Chapter 7 Accounting in Corporate Restructuring – Corporate Restructuring Insolvency Liquidation & Winding Up Notes is designed strictly as per the latest syllabus and exam pattern.

Accounting in Corporate Restructuring – Corporate Restructuring Insolvency Liquidation & Winding Up Study Material

Question 1.

What is the difference between “demerger* and ‘reconstruction’? (Dec 2013, 6 marks)

Answer:

| Demerger | Reconstruction | |

| 1. Meaning | Demerger, pursuant to a scheme of arrangement u\s section 230 to 240 of companies Act, 20131 means: (a) a transfer(b) where by a company called demerged company(c) transfers its one or more under-takings induding aft the liabilities and the: properties of the said undertaking (d) at values appearing in its books of account immed lately before dernerger (e) to a newly Incorporated; company called resulting company |

(a) A new company (Transferee Company) is incorporated and the existing company (Transferor Company) is dissolved through special resolution under members’ voluntary winding up.

(b) Thereafter, the liquidator transfers all the assets and liabilities of the transferor company to the transferee company. |

| 2. Consideration | The resulting company for consideration of the above demerger, issues its shares to the shareholders of the demerged company on a proportionate basis. | The transferee company issues and allots its shares to the shareholders of the transferor company in accordance with the pre-determined shares exchange ratio. |

![]()

Question 2.

What types of disclosures are required fo be published in the first financial statements following the amalgamation of the transferee company (both for pooling of interests method and purcIase method)? (June 2012, 7marks)

Answer:

(i) Disclosure requirements In every type of amalgamation:

- Names of amalgamating companies.

- General nature of businesses of the amalgamating companies.

- Effective date of amalgamation.

- Particulars of the scheme of amalgamation.

- Type of amalgamation.

- Accounting method used in amalgamation.

(ii) Additional disclosure requirements in’ case of amalgamation accounted for under the pooling of interests methods which are required to be made ¡n first financial statements:

- Description and number of shares issued.

- Percentage of each company’s equity shares exchanged.

- Amount of any difference between the consideration and the value of assets acquired and the treatment thereof.

(iii) Additional disclosure requirements that are required to be made in first financial statements in case of amalgamation accounted for under the purchase method:

- Description of the consideration paid or payable for the amalgamation.

- Amount of any difference between the consideration and the value of assets acquired and treatment thereof.

![]()

Question 3.

What is the meaning and importance of ‘appointed date’ particularly in case of demerger or spin-off? (June 2012, 5 marks)

Answer:

- ‘Appointed date’ means the date for identification of assets and liabilities of existing company for transfer to new company.

- ‘Appointed date’ is relevant for fixation of the share valuation / exchange ratio which the company would offer to the existing shareholders after demerger or spin-off.

- ‘Appointed date’ is different from ‘effective date’.

- Effective date is the date on which all consents & approvals required under the scheme were to be obtained and transfer effected.

![]()

Question 4.

What is meant by partial demerger? State the factors/features which differentiate it from complete demerger. (Dec 2012, 6 marks)

Answer:

| Partial Demerger | Complete Demerger | |

| 1. | When a part / division / department of a company is separated and transferred to one or more companies formed with the same shareholders who are allotted shares in new company in the same proportion as held by them in the demerged company, partial demerger occurs. | 1. Complete demerger occurs when the whole of the business/ undertaking of the existing company is transferred to one or more new company/ies formed for this purpose and the demerged company is dissolved by passing special resolution for voluntary winding up and the shareholders of the dissolved company are issued and allotted shares in the new company/ies as per the sanctioned share exchange ratio. |

| 2. | The existing company also continues to maintain its separate legal identity, and the new company being a separate legal identity, carries on the separated or spun off business and undertaking of the existing company. | 2. The existing company is voluntarily wound up and its entire business, undertaking etc. are transferred to one or more new companies. |

![]()

Question 5.

“Accounting Standard-14 is equally applicable whether it is a case of amalgamation or demerger.” Discuss the statement citing case law. (Dec 2012, 5 marks)

Answer:

In case of High Court of Gujarat, Gallops Realty (P) Ltd., under provisions of the Companies Act, 2013, petitioner companies i.e., demerged company and resulting company, sought for sanction of composite scheme of arrangement in nature of purchase of share and demerger of hotel business of demerged company to resulting company and consequent restructuring of share capital of demerged company consisting of reduction of paid up share capital as well as utilisation of share premium amount.

Regional Director states that as per scheme, capital profit on demerger would be transferred to general resen/e in books of resulting company which was not in consonance with generally accepted accounting principles.

Accounting Standard-14. AS-14 provide that any profit arising out of a capital transaction, like that in case of merger or demerger, ought to be treated as capital profit and hence would be transferred to capital reserve and not to general reserve.

So, it was held that observation of Regional Director was not in consonance with accounting principles in general and Accounting Standard- 14 in particular, as AS -14 is applicable only in case of amalgamation and not in case of demerger, as envisaged in this scheme.

![]()

Question 6.

What are the various ways in which demerger can be done? Also explain the concept of partial demerger. (June 20136, 8 marks)

Answer:

There are various ways in which de-merger can be done. Some of them are as under:

1. Demerger by agreement:

A demerger may be effected by agreement where under the demerged company spins off its specific under taking to a resulting company in such a manner that all the assets and liabilities of the undertaking becomes the assets and liabilities of the resulting company.

2. Demerger under scheme of arrangement:

Demerger under the scheme of arrangement can be done with the sanction of Tribunal .Memorandum of Association of the company must contain the provisions of demerger, in order to accomplish the scheme of arrangement.

3. Demerger under voluntary Winding Up:

Section 319(1) of the Companies Act, 2013 provides that where a company* is proposed to be wound up voluntarily, the liquidator of the transferor company may, with the sanction of special resolution of that company conferring on the liquidator either a general authority or an authority in respect to any particular arrangement, receive by way of compensation or past compensation for the transfer or sale of shares, policies or other like interests in the transferee company, for distribution among the members of the transferor company.

Partial Demerger:

Demerger may be carried out partially or completely.

When a part/division/department of a company is separated and transferred to one or more companies formed with the same shareholders who are allotted shares in new company in the same proportion as held by them in the demerged company, partial demerger occurs.

In partial demerger, the existing company also continues to maintain its separate legal entity and the new company being a separate legal identity, carries on the separated or spun off business and undertaking of the existing company.

![]()

Question 7.

Define ‘reverse merger’ and explain the strategic significance of reverse merger. (June 2014, 5 marks)

Answer:

- Reverse merger: Reverse merger takes place when a healthy company merges with a financially weak company.

- In the context of Companies Act, 2013 there is no distinction between a merger or a reverse merger because in either case one company merges with another company.

- Reverse merger like any amalgamation or merger is carried out through Tribunal under the provisions of Chapter XV (Section 230 to 240) of Companies Act, 2013.

- When the reverse merger of a sick company becomes effective, the healthy units loses its name and surviving sick company retains its name. In reverse merger, transferee company becomes entitled to various tax benefits.

Significance of Reverse Merger:

- Generally, a loss making or less profit earning company merges with a company with track record, to obtain the benefits of economies of scale of production, marketing, network, etc.

- This situation arises when the sick company’s survival becomes more important for strategic reasons and to conserve the interest of community. However, in a reverse merger, a healthy company merges with a financially weak company.

- The main reason for this type of reverse merger is the tax savings under the Income-Tax Act, 1961.

- Section 72A of the Income-Tax Act ensures the-tax relief, which becomes attractive for such reverse mergers, since the healthy and profitable company can take advantage of the carry forward losses of the other company. The healthy units loses its name and surviving sick company retains its name.

![]()

Question 8.

Explain amalgamation in the nature of merger. (Dec 2014, 5 marks)

Answer:

An amalgamation should be considered to be an amalgamation in the

nature of merger when all the following conditions are satisfied:

(i) All the assets and liabilities of the transferor company become, after amalgamation, the assets and liabilities of the transferee company.

(ii) Shareholders holding not less than 90% of the face value of the equity shares of the transferor company (other than the equity shares already held therein, immediately before the amalgamation, by the transferee company or its subsidiaries or their nominees) become equity shareholders of the transferee company by virtue of the amalgamation.

(iii) The consideration for the amalgamation receivable by those equity shareholders of the transferor company who agree to become equity shareholders of the transferee company is discharged by the transferee company wholly by the issue of equity shares in the transferee company, except that cash may be paid in respect of any fractional shares.

(iv) The business of the transferor company is intended to be carried on, after the amalgamation, by the transferee company.

(v) No adjustment is intended to be made to the book values of the assets and liabilities of the transferor company when they are incorporated in the financial statements of the transferee company except to ensure uniformity of accounting policies.

![]()

Question 9.

Flying Ltd. got demerged and the resulting company Soars Ltd. was formed. It was a demerger within the meaning of Section 2(19AA) of the Income-tax Act, 1961. Your advice is sought by Flying Ltd. regarding the tax concession available to a demerged company. (June 2015, 5 marks)

Answer:

If any demerger takes places within the meaning of Section 2(19AA) of the Income-tax Act, the following tax concessions shall be available to:

- Demerged company

- Shareholders of demerged company

- Resulting company

Tax concession to demerged company:

(i) Capital gains tax not attracted [Section 47 (vib)]:

According to Section 47(vib), where there is a transfer of any capitai asset in case of a demerger by the demerged company to the resulting company, such transfer will not be regarded as a transfer for the purpose of capital gain provided the resulting company is an Indian Company.

(ii) Tax concession to a foreign demerged company [Section 47 (vie)]:

Where a foreign company holds any shares in an Indian Company and transfers the same, in case of a demerger, to another resulting foreign company, such transaction will not be regarded as transfer for the purpose of capital gain under section 45 if the following conditions are satisfied:

(a) at least seventy-five per cent of the shareholders of the demerged foreign company continue to remain shareholders of the resulting foreign company; and

(b) such transfer does not attract tax on capital gains in the country, in which the demerged foreign company is incorporated.

(iii) Reserves for shipping business:

Where a ship acquired out of the reserve is transferred in a scheme of demerger, even within the period of eight years of acquisition there will be no deemed profits to the demerged company.

![]()

Question 10.

Comment on the following:

Applicability of Accounting Standard (AS) -14 for amalgamation. (Dec 2015, 3 marks)

Answer:

Accounting Standard-14: ‘Accounting for Amalgamations lays down the accounting and disclosure requirements in respect of amalgamations of companies and the treatment of any resultant goodwill or reserves. Accounting Standard (AS)-14 recognizes two types of amalgamation:

(a) Amalgamation in the nature of merger.

(b) Amalgamation in the nature of purchase.

Question 11.

“Certain disclosures are required to be made in the first financial statements prepared after the amalgamation orders.” Mention such disclosures. (June 2016, 6 marks)

Answer:

(a) For amalgamations of any type of the following disclosures should be made in the first financial statements following the amalgamations:

- names and general nature of business of the amalgamating companies;

- effective date of amalgamation for accounting purposes;

- the method of accounting used to reflect the amalgamation; and

- particulars of the scheme sanctioned under a statute.

![]()

(b) In case of amalgamations accounted for under the pooling of interests method, the following additional disclosures are required to be made in the first financial statements following the amalgamation:

- description and number of shares issued, together with the percentage of each company’s equity shares exchanged to effect the amalgamation;

- the amount of any difference between the consideration and the value of net identifiable assets acquired, and the treatment thereof.

(c) In case of amalgamations accounted for under the purchase method the following additional disclosures are acquired to be made in the first financial statements following the amalgamations:

- consideration for the amalgamation and a description of the consideration paid or contingently payable, and

- the amount of any difference between the consideration and the value of net identifiable assets acquired, and the treatment thereof including the period of amortization of any goodwill arising on amalgamation.

![]()

Question 12.

What is meant by ‘goodwill on amalgamation’? Which factors are to be taken into account in estimating useful life of goodwill? (Dec 2016, 5 marks)

Answer:

Goodwill on amalgamation may be called an excess payment made in anticipation of future income of the target company and it should be treated as an asset to be amortized to income over its useful life which may be set as five years or a longer period if there are justifications for the same. Since it is not easy to estimate its useful life, estimation is .therefore, done on a prudent basis.

The following factors are to be taken into account in estimating the useful life of goodwill:

- the foreseeable life of the business or industry;

- the effects of product obsolescence, changes in demand and other economic factors;

- the service life expectancies of key individuals or groups of employees;

- expected actions by competitors or potential competitors; and

- legal, regulatory or contractual provisions affecting the useful life.

![]()

Question 13.

Describe the ‘pooling of interests method’ of accounting adopted by amalgamated company. (Dec 2016, 5 marks)

Answer:

‘Pooling of interests method’:

In preparing the transferee company’s financial statements, the assets, liabilities and reserves (whether capital or revenue or arising on revaluation) of the transferor company is recorded at their existing carrying amounts at the date of amalgamation.

Balance of the profit and loss account of the transferor company is aggregated with the corresponding balances of the transferee company or it may be transferred to the General Reserves, if any.

In case of any conflicting accounting policies in transferor company and the transferee company at the time of amalgamation, a uniform set of accounting policies should be adopted and the effect of this change in accounting policy should be reported, as per AS-5, as per Net Profit or Loss for the Period ‘Prior Period Items and Changes in Accounting Policies’.

Difference between the issued share capital of the transferee company and share capital of the transferor company should be treated as capital reserve which will be not utilized for dividend and bonus shares.

Thus if the consideration amount exceeds the share capital of the transferor company, it will be, first, adjusted from the capital reserves and if capital reserve is insufficient, then from the revenues but there should not be any direct debit to the profit and loss account.

If there is insufficient balance in profit and loss account, then the different will be reflected on asset side under a separate heading.

![]()

Question 14.

Comment on the following:

Demerger may take the shape of spin-off, split-off or split-up. (Dec 2016, 3 marks)

Answer:

Sometimes Demerger takes the shape of:

(a) “Spin-off” is a kind of demerger when an existing parent company distributes on a pro rata basis all the shares it owns in a controlled subsidiary to its own shareholders by which it gains effect to making two of the one company or corporation. There is no money transaction, subsidiary’s assets are not revalued, transaction is treated as stock dividend and tax free exchange. Both the companies exist and carry on business. It does not alter ownership proportion in any company.

(b) “Split-off” is a process of reorganizing a corporate structure whereby the capital stock of a division or subsidiary of a corporation or of a newly affiliated company is transferred to the stakeholders of the parent corporation in exchange for part of the stock of the latter, or

(c) ‘Split-up’ is a process of re-organizing a corporate structure where by all the capital stock and assets are exchanged for those of two or more newly established companies, resulting in the liquidation of the parent corporation.

![]()

Question 15.

Apart from availing the benefit of set off and carry forward of unabsorbed depreciation and accumulated losses, what are the Other tax benefits if the strategy of the acquirer to merge with a loss making company is in the form of a reverse merger? (Dec 2017, 5 marks)

Answer:

One of the modes of corporate restructuring strategy is to merge with a sick or a company with accumulated losses. If the scheme of merger gets approval of the competent authority under section 72A of the Income-tax -Act, 1961, the resultant company avails the opportunity of getting losses of sick undertakings setoff against profit making undertakings of the transferee company.

Even if approval by Competent Authority is not obtained, the merged undertakings of the resultant company still avail other benefits and privileges as detailed below under the Income-tax Act, 1961:

(a) The benefit of amortization of preliminary expenses under section 35D for the balance unexpired period out of 10 or 5 years shall be available to the resultant company.

(b) Capital expenditure on scientific research under section 35 can be availed by the resultant company.

(c) Expenditure for patent or copyrights under section 35A for the balance unexpired period of out of 14 years.

(d) Section 35DD for expenses towards amalgamation or demerger for next 5 years in equal installments.

(e) Similarly benefits under sections 35AB(3) and 35ABB are available to resultant company for the unexpired period if incurred for expenditure on know-how and telecom licenses respectively.

![]()

Question 16.

State the distinctive features of Ind AS 103 in contrast to existing AS 14 for accounting treatment in cases of amalgamations and combinations. (Dec 2017, 5 marks)

Answer:

(i) Ind AS 103 defines business combination which has a wider scope whereas the existing AS 14 deals only with amalgamation.

(ii) Under the existing AS 14 there are two methods of accounting for amalgamation. The pooling of interest method and the purchase method. Ind AS 103 prescribes only the acquisition method for each business combination.

(iii) Under the existing AS 14, the acquired assets and liabilities are recognised at their existing book values or at fair values under the purchase method. Ind AS 103 requires the acquired identifiable assets liabilities and non-controlling interest to be recognised at fair value under acquisition method.

![]()

(iv) Ind AS 103 requires that for each business combination, the acquirer shall measure any non controlling interest in the acquire, either at fair value or at the non-controlling interest’s proportionate share of the acquiree’s identifiable net assets. On other hand, the existing AS 14 states that the minority interest is the amount of equity attributable to minorities at the date on which investment in a subsidiary is made and it is shown outside shareholders’ equity.

(v) Under Ind AS 103, the goodwill is not amortised but tested for impairment on annual basis in accordance with Ind AS 36.The existing AS 14 requires that the goodwill arising on amalgamation in the nature of purchase is amortised over a period not exceeding five years.

(vi) Ind AS 103 deals with reverse acquisitions whereas the existing AS 14 does not deal with the. same.

(vii) Under Ind AS 103, the consideration the acquirer transfers in exchange for the acquiree includes any asset or liability resulting from a contingent consideration arrangement. The existing AS 14 does not provide specific guidance on this aspect.

(viii) Ind AS 103 requires bargain purchase gain arising on business combination to be recognised in other comprehensive income and accumulated in equity as capital reserve, unless there is no clear evidence for the underlying reason for classification of the business combination as a bargain purchase, in which case, it shall be recognised directly in equity as capital reserve. Under existing AS 14 the excess amount is treated as capital reserve.

(ix) Appendix C of Ind AS 103, deals with accounting for common control transactions, which prescribes a method of accounting different from Ind AS 103. Existing AS 14 does not prescribe accounting for such transactions different from other amalgamations.

![]()

Question 17.

State the salient features of Reconstruction that differs with Demerger. (Dec 2017, 3 marks)

Question 18.

“Demerger is not expressly defined under the Companies Act, 2013”. How does an application move before the National Company Law Tribunal (NCLT) for Demerger under the said Act? (June 2018, 3 marks)

Answer:

The expression ‘demerger’ is not expressly defined in the Companies Act, 2013 (the Act). However, Explanation to Section 230(1) gives a clue about the word demerger.

Section 230(1) of the Act states that where a compromise or arrangement is proposed (a) between a company and its creditors or any class of them; or (b) between a company and its members or any class of them, the Tribunal may, on the application of the company or of any creditor or member of the company, or in the case of a company which is being wound up, of the liquidator, appointed under this Act or under the Insolvency and Bankruptcy Code, 2016, as the case may be, order a meeting of the creditors or class of creditors, or of the members or class of members, as the case may be, to be called, held and conducted in such manner as the Tribunal directs.

Explanation: For the purposes of this sub-section, arrangement includes a reorganisation of the company’s share capital by the consolidation of shares of different classes or by the division of shares into shares of different classes, or by both of those methods.

The Explanation to Section 230(1), thus provides an inclusive definition of arrangement i.e. consolidation or by the division of shares into shares of difference classes or by both the methods and the literary meaning of demerger is some what explained.

![]()

Question 19.

“Accounting treatment under AS 14 is confined to Amalgamations unlike Ind AS 103.” Discuss how far Ind AS 103 can be distinguished with AS 14. (Dec 2018, 5 marks)

Question 20.

Is it possible to retain the same characters of various reserves of transferor Companies post amalgamation, mergers or demergers as per Standards of Accounting concepts or conventions? (Dec 2018, 5 marks)

Answer:

Treatment of Reserves on Amalgamation:

If the amalgamation is an ‘amalgamation in the nature of merger’

The identity of the reserves is preserved and they appear in the financial statements of the transferee company in the same form in which they appeared in the financial statements of the transferor company.

The difference between the amount recorded as share capital issued and the amount of share capital of the transferor company is adjusted in reserves in the financial statements of the transferee company.

If the amalgamation is an ‘amalgamation in the nature of purchase’

If the amalgamation is an ‘amalgamation in the nature of purchase’, the identity of the reserves, other than the statutory reserves is not preserved.

![]()

Question 21.

The accounting treatment of Mergers and Acquisitions has undergone a drastic change with the introduction of IND-AS 103 – Business Combination. Comment. (Dec 2019, 5 marks)

Answer:

Accounting treatment of mergers and acquisitions (M&A) have undergone a drastic change with the introduction of IND AS-103 – Business Combination and Companies Act, 2013. Section 232 of the Companies Act, 2013 provides that accounting treatment prescribed in the court approved scheme for merger, demerger, amalgamation or group restructuring should be in accordance with the accounting standards prescribed under Section 133 of the Companies Act, 2013.

Certain other developments in M&A accounting are as under:

(a) Method of Accounting for business combination

Under AS-14 many companies were able to account for business combination between commonly controlled enterprises using purchase method. As a result of this, tax benefit for goodwill amortisation was available while computing book profit for MAT purpose.

Under IND AS-103 it is mandatory to use pooling of interests method for business combination between commonly controlled enterprises. As a result of this accounting alternatives gets restricted and the consequent tax benefits will also be not available.

![]()

(b) Appointed date v. Effective date

In court approved merger, demerger and other restructuring accounting was done from the appointed date once the court order became effective. However, with the implementation of IND AS-103 Business combinations this is going to change. As per IND AS-103 accounting for business combination should be done on the date on which the acquirer obtains control.

(c) Accounting for goodwill

AS-14 provided an accounting choice to compute the goodwill at the fair value of the assets taken over or at the net asset value of the assets taken over. However, this choice is not available in IND AS-103, as the value of goodwill has to be qpmputed using the fair value of the net assets taken over.

AS-14 provides for amortisation of goodwill over a period of five years. IND AS-103 prohibits amortisation of goodwill and is required to test goodwill for impairment annually. This will result, in a volatile profit and loss account.

Goodwill amortisation was available as tax deductible item while computing MAT liability. This is not available in the IND-AS regime.

![]()

Question 22.

How goodwill and capital reserve are differentiated as per AS-14? (Dec 2019, 3 marks)

Answer:

As per Accounting Standard -14, goodwill is the excess of the price paid in a purchase over the fair value of the net identifiable assets acquired. Capital reserve is the excess of the fair value of the net identifiable assets acquired over the purchase price.

The concept of Goodwill or capital reserve will arise only when amalgamation is in the nature of purchase.

Question 23.

There are certain departures in accounting aspects dealing with amalgamations or mergers as per IFRS -3 in comparison to IND- AS 103. Enlist such variations briefly. (Aug 2021, 5 marks)

Answer:

The principles of IND-AS 103 Business Combination and IFRS -3 are same to a very great extent.

There are only few crave out in IND-AS 103 when compared to IFRS 3. They are as follow:

IFRS-3 excludes from its scope business combinations of entities under common control. IND- AS 103 gives the guidance in this regard.

IFRS-3 requires bargain purchase gain arising on business combination to be recognised in profit or ioss account. IND-AS 103 requires that the bargain purchase gain to be recognised in other comprehensive income and accumulated in equity as capital reserve, unless there is no clear evidence for the underlying reason for classification of the business combination as a bargain purchase, in which case, it shall be recognised directly in equity as capital reserve.

The main reason for this carve out is, the recognition of such gains in profit or loss would result into recognition of unrealised gains as the value of net assets is determined on the basis of fair value of net assets acquired.

![]()

Question 24.

When does goodwill arise on amalgamation? Comment on its amortization. How will you estimate the useful life of the goodwill? Differentiate goodwill and capital reserve as per AS-14. (Dec 2021, 5 marks)

Answer:

Goodwill arising on amalgamation represents a payment made in anticipation of future income and it is appropriate to treat it as an asset to be amortised to income on a systematic basis over its useful life.

Due to nature of goodwill, it is difficult to estimate its useful life, but estimation is done on a prudent basis. Accordingly, it should be appropriate to amortise goodwill over a period not exceeding five years unless a somewhat longer period can be justified.

The following factors are to be taken into account in estimating the useful life of good will:

- the forcible life of the business or industry;

- the effects of product obsolescence, changes in demand and other economic factors;

- the service life expectancies of key individuals or groups of employees;

- expected actions by competitors or potential competitors; and

- legal, regulatory or contractual provisions affecting the useful life.

Good will Vs. Capital reserve as per AS-14:

Goodwill is the excess of the price paid in a purchase over the fair value of the net identifiable assets acquired.

Capital reserve is the excess of the fair value (agreed value) of the net identifiable assets acquired over the purchase price.

![]()

Question 25.

Briefly explain the provisions regarding accounting treatment in the books of the transferee company on amalgamation where Indian Accounting Standard 103 (Business Combinations of Entities under Common Control) is applicable. (Dec 2021, 5 marks)

Answer:

Accounting treatment in the books of the transferee company on amalgamation where Indian Accounting Standard 103 (Business Combinations of Entities under Common Control) is stated as under:

(a) All the assets and liabilities recorded in the books of Transferor Company shall be transferred to and vested in the books of Transferee Company pursuant to the scheme and shall be recorded by Transferee Company at their respective book values as appearing in the books of Transferor Company.

(b) The identified of the reserves of Transferor Company shall be preserved and they shall appear in the financial statements of Transferee Company in the same form and manner, in which they appeared in the financial statements of Transferor Company prior to this scheme being effective.

(c) The investments in the equity capital of Transferor Company as appearing in the financial statements of Transferee Company shall stand cancelled.

(d) Inter-company balances, loans and advances if any, will stand cancelled.

(e) In case of any differences in accounting policy between Transferor Company and Transferee Company, the accounting policies followed by Transferee Company will prevail and the difference till the appointed date shall be adjusted in capital reserves of Transferee Company, to ensure that the financial statements of Transferee Company reflect the financial position on the basis of consistent accounting policy.

(f) Subject to any corrections and adjustments as may, in the opinion of the Board of Directors of the Transferee Company, be required and except to the extent otherwise by law required, the reserves of the Transferor Company, if any, will be merged with the corresponding reserves of the Transferee Company.

![]()

Question 26.

The Boards of directors of Music India Ltd. (MIL) and Sound India Ltd. (SIL) have decided a scheme of arrangement. The scheme has been approved with adequate majority. As per the scheme of arrangement, the ‘software undertaking’ of MIL is proposed to be transferred to SIL under sections 230-232. One of the conditions of the scheme is that k any excess in the value of net assets of ‘software undertaking’ transferred to r SIL shall be available for distribution to the shareholders of SIL.

Regional Director, Ministry of Corporate Affairs, has raised objection in his affidavit filed with the Tribunal stating that excess, if any, in the value of the net assets of the ‘software undertaking’ should be adjusted to the capital reserve as prescribed in AS-14 and not to the general reserve as proposed in the scheme of arrangement.

Examine the applicability of AS-14 and give your opinion whether contention raised by the Regional Director holds good in law. (June 2014, 5 marks)

Answer:

In the above case, Regional Director, MCA has raised an objection that excess, if any, in the value of the assets of the software undertaking should be adjusted to the capital reserve and not to the general reserve as per the accounting principles in general and Accounting Standard-14 in particular.

View of Regional Director is not correct as Accounting Standard -14 is applicable only in case of amalgamation and not applicable to demerger.

Refer Case: Sony India Ltd. and Sony Software Ltd.

Thus the contentions of Regional Director does not hold good in law.

![]()

Question 27.

As per the scheme of arrangement, textiles undertaking of Cotton Ltd. is proposed to be demerged to Jutewel Ltd. under, sections 230 and 232 of the Companies Act, 2013. One of the conditions of the aforesaid scheme is that any excess in the value of net assets of textiles undertaking proposed to be transferred to the resulting company shall be credited to general reserve.

If you as an advisor to the parties to the arrangement are asked to advise, what will be your response considering the applicable accounting standards and legal provisions applicable to the aforesaid case. (June 2015, 5 marks)

Answer:

- In the above case, proposed scheme of demerger provides that excess, if any, in the value of the assets of the textile undertaking of Cotton Ltd. proposed to be transferred to the resulting company will be credited to the general reserve.

- Proposed scheme of transferring excess, if any, in the value of the assets to the general reserve is correct as Accounting Standard -14 is applicable only in case of amalgamation and not applicable to demerger.

- Reference Case: Sony India Ltd. v/s Sony Software Ltd.

- Thus, the proposed scheme is good in law.

Question 28.

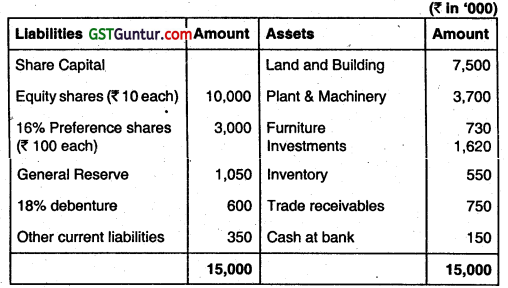

Draft balance sheet of Mentos Ltd. as on 31st March, 2019:

Additional Information:

(i) Zeus Ltd. will take over Mentos Ltd. on 10th May, 2019.

(ii) Debentureholder of Mentos Ltd. are discharged by issuing 12% debenture of Zeus Ltd. at a premium of 15%.

(iii) Intrinsic value per share of Mentos Ltd. is ₹ 40 and that of Zeus Ltd. ₹ 50. Zeus Ltd. will issue shares on basis of intrinsic value to satisfy the equity shareholder of Mentos Ltd. However the entry should be made at par value only. The nominal value of each equity share of Zeus Ltd. is ₹ 10.

(iv) 16% preference shareholder of Mentos Ltd. are discharged at a premium of 20% by issuing necessary number of 10% preference share of Zeus Ltd. (Face value ₹ 100 each).

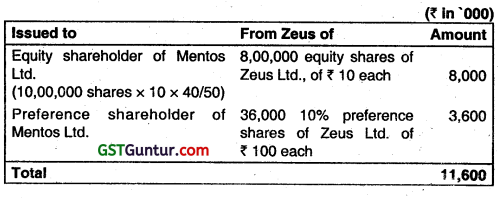

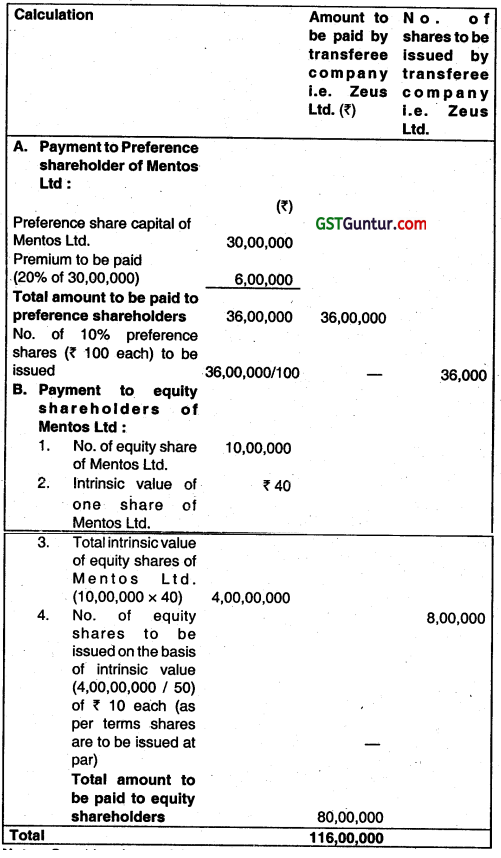

Compute the purchase consideration. (June 2019, 5 marks)

Answer:

Computation of Purchase Consideration:

The conversion ratio for equity share holders is 40:50 and for preference shares is 5:6

Note: Consideration to debenture holders not included in computation of purchase consideration as per AS-14. The same will be taken over by Zeus Ltd. and then discharged.

![]()

Alternate Answer:

Note : Consideration to debenture holders not included in computation of purchase consideration as per AS-14. The same will be taken over by Zeus Ltd., and then discharged.

![]()

Question 29.

Briefly explain the Key highlights of hid AS 103?

Answer:

Ind AS 103 – Business Combinations applies to a transaction or other event that meets the definition of a business combination.

IND-AS 103 provides definition of a business. It defines business as 4An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs or other economic benofit directly to investors or other owners, members or participants” Further a Business Combinations is a transaction or other event in which an acquirer obtains control of one or more businesses. Transactions sometimes referred to as ‘true mergers’ or ‘mergers of equals’ are also business combinations as that term is used in this Indian Accounting Standard.

Under Ind AS 103, Business Combinations, all business combinations are accounted for using the purchase method that considers the acquisition date fair values of all assets, liabilities and contingent liabilities of the acquiree. The limited exception to this principle relates to acquisitions between entities under common control.

An entity shall account for each business combination by applying the acquisition method.

![]()

Question 30.

Distinguish between “Ind AS 103” and “AS 14.

Answer:

| Particulars | Ind AS 103 | AS 14 . |

| Scope | Ind AS 103 defines business combination which has a wider scope | AS 14 deals only with amalgamation |

| Method of accounting | Ind AS 103 prescribes only the acquisition method for each business combination. | Under the AS 14, there are two methods of accounting for amalgamation:

(a) The pooling of interest method (b) The purchase method. |

| Valuation of acquired assets | Ind AS 103 requires the acquired identifiable assets liabilities and non-controlling interest to be recognised at fair value under acquisition method. | Under the AS 14, the acquired assets and liabilities are recognised at their existing book values or at fair values under the purchase method. |

| Minority ‘ Interest | Ind AS 103 requires that for each business combination, the acquirer shall measure any non-controlling interest in the acquire either at fair value or at the noncontrolling interest’s proportionate share of the acquiree’s identifiable net assets. | AS 14 states that the minority interest is the amount of equity attributable to minorities at the date on which investment in a subsidiary is made and it is shown outside shareholders’ equity. |

| Treatment of Goodwill | Under Ind AS 103, the goodwill is not amortised but tested for impairment on annual basis in accordance with Ind AS 36. | The existing AS 14 requires that the goodwill arising on amalgamation in the nature of purchase is amortised over a period not exceeding five years. |

| Reverse Acquisitions | Ind AS 103 deals with reverse acquisitions | AS 14 does not deal with the reverse acquisitions. |

| Contingent Assets | Under Ind AS 103, the consideration the acquirer transfers in exchange for the acquiree includes any asset or liability resulting from a contingent consideration arrangement. | The existing AS 14 does not provide specific guidance on this aspect. |

| Bargain purchase | Ind AS 103 requires bargain purchase gain arising on business combination to be recognized in other comprehensive income and accumulated in equity as capital reserve, unless there is no clear evidence for the underlying reason for classification of the business combination as a bargain purchase, in which case, it shall be recognised directly in equity as capital reserve. | Under existing AS14 the excess amount is treated as capital reserve. |

| Accounting for common control transactions | Appendix C of Ind AS 103, deals with accounting for common control transactions, which prescribes a method of accounting different from Ind AS 103. | AS 14 does not prescribe accounting for such transactions different from other amalgamations. |

![]()

Accounting in Corporate Restructuring Notes

Non – Applicability of Business Combinations (IND AS-103)

Business Combinations (IND AS-103)does not apply to the following:

(a) The formation of a joint venture

(b) The acquisition of an asset or a group of assets that does not constitute a business. In such cases the acquirer shall identify and recognise the individual identifiable assets acquired (including those assets that meet the definition of, and recognition criteria for, intangible assets in Ind AS 38 Intangible Assets) and liabilities assumed. The cost of the group shall be allocated to the individual assets and liabilities on the basis of their relative fair values at the date of purchase. Such a transaction or event does not give rise to goodwill.’

(c) Accounting for combination of entities or business under common control.

Accounting Standard 14 Accounting for Amalgamations

Accounting Standard (AS)-14 recognizes two types of amalgamation:

(a) Amalgamation in the nature of merger.

(b) Amalgamation in the nature of purchase.

Amalgamation in the nature of merger

An amalgamation should be considered to be an amalgamation in the nature of merger when all the following conditions are satisfied:

(i) All the assets and liabilities of the transferor company become, after amalgamation, the assets and liabilities of the transferee company.

![]()

(ii) Shareholders holding not less than 90% of the face value of the equity shares of the transferor company (other than the equity shares already held therein, immediately before the amalgamation, by the transferee company or its subsidiaries or their nominees) become equity shareholders of the transferee company by virtue of the amalgamation.

(iii) The consideration for the amalgamation receivable by those equity shareholders of the transferor company who agree to become equity shareholders of the transferee company is discharged by the transferee company wholly by the issue of equity shares in the transferee company, except that cash may be paid in respect of any fractional shares.

(iv) The business of the transferor company is intended to be carried on, after the amalgamation, by the transferee company.

(v) No adjustment is intended to be made to the book values of the assets and liabilities of the transferor company when they are incorporated in the financial statements of the transferee company except to ensure uniformity of accounting policies.

Amalgamation in the nature of purchase

An amalgamation should be considered to be an amalgamation in the nature of purchase, when any one or more of the conditions specified above is not satisfied. These amalgamations are in effect a mode by which one company acquires another company and hence, the equity shareholders of the combining entities do not continue to have a proportionate share in the equity of the combined entity or the business of the acquired company is not intended to be continued after amalgamation.

Methods of Accounting for Amalgamation

There are two main methods of accounting for amalgamations:

(a) the pooling of interests method; and

(b) the purchase method.

The pooling of interests method is used in case of amalgamation in the nature of merger. The purchase method is used in accounting for amalgamations in the nature of purchase.

![]()

The Pooling of interests Method

In preparing the transferee company’s financial statements, the assets, liabilities and reserves (whether capital or revenue or arising on revaluation) of the transferor company should be recorded at their existing carrying amounts and in the same form as at the date of the amalgamation. The balance of the Profit and Loss Account of the transferor company should be aggregated with the corresponding balance of the transferee company or transferred to the General Reserve, if any.

The difference between the amount recorded as share capital issued (plus 5 any additional consideration in the form of cash or other assets) and the amount of share capital of the transferor company should be adjusted in reserves.

It has been clarified that the difference between the issued share capital of the transferee company and share capital of the transferor company should be treated as capital reserve.

Reserve created on amalgamation is not available for the purpose of distribution to shareholders as dividend and/or bonus shares. It means that if consideration exceeds the share capital of the transferor company (or companies),the unadjusted amount is a capital loss and adjustment must be made, first of all in the capital reserves and incase capital reserves are insufficient, in the revenue reserves. However, if capital reserves and revenue reserves, are insufficient the unadjusted difference may be adjusted against revenue reserves by making addition thereto by appropriation from profit and loss account.

The Purchase Method

In preparing the transferee company’s financial statements, the assets and liabilities of the transferor company should be incorporated at their existing carrying amounts or, alternatively, the consideration should be allocated to individual identifiable assets and liabilities on the basis of their fair values at the date of amalgamation.

The reserves (whether capital or revenue or arising on revaluation) of the transferor company, other than the statutory reserves, should not be included in the financial statements of the transferee company except as in case of statutory reserve.

![]()

Any excess of the amount of the consideration over the value of the net assets of the transferor company acquired by the transferee company should be recognized in the transferee company’s financial statements as goodwill arising on amalgamation. If the amount of the consideration is lower than the value of the net assets acquired, the difference should be treated as Capital Reserve.

The goodwill arising on amalgamation should be amortised to income on a systematic basis over its useful life. The amortization period should not exceed five years unless a somewhat longer period can be justified.

The reserves of the transferor company, other than statutory reserve should not be included in the financial statements of the transferee company.

Consideration for Amalgamation

The consideration for amalgamation means the aggregate of the shares and other securities issued and the payment made in the form of cash or other assets by the transferee company to the shareholders of the transferor company. In determining the value of the consideration, assessment is made of the fair value of its various elements.

The consideration for the amalgamation should include any non-cash element at fair value. The fair value may be determined by a number of methods. For example, in case of issue of securities, the value fixed by the statutory authorities may be taken to be the fair value. In case of other assets, the fair value may be determined by reference to the market value of the assets given up, and where the market value of the assets given up cannot be reliably assessed, such assets may be valued at their respective net book values.

Treatment of Reserves on Amalgamation

If the amalgamation is an ‘amalgamation in the nature of merger’, the identity of the reserves is preserved and they appear in the financial statements of the transferee company in the same form in which they appeared in the financial statements of the transferor company.

Thus, for example, the Genera! Reserve of the transferor company becomes the General Reserve of the transferee company, the Capital Reserve of the transferor company becomes the Capital Reserve of the transferee company and the Revaluation Reserve of the transferor company becomes the Revaluation Reserve of the transferee company. As a result of preserving the identity, reserves which are available for distribution as dividend before the amalgamation would also be available for distribution as dividend after the amalgamation.

![]()

If the amalgamation is an ‘amalgamation in the nature of purchase’, the identity of the reserves, other than the statutory reserves is not preserved Goodwill on Amalgamation Goodwill arising on amalgamation represents a payment made in anticipation of future income and it is appropriate to treat it as an asset to be amortised to income on a systematic basis over its useful life.

It should be appropriate to amortise goodwill over a period not exceeding five years unless a somewhat longer period can be justified.

Balance of Profit and Loss Account

In the case of an ‘amalgamation in the nature of merger’, the balance of the Profit and Loss Account appearing in the financial statements of the transferor company is aggregated with the corresponding balance appearing in the financial statements of the transferee company. Alternatively, it is transferred to the General Reserve, if any.

In the case of an ‘amalgamation in the nature of purchase’, the balance of the Profit and Loss Account appearing in the financial statements of the transferor company, whether debit or credit, loses its identity. ’

Disclosure Requirements

(a) For amalgamations of every type following disclosures should be made in the first financial statements following the amalgamations:

- names and general nature of business of the amalgamating companies;

- effective date of amalgamation for accounting purposes;

- the method of accounting used to reflect the amalgamation; and

- particulars of the scheme sanctioned under a statute.

![]()

(b) In case of amalgamations accounted for under the pooling of interests method, the following additional disclosures are required to be made in the first financial statements following the amalgamation:

- description and number of shares issued, together with the percentage of each company’s equity shares exchanged to effect the amalgamation;

- the amount of any difference between the consideration and the value of net identifiable assets acquired, and the treatment thereof.

(c) In case of amalgamations accounted for under the purchase method the following additional disclosures are required to be made in the first financial statements following the amalgamations:

- consideration for the amalgamation and a description of the consideration paid or contingently payable, and

- the amount of any difference between the consideration and the value of net identifiable assets required, and the treatment thereof including the period of amortization of any goodwill arising on amalgamation.

Business Combination

- A transaction or other event in which an acquirer obtains control of one or more business.

- A business combination is an act of bringing together of separate entities or business into one reporting unit

- The resuit of business combination is one entity obtains control of one or more businesses.

- If an entity obtains control over other entities which are not business, the act is not a business combination. In such a case the reporting entity will account it as asset acquisition.

![]()

For example, if X Ltd., acquires 70% shares of Y Ltd., then it is a case of business combination even if X Ltd. and Y Ltd. will continue to exist. X Ltd. becomes a holding company of Y Ltd. and therefore, they become one reporting entity by reporting consolidated financial statements.

Difference between Ind AS-103 and Ind AS-110 Consolidated Financial Statements.

While Ind AS-110 defines a control and prescribes specific consolidation procedures, Ind AS-103 is more about the measurement of the items in the consolidated financial statements, such as goodwill, non controlling interest, etc.

While preparing consolidated financial statements, first you have to apply Ind AS-103 for measurement of assets and liabilities acquired, non-controlling interest and goodwill/bargain purchase then the consolidation procedure as per Ind AS-110.

Business Combination of Entities under Common Control

Common control business combination means a business combination involving entities or businesses in which all the combining entities or businesses are ultimately controlled by the same party or parties both before and after the business combination, and that control is not transitory. Common control business combinations will include transactions, such as transfer of subsidiaries or businesses, between entities within a group.

Method of accounting for common control business combinations

Business combinations involving entities or businesses under common control shall be accounted for using the pooling of interest method.

The pooling of interest method is considered to involve the following:

The assets and liabilities of the combining entities are reflected at their carrying amounts.

No adjustments are made to reflect fair values or recognise any new assets or liabilities.

The financial information in the financial statements in respect of prior , periods should be restated as if the business combination had occurred from the beginning of the earliest period presented in the financial statements, irrespective of the actual date of the combination.

![]()

Securities issued shall be recorded at nominal value.

The balance of the retained earnings appearing in the financial statements of the transferor is aggregated with the corresponding balance appearing in the financial statements of the transferee. Alternatively, it is transferred to General Reserve, if any.

The identity of the reserves shali be preserved and shall appear in the financial statements of the transferee in the same form in which they appeared in the financial statements of the transferor.

The excess, if any, between the amount recorded as share capital issued plus any additional consideration in the form of cash or other assets and the amount of share capital of the transferor is recognised as goodwill in the financial statements of the transferee entity; in case of any deficiency, the same shall be treated as capital reserve.

Recent Development’s in M&A Accounting/Difference between AS-14 and IND-AS 103

AS-14 Accounting for amalgamations did not provide guidance in many situations such as demerger, reverse acquisition. In the absence of specific accounting guideline companies were using various alternative accounting alternatives for achieving tax efficiencies.

With the introduction of IND-AS 103 – Business combination and Companies Act, 2013 accounting treatment of Mergers and Acquisitions have undergone a drastic change.

Under AS-14 many companies were able to account for business combination between commonly controlled enterprises using purchase method. As a result of this, tax benefits for goodwill amortisation was available while computing book profit for MAT purpose.

Under IND AS-103 it is mandatory to use pooling of interest method for business combination between commonly controlled enterprises.

In court approved merger, demerger and other restructuring accounting was done from the appointed date once the court order became effective.

![]()

With the implementation of IND-AS 103 Business combination this is going to change. As per IND-AS 103 accounting for business combination should be done on the date on which the acquirer obtains control.

AS-14 provided an accounting choice to compute the goodwill at the fair value of the assets taken over or at the net asset value of the assets taken over.

However, this choice is not available in IND AS 103 Business combination, as the goodwill has to be computed using the fair value of the net assets taken over.

AS-14 provides for amortisation of goodwill over a period of five years. IND-AS 103 Business combination prohibits amortisation of goodwill and is required to test goodwill for impairment annually. This will result in avolatile profit and loss account.

Goodwill amortisation was available as tax deductible item while computing MAT liability. This will not be available in the IND-AS regime.

Differences between IND- AS 103 Business combination and IFRS 3

IFRS-3 excludes from its scope business combinations of entities under common control. Ind AS 103 (Appendix C) gives the guidance in this regard.

![]()

IFRS-3 requires bargain purchase gain arising on business combination to be recognised in profit or loss account. IND-AS 103 requires that the bargain purchase gain to be recognised in other comprehensive income and accumulated in equity as capital reserve

Applicability of Accounting Standards on Demerger

As per various court decisions AS-14 -Accounting for Amalgamations is not applicable to demergers.