Accounting for Branches Including Foreign Branches – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Accounting for Branches Including Foreign Branches – CA Inter Accounts Question Bank

Question 1.

Why goods are marked on invoice price by the head office while sending goods to the branch? (May 2011, 4 marks)

Answer:

Goods are marled on invoice price to achieve the following objectives:

- To keep secret from the branch manager, the cost price of the joods and protit made, so that the branch manager may not start a rival and competitive business with the concern and

- To have effective control on stock i.e. stock at any time must be equal to opening stock plus goods received from head office minus sales made at branch.

- To dictate pricing policy to its branches, as well as save work at branch because puces have already been decided.

Question 2.

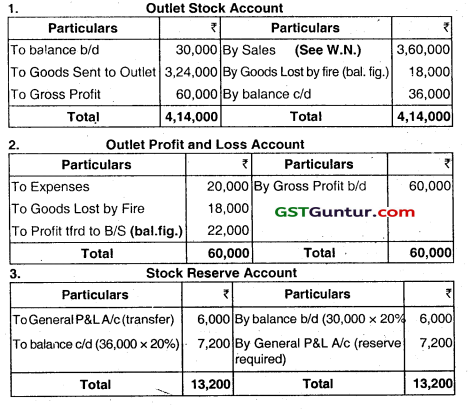

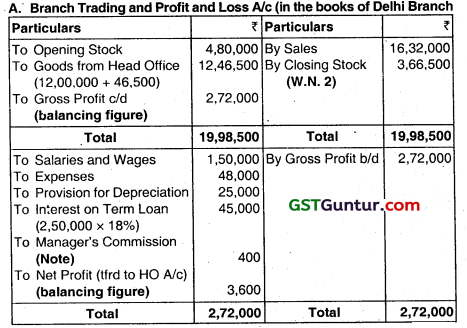

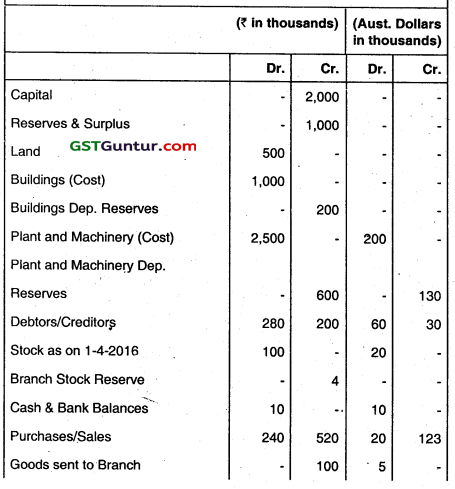

Ram Limited Chennai has a branch at Nagpurto which office, goods are invoiced at cost plus 25%. The branch makes sales both for cash and on credit. Branch expenses are paid direct from Head Office and the branch has to remit all cash received into the Head Office Bank Account at Nagpur.

From the following details, relating to the year 2009, prepare the accounts in Head Office Ledger and ascertain Branch Profit. Branch does not maintain any books of accounts, but sends weekly returns to Head Othce:

| Goods received from Head Office at Invoice price | ₹ 1,20,000 |

| Returns of Head Office at invoice price | ₹ 2,400 |

| Stock at Nagpur Branch on 1.1.2009 | ₹ 12,000 |

| Sales during the year- Cash | ₹ 40,000 |

| Credit | ₹ 72,000 |

| Debtors at Nagpur Branch | ₹ 14,400 |

| Cash received from Debtors | ₹ 64,000 |

| Discounts allowed to Debtors | ₹ 1,200 |

| Bad Debts during the year | ₹ 800 |

| Sales Returns at Na9pur Branch | ₹ 1,600 |

| Salaries and Wages at Branch | ₹ 12,000 |

| Rent, Rates and Taxes at Branch | ₹ 3,600 |

| Office, expenses at Nagpur Branch | ₹ 1,200 |

| Stock at Branch on 31.12.2009 at invoice price | ₹ 24,000 |

(May 2010, 8 marks)

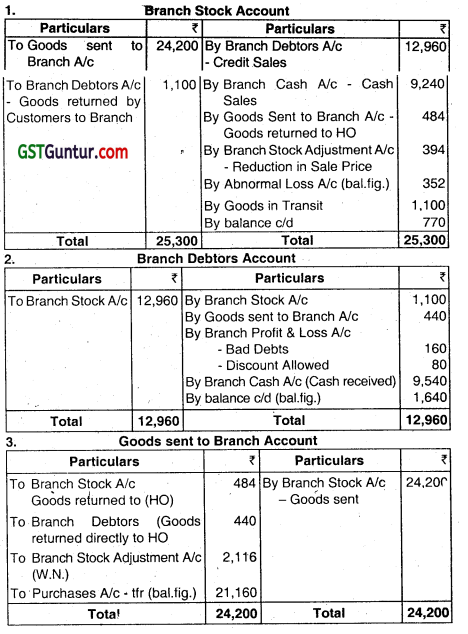

Answer:

![]()

Question 3.

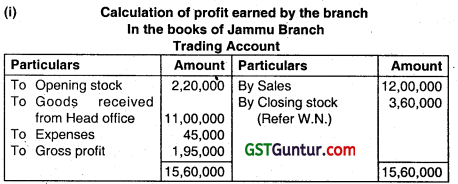

Following is the information of the Jammu branch of Best Ltd., New Delhi for the year ending 31 March 2010 from the following:

(1) Goods are invoiced to the branch at cost plus 20%.

(2)The sale price Is cost plus 50%.

(3) Other informations:

Stock as on 01-04-2009 ₹ 2,20,000.

Goods sent during the year ₹ 11,00,000

Sales during the year ₹ 12,00,000

Expenses incurred at the branch ₹ 45,000

Ascertain (i) the profit earned by the branch during the year (ii) branch stock reserve in respect of unrealized profit. (Nov 2010, 4 marks)

Answer:

(iii) Stock reserve In respect of unrealised profit

= 3,60,000 × (20/1 20) = ₹ 60,000

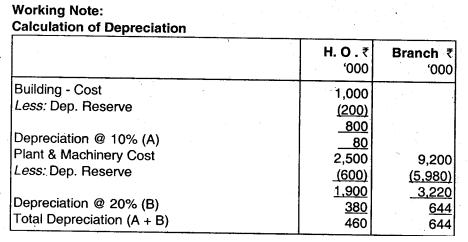

Working Note:

Cost Price 100

Invoice Price 120

Sale Price 150

Calculation of closing stock at invoice price

Opening stock at invoice price 2,20,000

Question 4.

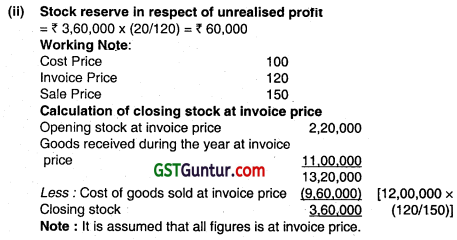

XYZ Company is having it’s Branch at Kolkata. Goods are invoiced to the branch at 20% profit on sale. Branch has been instructed to send all cash daily to head office. All expenses are paid by head office except petty expenses which are met by the Branch Manager. From the following particulars prepare branch account in the books of Head Office.

(May 2011,8 Marks)

Answer:

Note:

It is assumed that goods returned by branch are at invoice price.

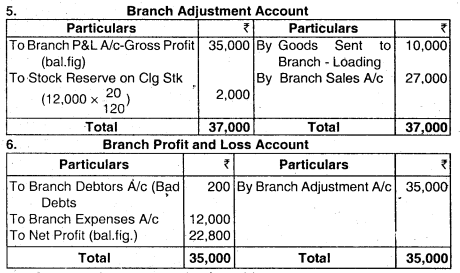

Question 5.

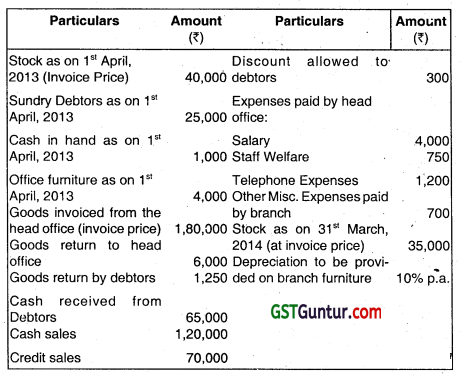

LMN is having branch at Mumbai. Goods are invoiced to the branch at 25% profit on sale. Branch has been instructed to send all cash daily to head office. All expenses are paid by head office except petty expenses, which are met by the Branch. From the following particulars, prepare branch account in the books of head office:

(Nov 2014, 8 Marks)

Answer:

Note: It is assumed that goods returned by branch are at invoice price.

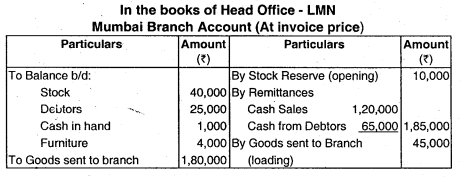

Question 6.

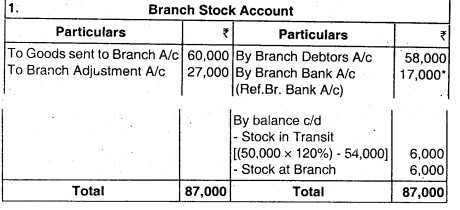

Raju Industries, Kolkata has a branch in Delhi to which office goods are invoiced at cost plus 25%. The branch sells both for cash and on credit. Branch expenses are paid direct from head office, and branch has to remit all cash received to the Head office Bank Account.

From the following details, relating to calendar year 2014, prepare the accounts In the Head Office Ledger and ascertain the Branch Profit. Branch does not maintain any books of account, but sends weekly returns to the Head Office.

| Particulars | Amount in ₹ |

| Goods received from Head Office at Invoice Price | 6,00,000 |

| Returns to Head Office at Invoice Price | 12,000 |

| Stock at Delhi as on 1 Jan., 2014 | 60,000 |

| Sales during the year – Cash | 1,80,000 |

| – Credit | 3,80,000 |

| Sundry Debtors at Delhi as on 1 Jan., 2014 | 72,000 |

| Discount allowed to debtors | 8,000 |

| Bad Debts in the year | 6,000 |

| Sales returns at Delhi Branch | 6,000 |

| Rent, Rates, Taxes at Branch | 16,000 |

| Salaries, Wages, Bonus at Branch | 62,000 |

| Office Expenses | 6,000 |

| Stock at Branchon 31st December 2014 | 1,20,000 |

(Nov 2015, 12 marks)

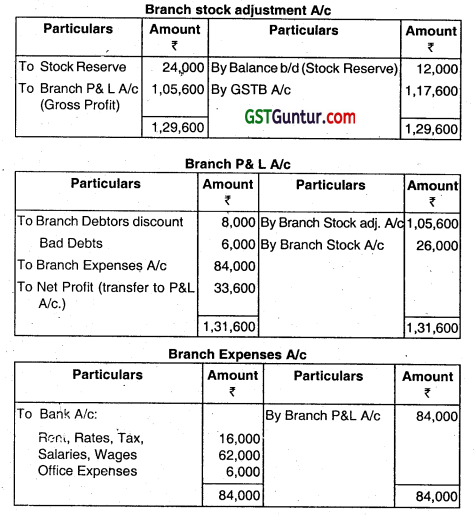

Answer:

Note: It is assumed that there is no closing balance of debtors. So all the cash received are adjusted in debtors A/c.

![]()

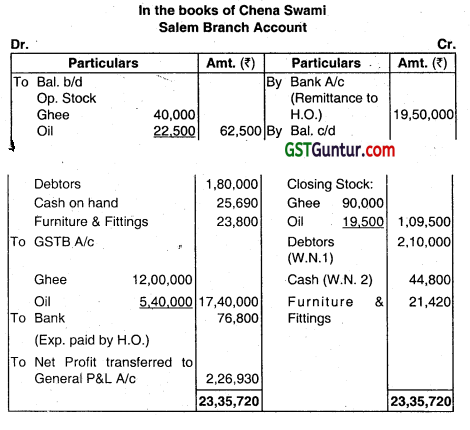

Question 7.

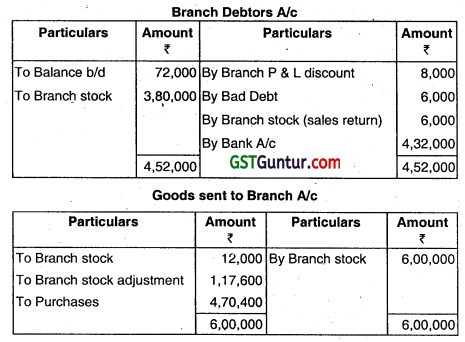

Mr. Chena Swami of Chennai trades in Refined Oil and Ghee. It has a branch at Salem. He despatches 30 tins of Refined Oil @ ₹ 1500 per tin and 20 tins of Ghee@ ₹ 5,000 per tin on 1 of every month. The Branch has incurred expenditure of ₹ 45,890 which Is met out of its collections; this in addition to expenditure directly paid by Head Office. Following are the other details:

Additional Information:

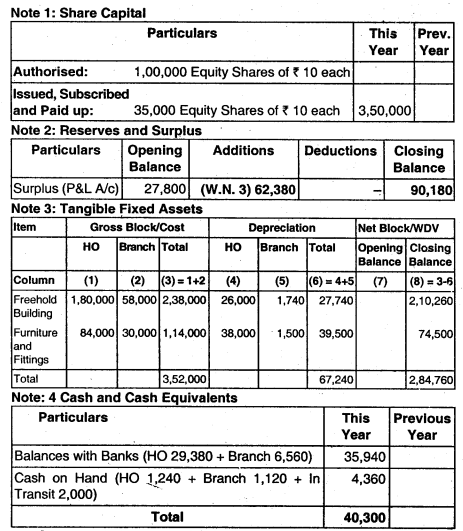

(i) Addition to Building on 01 -04-2015 ₹ 2,41,600 by H.O.

(ii) Rate of depreciation: Furniture & Fixtures @ 10% and Building @ 5% (already adjusted in the above figure) .

(iii) The Branch Manager is entitled to 10% commission on overall organisational profits after charging such commission.

(iv) The General Manager is entitled to a salary of ₹ 20,000 per month.

(v) General expenses incurred by Head Office is ₹ 1,86,000.

You are requested to prepare Branch Account in the Head Office books and also prepare Chena Swami’s Trading and Profit & Loss Account (excluding branch transactions) for the year ended 31st March 2016. (Nov 2016, 8 marks)

Answer:

Question 8.

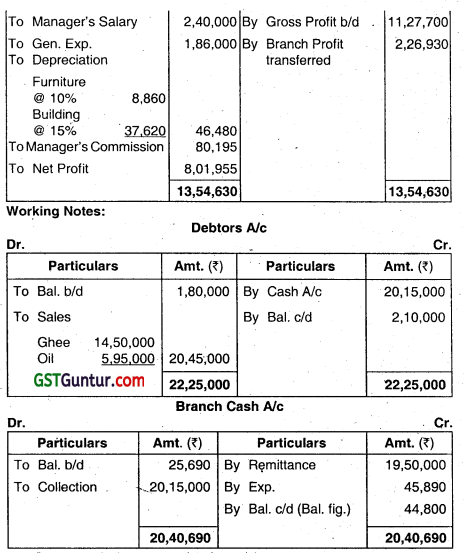

Ayan Ltd. invoices goods to its branch at cost plus 33%. From the following particulars prepare Branch Stock Account, Branch Stock Adjustment Account, and Branch Profit and Loss Account as they would appear in the books of head office.

| ₹ | |

| Stock at commencement at Branch at invoice Price | 3,60,000 |

| Stock at close at Branch at Invoice Price | 2,88,000 |

| Goods sent to Branch during the year at’ invoice price | 24,00,000 |

| (Including goods invoiced at 48,000 to Branch on 31.03.2018 but not received by Branch before close of the year). |

|

| Return of goods to head office (Invoice Price) | 1,20,000 |

| Credit Sales at Branch | 1,20,000 |

| Invoice value of goods pilfered | 24,000 |

| Normal loss at Branch due to wastage and deterioration of stock (at invoice price) | 36,000 |

| Cash Sales at Branch | 21,60,000 |

Ayan doses its books on 31st March 2018. (May 2018, 10 marks)

Answer:

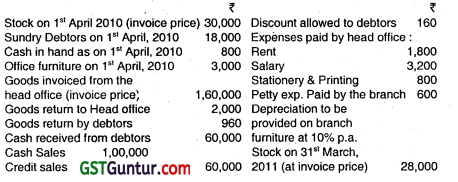

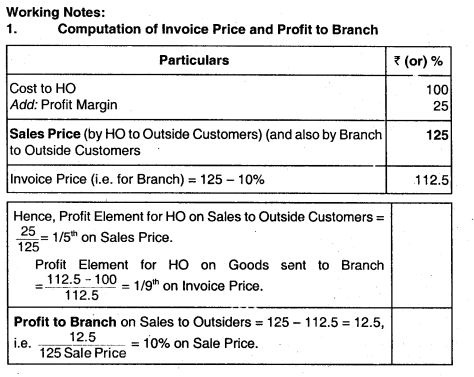

Question 9.

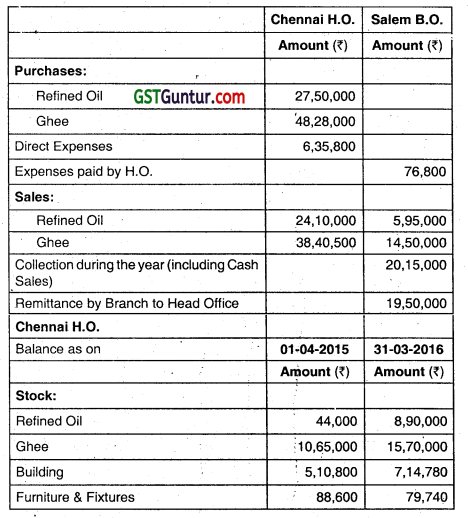

Vijay & Co. of Jaipur has a branch in Patna to which goods are sent @ 20% above cost. The branch makes both cash and credit sales. Branch expenses are paid direct from Head office and the branch has to remit all cash received into the bank account of Head office. Branch doesn’t maintain any books of accounts, but sends monthly returns to the Head office. Following further details are given for the year ended 31st March 2020:

| Amount (₹) | |

| Goods received from Head office at Invoice Price | 8,40,000 |

| Goods returned to Head office at Invoice Price | 60,000 |

| Cash sales for the year 2019-20 | 1,85,000 |

| Credit Sales for the year 2019-20 | 6,25,000 |

| Stock at Branch as on 01-04-2019 at Invoice price | 72,000 |

| S. Debtors at Patna branch as on 01-04-2019 | 96,000 |

| Cash received from Debtors | 4,38,000 |

| Discount allowed to Debtors | 7,500 |

| Goods returned by customers at Patna Branch | 14,000 |

| Bad debts written off | 5,500 |

| Amount recovered from Bad debts previously written off as Bad | 1,000 |

| Rent Rates and Taxes at Branch | 24,000 |

| Salaries & wages at Branch | 72,000 |

| Office Expenses (at Branch) | 9,200 |

| Stock at Branch as on 31-03-2020 at cost price | 1,25,000 |

Prepare necessary ledger accounts in the books of Head office by following Stock and Debtors method and ascertain Branch profit. (Nov 2020, 10 marks)

![]()

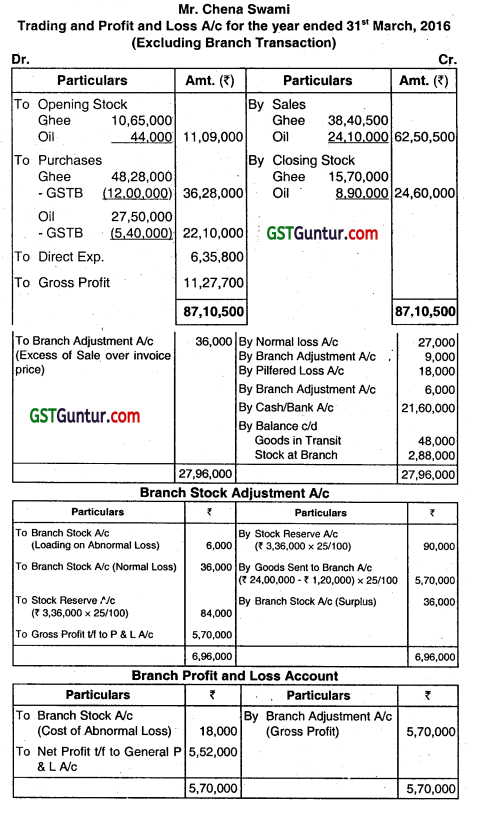

Question 10.

ABC Ltd. is a Compan, in the Retail Trade. Business had been concentrated in the past on the Shopping Premises in the Uttam Nagar area, but it has now been decided to open a Branch at RG Towers. The Branch was opened on 1 January, Goods were charged out to the Branch at Selling Pnce of 10% above Cost. The Branch sells to its Customers at such Invoice Price. The following information were extracted from the Head Office records relating to the branch at the end of the year, i.e. 31st December. All the Amounts shown are at Invoice Price.

Certain Stocks were lost by fire, the value of which was not yet known. Prepare the necessary Ledger Accounts in the books of the Head Office.

Answer:

Working Notes:

Loading reversed on Goods sent to Branch (Net) [(Sent 24,200- Returns 484-Returns 440) x \(\frac{10}{110}\) = 2,116

Working Notes:

Loading on Stock in Hano and Goods in Transit =(1,100+ 770) x \(\frac{10}{110}\) = ₹ 170

Question 11.

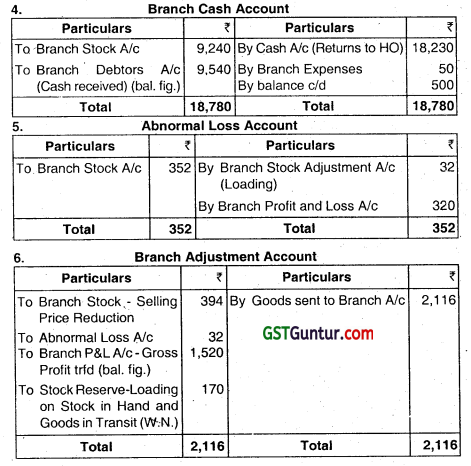

ABC Ltd, Delhi started a Branch in Jaipur on 1st April, to which goods were sent at 20% above Cost. The Branch makes both Credit and Cash Sales. Branch expenses are met from Branch Cash and balance money remitted to HO. The Branch does not maintain double entry books of account and necessary accounts relating to Branch are maintained in H.O. Following further details are given for the year ended on 31st March:

| Particulars | ₹ |

| Cost of Goods Sent to Branch | 50,000 |

| Goods received by Branch till 31st March at Invoice Price | 54,000 |

| Credit Sales for the year | 58,000 |

| Debtors as on 31st March | 20,800 |

| Bad Debts and Discount written off | 200 |

| Cash remitted to HO | 43,000 |

| Cash in Hand at Branch on 31st March | 2,000 |

| Cash remitted by HO to Branch during the year | 3,000 |

| Closing Stock at Branch at Invoice Price | 6,000 |

| Expenses incurred at Branch | 12,000 |

Prepare the necessary Ledger Accounts according to Stock and Debtors System, in the books of the Head Office and determine the Profit or Loss of the Branch for the year ended on 31st March.

Answer:

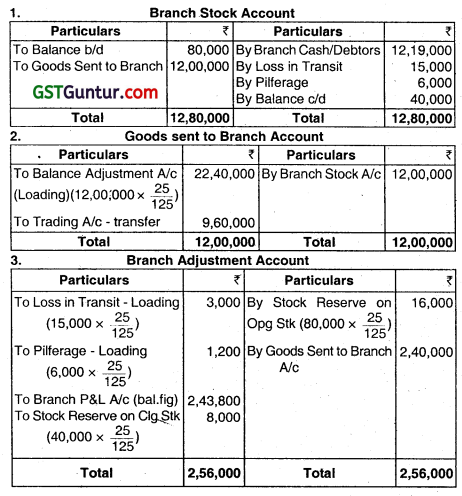

Question 12.

ABC Ltd. sends GDods to its Jaipur Branch at Cost plus 25%. The following particulars are available in respect of the Branch for the year ended 31st March:

| Particulars | ₹ |

| Opening Stock | 80,000 |

| Goods Sent to Branch (Invoice Price) | 12,00,000 |

| Loss in Transit (Invoice Price) | 15,000 |

| Pilferage (Invoice Price) | 6,000 |

| Sales | 12,19,000 |

| Expenses | 60,000 |

| Closing Stock | 40,000 |

| Recovered from Insurance Company against Loss in Transit | 10,000 |

Prepare Ledger Accounts in the HO Books for –

(1) Branch Stock Account,

(2) Goods Sent to Branch Account,

(3) Branch Adjustment Account, and

(4) Branch Profit and Loss Account.

Answer:

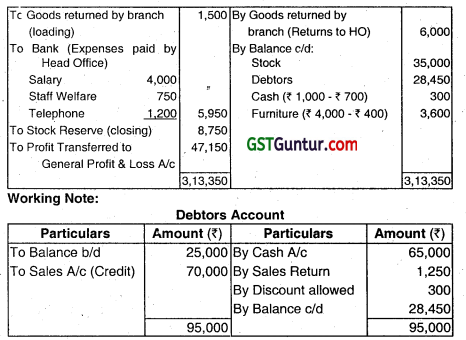

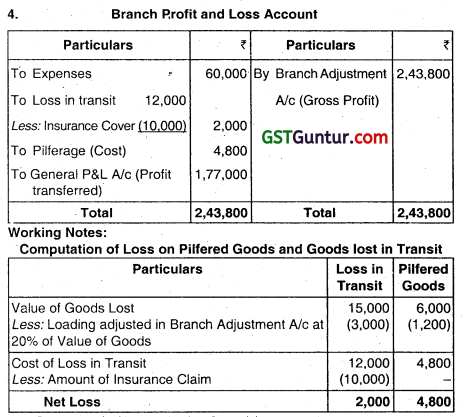

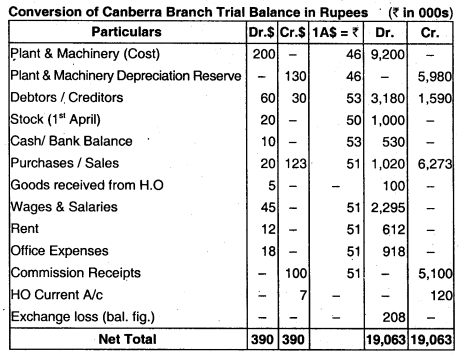

Question 13.

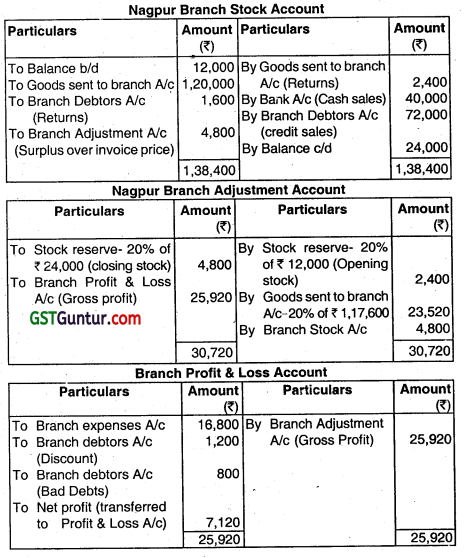

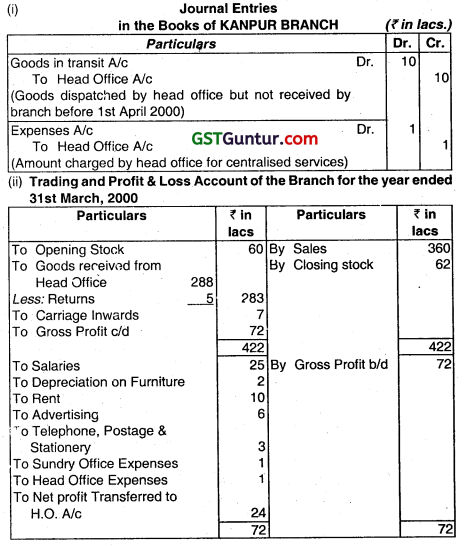

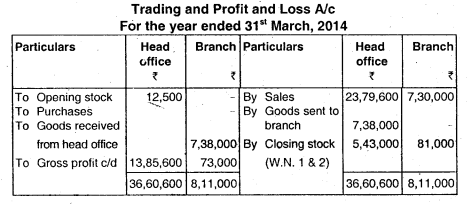

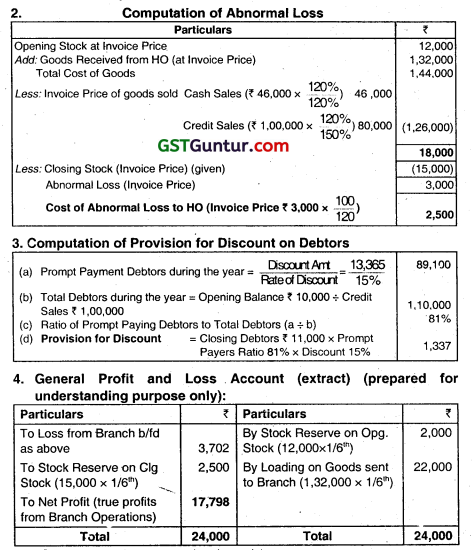

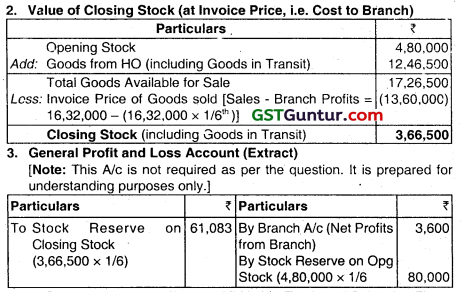

On 31st March, 2000 Kanpur Branch submits the following Trial Balance its Head Office at Lucknow:

Additional Information:

Stock on 31st March. 2000 was valued at ₹ 62 lacs on 29th March 2000 the Head Office despatched goods costing ₹ 10 lacs to its branch. Branch did not receive these goods before 1st April 2000. Hence the figure of goods received from Head Office does not include these goods. Also, he head office has charged the branch ₹ 1 lac for centralised services for which the branch has not passed the entry. You are required to:

(i) Pass Journal Entries in the books of the Branch to make the necessary adjustments.

(ii) Prepare Final Accounts of the Branch including Balance Sheet, and

(iii) Pass Journal Entries in the books of the Head Office to incorporate the whole of the Branch Thai Balance. (May 2002, 16 marks)

Answer:

![]()

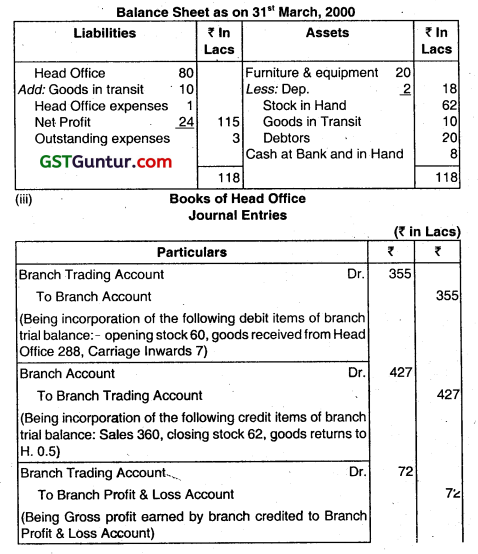

Question 14.

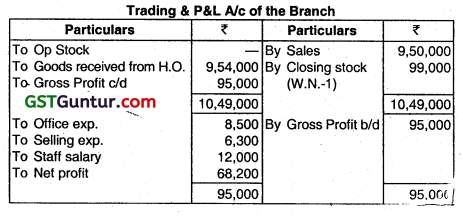

Beta Ltd. having head office at Mumbai has a branch at Nagpur. The Head Office does wholesale trade only at cost pIus 80%. The goods are sent to branch at the wholesale price viz., Cost plus 80%. The branch at Nagpur is wholly engaged in retail trade and the goods are sold at cost to H.O. plus 100%. Following details are furnished for the year ended 31st March, 2007:

You are required to prepare Trading and Profit and Loss Account of the Head Office and Branch for the year ended 31 March 2007. (Nov 2007,8 marks)

Answer:

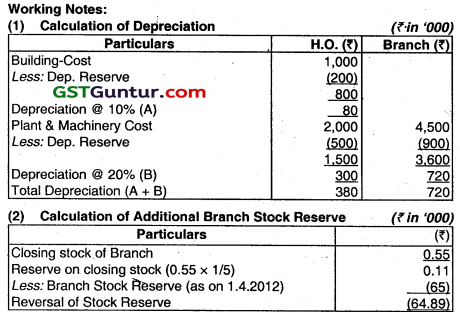

3. Calculation of unrealised profit ¡n branch stock:

Branch stock ₹ 99,000

Profit included 80% of cost

Therefore, unrealised profit would be = ₹ 99,000 x 80/180 = ₹ 44,000

Question 15.

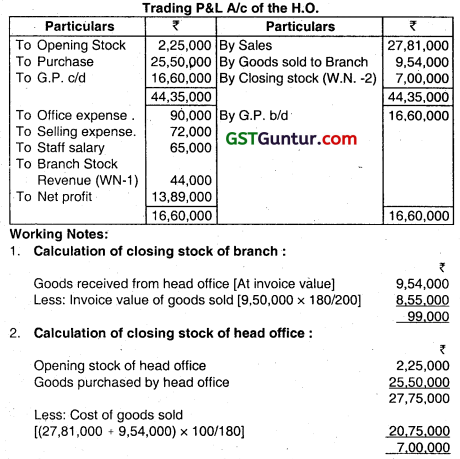

M/s. Sandeep. having Head Office at Delhi has a Branch at Kolkata. The Head Office does wholesale trade only at cost plus 80%. The Goods are sent to Branch at the wholesale price viz, cost plus 80%. The Branch at Kolkata wholly engaged in retail trade and the goods are sold at cost to Head Office plus 100%. Following details are furnished for the year ended 31st March 2014:

| Particulars | Head Office (₹) |

Kolkata Branch (₹) |

| Opening Stock (As on 01.04.2013) | 1,25,000 | – |

| Purchases | 21,50,000 | – |

| Goods sent to Branch (cost to H.O. plus 80%) | 7,38,000 | – |

| Sales | 23,79,600 | 7,30,000 |

| Office Expenses | 50,000 | 4,500 |

| Selling Expenses | 32,000 | 3,300 |

| Staff Salary | 45,000 | 8,000 |

You are required to prepare Trading and Profit & Loss Account of the Head Office and Branch for the Year ended 31st March 2014. (May 2015, 8 marks)

Answer:

Question 16.

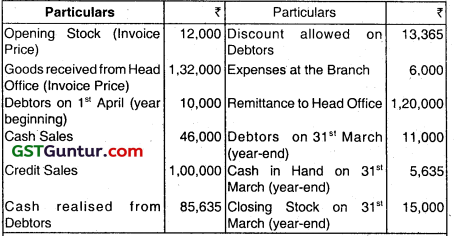

A and Co, with its Head Office in Mumbai invoiced goods to ils Branch at Pune, at 20% less than the Catalogue Price, which Is Cost plus 50%, with instructions that Cash Sales were to be made at invoice Price and Credit Sales at Catalogue Price. Discount on Credit Sale at 15% on prompt payment will be allowed. From the following particulars available from the Branch, prepare the Branch Trading and Profit and Loss Account of the Branch for the financial year:

It was reported that a part of Stock at the Branch was lost by fire during the year, whose value is to be ascertained, and Provision should be made for Discount to be allowed to Debtors as on 31st March (year-end) on the basis of the year’s occurrence of prompt payment.

Answer:

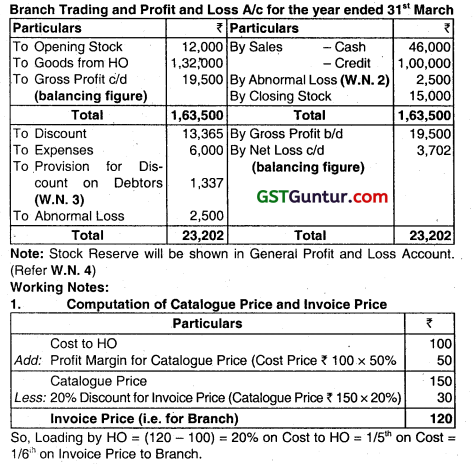

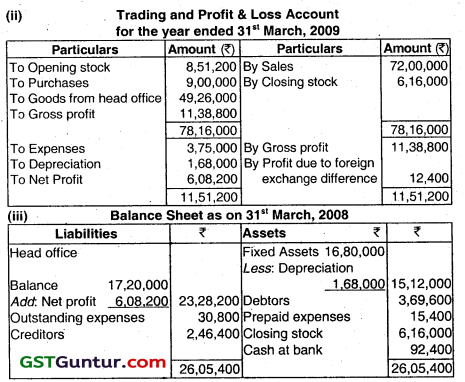

Question 17.

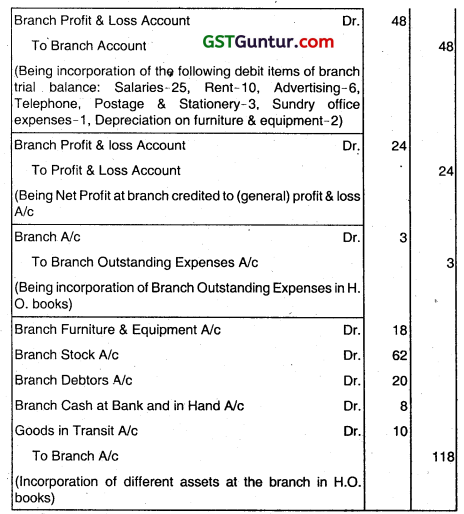

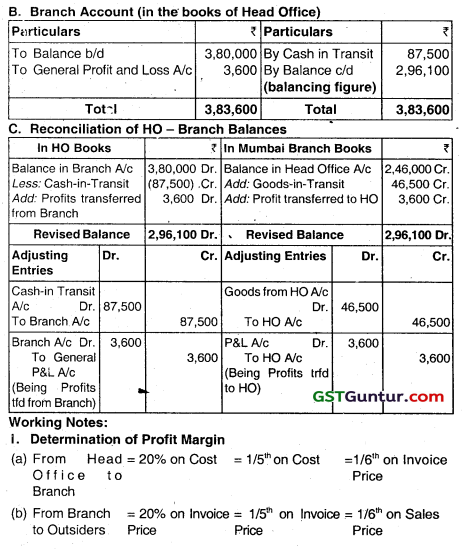

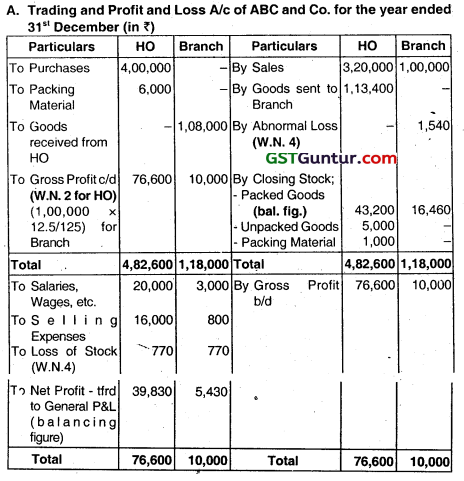

ABC and Bros. is a Partnership Firm. The Firm has a Branch at Delhi. As on the year ended 31st December, the Delhi Branch Manager sent the following Branch Trial Balance for incorporation in the Head Office Books:

1. Branch Manager is entitled to get 10% Commission on Net profit before Commission.

2. Branch Current Account in the HO books ₹ 3,80,000.

3. Branch Manager ser.t 87.500 which was not received at the HO as on 31st December. A Consignment valued at ₹ 46,500 despatched from HO did not reach the Branch till the year-end.

4. Depreciation on Branch Fixed Assets was chargeable at 10% p.a.

5. Goods were sent to branch at Cost Plus 20% and Sales were made making 20% Profit on invoice Price.

6. Branch did not maintain any HO Account. In the Trial Balance. HO. Account balance is just a Balancing Figure.

Prepare –

(1) Branch Account in the Head Office, and

(2) Branch Profit arid Loss Account.

Answer:

Since the question has given a separate Trial Balance for the Branch. it is treated as an Independent Branch.

It is assumed that the Firm follows ‘Trarister of Profit/Loss Method’ to record only the Net Profits in HO Books. Hence. Branch Assets and Liabilities are not transferred to HO.

Note: Manager’s Commission = 10% of [GP 2,72,000 – Other experts in P&L (1,50,000 + 48,000 + 25,000 + 45,000)] = 400

Note: Since this is only an Extract of P&L A/c, Totals and Balancing Figure are not drawn in the above account.

![]()

Question 18.

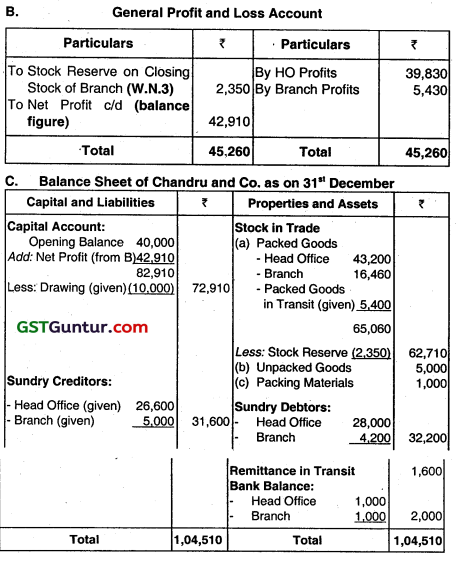

ABC Co. commenced business on 1st January wIth Head Office at Delhi and a Branch at Pune. All Goods were purchased by Head Office and normally packed immediately but on 31 December, Goods Costing ₹ 5,000 remained unpacked. Only Packed Goods were sent to the Branch which were charged at Selling Price less 10%. Following information is furnished to you on 31 December from the Head Office and Branch Office books:

Additional Information:

1. Sales by HO were at a unitorm Gross Profit (after charging Packing Materials) at 20% on the fixed Selling Price.

2. Sales at Branch were at Fixed Selling Price.

3. Goods invoiced and despatched by Head Office to Branch in December for ₹ 5,400, were received in the Branch Office only on 5th January oF next year.

4. Stock of Packing Materials on Hand as on 31 December was valued at ₹ 1,000.

5. Remittance of 1,600 from the Branch to the Head Office was in Transit on 31st December.

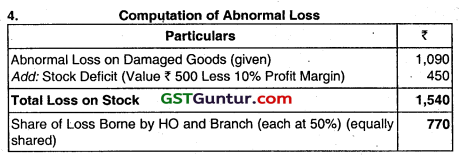

6. ₹ 2,000 worth of Stock at Selling Price was damaged at the Branch. For valuing Stock, this was reduced by ₹ 1,090 below the Invoice Cost to the Branch. It was decided that the Head Office and the Branch would share Equally the loss occasioned by this, and also the deficit in stock, ascertained on Actual Stock Taking at the Branch of goods at Selling Price of ₹ 500. Prepare a Columnar Trading and Profit and Loss A/c of the Delhi and Pune Offices, and also a Balance Sheet an on 31 December of the business.

Answer:

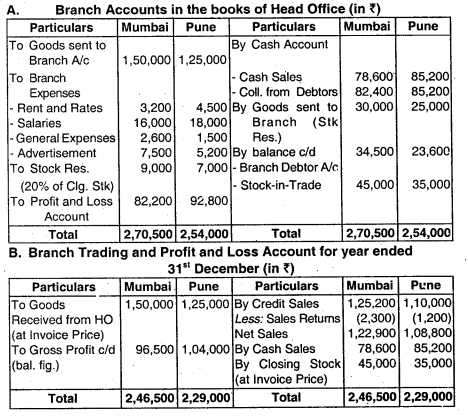

Question 19.

ABC Ltd., Delhi started on 1 January, has 2 branches at Mumbai and Pune. All goods sold at the Branches are received from the HO invoiced at Cost plus 25%. All expenses relating to branches are paid by the HO. Each Branch has its own Sales Ledger and sends weekly statements. All cash collections are remitted daily to HO by the Branches. The following particulars relating to the year-ended 31st December are extracted from the weekly statements sent by the Branches:

| Particulars | Mumbai | Pune |

| Credit Sales | 1,25,200 | 1,10,000 |

| Cash Sales | 78,600 | 85,200 |

| Sales Returns | 2,300 | 1,200 |

| Sundry Debtors | 34,500 | 23,600 |

| Rent and Taxes | 3,200 | 4,500 |

| Bad Debts | 6,000 | – |

| Salaries | 16,000 | 18,000 |

| General Expenses | 2,600 | 1,500 |

| Goods Received from Head Office | 1,50,000 | 1,25,000 |

| Advertisement | 7,500 | 5,200 |

| Stock as on 31st’ December | 45,000 | 35,000 |

Prepare the Branch Account, as they would appear in the Books of the Head Office, showing the Profit or Loss Account for the period, and the Trading and Profit and Loss Account separately for each Branch.

Answer:

Note: Goods are invoiced to Branch at Cost + 25% = Cost + 114th So.

Loading = 1\4th on Cost to HO = 1/5th on Invoice Price.

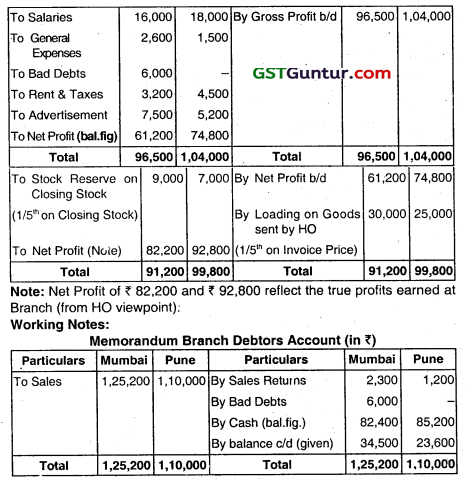

Question 20.

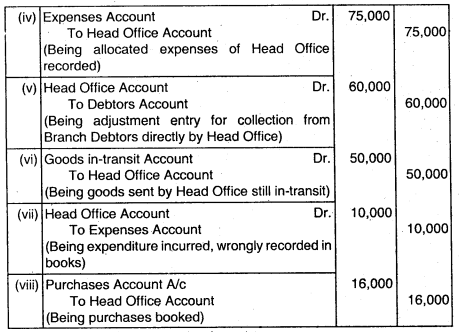

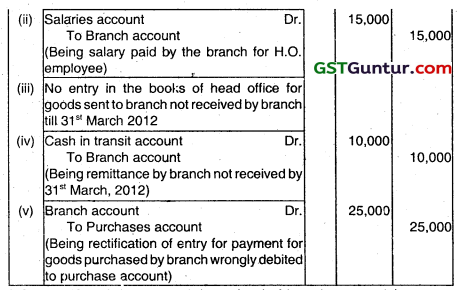

Pass necessary Journal entries in the books of an independent Branch of M/s TPL Sons. wherever required, to rectify or adjust the following transactions:

(i) Branch paid ₹ 5,000 as salary to a Head Office Manager, but the amount paid has been debited by the Branch to Salaries Account.

(ii) A remittance of ₹ 1,50,000 sent by the Branch has not received by Head Office on the date of reconciliation of Accounts.

(iii) Branch assets accounts retained at head office depredation charged for the year ₹15,000 not recorded by Branch.

(iv) Head Office expenses ₹ 75,000 allocated to the Branch, but not yet been recorded by the Branch.

(v) Head Office collected ₹ 60,000 directly from a Branch Customer. The intimation of the fact has not been received by the branch.

(vi) Goods dispatched by the Head office amounting to ₹ 50,000, but not received by the Branch till date of reconciliation.

(vii) Branch incurred advertisement expenses of ₹ 10,000 on behalf of other branches, but not recorded in the books of Branch.

(viii) Head office made payment of ₹ 16,000 for purchase of goods by branch, but not recorded in branch books.

Answer:

Question 21.

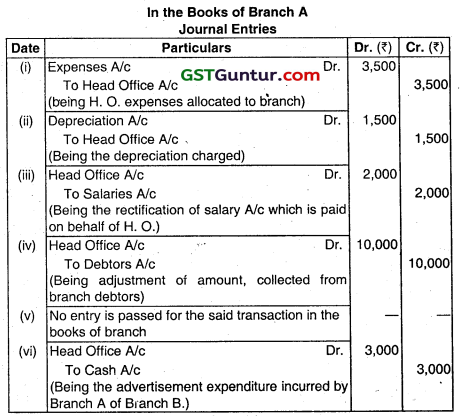

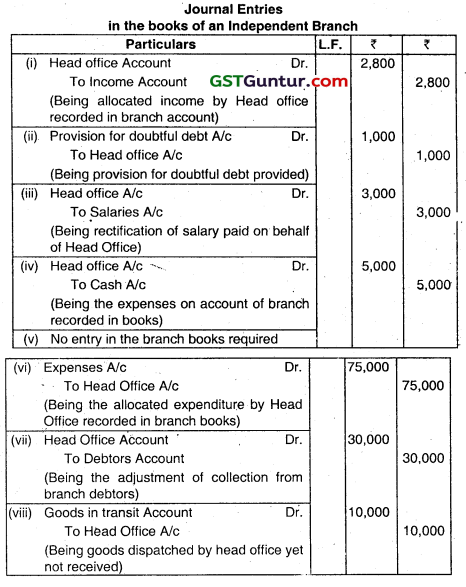

Give Journal Entries lithe books of Branch A to rectify or adjust the following.:

(i) Head Office expenses ₹ 3,500 allocated to the Branch, but not recorded in the Branch Books.

(ii) Depreciation of branch assets, whose accounts are kept by the Head Office not provided for ₹ 1,500.

(iii) Branch paid ₹ 2,000 as salary to a HO. Inspector, but the amount paid has been debited by the Branch to Salaries account.

(iv) HO. collected ₹ 10,000 directly from a customer on behalf of the Branch. but no intimation to this effect has been received by the Branch

(v) A remittance of ₹ 15,000 sent by the Branch has not yet been received by the Head Office.

(vi) Branch A incurred advertisement expenses of ₹ 3,000 on behalf of Branch B. (Nov 2004, 6 marks)

Answer:

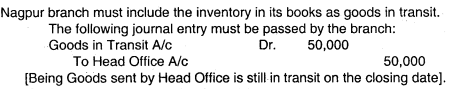

Question 22.

Alphs & Co., having head office in Mumbai has a branch in Nagpur. The branch at Nagpur is an independent branch maintaining separate books of account. On 31.32007, it was found that the goods dispatched by head office for ₹ 2,00,000 was received by the branch only to the extent of ₹ 1,50,000. The balance goods are in transit. What is the accounting entry to be passed by the branch for recording the goods ¡n transit, in its books? (May 2007, 2 marks)

Answer:

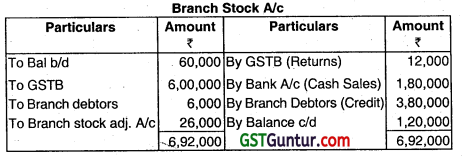

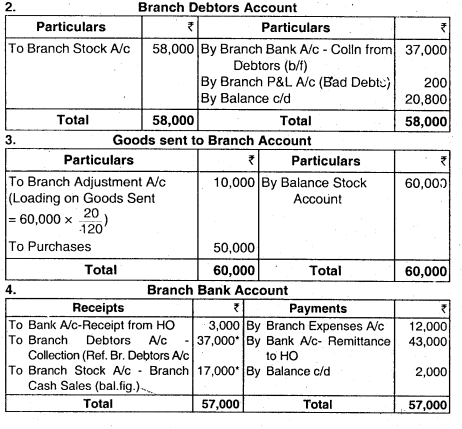

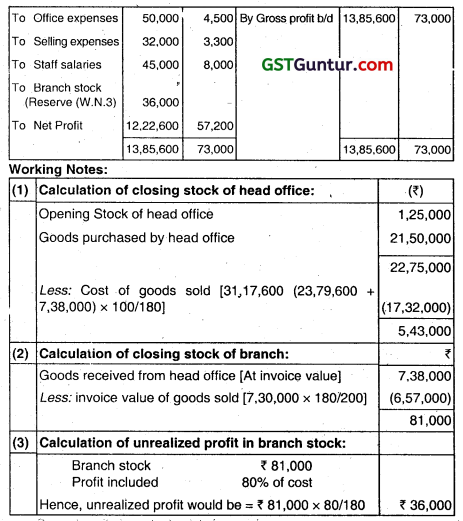

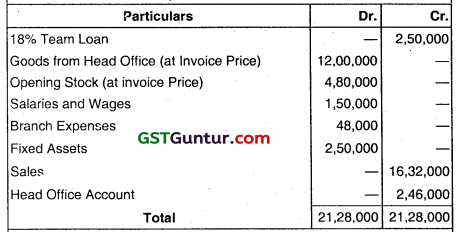

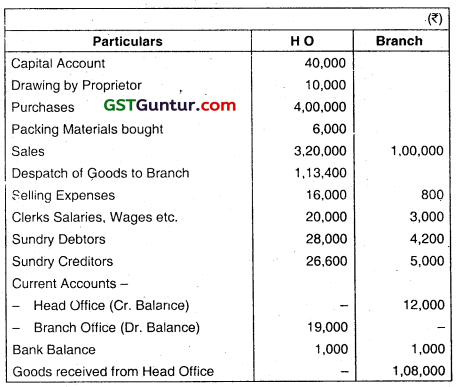

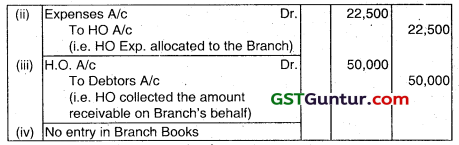

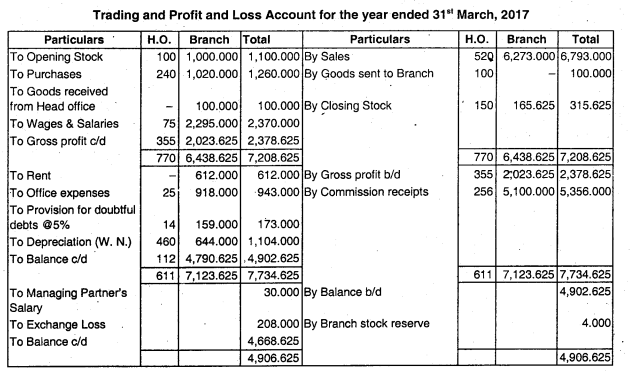

Question 23.

Goods worth 50,000 sent by head office but the branch has received till the closing date goods worth 40,000. Give journal entry in the books of HO. and branch for goods in transit. (Nov 2008, 2 marks)

Answer:

Assumption: It is assumed that refusal of branch manager (to accept liability of stolen goods) is accepted by the Head Office. Alternatively, Branch account will be credited on the basis of assumption that refusal of branch manager is not accepted by the Head Office.

Note: In entry (iii) the goods in transit entry will be passed in the Books of the Branch.

![]()

Question 24.

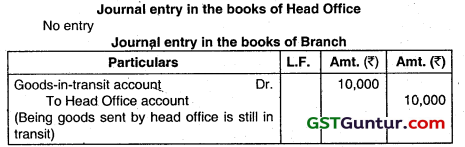

Pass necessary Journal entries in the books of an independent Branch of a Company, wherever required, to rectify or adjust the following:

(i) Income of ₹ 2,800 allocated to the Branch by Head Office but not recorded in the Branch books.

(ii) Provision for do’Lttul debts, whose accounts are kept by the Head office, not provided earlier for ₹ 1,000.

(iii) Branch paid ₹ 1,000 as salary to a Head Office Manager, but the amount paid has been debited by the Branch to Salaries Account.

(iv) Branch incurred travelling expenses of ₹ 5,000 on behälf of other Branches, but not recorded in the books of Branch.

(v) A remittance of ₹ 1,50,000 sent by the Branch has not received by Head Office on the date of reconciliation of Accounts:

(vi) Head Office allocates ₹ 75,000 to the Branch as Head Office expenses, which has not yet been recorded by the Branch.

(vii) Head Office collected ₹ 30,000 directly from a Branch Customer. The intimation of the tact has been received by the Branch only now.

(viii) Goods dispatched by the Head Office amounting to ₹ 10,000, but not received by the Branch till date of reconciliation. The Goods have been received subsequently. (May 2014, 8 marks)

Answer:

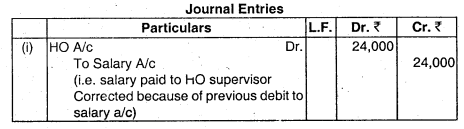

Question 25.

Pass necessary Journal Entries (with narration) in the books of branch to rectify or adjust the following:

(i) 8rarich Paid ₹ 24,000 as salary to HO Supervisor and the amount was debited to Salaries Account by the branch.

(ii) Head Office Expenses allocated to branch were ₹ 22,500, but these expenditures were not recorded by the branch.

(iii) HO collected ₹ 50,000 directly from the customer on branch’s behalf.

(iv) Branch has sent remittance of ₹ 1,20,000 but the same has not yet been received by HO. (Nov 2015, 4 marks)

Answer:

Question 26.

Answer the following:

Give Journal Entries in the books of Branch to rectify or adjust the following:

- Branch paid ₹ 5,000 as salary to H.O. supervisor, but the amount paid by branch has been debited to salary account in the books of branch.

- Asset Purchased by branch for ₹ 25,000, but the Asset was retained in HO. Books

- A remittance of ₹ 8,000 sent by the branch has not been received by H.O.

- H.O. collected ₹ 25,000 directly from the customer of Branch but fails to give the intimation to branch.

- Remittance of funds by H.O. to branch ₹ 5,000 not entered in branch books. (Jan 2021, 5 marks)

Question 27.

What are the indicators of Non-ntegraI Foreign Operation(NFO)? (Nov 2014, 4 marks)

Answer:

Indicators of Non-Integral Foreign Operations:

| 1. Autonomy | While the reporting enterprise may control the foreign operation, the activities of the foreign operation are carried out with a significant degree of autonomy from those of the reporting enterprise. |

| 2. Transaction Pattern | Transactions with the reporting enterprise are not a high proportion of the foreign operation’s activities. |

| 3. Financing | The activities of the foreign operation are financed mainly from its own operations or local borrowings rather than from reporting enterprises. |

| 4. Expenditure in local currency | Costs of labour, material, and other components of the foreign operations products or services are primarily Paid or settled in the local currency rather than in the reporting currency. |

| 5. Sales Pattern | The foreign operation’s sales are mainly 1n currencies other than the reporting currency. |

| 6. Effect of Cash Flows | Cash Flows of the reporting enterprise are insulated from day to day activities of the foreign operation rather than being directly affected by the activities of the foreign operation. |

| 7. Prices of Products | Sales prices for the foreign operation’s products are not primarily responsive on a short-term basis to changes in exchange rates but are determined more by local competition or Local Government Regulations. |

| 8. Local Market | There is an active local sales market for the reign operations products, although there might be significant amounts of exports. |

Question 28.

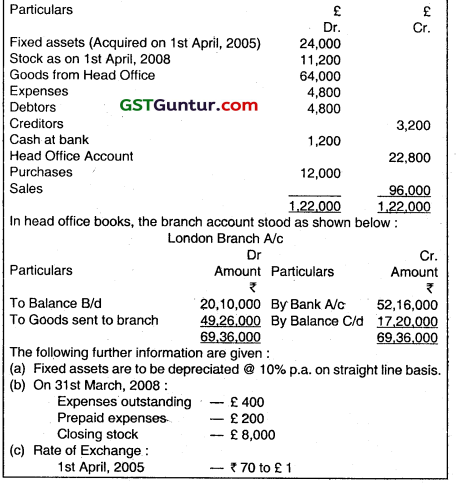

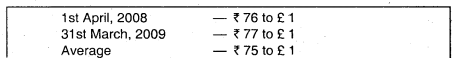

DM Ltd., Delhi has a branch in London. London branch is an Integral foreign operation of DM Ltd. At the end of the year 31st March 2009. the branch furnishes the following trial balance in U.K. Pound:

You are required to prepare:

(1) Trial balance, incorporating adjustments of outstanding and prepaid expenses, convèrting U.K. pound into Indian rupees.

(2) Trading and profit and loss A/c for the year ended 31st March. 2009 and the Balance Sheet as on that date of London branch as would appear in the books of Delhi head office of DM Ltd. (Nov 2009, 16 marks)

Answer:

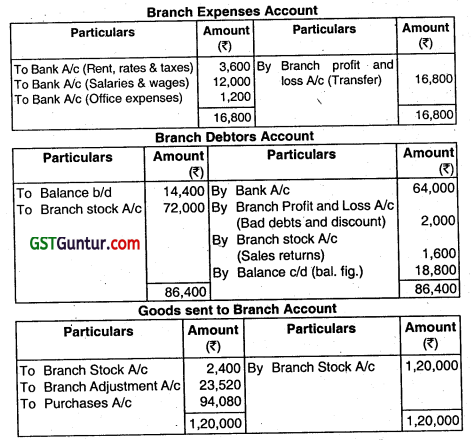

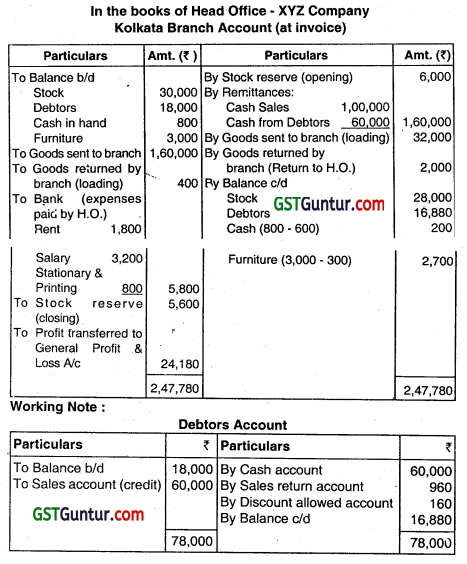

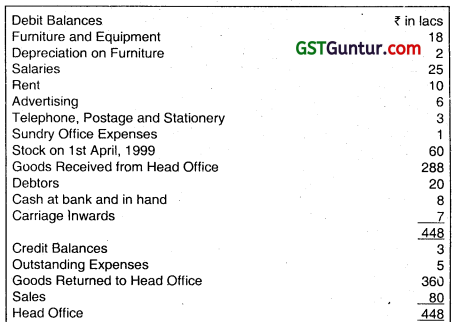

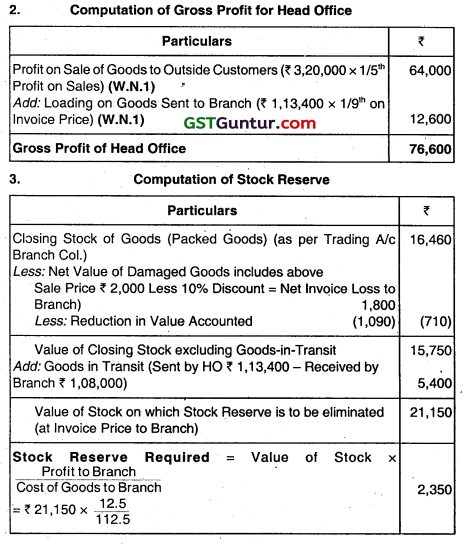

Question 29.

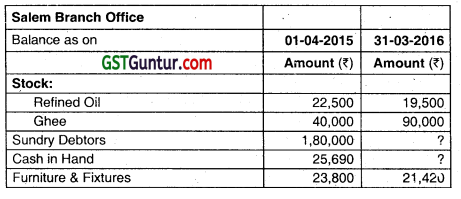

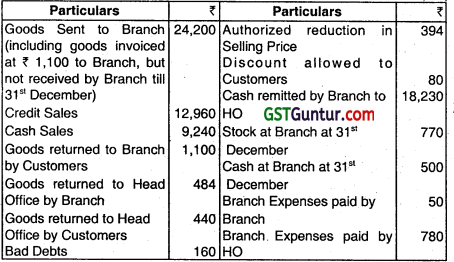

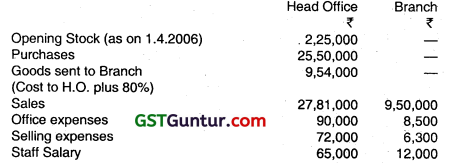

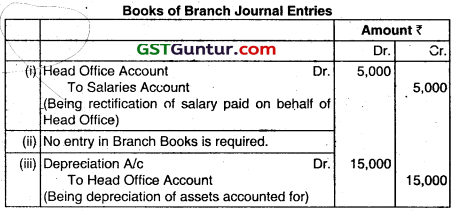

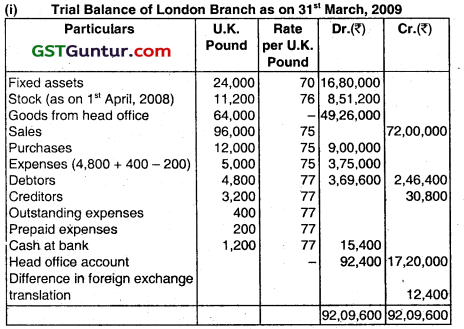

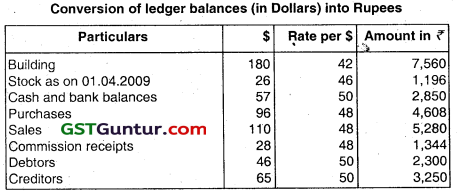

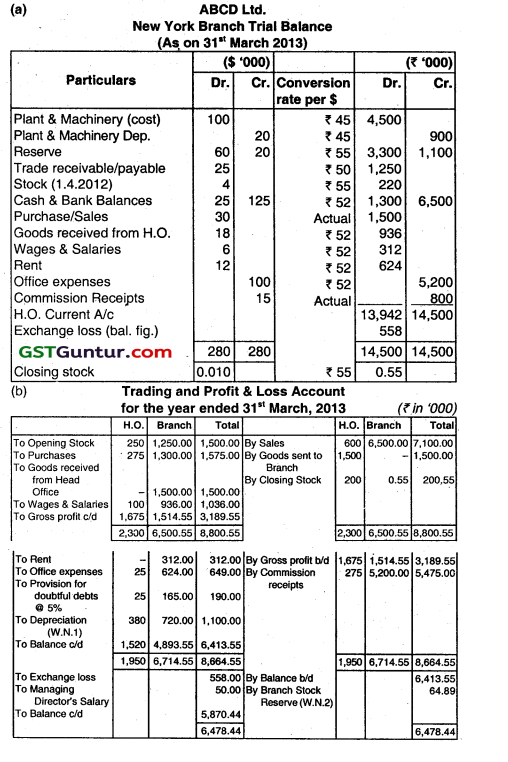

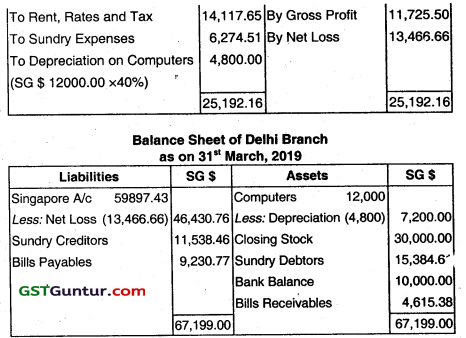

On 31st March 2010, the following Ledger balances have been extracted from the books of Washington branch office:

| Ledger A/c | $ |

| Building | 180 |

| Stock as on 1.4.2009 | 26 |

| Cash and Bank Balances | 57 |

| Purchases | 96 |

| Sales | 110 |

| Commission receipts | 28 |

| Debtors | 46 |

| Creditors | 65 |

You are required to convert above Ledger balances into Indian Rupees. Use the following rates of exchange:

Opening Rate $ = 46

Closing Rate $ = 50

Average Rate $ – = 48

For Fixed Assets $ = 42

(May 2010, 2 marks)

Answer:

Note:

1. All P & L items will be valued at Average Exchange Rate as these transactions are settled at various applable exchange rate during the year.

2. All Balance sheet items will be valued at specific opening or closing rates as applicable.

![]()

Question 30.

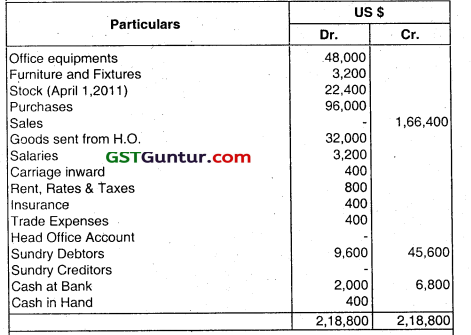

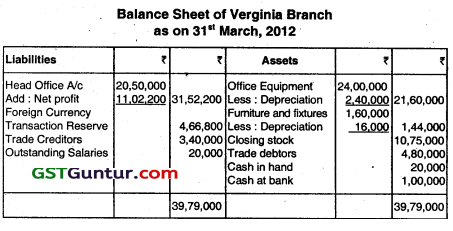

An Indian Company Moon Star Limited has a branch at Verginia (USA). The Branch is a non-integral foreign operation of the Indian Company. The trial balance of the Branch as at 31st March, 2012 is as follows:

The following further information are given:

1. SaLaries outstanding $ 400.

2. Depreciate office equipment and Furniture & Fixtures @ 10% p.a. at written down value.

3. The Head Office sent goods to Branch for ₹ 15,80,000.

4. The Head Office shown an amount of ₹ 20,50,000 due from Branch.

5. Stock on 31st March 2012- $ 21,500.

6. There were no transit Items either at the start or at the end of the year.

7. On April 1, 2010 when the fixed assets were purchased the rate of exchange was ₹ 43 to one $. On Ap411 1, 2011, the rate was ₹ 47 per $.

On March 31, 2012, the rate was ₹ 50 per$. Average Rate during the year was ₹ 45 to one $.

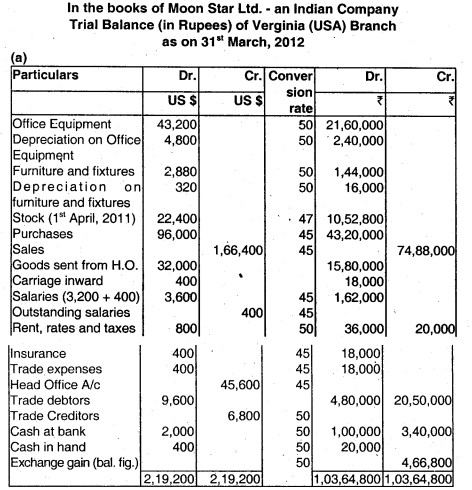

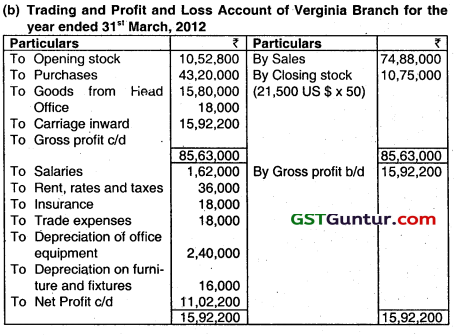

Prepare:

(a) Trial balance incorporating adjustments given converting dollars into rupees.

(b) Trading, Profit and Loss Account for the year ended 31st March; 2012 and Balance Sheet as on date depicting the profitability and net position of the Branch as would appear in the books of Indian Company for the purpose of Incorporating in the main Balance Sheet. (May 2012, 16 marks)

Answer:

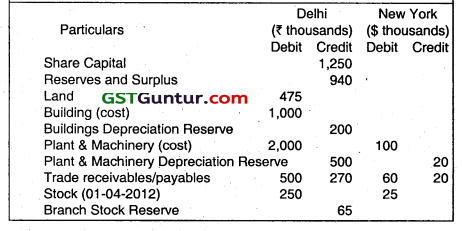

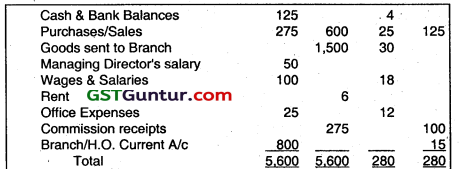

Question 31.

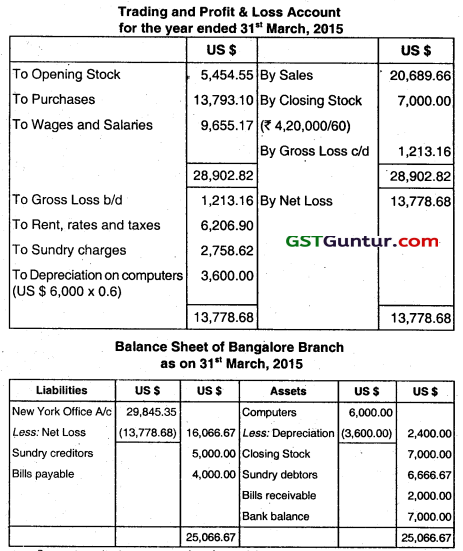

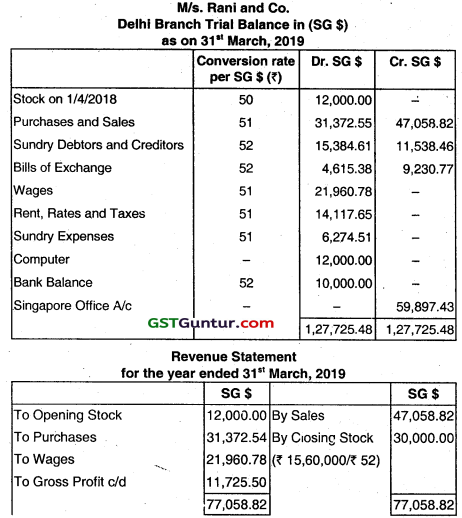

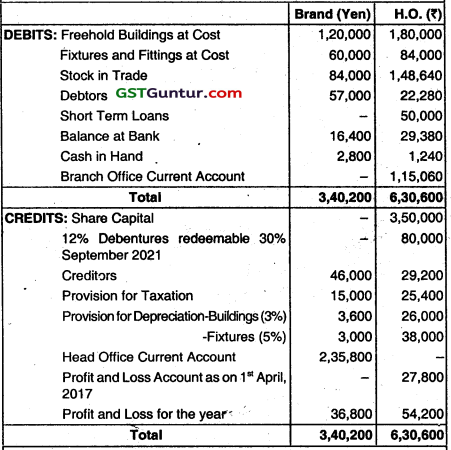

ABCD Ltd., Delhi has a branch in New York, USA, which is an integral foreign operation of the company. At the end of 31st March 2013, the following ledger balances have been extracted from the books of the Delhi office and the New York Branch:

The following information Is also available:

(1) Stock as at 31-03-2013

Delhi – 2,00.000

New York – $ 10 (all stock received from Delhi)

(2) Head Office always sent goods to the Branch at cost plus 25%.

(3) Provision is to be made for doubtful debts at 5%.

(4) Depreciation is to be provided on Buildings at 10% and on Plant and Machinery at 20% on written down values.

You are required:

(a) To convert the Branch Trial Balance Into rupees, using the following rates of exchange:

Opening rate 1$ = 50

Closing rate 1$=55

Average rate 1$ = 52

For fixed assets 1$ = 45

(b) To prepare the Trading and Profit & Loss Account for the year ended 31st March. 2013, showing to the extent possible, Head Office results and Branch results separately. (May 2013, 16 marks)

Answer:

Question 32.

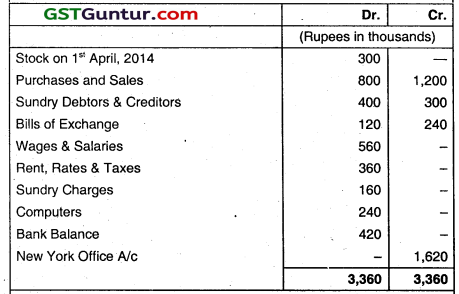

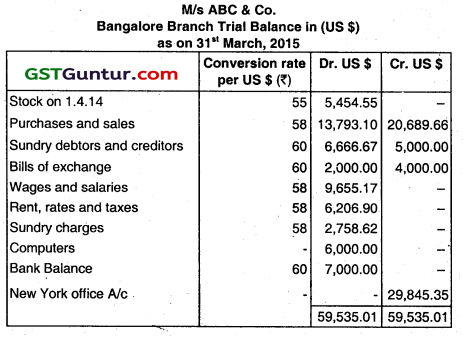

M/s ABC & Co. has head office at New York (U.S.A.) and branch in Bangalore (India). Bangalore branch is an integral foreign operation of M/s ABC&CO. Bangalore branch furnishes you with its trial balance as on 31st March 2015 and the additional information given thereafter:

Additional Information:

(a) Computers were acquired from a remittance of US $ 6.000 received from New York head office and paid to the suppliers. Depreciate computers at 60% for the year.

(b) Unsold stock of Bangalore branch was worth ₹ 4,20,000 on 31st March 2015.

(c) The rates of exchange may be taken as follows:

– On 01.04.2014 @ 55per US$

– On 31.03.2015 @ 60per US$

– Average exchange rate for the year © ₹ 58 per US $

– Conversion in $ shall be made up to two decimal accuracy.

You are asked to prepare in US dollars the revenue statement for the year ended 31st March, 2015 and the balance sheet as on that date of Bangalore branch as would appear In the books of New York head office of ABC & Co. You are informed that Bangalore branch account showed a debit balance of US $ 29845.35 on 31 .3.2015 in New York books and there were no items pending reconciliation. (May 2016, 8 marks)

Answer:

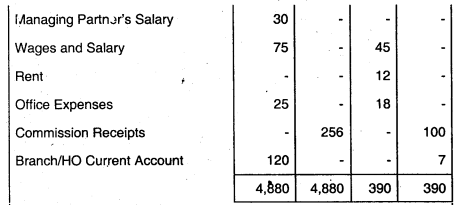

Question 33.

M & S Co. of Lucknow has a branch in Canberra, Australia. At the end of 31st March 2017, the following ledger balances have been extracted from the books of the Lucknow office and the Canberra.

The following information is also available:

(i) Stocic as at 31 March. 2017.

Lucknow 1,50,000

Canberra A$ 3125 (all stock are out of purchases made at Abroad)

(ii) Head Office always sent goods to the Branch at cost plus 25%

(iii) Provision is to be made for doubtful debts at 5%

(iv) Depreciation is to be provided on Buildings at 10% and on Plant and Machinery at 20% on written down value.

You are required to:

(1) Convert the Branch Trial BaLance into rupees by using the following change rates:

Openingrate 1A$=50

Closing rate 1A$=53

Average rate 1A$=51.00.

For Fixed Assets 1A$ = 46.00

(2) Prepare Trading and Profit and Loss Account for the year ended 31st March 2017 showing to the extent possible H.O. results and Branch results separately. (Nov 2017, 12 marks)

Answer:

Closing Stock

=A$3.125

=3.125 x ₹53

= ₹ 165.625 (000’s)

= ₹ 166 (000’s)

Note:

1. In the above solution, it has been assumed that the Australia branch is an Integral foreign operation of M & S Co. Alternative solution considering branch as non-integral foreign operation is also possible.

2. As the closing stock of Branch does not consist any stock transferred from M & S Co., there is no need to create dosing stock reserve. But the opening branch stock reserve has to be reversed k the P&L A/c.

Question 34.

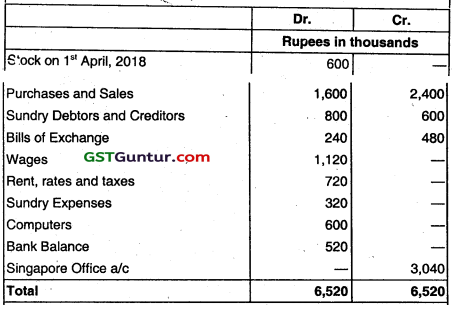

M/s Rani & Co. has head office at Singapore and branch at Delhi (India). Delhi branch is an Integral foreign operation of Ws Rani & Co., Delhi branch furnishes you with its Trial Balance as on 31st March, 2019 and the

additional information thereafter.

Additional information:

(a) Computers were acquired from a remittance of Singapore dohar 12,000 received from Singapore Head Office and paid to the suppliers. Depreciate Computers at the rate of 40% for the year.

(b) Closing Stbck of Delhi branch was ₹ 15,60,000 on 31st March 2019.

(c) The Rates of Exchange may be taken as follows:

(i) on 1.4.2018 @? 50 per Singapore Dollar

(iii) on 31.3.2019 @ 52 per Singapore Dollar

(iii) average Exchange Rate for the year @ ₹ 51 per Singapore Dollar

(iv) Conversion in Singapore Dollar shall be made up to two decimal accuracy.

(d) Delhi Branch Account showed a debit balance of Singapore Dollar 59,897.43 on 31.3.2019 in the Head office books and there were no items pending for reconciliation.

In the books of Head office, you are required to prepare:

1. Revenue statement for the year ended 31st March, 2019. (in Singapore Dollar)

2. Balance Sheet as on that date. (in Singapore Dollar) (May 2019, 8 marks)

Answer:

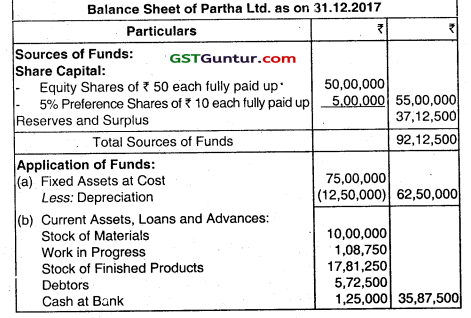

Question 35.

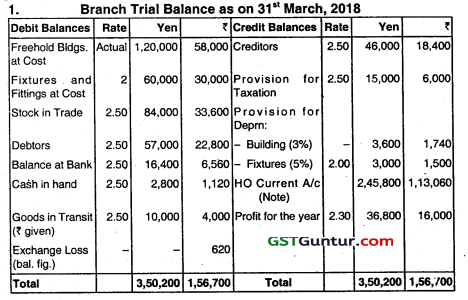

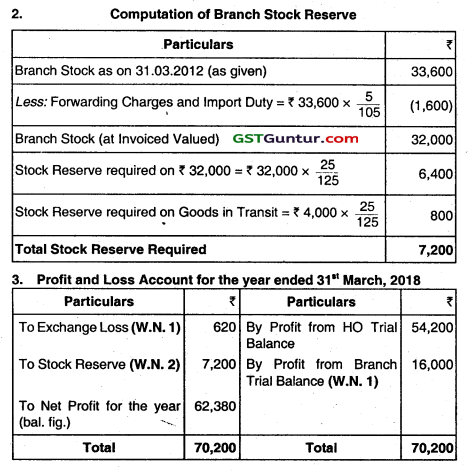

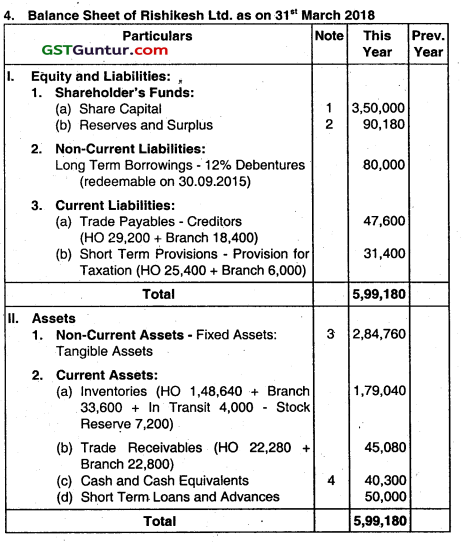

ABC Ltd. is a Company with an Authorized Share Capital of ₹ 10,00.000 In Shares of ₹ 10 each 01 which 35,000 Shares have been issued and fully paid. On 1st April 2017, It opened a Branch in a Foreign Country with a Fluctuating Currency Yen-having purchased (in the earlier year) Freehold Premises there for Yen ₹ 1,20,000 which were paid for by a Rupee Draft for ₹ 58,000. Fixtures and Fittings, costing Yen ₹ 60,000 were paid for on 1st April 2017, out of a Rupee Remittance of ₹ 50,000 from the Head Office on that date.

All Goods were purchased by Head Office and those for Sale by the Branch were Involved to it at Cost Plus 25%. The Cost of Forwarding and Import Duty were paid by the Branch on arrival of the Goods and averaged 5% of the Invoice Price. After making all the necessary Closing Entries, with the exception of the Branch Profft and the appropriation of the balance on P&L Account, the following were the Trial Balance as on 31st March 2018.

Rate of Exchange of Yen to the Rupee was as under -(a) 1st April 2017 – 2.00, (b) 31st March 2018 -2.50, and (c) Average for the year – 2.30. jock in Trade at HO was valued at Cost at the Branch at the Invoice Price Plus Forwarding Charges and Import Duty. Entries in the Current Account between the Head Office and the Branch had all been agreed except the following:

(a) Goods dispatched and invoiced to the Branch on 29th March 2018 – ₹ 4,000, and Remittance by the Branch to the Head Office on 30th March. 2018- Bcs. 5,000. Both were received in April 2018, the remittance realizing ₹ 2,000. In view of the need to maintain Cash Reserves for redemption of the 12% Debentures, the Directors decided to pay no

Dividend.

Prepare:

(1) Set out the Branch Trial Balance after Conversion, and

(2) Prepare the Company’s Balance Sheet as on 31st March 2018.

Answer:

Note: Provision for Depreciation of Building = ₹ 58,000 \(\frac{3,600}{1,20,000} \) = ₹ 1,740

HO Current A/c Revised (as per Branch Books) = 2,35,800 (given) + Goods in Transit 10,000 = Yen 2,45,800

Branch Current Nc Revised (as per HO Books) = 1,15,060 (given) (-) Cash in Transit 2,000 = ₹ 1,13,060

Question 36.

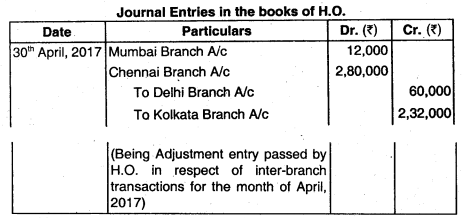

Show Adjustment Journal Enfry along with working notes in the books of head office at the end of April 2017 for Incorporation of inter-branch transactions assuming that only head office maintains different branch accounts its books:

(A) Delhi Branch:

(i) Received goods from Mumbai ₹ 1,40,000 and ₹ 60,000 from Kolkata.

(ii) Sent goods to Chennai ₹1,000, Kolkata ₹ 80,000

(iii) Bill receivable received ₹ 80,000 from Chennai

(iv) Acceptances sent to Mumbai ₹ 1,00,000, Kolkata ₹ 40,000

(B) Mumbai Branch (Apart from the above):

(i) Received goods from Kolkata ₹ 60,000, Delhi ₹ 80,000

(ii) Cash ent to Delhi ₹ 60,000, Kolkata ₹ 28.000

(C) Chennai Branch (Apart from the above):

(i) Received goods from Kolkata ₹ 1,20,000

(ii) Acceptances and cash sent to Kolkata₹ 80,000 and ₹ 40,000 respectively.

(D) Kolkata Branch (Apart from the above)

(I) Sent goods to Chennai ₹ 1,40,000

(ii) Paid cash to Chennai ₹ 60,000

(iii) Acceptances sent to Chennai ₹ 60,000. (May 2017, 8 marks)

Answer:

Question 37.

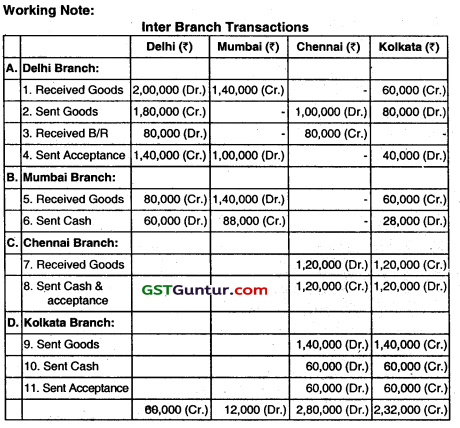

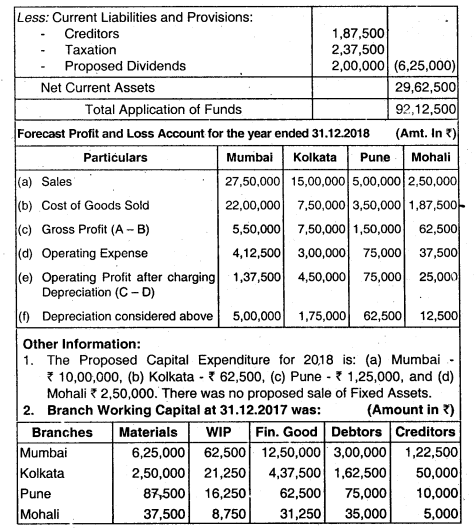

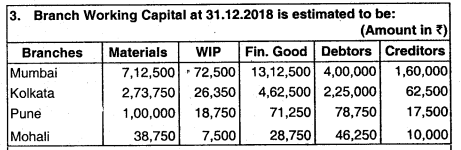

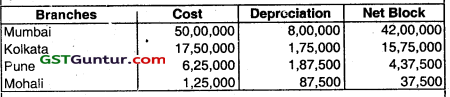

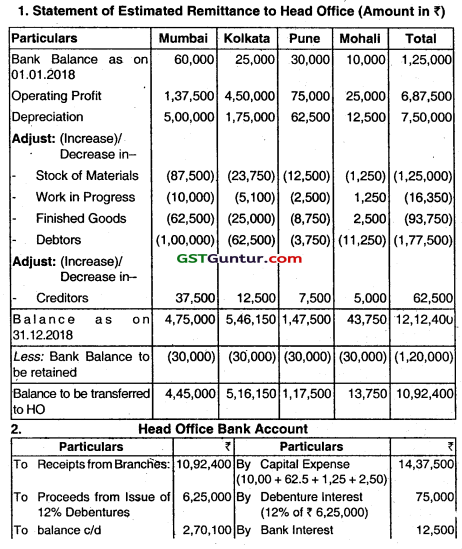

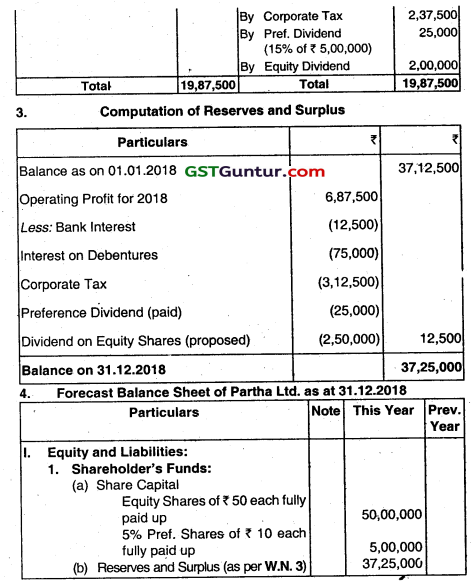

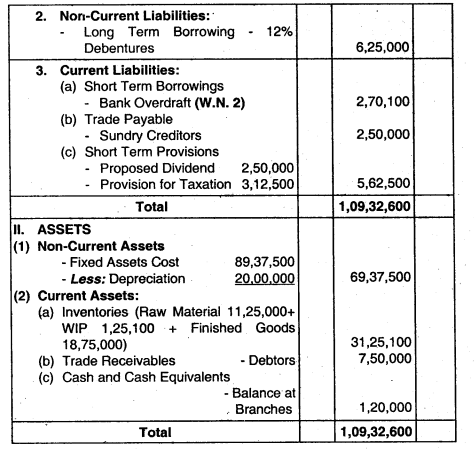

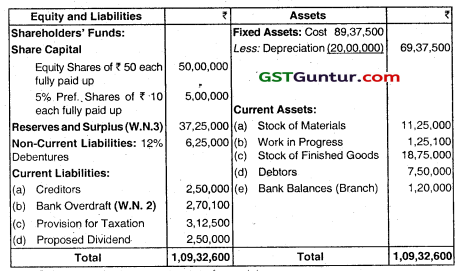

ABC Ltd. has tour Branches ¡n Mumbai. Kolkata and Mohali at each of which it manufactures Plastic Bottles. Each of the Branches has been controlled by a Manager with full responsibility for all aspects of the Branch affairs including the purchase locally of Fixed Assets.

During 20171 there have been problems in that, although in total the Company has had cash funds, because the Branches operate separate Bank Accounts, there have been simultaneous debit and credit Bank Balances. The Directors of Partha Ltd. have therefore decided to centralize the purchase of Fixed Assets, the raising of Loans and the payments of Tax and Dividends.

4. ABC Ltd. proposes to raise ₹ 6,25,000 by the Issue of 12% Debentures on 01.01.2018. Interest on Overdraft is estimated to be ₹ 12,500.

5. The Opening Balances at Bank on 01.01.2018 were – (a) Mumbai – ₹ 60,000, (b) Kolkata ₹ 25,000 (C) Pune – ₹ 30,000, and (d) Mohali – ₹ 10,000.

6. The Fixed Assets at 31.12.2017 were:

7. The Company pays the Preference Dividend for the year on December every year. It is proposed to pay a Dividend for 2018 of 5% on the Equity Shares.

8. The Corporate Tax charge for 2018 has been estimated at 3,12,500.

Prepare:

(1) Prepare a statement to show how much cash each Branch will be able to transfer o Head Office and still maritain a Bank Balance of ₹ 30,000 at each Branch as at 31.12.2018. and

(2) Prepare a Forecast Balance Sheet for ABC Ltd. as at 31 .12.2018.

Answer:

Note: This is only a Forecast Balance Sheet, therefore all disclosure requirements of Schedule III are not given. Alternatively. The forecast Balance Sheet can be prepared in T form as under:

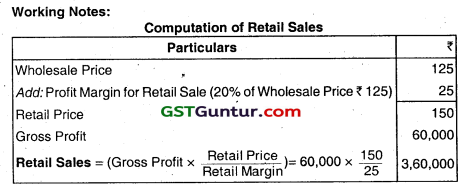

Question 38.

ABC Ltd. operates a number of Retail Outlets to which goods are invoiced at Wholesale Price, which is Cost Plus 25%. These sell the goods at the Retail Price, which is Wholesale Price plus 20%. Following is the information regarding one of the Outlets for the year ended 31st March

| Particulars | ₹ |

| Opening Stock at the Outlet | 30,000 |

| Goods invoiced to the Outlet during the year | 3,24,000 |

| Gross Profit made by the Outlet | 60000 |

| Goods Lost by Fire | ? |

| Expenses of the Outlet for the year | 20,000 |

| Closing Stock at the Outlet | 36,000 |

prepare the following accounts in the books of ABC Ltd. for the year-ended 31st March.

1. Outlet Stock – Account

2. Outlet Profit and – Loss Account

3. Stock Reserve – and Account

Answer: