Assessment of Charitable/ Religious Trusts, Political Parties & Electoral Trusts – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Assessment of Charitable/ Religious Trusts, Political Parties & Electoral Trusts – CA Final DT Question Bank

Taxation of Political Parties & Electoral Trust

Question 1.

(i) An electoral trust approved by the Central Board of Direct Taxes is not liable to income-tax in respect of voluntary contribution received and other income. Discuss the correctness of the statement.

(ii) What is the effect of contribution made by an individual to electoral trust on his taxable income? [CA Final May 2011, May 2010] [4 Marks]

Answer:

(i) The statement is incorrect. As per Sec. 13B, any voluntary contributions received by an electoral trust shall not be included in the total income of the previous year of such electoral trust, if:

- such electoral trust distributes to a registered political party during the year, 95% of the aggregate donations received by it during the year, along with surplus brought forward from any earlier year, and

- the electoral trust functions in accordance with the rules framed by the Central Government.

If the above conditions are satisfied, then only the electoral trust can get benefit of exemption u/s 13B in respect of voluntary contribution received by it. However, the exemption cannot be claimed in respect of any other income of the electoral trust.

(ii) As per Sec. 80GGC, an individual can claim deduction from gross total income in respect of amount contributed to an electoral trust during the year.

![]()

Taxation of Charitable/Religious Trusts

Question 2.

Asha Memorial Trust running hospitals is registered u/s 12A. Following particulars relevant for the previous year ended 31st March, 2021 are furnished to enable you to compute tax liability of the trust.

- Income from running of hospitals ₹ 14.25 lakhs.

- Donation received (including anonymous donation ₹ 3 lakhs) ₹ 5.75 lakhs.

- Amount applied for the purposes of hospital ₹ 13 lakhs.

- The trust had accumulated ₹ 15 lakhs u/s 11(2) in the financial year 2014-15 for a period of five years for extension of one of its hospitals. The trust has spent ₹ 13.50 lakhs for the said purpose till 31st March, 2020.

Compute the taxable income of the trust and tax payable by Asha Memorial Trust for the A.Y. 2021-22. [CA Final May 2010] [6 Marks]

Answer:

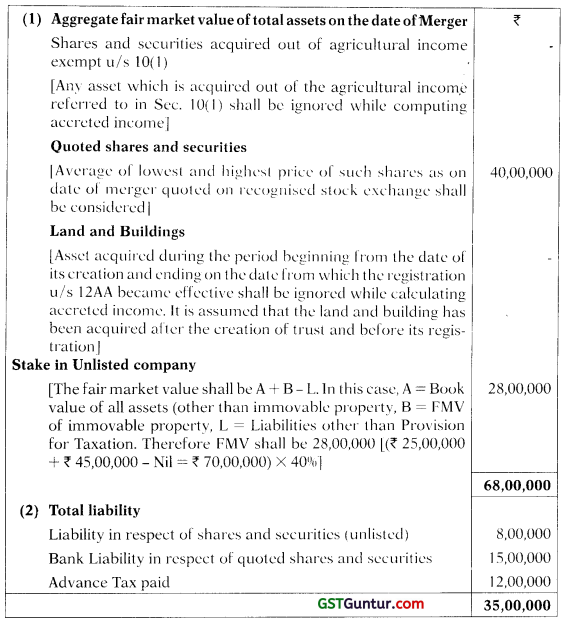

Computation of Taxable Income of Asha Memorial Trust for A.Y. 2021-22

Notes:

(1) As per Section 11(3), where the income accumulated for the specified purpose by the trust is not utilized for the said purpose within the period (not exceeding 5 years) for which it was accumulated, or in the year immediately following the expiry thereof, then the unutilised amount is deemed to be the income of the charitable institution for the year immediately following the expiry of the period of accumulation. In the given case, the institution accumulated ₹ 15,00,000 in the previous year 2014-15 for extension of one of its hospitals for a period of 5 years. Period of accumulation thus expired on 31.3.2020. The assessee has spent ₹ 13,50,000 [out of accumulated sum of ₹ 15,00,000] upto 31.3.2020. Hence, the unutilised amount of ₹ 1,50,000 is deemed to be income of the P.Y. 2020-21 (A.Y. 2021-22).

![]()

(2) Only the anonymous donations in excess of the limit specified below would be subject to tax @ 30% u/s 115BBC. The limit is the higher of the following:

- 5% of the total donations received by the assessee (5% of ₹ 5,75,000) = ₹ 28,750 or

- ₹ 1 lakh.

Therefore, Anonymous donations taxable @ 30% shall be ₹ 3,00,000 – ₹ 1,00,000 = ₹ 2,00,000

Now, total donation is ₹ 5,75,000 of which taxable Anonymous donation is ₹ 2,00,000.

Thus, Donations (other than taxable anonymous donations) taxable at normal rate = ₹ 5,75,000 – ₹ 2,00,000 = ₹ 3,75,000.

Here, a view is taken that the amount of anonymous donations exempt from the applicability of 30% tax [₹ 1,00,000 in this solution] is eligible for retention/accumulation to the extent of 15% as per sec. 11(1) without conditions in the same line as with other income and the voluntary contributions. A contrary view may also be taken that such anonymous donations chargeable to tax at normal rates are not eligible for retention/accumulation to the extent of 15%. If this view is taken, ₹ 2,55,000, being 15% of 17,00,000, has to be set apart (instead of ₹ 2,70,000, being 15% of ₹ 18,00,000)

![]()

Question 2.

A charitable institution registered u/s 12A of the Income-tax Act, 1961 filled in Form No. 10 for seeking permission to accumulate unapplied income u/s 11(2) of the Act for the objects of the institution and submitted it to the A.O. along with the resolution for accumulation. The A.O. found that the objects for which accumulation was sought were not particularized in as much as they covered the entire range of objects of the institution. Can the A.O. deny the benefit of accumulation in such a case? [CA Final Nov. 2010] [4 Marks]

Answer:

Section 11(2) provides that where 85% of the income referred in section 11(1 )(a) is not applied during the previous year but is accumulated or set apart, either in whole or in part, for application to charitable religious purpose, then such accumulated income shall not be included in total income of that previous year, provided that,

- the purpose for which the income is accumulated or set apart and

- the period for which the income is accumulated which shall not exceed 5 years,

are specified by furnishing a statement in prescribed form to the A.O. in prescribed manner.

In Bharat Krishak Samaj v. Deputy DIT (Exemption) (2008) (Del.), it was held that it is not necessary for a charitable trust to particularise each and every object for which accumulation is sought. It is enough if the assessee seeks permission for accumulation for the objects of the trust.

Therefore, in the given question, even though while seeking permission of the Assessing Officer to accumulate unapplied income for the objects of the institution, the institution has not stated the objects in particular for which accumulation is sought for the Assessing Officer cannot deny the benefit of accumulation in such a case.

![]()

Question 3.

“Save Wild Life” an institution having its main object as ‘preservation of wildlife’, used the entire income which it derived from an activity in the nature of trade for its main object during the P.Y. 2020-21. The institution seeks your opinion to know whether such utilization of its income be treated for “charitable purpose”? Would your answer be different, if the main object of the institution is “advancement of object of general public utility”? [CA Final May 2011] [4 Marks]

Answer:

“Charitable purpose” as defined in section 2(15) includes relief of the poor, education, yoga, medical relief, preservation of environment (including watersheds, forests and wildlife) and preservation of monuments or places or objects of artistic or historic interest and the advancement of any other object of general public utility. Therefore, preservation of wildlife is included in the definition of “charitable purpose” under section 2(15).

But as per the provisos to section 2(15), the “advancement of any other object of general public utility” shall not be treated as a charitable ; purpose, if the institution is carrying on any activity in the nature of trade, commerce or business, or any activity of rendering any service in relation to any trade, commerce or business, for access or fee or any other consideration, irrespective of the nature of use or application, or retention, of the income derived from such activity.

This restriction is not applicable to the purposes specified in the first six limbs of the definition. Therefore, an institution having the preservation of wildlife as its main object would not be subject to the restrictions which are applicable to the “advancement of any other object of general public utility”. Such institution would continue to retain its “charitable” status, even if it derives income from an activity in the nature of trade.

However, if the institution’s main object is “advancement of any other object of general public utility” and derives income from an activity in the nature of trade during the financial year, it would lose its “charitable” status for that year, even if it applies such income for its main objects.

It may be noted that if such activity is undertaken in the course of actual carrying out of such advancement of any other object of general public utility and the aggregate receipts from such activity or activities, during the previous year, does not exceed 20% of the total receipts, of the trust or institution undertaking such activity or activities, for the previous year, then, the institution would not lose its “charitable” status, even if its main object is “advancement of any other object of general public utility”.

![]()

Question 4.

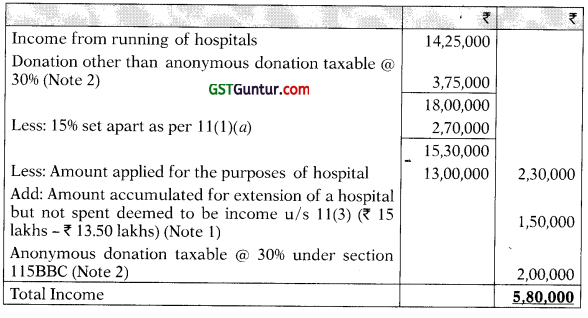

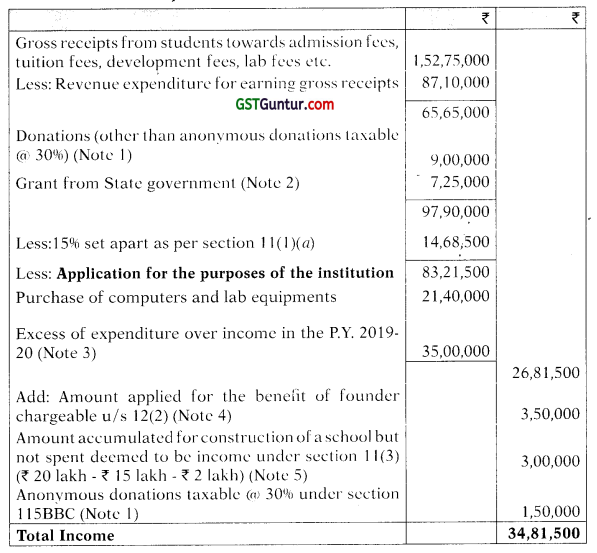

Jyoti Education Centre, a charitable institution registered u/s 12AA runs schools for primary and secondary education. The following particulars pertaining to the P.Y. 2020-21 are furnished to you by the institution:

Compute total income of the institution and tax payable by it for the A.Y. 2021-22. [CA Final Nov. 2011] [10 Marks]

Answer:

![]()

Notes:

(1) Only the anonymous donations in excess of the limit specified below would be subject to tax @ 30% under section 115BBC. The limit is the higher of the following:

- 5% of the total donations received by the assessee (5% × ₹10,50,000) = ₹ 52,500 or

- 1 lakh.

Therefore, Anonymous donation taxable 30% shall be ₹ 2,50,000 – ₹ 1,00,000 = ₹ 1,50,000.

Now, total donation is ₹ 10,50,000 of which taxable Anonymous donation is ₹ 1,50,000.

Thus, Donations (other than taxable anonymous- donations) taxable at normal rate = ₹ 10,50,000 – ₹ 1,50,000 = ₹ 9,00,000.

Here, a view is taken that the amount of anonymous donations exempt from the applicability of 30% tax [₹ 1,00,000 in this solution] is eligible for retention/accumulation to the extent of 15% as per sec. 11(1) without conditions in the same line as with other income and the voluntary contributions.

A contrary view may also be taken that such anonymous donations chargeable to tax at normal rates are not eligible for retention/accumulation to the extent of 15%. If this view is taken, ₹ 13,44,750, being 15% of ₹ 89,65,000, has to be set apart (instead of ₹ 13,59,750, being 15% of ₹ 90,65,000)

(2) As per Sec. 2(24)(xviii), assistance in the form of a subsidy received from the Central or State Government or any authority or body or agency shall be taxable.

(3) ₹ 35 lakhs, being excess of expenditure over income in the preceding financial year 2019-20 can be treated as application of income of the current year as held by Delhi High Court in Raghuvanshi Charitable Trust and others (2011).

(4) ₹ 3,50,000 applied for the benefit of the founder of the institution is taxable under section 12(2) read with section 13(1)(c)(d). This amount is taxable at the maximum marginal rate of 30% as per section 164(2).

(5) As per section 11 (3) where the income accumulated for the specified purpose by the trust is not utilized for the said purpose within the period (not exceeding 5 years) for which it was accumulated, or in the year immediately following the expiry thereof, then the unutilized amount is deemed to be the income of the charitable institution for the year immediately following the expiry of the period of accumulation.

In the given question, the institution accumulated ₹ 20,00,000 in the previous year 2017-18 for acquiring and developing a land for construction of a new school for a period of 2 years. Period of accumulation thus expired on 31.3.2020. The assessee has spent ₹ 17,00,000 [out of accumulated sum of ₹ 20,00,000] in the P.Y. 2020-21. Hence, the unutilized amount of ₹ 3,00,000 is deemed to be income of the previous year 2020-21.

![]()

Question 5.

MSO Foundation, a charitable institution set up on 1st April, 2020 and registered under section 12AA with effect from that date, is engaged in providing education in hotel management. The organisation acquires a building for using the same for holding classes and office activities. It has approached you for your opinion on its eligibility to claim the cost of the building and also depreciation thereon in the current year and the subsequent year. Advise the institution indicating the reasons. [CA Final Nov. 2012] [4 Marks]

Answer:

As per section 11,15% of the income from property held for charitable purposes is exempt from tax and the remaining 85% of such “income” would be exempt if it is “applied” for charitable purposes in India.

Where the expenditure is incurred for the purposes of carrying on the objects of the trust, it would be treated as application of income even if such expenditure is for capital purposes. Therefore, since the building is acquired by the organization for holding classes and office activities, : which is for the purposes of carrying on the objects of the charitable institution i.e., for providing education in hotel management, the cost of the building would be treated as application of income.

Further, section 11(6), provides that where the capital expenditure has been treated as application of Income by the trust or institution, it cannot claim depreciation on such capital expenditure in the current year and the subsequent years.

![]()

Question 6.

Ramji Charitable Trust, registered u/s 12AA and recognized u/s 80G was created for providing relief to disabled persons. It filed the return of income for the year ended 31.3.2021, declaring ‘Nil’ income. While completing the assessment, the A.O. found that a large sum was donated to the corpus of another trust by the assessee i.e., Ramji Charitable Trust. The contention of the assessee was that such donation was made out of the permissible accumulation of income of past years upto 15% u/s 11 (1) (a) of the Act.

The A.O. added the donation so made and by invoking the Explanation to section 11(2), computed the taxable income of the assessee. Discuss the validity of the action of the A.O., in this case. [CA Final Nov. 2014] [4 Marks]

Answer:

In the case of DIT (Exemption) v. Bagri Foundation (2010), the Delhi High Court held that the withdrawal of exemption as provided in Explanation to Sec. 11(2) is not’ applicable for the amount accumulated upto 15% u/s 11(1)(a). Thus, any amount paid out of such income accumulated to any trust or institution registered u/s 12AA or 12AB or 10(23C) is valid.

Consequently, if the donations made by Ramji Charitable Trust to another charitable trust were out of past accumulations upto 15% under section 11(1)(a), the same would not be liable to be included in the total income.

The action of the Assessing Officer in invoking the Explanation to section 11(2), to add such donations while computing the total income of the trust is, therefore, not valid.

![]()

Question 7.

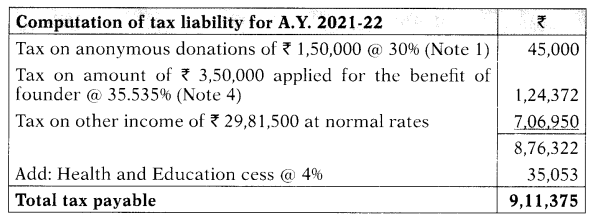

A public charitable trust registered under section 12AA runs a hospital and also a medical college. It furnishes you the following information for the year ended 31st March, 2021:

(i) Gross receipt from Hospital ₹ 425 lakhs

(ii) Income from business – incidental to main objects ₹ 2 lakhs.

(iii) Voluntary contributions received from public ₹ 32 lakhs. It includes corpus donation of ₹ 3 lakhs and anonymous donation of ₹ 5 lakhs.

Note: Voluntary contributions are included in Gross receipt given in (i) above.

(iv) Hospital operational expenses ₹105 lakhs. (This does not include capital expenditures and depreciation).

(v) Income from Medical College (solely for education purpose) ₹ 10 lakhs. Gross receipts of college for the year ₹ 90 lakhs.

(vi) Gross receipt given in (i) above includes a sum of ₹ 55 lakhs which has accrued but not received. However, a sum of ₹ 18 lakhs was received j only on 31st day of March, 2021.

(vii) The trust set apart t 80 lakhs for acquiring a building to expand its hospital. But the amount was paid in May 2021 when sale deed was registered in its name.

(viii)In June, 2020, the trust purchased and installed new computer software for ₹ 28 lakhs. The rate of depreciation is 40% as per Income-tax

Act, 1961.

(ix) The trust incurred ₹ 35 lakhs towards purchase of laptops, computers and printers for the hospital.

(x) It repaid loan of ₹ 15 lakhs taken earlier for construction of hospital building.

Compute the total income of the trust for the A. Y. 2021 -22 in order to avail maximum benefits within the law. [CA Final May 2015] [8 Marks]

Answer:

Computation of total income of the trust for the A.Y. 2021-22

For further reducing the tax liability, the trustees may, in accordance with section 11(2), furnish a statement in the prescribed form to the A.O. in the prescribed manner about their intention to accumulate ₹ 34.76 lakhs [₹ 37.26 lakhs minus ₹ 2.50 lakhs (basic exemption limit)] specifying the period (which in no case will exceed 5 years) and the purpose for which the accumulation is to be made and invest such sum in the modes specified u/s 11(5). Then such accumulation would not be includible in the total income and no tax will be payable on the total income (other than anonymous donations of ₹ 3.4 lakhs taxable @ 30% u/s 115BBC).

![]()

Notes:

(1) As per section 115BBC(1), the anonymous donations in excess of the higher of the following would be subject to tax @ 30%;

- ₹ 1 lakh; or

- ₹ 1.60 lakh, being 5% of the total donations received i.e., 5% of ₹ 32 lakhs.

Therefore, anonymous donations of ₹ 3.4 lakh (₹ 5 lakh – ₹ 1.60 lakh), would be subject to tax @ 30% under section 115BBC.

As per section 13(7), such anonymous donations are not eligible for the benefit of exclusion from total income under sections 11 and 12. Here, a view is taken that the amount of anonymous donations exempt from the applicability of 30% tax [₹ 1,60,000 in this solution] is eligible for retention/accumulation to the extent of 15% as per sec. 11(1)(a) in the same line as with other income and the voluntary contributions.

A contrary view may also be taken that such anonymous donations chargeable to tax at normal rates are not eligible for retention/accumutation to the extent of 15%. If this view is taken, ₹ 47.10 lakhs, being 15% of ₹ 314 lakhs has to be set apart (instead of ₹ 47.34 lakhs, being 15% of ₹ 315.60 lakhs)

(2) For availing the benefit of Deemed application as per Explanation 2 to section 11(1), the person in receipt of income from the property held under trust, has to exercise the option in writing, before the expiry of the time allowed u/s 139(1) to treat such income as deemed application of the year in which the income is earned.

(3) As per section 11(6), where the cost of assets is claimed as application, no deduction for depreciation on such assets would be allowed in determining income of the trust for the purposes of application. Hence, as the cost of new computer software, laptops, computers and printers purchased for the hospital has been claimed as application of income, no depreciation would be allowed on these assets while calculating income for the purpose of application.

(4) The word “applied” used in section 11 does not necessarily imply “spent”. Even if a certain amount is irretrievably earmarked and allocated for charitable purposes, the said amount can be deemed to have been applied for charitable purposes. [CIT y. Trustees of H.E.H. Niarns Charitable Trust (1981)(AP)]

![]()

Question 8.

State with reasons the validity of the following statement:

Charitable trusts and institutions registered u/s 12AA or 12AB, cannot claim exemption under any of the clauses of Section 10. [CA Final Nov. 2015] [2 Marks]

Answer:

The statement is not valid.

As per Sec. 11(7), where a trust or institution has been granted registration u/s 12AA or 12AB and the registration is in force for a previous year, then, I such trust or institution can still claim exemption of agricultural income u/s 10(1) as well as exemption available u/s 10(23C).

Therefore, the statement that such trust or institution cannot claim exemption under any of the clauses of section 10 is not valid, since it can still claim exemption u/s 10(1) and u/s 10(23C).

![]()

Question 9.

Keeping in view that Yoga is the present focused area and has been granted international recognition by the United Nations Organisation (UNO), an institution called “Hindustan Mahan” having ‘Yoga’ as its main object was registered u/s 12AA. For the P.Y. 2020-21, the total receipts of the institution are ₹ 135 lakhs including ₹ 26.5 lakhs from business activity.

(i) State with reasons whether the institution will continue to retain its “Charitable Status” and be eligible for exemption under section 11 ‘ for the Assessment Year 2021-22.

(ii) What would have been the effect, had the main object of the institution been “advancement of any other object of general public utility” and it had applied its receipts from business activities towards such main object? [CA Final Nov. 2016] [6 Marks]

Answer:

(i) As per section 2(15), “Charitable purpose” includes relief of the poor, education, yoga, medical relief, preservation of environment (including watersheds, forests and wildlife) and preservation of monuments or places or objects of artistic or historic interest and the advancement of any other object of general public utility. Therefore, yoga is included in the definition of “charitable purpose” under section 2(15).

But as per the proviso to section 2(15). the “advancement of any other object of general public utility shall not be a charitable purpose. if the institution is carrying on any activity in the nature of trade, commerce or business, or activity of rendering any service in relation to any trade, commerce or business, for access or fee or any other consideration, irrespective of the nature of use or application, or retention, of the income derived from such activity.

However, this restriction is not applicable to the purposes specified in the first six limbs of the definition. Therefore, an institution having ‘yoga’ as its main object would not be subject to the restriction of carrying on any activity in the nature of trade, commerce or business. Such institution would continue to retain its “charitable status”, even if it derives income from an activity in the nature of trade.

This restriction is applicable only to the “advancement of any other object of general public utility”. Therefore, “Hindustan Mahan” will continue to retain its “Charitable Status” and will be eligible for 1 exemption u/s 12AA for the A.Y. 2021-22 even if its total receipts include some receipts from business activity.

![]()

(ii) In case, if the institution’s main object is “advancement of any other object of general public utility” and it derives income from an activity in the nature of trade during the financial year, it would lose its “charitable status-” for that year, even if it applies such income for its main objects.

However, if such activity is undertaken in the course of actual carrying out of such advancement of any other object of general public utility and the aggregate receipts from such activity or activities, during the previous year, does not exceed 20% of the total receipts, of the trust or institution undertaking such activity or activities, for the previous year, then, the institution would not lose its “eharitable” status, even if its main object is “advancement of any other object of general public utility”.

In this case, the receipts from business activity are ₹ 26.5 lakhs which does exceed 20% of the total receipts of the institution and therefore, Hindustan Mahan will not lose its “Charitable Status”.

Question 10.

Rural Health Care Trust was formed on 1 st April, 2019 with the object of providing medical relief to people residing in rural areas of Assam. The trust applied for registration u/s 12AA on 15th May, 2020 to the CIT. Till the due date for filing ROI for A.Y. 2021-22, the CIT has not passed any order granting or refusing to grant such registration. The trust has filed its , ROI for A.Y. 2020-21 claiming exemption u/s 11 taking a view that as the order has not been passed by the Commissioner of Income-Tax within the prescribed period, the trust should be deemed to be registered u/s 12AA.

Discuss and explain, whether the view taken by the trust is correct. [CA Final Nov. 2017] [4 Marks]

Answer:

Issue involved: The issue under consideration is whether the trust would be deemed to be registered u/s 12AA when an application for registration of the trust made u/s 12A and the same is not respond within a prescribed time.

Provisions applicable: As per section 12AA, on receipt of application, the COMMISSIONER shall after proper enquiries pass an order in writing, If I satisfied then registering the Trust/Institution and If Not Satisfied then refusing to register. However every order granting or refusing registration shall be passed before expiry of 6 Months from the end of the month in which APPLICATION was received u/s 12A.

Analysis: The facts of the case are similar to the facts in CIT v. Society for the Promotion of Education (2016) (SC) wherein the above issue came up before the Supreme Court. The Apex Court held that once an application for registration of the trust is made u/s 12A and in case the same is not responded to within 6 months, the trust would be deemed to be registered u / s 12 AA as the non-consideration of the application for registration within the time fixed by the legal provision would lead to deemed grant of registration and there is no reason to make the assessee suffer merely because the Department is not able to keep its officers under check and control so as to take timely decisions on the matter. The Supreme Court further held that the deemed registration would commence only after 6 months from the date of application.

Conclusion: Thus, applying the rationale of the Supreme Court ruling to the present case, the view taken by the Rural Health Care Trust is correct that the trust shall be deemed to be registered u/s 12AA after a period of 6 month from the date of application u/s 12A as the same is not respond by the commissioner within a period of 6 month.

![]()

Question 11.

Mathi Charitable Trust registered u/s 12AA following cash system of accounting furnishes you the following information:

(i) Gross receipts from hospital by name “Full Cure” ₹ 400 lakhs.

(ii) Gross receipts from college by name “India Arts College” ₹ 180 lakhs (offering recognized degree courses).

(iii) Corpus donations by way of cheque ₹ 30 lakhs and by way of cash ₹ 5 Lakhs.

(iv) Anonymous donations by cash ₹ 10 Iakhs.

(v) Administrative expenses for hospital ₹ 220 lakhs and for college ₹ 100 lakhs.

(vi) Fees not realized from patients ₹ 20,60,000 and from students of the college ₹ 6,50,000 as on 31.03.2021.

(vii) Depreciation on assets of the trust ₹ 18,00,000. The entire cost of assets ₹ 300 lakhs claimed as application in the earlier years.

(viii) Acquired a building for ₹ 120 lakhs on 01.06.2020 for expansion of hospital (cost of land included therein ₹ 100 lakhs). Stamp duty value of the land and building on the date of registration of sale deed ₹ 140 lakhs.

(ix) The trust gave donation of ₹ 25 lakhs to Gandhiji Free Trust having objects of charitable nature registered under section 12AA but not similar to the objects of the donor trust.

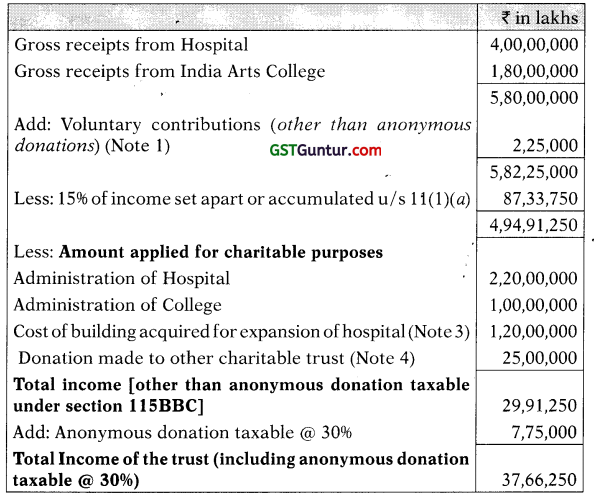

You are required to compute the total income of the trust and its income-tax liability in such a manner that it can avail the optimal benefit within the four corners of the Income-tax Act, 1961. Note: The trust does not want to seek accumulation of income by virtue of section 11(2) of the Act. [CA Final May 2018 (Old Syllabus)] [10 Marks]

Answer:

Computation of Total Income of the trust for the A.Y. 2021-22

Notes

(1) As per section 115BBC(1), the anonymous donations in excess of the higher of the following would be subject to tax @ 3096;

- ₹ 1 lakh; or

- ₹ 2.25 lakhs, being 5% of the total donations received i.e., 5% of ₹ 45 lakhs.

Therefore, anonymous donations of ₹ 7.75 lakhs (₹ 10 lakhs – ₹ 2.25 lakhs) would be subject to tax @ 30% under section 115BBC.

As per section 13(7), such anonymous donations are not eligible for the benefit of exclusion from total income under sections 11 and 12.

Here, a view is taken that the amount of anonymous donations exempt from the applicability of 30% tax [₹ 2,25,000 in this solution] is eligible for retention/accumulation to the extent of 15% as per sec. 11(1)(a) in the same line as with other income and the voluntary contributions.

A contrary view may also be taken that such anonymous donations chargeable to tax at normal rates are not eligible for retention/accumulation to the extent of 15%. If this view is taken, ₹ 39.00 lakhs, being 15% of ₹ 260 lakhs has to be set apart (instead of ₹ 39.34 lakhs, being 15% of ₹ 262.25 lakhs)

(2) As per section 11 (6), where the cost of assets is claimed as application, no deduction for depreciation on such assets would be allowed in determining income of the trust for the purposes of application. Hence, as the cost of assets has been claimed as application of a income, no depreciation would be allowed on these assets while calculating income for the purpose of application.

(3) The land and building acquired for the purpose of expansion of hospital would be treated as application of income. The difference of ₹ 20 lakhs between the stamp duty value and cost of acquisition of land and building would not be taxable in the hands of Mathi Charitable Trust by invoking the provisions of sec. 56(2)(v), since sec. 56(2)(A) is not applicable when any sum of money or property is received by a trust registered u/s 12AA. Therefore, ₹ 120 lakhs would be considered as application of income.

(4) Donation made to Gandhiji Free Trust would be treated as application of income.

![]()

Question 12.

Agroha Education Institution was established u/s 10(23C)(iiiad) to impart and spread education. It earned net surplus during the P.Y. 201920 and 2020-21 ₹ 6 lakhs and 5 lakhs respectively. It claimed exemption u/s 10(23C)(iiiad).

The A.O. rejected the claim of exemption of the institution on the ground that the assessee had made profit and did not exist solely for the purpose of education.

Examine the validity of the view taken by the Assessing Officer. [CA Final Nov. 2018 (Old Syllabus)] [4 Marks]

Answer:

The issue under consideration is where an institution engaged in imparting education incidentally makes profit, would it lead to an inference that it ceases to exist solely for educational purposes.

The facts of the case are similar to the facts in Queen’s Educational Society v. CIT (2015), where the Supreme Court laid down the following tests to determine whether an educational institution exists solely for education purposes and not for purposes of profit:

(a) Where an educational institution carries on the activity of education primarily for educating persons, the fact that it makes a surplus does not lead to the conclusion that it ceases to exist solely for educational purposes and becomes an institution for the purpose of making profit;

(b) The predominant object test must be applied – the purpose of education should not be submerged by a profit making motive;

(c) A distinction must be drawn between the making of surplus and an institution being carried on “for profit”. MeTely because imparting of education results in making a profit, it cannot be inferred that it becomes an activity for profit;

(d) If after meeting expenditure, surplus arises incidentally from the activity carried on by the educational institution, it will not cease to be one existing solely for educational purposes. The ultimate test is whether on an overall view of the matter in the concerned assessment year, the object is to make profit as opposed to educating persons.

Applying the above rationale of Supreme Court in the present case, the view taken by the Assessing Officer to reject the claim of exemption of the institution on the ground that it did not exist solely for the purpose of education, only because it incidentally made some profits, is therefore, not correct.

![]()

Question 13.

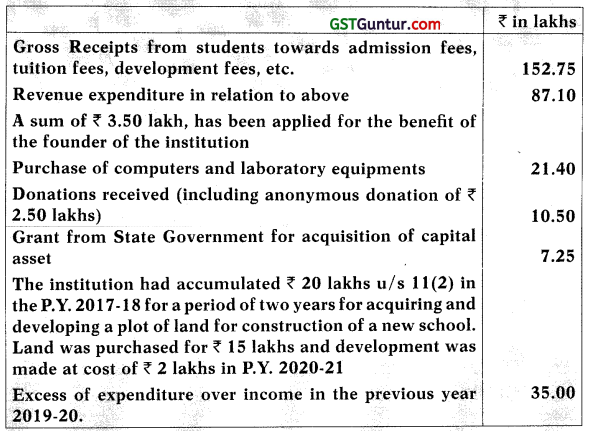

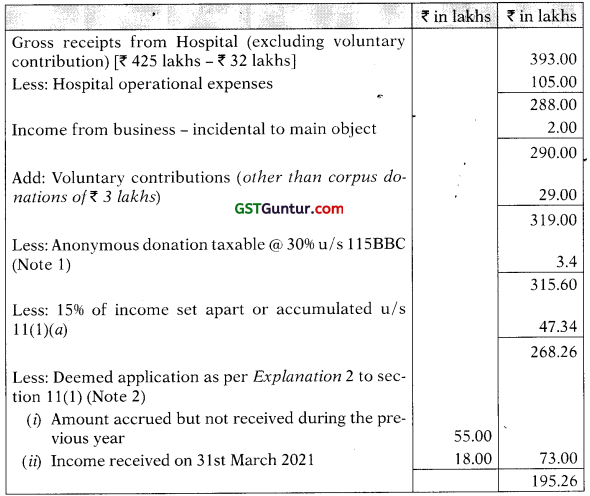

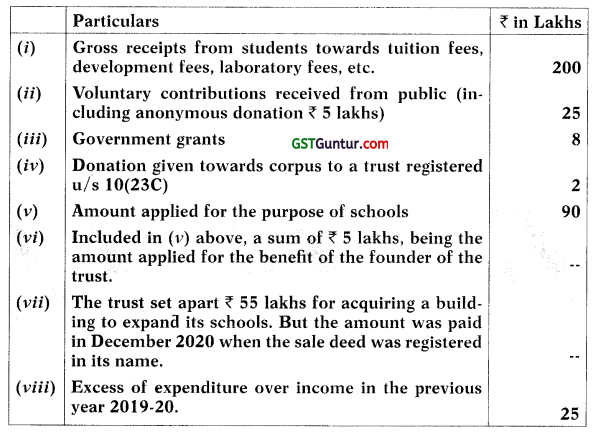

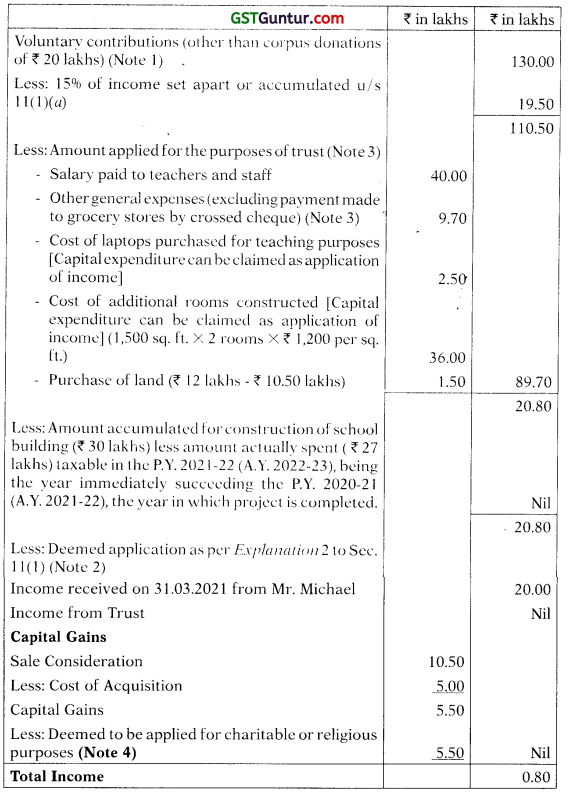

Mani foundations, a charitable trust registered u/s 12AA of the Income-tax Act run schools for primary and secondary education. The following particulars pertaining to the P.Y. 2020-21 are furnished to you by the trust:

Compute the total income of the trust for the assessment year 2021-22 in order to avail maximum benefits within the four corners of law. [CA Final Nov. 2018 (New Syllabus)] [8 Marks]

Answer:

![]()

Notes:

(1) Only the anonymous donations in excess of the limit specified below would be subject to tax @ 30% under section 115BBC. The limit is the higher of the following:

- 5% of the total donations received by the assessee (5% × ₹ 25,00,000)

= ₹ 1,25,000 or - 1 lakh.

Therefore, Anonymous donation taxable @ 30% shall be ₹ 5,00,000 – ₹ 1,25,000 = ₹ 3,75,000.

Now, total donation is ₹ 25,00,000 of which taxable Anonymous do-nation is ₹ 3,75,000.

Thus, Donations (other than taxable anonymous donations) taxable at normal rate = ₹ 25,00,000 – ₹ 3,75,000 = ₹ 21,25,000.

Here, a view is taken that the amount of anonymous donations exempt from the applicability of 30% tax ₹ 1,25,000 in this solution is eligible for retention /accumulation to the extent of 15% as per sec. 11(1) without conditions in the same line as with other income and the voluntary contributions.

A contrary view may also be taken that such anonymous donations chargeable to tax at normal rates are not eligible for retention/accumulation to the extent of 15%. If this view is taken, ₹ 31,20,000, being 15% of ₹ 2,08,00,000 has to be set apart (instead of ₹ 34,38,750, being 15% of ₹ 2,29,25,000)

(2) As per Sec. 2(24)(xviii), assistance in the form of a subsidy received from the Central or State Government or any authority or body or agency shall be taxable.

(3) A trust running an educational institution shall not lose the benefit of exemption of any income under section 11 other than the value of benefits of educational facilities provided to the specified persons referred to in section 13(3), solely on the ground that such benefits have been provided to such persons. Therefore, exemption shall not be available in respect of t 5,00,000 being the amount applied for the benefit of the founder of the trust.

(4) As per Explanation 2 to Sec. 11(1), any amount credited or paid out of income to any trust registered u/s 10(23C) as a contribution with a specific direction that it shall be part of the corpus of the trust shall not be treated as application of income for charitable or religious purposes.

(5) The word “applied” used in section 11 does not necessarily imply , “spent”. Even if a certain amount is irretrievably earmarked and allocated for charitable purposes, the said amount can be deemed to have been applied for charitable purposes. [CIT v. Trustees of H.E.H. Nizams Charitable Trust (1981)(AP)]

(6) ₹ 25 lakhs, being excess of expenditure over income in the preceding financial year 2019-20 can be treated as application of income of the current year as held by Delhi High Court in Raghuvanshi Charitable Trust and others (2011).

(7) ₹ 5,00,000 applied for the benefit of the founder of the institution is taxable under section 12(2) read with section 13(l)(c)(d). This amount is taxable at the maximum marginal rate of 30% as per section 164(2).

![]()

Question 14.

Mr. Jayant and Mr. Basant, created, a trust, out of the insurance policy amount received upon the death of their father. The trust deed named Jayant and Basant as the trustees and Mrs. Kamla and Mrs. Vimla (Iheir sisters) as the beneficiaries. However, it is the discretion of the trustees that they may either accumulate the net incomeof the trust or pay the same to any one or both the beneficiaries. During the previous year 2020-21, the total income of the trust amounted to ₹ 10,50,000. You are required to discuss the relevant provisions of the Income-tax Act in this regard and calculate the tax payable by the trust, if any. What would be your answer if the trust was created under the ‘Will’ of the deceased father and such trust is the only trust so created under the ‘Will’? [CA Final May 2019 (Old Syllabus)] [4 Marks]

Answer:

The trust created by Mr. Jayant and Mr. Basant out of the insurance policy amount received upon the death of their father is a private discretionary trust, as it vests with the trustees a discretionary power to pay the beneficiaries, or accumulate the income, as the trustees think fit.

In case of a private discretionary trust, declared by a duly executed trust deed, where the shares of the beneficiaries are unknown, as in this case, the trustees, Mr. Jayant and Mr. Basant, would be liable as representative assessees.

Since the income of the trust does not include profits and gains of business, it is taxable at the maximum marginal rate of 35.88% [i.e., 30% + surcharge @ 15% + cess @ 4%]. The tax payable would be ₹ 3,76,740, being 35.88% of ₹ 10,50,000.

However, where the trust is created under the “Will” of the deceased father and such trust is the only trust so created under the “Will”, then, the income of the trust would be chargeable to tax as if it were the income of an association of persons.

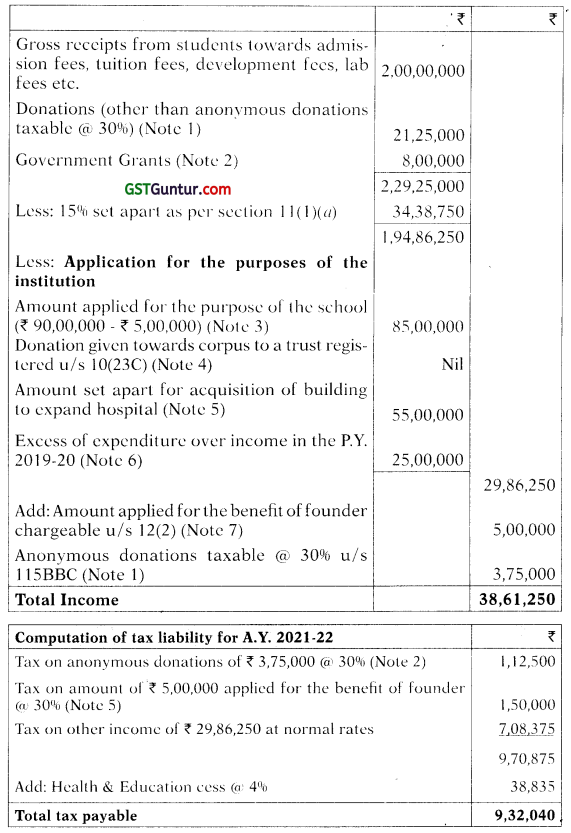

![]()

Question 15.

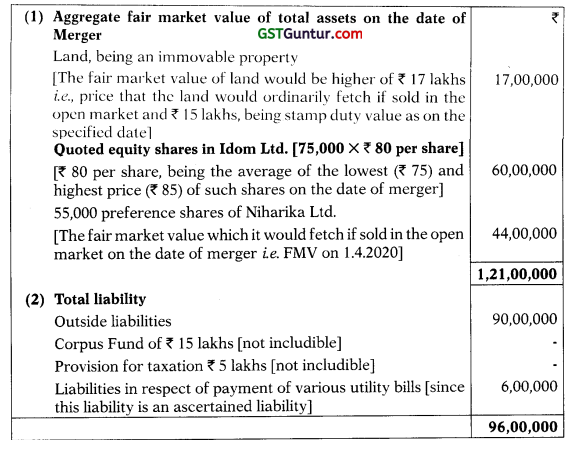

Supporting the Girl Child, a charitable trust, is registered u/s 12A of the Act. On 1.4.2020, it got merged with M/s. Ananya P Ltd., which is a company engaged in manufacturing of stationery items. All the assets and liabilities of the erstwhile trust became the assets and liabilities of M./s. Ananya P Ltd who is not entitled for registration u/s 12AA of the Act. The trust appointed a registered valuer for the valuation of its assets and liabilities. From the following particulars (including the valuation report), calculate the tax liability in the hands of the trust arising as a result of such merger:

(i) Stamp duty value of land held ₹ 15 lakhs. However; if this land is sold in the open market, it would ordinarily fetch ₹ 17 lakhs. The book value of the land is ₹ 20 lakhs.

(ii) 75,000 equity shares in Idom Ltd. traded in Bombay Stock Exchange. The lowest price per share on 1.4.2020 was ₹ 75 and the highest price on that day was ₹ 85. The book value was ₹ 67 lakhs.

(iii) 55,000 preference shares held in Niharika Ltd. The shares will fetch ₹ 44 lakhs, if they are sold in the open market on 1.4.2020. Book value was ₹ 25 Lakhs.

(iv) Corpus fund as on 1.4.2020 ₹15 Lakhs.

(v) Outside liabilities ₹ 90 lakhs

(vi) Provision for taxation ₹ 5 lakhs.

(vii) Liabilities in respect of payment of various utility bills ₹ 6 lakhs. [CA Final May 2019 (Old Syllabus)] [8 Marks]

Answer:

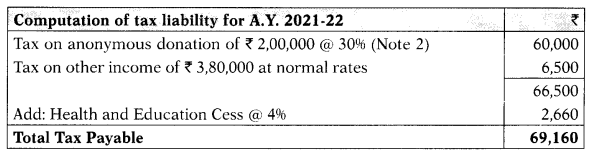

As per section 11 STD, where in any previous year, a trust or institution registered u/s 12AA has merged with any entity other than an entity which is a trust or institution having objects similar to it and registered u/s 12AA, then, in addition to the income tax on the total income of such trust or institution, the accreted income of the trust or the institution shall be charged to additional tax at the MMR.

In this case, a trust registered u/s 12AA got merged with M/s. Ananya P Ltd. which is a company engaged in manufacturing of stationery items and therefore, the accreted income of trust would be chargeable to tax at maximum marginal rale @ 34.944% [30% plus surcharge @ 12% plus cess @ 4%].

Computation of accreted income and tax liability in the hands of the trust arising as a result of merger with Ananya Pvt. Ltd. for A.Y. 2021-22

Working Notes:

![]()

Question 16.

M/s Mahan Charitable Trust is running an Educational Institution with hostel facility for the orphan children. It is registered u/s I2AA. The details of Income and expenditure of the Trust are as given below:

(a) Voluntary contributions received during the year 150 lakhs.

This Includes:

(i) Corpus donation 20 lakhs

(ii) Donation of 20 lakhs from Mr. Michael a foreign donor which was received on 31-3-2021.

(b) Salary paid to teachers and administrative staff 40 lakhs.

(c) Other general expenses ₹ 10 lakhs Include payment to grocery stores of 30,000 by crossed cheque.

(d) A land belonging to the Trust In a nearby village which was purchased In the year 2015-16 for ₹ 5 lakhs was sold for ₹ 10.50 lakhs and another land adjacent to the Trust premises was purchased for ₹ 12 lakhs to be used as playground for the children.

(e) Five laptops costing ₹ 50,000 each were purchased during the year for teaching purposes.

(f) The Trust had accumulated ₹ 30 lalths u/s 11(2) In the fInancial year 2016-17 for constructing a school building. Amount spent for the said purpose till 31-3-202 1 was 27 lakhs. The project Is completed with a saving In project cost.

(g) Two additional rooms measuring 1,500 sq. ft each was constructed in the existing hostel for the children. Cost of construction is 1,200 per sq. ft.

(h) It made a corpus donation of 20 lakhs to a charitable trust registered u/s 12AA having similar objects.

Compute taxable income of Mahan Charitable Trust for A.Y. 2021-22. Support your answer with necessary working notes. [CA Final May 2019 (New Syllabus)] [8 Marks]

Answer:

Computation of Taxable income of Mahan Charitable Trust for the A.Y. 2021-22

Notes:

(1) Voluntary contributions made with a specified direction that they shall form part of the corpus of the trust or institution shall be exempt in the hands of trust u/s 11(1).

(2) For availing the benefit of Deemed application as per Explanation 2 to section 11(1), the person in receipt of income from the property held under trust, has to exercise the option in writing, before the expiry of the time allowed u/s 139( 1) to treat such income as deemed application of the year in which the income is earned.

(3) As per Explanation 3 to Sec. 11(1), for determining the amount of f application, the provisions of Sec. 40(a)( ia) and 40A(3) and 40A(3A), shall, mutatis mutandis, apply as they apply in computing the income chargeable under the head Profits and Gains of Business or Profession

In this case, payment to a grocery stores of ₹ 30,000 has been made by crossed cheque which shall be disallowed u/s 40A(3).

(4) As per Sec. 11(1A), where a capital asset held under trust is transferred and the whole of the net consideration is utilised for acquiring another capital asset, the whole of the capital gain arising from such transfer shall be deemed to have been applied to charitable or religious purposes. In this case, whole of the net consideration is utilised for purchase of land and therefore, whole of the capital gains shall be deemed to have been applied for charitable purposes.

(5) As per section 11 (6), where the cost of assets is claimed as application, no deduction for depreciation on such assets would be allowed in i determining income of the trust for the purposes of application. Hence, as the cost of new laptops and cost of constructing additional rooms has been claimed as application of income, no depreciation would be allowed on these assets while calculating income for the purpose of application.

(6) As per Explanation 2 to Sec. 11(1), corpus donation made to other Charitable Institution shall not be treated as application of income. Therefore, ₹ 20 lakhs of corpus donation to a charitable trust registered u/s 12AA shall not be treated as application of income.

![]()

Question 17.

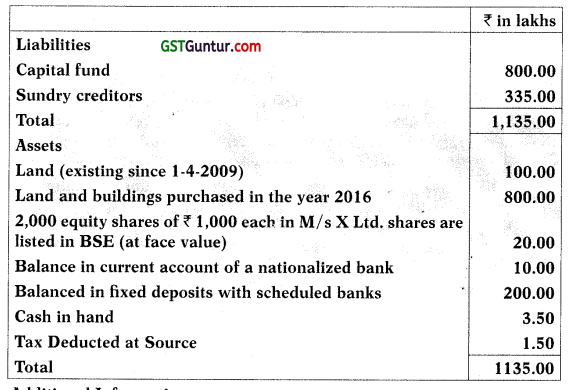

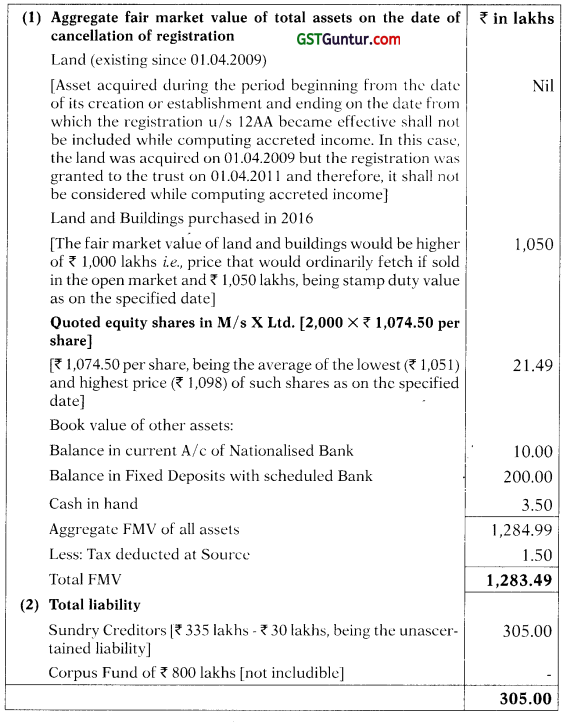

The registration granted u/s 12AA of the Income Tax Act on 1.4.2011 to M/s S Charitable Trust, was cancelled on 31.1.2021 on a finding that the Trust was merged, with another entity neither having similar objects nor registered u/s 12AA. An appeal was preferred against the order of cancellation, which was dismissed by the Appellate authorities. The order confirming the cancellation was received on 31.3.2021.

The Balance Sheet of M/s S Charitable Trust as on 31.1.2021, and its other information is as given thereunder:

Additional Information:

- Stamp duty value of the land (existing since 2009) as on 31.1.2021 was 120.00 lakhs but ¡f sold in the open market, the property would fetch ₹ 250 lakhs as per a registered valuer’s certificate.

- Land and building (purchased in 2016), If sold in the open market will fetch ₹ 1,000 lakhs as per a registered valuer’s certificate. Stamp duty value as on 31.1.2021 was ₹ 1,050 lakhs.

- The highest and lowest value per share of M/s X Ltd. traded on 31.1.2021 was 1,098 and 1,051 respectively.

- Included in Sundry Creditors is 30 lakhs provided on estimated basis to contractors for which no bills are received.

Based on the above information, calculate the exit tax payable by the ; Charitable Trust and state the latest day on which the said tax has to be paid. Give working notes wherever necessary. [CA Final Nov. 2019 (Old Syllabus)] [8 Marks]

Answer:

As per section 115TD(1), where in any previous year, a trust or institution registered u/s 12AA has converted into any form which is not eligible for grant of registration u/s 12AA, then, in addition to the income tax on the total income of such trust or institution, the accreted income of the trust or the institution shall be charged to additional tax at the MMR.

Sec. 115TD(2) provides that the trust or an institution shall be deemed to have been converted into any form not eligible for registration u/s ; 12AA if the registration granted to it u/s 12AA has been cancelled.

In this case, the registration granted to M/s. S Charitable Trust u/s 12AA was cancelled on a finding that the Trust was merged, with another entity neither having similar objects nor registered u/s 12AA. Therefore, it shall 5 be deemed that it has been converted into any form not eligible for registration u/s 12AA and the accreted income of trust would be chargeableto tax at maximum marginal rate @ 34.944% [30% plus surcharge @ 12% plus cess @ 4%].

![]()

Computation of accreted income and tax liability in the hands of M/s S Charitable Trust arising as a result of cancellation of registration u/s 12AA for A.Y. 2021-22

As per Sec. 115TD(5), where registration granted to trust hr celled, the principal officer or the trustee of the trust and the trust shall be liable to pay the tax on accreted income to the credit of the Central Government within 14 days from the date on which the order in any appeal confirming the cancellation of the registration, is received by the trust. In this case, the order confirming the cancellation of registration was received on 31.03.2021 and therefore, the tax on accreted income shall be paid within 14 days from 31.03.2021 i.e. upto 14th April, 2021.

Working Notes:

![]()

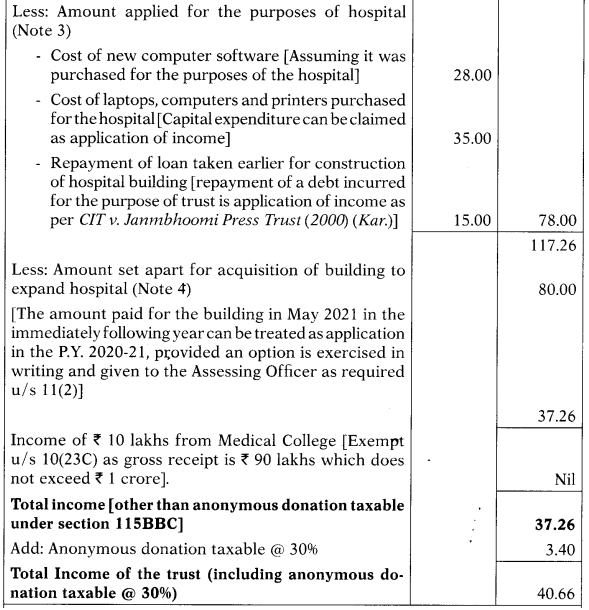

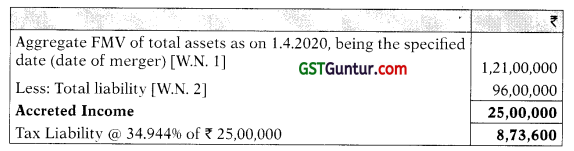

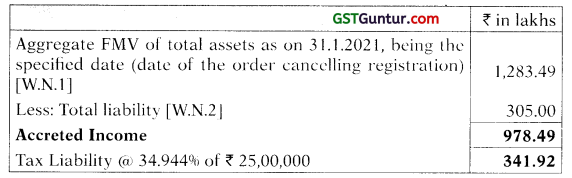

Question 18.

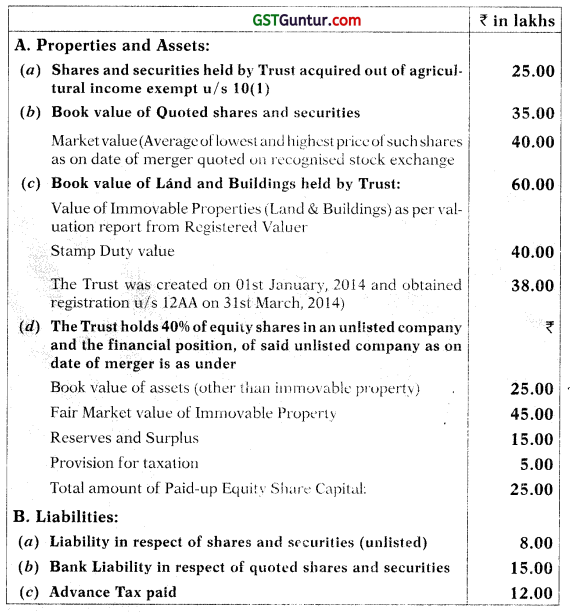

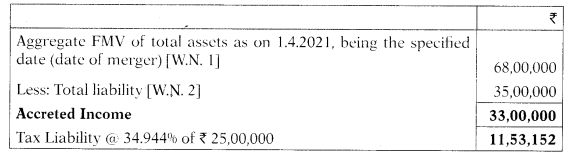

GVB Charitable Trust engaged in the activities of running a charitable hospital and medical college since 8 years, has been merged with a Corporate hospital on 31st March, 2021. The said Corporate Hospital is not eligible for registration u/s 12AA of the Act. The position of assets and liabilities of the Charitable trust as on the date of merger are furnished as under:

Compare the tax liability, if any, of Charitable Trust, arising out of above merger, giving explanation for treatment of each item in the context of relevant provisions contained in the Act. Assume that the trust has no tax liability in respect of other activities undertaken during previous year 2020-21. [CA Final Nov. 2019 (New Syllabus)] [8 Marks]

Answer:

As per section 115TD, where in any previous year, a trust or institution registered u/s 12AA has merged with any entity other than an entity which is a trust or institution having objects similar to it and registered u/s 12AA, then, in addition to the income tax on the total income of such trust or institution, the accreted income of the trust or the institution shall be charged to additional tax at the MMR.

In this case, a trust engaged in the activities of running a charitable hospital and medical college got merged with a Corporate Hospital not eligible for registration u/s 12AA therefore, the accreted income of trust would be chargeable to tax at maximum marginal rate (a 34.944% [30% plus surcharge @ 12% plus cess @ 4%].

Computation of accreted income and tax liability in the hands of the trust arising as a result of merger for A.Y. 2021-22

![]()

Working Notes: