Advance Tax, TDS and TCS – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Advance Tax, TDS and TCS – CA Inter Tax Question Bank

Question 1.

Briefly explain the following:

What is the difference between TDS and TCS under the Income-tax Act, 1961? (May 2015, 4 marks)

Answer:

TDS is Tax deducted at Source i.e. tax deducted at origin of income where person giving income deducts tax on it.

TCS is Tax Collection at Source i.e. tax collected where Source of income is given.

Question 2.

Answer the following with reference to the provisions of the Income-tax Act, 1961 for the assessment year 2021-22:

When will tax not required to be deducted at source on interest payable to a resident on any bond or security issued by a company though the aggregate amount of interest exceeds? 5,000, the basic exemption limit under Section 193 of the Act ? (May 2009, 2 marks)

Answer:

It is not necessary to deduct TDS from any interest on debentures paid to an individual who is resident in India if the following conditions are fulfilled, namely:

- If it is zero coupon bond;

- if it is Government Security;

- the aggregate amount of interest paid or likely to be paid by the company to the holder of debentures during the financial year does not exceed ₹ 5,000.

![]()

Question 3.

Answer the following with regard to the provisions of the Income-tax Act, 1961 :

Enlist the installments of advance tax and due dates thereon in case of companies. (May 2009, 4 marks)

Answer:

All corporate assessees and -other assessees (who are subject to compulsory audit under Section 44AB) will have to make electronic payment of tax through internet banking facility offered by authorized banks. Alternatively, these taxpayers can make electronic payment of tax through internet by way of credit or debit cards.

Advance tax is payable as follows:

| Period | Percentage |

| On or before June 15 of the previous year | Up to 15% of advance tax payable |

| On or before September 15 of the previous year | Up to 45% of advance tax payable |

| On or before December 15 of the previous year | Up to 75% of advance tax payable |

| On or before March 15 of the previous year | Up to 100% of advance tax payable |

(i) Where advance tax is payable by virtue of the notice of demand issued by the Assessing Officer, the whole or the appropriate part of the advance tax shall be payable in the remaining instalments.

(ii) Any payment of advance tax made before March 31 shall be treated as advance tax paid during financial year.

(iii) If the last day for payment of any instalment of advance tax is a day on which the receiving bank is closed, the assessee can make the payment on the next immediately following working day, and in such case, the mandatory interest leviable under Sections 234B and 234C would not be charged.

![]()

Question 4.

Answer the following :

Explain the consequences of failure to deduct tax at source and payment of the same to the Government A/c under Income Tax Act, 1961. (Nov 2009, 3 marks)

Answer:

Where a person who is required to deduct tax at source, does not deduct, or after deducting fails to pay, the whole or any part of tax, as required by the Act, then such person shall be deemed to be an assessee in default in respect of such tax u/s 201 (1). He will be liable for payment of tax, interest, penalty and prosecution. Beside, disallowance u/s 40(a) will be attracted.

Question 5.

Explain the consequences of not deducting tax and paying to Govt, account under Section 201 of the Income Tax Act, 1961. (Nov 2010, 4 marks)

Answer :

Consequences of failure to deduct tax at source or pay such tax deducted to the credit of the Central Government [Section 201]

- The following persons shall be deemed to be an assessee in default, if they do not deduct the whole or any part of the tax or after deducting, fail to pay the tax-

- any person including the principal officer of a Company, who is required to deduct any sum in accordance with the provisions of the Act, and

- an employer paying tax on non-monetary perquisites u/s 192(1 A).

- However, no penalty shall be charged under Section 221 from such person, principal officer or company unless the Assessing Officer is satisfied that such failure to deduct or pay the tax deducted, was without good and sufficient reasons.

- Such person, principal officer or company shall also be liable to pay simple interest at 1.5% per month or part of a month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is actually paid.

- Such interest should be paid before furnishing the statement in accordance with Section 200(3).

- Where the tax has not been paid after it is deducted, the amount of the tax together with the amount of simple interest thereon shall be a charge upon all the assets of the person or the company, as the case may be.

![]()

Question 6.

Answer the following:

Briefly discuss the provisions relating to payment of advance tax in case of capital gains and casual income. (May 2013, 4 marks)

Answer:

The Payment of advance tax in case of capital gains and casual income

- Advance tax is payable by an assessee on his/its total income, which includes capital gains and casual income like income from lotteries, crossword puzzles etc.

- As it is not possible for the assessee to estimate his capital gains, income from lotteries, etc., it has been provided that if any such income arises after the due date for any installment, then, the entire amount of tax payable (after considering tax deducted at source) on such capital gains or casual income should be paid in the remaining installments of advance tax which are due..

- When no such installment is due, the entire tax should be paid by 31st March of the relevant financial year.

- But, if the entire tax liability is so paid, no interest liability under section 234C would arise for deferment of advance tax.

Working Note: In the case of casual income (winnings from lotteries, crossword puzzles, card games, gambling, betting, races including horse races etc.), the entire tax liability is fully deductible at source@ 30% under Section 194B and 194BB. Advance tax liability would arise only in respect of the health and education cess element of such tax, if the same, along with ‘ tax liability in respect of other income, if any, is ₹ 10,000 or more.

![]()

Question 7.

Answer the following:

Who is liable to pay Advance Tax? What is the procedure to compute the Advance Tax payable? (May 2014, 2 × 2 = 4 marks)

Answer:

U/s 208, obligation to pay advance tax arises in every case where the tax liability is ₹ 10,000 or more. An assessee has to estimate his current income and calculate tax liability as per the rates in force on that income. If any tax has been deducted at source, the same may be reduced from his tax liability and only the balance may be paid as advance tax.

![]()

Question 8.

Answer the following: (Nov 2015)

(i) Explain briefly the provisions of advance tax on capital gains and casual income. (4 marks)

(ii) What are the consequences of failure to deduct or pay the tax under Section 201 of the Income Tax Act, 1961? (4 marks)

Answer:

(i) Advance tax is payable by an assessee on his/its total income, which includes capital gains and casual income like income from lotteries, crossword puzzles, etc.

Since, it is not possible for the assessee to estimate his capital gains, or income from lotteries etc., it has been provided that’ if any such income arises after the due date for any installment, then, the entire amount of the tax payable (after considering tax deducted at source) on such capital gains or casual income should be paid in the remaining installments of advance tax, which are due.

Where no such installment is due, the entire tax should be paid by 31st March of the relevant financial year.

No interest liability on late payment would arise under section 234C if the entire tax liability is so paid.

Note: In case of casual income, the entire tax liability is fully deductible at source @30% under Section 194B and 194BB. Therefore, advance tax liability would arise only in respect of the surcharge, if any, health and education cess element of such tax, if the same along with tax liability in respect of other income, if any, is ₹ 10,000 or more.

(ii) Any person, including principal officer of a company, responsible for deducting tax at source shall be deemed to be an assessee in default in respect of such tax, if he does not deduct or after deducting fails to pay, the whole or any part of the tax as required by or under the provisions of the Income-tax Act, 1961.

However, no penalty shall be charged under Section 221 from such person, unless the Assessing Officer is satisfied that such person, without good and sufficient reasons, has failed to educt and pay such tax.

As per Section 201(1 A), a person who fails to deduct tax or after deduction, fails to pay the tax, is liable to pay simple interest @ 1 % for every month or part of a month on the amount of such tax from the date on ‘which such tax was deductible to the date on which such tax is actually deducted and simple interest @ 1 /2% for every month or part of month from the date on which tax was deducted to the date on which such tax is actually paid. Such, interest should be paid before furnishing the statement of tax deducted at source under Section 200(3).

Where such tax has not been paid after it is deducted, the amount of tax together with the amount of simple interest thereon shall be a charge upon all the assets of the person, or the company, as the case may be.

![]()

Question 9.

Answer the following:

Briefly discuss the provisions of Section 234B of the Income-tax Act, 1961 for short-payment or non-payment of advance tax. (May 2016, 4 marks)

Answer:

Interest u/s 234 B is attracted for non payment of advance tax or payment of advance tax of an amount less than 90% of assessed tax (i.e. Tax on total income less TDS). Interest liability could be 10% per month or part of the month from 1st April following the financial year up to the date of determination of income i.e. self assessment u/s 140A.

Such interest is calculated on the amount of difference between the assessed tax and the advance tax paid.

Assessed tax is the tax calculated on total income less TDS & TCS.

![]()

Question 10.

Discuss the provision under Income Tax Act for Payment of Advance Tax in case of Capital Gain. (Nov 2016, 2 marks)

Answer:

Provisions for payment of advance tax in case of capital gains [First proviso to Section 234C]

Advance tax is payable by an assessee on his/its total income, which includes capital gains also.

Since it is not possible for the assessee to estimate his capital gains, it has been provided that if any such income arises after the due date for any installment, then, the entire amount of the tax payable (after considering tax deducted at source) on such capital gains should be paid in the remaining installments of advance tax, which are due.

Where no such installment is due, the entire tax should be paid by 31st March of the relevant financial year.

No interest liability under Section 234C would arise if the entire liability is so paid.

![]()

Question 11.

Answer the following:

Discuss the provisions, relating to the premature withdrawal from Employees Provident Fund, under Section 192A, for AY 2021-22. (Nov 2016, 4 marks)

Answer:

TDS provisions relating to premature withdrawal from EPF under Section 192 A:

Section 192A provides that where the accumulated balance due to an employee participating in a recognized provident fund is includible in his total income owing to

an employee making withdrawal from recognized provident fund before continuous service of five years (other than the cases of termination due to ill health, contraction or discontinuance of business, cessation of employment etc.) and

not opting for transfer of accumulated balance to new employer, tax is required to be deducted @ 10% at the time of payment of accumulated balance due to the employee by the trustees Of the Employees Provident Fund. Scheme, 1952 or any person authorised under the scheme to make payment of accumulated balance due to employees.

Tax deduction at source under this section has to be made only if the amount of such payment or aggregate amount of such payment of the payee is ₹ 50,000 or more.

Any person entitled to receive any amount on which tax is deductible under this section has to furnish his permanent account number (PAN) to the person responsible for deducting such tax. In case he fails to do so, tax would be deductible at the maximum marginal rate @30% plus -surcharge as applicable plus cess as applicable.

![]()

Question 12.

What are the clarifications made by CBDT with respect to Section 206 C (1F) relating to following issues:

(i) Whether TCS on sale of motor vehicle is applicable only to luxury car?

(ii) Whether TCS is applicable on each sale or aggregate value of sale of motor vehicle, exceeding ₹ 10 lakhs?

(iii) Whether TCS is applicable in case of an individual?

(iv) Whether TCS on sale of motor vehicle is at retail level also or only by manufacturer to distributor or dealer? (Nov 2019, 4 marks)

Answer:

(i) No, as per Section 206C(1 F), the seller shall collect tax@ 1% from the purchaser on sale of, any motor vehicle of the value exceeding ^10 lakhs.

(ii) Tax is to be collected at source@ 1 % on sale consideration of a motor vehicle exceeding ₹ 10 lakhs. It is applicable to each sale and not to aggregate value of sale made during the year.

(iii) The definition of Seller also includes an individual or a HUF whose total sales, gross receipts or turnover from the business or profession cabled on by him exceed the monetary limits specified under Section 44AB(a)/(b) during the financial year immediately preceding the financial year in which the goods of the nature specified in the Table in (1) are sold. Hence it is applicable on individual.

(iv) To bring high value transactions within the tax net, Section 206C has been amended to provide that the seller shall collect the tax @ 1 % from the purchaser on sale of motor vehicle of the value exceeding ₹ 10 lakhs. This is brought to cover all transactions of retail sales; and accordingly, it will not apply on sale of motor vehicles by manufacturers to dealers/distributors.

![]()

Question 13.

Briefly explain the provisions relating to tax deduction at source on cash withdrawal under section 194 N of the Income Tax Act, 1961. (Nov 2020, 4 marks)

Question 14.

Answer the following:

During the financial year 2020-21, the following payments/expenditure were made/incurred by Mr. Yuvan Raja, a resident individual (whose turnover during the year ended 31-3-2020 was 39 lacs):

(i) Interest of ₹ 12,000 was paid to Rehman & Co., a resident partnership firm, without deduction of tax at source;

(ii) Interest of ₹ 4,000 was paid as interest to Mr. R.D. Burman, a non resident, without deduction of tax at source;

(iii) He had sold goods worth ₹ 5 lacs to Mr. Deva. He gave Mr. Deva a cash discount of ₹ 12,000 later. Commission of 15,000 was paid to Mr. Vidyasagar on 2-7-2020. In none of these transactions, tax was deducted at source.

Briefly discuss whether any disallowance arises under the provisions of Section 40(a)(i)/40(a)(ia) of the Income-tax Act, 1961. (May 2011, 4 marks)

Answer:

Disallowance under Section 40(a)(i)/40(a)(ia) of the Income-tax Act, 1961 is attracted where the assessee fails to deduct tax at source as is required under the Act, or having deducted tax at source, fails to remit the same to the credit of the Central Government within the stipulated time limit.

The assessee is a resident individual, who was not subjected to tax audit during the immediately preceding previous year i.e., P.Y. 2019-20 (as his turnover is less than 1 crore in that year) and the TDS obligations have to be considered bearing this in mind.

![]()

(i) The obligation to deduct tax source from interest paid to a resident arises under Section 194A in the case of an individual, only where he was subject to tax audit under Section 44AB in the immediately preceding previous year, i.e., P.Y. 2019-20. From the data given, it is clear that he was not subject to tax audit under Section 44AB in the P.Y. 2019-20. Hence, disallowance under Section 40(a)(ia) is not attracted in this case.

(ii) In the case of interest paid to a non-resident, there is obligation to deduct tax at source under Section 195, hence non-deduction of tax at source will attract disallowance under Section 40(a)(i).

(iii) The obligation to deduct tax at source under Section 194-H from commission paid in excess of ₹ 15,000 in financial year to a resident arises in the case of an individual, only where he was subject to tax audit under Section 44AB in the immediately preceding previous year. From the data given, it is clear that he was riot subject to tax audit under Section 44AB in the P.Y. 2019-20. Hence, there is no obligation to deduct tax at source under Section 194H during the P.Y. 2020-21. Therefore, disallowance under Section 40(a)(ia) is not attracted in this case.

![]()

Question 15.

Answer the following:

(i) State the applicability of TDS provisions and TDS amount in the following cases:

(a) Rent paid for hire of machinery by B Ltd. to Mr. Raman ₹ 2,70,000.

(b) Fee paid to Dr. Srivatsan by Sundar.(HUF) ₹ 35,000 for surgery performed to a member of the family. (Nov 2011, 4 marks)

Answer:

(a) Since the rent paid for hire of machinery, by B. Ltd. to Mr. Raman exceeds ₹ 2,40,000, the provisions of Section 194-I for deduction of tax at source are attracted.

The rate applicable for deduction of tax at source under Section 194-I on rent paid for hire of plant and machinery is 2% (assuming before 14.05.2020) assuming that Mr. Raman had. furnished permanent account number to B Ltd.

Therefore, the amount of tax to be deducted at source:

= ₹ 2,70,000 × 2% = ₹ 5,400.

Note: In case Mr. Raman does not furnish his permanent account number to B. Ltd., tax shall be deducted @ 20% on ₹ 2,10,000, by virtue of provisions of Section 206AA.

(b) As per the provisions of Section 194J, a Hindu Undivided Family is required to deduct tax at source on fees paid for professional services only if it is subject to tax audit under Section 44AB in financial year preceding the current financial year.

However, if such payment made for professional services is exclusively for the personal purpose of any member of Hindu Undivided Family, then, the liability to deduct tax is not attracted.

Therefore, in the given case, even if Sundar (HUF) is liable to tax audit in the immediately preceding financial year, the liability to deduct tax at source is not attracted in this case since, the fees for professional service to Dr. Srivatsan is paid for a personal purpose i.e. the surgery of a member of the family.

![]()

Question 16.

Answer the following :

(1) What are the provisions relating to tax deduction at source in respect of:

(A) ABC and Co. Ltd. Paid ₹ 19,000 to one of its Directors as sitting fees on 01-01-2021.

(B) Mr. X sold his House to Mr. Y on 01 -02-2021 for ₹ 60 lacs? (May 2014, 2 × 2 = 4 marks)

Answer:

(A) TDS @ 10% (assuming before 14.05.2020) (i.e ₹ 1900) has to be deducted at source u/s 194 – J from sitting fees paid to directors

(B) TDS @ 1% (assuming before 14.05.2020) (i.e. ₹ 60,000) has to be 4 deducted at source u/s 194 – IA from payment made by Mr Y to Mr X.

Question 17.

Answer the following:

(i) State in brief the applicability of tax deduction at source provisions, the rate and amount of tax deduction in the following cases for the financial year 2021 -22:

(1) Payment of ₹ 27,000 made to Jacques Kallis, a South African cricketer, by an Indian newspaper agency on 02-07-2020 for contribution of articles in relation to the sport of cricket.

(2) Rent of ₹ 1,70,000 paid by a partnership firm for use of plant and machinery.

(3) Winning from horse race ₹ 1,50,000.

(4) ₹ 2,00,000 paid to Mr. A, a resident individual on 22-02-2021 by the State of Uttar Pradesh on compulsory acquisition of his urban land. (Nov 2014, 4 marks)

Answer:

(1) Section 194E provides that the person responsible for payment of any amount to a non-resident sportsman for contribution of articles relating to any game or sport in India in a newspaper has to deduct tax at source @ 20%. Further, since Jacques Kallis, a South African cricketer, is a non-resident, health and education cess @ 4% on TDS should also be added.

Therefore, tax to be deducted = ₹ 27,000 × 20.80% = ₹ 5,616.

![]()

(2) As per Section 194-I, tax is to be deducted at source @ 2% on payment of rent for use of plant and machinery, only if the payment exceeds ₹ 2,40,000 during the financial year.

Since rent of ₹ 1,70,000 paid by a partnership firm does not exceed ₹ 2,40,000, tax is not deductible.

(3) Under Section 194BB, tax is to be deducted at source, if the winnings from horse race exceed ₹ 10,000. The rate of deduction of tax at source is 30%. Assuming that winnings are paid to the residents, health and education cess @ 4% has not been added to the tax rate of 30%. Hence, tax to be deducted = ₹ 1,50,000 × 30% = ₹ 45,000.

(4) As per Section 194-LA, any person responsible for payment to a resident, any sum in the nature of compensation or consideration on account of compulsory acquisition under any law, of any immovable property, is required to deduct tax at source @ 10%, (before 14.05.2020, after 14.05.2020 to 31.03.2021 rate is 7.5%), if such payment or the aggregate amount of such payments to the resident during the financial year exceeds ₹ 2,50,000.

In the given case, there is no liability to deduct tax at source as the payment made to Mr. A does not exceed ₹ 2,50,000.

![]()

Question 18.

Briefly explain the following:

Mr. Madan sold his house property in Surat as well as his rural agricultural land for a consideration of ₹ 65 lakhs and ₹ 20 lakhs respectively, to Mr. Raman on 01-10-2020. He has purchased the house property for ₹ 40 lakhs and the land for ₹ 15 lakhs, in the year 2016. There was no difference in the stamp valuation. You are required to determine TDS implications, if any, assuming both persons are resident Indians. (May 2015, 4 marks)

Answer:

TDS deductible = 65,00,000 × 0.75% = 48,750

TDS shall be deducted on sale of immovable property other than agricultural land.

Question 19.

Answer the following:

(i) Ashwin a resident Individual carrying on business, furnishes you the following information:

| Turnover during financial year | ₹ |

| 2019- 20

2020- 21 |

2,20,00,000

20,00,000 |

![]()

State whether tax deduction at source provisions are attracted for the under mentioned expenses incurred during the financial year 2020-21:

| Particulars | ₹ |

| Commission paid to Babloo

Payment to Vijay for repair of office building Payment of fees for technical services, to Vivek |

8,500

23,000 35.000 |

All payments are made to residents.

If tax has to be deducted at source, state the amount of tax to be deducted at source. (May 2016,4 marks)

Answer:

(i) As the turnover of Mr. Ashwin for F.Y. 2019-20, i.e. ₹ 220 lakhs, has exceeded the monetary limit of ₹ 100 lakhs prescribed under Section 44AB, he has to comply with the tax deduction provisions during the financial year 2020-21 (even thought the turnover during F.Y. 2020-21 has not exceeded ₹ 100 Iakhs), subject to, however, the exemptions provided for under the relevant sections for applicability of TDS provisions.

![]()

(i) Commission paid to Babloo:

As per Section 1 94H, tax has to be deducted @ 5%, (3.75% for the period from 14.05.2020 to 31.03.2021), if the amount of commission paid exceeds ₹ 15,000.

Therefore, No tax is to be deducted as the commission amount is within the limit.

(ii) Payment to Vijay for repair of office building:

As per Section 1 94C, tax has to be deducted @ 1 % (0.75% for the period from 14.05.2020 to 31.03.2021) where the payment is made to an individual for repair of office building, however, tax has to be deducted at source only if the amount of payment exceeds ₹ 30,000.

In this case, Mr. Ashwin is not required to deduct tax at source as the amount of payment towards repair of office building does not exceed ₹ 30,000, assuming that ₹ 23,000 is the only payment made to Mr. Vijay during the P.Y. 2020-21.

(iii) Payment of fees for technical services to Vivek:

As per Section 1 94J, tax has to be deducted @ 10%, (7.5% for the period from 14.05.2020 to 31.03.2021) since the amount of fees for technical services paid to Vivek exceeds ₹ 30,000.

Therefore, tax of 3,500 (10% (assuming before 14.05.2020) of ₹ 35,000) has to be deducted at source.

![]()

Question 20.

State with reason whether the following receipt is taxable or not under the provision of Income-tax Act, 1961?

(4) TDS is not applicable in respect of payment of ₹ 1,00000 to Mr. Pandey a resident, being interest on recurring deposit with SBI. (Nov 2016, 2 marks)

Answer:

Taxability of receipt under the provision of the Income-tax Act, 1961

| Taxable/ Not Taxable | Reason | |

| 4. | Taxable | Interest of ₹ 1 lakh on recurring deposit is an income chargeable to tax as Income from Other Sources in the hands of the recipient, Mr. Pandey, a resident in India. |

Note: The requirement of question 4(a) is to examine whether the receipts mentioned in sub-paris [items (1) to (4)1 thereunder are taxable or not under the provisions of the Income-tax Act, 1961. Sub-part (4) thereunder states that TDS is not applicable in respect of payment of ₹ 1 lakh to Mr. Pandey, a resident, being interest on recurring deposit with SBI.

Owing to the language of this statement, it is possible to answer this sub-part on the basis of correctness of the statement rather than the taxability of the receipt as per the requirement contained in the opening paragraph of the question. On this basis, the answer would be that the statement is false on the reasoning that tax is required to be deducted under Section 194A on interest from recurring deposits, since with effect from 1.6,2016, time deposit would include recurring deposit and the interest thereon exceeds the threshold limit of ₹ 10,000, in this case.

![]()

Question 21.

Answer the following:

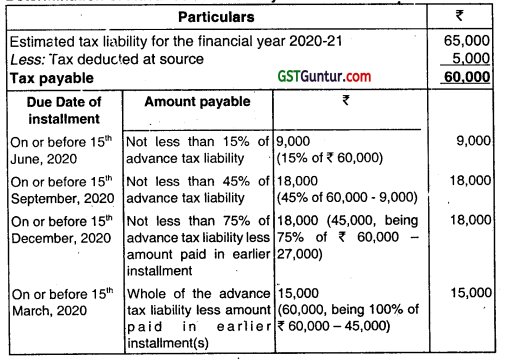

Mr. Barun provides you the following information and requests you to determine the Advance Tax liability with due dates for the financial year 2020-21.

Estimated tax liability for the financial year 2020-21 – ₹ 65,000

Tax deducted at source for this year – ₹ 5,000 (Nov 2016, 4 marks)

Answer:

Determination of Advance Tax Liability of Mr. Barun

Note – It is assumed that Mr. Barun’s age is less than 60 years as on 31.3.2021.

Advance tax is payable in his case since the tax payable is more than ₹ 10,000.

![]()

Question 22.

(a) Pallavi Bank Ltd., has paid interest of ₹ 9,000 to Mr. A, a resident Indian, from its Chennai branch and ₹ 8,000 from Bangalore branch. If there is no core banking services in the bank, is tax required to be deducted at source from such interest payments made on 31-3-2021? Will your answer be different if there is core banking service present in the bank? Also, explain the provisions of the Income-tax Act, 1961 in this regard. (May 2017) (4 marks)

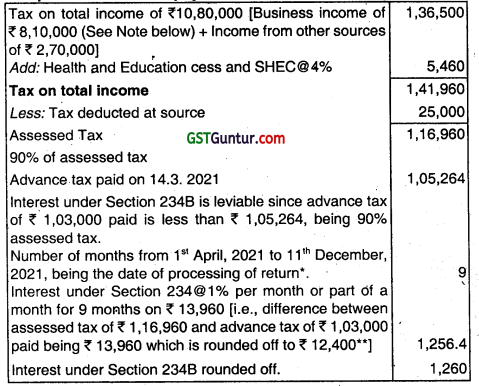

(b) Mr. Sachal, a resident individual aged 54, furnishes income details as under:

(i) Wholesale Cloth business, whose turnover is ₹ 150 lakhs, for which accounts are audited u/s 44AB. Income from such business ₹ 8,10,000.

(ii) Income from other sources ₹ 2,70,000.

(iii) Tax deducted at source ₹ 25,000.

(iv) Advance tax paid ₹ 1,03,000 on 14-3-2021.

Return of income will be filed on 11 -12-2021. The assessee is willing to pay the requisite self-assessment tax. Calculate the interest payable under Section 234B of the income-tax Act, 1961. Assume that the return of income would be processed on the same day of filing of return. (4 marks)

Answer:

(a) TDS need not be deducted if there is no core banking services. If core banking services is present TDS need to be deducted if interest on FD & RD exceeds ₹ 10,000 p.a.

(b) Computation of Interest payable under Section 234B by Mr. Sachal

Note: .

The presumptive income computed under Section 44AD would be ₹ 12 lakh, being 8% of ₹ 150 Iakhs. However, since Mr. Sachal has got his books of account audited under Section 44AB, he can declare lower income of ₹ 8,10,000.

It is assumed that the same represents the date of determination of total income under Section 143(1).

** Rounded oft under RWe 11 9A of income tax Rules, 1962.

![]()

Question 23.

(i) Under section 208, obligation to pay advance tax arises in every case where the advance tax payable is ₹ 10,000 or more. State exception to this rule. (Nov 2017) (2 marks)

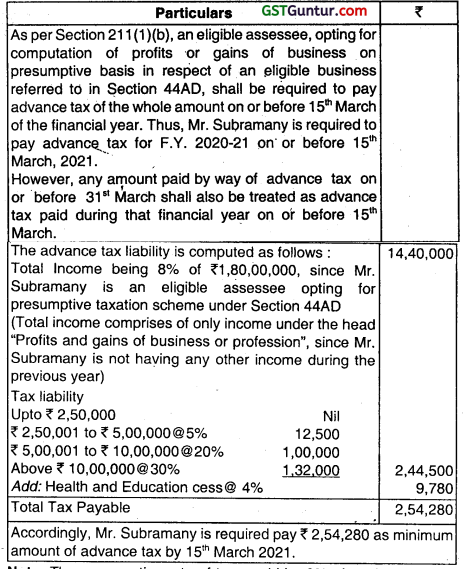

(ii) Mr. Subramany is engaged in the business of producing and selling toys. During the previous year 2020-21 his turnover was ₹ 1.80 crores. He opted for paying tax as per presumptive taxation scheme laid down in Section GAD. He has no other income during the previous year. Is he liable to pay advance tax and if so, what is the minimum amount of advance tax to be paid and the due date for payment of such advance tax? (3 marks)

Answer:

(i) Under Section 208, obligation to pay advance tax arises In every case where the advance tax payable is ₹ 10,000 or crore. However, as per Section 207(2), this requirement will not apply:

(a) in case of a resident individual, who is of the age of 60 years or more during the previous year and

(b) who does not have any income chargeable to tax under the head “Profits and gains of business or profession”.

(ii) Computation of advance tax liability in the hands of Mr. Subramany opting for presumptive taxation scheme under Section 44AD

Note: The presumptive rate of tax would be 8% of total turnover or gross receipts.

![]()

However, the presumptive rate of 6% of total turnover or gross receipts will be applicable in respect of amount which is received

- by an account payee cheque or

- by an account payee bank draft or

- by use of electronic clearing system

- through a bank account

- or through such other prescribed electronic modes

during the previous year or before the due date of filing of return under section 139(1) in respect of that previous year.

The question does not specify whether any part of the turnover has been received by such modes. Accordingly, the solution has been worked out considering presumptive income@8% of turnover. It can be assumed that the whole amount of turnover is received through banking channel digital means i.e., by an account payee cheque/bank draft or use of ECS Through a bank during the previous year.

In such a case, Mr. Subramany’s total income would be ₹ 10,80,000 (being 6% of ₹ 1,80,00,000). Tax liability would be ₹ 1,41,960 [₹ 1,36,500 (₹ 1,12,500 + 30% of ₹ 80,000) + ₹ 5,460 (3% of ₹ 1,36,500)], which has to be paid by way of advance tax on or before 15th March, 2021.

![]()

Question 24.

Mr. Dhanapal wishes to purchase a residential house costing ₹ 60 lakhs from Ms. Saipriya. The house is situated at Chennai. He also wants to purchase agricultural lands in a rural area for ₹ 65 lakhs. He wants to know whether there will be any obligation to deduct tax at source in these two situations. Both the buyer as well as the sellers are residents in India. Advise Mr. Dhanapal suitably. (Nov 2018, 2 marks)

Answer:

Since the sale consideration of residential house exceeds ₹ 50 lakh, Mr. Dhanapal is required to deduct tax at source@1% (0.75% for the period from 14.05.2020 to 31.03.2021) of sale consideration of ₹ 60 lakh under section 194-IA.

TDS provisions under section 194-IA are not attracted in respect of transfer of rural agricultural land, even if the consideration exceeds ₹ 50 lakh.

![]()

Question 25.

Rahil & Co., a partnership firm is having a car dealership show-room. They have purchased cars for ₹ 2 crores from XYZ Ltd., car manufacturers, the cost of each car being more than ₹ 12 lakhs.

They sell the cars to individual buyers at a price yielding 10% margin on cost. State whether there will be any obligation to collect tax in the above two situations. (Nov 2018, 2 marks)

Answer:

Every person, being a seller, who receives any amount as consideration for sale of a motor vehicle of the value exceeding ₹ 10 lakhs, is required to collect tax at source @ 1 % of the sale consideration from the buyer.

TCS provisions will, however, not apply on sale of motor vehicles by manufacturers to dealers/distributors. Hence, XYZ Ltd., the manufacturer- seller need not collect tax at source on sale of cars to the dealer, Rahil & Co., even if the value of each car exceeds ₹ 10 lakhs.

However, TCS provisions would be attracted when Rahil & Co., sells cars to v individual buyers, since the value of each car exceeds ₹ 10 lakhs. Rahil & Co. has to collect tax@1% of the consideration on sale of each car to an individual buyer.

![]()

Question 26.

Examine the TDS implications in the following cases along-with reasons thereof;

(i) Ms. Varsha received a sum of ₹ 95,000 on 31st December 2020 towards maturity proceeds of LIC taken on 1sl October 2015 for which sum assured was ₹ 80,000 and annual premium was ₹ 10,000.

(ii) Mr. Deepak transferred a residential house property to Mr. Karan for ₹ 45 lacs. The stamp duty value of such property is ₹ 55 lacs.

(iii) XYZ Private Limited pays the following amounts to Mr. Narayan during previous year 2020-21:

1. ₹ 22,000 towards fee for professional services

2. ₹ 18,000 towards royalty

(iv) Payment of ₹ 1,75,000 made to Mr. Vaibhav for purchase of calendar according to specifications of M/s. ABC Limited. However, no material was supplied for such calendar by ABC Limited to Mr. Vaibhav.

(v) Talent Private Limited pays ₹ 12,000 to Ms. Sudha, its director, towards sitting fee which is not taxable u/s 192.

(vi) Radha Limited is engaged for Shyam Limited only in the business of operation of call centre. On 18-03-2021, the total amount credited by Shyam Limited in the ledger account of Radha Limited is ₹ 70,000 regarding service charges of call centre. The amount is paid through cheque on 28/03/2021 by Shyam Limited. (May 2019, 7 marks)

Answer:

TDS implications

(i) On payment of LIC maturity proceeds –

The annual premium exceeds 10% of sum assured in respect of a policy taken after 31.3.2012, and consequently, the maturity proceeds of ₹ 95,000 would not be exempt u/s 10(10D) in the hands of Ms. Varsha. However, tax deduction provisions u/s 194-DA are not attracted since the maturity proceeds are less than ₹ 1 lakh.

![]()

(ii) On payment of sale consideration for purchase of residential house property –

Since the sale consideration of house property is less than ₹ 50 lakhs, Mr. Karan is not required to deduct tax at source u/s 194-IA, irrespective of the fact that the stamp duty value is more than the sale consideration as well as the threshold limit of ₹ 50 lakhs.

(iii) On payment of fee for professional services and royalty –

Under Section 194J, the threshold limit of ₹ 30,000 is specified separately for, inter alia, fees for professional services and royalty. Therefore, XYZ Private Limited is not required to deduct tax at source under Section 194J either on fee of ₹ 22,000 for professional services or on royalty of ₹ 18,000 paid to Mr. Narayan, since the payment under each category does not exceed the independent threshold ? 30,000 specified thereunder.

(iv) On payment for purchase of calendar according to specifications

As per Section 194C, the definition of “work” does not include the manufacturing or supply of product according to the specification by customer in case the material is purchased from a person other than the customer. Therefore, M/s ABC Limited is not required to deduct tax at source in respect of payment of ₹ 1,75,000 to Mr. Vaibhav, for purchase of calendar according to its specifications, since it did not supply the material for such calendar. Hence, the contract is a contract for ‘sale’ and not a works contract.

(v) On payment of sitting fees to the director –

Talent Private Limited is required to deduct tax at source @10% (7.5% for the period from 14.05.2020 to 31.03.2021) on sitting fees of ₹ 12,000 paid to its director, since the threshold limit of ₹ 30,000 u/s 194J is not applicable in respect of fees paid to a director of a company.

(vi) On payment of call centre service charges –

Since Radha Limited is engaged only in the business of operation of call centre, Shyam Limited is required deduct tax at source@1.5% for the period from 14.05.2020 to 31.03.2021 on the amount of ₹ 70,000 u/s 194J on 18.3.2021 i.e., at the time of credit of call centre service charges to the account of Radha Limited, since the said date is earlier than the payment date i.e., 28.3.2021.

![]()

Question 27.

Examine & explain the TDS implications in the following cases along with reasons thereof, assuming that the deductees are residents and having a PAN which they have duly furnished to the respective deductors.

(i) Mr. Tandon received a sum of ₹ 1,75,000 as pre-mature withdrawal from Employees Provident Fund Scheme before continuous service of 5 years on account of termination of employment due to ill-health.

(ii) A sum of ₹ 42,000 has been credited as interest on recurring deposit by a banking company to the account of Mr. Hasan (aged 63 years).

(iii) Ms. Kaul won a lucky draw prize of ₹ 21,000. The lucky draw was organized by M/s. Maximus Retail Ltd. for its customer.

(iv) Finance Bank Ltd. sanctioned and disbursed a loan of ₹ 10 crores to Borrower Ltd. on 31 -3-2021. Borrower Ltd. paid a sum of ? 1,00,000 as service fee to Finance Bank Ltd. for processing the loan application.

(v) Mr. Ashok, working in a private company, is on deputation for 3 months (from December, 2020 to February, 2021) at Hyderabad where he pays-a monthly house rent of ₹ 52,000 for those three months, totalling to ₹ 1,56,000. Rent is paid by him on the first day of the relevant month. (Nov 2019, 7 marks)

Answer:

(i) According to Rule Number 9 of Schedule IV and Section 111 of the Income Tax Act, the rules of unrecognised provident fund would be applicable in case of withdrawal before the completion of five years All the four components of EPF will be taxable. The amount of tax liability would have to be recomputed for each of the financial years at the tax rates that were applicable to the withdrawer in those respective years. There are certain cases when withdrawal before five years does not become taxable. These cases are as follows:

(a) If terminated due to employee’s ill health;

(b) Due to discontinuance of the employer’s business;

(c) Or any other reason beyond the control of the employee.”

In the present case, Mr. Tandon’s termination is due to ill health. Therefore withdrawal is not taxable and hence no TDS implication for the same.

![]()

(ii) As per the third proviso to Section 194A(3), no tax is required to be deducted at source in the case of senior citizens where the amount of interest or the aggregate of the amount-of interest credited or paid during the financial year by a banking company, Co-operative Society engaged in banking business or post office does not exceed ₹ 50,000. In the given case, since Mr. Hasan aged 63 years is a senior citizen receiving interest on recurring deposit of ₹ 42000/- below the specified limit hence no TDS is required to be made.

(iii) According to the provisions of Section 194B, every person responsible for paying to any person, whether resident or non-resident, any income by way of winnings from lottery or crossword puzzle or card game and other game of any sort, is required to deduct income-tax therefrom at the rate of 30% if the amount of payment exceeds ₹ 10,000. As Mr. Kaul won a lucky draw prize of ₹ 21,000 TDS is required to be made on entire 21000 @30% i.e. ₹ 6,300/-.

(iv) According to Section 2(28A) – “interest” means interest payable in any manner in respect of any moneys borrowed or debt incurred (including a deposit, claim or other similar right or obligation) and includes any service fee or other charge in respect of the moneys borrowed or debt incurred or in respect of any credit facility which has not been utilised. From the above definition it is clear that processing fees is included in the definition of Interest u/s 2(28A). No tax is deductible at source under section 194A, since the service fee are paid to a banking company, i.e., Finance Bank Ltd.

(v) Mr. Ashok, a salaried individual, is liable to deduct tax at source @ 5% under section 194-IB on ₹ 1,56,000 (being rent for 3 months from December 2020 to February 2021) from the rent to ₹ 52,000 payable on 1sl February, 2020, since the monthly rent exceeds ₹ 50,000.

![]()

Question 28.

State in brief the applicability of tax deduction at source provisions, the rate and amount of tax deduction in the following cases for the financial year 2020-2021 under the Income-tax Act, 1961. Assume that all payments are made to residents :

(i) Sanjay, a resident Indian individual, not deriving any income from business or profession makes payments of ₹ 12 lakh in January, 2021, ₹ 20 lakh in February, 2021 and ₹ 20 lakh in March, 2021 to Mohan, a contractor for reconstruction of his residential house.

(ii) ABC Ltd. makes the payment of ₹ 1,50,000 to Rarrrial, an individual transporter who owned 6 goods carriages throughout the previous year. He does not furnish his PAN.

(iii) Smt. Sarita paid ₹ 5,000 on 17th April, 2020 to Smt. Deepa from the deposits in National Savings Scheme account. (Nov 2020, 5 marks)

Question 29.

Examine TDS/TCS implications in case of following transactions, briefly explaining provisions involved assuming that all the payees are residents; state the rate and amount to be deducted, in case TDS/TCS is required to be deducted/collected.

(i) On 1.5.2020, Mr. Brijesh made three fixed deposits of nine months each of ₹ 3 lakh each, carrying interest @ 9% with Mumbai Branch, Delhi Branch and Chandigarh Branch of CBZ Bank, a bank which had adopted CBS. These Fixed Deposits mature on 31.01.2021.

(ii) Mr. Marwah, aged 80 years, holds 61/2% Gold Bonds, 1977 of ₹ 2,00,000 and 7% Gold Bonds 1980 of ₹ 3,00,000. He received yearly interest on these bonds on 28.02.2021.

(iii) M/s AG Pvt. Ltd. took a loan of ₹ 50,00,000 from Mr. Haridas. It credited interest of ₹ 79,000 payable to Mr. Haridas during they previous year 2020-21. M/s AG Pvt. Ltd. is not liable for tax audit x during previous years 2019-20 and 2020-21.

(iv) Mr. Prabhakar is due to receive ₹ 6 lakh on 31.3.2021 towards maturity proceeds of LIC policy taken on 1.4.2017, for which the sum assured is ₹ 5 lakhs and the annual premium is ₹ 1,40,000. (Jan 2021, 8 marks)

![]()

Question 30.

Examine the TDS implications under section 194A in the cases mentioned hereunder-

(i) On 1.10.2020, Mr. Harish made a six month fixed deposit of ₹ 10 lakh @ 9% p.a. with ABC Co- operative Bank. The fixed deposit matures on 31.3.2021.

(ii) On 1.6.2020 Mr. Ganesh made three nine month fixed deposits of ₹ 3 lakh each, carrying interest @ 9% with Dwarka Branch, Janakpuri Branch and Rohini Branch of XYZ Bank, a bank which has adopted CBS. The fixed deposits mature on 28.2.2021.

(iii) On 1.10.2020, Mr. Rajesh started a 6 month recurring deposit of ₹ 2,00,000 per month @ 8% p.a. with PQR Bank. The recurring deposit matures on 31.3.2021.

Answer:

(i) ABC Co-operative Bank has to deduct tax at source @ 10% on the interest of ₹ 45,000 (7.5% × ₹ 10lakh × 1/2) under section 194A. The tax deductible at source under section 194A from such interest is, therefore, ₹ 3,375.

(ii) XYZ Bank has to deduct tax at.source @ 7.5% under section 194A, since the aggregate interest on fixed deposit with the three branches of the bank is ₹ 60,750 [3,00,000 × 3 × 9% × 9/12], which exceeds the threshold limit of ₹ 40,000. Since XYZ Bank has adopted CBS, the aggregate interest credited/paid by all branches has to be considered. Since the aggregate interest of ₹ 60,750 exceeds the threshold limit of ₹ 40,000, tax has to be deducted @ 7.5% under section 194A.

(iii) Tax has to be deducted under section-194A by PQR Bank on the interest of ₹ 28,000 falling due on recurring deposit on 31.3.2021 to Mr. Rajesh, since –

- “recurring deposit” is included in the definition of “time deposit”; and

- such interest exceeds the threshold limit of ₹ 40,000.

![]()

Question 31.

ABC Ltd. Makes the following payments to Mr. X, a contractor, for contract work during the P.Y. 2020-21.

₹ 20,000 on 1.5.2020

₹ 25,000 on 1.8.2020

₹ 28,000 on 1.12.2020

On 1.3.2021, a payment of ₹ 30,000 is due to Mr. X or account of a contract work.

Discuss whether ABC Ltd. is liable to deduct tax at.source under section 194C from payments made to Mr. X

Answer:

In this case, the individual contract payments made to Mr. X does not exceed ₹ 30,000. However, since the aggregate amount paid to Mr. X during the P.Y. 2020-21 exceeds ₹ 1,00,000 (on account of the last payment of ₹ 30,000, due on 1.3.2021, taking the total from ₹ 73,000 to ₹ 1,03,000), the TDS provisions under section 194C would get attracted. Tax has to be deducted @ 0.75% on the entire amount paid of ₹ 1,03,000 from the last payment of ₹ 30,000 and the balance of ₹ 29,277 (i.e., ₹ 30,000 – ₹ 773) has to be paid to Mr. X.

![]()

Question 32.

Certain concessions are granted to transport operators in the context of cash payments under section 40A(3) and deduction of tax at source under section 194-C. Elucidate.

Answer:

Section 40A(3) provides for disallowance of expenditure incurred in respect of which payment or aggregate of payments made to a person in a day exceeds ₹ 10,000, and such payment or payments are made otherwise than by account payee cheque or account payee bank draft or use of electronic system through bank account or through other prescribed electronic modes. However, in case of payment made to transport operators for plying, hiring or leasing goods carriages, the disallowance will be attracted only if the payment made to a person in a day exceeds ₹ 35,000. Therefore, payment or aggregate of payments up to ₹ 35,000 in a day can be made to a transport operator otherwise than by way of account payee cheque or account payee bank draft or use of electronic system through bank account or through other prescribed electronic modes, without attracting disallowance under section 40A(3).

Under section 194C, tax had to be deducted in respect of payments made to contractors at the rate of 1 % in case the payment is made to individual or Hindu Undivided Family or at the rate of 2% in any other case.

However, no deduction is required to be made from any sum credited or paid or likely to be credited or paid during the previous year to the account of a contractor, during the course of the business of plying, hiring or leasing goods carriages, if the following conditions are fulfilled:-

- He owns not less than 10 goods carriages at any time during the previous year.

- He is engaged in the business of plying, hiring or leasing goods carriages;

- He has furnished a declaration to this effect along with his PAN.

![]()

Question 33.

Examine the applicability of the provisions for tax deduction at source under section 194DA in the following cases –

(i) Mr. X, a resident, is due to receive ₹ 4.50 lakhs on 31.3.2021, towards maturity proceeds of LIC policy taken on 1.4.2018, for which the sum assured is ₹ 4 lakhs and the annual premium is ₹ 1,25,000.

(ii) Mr. Y, a resident, is due to receive ₹ 3.25 lakhs on 31.3.2021 on LIC policy taken on 31.3.2012, for which the sum assured is ₹ 3 lakhs and the annual premium is ₹ 30,100;

(iii) Mr. Z, a resident, is due to receive ₹ 95,000 on 1.8.2020 towards maturity proceeds of LIC policy taken on 1.8.2013 for which the sum assured is ₹ 90,000 and the annual premium was ₹ 12,000.

Answer:

(i) Since the annual premium exceeds 10% of sum assured in respect of a policy taken after 31.3.2012, the maturity proceeds of ₹ 4.50 lakhs

due on 31.3.2021 are not exempt under section 10(10D) in the hands of .Mr. X. Therefore, tax is required to be deducted @ 3.75% under section 194DA on the amount of income comprised therein i.e., on ₹ 75,000 ₹ 4,50,000, being maturity proceeds – ₹ 3,75,000, being the entire amount of insurance premium paid).

(ii) Since the annual premium is less than 20% sum assured in respect of a policy taken before 1.4.2012, the sum of ₹ 3.25 lakhs due to Mr. Y would be exempt under Section 10(10D) in his hands. Hence, no tax is required to be deducted at source under Section 194DA on such sum payable to Mr. Y.

(iii) Even though the annual premium exceeds 10% of the sum assured in respect of a policy taken after 31.3.2012 and consequently, the maturity proceeds of ₹ 95,000 due on 1.8.2020 would not be exempt under Section 10(10D) in the hands of Mr. Z, the tax deduction provisions under Section 194DA are not attracted since the maturity proceeds are less than ₹ 1 lakh.

![]()

Question 34.

Calculate the amount of tax to be deducted at source (TDS) on payment made to Ricky Ponting, an Australian cricketer non-resident in India, by a newspaper for contribution of articles ₹ 25,000.

Answer:

Under section 194E, the person responsible for payment of any amount to a non – resident sportsman for contribution of articles relating to any game or sport in India in a newspaper shall deduct tax @ 20%. Further, since Ricky Ponting is a non – resident, health and education cess @ 4% on TDS would also be added. Therefore, tax to be deducted = ₹ 25,000 × 20.8% = ₹ 5,200.

Question 35.

Moon TV, a television channel, made payment of ₹ 50 lakhs to a production house for production of programme for telecasting as per the specifications given by the channel. The copyright of the programme is also transferred to Moon TV. Would such payment be liable for tax deduction at source under Section 194C? Discuss.

Also, examine whether the provisions of tax deduction at source under Section 194C would be attracted if the payment was made by Moon TV for acquisition of telecasting rights of the content already produced by the production house.

Answer:

In this case, since the programme is produced by the production house as per the specifications given by Moon TV, a television channel, ancf the copyright is also transferred to the television channel, the same falls within the scope of definition of the term ‘work’ under Section 194C. Therefore, the payment of ₹ 50 lakhs made by Moon TV to the production house would be subject to tax deduction at source under Section 194C.

If, however, the payment was made by Moon TV for acquisition of telecasting rights of the content already produced by the production house, there is no contract-for “carrying out any work”, as required in Section 194C(1). Therefore, such payment would not be liable for tax deduction at source under Section 194C.

![]()

Question 36.

Mr. X sold his house property in Bangalore as well as his rural agricultural land for a consideration of ₹ 60 lakh and ₹ 15 lakh, respectively, to Mr. Y on 1.8.2020. He has purchased the house property and the land in the year 2019 for ₹ 40 lakh and ₹ 10 lakh, respectively. The stamp duty value on the date of transfer, i.e., 1.8.2020, is ₹ 85 lakh and ₹ 20 lakh for the house property and rural agricultural land, respectively. Examine the tax implications in the hands of Mr. X and Mr. Y and the TDS implications, if any, in the hands of Mr. Y, assuming that both Mr. X and Mr. Y are resident Indians.

Answer:

(i) Tax implication in the hands of Mr.X

As per section 50C, the stamp duty value of house property (i.e., ₹ 85 lakh) would be deemed to be the full value of consideration arising on transfer of property, since the stamp duty value exceed 110% of the consideration received. Therefore, ₹ 45 lakh (i.e., ₹ 85 lakh – ₹ 40 lakh, being the purchase price) would be taxable as Short term capital gains in the A.Y. 2021-22.

Since rural agricultural land is not a capital asset, the gains arising on sale of such land is not taxable in the hands of Mr.X.

(ii) Tax implications in the hands of Mr. Y

In case immovable property is received for inadequate consideration, the difference between the stamp value and actual consideration would be taxable under Section 56(2)(x), if such difference exceeds the higher of ₹ 50,000 and 10% of the consideration.

Therefore, in this case ₹ 25lakh (₹ 85 lakh – ₹ 60 lakh) would be taxable in the hands of Mr. Y under Section 56(2).

Since agricultural land is not a capital asset, the provisions of Section 56(2)(x) are not attracted in respect of receipt of agricultural land for inadequate consideration,” since the definition of “property” under’ Section 56(2)(x) includes only capital assets specified thereunder.

(iii) TDS implication in the hands of Mr. Y

Since the sale consideration of house property exceeds ₹ 50 lakh, Mr. Y is required to deduct tax at source under Section 194-IA. The tax to be deducted under Section 194-IA would be ₹ 45,000, being 0.75% of ₹ 60 lakh.

TDS provisions under Section 194-IA are not attracted in respect of transfer of rural agricultural land.

![]()

Question 37.

Mr. X, a salaried individual, pays rent of ₹ 55,000 per month to Mr. Y from June, 2020. Is he required to deduct tax at source? If so, when is he required to deduct tax? Also, compute the amount of tax to be deducted at source.

Would your answer change if Mr. X vacated the premises on 31st December, 2020? Also, what would be your answer if Mr. Y does not provide his-PAN to Mr. X?

Answer:

Since Mr. X pays rent exceeding ₹ 50,000 per month in the F.Y. 2020-21, he is liable to deduct tax at source @ 3.75% of such rent for F.Y. 2020-21 under Section 194-IB. Thus, 20,625 [₹ 55,000 × 3.75% × 10] has to be deducted from rent payable for March, 2021.

If Mr. X vacated the premises in December, 2020, then tax of ₹ 14,438 [₹ 55,000 × 3.75% × 7] has to be deducted from rent payable for December, 2020.

In case Mr. Y does not provide his PAN to Mr. X, tax would be deductible @ 20%, instead of 3.75%.

In case 1 above, this would amount to ₹ 1,10,000[₹ 55,000 × 20% × 10] but the same has to be restricted to ₹ 55,000, being rent for March, 2021.

In case 2 above, this would amount to ₹ 77,000 [₹ 55,000 × 20% × 7] but the same has to be restricted to ₹ 55,000, being rent for December, 2020.

![]()

Question 38.

XYZ Ltd. Makes a payment of ₹ 28,000 to Mr. Ganesh on 2.8.2020 towards fees for professional services and another payment of ₹ 25,000 to him on the same date towards fees for technical services. Discuss whether TDS provisions under section 194J are attracted.

Answer:

TDS provisions under section 194J would not get attracted, since the limit of ₹ 30,000 is applicable for fees for professional services and fees for technical services, separately. It is assumed that there is no other payment to Mr. Ganesh towards fees for professional services and fees for technical services during P.Y. 2020-21.

![]()

Question 39.

Explain the provision relating to payment made by an individual or a HUF for contract work or by way of fees for professional services or commission or brokerage [Section 194M]?

Answer:

1. Applicability and rate of TDS:

Section 194M, inserted with effect from 1.9.2019, provides for deduction of tax at source @ 5% by an individual or a HUF responsible for paying any sum during the financial year to any resident-

- for carrying out any work (including supply of labour for carrying out any work) in pursuance of a contract; or

- by way of commission (not being insurance commission referred to in Section 194D) or brokerage; or

- by way of fees for professional services.

It may be noted that only individuals and HUFs ( other than those who are required to deduct income-tax as per the provisions of Section 194C or 194H or 194J) are required to deduct tax in respect of the above sums payable during the financial year to a resident.

2. Time of deduction:

The tax should be deducted at the time of credit of such sum or at the time of payment of such sum, whichever is earlier.

3. Threshold Limit:

No tax is required to be deducted where such sum or, as the case may be, aggregate amount of such sums credited or paid to a resident during the financial year does not exceed 50 Lacs.

![]()

4. Non-applicability of TDS under section 194M:

An individual or a Hindu undivided family is not liable to deduct tax at source under Section 194M if they are required to deduct tax at source under section 194C for carrying out any work (including supply of labour for carrying out any work) in pursuance of a contract i.e., an individual or a HUF who is subject to tax audit under Section 44AB(a)/(b) in the immediately preceding financial year and such amount is not exclusively credited or paid for personal purposes of such individual or HUF.

(i) they are required to deduct tax at source under Section 194H on commission (not being insurance commission referred to in Section 194D) or brokerage i.e., an individual or a HUF whose total sales, gross receipts or turnover from the business or profession carried on by him exceed the monetary limits of ₹ 1 crore and ₹ 50 lakhs, respectively, specified under Section 44AB during the immediately preceding financial year.

(ii) they are required to deduct tax at source under Section 194J on fees for professional services i.e., an individual or a HUF whose total sales, gross receipts or turnover from the business or profession carried on by him exceed the monetary limits of ₹ 1 crore and ₹ 50 lakhs, respectively, specified under section 44AB during the immediately preceding financial year and such amount is not exclusively credited or paid for personal purposes of such individual or HUF.

5. No requirement to obtain TAN:

The provisions of Section 203A containing the requirement of obtaining Tax deduction account number (TAN) shall not apply to the person required to deduct tax in accordance with the provisions of Section 194M.

![]()

Question 40.

Examine whether TDS provisions would be attracted in the following cases, and if so, under which section. Also specify the rate of TDS applicable in each case. Assume that all payments are made residents.

| Particulars of the payer | Nature of Payment | Aggregate of payments made in the F.Y. 2020-21 | |

| 1 | Mr. Ganesh, an individual carrying on retail business with turnover of ₹ 2.5 crores in the P.Y. 2019-20. | Contract payment for repair of residential house | ₹ 5 lakhs |

| Payment of commission to Mr. Vallish for business purposes | ₹ 80,000 | ||

| 2 | Mr. Rajesh, a wholesale trader whose turnover was ₹ 95 lakhs in P.Y. 2019-20. | Contract Payment for reconstruction of residential house (made during the period January- March, 2021) | ₹ 20 lakhs in January, 2021,

₹ 15 lakhs in Feb 2021 and ₹ 20 lakhs in March 2021. |

| 3 | Mr. Satish, a salaried individual | Payment of brokerage for buying a residential house in March, 2021. | ₹ 51 lakhs |

| 4; | Mr. Dheeraj, a pensioner | Contract payment made during October-November 2020 for • reconstruction of residential house | ₹ 48 lakhs |

![]()

Answer:

| Particulars of the payer | Nature of Payment | Aggregate of payments in the F.Y. 2020-21 | Whether TDS provisions are attracted? | |

| Mr. Ganesh, an individual carrying on retail business with turnover of ? 2.5 crores in the P.Y. 2019:20. | Contract payment for repair of residential house | ₹ 5 lakhs | No, TDS undersection 194C is not attracted since the payment is for personal purpose and TDS under section 194 M is not attracted as aggregate of contract payment to the payee in the P.Y. 2020-21 does not exceeds ₹ 50 lakh. | |

| Payment of commission to Mr. Vallish for business purposes | ₹ 80,000 | Yes, u/s 194H, since the payment exceeds ₹ 15,000, and Mr. Ganesh’s turnover exceeds ₹ 1 crore in the P.Y. 2019-20. | ||

| 2 | Mr. Rajesh, a wholesale trader whose turnover was ₹ 95 lakhs in P.Y. 2019-20 | Contract Payment for reconstruction of residential house | ₹ 55 lakhs | Yes, under section 194M, since the aggregate of payments (i.e., ₹ 55 lakhs) Since his turnover does not exceed 1 Crore in the previous year 2019-20 TDS provisions under section 194C are not attracted in respect of payments made in the P.Y. 2020-21. |

| 3 | Mr. Satish, a salaried individual | Payment of brokerage for buying a residential house | ₹ 51 lakhs | Yes, under section 194M, since the payment of ₹ 51 lakhs made in March 2021 exceeds the threshold of ₹ 50 lakhs. Since Mr. Satish is a salaried individual, the provisions of section 194H are not applicable in this case. |

| 4 | Mr. Dheeraj, a pensioner | Contract payment for reconstruction of residential house | ₹ 48 lakhs | TDS provisions under section 194C are not attracted since Mr. Dheeraj is a pensioner and hence, not subject to tax audit. TDS provisions under section 194M are also not applicable in this case, since the payment of ₹ 48 lakhs, even though made after 1.9.2020, does not exceed the threshold of ₹ 50 lakhs. |

![]()

Question 41.

Explain the provision relating to TDS on withdrawal?

Answer:

(1) Applicability and rate of TDS:

Section 194N, inserted with effect from 1.9.2019, provides that every person, being

- a banking company to which the Banking Regulation Act, 1949 applies (including any bank or banking institution referred under Section 51 of that Act)

- a co-operative society engaged in carrying on the business of banking or

- a post office

who is responsible for paying, in cash, any sum or aggregate of sums exceeding ₹ 1 crore during the previous year to any person from one or more accounts maintained by such recipient-person with it, shall deduct tax at source @ 2% of sum exceeding ₹ 1 Crore.

(2) Time of deduction:

This deduction is to be made at the time of payment of such sum.

(3) Non-applicability of TDS under section 194N:

Liability to deduct tax at source under Section 194N shall not be applicable to any payment made to-

- The Government

- any banking company or co-operative society engaged in carrying on the business of banking or a post office.

- any business correspondent of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the RBI guidelines any white label ATM operator of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the authorization issued by RBI under the Payment and Settlement Systems Act, 2007.

- such other person or class of persons notified by the Central Government in consultation with the RBI.

![]()

Question 42.

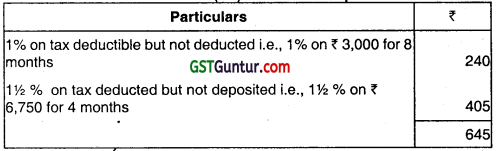

An amount of ₹ 40,000 was paid to Mr. X on 1.7.2020 towards fees for professional services without deduction of tax at source. Subsequently, another payment of ₹ 50,000 was due to Mr. X on 28.2.2021, from which tax @ 7.5% (amounting to ₹ 6,750) on the entire amount of ₹ 90,000 was deducted. However, this tax of ₹ 6,750 was deposited only on 22.6.2021. Compute the interest chargeable under Section 201(1 A).

Answer:

Interest under section 201 (1 A) would be computed as follows-

(i) Such interest should be paid before furnishing the statements in accordance with Section 200(3).

(ii) Where the payer fails to deduct the whole or any pay of the tax on the amount credited or payment made to a payee and is not deemed to be an assessee-in-default under section 201 (1) on account of payment of taxes by such payee, interest under section 201 (1 A)(i) i.e., @ 1% p.m. or part of month, shall be payable by the payer from the date on which such tax was deductible to the date of furnishing of return of income by such payee. The date of deduction and paymertt of taxes by the payer shall be deemed to be the date on which return of income has been furnished by the payee.

(iii) Where the tax has not been paid after it is deducted, the amount of the tax together with the amount of simple interest thereon shall be a v charge upon all the assets of the person or the company, as the case may be.

![]()

Question 43.

Explain the provision relating to furnishing of statements in respect of payment of any income to residents without deduction of tax [Section 206A] ?

Answer:

1. This section casts responsibility on every banking company or co-operative society or public company referred to in the proviso to Section 194(3)(i) [i.e., a public company formed and registered in India with the main object of carrying on the business of providing long-term finance for construction or purchase of residential houses in India and which is eligible for deduction under Section 36(1 )(viii)] to prepare such statement, for such period as may be prescribed –

- if they are responsible for paying to a resident,

- the payment should be of any income.not exceeding ₹ 40,000, where the payer is a banking company or a co-operative society, and ₹ 5,000 in any other case.

- such income should be by way of interest (other than interest on securities)

2. The statements have to be delivered or caused to be delivered to the prescribed income tax authority or the person authorised by such authority.

3. The statements have to be in the prescribed form, containing such particulars verified in the prescribed manner. The statement has to be filed within the prescribed time.

4 The CBDT may cast responsibility on any person other than a person mentioned in (1) above, who is responsible for paying to a resident any income liable for deduction of tax at source.

5. Such persons may be required to prepare statement for such period as may be prescribed in the prescribed form and deliver or cause to be delivered such statement within the prescribed time to the prescribed income-tax authority or the person authorized by such authority.

Such statements should be in the prescribed form, containing such particulars and verified in the prescribed manner.

6. Such person referred to in (1) and (4) above may also deliver to the prescribed authority, a correction statement-

(a) for rectification of any mistake; or

(b) to add, delete or update the information furnished in the statement delivered referred in (2) & (5) above.

![]()

Question 44.

Ashwin doing manufacture and wholesale trade furnishes you the following information:

Total turnover for the financial year

| Particulars | |

| 2019- 20

2020- 21 |

2,05,00,000

95,00,000 |

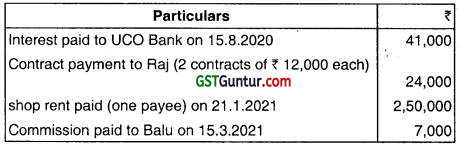

Examine whether tax deduction at source provisions are attracted for the below said expenses Incurred during the financial year 2020-21:

Answer:

As the turnover of Ashwin for F.Y. 2019-20 i.e., ₹ 205 lakh, has exceeded the monetary limit of ₹ 100 lakh prescribed under Section 44AB, ha has to comply with the tax deduction provisions during the financial year 2020-21, subject to, however, the exemptions provided for under the relevant sections for applicability of TDS provisions.

Interest paid to UCO Bank:

TDS under section 194A is not attracted in respect of interest paid to a banking company.

Contract payment ₹ 24,000 to Raj for 2 contracts of ₹ 12,000 each:

TDS provisions under Section 194C would not be attracted if the amount paid to a contractor does not exceed ₹ 30,000 in a single payment or ₹ 1,00,000 in the aggregate during the financial year. Therefore, TDS provisions under Section 194C are not attracted in this case.

Shop Rent paid to one payee- Tax has to be deducted under Section 194-I as the rental payment exceeds ₹ 2,40,000. Commission paid to Balu: No, tax has to be deducted under section 194-H in this case as the commission does not exceed ₹ 15,000.

![]()

Question 45.

Compute the amount of tax deduction at source on the following payments made by M/s. S Ltd. During the financial year 2020-21 as per the provisions of the Income-tax Act, 1961.

| Sr.

No. |

Date | Nature of Payment |

| (i) | 1-10-2020 | Payment of ₹ 2,00,000 to Mr. “R” a transporter who owns 8 goods carriages throughout the previous year and furnishes a declaration to this effect along with his PAN. |

| (ii) | 1 -11 -2020 | Payment of fee for technical services of ₹ 25,000 and Royalty of ₹ 20,000 to Mr. Shyam who is having PAN. |

| (iii) | 30-06-2020 | Payment of ₹ 25,000 to M/s X Ltd. for repair of building. |

| (iv) | 01-01-2021 | Payment of ₹ 2,00,000 made to Mr. A for purchase of diaries made according to specifications of M/s S Ltd. However, no material was supplied for such diaries to Mr. A by M/s S Ltd. |

| (v) | 01-01-2021 | Payment made ₹ 1,80,000 to Mr. Bharat for compulsory acquisition of his house as per law of the State Government. |

| (vi) | 01-02-2021 | Payment of commission of ₹ 14,000 to Mr. Y. |

![]()

Answer:

(i) No tax is required to be deducted at source under Section 194C by M/s S Ltd. on payment to transporter Mr. R, since he satisfies the following conditions:

- He owns ten or less good carriages at any time during the previous year.

- He is engaged in the business of plying, hiring or leasing goods carriages;

- He has furnished a declaration to this effect along with his PAN.

(ii) As per Section 194J, liability to deduct tax is attracted only in case the payment made as fees for technical services and royalty, individually, exceeds 30,000 during the financial year. In the given case, since, the individual payments for fee of technical services i.e., ₹ 25,000 and royalty ₹ 20,000 is less than ₹ 30,000 each, there is no liability to deduct tax at source. It is assumed that no other payment towards fees for technical services and royalty were made during the year to Mr. Shyam.

(ii) Provisions of Section 194C are not attracted in this case, since the payment for repair of building on 30.06.2020 to M/s. X Ltd. Is less than the threshold limit of ₹ 30,000.

(iii) According to Section 194C, the definition of “work” does not include the manufacturing or supply of product according to the specification by customer in case the material is purchased from a person other than the customer.

Therefore, there is no liability to deduct tax at source in respect of payment of ₹ 2,00,000 to Mr. A, since the contract is a contract for ‘sale’.

(iv) As per Section 194LA, any person responsible for payment to a resident, any sum in the nature of compensation or consideration on account of compulsory acquisition under any law, of any immovable property, is responsible for deduction of tax at source if such payment or the aggregate amount of such payments to the resident during the financial year exceeds ₹ 2,50,000.

In the given case, no liability to deduct tax at source is attracted as the payment made does not exceed ₹ 2,50,000.

(v) As per Section 194H, tax is deductible at source if the amount of commission or brokerage or the aggregate of the amounts of commission or brokerage credited or paid during the financial year exceeds ₹ 15,000.

Since the commission payment made to Mr. Y does not exceed ₹ 15,000, the provisions of Section 194H are not attracted.

![]()

Question 46.

Examine the applicability of TDS provisions and TDS amoynt in the following cases:

(a) Rent paid for hire of machinery by B Ltd. To Mr. Raman ₹ 2,60,000 on 27.9.2020.

(b) Fee paid on 1.12.2020 to Dr. Srivatsan by Sunder, (HUF) ₹ 35,000 for surgery performed on a member of the family.

(c) ABC and Co. Ltd. Paid ₹ 19,000 to one of its Directors as sitting fees on 01-01-2021.

Answer:

(a) Since the rent paid for hire of machinery by B. Ltd. to Mr. Raman exceeds ₹ 2,40,000, the provisions of Section 194-I for deduction of tax at source are attracted.

The rate applicable for deduction of tax at source under section 194-I on rent paid for hire of plant and machinery is 1.5% assuming that Mr. Raman had furnished his permanent account number to B Ltd.

Therefore, the amount of tax to be deducted at source:

= ₹ 2,60,000 × 1.5% = ₹ 3,900.

Note: In case Mr. Raman does not furnish his permanent account number to B Ltd., tax shall be deducted @ 20% on ₹ 2,60,000, by virtue of provisions of Section 206AA.

![]()

(b) As per the provisions of Section 194J, a Hindu Undivided Family is required to deduct tax at source on fees paid for professional services only if the total sales, gross receipts or turnover form the business or profession exceed ₹ 1 crore or ₹ 50 lakhs, as the case may be, in the financial year preceding the current financial year and such payment made for professional services is not exclusively for the personal purpose of any member of Hindu Undivided Family.

Section 194M, inserted with effect from 1.9.2019,provides for deduction of tax at source by a HUF (which is not required to deducte tax at source under section 194J) in respect of fees for professional service and such sum exceeds ₹ 50 lakhs during the financial year.

In the given case, the fees for professional service to Dr. Srivatsan is paid on 1.12.2020 for a personal purpose, therefore, section 194M would have been applicable If the payment or aggregate of payments exceeded ₹ 50 lakhs in the P.Y. 2020-21. However, since the payment does not exceed ₹ 50 lakh in this case, there is liability to deduct tax at source under section 194M.

![]()

(c) Section 194J provides for deduction of tax at source @ 7.5% from any sum paid by way of any remuneration or fees or commission, by whatever name called, to a resident director, which is not in the nature of salary on which tax is deductible under Section 192. The threshold limit of ₹ 30,000 upto which the provisions of tax deduction at source are not attracted in respect of every other payment covered under section 194J is, however, not applicable in respect of sum paid to a director. Therefore, tax @ 7.5% has to be deducted at source under Section 194J in respect of the sum of ₹ 19,000 paid by ABC Ltd. to its director.

(d) Therefore, the amount of tax to be deducted at source:

= 19,000 × 7.5% = 1,425

![]()

Question 47.

Examine the applicability of tax deduction at source provisions, the rate and amount of tax deduction in the following cases for the financial year 2020-21:

1. Payment of ₹ 27,000 made to Jacques Kallis, a South African cricketer, by an Indian newspaper agency on 02-07-2020 for contribution of articles in relation to the sport of cricket.

2. Payment made by a company to sub-contractor ₹ 3,00,000 with outstanding balance of ₹ 1,20,000 shown in the books as on 31 – 03-2021.

3. Winning from horse race ₹ 1,50,000 paid to Mr. Shyam an Indian resident.

4. ₹ 2,00,000 paid to Mr. A, a resident individual, on 22-02-2021 by the state of Uttar Pradesh on compulsory acquisition of his urbanland.

Answer:

1. Section 194E provides that the person responsible -for payment of any amount to a non-resident sportsman who is not a citizen of India for contribution of articles relating to any game or sport in India in a newspaper has to deduct tax at source @ 20%. Further, since Jacques Kallis, a South African cricketer, is a non-resident, Health and education cess @ 4% on TDS should also be added.

Therefore, tax to be deducted = ₹ 27,000 × 20.80% = ₹ 5,616.

![]()

2. Provisions of tax deduction at source under Section 194C are attracted in respect of payment by a company to a sub-contractor. Under section 194C, tax is deductible at the time of credit or payment, whichever is earlier @ 0.75% if the payment is made to an individual or HUF. Assuming that sub-contractor to whom payment has been made is an individual and the aggregate amount credited durihg the year is ₹ 4,20,000, tax is deductible @ 0.75% on ₹ 4,20,000.

Tax to be deducted = ₹ 4,20,000 × 0.75% = ₹ 3,150

3. Under section 194BB, tax is to be deducted at source, if the winnings from, horse races exceed ₹ 10,000 . The rate of deduction of tax at source is 30%. Assuming the winnings are paid to a resident, health and education cess @ 4% has not been added to the tax rate of 30%. Hence, tax to be deducted = ₹ 1,50,000 × 30% = ₹ 45,000.

4. Under section 194LA, any person responsible for payment to a resident, any sum in the nature of compensation or consideration on account of compulsory acquisition under any law, of any immovable property, is required to deduct tax at source @ 10%, if such payment or the aggregate amount of such payments to the resident during the financial year exceeds, ₹ 2,50,000.

In the given case, there is no liability to deduct tax at source as the payment made to Mr. A does not exceed ₹ 2,50,000.

![]()

Question 48.

Briefly discuss the provisions relating to payment of advance tax on income arising from capital gains and casual income.

Answer:

The proviso to Section 234C contains the provisions for payment of advance tax in case of capital gains and casual income.

Advance tax is payable by an assessee on his/its total income, which includes capital gains and casual income like income from lotteries, crossword puzzles, etc.