Students should practice Assessment of Partnership Firms, LLP, AOP & BOI – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Assessment of Partnership Firms, LLP, AOP & BOI – CS Executive Tax Laws MCQ Questions

Question 1.

Profit earned during the year by a partnership firm is ₹ 1,40,000.

The maximum amount of remuneration deductible from profit is

(A) ₹ 1,26,000

(B) ₹ 1,40,000

(C) ₹ 1,50,000

(D) ₹ 50,000 [Dec. 2014]

Hint:

As per section 40(b) deduction allowable to partnership firm on the first ₹ 3,00,000 of book profit or in case of loss is 90% of book profit or ₹ 1,50,000 whichever is more. As book profit is only ₹ 1,40,000, the firm can get the deduction of ₹ 1,50,000.

Answer:

(C) ₹ 1,50,000

Question 2.

Under the Income-tax Act, 1961, Partnership Firm is chargeable to tax @:

(A) 30% plus H&EC or AMT @ 18.596 plus H&EC

(B) 30% plus H&EC or AMT @ 17.596 plus H&EC

(C) 30% plus H&EC or MAT @ 18.596 plus H&EC

(D) 30% plus H&EC or MAT @ 18.596 plus H&EC [June 2015]

Answer:

(A) 30% plus H&EC or AMT @ 18.596 plus H&EC

Question 3.

Under the Income-tax Act, 1961, interest on capital received by a partner from a partnership firm is chargeable under the head

(A) Profits and gains of business or profession

(B) Income from other sources

(C) Capital gains

(D) None of the above [June 2015]

Answer:

(A) Profits and gains of business or profession

Question 4.

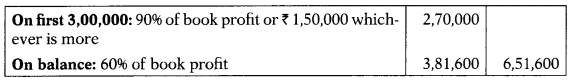

A non-professional firm M/s Bright has book profits of ₹ 9,36,000.

The admissible remuneration to working partners for the income-tax purpose shall be

(A) ₹ 6,51,600

(B) ₹ 6,81,600

(C) ₹ 2,70,000

(D) None of the above [June 2015]

Hint:

Answer:

(A) ₹ 6,51,600

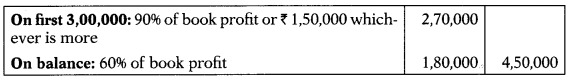

Question 5.

When an LLP has a book profit of ₹ 6 lakhs, the maximum amount allowable towards the salary of working partners would be

(A) ₹ 4,50,000

(B) ₹ 6,00,000

(C) ₹ 3,00,000

(D) Nil [Dec. 2015]

Hint:

Answer:

(A) ₹ 4,50,000

Question 6.

When a partnership firm has total sales of ₹ 90 lakhs, the maximum amount deductible as the salary of working partners on the basis of presumptive income determined u/s 44AD is

(A) ₹ 5,22,000

(B) ₹ 3,60,000

(C) ₹ 3,30,000

(D) Nil [Dec. 2015]

Hint:

Deduction to firm u/s 40(b) is not available if the firm opts for the presumptive taxation scheme referred to in Section 44AD.

Answer:

(D) Nil

Question 7.

From a tax point of view, a limited liability partnership (LLP) is treated as

(A) Sole trader concern

(B) General partnership firm

(C) Private limited company

(D) Public limited company. [Dec. 2015]

Answer:

(B) General partnership firm

Question 8.

The book profit of a partnership firm is ₹ 1,20,000. The actual remuneration paid to working partners is ₹ 3,54,000.

The allowable deduction under Section 40(b) towards remuneration to partners is

(A) ₹ 1,50,000

(B) ₹ 3,54,000

(C) ₹ 1,08,000

(D) ₹ 1,20,000 [June 2016]

Hint:

As per Section 40(b) deduction allowable to partnership firm on the first ₹ 3,00,000 of book profit or in case of loss is 90% of book profit or ₹ 1,50,000, whichever is more. As book profit is only ₹ 1,20,000, the firm can get de-duction of ₹ 1,50,000.

Answer:

(A) ₹ 1,50,000

Question 9.

When a non-domestic company is a member of an AOP and its share of profit is indeterminate, the tax on the total income of the AOP is charged at the

(A) Nominal rate

(B) Maximum marginal rate

(C) Rate applicable to the company

(D) Least of the above three rates [June 2016]

Answer:

(C) Rate applicable to the company

Question 10.

Salary received by a partner from his partnership firm is considered in his personal assessment as

(A) Income from salary

(B) Profit from business or profession

(C) Income from other sources

(D) Exempted income [June 2016]

Answer:

(B) Profit from business or profession

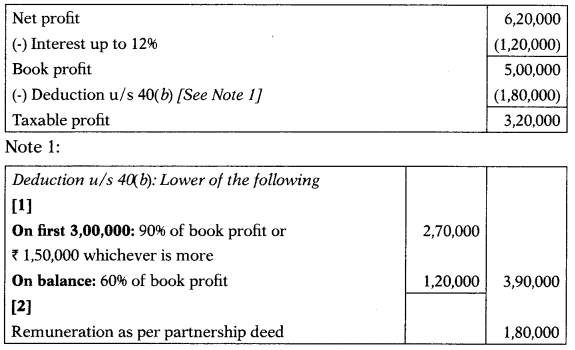

Question 11.

A partnership firm had net profit of ₹ 6,20,000 before deducting interest on capitals to partners @ 1596 of ₹ 1,50,000 and working partners salary of ₹ 1,80,000 (as per deed of partnership) total income of firm chargeable to tax with the –

(A) ₹ 1,10,000

(B) ₹ 3,20,000

(C) ₹ 2,90,000

(D) ₹ 1,00,000 [Dec. 2016]

Hint:

Answer:

(B) ₹ 3,20,000

Question 12.

An association of persons (AOP) has paid tax at the maximum marginal rate. Yash, a member of AOP received ₹ 1 lakh as his share income.

Such income is chargeable to tax in his assessment @

(A) 10%

(B) Nil

(C) 20%

(D) 30% [Dec. 2016]

Answer:

(B) Nil

Question 13.

If an LLP claims a deduction under Section 35AD, the provisions of Alternate Minimum Tax (AMT) under Section 115JC will apply when the adjusted total income exceeds

(A) ₹ 10 i.e. no limit

(B) ₹ 10 lakh

(C) ₹ 20 lakh

(D) ₹ 3 Crore [Dec. 2016]

Hint:

Limit of ₹ 20,00,00 of ATI is only for individual/HUF.

Answer:

(A) ₹ 10 i.e. no limit

Question 14.

Surabi Textiles (firm) incurred a business loss of ₹ 4,40,000 for the assessment year 2021-22 before the allowance of working partner salary. The firm paid a working partner salary of ₹ 1,20,000 each to three partners.

The business income of the firm for the assessment year 2021-22 after deduction of working partner salary is:

(A) Loss ₹ 5,90,000

(B) Loss ₹ 4,40,000

(C) Loss ₹ 80,000

(D) Loss ₹ 8,00,000 [June 2017]

Hint:

Remuneration to working partners:

[A]

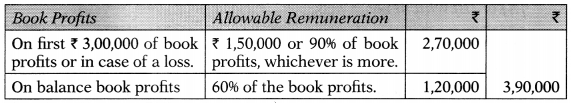

| On first ₹ 3,00,000 of book profits or in case of a loss. | ₹ 1,50,000 or 90% of book profits, whichever is more. |

| On balance book profits | 60% of the book profits. |

[B]

| Book Profit | (4,40,000) |

| (-) Deduction u/s 40(b) | (1,50,000) |

| Income/(loss) under the head PGBP | (5,90,000) |

Answer:

(A) Loss ₹ 5,90,000

Question 15.

The provisions of alternate minimum tax under section 115JC are applicable for limited liability partnership when the adjusted total income exceeds:

(A) ₹ 10 lakh

(B) ₹ 20 lakh

(C) ₹ 100 lakh

(D) ₹ 5 lakh [June 2017]

Hint:

Special provisions for payment of tax by certain persons other than a company [Section 115JC]: Provisions shall be applicable to, a person, other than a company, whose regular income-tax payable for a previous year is less than the Alternate Minimum Tax (AMT) payable.

Adjusted total income to be deemed income: If regular income-tax payable for a previous year is less than the alternate minimum tax payable then the adjusted total income shall be deemed to be the total income of that person for such previous year and he shall be liable to pay tax on such income @ 18.5% of adjusted total income.

Provisions applicable when adjusted total income exceeds ₹ 20 lakh: The above provisions shall apply to an individual or for an AOP/BOIor an artificial juridical person if the adjusted total income exceeds ₹ 20 lakh.

Thus, the above relaxation is not available to LLP. Hence, none of the given options is correct.

Answer:

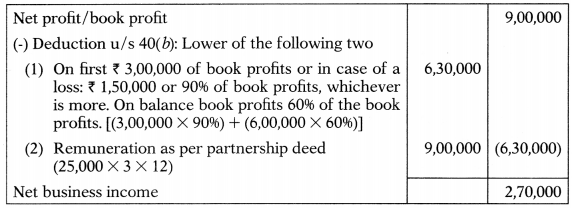

Question 16.

Murali & Co. a partnership firm consisting of 3 partners is engaged in the textile trade. Its net profit before allowing interest on capital and working partner salary to partners was ₹ 9 lakhs. The partnership deed does not provide for interest on capital. It provides for working partner salary at ₹ 25,000 per month each for all the 3 partners.

The income of the firm after the allowance of working partner salary would be:

(A) ₹ 90,000

(B) ₹ 2,70,000

(C) Nil

(D) ₹ 3,60,000 [Dec. 2017]

Hint:

Answer:

(B) ₹ 2,70,000

Question 17.

The provisions of Alternate Minimum Tax (AMT) will apply only when the adjusted total income computed under section 115JC exceeds:

(A) ₹ 5 lakh

(B) ₹ 20 lakh

(C) ₹ 50 lakh

(D) ₹ 100 lakh [Dec. 2017]

Hint:

Only for individual/HUF → ATI should exceed ₹ 20,00,000. For LLP/Firm, there are no such criteria.

Answer:

(B) ₹ 20 lakh

Question 18.

Mr. Vijay is a partner in Tools & Co., a partnership firm in Mumbai. He received ₹ 30,000 as share income from the firm for the year ended 31.3.2021. He also received interest at 12% per annum on the capital invested in the firm and the amount being ₹ 24,000.

His income from the firm includible in individual assessment is:

(A) ₹ 54,000

(B) ₹ 24,000

(C) ₹ 30,000

(D) Nil [Dec. 2017]

Hint:

Share income of a person being a partner of a firm (includes LLP) which is separately assessed as such is exempt from tax.

In computing the income under the head PGBP of a Firm, interest to partner in excess of 12% simple interest p.a. shall be disallowed. In other words interest, up to 12% is taxable in the hands of a partner in his individual capacity and Interest above 12% is taxable in the hands of the firm.

Hence, only ₹ 24,000 will be taxable in the hands of Vijay.

Answer:

(B) ₹ 24,000

Question 19.

Ram & Co., a partnership firm, worked out total book profits for the year ended 31st March 2021 at ₹ 5,00,000. The firm has made payment of salary of ₹ 4,60,000 authorized by the deed to the working partners and wants to know that how much amount of salary paid to partners is allowable:

(A) Actual salary paid of ₹ 4,60,000

(B) ₹ 3,90,000

(C) ₹ 2,70,000

(D) ₹ 2,50,000 [June 2018]

Hint:

Remuneration to working partners:

[A]

[B] Remuneration as per partnership deed 4,60,000

[A] or [B] whichever is less.

Hence, remuneration allowed as per Section 40(h) is ₹ 3,90,000.

Answer:

(B) ₹ 3,90,000

Question 20.

DJPA, LLP, resident in India has received a dividend of ₹ 15 lakh from R Ltd., an Indian company.

The amount of tax payable by DJPA, LLP in respect of such dividend income for A.Y. 2021-22 shall be:

(A) ₹ 5 lakh

(B) ₹ 10 lakh

(C) ₹ 4,68,000

(D) ₹ 78,000 [Dec. 2018]

Hint:

W.e.f. 1/4/2020, DDT u/s 115-0 is not applicable ie. Co. will not be liable to pay DDT. The recipient has to pay tax on dividend received :

15,00,000 × 31.20% = 4,68,000.

Answer:

(B) ₹ 10 lakh

Question 21.

The tax shall be charged on the total income of the AOP at the maximum marginal rate under the provisions of Section 167B of Income Tax Act, 1961:

(A) Where individual shares of the members of an association or body are indeterminable or unknown in relation to the whole of the income

(B) Where members share equally

(C) Where the individual shares of the members of an associate or body are indeterminable or unknown relating to any part of the income

(D) Both (A) and (C) [Dec. 2018]

Answer:

(D) Both (A) and (C)

Question 22.

Ram & Co., a partnership firm worked out total book profits for the year ended 31st March 2021 of ₹ 6,00,000 and has made payment of salary of ₹ 4,60,000 authorized by the partnership deed to the working partners. The firm wants to know that how much amount of salary paid to partners be allowable as deduction in A.Y. 2021-22.

(A) ₹ 4,60,000

(B) ₹ 3,90,000

(C) ₹ 2,70,000

(D) ₹ 4,50,000 [Dec. 2019]

Hint:

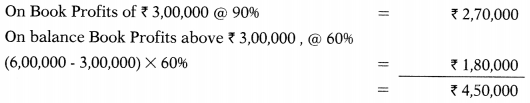

Computation of deductible salary payable to partners:

Lower of following 2:

a. Salary as debited: ₹ 4,60,000 OR;

b. Ceiling Limit u/s 40(b):

Therefore, Allowable remuneration to partners shall be ₹ 4,50,000, being lower of the two.

Answer:

(D) ₹ 4,50,000