Students should practice Assessment of Trusts – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Assessment of Trusts – CS Executive Tax Laws MCQ Questions

Question 1.

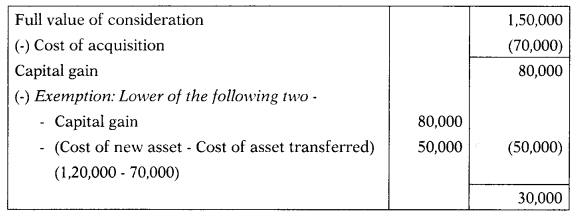

Ramji Charitable Trust had sold a capital asset costing ₹ 70,000 on 13th June 2020 for ₹ 1,50,000. It purchased new assets on 1st July 2020 for ₹ 1,20,000.

The amount taxable as capital gains for Ramji Charitable Trust after exemption u/s 11(1 A) in A.Y. 2021-22 is

(A) ₹ 80,000

(B) Nil, because of charitable trust

(C) ₹ 30,000

(D) ₹ 40,000 [Dec. 2015]

Hint:

Answer:

(C) ₹ 30,000

Question 2.

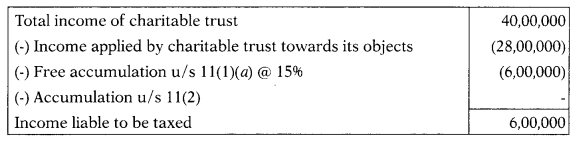

A charitable trust registered u/s 12AA has a total income of ₹ 40 lakhs, it spent ₹ 28 lakh, towards its objects.

The total income of the trust chargeable to income-tax would be –

(A) Nil

(B) ₹ 12 lakh

(C) ₹ 6 lakh

(D) ₹ 2 lakh [Dec. 2016]

Hint:

Answer:

(C) ₹ 6 lakh

Question 3.

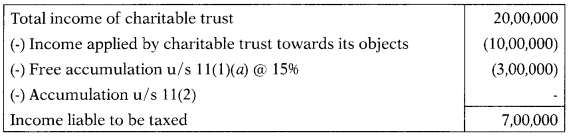

Ray Charitable Trust (registered under section 12AA) has a total income of ₹ 20 lakh. It applied ₹ 10 lakh towards its objects.

How much is chargeable to tax in case the trust does not opt for accumulation of income under section 11(2) of the Act?

(A) ₹ 10 lakh

(B) ₹ 7 lakh

(C) ₹ 5 lakh

(D) ₹ 3 lakh [Dec. 2017]

Hint:

Answer:

(B) ₹ 7 lakh

Question 4.

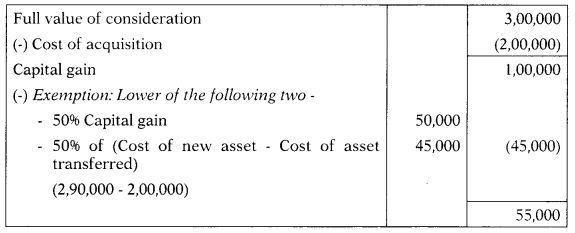

Ram Kripa Charitable Trust owns a capital asset of ₹ 2,00,000 and half of the income from such asset is utilized for charitable purposes. The asset was sold for ₹ 3,50,000 and from the sale proceeds, the trust bought another asset for ₹ 2,90,000.

The amount taxable as capital gains:

(A) ₹ 55,000

(B) ₹ 45,000

(C) ₹ 10,000

(D) None of the above [June 2018]

Hint:

Answer:

(A) ₹ 55,000

Question 5.

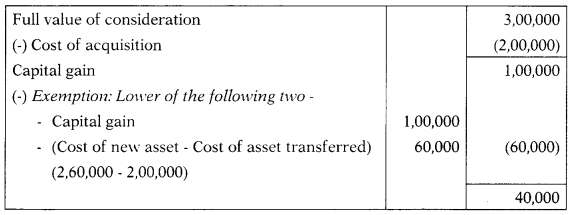

A capital asset purchased on 11th Sept. 2014 for ₹ 2,00,000 was sold for ₹ 3,00,000 on 18th Dec. 2020 by a Charitable Trust registered under section 12AA of the Income Tax Act. New capital assets after the sale were purchased on 1st January 2021 for ₹ 2,60,000.

The amount of capital gain arising from the sale of capital asset utilized in the purchase of a new asset for the A.Y. 2021-22 shall be and the taxable amount shall be

(A) ₹ 40,000 and ₹ 60,000

(B) ₹ 1,00,000 and ₹ 2,60,000

(C) ₹ 2,60,000 and ₹ 1,00,000

(D) ₹ 60,000 and ₹ 40,000 [Dec. 2018]

Hint:

Answer:

(D) ₹ 60,000 and ₹ 40,000

Question 6.

A charitable trust registered as per section 12AA of Income-tax Act, having capital asset purchased in June 2017 for ₹ 1,00,000 and used for charitable purposes till the same was sold in December 2020 for ₹ 1,50,000. The Trust, after the sale of capital assets, purchased a new capital asset for ₹ 1,20,000 which was also used for charitable purposes of the Trust. The amount of capital gain utilized in pur¬chase of new capital asset by Trust shall be

(A) ₹ 20,000

(B) ₹ 50,000

(C) ₹ 30,000

(D) Nil [Dec. 2019]

Answer:

(A) ₹ 20,000

Question 7.

Samode Charitable Trust formed under the Trust Deed on 1st May 2020 filed an application for grant of registration u/s 12AA of the Act to the CIT (Exemption) on 13th May 2020. The CIT (Exemption) did not pass any order as to Registration of the Trust, till 31 st March 2021. The trust shall be deemed to have the registration as per provisions of Act under section 12AA effective from

(A) 1st May 2020

(B) 1st December 2020

(C) 13th May 2020

(D) 13th November 2020 [Dec. 2019]

Hint:

Both options B/D are correct. Option B: As per section 12AA(2), every order granting or refusing registration shall be passed before the expiry of six months from the end of the month in which the application was received. If no order has been passed, then it is considered as deemed registration has been granted option D: In the case of CIT v. Society for the Promotion of Education, it has been held that if no order has been passed, then it is considered as deemed registration has been granted after the expiry of 6 months from the date of application.

Answer:

(B) 1st December 2020 / (D) 13th November 2020