Activity Based Costing (ABC) – CA Inter Costing Study Material is designed strictly as per the latest syllabus and exam pattern.

Activity Based Costing (ABC) – CA Inter Costing Study Material

Theory Questions

Question 1.

Explain Activity Based Budgeting. [CA Inter Nov. 2018, 5 Marks]

Answer:

- Activity Based Budgeting analyse the resource input or cost for each activity.

- It provides a framework for estimating the amount of resources required as per the budgeted level of activity.

- Actual results can be compared with budgeted results to highlight (both in financial and non-financial terms) those activities with major discrepancies from budget for potential reduction in supply of resources.

- It is a planning and control system which seeks to support the objectives of continuous improvement.

- It means planning and controlling the expected activities of the organi-sation to derive a cost effective budget that meet forecast workload and agreed strategic goals.

- ABB is the reversing of the ABC process to produce financial plans and budgets.

Question 2.

What is the fundamental difference between Activity Based Costing System (ABC) and Traditional Costing System? Why more and more organisations in both the manufacturing and non-manufacturing industries are adopting ABC? [ICAI Module]

Answer:

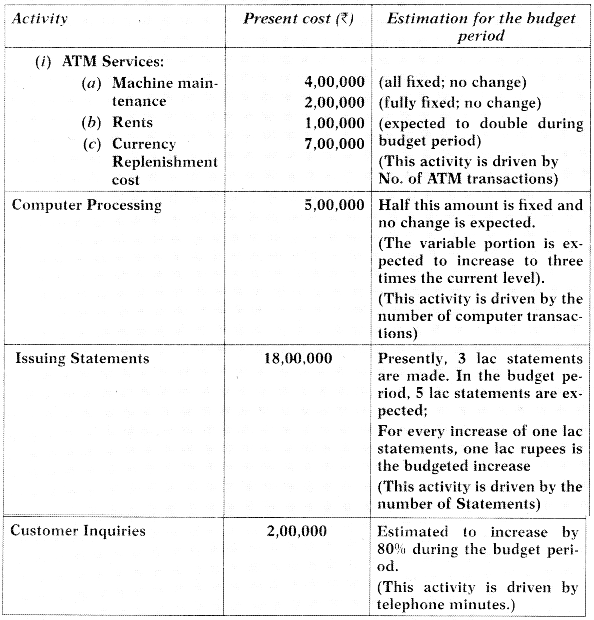

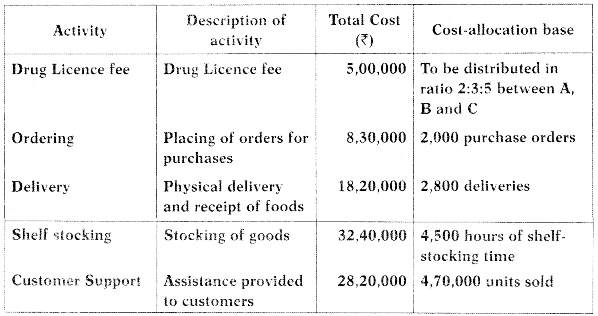

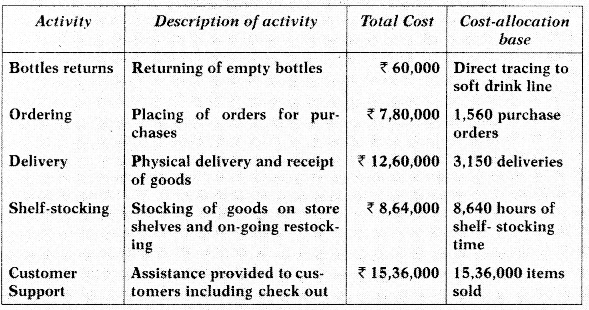

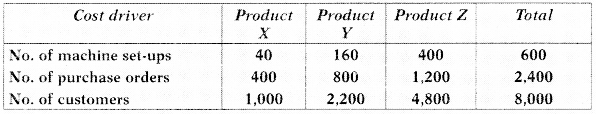

Fundamental difference between ABC and Traditional costing are as follows:

| Activity Based Costing | Traditional Absorption Costing |

| OH are related to activities grouped into cost pools. | OH are related to cost centers/departments. |

| Costs are related to activities and hence are more realistic. | Costs are related to cost centers and hence not realistic of cost behaviour. |

| Activity-wise Cost Drivers are determined. | Time (Hours) is assumed to be the only cost driver governing cost in all departments. |

| Specific activity-wise recovery rates are used. There is no concept of single overhead recovery rate. | Either multiple overhead recovery rates (for each department) or single overhead recovery rate may be used. |

| Costs are assigned to Cost Objects, e.g. customers, services, distribution channels, products, departments, etc. | Costs are assigned to Cost Units, i.e. to products or jobs or hours. |

| Essential activities can be simplified and unnecessary activities can be eliminated. Thus, corresponding costs are also reduced/’ minimized. Hence ABC aids cost control. | Cost Centers/departments cannot be eliminated. Hence, not suitable for cost control. |

![]()

Question 3.

Explain the following terms:

(i) Cost Object

(ii) Cost Driver

(iii) Cost Pool [ICAI Module]

Answer:

(i) Cost Object: It is an item for which cost measurement is required e.g. product or customer.

(ii) Cost Driver: It is a factor that causes a change in the cost of an activity. Categories of cost driver:

- Resource Cost Driver: It is a measure of quantity of resources con-sumed by an activity. It is used to assign the cost of a resource to an activity or cost pool.

- Activity Cost Driver: It is a measure of the frequency and intensity of demand, placed on activities by cost objects. It is used to assign activity costs to cost objects.

(iii) Cost Pool: It represents a group of various individual cost items. It consists of costs that have same cause and effect relationship e.g. machine set-up.

Question 4.

Describe the various levels of activities under ‘ABC’ methodology. [CA Inter Nov. 2020, 4 Marks]

Answer:

1. Unit level activities: Those activities for which the consumption of resources can be identified with the number of units produced e.g. use of indirect materials/consumables tends to increase in proportion to the number of units produced.

2. Batch level activities: The activities such as setting up of a machine or processing a purchase order are performed in batches. The cost of batch related activities varies with number of batches made, but is common (or fixed) for all units within the batch e.g.

- Material ordering, where an order is placed for every batch of production; or

- Machine set-up costs, where machines need resetting between each different batch of production.

3. Product level activities: Activities which are performed to support dif-ferent products in product line e.g. designing the product, producing parts specifications, keeping technical drawings of products up to date.

4. Facilities level activities: Those activities which cannot be directly attributed to individual products. These activities are necessary to sustain the manufacturing process and are common and joint to all products manufactured e.g. maintenance of buildings, plant security.

Question 5.

What are the advantages of ABC? [ICAI Module]

Answer:

- More accurate costing of products/services.

- Overhead allocation is done on logical basis.

- Enables better pricing policies by supplying accurate cost information.

- Utilizes unit cost rather than just total cost.

- Help to identify non-value added activities which facilitates cost reduction.

- It is helpful to the organizations with multiple products.

- It highlights problem areas which require attention of the management.

Question 6.

State the limitations of ABC? [ICAI Module]

Answer:

- It is more expensive, particularly in comparison with traditional costing system.

- It is not helpful to the small organizations.

- It may not be applied to organizations with limited products.

- Selection of the most suitable cost driver may not be easy.

Question 7.

Which are the stages required in the implementation of ABC? [ICAI Module]

Answer:

- Staff Training: Workforce co-operation is essential for successful implementation of ABC. Staff training should be done to create an awareness on the purpose of ABC.

- Process Specification: Informal, but structured interviews with key members of personnel will identify the different stages of the production process, the commitment of resources to each, processing times and bottlenecks.

- Activity Definition: The activities must be defined clearly in the early stage in order to manage the problems, if any, effectively.

- Activity Driver Selection: Cost driver for each activity shall be selected.

- Assigning Cost: A single representative activity driver can be used to assign costs from the activity pools to the cost objects.

Question 8.

What are the key elements of Activity Based Budgeting? [ICAI Module]

Answer:

The three key elements of activity based budgeting are as follows:

- Type of work to be done

- Quantity of work to be done

- Cost of work to be done

![]()

Question 9.

What are the benefits of Activity Based Budgeting? [ICAI Module]

Answer:

- It can enhance accuracy of financial forecasts and increasing manage-ment understanding.

- When automated, ABB can rapidly and accurately produce financial plans and models based on varying levels of volume assumptions.

- It eliminates much of the needless rework created by traditional bud-geting techniques. .

Practical Questions

Question 1.

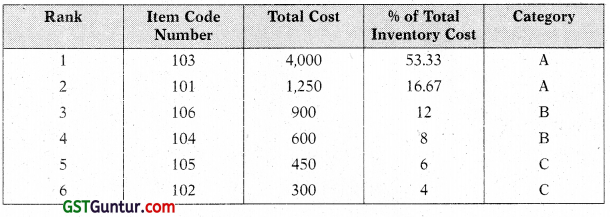

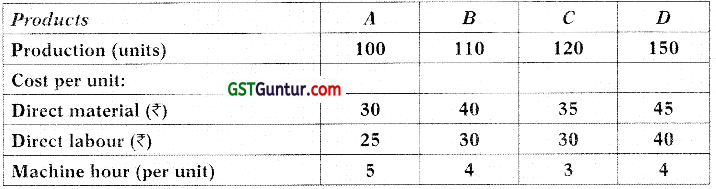

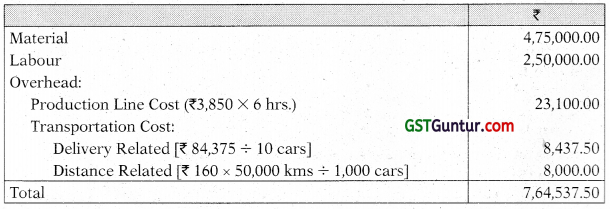

A company manufacturing two products furnishes the following data for a year:

The annual overheads are as under:

Volume-related activity costs ₹ 5,50,000

Set up related cost ₹ 8,20,000

Purchase-related costs ₹ 6,18,000

You are required So calculate the cost per unit of each Product A and B based on:

(i) Traditional method of charging overheads

(ii) Activity based costing method. [CA Final Nov. 2002, 9 Marks]

Answer:

(i) Statement showing overhead cost per unit (based on traditional method of charging overheads)

Machine Hour Rate for absorbing overheads = \(\frac{\text { Total Annual Overheads }}{\text { Total Machine Hours }}\)

= \(\frac{19,88,000}{1,40,000}\) = ₹ 14.2 per hour.

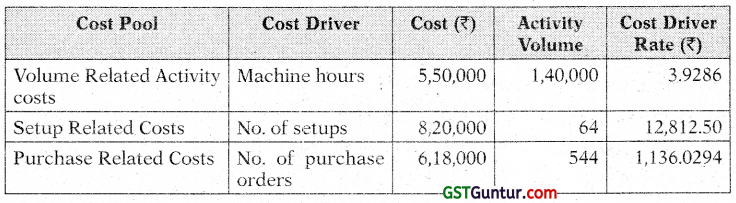

(ii) Statement showing overhead cost per unit (based on Activity Based Costing method)

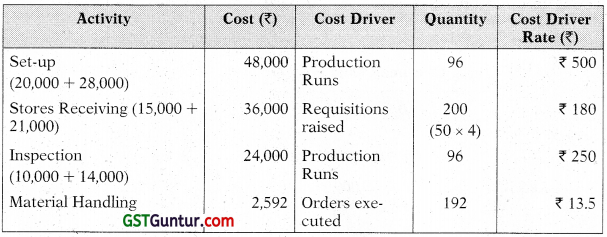

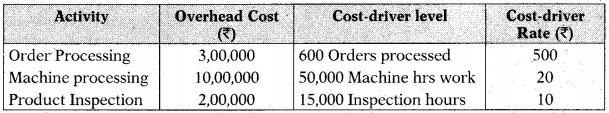

Calculation of Cost Driver Rates

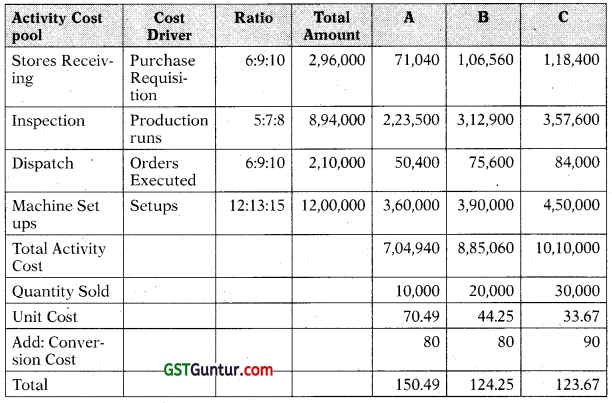

Question 2.

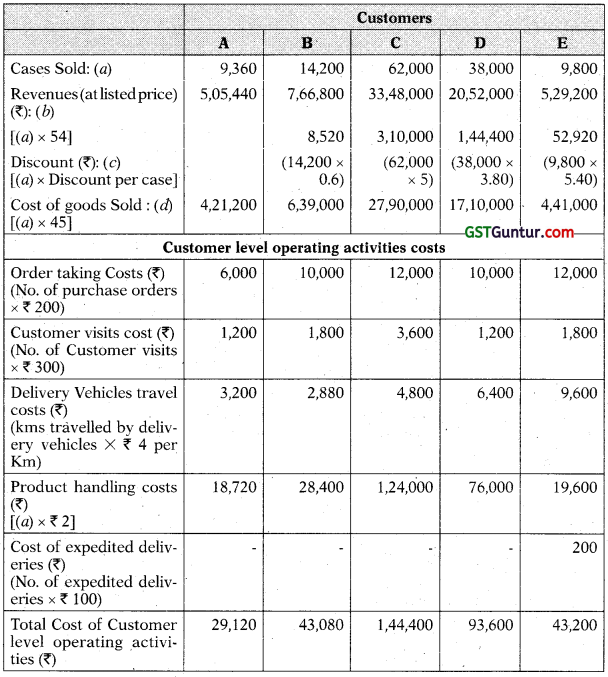

MNP suits is a ready-to-wear suit manufacturer. It has four customer wholesale-channel customers and two retail-channel customers. MNP suits has developed the following activity-based costing system:

| Activity | Cost Driver | Rate in 2021 |

| Order processing | Number of purchase order | 1,225 per order |

| Sales visits | Number of customer visits | 7,150 per visit |

| Delivery-regular | Number of regular deliveries | 1,500 per delivery |

| Delivery rushed | Number of rushed deliveries | 4,250 per delivery |

List selling price per suit is 1,000 and average cost per suit is 550.

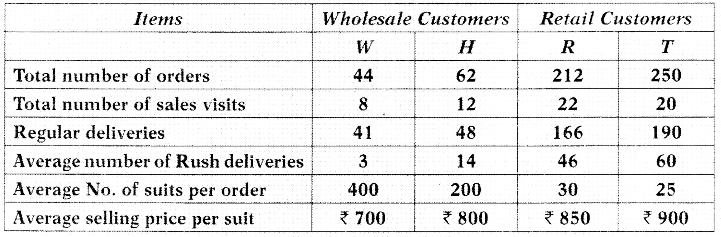

The CEO of MNP suits u’ants to evaluate the profitability of each of the four customers in 2020 to explore opportunities for increasing profitability of his company in 2021. The following data are available for 2020:

Required:

(i) Calculate the customer-level operating income in 2020

(ii) What do you recommend to CEO of MNP suits to do to increase the Company’s operating income in 2021?

(iii) Assume MNP suits’ distribution channel costs are ₹ 17,50,000 for its wholesale customers and ₹ 10,50,000 for the retail customers. Also, assume that its Corporate sustaining costs are ₹ 12,50,000. Prepare Income statement of MNP suits for 2021. [CA Final Nov. 2004, 10 Marks]

Answer:

(i) Computation of Customer level operating income in 2020:

(ii) The key challenges that may be faced by CEO:

- Reduce level of price discounting, especially by the wholesale customer ‘W’.

- Reduce level of Customer level costs’, especially by retail cus-tomers R&T.

- ABC cost system highlights some of the problem areas regarding the customers R and T. Such as:

- high number of orders,

- high number of customer visits,

- high number of rushed deliveries.

- The CEO needs to consider whether this high level of activity can be reduced without reducing customer revenues.

(iii) Income Statement of MNP suits for 2020:

![]()

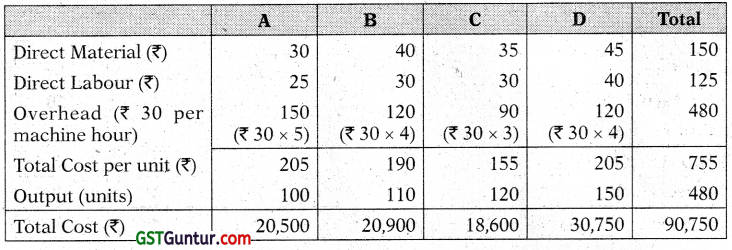

Question 3.

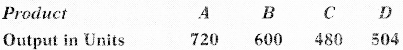

ABCD Co. Ltd. produces and sells four products A, B, C and D. These products are similar and usually produced in production runs of 10 units and sold in a batch of 5 units. The production details of these, products are as follows:

The production overheads during the period are as follows:

Factory works expenses ₹ 22,500

Stores receiving costs ₹ 8,100

Machine set up costs ₹ 12,200

Cost relating to quality control ₹ 4,600

Material handling and dispatch ₹ 9.600 ₹ 57, 000

| Cost | Cost drivers |

| Factory works expenses | Machine hours |

| Stores receiving costs | Requisitions raised |

| Machine set up costs | No. of production runs |

| Cost relating to quality control | No. of production runs |

| Material handling and dispatch | No. of orders executed |

The number of requisitions raised on the stores was 25 for each product and number of orders executed was 96, each order was in a batch of 5 units.

Required:

(i) Total cost of each product assuming the absorption of overhead on machine hour basis;

(ii) Total cost of each product assuming the absorption of overhead by using activity base costing; and

(iii) Show the differences between (i) and (ii) and comments. [CA Final May 2005, 12 Marks]

Answer:

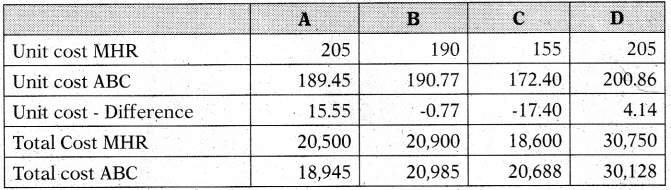

(i) Statement showing total cost of each product by absorbing overheads on machine hour rate basis:

Machine hour over-head Rate = \(\frac{\text { Total overhead costs }}{\text { Total machine hrs }}=\frac{₹ 57,000}{1,900 \mathrm{hrs}}\) = ₹ 30/machine

(ii) Statement showing total cost of each product by absorbing overheads on activity based cost method:

Total Production overhead and Production OH/Cost driver:

(iii) Statement showing Difference between (i) and (ii) :

- The above analysis shows that, ‘A’ consumes comparatively more of Machine hours.

- On the use of activity based costing gives different product costs than what were arrived at by utilising traditional costing.

- The product cost is more precise by using ABC because in this method of absorption overhead have been identified with specific activities.

Question 4.

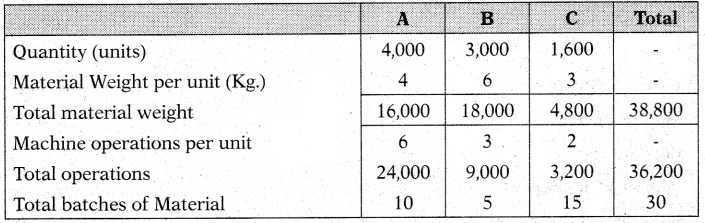

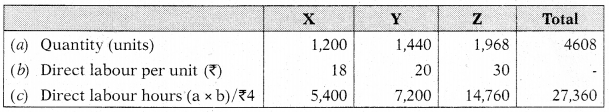

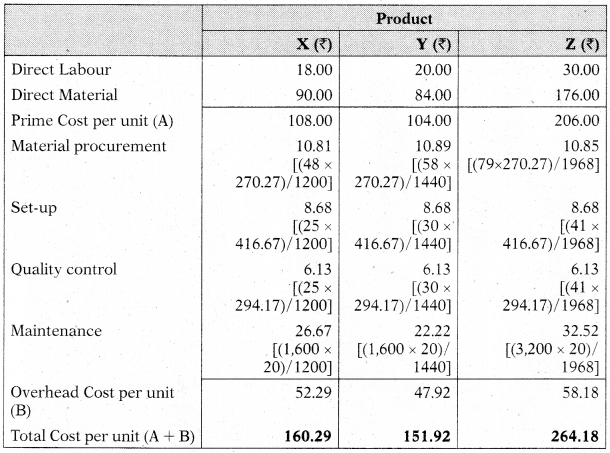

ABC Ltd. is a multiproduct company, manufacturing three products A, B and C. The budgeted costs and production for the year ending 31st March are as follows:

The budgeted direct labour rate was ? 10 per hour, and the budgeted material cost w as ₹ 2 per kg. Production overheads were budgeted at ₹ 99,450 and were absorbed to products using the direct labour hour rale. ABC Ltd. followed the Absorption Costing System.

ABC Ltd. is now considering to adopt an Activity Based Costing system. The following additional information is made available for this purpose.

1. Budgeted overheads were analysed into the following:

| ₹ | |

| Material handling | 29,100 |

| Storage costs | 31,200 |

| Electricity | 39,150 |

You are requested to:

2. The cost drivers identified were as follows:

| Material handling | Weight of material handled |

| Storage costs | Number of batches of material |

| Electricity | Number of Machine operations |

3. Data on Cost Drivers was as follows:

You are requested to:

1. Prepare a statement for management showing the unit costs and total costs of each product using the absorption costing method.

2. Prepare a statement for management showing the product costs of each product using the ABC approach.

3. State what are the reasons for the different product costs under the two approaches? [ICAI Module]

Answer:

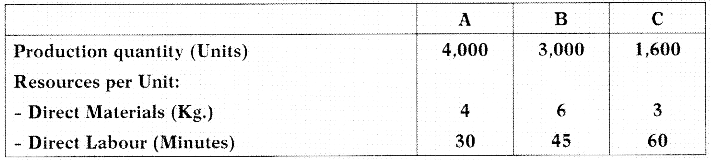

1. Traditional Absorption Costing

Total budgeted direct labour hours:

\(\frac{4,000 \times 30 \mathrm{~min}+3,000 \times 45 \mathrm{~min}+1,600 \times 60 \mathrm{~min}}{60 \mathrm{~min}}\)

Total joint cost Total sale value = 5,800 hours

Overhead rate per direct labour hour:

= Budgeted overheads ÷ Budgeted labour hours

= ₹ 99,450 ÷ 5,850 hours

= ₹ 17 per direct labour hour

Unit Costs:

2. Activity Based Costing

Material handling rate per kg. = ₹ 29,100 4- 38,800 kg. = ₹ 0.75 per kg.

Electricity rate per machine operations = ₹ 39,150 4- 36,200

= ₹ 1.081 per machine operations

Storage rate per batch = ₹ 31,200 4- 30 batches

= ₹ 1,040 per batch

Unit Costs:

3. The difference in the total costs under the two systems is due to the differences in the overheads borne by each of the products. The Activity Based Costs appear to be more precise.

![]()

Question 5.

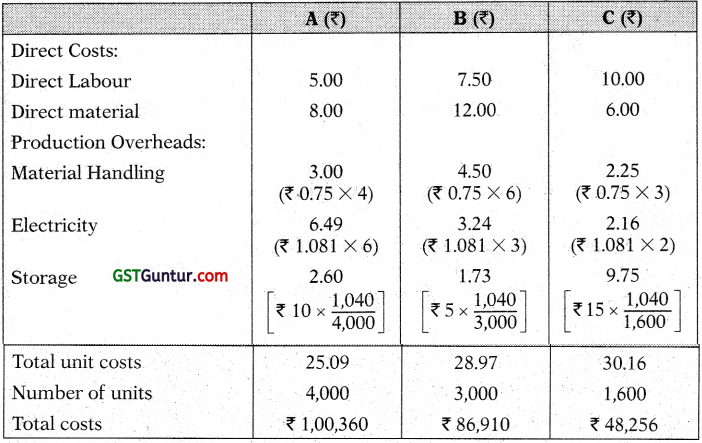

An engine manufacturing company has two production departments: (i) Snow mobile engine and (ii) Boat engine and two service departments: (i) Maintenance and (ii) Factory office.

Budgeted cost data and relevant cost drivers are as follows:

| Departmental costs: | ₹ |

| Snow mobile engine | 6,00,000 |

| Boat engine | 17,00,000 |

| Factory office | 3,00,000 |

| Maintenance | 2,40,000 |

| Cost drivers: | |

| Factory office department: | No. of employees |

| Snow mobile engine department | 1,080 |

| Boat engine department | 270 |

| Maintenance department | 150 |

| 1,500 | |

| Maintenance department: | No. of work orders |

| Snow mobile engine department | 570 |

| Boat engine department | 190 |

| Factory office department | 40 |

| 800 |

Required:

(i) Compute the cost driver allocation percentage and then use these percentages to allocate the service department costs by using direct method.

(ii) Compute the cost driver allocation percentage and then use these percentages to allocate the service department costs by using non-reciprocal method/step method. [CA Final May 2005, 5 Marks]

Answer:

(i) Direct Method:

Cost Driver Allocation Percentage:

| Factory office dept. | No. of employees | % used |

| Snow mobile engine | 1,080 | 80% |

| Boat engine | 270 | 20% |

| Total | 1,350 | 100% |

| Maintenance dept. | Number of work orders | |

| Snow mobile engine | 570 | 75% |

| Boat engine | 190 | 25% |

| 760 | 100 |

Service Department Allocation:

(ii) Step Method:

Cost Driver Allocation Percentage:

| Factory office dept. | Number of employees | % used |

| Snow mobile engine | 1,080 | 72% |

| Boat engine | 270 | 18% |

| Maintenance dept. | 150 | 10% |

| 1,500 | 100% | |

| Maintenance dept. | Work order | % used |

| Snow mobile engine | 570 | 75% |

| Boat engine | 190 | 25% |

| 760 | 100% |

Service Department Allocation:

Question 6.

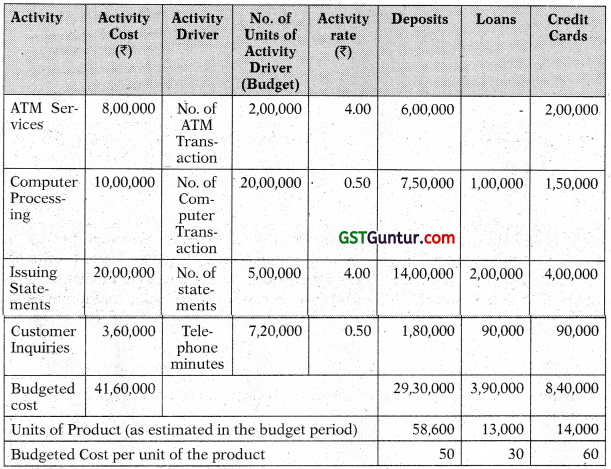

A bank offers three products, viz., deposits, Loans and Credit Cards. The bank has selected 4 activities for a detailed budgeting exercise, following activity based costing methods.

The bank wants to know the product wise total cost per unit for the selected activities, so that prices may be fixed accordingly.

The following information is made available to formulate the budget:

The activity drivers and their budgeted quantities are given below:

| Deposits | Loans | Credit Card | |

| No, of ATM Transactions | 1,50,000 | 50,000 | |

| No. of Computer Processing Transactions | 15,00,000 | 2,00,000 | 3,00,000 |

| No. of Statements to be issued | 3,50,000 | 50,000 | 1,00,000 |

| Telephone Minutes | 3,60,000 | 1,80,000 | 1,80,000 |

The bank budgets a volume of 58,600 deposit accounts, 13,000 loan accounts, and 14,000 Credit Card accounts.

You are required to:

(i) Calculate the budgeted rate for each activity.

(ii) Prepare the budgeted cost statement activity wise. Find the budgeted product cost per account for each product.

(iii) Find the budgeted product cost per account for each product using (i) and (ii) above. [CA Final May 2009, 12 Marks]

Answer:

Statement showing Budget Cost per unit

Working Note:

| Activity | Budgeted Cost (₹) | Remark |

| ATM Services | ||

| (a) Machine Maintenance | 4,00,000 | All fixed, no change. |

| (b) Rents | 2,00,000 | Fully fixed, no change. |

| (c) Currency Replenishment Cost | 2,00,000 | Doubled during budget period |

| Total | 8,00,000 | |

| Computer Processing | 2,50,000 | ₹ 2,50,000 (half of ₹ 5,00,000) is fixed and no change is expected |

| 7,50,000 | ₹ 2,50,000 (variable portion) is expected to increase to three times the current level. | |

| Total | 10,00,000 | |

| Issuing Statements | 18,00,000 | Existing |

| 2,00,000 | 2 lakhs statements are expected to be increased in budgeted period. For every increase of one lakh statement, one lakh rupees is the budgeted increase. | |

| Total | 20,00,000 | |

| Computer Inquiries | 3,60,000 | Estimated to increase by 80% during the budget period. (₹ 2,00,000 x 180%) ‘ |

| Total | 3,60,000 |

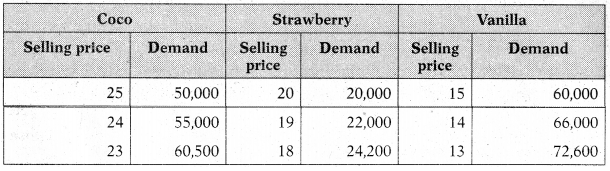

Question 7.

AML Ltd. is engaged in production of three types of ice-cream products Coco, Strawberry and Vanilla. The company presently sells 50,000 units of Coco @ ₹ 25 per unit, Strawberry 20,000 @ ₹ 20 per unit and Vanilla 60,000 units @ ₹ 15 per unit. The demand is sensitive to selling price and it has been observed that every reduction of ₹ 1 per unit in selling price, increases the demand for each product by 10% to the previous level. The company has the production capacity of 60,500 units of Coco, 24,200 units of Strawberry and 72,600 units of Vanilla. The company marks up 25% on cost of the product.

The Company management decides to apply ABC analysis. For this purpose it identifies tour activities and the rates as follows :

| Activity | Cost Rate |

| Ordering | ₹ 800 per purchase order |

| Delivery | ₹ 700 per delivery |

| Shelf stocking | ₹ 199 per hour |

| Customer support and assistance | ₹ 1.10 per unit sold. |

The other relevant information for the products are as follows:

| Coco | Strawberry | Vanilla | |

| Direct Material per unit | 8 | 6 | 5 |

| Direct Labour per unit | 5 | 4 | 3 |

| No. of purchase orders | 35 | 30 | 15 |

| No. of deliveries | 112 | 66 | 48 |

| Shelf stocking hours | 130 | 150 | 160 |

Under the traditional costing system, store support costs are charged @ 30% of prime cost. In ABC these costs are coming under customer support and assistance.

Required:

(i) Calculate target cost for each product after a reduction of selling price required to achieve the sales equal to the production capacity.

(ii) Calculate the total cost and unit cost of each product at the maximum level using traditional costing.

(iii) Calculate the total cost and unit cost of each product at the maximum level using activity based costing.

(iv) Compare the cost of each product calculated in (i) and (ii) with (iii) and comment on it. [CA Final May 2010, 12 Marks]

Answer:

(i) Cost of products under target costing

Demanded unit and selling price

Target cost of each product after reduction in selling price

| Coco | Strawberry | Vanilla | |

| Selling price alter reduction | 23.00 | 18.00 | 13.00 |

| Profit marks up 25% on cost i.e. 20ao on selling price | 4.60 | 3.60 | 2.60 |

| Target cost of production (per unit) | 18.40 | 14.40 | 10.40 |

(ii) Cost of product under traditional costing

| Coco | Strawberry | Vanilla | |

| Units | 60,500 | 24,200 | 72,600 |

| Material cost (8, 6, 5 per unit) | 8 | 6 | 5 |

| Labour cost (5, 4, 3 per unit) | 5 | 4 | 3 |

| Prime cost | 13 | 10 | 8 |

| Store support costs (30% of prime) | 3.90 | 3 | 2.40 |

| Cost per unit | 16.90 | 13.00 | 10.40 |

(iii) Cost of product under activity based costing

| Coco | Strawberry | Vanilla | |

| Units | 60,500 | 24,200 | 72.600 |

| Materia] cost (8, 6, 5 per unit) | 4,84,000 | 1,45.200 | 3,63,000 |

| Labour cost (5, 4, 3 per unit) | 3,02,500 | 96,800 | 2,17,800 |

| Prime cost | 7,86,500 | 2,42,000 | 5,80,800 |

| Ordering cost @ ₹ 800 (35, 30, 15) | 28,000 | 24,000 | 12,000 |

| Delivery cost @ ₹ 700 (112, 66, 48) | 78,400 | 46,200 | 33,600 |

| Shelf stocking @ ₹ 199 (130, 150, 160) | 25,870 | 29,850 | 31,840 |

| Customer Support ₹ 1.10 | 66,550 | 26,620 | 79,860 |

| Total Cost | 9,85,320 | 3,68,670 | 7,83,100 |

| Cost Per unit | 16.29 | 15.23 | 10.17 |

(iv) Comparative Analysis of cost of production

| Coco | Strawberry | Vanilla | |

| (a) As per Target Costing | 18.40 | 14.40 | 10.40 |

| (b) As per traditional Costing | 16.90 | 13.00 | .10.40 |

| (c) As per Activity Based Costing | 16.29 | 15.23 | 10.17 |

| (a)-(c) | 2.11 | -0.83 | 0.23 |

| (b)-(c) | 0.61 | -2.23 | 0.23 |

Note: The cost of product of strawberry is higher in ABC method in comparison to target costing and traditional methods. It indicated that actual profit under target costing is less than targeted. For remaining two products, ABC is most suitable.

![]()

Question 8.

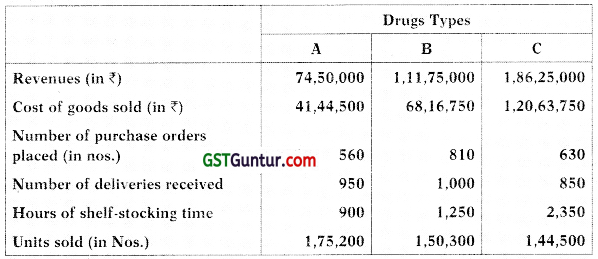

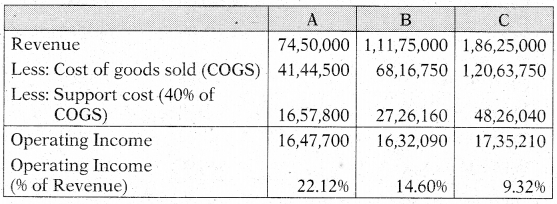

A Drug Store is presently selling three types of drugs namely ‘Drug A’, ‘Drug B’ and ‘Drug C’. Due to some constiaints, it has decided to go for only one product line of drugs. It has provided the following data for year 202021 for each product line:

Following additional information is also provided:

You are required to:

(i) Calculate the operating income and operating income as a percentage (%) of revenue of each product line if:

(a) All the support costs (Other than cost of goods sold) are allocated in the ratio of cost of goods sold.

(b) All the support costs (Other than cost of goods sold) are allocated using activity-based costing system.

(ii) Give your opinion about choosing the product line on the basis of operating income as a percentage (%) of revenue of each product line under both the situations as above. [CA Inter Dec. 2021, Nov. 2010, 10 Marks]

Answer:

(i) (a) Statement of operating income and operating income as a percentage (%) of revenue of each product line where all the support costs (Other than cost of goods sold) are allocated in the ratio of cost of goods sold.

Workings:

| Calculation of Total Support Cost: | ₹ |

| Drug License lees | 5,00,000 |

| Ordering Cost | 8,30,000 |

| Delivery Cost | 18,20,000 |

| Shelf-stocking cost | 32,40,000 |

| Customer support cost | 28,20,000 |

| Total Support Cost | 92,10,000 |

Percentage of support cost to COGS = \(\frac{\text { Total Support Cost }}{\text { Total COGS }}\)

= \(\frac{₹ 92,10,000}{₹ 2,30,25,000}\) × 100 = 40%

(b) Statement of operating income and operating income as a percentage (%) of revenue of each product line where all the support costs (Other than cost of goods sold) are allocated using activity-based costing system.

Workings: Calculation of Cost Driver Rate

| Activity | Cost (₹) | Allocation base | Cost Driver Rate |

| Ordering Cost | 8,30,000 | 2,000 pur. orders | ₹ 415/order |

| Delivering Cost | 18,20,000 | 2,800 deliveries | ₹ 650/delivery |

| Shelf-stock cost | 32,40,000 | 4,500 hours | ₹ 720/hour |

| Customer support | 28,20,000 | 4,70,000 units sold | ₹ 6/ unit |

(ii) Choosing the product line on the basis of operating income as a percentage (%) of revenue of each product line:

When using COGS as the basis for allocating support costs, Drug A seems to be most profitable @ 22% and Drug C seems to be least profitable @ 9.32%. But this can be deceptive, since above method uses COGS as a flat rate for allocating support costs.

ABC method on the other hand uses the cost driver in each of the support costs for allocating it to the product line. Thus, it is much more accurate.

Accordingly now Drug C seems to be most profitable at 15.78% and Drug A seems to be the least profitable at 8.81%

Therefore, it is suggested that company should go with Drug C for Product line.

Question 9.

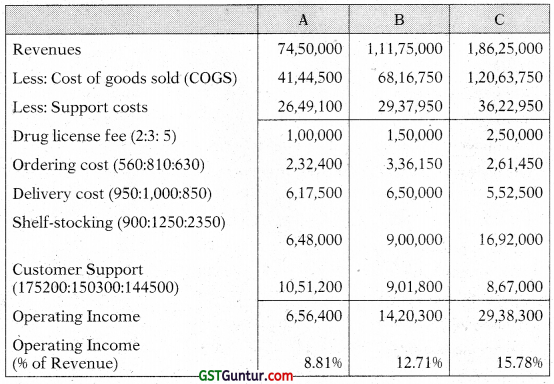

DEF Bank operated for years under the assumption that profitability can be increased by increasing Rupee volumes. But that has not been the case. Cost Analysis has revealed the following:

| Activity | Activity cost (₹) | Activity Driver | Activity capacity |

| Providing ATM service | 1,00,000 | No. of transactions | 2,00,000 |

| Computer processing | 10,00,000 | No. of transactions | 25,00,000 |

| Issuing Statements | 8,00,000 | No. of statements | 5,00,000 |

| Customer inquiries | 3,60,000 | Telephone minutes | 6,00,000 |

The following annual information on three products was also made available:

| Checking Accounts | Personal Loans | Gold Visa | |

| Units of product | 30,000 | 5,000 | 10,000 |

| ATM transactions | 1,80,000 | 0 | 20,000 |

| Computer transactions | 20,00,000 | 2,00,000 | 3,00,000 |

| Number of statements | 3,00,000 | 50,000 | 1,50,000 |

| Telephone minutes | 3,50,000 | 90,000 | 1,60,000 |

Required:

(i) Calculate rates for each activity.

(ii) Using the rates computed in requirement (i), calculate the cost of each product. [CA Final May 2013, 8 marks]

Answer:

Computation showing Rates for each Activity

Question 10.

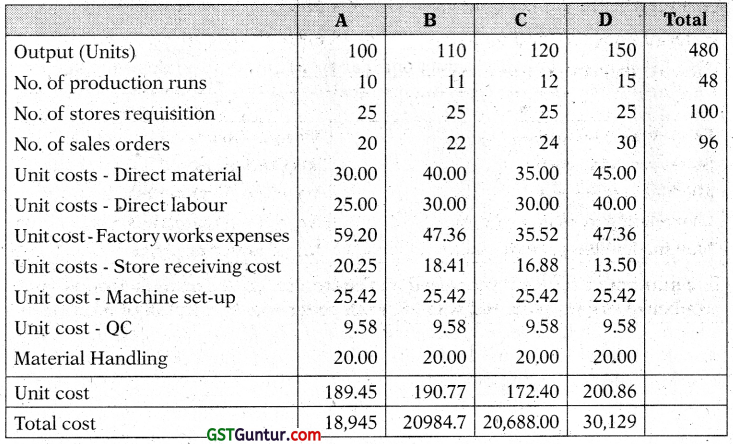

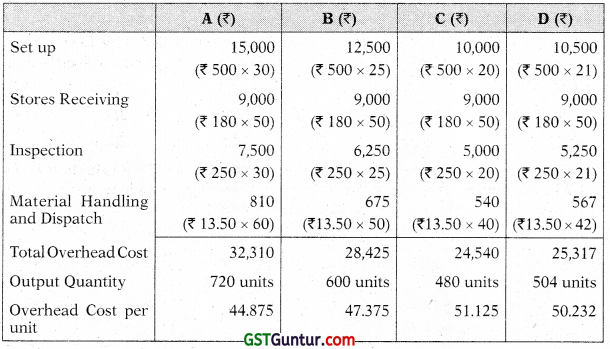

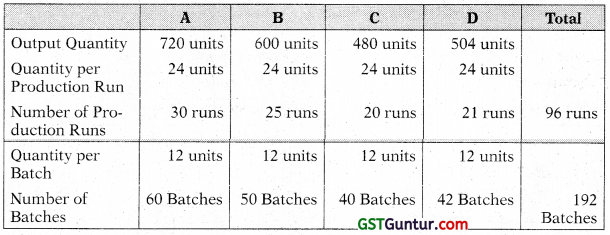

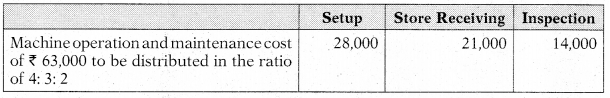

MK Ltd. manufactures four products, namely A, B, € and D using the same plant and process. The following information relates to a production period:

The four products are similar and are usually produced in production runs of 24 units and sold in batches of 12 units. The total overheads incurred by the company for the period are as follows:

| ₹ | |

| Machine operation and maintenance cost | 63,000 |

| Setup costs | 20,000 |

| Store receiving | 15,000 |

| Inspection | 10,000 |

| Material handling and dispatch | 2,592 |

During the period the fallowing cost drivers are to be used for the overhead cost:

| Cost | Cost Driver |

| Setup cost | No. of production runs |

| Store receiving | Requisitions raised |

| Inspection | No. of production runs |

| Material handling and dispatch | Orders executed |

It is also determined that:

- Machine operation and maintenance cost should be apportioned be-tween setup cost, store receiving and inspection activity in the ratio 4:3:2.

- Number of requisition raised on store is 50 for each product and the No. of orders executed is 192, each order being for a batch of 12 units of a product.

Calculate the total overhead cost per unit of each product using activity based costing after finding activity wise overheads allocated to each product. [CA Final Nov. 2013, 8 Marks]

Answer:

Statement Showing Overhead Cost per unit

Workings:

Calculation of No. of Production runs and No. of Batches

Allocation of Machine Operation and Maintenance Cost

Calculation of Cost Driver Rate

Question 11.

Linex Limited manufactures three products P, 0 and R which are similar in nature and are usually produced in production runs of 100 units. Product P and R require both machine hours and assembly hours, whereas product 0 requires only machine hours. The overheads incurred by the company during the first quarter are as under:

| ₹ | |

| Machine Department expenses | 18,48,000 |

| Assembly Department expenses | 6,72,000 |

| Setup costs | 90,000 |

| Stores receiving cost | 1,20,000 |

| Order processing and dispatch | 1,80,000 |

| Inspection and Quality control cost | 36,000 |

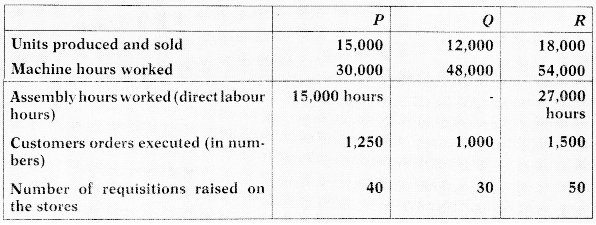

The data related to the three products during the period are as under:

Prepare a statement showing details of overhead costs allocated to each product type using activity based costing. [CA Final May 2015, 8 Marks]

Answer:

Computation of Activity Rate

*Number of production Runs is 450 (150 + 120 + 180)

Statement Showing Overhead Allocation

![]()

Question 12.

PCP Limited belongs to the apparel industry. It specializes in the distribution of fashionable garments. It buys from the industry and resells the same to the following two different supermarkets:

(i) Supermarket A dealing in Adults’ garments (Age group 15 – 30)

(ii) Supermarket B dealing in Kids’ garments (Age group 5 – 10)

The following data for the month of April in respect of PCP Limited has been reported:

| Supermarket A (₹) | Supermarket B (₹) | |

| Average revenue per delivery | 1,69,950 | 57,750 |

| Average cost of goods sold per delivery | 1,65,000 | 55,000 |

| Number of deliveries | 660 | 1,650 |

In the past, PCP Limited has used gross margin percentage to evaluate the relative profitability of its supermarket segments.

The company plans to use activity-based costing for analysing the profitability of its supermarket segments.

The April month’s operating costs (other than cost of goods sold) of PCP Limited are ? 16,55,995. These operating costs are assigned to five activity areas. The cost in each area and Activity analysis including cost driver for the month of April are as follows:

| Supermarket A | Supermarket B | |

| Total number of store deliveries | 1,100 | 2,805 |

| Average number of cartons shipped per store delivery | 250 | 50 |

| Average number of hours of shelf-stocking per store delivery | 6 | 1.5 |

| Average number of line items per order | 14 | 12 |

| Total number of orders | 770 | 1,980 |

Other data for the month of April include the following:

| Activity Area | Total costs (₹) | Cost Driver |

| Store delivery | 3,90,500 | Store deliveries |

| Cartons dispatched to store | 4,15,250 | Cartons dispatched to a store per delivery |

| Shelf-stocking at customer store | 64,845 | Hours of shelf-stocking |

| Line-item ordering | 3,45,400 | Line-Items per purchase order |

| Customer purchase order processing | 4,40,000 | Purchase orders by customers |

Required:

(i) Compute gross-margin percentage for each of its supermarket segments and compute PCP Limited’s operating income.

(ii) Compute the operating income of each supermarket segments using the activity-based costing information. [CA Inter RTP May 2022]

Answer:

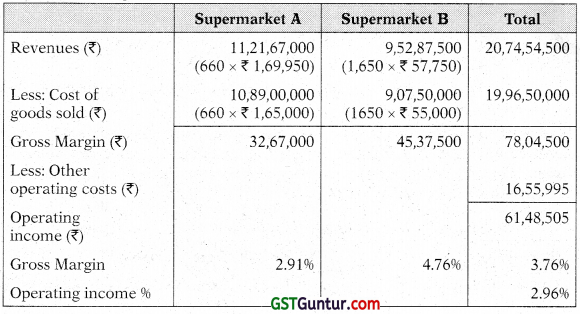

(i) Statement of operating income and gross margin percentage for each of its supermarket segments:

(ii) Operating Income Statement of each distribution channel in April (Using the Activity based Costing information)

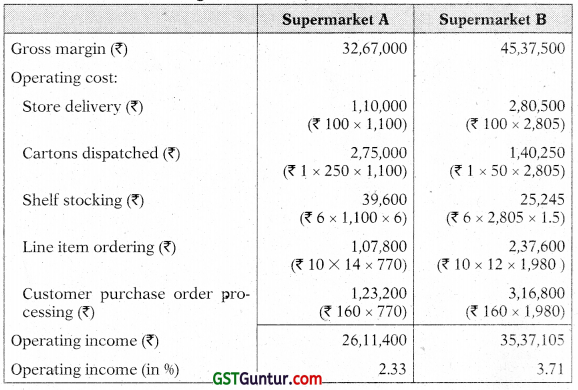

Calculation of Cost Driver Rate

Question 13.

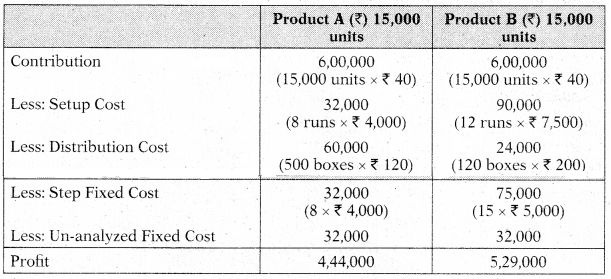

Speedo Limited is a specialist car manufacturer that produces various models of cars. The organization is due to celebrate its 100th anniversary next year. To mark the occasion, Speedo Limited intends to produce a sports car, the Model Royal. As this will be a special edition, production will be limited to 1,000 numbers of Model Royal Cars.

Speedo Limited is considering using a target costing approach and has conducted market research to determine the features that consumers require in a sports car. Based on this market research and knowledge of competitor’s products, company has decided to price the Model Royal at ₹ 9.75 lakhs. Company requires an operating profit margin of 25% of the selling price of the car. Details for the forthcoming year are as follows:

Forecast of direct costs for a Model Royal Car

| Labour | ₹ 2,50,000 |

| Material | ₹ 4,75,000 |

Forecast of annual overhead costs

| ₹ in lakhs | Cost driver | |

| Production line cost | 2,310 | See note 1 |

| Transportation cost | 900 | See note 2 |

Note 1:

The production line that would be used for Model Royal has a capacity of

60.0 machine hours per year. The production line time required for Model Royal is 6 machine hours per err. This production line will also be used to make other cars and will be working at full capacity.

Note 2:

Some models of cars are delivered to showrooms using car transporters 60% of the transportation costs are related to the number of deliveries made. 40% of the transportation costs are related to the distance travelled. The car transporters have forecast to make a total of 640 deliveries in the year and carry 10 cars each time. The car transporter will always carry its maximum capacity of 10 cars.

The total annual distance travelled by car transporters is expected to be 2.25.0 kms. 50,000 kms of this is for the delivery of Model Royal cars only. All 1,000 Model Royal cars that will be produced will be delivered in the year using the car transporters.

Required:

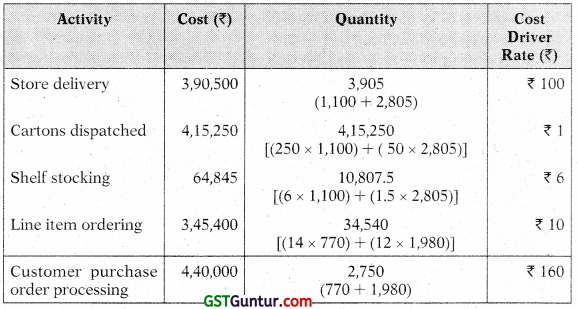

(1) Calculate the forecast total cost of producing and delivering a Model Royal car using Activity Based Costing principles to assign the overhead costs.

(2) Calculate the cost gap that currently exists between the forecast total cost and the target total cost of a Model Royal car. [CA Final Nov. 2016, 10 Marks]

Answer:

Statement showing ‘Cost Driver Rate’

(i) Forecast Total Cost using Activity Based Costing Principles

(ii) Calculation of Cost Gap Between Forecast Total Cost and the Target Total Cost:

| ₹ | |

| Target selling price | 9,75,000.00 |

| Less: Operating Profit Margin (₹ 9,75,000 × 25%) | 2,43,750.00 |

| Target Total Cost | 7,31,250.00 |

| Forecast Total Cost | 7,64,537.50 |

| Cost Gap | 33,287.50 |

![]()

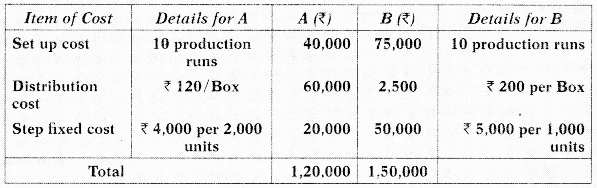

Question 14.

A company can make any or both of products A and B in a production period not exceeding a total of 10,000 units due to non-availability of the required material and labour. Until now, the company had been taking decisions on the product mix, based on the following marginal cost analysis.

| A | B | ||

| Selling Price | 100 | 120 | |

| Variable Cost | 60 | 70 | |

| Contribution | 40 | 50 | |

| Total fixed costs | 3,00,000 | ||

Since the decisions based on the above approach did not yield the required results, the fixed costs were analysed as follows for 10,000 units of only A or 10,000 units of only B.

₹ 30,000 can be taken as the unanalysed fixed cost, and unavoidable whether A or B or both are produced.

The following cost reduction measures were taken by the Product Managers of A and B:

| A | B | |

| Increase in number of units per run to | 2,000 units | 1,250 units |

| Increase in the number of units per box distributed to | 30 units | 125 units |

Further, the Management ensured availability of raw material and labour to support a production of 15,000 units of either A or B or both together. There was no change to the step costs or contribution. However, the total unanalysed fixed cost increased to ₹ 32,000.

(i) Based on the principles of Activity Based Costing, prepare a statement showing the contribution and item wise analysed overheads for each product, arrive at the profitability of A and B and then the final profits it 15,000 units of only A or 15,000 units of only B are manufactured.

(ii) Find the minimum break-even point in units if only product A is manufactured after the cost reduction. [CA Final May 2017, 12 Marks]

Answer:

(i) Statement Showing “Profitability of Product A & B”

(ii) Break Even Point ‘A’

Un-analyzed Fixed Cost is ₹32,000

Minimum units for BEP = \(\frac{₹ 32,000}{40}\) = 800 units

Setup Cost (fixed for 2,000 units); 1 Production Run; ₹ 4,000

Distribution Cost will have to be recovered on the basis of 30 units.

Let BEP (units) = ‘K’

40 × K = ₹ 32,000 + ₹ 8,000 + \(\frac{\mathrm{K}}{30 \text { units }}\) Boxes × ₹ 120

K = 1,111.11 units

Refining, 1,111.11 will have 37.03 boxes or say 38 boxes. The last box will cost ₹ 120 which is equivalent to contribution from 3 units. Hence, BEP is 1,114 units.

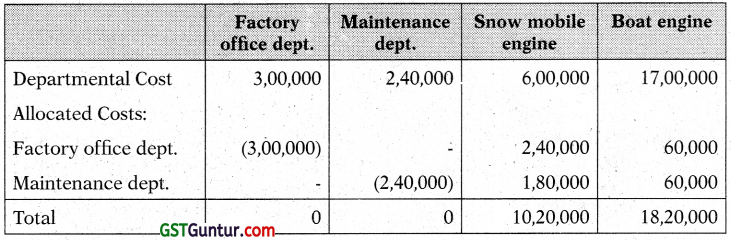

Question 15.

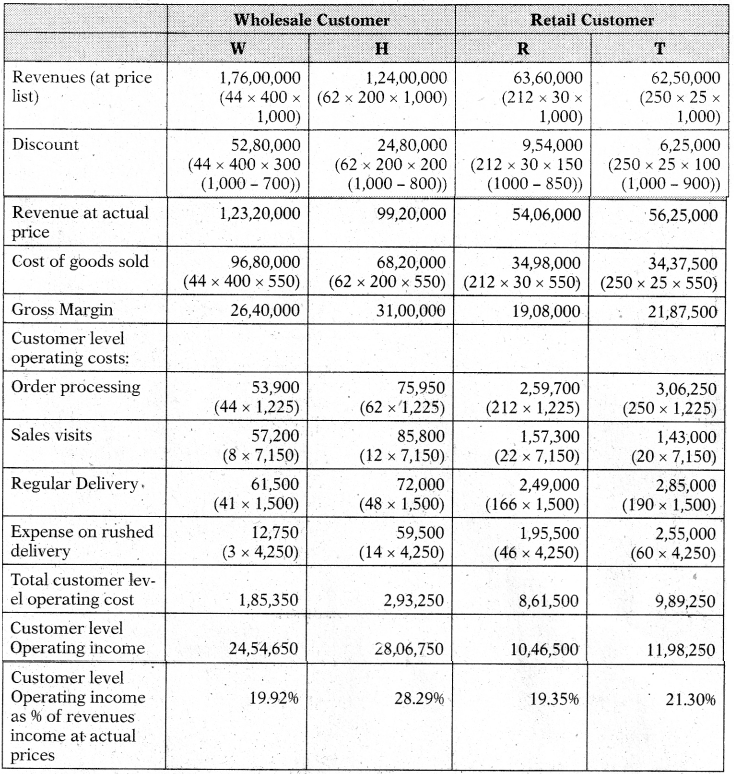

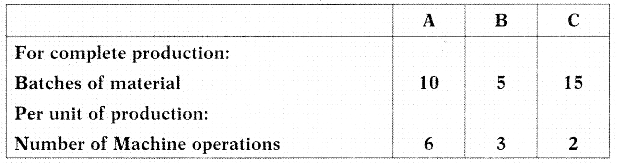

PQR Pens Ltd. manufactures two products – Gel Pen and Ball Pen. It furnishes the following data for the year 2020:

The annual overheads are as under:

| ₹ | |

| Volume related activity costs | 4,75.020 |

| Set up related costs | 5,79.988 |

| Purchase related costs | 5,04,992 |

Calculate the overhead cost per unit of each Product – Gel Pen and Ball Pen on the basis of:

(i) Traditional method of charging overheads

(ii) Activity based costing method and

(iii) Find out the difference in cost per unit between both the methods. [CA In ter May 2018, 10 Marks]

Answer:

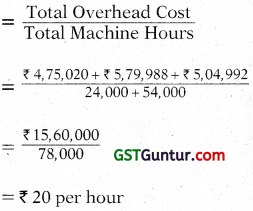

(i) Statement showing Overhead Cost per unit using Traditional method

| Gel Pen | Ball Pen | |

| Units | 5,500 | 24,000 |

| Overheads (₹) | 4,80,000 (20 × 24,000 hrs) | 10,80,000 (20 × 54,000) |

| Overhead Cost Per Unit (₹) | 87.27 (₹ 4,80,000 ÷ 5,500) |

45 (₹ 10,80,000 ÷ 24,000) |

Overhead Rate per Machine Hour

(ii) Statement Showing “Activity Based Overhead Cost”

(iii) Calculation of difference in cost between above methods

| Gel pen | Ball Pen | |

| Overheads Cost per unit (₹) (Traditional Method) | 87.27 | 45 |

| Overheads Cost per unit (₹) (ABC) | 95.39 | 43.13 |

| Difference per unit | -8.12 | + 1.87 |

Note: Volume related activity cost, set up related costs and purchase related cost can also be calculated under Activity Base Costing using Cost driver rate. However, there will be no changes in the final answer.

![]()

Question 16.

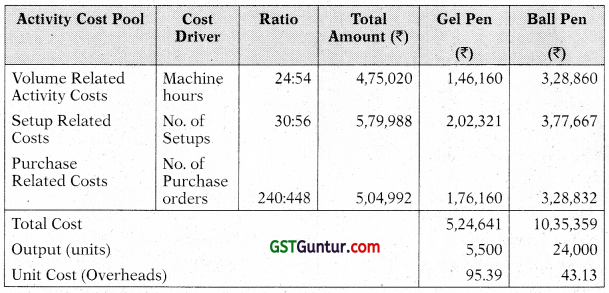

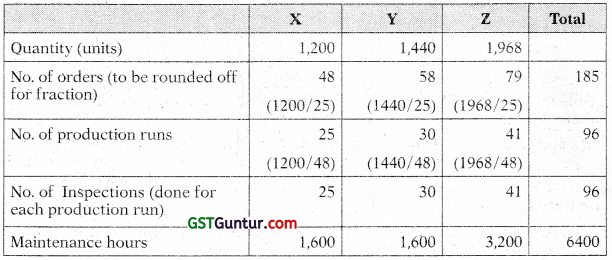

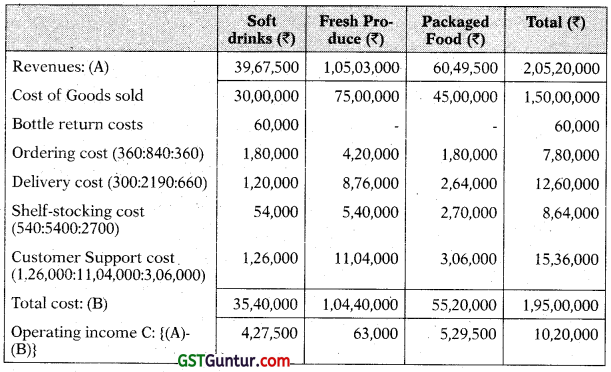

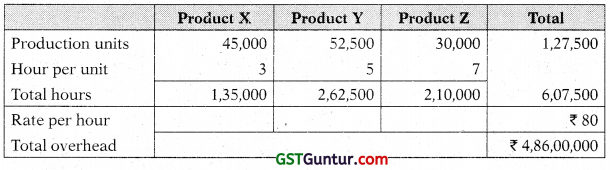

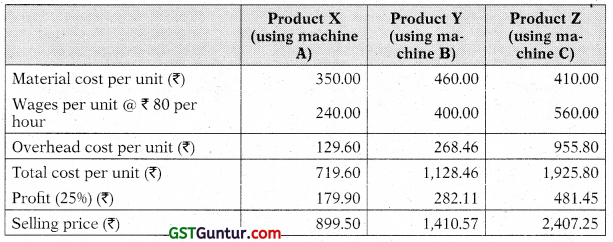

ABC Ltd. manufactures three products X, Y and Z using the same plant and resources. It has given the following information for the year ended on 31st March, 2020:

Budgeted direct labour rate was 4 per hour and the production overheads, shown in table below, wrere absorbed to products using direct labour hour rate. Company followed Absorption Costing Method. However, the company is now considering adopting Activity Based Costing Method:

Required:

1. Calculate the total cost per unit of each product using the Absorption Costing Method

2. Calculate the total cost per unit of each product using the Activity

Based Costing Method. [CA Inter January 2021, 10 Marks]

Answer:

Traditional Absorption Costing

Overhead rate per direct labour hour:

= Budgeted overheads/Budgeted labour hours

= (₹ 50,000 + ₹ 40,000 + ₹ 28,240 + ₹ 1,28,000)/27,360 hours

= ₹ 2,46,240/27,360 hours

= ₹ 9 per direct labour hour

Unit Costs:

Calculation of Cost-Driver level under Activity Based Costing

Calculation of Cost-Driver rate

Calculation of total cost of products using Activity Based Costing

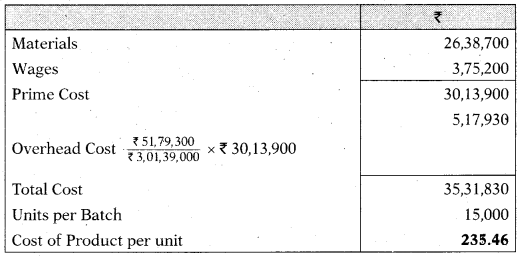

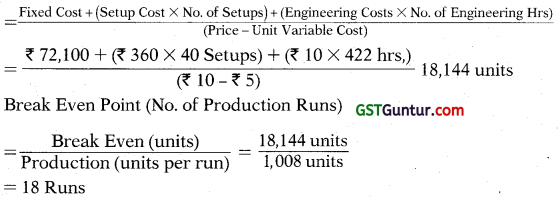

Question 17.

Ms. HMB Limited is producing a product in 10 batches each of 15,000 units in a year and incurring following overheads thereon:

| ₹ | |

| Material procurement | 22,50,000 |

| Maintenance | 17,30,000 |

| Set-up | 6,84,500 |

| Quality control | 5,14,800 |

| Total | 51,79,300 |

The prime costs for the year amounted to ₹ 3,01,39,000.

The company is using currently the method of absorbing overheads on the basis of prime cost. Now it wants to shift to activity based costing. Information relevant to Activity drivers for a year are as under:

| Activity Driver | Activity Volume |

| No. of purchase orders | 1,500 |

| Maintenance hours | 9,080 |

| No. of set-ups | 2,250 |

| No. of inspections | 2,710 |

The company has produced a batch of 15,000 units and has incurred ₹ 26,38,700 and ₹ 3,75,200 on materials and wages respectively.

The usage of activities of the said batch are as follows:

| Material orders | 48 orders |

| Maintenance hours | 810 hours |

| No. of set-ups | 40 set-ups |

| No. of inspections | 25 inspections |

You are required to:

(i) Find out cost of product per unit on absorption costing basis for the said batch.

(ii) Determine cost driver rate, total cost and cost per unit of output of the said batch on the basis of activity based; costing. [CA Inter Nov. 2018, 10 Marks]

Answer:

Overhead Absorption rate = \(\frac{\text { Total Overheads }}{\text { Prime Cost }}\) × 100

= \(\frac{₹ 51,79,300}{₹ 3,01,39,000}\) × 100 = 17.18%

(i) Cost of Product Under Absorption Costing

(ii) Calculation of cost driver rate:

Calculation of Total Cost an d Cost per unit:

![]()

Question 18.

MNO Ltd. manufactures two types of equipments A and B and absorbs overheads on the basis of direct labour hours. The budgeted overheads and direct labour hours for the month of March 2021 are 15,00,000 and 25,000 hours respectively. The information about the company’s products is as follows:

| Equipment | ||

| A | B | |

| Budgeted Production Volume | 3,200 units | 3,850 units |

| Direct Material Cost | ₹ 350 per unit | ₹ 400 per unit |

| Direct Labour Cost | ||

| A; 3 hours @ ₹ 120 per hour | ₹ 360 | |

| B: 4 hours @ ₹ 120 per hour | ₹ 480 | |

Overheads of ₹ 15,00,000 can be identified with the following three major activities:

| Order processing | ₹ 3, 00,000 |

| Machine processing | ₹ 10, 00, 000 |

| Product Inspection | ₹ 2, 00, 000 |

These activities are driven by the number of orders processed, machine hours worked and inspection hours respectively. The data relevant to these activities is as follows:

| Equipment | Orders processed | Machine hours worked | Inspection hours |

Required:

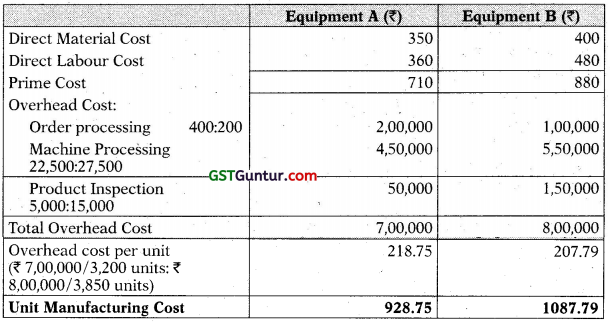

(i) Prepare a statement showing the manufacturing cost per unit of each product using the absorption costing method assuming the budgeted manufacturing volume is attained.

(ii) Determine cost driver rates and prepare a statement showing the manufacturing cost per unit of each product using activity based costing, assuming the budgeted manufacturing volume is attained.

(iii) MNO Ltd.’s selling prices are based heavily on cost. By using direct labour hours as an application base, calculate the amount of cost distortion (under costed or over costed) for each equipment. [CA Inter May 2019, Final Nov. 2006, 10 Marks]

Answer:

(i) Overheads Application Base: Direct Labour hours

| Equipment (A) (₹) | Equipment (B) (₹) | |

| Direct Material Cost | 350 | 400 |

| Direct Labour Cost | 360 | 480 |

| Overheads | 180 | 240 |

| 890 | 1,120 |

* Per-determined rate = \(\frac{\text { Budgeted Overheads }}{\text { Budgeted direct labour hours }}\)

= \(\frac{₹ 15,00,000}{25,000 \text { hours }}\)

= ₹ 60

(ii) Estimated Cost Driver Rate:

Statement showing the manufacturing cost per unit using activity based costing

(iii) Calculation of Cost Distortion

Cost distortion

Low volume product A is under-costed and high volume product B is over costed using direct labour hours for overhead absorption.

Question 19.

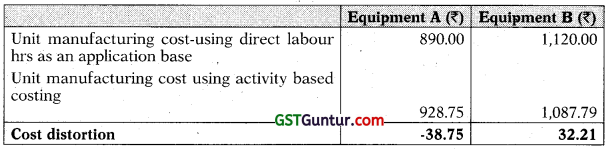

PQR Ltd. has decided to analyse the profitability of its five new customers. It buys soft drink bottles in cases at 45 per case and sells them to retail customers at a list price of 54 per case. The data pertaining to five customers are given below:

Its five activities and their cost drivers are:

| Activity | Cost Driver |

| Order taking | 200 per purchase order |

| Customer visits | 300 per each visit |

| Deliveries | 4.00 per delivery km travelled |

| Product Handling | 100 per case sold |

| Expedited deliveries | 100 per each such delivery |

You are required to:

(i) Compute the customer level operating income of each of five retail customers by using the Cost Driver rates.

(ii) Examine the results to give your comments on Customer ‘D’ in comparison with Customer ‘C’ and on Customer ‘E’ in comparison with Customer ‘A’. ]CA Inter Nov. 2019, 10 Marks]

Answer:

Computation of revenues (at listed price), discount, cost of goods sold and Customer level operating activities costs:

(i) Computation of Customer level operating income

(ii) Comments:

Customer D in comparison with Customer C:

Operating income of Customer D is more than of Customer C, despite having only 61.29% (38,000 units) of the units volume sold in comparison to Customer C (62,000 units). Customer C receives a higher per cent of discount Le. 9.26% (₹ 5) while Customer D receives a discount of 7.04% (₹ 3.80). Though the grpss margin of customer C (₹ 2,48,000) is more than Customer D (₹ 1,97,600) but total cost of customer level operating activities of C (₹ 1,44,400) is more in comparison to Customer D (₹ 93,600). As a result, operating income is more in case of Customer D.

Customer E in comparison with Customer A:

Customer E is not profitable while Customer A is profitable. Customer E receives a discount of 10% (₹ 5.4) while Customer A doesn’t receive any discount. Sales Volume of Customers A and E is almost same. However, total cost of customer level operating activities of E is far more (₹ 43,200) in comparison to Customer A (₹ 29,120). This has resulted in occurrence of loss in case of Customer E.

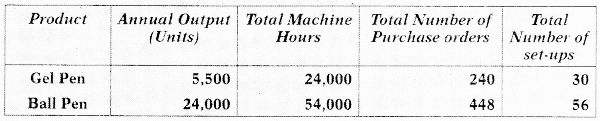

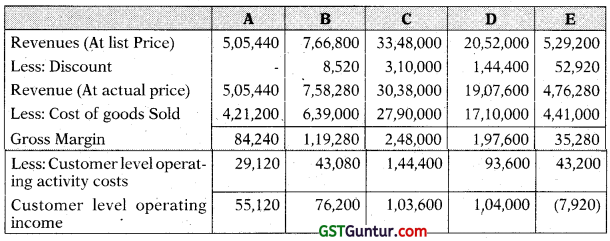

Question 20.

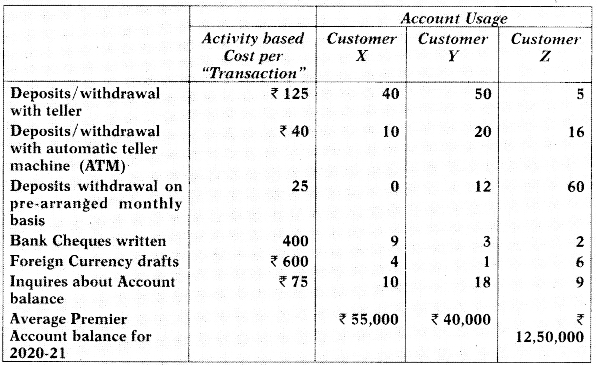

PQR Ltd. Is engaged in the production of three products P, Q and R. The company calculates activity cost rates on the basis of cost Driver capacity which is provided as below:

The consumption of activities during the period is as under:

| P | Q | R | |

| Direct Labour hours | 10,000 | 8,000 | 6,000 |

| Production runs ‘ | 200 | 180 | 160 |

| Quality Inspection | 3000 | 2500 | 1500 |

You are required to:

(i) Compute the costs allocated to each Product from each Activity,

(ii) Calculate the cost of unused capacity for each Activity.

(iii) A potential customer has approached the company for supply of 12,000 units of a new product ‘S’ to be delivered in lots of 1500 units per quarter. This will involve an initial design cost of 30,000 and per quarter production will involve the following:

| Direct Material | 18,000 |

| Direct Labour hours | 1,500 hours |

| No. of Production runs | 15 |

| No. of Quality Inspection | 250 |

Prepare cost sheet segregating Direct and Indirect costs and compute the Sales value per quarter of product ‘S’ using ABC system considering a markup of 20% on cost. [CA Inter July 2021, Final May 2004, 10 Marks]

Answer:

(i) Statement of Cost Allocation

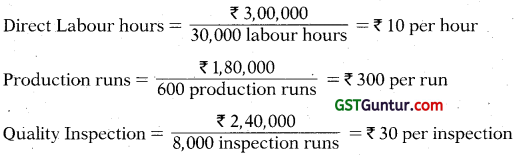

Working note: Calculation of Cost driver rate

(ii) Calculation of cost of unused capacity for each activity

Direct Labour hours = ₹ 3,00,000 – ₹ 2,40,000 = ₹ 60,000

Production runs = ₹ 1,80,000 – ₹ 1,62,000 = ₹ 18,000

Quality Inspection = ₹ 2,40,000 – ₹ 2,10,000 = ₹ 30,000

(iii) Cost Sheet

![]()

Question 21.

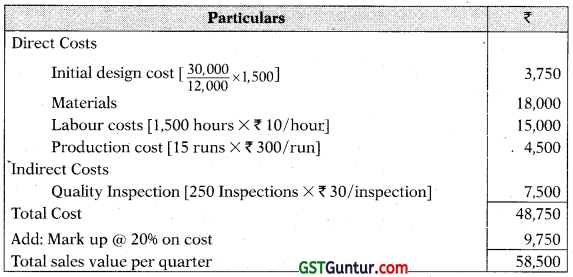

ABC Bank is examining the profitability of its Premier Account, a combined Savings & Cheque account. Depositors receive a 7% annual interest on their average deposit. ABC Bank earns an interest rate spread of 3% (the difference between the rate at which it lends money and rate it pays to depositors) by lending money for home loan purpose at 10%.

The Premier Account allows depositors unlimited use of services such as deposits, withdrawals, cheque facility, and foreign currency drafts. Depositors with Premier Account balances of ₹ 5.0,000 or more receive unlimited free use of services. Depositors with minimum balance of less than ₹ 50,000 pay ₹ 1,000 a month service fee for their Premier Account ABC Bank recently conducted an activity-based costing study of its services. The use of these services in 2020-21 by three customers is as follows:

Assume Customer X and Z always maintain a balance above ₹ 50,000, whereas Customer Y always has a balance below ₹ 50,000.

Required:

(i) Compute the 2020-21 profitability of the customers X, Y and Z Premier Account at ABC Bank.

(ii) Premier Accounts? Why might ABC bank worry about this Cross subsidization, if the Premier Account product offering is profitable as a whole?

(iii) What changes would you recommend for ABC Bank’s Premier Account? [CA Final May 2006, 11 Marks]

Answer:

(i) Customer Profitability Analysis of ABC Bank Premier Account

(ii) Above computation shows that Customer Z is most profitable and is cross-subsidising the most demanding customer X. Customer Y is paying for the services used, because of not being able to maintain minimum balance. No doubt, ‘Premier Account’ product offering is profitable as a whole, but the worry is of not finding customers like customer Z who will maintain a balance higher than the stipulated minimum. It appears, the minimum balance stipulated is inadequate considering the services availed by depositors in ‘Premium Account’.

(iii) The changes suggested to ABC Bank’s ‘Premier Account’ are as follows:

- Increase the requirement of minimum balance from ₹ 50,000 to ₹ 1,00,000.

- Charge for value added services like Foreign Currency Drafts.

- Do not allow deposits/withdrawal below ₹ 10,000 at the teller. Only ATM machine withdrawal is allowed.

- Inquiries about account balance to be entertained only through Phone Banking/’ATM.

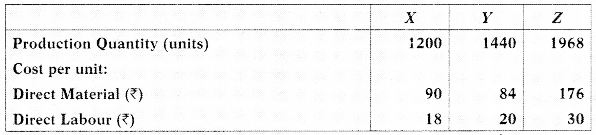

Question 22.

PQ Ltd. makes two products P and 0, which are similar products with dimensions, but use the same manufacturing process facilities. Production may be made interchangeably after altering machine setup. Production time is the same for both products. The cost structure is as follows:

| (Figures per unit) | P | 0 |

| Selling Price | 100 | 120 |

| Variable manufacturing cost | 45 | 50 |

| (directly linked to units produced) Contribution | 55 | 70 |

| Fixed manufacturing cost | 10 | 10 |

| Profit | 45 | 60 |

Fixed cost per unit has been calculated based on the total practical capacity of 20,000 units per annum (which is either P or Q or both put together). Market demand is expected to be the deciding factor regarding the product mix for the next 2 years. The company does not stock inventory of finished goods. The company wishes to know whether ABC system is to be set up at a cost of 10,000 per month for the purpose of tracking and recording the fixed overhead costs for allocation to products. Support your advice with appropriate reasons.

Independent of the above, if you are told to assume that fixed costs stated above, consist of a non-cash component of depreciation to plant at ₹ 90,000 for the year, will your advice change? Explain. [CA Final Nov. 2011, 8 Marks]

Answer:

| Data | Reasoning | |

| Similar Products, Similar Production Resources | Overhead Cost based on production units is appropriate. ABC will also yield identical results | ABC system not required for Overhead allocation |

| Present overhead Cost = ₹ 10/unit Proposed Increase due to ABC system: 1,20,000/ 20,000 = ₹ 6/unit | Current overhead cost of ₹ 10/unit will increase by ₹ 6 per unit due to installing ABC system (60% increase) | For allocation purpose. ABC not justified |

| Both have positive contribution/ unit Market demand determines the mix | OH allocation has no role in decision making | No need for ABC System |

| For the purpose of OH allocation, ABC need not be installed. However, if the fixed overhead of ₹ 2,00,000 are analysed by activity and thereby a saving of at least ₹ 1,20,000 be expected (which is the cost of installing ABC system), then, ABC system may be installed. | ||

| For the non-cash component of depn.= ₹ 90,000, Fixed cost that can be saved is a maximum of ₹ 1,10,000 (₹ 2,00,000 – ₹ 90,000). | ||

| Hence, this is clearly less than ABC cost installation. Hence do not install ABC System. | ||

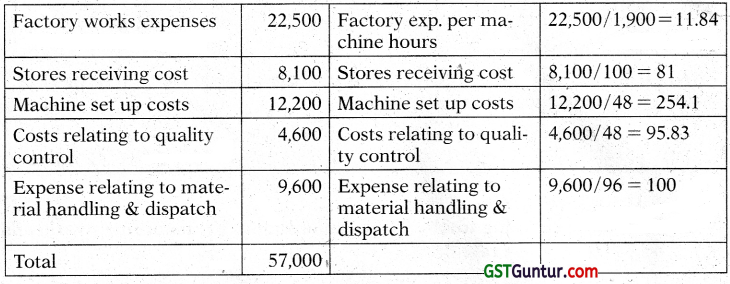

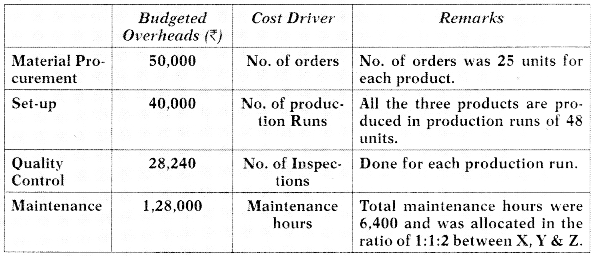

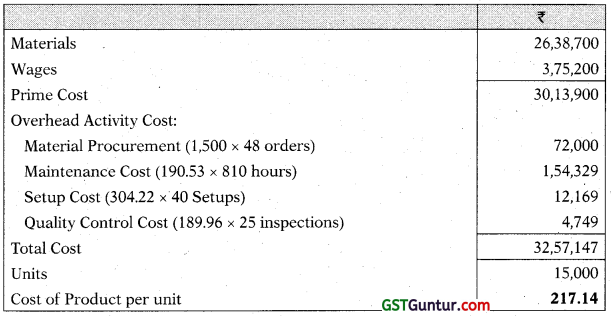

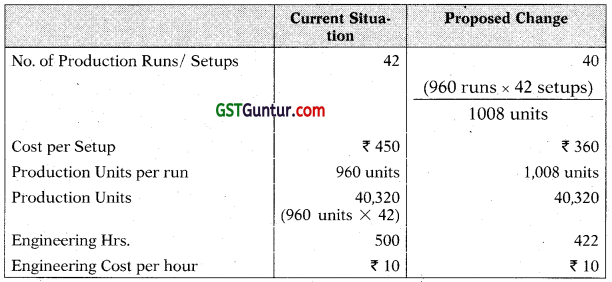

Question 23.

Traditional Ltd. is a manufacturer of a range of goods. The cost structure of its different products is as follows:

| Product A | Product B | Product C | |

| Direct materials | 50 | 40 | 40 |

| Direct labour @10 /hour | 30 | 40 | 50 |

| Production overheads | 30 | 40 | 50 |

| Total Cost | 110 | 120 | 140 |

| Quantity produced | 10,000 | 20,000 | 30,000 units |

Traditional Ltd. was absorbing overheads on the basis of direct labour hours. A newly appointed management accountant has suggested that the company should introduce ABC system and has identified cost drivers and cost pools as follows:

| Activity Cost Pool | Cost Driver | Associated Cost (%) |

| Stores Receiving | Purchase Requisitions | 2,96,000 |

| Inspection | Number of production runs | 8,94,000 |

| Dispatch | Orders Executed | 2,10,000 |

| Machine Set-up | Number of Setups | 12,00,000 |

The following information is also supplied:

| Product A | Product B | Product C | |

| No. of Setups | 360 | 390 | 450 |

| No. of Orders Executed | 180 | 270 | 300 |

| No. of Production runs | 750 | 1,050 | 1,200 |

| No. of Purchase Requisitions | 300 | 450 | 500 |

You are required to calculate activity based production cost of all the three products. [CA Final May 2009, 5Marks]

Answer:

The total production overheads are ₹ 26,00,000.

Product A: 10,000 × 30 = ₹ 3,00,000

Product B: 20,000 × 40 = ₹ 8,00,000

Product C: 30,000 × 50 = ₹ 15,00,000

On the basis of ABC analysis this amount will be apportioned as follows:

Statement of Activity Based Production Cost

![]()

Question 24.

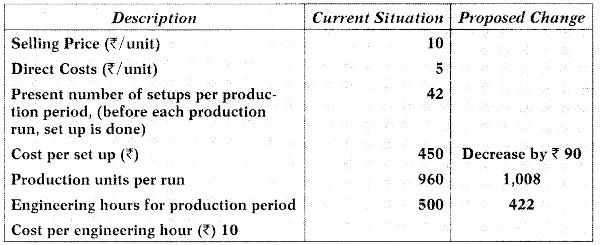

X Ltd. makes a single product with the following details:

The company has begun Activity Based Costing of fixed costs and has presently identified two cost drivers, viz. production runs and engineering hours. Of the total fixed costs presently at 96,000, after the above, 72,100 remains to be analysed. There are changes as proposed above for the next production period for the same volume of output.

(i) How many units and in how many production runs should X Ltd. produce in the changed scenario in order to break-even?

(ii) Should X Ltd. continue to break up the remaining fixed costs into activity based costs? Why? [CA Final Nov. 2015, 8 Marks]

Answer:

Statement Showing ‘Non-unit Level’ Overhead Costs

(i) Break Even Point (Changed Scenario)

(ii) A company should adopt Activity Based Costing (ABC) system for accurate product costing, as traditional volume based costing system does not take into account the Non-unit Level Overhead Costs such as Setup Cost, Inspection Cost, and Material Handling Cost etc. Cost Analysis under ABC system showed that while these costs are largely fixed with

respect to sales volume, but they are not fixed to other appropriate cost drivers. If breakup of the remaining ? 72,100 fixed costs consist of only a small portion of these costs, ABC need not be applied.

However, it may also be noted that the primary study has resulted in cost savings. If the savings in cost are expected to exceed the cost of study and implementing ABC, it may be justified. Further it is pertinent to mention that ABC offers no increase in product-costing accuracy for -Space to write important points for revision single-product setting.

Question 25.

ABC Ltd. is engaged in production of three types of Fruit Juices: Apple, Orange and Mixed Fruit.

The following cost data for the month of March 2020 are as under:

| Particulars | Apple | Orange | Mixed Fruit |

| Units produced and sold | 10,000 | 15,000 | 20,000 |

| Material per unit (₹) | 8 | 6 | 5 |

| Direct Labour per unit (₹) | 5 | 4 | 3 |

| No. of Purchase Orders | 34 | 32 | 14 |

| No. of Deliveries | 110 | 64 | 52 |

| Shelf Stocking Hours | 110 | 160 | 170 |

Overheads incurred by the company during the month are as under:

| ₹ | |

| Ordering costs | 64,000 |

| Delivery costs | 1,58,200 |

| Shelf Stocking costs | 87,560 |

Required:

(i) Calculate cost driver’s rate.

(ii) Calculate total cost of each product using Activity Based Costing. [CA Inter Nov. 2020, 6 Marks]

Answer:

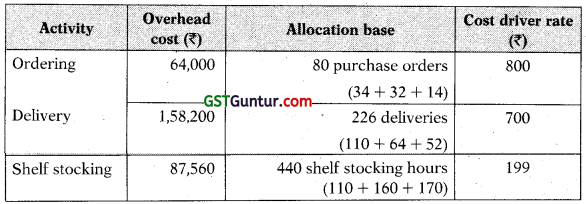

(i) Calculation Cost-Driver’s rate

(ii) Calculation of total cost of products using Activity Based Costing

![]()

Question 26.

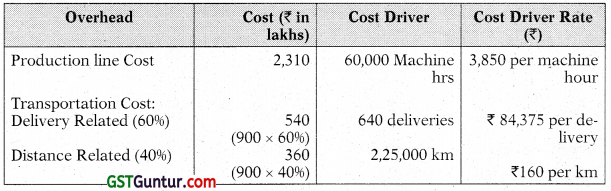

KD Ltd. is following Activity based costing. Budgeted overheads, cost drivers and volume are as follows:

| Cost pool | Budgeted overheads (₹) | Cost driver | Budgeted volume |

| Material procurement | 18,42,000 | No. of orders | 1,200 |

| Material handling | 8,50,000 | No. of movement | 1,240 |

| Maintenance | 24,56,000 | Maintenance hours | 17,550 |

| Set-up | 9,12,000 | No. of set-ups | 1,450 |

| Quality control | 4,42,000 | No. of inspection | 1,820 |

The company has produced a batch of 7,600 units, its material cost was ₹ 24,62,000 and wages ₹ 4,68,500. Usage activities of the said batch are as follows:

| Material orders | 56 |

| Material movements | 84 |

| Maintenance hours | 1,420 hours |

| Set-ups | 60 |

| No. of inspections | 18 |

Required:

(i) CALCULATE cost driver rates.

(ii) CALCULATE the total and unit cost for the batch. [CA Inter Nov. 2020, RTP]

Answer:

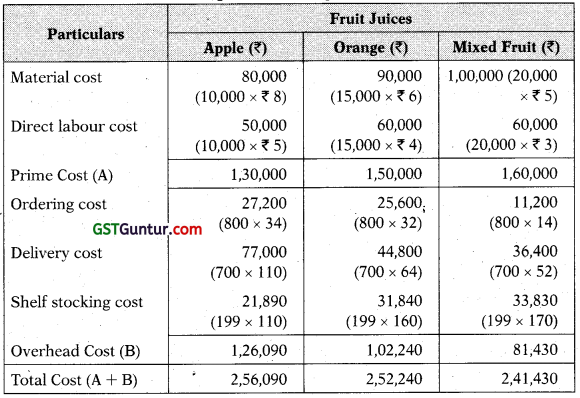

(i) Calculation of cost driver rate

| Cost pool | Budgeted overheads (₹) | Cost driver | Cost driver rate (₹) |

| Material procurement | 18,42,000 | 1,200 | 1,535.00 |

| Material handling | 8,50,000 | 1,240 | 685.48 |

| Maintenance | 24,56,000 | 17,550 | 139.94 |

| Set-up | 9,12,000 . | 1,450 | 628.97 |

| Quality control | 4,42,000 | 1,820 | 242.86 |

(ii) Calculation of cost for the batch

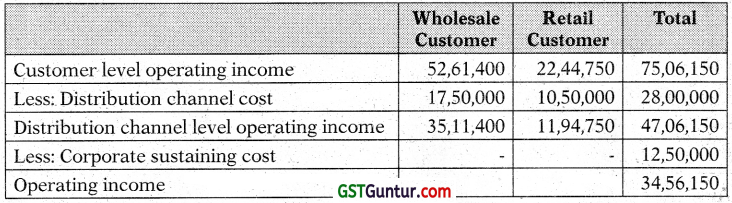

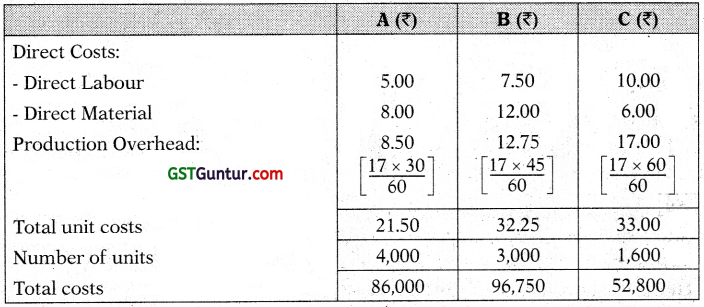

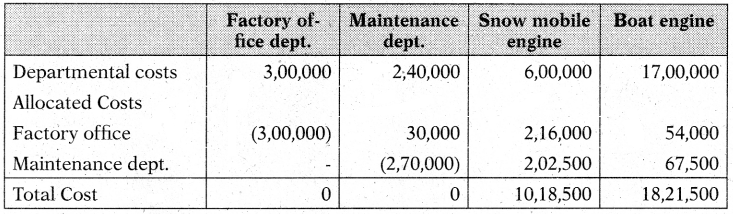

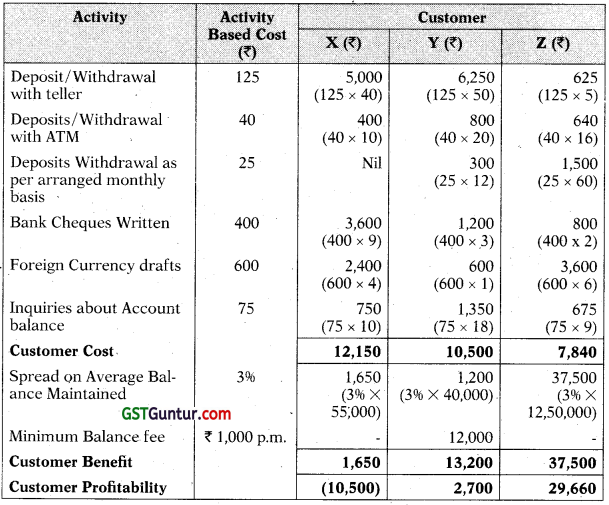

Question 27.

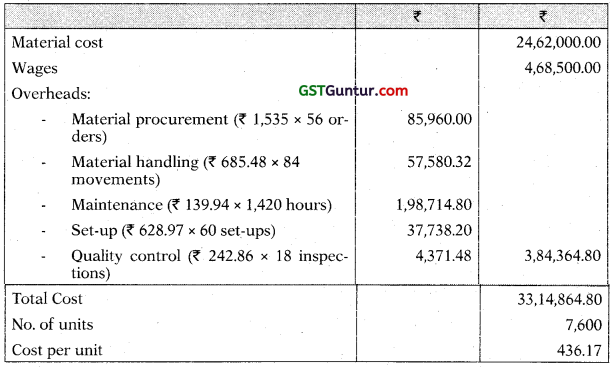

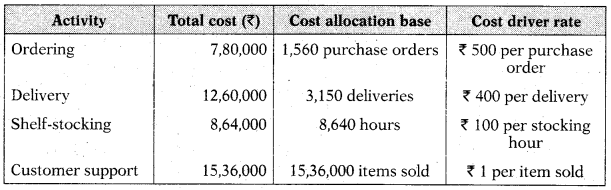

Following are the data of three product lines of a departmental store for the year 2020-21:

Additional information related with the store are as follows:

Required:

CALCULATE the total cost and operating income using Activity Based Costing method. [CA Inter May 2020, RTP]

Answer:

Calculation of Total Support costs

| ₹ | |

| Bottles returns | 60,000 |

| Ordering | 7,80,000 |

| Delivery | 12,60,000 |

| Shelf-stocking | 8,64,000 |

| Customer support | 15,36,000 |

| Total support cost | 45,00,000 |

Computation of Cost Driver Rate

Statement of Total cost and Operating income

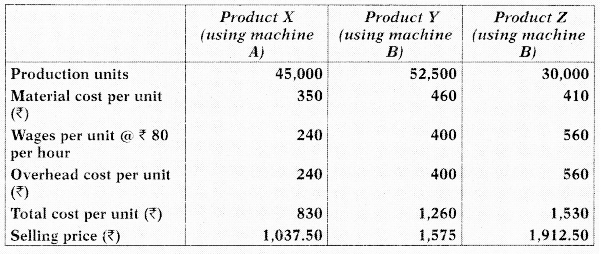

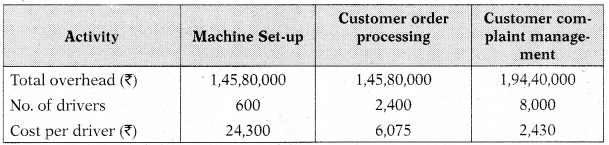

Question 28.

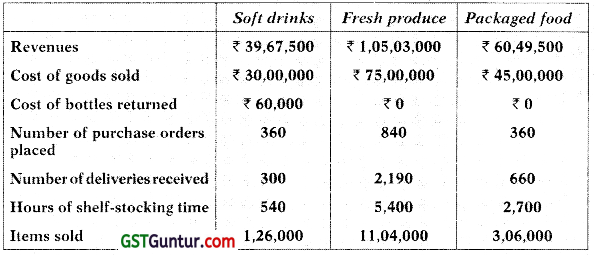

SMP Pvt. Ltd. manufactures three products using three different machines. At present the overheads are charged to products using labour hours. The following statement for the month of September 2021, using the absorption costing method has been prepared:

The following additional information is available relating to overhead cost drivers.

Actual production and budgeted production for the month is same. Workers are paid at standard rate. Out of total overhead costs, 30% related to machine set-ups, 30% related to customer order processing and customer complaint management, while the balance proportion related to material ordering.

Required:

(i) Compute overhead cost per unit using activity based costing method.

(ii) Determine the selling price of each product based on activity-based costing with the same profit mark-up on cost. [CA Inter Nov 2019, RTP]

Answer:

Total labour hours and overhead cost

Cost per activity and driver

(i) Computation of Overhead cost per unit:

(ii) Determination of Selling price per unit

![]()

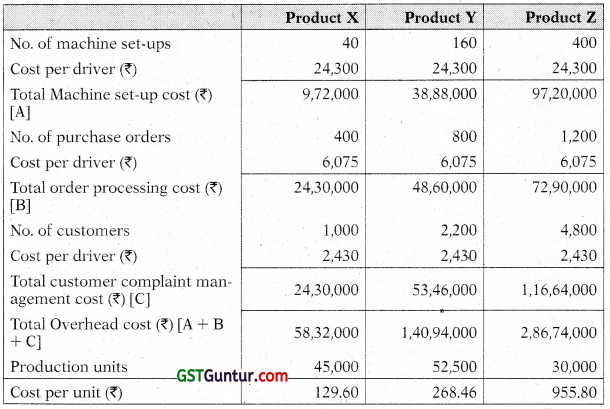

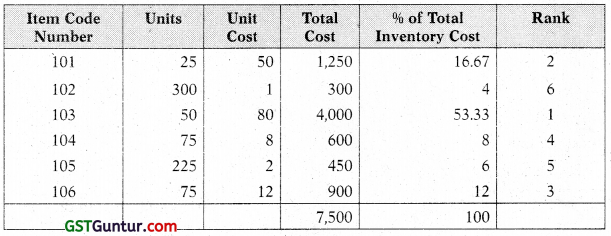

Question 29.

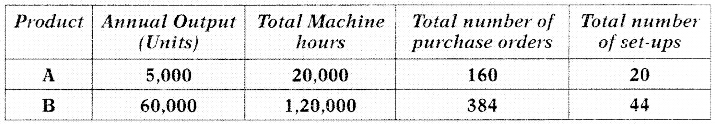

MM Ltd. has provided the following information about the items in its inventory.

| Item Code Number | Units | Unit Cost (₹) |

| 101 | 25 | 50 |

| 102 | 300 | 01 |

| 103 | 50 | 80 |

| 104 | 75 | 08 |

| 105 | 225 | 02 |

| 106 | 75 | 12 |

MM Ltd. adopted the policy of classifying the items constituting 15% or above of Total Inventory Cost as ‘A’ category, items constituting 6% or less of Total Inventory Cost as ‘C’ category and the remaining items as ‘B’ category.

You are request to:

(i) Rank the items on the basis of % of Total Inventory Cost.

(ii) Classify the items into A, B and C categories as per ABC Analysis of Inventory Control adopted by MM Ltd. [CA Inter July 2021, 5 Marks]

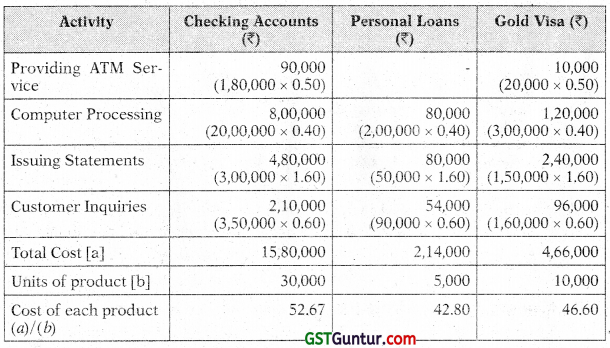

Answer:

Statement showing % of Total inventory Cost and Rank

Statement Showing classification of items into ABC