BCK CA Foundation Question Paper | CA Foundation Business and Commercial Knowledge Question Paper

These CA Foundation BCK MCQ Questions BCK CA Foundation Question Paper is designed strictly as per the latest syllabus and exam pattern.

Business and Commercial Knowledge BCK CA Foundation Question Paper

1. The capitalist Economy uses _________ as principle means of allocation of resources _________

(a) Price

(b) Demand

(c) Supply

(d) None of the above

Answer:

(a) Price

2. Consumer sovereignty is found in which economy?

(a) Capitalist Economy

(b) Socialist Economy

(c) Mixed Economy

(d) Communist Economy

Answer:

(a) Capitalist Economy

![]()

3. Capitalistic economy uses _________ as principal means of allocating resources

(a) Demand

(b) Supply

(c) Price

(d) All of the above

Answer:

(c) Price

4. A study of how increases in the corporate income tax rate will affect the national unemployment rate an example of _________

(a) Macro-Economics

(b) Descriptive Economics

(c) Micro-economics

(d) Normative Economics

Answer:

(a) Macro-Economics

5. Which of the following statement does not apply to a market economy?

(a) Firms decide whom to hire and what to product

(b) Firms at maximizing profits

(c) Households decide which firms to work for and what to buy with their incomes

(d) Government policies are the pri-mary forces that guide the deci-sions of firms and households.

Answer:

(d) Government policies are the pri-mary forces that guide the deci-sions of firms and households.

6. Factors of production are owned by in market economies.

(a) Govt.

(b) Investors

(c) Privately

(d) None

Answer:

(c) Privately

![]()

7. Consumer sovereignty is the char-acteristic of which economy _________

(a) Capitalistic economy

(b) Socialistic Economy

(c) Mixed Economy

(d) None

Answer:

(a) Capitalistic economy

8. Which of the following is used for allocation of resources?

(a) Micro-Economics

(b) Marco-Economics

(c) Econometrics

(d) Descriptive Economics

Answer:

(a) Micro-Economics

9. Which book of economics is known as first book of modern economics?

(a) An Inquiry into nation

(b) An inquiry into wealth of nation

(c) An inquiry into wealth

(d) Wealth of nation.

Answer:

(b) An inquiry into wealth of nation

10. In Economics, we use “scarcity” the term to mean:

(a) Absolute scarcity and lack of resources in less developed countries.

(b) Relative scarcity i.e. scarcity in relation to the wants of the society.

(c) Scarcity during times of business failure and natural calamities.

(d) Scarcity caused on account of excessive consumption by the rich.

Answer:

(b) Relative scarcity i.e. scarcity in relation to the wants of the society.

11. Indifference curve slopes down-wards as one product increase and another decreases because they give.

(a) Equal satisfaction

(b) Greater Satisfaction

(c) Lesser Satisfaction

(d) None

Answer:

(a) Equal satisfaction

12. Income elasticity of luxury goods _________

(a) Zero

(b) Positive and greater than one

(c) Positive and lesser than one

(d) Negative and greater than – 1

Answer:

(b) Positive and greater than one

13. Price elasticity of supply refers to change in responsiveness of quantity to change in:

(a) Price

(b) Price in substitute

(c) Income

(d) Preference

Answer:

(a) Price

![]()

14. Which of the following is a pro-perty of an indifference curve?

(a) It is convex to the origin.

(b) The marginal rate of substitution is constant as you move along an indifference curve.

(c) Marginal utility is constant as you move along an indifference curve.

Answer:

(a) It is convex to the origin.

15. The supply of a good refers to:

(a) Actual production of the good

(b) Total existing stock of the good.

(c) Stock available for sale.

(d) Amount of the good offered for sale at a particular price per unit of time.

Answer:

(d) Amount of the good offered for sale at a particular price per unit of time.

16. Which of the following state¬ments about price elasticity of demand is correct?

(a) Price elasticity of demand is a measure of how much the quan-tity demanded of a good responds to a change in the price of that good.

(b) Price elasticity of demand is com¬puted as the percentage change in quantity demanded divided by the percentage change in price.

(c) Price elasticity of demand in the long run would be different from that of the short run.

(d) All of the above.

Answer:

(d) All of the above.

17. Which of the following statements is correct?

(a) With the help of statistical tools, the demand can be forecasted accurately.

(b) The more the number of sub-stitutes of a commodity, more elastic is the demand.

(c) Demand for butter is perfectly elastic.

(d) Gold jewellery will have negative income elasticity.

Answer:

(b) The more the number of sub-stitutes of a commodity, more elastic is the demand.

18. Assume that when price is Rs. 40, the quantity demanded is 15 units and when price is Rs. 38, the quantity demanded is 16 units. Based on this information, what is the marginal revenue resulting from an increase in output from 15 units to 16 units-

(a) 36

(b) 32

(c) 24

(d) 08

Answer:

(d) 08

19. Large production of goods would lead to higher production in future.

(a) Consumer Goods

(b) Capital Goods

(c) Agricultural Goods

(d) Public Goods

Answer:

(b) Capital Goods

20. Supply of land is :

(a) Elastic

(b) Perfectly Elastic

(c) Perfectly Inelastic

(d) Inelastic

Answer:

(c) Perfectly Inelastic

21. Marginal product is the slope of:

(a) Total Product

(b) Average Product

(c) Marginal Product

(d) Implicit Product

Answer:

(a) Total Product

22. Which of the following is correct:

(a) TFC = TVC – TC

(b) TC = TVC – TFC

(c) TFC = TC – TVC

(d) TC = TFC – TVC

Answer:

(c) TFC = TC – TVC

![]()

23. Total Cost = Explicit cost + Implicit cost + _________

(a) Super Normal Profit

(b) Normal Profit

(c) Super Normal Losses

(d) Average Fixed Cost

Answer:

(b) Normal Profit

24. Large scale production is associ-ated with _________

(a) Technical Economies

(b) Un-managerial economies

(c) Commercial Economies

(d) Financial Economies

Answer:

(a) Technical Economies

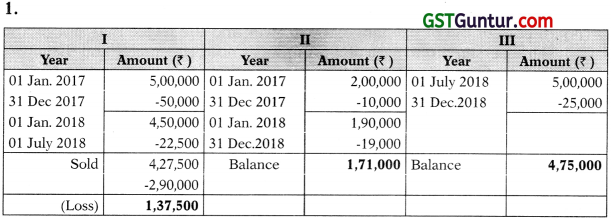

25.

| Output | TP | MP |

| 0 | — | — |

| 1 | 10 | 10 |

| 2 | — | 8 |

| 3 | 24 | — |

What is the MP of 3rd unit of output?

(a) 6

(b) 8

(c) 10

(d) 11

Answer:

(a) 6

26. What is the total product of producing 2nd unit of output?

(a) 8

(b) 10

(c) 18

(d) 24

Answer:

(c) 18

27. What is the AP of 1st three units of output?

(a) 8

(b) 10

(c) 18

(d) 72

Answer:

(c) 18

28. What is the AP of 1st three units of output?

(a) 8

(b) 100

(c) 108

(d) 540

Answer:

(c) 108

29. Diminishing marginal returns implies:

(a) Decreasing average variable costs

(b) Decreasing marginal costs

(c) Increasing marginal costs

(d) Decreasing average fixed costs

Answer:

(c) Increasing marginal costs

![]()

30. Average fixed cost for producing 8 units of output was 60, what is the average Fixed cost at 6 units of output _________

(a) 40

(b) 60

(c) 80

(d) 50

Answer:

(c) 80

31. For 15 units of output, average cost was ₹ 250 end fixed cost per unit of output was 125, then the average variable cost per at 15 units?

(a) 25

(b) 50

(c) 125

(d) 250

Answer:

(c) 125

32. Diminishing returns occur _________

(a) When units of a variable input are added to a fixed input and total product falls

(b) When units of a variable input are added to a fixed input and marginal product falls

(c) When the size of the plant is in-creased in the long run.

(d) When the quantity of the fixed input is increased and returns to the variable input falls

Answer:

(b) When units of a variable input are added to a fixed input and marginal product falls

33. Which of the following curve is never U shape _________.

(a) Average cost.

(b) Average Variable Cost

(c) Average Fixed cost

(d) Marginal Cost

Answer:

(c) Average Fixed cost

34. The “law of diminishing returns” applies to :

(a) The short run, but not the long run.

(b) The long run, but not the short run.

(c) Both the short run and the long run.

(d) Neither the short run nor the long run.

Answer:

(a) The short run, but not the long run.

35. A firm producing 7 units of out-put has an average total cost of Rs. 150 and has to pay Rs. 350 to its fixed factors of production whether it produces or not. How much of the average total cost is made up of variable costs?

(a) Rs. 200

(b) Rs. 60

(c) Rs. 100

(d) Rs. 1,400

Answer:

(c) Rs. 100

![]()

36. Marginal Cost changes due to changes in _________

(a) Total cost

(b) Average cost

(c) Variable cost

(d) Quantity of output

Answer:

(a) Total cost

37. Diminishing marginal returns for the first four units of a variable in¬put is exhibited by the total product sequence:

(a) 50, 50, 50,50

(b) 50, 110, 180, 260

(c) 50, 100, 150, 200

(d) 50, 90, 120, 140

Answer:

(d) 50, 90, 120, 140

38. Budget line is otherwise called as _________.

(a) Money line

(b) Preference line

(c) Income line

(d) Price line

Answer:

(d) Price line

39. Elasticity of demand under per-fect competition is _________.

(a) One

(b) Two

(c) Zero

(d) Infinite

Answer:

(d) Infinite

40. Which among the following market situation is known as a ‘myth in the market’?

(a) Duopoly

(b) Oligopoly

(c) Discriminating

(d) Perfect Competition

Answer:

(d) Perfect Competition

41. “Let and live philosophy” concern from which market:

(a) Perfect competition

(b) Monopoly

(c) Oligopoly

(d) Monopolistic Competition

Answer:

(c) Oligopoly

42. What is true about the perfect competition market ____________.

(a) AR = MR = PRICE

(b) AR = AC = P

(c) AR > AC

(d) None

Answer:

(a) AR = MR = PRICE

43. If a perfect competition firm is making losses then which condition is suitable. To carry on business as long as it covering variable cost.

(a) Shutdown

(b) Expand it’s plant

(c) Do nothing

(d) Reduce productions

Answer:

(b) Expand it’s plant

44. If in a short run perfect compe-tition earn super normal profit then which condition satisfy.

(a) ATOMC

(b) ATC < MC

(c) MR < AR

(d) MR > AR

Answer:

(b) ATC < MC

45. Group behaviour from which market belongs

(a) Perfect Competition

(b) Monopolistic Competition

(c) Monopoly

(d) Oligopoly

Answer:

(d) Oligopoly

![]()

46. In the long run Monopolistic comp, and perfect comp, are same because of _________

(a) Normal Profit

(b) Abnormal Production

(c) Losses

(d) None of these

Answer:

(a) Normal Profit

47. Suppose that the demand curve for the XYZ Co. slopes downward and to the right. We can conclude Suppose that the demand curve for the XYZ Co. slopes downward and to the right. We can conclude _____________

(a) The firm operates in perfectly competitive market

(b) The firm can sell all that it was to at the established market price.

(c) The XYZ Co. is not a price taker in the market because it must lower price to sell additional units of output.

(d) The XYZ Co. will not be maximize profits because price and revenue are subject to change.

Answer:

(c) The XYZ Co. is not a price taker in the market because it must lower price to sell additional units of output.

48. Extreme Product differentiation is found in which market?

(a) Monopolistic Competition

(b) Monopoly

(c) Perfect Competition

(d) Oligopoly

Answer:

(c) Perfect Competition

49. Monopoly firm faces which demand curve?

(a) Downward Sloping

(b) Horizontal

(c) Rising

(d) All of these

Answer:

(a) Downward Sloping

50. A market where there is no restrictions on the transactions is called as _________

(a) Regulated market

(b) Unregulated market

(c) Spot market

(d) Future market

Answer:

(b) Unregulated market

51. Under perfect competition, price elasticity of demand of a firm is _________

(a) Large

(b) Slight

(c) Infinite

(d) Extreme

Answer:

(c) Infinite

![]()

52. When Total Revenue (TR) is at the peak Marginal Revenue is equal to _________

(a) Zero

(b) Positive

(c) Negative

(d) More than one

Answer:

(a) Zero

53. As a price of Rs. 20 the quantity demanded is 10 units. With 5% decrease in price the demand increases by 10%. The marginal revenue for the 11th unit will be _________

(a) Rs. 20

(b) Rs. 12

(c) Rs. 9

(d) Rs. 11

Answer:

(c) Rs. 9

54. It is the amount of revenue from sales which exactly equals the amount of expense.

(a) Shut down point

(b) Break-even Point

(c) Profit point

(d) None

Answer:

(b) Break-even Point

55. Which statement is incorrect?

(a) Depression of Severe form of trough

(b) Depression causes fall in Interest rate

(c) Peak is highest point

(d) All of the above

Answer:

(d) All of the above

56. During recession the employment rate _________ and output _________.

(a) Rises-falls

(b) Rises-rises

(c) falls-rises

(d) Falls-falls

Answer:

(d) Falls-falls

57. The internal cause of business cycle is _________

(a) Technology shocks

(b) Fluctuation in effective demand

(c) Post war reconstruction

(d) Population Growth

Answer:

(b) Fluctuation in effective demand

58. An unemployment type cause due to structural changes in the economy is which of the following _________

(a) Involuntary

(b) Ethical friction

(c) Full employment

(d) Structural

Answer:

(d) Structural

![]()

59. At ‘trough’ the production in the economy reaches at which of the fol-lowing _________

(a) High

(b) Low

(c) Constant

(d) Negative

Answer:

(b) Low

60. According to some economists which is not the prime cause of Busi-ness Cycles?

(a) Fluctuations in investment

(b) Micro Economic policy

(c) Impact on aggregate economic activity

(d) Psychological factors

Answer:

(b) Micro Economic policy

61. The four phases of Business Cycle are _________

(a) Peak, Construction, Depression and Boom

(b) Prosperity, Recession, Depression and Expansion

(c) Boom, Downswing, Expansion and Prosperity

(d) Peak, Recession, Trough and Recovery

Answer:

(d) Peak, Recession, Trough and Recovery

62. Chinas recent slowdown causes _________

(a) Cycle of decline and panic across the world

(b) Countries across the Globe were able to insulate themselves from the crisis

(c) Stock markets in the Emerging Economics largely remained unaffected

(d) Old technology fuelled the economic decline

Answer:

(a) Cycle of decline and panic across the world

63. Friction unemployment is the characteristic of which of the following stages _________

(a) Expansion

(b) Peak

(c) Construction

(d) Recovery

Answer:

(a) Expansion

64. Actual demand stagnates in which stage _________

(a) Peak

(b) Trough

(c) Recovery

(d) Contraction

Answer:

(a) Peak

65. Find the odd one out from the following question Example of coin-cident indicators are _________

(a) Industrial production

(b) Inflation

(c) Retail Sales

(d) New orders for plant and equipment

Answer:

(d) New orders for plant and equipment

66. Excess capacity in capital industries is the characteristics of which of the following stage?

(a) Trough

(b) Recovery

(c) Depression

(d) Peak

Answer:

(a) Trough

67. Which of the following concern is related to business and commercial knowledge?

(a) Sustainability

(b) Sociology

(c) Traditional

(d) Social At large

Answer:

(a) Sustainability

68. Which one is not a feature of LLP _________

(a) It is a legal entity separate from its member

(b) No limit on maximum No. of members

(c) Every partner is only agent of firm

(d) Registrar of firm is the administrating authority

Answer:

(a) It is a legal entity separate from its member

69. Organic objective of business _________

(a) Sales profit

(b) Fitness of human resources

(c) Product usage and disposal

(d) All of the above

Answer:

(d) All of the above

![]()

70. Ideal corresponds to business commercial knowledge _________

(a) Social

(b) Sustainable development

(c) Political

(d) Economic

Answer:

(b) Sustainable development

71. Find odd one out. There can be partnership between _________

(a) Natural person

(b) Partnership firm

(c) Artificial Person

(d) Any Combination of natural and artificial

Answer:

(b) Partnership firm

72. Which of the following is not within the scope of Business Economics?

(a) Capital Budgeting

(b) Risk Analysis

(c) Business Cycles

(d) Accounting Standards

Answer:

(d) Accounting Standards

73. A partnership may be formed to carry on:

(a) Any trade

(b) Profession

(c) Occupation

(d) Social Enterprise

Answer:

(a) Any trade

74. Which of the following is not a feature of LLP _________

(a) Legal entity separate from its partners

(b) No limit on maximum No. of persons

(c) Every partners is agent of LLP

(d) Register of firm is the administering authority

Answer:

(d) Register of firm is the administering authority

75. Which of the following is not within the scope of Business Eco-nomics?

(a) Risk Analysis

(b) Capital Budgeting

(c) Business Cycle

(d) Accounting Standards

Answer:

(d) Accounting Standards

76. Which factor affect demand for companies product?

(a) Political

(b) Social

(c) Economic

(d) Legal

Answer:

(c) Economic

77. Which analysis is used for proac-tive and strategic thinking in its deci-sion making?

(a) SWOT

(b) TOWS

(c) PESTLE

(d) None

Answer:

(c) PESTLE

78. Which pharmaceutical company has the slogan caring for life?

(a) Dr. Reddy’s

(b) Lupin Ltd.

(c) Cipla Ltd.

(d) Sun pharmaceutical Industries.

Answer:

(c) Cipla Ltd.

79. Which gas company owns India’s largest pipeline network?

(a) Gail (India) Ltd.

(b) Bharat Petroleum Corporation Ltd.

(c) Reliance Industries Ltd.

(d) None of the above

Answer:

(a) Gail (India) Ltd.

80. _________ curtail all benefits in some particular issue

(a) Restrictive policies

(b) Regulatory Policies

(c) Facilitating policies

(d) None of these

Answer:

(a) Restrictive policies

81. In which of the following sector (s), FDI is prohibited under both routes

(a) Nidhi Company

(b) Media

(c) Real Estate

(d) Shell Company

Answer:

(a) Nidhi Company

82. A type of privatization where Government surrender partial own-ership and responsibility and sells the majority stake to one or more entities is called as _________

(a) Delegation

(b) Divestment

(c) Displacement

(d) Disinvestment

Answer:

(d) Disinvestment

83. Which of the following policy is used to curtail benefits related to some public issue?

(a) Restrictive

(b) Regulatory

(c) Facilitating

(d) Delegation

Answer:

(a) Restrictive

![]()

84. The form of privatization, where government keeps hold of responsibility and private enterprise handles the management of it fully or partly is known as:

(a) Disinvestment

(b) Deregulation

(c) Delegation

(d) Decentralization

Answer:

(d) Decentralization

85. The RBI has been vested with extensive power to control and supervise commercial banking system under the _________

(a) Reserve Bank of India Act, 1934

(b) The Banking Regulation Act, 1949

(c) Both (a) and (b).

(d) None of the above.

Answer:

(c) Both (a) and (b).

86. SEBI, RBI and IRDA are:

(a) Regulatory Institutions

(b) Policy institutions

(c) Satellite institutions

(d) None of these

Answer:

(a) Regulatory Institutions

87. A stock the provides a constant dividends and stable earnings in the periods of economic downturn is _________

(a) Defensive Stock

(b) Cash Budget

(c) Income Stock

(d) Listed Stock

Answer:

(a) Defensive Stock

88. A reduction of 45 basis points will be equal to how much of the following?

(a) 45%

(b) 0.4596

(c) 4.596

(d) 45096

Answer:

(a) 45%

89. Which of the following sets as an indicator of bank’s liquidity and solvency _________

(a) Statutory liquidity ratio

(b) Cash Reserve ratio

(c) Repo rate

(d) Reserve repo rate

Answer:

(a) Statutory liquidity ratio

90. It is loan where the time and cash flow between a short loan and a long term loan is filled up.

(a) Debt financing

(b) Bridge financing

(c) Closure Time

(d) None of these

Answer:

(b) Bridge financing

91. The lowest price at which an owner is willing to sell his securities.

(a) Sale

(b) Ask

(c) Auction

(d) None

Answer:

(b) Ask

92. Selling a portion of ownership in a public enterprise to private parties _________

(a) Delegation

(b) Disinvestment

(c) Divestment

(d) Deregulation

Answer:

(c) Divestment

![]()

93. The form in which government surrendered partial ownership and sold the majority stake to one or more private entities in course of time.

(a) Disinvestment

(b) Displacement

(c) Divestment

(d) Delegation

Answer:

(a) Disinvestment

94. Carrying forward of transaction from one settlement period to the next payment is called _________.

(a) Badla

(b) Beta

(c) Blue chips

(d) None

Answer:

(a) Badla

95. A series of payments of an equal amount at fixed intervals for a specified periods is called _________.

(a) Amortize

(b) Annuity due

(c) Annuity

(d) Arbitrage

Answer:

(c) Annuity

96. In a Bull market _________.

(a) Stock prices are decreasing con-sistently

(b) Stock Prices are increasing con-sistently

(c) Stock Prices are stable

(d) Stock Prices are wildly fluctuating

Answer:

(b) Stock Prices are increasing con-sistently

97. What is consolidation?

(a) It is expense that is supposed to reflect the loss in value of a fixed asset.

(b) Combination of two or more entities that occurs when the entities transfer all their net assets to a new entity created for that purpose.

(c) Costs that can be attributed clearly to the activity you are considering.

(d) None

Answer:

(b) Combination of two or more entities that occurs when the entities transfer all their net assets to a new entity created for that purpose.

98. _________ is the simultaneous purchase land sale of two identical commodities or in-struments. This simultaneous sale and purchase is done in order to take advantage of the price variations in two different markets.

(a) Cap

(b) Term insurance

(c) Arbitrage

(d) Hedge

Answer:

(d) Hedge

99. _________ is a combination of several companies working together for a particular purpose for example in order to buy something or build something.

(a) Consortium

(b) Joints Venture

(c) Co-opting

(d) All of above

Answer:

(a) Consortium

100. It is known as electronic cash and digital cash, it uses computer, in-ternet and other networks to execute transactions and transfer funds.

(a) Cash

(b) E-Cash

(c) E- commerce

(d) None

Answer:

(b) E-Cash