Students should practice Accounting for Share Based Payments (ESOS & ESOP) – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Accounting for Share Based Payments (ESOS & ESOP) – Corporate and Management Accounting MCQ

Question 1.

______means the option given to the whole-time directors, officers or employees of a company, which gives such directors, officers, or employees the benefit or right to purchase or subscribe at a future date, the securities offered by the company at a pre-determined price.

(A) Employee Stock Purchase

(B) General Employee Benefits

(C) Employee Stock Option

(D) Retirement Benefits

Answer:

(C) Employee Stock Option

Question 2.

Which of the following section of the Companies Act, 2013 allows a company to offer shares to employees under a scheme of employee’s stock option?

(A) Section 61

(B) Section 65

(C) Section 62

(D) Section 68

Answer:

(C) Section 62

Question 3.

As per Section 62(2) of the Companies Act, 2013, a company can offer shares to employees under a scheme of employees stock option bypassing

(A) Board Resolution

(B) Special Resolution

(C) Ordinary Resolution

(D) Extraordinary Resolution

Answer:

(B) Special Resolution

Question 4.

A listed company can offer various benefits to employees such as ESOS or ESPS by complying with provisions of the

(1) Companies Act, 2013

(2) SEBI (Share Based Employee Benefits) Regulations, 2014

(3) Companies (Share Capital & Debentures) Rules, 2014

Select the correct answer from the options given below.

(A) (1) only

(B) (1) and (2) only

(C) (2) and (3) only

(D) (1), (2), and (3)

Answer:

(B) (1) and (2) only

Question 5.

Which of the following persons is covered under the provisions relating to share-based payment regulation made by the SEBI?

(A) Permanent employee

(B) Whole-time director

(C) Employee of a subsidiary

(D) All of the above

Answer:

(D) All of the above

Question 6.

As per Rule 12 of the Companies (Share Capital & Debentures) Rules, 2014, ’employee’ includes

(I) A permanent employee of the company who has been working outside India

(II) Independent director

(III) An employee who is a promoter

(IV) Whole-time director

(V) Director who holds more than 10% of the outstanding equity shares of the start-up company

Select the correct answer from the options given below.

(A) (III), (II) & (IV)

(B) (I), (II), (IV) & (V)

(C) (V), (IV) & (I)

(D) (I) and (IV)

Answer:

(D) (I) and (IV)

Question 7.

Which of the following person can be treated as ‘employee’ and hence eligible for employees’ share-based payment benefits?

(A) Relative of the director who holds more than 10% of the outstanding equity shares of the company

(B) Temporary employee of the company who has been working in India

(C) Employee of Associate Company

(D) None of the above

Answer:

(D) None of the above

Question 8.

SEBI (Share Based Employee Benefits) Regulations, 2014 applies to:

(1) Employee Stock Option Schemes

(2) Employee Stock Purchase Schemes

(3) Stock Appreciation Rights Schemes

(4) General Employee Benefits Schemes

(5) Retirement Benefit Schemes

Select the correct answer from the options given below.

(A) (2) and (1)

(B) (3) and (4)

(C) (4) and (5)

(D) All of the above are correct

Answer:

(D) All of the above are correct

Question 9.

Under the employees are given an option to purchase shares on the spot at a discount price.

(A) Employees Stock Purchase Scheme

(B) Employee Stock Option Scheme

(C) Stock Appreciation Rights Scheme

(D) Preferential Allotment Scheme

Answer:

(A) Employees Stock Purchase Scheme

Question 10.

Under ESPS employees are given an option to purchase shares on the spot at a

(A) Discounted price

(B) Special price

(C) Discount price

(D) Floor price

Answer:

(C) Discount price

Question 11.

Under ESOS,____ employees are given an option to purchase shares at:

(A) On the spot

(B) Later date i.e. after vesting period

(C) Relevant date

(D) Later date i.e. after the end of the accounting year

Answer:

(B) Later date i.e. after vesting period

Question 12.

Shares to be issued under ESOS

(A) Can be issued as a part of a public issue.

(B) Has no vesting periods

(C) Has to be approved separately by the company in general meeting by passing a special resolution.

(D) All of the above

Answer:

(C) Has to be approved separately by the company in general meeting by passing a special resolution.

Question 13.

______means the price, if any, payable by the employee for exercising the option or SAR granted to him.

(A) Offer price

(B) the Exercise price

(C) Market Price

(D) Fair price

Answer:

(B) the Exercise price

Question 14.

____means the process by which the company issues Options, SARs, Shares, or any other benefits under any of the schemes.

(A) Grant

(B) Option

(C) Exercise

(D) Appreciation

Answer:

(A) Grant

Question 15.

A company may implement share-based employees benefit schemes:

(A) Directly

(B) Trust Route

(C) Either (A) or (B)

(D) Neither (A) nor (B)

Answer:

(C) Either (A) or (B)

Question 16.

On 1.4.2019, a company offered 300 shares to each of its 1,200 employees at ₹ 75 per share. The employees are given a month to accept the shares. The shares issued under the plan shall be subject to lock-in to transfer for 3 years from the grant date Le. 30.4.2019. The market price of shares on the grant date is ₹ 90 per share. Due to post vesting restrictions, the fair value of shares issued under the plan is estimated at ₹ 84 per share. Up to 30.4.2019,50% of employees accepted the offer and paid ₹ 75 per share. The face value of the share is ₹ 10. Expenses to be recognized in the year 2019-2020 =?

(A) ₹ 5,40,000

(B) ₹ 32,40,000

(C) ₹ 16,20,000

(D) ₹ 10,800

Hint:

The market price of the share on the grant date is not considered as Fair Value is specifically given.

Fair value of an option = ₹ 84 – ₹ 75 = ₹ 9

Number of employees accepting the offer = 1,200 employees × 50% = 600 employees .

Number of shares issued = 600 employees × 300 shares = 1,80,000 shares

Fair value of ESOS = 1,80,000 shares × ₹ 9 = ₹ 16,20,000 Expenses recognized in 2019-2020 = ₹ 16,20,000

Alternatively,

(84 – 75) × 1,200 employees × 300 shares × 50% = 16,20,000

Answer:

(C) ₹ 16,20,000

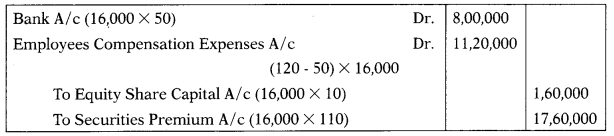

Question 17.

X Ltd. has its share capital divided into equity shares of ₹ 10 each. On 1.1.2020 it granted 20,000 employees stock option at ₹ 50 per share when the market price was ₹ 120 per share. The options were to be exercised between 15.3.2020 & 31.3.2020. The employees exercised their options for 16,000 shares only and the remaining options lapsed. The company closes its books on 31st March every year. Which of the following is correct?

(A) No entry is passed when Stock Options are granted to employees. Hence, no entry will be passed on 1.1.2020.

(B) The difference ₹ 120 ₹ 50 = ₹ 70 per share is employee compensation expense and will be charged to Profit & Loss A/c for the number of options exercised Le. 16,000 shares by ₹ 11,20,000.

(C) Securities Premium A/c will be credited by ₹ 17,60,000

(D) All of the above

Hint:

1. No entry is passed when Stock Options are granted to employees. Hence, no entry will be passed on 1.1.2020.

2. The difference ₹ 120 – ₹ 50 = ₹ 70 per share is employee compensation expense and will be charged to Profit & Loss A/c for the number of options exercised ie. 16,000 shares by ₹ 11,20,000.

Answer:

(D) All of the above

Question 18.

A company has its share capital divided into shares of ₹ 10 each. On 1.1.2016, it granted 5,000 employees stock option at ₹ 50, when the market price was ₹ 140. The options were to be exercised between 1.3.2017 to 31.3.2017. The employees exercised their options for 4,800 shares only; the remaining options lapsed. How much amount will be transferred from Employees Compensation Expenses A/c to Profit & Loss A/c?

(A) ₹ 4,32,000

(B) ₹ 4,36,000

(C) ₹ 4,28,000

(D) ₹ 4,44,000

Hint:

(140 – 50) × 4,800 = 4,32,00019.

Answer:

(A) ₹ 4,32,000

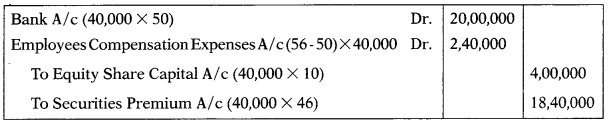

Question 19.

On 1.4.2019, GP Ltd. offered 100 shares to each of its 500 employees at ₹ 50 per share. Employees are given a year to accept the offer. Shares issued under the plan shall be subject to lock-in on transfer for 3 years from the grant date. The market price of shares on the grant date is ₹ 60 per share. Due to post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 56 per share. On 31.3.2020,400 employees accepted the offer and paid ₹ 50 per share, (a) Expenses to be recognized = ? & (b) Securities Premium A/c will be credited by =?

(A) ₹ 3,40,000; ₹ 20,40,000

(B) ₹ 2,40,000; ₹ 18,40,000

(C) ₹ 2,40,000; ₹ 22,40,000

(D) ₹ 3,40,000; ₹ 18,40,000

Hint:

Answer:

(B) ₹ 2,40,000; ₹ 18,40,000

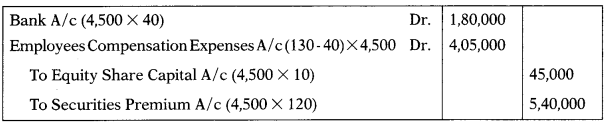

Question 20.

A company has its share capital divided into shares of ₹ 10 each. On 1.4.2018, it granted 5,000 shares as employee stock options at ₹ 40 per share, when the market price was ₹ 130 per share. The options were to be exercised between 16.12.2018 and 15.3.2019. The employees exercised their options for 4,500 shares only; the remaining options lapsed. Which of the following is correct?

(A) Bank A/c will be debited by ₹ 5,85,000 (4,500 shares × ₹ 130)

(B) Equity Share Capital A/c will be credited by ₹ 5,00,000 (5,000 shares × ₹ 10)

(C) Securities Premium A/c will be credited by ₹ 5,40,000 (4,500 shares × ₹ 120)

(D) All of the above

Hint:

Answer:

(C) Securities Premium A/c will be credited by ₹ 5,40,000 (4,500 shares × ₹ 120)