Students should practice Agricultural Income & Exempted Incomes – CS Executive Tax Laws MCQ Questions with Answers based on the latest syllabus.

Agricultural Income & Exempted Incomes – CS Executive Tax Laws MCQ Questions

Question 1.

The income of an assessee engaged in the business of growing and manufacturing tea in India is taxable to the extent of

(A) 40% of such income

(B) 60% of such income

(C) 70% of such income

(D) 30% of such income [Dec. 2014]

Answer:

(A) 40% of such income

Question 2.

If non-agricultural income is ₹ 4,52,000 and net agricultural income is ₹ 40,000, the tax liability of an individual assessee will be

(A) Nil

(B) ₹ 200

(C) ₹ 206

(D) ₹ 4,326 [Dec. 2014]

Answer:

(A) Nil

Question 3.

Incomes of two minor children are included in the income of their father.

Father is entitled to exemption u/s 10(32) up to

(A) ₹ 1,500

(B) ₹ 1,000

(C) ₹ 3,000

(D) ₹ 2,000 [Dec. 2014]

Answer:

(C) ₹ 3,000

Question 4.

Which of the following additional incomes will not be treated as agricultural income?

(A) Additional income from selling ginned cotton as compared to unpinned cotton

(B) Additional income from selling dried-up coffee as compared to raw coffee

(C) Additional income from selling cured tobacco as compared to green tobacco leaves

(D) Additional income from selling dried-up tea leaves as compared to raw tea leaves. [June 2015]

Answer:

Question 5.

Pawan reports a net income of ₹ 5 lakh from the activity of growing and manufacturing rubber.

How much of such income is to be treated as non-agricultural income

(A) ₹ 1,75,000

(B) ₹ 2,00,000

(C) ₹ 1,25,000

(D) Nil [Dec. 2015]

Hint:

5,00,000 × 35% = 1,75,000.

Answer:

(A) ₹ 1,75,000

Question 6.

Murali received ₹ 1 lakh from the HUF of which he is a coparcener. The HUF consists of four coparceners including his father who is the Karta of the HUF.

The amount paid was by way of debit to the capital account of HUF engaged in the textile business. Is the amount of receipt chargeable to tax

(A) Yes, the full amount is taxable

(B) 50%, le. ₹ 50,000 is taxable

(C) Nil, le. it is exempt from tax

(D) 25%, le. 125,000 is taxable [Dec. 2016]

Answer:

(C) Nil, le. it is exempt from tax

Question 7.

Tax holiday under Section 10AA in respect of newly established units in SEZ is allowed for a total period of

(A) 5 Years

(B) 10 Years

(C) 15 Years

(D) 20 Years [Dec. 2016]

Answer:

(C) 15 Years

Question 8.

Mrs. Rose derives 15,40,000 by way of income from the sale of coffee grown and cured by sellers in India.

The income chargeable to income tax would be

(A) 50%, le. ₹ 12,70,000

(B) 25%, le. ₹ 1,35,000

(C) 40%, le. ₹ 2,16,000

(D) 60%, le. ₹ 3,24,000 [Dec. 2016]

Answer:

(B) 25%, le. ₹ 1,35,000

Question 9.

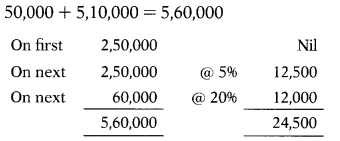

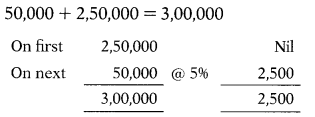

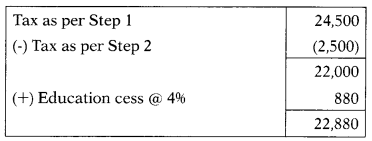

Mr. Robert aged 52 years received an annual pension of ₹ 5,60,000 during the financial year 2020-21.

His agricultural income in India is 150,000. His net income-tax liability is:

(A) ₹ 22,660

(B) ₹ 9,880

(C) ₹ 22,880

(D) ₹ 24,500 [June 2017]

Hint:

Taxable salary/pension = 5,60,000 – 50,000 (Standard deduction) = 5,10,000

Step 1:

Calculate tax on: Agricultural income + Non-agricultural income

Step 2:

Calculate tax on: Agricultural income + Basic exemption limit

Step 3:

Answer:

(C) ₹ 22,880

Question 10.

Mr. Vinayak derived income from the sale of tea manufactured and grown in Coorg, Karnataka. His income for the previous year 2020-21 from the said activity is ₹ 20 lakh.

The amount exempt from tax by way of agricultural income is:

(A) ₹ 8 lakhs (40%)

(B) ₹ 5 lakhs (25%)

(C) ₹ 12 lakhs (60%)

(D) ₹ 7 lakhs (35%) [June 2017]

Answer:

(C) ₹ 12 lakhs (60%)

Question 11.

Mr. Sankar received ₹ 50,000 as an educational scholarship from Nehru Memorial Trust (a charitable trust). The scholarship is to assist Mr. Sankar in pursuing an M.A. (History) at Jawaharlal Nehru University, New Delhi.

The amount of scholarship liable to tax is:

(A) ₹ 50,000

(B) ₹ 10,000

(C) ₹ 25,000

(D) Nil [June 2017]

Answer:

(D) Nil

Question 12.

Mr. Ramesh engaged in the business of growing and manufacturing tea in India received ₹ 2 lakhs from the Tea Board towards a replacement of tea bushes destroyed by a forest fire.

The amount received from Tea Beard by Mr. Ramesh is:

(A) Liable to tax

(B) Exempt from tax

(C) 50% is exempt from tax

(D) 25% is exempt from the tax [June 2017]

Hint:

Exempt. Refer to Section 10(30) of the Income-tax Act, 1961.

Answer:

(B) Exempt from tax

Question 13.

Mr. Menon having a tea estate in Munnar (Kerala) earned ₹ 5 lakh by way of growing tea leaves and manufacturing tea.

The income chargeable to tax would be:

(A) ₹ 2,00,000

(B) ₹ 1,75,000

(C) ₹ 1,25,000

(D) ₹ 3,00,000 [Dec. 2017]

Hint:

5,00,000 × 40% = 2,00,000

Answer:

(A) ₹ 2,00,000

Question 14.

A registered trade union earned income by way of interest on a fixed deposit held with the State Bank of India of ₹ 5,60,000.

The interest income chargeable to tax in the hands of a trade union would be:

(A) ₹ 5,60,000

(B) Nil

(C) ₹ 2,60,000

(D) ₹ 3,10,000 [Dec. 2017]

Hint:

Any income chargeable under the head ‘income from house property and ‘income from other sources of a registered Trade Union within the meaning of the Indian Trade Unions Act, 1926, formed primarily for the purposes of regulating the relations between workmen and the employers or between the workmen and the workmen is exempt from income-tax and also of a federation of such unions. [Section 10(24)]

Answer:

(B) Nil

Question 15.

Registered political parties have to maintain a record of the contributions and names and address of the persons who have made such contribution where each contribution exceeds:

(A) ₹ 1,000

(B) ₹ 5,000

(C) ₹ 10,000

(D) ₹ 20,000 [Dec. 2017]

Answer:

(D) ₹ 20,000

Question 16.

An electoral trust receiving voluntary contributions for the purpose of distributing to political parties registered under Section 29A of the Representation of the People

Act, 1951 must distribute such contributions.

(A) 100%

(B) 95%

(C) 75%

(D) 50% [Dec. 2017]

Answer:

(B) 95%

Question 17.

Mr. Sridhar employed in KL Ltd. took voluntary retirement in December 2020 and received ₹ 2,00,000 from National Pension System Trust.

The amount so received chargeable to income-tax is:

(A) Nil as 10096 is exempt

(B) ₹ 1,20,000 as 40% is exempt

(C) ₹ 1,00,000 as 50% is exempt

(D) ₹ 80,000 as 60% is exempt [Dec. 2017]

Answer:

(B) ₹ 1,20,000 as 40% is exempt

Question 18.

The income derived from growing, manufacturing, and sale of Centrifuged latex or Cenex or Latex-based cops as per Rule 7A of the Income-tax Rules, 1962 shall be taken as agricultural and non-agricultural income in the following ratio:

(A) 75% and 25%

(B) 60% and 40%

(C) 65% and 35%

(D) None of the above [June 2018]

Answer:

(C) 65% and 35%

Question 19.

The following incomes derived, received, and earned during the previous year are not subject to tax being exempt under the Act:

(i) Money received by an individual as a member of HUF.

(ii) Share of profit received by a partner from LLP.

(iii) Interest in Savings bank account.

(iv) Income of SAARC Fund.

(A) (i) and (ii)

(B) (i), (ii) and (iv)

(C) None of the above

(D) All of the above [June 2018]

Answer:

(B) (i), (ii) and (iv)

Question 20.

XYZ Pvt. Ltd. had distributed an income of ₹ 9,00,000 to Rajesh for the reason of buy-back of its shares from him on 1st March 2021. These shares were purchased by him for ₹ 5,00,000 on 1st March 2014.

The income out of the amount received by Rajesh against the buy-back of shares from the company XYZ Pvt. Ltd. shall be subject to tax in AY 2021-22 shall be of

(A) ₹ 4 lakh

(B) ₹ 9 lakh

(C) Nil being exempt u/s 10(34A) of Act

(D) None of the above [Dec. 2018]

Answer:

(C) Nil being exempt u/s 10(34A) of Act

Question 21.

Any payment in commutation of pension received from a pension fund set up by the Life Insurance Corporation of India in terms of section 10(23AAB) of the Income-tax Act, 1961, is:

(A) Liable for tax

(B) Fully exempt from tax

(C) Partly liable for tax

(D) Taxable @10% [June 2019]

Answer:

(B) Fully exempt from tax

Question 22.

Green-Wood Plantation Ltd. is engaged in the cultivation and processing of Tea. Their net income during AY 2021-22 is to the tune of ₹ 20 Lakh.

What proportion out of the income of ₹ 20 lakh would be treated as agriculture income?

(A) 10%

(B) 25%

(C) 40%

(D) 60% [June 2019]

Answer:

(D) 60%

Question 23.

A registered political party has income during the year 2020-21 of banks interest ₹ 5,00,000, rent from letting of building ₹ 3,00,000 and voluntary contribution by cheque ₹ 8,00,000.

Total income chargeable to tax u/s 13 A of the Income-tax Act, 1961 for the AY 2021 -22 of the political party shall be:

(A) ₹ 5,00,000

(B) ₹ 8,00,000

(C) ₹ 16,00,000

(D) NIL [June 2019]

Answer:

(D) NIL

Question 24.

XYZ Pvt. Ltd. had distributed income of ₹ 6 lakh to Rajesh for the reason of buyback of its shares (Not being listed on a recognized stock exchange) from him on 1st February 2021. The amount of ₹ 6 lakh received by Rajesh in the A.Y. 2021-22 shall be

(A) Taxable in full

(B) Exempt u/s 10(344)

(C) Taxable @ 20%

(D) Taxable at the normal rate of tax [Dec. 2019]

Answer:

(B) Exempt u/s 10(344)

Question 25.

The maximum amount of any death-cwm-retirement gratuity received by an employee not covered under the Payment of Gratuity Act, 1972 on Superannuation from the employer exempt from tax is of

(A) ₹ 20 Lakh

(B) ₹ 10 Lakh

(C) ₹ 5 Lakh

(D) ₹ 15 Lakh [Dec. 2019]

Answer:

(A) ₹ 20 Lakh