Audit under Fiscal Laws – CA Final Audit Question Bank is designed strictly as per the latest syllabus and exam pattern.

Audit under Fiscal Laws – CA Final Audit Question Bank

Audit of Public Trusts

Question 1.

Draft an Audit programme for conducting the audit of a Public Trust registered under section 12A of the Income-tax Act, 1961. [May 09 (8 Marks)]

Answer:

Audit Programme for conducting audit of a public trust:

1. Preliminary: Obtain the following from the trust:

- A copy of resolution frorn the trust so as to determine the scope of audit.

- A list of accounting records maintained by the trust.

- A certified true copy of trust deed.

- Trial Balance as at end of accounting period.

- Balance Sheet and Profit & Loss account of the trust authenticated by the trustee.

2. Compliance and Substantive Checking

- Examine the system of accounting and internal control.

- Vouch the transactions of the trust so as to ensure the following:

(a) transaction falls within the ambit of the trust;

(b) transaction is properly authorized by the trustees or other delegated authority;

(c) Proper accounting of all incomes and expenses on the basis of the system of accounting followed by the trust;

(d) Amount applied towards the object of the trust are covered by the objects of trust as specified in the trust deed. - Check whether the financial statements agrees with the trial balance.

3. Issuing Audit Report

- Audit Report shall be furnished in Form No. 10B.

- Annexure to Form 10B requires certain information to be provided by the auditor, which need to be obtained from the trustees.

![]()

Tax Audit u/s 44AB

Question 2.

A Co-operative Society having receipts above ₹ 100 lakhs get its accounts audited by a person eligible to do audit under Co-operative Societies Act, 1912, who is not a C.A. State with reasons whether such audit report can be furnished as tax audit report u/s 44AB of the Income Tax Act, 1961? [Nov. 09 (3 Marks)]

Or

A Co-operative society having receipts over ₹ 2 crores have appointed Mr. D as the statutory auditor : – Mr. D is eligible to do the same under the state Co-operative Societies Act. Mr. D is not a chartered l accountant. Mr. D is also appointed to conduct the tax audit of the society under section 44AB of the Income Tax Act, 1961. Comment. [Nov. 17 (4 Marks)]

Answer:

Tax Audit Report in case of Co-operative society:

Proviso to Sec. 44AB of Income Tax Act, 1961 lays down that where the accounts of an assessee are required to be audited by or under any other law, it shall be sufficient compliance with the provisions of this section, if such person get the accounts of such organisation audited under such other law before the specified date and furnishes by that date, the report of the audit as required under such other law and a further report by an Accountant in the form prescribed under this section.

The term “accountant” as defined in Explanation to Sec. 288[2)’of the Income Tax Act, 1961 means a chartered accountant within the meaning of the Chartered Accountants Act, 1949, who holds a valid certificate of practice.

Accordingly, the person who is not a Chartered Accountant as mentioned in the question, though is eligible to act as auditor of Cooperative Society under the Cooperative Society Act, 1912, but is not eligible to carry out tax audit under Section 44AB of the Income Tax Act, 1961.

Conclusion: Audit report by a person other than Chartered Accountant cannot be furnished as tax audit report under Section 44AB of the Income-tax Act, 1961.

“ICAI Examiner Comments”

Even though many examinees have given correct conclusion, few examinees failed to refer Sec. 288(2) of the Income-tax Act, 1961 and its explanation while some of them mistakenly related with Professional misconduct under CA Act, 1949.

![]()

Question 3.

Mr. X deals in a commodity and purchase and sales of that commodity is ultimately settled otherwise than by the actual delivery. During the financial year 2020-21 he purchased the commodity worth ? 95 Lacs and sold the same commodity for ₹ 104 Lacs and the contract was settled otherwise than by the actual delivery. X seeks your advice whether he is liable for tax audit u/s 44AB of the Income Tax Act.

Answer:

Liability for Tax Audit in case of Speculative Transactions:

Mr. X deals in commodity as a speculator. A speculative transaction means a transaction in which a contract for the purchase or sale of any commodity, including stocks and shares, is periodically or ultimately settled otherwise than by the actual delivery.

As such, in such transaction the difference amount is ‘turnover’. In the given case the difference of ₹ 104 lacs and ₹ 95 lakhs i.e., ₹ 9 Lakhs is the turnover.

In such transactions though the contract notes are issued for full value of the purchases or sales, but the entries in the books of account are made only for the differences.

Conclusion: Mr. X is not liable for Tax audit u/s 44AB of the Income Tax Act, 1961.

![]()

Question 4.

Concession Ltd. is engaged in the business of manufacturing of threads. The company recorded the turnover of ₹ 1.13 crore during the financial year 2020-21 before adjusting the following:

Discount allowed in the Sales Invoice – ₹ 8,20,000

Cash discount (other than allowed in Cash memo/sales invoice) – ₹ 9,20,000

Trade discount – ₹ 2,90,000

Commission on Sales – ₹ 6,00,000

Sales Return (F.Y. 2019-20) – ₹ 1,60,000

Sale of Investment – ₹ 6,60,000

You are required to ascertain the effective turnover to be considered for the prescribed limit of tax audit and guide-the company whether the provisions relating to tax audiL applies.

Answer:

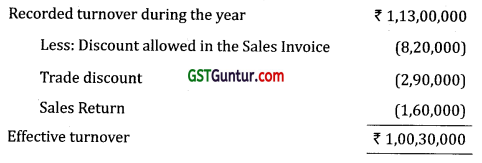

Computation of Turnover for the purpose of determining requirement of Tax Audit:

As per section 44AB of the Income Tax Act, 1961, audit is required in case of every person carrying on business, if his total sales, turnover or gross receipts in business exceed ₹ 1 crore and in case of every person carrying on a profession, if his gross receipts from profession exceed ₹ 50 lakhs in any previous year.

As per Guidance Note on Tax Audit issued by the ICAI, the following points merit consideration for the purpose of computing turnover:

- Discount allowed in the sales being in the nature of trade discount will be deducted from the turnover.

- Cash discount otherwise than that allowed in a cash memo/sales invoice is in the nature of a financing charge and hence should not be deducted from the turnover.

- Special rebate allowed to a customer can be deducted from the sales if it is in the nature of trade discount. If it is in the nature of commission on sales, the same cannot be deducted from the figure of turnover.

- Price of goods returned should be deducted from the turnover even if the returns are from the sales made in the earlier year/s.

- Sale proceeds of any shares, securities, debentures, etc., held as investment will not form part of turnover. However, if the shares, securities, debentures etc., are held as stock-in-trade, the sale proceeds thereof will form part of turnover.

Accordingly, the turnover of concession limited may be computed as under:

Conclusion: As the effective turnover of Concession Ltd. is more than ₹ 1 Crore, the provisions related to tax audit are applicable to the company.

![]()

Question 5.

Mr. A engaged in business as a sole proprietor presented the following information to you for the FY 20-21. Turnover made during the year ₹ 124 lacs. Goods returned in respect of sales made during FY 19-20 is ₹ 20 lacs not included in the above. Cash discount allowed to his customers ₹ 1 lac for prompt payment. Special rebate allowed to customer in the nature of trade discount ₹ 5 lacs. Kindly advise him whether he has to get his accounts audited u/s 44AB of the Income Tax Act, 1961. [Nov. 13 (4 Marks)]

Answer:

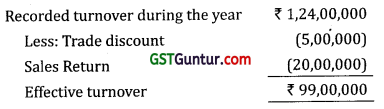

Computation of Turnover for the purpose of determining requirement of Tax Audit:

As per section 44AB of the Income Tax Act, 1961, audit is required in case of every person carrying on business, if his total sales, turnover or gross receipts in business exceed ₹ 1 crore and in case of every person carrying on a profession, if his gross receipts from profession exceed ₹ 50 lakhs in any previous year.

As per Guidance Note on Tax Audit issued by the ICAI, the following points merit consideration for the purpose of computing turnover:

- Discount allowed in the sales being in the nature of trade discount will be deducted from the turnover.

- Cash discount otherwise than that allowed in a cash memo/sales invoice is in the nature of a financing charge and hence should not be deducted from the turnover.

- Special rebate allowed to a customer can be deducted from the sales if it is in the nature of trade discount.

- Price of goods returned should be deducted from the turnover even if the returns are from the sales made in the earlier year/s.

Accordingly, the turnover of Mr. A may be computed as under:

Conclusion: As the effective turnover of Mr. A is less than ₹ 1 Crore, the provisions related to tax audit are not applicable to Mr. A.

![]()

Question 6.

Comment with respect to computation of total sales, turnover or gross receipts in business exceeding the prescribed limit under section 44AB of Income Tax Act, 1961.

- Discount allowed in the sales invoice

- Cash discount

- Price of goods returned related to earlier year

- Sale proceeds of fixed assets. [May 15 (4 Marks)]

Answer:

Computation of Total Sales:

- Discount allowed in the sales invoice: Deducted from turnover as it reduces the sale price.

- Cash discount: Not to be deducted being in the nature of financing charge.

- Price of goods returned related to earlier year: Deducted from turnover.

- Sale proceeds of fixed assets: Will not form part of turnover as these are not held for resale.

Question 7.

Write short note on: Circumstances in which Chartered Accountant in practice or firm of Chartered Accountants cannot conduct tax audit u/s 44AB of the Income Tax Act, 1961 of the concern.

Answer:

Circumstances in which CA in Practice cannot conduct tax audit:

As per Explanation to Sec. 288, the following persons cannot conduct tax audit:

- In case of a company, the person who is not eligible for appointment as an auditor of as per provisions of Sec. 141(3) the Companies Act, 2013 cannot conduct tax audit.

- In case of assessee other than company, following persons cannot conduct tax audit:

- the assessee himself or in case of the firm or AOP or HUF, any partner of the firm, or member of the AOP or the HUF;

- in case of the assessee, being a trust or institution, any person referred to in Sec. 13(3);

- the person who is competent to verify the return in accordance with the provisions of section 140;

- arty relative of any of the persons referred above;

- an officer or employee of the assessee;

- an individual who is a partner, or who is in the employment, of an officer or employee of the assessee;

- an individual who, or his relative or partner

(a) is holding any security of, or interest in, the assessee: Provided that the relative may hold security or interest in the assessee of the face value not exceeding ₹ 1,00,000;

(b) is indebted to the assessee: Provided that the relative may be indebted to the assessee for an amount not exceeding ₹ 1,00,000;

(c) has given a guarantee or provided any security in connection with the indebtedness of any third person to the assessee: Provided that the relative may give guarantee or provide any security in connection with the indebtedness of any third person to the assessee for an amount not exceeding ₹ 1,00,000; - a person who, whether directly or indirectly, has business relationship with the assessee of such nature as may be prescribed;

- a person who has been convicted by a court of an offence involving fraud and a period of ten years has not elapsed from the date of such conviction.

![]()

Question 8.

M/s. SB & Co. has been appointed as tax auditor under section 44AB of Income Tax Act, 1961 by Woodcraft Interior Consultants, a professional partnership firm, having turnover ₹ 1.25 Crores. M/s RS & Co. are the statutory auditors of the firm but they are unable to give their report on the financial statements of the firm. M/s. SB & Co., have, however, completed their tax audit and want to issue their reports. Comment. [May 17 (4 Marks)]

Answer:

Tax Audit Report in case of Partnership firm :

Proviso to Sec. 44AB of Income Tax Act, 1961 lays down that where the accounts of an assessee are required to be audited by or under any other law, it shall be sufficient compliance with the provisions of this section, if such person get the accounts of such organisation audited under such other law before the specified date and furnishes by that date, the report of the audit as required under such other law and a further report by an Accountant in the form prescribed under this section.

There is no statutory requirement of audit of a firm under the provisions of Partnership Act, 1932. So, appointment of two auditors one as tax auditor and another as statutory auditor does not appears to be correct.

It is also provided under Section 44AB that the tax auditor should report whether in his opinion the particulars in respect of Form 3CD are true and correct. The audit report is in the form of 3CA if accounts are being examined under the requirements of provisions of any other Act, otherwise report should be in Form 3CB.

In the present case, assessee is a partnership firm and appoints separate persons as tax auditor and statutory auditor. Statutory auditor is not able to give their report on financial statements of firm.

Conclusion: Form No. 3CA requires the tax auditor to enclose a copy of the audit report conducted by the statutory auditor. Where the report of the statutory auditor is not available for whatever reasons, it will be possible for the tax auditor to give his report in Form No. 3CB and to certify the relevant particulars in Form No. 3CD.

![]()

Note: There is no requirement of statutory audit under Partnership Act, 1932.Hence while answering the question, this fact also need to be stated.

“ICAI Examiner Comments”

Majority of candidates failed to discuss the circumstances in which Form 3CA and Form 3CB are furnished by a Tax auditor. Some candidates wrongly discussed the relationship between , the statutory auditor and tax auditor and concluded wrongly that Tax auditor has to wait till statutory audit is completed.

It seems that Candidates failed to understand the requirement of the question.

Question 9.

Mr. PK is conducting the Tax audit u/s 44AB of the Income Tax Act, 1961 of MG Ltd. for the year ended 31st March, 2021. There is a difference of opinion between Mr. PK and the Management in respect of certain information to be furnished in Form No. 3CD. As a tax auditor, Mr. PK has to report whether the statement of particulars in Form 3CD are true and correct and the same is to ; be annexed to the report in Form No. 3CA. Advise on the matters to be considered by Mr. PK while furnishing the particulars in Form No. 3CD. [Nov. 19 – New Syllabus (4 Marks)]

Answer:

Form 3CD – Considerations for auditor while furnishing particulars in Form 3CD:

While furnishing the particulars in Form No. 3CD it would be advisable for the tax auditor to consider the following:

1. If a particular item of income/expenditure is covered in more than one of the specified clauses, care should be taken to make a suitable cross reference to such items at the appropriate places.

2. If there is any difference in the opinion of the tax auditor and that of the assessee in respect of any information furnished in Form No. 3CD, the tax auditor should state both the view points and also the relevant information in order to enable the tax authority to take a decision in the matter.

![]()

3. If any particular clause in Form No. 3CD is not applicable, he should state that the same is not applicable.

4. In computing the allowance or disallowance, he should keep in view the law applicable in the relevant year, even though the form of audit report may not have been amended to bring it in conformity with the amended law.

5. In case the prescribed particulars are given in part to the tax auditor or relevant form is incomplete and the assessee does not give the information against all or any of the clauses, the auditor should not withhold the entire audit report. In such a case, he can qualify his report on matters in respect of which information is not furnished to him.

6. The information in Form No. 3CD should be based on the books of account, records, documents, information and explanations made available to the tax auditor for his examination.

7. In case the auditor relies on a judicial pronouncement, he may mention the fact as his observations in Form No. 3CA or Form No. 3CB, as the case may be.

![]()

Methods of Accounting & ICDSs (See. 145)

Question 10.

As the tax auditor of a non-corporate entity u/s 44AB of the Income Tax Act, 1961, how would you ensure compliance of section 145 of the Income Tax Act, 1961? [May 09 (8 Marks)]

Answer:

Compliance of Section 145:

Sec. 145(1) of Income Tax Act,1961 requires that the income chargeable under the head ‘PGBP’ or ‘Other sources’ shall, be computed in accordance with either cash or mercantile system of accounting regularly employed by the assessee.

Sec. 145(2) provides that the C.G. may notify in the Official Gazette from time to time Income Computation and Disclosure Standards to be followed by any class of assessee or in respect of any class of income.

Sec. 145(3) provides that where the A.O. is not satisfied about the correctness or completeness of the accounts of the assessee, or where method of accounting provided u/s 145(1) have not been regularly followed by the assessee or income has not been computed in accordance with thq Standards notified u/s 145(2), the A.O. may make an assessment in a manner provided in Sec. 144 of the Income Tax Act.

Auditor has to therefore ensure the following:

(a) That the entity follows either the cash or accrual method of accounting and same is to be reported in clause 13(a) of form 3CD.„

(b) Accounting policies has been disclosed separately.

(c) Provisions as stated in Income Computation and Disclosure Standards (ICDS) notified by Central Government u/s 145(2) has been complied with.

![]()

Question 11.

Discuss briefly Income Computation and Disclosure Standards to be followed by assessee under the Income-tax Law. [Nov. 09 (4 Marks)]

Answer:

Income Computation and Disclosure standards to be followed by assessee under Income Tax Law:

The Central Government has prescribed the following Income Computation and Disclosure Standard:

| I | Accounting Policies |

| II | Valuation of Inventories |

| III | Construction Contracts |

| IV | Revenue Recognition |

| V | Tangible Fixed Assets |

| VI | Effects of Changes in Foreign Exchange Rates |

| VII | Government Grants |

| VIII | Securities |

| IX | Borrowing Costs |

| X | Provisions, Contingent Liabilities and Contingent Assets |

The above Standards are to be followed by all assessee following mercantile system of accounting for computation of income under the head “PGBP” and “Other Sources”. Therefore, it is clear that those assessees who are following cash system of accounting need not follow the ICDSs notified above.

![]()

Form 3CD

Question 12.

Mr. A, is a renowned lawyer. During the previous year, he collected GST of ₹ 25 lakhs but utilized it for his personal use. The department issued a show cause notice to him as to why the tax, collected by him, is not deposited to the government account. He appeared before the department and stated his inability to pay the sum due to financial crisis. The proceedings are still pending.

Mr. A instructed his tax auditor not to disclose his GST registration details, while filling particulars to be furnished in Form No. 3CD, believing that the income tax department might trace his scrutiny proceedings details pending before department which would bring disrepute to his profession.

Or

You are appointed as tax auditor of Mr. X a practicing advocate in Agra. During the previous year he collected GST of ₹ 7 lakhs but utilized for personal use. The department issued a show cause notice to him why the tax collected by him in not deposited to the Government account. He appeared before the department and stated his inability to pay the sum due to financial crisis. The proceedings are still pending. Mr. X requests you not to disclose his GST registration details while filling particulars to be furnished in From No. 3CD.

As a tax auditor how would you deal with this? [May 16 (4 Marks)]

Answer:

Reporting Requirement of Form 3CD:

Clause (4) of Form 3CD, requires tax auditor to mention the registration number or any other identification number, if any, allotted, in case the assessee is liable to pay indirect taxes like excise duty, service tax, sales tax, G§T, customs duty, GST etc. Auditor is required to furnish the details of registration numbers as provided to him by the assessee.

The reporting is however, to be done in the manner or format specified by the e-filing utility in this context. The information may be obtained and maintained in-the following format:

| Sr. No. | Relevant Indirect Tax Law which requires registration | Place of Business/profession/ service unit for which registration is in place/or has been applied for | Registration/Identification number |

In the present case Mr. X has defaulted in payment of GST for the previous year. Consequently, the department issued a show cause notice for such non-payment of tax. The arguments are still going on between the department and assessee. He also restrained his tax auditor from disclosing GST registration details in tax audit report.

Conclusion: Instruction of Mr. X is not acceptable as clause 4 of Form 3CD requires tax auditor to furnish the details of registration number or other identification number of assessee, if assessee is required to pay indirect taxes like excise duty, service tax, GST etc.

“ICAI Examiner Comments”

Most of the candidates failed to visualize the requirement of the question and answered about reporting requirement due to non-payment of GST under clause 41 instead of GST registration number under clause 4.

![]()

Question 13.

BB Ltd., a non-resident company, is engaged in the business of extraction of mineral oils, having i turnover of ₹ 20 lakhs during the financial year 2020-21. The company claims that its profits and gains chargeable to tax under the head “Profits and gains of business or profession” is lower than the deemed income chargeable under section 44BB of the Income Tax Act, 1961. Therefore, it decided to get its accounts audited under section 44AB of the Income Tax Act, 1961. Discuss reporting requirement of Form 3CD in this behalf.

Answer:

Reporting Requirement of Form 3CD:

BB Ltd., is a non-resident company which is engaged in the business of extraction of mineral oils, hence, its income is chargeable in accordance with the provisions of section 44BB of the Income Tax Act, 1961. But as the company is claiming lower income in comparison to deemed income u/s 44BB, provisions of Section 44AB in relation to audit has to be complied with.

Clause (8) of Form 3CD, requires tax auditor to mention the relevant clause of section 44AB under which the audit has been conducted. Accordingly, auditor is required to mention clause (c) of Section 44AB which requires tax audit.

Further, as per Clause (12) of Form 3CD, if the profit and loss account of the assessee includes any profits and gains assessable on presumptive basis, the tax auditor has to indicate the amount and the relevant sections.

Conclusion: Under Clause 8, auditor is required to indicate the relevant clause of Section 44AB under which audit is to be conducted and in addition under clause 12, auditor is required to indicate the amount of profits of business covered u/s 44BB and the relevant section.

Question 14.

State the reporting requirement regarding books of account (prescribed, maintained and examined) in Form No. 3CP of Tax Audit under Section 44AB of the, Income Tax Act, 1961.

Answer:

Reporting Requirement regarding books of account in Form 3CD:

Clause 11 of Form 3CD requires the following reporting requirements in Form 3CD w.r.t. books of account:

(a) Whether books of account are prescribed under section 44AA, if yes, list of books so prescribed.

(b) List of books of account maintained and the address at which the books of account are kept. (In case books of account are maintained in a computer system, mention the books of account generated by such computer system. If the books of account are not kept at one location, please furnish the addresses of locations along with the.details of books of account maintained at each location.)

(c) List of books of account and nature of relevant documents examined.

![]()

Question 15.

Write a short note on: Method of Accounting in Form No. 3CD of Tax Audit.

Answer:

Method of Accounting in Form No. 3CD:

Clause 13 of Form 3CD requires the following reporting requirements w.r.t. Methods of accounting:

(a) Method of accounting employed in the previous year

(b) Whether there had been any change in the method of accounting employed vis-a-vis the method employed in the immediately preceding previous year.

(c) If answer to (b) above is in the affirmative, give details of such change, and the effect thereof on the profit or loss.

| Serial number | Particulars | Increase in profit (₹) | Decrease in profit (₹) |

(d) Details of deviation, if any, in the method of accounting employed in the previous year from accounting standards prescribed under section 145 and the effect thereof on the profit or loss.

![]()

Question 16.

A leading manufacturing concern valued its inventory following a method not in line with the provisions of Income Computation and Disclosure Standard (ICDS)- 2 ‘Valuation of Inventories’.

In such a situation, discuss the relevant clause of Form No. 3CD under which the tax auditor is required to report?

Or

ABC Ltd., is consistently following accounting standards as required u/s 133 of the Companies Act, 2013. During your tax audit u/s 44AB of the Income-tax Act, 1961, the board of directors informed ! you that profits of the company is properly arrived at and the ASs applicable to it have been followed consistently and as such, there need not be any adjustments to be made as per ICDS notified u/s 145 of Income-tax Act, 1961. Based on the requirement of Law in this regard, examine the validity of the stand of management in this regard. [May 18-New Syllabus (5 Marks)]

Answer:

Reporting for Adjustment to be made to the Profits or Loss for complying with ICDSs:

Central Government has, in exercise of the powers conferredu/s 145(2) of Income-tax Act, 1961, notified ten income computation and disclosure standards (ICDSs) to be followed by all assesses (other than an individual or a HUF who is not required to get his accounts of one previous year audited in accordance with the provisions of section 44AB), following the mercantile system of accounting, for the purposes of computation of income chargeable to income-tax under the head “Profit and gains of business or profession” or “Income from other sources”.

Clause 13(d) of Form No. 3CD of the tax audit report requires the tax auditor to state whether any adjustment is required to be made to the profits or loss for complying with the provisions of income computation and disclosure standards notified under section 145(2) of the Income- tax Act, 1961.

Further, the tax auditor is also required to report under Clause 13(e), if answer to Clause 13(d) above is in the affirmative i.e. the auditor is required to give details of such adjustments as follows:

| Increase in Profit (₹) | Decrease in Profit (₹) | Net Effect (₹) | ||

| ICDS 1 | Accounting Policies | |||

| ICDS II | Valuation of Inventories • | – | ||

| ICDS III | Construction Contracts : | |||

| ICDS IV | Revenue Recognition | |||

| ICDS V | Tangible Fixed Assets | |||

| ICDS VI | Changes in Foreign Exchange Rates | |||

| ICDS VII | Governments Grants | |||

| ICDS VIII | Securities | |||

| ICDS IX | Borrowing Costs | |||

| ICDS X | Provisions, Contingent Liabilities & Contingent Assets | |||

| Total |

Conclusion: Contention of the management that they are following Accounting Standards and need not to make any adjustments as per ICDS, is not correct. Thus, ABC Ltd. is required to adjust the profits in compliance with ICDS.

![]()

Question 17.

A leading jewellery merchant used to value his inventory at cost on LIFO basis. However, for the current year, in view of requirements of AS-2, he changed over to FIFO method of valuation. The difference in value of stock amounted to ₹ 55 lakhs which is higher than that under the previous method. In such a situation, what are the reporting responsibilities of a Tax Audit u/s 44AB of Income Tax Act, 1961.

Answer:

Reporting of Changes in Valuation of Inventory:

- As per the provisions of Income Tax Act, 1961, if the change in method of valuation is bona fide, and is regularly and consistently adopted in the subsequent years as well, such change would be permitted to be made for tax purposes.

- In the instant case, the change in the valuation of stock is pursuant to mandatory requirements of the AS-2 ‘Valuation of Inventories’ and therefore should be viewed as bona fide change and allowed.

- Clause 14 of Form 3CD also requires in this regard reporting over the following:

1. Method of valuation of closing stock employed in the previous year.

2. In case of deviation from the method of valuation prescribed under section 145A, and the effect thereof on the profit or loss. - In reference to Section 145A, auditor is not required to report change in the method of valuation of purchases, sales and inventories which is regularly employed by the assessee. Auditor is required to adjust the valuation for any tax, duty, cess or fee actually paid or incurred by the assessee, if the same had not already been adjusted.

![]()

Question 18.

T Ltd’s previous year ended on 31st March 2021. During that period, it made a claim for refund of customs duty which was admitted as due by the customs authorities during April 2021. T Ltd. neither credited the claim in the profit and loss account nor reported the same in clause 16(h) of Form 3CD for the reason that this has been admitted as due by the authorities only in the next financial year. Further T Ltd. had changed the method of determination of cost formula for the purpose of stock valuation from FIFO basis to Weighted Average Cost basis, but that was also not reflected in clause 13(b) of Form 3CD which requires reporting on change in accounting method employed. Comment. [May 12 (6 Marks)]

Answer:

Reporting requirement of Claim of Custom Duty Refund and change in Accounting policy:

As per Clause 16(b) of form 3CD, the details of custom duty refund, if admitted as due but not

reported in Profit and Loss account, are to be stated. But the claim which have been admitted as due after the relevant previous year need not be reported.

Hence non-reporting of claim of refund of custom duty in Form 3 CD is in order.

Clause 13 (b) of Form 3CD required reporting in case of change in method of accounting employed. But in the present case there is a change in accounting policy. Change in Accounting policy cannot be treated as change in method of accounting, hence does not require any reporting under clause 13(b) in Form 3CD.

Hence non-reporting of method of valuation in Form 3CD is in order.

![]()

Question 19.

While conducting the tax audit of A & Co. you observed that it made an escalation claim to one of its customers but which was not accounted as income. What is your reporting responsibility? [May 11 (4 Marks)]

Answer:

Clause 16(c) of Form 3CD:

A tax auditor has to report under clause 16(c) of Form 3CD on any escalation claim accepted during the previous year and not credited to the profit and loss account under clause 16(c) of Form 3CD.

The escalation claim accepted during the year would normally mean “accepted during the relevant previous year.’’ If such amount is not credited to Profit and Loss Account the fact should be reported. The system of accounting followed in respect of this particular item may also be brought out in appropriate cases. If the assessee is following cash basis of accounting with reference to this item, it should be clearly brought out since acceptance of claims during the relevant previous year without actual receipt has no significance in cases where cash method of accounting is followed.

Escalation claims should normally arise pursuant to a contract (including contracts entered into in earlier years), if so permitted by the contract. Only those claims to which the other party has signified unconditional acceptance could constitute accepted claims. Mere making claims by the assessee or claims under negotiations cannot constitute accepted claims. After ascertaining the relevant factors as outlined above, a decision whether to report or not, can be taken.

![]()

Question 20.

While writing the audit program for tax audit in respect of A Ltd. you wish to include possible in; stances of capital receipt if not credited to Profit & Loss Account which needs to be reported under clause 16(e) of Form 3CD. Please elucidate possible instance. [May 13 (4 Marks)]

Or

What can be the possible instance of capital receipt which, if not credited to the profit and loss account, needs to be reported in form 3CD? [Nov. 15 (4 Marks)]

Or

In the course.ofyour tax audit assignment u/s44AB of the Income-tax Act, 1961 of Dream Bank Ltd. You have instructed your assistant to find out receipt of capital nature which might not have been credited to Profit & Loss Account and needs to be reported in Para 16(e) of 3CD. Your audit assistant seeks your guidance in reporting the same. Specify any four illustrative examples of such receipt. [May 19 – New Syllabus (4 Marks)]

Answer:

Instances of Capital receipt:

(a) Capital subsidy received in the form of Government grants, which are in the nature of promoters’ contribution i.e., they are given with reference to the total investment of the undertaking or by way of contribution to its total capital outlay. For e.g., Capital Investment Subsidy Scheme.

(b) Government grant in relation to a specific fixed asset where such grant is shown as a deduction from the gross value of the asset by the concern in arriving at its book value.

(c) Compensation for surrendering certain rights.

(d) Profit on sale of fixed assets/investments to the extent not credited to the profit and loss account.

Audit procedures:

Capital receipts are not generally credited to profit and loss account hence the auditor should take enough care to check out any transaction generating the capital receipts by –

- Enquiring whether the assessee is in receipt of any amount of capital nature during the previous year.

- Going through the financial statements, in particular reserve account, to ascertain whether the assessee has received any such receipts and credited them directly to reserve account.

- Enquiring whether the assessee has credited such receipts to profit and loss account.

- Checking that any such receipts is accounted for in terms of method of accounting followed by the assessee.

“ICAI Examiner Comments”

Some examinees wrote about Form No. 3CD. Also, few examinees discussed about the items of profit and loss account which was not required.

![]()

Question 21.

ABC Ltd., a manufacturing concern, sold a house property in Mumbai for a consideration of ₹ 48 lakh, to Mr. X on 1.8.2020. ABC Ltd. had purchased the house property in the year 2014 for ₹ 30 lakh. The stamp duty value on the date of transfer, i.e., 01.08.2020, is ₹ 65 lakh for the house property. How would you deal this matter in tax audit report?

Answer:

Reporting of Sale of property at a price lower than value adopted for the purpose of stamp duty:

Clause 17 of Form 3CD requires tax auditor to furnish certain information if land or building or both is transferred during the previous year for a consideration less than value adopted by any authority of a State Government as under:

| Details of Property | Consideration Received or Accrued | Value adopted or assesses or assessable |

For this purpose, auditor should obtain a list of all properties transferred by the assessee during the previous year and furnish the amount of consideration received or accrued, as disclosed in the books of account of the assessee.

For reporting the value adopted or assessed or assessable, the auditor should obtain from the assessee a copy of the registered sale deed. In case the property is not registered, the auditor may verify relevant documents from relevant authorities or obtain third party expert like lawyer, solicitor representation to satisfy the compliance of section 43CA/section 50C of the Act.

Conclusion: ABC Ltd. has sold the house property to Mr. X at a price lower than value adopted for stamp duty purpose, tax auditor is required to report on the same under Clause 17 of Form 3CD.

![]()

Question 22.

A is proprietor of a firm M/s ABC & Co. The firm has a turnover of ₹ 500 lakhs during the financial year ended 31.03.2021. The firm sold land and building during the year for a consideration of ₹ 15 lakhs, whose value for stamp duty purpose was ₹ 16 lakhs. As the Tax Auditor of the said firm, is the above to be reported? If yes, how will you report the same? [Nov. 19 – Old Syllabus (4 Marks)]

Answer:

Reporting of Sale of property at a price lower than value adopted for the purpose of stamp duty:

Clause 17 of Form 3CD requires tax auditor to furnish certain information if land or building or both is transferred during the previous year for a consideration less than value adopted by any authority of a State Government as under:

| Details of Property | Consideration Received or Accrued | Value adopted or assesses or assessable |

For this purpose, auditor should obtain a list of all properties transferred by the assessee during the previous year and furnish the amount of consideration received or accrued, as disclosed in the books of account of the assessee.

For reporting the value adopted or assessed or assessable, the auditor should obtain from the assessee a copy of the registered sale deed. In case the’ property is not registered, the auditor may verify relevant documents from relevant authorities or obtain third party expert like lawyer, solicitor representation to satisfy the compliance of section 43CA/section 50C of the Act.

Conclusion: ABC & Co. has sold the house property to Mr. X at a price lower than value adopted for stamp duty purpose, tax auditor is required to report on the same under Clause 17 of Form 3CD.

Note: Suggested answer oflCAI also requires reporting under Clause 29B. Reporting under clause 29B is required when the assessee receives any property. But in this case the assessee, i.e.firm ABC and Co. sold its property, hence no reporting required under Clause 29B.

![]()

Question 23.

As an auditor of a partnership firm under section 44AB of the Income Tax Act, 1961, how would you report on the following: Capital Expenditure incurred for scientific research assets. [Nov. 12 (2 Marks)]

Answer:

Reporting of Capital Expenditure incurred on Scientific Research Assets in Form 3CD:

Clause 19 of Form 3CD requires the auditor to report the following:

- Amount debited to profit and loss account.

- Amounts admissible as per the provisions of the Income Tax Act, 1961 and also fulfils the conditions, if any specified under the relevant provisions of Income Tax Act, 1961 or Income Tax Rules, 1962 or any other guidelines, circular, etc., issued in this behalf.

Question 24.

As a tax auditor how would you deal and report the following: An assessee has incurred payments to clubs. [Nov. 11 (2 Marks)]

Or

As an auditor of a partnership firm under section 44AB of the Income Tax Act, 1961, how would you report on the following: Expenditure incurred at Clubs. [Nov. 12 (2 Marks)]

Answer:

Reporting of Payment to Club in Form 3CD:

- Clause 21(a) of Form 3CD requires the tax auditor is required to furnish the details of amounts debited to the profit and loss account, being in the nature of capital, personal, advertisement expenditure etc.

- Such reporting requires the tax auditor to report on the

(a) Expenditure incurred at clubs being-entrance fees and subscriptions; and

(b) Expenditure incurred at clubs being cost for club services and facilities used. - The payments made may be in respect of directors and other employees in case of companies, and for partners or proprietors in other cases .

- The fact whether such expenses are incurred in the course of business or whether they are of personal nature should be ascertained.

![]()

Question 25.

M/s PQRS& Associates is appointed for conducting tax audit as per Income Tax Act, 1961 of QW Ltd., a cotton textile company. The Company had incurred ₹ 6 lac towards advertisement expenditure on a brochure/pamphlet published by a political party in Pune. Advise the auditor whether such expenditure should be included in the tax audit report or not. [RTP-Nov. 20]

Answer:

Expenses on Advertisement in the Media of a Political Party:

Clause 21(a) of Form 3 CD requires the tax auditor to furnish the details of amounts debited to the Profit and Loss Account, being in the nature of advertisement expenditure in any souvenir, brochure, tract, pamphlet or the like published by a political party in his tax audit report.

In the given situation, M/s PQRS & Associates is appointed for conducting tax audit as per Income Tax Act, 1961 of QW Ltd., a cotton textile company. The Company had incurred ? 6 lac towards advertisement expenditure on a brochure/pamphlet published by a political party.

Conclusion: Advertisement expenditure of ₹ 6 lac on brochure/pamphlet published by a political party shall be reported in the tax audit report as per Clause 21(a) of Form 3CD.

![]()

Question 26.

ABC Ltd., engaged in the manufacturing of goods carriage, appointed you as the tax auditor for the financial year 2020-21. How would you deal with the following matters in your tax audit report:

- Payments of 6 invoices of ₹ 5,000 each made in cash to Mr. X, engaged in leasing of goods carriages on 4th July, 2020.

- Payments of 2 invoices of ₹ 18,000 each made in cash to Mr. Y, engaged in leasing of goods carriages on 5th July, 2020 and 6th July, 2020 respectively.

- Payment of ₹ 40,000 made in cash to Mr. Z, engaged in leasing of goods carriages on 7th July, 2020 against an invoice for expenses booked in 2019-20.

Answer:

Reporting of Payments Exceeding ₹ 35,000 in Cash:

Clause 21(d) (A) and 21(d)(B) of Form 3CD, requires tax auditor to scrutinize on the basis of the examination of books of account and other relevant documents/evidence, whether the expenditure covered under section 40A(3) and 40A(3A) respectively read with rule 6DD were made by account payee cheque drawn on a bank or account payee bank draft. If not, the same has to be reported under above mentioned clauses.

As per section 40A(3) of the Income Tax Act, 1961, an expenditure is disallowed if the assessee incurs any expenses in respect of which payment or aggregate of payments made to a person in a day, otherwise than by an account payee cheque drawn on bank or account payee draft, exceeds ? 10,000. However, in case of payment made for plying, hiring or leasing of goods carriage, limit is ₹ 35,000 instead of ₹ 10,000.

As per section 40A(3A) of the Income Tax Act, 1961, where an allowance has been made in the assessment for any year in respect of any liability incurred by the assessee for any expenditure and subsequently during any previous year the assessee makes payment in respect thereof, otherwise than by an account payee cheque drawn on a bank or account payee bank draft, the payment so made shall be deemed to be the profits and gains of business or profession and accordingly chargeable to income-tax as income of the subsequent year if the payments made to a person in a day, exceeds ₹ 10,000 (₹ 35,000 in case of plying, hiring or leasing of goods carriages).

Based on the above mentioned provisions, following conclusion may be drawn:

- Payments of 6 invoices of ₹ 5,000 each aggregating ₹ 30,000 made in cash on 4th July, 2020 need not be reported as the aggregate of payments do not exceed ₹ 35,000.

- Payments of 2 invoices of ₹ 18,000 each made in cash on 5th July, 2020 and 6th July, 2020 respectively aggregating ₹ 36,000 need not be reported as the payment do not exceed ₹ 35,000 in a day.

- Payment of ₹ 40,000 made in cash against an invoice for expenses booked in 2019-20 is likely to be deemed to be the profits and gains of business or profession under section 40A(3A) of the Income Tax Act, 1961. Thus, the details of such amount need to be furnished under clause 21(d)(B) of Form 3CD.

![]()

Question 27.

Mr. R, the Tax Auditor finds that some payments inadmissible under Section 40A(3) were made, and advised the client to report the same in Form 3CD. The client contends that cash payments were made since the other parties insisted upon the same and did not have Bank Accounts. Comment. [Nov. 10 (5 Marks)]

Answer:

Reporting for Cash payments above ₹ 10,000:

Clause 21(d) of Form 3CD requires tax auditor to report on disallowance under section 40A(3). Disallowance u/s 40A(3) of the Income Tax Act, 1961 is attracted if the assessee incurs any expenses in respect of which payment or aggregate of payments made to a person in a day, otherwise than by an account payee cheque drawn on bank or account payee draft, exceeds ₹ 10,000.

However, there are certain cases as specified in Rule 6DD, in which, disallowance under section 40A(3) would notbe attracted. Cash payment made on insistence of other parties on the contention that they do not have bank accounts is not covered under the list of exceptions provided under Rule 6DD.

In the present case, tax auditor is required to scrutinize on the basis of the examination of books of account and other relevant documents/evidence, whether the expenditure covered under section 40A(3) read with rule 6DD were made by account payee cheque drawn on a bank or account payee bank draft. If not, the same has to be reported under abovementioned clause.

Conclusion: Payments made by the XYZ Ltd. are inadmissible u/s 40A(3) of the Income Tax Act, 1961 and hence, needs to be reported under clause 21(d) of Form 3CD.

![]()

Question 28.

XYZ Ltd. pays ₹ 90,000 for its 10 employees to a Hotel as boarding and lodging expenses of such employees for a conference. The Company pays the amount in cash to the Hotel. The Hotel gives 10 bills each amounting to ₹ 9,000. The Company contends that each bill is within the limit, so there is no violation of the provisions of the Income Tax Act, 1961. As the tax auditor, how would you deal with the matter in your tax audit report for the Assessment Year 2021-22? [Nov. 14 (4 Marks)]

Answer:

Reporting for Cash payments above ₹ 10,000:

Clause 21(d) of Form 3CD requires tax auditor to report on disallowance under section 40A(3). Disallowance u/s 40A(3) of the Income Tax Act, 1961 is attracted if the assessee incurs any expenses in respect of which payment or aggregate of payments made to a person in a day, otherwise than by an account payee cheque drawn on bank or account payee draft, exceeds ₹ 10,000.

In the given case, the tax auditor found that a hotel issued 6 bills to XYZ Ltd. Each amounting to ₹ 9,000 for boarding & lodging expenses of 6 employees. XYZ Ltd. In aggregate has paid ₹ 90,000 to the hotel in cash. Consequently, no expenditure shall be allowed for deduction as per the provisions of section 40A(3).

Contention of the company that each bill is within the limit is not tenable since aggregate of payments need to be considered.

Conclusion: Payments made by the XYZ Ltd. are inadmissible u/s 40A(3) of the Income Tax Act, 1961 and hence, needs to be reported under clause 21(d) of Form 3CD.

![]()

Question 29.

Answer the following: As the tax auditor of a Company, how would you report on payments exceeding ? 10,000 made in cash to a supplier against an invoice for expenses booked in an earlier year?

Answer:

Reporting of payments exceeding ₹ 10,000 in cash:

- Reporting is required under clause 21(d) of Form 3CD for the payments exceeding ₹ 10,000 made in cash against an invoice for expenses booked in an earlier year.

- Section 40A(3A) disallowed an expense payment exceeding ₹ 10,000 made in cash against an invoice booked in an earlier year.

- Clause 21(d) of Form 3CD requires furnishing of the amount inadmissible u/s 40A(3) read with rule 6DD along with computation.

- The entire amount paid, is likely to be disallowed u/s 40A(3A) of the Income Tax Act, 1961.

Question 30.

You are the Tax auditor of BL & Co., a partnership firm engaged in the business of plying of Goods Carriages for the financial year 2020-21 having a turnover of Rs. 20 crores. How would you deal and report on the following:

(i) Payment of Rs. 50,000 in cash to Mr. R on 10th September, 2020 towards settlement of invoice for expenses accounted in financial year 2019-20.

(ii) Payments of 3 invoices of Rs. 15,000 each made in cash to Mr. Y on 8th, 9th, 10th, July, 2020 respectively. [Nov. 18-Old Syllabus (4 Marks)]

Answer:

Reporting of Payments Exceeding Rs. 10,000 in Cash:

Clause 21(d)(A) and 21(d)(B) of Form 3CD, requires tax auditor to scrutinize on the basis of the examination of books of account and other relevant documents/evidence, whether the expenditure covered under section 40A(3) and 40A(3A] respectively read with rule 6DD were made by account payee cheque drawn on a bank or account payee bank draft. If not, the same has to be reported under above mentioned clauses.

As per section 40A(3) of the Income-tax Act, 1961, an expenditure is disallowed if the assessee incurs any expenses in respect of which payment or aggregate of payments made to a person in a day, otherwise than by an account payee cheque drawn on bank or account payee draft, exceeds Rs. 10,000. However, in case of payment made for plying, hiring or leasing of goods carriage, limit is Rs. 35,000 instead of Rs. 10,000.

As per section 40A(3A) of the Income-tax Act, 1961, where an allowance has been made in the assessment for any year in respect of any liability incurred by the assessee for any expenditure and subsequently during any previous year the assessee makes payment in respect there of, otherwise than by an account payee cheque drawn on a bank or account payee bank draft, the payment so made shall be deemed to be the profits and gains of business or profession and accordingly chargeable to income-tax as income of the subsequent year if the payments made to a person in a day, exceeds Rs. 10,000 (Rs. 35,000 in case of plying, hiring or leasing of goods carriages).

Based on the above-mentioned provisions, following conclusion may be drawn:

- Reporting required under Clause 21(d)(B) w.r.t. payment of ₹ 50,000.

- Reporting required under Clause 21(d) (A) w.r.t. each payment as individual payment made on a day exceeds ₹ 10,000.

Note: Limit of ₹ 35,000 is not applicable as this limit is applicable when the payee is engaged in the business of plying of goods carriages. In this case, payer is engaged in the business of plying of goods carriages hence, limit of ₹ 10,000 will be applicable assuming that payee is not engaged in business of plying of goods carriages.

![]()

Question 31.

Mr. Sharma carries on the business of dealing and export of diamonds. For the year ended 31st March 2021, you as the tax auditor find that the entire exports are to another firm in U.S.A. which is owned by Mr. Sharma’s brother. Comment.

Answer:

Export Payments to a Relative:

- Clause 23 of Form 3CD, requires the tax auditor to specify particulars of payments made to persons specified u/s 40(A)(2)(b) of the Income Tax Act, 1961. Persons specified in the said section are relatives of an assessee and sister concerns, etc.

- In the instant case, however, Mr. Sharma has not made any payments to his brother. On the contrary, he must have received payments from him against exports made and, thus, this clause would not be applicable to him.

Auditor will nonetheless be still as a part of his normal audit planning would be required to verify whether the exports are genuine, i.e., whether the diamonds have been delivered by verifying the necessary delivery documents, relevant invoices, etc., the reasonableness of the price and whether the export realisations have been received.

![]()

Question 32.

As a tax auditor how would you deal and report the following: An assessee has paid rent to his brother ₹ 2,50,000 and paid interest to his sister ₹ 4,00,000. [Nov. 11 (2 Marks)]

Or

As an auditor appointed under section 44AB of the Income Tax Act, 1961, how would you verify and report on the following: The assessee has paid rent of ₹ 5 lakhs for premises to his brother. [Nov. 17 (3 Marks)]

Answer:

Reporting of payment of rent and interest to relative:

Clause 23 of Form 3CD requires the tax auditor to furnish the particulars of payments made to persons specified under Section 40A(2)(b) of the Income Tax Act, 1961. In relation to an individual, the specified persons include any relative of the assessee (i.e. Husband, Wife, Brother, Sister or any other Lineal Ascendant or Descendant).

In the present case, an assessee has paid rent to his brother and interest to his sister which may be disallowed if, in the opinion of the Assessing Officer, such expenditure is excessive or unreasonable having regard to:

- the fair market value of the goods, services or facilities for which the payment is made; or

- for the legitimate needs of business or profession of the assessee; or

- the benefit derived by or accruing to the assessee from such expenditure.

Conclusion: Auditor is required to report the payments made to specified persons.

“ICAI Examiner Comments”

Examinees have discussed generally on vouching and verification aspects instead of mentioning the reporting requirements of Tax auditor. Some examinees failed to explain with reference to Clause 23 of Form 3CD for reporting the particulars of payments made to persons : specified under section 40A(2)(b) of the Income Tax Act, 1961. Instead of explaining Tax audit ; requirements few examinees wrongly discussed AS 18 and SA 550 on “Related parties”.

![]()

Question 33.

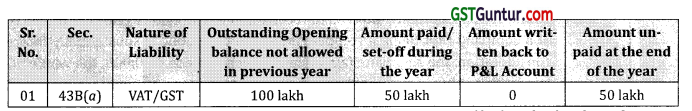

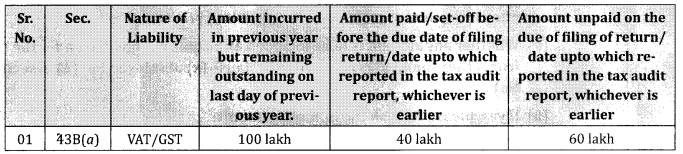

You are doing Tax Audit of Private Limited Company for the financial year.ending 31st March, 2021. During audit, you notice that the company is not regular in deposit of VAT/GST and there remains pendency every year. The details of VAT/GST payable are:

- GST payable as on 31/03/2020 of FY 2019-20 was ₹ 200 Lakh and out of which ₹ 100 Lakh was paid on 15/09/2020 and ₹ 50 Lakh on 30/03/2021 and balance of ₹ 50 Lakh is outstanding.

- GST payable of current financial year 2020-21 was ₹ 100 lakh and out of this, 40 Lakh was paid on 25/05/2020 and balance of ₹ 60 Lakh remained unpaid till the due date of return.

The date of Tax Audit report and due date of return was 30th September.

Now as a Tax Auditor, how/where the said transaction will be reflected in Tax Audit Report under Section 43B(a)? [MTP-Oct. 19, RTP-Nov. 19]

Answer:

Reporting in Tax Audit Report:

Any amount of GST/Tax payable on the last day of previous year (opening balance) as well as on the last day of current year has to be reported in Tax Audit Report under clause 26(A) and 26(B) in reference of section 43B.

Clause 26(A) dealt GST/VAT payable on the pre-existed of the first day of the previous year but was not allowed in the assessment of any preceding previous year and was either paid (clause 26(A)(a))/or and, not paid during the previous year (clause 26(A)(b)}

The details will be as under in regard to opening balances:

Liability Pre-existed on the previous year.

It has been assumed that 100 lakh was allowed in last year as it was paid before the due date of return.

Liability incurred during the previous year

![]()

Question 34.

How will you verify the Income & Expenditure of earlier years credited/debited in current year for reporting under clause 27(b) of 3CD while carrying out Tax Audit u/s 44AB of the Income Tax Act, 1961? [Nov. 19 – Old Syllabus (5 Marks)]

Answer:

Reporting under Clause 27(b) of Form 3CD:

Clause 2 7 (b) requires the tax auditor to report particulars of income or expenditure of prior period credited or debited to the profit and loss account. Information under clause 27(b) would be relevant only in those cases where the assessee follows mercantile system of accounting.

The tax auditor may perform following procedures for the purpose of reporting under clause 2 7(b):

(i) Ask the assessee to furnish a schedule indicating particulars of expenditure/incdme of any earlier year debited/credited to the Profit & Loss account of the relevant previous year.

(ii) Verify various expenses account to see whether any expenditure pertaining to any earlier year has been debited to the profit and loss account. For example, an assessee might have paid some certification fee etc., for four years in the year under audit. In that case payment of expenses for previous three years would be prior period payment.

(iii) Also see that all such items are properly disclosed.

(iv) Check while conducting the routine audit, that there is no expenditure/income relating to earlier years that has not been mentioned in the particulars furnished by the assessee.

(v) In case of cash system of accounting, there will be no amount to be disclosed under this head.

![]()

Question 35.

ABC Pvt. Ltd. was XYZ Pvt. Ltd. are the Companies in which public are not substantially interested. During the previous year 2020-21, ABC Pvt. Ltd. received some property being shares of XYZ Pvt. Ltd. The details of which are provided below:

No. of shares – 1000

Face Value – ₹ 10 per share

Aggregate Fair Market Value – ₹ 1,00,000

Consideration Value – Nil

As the tax auditor how would you deal with the situation? [May 16 (4 Marks), MTP-April 18]

Answer:

Reporting requirement in Form 3CD:

Clause 28 of Form 3CD requires the auditor to report “Whether during the previous year the assessee has received any property, being share of a company not being a company in which the public are substantially interested, without consideration or for inadequate consideration as referred to in section 56(2) (viia), if yes, please furnish the details of the same”

Section 56(2) (viia) provides that where a firm or a company not being a company in which the public are substantially interested, receives, in any previous year any property being shares of a company (not being a company in which the public is substantially interested, without consideration, the aggregate fair value of which exceeds ₹ 50,000, the whole of the aggregate fair market value of such property shall be chargeable to income-tax under the head “Income from other sources”. Finance Act, 2017 amends Sec. 56(2), in accordance with which provisions of Section 56(2)(viia) are not applicable for transactions taken place on or after 01.04.2017.

This transaction now, falls under clause (x) of Sec. 56(2). For transactions falling u/s 56(2)(x), reporting is required as per Clause No. 29B, which provides as follow:

(a) Whether any amount is to be included as income chargeable under the head ‘income from other sources’ as referred to in clause (x) of sub-section (2) of section 56? (Yes/ No)

(b) If yes, please furnish the following details:

- Nature of income;

- Amount (in Rs.) thereof.

“ICAI Examiner Comments”

Candidates, in general, were not aware of the Section 56(2) (viia) of the Income Tax Act, 1961 and clause 28 of Form 3CD. Quite a few treated it as capital gain instead of “income from other sources”

![]()

Question 36.

While doing Tax Audit, under section 44AB of the Income-tax Act, 1961, of the accounts of Glue Private Limited for the Assessment Year 2021-22, it was found that during the Financial Year 202021, Glue Private Limited had received 9,000 shares, the market value of which was Rs. 90,000 on the date of transfer, at a price of Rs. 45,000 from Stick Private Limited. The Management of Glue Private Limited maintained that the transaction was-as per the terms of negotiations and there would be no cause for the Auditor to bring this matter in his Tax Audit Report-Comment. [Nov. 18 – New Syllabus (5 Marks)]

Answer:

Reporting requirement in Form 3CD:

Clause 28 of Form 3CD requires the auditor to report “Whether during the previous year the assessee has received any property, being share of a company not being a company in which the public are substantially interested, without consideration or for inadequate consideration as referred to in section 56(2) (viia), if yes, please furnish the details of the same”.

Section 56(2) (viia) provides that where a firm or a company not being a company in which the public are substantially interested, receives, in any previous year any property being shares of a company (not being a company in which the public is substantially interested, without consideration, the aggregate fair value of which exceeds Rs. 50,000, the whole of the aggregate fair market value of such property shall be chargeable to income-tax under the head “Income from other sources”. Finance Act, 2017 amends Sec. 56(2), in accordance with which provisions of Section 56(2)(viia) are not applicable for transactions taken place on or after 01.04.2017.

This transaction now, falls under clause (x) of Sec. 56(2). For transactions falling u/s 56(2) (x), reporting is required as per Clause No. 29B, which provides as follow:

(a) Whether any amount is to be included as income chargeable under the head ‘income from other sources’ as referred to in clause (x) of sub-section (2) of section 56? (Yes/ No)

(b) If yes, please furnish the following details:

- Nature of income;

- Amount (in Rs.) thereof.

As per Sec. 56(2) (x), where any person receives, in any previous year, from any person or persons on or after the 1st day of April, 2017, any property, other than immovable property, for a consideration which is less than the aggregate FMV of the property by an amount exceeding ? 50,000, the aggregate FMV of such property as exceeds such consideration, shall be chargeable to income-tax under the head “Income from other sources”.

Conclusion: In the present case, difference of Fair Market Value and consideration paid is lower than Rs. 50,000, auditor is required to state the answer with “No”.

![]()

Question 37.

AB Ltd. is a company in which public are not substantially interested. During the previous year 2020-21, the company issued shares to residents of India and provides you the following data related to such issue:

No. of shares issued – 1,00,000

Face Value – ₹ 10 per share

Fair Market’Value (FMV) – ₹ 60 per share

Consideration received – ₹ 80 per share

The management of the company contends that, it is a normal issue of shares, thus, needs not to be reported. As the tax auditor of AB Ltd., how would you deal with the matter in your tax audit report?

Answer:

Reporting for Issue of Shares for Value Exceeding Fair Market Value:

Clause 29 of Form 3CD requires tax auditor to report whether, the assessee received any consideration for issue of shares which exceeds the fair market value of the shares as referred to in section 56(2)(viib) of the Income Tax Act, 1961.

Section 56(2)(viib) provides that where a company, not being a company in which the public are substantially interested, receives, in any previous year, from any person being a resident, any consideration for issue of shares that exceeds the face value of such shares, the aggregate consideration received for such shares as exceeds the fair market value of the shares shall be chargeable to income-tax under the head “Income from other sources”.

In the present case, AB Ltd. is a company, in which public is not substantially interested. Company has received consideration for issue of shares of ₹ 80 per share (Face value ₹ 10 per share + Premium ₹ 70 per share) which exceeds the face value of ₹ 10 per share and fair market value of the shares of ₹ 60 per share, and hence the case covered u/s 56(2)(viib).

Conclusion: Tax auditor of AB Ltd. is required to furnish the details of shares issued under clause 29 of Form 3CD.

![]()

Question 38.

As a tax auditor how would you deal and report the following: An assessee has borrowed ₹ 50 Lakhs from various persons. Some of them by way of cash and some of them by way of Account payee cheque/draft. (Nov. 11 (3 Marks)]

Or

As an auditor appointed under section 44AB of the Income Tax Act, 1961, how would you verify and report on the following: The assessee has borrowed ₹ 50 lakhs from various persons partly in cash and partly by account payee cheque. [Nov. 17 (3 Marks)]

Answer:

Reporting of Borrowing in Form 3CD:

Clause 31(a) of Form 3CD requires tax auditor to report on below mentioned particulars of each loan or deposit for an amount exceeding the limit specified in section 269SS taken or accepted during the previous year:

- name, address and permanent account number (if available with the assessee) of the lender or depositor;

- amount of loan or deposit taken or accepted;

- whether the loan or deposit was squared up during the previous year;

- maximum amount outstanding in the account at any time during the previous year;

- whether the loan or deposit was taken or accepted by cheque or bank draft or use of electronic clearing system through a bank account;

- in case the loan or deposit was taken or accepted by cheque or bank draft, whether the same was taken or accepted by an account payee cheque or an account payee bank draft.

Conclusion: Auditor should verily the compliance with the provisions of section 2 69SS of the Income Tax Act and report the same under Clause 31(a) of Form 3CD.

“ICAI Examiner Comments”

Examinees failed to explain with reference to clause 31 of Form 3CD for reporting on the mode of amount borrowed. Few examinees have discussed generally on vouching and verification aspects instead of mentioning the reporting requirements of Tax auditor. Few examinees mixed up section 40A(3) of the Income-tax Act, 1961 on disallowance of cash payments i exceeding ₹ 20000 instead of explaining the provisions of section 269SS.

![]()

Question 39.

Discuss the reporting requirements in Form 3CD of the Tax Audit Report u/s 44AB of the Income-tax Act, 1961 for the Brought forward loss or depreciation allowance.

Answer:

Reporting requirements for Brought forward loss or depreciation allowance in Form 3CD:

Clause 32(a) of Form 3CD requires the following details of brought forward loss or depreciation allowance, in the following manner, to the extent available:

| 1 | Serial Number |

| 2 | Assessment Year |

| 3 | Nature of loss/allowance (in rupees) |

| 4 | Amount as returned (in rupees)* |

| 5 | All losses/allowances not allowed u/s 115BAA |

| 6 | Amount as adjusted by withdrawal of additional depreciation on account of opting for taxation u/s 115BAA^ |

| 7 | Amounts as assessed (give reference to relevant order) |

| 8 | Remarks |

*If the assessed depreciation is less and no appeal pending than take assessed.

To be filled in for assessment year 2020-21 only.”

![]()

Question 40.

Tiger Ltd., is a company engaged in the production of wool. Along with its production business, it is also engaged in buying and selling of securities with the expectation of a favourable price change. During the year, its speculation loss on account of purchase and sale of securities was to the tune of ₹ 12 lacs.

As a tax auditor, what is the reporting requirement in Form 3CD u/s 44AB of the Income Tax Act, 1961? [May 18 – Old Syllabus (4 Marks)]

Answer:

Reporting Requirement Under Clause (32)(e) of Form 3CD:

Clause 32(e) of Form 3CD requires the auditor to furnish the details of speculation loss if any incurred during the previous year, in case of a company which is deemed to be carrying on a speculation business.

Explanation to section 73 provides that where any part of the business of a company consists in the purchase and sale of shares of other companies, such company shall, for the purposes of this section, be deemed to be carrying on a speculation business to the extent to which the business consists of the purchase and sale of such shares.

In the present case, SL Pvt. Ltd. is engaged in production business and side by side dealing in buying and selling of securities with the intention of speculation and during the current financial year, hence the company will be deemed to be carrying on a speculation business.

Conclusion: Tax auditor of is required to furnish the details under Clause 32(e) of Form 3CD with respect to the speculation loss of? 12 lakhs made during the year.

![]()

Question 41.

Discuss the reporting requirement in Form 3CD of Tax Audit Report under Section 44AB of the Income-tax Act, 1961 for the Tax Deducted at Source.

Answer:

Reporting requirement for Tax Deducted at Source in Form 3CD:

Clause 34(a) of Form 3CD requires the auditor to furnish below mentioned information if the assessee is required to deduct or collect tax as per the provisions of Chapter XVII-B or Chapter XVII-BB:

- Tax deduction and collection Account Number (TAN)

- Section

- Nature of payment

- Total amount of payment or receipt of the nature specified in (3)

- Total amount on which tax was required to be deducted or collected out of (4)

- Total amount on which tax was deducted or collected at specified rate out of (5)

- Amount of tax deducted or collected out of (6)

- Total amount on which tax was deducted or collected at less than specified rate out of (7)

- Amount of tax deducted or collected on (8)

- Amount of tax deducted or collected not deposited to the credit of the Central Government out of (6) and (8)

![]()

Question 42.

ABC Printing Press, a proprietary concern, made a turnover of above ₹ 103 lacs for the year ended 31.03.2021. The Management explained its auditor Mr. Z, that it undertakes different job work orders from customers. The raw materials required for every job are dissimilar. It purchases the raw materials as per specification/requirements of each customer, and there is hardly any balance of raw materials remaining in the stock, except pending work-in-progress at the year end. Because of variety and complexity of materials, it is rather impossible to maintain a stock-register. Give your comments. [Nov. 09 (5 Marks), RTP-May 20]

Answer:

Non-maintenance of stock register:

As per requirement of Para 35(b) and Para 11(b) of Form 3CD, auditor is required to report on the details of stock and account books (including stock register) maintained.

Auditor need to verify the closing stock of raw materials and finished products and by-products of the entity. In case the details are not properly maintained, he has to specifically mention the same, with reasons for non-maintenance of stock register by the entity.

The explanation of the entity for the use of varieties of raw materials for different jobs undertaken may be valid. But the auditor needs to verily the specified job-orders received and the different raw materials purchased for each job separately. The auditor may also enquire with the other similar printers in the locality to ensure the prevailing custom.

Conclusion: Auditor is required to report under Para 35(b) and 11(b) about non-maintenance of stock register.

![]()

Question 43.

Discuss the reporting requirements in Form 3CD of the Tax Audit Report u/s 44AB of the Income-tax Act, 1961 for the Tax on distributed profits.

Answer:

Reporting for tax on distributed profits in Form 3CD:

Clause 36 of Form 3CD requires the following reporting requirements in the case of a domestic company, w.r.t. tax on distributed profits under section 115-0 in the following form:

(a) total amount of distributed profits;

(b) amount of reduction as referred to in section 115-0(1A)(i);

(c) amount of reduction as referred to in section 115-0(1A)(ii);

(d) total tax paid thereon;

(e) dates of payment with amounts.

Question 44.

ABC Ltd., having principal place of business in Delhi, is engaged in the generation, transmission, distribution and supply of electricity throughout the India. The management of the company came to know that the provisions related to maintenance of cost records and cost audit are applicable to the company. The company, therefore, appointed a cost auditor for the financial year 2020-21.

The cost auditor reported certain disqualifications in Form CRA-3 of the cost audit report to which the management of the company disagreed.

The management of ABC Ltd. instructed its tax auditor not to reveal any of the disqualifications related to the cost audit while filling particulars to be furnished in Form No. 3CD contending that the disqualifications are not relevant and there is no correlation between tax audit and cost audit as well. As a tax auditor, how would you deal with the matter? [MTP-Aug. 18]

Answer:

Reporting Requirement for Disqualifications in Cost Audit Report:

Clause (3 7) of Form 3 CD requires cost auditor to comment upon whether cost audit was carried out and if yes, details of disqualification or disagreement on any matter/item/value/quantity as may be identified by the cost auditor should be reported.

For this purpose, tax auditor should obtain the copy of cost audit report from the assessee. Tax auditor is not required to make any detailed study of such report, he is required to take note of the details of disqualification on any matter/item/value/quantity as may be reported by the cost auditor.

In the present case, the cost auditor of ABC Ltd. has reported certain disqualifications in Form CRA-3 of the cost audit report. Tax auditor of is required to provide the details of disqualifications reported by the cost auditor as per Clause (37) of the Form 3CD.

Conclusion: Contention of management is not acceptable as auditor is required to provide the details of disqualifications on any matter/item/value/quantity as may be reported/identified by cost auditor under clause 37 of Form 3CD.

![]()

Question 45.

Write a short note on – Accounting ratios in Form 3 CD of Tax Audit.

Or

As a tax auditor, which are the accounting ratios required to be mentioned in the report in case of manufacturing entities? Explain in detail any one of the above ratios and how does it help the tax auditor in his analytical review.

Answer:

Accounting Ratios in Form 3CD:

Clause 40 of Form 3CD requires the details regarding turnover, gross profit, etc., for the previous year and preceding previous year as mentioned below:

| Serial number | Particulars | Previous year | Preceding previous year |

| 1. | Total turnover of the assessee | ||

| 2. | Gross profit/turnover | ||

| 3. | Net profit/turnover | ||

| 4. | Stock-in-trade/turnover | ||

| 5. | Material consumed/finished goods produced |

The details required to be furnished for principal items of goods traded or manufactured or services rendered. These ratios have to be given for the business as a whole and not product wise.

Details of Profitability Ratio: By relating sales with the Gross profit or net profit, auditor may ascertain the operating efficiency of an enterprise. Auditor is required to inquire any variations in any of these ratios. The fall in the gross profit ratio and net profit ration alert the auditor who, in turn should ask the management for the reasons thereof and which should be’ carefully examined by him.

Details of Stock in trade/Turnover Ratio: The relationship of stock-in-trade to turnover over a period of time would reveal whether the entity has been accumulating stocks or there is a decline in the same. The auditor may obtain data for about 4-5 years, compute ratio of stock-in-trade/turnover and compare the change made. A study of this relationship would reveal whether stocks are being accumulated or they are dwindling over a period. Such information would provide an input to tax auditor as to whether figures of either stock or turnover are being manipulated.

![]()

Question 46.