Chapter 9 Adjudication and Appeals for Corporate Persons – CS Professional Insolvency Law and Practice Notes is designed strictly as per the latest syllabus and exam pattern.

Adjudication and Appeals for Corporate Persons – CS Professional Insolvency Law and Practice Study Material

Question 1.

After acceptance of the application for initiating Corporate Insolvency Resolution Process (CIRP) by National Company Law Tribunal (NCLT), the powers of the Board of Directors of the Company (Corporate Debtor) is suspended. The Company wants to make an appeal against the order of the NCLT. Whether the suspended Board of the Company can make appeal? Elucidate quoting relevant case law, if any. (Dec 2020, 6 marks)

Answer:

The present case is similar to the case of Steel Konnect (India) Private Limited v/s. Hero Fincorp Ltd., In the case of Steel Konnect (India) Private Limited v/s. Hero Fincorp Ltd., Initially Courts were of view that once an insolvency application is admitted, the Code does not permit erstwhile company directors to maintain an appeal on behalf of the corporate debtor and only the interim resolution professional (IRP”) can maintain an appeal on behalf of the company.

Further, it was observed the power of the IRP as provided under the Code does not include the power to initiate proceedings on behalf of the Corporate Debtor. The aforesaid issue was raised in Steel Konnect (India) Pvt Ltd. v. M/s Hero Fincorp Ltd. where it was held that upon admission of application under the Insolvency and Bankruptcy Code, 2016 and commencement of corporate insolvency resolution process, for preferring an appeal before NCLAT; the corporate debtor can appear through its Board of Directors or its officer or its authorized representative.

If corporate debtor is represented before Adjudicating Authority during appeal through its Board of Directors, no objection can be raised in this regard as initiation of corporate insolvency resolution process only suspends functioning of Board of Directors in that corporate debtor not the Board of Directors as a whole. Also, the directors continue to be in their position and are still present in the records maintained by the Registrar of Companies. They are just put in temporary suspension for 180/270 days till continuation of the insolvency resolution process.

Therefore, suspended Board of Directors being aggrieved party can make an appeal against the order of NCLT.

![]()

Question 2.

Liquidation of ABC Private Ltd. has been ordered by Adjudicating Authority. Mumbai vide its order dated 27th May, 2018. Amit Kumar was appointed as Liquidator of ABC Private Limited. The particulars relating to ABC Private Ltd. which has gone into liquidation are as follows:

| Particulars | Amount (₹) |

| 1. Amount realized from the sale of liquidation of assets | 16,00,000 |

| 2. Secured Creditor who has relinquished the security | 5,00,000 |

| 3. Unsecured Financial Creditors | 4,00,000 |

| 4. Income-tax payable within a period of 3 years preceding the Liquidation commencement date. The Income Tax payable is ₹ 25,000 in each Financial Year. | 75,000 |

| 5. CESS payable to State Government within a period of one year preceding the liquidation commencement date. | 20,000 |

| 6. Fees payable to Resolution Professional | 75,000 |

| 7. Expenses incurred by the Resolution Professional in running the business of the ABC Private Ltd. as a going concern. | 25,000 |

| 8. Workmen salary payable for a period of thirty months preceding the liquidation commencement date. The workmen’s salary is the same for each of the 30 months. | 3,00,000 |

| 9. Preference Shareholders | 1,00,000 |

| 10. Equity Shareholders | 10,00,000 |

Distribute the proceeds among all categories of dues as per the priority order in terms of the provisions of the IBC, 2016. While distributing the proceeds, it may be presumed that the proportionate contribution of each in all categories to the fees payable to the Resolution Professional has been taken into account already and need not be recalculated. (Dec 20216 marks)

Answer:

| (i) Fees payable to Resolution Professional in full (deducted from the amounts payable to all categories below as per the provision of sub-section 3 of section 53 of the Code. The amount shown as payable is after deducting proportional amount) | 75,000 |

| (ii) Expenses incurred by the Resolution Professional in running the business on going concern (deducted from sale proceeds) | 25,000 |

| (iii) Workmen Salary outstanding for a period of 24 months (proportionate to 24 months only). The balance ₹ 60,000 is considered as remaining debts and dues and will be settled before preference shareholder/equity shareholder. | 2,40,000 |

| (iv) Secured creditor who has relinquished the security. | 5,00,000 |

| (v) Unsecured Financial Creditors | 4,00,000 |

| (vi) Income-Tax payable within the period of 2 years | 50,000 |

| (vii) CESS to State Government payable within a period of one year | 20,000 |

| (viii) Balance amount in workmen salary | 60,000 |

| (ix) Balance amount for income tax | 25,000 |

| (x) Total distribution in the above priority | 13,95,000 |

| (xi) Amount realized from the sale of Liquidation of Assets | 16,00,000 |

| (xii) Preference shareholders | 1,00,000 |

| (xiii) Balance available to Equity Shareholders on pro rata basis | 1,05,000 |

Alternate Answer:

| Particulars | Amount (₹) | |

| (a) Insolvency resolution process cost (to be paid in full) | Fees payable to Resolution Professional in full (deducted from the amounts payable to all categories below as per the provision of sub section 3 of section 53 of the Code. The amount shown as payable is after deducting proportional amount) | 75,000 |

| Expenses incurred by the Resolution Professional in running the business on going concern (deducted from sale proceeds) | 25,000 | |

| (b) Workmen’s dues (24 months preceding liquidation commencement date) and debts owed to secured creditors who have relinquished their security interest (equally ranked) | Workmen Salary outstanding for a period of 24 months (proportionate to 24 months only).The balance ₹ 60,000 is considered as remaining debts and dues and will be settled before preference shareholder / equity shareholder. | 2,40,000 |

| Secured creditor who has relinquished the security. | 5,00,000 | |

| (c) Financial debts owed to unsecured financial creditors | 4,00,000 | |

| (d) Amount due to Central govt, and State govt, (two years preceding liquidation commencement date) | Income Tax payable within the period of 2 years. | 50,000 |

| CESS to State Government payable within a period of one year. | 20,000 | |

| (e) Any remaining debts and dues | Balance amount in workmen salary | 60,000 |

| Balance amount in Income Tax | 25,000 | |

| Total distribution in the above priority | 13,95,000 | |

| Amount realized from the sale of Liquidation of Assets | 16,00,000 | |

| (f) Preference Shareholders | 1,00,000 | |

| (g) Equity Shareholders | 1,05,000 | |

![]()

Question 3.

Operational Creditor (OC) filed an application under Section 9 of the Insolvency and Bankruptcy Code, 2016 (IBC) for initiation of Corporate Insolvency Resolution Process (CIRP) against Corporate Debtor (CD). The Adjudicating Authority (AA) admitted the application.

The CD challenged the order on the ground that the application under Section 9 of IBC was filed fraudulently with malicious intent for the purpose, other than for the resolution of insolvency or liquidation and attracts penal amount in terms of Section 65(1) of the IBC.

The OC is claiming the amount, on the basis of two Memorandum of Understanding(s), (MOUs), first one is for claim against invoices raised and the second one is for reimbursement of custom duty, paid to the relevant authorities.

As per CD, he offered 100% of the amount actually payable in terms of the first MOU on account of the invoices raised by the OC, but the OC declined to settle the amount and asked for more.

Further, the OC also demands for customs duty paid to the relevant authorities. However, no such arrangement has been made as per the MOU terms.

CD appealed to, the National Company Law Appellate Tribunal (NCLAT). During the proceedings, NCLAT, on request of CD, allowed CD to pay entire amount as mentioned in 1st MOU, and also to pay certain additional amount. However, the OC refused to accept the same and asked for more interest. Discuss, whetherthe appeal filed by the CD at NCLAT, will be maintainable? (June 2022, 6 marks)

Question 4.

An Appeal is filed by the Appellant-Anil Sharma, Resolution Professional (RP) of S. K. Oils Ltd. under Section 61 of the Insolvency and Bankruptcy Code, 2016 (IBC) against the impugned order passed by the Adjudicating Authority (AA).

The grievance of the Appellant-RP is that, despite lapse of 985 days from the date of filing of the Application seeking broadly to consider passing orders for liquidation of the Corporate Debtor (CD) i.e. S. K. Oils Ltd., as no Resolution Plan has been approved by the Committee of Creditors (CoC) before the maximum period permitted for the Corporate Insolvency Resolution Process (‘CIRP’) under Section 12 of the IBC, instead the AA has dismissed the Application as not maintainable and being infructuous.

The Appellant-RP has sought the following reliefs:

(i) Allow the instant appeal and set aside/quash the impugned order passed by the AA.

(ii) Pass an order initiating liquidation of the Corporate Debtor M/s. S. K. Oils Ltd., under Section 33(1) of IBC.

Discuss based on decided case law, whether Appellant-RP will succeed in getting relief ? (June 2022, 6 marks)

Question 5.

Who is the adjudicating authority for the purpose of insolvency and liquidation of corporate persons?

Answer:

National Company Law Tribunal (NCLT) constituted under section 408 of the Companies Act, 2013 is the adjudicating authority for the purpose of insolvency and liquidation of corporate persons.

Also, the NCLT replaced the jurisdiction of the erstwhile Company Law Board (CLB), the Board for Industrial and Financial Restructuring (BIFR) and the High Court in exercise of its jurisdiction as Company Court.

The application for initiating the insolvency resolution process or liquidation of corporate debtors shall be filed before NCLT having jurisdiction over the place where the registered office of the company is situated.

Question 6.

Explain the role of Adjudicating Authority.

Answer:

- Adjudicating Authority plays a two-fold role while functioning under the Code.

- One role is administrative in nature and other is judicial in nature.

- By administrative it means that Adjudicating Authority has to ascertain whether a particular case is complete in terms of Sections 7/9/10 of the Insolvency and Bankruptcy Code, 2016 (as the case may be) or it suffers from some defect.

- Whereas by judicial it means to decide whether to admit corporate insolvency resolution process or liquidation of a corporate debtor or not.

![]()

Question 7.

Can two parallel proceeding against the corporate debtor and the personal guarantor go simultaneously in two different jurisdictions?

Answer:

In the case of Sanjeev Shriya v/s. State Bank of India, Allahabad High Court held that two parallel proceeding against the corporate debtor and the personal guarantor cannot go simultaneously in two different jurisdictions. (Allahabad High Court order dated 6th September, 2017)

Question 8.

Discuss the powers of NCLT regarding the entertainment and disposal of application against the corporate person or debtor.

Answer:

Notwithstanding anything to the contrary contained in any other law for the time being in force, NCLT shall have jurisdiction to entertain or dispose of:

(a) any application or proceeding by or against the corporate debtor or corporate person

(b) any claim made by or against the corporate debtor or corporate person, including claims by or against any of its subsidiaries situated in India; and

(c) any question of priorities or any question of law or facts, arising out of or in relation to the insolvency resolution or liquidation proceedings of the corporate debtor or corporate person under this Code.

Question 9.

Explain the grounds on which appeals can be made against the order of Adjudicating Authority.

Answer:

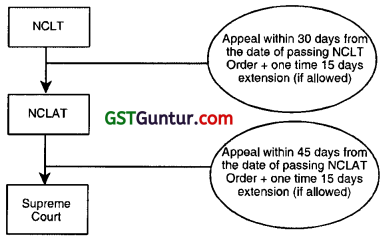

- Section 61 of the Insolvency and Bankruptcy Code, 2016 provides that notwithstanding anything to the contrary contained underthe Companies Act 2013, any person aggrieved by the order of the Adjudicating Authority in the context of corporate insolvency resolution process or liquidation of corporate person may prefer an appeal to the National Company Law Appellate Tribunal (NCLAT).

- Every appeal before NCLAT shall be filed within thirty days (30 days) from the date of receipt of such order.’

- However, NCLAT may allow one-time extension of fifteen days (15 days) to file an appeal after the expiry of 30 days if it is satisfied that there was sufficient cause for not filing the appeal within first 30 days.

An appeal against an order approving a resolution plan under Section 31 of the Insolvency and Bankruptcy Code, 2016 may be filed on the following grounds:

(a) The approved resolution plan is in contravention of the provisions of any law for the time being in force;

(b) There has been material irregularity in exercise of the powers by the resolution professional during the corporate insolvency resolution period;

(c) The debts owed to operational creditors of the corporate debtor have not been provided for in the resolution plan in the manner specified by the Insolvency and Bankruptcy Board of India (“Board”);

(d) The insolvency resolution process costs have not been provided for repayment in priority to all other debts; or

(e) The resolution plan does not comply with any other criteria specified by the Board.

Question 10.

Can the erstwhile company directors make an appeal on behalf of the corporate debtor against the order of Adjudicating order?

Answer:

- It was observed the power of the Insolvency Resolution Professional as provided under the Code does not include the power to initiate proceedings on behalf of the Corporate Debtor.

- The aforesaid issue was raised in Steel Konnect (India) Pvt Ltd v M/s Hero Fincorp Ltd, where it was held that upon admission of application under the Insolvency and Bankruptcy Code, 2016 and commencement of corporate insolvency resolution process, for preferring an appeal before NCLAT; the corporate debtor can appear through its Board of Directors or its officer or its authorized representative.

- If corporate debtor is represented during appeal through its Board of Directors, no objection can be raised in this regard as initiation of corporate insolvency resolution process only suspends functioning of Board of Directors in that corporate debtor not the Board of Directors as a whole.

- Also, the directors continue to be in their position and are still present in the records maintained by the Registrar of Companies and are just put in temporary suspension for 180/270 days till continuation of the insolvency resolution process. (NCLAT order dated 29th August, 2017)

![]()

Question 11.

Discuss the provisions related to appeal to Supreme Court against the order of NCLAT.

Answer:

- Section 62 of the Insolvency and Bankruptcy Code, 2016 (31 of 2016) provides that, any person aggrieved by the order of NCLAT may prefer an appeal to the Supreme Court (SC) on a question of law arising out of such order.

- Every appeal before SC shall be filed within forty five (45 days) from the date of receipt of such order.

- However SC may allow one time extension of fifteen days (15 days) to file an appeal after the expiry of 45 days if it is satisfied that there was sufficient cause for not filing the appeal within first 45 days.

Question 12.

Name the benches of NCLT and their respective jurisdiction.

Answer:

| Name of the NCLT Bench | Location | Territorial Jurisdiction of the NCLT Bench |

| 1. (a) Principal Bench | New Delhi | Union territory of Delhi |

| 2. Ahmedabad Bench | Ahmedabad | State of Gujarat, Union territory of Dadra and Nagar Haveli and Union territory of Daman and Diu |

| 3. Allahabad Bench | Allahabad | State of Uttar Pradesh and State of Uttarakhand |

| 4. Amravati Bench Bench | Amravati | State of Andhra Pradesh |

| 5. Bengaluru Bench | Bengaluru | State of Karnataka |

| 6. Chandigarh Bench | Chandigarh | State of Himachal Pradesh, State of Jammu and Kashmir, State of Punjab, Union territory of Chandigarh and State of Haryana |

| 7. Chennai Bench | Chennai | State of Tamil Nadu and Union territory of Puducherry |

| 8. Cuttack Bench | Cuttack | State of Chattisgarh and State of Odisha |

| 9. Guwahati Bench | Guwahati | State of Arunachal Pradesh, State of Assam, State of Manipur, State of Mizoram, State of Meghalaya, State of Nagaland, State of Sikkim and State of Tripura |

| 10. Hyderabad Bench | Hyderabad | State of Telangana |

| 11. Indore Bench | Indore | State of Madhya Pradesh |

| 12. Jaipur Bench | Jaipur | State of Rajasthan |

| 13. Kochi Bench | Kochi | State of Kerala and Union Territory of Lakshadweep |

| 14. Kolkata Bench | Kolkata | State of Bihar, State of Jharkhand, State of West Bengal and Union territory of Andaman and Nicobar Islands |

| 15. Mumbai Bench | Mumbai | State of Goa and State of Maharashtra |

![]()

Question 13.

Whether any civil court or authority shall have jurisdiction to entertain any suit or proceedings in respect of any matter on which NCLT/NCLAT has jurisdiction under Insolvency and Bankruptcy Code, 2016?

Answer:

Section 63 of the Insolvency and Bankruptcy Code, 2016 (31 of 2016) provides that no civil court or authority shall have jurisdiction to entertain any suit or proceedings in respect of any matter on which NCLT/NCLAT has jurisdiction under this Code.

Question 14.

Discuss the penal provisions with regards to Fraudulent or malicious initiation of proceedings.

Answer:

- Section 65 of the Insolvency and Bankruptcy Code, 2016 (31 of 2016) provides that if any person initiates the insolvency resolution process or liquidation proceedings fraudulently or with malicious intent for any purpose other than for the resolution of insolvency, or liquidation, as the case may be, Adjudicating Authority may impose upon a such person a penalty which shall not be less than One Lakh Rupees, but may extend to One Crore Rupees.

- Whereas, if any person initiates voluntary liquidation proceedings with the intent to defraud any person, Adjudicating Authority may impose upon such person a penalty which shall not be less than One Lakh Rupees, but may extend to One Crore Rupees.

Question 15.

Discuss the relevant provisions of Section 66 and 67 of Insolvency and Bankruptcy Code, 2016.

Answer:

Section 66 of the Insolvency and Bankruptcy Code, 2016 :

- It provides that if during corporate insolvency resolution process or a liquidation process, it is found that any business of the corporate debtor has been carried on with intent to defraud creditors of the corporate debtor or for any fraudulent purpose, than Adjudicating Authority may on the application of the resolution professional pass an order that any persons who were knowingly parties to the carrying on of the business in such manner shall be liable to make such contributions to the assets of the corporate debtor as it may deem fit.

- On an application made by a resolution professional during the corporate insolvency resolution process, the Adjudicating Authority may by an order direct that a director or partner of the corporate debtor, as the case may be, shall be liable to make such contribution to the assets of the corporate debtor as it may deem fit, if:

(a) before the insolvency commencement date, such director or partner knew or ought to have known that the there was no reasonable prospect of avoiding the commencement of a corporate insolvency resolution process in respect of such corporate debtor; and

(b) such director or partner did not exercise due diligence in minimising the potential loss to the creditors of the corporate debtor.

Section 67 of the Insolvency and Bankruptcy Code, 2016:

It provides that where the Adjudicating Authority passes an order under sub-section (1) or subsection (2) of section 66, as the case may be, it may give such further directions as it may deem appropriate for giving effect to the order, and in particular, the Adjudicating Authority may:

(a) provide for the liability of any person under the order to be a charge on any debt or obligation due from the corporate debtor to him, or on any mortgage or charge or any interest in a mortgage or charge on assets of the corporate debtor held by or vested in him, or any person on his behalf, or any person claiming as assignee from or through the person liable or any person acting on his behalf; and

(b) from time to time, make such further directions as may be necessary for enforcing any charge imposed under this section.