ||

| 100 ordinary shares | 300 | |

| 60 ordinary shares | 60 | |

| Total shareholders’ equity | 1,100 | 2,000 |

| Total liabilities and shareholders’ equity | 1,800 | 3,700 |

On 30th September, 2017, A Ltd. Issues 2.5 ordinary shares for each ordinary share of Entity B. All shareholders of Entity B exchange their shares in Entity B. Therefore, Entity A issues 150 ordinary shares in exchange for all 60 ordinary shares of Entity B.

The fair value of each ordinary share of Entity B at 30 September, 2017 is INR 40. The quoted market price of ordinary shares of Entity A at that date is INR 16.

The fair values of the identifiable assets and liabilities of Entity A at 30 September 2017 are the same as their carrying amounts, except that the fair value of its non-current assets at 30 September, 2017 is INR 1,500 crores.

How should the above acquisition be accounted?

Answer:

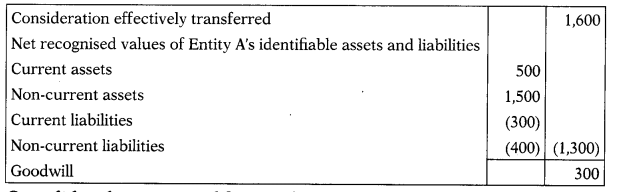

As a result of Entity, A (legal acquirer, accounting acquiree) issuing 150 ordinary shares, Entity B’s shareholders own 60 per cent of the issued shares of the combined entity (ie. 150 of 250 issued shares). The remaining 40 per cent are owned by the shareholders of Entity A. If the business combination had taken the form of Entity B issuing additional ordinary shares to Entity A’s shareholders in exchange for their ordinary shares in Entity A, Entity B would have had to issue 40 shares for the ratio of ownership interest in the combined entity to be the same. Entity B’s shareholders would then own 60 of the 100 issued shares of Entity B—60 per cent of the combined entity. As a result, the fair value of the consideration effectively transferred by Entity B and the group’s interest in Entity A is INR 1,600 crores (40 shares with a fair value per share of INR 40).

The fair value of the consideration effectively transferred should be based on the most reliable measure. In this example, the quoted price of Entity A’s shares in the principal (or most advantageous) market for the shares provides a more reliable basis for measuring the consideration effectively transferred than the fair value of the shares in Entity B, and the consideration is measured using the market price of Entity A’s shares, ie., 100 shares with a fair value per share of INR 16.

The goodwill is measured as the excess of the fair value of the consideration effectively transferred (the group’s interest in A Ltd.) over the net amount of A Ltd.’s recognized identifiable assets and liabilities.

In the instant case, the fair value of the consideration effectively transferred is INR 1,600 crores and the net recognized values of Entity A’s identifiable assets and liabilities are as below:

| Current assets | 500 |

| Non-current assets | 1,500 |

| Current Liabilities | (300) |

| Non-current liabilities | (400) |

| Total | 1,300 |

![]()

Therefore, the goodwill shall be measured at INR 300 crores (1,600 – 1300).

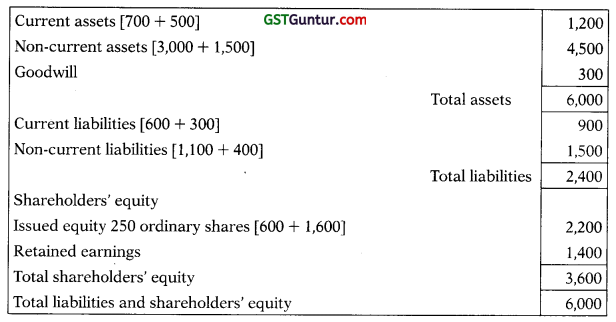

Based on paragraph B21-B22 of Ind AS 103, the consolidated balance sheet immediately after the business combination will be as below:

| Particulars | INR in crores |

| Current assets (INR 700+ INR 500) | 1,200 |

| Non-current assets (INR 3,000+ INR 1,500) | 4,500 |

| Goodwill | 300 |

| Total assets | 6,000 |

| Current liabilities (INR 600+INR 300) | 900 |

| Non-current liabilities (INR 1,100+INR 400) | 1,500 |

| Total liabilities | 2,400 |

| Shareholders’ equity | |

| Retained earnings | 1,400 |

| Issued equity | |

| 250 ordinary shares (INR 600+INR 1,600) | 2,200 |

| Total shareholders’ equity | 3,600 |

| Total liabilities and shareholders’ equity | 6,000 |

The amount recognized as issued equity interests in the consolidated financial statements (INR 2,200 crores) is determined by adding the issued equity of the legal acquiree immediately before the business combination (INR 600 crores) and the fair value of the consideration effectively transferred (INR 1,600 crore).

However, the equity structure appearing in the consolidated financial statements (i.e. the number and type of equity interests issued) must reflect the equity structure of the legal acquirer, including the equity interests issued by the legal acquirer to effect the combination.

![]()

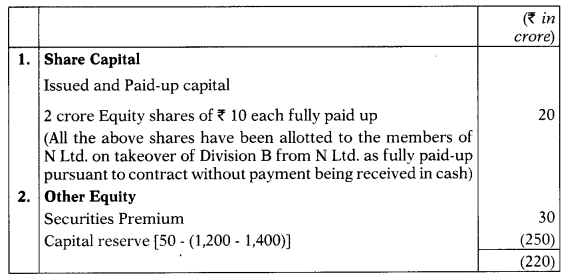

Question 31.

On September 30, 20X1, Entity A issues 2.5 shares in exchange for each ordinary share of Entity B. All of Entity B’s shareholders exchange their shares in Entity B. Therefore, Entity A issues 150 ordinary shares in exchange for all 60 ordinary shares of Entity B.

The fair value of each ordinary share of Entity B at September 30, 20X1 is ? 40. The quoted market price of Entity A’s ordinary shares at that date is ₹ 16.

The fair values of Entity A’s identifiable assets and liabilities at September 30, 20X1 are the same as their carrying amounts, except that the fair value of Entity A’s non-current assets at September 30, 20X1 is 1,500.

The draft statements of financial position of Entity A and Entity B immediately before the business combination are:

Entity B’s earnings for the annual period ended December 31,20X0 were 600 and that the consolidated earnings for the annual period ended December 31, 20X1 were 800. Also there was no change in the number of ordinary shares issued by Entity B during the annual period ended December 31, 20X0 and during the period from January 1, 20X1 to the date of the reverse acquisition on September 30, 20X1.

Required:

Calculate the fair value of the consideration transferred, measure goodwill and prepare the consolidated balance sheet as on September 30, 20X1 as per Ind AS. Also compute Earnings per share as on December 31, 20X1.

Answer:

Identifying the acquirer

As a result of Entity A issuing 150 ordinary shares, Entity B’s shareholders own 60 per cent of the issued shares of the combined entity (ie., 150 of the 250 total issued shares). The remaining 40 per cent are owned by Entity A’s shareholders. Thus, the transaction is determined to be a reverse acquisition in which Entity B is identified as the accounting acquirer while Entity A is the legal acquirer.

Calculating the fair value of the consideration transferred

If the business combination had taken the form of Entity B issuing additional ordinary shares to Entity A’s shareholders in exchange for their ordinary shares in Entity A, Entity B would have had to issue 40 shares for the ratio of ownership interest in the combined entity to be the same. Entity B’s shareholders would then own 60 of the 100 issued shares of Entity B — 60 per cent of the combined entity. As a result, the fair value of the consideration effectively transferred by Entity B and the group’s interest in Entity A is 1,600 (40 shares with a fair value per share of 40).

The fair value of the consideration effectively transferred should be based on the most reliable measure. Here, the quoted market price of Entity A’s shares provides a more reliable basis for measuring the consideration effectively transferred than the estimated fair value of the shares in Entity B, and the consideration is measured using the market price of Entity A’s shares – 100 shares with a fair value per share of 16.

Measuring goodwill

Goodwill is measured as the excess of the fair value of the consideration effectively transferred (the group’s interest in Entity A) over the net amount of Entity A’s recognised identifiable assets and liabilities, as follows:

Consolidated statement of financial position at September 30, 20X1

The consolidated statement of financial position immediately after the business combination is:

The amount recognised as issued equity interests in the consolidated financial statements (2,200) is determined by adding the issued equity of the legal subsidiary immediately before the business combination (600) and the fair value of the consideration effectively transferred (1,600).